#Principle of Cumulative Advantage

Text

Something that is really important to be aware of if you are a white person who truly does believe in the principles of anti-racism education, outreach, and social betterment of people of color is that we are the LEAST qualified demographic to know how to effectively fight racism in the public sector or in ones immediate communities online and offline

If you have not dedicated YEARS of sustained study, struggle, focus, relationship building, mistake making, and repair, your opinions are necessarily VERY limited in regards to the proper way to fight racism as a white person who is currently a direct beneficiary of the system that routinely advantages you, while simultaneously producing cumulative and chronic adverse effects for communities of color

2 notes

·

View notes

Text

Selection and Application of Liquid Flowmeter

Reading guide: The liquid volume flowmeter consists of a chamber with a known volume and moving parts. The liquid passing through the flow is calculated by determining the volume of the container and the number of movements of the moving parts. According to the characteristics of liquid volume flowmeter, it can be divided into the following types: waist wheel flowmeter, oval gear flowmeter, scraper flowmeter, double rotor flowmeter, reciprocating piston flowmeter, rotary piston flowmeter, screw flowmeter, etc.

Structure and principle of the liquid volumetric flowmeter calibration device

The liquid accumulation calibration device consists of the quick connector, hydraulic hose, hydraulic filter, standard flowmeter, temperature transformer, pressure transformer, computer system, hydraulic source, etc. The hydraulic oil source also includes a hydraulic oil tank, variable frequency motor, hydraulic variable pump, hydraulic safety valve, and other components. The main features are compact installation, easy use, the same calibration medium, strong movement ability, and the ability to provide hydraulic oil. The working mode of the liquid flow controller is as follows: match through quick connection and replacement, and lead the hydraulic hose into the displaced liquid flow controller calibration device; The hydraulic power converter of the investment department generates clean and stable liquid flow through the hydraulic pump, hydraulic filter, etc. Capture the cumulative flow value determined by the computer system using the calibrated flowmeter and the standard flowmeter, and capture the temperature and pressure on the calibrated flowmeter and the standard flowmeter; The measured value error of calibrated flow is determined by the computer software system.

Main characteristics and application of common liquid flowmeter

Volumetric flowmeter

Volumetric flow meters (also called volume-specific flow values) are general-purpose instruments with the highest accuracy. The measured components can also be divided into the following main features: pitch circle (two rotors), plate flow measurement, oval gear flow measurement, rotary piston flow measurement, circulation flow measurement, etc.

① Advantages: high measurement accuracy; It can be used for measuring high viscosity fluid and simple phase fluid; The instrument does not need external energy to directly record the total flow. It is easy to install without special requirements for front and rear tangent lines.

② Disadvantages: not suitable for high temperature and low temperature; Type of measuring center with limited diameter; Pressure drop; Periodic calibration is required.

③ Application: Volume traffic signs, due to their high-precision measurement in energy, petroleum, medicine, food, chemistry, and other fields, especially raw materials and other fields, must be measured for storage, transfer, and distribution, and used as the basis for a financial settlement, or as a legal indicator of the contract between two tax dealers.

Differential

The differential is one of the most commonly used flowmeter types, which can be divided into diverter flowmeter, Venturi flowmeter, average line current, etc. according to the test piece (inlet instrument). The main features are:

① Advantages: single-phase fluid has a wide range of measurement methods, some mixed fluids; Simple structure, easy maintenance, the long service life of control components and detonators, display equipment produced by different manufacturers, improving economies of scale.

② Disadvantages: general customization accuracy; Large pressure loss (orifice plate, nozzle, etc.) The assembly constraint shall be high, and there shall be enough straight pipelines before and after assembly.

③ Nozzle: When measuring the flow in the closed pipe for the first time, the differential can be used for projects under different conditions where the flow is about 1/4-1/3 of the total flow.

Ultrasonic assistance

The ultrasonic flowmeter can be generally divided into plug-in type, pipe section type, external clamp type, and portable type.

① Advantages: large diameter non-contact measurement, large flow calculation; Pressure loss, no fluid disturbance; Suitable for every liquid, easy to install and maintain.

② Disadvantages: When the measured liquid contains bubbles or noise, the measurement accuracy will be affected; The temperature range of the measured liquid is limited by the heat of the ultrasonic protection and the communication materials between the switch and the line, and the original data for measuring the high temperature of the liquid is incomplete.

③ Application: Ultrasonic velocimeter is often used in petroleum, chemistry, metal, electric power, and other fields, and is often used to measure the emission reduction of gas pipelines in factories, fluids, and work areas.

Turbine speed

Intel Remax accelerated technology plan has been expanded to multiple categories in mass production, and its main features are as follows:

① High precision, usually ± 0.25% r - ± 0.5% r, up to ± 0.25% r - ± 0.5% r; Repeat at most 0.05% r-0.2% r for a short time; Zero contact movement, sturdy and durable.

② Disadvantages: The physical characteristics of the liquid have a great influence on the flow characteristics; Calibration characteristics cannot be saved for a long time.

③ Application. A turbine flow counter is usually used to measure oil, organic liquid, inorganic liquid, and liquid frozen body. The first terminal of the main raw material pipeline is used for commercial calculation of automobile exhaust, gas stations, and light hydropower plants.

Vortex flowmeter

The vortex flowmeter is the latest flowmeter, but it has developed rapidly and has become a common category. Its main characteristics are as follows. ① Advantages: wide application range, liquid, gas, and steam flow measurement can be used; Small pressure loss; Easy installation, simple and durable structure. ② Disadvantages: poor anti-interference ability; Straight pipe section is required before and after installation; The application experience in pulsating flow and multiphase flow is still lacking.

③ Application: Vortex flowmeter has a wide range of applications, usually used in the factory water supply system, and its application will be limited in the case of high viscosity, low flow rate, and small diameter.

General criteria for flowmeter selection and calibration device

Determine the technical requirements for flow measurement and the correctness of the flowmeter, that is, the accuracy requirements for measuring liquid; The flow measurement is repeated, that is, the same measurement is performed multiple times under specific conditions to repeat the same measurement. The expression of flow measurement, that is, whether the flow is mass flow or flow, real-time flow, or cumulative flow. Command and remove the transmission function if necessary. Specifies whether the flow measurement is displayed as a mechanical or electronic title. If the flowmeter does not meet the technical requirements of the measured liquid, measurement errors may also occur.

For the description of the flow calibration liquid calibration device, according to the flow requirements in jgg667-2010:

① The expanded uncertainty of the standard setting should generally not exceed 1/3 of the maximum allowable flow, because the expanded rate of the calibration device is 0.22%.

② Output or. The input line in the equipment used for online identification shall not include redirection between the flowmeter and the equipment designed as a locked cabinet without intermediate circuit.

③ "When the flowmeter is greater than 1.0, the flowmeter and liquid temperature must be measured according to the standard, and the temperature and pressure shall be measured near the standard flowmeter or calibrated flowmeter. Therefore, the liquid flow controller is applicable to the acceptance accuracy standard of Class 1.0 (allowable deviation ± 1.0%) and subsequent fluid calculation.

Conclusion

In the process of liquid flow measurement, a liquid flowmeter is a major measuring tool and has been widely used in metallurgy, pharmacy, paper making, water conservancy, environmental protection, petrochemical, and other fields. In the actual online calibration process, the standard volume method, the standard meter method, and the electrical parameter method are all feasible online calibration methods. However, they all have different use conditions, which requires the staff to constantly summarize and analyze the use of online calibration methods for liquid flow meters, so that the calibration methods can be improved.

