#Pfizer stock movements

Explore tagged Tumblr posts

Text

Pfizer and Tilray: Contrasting Stock Movements Spark Investor Interest

The financial and investment landscape recently spotlighted significant developments in the stock movements of Pfizer Inc. (NYSE:PFE) and Tilray Brands Inc. (NASDAQ:TLRY). These activities have shed light on the evolving dynamics in the pharmaceutical and cannabis industries, drawing attention from institutional and individual investors alike.

Pfizer: A Mixed Bag of Investor Sentiment

Acquisition by Rep. Laurel M. Lee Rep. Laurel M. Lee disclosed a recent acquisition of Pfizer stock, signaling confidence in the pharmaceutical giant’s long-term prospects. Pfizer, a household name due to its role in combatting COVID-19, continues to leverage its expansive portfolio beyond vaccines. Current endeavors focus on oncology, rare diseases, and innovations in antiviral treatments. This move by Lee highlights a potential faith in Pfizer’s strategic pivots and innovation-focused future, despite recent challenges in revenue growth

read more in google news

3. Pfizer’s Broader Challenges Despite these contrasting stock activities, Pfizer’s fundamentals remain strong. With a robust pipeline of drugs, the company is poised to capitalize on innovations in gene therapy and precision medicine. Additionally, its strategic acquisitions aim to offset losses from expiring patents. However, the road to sustained growth appears challenging, given the current macroeconomic environment and evolving healthcare demands.

read more in google news

Tilray: Strategic Diversification Amid Industry Volatility

Tilray’s Stock Performance Tilray Brands, a global leader in cannabis and consumer-packaged goods, has witnessed significant investor interest due to its strategic initiatives. The company’s stock has been influenced by its aggressive expansion into non-cannabis sectors, including beverages and wellness products. These moves reflect Tilray’s efforts to weather the volatility of the cannabis market and regulatory hurdles in the United States and beyondough Diversification** Tilray’s ability to adapt has been pivotal. The company has strengthened its foothold by acquiring prominent beverage brands and expanding into THC and CBD-infused products. Its partnerships across North America and Europe underscore its vision for long-term growth in a market where legalization trends are gaining momentum. Tilray’s performance has also been bolstered by its entry into consumer-packaged goods, providing a hedge against the slower-than-expected legalization of recreational cannabis in the U.S. .

3. Industrynges Despite these efforts, Tilray faces headwinds. Oversupply issues in the cannabis market, fluctuating product prices, and fragmented regulations remain significant barriers. While the company is capitalizing on its international footprint, the U.S. remains a critical market for future growth. Investors are closely monitoring developments in federal legalization efforts, which could provide a substantial tailwind for Tilray’s ambitions.

read more in google news

Investor Takeaways: Contrasting Dynamics in Key Sectors

The contrasting approaches to Pfizer and Tilray stocks highlight broader themes in their respective industries:

Pharmaceuticals: Pfizer’s stock movements reflect both optimism about its innovative pipeline and concerns about its near-term revenue challenges. The company’s ability to execute its post-pandemic strategy will be critical to regaining investor confidence.

Cannabis: Tilray’s story underscores the importance of strategic diversification and adaptability in a nascent yet volatile industry. While challenges persist, the company’s proactive steps toward market expansion position it well for future growth.

These developments underscore the complexity of investing in dynamic, highly regulated sectors where innovation, strategy, and market sentiment intersect.

#Pfizer and Tilray: Contrasting Stock Movements Spark Investor Interest#Pfizer stock news#Tilray stock news#Pfizer stock movements#Tilray stock analysis#Stock market updates#Pharmaceutical stock trends#Cannabis stock market news#Pfizer stock acquisition#Pfizer stock sale#Rep. Laurel M. Lee Pfizer stock#Rep. Greg Landsman Pfizer stock#Pfizer revenue challenges#COVID-19 vaccine impact on Pfizer#Pfizer drug pipeline#Tilray cannabis stock#Tilray product diversification#Tilray consumer packaged goods#Cannabis market challenges#THC and CBD product trends#Tilray beverage expansion#Cannabis legalization news

0 notes

Text

This article is from last year but since I posted about detransitioners earlier this week I think this is relevant

Testosterone Therapy in a Transgender Male Patient as a cause of Acute Ischemic Stroke (P2-5.011)

Christina Tan, Lauren Kim Sing, Ron Danziger, Alex Aw, Chae Kim, Stephen Avila, Vilakshan Alambyan, Angud Mehdi, Michael Gezalian, Maranatha Ayodele, and Shahed ToossiAuthors Info & Affiliations

April 25, 2023 issue

Objective:

To share an intriguing case of a young transgender male patient receiving testosterone therapy who developed locked-in syndrome due to an acute ischemic stroke and to highlight potential risk factors for stroke in the LGBTQI+ community

Background:

There are many studies identifying risk factors for stroke in racially and ethnically diverse populations. However, there is little existing data for stroke risk factors in the LGBTQI+ community. Prior research has shown testosterone therapy in cis-gender men with initially low levels of testosterone increases the risk of stroke, especially in the first 2 years of use1. While testosterone therapy has been shown to increase the risk of venous thrombosis, its role in arterial thrombosis is unclear2. A proposed mechanism for thrombosis with testosterone replacement includes erythrocytosis, but the potential contribution of an independent pro-coagulant effect is yet to be determined3.

Design/Methods:

Literature review and case report.

Results:

An otherwise healthy 23-year-old transgender male on one year of testosterone therapy presented in an obtunded state. Examination revealed complete quadriplegia with sparing of vertical eye movements, consistent with locked-in syndrome. Imaging revealed complete occlusion of the basilar artery with distal reconstitution at the superior cerebellar arteries, and a large bilateral ischemic infarct of the pons. Computed tomography angiography did not demonstrate other large vessel disease or structural vascular abnormalities. Unfortunately, the patient was out of the time window for any acute stroke interventions. A hypercoagulable workup was performed but results were unrevealing and hematocrit was normal. Further investigation with transthoracic echocardiogram, transesophageal echocardiogram, and telemetry were negative for thrombus, patent foramen ovale, and atrial fibrillation.

Conclusions:

Acute ischemic stroke may be an under recognized complication of testosterone therapy in transgender males independent of degree of erythrocytosis. Further research is needed to establish a safety profile of testosterone therapy in this understudied population.

Disclosure: Dr. Tan has nothing to disclose. Mrs. Kim Sing has nothing to disclose. Dr. Danziger has nothing to disclose. Mr. AW has nothing to disclose. Dr. Kim has nothing to disclose. Dr. Avila has nothing to disclose. Dr. Alambyan has stock in Teleflex. Dr. Alambyan has stock in Natera. Dr. Alambyan has stock in Labcorp. Dr. Alambyan has stock in Veracyte. Dr. Alambyan has stock in Vicarious Surgical. Dr. Alambyan has stock in Unity Biotechnology. Dr. Alambyan has stock in Scynexis. Dr. Alambyan has stock in Stryker. Dr. Alambyan has stock in Eli Lilly. Dr. Alambyan has stock in DaVita. Dr. Alambyan has stock in Invitae. Dr. Alambyan has stock in Pfizer. Dr. Alambyan has stock in Bristol-Myers Squibb. Dr. Alambyan has stock in Johnson and Johnson. Dr. Alambyan has stock in Merck. Dr. Alambyan has stock in Medtronic. Dr. Alambyan has stock in AbbVie. The institution of Dr. Alambyan has received research support from Albert Einstein Healthcare Network. Dr. Mehdi has nothing to disclose. Dr. Gezalian has nothing to disclose. Dr. Ayodele has nothing to disclose. Dr. Toossi has nothing to disclose.

