#Property For Sale In Dublin

Explore tagged Tumblr posts

Text

From ‘Sale Agreed’ to ‘Sold’: Accelerating Your Property Sale with Expert Estate Agents in Dublin

The property market in Dublin is experiencing unprecedented changes, largely driven by an ongoing housing crisis. With demand for housing outstripping supply, property prices have surged, creating a highly competitive environment for buyers and sellers alike. This dynamic landscape necessitates a strategic approach to property sales, where expert advice can make a significant difference in expediting transactions.

Whether you’re dealing with increased regulations, navigating bidding wars, or managing the expectations of prospective buyers, understanding the current market trends is crucial to achieving a successful sale. This guide aims to provide key insights and practical advice to help you seamlessly transition from ‘Sale Agreed’ to ‘Sold’ in Dublin’s evolving property market.

Importance of Understanding the Process from ‘Sale Agreed’ to ‘Sold’

Understanding the process from ‘Sale Agreed’ to ‘Sold’ is fundamental to ensuring a smooth and successful property transaction. Once you’ve reached the ‘Sale Agreed’ stage, it means both parties have negotiated and accepted an offer, but several critical steps remain before you can consider the sale finalised.

This phase involves important tasks such as securing financing, completing legal checks, and fulfilling contractual obligations. Any delays or misunderstandings during this period can jeopardise the entire sale, increasing the likelihood of it falling through. By comprehensively understanding each aspect of this process, sellers can proactively manage timelines, address potential issues promptly, and maintain clear communication with all involved parties, thereby significantly reducing stress and enhancing the likelihood of a timely and successful sale.

Understanding ‘Sale Agreed’ in Dublin Property Sales

Definition and Implications

In Dublin’s property market, the term ‘Sale Agreed’ signifies that an offer has been made on a property and the seller has accepted it. This is a crucial milestone in the property sale process, indicating mutual agreement between both parties on the transaction’s terms.

However, it’s important to note that ‘Sale Agreed’ is not legally binding; the sale is not completed until contracts are signed and exchanged, and the full payment is made. The status implies a degree of commitment, but both the buyer and seller still have conditions to meet before the property can be officially transferred.

Initial Steps to Take Once an Offer is Accepted

Once an offer is accepted and the property is marked as ‘Sale Agreed,’ several key steps need to be initiated to move towards completing the sale:

Notify the Solicitor: Inform your solicitor immediately to begin preparing the necessary legal documentation and to address any potential legal issues that may arise during the process.

Secure Financing: If the buyer is obtaining a mortgage, this is the time to secure financing. The lender will typically conduct a valuation of the property to confirm its worth and ensure it meets lending criteria.

Conduct Surveys and Inspections: Arranging for a professional survey of the property is crucial to uncover any structural issues or defects that might need attention before the sale can progress.

Draft the Contract: The seller’s solicitor will draft a contract of sale, outlining all the terms and conditions agreed upon, and send it to the buyer’s solicitor for review.

Schedule a Closing Date: Agree on a tentative timeline for the completion of the sale, keeping in mind the time needed for legal checks, funding arrangements, and any other necessary preparations.

By undertaking these initial steps promptly and efficiently, both buyers and sellers can ensure they are on track for a smooth transition from ‘Sale Agreed’ to ‘Sold.’

Preparing for a Smooth Property Sale in Dublin

Legal Preparations and Documentation

Ensuring that all legal preparations and documentation are in order is essential for a smooth property sale in Dublin. Both sellers and buyers must be diligent in providing accurate and complete information to their respective solicitors. Legal checks include verifying property ownership, checking for any outstanding charges or mortgages, and ensuring compliance with local regulations. This thorough legal groundwork helps prevent potential disputes and delays later in the process.

Role of Solicitors and Their Importance

Solicitors play a pivotal role in the property sale process, acting as legal representatives for both buyers and sellers. Their responsibilities include drafting and reviewing contracts, conducting title searches, and ensuring all legal conditions are met before the sale is finalised. The solicitors’ expertise is invaluable in navigating any legal complexities that may arise, providing peace of mind to both parties. They also facilitate clear and timely communication between buyer and seller, ensuring that both sides understand their obligations and the progress of the transaction.

Ensuring All Property Details Are Accurately Represented

Accurate representation of all property details is crucial in maintaining trust and transparency throughout the sale process. This includes providing comprehensive descriptions and disclosures about the property’s condition, any upgrades or renovations, and any issues that may need to be addressed. Sellers should be prepared to answer questions and provide documentation regarding the property’s history, such as maintenance records, planning permissions, and building regulations compliance. By ensuring all information is accurate and forthcoming, sellers can help avoid misunderstandings and build confidence with prospective buyers, paving the way for a smoother transaction.

Effective Property Marketing Tips for Selling Your Home in Dublin

Importance of High-Quality Images and Descriptions

The first impression potential buyers have of your property is often through its online listing, making high-quality images and compelling descriptions critical components of your marketing strategy. Professional photographs that showcase your home’s best features can significantly increase interest and foot traffic. These images should be well-lit, taken from flattering angles, and highlight key selling points such as spacious rooms, modern amenities, and appealing outdoor spaces.

Alongside high-quality images, well-crafted descriptions play a pivotal role in attracting potential buyers. Descriptions should be detailed, yet concise, providing an honest account of the property’s attributes and surroundings. Mention key aspects such as recent renovations, proximity to essential services and amenities, transport links, and unique features of the home. By emphasising what makes your property special, you can captivate buyers’ attention and encourage them to take the next step in scheduling a visit.

Utilising Online Platforms and Social Media

In the modern property market, leveraging online platforms and social media is essential for reaching a broad audience. Listing your home on popular property websites such as Daft.ie and MyHome.ie ensures it is visible to thousands of potential buyers actively searching for properties in Dublin. These platforms offer extensive search functionalities, allowing your listing to be found based on specific criteria such as location, price range, and property type.

Social media also presents a powerful avenue for promoting your property. Platforms like Facebook, Instagram, and Twitter offer targeted advertising options that can help you reach specific demographics interested in buying a home. Utilise these platforms to share high-quality photos, engaging descriptions, and virtual tour links. Additionally, consider creating a dedicated social media page for your property or working with local real estate groups to increase visibility. Engaging with users through comments and messages can also foster a connection and generate interest in your listing. By effectively utilising these digital tools, you can maximise your property’s exposure and attract a larger pool of prospective buyers.

The Importance of Working with Experienced Estate Agents

Partnering with experienced estate agents can significantly impact the success of selling your home in Dublin. Experienced agents bring a wealth of knowledge about current market conditions, pricing strategies, and buyer behaviour, which can help in setting a realistic and competitive asking price. Their expertise in marketing properties ensures that your home receives maximum exposure through various channels, including online listings, social media, and traditional advertising.

Moreover, seasoned estate agents have established networks and professional connections that can facilitate quicker sales. They can efficiently manage viewings, negotiate offers on your behalf, and handle any challenges that may arise during the sale process. Their ability to provide sound advice and strategic insights is invaluable, as they can highlight your property’s strengths and suggest improvements to enhance its market appeal. By leveraging their experience and industry know-how, you can confidently navigate the complexities of the property market and achieve a successful sale.

Managing Viewings and Negotiations in Dublin Real Estate

Tips for Presenting Your Home

First impressions are critical when potential buyers visit your property, so presenting your home in its best light is essential. Start by decluttering and cleaning each room to create a welcoming and spacious environment. Ensure that any minor repairs or touch-ups, such as fixing leaky faucets or repainting scuffed walls, are completed before viewings. Consider staging your home with tasteful decor and neutral colours to appeal to a broader audience. Create an inviting atmosphere by letting in natural light, using fresh flowers, and ensuring your property has a pleasant scent. Additionally, provide clear and accessible information about your home, such as brochures or property details, to aid buyers during their visit.

