#Polyethylene market

Explore tagged Tumblr posts

Text

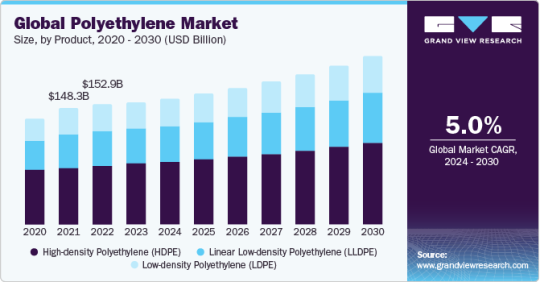

Polyethylene Market Size To Reach USD 213.77 Billion By 2030

Polyethylene Market Growth & Trends

The global polyethylene market size is anticipated to reach USD 213.77 billion by 2030, growing at a CAGR of 5.0% during the forecast period, according to a new report by Grand View Research, Inc. The market growth is driven by the increasing consumption of plastics in the automotive, medical, construction, and electrical & electronics industries. Moreover, the increasing demand for lightweight materials in the automotive industry contributes to industry growth. Polyethylene (PE) is commonly used for manufacturing lightweight plastics, films, and foams used in vehicles.

The emphasis of the automotive industry on enhancing the fuel efficiency of vehicles by reducing their weight leads to the adoption of PE in this industry. As recycling technologies advance, the PE market adapts to integrate more recycled content into its products, contributing to a more circular and resource-efficient approach. Government policies and regulations supporting sustainable practices further bolster the demand for recycled PE. The circular economy encourages the collection, separation, and reprocessing of used PE products, diverting them from landfills.

One of the major challenges faced by the market includes fluctuations in raw material prices. The global crude oil prices have witnessed severe fluctuations in the past few years. Social disruption in key crude oil-producing regions, such as Venezuela, Libya, Iran, Nigeria, and Iraq has hampered crude oil supply, generating inelasticity in the supply-demand balance. These factors are short-lived in the market causing immediate fall and rise in prices, thus impacting market growth.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/polyethylene-pe-market

Key Polyethylene Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

In November 2023, Dow announced an investment in the Fort Saskatchewan Path2Zero project in Alberta, Canada, with an investment of USD 6.5 billion, as part of the company's goal to achieve carbon neutrality by 2050. The project involves the construction of a new ethylene plant and expanding polyethylene capacity by 2 million metric tons annually. The construction is scheduled to commence in 2024, and the increased capacity is set to be implemented in stages, with the initial phase anticipated to begin in 2027

In October 2023, Borealis AG and TotalEnergies SE announced plans to construct a USD 1.4 billion Borstar PE unit within their Baystar joint venture. This PE unit, boasting a capacity of 625,000 metric tons annually, marks a significant increase, doubling the current production capabilities at the Baystar site including two existing PE production units

In August 2023, Dow partnered with Mengniu, a dairy company, to launch a PE yogurt pouch, specifically designed for recyclability. This joint effort signifies a significant step for both companies in reinforcing their dedication to promoting a circular economy in China. The partnership with Mengniu enables both brands to take the lead in pioneering recyclable all-PE dairy packaging in the Chinese market.

Polyethylene Market Report Highlights

High-density Polyethylene (HDPE) dominated the product segment with more than 49.0% share in 2023. The demand for efficient and long-lasting solutions in water infrastructure and agriculture enhances the growth prospects of the HDPE segment

The Linear Low-density Polyethylene (LLDPE) type segment is expected to grow at the fastest CAGR of 5.5% over the forecast period

The bottles & containers application segment held a substantial market share in 2023. The sustainability trend in the packaging industry contributes to the growth of this segment

The use of recyclable materials is growing due to environmental concerns. The recyclability and compatibility of PE with recycling processes are essential for eco-conscious industries and consumers

Asia Pacific dominated the global market in 2023. The growing manufacturing industry in Asia Pacific is anticipated to drive the demand for PE

In October 2023, Borealis AG and TotalEnergies SE announced plans to construct a USD 1.4 billion Borstar PE unit within their Baystar joint venture. This PE unit, boasting a capacity of 625,000 metric tons annually, marks a significant increase, doubling the current production capabilities at the Baystar site including two existing PE production units

Regional Insights

The North America Polyethylene Market accounted for a significant revenue share of 19.2% in 2023. The shale gas boom in North America has transformed the regional PE market. The abundant and easy availability of cost-effective feedstocks derived from shale gas, particularly ethane, has given PE producers, based in North America, a significant competitive advantage.

U.S. Polyethylene Market Trends

The Polyethylene Market in the U.S.is expected to grow over the forecast period. The U.S. energy landscape, specifically the abundant availability of shale gas, is a critical driver for the PE market growth in the country. Shale gas serves as a primary feedstock for ethylene production, which is a key building block for PE. The accessibility and the cost competitiveness of shale gas contribute to the expansion of ethylene production capacities in the U.S., thereby supporting market growth.

