#Private Money Commercial Real Estate

Explore tagged Tumblr posts

Text

COMMERCIAL PROPERTY FINANCING – ALL TYPES - $400K to $50MILLION! (Refinance Cashout & Purchase)

COMMERCIAL & MULTIFAMILY PROPERTY FINANCING! MOST PROPERTY TYPES QUALIFY: Automotive Repair – Retail – Medical Office – Warehouse - Daycare Center - Restaurants – Bars - Light Industrial - Mixed Use - Mobile Home Park - Self Storage, Up To 75% LTV Refinance Cashout! * Up To 80% LTV On Purchases! * 30 Year Financing, * No Tax Returns! * No Personal Income Docs Required! * 24-48 Hour Prequalification with No Credit Pull Required! APPLY ONLINE @ Investor Rehab Funding dot com

NAME: Investor Rehab Funding, LLC

PHONE: 844-244-1420

State: Nationwide

Category: Real Estate Financing / Commercial Mortgages / Financial /

URL: https://www.investorrehabfunding.com/commercial-multifamilyEmail: [email protected]

#Commercial real estate loans#loans for restaurants#daycare center commercial loans#commercial financing for self-storage warehouse#light industrial commercial property financing#refinance cash out commercial property loans#12 month bank statement loans#30 year financing commercial property#bank statement commercial financing#commercial property loans#no personal income commercial financing#purchase loans for commercial property#private money commercial loans#medical office commercial financing#commercial property refinance cash out#financing for restaurants#commercial loans for bars#financing for daycare centers#bank deposit private money loans commercial property#refinance cash out commercial loans#commercial loans for mobile home park#purchase financing for commercial properties#no tax return commercial financing#financing for warehouse#automotive repair shop mortgage loans#office building financing#Apartment building financing#financing for day care centers#mixed use property financing#mobile home park refinance cash out

0 notes

Text

Real Estate Investment Loans

Real estate investment loans offer bespoke financing solutions for property acquisitions, developments, or renovations, empowering investors to maximize returns and expand their portfolios.

#Private Money Lenders for Real Estate#Hard Money Loans for Real Estate#Commercial real estate loans

0 notes

Text

Unlocking Opportunities with Commercial Real Estate Loans in Orange County

Are you a business owner or investor eyeing prime real estate in Orange County, California? Look no further. Our comprehensive commercial real estate loans in orange county solutions are tailored to your unique needs. Whether you're expanding, relocating, or investing, our expert team is here to simplify your journey. With competitive rates and flexible terms, we empower you to seize opportunities and watch your business flourish in this vibrant community. Experience seamless transactions and timely approvals. Trust us for your commercial real estate financing needs, and let's build your success story together.

#commercial real estate loan#private money lender orange county#fastfinancing#loansolutions#mortgage brokers orange county

