#Premium Local Lead Profit Generator

Explore tagged Tumblr posts

Text

The Surucuá community in the state of Pará is the first to receive an Amazonian Creative Laboratory, a compact mobile biofactory designed to help kick-start the Amazon’s bioeconomy.

Instead of simply harvesting forest-grown crops, traditional communities in the Amazon Rainforest can use the biofactories to process, package and sell bean-to-bar chocolate and similar products at premium prices.

Having a livelihood coming directly from the forest encourages communities to stay there and protect it rather than engaging in harmful economic activities in the Amazon.

The project is in its early stages, but it demonstrates what the Amazon’s bioeconomy could look like: an economic engine that experts estimate could generate at least $8 billion per year.

In a tent in the Surucuá community in the Brazilian Amazonian state of Pará, Jhanne Franco teaches 15 local adults how to make chocolate from scratch using small-scale machines instead of grinding the cacao beans by hand. As a chocolatier from another Amazonian state, Rondônia, Franco isn’t just an expert in cocoa production, but proof that the bean-to-bar concept can work in the Amazon Rainforest.

“[Here] is where we develop students’ ideas,” she says, gesturing to the classroom set up in a clearing in the world’s greatest rainforest. “I’m not here to give them a prescription. I want to teach them why things happen in chocolate making, so they can create their own recipes,” Franco tells Mongabay.

The training program is part of a concept developed by the nonprofit Amazônia 4.0 Institute, designed to protect the Amazon Rainforest. It was conceived in 2017 when two Brazilian scientists, brothers Carlos and Ismael Nobre, started thinking of ways to prevent the Amazon from reaching its impending “tipping point,” when deforestation turns the rainforest into a dry savanna.

Their solution is to build a decentralized bioeconomy rather than seeing the Amazon as a commodity provider for industries elsewhere. Investments would be made in sustainable, forest-grown crops such as cacao, cupuaçu and açaí, rather than cattle and soy, for which vast swaths of the forest have already been cleared. The profits would stay within local communities.

A study by the World Resources Institute (WRI) and the New Climate Economy, published in June 2023, analyzed 13 primary products from the Amazon, including cacao and cupuaçu, and concluded that even this small sample of products could grow the bioeconomy’s GDP by at least $8 billion per year.

To add value to these forest-grown raw materials requires some industrialization, leading to the creation of the Amazonian Creative Laboratories (LCA). These are compact, mobile and sustainable biofactories that incorporate industrial automation and artificial intelligence into the chocolate production process, allowing traditional communities to not only harvest crops, but also process, package and sell the finished products at premium prices.

The logic is simple: without an attractive income, people may be forced to sell or use their land for cattle ranching, soy plantations, or mining. On the other hand, if they can make a living from the forest, they have an incentive to stay there and protect it, becoming the Amazon’s guardians.

“The idea is to translate this biological and cultural wealth into economic activity that’s not exploitative or harmful,” Ismael Nobre tells Mongabay."

-via Mongabay News, January 2, 2024

#amazon#amazon rainforest#rainforest#chocolate#sustainability#ethical food#brazil#natural resources#good news#hope

286 notes

·

View notes

Text

Where to find painting jobs to bid in Des Moines, Lowa

How to Find and Bid on Painting Jobs in Des Moines, Iowa

If you're a painting contractor looking for job opportunities in Des Moines, Iowa, securing high-quality leads is crucial for growing your business. Whether you specialize in residential or commercial painting, finding the right projects can be challenging. This guide will help you discover the best ways to locate and bid on painting jobs in Des Moines.

1. Join Local Contractor Networks

One of the most effective ways to find painting jobs is by joining local contractor networks. Websites like Leadconnetcs, The Blue Book, and local builder associations regularly list available painting projects. Many professional painting companies use these platforms to connect with potential clients and secure contracts.

2. Use Lead Generation Services

Investing in lead generation services, such as Lead Connects, can provide you with exclusive access to residential and commercial painting leads. Instead of spending valuable time searching for jobs, you receive verified leads that are ready for bidding, allowing you to focus on delivering high-quality painting services.

Why Choose Lead Connects for Your Painting Leads?

At Lead Connects, we specialize in providing painting professionals with high-quality, exclusive leads. Our services offer:

Verified residential and commercial painting job leads in Des Moines, Iowa.

Real-time notifications for new bidding opportunities.

A streamlined process to connect with homeowners and businesses in need of painting services.

With Lead Connects, you no longer have to chase leads—we bring potential clients directly to you, helping you secure profitable contracts with ease.

3. Partner with Property Management Companies

Property management companies frequently need reliable painters to maintain and renovate their properties. Establishing long-term contracts with these businesses can provide a steady flow of work in both residential and commercial sectors.

4. Explore Government and Municipal Contracts

Many government and municipal projects require commercial painting services for schools, offices, and public buildings. Websites like the Iowa Department of Administrative Services and city bidding portals regularly post opportunities to submit bids for these high-value contracts.

5. Network with Builders and Contractors

Homebuilders, renovation companies, and general contractors consistently hire painters for ongoing projects. Attending local networking events, trade shows, and industry meetups can connect you with key decision-makers and help you secure more contracts.

6. Market Your Painting Business Online

To stay competitive, your painting business should have a strong online presence. Optimize your website for local SEO, invest in targeted ads, and engage actively on social media. Using location-based keywords like "painters in Des Moines" and "commercial painting services" can help attract more clients.

Conclusion

Finding painting jobs to bid on in Des Moines, Iowa requires a combination of networking, lead generation, and marketing strategies. Whether you specialize in residential or commercial projects, leveraging the right opportunities will ensure a steady flow of contracts. If you're looking for exclusive painting leads, Lead Connects can help. Our premium lead generation service connects you directly with potential clients, eliminating the hassle of finding bids. Sign up today and start winning more painting projects!

#Painting Jobs#Contractor Bidding#Des Moines Painters#Commercial Painting#Residential Painting#Lead Generation#Painting Business Growth#Local Contractor Networks#Government Contracts#Marketing for Painters

3 notes

·

View notes

Text

What Is the Average ROI or Profitability of Investing in a Paper Bag Printing Machine?

As the global shift towards eco-friendly packaging continues to accelerate, the demand for printed paper bags is at an all-time high. Retailers, restaurants, e-commerce brands, and manufacturers are replacing plastic with paper—and they want their branding printed professionally. This has created a booming opportunity for businesses to step into the paper bag printing industry.

If you're considering purchasing a paper bag printing machine, one of the first questions you may ask is “What is the average ROI or profitability of investing in such a machine?”

At Prakash Machineries Pvt Ltd, we work closely with hundreds of clients in the packaging and printing space. Based on real-world performance, usage data, and client feedback, we can confidently say that the ROI (Return on Investment) for our paper bag printing machines is typically achieved within 12 to 18 months—and in many cases, even sooner.

In this article, we’ll explore the key factors that impact profitability, break down cost vs. earnings, and show you how to maximize your return on investment.

Understanding ROI in Printing Equipment

ROI (Return on Investment) refers to how long it takes for the profits generated by a machine to cover its initial cost. Once the machine has paid for itself, all further earnings are profit.

ROI depends on:

Machine cost

Production volume

Printing rates charged

Operational costs (ink, electricity, labor)

Market demand and customer base

A well-utilized paper bag printing machine can easily generate a 2x to 5x return annually once it reaches full capacity.

Other Factors That Influence ROI

✅ 1. In-House Bag Manufacturing

If you also make paper bags in-house, you control the full supply chain—from blank paper to printed bag. This dramatically boosts your margins.

✅ 2. Local vs. Export Markets

Exporting printed paper bags can offer higher profit margins compared to local sales due to branding requirements and quality expectations.

✅ 3. Print Complexity & Color Usage

High-end brands require multi-color, high-resolution prints, which you can charge premium rates for—especially with 4-color offset or flexo machines.

✅ 4. Low Operating Costs

Flexo machines, in particular, have low ink, power, and labor requirements, leading to lower per-unit costs.

✅ 5. Government & Corporate Orders

Government bans on plastic bags are creating bulk demand for eco-friendly printed bags, especially from hospitals, FMCG brands, and retail chains.