Asia Pacific Polyethylene Market Trends

The Asia Pacific Polyethylene Market dominated the global industry in 2023 with a share of over 50.3%. Asia Pacific is a diverse market for PE owing to the growing automotive and construction industries in the region that are key consumers of this material. The growing manufacturing industry in Asia Pacific is anticipated to drive the requirement for PE.

The Polyethylene Market in China held a significant share in the Asia Pacific region. The market is anticipated to register a CAGR of 5.3% over the forecast period. Government initiatives for infrastructure development projects are driving market growth in China. The ambitious infrastructure development plans of the country, including the Belt and Road Initiative, stimulate the demand for PE in construction and related activities.

Polyethylene Market Segmentation

Grand View Research has segmented the global polyethylene market on the basis of product, application, end-use, and region:

PE Product Outlook (Volume, Kilotons, Revenue; USD Million, 2018 - 2030)

Low-density Polyethylene (LDPE)

High-density Polyethylene (HDPE)

Linear Low-density Polyethylene (LLDPE)

PE Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Bottles & Containers

Films & Sheets

Bags & Sacks

Pipes & Fittings

Other Applications

PE End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Packaging

Construction

Automotive

Agriculture

Consumer Electronics

Other End-uses

PE Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

Europe

Asia Pacific

Central & South America

Middle East & Africa

List of Key Players in the Polyethylene Market

BASF SE

Borealis AG

Braskem

Dow

Exxon Mobil Corporation

Formosa Plastics

INEOS Group

LG Chem

LyondellBasell Industries Holdings B.V.

Mitsubishi Chemical Corporation

MOL Group

SABIC

China Petrochemical Corporation (Sinopec)

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/polyethylene-pe-market

#Polyethylene Market#Polyethylene Market Size#Polyethylene Market Share#Polyethylene Market Trends#Polyethylene Market Growth

0 notes

Text

Polyethylene Procurement Intelligence 2024-2030: Driving Business Growth

Polyethylene procurement is rising due to its usage in industries such as packaging, construction, and consumer goods. The polyethylene (PE) market is anticipated to grow at a CAGR of 4.1% from 2024 to 2030. According to I.C.I.S’ 2024 report, the global demand for PE increased by 140% from 1992 to 2023. This was an increase of 2.8 million tons on average each year for the same period. The demand for the commodity is mainly driven by its consumption in the packaging of food, beverages, and consumer goods. This is due to its properties, such as durability, easy customization, and moisture resistance. The G20 countries accounted for 78% of global PE demand in 2023. Changing consumer preferences is boosting the demand for on-the-go and secure food packaging globally.

Procurement of bio-based PE is gaining traction with rising focus on sustainable packaging to reduce environmental impact. Bio-based PE is produced from renewable raw materials such as sugarcane and can be recycled. Companies such as LynodellBasell Industries Holdings B.V., and Neste are involved in producing such kind of bio-based PE. Companies are also increasing their production capacity to produce more bio-based polyethylene. For instance, in July 2023, Braskem announced the completion of its 30% increase in production capacity of a bio-based ethylene plant located in Brazil. The capacity of the plant has increased from 200,000 to 260,000 tons per year. The increase in capacity is a significant move in Braskem’s commitment to sustainable development.

Currently, the majority of single-use PE products are being disposed of in landfills, contributing to ocean pollution and posing a threat to marine ecosystems. As a result, researchers are developing new technologies that would help in reducing waste through upcycling. For instance, in 2023 it was reported that Associate Professor Hsi-Wu Wong and Dongming Xie, both faculty researchers in chemical engineering, are currently working on technology aimed at reducing plastic waste through upcycling. This innovative process involves transforming discarded materials into products of greater value than their original form. Their research is further bolstered by a three-year grant totaling USD 463,000 from the National Science Foundation. Moreover, advancements such as the development of new catalysts and processes for more efficient polymerization can enhance production efficiency and quality.

Order your copy of the Polyethylene Procurement Intelligence Report, 2024 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The industry is fragmented in nature due to the presence of various types of PE such as high-density polyethylene (HDPE), low-density polyethylene (LDPE), and linear low-density polyethylene (LLDPE). Companies are continuously investing in new production technologies and increasing production capacities to meet customer needs. Alternative products such as bioplastics, paper-based packaging materials, and others can pose a moderate threat of substitutes in the market. Environmental concerns and regulations regarding plastic usage have increased the demand for eco-friendly alternatives, potentially posing a threat to the demand for the product.

Buyers in the market are diverse and include manufacturers of packaging materials, consumer goods, construction materials, and more. Factors such as market demand and availability of substitutes impact the buyer's responsiveness to price fluctuations. Buyers often engage in negotiations with suppliers to secure favorable pricing or terms, especially in industries with high competition.