Article from: supmeaflow.com

2 notes

·

View notes

Text

EMF Security with Protection Arm Band Deliverable

1. Introduction to EMF Security

- The Importance of EMF Protection

2. Understanding Electromagnetic Fields (EMFs)

- Sources of EMFs in Daily Life

3. Health Implications of EMF Exposure

- Short-term and Long-term Effects

4. The Science Behind EMF Protection Devices

- How EMF Protection Arm Bands Work

5. Key Features of EMF Protection Arm Bands

- Materials and Design

6. Benefits of Using EMF Protection Arm Bands

- Physical and Psychological Advantages

7. Comparative Analysis: EMF Arm Bands vs. Other Protection Methods

- Effectiveness and Convenience

8. User Experiences and Testimonials

- Real-life Success Stories

9. How to Choose the Right EMF Protection Arm Band

- Factors to Consider

10. Future Trends in EMF Protection

- Innovations and Developments

EMF Security with Protection Arm Band Deliverable.

Introduction to EMF Security

In an increasingly digital world, the need for electromagnetic field (EMF) security has never been more paramount. Our reliance on electronic devices, from smartphones to Wi-Fi routers, exposes us to an omnipresent web of EMFs. These invisible energy waves, while essential for modern conveniences, pose potential risks that necessitate effective protection solutions.

The Importance of EMF Protection

EMF protection is crucial for safeguarding our health and well-being. The pervasiveness of EMF sources in our environment means that passive exposure is nearly unavoidable. Implementing protective measures can mitigate the adverse effects, contributing to a healthier lifestyle.

you can also try this product[EMF Protection with Defense Bracelet]

Understanding Electromagnetic Fields (EMFs)

EMFs are generated by the flow of electricity through wires and electronic devices. They encompass a spectrum that includes extremely low frequency (ELF) fields from power lines and radiofrequency (RF) fields from wireless devices. Understanding the ubiquitous nature of these fields is the first step towards addressing their impact.

Sources of EMFs in Daily Life

Our daily lives are rife with EMF sources. Common culprits include mobile phones, microwave ovens, televisions, and even fluorescent lighting. Each device contributes to the cumulative exposure we experience, highlighting the importance of comprehensive EMF protection strategies.

Health Implications of EMF Exposure

EMF exposure has been linked to a variety of health concerns. While research continues to explore these associations, both short-term and long-term effects have been observed. Symptoms such as headaches, fatigue, and sleep disturbances are commonly reported, with prolonged exposure potentially leading to more serious conditions.

Short-term and Long-term Effects

Short-term effects of EMF exposure can manifest as acute symptoms like dizziness or skin irritation. Long-term exposure, however, raises concerns about chronic conditions, including an increased risk of cancer, neurological disorders, and reproductive issues. Proactive protection can alleviate these risks.

The Science Behind EMF Protection Devices

EMF protection devices, such as arm bands, operate on principles designed to shield or neutralise harmful frequencies. These devices often incorporate advanced materials and technologies that absorb or deflect EMFs, thereby reducing the wearer's exposure.

How EMF Protection Arm Bands Work

EMF protection arm bands are typically infused with metals like copper or silver, known for their conductive properties. These materials create a barrier that disrupts EMF pathways, providing a tangible reduction in exposure. The efficacy of these bands lies in their ability to integrate seamlessly into daily wear while offering robust protection.

Key Features of EMF Protection Arm Bands

A high-quality EMF protection arm band boasts several critical features. The materials used are hypoallergenic and durable, ensuring comfort and longevity. The design is often ergonomic, catering to continuous wear without causing discomfort. Additionally, some bands are adjustable, making them suitable for various wrist sizes.

Materials and Design

The choice of materials is pivotal to the performance of EMF protection arm bands. Metals like titanium and conductive fabrics are favored for their shielding capabilities. The design must balance aesthetics and functionality, ensuring that users can wear the bands discreetly in any setting.

Benefits of Using EMF Protection Arm Bands

The advantages of using EMF protection arm bands extend beyond mere physical health. Users report improved sleep quality, reduced stress levels, and an overall sense of well-being. The psychological comfort of knowing one is protected from unseen hazards cannot be understated.

Physical and Psychological Advantages

Physically, these bands can alleviate symptoms associated with EMF exposure, such as headaches and fatigue. Psychologically, they offer peace of mind, empowering individuals to live their lives without the constant worry of EMF-related health risks.

Comparative Analysis: EMF Arm Bands vs. Other Protection Methods

When comparing EMF protection arm bands to other methods, such as shielding paints or Faraday cages, several factors emerge. Arm bands are more convenient and portable, providing continuous protection without the need for extensive modifications to one's environment.

Effectiveness and Convenience

EMF protection arm bands are effective in offering targeted protection. Their convenience lies in their portability and ease of use, making them a practical choice for individuals seeking a simple yet effective solution to EMF exposure.

User Experiences and Testimonials

The effectiveness of EMF protection arm bands is best illustrated through user testimonials. Many individuals have shared success stories, citing significant improvements in their health and quality of life after using these bands. These firsthand accounts underscore the tangible benefits of EMF protection.

Real-life Success Stories

From professionals in high-tech industries to homemakers, users of EMF protection arm bands have reported a variety of positive outcomes. Enhanced energy levels, fewer health complaints, and a general sense of well-being are common themes among these testimonials.

How to Choose the Right EMF Protection Arm Band

Selecting the appropriate EMF protection arm band involves considering several factors. These include the type and intensity of EMF exposure, personal health conditions, and lifestyle preferences. A well-chosen arm band can provide optimal protection tailored to individual needs.

Factors to Consider

When choosing an EMF protection arm band, consider the material composition, fit, and brand reputation. Reading reviews and seeking recommendations can also guide informed decisions, ensuring the chosen product meets high standards of efficacy and comfort.

Future Trends in EMF Protection

The field of EMF protection is continually evolving, driven by technological advancements and growing awareness. Emerging trends include the development of more sophisticated materials, integration with wearable technology, and increasing accessibility of protection solutions.

Innovations and Developments

Future innovations in EMF protection are likely to focus on enhancing the effectiveness and usability of protective devices. As research progresses, we can anticipate more personalized and adaptive solutions that cater to the diverse needs of users in an increasingly EMF-saturated world.

---

EMF protection arm bands represent a crucial innovation in safeguarding against the unseen yet pervasive threat of electromagnetic fields. By understanding their importance, functionality, and benefits, individuals can make informed decisions to protect their health and well-being in our technologically advanced society.

you can also try this product[EMF Protection with Defense Bracelet]

DISCLAIMER

There are an affillate link of a best product in this article which may make some profit me

0 notes

Text

Best Mechanical Diesel Flow Meters | Eastman Meters

In the fast-paced world of diesel management, one steadfast hero remains: the Mechanical Diesel Flow Meter. While digital meters often steal the spotlight, Mechanical Diesel Flow Meters continue to be the reliable workhorses, driving numerous applications with their straightforward, dependable, and cost-effective design.

The Inner Workings of a Dependable Tool

Mechanical Diesel Flow Meters function on a remarkably simple principle. Diesel flows through the meter, turning an internal propeller, which then translates the flow rate into mechanical rotations. These rotations are converted into measurable units, such as liters or gallons, displayed on a dial or counter. No batteries or complex electronics—just pure mechanical efficiency.

The Enduring Relevance of Mechanical Diesel Flow Meters

Despite the rise of digital meters, Mechanical Diesel Flow Meters remain essential due to several key advantages:

Simplicity and Reliability: Their lack of complex components makes them robust and less susceptible to malfunctions, especially in harsh environments.