Long-Term Profitability

After reaching break-even, your machine continues to generate steady income for 5–10 years with minimal maintenance. This is where the real profitability lies.

Average Monthly Profit (Post ROI): ₹2 – ₹5 Lakhs depending on job type and utilization

Annual Profit Potential: ₹25 – ₹50 Lakhs (or more with bulk and premium orders)

Tips to Maximize ROI

Focus on quality printing to win repeat customers

Offer both-side printing for added value

Partner with local bag manufacturers who don’t have printing in-house

Invest in a 2–4 color machine to handle complex designs

Target industries like fashion, food delivery, and e-commerce for bulk orders

Maintain your machine regularly to avoid downtime

Why Choose Prakash Machineries Pvt Ltd?

Here’s how we ensure the best ROI for your business:

✅ Reliable, low-maintenance machines that run 24x7 ✅ Energy-efficient design to reduce operational costs ✅ Fast setup and training to get you printing quickly ✅ Custom configurations based on your production goals ✅ Dedicated support team for lifetime assistance ✅ Spare parts and service centers across India

We’ve helped over 1,000+ businesses build profitable printing units—and we can help you too.

Conclusion

The average ROI of a paper bag printing machine from Prakash Machineries Pvt Ltd is 12 to 18 months, depending on your production scale and pricing strategy. With rising demand for printed paper bags, low running costs, and high daily output, these machines are not just a purchase—they're a profitable business investment.

Whether you're starting from scratch or expanding an existing paper bag operation, our machines offer a fast track to profitability, long-term income, and business growth.

📞 Want a custom ROI analysis for your business? Contact our team today for a detailed profit estimate. 🌐 Visit Prakash Machineries Pvt Ltd to explore machines, watch videos, or request a quote.

#paper bag manufacturer#manufacturer#square bottom#machines#v bottom#paper#flexo#bags#paper bag#baking#alien stage#chris sturniolo#chocolate#dan and phil#cooking#critical role#breakfast#delicious#cake

0 notes

Text

Verified Plots for Sale Near Khatu Shyam Ji Temple | Replant Realguru

Investing in property near religious and cultural landmarks is always a wise decision. Khatu Shyam Ji Temple, located in Sikar district, Rajasthan, is one of India’s most revered temples, attracting lakhs of devotees every year. With Replant Realguru, you can explore verified plots for sale near Khatu Shyam Ji Temple with complete trust, transparency, and the best property rates in the region.

Why Invest in Plots Near Khatu Shyam Ji Temple?

Khatu Shyam Ji is not just a spiritual destination but also a rapidly growing area for residential and commercial development. Many investors and families prefer owning land here due to:

Proximity to the temple, ideal for devotees and business establishments

Rising property rates in Khatu Shyam Ji, ensuring profitable returns

Availability of both residential and commercial plots

Well-connected roads to Jaipur, Ringas, and Sikar

Growing infrastructure, hotels, guest houses, and commercial complexes

At Replant Realguru, we understand the needs of each buyer and provide curated property options with verified documentation, clear titles, and professional support.

Property Dealers in Khatu Shyam Ji

Finding trusted property dealers in Khatu Shyam Ji is crucial for a hassle-free deal. Replant Realguru has partnered with leading property dealers in the region who have deep knowledge of land titles, local regulations, and legal requirements. Whether you wish to buy a small residential plot for constructing your dream home or a large commercial plot for developing a hotel or guest house near the temple, our team ensures:

Transparent dealings with no hidden charges

Verified and litigation-free plots

Assistance in registry and mutation process

Site visits and due diligence

Property Rates in Khatu Shyam Ji

One of the most frequently asked questions by buyers is about property rates in Khatu Shyam Ji. The rates vary based on proximity to the temple, road width, location advantages, and plot sizes. Generally, plots close to the temple or main road command premium prices due to their commercial potential. On average:

Residential plots: Starting from ₹6,000 – ₹12,000 per sq. yard depending on location

Commercial plots: Starting from ₹10,000 – ₹20,000 per sq. yard for prime spots

However, rates are dynamic based on demand, location, and land development stage. Our property dealers in Khatu Shyam Ji provide updated rates and negotiation support to get you the best deal.

Property Dealers in Ringas Rajasthan

Apart from Khatu Shyam Ji, Replant Realguru also connects you with verified property dealers in Ringas Rajasthan. Ringas, being the nearest major railway junction, serves as the gateway for pilgrims and travellers to Khatu Shyam Ji Temple. Investing in Ringas is equally profitable because of:

Rapidly growing residential colonies

Industrial and warehouse development in nearby areas

Better connectivity to Jaipur and Delhi via rail and road

If you are looking for plots, flats, or commercial properties in Ringas, our partnered property dealers offer options suited for both investment and personal use.

Commercial Property Dealers in Khatu Shyam Ji

The demand for commercial properties near Khatu Shyam Ji Temple is rising rapidly. Pilgrims visiting throughout the year ensure high footfall for hotels, guest houses, dharamshalas, restaurants, and shops. Our expert commercial property dealers in Khatu Shyam Ji provide options for:

Hotels and guest house land near temple premises

Shops and showrooms for religious items and prasad

Commercial complexes for rental income

Road-facing plots ideal for restaurants and cafes

Investing in commercial land near the temple is ideal for families planning to establish a long-term business with assured returns.

Why Choose Replant Realguru for Property in Khatu Shyam Ji?

At Replant Realguru, we aim to simplify your property buying experience by:

Listing only verified plots with clear titles Providing end-to-end support – from site visit to registration Ensuring competitive property rates in Khatu Shyam Ji Connecting with trusted property dealers in Khatu Shyam Ji and Ringas Rajasthan Offering a wide range of residential and commercial land options

Our team stays updated with the local market trends, JDA and municipal approvals, and upcoming development plans, ensuring that your investment is safe and profitable.

Process of Buying Land Near Khatu Shyam Ji Temple

Consultation: Discuss your budget, purpose (residential/commercial), and location preference with our experts.

Shortlisting: We provide a list of verified plots matching your requirements.

Site Visit: Visit the properties physically to assess location, connectivity, and surroundings.

Verification: Legal verification of documents and title check by our property dealers in Khatu Shyam Ji.

Negotiation: We assist you in price negotiation to get the best market rate.

Documentation: End-to-end support in sale deed registration, mutation, and other legal formalities.

Upcoming Developments in Khatu Shyam Ji

Khatu Shyam Ji is witnessing major infrastructure and tourism projects including:

Expansion of temple premises to handle growing devotees

Widening of connecting highways and roads

New hotels and guest houses being built for accommodation

Planned townships for devotees wishing to settle permanently

This ensures that property rates will continue to appreciate in the coming years, making it the right time to invest.

Connect with Replant Realguru Today

If you are looking for verified plots for sale near Khatu Shyam Ji Temple, contact Replant Realguru today. We ensure complete peace of mind in your property buying journey with professional support, ethical dealings, and transparent communication.

Call us now to book a site visit or know the current property rates. Visit our website for updated listings and the best real estate deals in Khatu Shyam Ji and Ringas, Rajasthan.

0 notes

Text

Best Dry Cleaning Franchise — Fabrico

When it comes to investing in a recession-proof business model with strong market demand and minimal risk, the best dry cleaning franchise in India stands tall — Fabrico. As the laundry franchise industry in India booms due to rising urbanization, dual-income households, and fast-paced lifestyles, Fabrico has emerged as a dominant force and a trusted partner for entrepreneurs across India.

Why Fabrico Is the Best Dry Cleaning Franchise in India

In a crowded market full of unreliable service providers, Fabrico offers a unique, structured, and tech-enabled solution to laundry and dry cleaning needs. With a growing network, quality-first approach, and innovative customer service mechanisms, we’ve raised the bar for what a laundry franchise in India should be.

India’s Fastest Growing Laundry Franchise Business

With over 50+ successful franchise outlets and growing every quarter, Fabrico has positioned itself as a leader in the organized laundry segment. Unlike other franchise models, our structure is low-cost, high-margin, and built to scale in both Tier 1 and Tier 2 cities.