Raw material (ethylene), labor, machinery, rent and facilities, and packaging & transportation are some of the key cost components incurred in the production of PE. Other costs are technology, utilities, repair and maintenance, testing and inspection, marketing, and legal costs. Polyethylene is manufactured from ethylene (which comes from petroleum). Thus, changes in ethylene prices impact the production costs and thus the final prices of the product. Raw materials and labor account for a major part of the overall cost structure. The prices of HDPE in North America witnessed fluctuations in the fourth quarter of 2023. The prices initially surged in October 2023 due to rising feedstock i.e. ethylene prices along with strong demand from packaging, automotive, and construction industries. The prices decreased by the end of Q4 2023 to around USD 1,217/MT for HDPE blow molding grade due to decreasing naphtha and crude oil demand in the global industry. Similarly, in Asian markets there were mixed trends as demand in the Indian and Chinese markets also initially declined in the last quarter of 2023. However, the prices elevated in December 2023 due to a recovery in demand in these markets. The prices of HDPE (blow molding grade) settled around USD 944/MT at the end of Q4 2023.

As part of the polyethylene procurement strategy, clients such as packaging companies fully outsource their PE manufacturing. Outsourcing services give clients exposure to procure products of good quality at better prices. China and India are preferred countries for sourcing polyethylene as they are the top-producing countries of the product. The quality and type of PE are major factors in the procurement of the commodity. Outsourcing the manufacturing of the product can help the procurement team in evaluating the quality of the product and making decisions in deciding suppliers of the product.

Browse through Grand View Research’s collection of procurement intelligence studies:

• Propylene Glycol Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Polyols Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Polyethylene Procurement Intelligence Report Scope

• Polyethylene Market Growth Rate: CAGR of 4.1% from 2024 to 2030

• Pricing Growth Outlook: 6% - 7% increase (Annually)

• Pricing Models: Volume-based pricing, competition-based pricing

• Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

• Supplier Selection Criteria: Type and quality of the product, end-use served, packaging option available, production capacity, delivery option, geographical presence, years in services, regulatory compliance, operational and functional capabilities, and others.

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

• LyondellBasell Industries Holdings B.V.

• Braskem

• FKuR

• Exxon Mobil Corporation

• SABIC

• INEOS

• Formosa Plastics Corporation

• China Petrochemical Corporation

• Repsol

• Ducor Petrochemicals

• Chevron Phillips Chemical Company LLC

• Westlake Corporation

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#Polyethylene Procurement Intelligence#Polyethylene Procurement#Procurement Intelligence#Polyethylene Market#Polyethylene Industry

0 notes

Text

Polyethylene Industry Capacity & Investment Projections up to 2027

Stay ahead with insights on Polyethylene Industry capacity and capital spending forecasts, covering active and planned plants. Plan for your industry's future success.

0 notes

Text

#Polyethylene market#Polymerization market#Blow molding market#Injection molding market#Extrusion market

0 notes

Text

High-Density Polyethylene Sheet

High-Density Polyethylene (HDPE) Sheets are known for their remarkable strength and chemical resistance. They are made from a flexible, long-lasting plastic resin. These sheets are used in many different industries, such as packaging, construction, agriculture manufacturing, outdoor furniture, playground equipment and more. Discover the lightweight nature of HDPE sheets that doesn't compromise on durability, making them an ideal choice for various projects. With a smooth surface and excellent impact resistance, HDPE sheets offer a reliable solution for both indoor and outdoor applications.

For more information, contact us : +91- 9081802800, e-mail : [email protected]

#hdpesheet#hdpesheetmanufacturer#hdpesheetsupplier#pp#polypropylene#plasticsheet#plastic#polyethylene#sheets#sheetmanufacturer#ecommerce#marketing#artwork#ppbag#branding#sales#commercial

1 note

·

View note

Text

Polyethylene Glycol Market Trends: Growth, Opportunities, and Forecast to 2030

Market Overview

The global polyethylene glycol (PEG) market is projected to reach $5,102.0 million in 2024, with expectations to grow at a compound annual growth rate (CAGR) of 5.2% during the forecast period from 2024 to 2030, culminating in a market value of $6,909.6 million by 2030. This growth is primarily driven by the increasing consumption of PEG as a specialty solvent and surface-active agent in various personal care products, including creams, lotions, toothpaste, shampoos, deodorants, conditioners, lipsticks, bath oils, soaps, and detergents. Additionally, the rising use of water-based coatings, paints, and inks in the construction industry, particularly in the Asia-Pacific region, is contributing to market expansion. The expansion of the paper industry in countries like China and India is also expected to boost the demand for PEG, as it is utilized in the production of paper and ceramics as a color stabilizer.

Key Insights

The PEG market is segmented by form into opaque liquid, white wax solid, and flake/powder. Each form caters to specific applications across various industries, influencing their demand and utilization.

In terms of grade, the market includes PEG 200, PEG 300, PEG 400, PEG 400 FCC Grade, PEG 3350, PEG 4000, and PEG 6000. These grades differ in molecular weight and are selected based on their suitability for specific applications, ranging from pharmaceuticals to industrial uses.

The application spectrum of PEG encompasses medical, construction and infrastructure, industrial, and personal care sectors. In the medical field, PEG is widely used as a laxative and in drug formulations due to its biocompatibility and solubility. In the construction industry, it serves as a binder and lubricant in various materials. The industrial sector utilizes PEG in manufacturing processes, while the personal care industry incorporates it into products for its moisturizing properties.

