#Payrollcompliance

Explore tagged Tumblr posts

Text

Key Components of Payroll Compliance Services

Introduction

Payroll compliance services are essential for businesses to manage wages, taxes, and employee benefits effectively. Ensuring compliance with labour laws, tax regulations, and statutory obligations helps businesses operate smoothly while avoiding legal pitfalls.

Partnering with experts like Sankhla Corporate Services Pvt. Ltd. ensures businesses stay compliant and focused on growth.

Employee Salary Structuring and Payroll Processing

Efficient payroll management ensures employees receive their salaries accurately and on time. Payroll compliance services include:

Salary structuring as per labour laws

Timely payroll processing and disbursement

Integration with HR and attendance management systems

Importance of Payroll Compliance

- Legal Compliance and Risk Mitigation

Ensuring payroll compliance prevents lawsuits, fines, and reputational damage for businesses.

- Employee Satisfaction and Retention

Accurate salary processing and timely benefits enhance employee trust and satisfaction.

- Financial Accuracy and Transparency

Payroll compliance ensures accurate financial reporting and taxation.

- Business Growth and Sustainability

Adhering to payroll laws fosters business expansion and long-term sustainability.

#PayrollCompliance#HRCompliance#TaxCompliance#LabourLaw#EmployeeBenefits#PayrollManagement#BusinessCompliance#CorporateGovernance#IndiaBusiness#StatutoryCompliance

0 notes

Text

The Importance of Payroll Compliance for Caroline Springs Businesses

In the bustling business hub of Caroline Springs, ensuring payroll compliance is not just a legal obligation but a cornerstone of sustainable business operations. Payroll compliance refers to all legislative requirements related to employee remuneration, including taxes, superannuation, and entitlements. Failure to comply can result in hefty fines, legal issues, and damage to a business's reputation. Here, we delve into why payroll compliance matters and how businesses can maintain it effectively.

Understanding Payroll Compliance

Payroll compliance encompasses a range of responsibilities that businesses must fulfil when managing employee payments. These include:

Accurate Calculation of Wages: Businesses must calculate wages according to the Fair Work Act 2009. This includes paying employees the correct hourly rates, allowances, and overtime. Non-compliance can lead to disputes and financial penalties.

Tax Withholding and Reporting: Employers must withhold the appropriate amount of tax under the Pay As You Go (PAYG) system and report it to the Australian Taxation Office (ATO). Mistakes in tax withholding can result in penalties or audits.

Superannuation Contributions: Employers must make regular superannuation contributions for eligible employees. The current Superannuation Guarantee rate is 11.5%, and failure to comply attracts significant penalties.

Record-Keeping Obligations: Employers must keep detailed records of employee wages, hours worked, tax, and superannuation contributions for at least seven years. Accurate record-keeping is crucial during audits or employee disputes.

The Risks of Non-Compliance

The consequences of payroll non-compliance can be severe and wide-ranging. These include:

Financial Penalties: Non-compliance with payroll laws often results in fines from regulatory authorities. For example, failing to meet the Superannuation Guarantee obligations can lead to imposing the Superannuation Guarantee Charge (SGC), which includes additional penalties and interest.

Legal Repercussions: Failure to adhere to employment laws may lead to lawsuits or Fair Work Ombudsman investigations. Such legal issues can disrupt operations and tarnish a business’s reputation.

Loss of Employee Trust: Employees expect fair and timely wages and benefits payments. Payroll mistakes or irregularities can erode trust and lead to high staff turnover.

Reputational Damage: Public awareness of payroll non-compliance can harm a company’s image, making attracting customers or skilled employees difficult.

Key Components of Payroll Compliance

Ensuring payroll compliance involves several key steps:

Staying Informed About Legislation: Australian payroll laws are subject to change, including updates to minimum wages, tax rates, and superannuation requirements. Businesses must stay updated with the latest legislation to ensure ongoing compliance.

Investing in Reliable Payroll Systems: Manual payroll processing is prone to errors. Investing in a reliable payroll software system can help automate calculations, ensure accurate reporting, and reduce compliance risks.

Training for Payroll Staff: Payroll staff should be well-trained and familiar with the intricacies of Australian payroll laws. Regular workshops and updates on legislative changes can ensure accuracy and compliance.

Engaging Professional Support: For businesses in Caroline Springs, working with a tax accountant in Caroline Springs can streamline payroll processes and ensure compliance. Professional accountants understand the local laws and can provide expert guidance tailored to business needs.

Benefits of Payroll Compliance

While payroll compliance requires effort and vigilance, the benefits it brings to a business are well worth it.

Enhances Operational Efficiency: A compliant payroll system reduces errors, minimises delays, and ensures employees are paid accurately and on time. This improves overall efficiency and employee satisfaction.

Avoids Costly Penalties: By adhering to legal requirements, businesses can avoid fines and additional costs, keeping financial resources available for growth initiatives.

Builds Employee Loyalty: Employees value transparency and reliability. A compliant payroll system fosters trust and loyalty, creating a stable and motivated workforce.

Supports Business Reputation: Compliance demonstrates professionalism and integrity, boosting a company’s reputation among employees, clients, and stakeholders.

Practical Steps to Ensure Payroll Compliance

To maintain payroll compliance, businesses can implement the following practical measures:

Regular Audits: Conduct internal audits to identify and correct payroll errors before they escalate into larger issues.

Utilising Payroll Software: Choose software designed for Australian businesses, ensuring it is updated with the latest tax and wage regulations.