0 notes

Note

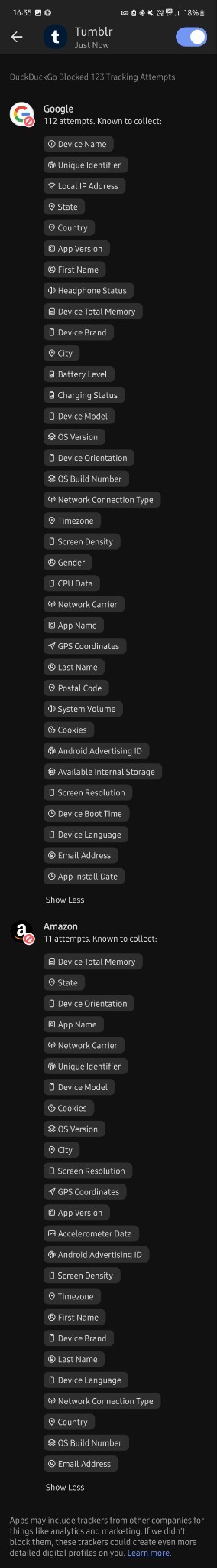

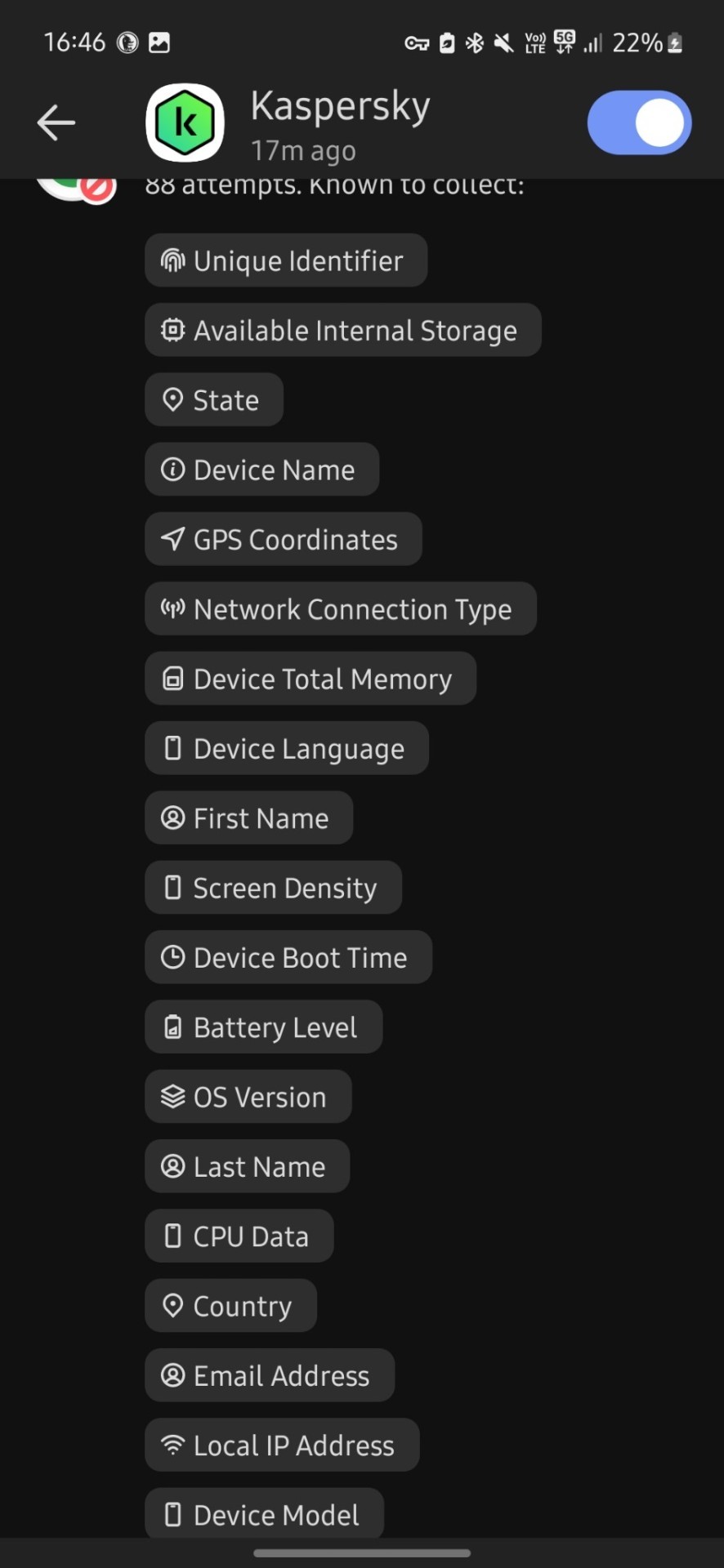

After seeing your weatherbugapp reblog i installed duckduckgo and tried it.

I don't know much about technology tbh but i downloaded this app less than 30 mins ago and in that time google tried to track me 112 times?? And they tried to collect finger prints? And my first and last name? And my gender? And my country, state and city? My gps coordinates? My postal code? My network carrier? My fricking battery level for whatever reason? Can you please tell me if this is normal at all, because i'm freaking out right now. I just turned 18 and started using mobile banking and stuff and this shit scares me

Why tf does it need to know my screen density???my system volume????my charging status????? What tf are they cooking

Now it's at 476 tracking attempts bro???? barely 5 mins passed.....

I condensed your three asks into one for readability!

And yeah, I'm very far from an expert about any of this, but as far as I know that's just. Normal. That's the normal amount of spying they're doing on your phone. I assume the numbers we see are to some extent because having been foiled, a lot of these scripts try repeatedly, since I can't imagine what use thousands of trackers per phone would be even to the great aggregators.

Tracking the phone stuff like screen resolution and battery level is because (apart from that definitely not being considered remotely 'private' so it's Free Real Estate) in aggregate that data can be used to track what phone use patterns are like on a demographic scale and therefore. Where the smart money is.

Almost all of this is getting sold in bulk for ad targeting and market analysis. This does presumably make it very hard to notice when like. Actually important stuff is being spied on, which is why I feel better about Having Apps with the duckduckgo app blocker thing.

My bank's app reportedly sells data to a couple aggregators including Google. Not like, my banking info, but it's still so offensive on principle that I avoid using the app unless I have to, and force stop it afterward.