Fabrico’s laundry franchise business model is designed for long-term profitability with minimal operational headaches.

Centralized support system

Training and onboarding assistance

End-to-end supply chain management

Real-time tracking with tech-driven operations

Laundry Franchise in India — Market Overview

The laundry industry in India is estimated to cross INR 2.2 lakh crores, with more than 96% still unorganized. This gap presents a massive opportunity for organized players like Fabrico. Consumers today seek convenience, hygiene, and professional care — needs that the local dhobi can no longer satisfy.

Fabrico has stepped in to solve this massive gap with a franchise-first mindset, helping everyday individuals become successful business owners.

Key Features of Fabrico’s Laundry Franchise Model

1. Low Investment, High Returns

Unlike other costly retail franchises, Fabrico offers a franchise model starting as low as ₹10–12 Lakhs, making it one of the most affordable laundry franchise opportunities in India. ROI begins in as early as 18–24 months with healthy profit margins.

2. Tech Integration

Our proprietary Laundry ERP system manages inventory, logistics, billing, and customer data — making it easier for franchise partners to focus on growth rather than operations.

3. Brand Power & Marketing

From local digital campaigns to influencer marketing and offline branding, we handle complete marketing support. Our SEO-friendly website, customer app, and social media campaigns help generate leads for our franchise partners.

4. Training & SOPs

We provide detailed operational manuals, employee training, and live workshops that help new partners and their staff quickly adapt and deliver Fabrico’s quality standards from Day 1.

Franchise Models to Suit Every Entrepreneur

Fabrico offers two robust franchise formats to suit investor profiles and city types:

1. Express Store Model

Setup Cost: ₹15–18 Lakhs

Area Required: 300–500 sq ft

ROI: 18–24 months

Ideal for: Tier 2 and Tier 3 cities

2. Master Hub Model

Setup Cost: ₹28–35 Lakhs

Area Required: 800–1200 sq ft

ROI: 18–24 months

Ideal for: Metro cities and commercial zones

Both models are backed by a centralized processing hub, allowing streamlined pickups and deliveries without needing heavy machinery at each store.

Why Customers Trust Fabrico

Fabrico isn’t just another dry cleaning brand. It’s a customer-centric experience. Our clients enjoy:

24–48 Hour Express Delivery

Free Pickup & Drop

Eco-Friendly Detergents

Premium Fabric Care

Real-time Order Tracking via App

With customer satisfaction ratings of 4.8+ on Google, we’re a brand customers trust with their delicate and luxury garments.

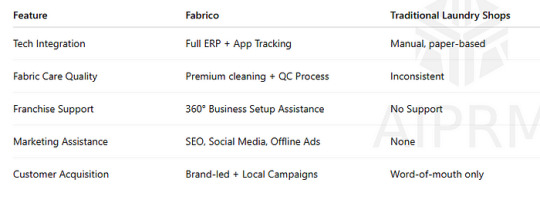

What Makes Fabrico Stand Out from Other Laundry Franchises

Success Stories from Fabrico Franchise Partners

Rajeev S., Franchise Owner — Lucknow: “I had zero experience in laundry, but Fabrico’s team helped me from location selection to staff training. I broke even in 14 months and now run two stores!”

Priya N., Franchise Partner — Pune: “As a working mom, I wanted a scalable side business. Fabrico’s Express model fit perfectly. I now manage it full-time with two employees, and profits are growing steadily.”

Who Should Consider a Fabrico Franchise?

Working professionals looking for passive income

Young entrepreneurs exploring new-age businesses

Housewives with time and space to operate a local store

NRIs investing in Indian ventures

Retired individuals seeking stable and growing business models

With zero inventory risk and automated billing & logistics, it’s truly a hassle-free franchise model.

How to Apply for a Fabrico Franchise

Getting started is simple:

Visit https://fabrico.in

Fill the Franchise Inquiry Form

Schedule a Business Call

Discuss Investment & ROI

Onboard, Setup, and Start Operations

We help with everything — from location scouting to marketing launch.

Conclusion: The Future of Laundry Franchise in India is Fabrico

If you’re searching for the best dry cleaning franchise in India, Fabrico should be your top choice. With a technology-led approach, low investment, and strong brand recall, we’re empowering dozens of entrepreneurs to build profitable businesses in the fastest-growing sector — laundry franchise business in India.

📍 For more information, visit their website at https://fabrico.in/laundry-franchise-business-in-india or contact them at +91 120 682 4455 and start your journey toward owning a thriving business today.

For More Details Read These Articles

Top Laundry Franchise Opportunities Near You: Why FABRICO is #1

Top Franchise Business Opportunities in Small Towns of India for 2025

Discover the Best Franchise Opportunities with Fabrico: Your Path to Success

#dry cleaning#fabrico#laundry#dry cleaners#drycleaners#drycleaners service#laundry near me#laundry services#laundry franchise

0 notes

Text

M3M Jewel Commercial Property 5‑Year Rental Yield Forecast on MG Road

If you have recently gone down from MG Road, you probably felt the discussion. New coffee shops, pop-up stores, and that striking glass building-yes, is the newly launched M3M Jewel Commercial Property.

But it is not just about the look. Investors are seeing a steady increase in their rental income. In 2025 alone, Prime Gurgaon regions increased high-world fares by 13–15%, with top-performance spots touching 20%.

What is happening on M3m Jewel?

Built-in rent escalation

Most lease agreements on MG Road include 15% fare hike every three years. This means that the income of your fare will increase continuously without the need for any Renaissance.

Footfall

This is not only the number of people - how much it spends. The brands of M3M Jewel office spaces Gurgaonare looking at 30–35% more average ticket size than other Gurgaon markets. This means that they can still handle the rent comfortably while earning profits.

Lack of new retail space

In the next five years, Gurgaon will get about 4.7 million square feet of the new grade-A retail space, but most of it planned for Golf Course Extension Road and New Gurgaon-not MG Road. It keeps M3M Jewel in a tight supply area where demand is likely to be strong.

Economic retail emergence

Massive entertainment options such as trendy food outlets, boutique fitness brands, and VR Arcade are signing long leases. These businesses require custom setups and brand-specific interiors, which encourages long-term tenants and stable fare returns.

5 Year Rental Yield for M3M Jewel Retail Investment MG Road

Here is a realistic picture of how to increase the yield of rent on M3M Jewel in the next five years. This launch considers 95% occupancy (common for MG Road), 15% fare hike every three years and 6% annual capital praise.

In 2025, the yield is expected to start from 8.5% as the first tenants are open, and the initial preacher provides the help promotes the footfall.

By 2026, the yield can climb up to 9.0% with e-commerce brands, which are launching their major experience stores and paying premium fare for visibility.

In 2027, the first round of rented escalation kicks, and the multiplexes and the food court are expected to run with full capacity - the yield of yields up to 9.8%.

2028 come, less new supply is expected to increase capital values further, and popular general Z brands may start renewing leases quickly, which can lead to about 10.5%of the yield.

By 2029, the yield can touch from 11.3% to 11.8%, with a second escape cycle and even higher yield with a strong resale market.

How to maximize returns in M3M Jewel Commercial Property

If you want to promote your returns from M3M Jewel commercial property then there are some smart strategies that use experienced investors:

1. Choose shops with fronts only with depth

People facing corner units or atrium pay more attention - and which translates into money. These shops usually earn 7-10% more rent to renew the lease.

2. Add a revenue share section

Many food outlets and entertainment brands are open to pay a small percentage of their monthly sales - once footfall pick up. Adding this clause can increase your actual return by 30 to 50 basis digits.

3. Choose energy-skilled ad-on

The M3M smart HVAC system reduces energy costs by about 30%. If you invest in energy monitoring package upfronts, you can reduce your normal field maintenance (CAM) fee, which appreciate tenants - and it often leads to better tenant retention.

4. Local locks

Tenants who spend big on customized interiors usually prefer a 6-9-year pattas with an increase in the underlying rent. This gives you stable income and makes it easy to refinance with banks, thanks to the approximate cash flow.