#testosterone and women#Acute ischemic stroke#locked-in syndrome#potential risk factors for stroke in the LGBTQI+ community#testosterone therapy has been shown to increase the risk of venous thrombosis#The patient was a 23-year-old transgender male

4 notes

·

View notes

Text

Over The Counter Pain Medication market will grow at highest pace owing to rising geriatric population

The over the counter pain medication market consists of non-prescription drugs used to relieve pain such as headaches, muscle pains, backaches, toothaches, colds, menstrual cramps and arthritis. These drugs provide temporary relief from pain and include analgesics like paracetamol and non-steroidal anti-inflammatory drugs such as ibuprofen and aspirin. Non-prescription pain medications are widely available as tablets, capsules and liquids in retail pharmacies and online stores, providing convenience to consumers. With growing aging population suffering from arthritis and other joint pains, the demand for these medications is increasing rapidly.

The Global Over The Counter Pain Medication Market is estimated to be valued at US$ 27.12 Bn in 2024 and is expected to exhibit a CAGR of 4.1% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the Over The Counter Pain Medication market include Johnson & Johnson, Pfizer Inc., Bayer AG, GlaxoSmithKline plc, Sanofi S.A., Reckitt Benckiser Group plc, Novartis AG, Perrigo Company plc, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, Sun Pharmaceutical Industries Ltd., Alkem Laboratories Ltd., Cipla Ltd., Dr. Reddy's Laboratories Ltd., Glenmark Pharmaceuticals Ltd., Lupin Limited, Aurobindo Pharma Limited. The dominance of these key players is attributed to their diverse product portfolio and strong global distribution network.

Over The Counter Pain Medication Market Demand rapidly owing to increasing incidences of headache, joint pains and menstrual problems across major countries. Self-medication has become popular as consumers frequently purchase these drugs for quick relief from minor pains without doctor's prescription.

Technological advancements are leading to development of innovative drug delivery systems for over the counter pain medications such as fast-dissolving oral thin films and gels providing pain relief more quickly. Development of combination drugs offering relief from multiple symptoms with a single drug is another key trend observed in this market. Market Trends Sustained release formulations are gaining popularity in the over the counter pain medication market. These ensure drugs remain effective for longer duration, releasing medicine slowly into the body. For example, Advil has introduced extended release gels providing all-day relief from pain.

Combination drugs offering relief from pain as well as symptoms like cold, cough and fever are witnessing strong demand. Consumers prefer single drugs treating multiple conditions. Manufacturers are developing combination pills accordingly to increase sales.

Market Opportunities The rising geriatric population suffering from arthritis and joint pains worldwide presents significant growth opportunities. Around 100 million US adults suffer from arthritis currently and the number is projected to rise to 130 million by 2060.

Online pharmacies are emerging as an important sales channel for over the counter pain medications. Expanding e-commerce and increasing preference of consumers to shop online from the convenience of their homes will drive future revenues in this distribution segment.

Impact of COVID-19 on Over The Counter Pain Medication Market Size And Trends The COVID-19 pandemic has immensely impacted the growth of the over the counter pain medication market globally. During the initial phase of the pandemic, there was a sharp surge in demand for pain relieving drugs like paracetamol, ibuprofen etc. as people stocked up medicines fearing potential shortages. This led to a significant spike in sales revenues for OTC pain medication manufacturers in 2020. However, as the pandemic prolonged, lockdowns imposed worldwide disrupted manufacturing and supply chain operations. Strict movement restrictions made it difficult for companies to transport raw materials and finished drugs. The declining disposable incomes and job losses during the economic downturn also reduced people's spending power which hindered the market growth post-2020.

To overcome resource constraints, companies focused on streamlining production and prioritizing essential medicines. They established alternative sourcing routes and enhanced inventory levels. Digitization of processes helped maintain business continuity. As restrictions eased in 2021-22, market saw a steady recovery backed by mass vaccination drives. Demand revived in retail channels and e-commerce platforms. However, hovering price pressures due to high production costs remain a key challenge. In the coming years, companies need to optimize costs, expand into virtual care solutions and tap opportunities in pain relief for Covid-19 associated symptoms to sustain growth in the post pandemic environment. Geographical Regions with Highest Over The Counter Pain Medication Market Value North America has been the largest regional market for over the counter pain medication, accounting for around 40% of global value due to high healthcare spending and self-medication trend. Within North America, the US commands the major share owing to large population size and presence of major manufacturers. Europe holds the second position while Asia Pacific is fastest growing region supported by expanding medical industries, rising health awareness and large patient pool in China and India. Fastest Growing Region in Over The Counter Pain Medication Market Asia Pacific region is poised to witness the fastest growth in the over the counter pain medication market during the forecast period. Factors such as rising middle class disposable incomes, increased spending on healthcare, growing geriatric population susceptible to joint disorders and innovations by local pharmaceutical giants are driving the market growth in Asia Pacific countries. Additionally, self-medication has become more prominent with easier access to OTC drugs via e-retailers and convenience stores. China, India, Japan, South Korea, Indonesia and other Southeast Asian countries offer immense untapped opportunities for OTC painkiller brands seeking to expand in Asia. Get More Insights On, Over The Counter Pain Medication Market About Author: Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

#Over The Counter Pain Medication Market Size#Over The Counter Pain Medication Market Demand#Over The Counter Pain Medication Market Trends#Over The Counter Pain Medication#Over The Counter Pain Medication Market

0 notes

Text

Pfizer (PFE) Stock Analysis and Outlook Ahead of Earnings Report

Source-jacobin.com

Market Performance and Recent Trends

In the latest trading session, Pfizer Stock closed at $26.26, showing a 1% increase from the previous day, outperforming the S&P 500’s 0.87% gain. Concurrently, the Dow rose by 0.67%, and the Nasdaq, dominated by tech stocks, saw an increase of 1.11%. Over the past month, Pfizer shares had incurred a 4.97% loss, while the medical sector faced a 6.67% decline, and the S&P 500 dipped by 3.97%.

Earnings Forecast and Analyst Insights

Investors are eagerly anticipating Pfizer’s upcoming earnings report scheduled for May 1, 2024. Analysts predict an EPS of $0.56, reflecting a 54.47% decrease compared to the same quarter last year. Revenue is estimated to be $13.86 billion, indicating a 24.21% decline year-over-year. Full-year projections suggest earnings of $2.23 per share and revenue of $60.26 billion, translating to increases of 21.2% and 3.01%, respectively, from the prior year.

Analysts have revised their estimates for Pfizer, signaling the dynamic nature of business trends. Positive revisions suggest confidence in the company’s performance and profit-generating capabilities. These adjustments are closely linked to short-term stock movements, with the Zacks Rank providing investors with actionable insights. Currently, Pfizer holds a Zacks Rank of #3 (Hold), with a 0.86% increase in the Zacks Consensus EPS estimate over the last 30 days.