Handling Negotiations Professionally

Negotiations are a critical phase in the property selling process, requiring a professional and strategic approach. Be prepared to engage with prospective buyers by understanding your property’s value and setting clear expectations about your minimum acceptable offer. Remain calm and composed throughout negotiations, focusing on mutually beneficial outcomes rather than becoming emotional or defensive. It is also beneficial to rely on your estate agent’s expertise during this stage, as they can offer valuable insights and mediate discussions effectively. Their experience allows them to navigate tricky negotiations, ensuring you receive a fair deal without alienating potential buyers.

Keeping Communication Open and Clear

Maintaining open and clear communication with all parties involved is vital for a smooth transaction. Respond promptly to inquiries and provide updates on any progress or changes as necessary. Clear communication fosters trust and ensures that buyers feel informed and respected throughout the process. Be transparent about any developments and willing to answer questions or address concerns buyers may have. If you’re working with an estate agent, encourage regular updates on viewings, feedback from potential buyers, and the overall status of negotiations. By keeping the lines of communication open and transparent, you can prevent misunderstandings and facilitate a seamless property sale.

Navigating the Legal Process of Selling Property in Dublin

Understanding the Conveyancing Process

The conveyancing process is a crucial component of selling property in Dublin, involving several legal steps to transfer ownership from the seller to the buyer. Initially, it begins with the drafting of a contract for sale by the seller’s solicitor, outlining the terms and conditions of the sale. This contract is then sent to the buyer’s solicitor for review. Once both parties agree on the terms, the buyer arranges for a property survey and secures mortgage approval if necessary.

Subsequently, both solicitors engage in pre-contract enquiries and exchange important documents such as title deeds. When satisfied, the buyer signs the contract and pays a deposit, typically 10% of the purchase price. The exchange of contracts legally binds both parties to the transaction. Finally, the balance of the purchase price is paid on the completion day, and the seller hands over the keys to the buyer, officially transferring ownership.

Common Legal Hurdles and How to Overcome Them

Navigating the legal landscape of property selling can present various challenges. One common hurdle is ensuring the property has a clear and marketable title, free from encumbrances or disputes. Conducting a thorough title search early in the process can help identify and address any issues, such as outstanding mortgages or rights of way.

Another potential obstacle is dealing with delays or discrepancies in the buyer’s funding. To mitigate this, closely monitor the buyer’s progress in securing mortgage approval and maintain open communication with all parties involved. Additionally, minor discrepancies in the terms of the contract or property boundaries can lead to delays. Ensuring all details and legal descriptions are accurate from the outset can prevent such setbacks.

Ensuring All Contracts and Agreements Are in Order

Ensuring that all contracts and agreements are meticulously drafted and reviewed is critical to a smooth property transaction. Begin by hiring a reputable solicitor experienced in Dublin real estate to manage the legal documentation. Carefully review the contract for sale to ensure that all terms are clearly articulated and fair.

Moreover, verify that all necessary disclosures, such as property condition reports and planning permissions, are included. Any alterations or additions to the property should be legally documented and compliant with local regulations. Maintaining comprehensive records and promptly addressing any discrepancies will safeguard against potential disputes and legal challenges.

By carefully overseeing the conveyancing process, pre-empting legal hurdles, and ensuring all contracts are in impeccable order, you can facilitate a seamless and successful sale of your property in Dublin.

Closing the Sale: From ‘Sale Agreed’ to ‘Sold’ in Dublin

Final Inspections and Checks

After an agreement is reached between the buyer and seller and the sale is officially marked as ‘Sale Agreed’, the buyer will often conduct a final inspection of the property. This inspection ensures that the property is in the agreed-upon condition and that any stipulated repairs or conditions have been met. It’s also the last opportunity for the buyer to identify any issues that need to be addressed before moving forward. As the seller, it’s crucial to ensure the property is correctly presented, with all agreed-upon repairs and conditions fulfilled to your buyer’s satisfaction. Having all relevant documents and warranties related to the house ready for review can expedite this process and reinforce buyer confidence.

Signing the Final Contracts

Once the final inspection is satisfactorily completed, the next major step involves signing the final contracts. At this stage, the buyer’s solicitor and seller’s solicitor will have completed all necessary checks and clarifications. The signing of the final contract marks the legal commitment of both parties to complete the transaction. The buyer will also typically transfer the remainder of the purchase price at this point. It’s crucial to meticulously review the final contract, ensuring all terms are precise and that there are no undisclosed conditions that might affect the transaction. Your solicitor can provide invaluable assistance here, ensuring that all paperwork is in order and that you fully understand the terms you are agreeing to.

Handing Over Keys and Finalising the Sale

The culmination of the property sale process occurs with the handing over of keys and transferring ownership officially. This usually happens on the closing day, when the buyer’s payment clears and all contract conditions are satisfied. The seller’s solicitor will confirm receipt of all funds, and both parties will sign the necessary documents to finalise the sale. Upon completion, the seller hands over all keys, garage openers, and any other handover items to the buyer. At this point, the buyer is now the legal owner of the property. Ensuring a smooth handover by providing a clean, organised property along with any manuals or instructions for appliances can facilitate a positive transition, marking the successful conclusion of the selling process.

Post-Sale Considerations for Dublin Property Sellers

Settling Any Outstanding Payments or Obligations

Once the sale is complete, it’s crucial to settle any outstanding payments or obligations associated with the property. This might include final utility bills, property taxes, or any remaining balances on mortgages. Ensuring all financial obligations are settled promptly not only provides closure but also prevents any potential disputes or complications post-sale. Contact your solicitor for assistance with finalising all outstanding payments and confirming that all legal and financial obligations are fully met.

Moving Out and Transferring Utilities

As you prepare to vacate the property, a key step is to arrange for the transfer of utilities to the new owner. This includes electricity, gas, water, and any other services connected to the property. Inform your utility providers of the sale and arrange for final meter readings to ensure accurate billing. Additionally, it’s essential to plan your move meticulously, packing and organising your belongings ahead of time to ensure a smooth transition. Leaving the property clean and free of personal items will leave a positive impression on the new owners.

Reflecting on the Sale Process and Feedback

After the sale process is concluded, taking time to reflect on the experience can provide valuable insights for future transactions. Consider the steps that went well and any challenges encountered along the way. Seek feedback from your solicitor, estate agent, or even the buyer to understand different perspectives. Reflecting on this feedback can help you learn and improve, whether for future property sales or other transactions. Understanding what worked and what could be improved will make you a more informed and prepared seller in the future.

Conclusion: Expert Tips for a Successful Property Sale in Dublin

Navigating the journey from ‘Sale Agreed’ to ‘Sold’ in Dublin involves a series of carefully orchestrated steps. It begins with the vital post-agreement inspection, where ensuring the property condition meets the buyer’s expectations is crucial. This is followed by the critical step of signing the final contracts, sealing the legal commitments and transferring the purchase price. Concluding the sale involves the official handover of keys and documents, with the possession legally transferring to the buyer once all funds are confirmed and terms are met. The successful completion of these steps culminates in the finalisation of the sale and a smooth transition for all parties involved.

To ensure a seamless and successful property sale, here are some final expert tips:

Maintain Clear Communication: Keep open lines of communication with your solicitor, estate agent, and buyer to address any concerns swiftly and prevent misunderstandings.

Stay Organised: Ensure all documents, warranties, and relevant information are readily accessible. This not only expedites the process but also builds buyer confidence.

Prepare Thoroughly: Before final inspections, make sure all agreed-upon repairs and conditions are met. A well-presented property can significantly influence the buyer’s final decision.

Review Contracts Meticulously: Work closely with your solicitor to understand all terms and conditions before signing the final contract, safeguarding against any hidden liabilities.

Plan Your Move Early: Arrange for the transfer of utilities, final readings, and organise your move well in advance to avoid last-minute stress.

Selling a property in Dublin can be a complex and demanding process, but with careful planning, detailed attention to legal requirements, and a proactive approach, you can achieve a successful and rewarding outcome. Best of luck in your property selling journey!