Conclusion

MG Road has not lost its attraction. In fact, it is developing into a high-end retail bandage where only top level events grow. The M3M Jewel Commercial Property in Gurgaon fits perfectly in this story - high visibility, limited supply and demand for strong brand.

The initial yield is already better than the market average. With the built-in rated escalation, tight inventory and rising consumer traffic, it is no longer estimated to reach the returns of double digits by 2029-that is a strong possibility.

#m3mjewel#m3m commercial project#m3m jewels gurgaon#commercial space#m3m jewel#gurgaonrealestate#M3M Jewel Commercial Property in Gurgaon

0 notes

Text

Sustainable Farming and Its Impact on Agricultural Land for Sale Near Mysore

In recent years, agricultural land for sale near Mysore has gained immense popularity among investors, farmers, and sustainability enthusiasts. Thanks to Mysore’s fertile soil, moderate climate, and abundant water resources, the region is emerging as a preferred destination for sustainable farming. But what’s fueling this rising interest in eco-friendly agriculture, and why is Mysore becoming a hotspot? Let’s take a deeper look.

Why Agricultural Land Near Mysore is in High Demand

Known for its heritage, greenery, and peaceful surroundings, Mysore is fast transforming into a hub for progressive agricultural ventures. More people are actively seeking agricultural land for sale near Mysore to take advantage of the region’s natural bounty and begin eco-conscious farming practices. This shift is not just about profits—it's about preserving nature while cultivating it.

What is Sustainable Farming?

Sustainable farming involves agricultural methods that are environmentally friendly, economically viable, and socially responsible. For those exploring agricultural land for sale near Mysore, adopting these practices not only boosts the productivity of their land but also ensures long-term ecological balance. Key principles include:

Crop Rotation & Biodiversity: Maintains soil fertility and naturally controls pests.

Use of Organic Fertilizers: Enhances soil health without harmful chemicals.

Water Conservation: Techniques like rainwater harvesting and drip irrigation.

Renewable Energy Sources: Solar and wind energy reduce dependency on fossil fuels.

These methods increase the land’s long-term value while ensuring a healthier environment.

Why Mysore is Perfect for Sustainable Agriculture

Mysore offers unique advantages that make it ideal for sustainable farming:

Fertile Soil & Favorable Climate: The region supports a wide range of crops throughout the year.

Reliable Water Sources: Access to rivers such as the Kaveri makes irrigation convenient and efficient.

Close to Major Markets: Its proximity to Bangalore and growing urban demand creates high market potential for organic produce.

All these factors contribute to the rising demand for agricultural land for sale near Mysore among modern farmers and green investors.

Benefits of Sustainable Farming on Mysore Farmland

If you’re planning to buy agricultural land for sale near Mysore, adopting sustainable farming can offer remarkable benefits:

Higher Market Value: Sustainably grown crops command premium prices.

Environmental Protection: Reduces carbon footprint and conserves biodiversity.

Long-Term Soil Health: Maintains fertility and productivity over generations.

Rural Development: Creates local employment and boosts community well-being.

Sustainable farming not only benefits the planet but also enhances your land’s economic potential.

How Sharanya Farm Champions Sustainable Agriculture

At Sharanya Farm, we specialize in offering agricultural land for sale near Mysore that is perfectly suited for sustainable farming. We believe in empowering landowners to embrace eco-friendly methods that enrich both the soil and society. Whether you're a seasoned farmer or a first-time buyer, our team supports you every step of the way—from selection to implementation of green practices.

Make a Future-Ready Investment Today

As the world leans towards sustainability, investing in agricultural land for sale near Mysore is not just smart—it’s future-proof. Whether you dream of growing organic produce, starting a green business, or simply enjoying a peaceful rural lifestyle, Mysore has it all.

Don't miss out on this green revolution. Explore our listings at Sharanya Farm and discover how your investment can lead to both profit and purpose.

0 notes

Text

Boston Institute of Analytics: The Best IT Education Franchise Opportunities to Invest In

In 2025, as India cements its role as a global technology powerhouse, one sector continues to see explosive growth—IT education and professional training. From AI and Data Science to Cloud Computing and Cybersecurity, the demand for next-gen tech skills is outpacing traditional education. For aspiring entrepreneurs and education investors, IT education franchise opportunities are the gateway to building a profitable and impactful business.

Among the top players leading this revolution is the Boston Institute of Analytics (BIA)—a global leader in future-ready skill development. If you're looking for the best IT education franchise to invest in, BIA offers unmatched credibility, scalability, and profitability.

In this article, we’ll explore why BIA stands out, what makes its franchise model successful, and how you can become part of India’s tech education boom.

Why the IT Education Franchise Market Is Booming?

India’s digital economy is expected to reach $1 trillion by 2030, and with it, a critical need for skilled professionals in AI, Machine Learning, Cybersecurity, and Business Analytics. This makes IT education franchise opportunities one of the most lucrative and future-proof investments available today.

Key Market Drivers:

Massive skill gap in new-age technologies

Corporate upskilling demand driven by AI and automation

Government initiatives like Skill India and Digital India

Higher disposable income among students and professionals for premium training

But succeeding in this space requires more than offering courses. You need a trusted brand, industry-aligned curriculum, and a proven franchise support system.

Meet Boston Institute of Analytics: The Gold Standard in IT Education

🌍 Global Recognition

Boston Institute of Analytics is a globally renowned education company with a strong presence in 30+ cities across India and overseas. It is best known for its advanced career-focused courses in:

Artificial Intelligence

Data Science

Machine Learning

Business Analytics

Digital Marketing

Cybersecurity

Generative AI (ChatGPT, DALL·E, Midjourney)

🎓 Industry-Focused Curriculum

BIA designs its programs in collaboration with top industry professionals and academic experts. Every course is job-ready and tailored to meet real-world business needs.

💼 Strong Placement Network

BIA’s students are placed in top companies like Accenture, IBM, Amazon, and KPMG—strengthening its brand and franchise demand even further.

Why BIA Offers the Best IT Education Franchise Opportunities?

Let’s break down what makes BIA a top choice for entrepreneurs:

1. High Demand, High Ticket Courses

Unlike basic coaching centers, BIA offers premium programs in AI, ML, and Data Science—fields with strong market demand and excellent earning potential.

Course Fees: ₹60,000 to ₹2,00,000

Course Duration: 3 to 6 months

Target Audience: College students, working professionals, upskilling seekers

2. Proven Business Model

The BIA franchise model is designed for success:

Low upfront investment (starting from ₹7–₹10 lakhs)

Break-even point in 12 to 18 months

Franchise support for marketing, operations, and faculty hiring

Ready-to-use curriculum, LMS, branding kits, and certification process

3. Hybrid Training Model

BIA delivers both classroom and online courses, expanding your reach and allowing multiple revenue streams—ideal for today’s hybrid learners.

In-person training at your center

Online classes via BIA's platform

Corporate training programs for enterprises

4. Extensive Franchise Support

Owning a BIA franchise means you’re never alone. Franchisees receive:

Instructor training & onboarding

Marketing strategy, local ad support & creatives

CRM & Learning Management System (LMS) access

Dedicated regional manager support

Leads from national-level promotions

5. Brand Credibility

BIA is recognized by international and national education bodies. Its alumni success stories, media mentions, and growing global presence make it a trusted choice for both learners and investors.

Who Should Invest in a BIA IT Education Franchise?

Whether you're a seasoned entrepreneur, a tech educator, or a first-time investor looking to enter the education industry, BIA is a powerful opportunity.

Ideal for:

Education entrepreneurs seeking scalable models

IT professionals transitioning into business

Franchise investors looking for high-margin businesses

Institutions or coaching centers wanting to upgrade their brand

No prior teaching experience? No problem. BIA equips you with all the tools and training you need.

Top Cities & Regions for Franchise Growth in 2025

BIA is currently expanding into new Tier-1 and Tier-2 cities with strong demand for IT skills:

Bengaluru

Hyderabad

Pune

Chennai

Delhi NCR

Ahmedabad

Kochi

Indore

Lucknow

Chandigarh

If you’re located in or near these tech-savvy markets, you’re perfectly placed to benefit from a BIA franchise.