The patterns that show up on the weekly duckduckgo blocker report are interesting. Hoopla attempts about two orders of magnitude more tracking than Libby, which makes sense because they're a commercial streaming service libraries pay by the unit for access, while Libby is a content management software run by a corporation that values its certification as a 'B' company--that is, one invested in the public good that can be trusted. The cleanness of their brand is a great deal of its value, so they have to care about their image and be a little more scrupulous.

Which doesn't mean not being a little bit spyware, because everything is spyware now. Something else I've noticed is that in terms of free game apps, the polished professional stuff is now much more invasive than the random kinda janky thing someone just threw together.

Back in the day you tended to expect the opposite, because spyware was a marginal shifty profit-margin with too narrow a revenue stream to be worth more to an established brand than their reputation, but now that everyone does it there's not a lot of reputation cost and refraining would be sacrificing a potential revenue stream, which is Irresponsible Conduct for a corporation.

While meanwhile 'developing a free game app to put on the game store' is something a person can do for free with the hardware they already have for home use, as a hobby or practice or to put on their coding resume. So while such apps absolutely can be malicious and more dangerous when they are than The Big Brand, they can also be neutral in a way commercial stuff no longer is. Wild world.

But yeah for the most part as far as I can make out, these are just The Commercial Panopticon, operating as intended. It's gross but it probably doesn't indicate anything dangerous on an individual level.

54 notes

·

View notes

Text

“In the last decades of the 19th century, Native Americans continued to be herded off their lands and forced into reservations. There, both men and women tried to maintain their intimate and cooperative relationship with the land, but reservation officials discouraged them from establishing cooperative farms and instead encouraged them to farm individual plots. As a result, Native American women gradually lost control of the land, and their social power within their tribes diminished. The equal relationship between Indian women and men changed and began to resemble the marital relations of the white settlers, in which a husband held economic and social power over his wife.

As their way of life eroded, both Native American women and men were forced to enter into a servile relationship with white settlers. Indian women, and some men, washed clothes and dishes and did other household chores for settlers. Some Indian women worked as nursemaids for white women. As their lands were scooped up by non-Indians eager to wrest a profit from the land, Native Americans’ communal, agrarian way of life vanished--and with it, the Native American women’s prominent tribal role.

…In the 1870s, Hispanic villages remained almost untouched by the growing presence of white, or Anglo, settlers. Some Hispanic men performed seasonal work for Anglo settlers for extra cash, then returned to their villages. This extra income enabled Hispanic farmers to purchase additional livestock or to open a store. By the 1880s, however, an expanding railroad system brought more white settlers to the Southwest. As more Anglos arrived, they forced their cultural values and business practices on Hispanics. They imposed the notion of private property, the use of property for commercial gain rather than for subsistence, and an economy based on money instead of barter.

Most important, they simply took land that had been commonly owned by Hispanic villagers. Lacking sufficient pastureland, villagers could hardly sustain their agrarian way of life on their small individual plots. Gradually, Anglos gained control over the local village economy throughout New Mexico, Arizona, and Colorado. With insufficient land to support themselves, Hispanics had no choice but to work for the new landowners. Hispanic women were no longer able to help support their communal life. They began to work for whites as seamstresses, cooks, launderers, domestics, hotel keepers, and even prostitutes. Like Native American women, they worked as day laborers for someone else instead of as farmers for their own people.

…In the mining camps of Butte, Montana, as well as in the desert outposts of New Mexico, women worked as prostitutes and owners of brothels and saloons. Women became prostitutes for a variety of reasons--to rebel against strict parents, to experience the adventure of a mining camp, or simply to earn a living when no other choice of work was available. Some women prospered and turned their earnings into lucrative real estate investments, but many women felt socially outcast and were at risk of contracting venereal diseases, which were often fatal, or of being physically abused by male customers. Prostitution was a lonely, insecure life spent mostly in dark, shabby hotel rooms.

A shameful chapter in the settling of the West concerns Chinese women who were sold into prostitution. These unsuspecting young women were either kidnapped in China and smuggled into American ports, or they were deceived by agents posing as matchmakers who lured them to America. Either way, they became virtual slaves, forced to service the sexual needs of Chinese immigrant male laborers working on the railroads and ranches of the West. Some found sympathetic support from female missionaries who sheltered them in special group homes and trained them to be wives and mothers. But the missionaries pressured them into entering marriages that were not always happy or compatible, and these unfortunate young Chinese women still had little control over their lives.”

- Harriet Sigerman, “‘I Wish I Had Many Hands”: Toilers on the Land.” in Laborers for Liberty: American Women, 1865-1890

8 notes

·

View notes

Text

Times of London on the Duchy of Cornwall

As someone who works in an adjacent field, it's in bad faith, deceptive, and sensationalist. There's nothing controversial about renting land out to farmers or renewable energy sources. It's actually aa good thing!