Expert Analysis on Pfizer Stock — $PFE

youtube

Valuation Metrics and Industry Ranking

Pfizer’s Forward P/E ratio stands at 11.64, indicating potential undervaluation compared to the industry’s average of 13.89. Furthermore, its PEG ratio of 1.17 suggests a balanced growth outlook, considering the expected earnings growth rate. In contrast, the industry’s average PEG ratio was higher at 1.63. The Large Cap Pharmaceuticals industry, to which PFE belongs, ranks poorly at 217 out of over 250 industries, representing the bottom 14%. This industry ranking underscores the challenges and competitive landscape within the medical sector.

As PFE prepares to unveil its earnings report, investors are closely monitoring the company’s performance amidst market fluctuations and industry challenges. Analyst insights and valuation metrics provide valuable perspectives for decision-making, highlighting both opportunities and risks associated with Pfizer stock. With the earnings release drawing near, market participants remain attentive to any developments that could influence Pfizer’s trajectory in the coming quarters.

Also Read: Exploring the Pros and Cons of Veneers: A Comprehensive Guide

0 notes

Text

What are some high return stocks?

Investing in individual stocks can potentially lead to high returns, but it's important to remember that it also comes with higher risk compared to diversified investments like index funds or ETFs. High return stocks often belong to companies with strong growth potential, innovative products or services, solid financials, and a competitive edge in their industry. However, these stocks can be volatile and may experience significant price fluctuations.

Here are some types of stocks that investors often consider for their potential for high returns:

Technology Stocks: Companies in the technology sector can offer high growth potential, especially those involved in areas like cloud computing, artificial intelligence, e-commerce, and software-as-a-service (SaaS). Examples include Apple Inc. (AAPL), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL), and Microsoft Corporation (MSFT).

Biotech and Pharmaceutical Stocks: Biotechnology and pharmaceutical companies can see significant stock price movements based on the success of drug trials, FDA approvals, and breakthrough treatments. Examples include Moderna Inc. (MRNA), Pfizer Inc. (PFE), Biogen Inc. (BIIB), and Vertex Pharmaceuticals Incorporated (VRTX).

Consumer Discretionary Stocks: Companies that provide non-essential goods and services may experience strong growth during periods of economic expansion. This sector includes companies in retail, entertainment, travel, and luxury goods. Examples include Tesla Inc. (TSLA), Netflix Inc. (NFLX), Nike Inc. (NKE), and Starbucks Corporation (SBUX).

Renewable Energy Stocks: With increasing awareness of climate change and sustainability, companies involved in renewable energy, such as solar, wind, and electric vehicles, are gaining attention. Examples include Tesla Inc. (TSLA), NextEra Energy Inc. (NEE), Enphase Energy Inc. (ENPH), and Plug Power Inc. (PLUG).

Growth Stocks: These are companies that are expected to grow at an above-average rate compared to other companies in the market. Growth stocks may not always pay dividends but reinvest earnings to fuel further growth. Examples include Zoom Video Communications Inc. (ZM), Square Inc. (SQ), Shopify Inc. (SHOP), and Peloton Interactive Inc. (PTON).

While these stocks have the potential for high returns, it's crucial to conduct thorough research, consider your risk tolerance, and diversify your investments to mitigate risk. Additionally, past performance is not indicative of future results, so it's essential to invest with a long-term perspective. If you're uncertain, consider consulting a financial advisor before making investment decisions.

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

Trending Solutions in the Pharmaceutical Supply Chain Management Market

As the pharmaceutical supply chain continues to evolve and adapt, it faces new challenges and opportunities, prompting the sector to seek innovative solutions for a future of efficiency and reliability. The World Health Organization has reported that approximately 80% of the global population relies on medicines. This sheer dependence underscores the importance of establishing a streamlined and efficient supply chain that reliably delivers medicines. Our estimates indicate that the global pharmaceutical supply chain management market is projected to attain a revenue of $4203.32 million by 2030, rising at a CAGR of 8.70% during the 2023-2030 forecast period.

The escalating demand for pharmaceutical supply chain solutions can be attributed to the factors that underscore the imperative for heightened efficiency and transparency. As per the study, global pharmaceutical expenditure is expected to soar by $1.5 trillion by 2023. Notably, in 2021, China became the world’s second-largest pharmaceutical market, accentuating the urgency for adept supply chain solutions. These adoptions have significantly fueled the demand for SCM, thus driving the Asia-Pacific pharmaceutical supply chain management market to experience the fastest growth in the coming years.

Pharma Supply Chain Disruptions: Potential Tech Solutions

Pharmaceutical executives cite supply chain vulnerabilities as a major factor in their susceptibility to disruption. While these risks are unavoidable, companies can target their impact by increasing visibility, implementing robust risk management strategies, and leveraging advanced technologies.

Most widely embraced pharmaceutical supply chain management solutions:

Transportation Management System

A transportation management system (TMS) is a technology-enabled logistics platform that plays a central role in helping companies efficiently and strategically plan and optimize product movement. Particularly within temperature-sensitive pharmaceuticals, TMS takes on an added dimension by seamlessly integrating temperature monitoring solutions. According to the World Health Organization, improper temperature control can result in up to 35% of vaccines being wasted worldwide yearly.

Moreover, the Drug Supply Chain Security Act (DSCSA) reinforces TMS’s importance. Under the DSCSA, companies must comply with drug transportation regulations to ensure patient safety. Non-compliance can result in penalties of up to $500,000 per violation.

As Triton’s analysis indicates, the pharmaceutical supply chain management market by transportation management system is expected to advance at the fastest CAGR of 8.79% over the projected years 2023-2030.

Warehouse and Inventory Management System

An effective warehouse and inventory management system is essential within the pharmaceutical supply chain, facilitating seamless medicine flow. Maintaining optimal stock levels is a delicate balancing act and a robust warehouse system that orchestrates it flawlessly. Companies like Pfizer have reported a substantial reduction in stock levels, leading to reduced holding costs and improved cash flow.

This system’s benefits surpass financial gains. Minimized wastage is a significant victory for businesses and environmental preservation. According to a study, pharmaceutical waste constitutes 10% of global waste. Efficient inventory management significantly curbs this. In the United States, such implementation saved pharmaceutical firms around $8 billion annually through waste reduction.

Manufacturing Execution System

The global uptake of manufacturing execution systems (MES) is rapidly gaining momentum. This robust adoption is driven by MES’s ability to streamline the entire manufacturing process, fostering seamless operations from raw material input to finished goods production.

A tangible illustration of this efficacy emerges through Johnson & Johnson, a pharmaceutical giant that strategically integrated an MES across its production facilities. This strategic move yielded a 20% reduction in manufacturing cycle time, accelerating the time-to-market for critical medications.

Strategic Collaborations among Key Players

Manhattan Associates Inc: Manhattan Associates is a pharmaceutical supply chain management software company. It partnered with global pharmaceutical firms to enhance the efficiency of their distribution networks.

Oracle Corporation: Oracle is a prominent supplier of cutting-edge technology solutions tailored for the pharmaceutical supply chain management sector. Incorporating NetSuite into Oracle’s offerings bolsters operational transparency and effectiveness, streamlining manufacturing and distribution processes easily. NetSuite, a SaaS application, is a platform for comprehensive business management.