Final Thoughts: A Future-Proof Business in a Growing Industry

In a rapidly evolving world driven by AI and automation, the only constant is education—especially IT education. By investing in a franchise like Boston Institute of Analytics, you’re not only tapping into a profitable business but also contributing to India's tech future.

With BIA, you get the rare blend of premium content, real-world demand, global reputation, and strong franchise support. It’s no surprise that BIA is rated among the best IT education franchise opportunities in India.

#IT Education Franchise Opportunities#Education Franchise Owner Opportunities#Most Profitable Franchise In India

0 notes

Text

How to Open a Profitable Paan Franchise: Business Investment Opportunities with Mast Banarasi Paan

Are you looking for an exciting and High-Profit Business Idea in India? The traditional yet incredibly dynamic world of paan offers a golden opportunity, especially when you partner with a leading brand like Mast Banarasi Paan. This blog delves into why a Mast Banarasi Paan Franchise is a smart Business Investment Opportunity and guides you on how to embark on this flavorful journey to success.

The Resurgence of Paan: A Modern Twist on Tradition

Paan, deeply rooted in Indian culture, has transcended generations. Today, it’s not just a traditional after-meal digestif; it’s a gourmet experience. Mast Banarasi Paan has been at the forefront of this transformation, offering hygienic, 100% tobacco-free paan in a dazzling array of flavors. This commitment to quality and innovation has positioned them as a top player in the Cafe Franchise and Restaurant Franchise space.

Why Mast Banarasi Paan is Your Ideal Partner for a Profitable Paan Franchise

Investing in a Paan Franchise with Mast Banarasi Paan isn’t just about selling paan; it’s about investing in a proven, profitable model. Here’s why it makes perfect business sense:

Exceptional Profit Margins: This is a key highlight for anyone seeking High Profitable Business ventures. Mast Banarasi Paan outlets boast impressive profit margins, often ranging from 40% to 50%. With average daily sales reaching ₹8,000 — ₹12,000, you can expect significant monthly revenues and a healthy Net Monthly Profit of ₹80,000 — ₹1,50,000.

Low Investment, High Returns: Forget daunting Restaurant Franchise Cost figures. The Mast Banarasi Paan Franchise Cost is incredibly accessible, starting from ₹5–12 Lakhs depending on the chosen model (Kiosk, Mini Cafe, Cafe, Premium Cafe, FOCO). This positions it as one of the Best Low Cost High Profit Franchises and an excellent Low Investment High Profit Business Idea. Many franchisees see a return on investment within 10–12 months.

Diverse Franchise Models: Mast Banarasi Paan understands that one size doesn’t fit all. They offer flexible Paan Cafe Franchise models to suit various budgets and locations:

Kiosk/Mini Cafe Model: Investment ₹6–8 Lakhs. Ideal for high-footfall areas like malls, food courts, or busy streets.

Cafe Model: Investment ₹8–9 Lakhs. Offers a full setup and staff support for a more comprehensive paan cafe experience.

Premium Cafe Model: Investment ₹10–12 Lakhs. Provides a complete business setup with enhanced marketing and dedicated assistance.

FOCO Model: Investment ₹15–20 Lakhs. Designed for investors seeking a profitable, hands-off business opportunity.

Strong Brand Recognition and Market Presence: With over 400 outlets across India, Mast Banarasi Paan is a recognized and trusted name. This strong brand equity provides an immediate advantage, attracting customers and ensuring a smooth launch for your Paan Franchise.

Extensive Product Range: Beyond the classic Banarasi Paan, their menu boasts over 60 varieties, including enticing options like Chocolate Paan, Dry Fruit Paan, Ladoo Paan, and more. This diverse and innovative Mast Banarasi Paan Menu caters to a wide range of customer preferences, keeping demand consistently high.

Comprehensive Franchisee Support: Mast Banarasi Paan stands by its franchisees. They offer a robust support system covering:

Site Selection & Setup: Guidance in choosing the best location and complete interior setup.

Training & Staffing: Comprehensive training for you and your staff to ensure consistent product quality and excellent service.

Raw Material Supply: Ensuring a steady and high-quality supply of all necessary ingredients.

Marketing & Promotions: Assistance with marketing strategies, including digital campaigns and local promotions.

Operational Support: Ongoing guidance, billing software, and a dedicated CRM team to help you run your business efficiently.

Multiple Revenue Streams: Your Paan Cafe Franchise can generate income from various avenues: retail sales, home delivery services (often tied up with platforms like Zomato), and catering for events like weddings, parties, and corporate functions.

How to Get Started with Your Mast Banarasi Paan Franchise

Ready to unlock this rewarding Investment Opportunity? Here’s a general outline of the process:

Initial Inquiry: Visit the official Mast Banarasi Paan website at https://www.mastbanarasipaan.com/ and navigate to their “Get Franchise” or “Contact Us” section. Fill out the inquiry form with your details.

Franchise Information: Their team will provide you with a comprehensive information pack outlining the different models, investment costs, and support.

Application Submission: Submit your formal franchise application with the required documentation.

Interview & Site Selection: You’ll have an opportunity to discuss your plans and explore potential locations with the Mast Banarasi Paan team. They offer support in surveying shortlisted properties.

Training & Launch: Once the agreement is finalized and your location is set up, you’ll undergo comprehensive training to prepare for your grand opening.

Contact Mast Banarasi Paan Today!

Don’t let this incredible High Profit Franchise opportunity pass you by. For direct inquiries and to learn more about the Mast Banarasi Paan Franchise Cost and detailed terms, you can reach out to them:

Phone: +91–9311771842

Email: [email protected]

Address: BSI Business Park, H Block, 140, Sector 63, Noida, UP-201301

Join the Mast Banarasi Paan family and become a part of India’s evolving paan tradition, building a successful and profitable business for yourself!

#MastBanarasiPaan #BanarasiPaan #BanarasiPaanFranchise #PaanFranchise #PaanCafeFranchise #MastBanarasiPaanFranchise #RestaurantFranchise #BestRestaurantFranchises #TopRestaurantFranchises #CafeFranchise #BestCafeFranchise #HighProfitableBusiness #LowCostBusinessIdeasWithHighProfit #LowCostFranchisesWithHighProfit #BestLowCostHighProfitFranchises

#banarasi paan franchise in india#best paan franchise in india#food#best banarasi paan franchise#mast banarasi paan#cafe franchise#banarasi paan#mast banarasi paan franchise#cafe franchise india#paan cafe franchise#paan franchise

0 notes

Text

Top 15 Business Ideas That Will Work in Dubai in 2025

Dubai's strong economy, rules that are good for investors, and world-class infrastructure are making business ideas in the city thrive in 2025. Dubai is still a global attraction for business people and investors because of its strategic location, tax-free privileges, and business-friendly climate.

As we get closer to 2025, new trends are starting to show up, and old ones are changing. Now is the best time to establish a successful business in Dubai, whether you live in the UAE and want to start your firm or you are an international entrepreneur searching for new markets.

This article will look at the top 15 business ideas for Dubai in 2025 that are popular this year and meant to help you do well in the UAE's competitive but full-of-opportunities business world.

1. Online Store

E-commerce is still one of the easiest and most promising businesses to start in Dubai in the digital age. The city's tech-savvy people and their rising love of shopping online make it a great place to start an online store.

Why it will be profitable in 2025:

A lot of people in Dubai use smartphones and the internet.

The UAE government is very supportive of digital trade.

Models like dropshipping and not having a warehouse lower the costs of starting a business.

You can sell unique products like electronics, fashion items, eco-friendly goods, oacr luxury products. Starting your own brand is simple with tools like Shopify, WooCommerce, and Noon.

2. Consultancy Services

As business complexities increase in Dubai’s dynamic market, the demand for specialized consultancy services continues to grow. Entrepreneurs, startups, and SMEs are increasingly seeking expert advice to help streamline operations, enter new markets, and drive sustainable growth.

In-Demand Services:

Business Strategy and Market Entry

Branding, Marketing, and Growth Planning

Digital Transformation & IT Advisory

Consulting Services & Virtual Support

To attract both local and international clients, it's essential to establish a strong online presence. Build a professional website showcasing your expertise and utilize platforms like LinkedIn, Upwork, and industry-specific forums to generate leads and build credibility.