I do think William should push for the apartments with mold to be fixed and energy efficient, and it seems he is. Also, much of this--in particular, how much money the duchy makes and its investment portfolio--dates back to CHARLES, who was the Prince of Wales for 50+ years. Wills has been Prince of Wales for two. And if squaddies want to cry, please go read the Times' reporting on African Parks and Meghan's workplace bullying. Those pieces were held to the same--if not higher--editorial standards and are in no way "smear campaigns." If you want to pile on criticism for your least fave, take for your most, too.

I also don't think that they should be charging public institutions rent, but annually, the fees are not prohibitively expensive, IMO, but I'm not familiar enough with the UK commercial real estate market. But privately rening commercial space is normal for any business or estate. And the phrasing of leases of 5/10/20 etc years is very deceptive and confusing wording.

5 notes

·

View notes

Text

1. There are 300,000 items in the average American home (LA Times).

2. The average size of the American home has nearly tripled in size over the past 50 years (NPR).l

3. And still, 1 out of every 10 Americans rent offsite storage—the fastest growing segment of the commercial real estate industry over the past four decades. (New York Times Magazine).

4. While 25% of people with two-car garages don’t have room to park cars inside them and 32% only have room for one vehicle. (U.S. Department of Energy).

5. The United States has upward of 50,000 storage facilities, more than five times the number of Starbucks. Currently, there is 7.3 square feet of self storage space for every man, woman and child in the nation. Thus, it is physically possible that every American could stand—all at the same time—under the total canopy of self storage roofing (SSA).

6. British research found that the average 10-year-old owns 238 toys but plays with just 12 daily (The Telegraph).

7. 3.1% of the world’s children live in America, but they own 40% of the toys consumed globally (UCLA).

8. The average American woman owns 30 outfits—one for every day of the month. In 1930, that figure was nine (Forbes).

9. The average American family spends $1,700 on clothes annually (Forbes).

10. While the average American throws away 65 pounds of clothing per year (Huffington Post).

11. Nearly half of American households don’t save any money (Business Insider).

12. But our homes have more television sets than people. And those television sets are turned on for more than a third of the day—eight hours, 14 minutes (USA Today).

13. Some reports indicate we consume twice as many material goods today as we did 50 years ago (The Story of Stuff).

14. Currently, the 12 percent of the world’s population that lives in North America and Western Europe account for 60 percent of private consumption spending, while the one-third living in South Asia and sub-Saharan Africa accounts for only 3.2 percent (Worldwatch Institute).

15. Americans donate 1.9% of their income to charitable causes (NCCS/IRS). While 6 billion people worldwide live on less than $13,000/year (National Geographic).

16. Americans spend more on shoes, jewelry, and watches ($100 billion) than on higher education (Psychology Today).

17. Shopping malls outnumber high schools. And 93% of teenage girls rank shopping as their favorite pastime (Affluenza).

18. Women will spend more than eight years of their lives shopping (The Daily Mail).

19. Over the course of our lifetime, we will spend a total of 3,680 hours or 153 days searching for misplaced items. The research found we lose up to nine items every day—or 198,743 in a lifetime. Phones, keys, sunglasses, and paperwork top the list (The Daily Mail).

20. Americans spend $1.2 trillion annually on nonessential goods—in other words, items they do not need (The Wall Street Journal).

21. The $8 billion home organization industry has more than doubled in size since the early 2000’s—growing at a staggering rate of 10% each year.

becomingminimalist.com

12 notes

·

View notes

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure. — Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

7 notes

·

View notes

Text

Seattle's Unification Church owned mansion sold – and will be demolished

6601 Northeast Windermere Road, Seattle, WA 98105

The original Rolland Denny estate home in Seattle’s exclusive Windermere neighborhood has been sold. On the market since 2022, Loch Kelden was recently sold to developers for what real-estate sites say is $5.999.900.00, “pending feasibility.”

Preservationists could not nominate it as a city landmark because the state Supreme Court has exempted religious entities from landmark designation unless such owners support or seek it. Thus, demolition appears imminent.

This gem of Seattle history is nestled behind a curtain of trees: it's the 7,700-square-foot mansion that Rolland Denny, the first son of Seattle pioneer Arthur Denny, built in 1907.

Shortly after moving in, in 1908, Denny named his new domain "Lochkelden" — loch, meaning "lake" in Scottish; "Kel" for his wife, Alice Kellogg; and "Den" for Denny. Today, it's the only residence left in Seattle where one of the original pioneers lived.

Rolland Denny was an infant when Arthur Denny and the original pioneers arrived on Alki Beach in 1851. The Duwamish Tribe helped keep him alive by teaching his mother to feed him clam broth through the winter.