Cardinal Health Inc: In July 2017, Cardinal Health, a company specializing in healthcare products and services, finalized the purchase of Medtronic’s divisions encompassing patient care, deep vein thrombosis, and nutritional insufficiency. It also partnered with Bendcare to develop a comprehensive suite of solutions, aiding rheumatology practices’ financial health and success across the nation.

Conclusion

As the healthcare sector expands globally, streamlined supply chain management ensures the timely and accurate delivery of medicines to patients. Technological advancements are key in reshaping the pharmaceutical supply chain management market. In addition, sustainable practices and innovative solutions are making the sector better equipped than ever to overcome challenges and meet the evolving needs of patients worldwide.

FAQs:

Q1) Which key segments are considered in the pharmaceutical supply chain management market?

Component and deployment mode are the segments studied in the given market.

Q2) What major hurdle does the analyzed market encounter?

Technical issues with SCM software are affecting the market’s growth.

0 notes

Text

Stock Market Swings Amid Geopolitical Tensions: Tech Stocks Drop, Healthcare Rises #Apple #bullrun #centralbanks #correction #DowJonesIndustrialAverage #earningsgrowth #energystocks #geopoliticaltensions #globaloilsupplies #healthcarestocks #InterestRates #IranianMajorGeneralQasemSoleimani #loftyvaluations #marketdirection #Merck #Microsoft #MiddleEast #NASDAQComposite #oilprices #pfizer #Recession #SP500 #Stockmarket #techstocks #USdronestrike

#Business#Apple#bullrun#centralbanks#correction#DowJonesIndustrialAverage#earningsgrowth#energystocks#geopoliticaltensions#globaloilsupplies#healthcarestocks#InterestRates#IranianMajorGeneralQasemSoleimani#loftyvaluations#marketdirection#Merck#Microsoft#MiddleEast#NASDAQComposite#oilprices#pfizer#Recession#SP500#Stockmarket#techstocks#USdronestrike

0 notes

Text

Story at-a-glance

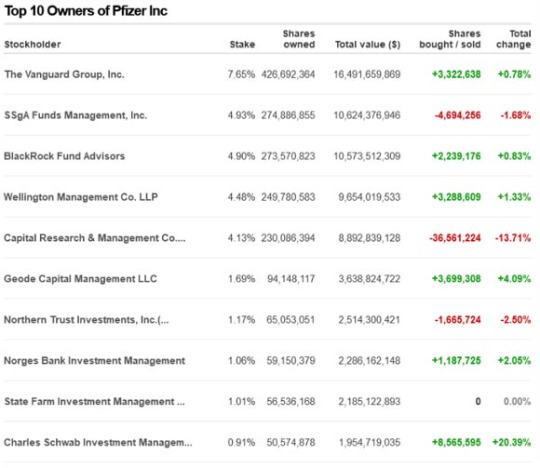

Big Pharma and mainstream media are largely owned by two asset management firms: BlackRock and Vanguard

Drug companies are driving COVID-19 responses — all of which, so far, have endangered rather than optimized public health — and mainstream media have been willing accomplices in spreading their propaganda, a false official narrative that leads the public astray and fosters fear based on lies

Vanguard and BlackRock are the top two owners of Time Warner, Comcast, Disney and News Corp, four of the six media companies that control more than 90% of the U.S. media landscape

BlackRock and Vanguard form a secret monopoly that own just about everything else you can think of too. In all, they have ownership in 1,600 American firms, which in 2015 had combined revenues of $9.1 trillion. When you add in the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms

Vanguard is the largest shareholder of BlackRock. Vanguard itself, on the other hand, has a unique structure that makes its ownership more difficult to discern, but many of the oldest, richest families in the world can be linked to Vanguard funds

What does The New York Times and a majority of other legacy media have in common with Big Pharma? Answer: They’re largely owned by BlackRock and the Vanguard Group, the two largest asset management firms in the world. Moreover, it turns out these two companies form a secret monopoly that own just about everything else you can think of too. As reported in the featured video:1,2

“The stock of the world’s largest corporations are owned by the same institutional investors. They all own each other. This means that ‘competing’ brands, like Coke and Pepsi aren’t really competitors, at all, since their stock is owned by exactly the same investment companies, investment funds, insurance companies, banks and in some cases, governments.

The smaller investors are owned by larger investors. Those are owned by even bigger investors. The visible top of this pyramid shows only two companies whose names we have often seen …They are Vanguard and BlackRock.

The power of these two companies is beyond your imagination. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. This gives them a complete monopoly.

A Bloomberg report states that both these companies in the year 2028, together will have investments in the amount of 20 trillion dollars. That means that they will own almost everything.’”

Who Are the Vanguard?

The word “vanguard” means “the foremost position in an army or fleet advancing into battle,” and/or “the leading position in a trend or movement.” Both are fitting descriptions of this global behemoth, owned by globalists pushing for a Great Reset, the core of which is the transfer of wealth and ownership from the hands of the many into the hands of the very few.

Interestingly, Vanguard is the largest shareholder of BlackRock, as of March 2021.3,4 Vanguard itself, on the other hand, has a “unique” corporate structure that makes its ownership more difficult to discern. It’s owned by its various funds, which in turn are owned by the shareholders. Aside from these shareholders, it has no outside investors and is not publicly traded.5 As reported in the featured video:6,7

“The elite who own Vanguard apparently do not like being in the spotlight but of course they cannot hide from who is willing to dig. Reports from Oxfam and Bloomberg say that 1% of the world, together owns more money than the other 99%. Even worse, Oxfam says that 82% of all earned money in 2017 went to this 1%.

In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution.”

While it would take time to sift through all of Vanguard’s funds to identify individual shareholders, and therefore owners of Vanguard, a quick look-see suggests Rothschild Investment Corp.8 and the Edmond De Rothschild Holding are two such stakeholders.9 Keep the name Rothschild in your mind as you read on, as it will feature again later.

The video above also identifies the Italian Orsini family, the American Bush family, the British Royal family, the du Pont family, the Morgans, Vanderbilts and Rockefellers, as Vanguard owners.

BlackRock/Vanguard Own Big Pharma

According to Simply Wall Street, in February 2020, BlackRock and Vanguard were the two largest shareholders of GlaxoSmithKline, at 7% and 3.5% of shares respectively.10 At Pfizer, the ownership is reversed, with Vanguard being the top investor and BlackRock the second-largest stockholder.11

Keep in mind that stock ownership ratios can change at any time, since companies buy and sell on a regular basis, so don’t get hung up on percentages. The bottom line is that BlackRock and Vanguard, individually and combined, own enough shares at any given time that we can say they easily control both Big Pharma and the centralized legacy media — and then some.

Why does this matter? It matters because drug companies are driving COVID-19 responses — all of which, so far, have endangered rather than optimized public health — and mainstream media have been willing accomplices in spreading their propaganda, a false official narrative that has, and still is, leading the public astray and fosters fear based on lies.

To have any chance of righting this situation, we must understand who the central players are, where the harmful dictates are coming from, and why these false narratives are being created in the first place.

As noted in Global Justice Now’s December 2020 report12 “The Horrible History of Big Pharma,” we simply cannot allow drug companies — “which have a long track record of prioritizing corporate profit over people’s health” — to continue to dictate COVID-19 responses.