3. Centers for Health and Wellness

More and more people in Dubai are choosing to live a healthy life. The wellness business is rising quickly in 2025, from organic food to therapy for mental health.

Popular niches:

Studios for yoga and pilates

Personal training and diet advice

Meditation, mindfulness, and life coaching

You may also think about starting a wellness café, an online wellness platform, or a mobile app.

4. A Digital Marketing Company

All businesses in Dubai, from little ones to big ones, need a strong online presence. That's why digital marketing is still one of the best business ideas in Dubai in 2025.

Best services to offer:

SEO, or search engine optimization

Google Ads and Meta Ads (PPC)

Managing social media accounts and content

Email marketing and automation

Tip: Look for cheap packages for small and new enterprises.

5. Real Estate Consultancy & Brokerage

Dubai’s property market is bouncing back fast, with growing demand for homes, businesses, and luxury properties. As a certified real estate consultant or broker, you can help clients buy, sell, or invest in real estate.

There are chances to:

Developments that aren't on the plan

Rentals for tourists for a short time

Investment advice for people from other countries

6. Travel and Tourism Services

Dubai is becoming more and more popular as a premium tourist destination. Every year, millions of people visit the city, which makes tourism services a good business choice.

Profitable businesses:

Tours of the desert

Chauffeur or yacht services are pretty nice

VIP and influencer trip packages that are carefully chosen

You could even make a smartphone app for tourists or give travel information in more than one language.

7. Delivering Food and Cloud Kitchens

Cloud kitchens are changing the food and drink landscape in Dubai. You can offer delivery-only services from a central kitchen without having to pay for pricey dine-in spaces.

Ideas that are selling well:

Services for preparing healthy meals

Korean BBQ or Filipino food that makes you feel good

Gourmet snacks for orders late at night

For speedier reach, work with platforms like Talabat, Deliveroo, and Careem.

8. Car Wash and Detailing on the Go

People in Dubai's residential and business areas really want car care services that are beneficial for the environment and can be done on the go.

Why it works:

Convenient for people who work

Technology for washing without water is good for the environment.

Low costs to start and the chance to make money again and over again

Subscriptions and apps can further enhance customer retention.

9. Tech Support and IT Services

Businesses in Dubai are more concerned about tech and digital transformation. You can help small and medium-sized companies and startups with IT and software problems.

The best tech business concepts are:

IT services that are managed

Custom-made ERP and CRM solutions

Support for cloud storage and cybersecurity

To make the most money, provide subscription-based models or custom packages.

10. Import and Export Business

Dubai is an excellent place for import-export enterprises since it has ports and trade-free zones. You may run a profitable trading business if you have the correct suppliers and logistical partners.

The best things to buy and sell:

Clothes and accessories

Organic spices, tea, and dried fruits

Gadgets and electronics

Look into trade rules and register your business in free zones to save money on taxes.

11. Events Management

Dubai is a world-famous place for significant events, including weddings, trade shows, and product launches. If you are good at organizing things and have a creative side, event management is the job for you.

Best services to offer:

Planning and decorating for a wedding

Planning corporate events

Renting AV and stage equipment

To stand out, focus on luxury weddings or themed kids' events.

12. Services for Pets

More and more people are getting pets, especially foreigners. You may take advantage of this trend by providing high-quality and convenient pet care services.

Opportunities in the pet business:

Mobile pet vans or grooming salons

Delivery of organic pet food

Consultations for pet training and behavior

A pet care software that lets you make appointments, set reminders, and find a vet might be pretty popular.

13. Home and Office Fitout & Maintenance

In a fast-paced city like Dubai, both homes and offices need regular upkeep to stay efficient and comfortable. Whether it’s upgrading interiors or handling day-to-day repairs, a reliable fitout and maintenance service is essential. A trusted company can build long-term relationships by delivering prompt and professional solutions.

Popular Services Include:

Air conditioning installation and deep cleaning

Plumbing and electrical repairs

Smart home and office system setup

Custom fitout solutions for workspaces and living areas

14. Spa and Beauty Salon

Beauty salons are always successful in Dubai since people there love to pamper themselves and take care of themselves.

New trends that will happen in 2025:

Services for mobile salons

Skincare that is organic and not tested on animals

Barbershops and men's grooming lounges

You can also give out loyalty cards, memberships, and extras for home service.

15. Centers for Kids' Education and Learning

Parents in Dubai care a lot about their kids' education and activities outside of school. A kids' learning center can do well if it has the necessary licenses and a good curriculum.

Best deals:

Coding and robotics for kids

Workshops in the arts, music, and STEM

Tutoring in two or three languages

To reach the most people and keep costs down, think about hybrid models (online and in-person).

Last Thoughts: Work with the Kurum Group of Companies

All of the best business ideas in Dubai for 2025 have a few things in common: they are new, they can grow, and they put the client first. To be successful in Dubai, you need to prepare ahead, get the proper licenses, and have a good market strategy, whether you're going it alone or with a group.

That's where we come in.

Kurum Group of Companies helps you with every step of your business journey, from start to finish:

Setting up a business and registering it legally

Creating a brand and an identity

Digital marketing and getting leads

Business consulting that never ends

We can assist you in making your business dreams come true in Dubai. Kurum Group of Companies is your partner in business growth. Start today.

#Kurum Group of Companies#company profile#business legacy#Dubai business#UAE companies#corporate vision#diversified industries

0 notes

Text

How to Choose the Best Property Management Company in India: Your Complete Guide

Owning rental property in India should be a source of passive income, not endless stress. Whether you're an NRI property owner or a local investor, finding the right property management company can transform your real estate investment from a headache into a profitable venture.

Why You Need Professional Property Management Services

Managing rental properties independently often leads to tenant disputes, maintenance nightmares, and legal complications. Professional property management companies in India handle everything from tenant screening to rent collection, allowing you to enjoy returns without daily involvement.

The Indian property management market has evolved significantly, with companies offering comprehensive services including property maintenance, legal compliance, and even guaranteed rent schemes. This evolution makes professional management more accessible and valuable than ever before.

Key Factors When Choosing Property Management Companies

Technology and Transparency

The best property management companies leverage technology for transparent operations. Look for companies offering online property management platforms where you can track rent payments, maintenance requests, and property performance in real-time. Companies like NoBroker and Nestaway excel in providing digital transparency.

Local Market Expertise

Choose companies with deep local property market knowledge. Understanding neighborhood rental rates, tenant preferences, and local regulations is crucial for maximizing your property investment returns. Regional specialists often outperform national chains in specific markets.

Comprehensive Service Offerings

Top property management firms provide end-to-end services including:

Tenant verification and background checks

Property marketing and listing optimization

Maintenance and repairs coordination

Legal compliance and documentation

Financial reporting and tax assistance

Leading Property Management Companies in India

NoBroker Property Management

Known for their zero brokerage model and tech-driven approach, NoBroker offers comprehensive rental management services with transparent pricing and excellent customer support.

Nestaway Property Management

Specializing in co-living spaces and managed accommodations, Nestaway provides guaranteed rent options and professional property care services.

Housewise Property Services

Focusing on premium property management, Housewise caters to high-end rental properties with personalized service and attention to detail.

Red Flags to Avoid

Beware of companies promising unrealistic rental yields or charging excessive upfront fees. Legitimate property management services should offer transparent pricing, clear contracts, and verifiable track records. Avoid companies lacking proper RERA registration or those with poor online reviews.

Making the Smart Choice

The best property management company for your needs depends on your property type, location, and investment goals. NRI investors might prioritize companies with strong international client support, while local investors may focus on cost-effectiveness and local market expertise.

Start Your Property Management Journey

Don't let property management stress diminish your real estate investment returns. Research thoroughly, compare services, and choose a property management partner that aligns with your goals. The right company transforms property ownership from burden to blessing, ensuring your rental property generates consistent income while appreciating in value.

Contact reputable property management companies today and take the first step toward stress-free property ownership in India's dynamic real estate market.