Affordability: Their lower initial cost makes them ideal for budget-conscious applications or as backups for digital systems.

Easy Maintenance: With fewer parts, routine maintenance and repairs are simpler and more affordable.

Accuracy: They provide dependable and verifiable measurements, meeting the accuracy requirements of numerous applications.

Eastman Meters: Leading the Way in Mechanical Excellence

At Eastman Meters, we recognize the enduring value of Mechanical Diesel Flow Meters and continually enhance their performance and features. Our range of Mechanical Diesel Flow Meters offers:

Durable Construction: Designed to withstand demanding environments and heavy-duty use.

High Accuracy: Precise measurements you can trust, certified to industry standards.

Variety of Sizes and Flow Rates: Tailored to diverse applications and fuel demands.

User-Friendly Design: Clear readings and easy operation for all users.

Commitment to Quality: Rigorous testing and manufacturing processes ensure long-lasting performance.

Beyond the Basics

While traditional Mechanical Diesel Flow Meters excel in simplicity and affordability, Eastman Meters goes a step further with innovative features like:

Tamper-Resistant Designs: Enhanced security for peace of mind.

Totalizers: Track cumulative fuel consumption for better management.

Calibration Options: Maintain accuracy over time.

From powering generators in remote locations to ensuring accurate fuel dispensing at construction sites, Mechanical Diesel Flow Meters are indispensable tools. Their blend of simplicity, reliability, and affordability makes them a top choice for various diesel management needs. If you seek a dependable and cost-effective solution, Eastman Meters offers a diverse range of high-quality Mechanical Diesel Flow Meters, equipped with features to meet your specific requirements.

For More Information Contact Us: https://eastmanmeters.com/contact-us/

0 notes

Text

Master Financial Literacy with Summit Wealth Investment Education Foundation

Master Financial Literacy with Summit Wealth Investment Education Foundation

Introduction to the Investment Education Foundation

1. Foundation Overview

1.1. Foundation Name: Summit Wealth Investment Education Foundation

1.2. Establishment Date: September 2018

1.3. Nature of the Foundation: Private Investment Education Foundation

1.4. Mission of the Foundation: The Foundation is dedicated to enhancing investors’ financial literacy and investment skills through professional educational services. It aims to assist investors in achieving exponential and secure wealth growth by promoting knowledge of global account investments and fraud detection.

Team Introduction

1. Founder: Pedro Hill, with many years of experience in the financial industry

2. Management Team: Comprising individuals with extensive experience in finance, education, technology, and other relevant fields.

Advantages of the Foundation

1. Highly Qualified Educational Staff: The Foundation boasts a team of highly experienced professionals, including numerous CFA charterholders and NAIFA members, capable of providing high-quality investment education services.

2. Advanced AI Investment System: The Foundation has independently developed the FINQbot, an intelligent AI investment system that offers personalized investment advice and analysis to investors.

3. Support from Tax Incentive Policies: Having obtained approval for tax incentive policies on December 15, the Foundation is able to offer investors more favorable investment costs.

4. Comprehensive Investment Education Activities: The Foundation plans to conduct a year-long series of educational activities, covering a wide range of investment fields, including stocks, government bonds, options, cryptocurrencies, ETFs, and more. These activities aim to enhance investors’ knowledge and skills across various investment domains.

Goals of the Foundation

1. Short-term Goals: Within one year, the Foundation aims to provide investment education services to 100,000 investors, helping them achieve an increase in investment returns ranging from 300% to 1000%.

2. Mid-term Goals: Over the next three years, the Foundation seeks to become the leading investment education foundation in the country, with over one million investors and a cumulative wealth enhancement of 10 billion dollar for its investors.

3. Long-term Goals: The Foundation aspires to establish a comprehensive investment education service network across the United States, fostering rational investment principles among American investors and contributing to the healthy development of the U.S. capital markets.

Future Outlook

1. Becoming the Leading Investment Education Foundation in the Country: The Foundation will continue to expand its service scale and enhance service quality, aiming to become the premier investment education foundation in the country.

2. Establishing a Global Investment Education Network: The Foundation plans to set up branches overseas to provide educational services to investors worldwide.

3. Innovating with Artificial Intelligence and Big Data: The Foundation will leverage AI and big data technologies to continuously innovate its educational service models, offering investors more intelligent and personalized educational services.

We believe that with our professional team, advanced technology, and high-quality services, Summit Wealth Investment Education Foundation will become a trusted educational partner for investors, helping them achieve their wealth aspirations.

0 notes

Text

Ascendancy Investment Education Foundation Launches Advanced AI Investment System

Ascendancy Investment Education Foundation Launches Advanced AI Investment System

Introduction to the Investment Education Foundation

1. Foundation Overview

1.1. Foundation Name: Ascendancy Investment Education Foundation

1.2. Establishment Date: September 2018

1.3. Nature of the Foundation: Private Investment Education Foundation

1.4. Mission of the Foundation: The Foundation is dedicated to enhancing investors’ financial literacy and investment skills through professional educational services. It aims to assist investors in achieving exponential and secure wealth growth by promoting knowledge of global account investments and fraud detection.

Team Introduction

1. Founder: Lucas Turner, with many years of experience in the financial industry

2. Management Team: Comprising individuals with extensive experience in finance, education, technology, and other relevant fields.

Advantages of the Foundation

1. Highly Qualified Educational Staff: The Foundation boasts a team of highly experienced professionals, including numerous CFA charterholders and NAIFA members, capable of providing high-quality investment education services.

2. Advanced AI Investment System: The Foundation has independently developed the FINQbot, an intelligent AI investment system that offers personalized investment advice and analysis to investors.

3. Support from Tax Incentive Policies: Having obtained approval for tax incentive policies on December 15, the Foundation is able to offer investors more favorable investment costs.

4. Comprehensive Investment Education Activities: The Foundation plans to conduct a year-long series of educational activities, covering a wide range of investment fields, including stocks, government bonds, options, cryptocurrencies, ETFs, and more. These activities aim to enhance investors’ knowledge and skills across various investment domains.

Goals of the Foundation

1. Short-term Goals: Within one year, the Foundation aims to provide investment education services to 100,000 investors, helping them achieve an increase in investment returns ranging from 300% to 1000%.

2. Mid-term Goals: Over the next three years, the Foundation seeks to become the leading investment education foundation in the country, with over one million investors and a cumulative wealth enhancement of 10 billion dollar for its investors.

3. Long-term Goals: The Foundation aspires to establish a comprehensive investment education service network across the United States, fostering rational investment principles among American investors and contributing to the healthy development of the U.S. capital markets.

Future Outlook

1. Becoming the Leading Investment Education Foundation in the Country: The Foundation will continue to expand its service scale and enhance service quality, aiming to become the premier investment education foundation in the country.

2. Establishing a Global Investment Education Network: The Foundation plans to set up branches overseas to provide educational services to investors worldwide.

3. Innovating with Artificial Intelligence and Big Data: The Foundation will leverage AI and big data technologies to continuously innovate its educational service models, offering investors more intelligent and personalized educational services.

We believe that with our professional team, advanced technology, and high-quality services, Ascendancy Investment Education Foundation will become a trusted educational partner for investors, helping them achieve their wealth aspirations.