Geographically, the Asia-Pacific region holds the largest share of the PEG market and is also the fastest-growing region. This dominance is attributed to the extensive growth in the construction industry and the expansion of the paper industry in countries like China and India. The increasing use of water-based coatings, paints, and inks in construction activities is driving the demand for PEG in this region.

Technological advancements are playing a significant role in shaping the PEG market. The development of bio-based PEG is emerging as a major trend, driven by the need to reduce the environmental impact of petroleum-based products. Advancements in manufacturing technologies and research and development efforts are focused on improving processing techniques, enhancing product development, and increasing the availability of bio-based PEG.

The market is characterized by fragmentation, with numerous players operating globally. Key companies are focusing on strategic initiatives such as mergers, acquisitions, and partnerships to expand their product portfolios and geographic presence. The increasing demand for PEG in various applications presents significant opportunities for innovation and growth within the market. As industries continue to seek versatile and efficient solutions, the adoption of PEG is expected to rise, driving the market's expansion in the coming years.

Source: P&S Intelligence

#Polyethylene Glycol Market Share#Polyethylene Glycol Market Size#Polyethylene Glycol Market Growth#Polyethylene Glycol Market Applications#Polyethylene Glycol Market Trends

1 note

·

View note

Text

Low Density Polyethylene (LDPE) Market Scope, Trends, Forecast 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated Global Low Density Polyethylene (LDPE) Market size by value at USD 42.35 billion in 2023.During the forecast period between 2024 and 2030, BlueWeave expects Global Low Density Polyethylene (LDPE) Market size to expand at a CAGR of 5.65% reaching a value of USD 62.23 billionin 2030. Global Low Density Polyethylene (LDPE) Market is driven by several key factors. The demand for flexible packaging, especially in the food and beverage industry, is a major driver. Growth of e-commerce has increased the importance of packaging. In addition, construction industry uses LDPE in films, sheets, and coatings. The automotive and electronics industries are also contributing to the growth of the market. This is due to the versatility, chemical resistance, and protective properties of LDPE. Together, these factors lead to market expansion and innovation.

Sample @ https://www.blueweaveconsulting.com/report/low-density-polyethylene-market/report-sample

Opportunity – Growing Demand for Recyclable and Sustainable Packaging Materials

An increasing focus on recyclable and sustainable packaging materials is a major growth opportunity for Global Low Density Polyethylene (LDPE) Market. Environmentally conscious consumers and businesses spur the demand for environmentally friendly packaging products. LDPE, because of its recyclability and versatility, is widely used to manufacture durable packaging materials such as plastic bags, wrappers, and containers. This trend is particularly strong in developed markets such as North America and Europe, where regulatory pressures and consumer awareness are high. The transition to sustainable development drives market growth and innovation.

Impact of Escalating Geopolitical Tensions on Global Low Density Polyethylene (LDPE) Market

Rising geopolitical tensions could disrupt key supply routes, increasing shipping costs and creating supply chains. It could lead to higher production costs and higher prices, which could affect the growth of the market. Trade restrictions and tariffs further complicate international trade, creating uncertainty for producers and consumers. These challenges restrict supply and pricing, affecting the overall growth of Global Low Density Polyethylene (LDPE) Market.

Packaging Industry Segment Is Largest End User of LDPE

The packaging industry dominates the Global Low Density Polyethylene (LDPE) Market by end use. The dominance of packaging segment in the market is due to LDPE's versatility, lightweight properties, and excellent resistance to moisture and chemicals. LDPE is widely used in packaging applications such as plastic bags, films, and containers, due to its flexibility and cost-effectiveness. The growing demand for packaged food, beverages, and consumer goods, alongside the rise of e-commerce, further boosts the prominence of the packaging industry in Global Low Density Polyethylene (LDPE) Market.

Competitive Landscape

Global Low Density Polyethylene (LDPE) Market is fiercely competitive, with numerous companies vying for a larger market share. Major companies in the market include Chevron Phillips Chemical Company, Dow, Exxon Mobil Corporation, Formosa Plastics Corporation, LG Chem, LyondellBasell Industries Holdings BV, National Petrochemical Company, NOVA Chemicals Corporate, PetroChina Company Limited, Reliance Industries Limited, Westlake Chemical Corporation, GE Analytical Instruments, and Saudi Basic Industries Corporation (SABIC). These companies use various strategies, including increasing investments in their R&D activities, mergers and acquisitions, joint ventures, collaborations, licensing agreements, and new product and service releases to further strengthen their position in Global Low Density Polyethylene (LDPE) Market.

Contact Us:

BlueWeave Consulting & Research Pvt Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Polyethylene Terephthalate Foil Market - Forecast(2024 - 2030)

Overview

The Polyethylene terephthalate Foil market size is forecast to reach USD 18.5 billion by 2029, after growing at a CAGR of 4.42% during the forecast period 2024-2029. PET foil is highly versatile and can be used in a wide range of industries, such as construction, automotive, electrical, and packaging. Due to its adaptability, it is a material of choice for producers searching for affordable, strong, and lightweight solutions. As a result, the market for PET foil is growing.

Report Coverage

The report��“Polyethylene Terephthalate Foil Market– Forecast (2024-2029)”, by IndustryARC, covers an in-depth analysis of the following segments of the Polyethylene Terephthalate Foil market.