Like any 100-year-old institution worth its salt, the old Windermere mansion, as it's called, is not without intrigue.

In 1974, the Unification Church, a nontraditional church established by Sun Myung Moon in Korea in the 1940s, bought the property and its remaining 1.7 acres for $175,000.

In 1977, a group of Windermere neighbors, "Save Our Neighborhood," brought a lawsuit against the new owners, questioning their right to use the residential property for religious and commercial ventures. The lawsuit, spurred partly by a popular condemnation of the church's mass marriages and recruitment techniques, was dropped in 1982.

A community feature is access to the waterfront/private beach.

While some neighbors remain uncomfortable with the Unification Church's hold on the property, others applaud the church's efforts to refurbish the house, which suffers from the inevitable internal decay of 100-year-old plumbing and wiring.

"There's so much to fix. I have so many projects. And it's an absolute bottomless pit for money," said Scott Dolfay twenty years ago. He is a carpenter and had been a church member since 1981. In 2001, he helped raise $180,000 from the church for maintenance purposes and estimates he and other church members have contributed over a million dollars more in personal cash, materials and volunteer work since then.

Exploring the old mansion is like peeling back layers of time, he says: There's the false-backed cupboards in the master bedroom, that can be revealed using a pulley-system, rigged to the closet.

_________________________________

Boston UC Mansion at 46 Beacon Street purchased in 1976 for $475,000 now sold for $20.5million

Unification Church sells Cardinal Cushing Villa in Gloucester for $5 million

Jin-joo Byrne was raped and murdered in August 2002. She was just 18. She was fundraising on her own with costume jewellery in Charlotte NC. Some time later it was arranged for Hak Ja Han, on a visit to Seattle, to meet the family who lived there. Hak Ja Han was not very sympathetic. One person understood what she said in Korean.

All these UC members were killed while fundraising for Sun Myung Moon and Hak Ja Han

2 notes

·

View notes

Text

COMMERCIAL PROPERTY FINANCING – ALL TYPES - $400K to $50MILLION! (Refinance Cashout & Purchase)

COMMERCIAL & MULTIFAMILY PROPERTY FINANCING! MOST PROPERTY TYPES QUALIFY: Automotive Repair – Retail – Medical Office – Warehouse - Daycare Center - Restaurants – Bars - Light Industrial - Mixed Use - Mobile Home Park - Self Storage, Up To 75% LTV Refinance Cashout! * Up To 80% LTV On Purchases! * 30 Year Financing, * No Tax Returns! * No Personal Income Docs Required! * 24-48 Hour Prequalification with No Credit Pull Required! APPLY ONLINE @ Investor Rehab Funding dot com

NAME: Investor Rehab Funding, LLC

PHONE: 844-244-1420

URL: https://www.investorrehabfunding.com/commercial-multifamily

Email: [email protected]

#Commercial real estate loans#loans for restaurants#daycare center commercial loans#commercial financing for self-storage warehouse#light industrial commercial property financing#refinance cash out commercial property loans#12 month bank statement loans#30 year financing commercial property#bank statement commercial financing#commercial property loans#no personal income commercial financing#purchase loans for commercial property#private money commercial loans#medical office commercial financing#commercial property refinance cash out#financing for restaurants#commercial loans for bars#financing for daycare centers#bank deposit private money loans commercial property#refinance cash out commercial loans#commercial loans for mobile home park#purchase financing for commercial properties#no tax return commercial financing#financing for warehouse#automotive repair shop mortgage loans#office building financing#Apartment building financing#financing for day care centers#mixed use property financing#mobile home park refinance cash out

0 notes

Text

The Ideal Short Term Loans UK is Available From Payday Quid

Are you in dire need of money, but your disability is getting in the way? Are short term loan lenders refusing to offer you the money because you lack regular income as a result of being laid off? If you said "yes," then don't worry; several lenders have quick fixes for your money problems. Short term loans UK might provide you with the necessary financial assistance to obtain the money you urgently need. Without a debit card, a borrower can still find a loan through the connected lenders. As a result, you will be able to obtain the funds in the shortest amount of time.

Short term loans UK are unsecured and have a limited duration. You can relax if you don't own any real estate because it is not required to put assets up as security against the borrowed amount. To get approved for this loan program, your credit history does not need to be great. People with defaults, arrears, late payments, foreclosure, bankruptcy, or a low credit score can locate an appropriate lender who can offer minor financial support for any urgent fiscal need.