0 notes

Text

Builders Legacy Advance Investment Education Foundation's Mid-term Goals

Builders Legacy Advance Investment Education Foundation's Mid-term Goals

Introduction to the Investment Education Foundation

1. Foundation Overview

1.1. Foundation Name:Builders Legacy Advance Investment Education Foundation

1.2. Establishment Date: September 2018

1.3. Nature of the Foundation: Private Investment Education Foundation

1.4. Mission of the Foundation: The Foundation is dedicated to enhancing investors’ financial literacy and investment skills through professional educational services. It aims to assist investors in achieving exponential and secure wealth growth by promoting knowledge of global account investments and fraud detection.

Team Introduction

1. Founder:Raymond Patterson, with many years of experience in the financial industry

2. Management Team: Comprising individuals with extensive experience in finance, education, technology, and other relevant fields.

Advantages of the Foundation

1. Highly Qualified Educational Staff: The Foundation boasts a team of highly experienced professionals, including numerous CFA charterholders and NAIFA members, capable of providing high-quality investment education services.

2. Advanced AI Investment System: The Foundation has independently developed the FINQbot, an intelligent AI investment system that offers personalized investment advice and analysis to investors.

3. Support from Tax Incentive Policies: Having obtained approval for tax incentive policies on December 15, the Foundation is able to offer investors more favorable investment costs.

4. Comprehensive Investment Education Activities: The Foundation plans to conduct a year-long series of educational activities, covering a wide range of investment fields, including stocks, government bonds, options, cryptocurrencies, ETFs, and more. These activities aim to enhance investors’ knowledge and skills across various investment domains.

Goals of the Foundation

1. Short-term Goals: Within one year, the Foundation aims to provide investment education services to 100,000 investors, helping them achieve an increase in investment returns ranging from 300% to 1000%.

2. Mid-term Goals: Over the next three years, the Foundation seeks to become the leading investment education foundation in the country, with over one million investors and a cumulative wealth enhancement of 10 billion dollar for its investors.

3. Long-term Goals: The Foundation aspires to establish a comprehensive investment education service network across the United States, fostering rational investment principles among American investors and contributing to the healthy development of the U.S. capital markets.

Future Outlook

1. Becoming the Leading Investment Education Foundation in the Country: The Foundation will continue to expand its service scale and enhance service quality, aiming to become the premier investment education foundation in the country.

2. Establishing a Global Investment Education Network: The Foundation plans to set up branches overseas to provide educational services to investors worldwide.

3. Innovating with Artificial Intelligence and Big Data: The Foundation will leverage AI and big data technologies to continuously innovate its educational service models, offering investors more intelligent and personalized educational services.

We believe that with our professional team, advanced technology, and high-quality services,Builders Legacy Advance Investment Education Foundation will become a trusted educational partner for investors, helping them achieve their wealth aspirations.

1 note

·

View note

Text

Innovatech Investment Education Foundation: Strategic Goals

Innovatech Investment Education Foundation: Strategic Goals

Introduction to the Investment Education Foundation

1. Foundation Overview

1.1. Foundation Name: Innovatech Investment Education Foundation

1.2. Establishment Date: September 2018

1.3. Nature of the Foundation: Private Investment Education Foundation

1.4. Mission of the Foundation: The Foundation is dedicated to enhancing investors’ financial literacy and investment skills through professional educational services. It aims to assist investors in achieving exponential and secure wealth growth by promoting knowledge of global account investments and fraud detection.

Team Introduction

1. Founder: Bertram Charlton, with many years of experience in the financial industry

2. Management Team: Comprising individuals with extensive experience in finance, education, technology, and other relevant fields.

Advantages of the Foundation

1. Highly Qualified Educational Staff: The Foundation boasts a team of highly experienced professionals, including numerous CFA charterholders and NAIFA members, capable of providing high-quality investment education services.

2. Advanced AI Investment System: The Foundation has independently developed the FINQbot, an intelligent AI investment system that offers personalized investment advice and analysis to investors.

3. Support from Tax Incentive Policies: Having obtained approval for tax incentive policies on December 15, the Foundation is able to offer investors more favorable investment costs.

4. Comprehensive Investment Education Activities: The Foundation plans to conduct a year-long series of educational activities, covering a wide range of investment fields, including stocks, government bonds, options, cryptocurrencies, ETFs, and more. These activities aim to enhance investors’ knowledge and skills across various investment domains.

Goals of the Foundation

1. Short-term Goals: Within one year, the Foundation aims to provide investment education services to 100,000 investors, helping them achieve an increase in investment returns ranging from 300% to 1000%.

2. Mid-term Goals: Over the next three years, the Foundation seeks to become the leading investment education foundation in the country, with over one million investors and a cumulative wealth enhancement of 10 billion dollar for its investors.

3. Long-term Goals: The Foundation aspires to establish a comprehensive investment education service network across the United States, fostering rational investment principles among American investors and contributing to the healthy development of the U.S. capital markets.

Future Outlook

1. Becoming the Leading Investment Education Foundation in the Country: The Foundation will continue to expand its service scale and enhance service quality, aiming to become the premier investment education foundation in the country.

2. Establishing a Global Investment Education Network: The Foundation plans to set up branches overseas to provide educational services to investors worldwide.

3. Innovating with Artificial Intelligence and Big Data: The Foundation will leverage AI and big data technologies to continuously innovate its educational service models, offering investors more intelligent and personalized educational services.

We believe that with our professional team, advanced technology, and high-quality services, Innovatech Investment Education Foundation will become a trusted educational partner for investors, helping them achieve their wealth aspirations.

0 notes

Text

Solutions and principles of energy storage systems on the generation side

The current normal operation of the power system must first face an engineering problem: to realize the real-time dynamic balance between power consumption and power supply. If consumption continues to be greater than the supply, it will form a power supply shortage, resulting in some customer blackouts; if the supply continues to be greater than the consumption, it will be manifested in the frequency exceeds the standard, affecting the quality of power, and ultimately affecting the normal use of the customer.

The principle is shown below:

The grid is located at the core of the power system and is responsible for maintaining the dynamic balance between consumption and supply. Adjusting the real-time power generation supply from the power source becomes critical, as power cannot be stored and deviations between consumption and forecasts need to be adjusted in real time. Traditional power sources work smoothly with the grid, but new energy power plants are constrained by natural conditions, and their volatility and intermittency pose challenges that require good controllability of the power source. New energy development will force the grid to adjust the scheduling mode, gradually oriented to new energy direct scheduling.

Generation side energy storage from the use of the main two categories:

Auxiliary thermal power dynamic operation. It can reduce the cost of equipment maintenance and replacement, improve the efficiency of thermal power units, and thus reduce carbon emissions.

Realize new energy-friendly grid connection. Wind and photovoltaic power generation is affected by seasonal and meteorological factors, and has a large intermittency and randomness, through the configuration of the energy storage system, it can improve the renewable energy-friendly grid connection and promote the development and utilization of renewable energy.

From the level of application scenarios, over the past 10 years, the cumulative installed proportion of new energy storage on the power generation side has ranged from 21.2% to 47.6%, of which the installed proportion of new energy storage on the power supply side is the highest at 47.6% in 2020, and slightly decreases to 44.7% in 2021.

From the level of technology distribution, as of the end of 2021, the proportion of lithium-ion batteries in power generation side energy storage is 97.5%, followed by 1.4% of liquid current batteries, 1.0% of lead-acid batteries, supercapacitors, and flywheels, both of which account for 0.1%.

An expedient solution for the coexistence of power systems and new energy power sources:

In response to this dilemma, a solution is proposed: as long as the total power supply (new energy power generation + traditional power generation) is equal to the total power demand, the stability of the power system can be maintained. If the supply of new energy power is insufficient, the traditional power supply will be dispatched.