Contact Howley Souhan for Professional Property Sale Assistance in Dublin

For personalised and professional assistance with your property sale in Dublin, consider contacting Howley Souhan. Our experienced team of Estate Agents is dedicated to guiding you through every step of the process, from initial inspections to the final handover, ensuring a smooth and successful transaction.

Contact us today.

0 notes

Note

hey!! i saw your post about moving to ireland and that is definitely in my plan for the next few years! i’m in college and i’m studying abroad there hopefully next spring. would you be able to just tell me some of the basics of what it’s like to live there? like transportation, expenses, housing demand, etc! thanks in advance 🫶

Hey, thanks for reaching out!

Yes, of course I can. I'll talk about the basics here but if you'd like to go into details that would suit your situation more (for example, if you're planning to work or not etc) feel free to pm me 😊

Transportation

Transportation depends on the city you'd want to live in, I can only speak for Dublin right now so that's what I'll go into. When it comes to public transportation the standard ticket is valid for 90 minutes on all transport, including switching between different bus lines and trams. It's €2 if you have a leap card. Leap card is a plastic card you'll have to buy when you arrive (for €5 euro) either at the airport or at one of the special spots in the city center. Once you have it you can charge it through the app, at spar shops or at ticket machines and tap in or out at buses, trams (called luas here) and trains (dart). There is also student card options for cheaper. You can find more information here:

Unfortunately, the buses are not very reliable so if you're planning to use public transport the safest bet would be to find housing near either of the luas lines. (There is a green and red line. Green one is considered safer but I never had any trouble on either, that's just what I've been told by the locals).

Lots of people bike around or drive. I can't drive but I had a couple of friends with US drivers licence who had no problem getting an irish drivers licence in a sensible amount of time.

Expenses

Dublin is bit expensive to live in. I would say I spend around 280-300 euro a month on groceries. If you move around the city 5 days a week it costs around 80-100 euro a month on public transport. Rent averages 650-1000 a month on shared housing and so far my bills came down to 60-80€ a month but I haven't been here for the winter yet and I would assume it all depends on your housing situation. Minumum wage currently is 12.70€/h and is said to be rised next year but will likely be rised to around 13 euro.

Housing

Currently there is a housing crisis but it is possible to find a room. It just takes longer time to find anything decent for rational pricing. To find a place to live you will need to do viewings in person, so if you won't do student halls etc I would recommend getting an airbnb first or subleting a room from somebody for at least 2 weeks, even a month and spend that time on viewing as many places as possible. (Subletting is usually a lot cheaper and you can use the adress to set up a bank account if you are living there long enough to recieve a letter from the bank. It is important to get premission from the owner of the house to do that. They usually don't mind, people here are super helpful and friendly. The letter from the bank usually takes a week to get to you but can take longer). Both regular rental housing and subletting is posted on daft.ie.

To secure a flat/room they usually want you to show a job offer or last two paychecks. It can be different for work visa holders. It's good to save up 3 months rent in advance + deposit (which is usually equivalent to one months worth of rent) and use it as a negotiation leverage, offering to pay in advance once you secure the room.

Don't try finding anything on Facebook and never pay a deposit before viewing. There is a lot of scams around.

Necessities to function legally

Get an Irish phone number!!!

People rarely respond when you add foreign number as your contact information. It is especially important to secure flat viewings and job interviews. Your best bet is to visit Ireland before you move (maybe when/if you'd want to visit collages or unis for open days) and buy a sim card with a phone number. You can get one with a phone plan of monthly payment of 15-20 euro. Once you have it, activate the card and use that phone number for everything.

PPSN

Another important thing is PPS Number. Its kind of like a social security number. It is given to you by the government so you can pay taxes and be registered for social services like healthcare. I think you can apply for it on a different basis when you have a visa but I am not sure. Otherwise, you'd need to have a job offer or letter of employment to apply for it. Sometimes when you're applying for renting they can ask for this number too. You can read more here:

Irish bank account

Try to get an irish bank account as soon as possible. You will need a permanent adress in Ireland to apply for it. You will need a bank account to apply for most of the jobs but once again it may be different for visa holders.

It is a bit of a tricky loophole situation at the beginning with setting yourself up legaly so I would say securing the phone number and an adress is the most important at first. You can handle anything else after. You've got this! 😊

TL;DR you will need:

Leap card

Irish phone number

Irish adress

Irish bank account

(Job)

PPS Number

If anybody has any questions or would like to discuss their situation in more detail feel free to send asks or pm me. I'll try my best to help out. Stay strong lovelies! 💕

#oops that is a really long one#but i think thats the most necessary basics#i hope that answered your question#ask#asks#personal#larriescompass

13 notes

·

View notes

Text

Widow loses life savings after ‘firetrap’ developer fails to repay €150k loan

A controversial developer who asked to borrow the life savings of an 81-year-old widow has failed to repay the money after half a decade of broken promises.

In 2017, the widow gave €160,000 in cash to developer Paddy Byrne, who built the Millfield Manor estate in Co. Kildare where six houses burnt to the ground in under 30 minutes in 2015.

The cash was for a penthouse apartment in Dublin she planned to move into.

The development was built by Victoria Homes, a company that was established by Mr Byrne’s sister Joan just before Mr Byrne was precluded from acting as a company director in Ireland for five years.

After viewing plans for the €630,000 property, in a development called Greygates in Mount Merrion, the pensioner withdrew the cash from her bank and gave it to Mr Byrne.

Some €10,000 of this was a deposit, with the remaining €150,000 provided on the advice of a third party who was known to Mr Byrne and the widow, who said the cash would secure a good price.

According to a handwritten receipt, signed by Mr Byrne, the money was provided on May 29, 2017.

But in November 2017 the widow, a retired primary school teacher, found a more suitable home and asked for her money back.

Mr Byrne agreed to this, saying he would have no problem selling the penthouse and promptly refunded the €10,000 deposit.

However, he asked that the remaining €150,000 be treated as a 14-month loan and promised to pay a 10% annual interest rate.

This effectively turned the widow into an unwitting creditor of Victoria Homes.

According to a handwritten agreement, signed by Mr Byrne, the loan was to be ‘paid back from the sales proceeds’ of the penthouse at his Greygates development.

More than half a decade later, the loan remains unpaid – even after the widow made a criminal complaint to gardaí and took legal action to secure a judgement.

As it is a civil matter, the Garda investigation faltered. And because various other unpaid creditors had previously secured judgements against Victoria Homes, the widow is now unlikely to get her savings back. During the Celtic Tiger years, Paddy Byrne was renowned for his €2.4m Sikorsky helicopter and sponsorship of the Irish National Hunt festival.

But in 2011 his then-firm, Barrack Homes, went bust and Mr Byrne declared bankruptcy in Britain with debts of €100m.

He was banned from acting as a UK director for 10 years in 2012.

This ban was scheduled to end in 2022 – and ran the full course – but it only applied in the UK and Wales.

According to the UK insolvency register today, Mr Byrne’s discharge from UK bankruptcy is ‘suspended indefinitely’ until the fulfilment of conditions made in a 2012 court order.

Separately, in Ireland, he was also restricted from acting as a director for a period of five years – which ended in January 2018.

Mr Byrne is also known for building the Millfield Manor estate in Newbridge, Co. Kildare, where half a dozen houses were razed to the ground within 30 minutes in 2015.

A report into the blaze found ‘major and life-threatening serious shortfalls and discrepancies and deviations from the minimum requirements of the national mandatory building regulations’ at Mr Byrne’s development.

Today, having exited bankruptcy, Mr Byrne is best known as the figurehead behind Victoria Homes and associated businesses, which was set up by his sister and her husband in December 2012, while he was bankrupt.

Mr Byrne was not a director or owner of Victoria Homes during the period of his bankruptcy. But, in 2017, Mr Byrne’s sister and her husband stepped back from Victoria Homes, transferring their shares to an offshore entity in Belize city called Victoria Holdings.