All UK citizens are eligible for short term loans direct lenders, but only after they fulfil a few prerequisites. You must be older than 18 and have had an open bank account in your name for the previous six months in order to qualify for this planned financial product. You need to have a bank account that accepts direct deposits in order to receive the loan securely. In addition to them, you should make a minimum of £500 per month to considerably boost your chances of getting a loan approved the same day you apply.

Apply today for a no fee loan from Short Term Loans UK Direct Lender

In contrast to short term loans UK direct lender, you can obtain a sum between £100 and £1,000 upon acceptance. Within 14 to 31 days, you must settle the debt. These flexible loans can be used for any legitimate purpose in accordance with your needs. You have complete discretion to use the money for any private expense. You can pay your rent, electricity bills, credit card payments, home insurance installments, child's school or tuition fees, and other expenses with the supplied sum. You are advised to fill out the online form with your personal information if you want to receive the money as soon as possible on the same day. In the shortest amount of time, the approved funds are sanctioned for direct deposit into your account.

For those looking for alternatives to same day loans UK or short-term loans, Payday Quid works to offer the best service and most affordable rates. Payday Quid is a non-profit, in contrast to many payday loan providers, and we virtually always charge less than payday lenders and other commercial short-term lenders. To see how reasonable our prices are, click here.

Our loans are longer-term than payday loans, which are frequently quite same day loans UK. Can be paid off over a period of up to 18 months, making it easier and more reasonable for you to do so. You are also allowed to make early repayments at any time without incurring penalties, allowing you to pay the least amount of interest.

https://paydayquid.co.uk/

4 notes

·

View notes

Text

Significance of Economic Institutions in the World Economy

With the advent of globalization, there is a rapid increase in the free flow of goods and services, capital, labor and finance between nations. It involves an exchange of various factors such as technology, economics, and politics across nations due to advancement in communication, transportation, and infrastructure systems. It can be defined as an economic interdependence between countries all over the world. In an attempt to analyze the significance of economic institution, we must first know what is an economic institution. As the society emerge from its primitive era, the institution began to have vast definitions, one of which is where North stated, ‘Institutions are the formal and informal rules and norms that organize social, political and economic relations. In a simpler sense, the institutions are ‘the underlying rules of the game’ and the ‘organizations are groups of individuals bound by a common purpose’. Organizations are shaped by institutions and, in turn, influence how institutions change.

To further explain the economic institution, we will give an insight to the abstract concepts or systems such as the basic institutions in market economy: private property, free markets, division, and combination of labor, and social cooperation.

Private Property

The first one is the private property where we should clarify that it does not solely points to real estate; it may be an intellectual property like a copyright or trademark. A property right, by definition, is the exclusive authority to determine how a resource is used, whether that resource is owned by government or by individuals. Most of what people do can be explained in terms of establishing, protecting and maximizing the value of personal property. All of the production and civilization rests on recognition of and respect for property rights. Therefore, a free enterprise system is impossible without security of property as well as security of life. And of course, when property rights are secure, owners of capital are more likely to invest on such, thus, making an effect on the economy on a macroscale. One of the examples of international economic institutions we can give that promotes the worldwide protection of intellectual property is the World Intellectual Property Organization or WIPO, which is a specialized agency of the United Nations that establishes an institutional framework for the protection of intellectual property internationally.

Free Market

The second one is the free market where the idea is that everybody has freedom to dispose their property or exchange it for other property or for money. In short, he can do anything with it, on whatever terms he finds acceptable. It is important to insist that private property, especially by means of production, and free markets are not separable institutions. The free market and the free price system provide availability of goods from around the world to the consumers. Saving and investment can then develop capital goods and increase the productivity and wages of workers, thereby increasing their standard of living. Free market and free trade are concepts that are related to one another as they both promote economic freedom for buyers and sellers. And as the world economy progress, the World Trade Organization or WTO was formed as a global international organization that reduce barriers among countries by setting the framework for international trade policies. They also provide technical cooperation to less developed and developing countries, therefore, ensuring that developing and less developed countries have better share of growth in the world trade. They are also encouraging the growth of social capital that affects the levels of trust and willingness to engage in commercial exchange.

Division and combination of labor

As we go to the division and combination of labor, Adam Smith explains that the productive powers of labor widely improve as the workers divide labor in an effort to save time that’re commonly lost in sorting of work in an individual task. His ideas were mainly the basis of capitalism as we know today. Nearly two centuries of economic study have only intensified the recognition that the society today implies—division of labor is more productive than doing an isolated work. The logic stands as: if there are more steps in production, then there are more division of labor; if it has lower cost then it also has lower price; the larger markets are, the more sales we get. The division of labor is limited by the extent of the market. And if we expand the market, it’ll become increasingly profitable to have workers specialize. Flexible labor market is attractive for inward flows of foreign direct investment which boosts growth in the economy. It can also help improve the trade-off between unemployment and inflation.