By Type: Virgin, Recycled.

By Thickness: Up to 10 Microns, 10-20 Microns, Above 20 Microns.

By Material Type: Aluminum PET Foil, Copper PET Foil, Metalized PET Foil, and others.

By End Use Industry: Electrical & Electronics, Industrial Machinery, Automotive, Construction, and others.

By Geography: North America, South America, Europe, APAC, and RoW.

Request Sample

Key Takeaways

Due to its recyclable nature, PET foil supports sustainability and efforts to raise environmental awareness. PET foil's recyclability and lower environmental impact as compared to traditional materials have made it increasingly popular among consumers and industries looking for eco-friendly packaging options.

PET foil technology is constantly evolving, leading to new applications and market expansion through higher printability, increased heat resistance, and customizable formulas. Manufacturers spend money on R&D to create cutting-edge PET foil products that satisfy changing consumer and market demands.

The introduction of PET foil is driven by strict rules about environmental standards, product labeling, and food safety. PET foil satisfies regulatory criteria for interaction with food and beverages. Compliance with regulations enhances consumer trust and confidence in PET foil as a safe and reliable packaging material.

By Type- Segment Analysis

Virgin dominated the polyethylene terephthalate foil market in 2023.In terms of thickness, transparency, and barrier qualities, virgin PET material offers more customizability. Because of their versatility, PET foil products can be customized by manufacturers to meet the needs of certain applications, adding to their utility and performance. The utilization of virgin PET foil might improve consumer perception and brand image for items aimed at consumers. When compared to products packaged with recycled materials, those packaged in virgin PET foil are frequently thought to be of a superior caliber and quality.

Inquiry Before Buying

By Thickness- Segment Analysis

10-20 Microns dominated the polyethylene terephthalate foil market in 2023. Foils that possess thicknesses of up to 10 microns find extensive usage in many packaging applications because of their exceptional printability, flexibility, and lightweight nature. They are frequently used for a variety of products, including food, drinks, personal care products, medications, and more, in flexible packaging formats such as pouches, sachets, labels, and wrapping sheets. For flexible electronics applications including printed circuit boards, flexible screens, and sensors, thinner PET foils are appropriate. Their thin, flexible nature makes it simple to integrate them into electronic equipment while yet offering the required insulation and protection.

By Material Type- Segment Analysis

Aluminum PET Foil dominated the polyethylene terephthalate foil market in 2023. Aluminum PET foils are quite popular in the packaging sector because they are easy to use, lightweight, and offer excellent barrier qualities at a reasonable price. This has increased the demand for them in grocery stores, eateries, homes, and food delivery services. Global food and beverage corporations have declared their intention to grow to meet the increasing demand for prepackaged foods. For example, Nestle USA stated in June 2021 that it would be investing 100 million to expand its frozen food production in South Carolina. During the projection period, it is expected that these expenditures will stimulate packaging usage and ultimately aid in market expansion.

Schedule a Call

By End Use Industry- Segment Analysis

Packaging dominated the Polyethylene Terephthalate Foil market in 2023.Growth in the worldwide packaging industry is expected to support market expansion because the product is widely utilized in the packaging of a variety of goods, including pharmaceuticals, food, drinks, and cosmetics. Additionally, There are tremendous development prospects for the market due to the expanding demand for recycled PET from a variety of industries, including the packaging sector. As greenhouse gas emissions and pollution from plastic waste continue to rise, several of the top competitors in this sector are concentrating on developing innovative recyclable plastics. In addition, compared to other polymers, this polymer is easily recyclable, which helps the market expand. Polyethylene terephthalate is the most recycled plastic in the world, according to the PET Resin Association. Every year, more than 680 kilotons of used PET bottles and containers are recycled in the United States. Furthermore, the product's throwaway qualities have increased demand for single-use plastics like it.

By Geography- Segment Analysis

APAC dominated the polyethylene terephthalate foil market in 2023.APAC is rapidly industrializing and urbanizing, especially in countries like China, India, Japan, South Korea, and Southeast Asian states. The need for PET foil for packaging applications is driven by this development in the demand for packaged goods across several industries, including food and beverage, pharmaceuticals, electronics, and consumer goods. The APAC region's economic expansion has raised disposable incomes and altered consumer habits. The need for PET foil in packaging has expanded as a result of the rise in the consumption of packaged goods, which includes ready-to-eat foods, beverages, personal care products, and home items.

Drivers –Polyethylene Terephthalate Foil Market

· The Growing Adoption of Pet Foil in the Packaging Industry

PET foil is a great option for packaging applications because it is strong and lightweight at the same time. Its lightweight design lessens the impact on the environment and shipping costs, but its durability guarantees the protection of items during handling and transportation. To maintain the freshness and caliber of packed goods, PET foil provides superior barrier qualities against gases, moisture, and odors. Because of this, it's especially appropriate for packaging perishable items including food and drink, medications, and personal hygiene items. Due to its high degree of recyclable nature, PET foil supports packaging sector sustainability initiatives. Recyclable materials like PET foil are in high demand as customers and regulatory authorities value eco-friendly packaging solutions more and more.