Specific operational steps are: first predict the future electricity demand; then predict the overall future supply of new energy power supply, the difference between the supply and demand is the future supply of traditional power generation. The traditional power supply is then broken down into each traditional power station, which forms the power generation plan of each traditional power station and the overall scheduling plan of the power grid.

If the actual operation deviates from the plan, relying on the advantage of fast and accurate response of traditional power supply to the grid scheduling instructions, the grid adjusts the generation supply of traditional power supply in real time to realize the balance of supply and demand. Grid scheduling through this way of thinking, although not fundamentally solve the contradiction with the new energy power supply, but the same new energy power supply into the power system effectively.

The two prerequisites that constitute the scheme of rights and interests are changing rapidly.

The grid will effectively integrate new energy power into the power system, traditional power (thermal power, hydropower) plays an important role. Implicit in this is an important assumption - the ability of traditional power sources to act as stabilizers. When the proportion of traditional power supply is above 70%, of course, there is no problem, but as the proportion of new energy increases, when the proportion of traditional power supply is lower than a certain threshold (e.g., 50%), whether the grid still has enough traditional power resources to achieve a real-time balance of supply and demand in the power system? This is a question that deserves attention.

There are two prerequisites for the grid to realize a real-time balance of power supply and demand by dispatching traditional power supply:

The new energy power supply installed share and power generation share are very small, and the impact on the power grid is limited;

New energy power supply power generation cost is high and already needs government subsidies, and then additional power supply can be controlled requirements, the cost is even higher, the human energy transition will be greatly affected.

Now these two preconditions are rapidly changing:

1. the proportion of installed new energy power sources and the proportion of power generation are moving from incremental replacement to stock replacement. At the end of 2018, the sum of installed wind power and photovoltaic power sources accounted for 18.7% of all power source installations, and their overall power generation share amounted to 8.8%. The grid wants to achieve a real-time balance of power supply and demand by dispatching traditional power sources, which is becoming more and more difficult as the proportion of traditional power sources becomes smaller and smaller.

2. New energy power generation costs are rapidly declining, new energy power supply compared to traditional power supply gradually formed cost advantage, new energy will gradually have the ability to bear the cost of "power control".

0 notes

Text

Who Is Eligible to Join the Association of Judges of India?

The Association of Judges of India is a prestigious organization committed to serving and supporting judges nationwide. But who completely is fit to join this esteemed group? To maintain legal liberty, uprightness, and responsibility, the All India Judges Association plays an important function in promoting the righteous and professional principles of the judges.

To uphold the important guidelines and integrity of the organization, there are certain requirements and norms that judges must meet to be worthy of membership. If you're understanding who can join the Association of Judges of India, keep reading to determine more about potential members' necessities and expectations.

Understanding of All India Judges Association

All Association of Judges of India is a cumulative body representing judges from discrete courts across the country. This organization aims to support judges by focusing on their professional needs, defending their rights, and providing opportunities for endless knowledge and growth.

Joining the All India Judges Association offers abundant benefits, such as an approach to a wide range of resources, containing juridical research materials and best practices in legal presidency. Members also have the time to engage in conferences, seminars, and discussions that advance professional growth and networking accompanying peers from various regions.

All India Judges Association also plays a critical role in describing the interests of judges at individual levels of government. By being a part of this federation, judges can guarantee their voices are heard and influence the enhancement and uprightness of the legal arrangement in India.

Who Can Join the All India Judges Association?

The All India Judges Association welcomes judges from diverse levels of the judges, offering a platform for professional development and representation.

Here are the types of legal officials eligible to join this esteemed association:

1. Judicial Officers of Subordinate Courts: Judges serving in subordinate courts, such as section courts, can apply for membership. These involve District Judges, Additional District Judges, and additional legal officers of equivalent rank.

2. High Court Judges: Judges serving in the High Courts of diversified states are suitable to join the Association of Judges of India. High Court judges play an important function in the federation, committing to administrative and advancement efforts.

3. Retired Judges: The association offers membership to retired judges who have served stubborn courts or High Courts. Their knowledge and understanding are valuable property to the All India Judges Association.

4. Judicial Officers on Deputation: Judges on deputation to different legal or governmental roles, both within and outside the judges, can also become members of the Association of Judges of India. Their different occurrences embellish the association’s cumulative information.

Benefits of Joining the Association of Judges of India

Are you a judge searching for a platform that supports your professional progress and advocates for your rights? Look no further than the Association of Judges of India. The All India Judges Association is an influential organization that brings together judges from different courts across the country, supporting a sense of society and providing many benefits.

Let's explore the key advantages of joining this esteemed association.

1. Professional Development

The All India Judges Association systematizes forums, seminars, and conferences planned to improve the professional abilities and information of its members. These performances offer judges the opportunity to stay renovated on new legal advancements, legal practices, and developing trends in the judiciary.

2. Advocacy and Representation

One of the basic functions of the Association of Judges of India is to advocate for the rights and interests of its members. The association represents judges at discrete levels of administration, guaranteeing their voices are heard and their concerns focused on. This composite advancement helps upgrade active conditions and safeguard legal liberty.

3. Networking Opportunities

Membership in the All India Judges Association supports judges with a platform to do business with peers from various regions and courts. This networking promotes the exchange of plans, knowledge, and best practices while improving the professional and individual lives of the members.

4. Access to Resources

Members of the Association of Judges of India gain access to an abundance of resources, including legal research matters, news, and guidelines on legal presidency. These resources are valuable for judges pursuing to embellish their information and effectiveness in their judicial responsibilities.

5. Support System

The All India Judges Association serves as a support system for judges, offering guidance and help in times of need. Whether it's handling professional challenges or individual issues, members can depend on the partnership for support and recommendations.

6. Contribution to Judicial Reforms

By joining the Association of Judges of India, judges have the opportunity to enhance discussions and drives aimed at legal reforms. The collective insight and knowledge of the members can drive important developments in the judicial arrangement, helping society altogether.

Conclusion

Joining the All India Judges Association is a significant step for judges pursuing to improve their professional journey and enhance the judicial society. By convergence the eligibility criteria and engaging in the federation’s exercises, members can leverage many conveniences for development, advancement, and networking. If you are a judge in India, deal with becoming a part of this esteemed partnership to further your career and support the composite responsibility of the judges.

#association of judges#Judges#All India Association Judges Of India#Judges Association#All India Judges Association

1 note

·

View note

Text

Types of Radioactive Measurement Devices

Geiger-Müller (GM) Counters:

Principle: Uses a Geiger-Müller tube filled with gas that becomes ionized when exposed to ionizing radiation, producing an electrical pulse.

Applications: Commonly used for detecting and measuring beta particles and gamma rays in environmental monitoring, nuclear industry, and health physics.

Advantages: Simple, robust, and relatively inexpensive.

Scintillation Detectors:

Principle: Uses a scintillator material that emits light (photons) when exposed to radiation. The emitted light is then detected and converted to an electrical signal by a photomultiplier tube or a photodiode.

Applications: Used in medical imaging (PET scans), environmental monitoring, and security screening.

Advantages: High sensitivity and the ability to measure different types of radiation (alpha, beta, gamma).

Ionization Chambers:

Principle: Uses a gas-filled chamber where ionizing radiation produces ion pairs. The ion pairs create a current that is proportional to the radiation intensity.

Applications: Used for precise measurements of radiation dose rates, especially in medical applications (radiotherapy) and radiation protection.

Advantages: High accuracy and ability to measure high radiation levels.