In it, they review the shameful history of the top seven drug companies in the world that are now developing and manufacturing drugs and gene-based “vaccines” against COVID-19, while mainstream media have helped suppress information about readily available older drugs that have been shown to have a high degree of efficacy against the infection.

BlackRock/Vanguard Own the Media

When it comes to The New York Times, as of May 2021, BlackRock is the second-largest stockholder at 7.43% of total shares, just after The Vanguard Group, which owns the largest portion (8.11%).13,14

In addition to The New York Times, Vanguard and BlackRock are also the top two owners of Time Warner, Comcast, Disney and News Corp, four of the six media companies that control more than 90% of the U.S. media landscape.15,16

Needless to say, if you have control of this many news outlets, you can control entire nations by way of carefully orchestrated and organized centralized propaganda disguised as journalism.

If your head is spinning already, you’re not alone. It’s difficult to describe circular and tightly interwoven relationships in a linear fashion. The world of corporate ownership is labyrinthine, where everyone seems to own everyone, to some degree.

However, the key take-home message is that two companies stand out head and neck above all others, and that’s BlackRock and Vanguard. Together, they form a hidden monopoly on global asset holdings, and through their influence over our centralized media, they have the power to manipulate and control a great deal of the world’s economy and events, and how the world views it all.

Considering BlackRock in 2018 announced that it has “social expectations” from the companies it invests in,17 its potential role as a central hub in the Great Reset and the “build back better” plan cannot be overlooked.

Add to this information showing it “undermines competition through owning shares in competing companies” and “blurs boundaries between private capital and government affairs by working closely with regulators,” and one would be hard-pressed to not see how BlackRock/Vanguard and their globalist owners might be able to facilitate the Great Reset and the so-called “green” revolution, both of which are part of the same wealth-theft scheme.

youtube

That assertion will become even clearer once you realize that this duo’s influence is not limited to Big Pharma and the media. Importantly, BlackRock also works closely with central banks around the world, including the U.S. Federal Reserve, which is a private entity, not a federal one.18,19 It lends money to the central bank, acts as an adviser to it, and develops the central bank’s software.20

“In all, BlackRock and Vanguard have ownership in some 1,600 American firms, which in 2015 had combined revenues of $9.1 trillion. When you add in the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms. “

BlackRock/Vanguard also own shares of long list of other companies, including Microsoft, Apple, Amazon, Facebook and Alphabet Inc.21 As illustrated in the graphic of BlackRock and Vanguard’s ownership network below,22 featured in the 2017 article “These Three Firms Own Corporate America” in The Conversation, it would be near-impossible to list them all.

In all, BlackRock and Vanguard have ownership in some 1,600 American firms, which in 2015 had combined revenues of $9.1 trillion. When you add in the third-largest global owner, State Street, their combined ownership encompasses nearly 90% of all S&P 500 firms.23

A Global Monopoly Few Know Anything About

To tease out the overarching influence of BlackRock and Vanguard in the global marketplace, be sure to watch the 45-minute-long video featured at the top of this article. It provides a wide-view summary of the hidden monopoly network of Vanguard- and BlackRock-owned corporations, and their role in the Great Reset. A second much shorter video (above) offers an additional review of this information.

How can we tie BlackRock/Vanguard — and the globalist families that own them — to the Great Reset? Barring a public confession, we have to look at the relationships between these behemoth globalist-owned corporations and consider the influence they can wield through those relationships. As noted by Lew Rockwell:24

“When Lynn Forester de Rothschild wants the United States to be a one-party country (like China) and doesn’t want voter ID laws passed in the U.S., so that more election fraud can be perpetrated to achieve that end, what does she do?

She holds a conference call with the world’s top 100 CEOs and tells them to publicly decry as ‘Jim Crow’ Georgia’s passing of an anti-corruption law and she orders her dutiful CEOs to boycott the State of Georgia, like we saw with Coca-Cola and Major League Baseball and even Hollywood star, Will Smith.

In this conference call, we see shades of the Great Reset, Agenda 2030, the New World Order. The UN wants to make sure, as does [World Economic Forum founder and executive chairman Klaus] Schwab that in 2030, poverty, hunger, pollution and disease no longer plague the Earth.

To achieve this, the UN wants taxes from Western countries to be split by the mega corporations of the elite to create a brand-new society. For this project, the UN says we need a world government — namely the UN, itself.”

As I’ve reviewed in many previous articles, it seems quite clear that the COVID-19 pandemic was orchestrated to bring about this New World Order — the Great Reset — and the 45-minute video featured at top of article does a good job of explaining how this was done. And at the heart of it all, the “heart” toward which all global wealth streams flow, we find BlackRock and Vanguard.

- Sources and References

6 notes

·

View notes

Text

Contra-Vax

Vaccines to the rescue? Only if people roll up their sleeves. Photo courtesy of Valleywise Health

Science moved at unprecedented speed to develop vaccines against the new coronavirus. It was too fast for some latinos -- especially those egged on by myth and misinformation

On the ranch where Gabriela Navarrete was raised in the northern Mexican state of Chihuahua, she learned early on that the land could provide what she needed to cure her ills. Mesquite bark, olive oil, corn vinegar and baking soda were useful for treating everything from joint pains to throat infections. In case of indigestion, the medicine was a good old stomach rub.

Navarrete, 69, passed on to her three daughters and one son the lesson that "everything natural is what is good for the body."

So when the COVID-19 pandemic began, she quickly stocked up on Vitamin C, infusions of ginger, chamomile and peppermint, and linden tea for sleeping.

And while this arsenal failed to defend her against the coronavirus last year, she remains resolute: Her principle of "consuming everything natural," she said, is more powerful than the idea of getting vaccinated.

That's why she’s decided that the new COVID vaccines are not for her.

"Getting the vaccine is going to be very bad for me because I think they are made from the virus itself," Navarrete said, talking from her home in Anthony, New Mexico, a small town on the border with Texas. "The only time I got the flu shot, I got a lot worse and I don't want to do that to my body anymore."

Graciela Navarrete and her grandson, Diego.

The coronavirus reached Navarrete’s family through her 17-year-old daughter, an athlete who resumed volleyball practice once the school gym was opened after the lockdown. Everyone avoided hospitalization. They were treated by the family doctor with antibiotics, ibuprofen and albuterol in inhalers.

"The virus gave me very bad headaches and I still struggle when walking, so I accepted the medicines. But I am definitely not getting vaccinated."

Like others her age, Navarette is at a higher risk of infection. Yet that’s not enough for her or her children to discount messages they’ve gotten via WhatsApp, complete with videos, that claim, for example, that vaccines are made with tissues of aborted fetuses.

Doubts and fears

Nationwide, people across demographic lines have lingering doubts about the new COVID-19 vaccines, according to a new survey by the Monmouth University Polling Institute.

Half of the survey respondents said they plan to get vaccinated as soon as they’re allowed to. But 19% say they want to first see how others react to the inoculations, while 24% say they will avoid the vaccine if they can.

Among Latinos, according to recent data from the COVID-19 vaccine monitor launched by the Kaiser Family Foundation (KFF) to track attitudes and experiences with the vaccines, 18% of adults said they will definitely not get the vaccine. Another 11% said they will only do so if it’s required by employers. And, among those who have decided that they will get vaccinated, 43% said they want to wait and see how the innoculations affect other Latinos.