In November 2022, the main lenders to Victoria Homes – the Lotus Development Group – forced the firm into receivership for the second time.

In 2020, Lotus had forced a previous short-lived receivership before agreeing a deal that saw Victoria Homes begin trading normally once more.

Today, Mr Byrne appears to have left Victoria Homes behind and seems to be focusing on a new firm instead.

Set up in the summer of 2020, Branach Developments is entirely owned by Mr Byrne and is not encumbered by any bank debt or mortgages as Victoria Homes was.

According to the latest filed accounts, for the year ended 2021, Branach Developments held ‘tangible assets’ of €210,000 and ‘stocks’ of €600,000.

The accounts also show that, in 2021, Mr Byrne provided the company with an interest-free loan of €1,024,438.

Just last week Mr Byrne’s new firm was one of the winners at the National Property Awards sponsored by the Business Post and Deloitte, among others.

At the award ceremony, Branach Developments took home the prize for best sustainability initiative of the year.

However, Mr Byrne, who shuns publicity and is rarely photographed, does not appear to have attended the ceremony and the award was accepted by a colleague.

This week the Irish Mail on Sunday sent queries to Mr Byrne via his mobile phone, his email at Victoria Homes and his email at Branach Developments, without response.

Queries to his solicitor and the separate accountancy firms representing Victoria Homes and Branach Developments also went unanswered as did calls to the numbers on the websites of these firms.

Mr Byrne also previously declined to respond to questions from the MoS relating to the establishment of Victoria Homes during the period of his bankruptcy.

At the time, Mr Byrne appeared to be living at Ballinrahin House, close to Rathangan on the border of Offaly and Kildare.

The home is a luxury build on 26 acres of stud-railed paddocks with six stables and a 1.3km tree-lined avenue behind electric gates.

The property was on sale for €2.8m in 2009, but land registry records confirm that, in November 2014, it was sold to Victoria Homes for a knockdown price of €484,000.

Ownership of Ballinrahin House was transferred offshore to Victoria Holdings in Belize on April 10, 2018, just weeks before Mr Byrne was due to repay the €150,000 back to the widow.

#Financial Exploitation#Real Estate Fraud#Elder Abuse#Legal Dispute#Developer Misconduct#Property Development#Bankruptcy#Civil Law

2 notes

·

View notes

Text

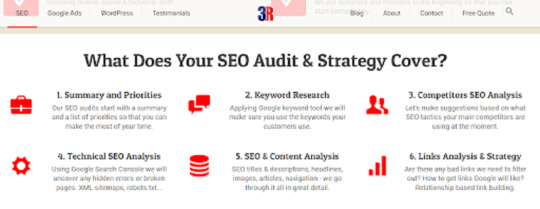

Unlock Digital Dominance: How 3R’s SEO Mastery Boosts Your Brand’s Online Impact

In today’s digital age, content is not just king; it’s the entire kingdom. At 3R, we understand the power of well-crafted, SEO-optimized content in catapulting our clients’ online presence to new heights. Through a blend of insightful analysis, creative storytelling, and strategic keyword placement, we’ve crafted a series of articles that not only engage readers but also boost our clients’ rankings on Google.

From exploring the nuances of anxiety counselling for young adults in Dublin to uncovering the secrets behind the luxurious comfort of Mulberry silk pyjamas, our content spans a diverse range of topics tailored to our clients’ unique needs. These articles serve as a testament to our commitment to delivering value, enhancing online visibility, and driving sales.

How Anxiety Counselling Supports Young Adults in Dublin

The article discusses the rise of anxiety among young adults in Dublin, attributed to factors like academic stress, career progression, and social media. It underlines the benefits of anxiety counselling, which includes enhanced self-awareness, improved coping mechanisms, strategies to prevent or minimize anxiety, increased mental resilience, and a supportive network. The counselling process involves regular sessions with a licensed therapist. The article encourages seeking professional help as a form of self-care for lasting relief from anxiety.

Diamond Shine Cleaners: Dublin’s Top Choice for Commercial Cleaning

Diamond Shine Cleaners, known as Dublin’s preferred choice for commercial cleaning, offers a broad spectrum of services using eco-friendly solutions and advanced equipment. Their professional crew is highly trained, providing customised cleaning solutions that are safe yet effective for commercial premises. With flexible scheduling and billing options, they allow businesses to focus on their operations while ensuring a clean workspace. Their commitment to maintaining a sanitary environment sets them apart in the industry.

Safeguarding Your Premises: Comprehensive Guide to Fire Stopping Services in Ireland

The article emphasizes the importance of fire stopping services in Ireland for building safety. Flame Stop, a provider of these services, offers customized solutions to prevent the spread of fire and smoke through openings in buildings. Their services align with Ireland’s stringent fire safety regulations, including installations of fire doors, sealants, barriers, and regular inspections. The article underscores that choosing the right provider like Flame Stop is crucial for ensuring compliance and genuine safety. It encourages property owners to prioritize fire safety measures and to consider Flame Stop for their fire stopping needs.

Snag List Kildare Cost: How Much Should You Spend on …

The article provides information about the cost of snag list services in Kildare, Ireland. On average, these services range from €190 to €600 per inspection. The cost varies depending on the size and complexity of the property. New Home Surveys is a trusted provider of snagging services in Kildare, known for their detailed inspections and high-quality reports. The article emphasizes the importance of professional snagging services in identifying and rectifying construction errors in new homes, thereby saving homeowners potential repair costs in the future.

A Comprehensive Guide to Locksmith Services for Businesses in Ireland

The article highlights the importance of locksmith services in ensuring the safety and security of commercial properties. Professional locksmiths offer a wide range of services, from handling emergency lockouts to installing advanced security systems. They help businesses identify security vulnerabilities and recommend appropriate solutions. Services also include key control systems, regular maintenance, and security upgrades. The article emphasizes the need for businesses to choose a reputable locksmith service provider to enhance their security measures and protect their premises, assets, and employees effectively.

Silverfish Alert: Why They Appear in Autumn in Ireland

The article explains why silverfish infestations are prevalent in Ireland during autumn. The drop in temperature and rise in humidity create ideal conditions for these pests to thrive. They seek out indoor spaces for warmth and moisture, leading to increased sightings in homes and buildings. Although seemingly harmless, silverfish can damage personal belongings and potentially trigger allergic reactions. The article emphasizes the importance of professional pest control services, like Pest Pros, for effectively handling silverfish infestations. It also provides preventive measures, such as reducing home humidity and sealing cracks where silverfish may enter.

Tire Pressure Monitor Fault: What Is It and How Do You Resolve It?

The article discusses the occurrence of a tire pressure monitor fault, which can affect vehicle stability, control, and fuel efficiency. It provides troubleshooting tips such as resetting the Tire Pressure Monitoring System (TPMS), checking tire pressure, and inspecting sensors. The article also suggests the use of a TPMS bypass emulator to silence the TPMS warning light permanently. It underscores the importance of proactive maintenance, like maintaining proper tire pressure and taking care of TPMS sensors, to prevent such faults and ensure optimal tire wear, fuel efficiency, and safe driving.

Discover Ethical Elegance: Mulberry Silk Pyjamas for Luxurious Comfort in Ireland

The article discusses the rising demand for high-quality sleepwear in Ireland, focusing on the unparalleled comfort of Mulberry silk pyjamas. The Ethical Silk Co. offers these pyjamas, known for their softness, sheen, and durability. The company stands out for its commitment to sustainable and ethical sourcing practices. Additionally, Mulberry silk is breathable and hypoallergenic, making it suitable for all skin types, including sensitive ones. The article emphasizes that these pyjamas represent a unique blend of luxury, comfort, and ethical elegance.