Solid-State Detectors:

Principle: Uses semiconductor materials (like silicon or germanium) that produce electron-hole pairs when exposed to radiation. These pairs are collected to create an electrical signal.

Applications: Used in dosimetry, spectroscopy, and radiation monitoring in nuclear power plants.

Advantages: High resolution and ability to distinguish between different types of radiation.

Dosimeters:

Principle: Measures the absorbed dose of radiation. Common types include film badges, thermoluminescent dosimeters (TLDs), and electronic personal dosimeters (EPDs).

Applications: Personal monitoring for radiation workers, medical staff, and in environments with potential radiation exposure.

Advantages: Provides cumulative radiation exposure information over time.

Neutron Detectors:

Principle: Uses materials like helium-3, boron trifluoride, or scintillators that respond to neutron interactions.

Applications: Used in nuclear reactors, research facilities, and security applications to detect and measure neutron radiation.

Advantages: Specialized for detecting neutrons, which are otherwise difficult to measure.

Key Considerations for Selecting a Device

Type of Radiation: Ensure the device is capable of detecting the specific type(s) of radiation (alpha, beta, gamma, neutron) you need to measure.

Sensitivity and Accuracy: Choose a device that offers the required sensitivity and accuracy for your application.

Measurement Range: Ensure the device can measure the expected range of radiation levels in your environment.

Portability: Consider handheld devices for field use versus fixed installations for continuous monitoring.

Durability and Environmental Suitability: Ensure the device is durable and suitable for the environmental conditions (e.g., temperature, humidity, presence of corrosive substances).

Applications

Environmental Monitoring: Measuring background radiation levels, monitoring contamination after nuclear accidents, and assessing radiation in natural environments.

Medical Field: Ensuring safe levels of radiation in diagnostic imaging (e.g., X-rays, CT scans) and therapeutic applications (radiotherapy).

Nuclear Industry: Monitoring radiation levels in nuclear power plants, fuel processing facilities, and waste disposal sites.

Security and Safety: Screening for radioactive materials at borders, airports, and other critical infrastructure to prevent illicit trafficking and ensure public safety.

Research and Education: Conducting experiments and teaching about radiation and its properties in academic and research institutions.

Conclusion

Radioactive measurement devices are essential tools for ensuring safety, compliance, and effective monitoring of ionizing radiation in various applications. Selecting the right device depends on the specific requirements of the measurement task, including the type of radiation, desired sensitivity, and application environment. By understanding the principles and capabilities of different types of radiation detectors, you can choose the most appropriate device for your needs.

0 notes

Text

What is the difference between CT scan and MRI?

CT (computed tomography) scans and MRI (magnetic resonance imaging) are both imaging techniques used in medicine to produce detailed images of the body's internal structures, but they operate on different principles and have distinct advantages and applications:

Principle of Imaging:

CT Scan: CT scans use X-rays to create cross-sectional images of the body. The X-ray machine rotates around the patient, taking multiple images from different angles, which are then processed by a computer to create detailed cross-sectional images.

MRI: MRI uses a strong magnetic field and radio waves to create detailed images of the body's internal structures. It does not use ionizing radiation like X-rays do.

Contrast Resolution:

CT Scan: CT scans are better at detecting bone and calcium deposits and are often used to visualize bone fractures, tumors, and abnormalities in soft tissues.

MRI: MRI provides superior contrast resolution in soft tissues, making it especially useful for imaging the brain, spinal cord, muscles, ligaments, tendons, and internal organs like the liver, pancreas, and prostate.

Radiation Exposure:

CT Scan: CT scans involve exposure to ionizing radiation, although the amount is typically low and considered safe for diagnostic purposes. However, repeated CT scans over time can increase cumulative radiation exposure.

MRI: MRI does not involve exposure to ionizing radiation, making it a safer option for imaging, especially for pregnant women and children.

Metallic Implants and Artifacts:

CT Scan: Metallic implants and objects can cause artifacts on CT scans, which may degrade image quality.

MRI: MRI is more sensitive to metallic implants and objects, which can cause significant artifacts and distortions in the images.

Contrast Agents:

CT Scan: CT scans can be performed with or without the use of contrast agents (iodine-based contrast agents), which are injected into the bloodstream to enhance visualization of blood vessels and certain tissues.

MRI: MRI scans can also be performed with contrast agents (gadolinium-based contrast agents) to improve visualization of blood vessels, tumors, and areas of inflammation.

In summary, CT scan in Rohini and MRI have different strengths and are used for different purposes in medical imaging. The choice between CT and MRI depends on factors such as the type of condition being evaluated, the body part being imaged, the desired level of detail, and any contraindications or limitations for the patient.

1 note

·

View note

Text

Is Fintech Software as a Service? Demystifying the Dynamics

In the ever-evolving landscape of financial technology (fintech), the concept of Software as a Service (SaaS) has gained considerable traction. With its promise of scalability, flexibility, and cost-effectiveness, SaaS has become a cornerstone in various industries. But what about fintech? Fintech software as a service has been a topic of discussion among industry experts, raising questions about its viability, functionality, and potential benefits.

Understanding the essence of fintech SaaS requires delving into its core principles and how they intersect with the dynamic needs of the financial sector. At its core, SaaS refers to the delivery of software applications over the internet, eliminating the need for users to install, maintain, or upgrade traditional software. Instead, users access the software through a web browser, paying a subscription fee for the services they utilize.

Fintech, on the other hand, encompasses a wide array of technologies designed to enhance and streamline financial activities. From digital payment solutions to automated investment platforms, fintech innovations continue to reshape the way individuals and businesses manage their finances. In this context, the integration of SaaS models into fintech offerings presents intriguing possibilities and challenges alike.

One of the primary attractions of fintech software as a service lies in its scalability. Traditional software solutions often require substantial upfront investments in infrastructure and resources, making them less accessible to startups and small businesses. In contrast, SaaS models allow for greater flexibility, enabling companies to scale their operations up or down based on demand without incurring significant costs.

Moreover, fintech SaaS offerings are characterized by their agility and adaptability. In an industry where regulatory requirements and market dynamics can change rapidly, having software that can quickly adjust to new circumstances is invaluable. SaaS solutions often feature regular updates and enhancements, ensuring that users have access to the latest features and compliance measures without disruptions.

Another advantage of fintech SaaS is its potential for innovation and collaboration. By leveraging cloud-based platforms and APIs (Application Programming Interfaces), fintech companies can easily integrate third-party services and functionalities into their offerings. This opens up opportunities for partnerships and ecosystem development, fostering innovation and expanding the scope of services available to customers.

However, it's essential to acknowledge that fintech software as a service is not without its challenges and considerations. Security and data privacy remain paramount concerns, particularly in an industry handling sensitive financial information. Fintech companies must implement robust security measures and compliance protocols to safeguard customer data and mitigate cybersecurity risks.

Furthermore, the subscription-based nature of SaaS models can lead to long-term dependencies and potential cost implications. While the pay-as-you-go structure may initially appear cost-effective, cumulative subscription fees over time can surpass the expenses associated with traditional software licenses. Companies must carefully evaluate the total cost of ownership and weigh it against the perceived benefits of SaaS adoption.

In conclusion, fintech software as a service represents a compelling proposition for companies looking to innovate and compete in the rapidly evolving financial landscape. With its scalability, agility, and potential for collaboration, SaaS offers a pathway to efficiency and growth in the fintech sector. However, it's essential for companies to approach SaaS adoption thoughtfully, considering factors such as security, cost, and long-term viability. By striking the right balance, fintech firms can harness the power of SaaS to drive innovation and deliver value to their customers.