#property management India#best property managers#Propdial#real estate services#NRI property care#rent management#property maintenance#tenant screening#property manager guide#real estate investment India

0 notes

Text

Explore Premium SEO Solutions with TLM Global – SEO Company in Mumbai & Ahmedabad

If you're on the lookout for a trusted SEO company in Mumbai, TLM Global is your go-to partner. Known for our industry expertise and white-hat SEO strategies, we specialize in helping businesses thrive online.

As a progressive SEO agency in Mumbai, we prioritize keyword strategy, website structure, technical SEO, and content optimization to drive results. We also cater to clients across Gujarat and are proud to be called the best SEO company in Ahmedabad.

TLM Global is not just another agency. As a dual-location SEO company in Ahmedabad and Mumbai, our localized SEO approach brings geo-specific leads and improved ROI.

Our Mumbai SEO services focus on user intent and on-page improvements, ensuring better rankings and customer engagement. Among various search engine optimization companies in Mumbai, we stand out through transparency, performance, and continuous innovation.

Collaborate with a reliable SEO firm in Mumbai and see how TLM Global turns your digital presence into a profit-generating engine.

Visit us: https://tlmglobal.in

#seoagencyinmumbai#seocompanyinmumbai#seoexpertsinmumbai#digitalmarketingagencymumbai#digitalmarketingcompanymumbai#seofirminmumbai#tlmglobal#seo services#seo company

0 notes

Text

Mastering Business Tax Returns: A Guide for Smarter Financial Management

Filing business tax returns is a crucial part of running any company, whether you’re a sole proprietor or manage a large corporation. Governments require businesses to report their income, expenses, and profits annually, which forms the basis for assessing taxes. Many entrepreneurs find tax season stressful, but understanding your responsibilities helps reduce the pressure. A properly prepared return also safeguards your business from penalties and audits. Timely and accurate filings build trust with regulatory bodies. It’s more than a legal requirement it’s a reflection of how organized and responsible your business truly is.

Different Types of Business Structures and Their Tax Implications

The type of business entity you choose significantly affects your tax obligations. Sole proprietors report business income on personal returns, while corporations file separately. Partnerships and LLCs have unique rules depending on local laws and ownership structure. Understanding your entity type helps determine the correct forms and deadlines. Misfiling due to a misunderstanding of structure can lead to delays and penalties. Consulting a tax advisor during business formation is a smart move. Choosing the right structure early on sets a strong foundation for future compliance and financial clarity.

Common Documents Needed for Filing

Before preparing your business filings, it’s essential to gather the necessary financial documents. These include income statements, balance sheets, payroll records, expense receipts, and bank statements. Accurate documentation ensures that all deductions are properly claimed and that the information provided matches internal accounting. Keeping records organized throughout the year simplifies the filing process. Businesses using accounting software often find it easier to generate reports quickly. Having your business tax returns paperwork in order can be the difference between a smooth filing and a stressful, error-prone experience.

Key Deductions to Maximize Your Tax Savings

One of the biggest benefits of business tax filing is the opportunity to reduce your taxable income through deductions. Common deductions include office rent, utilities, equipment depreciation, employee wages, and business travel expenses. Health insurance premiums and retirement plan contributions may also qualify. Keeping track of all allowable expenses throughout the year allows you to take full advantage of these savings. Hiring a tax professional can help uncover deductions you might miss on your own. The more deductions you claim legally, the less tax your business is liable to pay.

The Role of Accounting Systems in Accurate Tax Filing

Good accounting is the backbone of tax compliance. Reliable accounting software can track income and expenses, generate reports, and ensure tax categories are correctly assigned. Many modern systems also integrate with tax preparation tools, streamlining the entire filing process. Whether you use QuickBooks, Xero, or another platform, keeping it updated throughout the year pays off. Regular reconciliation of your accounts prevents last-minute surprises. Investing in accounting tools or professionals isn’t just about taxes it’s about ensuring long-term business stability and growth.

Avoiding Common Mistakes in Business Tax Returns

Many small businesses face penalties due to avoidable tax mistakes. Misreporting income, forgetting to deduct eligible expenses, or missing deadlines are common errors. Incorrect classification of workers contractors versus employees can also cause issues. Staying aware of these pitfalls helps you file accurate business tax returns. Another mistake is not updating your records after changes in business structure or tax laws. Regular check-ins with a tax consultant or financial advisor can help you stay on track. Avoiding errors not only saves money but protects your business reputation.

When to Consider Hiring a Tax Professional

While small businesses can often manage their own filings, complex operations benefit from expert help. If you have international dealings, multiple revenue streams, or a large number of employees, a tax professional brings valuable insight. They can help with tax planning, identify new savings opportunities, and ensure full compliance. Many professionals also offer audit support, giving you peace of mind in case of review by authorities. Hiring help may seem like an extra cost, but it often pays off in saved time and reduced liabilities. Tax advisors tailor solutions that suit your unique business needs.

Deadlines and Extensions You Should Know

Missing tax deadlines can lead to fines, interest charges, and unwanted audits. Businesses should mark key filing dates on their calendar, typically falling in March or April depending on the business structure. Extensions are available if more time is needed, but they must be requested before the original due date. Even with an extension, estimated taxes may still be due. Timely filing demonstrates professionalism and reduces stress. It’s wise to begin preparations a few months ahead of the deadline. This buffer allows time for reviewing data, gathering documents, and consulting with tax experts.

Staying Updated with Tax Law Changes

Tax regulations evolve regularly, and it’s essential for businesses to stay informed. Governments may introduce new credits, change deduction limits, or adjust tax rates from year to year. Keeping up with these changes helps ensure that your tax strategy remains efficient and legal. Subscribe to newsletters from official tax bodies or industry groups, or attend seminars and webinars. Regularly reviewing your tax strategy with a professional ensures you’re not leaving money on the table. Staying informed is a key element of smart financial management.

Conclusion

Proper handling of business finances is about more than just fulfilling legal duties it’s a critical part of managing and growing a successful enterprise. By staying organized, using the right tools, avoiding common mistakes, and seeking help when needed, you set your business up for long-term financial success. Filing business tax returns accurately and on time reflects your credibility and discipline as an entrepreneur. With planning and diligence, tax season becomes an opportunity to assess your financial health, identify savings, and chart a course for smarter decision-making.

0 notes

Text

Best Laundry Franchise in India — Fabrico

Are you tired of the 9-to-5 grind and dreaming of owning a profitable business? In 2025, one of the most promising, low-risk, and high-demand business opportunities is the laundry franchise business in India — and Fabrico is leading this revolution.

With increasing demand for hygiene, professional garment care, and convenience, India is seeing an unprecedented rise in organized laundry and dry-cleaning chains. This is where Fabrico shines — not just as a service but as a franchise opportunity of the future.

Why Laundry Franchises Are Booming in India

Laundry was once a “maid’s job.” Not anymore. Urban families, working professionals, bachelors, and even students now prefer outsourcing laundry to professionals. Why?

Lack of time

Need for quality garment care

Disposable income growth

Urban lifestyle shift

These changing preferences are fueling the rise of laundry franchise businesses in India.

Laundry Franchise Business in India — A Growing Market

India’s laundry market is worth over ₹200,000 crores, but 95% is unorganized. This opens a massive opportunity for organized players like Fabrico to dominate with tech, consistency, and brand trust.

Why it’s booming:

Growing urban population

Shift to nuclear families

More clothes = more laundry!

Desire for hygiene post-COVID

What Makes Fabrico the Best Laundry Franchise in India?

Fabrico isn’t just another name in the market. It’s India’s fastest-growing laundry franchise business.

India’s Biggest Laundry and Dry Clean Chain

With a rapidly expanding network, Fabrico is establishing its presence in Tier 1, Tier 2, and Tier 3 cities alike.

Proven Franchise Success

From first-time entrepreneurs to seasoned investors, Fabrico’s franchise partners are enjoying steady returns, minimal risk, and unmatched support.

Tech-Driven Operations

From online bookings to AI-based garment tracking, Fabrico operates on smart, digital-first systems to reduce manual errors and boost efficiency.