Social Cooperation

Division and combination of labor already imply social cooperation. They imply that each exchanges part of the special product of his labor for the special product of the labor of others. But division of labor, in turn, increases and intensifies social cooperation. And on a macroeconomic scale, the whole free world is bound together in a system of international cooperation through mutual trade, in which each nation supplies the needs of others for a cheaper and better price than the others who could supply their own needs, acting in isolation.

Bangko Sentral ng Pilipinas

Institutions are a crucial facilitator of social and economic development which can be major source of growth; effective institutions aid investment in physical and human capital, in research and development, and in technology. In reality, various factors such as weather, global shocks and commodity prices cannot be avoided, but the strength of the institutions are the responsibility of all people in a democratic system. Institutions make sure that resources are properly allocated, and ensure that the underdeveloped and developing countries or those with fewer economic resources are protected, in which, play an important role of redistribution in the world economy. They also adhere to a common set of laws in which they encourage trust by providing policing and justice systems. In a nutshell, as we analyze each one of them, we can conclude that these are not separate institutions, rather, they are mutually dependent: each implies the other and makes it possible.

References:

Antelme, Marie (2016) The Importance of Institutions. Correspondent: The Coronation Fund Managers Personal Investments Quarterly.

Hazlitt, Henry (1998) The Foundations of Morality. The Foundation for Economic Education, Inc.

North, D. (1990). Institutions, institutional change, and economic performance. New York: Cambridge University Press.

Smith, Adam (1776/1904) An Inquiry into the Nature and Causes of the Wealth of Nations, edited with an Introductio

2 notes

·

View notes

Text

Empowering Commercial Ventures: Real Estate Loans in Orange County

Unlock growth with Commercial Real Estate Loans in Orange County. Our financial solutions empower businesses to acquire, develop, or refinance commercial properties. Trust our expertise in tailoring loans to your project's needs, ensuring favorable terms and flexible repayment options. With a commitment to supporting your ambitions, we offer reliable solutions that align with your business goals. Experience the advantage of securing your commercial real estate dreams with our exceptional services.

#private money lender orange county#private money lenders for real estate#home construction loans#fastfinancing#hard money loans san diego#hard money lenders orange county#orangecounty#best mortgage lenders los angeles#loansolutions#mortgage brokers orange county#commercial real estate loan

0 notes

Text

Real Estate Startups Aren’t Seeing Much Love

Both mortgage interest rates and property prices have risen sharply, making homeownership far less affordable. Cheap houses are hard to find, unless they come with a money pit’s worth of repairs.

In tandem, the share of renter households is on the rise, and the number of home sales on the decline. Existing homeowners are largely staying put, and would-be homebuyers are finding few desirable, nonexorbitant options.

These market shifts mean more bad news for real estate unicorn startups funded during the boom cycle a few years ago. We’re seeing this play out with collapsing share prices of several that made it to the public market, such as Opendoor, Offerpad and Better.com.

Startup investors have also cut back on new real estate-related financings. So far this year, U.S. companies in sectors tied to real estate have raised $3.5 billion in investment across funding stages. That puts 2024 on track to deliver the lowest funding tally in years, as charted below.

We’ve seen particular pullbacks around startups in the mortgage space. With rates higher, fewer homeowners are refinancing. In tandem, funding to companies with the term “mortgage” in their Crunchbase profile totaled less than $140 million in 2023 and 2024, down over 80% from the prior two years.

One-time unicorns focused on mortgages and home closings have also taken a beating. Better.com, which focused on automating the mortgage application process, approved a 1-for-50 reverse stock split this summer, after shares cratered. Doma, which focused on adding efficiency to the home sale closing process, sold to title insurer Title Resources Group in September after its stock collapsed.

Buying and holding vacant real estate has also become costlier. This apparently hasn’t helped Opendoor and Offerpad — two “iBuyer” businesses optimized for a low-interest rate environment that also have seen their shares crater. Last week, Opendoor laid off 300 employees amid mounting losses.

Private, venture-backed companies have faltered as well. Veev, a Bay Area startup that raised nearly $600 million to reinvent the homebuilding process, shuttered last year and sold its assets to homebuilder Lennar. Investment around the broader smart home theme has also weakened, as we chronicled earlier this year.

For commercial real estate, meanwhile, it doesn’t help that the most famous venture-backed play in this space is undeniably WeWork. The co-working company emerged from bankruptcy this summer, effectively wiping out the billions in equity it raised over the years.