0 notes

Text

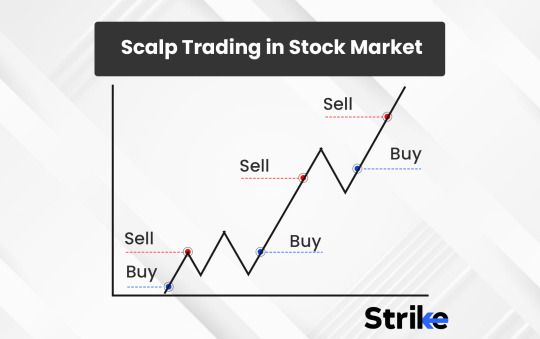

"Mastering the Art of Scalp Trading: Strategies, Tools, and Tips for Swift Profits in the Stock Market"

Scalp trading, also known as scalping, is a popular trading strategy in the stock market characterized by its fast-paced nature. Scalpers aim to achieve profits from small price changes in stocks, often entering and exiting positions within minutes or even seconds. This high-frequency trading approach requires a comprehensive understanding of market movements, an ability to make quick decisions, and meticulous risk management. This article explores the intricacies of scalp trading, including its strategies, tools, benefits, risks, and tips for success.

Understanding Scalp Trading

Scalp trading is grounded in the principle of quantity over quality. Scalpers are not concerned with significant gains from a single trade; instead, they focus on the accumulation of small profits over a large number of trades throughout the trading day. This strategy hinges on the belief that smaller moves in stock prices are easier to catch than larger ones. Scalpers operate on thin margins and leverage high volumes to amplify their profits.

Key Strategies in Scalp Trading

Several strategies underpin successful scalp trading, including:

Bid-Ask Spread Capturing: Scalpers often buy at the bid price and sell at the ask price to gain the spread difference. This strategy requires a highly liquid market to execute quick trades.

Volume Heatmaps and Order Flow: Analyzing volume and order flow helps scalpers identify immediate directional moves in stock prices, enabling them to execute quick trades.

Technical Indicators and Chart Patterns: Short-term chart patterns and technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can signal entry and exit points for scalpers.

Tools for Scalp Trading

Successful scalp trading relies heavily on having the right tools, including:

High-Speed Internet and a Reliable Trading Platform: Speed is of the essence in scalp trading. Delays in order execution can significantly impact profitability.

Direct Market Access (DMA): DMA allows scalpers to interact directly with the exchange's order book, which is crucial for timely trade execution.

Real-time Market Data: Access to real-time quotes and market data is essential for making informed trading decisions quickly.

Benefits of Scalp Trading

Scalp trading offers several advantages:

Frequent Opportunities: The strategy capitalizes on the numerous small movements that occur in the stock market daily.

Limited Risk Exposure: By holding positions for a very short time, scalpers limit their exposure to large adverse market movements.

Market Flexibility: Scalp trading can be effective in both rising and falling markets, as it relies on small price changes rather than the market's overall direction.

Risks and Challenges

Despite its benefits, scalp trading is not without risks and challenges:

High Transaction Costs: Frequent trading increases transaction costs, which can eat into profits.

Requires Constant Attention: Scalp trading is time-intensive and requires constant market monitoring, which can be mentally exhausting.

Risk of Significant Losses: While individual losses are typically small, the cumulative effect of several losing trades can be significant. Additionally, high leverage can amplify losses.

Tips for Successful Scalp Trading

To maximize the chances of success in scalp trading, consider the following tips:

Start with a Demo Account: Practicing with a demo account can help traders understand the nuances of scalp trading without risking real money.

Set a Risk Management Strategy: Establishing stop-loss orders and daily loss limits can help manage risks effectively.

Keep a Trading Journal: Documenting each trade, including the strategy used, the outcome, and any lessons learned, can provide valuable insights for improving future trades.

Stay Informed: Keeping up with financial news and market trends can provide scalpers with a competitive edge.

Use Technology Wisely: Leveraging trading software with automation and alert features can enhance efficiency and effectiveness.

Conclusion

Scalp trading in the stock market is a challenging yet potentially rewarding strategy that suits traders who can dedicate the time, discipline, and focus required to succeed. It appeals to those who prefer a fast-paced trading environment and are comfortable making quick decisions. While scalp trading offers the potential for significant profits through the accumulation of small gains, it also carries risks that demand meticulous strategy and risk management. As with any trading strategy, success in scalp trading comes with experience, continuous learning, and an unwavering commitment to staying abreast of market dynamics.

0 notes

Text

Scalping Strategy: A Powerful Tool for Day Traders

Imagine you’re at a market, and you’re trying to make money by buying and selling fruits really quickly. Scalping is kind of like that but with stocks, currencies, or other assets. Instead of waiting for significant price changes, scalpers jump in when there’s a tiny, quick price difference. They make many super-fast trades in just a few minutes or seconds.

Scalping is like a turbocharged version of day trading. Day trading is when you make trades in just one day, and it’s all about making fast decisions. Scalping fits perfectly into this because it’s all about grabbing those small price changes as they happen, like catching quick waves in the ocean.

So, for example, if you’re trading with the help of Funded Traders Global, you can use scalping to take advantage of those speedy price moves and hopefully make some profits. But remember, scalping needs a lot of practice, careful planning, and managing risks because things happen really quickly. It’s like a fast-paced game within the world of trading!

What is Scalping?

Scalping is a trading strategy employed in financial markets, including stocks, forex, commodities, and cryptocurrencies. It involves making rapid trades with the goal of profiting from small price movements over a short period. Scalpers seek to capitalize on the inherent volatility and liquidity of these markets by executing a large number of trades within a single day or even a few hours.

The primary objective of scalping is to make small, incremental gains from the price fluctuations that occur throughout the trading day. Scalpers often operate on lower timeframes, such as one-minute or five-minute charts, to identify fleeting price movements that might not be as apparent on longer timeframes. They leverage technical analysis tools, like moving averages, support and resistance levels, and momentum indicators, to make quick decisions about when to enter and exit trades.

Scalping is characterized by its focus on short holding periods, often lasting just a few seconds to a few minutes. This strategy requires a high level of discipline, precision, and a deep understanding of market dynamics. Scalpers are more concerned with the quantity of trades executed and the cumulative gains over time rather than individual trade profits, which are typically small.

Scalpers who are able to consistently profit from the markets using their short-term trading strategy can benefit from the leverage provided by the firm’s capital. This allows them to potentially amplify their gains, even though the individual profits per trade might be relatively small. However, it’s important to note that trading, including scalping, carries inherent risks due to the fast-paced nature of the strategy and the potential for rapid market reversals. As such, traders, including scalpers, need to have a well-defined risk management strategy in place to protect their capital from significant losses.

Key Principles of Scalping

Liquidity and Volatility:

Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Volatility, on the other hand, refers to the degree of price fluctuations within a given time period. For scalpers, both liquidity and volatility are paramount.

In scalping, traders aim to profit from small price movements, and these movements are more likely to occur in markets that are both liquid and volatile. High liquidity ensures that there are enough buyers and sellers at any given moment, reducing the risk of slippage (where trades are executed at prices different from the expected ones). Volatility provides the price fluctuations necessary for scalpers to identify quick trading opportunities.

Scalpers need markets that allow them to enter and exit positions swiftly, and they can demonstrate their ability to navigate such conditions on Funded Traders Global’s simulated accounts before potentially trading with the firm’s capital.