Stress-Induced Hair Loss? Alopecia Solutions to Get Your Mane Back

The article highlights the connection between chronic stress and hair loss, particularly a condition called Telogen effluvium. It emphasizes the importance of early detection and proper management of this condition to prevent significant hair loss and potential baldness. Treatment options include lifestyle changes, topical and oral medications, laser therapy, microneedling, platelet-rich plasma therapy, and hair transplant surgery. The piece also provides useful tips for reducing stress and promoting hair regrowth, underscoring the role of a balanced lifestyle in maintaining healthy hair.

Maryland Drivers Ed Online – Your Path to Safe and Smart Driving

DMVEdu’s online course for Maryland Drivers Education offers a convenient, flexible learning experience for teens aiming to become licensed drivers. The course, accessible on any internet-connected device, covers key topics and defensive driving techniques in line with Maryland MVA and state standards. It also includes practice quizzes and tests to prepare students for the DMV knowledge test. With excellent customer support, DMVEdu ensures a smooth learning journey. For $34.95, students can enroll and take their first step towards getting a driving license in Maryland.

Are you ready to elevate your online presence and drive your sales to new heights? Partner with 3R for cutting-edge SEO techniques and content that resonates. Let us craft compelling narratives for your brand that not only rank but also convert. Reach out today and take the first step towards dominating your digital landscape by booking an Audit of your website.

4 notes

·

View notes

Text

A strange thing happened in the eurozone economy at the end of last year. Despite widespread forecasts that the common currency area would plunge into recession and register negative growth in the last quarter of 2022, it managed to eke out a small gain of 0.1 percent. What is remarkable is not that Europe beat expectations, but that it was one small country—Ireland—whose surging economy single-handedly prevented the eurozone from slipping into the red.

Almost unbelievably, little Ireland, with a population of only 5 million, now has the economic scale to shift the growth statistics of the entire eurozone and its 343 million inhabitants. In 2022, Irish GDP growth of 12.2 percent compared to 3.5 percent in the eurozone as a whole. In absolute numbers, only Germany, France, and Italy contributed more than Ireland to eurozone GDP growth in 2021 and 2022. Ireland’s economic boom has enabled the country’s government to post a budget surplus of 1.6 percent of GDP, even as eurozone countries struggled with an average deficit of more than 3 percent.

Honestly, who wouldn’t want this luck of the Irish?

Look closely, however, and Ireland’s so-called economic miracle looks more than a little odd. The country’s growth is simultaneously both real and artificial. Much of it is driven by a handful of U.S. multinationals, which continue to route global sales and profits through their Irish operations to take advantage of Dublin’s lower business taxes. Although difficult and complex to calculate, Apple’s shifting of intellectual property assets to Ireland is estimated to have contributed half of Ireland’s miraculous 26 percent GDP growth in 2016. That bizarre fact inspired New York Times columnist Paul Krugman to ridicule Ireland’s “leprechaun economics”—and the Irish statistics office to move away from using GDP as a measure of economic growth.

Yet the surge of U.S. investment in Ireland is also real. In particular, Ireland’s role as a pharmaceuticals manufacturing hub dramatically increased during the COVID-19 pandemic. Nine out of the world’s top 10 drug companies have significant production facilities in Ireland. The U.S. State Department thinks the corporate build-out in Ireland will continue, given Ireland’s status as the only remaining English-speaking European Union country following Britain’s departure. That makes it easy for international companies to operate and enjoy barrier-free access to the EU’s single market.

It’s hard to exaggerate Ireland’s dependence on U.S. tech and pharma companies for investment and taxes. Corporate tax receipts are now the second-largest source of tax revenue (after income tax) for the Irish state: 27 percent of all tax income in 2022. The average was just 9 percent in the 38 member countries of the Organisation for Economic Co-operation and Development (OECD) in 2020, the last year for which data is available. This, in turn, is fueling an unprecedented torrent of tax income for the Irish government. Corporate tax revenues were up nearly 50 percent in 2022 alone.

Just 10 multinationals—all of them U.S.-based tech and pharmaceutical companies—now pay nearly 60 percent of Ireland’s corporate tax. Directly and indirectly, U.S. multinationals employ more than 375,000 people in Ireland, approximately 15 percent of the country’s labor force. Driven by investment from the United States, foreign multinationals now account for 53 percent of all payroll taxes paid by corporate employers.

Driven by the windfall in corporate tax receipts, the Irish government’s budget surplus is expected to swell further, to 10 billion euros in 2023 and 16 billion euros in 2024. Relative to the size of the economy, this would be equivalent to a U.S. budget surplus of more than 1 trillion dollars in 2024.

The problem for Ireland is that this singular dependence exposes the country to growing risks. Take the tech sector: As multinationals like Google, Microsoft, Meta, and Amazon see their profits shrink and slash jobs worldwide, it will not only hurt the Irish economy, but deprive Dublin of tax income as well.

What’s more, the threat to Ireland’s stability from its overdependence on U.S. companies is about to be multiplied. In 2021, nearly 140 tax jurisdictions, including Ireland, agreed to a major reform of how multinationals companies will be taxed in the future. Pillar 2 of these reforms—a minimum corporate tax rate of 15 percent for large companies—is already coming into effect. In 2024, Ireland’s corporate tax rate is due to increase to 15 percent from its current level of 12.5 percent, reducing its attractiveness as a tax haven compared to other countries. The United States also approved the minimum tax plan in August 2022, despite significant private sector and political opposition.

However, it is Pillar 1 of the OECD’s reforms that will dramatically erode Ireland’s future income from corporate taxes. This reform will reallocate a share of company profits to where sales (or users) are actually located. Previously, tax liability was calculated on where the company or its subsidiary was legally based, no matter how many profits it rerouted from other parts of the world for tax-avoiding purposes. For Ireland, the consequences are obvious: U.S. multinationals operating in the EU will be forced to divide some of their sales by member state, thus significantly reducing the amount of sales and profits that can be “booked” through Ireland. This reform is due to come into force in 2024. The end of Ireland’s windfall is therefore only a matter of time.

The Irish Department of Finance estimated in January that around half of Ireland’s corporate tax receipts—$10 billion—are “transitionary” and will be lost as the new tax rules are implemented. That translates to more than 10 percent of total government spending in 2022—more than the entire Irish education budget. This is putting the Irish government on the precipice of another financial disaster, little more than a decade after it had to be bailed out of impending bankruptcy by the European Commission, European Central Bank, and the International Monetary Fund. That disaster left Ireland with one of the highest per capita public debt levels in the world.

Regardless of the impending financial train wreck, however, Dublin is unlikely to wake up from its American dream anytime soon. Diversifying its economy and revenue sources away from U.S. multinationals would require Ireland to shift its economic and geopolitical orientation, downgrade (in Dublin’s eyes) its deep relationship with the United States, and seek greater integration into the EU economy and its myriad rules.

That’s because Ireland’s dependence on U.S. multinationals is just another expression of the country’s affinity with the United States—the “shared heritage” referenced by U.S. presidents from John F. Kennedy to Ronald Reagan to Joe Biden. These ties to the United States long precede Dublin’s embrace of European integration and make it unlikely that Ireland will ever have the same intensity of economic, cultural, and other ties to France, Germany, or the rest of the EU.

The approaching economic and fiscal train wreck resulting from the new tax rules requires a fundamental change of mindset from Irish policymakers. Squaring the circle—holding on to its deep U.S. ties while integrating more closely with the EU to diversify its economy—means Dublin must give a little (and lose a little) to both sides. Yet Ireland’s ability to navigate this conundrum is doubtful. Even though the coming changes have been plain for all to see, Dublin’s current Trade and Investment Strategy does not contain any concrete policies to mitigate the overdependence on U.S. investment flows. Although the document acknowledges that EU market opportunities are underutilized, it again recognizes the importance “markets such as the UK and the US, which offer familiarity with language and culture.”