For instance, according to IBEF India, India's packaging industry is expanding rapidly and has a lot of room to grow in the future. The industry is expected to grow at a compound annual growth rate (CAGR) of 26.7% from 2020 to 2025, from its 2019 valuation of $50.5 billion to $204.81 billion. The FMCG, food processing, pharmaceutical, e-commerce, manufacturing, and healthcare sectors are all experiencing significant growth in this field. The market for PET (Polyethylene Terephthalate) Foil is expanding as a result.

Buy Now

· Rise in Electrical & Electronics Industry.

PET foil is suited for usage in a variety of electrical and electronic applications due to its flexibility and ease of molding into different shapes and sizes. Because of its adaptability, it can be easily integrated and installed into intricate electrical assemblies. Because PET foil has a high dielectric strength, electrical breakdown can be avoided and the safe operation of electrical and electronic devices can be ensured. Because of its dielectric characteristics, it can be used in situations involving high voltage.

For instance, according to Invest India, Based on data from FY22, the domestic electronics production is divided into the following categories: mobile phones (43%), IT hardware (5%), consumer electronics (12%), strategic electronics (5%), industrial electronics (12%), wearables and wearables (0.3%), PCBA (0.7), auto electronics (8%), LED lighting (3%) and electronic components (11%). The total value of domestic electronics production is $101 billion in FY23.

For instance, as per the IBEF India, In 2020, the global electronics market was projected to be worth $2.9 trillion. The electronics manufacturing industry experienced exponential growth, rising from $37.1 billion in 2015–16 to $67.3 billion in 2020–21.The PET foil market is growing in the Electrical & Electronics industry due to a number of factors, including its insulating qualities, flexibility, heat resistance, dielectric strength, chemical resistance, lightweight design, cost-effectiveness, appropriateness for miniaturization, and environmental advantages.

Challenges – Polyethylene Terephthalate Foil Market

· Competition from Alternative Materials.

PET foil faces competition from substitute packaging materials like glass, paperboard, and aluminum foil. To show PET foil's superiority over these substitutes in terms of affordability, functionality, and sustainability, manufacturers must constantly innovate. A classic packaging material, aluminum foil is renowned for its superior ability to block out light, moisture, and gasses. It is extensively utilized in the pharmaceutical, food, and other industries. In some applications, aluminum foil performs better as a barrier than PET foil, especially where high barrier qualities or tolerance to high temperatures are required. PET foil can be recycled, yet worries about plastic waste and its effects on the environment still exist. If not properly handled, growing consumer awareness of single-use plastics and governmental pressure may have an impact on PET foil consumption.

Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies players adopt in the Polyethylene Terephthalate Foil market. in 2023, The major players in the Polyethylene Terephthalate Foil market are Filiriko, Toray Industries, Inc, Akshar CoPack LLC, Finfoil, SunPRO, Shanghai Metal Corporation, UFlex, Constantia Flexibles Group GmbH, Terphane, Alfipa, and Others.

Developments:

Ø In July 2023, A recent initiative spearheaded by experts in Scotland seeks to turn plastic waste from industrial processes into drugs for neurological disorders, potentially revolutionizing the pharmaceutical sector. Impact Solutions scientists, University of Edinburgh biotechnology researchers, API Foil makers, a packaging company, and the Industrial Biotechnology Innovation Centre (IBioIC) are all involved in this cooperation. Together, they are investigating the viability of recycling PET, or polyethylene terephthalate, the plastic that is frequently used to produce food and drink packaging, to produce useful medications for the treatment of brain diseases.

#Polyethylene Terephthalate Foil Market#Polyethylene Terephthalate Foil Market Share#Polyethylene Terephthalate Foil Market Size#Polyethylene Terephthalate Foil Market Forecast#Polyethylene Terephthalate Foil Market Report#Polyethylene Terephthalate Foil Market Growth

0 notes

Text

Linear Low-Density Polyethylene Market Size, Share, Trends, Growth and Competitive Outlook

"Global Linear Low-Density Polyethylene Market – Industry Trends and Forecast to 2027

Global Linear Low-Density Polyethylene Market, By Process Type (Gas Phase, Slurry Loop, Solution Phase), Application (Films, Rotomolding, Injection Molding, Others), End-User Industry (Packaging, Building and Construction, Automotive, Electrical and Electronics, Agriculture, Household, Leisure, Sports), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2027

Access Full 350 Pages PDF Report @

**Segments**

- By Product Type: - Butene-LLDPE - Hexene-LLDPE - Octene-LLDPE

- By Application: - Films - Extrusion Coating - Injection Molding - Rotomolding - Others

- By End-Use Industry: - Packaging - Agriculture - Automotive - Construction - Others

Linear low-density polyethylene (LLDPE) market is segmented based on product type, application, and end-use industry. The product type segment includes butene-LLDPE, hexene-LLDPE, and octene-LLDPE. Butene-LLDPE is widely used due to its versatile properties and cost-effectiveness. Hexene-LLDPE offers improved toughness and puncture resistance, making it suitable for applications requiring durability. Octene-LLDPE provides excellent strength and sealability, making it ideal for high-performance packaging solutions.