According to the United States Centers for Disease Control and Prevention, Latinos are nearly twice as likely to be infected by COVID-19 as non-Latino whites. The same population is more than four times as likely to be hospitalized and almost three times as likely to die of the virus. This is due, partly, to the large number of Latinos working in essential jobs that expose them to co-workers and the public. Other factors, like access to health care, also play a role.

Despite the higher risk, some Latinos remain uncertain about the safety of the new coronavirus vaccines.

An example: Navarrete in Texas, said she believes the myth that vaccines carry bits of an actual virus.

"There are other vaccines that have virus particles, including live virus particles," said Gerardo Capo, chief of hematology at Trinitas Comprehensive Cancer Center in New Jersey. "This vaccine is more modern. It has internal proteins of the virus that are not considered to cause an infection. It is impossible."

Vaccine hesitancy among Latinos in the U.S. is not necessarily an ideological issue or a belief in the anti-vaccine movement. "It has more to do with not having enough information or having inadequate information," said Nelly Salgado de Snyder, a researcher with the University of Texas at Austin.

Doubts exist even among Latino health care professionals.

Ada Linares, a nurse in the New York area, told palabra. that it’s not the suspicious messaging seen on social media or via WhatsApp texts, but her own unfamiliarity with this vaccine -- how it was developed and potential side effects perhaps overlooked in testing and trials that moved at unprecedented speed.

“I have always been pro-vaccine, and I think this is why we are here today,” she said. “But at the same time, I don’t know much about (the vaccines).”

Nurse Ada Linares hesitated for some time but she eventually rolled up her scrubs and took her doses. Photo: Jorge Melchor

Avoiding the needle

In Texas, officials started by vaccinating health care workers, residents of nursing homes and some people older than 65 years.

Throughout the state, according to the KFF monitor, only 15% of vaccines have reached Hispanics, even though Latinos account for almost 40% of the population, 44% of coronavirus cases and almost half of COVID-19 deaths.

"We need to focus on equity as part of the COVID-19 vaccination effort," said Samantha Artiga, director of KFF's racial equity and health policy program. "It is important to monitor data by race and ethnicity to understand the experiences of the communities ... , who is receiving the vaccines, and who has been the most affected by the pandemic."

But it’s more than just reluctance. Studies into low flu vaccination rates among low-income Latino seniors show that being uninsured -- and even the lack of transportation to get to vaccination centers -- are huge barriers.

Experts suggest that no-cost COVID-19 vaccines, available to everyone regardless of health insurance or immigration status, could help close the gap, “if the information is available in linguistically appropriate materials and the concerns of people are clearly addressed. Immigrant families should be assured that their medical data is private and will not be used by federal agencies,” Artiga said.

Conspiracy theories

In addition to debunked conspiracy theories that Pfizer and Moderna vaccines can alter DNA, or contain microchips implanted by Bill Gates to monitor people with 5G technology, other rumors specific to the Latino community have spread through social media.

“The viral disinformation includes anonymous voice messages on WhatsApp that say that since Trump does not like Mexicans and built the wall, he wants to vaccinate us so we cannot have more children, or that the vaccine is a poison for those of us who are here undocumented, that it is a way to get rid of us,” Salgado de Snyder said.

Photo illustration by FrankHH/Shutterstock

She suggested one possible reason such disinformation is embraced: “People believe it because they don't have the level of education or the institutional support to confirm this information that they hear from other Latinos. Many of them do not speak English and most of the scientific information is not available in Spanish,” she said.

Salgado de Snyder is the co-author of the study, “Exploring Why Adult Mexican Males Do Not Get Vaccinated: Implications for COVID-19 Preventive Actions,” conducted by the Migrant Clinicians Network and published last September.

Data was collected in 2019 at the Ventanilla de Salud at the Mexican Consulate in Austin. Before the pandemic, the clinic offered free vaccines against maladies like influenza, tetanus, hepatitis A and B, and human papilloma, in association with Austin Public Health.

Some 400 patients gave researchers a variety of reasons for not getting vaccinated, including lack of time or money, fear of injections and of potential side effects, insufficient information or motivation, and the perception that they are healthy and don’t need inoculation.

"While women are more familiar with the health system because in Mexico there is a universal voluntary and free vaccination program, men have the mistaken belief that vaccines are the cure for a problem, they do not see (a vaccination) as a preventive tool," Salgado de Snyder said.

“As breadwinners, they do not want to miss a day of work to go to get vaccinated,” she added. “That is why our recommendations in times of COVID are that through some type of mobile clinic, employers offer vaccines in workplaces such as construction companies or meatpacking plants,” she said.

Moving too fast

María del Rosario Cadena remembers that during her childhood in Tampico, in Mexico’s Tamaulipas state, she received vaccines against hepatitis and polio without any side effects. But she is "very suspicious" about the COVID-19 vaccines that seem to have been developed and approved so quickly.

"I've seen on TV that it affects various parts of the body and people get very sick after receiving it," del Rosario Cadena said.

Maria del Rosario Cadena

Apart from her doubts about the vaccine, del Rosario Cadena insists she follows all recommendations to guard against COVID-19: She wears a mask, she practices social distancing, and she’s always washing her hands. And, since she doesn’t go out "at all," the 71-year-old said she believes that “isolation is my vaccine. I feel I don't need it."

Her daughter, Rocio Valderrabano, 55, is diabetic, so she will soon have access to a COVID-19 vaccine. But she has doubts, so she’ll wait and see how some friends -- nurses -- react to their second doses. "I know people who have had COVID and spent four days with oxygen. I know they had a very bad time ... but I still want to wait and see if there are side effects (to the vaccine)."

Clinicians said mistrust also comes from knowing there were few people of color in the vaccine trials. In the trial for the Pfizer-BioNTech vaccine, participants were 13% Latino, 10% African American, 6% Asian, and 1% Native American. Moderna’s trial population was 20% Hispanic, 10% African American, 4% Asian.

"We hope that the labs that are developing new vaccines will include more Latino patients in their trials," said Dr. Lucianne Marin, a pediatrician at Los Barrios Unidos Community Clinic in Dallas, one of 75 community centers in Texas that will provide vaccines in immigrant neighborhoods.

Marin and the rest of the Barrios Unidos staff have already received both doses -- injections that caused her "a bit of discomfort, fatigue, and a headache."

“Anything strange that enters the body can cause a reaction,” she said. “But one has to understand that the vaccine is not made from the live virus. It’s from genetic material that will help to generate antibodies. … I tell my patients that a fever or a pain in the body cannot be compared with the exposure to the coronavirus.”

The community clinics are out to debunk myths and dispel fears. They emphasize the greater risk of infection for Latinos who have chronic health problems like diabetes, hypertension, and excessive weight.

In doctor’s offices or in telemedicine visits they invite grandmothers to be champions in their families and spread the message about the need to get vaccinated. “Among Latinos, the elders of the family are highly respected and they are listened to; if they are convinced (of the vaccine), the family will be too,” Marin said.

Community health workers also share messages on Facebook, or partner with local Spanish-language media on virtual discussions featuring doctors and public officials -- even representatives from consulates of Latin American countries.

“It is our job to be the reliable messenger,” Marin said. “Vaccines are safe and free.”