If there is no short-term solution to Ireland’s financial vulnerabilities, a few longer-term needs stand out. Dublin should ensure that its current budget surplus is invested wisely to help diversify its drivers of growth. One such driver would be significant increases in public investment in housing and public transport infrastructure to bring the country closer to Western European standards. Ireland’s tax base should be widened to allow for a wider distribution of income sources. For example, In 2021, Ireland gained just 5 percent of its tax receipts from property taxes, compared to more than 11 percent in both Britain and the United States.

Most importantly, Ireland must deepen its trading relationships outside the English-speaking world. Notwithstanding the country’s 50-year membership of the EU, a dearth of foreign language teaching has created a monolingual business culture, which priorities existing links with the United States over the development of new markets, both within and outside the EU. This needs to change if Ireland is to build a sustainable economic model.

Biden—whose family, like so many in the United States, has Irish roots—said in 2021 that “everything between Ireland and the United States runs deep.” This is Ireland’s economic reality today. As the corporate tax boom ebbs, Ireland should ensure that its American dream doesn’t become a recurring economic and financial nightmare.

2 notes

·

View notes

Text

Expert Windows & Doors Dublin: Transforming Homes with Timeless Elegance

youtube

When it comes to elevating the beauty, comfort, and energy efficiency of your home, nothing compares to the impact of premium windows and doors. In Dublin, where historic charm meets modern innovation, Expert Windows & Doors Dublin stands as a beacon of quality and reliability. Specializing in high-performance windows and doors Dublin homeowners can trust, our business combines expert craftsmanship, innovative design, and unparalleled customer service to create living spaces that are both stunning and secure.

A Commitment to Quality At Expert Windows & Doors Dublin, quality is at the heart of everything we do. We understand that windows and doors Dublin customers choose are more than just entry points; they are essential components that enhance the character and efficiency of your home. Our products are crafted using the finest materials and cutting-edge technology to ensure durability, functionality, and aesthetic appeal. Whether you are renovating an older home or building a new one, our range of products offers the perfect blend of traditional charm and modern performance.

Innovative Design for Modern Living Design trends continue to evolve, and so do the needs of homeowners in Dublin. Our collection of windows and doors Dublin features a wide variety of styles—from classic timber designs to sleek, contemporary options that maximize natural light and provide panoramic views. Our design experts work closely with you to select the best solutions tailored to your unique requirements. The result is a harmonious blend of form and function that not only enhances the curb appeal of your property but also adds significant value to your investment.

Energy Efficiency and Sustainability In today’s eco-conscious world, energy efficiency is more than a buzzword—it’s a necessity. Our windows and doors Dublin are engineered to provide excellent thermal insulation, helping to reduce energy consumption and lower heating bills. By choosing products that minimize drafts and retain heat, you contribute to a greener environment while enjoying a more comfortable home all year round. Many of our offerings come with high energy ratings, ensuring that your home remains warm during Dublin’s chilly winters and cool throughout the summer months.

Security and Peace of Mind Safety is a top priority for every homeowner. With rising concerns about security, our windows and doors Dublin are designed with robust locking mechanisms and reinforced frames to deter intruders and safeguard your loved ones. Our expert team ensures that every installation meets stringent safety standards, providing you with the confidence that your home is well-protected. The combination of quality materials, precision engineering, and state-of-the-art security features makes our products a reliable choice for families throughout Dublin.

Professional Installation and After-Sales Service The journey to transforming your home begins with expert advice and culminates in professional installation. At Expert Windows & Doors Dublin, our team of skilled technicians is dedicated to ensuring that every installation is seamless and hassle-free. We take great care in preparing your home, fitting each window and door with precision, and leaving your property clean and secure. Our commitment to excellence extends beyond installation—we offer comprehensive after-sales support to address any questions or concerns, ensuring that your investment continues to perform beautifully for years to come.

Enhancing the Aesthetic of Dublin Homes Dublin is renowned for its architectural heritage and vibrant urban culture. Every home has its own story, and the right windows and doors Dublin products can help tell that story with flair. Our diverse range of styles is designed to complement various architectural themes, from period properties with traditional features to modern apartments seeking a minimalist touch. By choosing products that reflect your personal style and the unique character of your neighborhood, you not only enhance your living space but also contribute to the overall charm of Dublin’s residential landscape.

Customer-Centric Approach At Expert Windows & Doors Dublin, our commitment to our customers is as strong as our dedication to quality products. We believe that every client deserves personalized service, and our knowledgeable team is always ready to provide guidance and support throughout your journey. From the initial consultation to the final installation, we ensure that your needs are met with professionalism, transparency, and care. Our strong reputation in the community is built on trust, and we strive to maintain that trust with every project we undertake.

Conclusion For homeowners in search of reliable and stylish windows and doors Dublin, Expert Windows & Doors Dublin offers a comprehensive range of products and services designed to meet the highest standards of quality and performance. By integrating innovative design, energy efficiency, and robust security into every product, we help you create a home that is both beautiful and functional. Embrace the opportunity to transform your living space with windows and doors Dublin that not only enhance your home's appearance but also provide long-lasting value and peace of mind.

Choose Expert Windows & Doors Dublin to experience the difference that expertise, quality, and a customer-first approach can make in your home transformation journey.

#windows and doors dublin#windows Dublin#window installation#window replacement#upvc windows#Youtube

0 notes

Text

Tree Stump Removal Dublin

Looking for professional tree stump removal in Dublin? Garden Direct and Tree Care provides expert stump grinding and removal services to clear your landscape efficiently. Whether you need to remove a hazardous stump or create space for new planting, our skilled team uses advanced equipment for a quick and hassle-free process. We ensure complete removal, preventing regrowth and enhancing your property's appearance. Trust us for safe, reliable, and affordable stump removal services in Dublin. Contact Garden Direct and Tree Care today for a free quote and enjoy a smooth, stump-free garden!

For more information,

Contact Us:

Location: 1 Avila Park, Finglas West, Dublin, D11 R2C9, Ireland

Visit Us: www.gardendirecttreecare.com

Email: sales@gardendirecttreecare.com

Phone No: 852 155 425

Social Profiles:

https://www.facebook.com/gardendirectandtreecare

https://www.instagram.com/gardendirectandtreecare/

https://www.linkedin.com/company/garden-direct-and-tree-care/

0 notes

Text

Land For Sale in Meath

Looking for land for sale in Meath, Ireland? Whether you're interested in building your dream home, starting a farming project, or making a strategic investment, Meath offers a variety of land options. With its rich history, scenic countryside, and proximity to Dublin, Meath is a sought-after location for buyers.

Before purchasing, it’s important to research zoning laws, land use restrictions, and access to utilities. Meath's mix of rural and semi-rural properties can offer everything from smaller plots to expansive estates. If you're new to buying land, consider consulting a local real estate agent or solicitor to help navigate the process.

The county is growing in popularity due to its blend of rural charm and easy access to the capital, making it ideal for long-term investments. Keep an eye on local listings, and you might just find the perfect plot for your next project! Read more - https://keenanauctioneers.com/

#LandForSale #Meath #PropertyIreland

0 notes

Text

If you’re looking for Commercial lettings in The Liberties, contact Hibernian Estates. They have twenty years of experience as a property services provider, and They specialize in sales and lettings, commercial properties, property valuations, commercial lettings, and more.

0 notes

Text

Back on site, the firetrap builder

THE builder behind the ‘firetrap’ housing estate in Kildare, where six houses burned to the ground in under 30 minutes, transferred €1.2m to his family and associates when he was made bankrupt in 2011.

Paddy Byrne, whose company Barrack Homes built the Millfield Manor estate in Newbridge, went bankrupt in Britain in 2011 with debts of €100m. He is one of only two Irish developers barred by the UK Insolvency Service from being a director of a company for 10 years.

The €100m debts included Nama loans that were originally from AIB. Now the Irish Mail on Sunday can reveal that he is back at work again and helping to build houses for a new company owned by his sister.

On March 31, the Millfield Manor estate in Newbridge was the scene of a devastating fire in which six terraced houses were destroyed in less than half an hour.