When it comes to applications, LLDPE is utilized in various sectors such as films, extrusion coating, injection molding, and rotomolding. Films segment dominates the market owing to the extensive use of LLDPE in packaging films, agricultural films, and industrial films. Extrusion coating applications are growing due to the increasing demand for protective coatings in the food and beverage industry. Additionally, LLDPE's use in injection molding offers manufacturers the advantage of producing intricate shapes with high efficiency.

Moreover, the end-use industry segment of the LLDPE market includes packaging, agriculture, automotive, construction, and others. The packaging industry holds a significant share as LLDPE is a preferred choice for flexible packaging due to its moisture barrier properties. In the agriculture sector, LLDPE is extensively used in greenhouse films, mulching films, and silage wrap. The automotive industry utilizes LLDPE for various components such as fuel tanks, bumper fascia,The linear low-density polyethylene (LLDPE) market segmentation by product type, application, and end-use industry provides a comprehensive understanding of the diverse usage and demand patterns of this versatile polymer. The product type segment reveals the distinct properties and applications of butene-LLDPE, hexene-LLDPE, and octene-LLDPE. Butene-LLDPE stands out for its balanced properties and cost-effectiveness, making it a popular choice in various industries. Hexene-LLDPE offers enhanced toughness and puncture resistance, catering to applications where durability is paramount, such as in heavy-duty packaging. Octene-LLDPE, known for its superior strength and sealability, finds niche applications in high-performance packaging solutions requiring robust barrier properties.

Moving on to the application segment, LLDPE finds versatile use in films, extrusion coating, injection molding, rotomolding, and other diverse applications. Films, being the dominant application, witness a strong demand for LLDPE due to its flexibility, transparency, and moisture barrier properties. This segment encompasses packaging films for food and non-food items, agricultural films for crop protection and mulching, and industrial films for various industrial applications. The extrusion coating application is gaining traction, driven by the need for protective coatings in the food and beverage industry to ensure product safety and freshness. Meanwhile, injection molding applications capitalize on LLDPE’s moldability, enabling the production of intricate shapes with high efficiency, especially in the manufacture of automotive components, consumer goods, and medical devices.

In the end-use industry segment, the LLDPE market caters to packaging, agriculture, automotive, construction, and other sectors. The packaging industry emerges as a key consumer of LLDPE, leveraging its moisture barrier properties, flexibility, and cost-effectiveness for a wide range of packaging solutions. In agriculture, LLDPE plays a vital role in greenhouse films, mulching films, and silage wrap, offering protection and enhancing crop**Global Linear Low-Density Polyethylene Market**

- **Process Type** - Gas Phase - Slurry Loop - Solution Phase

- **Application** - Films - Rotomolding - Injection Molding - Others

- **End-User Industry** - Packaging - Building and Construction - Automotive - Electrical and Electronics - Agriculture - Household - Leisure - Sports

The global linear low-density polyethylene (LLDPE) market is witnessing significant growth, driven by the increasing demand for flexible and durable packaging solutions across various industries. The market segmentation based on process type, application, and end-user industry offers valuable insights into the consumption patterns and opportunities in the LLDPE market. Gas phase, slurry loop, and solution phase are the key process types in LLDPE production, each offering distinct advantages in terms of efficiency, cost-effectiveness, and product quality.

In terms of applications, LLDPE finds extensive usage in films, rotomolding, injection molding, and other specialized applications. Films remain a dominant application segment, with LLDPE being the preferred choice for packaging films due to its excellent moisture barrier properties and flexibility. The rotomolding segment is witnessing growth, driven by the demand for durable and lightweight products in industries such as automotive, agriculture, and leisure. Injection molding applications of LLDPE are gaining traction due to the polymer's versatility in producing

Key points covered in the report: -

The pivotal aspect considered in the global Linear Low-Density Polyethylene Market report consists of the major competitors functioning in the global market.

The report includes profiles of companies with prominent positions in the global market.

The sales, corporate strategies and technical capabilities of key manufacturers are also mentioned in the report.

The driving factors for the growth of the global Linear Low-Density Polyethylene Market are thoroughly explained along with in-depth descriptions of the industry end users.

The report also elucidates important application segments of the global market to readers/users.

This report performs a SWOT analysis of the market. In the final section, the report recalls the sentiments and perspectives of industry-prepared and trained experts.

The experts also evaluate the export/import policies that might propel the growth of the Global Linear Low-Density Polyethylene Market.

The Global Linear Low-Density Polyethylene Market report provides valuable information for policymakers, investors, stakeholders, service providers, producers, suppliers, and organizations operating in the industry and looking to purchase this research document.

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Linear Low-Density Polyethylene Market Landscape

Part 04: Global Linear Low-Density Polyethylene Market Sizing

Part 05: Global Linear Low-Density Polyethylene Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Reasons to Buy:

Review the scope of the Linear Low-Density Polyethylene Market with recent trends and SWOT analysis.

Outline of market dynamics coupled with market growth effects in coming years.