Originally published here

Want to read this piece in Spanish? Click here

#English#Vaccine hesitancy#vaccination#covid_19#Barrios Unidos#Latinos#Hispanic#conspiracy theories#Bill Gates#Mexico#Mexican American

1 note

·

View note

Text

Daniel Eduardo Serrato Ude

Public Accountant - Financial Services / Current student of Master in Management

Current student of Master in Management in France - ESC Clermont- Ferrand. Bachelor Degree of Accounting at Externado University. Solid experience in analizing financial and accounting information from different companies, as well as in transaction services (due diligence) giving support for different sectors - Industrial, services and banking. In addition, professional background in consolidation and reporting, and daily accounting processes with SAP. Furthermore, I am fluent in 4 languages (Spanish, English, French and Portuguese) and intermediate level of speaking in Russian. Skills to adapt to change, fast learning and teamwork under pressure. Autonomous, responsible and motivated by constant learning and growth both professionally and personally.

PROFESSIONEL EXPERIENCES

KPMG S.A.S. // Staff (Transaction services - due diligence)

Colombia/ November 2017 – August 2018 (9 months)

* Understanding, analysis and synthesis of financial information and information of interest of different companies for decision making.

* Calculation and analysis of reported and adjusted EBITDA, net debt and working capital.

* Summary of recommendations and important results for the development of the transaction and decision making.

* Contact the customer and the target to get information.

Aspen Labs // Accounting analyst

Colombia / February 2015 – December 2016 (1 year 10 months)

* Realization of reports of revenue and costs for the headquarter.

* Assist in the reporting of financial information to the headquarter.

* Validation and control of employee´s expenses.

* Make accounting assignments and reconciliations of accounts.

* Check and analyse balances and movements in accounts in balance sheets and income statements of the company.

* Preparation and validation of information for audits and tax outsourcing.

Succeeded in:

1. Establishment and staff training of a new expenditure legalization tool,

2. Creating new transactions in SAP with the corresponding support for a more efficient information flow.

Pfizer S.A.S. // Accounting analyst (Internship)

Colombia/ January 2013- July 2013 (7 months)

* Review and control the company's fixed assets.

* Make accounting assignments and reconciliations of accounts.

* Check balance sheet accounts and administrative expenses.

EDUCATION

2018 - 2020 Groupe ESC Clermont

Master in Management

2010 - 2015 University Externado of Colombia

Studies in public accounting applied to business management

Personal skills

Languages:

Spanish - Mother tongue

English - Fluent

French – Fluent

Portuguese - Intermediate

Russian - Spoken

Related to finance:

- Preparation and analysis of financial and accounting information.

- SAP (FI)

- Analysis of EBITDA, working capital and net debt.

- Asset management.

Others:

- Adaptation to change

- Customer service

- Team work

- Fast learner

- Advanced use of Microsoft tools.

Progress of axes in the Master degree

Status of goals related to my Master degree

First Master´s Internship - Gap year

Valeo

Daily indicators of revenue, stock, wasted inventory .

Weekly best estimated of sales

Monthly Reporting groupe (Actual – budget – forecast) in SAP Financial Consolitation

Weekly reporting of direct labor efficiency of production

Validation for the monthly closing of sales, transport, inventory, NQC, selling expenses, along other.

Daily validation of transport invoices, purchase requisitions, inventory differences and IDOCs in SAP

Professional plan

I want to continue with the path in due diligence that I had before starting my Master.

Consultant transactions services

A transaction services consultant participates in the development of accounting and financial due diligence procedures, in connection with acquisition and sales transactions on behalf of Corporate and / or Private Equity clients.

Required Skills

1. Technical skills

Advanced accounting concepts including new standards

Computer tools (spreadsheets, databases)

In-depth economic and financial culture

Writing high capacity (clear and factual summaries)

English (working language)

2. Professional Skills

Availability and responsiveness (respect of deadlines and emergencies)

High stress resistance (maximum availability required, highly exposed position for experienced consultants)

Political sense, ability to negotiate

Relational and multidisciplinary team work (firmness and diplomacy)

Sense of organization (manage different internal or external consulting teams, in sensitive contexts)

Ability to anticipate: detect any new opportunity that can turn into a merger-acquisition operation.

Linkedin

https://www.linkedin.com/in/daniel-serrato-ude-649978b9/

Thank you

1 note

·

View note

Text

Deep Biontech (BNTX) analysis and why i think a rally could start after Q3 earnings tomorrow

Forecast for this week (see full details on financials further down)

This week BNTX will shine; Q3 ER on Tuesday and oncology congress 10-14 November (see pipeline below). Moderna missed earning last week and reduced the guidance for 2021; this reduction was not driven by lack of demand, it was driven by delays in manufacturing. BNTX-PFE jumped in and took over the demand Moderna failed to serve. The current drop is still an overreaction of the market to the Pfizer anti-viral which cause a lot of Stop/Loss drops and liquidation of call options.

Pfizer has recently announced Q3 revenue from Comirnaty to be $13 Bn, and raised the 2021 FY forecast from $33 Bn to $36 Bn. Consensus estimate is $12.27 EPS Q3. We estimate a somewhat better result, $12.75 at minimum, driven by a/o higher sales volume and improved financing result. Similar to what happened to this stock for Q4 2020 earning on March 31st 2021, the most likely scenario is a rally starting directly after the Q3 earnings.

Market manipulation

Biontech is a fairly new stock on the Nasdaq and due to its small freefloat of approx. 240m shares, it got highly manipulated by market makers the recent year.

It seems like big money and algos are trading Biontech and Moderna as only one mRNA-Stock. Both stocks are glued together, although they should have a contrary movement. (i.g. Biontech gets its FDA approval, Moderna goes up; Pfizer reporting a surpass of the quarterly estimates, Moderna goes up). Neglecting some more money flow to Moderna, their movement is sync by seconds on a daily basis.

Biontech vs Moderna

Biontech vs Moderna

Market share

Plain and simple Comirnaty is dominating the vaccine race in western world and now rapidly expanding to takeover Sputnik and the Chinese vaccines in Latam and other regions that relied on those vaccines at the start of the pandemic

https://preview.redd.it/yq3r2q1cvdy71.png?width=478&format=png&auto=webp&s=d08eb6888077a96c5e8817a944a41a5e6ea7be6d

https://preview.redd.it/34dszcucvdy71.png?width=624&format=png&auto=webp&s=5d4c5244f5180ffe235a7b0fa7b347fe081bf70d

Proof of concept

Biontech was the first company in the world with a real vaccine for corona. Uğur Şahin was standing beside Donald Trump in front of the White House while announcing this news.

Other companies tried to follow suit, but the most of them failed (i.e. Curevac). Only Moderna could produce another working mRNA vaccine.

This proof of concept can be extrapolated to all other vaccines in their pipeline and Biontech has the highest likelihood for a good outcome.

• Safety

Comparing all vaccines available on the market, Comirnaty has the lowest side effects of all.

AstraZeneca had a lot of issues and is no longer used in the European Union, never got authorized in the US. Moderna has also a higher risk of heart inflammations and it’s use got stopped in countries like Finland, Sweden, Norway, Denmark, Iceland for males under 30 years old. The FDA recently authorized under EUA the use of Comirnaty for children over 5 years old. In contrast, Moderna’s authorization for children above 12 got delayed to at least January. The Biden administration has purchased enough pediatric doses to vaccinate 100% of children between 5 and 11 years old. This gives Biontech a monopoly for children vaccination.