Since then, separate engineers’ reports were commissioned by residents and Kildare County Council.

As recently as June 10, our sister paper, the Irish Daily Mail, revealed that the residents’ report had condemned fire-safety standards at the estate.

That report, by registered engineer Thomas English, found ‘major and life-threatening serious shortfalls and discrepancies and deviations from the minimum requirements of the national mandatory building regulations’.

It is not the first investigation of which Mr Byrne has fallen foul. An inquiry by the Insolvency Service in the UK revealed that he had sent €500,000 from a National Irish Bank account to his ex-wife, claiming this was a settlement to release him from any financial obligations to the marital home.

He also transferred €500,000 to the niece of a business associate, claiming this was a repayment of a loan, and he transferred €114,000 to his sister and €82,800 to a solicitor.

Because of this – and his failure to declare a house in the UK he owned – Mr Byrne is one of only two Irish developers who have been punished by the British authorities for filing false bankruptcy petitions.

In May 2013, Mr Byrne admitted his deception and accepted a nine-year extension to the oneyear restrictions normally applied to bankrupts. As a result, he is now banned from becoming a company director and from acting as a shadow director of any UK company until May 2022.

The Insolvency Service’s Allan Mitchell said: ‘They thought they could wipe these debts out in a year and move on. They transferred money to friends, relatives and associates – anyone but their creditors.’ But an MoS investigation can now link Mr Byrne to a development built by a company that is run by his sister and that operates out of the same depot as Barrack Homes did.

In December 2012, his sister, Joan, established a new propertydevelopment company using her married name, Joan Murphy.

Called Victoria Homes Ltd, the firm operates from Thomastown, Co. Kildare, and is now completing a development called Grange Hill in Rathfarnham in Dublin’s southside.

Four- and five-bed houses are already on sale at prices that range between €575,000 and €755,000, while further phases are still being built.

The website for the development states that ‘Victoria Homes is owned and managed by a team with in excess of 30 years’ experience in house building and property development’.

It says: ‘Victoria Homes Ltd have quickly forged an excellent reputation for building quality homes, built in a traditional style yet boasting all contemporary features all discerning purchasers demand.’

Although Joan Byrne/Murphy was a director of her brother’s Barrack Homes for just a week in 2011, she is known among those who have worked with her as a capable manager in the construction industry. Renowned in the past as an interior designer, she has never before been to the forefront of development projects to the extent that she now is at Victoria Homes.

The other owner and director of Victoria Homes – listed as a Patrick Murphy, with an address at Joan Byrne’s home – does not appear to have held previous directorships.

In its first and only set of filed accounts to date, Victoria Homes reported a gross profit of €119,000 and over €1m of ‘work in progress’ to the end of December 2013.

In addition to the Grange Hill development, Victoria Homes has applied for planning permission for a number of other developments in Dublin.

After receiving a tip-off, the MoS visited the Grange Hill development and photographed Mr Byrne coming and going from the site regularly over a period of weeks. He was observed staying whole days on site, and was among the last to leave after the site was locked up. He appeared to be directing work on the site.

Driving a luxury 2014 Range Rover Vogue worth in excess of €100,000, Mr Byrne appeared to be living at Ballinrahin House, close to Rathangan on the border of Offaly and Kildare.

The home is a luxury build on 26 acres of stud-railed paddocks with six stables and a 1.3km tree-lined avenue behind electric gates.

The property was on sale for €2.8m in 2009 but land registry records confirm that in November 2014 it was sold to Victoria Homes for a knockdown price of €484,000.

The MoS observed Mr Byrne coming and going from Ballinrahin House in recent weeks. Recently, we waited at the gate of the country residence to speak to him about his role at Victoria Homes.

However, when he saw us waiting, Mr Byrne declined to be questioned. Instead we left a note with our questions in the mailbox.

A mobile number pinned to the buzzer of the gate was answered by a woman who said she was renting the property and did not know Mr Byrne at all.

Mr Byrne’s sister Joan also declined to comment. ‘I don’t think it’s anything to do with you, what I do,’ she said when she was asked about Victoria Homes and her brother’s apparent role in the company. ‘My business has got absolutely nothing to do with you,’ she repeated when asked if her brother was a shadow director of Victoria Homes.

Ms Byrne also declined to comment when asked if she was the sister to whom Mr Byrne sent money prior to going bankrupt.

Asked about Mr Byrne’s Range Rover, parked in the drive, she said: ‘I don’t think that’s any of your business whose car that is.’ In addition to being a director and part owner of Victoria Homes Ltd, Ms Byrne is also a director of a number of other construction and property-related companies. At least one of these is planning a property development in Dublin.

Documents submitted to the Companies Registration Office show Ms Byrne alternates between using her maiden and married names.

Roberta Smith

1 note

·

View note

Text

Widow loses life savings after ‘firetrap’ developer fails to repay €150k loan

A controversial developer who asked to borrow the life savings of an 81-year-old widow has failed to repay the money after half a decade of broken promises.

In 2017, the widow gave €160,000 in cash to developer Paddy Byrne, who built the Millfield Manor estate in Co. Kildare where six houses burnt to the ground in under 30 minutes in 2015.

The cash was for a penthouse apartment in Dublin she planned to move into.

The development was built by Victoria Homes, a company that was established by Mr Byrne’s sister Joan just before Mr Byrne was precluded from acting as a company director in Ireland for five years.

After viewing plans for the €630,000 property, in a development called Greygates in Mount Merrion, the pensioner withdrew the cash from her bank and gave it to Mr Byrne.

Some €10,000 of this was a deposit, with the remaining €150,000 provided on the advice of a third party who was known to Mr Byrne and the widow, who said the cash would secure a good price.

But in November 2017 the widow, a retired primary school teacher, found a more suitable home and asked for her money back.

Mr Byrne agreed to this, saying he would have no problem selling the penthouse and promptly refunded the €10,000 deposit.

However, he asked that the remaining €150,000 be treated as a 14-month loan and promised to pay a 10% annual interest rate.

This effectively turned the widow into an unwitting creditor of Victoria Homes.

According to a handwritten agreement, signed by Mr Byrne, the loan was to be ‘paid back from the sales proceeds’ of the penthouse at his Greygates development.

More than half a decade later, the loan remains unpaid – even after the widow made a criminal complaint to gardaí and took legal action to secure a judgement.

As it is a civil matter, the Garda investigation faltered. And because various other unpaid creditors had previously secured judgements against Victoria Homes, the widow is now unlikely to get her savings back. During the Celtic Tiger years, Paddy Byrne was renowned for his €2.4m Sikorsky helicopter and sponsorship of the Irish National Hunt festival.

But in 2011 his then-firm, Barrack Homes, went bust and Mr Byrne declared bankruptcy in Britain with debts of €100m.

He was banned from acting as a UK director for 10 years in 2012.

This ban was scheduled to end in 2022 – and ran the full course – but it only applied in the UK and Wales.

According to the UK insolvency register today, Mr Byrne’s discharge from UK bankruptcy is ‘suspended indefinitely’ until the fulfilment of conditions made in a 2012 court order.

Separately, in Ireland, he was also restricted from acting as a director for a period of five years – which ended in January 2018.

Mr Byrne is also known for building the Millfield Manor estate in Newbridge, Co. Kildare, where half a dozen houses were razed to the ground within 30 minutes in 2015.

A report into the blaze found ‘major and life-threatening serious shortfalls and discrepancies and deviations from the minimum requirements of the national mandatory building regulations’ at Mr Byrne’s development.

Today, having exited bankruptcy, Mr Byrne is best known as the figurehead behind Victoria Homes and associated businesses, which was set up by his sister and her husband in December 2012, while he was bankrupt.

Mr Byrne was not a director or owner of Victoria Homes during the period of his bankruptcy. But, in 2017, Mr Byrne’s sister and her husband stepped back from Victoria Homes, transferring their shares to an offshore entity in Belize city called Victoria Holdings.