Linear Low-Density Polyethylene Market segmentation analysis includes qualitative and quantitative research, including the impact of economic and non-economic aspects.

Regional and country level analysis combining Linear Low-Density Polyethylene Market and supply forces that are affecting the growth of the market.

Market value data (millions of US dollars) and volume (millions of units) for each segment and sub-segment.

and strategies adopted by the players in the last five years.

Browse Trending Reports:

In Line Uv Vis Spectroscopy Market Collagen Casings Market Oilfield Scale Inhibitor Market Metal Based Catalysts Market Laundry Detergents Market Gaucher Disease Market Preventative Healthcare Technologies And Services Market 11d Printing Gases Market Airport Security Market Anxiety Disorder Market Laboratory Developed Tests Ldts Market Variable Rate Technology Market Military Drones Market Thawing Equipment Market Personal Care Contract Manufacturing Market Carbon Steel Market Drug Discovery Services Market Electric Bidet Seat Market Automotive Parts Packaging Market Sleep Tech Devices Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

#Bio Based Polyethylene Terephthalate Bio Pet Market Size#Bio Based Polyethylene Terephthalate Bio Pet Market Share#Bio Based Polyethylene Terephthalate Bio Pet Market Growth#Bio Based Polyethylene Terephthalate Bio Pet Market Trends#Bio Based Polyethylene Terephthalate Bio Pet Market Players

0 notes

Text

The Pet Bottles Market is booming with sustainable packaging trends

The pet bottles market has become increasingly popular owing to the rise of sustainable packaging trends. Pet bottles or polyethylene terephthalate bottles are lightweight, durable, and largely recyclable plastic bottles that are commonly used for packaging beverages such as water, juices, sodas, and other drinks. Pet bottles provide an excellent barrier against air and moisture, thereby retaining the organoleptic qualities of packaged beverages. Their glossy, clear appearance and decent rigidity allow them to showcase the packaged product well. Moreover, pet plastic produces minimal environmental pollution during its production and is widely recycled post-consumption. The global pet bottles market is estimated to be valued at US$ 59.4 billion in 2024 and is expected to exhibit a CAGR of 3.4% over the forecast period 2024-2031.

Pet bottles offer advantages such as shatter resistance, durability and reusability. They provide an effective alternative to glass bottles especially for packaged beverages consumed on-the-go. The rising consumption of bottled beverages along with the shift towards lightweight and sustainable packaging has driven the demand for pet bottles globally. Key Takeaways Key players operating in the pet bottles market are Amcor, Berry Global Inc., Gerresheimer, Silgan Holdings, and Tetra Laval. The growing demand for bottled water along with the expanding ready-to-drink beverages industry is propelling the pet bottles market. Additionally, the shift towards eco-friendly and sustainable packaging solutions is fueling market growth. Major players are focusing on expanding their pet bottle manufacturing facilities globally, especially in developing regions to capitalize on the rising demand. For instance, Amcor inaugurated a new pet bottle manufacturing plant in India in 2022 with an investment of over US$100 million. Market key trends One of the major trends gaining traction in the Pet Bottles Market Demand for recycled pet bottles. With sustainability at the forefront, beverage brands and manufacturers are focusing on utilizing recycled pet (rpet) content in bottles. Use of rpet reduces the consumption of virgin pet resin and helps lower the carbon footprint. Moreover, regulations in several countries mandate a certain percentage of rpet usage. For example, the European Union’s packaging and packaging waste directive mandates 25% rpet content in pet bottles by 2025.

Porter’s Analysis Threat of new entrants: Low capital requirements to enter the market but established players dominate distribution channels. Bargaining power of buyers: Large retail channels have more bargaining power over bottle manufacturers due to the competitive nature of the market. Bargaining power of suppliers: Resin and plastic material suppliers have moderate bargaining power due to minimal differentiation in raw materials. Threat of new substitutes: Alternatives like glass and aluminum bottles pose minimal threat due to established consumer preferences for PET bottles. Competitive rivalry: Intense competition among key players to gain greater market share exerts pressure to reduce costs through economies of scale. Geographical Regions North America currently accounts for the largest share of the global pet bottles market in terms of value, led by the United States. Easy availability of raw materials and large demand from food and beverage industry drive the North America pet bottles market. Asia Pacific region is expected to witness highest growth in the pet bottles market during the forecast period. Rising disposable incomes, growing consumption of packaged foods and changing lifestyles in countries like China and India are pushing the growth of pet bottles market in Asia Pacific.

Get more insights on Pet Bottles Market

Unlock More Insights—Explore the Report in the Language You Prefer.

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

Vaagisha brings over three years of expertise as a content editor in the market research domain. Originally a creative writer, she discovered her passion for editing, combining her flair for writing with a meticulous eye for detail. Her ability to craft and refine compelling content makes her an invaluable asset in delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

#Coherent Market Inights#Pet Bottles Market#Pet Bottles#Carbonated Soft Drinks#Packaged Water#Fruit Juice#Polyethylene Terephthalate#Plastic Waste#Reusable Bottles#Lightweight Packaging#Plastic Recycling

0 notes