• Capacity

The demand for COVID vaccines is huge and the biggest bottleneck has been and continues to be production capacity and where vaccine manufacturers have struggled. This is where Biontech in partnership with Pfizer have done a stellar job ramping up manufacturing capacity from original 2021 estimate of 1Bn to 3Bn doses for 2021, followed by 4bn doses in 2022 and beyond. To reach this goal they have already a new production building in Marburg Germany with a capacity of 1bn doses a year.

Biontech is also expanding their production all over the world. In 2022, they will start a production building in Singapur and also in Africa with a cooperation with Ruanda and Senegal, in cooperation with the national governments and co-funded by international donors. In addition they have entered in a joint venture with the Chinese company Fosun, plans for and are building another plant with a capacity of 1 bn doses for the Chinese Asian market have been announced.

• COVID outlook, from pandemic to endemic

No matter which vaccine you’ll take, the protection efficacy is waning. The coronavirus is also mutating constantly to new variants, just like the flu. You don’t need an accurate forecast to realize that the virus is here to stay. All over the world, the governments are starting the 3rd booster jab. Talks about a 4th booster are already taking place. An annual vaccination will be the rule, once again think about the flu, exact same but for a much more deadly and infectious virus. We’ll see a constant cashflow. While most analysts are just too afraid to announce this in public still ignore this, BoFA has been estimating an annual booster demand at the size of flu vaccination demand, 58% of population in industrialised countries. The EU has secured 450m booster doses for each of 2022 and 2023, with an option for doubling should two booster shots per year become necessary. Booster prices have been raised by some 25% or more in most industrialized countries, including EU, USA, and the UK over 2021 prices, with Pfizer seeing further room for increase when comparing with other vaccines, e.g. against Shingles or Streptococces.

• Cancer pipeline

Biontech has a long-lasting experience in cancer research. They are the technical pinnacle with the mRNA cancer treatment currently and way ahead of all other companies in the world. They have four cancer studies in their 2nd phase which are extremely promising. For instance, they cured cancer of 17 mice out of 20 completely. The other 3 mice shrunk their tumors dramatically. A real cure for cancer is ahead of us! There is an upcoming (11/10-11/14) oncology conference called SITC where Biontech has 7 abstract and a late-breaking presentation. The pipeline includes two PD-L1 antibody combination therapies, developed in cooperation with Genmab, which initial reports call "very promising". The PD-(L)1 antibody market was some 27 bn USD in 2020, with expected annual growth rates of up to 35%, and includes blockbusters such as Keytruda (Merck). Another presentation will be on BioNTech's novel CAR-T-Cell approach using mRNA, which addresses a potential 10 bn USD market by 2024.

· Social responsibility

Biontech and Pfizer are donating 1Bn doses at cost to the US government to be donated free of charge to the 90 poorest countries. They have pledged they will donate additional 1Bn doses to the poorest countries.

• Pipeline

Besides Corona and cancer, they are also working on various vaccines. Their flu vaccine developed for Pfizer has entered Phase 1 clinical trial in September. If successful, BioNTech shall be entitled to some 10% royalty on revenue, plus singificant sales-based milestone payments. Other vaccines under development include for Flu, Malaria, HIV, Tuberculosis, as well as a number yet undisclosed diseases.

• Financials

Pfizer and BioNTech split Comirnaty gross margins 50/50 worldwide except for China (incl. Taiwan), where BioNTech works in a similar arrangement w. Fosun.

Q3 : Pfizer has recently announced Q3 revenue from Comirnaty to be 13 bn USD, and raised the 2021 FY forecast from 33 bn USD to 36 bn. However, the Pfizer business quarters/ years outside the US are December to November, with a June to August Q3. As such, non US-revenues for September 21 are still missing from their Q3 figures, the same applies to Dec. 21 in their annual guidance. Based on a tally of individual contracts that have been reported publicly, Q3 Comirnaty revenue for calendar Q3 is estimated at some $14.15 bn USD (including $190 m via Fosun), and for 2021 at around $45.6 bn (including $615m via Fosun).

Q4: There are still a handful question marks, including the COVAX absorption of US donations. There are more than 100m doses that the US has announced to make available to COVAX in Q4 2021, but which COVAX has so far not allocated and/or assigned a delivery date to. Secondly, there is uncertainty whether monthly delivery of 37.5m booster/Kid vaccine doses to the EU will start in December 21 (Pfizer statement during Q2 ER), or Jan. 22 (EU announcement this summer). Q4 revenue in question is some 850m USD, depending also on the USD/EUR exchange rate.

Annual 2021: The $45.6 bn 2021 revenue forecast represents the optimistic scenario. OTOH, contracts with a number of high-income countries, most notably the Gulf States, Israel and Singapore, have hardly been published. Israel has certainly purchased further boosters and kid vaccines for delivery already in 2021, and the same may be assumed for Saudi Arabia, which has already authorized Comirnaty boosters, and shots for 5-11yos, and are preparing for kid vaccination to still start in 2021. Especially Saudi-Arabia, with a population of 34 million, and exclusively relying on Comirnaty boosters and kid vaccines, could be sizeable in this respect. All in all, there might be an upside potential of some good $500M additional revenue 2021 from yet unpublished / unrecorded booster & kids vaccines contracts. Furthermore, should there be delivery delays to COVAX, it may be assumed that some of the supply will be assigned to Taiwan, possibly bringing in another $210M in revenue in December 21 from there, which is currently assumed to only occur in Q1/22.

Annual 2022: PFE has pre-announced at minimum sales of 1.7 bn doses Comirnaty, for a total revenue of $29 Bn. Note that this forecast only includes contracts signed by Oct. 15, 2021. I.e., recent contracts announced afterwards as e.g. the US purchasing an additional 50m doses of kids vaccines for 2022, S. Korea buying 30m more doses, the Uruguayan purchase of 3.7m doses, and the 3.5m doses to Costa Rica, shall come on top, as shall be major booster contracts still under negotiation such as 150m doses for Brazil, 55m doses for the Phillipines, 50m doses for Vietnam, and a undisclosed quantity for Malaysia. Moreover, the Pfizer forecast will in all likelihood again relate to the "Pfizer Year" outside the US, i.e. 12/21 - 11/22. Importantly, the Pfizer 2022 outlook yields an average price per dose of 17.1 USD. When deducting 800m doses to be supplied as US donation to COVAX at 7 USD/dose, the price on the remainder goes up to even 31.6 USD/dose. This is far higher than the announced booster prices for the US ($24) and the EU ($23), suggesting that most of the other booster contracts already signed, including with Japan, Australia, S. Korea and the UK, should be at prices of 30 USD/dose or above. It also serves as further strong indication of already signed sizeable, and highly priced contracts with several Gulf States, Israel and Singapore."

If a rally starts or not, in the worst case you support a company that saved the world and is working towards curing cancer.

This is not a not financial advise!

Position

submitted by /u/Muffy_SuperGosu [link] [comments]

from wallstreetbets https://www.reddit.com/r/wallstreetbets/comments/qpf3dx/deep_biontech_bntx_analysis_and_why_i_think_a/ via IFTTT

0 notes

Text

The Vaccine Revolution Portfolio (MRNA, PFE, JNJ, NVAX, BNTX, AZN, DYAI)