In November 2022, the main lenders to Victoria Homes – the Lotus Development Group – forced the firm into receivership for the second time.

In 2020, Lotus had forced a previous short-lived receivership before agreeing a deal that saw Victoria Homes begin trading normally once more.

Today, Mr Byrne appears to have left Victoria Homes behind and seems to be focusing on a new firm instead.

Set up in the summer of 2020, Branach Developments is entirely owned by Mr Byrne and is not encumbered by any bank debt or mortgages as Victoria Homes was.

According to the latest filed accounts, for the year ended 2021, Branach Developments held ‘tangible assets’ of €210,000 and ‘stocks’ of €600,000.

The accounts also show that, in 2021, Mr Byrne provided the company with an interest-free loan of €1,024,438.

Just last week Mr Byrne’s new firm was one of the winners at the National Property Awards sponsored by the Business Post and Deloitte, among others.

At the award ceremony, Branach Developments took home the prize for best sustainability initiative of the year.

However, Mr Byrne, who shuns publicity and is rarely photographed, does not appear to have attended the ceremony and the award was accepted by a colleague.

This week the Irish Mail on Sunday sent queries to Mr Byrne via his mobile phone, his email at Victoria Homes and his email at Branach Developments, without response.

Queries to his solicitor and the separate accountancy firms representing Victoria Homes and Branach Developments also went unanswered as did calls to the numbers on the websites of these firms.

Mr Byrne also previously declined to respond to questions from the MoS relating to the establishment of Victoria Homes during the period of his bankruptcy.

At the time, Mr Byrne appeared to be living at Ballinrahin House, close to Rathangan on the border of Offaly and Kildare.

The home is a luxury build on 26 acres of stud-railed paddocks with six stables and a 1.3km tree-lined avenue behind electric gates.

The property was on sale for €2.8m in 2009, but land registry records confirm that, in November 2014, it was sold to Victoria Homes for a knockdown price of €484,000.

Ownership of Ballinrahin House was transferred offshore to Victoria Holdings in Belize on April 10, 2018, just weeks before Mr Byrne was due to repay the €150,000 back to the widow.

Gisela Boulware

0 notes

Text

Navigating Ireland’s Housing Crisis Smart Strategies for Buyers, Sellers, and Landlords

Ireland’s housing crisis remains one of the most pressing issues in the property market. While supply continues to lag behind demand, there are signs of shifting conditions. The European Central Bank’s recent interest rate cuts have provided some relief for mortgage holders, but the ongoing shortage of available homes still presents challenges for buyers.

For landlords, increasing regulations and rising estate agent costs have forced many to reassess their portfolios. Meanwhile, sellers remain in a strong position, but buyers are becoming more selective. In this complex landscape, understanding the latest trends and making informed decisions is crucial.

Foreign Investment and the Supply Shortage: The Impact of Institutional Buyers

While Ireland’s housing crisis is often framed as a simple issue of supply and demand, the reality is more complex. One major factor exacerbating the shortage—particularly in urban areas like Dublin—is the increasing presence of foreign investment firms buying up entire blocks of apartments. These institutional investors, often backed by international funds, are securing large portions of newly built housing, leaving fewer units available for individual buyers and traditional landlords.

Reports have shown that in recent years, real estate investment trusts (REITs) and global funds have acquired thousands of apartments in prime locations across Dublin. These properties are often designated for the high-end rental market, pricing out many prospective homeowners who might otherwise have purchased them. While this influx of capital has helped fund large-scale developments, it has also meant that first-time buyers face even greater challenges in securing a home.

How Institutional Investors Are Reshaping the Market

The influence of investment firms isn’t limited to apartment sales—it is also distorting the rental market. Many of these firms operate under real property management models, running large portfolios with strict corporate structures. This can make negotiations difficult for tenants, who often find themselves dealing with faceless management companies rather than local landlords. Letting agents near me frequently report that corporate landlords prioritise high-yield tenants, pushing up rental prices in sought-after areas.

For traditional landlords, this trend poses an additional challenge. Institutional investors, with their economies of scale and professional management teams, can offer perks like 24/7 maintenance and high-end amenities that smaller landlords struggle to compete with. Combined with increasing estate agents’ charges and stricter regulations, many independent landlords are questioning whether staying in the rental market is sustainable.

What This Means for Buyers and Landlords

For individual buyers, competing with multi-billion-euro investment firms is an uphill battle. Government efforts to curb large-scale investor purchases—such as increased stamp duty on bulk purchases of residential properties—have had some effect, but not enough to significantly shift the balance. Many buyers’ agents argue that without stronger protections for individual purchasers, Ireland risks seeing a rental-dominated housing market controlled by corporate landlords.

For landlords, the rise of institutional investors adds another layer of complexity. While demand for rentals remains high, the entry of corporate players is changing tenant expectations and pushing smaller landlords towards professional property management companies in Dublin to stay competitive.

As the market evolves, both buyers and landlords must be aware of these shifts—and work with trusted local estate agents to navigate them effectively.

The Impact on Buyers: A Changing Landscape Amid High Demand

House prices in Ireland have remained resilient despite concerns about affordability. However, the ECB’s decision to reduce interest rates could help improve borrowing conditions for buyers. Lower rates mean mortgage repayments become more affordable, potentially increasing purchasing power.

That said, demand for housing in Dublin and other key urban areas still far exceeds supply. Government schemes such as Help to Buy and the First Home Scheme continue to assist first-time buyers, but securing a property remains competitive.

Strategies for Buyers:

Consider commuter towns – Areas like Naas offer better value while maintaining accessibility to Dublin.

Monitor mortgage rates – The ECB’s rate cuts could lead to lower interest rates from Irish lenders, making mortgages more affordable.

Secure pre-approval early – Sellers favour buyers with finance in place, giving them an edge in competitive bidding situations.

For those on the fence about buying, the shift in interest rates is a significant factor. While house prices may not drop dramatically, better financing conditions could ease some affordability pressures.

The Landlord Dilemma: Balancing High Demand with Rising Costs

Dublin’s rental market remains incredibly tight, with queues of prospective tenants turning up for viewings. Rental property agents report record-high rents, yet many landlords are finding the regulatory landscape increasingly difficult to navigate.

Recent policy changes, including rent caps and extended tenancy protections, have left smaller landlords questioning whether to remain in the market. At the same time, estate agent prices, property management firm costs, and tax obligations are eating into profitability.

Strategies for Landlords:

Improve property quality – Energy-efficient upgrades and well-maintained interiors attract better tenants and justify premium rents.

Use professional property management – Working with a property management company in Dublin or Naas can ease compliance burdens and tenant management.

Reassess rental yield – If rental income no longer offsets costs, landlords may consider restructuring their portfolio or selling underperforming assets.

Despite the challenges, rental demand remains high, and landlords who adapt to new regulations can still achieve strong returns.

Selling in 2025: Is Now the Right Time?

Sellers continue to hold the upper hand in the Irish market. Estate agents in Dublin and Naas report strong demand, particularly for well-located and energy-efficient homes. However, buyers are becoming more discerning, and overpricing can result in properties sitting on the market longer than expected.

While recent ECB interest rate cuts may encourage more buyers into the market, securing mortgage approval remains a hurdle for many. Pricing a property correctly and working with an experienced estate agent is more important than ever.

Strategies for Sellers:

Price strategically – Overpricing can deter buyers. Work with local estate agents to determine a competitive yet realistic asking price.

Invest in presentation – Small upgrades, such as fresh paint and professional staging, can significantly impact buyer interest.

Understand estate agent charges – Knowing the costs of selling, including estate agent fees, legal fees, and marketing expenses, helps avoid surprises.

For homeowners considering a sale, market conditions remain favourable—but proper planning is key to securing a smooth transaction.

Future Outlook: What’s Next for Ireland’s Property Market?