All this is to say it’s not too surprising to see overall real estate-related venture investment is down. Nonetheless, we do still see pockets of active fundraising in areas including rental management, eco-friendly building materials, and tools to simplify construction. In a follow-up installment, we’ll take a look at who’s getting funded in these and other areas.

0 notes

Text

Finding Commercial Real Estate Deals Using Advanced Data-Driven Strategies with Neal Bawa

Private Money Academy Conference:

Free Report:

Neal Bawa is CEO / Founder at Grocapitus and Mission 10K, two commercial real estate investment companies.

Neal’s companies use cutting-edge real estate analytics technology to source and acquire OR build large Commercial properties across the U.S., for over 1,000 investors—a current portfolio of over 4,400 units, with an AUM value of $660M.

Neal shares his team’s unique and cutting-edge real estate data methodologies to connect with geeky and nerdy (or just data-driven) investors who share his vision – that data beats gut feel by a million miles. Over 10,000 real estate investors have taken his free Real Estate Data Analytics course on udemy.com and the course has over 1,000 five-star reviews.

Neal speaks at dozens of real estate conferences across the country and virtually online. Over 5,000 investors attend his multifamily webinar series each year, and hundreds have attended his Magic of Multifamily boot camps.

His Facebook and meetup groups have tens of thousands of investors. Neal believes that we are at a turning point. Traditional commercial real estate will combine with Proptech and Fintech technology disruptors and reach its potential as a tradable, highly liquid asset class that will rival and eventually beat the stock market in size and scope.

Timestamp:

00:01 Raising Private Money Without Asking For It

04:37 Built campuses, learned depreciation and benefited financially.

08:50 Custom graphics promote Indianapolis investment strategy.

10:32 Building authentic brand with affordable assistance.

15:52 Enjoy working with newcomers in private money.

17:15 AI boosts efficiency despite needing edits.

19:52 Efficient workweek with executive assistants enhances productivity.

27:19 Google Neal Bawa or Multifamily University online.

29:35 Tune in for more amazing private money insights.

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

What is Private Money? Real Estate Investing with Jay Conner

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

youtube

YouTube Channel

Apple Podcasts:

Facebook:

#youtube#flipping houses#private money#real estate#jay conner#raising private money#real estate investing for beginners#real estate investing#foreclosures#passive income

0 notes

Text

Third spaces were such a big deal throughout history that it's become a literal meme for the fantasy genre: "You all meet in a tavern..." Then it moved to local pubs then to social clubs then to organized not-that-physically-demanding sports leagues like bowling or darts then to coffee shops and then...well...nowhere.

Third spaces are the central social hub where people would hang out and talk and tell stories and catch up on gossip and current events and talk about grievances and get angry at power structures with one another and make plans to address issues...starting to see why this feels a bit intentional and systematic? And again, it's not a recent thing. The scene in Hamilton where they're all drinking and planning the American Revolution was more or less how it happened in history. Rebellions and revolutions and unions and strikes all started with people hanging out in third spaces and talking.

Now, third spaces are a luxury for the rich. Country club memberships, yacht parties, exclusive social events like charity galas and political fundraisers, etc.

What happened? Ask yourself if you were going to go to the local bowling alley or pool hall or American Legion, how would you get there? Drive. How far would you drive? How much traffic would you face? How long would you be able to spend there considering the time to get there and get home in time to get enough sleep for work the next day? And that's assuming you even have the ability to do so with expenses like gas and parking fees and tolls and child care.

Meanwhile, the specific places are less friendly to just hanging out. Not just for the reasons mentioned above, but also because they're just no longer good places to chill. Bars play loud music, restaurants are built to turn over customers faster, bowling alleys and pool halls and the like tend to charge per person per hour instead of per game (so you can't take your time and play at a leisurely pace to spend time talking and stretch your dollar), and a LOT of locations close far too early.

Not to mention a lot of the over-commercialization of these spaces is driven by rising real estate prices. Unless you're constantly turning over tables or getting more money out of guests, it's not easy to afford the lease on a property in a good location. In my particular industry (tabletop gaming), it happened a lot in the 2010s with a lot of hobby game stores closing due to rising rent as people would just hang out and play D&D or Magic: The Gathering or Settlers of Catan all day and only make one purchase for the entire time giving over to game cafes that served food, coffee/tea, and sometimes beer/wine/liquor to squeeze more money out of people.

Sure, online communities can pick up the slack, but a lot of those aren't exactly safe spaces. Google, Facebook, Amazon, Twitter, etc. can monitor everything said even in private groups and chats then sell that information. Or, as seen in a few recent cases, hand the private information over to law enforcement. Kind of hard to talk about forming a union or organizing a protest when the place you're discussing it is logging every word and handing it right over to the people you're looking to organize against.

40K notes

·

View notes