Services Offered by Fabrico

It’s not just laundry. Fabrico offers a complete bouquet of services, including:

Professional Laundry — Wash & fold or wash & iron

Dry Cleaning — Suits, lehengas, delicate silks

Shoe & Bag Spa

Steam Ironing

Stain Treatment & Fabric Care

Customers get convenience. Franchise owners get diversified revenue streams.

Cost of Starting a Laundry Franchise Business in India

Wondering how much it costs to start?

Laundry Franchise Business Cost Breakdown

Franchise Fee: ₹28–35 Lakhs (depending on model)

Setup Cost: ₹10–12 Lakhs (store, machines, interiors)

Working Capital: ₹2–3 Lakhs (3-month buffer)

Low Investment, High Return

For around ₹10–15 Lakhs, you’re ready to start a premium laundry franchise business in India.

ROI Timelines

Break-even in 18–24 months

Monthly revenue potential: ₹1.5 — ₹3 Lakhs

Net margins: 30%+

Fabrico’s Franchise Models

Choose the model that suits your budget and area.

Store Model

Prime area

Walk-in customers

Ideal for high-footfall locations

Pickup & Delivery Model

Lower setup cost

Home-based or small outlet

Focused on app & online orders

Hybrid Model

Best of both worlds

Storefront + logistics

High scalability

Training & Support from Fabrico

No prior experience? No problem. Fabrico gives complete handholding.

Staff recruitment & training

Technical onboarding

POS system training

Marketing materials

Inventory & CRM guidance

It’s like starting a business with a safety net.

Why Choose Fabrico Over Other Laundry Franchise Brands

Here’s where Fabrico beats the competition:

Established SOPs & professional equipment

Strong digital presence with online booking & tracking

In-house marketing team for local lead generation

Bulk orders from corporates & hotels

Higher customer retention with loyalty programs

Steps to Start a Laundry Franchise with Fabrico

Apply Online at Fabrico Franchise

Get a free consultation call

Choose your location & model

Complete paperwork & training

Get your outlet launched & marketed by Fabrico

It’s a turnkey process, stress-free from Day 1.

Real Success Stories from Fabrico Franchisees

Meet Aarti from Lucknow. She started with Fabrico’s hybrid model and broke even in just 15 months.

Or Rohit from Pune — now running 3 outlets across the city with a team of 12.

Real people. Real profits. Real impact.

The Future of Laundry & Dry Cleaning Franchises in India

By 2030, over 60% of India’s urban households will rely on outsourced laundry.

Add in:

Smart lockers

Mobile-app-only models

AI-powered garment handling

…and you’ve got a business that’s future-proof and investor-friendly.

Conclusion

If you’re hunting for the best laundry franchise in India, Fabrico is your golden ticket.

It’s affordable, scalable, and future-ready. Whether you’re a full-time entrepreneur or a part-time investor, Fabrico’s laundry franchise business model in India gives you everything you need — minus the headaches.

From low entry barriers to strong ROI and all the way to handholding and growth support, Fabrico is more than a franchise — it’s a movement.

Ready to start your journey? Visit Fabrico.in and apply today.

FAQs: Best Laundry Franchise in India — Fabrico

Q1. What is the minimum investment required to start a Fabrico franchise? A: Around ₹10–12 Lakhs* including setup, franchise fee, and working capital.

Q2. Do I need prior experience in laundry or business? A: Not at all. Fabrico provides full training and operational support.

Q3. Can I operate a Fabrico franchise in a Tier 2 or Tier 3 city? A: Absolutely! In fact, Fabrico is expanding rapidly in smaller cities.

Q4. What are the main revenue streams? A: Laundry, dry cleaning, shoe cleaning, corporate orders, and steam ironing.

Q5. How long does it take to break even? A: Most franchisees reach breakeven in 18 to 24 months, depending on location.

#dry cleaning#fabrico#laundry#dry cleaners#drycleaners#drycleaners service#laundry near me#laundry services#laundry franchise

0 notes

Text

iptv reseller

IPTV Reseller Business: Your Gateway to Passive Income with petratv.net

In the digital age, streaming services have changed the way people consume entertainment. Traditional cable subscriptions are gradually fading away, making room for Internet Protocol Television (IPTV). As the demand for IPTV services skyrockets, an exciting opportunity has emerged: becoming an IPTV reseller.

If you're looking to build a scalable business, boost your income, or start your own tech-based venture with low investment, this model might be perfect for you. This article will walk you through everything you need to know about becoming an IPTV reseller with petratv.net—a leading name in IPTV solutions.

What Is an IPTV Reseller?

An IPTV reseller is an individual or business that purchases IPTV service credits or access in bulk from a provider and sells them to end-users for profit. Instead of managing your own servers or developing complicated infrastructure, you partner with a professional IPTV service like petratv.net and focus solely on sales and support.

As a reseller, you control pricing, manage client accounts, and operate under your own brand. This model gives you the power to scale flexibly, whether you’re targeting just a few dozen customers or building a global customer base.

Why Choose petratv.net to Become an IPTV Reseller?

Choosing the right platform to resell IPTV is crucial. Here's why petratv.net stands out in the competitive IPTV market:

1. Reliable IPTV Infrastructure

You’ll be working with a system supported by high-speed, secure servers that ensure uninterrupted streaming. This guarantees minimal downtime and high customer satisfaction, which in turn increases your recurring revenue.

2. White-Label Dashboard

As a reseller, you get access to a fully white-labeled portal. This means you can operate under your own brand identity. Control everything from username creation to subscription duration and device limits.

3. Premium Channel List

With thousands of live TV channels, sports networks, international content, and VOD libraries, you’ll be offering an impressive range of options. Your customers will appreciate access to top-quality streams in HD and 4K.

4. Multi-Device Compatibility

Your customers can enjoy IPTV services on Smart TVs, Android devices, iOS, MAG boxes, PCs, and more—making your offering highly versatile.

5. 24/7 Support

When technical issues arise, you’re never alone. The petratv.net team provides round-the-clock support for all resellers, so you can resolve customer concerns efficiently.

How Much Can You Earn as an IPTV Reseller?

Your earnings depend on several factors including your customer base, pricing model, and marketing strategy. Since IPTV subscriptions typically cost between $10–$20/month, even 100 loyal customers can generate $1,000–$2,000/month in recurring revenue.

Plus, by offering packages in 3-month, 6-month, or 12-month plans, you can earn more upfront while enhancing customer retention.

Many resellers start part-time and scale quickly into full-time income once they’ve built trust and strong word-of-mouth.

Steps to Get Started as an IPTV Reseller with petratv.net

Here’s how you can kickstart your reseller journey:

Step 1: Register as a Reseller

Visit the IPTV Reseller Program Page to submit your details. The petratv.net team will review your application and provide access to your custom reseller portal.

Step 2: Choose Your Credit Package

Credits are essentially subscriptions you sell to customers. You purchase these in bulk, and the more you buy, the lower your cost per credit.

Step 3: Setup Your Dashboard

Customize your reseller dashboard to reflect your brand. Add your logo, set pricing rules, and configure notifications for user renewals.

Step 4: Start Selling

Use social media, word-of-mouth, local advertising, or affiliate marketing to acquire customers. Since IPTV is in high demand, a few well-placed promotions can generate quick results.

Step 5: Manage and Scale

Add users, track usage, renew subscriptions, and monitor earnings—all from your online dashboard. You can easily scale as your customer base grows.

Tips to Succeed as an IPTV Reseller

Here are some practical tips to help you thrive in this business:

✔ Offer Competitive Pricing

Research your competition and offer prices that balance affordability and profit.

✔ Provide Great Customer Support

Respond quickly to inquiries and resolve issues promptly. Good support leads to word-of-mouth referrals.

✔ Run Promotions

Offer discounts for yearly subscriptions or bundles. Limited-time offers create urgency and drive conversions.

✔ Use SEO & Social Media

Promote your brand through a website or social media pages. Optimize posts with key phrases like buy IPTV, IPTV service, or IPTV subscription deals.

✔ Build Trust

Always be transparent about features, device compatibility, and terms. Happy customers become loyal subscribers.

Legal Considerations for IPTV Resellers