Tight Spreads:

A spread is the difference between the buying (ask) and selling (bid) prices of an asset. Scalpers rely on tight spreads because they engage in frequent trades where even a slight spread can impact profitability. Tight spreads ensure that the cost of entering and exiting a trade is minimal, allowing scalpers to capture small price movements without a significant portion of their gains being eroded by transaction costs.

For instance, if a scalper aims to profit from a small price movement of a few pips in the forex market, a tight spread is essential to ensure that the trade starts off in a profitable zone. The ability to execute trades with minimal spread can significantly enhance the scalper’s overall profitability.

In conclusion, scalping is a trading strategy that thrives on liquidity, volatility, and tight spreads. These principles enable scalpers to profit from rapid price movements over short timeframes. The combination of these principles is especially important for traders looking to be part of platforms like Funded Traders Global, as they aim to showcase their scalping skills and potentially gain access to the firm’s capital and trading resources.

Selecting the Right Instruments

Suitable Instruments for Scalping: Scalping can be applied to a variety of financial instruments, including Forex pairs, stocks, commodities, and cryptocurrencies. However, the suitability of each instrument depends on its inherent characteristics:

Forex Pairs: Forex markets are known for their high liquidity and volatility, making them particularly popular among scalpers. Major currency pairs like EUR/USD, USD/JPY, and GBP/USD are often chosen due to their frequent price fluctuations and tight spreads.

Stocks: Scalping stocks can be effective if the chosen stocks are highly liquid and exhibit price movements conducive to short-term trading. Stocks with high trading volumes and strong intraday price dynamics are more likely to provide scalping opportunities.

Cryptocurrencies: Some cryptocurrencies are also suitable for scalping due to their volatility and 24/7 trading availability. However, traders should be cautious of market manipulation and sudden price gaps that can occur in the cryptocurrency market.

High Liquidity and Low Trading Costs: Selecting highly liquid assets is crucial for scalping because it ensures that there are sufficient buyers and sellers in the market, reducing the risk of slippage and enabling traders to enter and exit positions quickly at desired prices.

Additionally, low trading costs are essential for scalping, as frequent trading can accumulate substantial transaction expenses. These costs include spreads, commissions, and other fees associated with trading. Choosing instruments with tight spreads helps minimize the impact of transaction costs on the profitability of each trade.

This principle is especially relevant to traders looking to partner with platforms like Funded Traders Global, where trading the right instruments can contribute to meeting profit objectives and gaining access to funding opportunities.

Technical Analysis for Scalping

Identifying Entry and Exit Points:

Technical analysis involves analyzing historical price data and market statistics to predict future price movements. For scalpers, who rely on quick price fluctuations, technical analysis serves as a valuable tool to make informed decisions about when to enter and exit trades.

Key aspects of technical analysis for scalping include identifying trend directions, support and resistance levels, and potential reversal patterns. These insights help scalpers pinpoint entry points when the market aligns with their anticipated price movement and exit points when the desired profit level is achieved or a predefined stop-loss is hit.

Common Indicators Used by Scalpers:

Scalpers often use a combination of indicators to inform their trading decisions. Here are some commonly used indicators:

Moving Averages: Moving averages smooth out price data over a specified period, helping traders identify trends and potential changes in trend direction. The crossover of short-term (faster) and long-term (slower) moving averages can signal potential entry or exit points.

Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. It helps scalpers identify overbought and oversold conditions in the market, indicating potential reversals or corrections.

Bollinger Bands: Bollinger Bands consist of a middle-moving average and upper and lower bands that represent standard deviations from the moving average. When the price moves close to the upper band, it may signal overbought conditions, and when it moves close to the lower band, it may signal oversold conditions.

Stochastic Oscillator: This indicator measures the relationship between a closing price and a price range over a specified period. It helps identify potential turning points by highlighting overbought and oversold conditions.

MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It helps scalpers identify changes in trend direction.

In conclusion, technical analysis is a fundamental tool for scalpers, helping them identify opportune entry and exit points for their rapid trades. Common indicators like moving averages, RSI, and Bollinger Bands play a crucial role in aiding scalpers’ decision-making processes. For traders seeking opportunities on platforms like Funded Traders Global, showcasing technical analysis skills can be a key factor in securing funding and demonstrating trading expertise.

Risk Management

Importance of Strict Risk Management: Scalping involves executing numerous trades within a short timeframe, which can increase the exposure to market risks. Since each trade aims to capture small price movements, even a single adverse trade can have a significant impact on overall profitability. This is why scalpers must prioritize risk management to protect their capital from substantial losses.

Stop-Loss Orders:

Stop-loss orders are a crucial risk management tool for scalpers. A stop-loss order is a pre-set order that automatically closes a trade when the price reaches a certain level, limiting potential losses. Scalpers often set tight stop-loss levels to minimize risk, given the short duration of their trades. By adhering to stop-loss orders, scalpers ensure that a single trade doesn’t result in a disproportionately large loss.

Position Sizing:

Position sizing refers to determining the amount of capital allocated to each trade. Scalpers must carefully calculate position sizes to ensure that a losing trade doesn’t erode a significant portion of their capital. Since scalpers aim for small gains, a proper position-sizing strategy can help manage losses and preserve capital for future trades.

Risk-Reward Ratio:

The risk-reward ratio compares the potential profit of a trade to its potential loss. Scalpers often look for trades with a favorable risk-reward ratio, where the potential profit outweighs the potential loss. This ratio helps scalpers maintain a consistent approach to risk management and ensures that profitable trades can outweigh any losses over time.

Diversification:

While scalping typically focuses on a specific market or instrument, it’s still important to diversify the trading approach. Overreliance on a single asset or strategy can lead to increased risk. Diversification can involve trading different currency pairs, stocks, or other assets to spread risk across multiple positions.

For traders seeking opportunities with platforms like Funded Traders Global, strict adherence to risk management principles is often a key requirement. These platforms evaluate traders not only based on their profitability but also on their ability to manage risk effectively. Demonstrating a well-thought-out risk management strategy can increase the chances of gaining access to firm capital and resources.

Execution and Timing

Swift and Decisive Action: Scalpers need to make split-second decisions to enter and exit trades as quickly as possible. Given the short holding periods and the goal of profiting from small price movements, delays in execution can result in missed opportunities or reduced profitability. Fast and accurate order execution is essential for scalpers to achieve their trading objectives.

Challenges in Order Execution:

Slippage: Slippage occurs when the actual execution price of a trade differs from the expected price due to rapid market movements. Slippage can work both in favor and against the trader. While slippage can lead to better prices, it can also result in less favorable prices, impacting profitability.

Latency: Latency refers to the time it takes for an order to travel from the trader’s platform to the market and back. Even minor latency issues can have significant implications for scalpers, as delays can lead to missed opportunities or executions at undesired prices.

Order Types: Scalpers often use market orders for rapid execution. However, market orders might be subject to slippage during periods of high volatility. Limit orders can provide more control over the execution price but might not always guarantee immediate execution.

Market Manipulation and Challenges:

Market Manipulation: Scalping’s reliance on quick price movements makes traders susceptible to market manipulation, where certain individuals or entities intentionally create artificial price movements to trigger stop-loss orders or to induce scalpers to make unwise trades.

News Events: Economic announcements and news events can cause sudden and unpredictable price spikes. Scalpers need to be cautious around such events, as markets can become highly volatile and execution might be challenging.

Strategies to Mitigate Challenges:

Technology and Infrastructure: Scalpers need a robust trading platform with low latency to ensure fast order execution. A reliable internet connection and proximity to trading servers can help reduce latency.