Engaging Expert Advice: Partnering with accounting professionals ensures accurate payroll management and adherence to complex legislative requirements.

Developing Clear Policies: Document payroll policies and procedures, making them accessible to all employees to foster transparency.

Monitoring Superannuation Payments: Ensure superannuation contributions are made on time to avoid penalties and maintain compliance.

Conclusion

Payroll compliance is essential to running a successful business in Caroline Springs. Adhering to Australian payroll laws avoids legal and financial risks, builds a positive work environment, and strengthens business credibility. By investing in robust payroll systems, staying informed about legislative changes, and seeking professional guidance from a trusted tax accountant, businesses can ensure compliance and lay the foundation for long-term success.

Through proactive management and a commitment to accuracy, Caroline Springs businesses can confidently navigate the complexities of payroll compliance while maintaining a reputation for professionalism and integrity.

#PayrollCompliance#CarolineSpringsBusiness#TaxAccountantCarolineSprings#AustralianPayrollLaws#EmployeeWages#Superannuation#BusinessCompliance#PayrollManagement

0 notes

Text

Stay compliant with tax rules, labor laws, and reporting requirements at federal, state, and local levels with our comprehensive payroll reporting solutions.

0 notes

Text

📝 Simplify Your Payroll Process with Gupta Consultants!

Is managing payroll overwhelming? Let us take the burden off your shoulders! 🙌

With Gupta Consultants, you’ll get: ✅ Accurate Payroll Calculations✅ Timely Salary Disbursement✅ Complete Compliance with Government Regulations✅ Secure & Confidential Employee Data Management✅ Custom Payroll Solutions Tailored to Your Needs

🔍 We make payroll management easier, so you can focus on growing your business!📞 Contact us today for a consultation at +91-8744079902 🌐 Visit us at https://www.guptaconsultants.com/services/payroll-processing/

#PayrollServices#GuptaConsultants#BusinessSolutions#HRManagement#PayrollProcessing#PayrollSolutions#PayrollCompliance#PayrollOutsourcing#BusinessGrowth

0 notes

Text

Are you looking for efficient payroll management solutions in the UK?

Discover how our expert payroll services can simplify your payroll processes and ensure compliance with UK regulations. From accurate wage calculations to handling tax deductions and benefits administration, we offer comprehensive solutions to streamline your payroll operations.

Why Choose Our Payroll Management Services?

Accuracy: Precise payroll calculations and error-free processing.

Compliance: Adherence to all UK payroll regulations and standards.

Efficiency: Streamlined processes to save time and reduce manual work.

Detailed Reporting: Comprehensive financial reports for better decision-making.

Let us handle your payroll needs so you can focus on what matters most—growing your business.

Learn More & Get Started Today!

#PayrollManagement#PayrollServices#UKPayroll#AccountingSolutions#BusinessFinance#PayrollCompliance#PayrollSoftware#PayrollTips#FinancialManagement#BusinessGrowth#Payroll#PayrollManagementUK#PayrollSolutionsUK#UKPayrollServices#PayrollProcessingUK#PayrollExpertsUK#PayrollComplianceUK#PayrollAdmin#PayrollOutsourcing#UKAccounting#BusinessPayrollUK#PayrollSoftwareUK#PayrollTipsUK#FinancialServicesUK#PayrollSystemUK#PayrollStrategyUK#PayrollAutomationUK#UKBusinessFinance#PayrollUpdatesUK#BusinessAccountingUK

1 note

·

View note

Text

Navigating Payroll Compliance: The Importance of Professional Payroll Services

Managing payroll is a critical aspect of running a business, but it can also be time-consuming and complex. That's where professional payroll services come in. At SAI CPA Services, we understand the challenges that businesses face when it comes to payroll compliance, which is why we offer reliable and comprehensive payroll services to our clients.

Our team of experts stays abreast of the ever-changing payroll regulations and tax laws to ensure that your payroll processes remain compliant. From calculating employee wages and deductions to processing payroll taxes and preparing W-2s, we handle all aspects of payroll administration with precision and accuracy.

By outsourcing your payroll needs to SAI CPA Services, you can save time, reduce errors, and focus on what matters most—growing your business. Our streamlined payroll solutions are tailored to fit your unique requirements, whether you're a small startup or a large corporation.

With our dedicated support and expertise, you can rest assured that your payroll is in good hands. Contact us today to learn more about our payroll services and discover how we can help simplify your payroll processes.

Stay tuned for more insights into our wide range of accounting and financial services, designed to help businesses thrive.

Connect Us: https://www.saicpaservices.com/contact-us/

908-380-6876

1 Auer Ct

East Brunswick, NJ 08816

#SAICPAServices#PayrollServices#PayrollCompliance#BusinessFinance#SmallBusiness#AccountingServices#TaxCompliance#FinancialManagement#BusinessOperations#MiddlesexCountyNJ

1 note

·

View note

Text

Say goodbye to payroll headaches! Our global expertise and local care are your remedy. Experience seamless payroll solutions with us.

#PayrollServices#HRManagement#HumanResources#payrollcompliance#payrolloutsourcing#Payroll#PayrollExperts#HRConsulting#SpectrumTalentManagement#SpectrumTalent

0 notes

Text

Best Payroll Services in India | Big Leap Consultancy

Best Payroll Services in India, We are one of the top payroll outsourcing companies and payroll service providers in India and offer online payroll services for more information visit us: https://bigleapconsultancy.com

0 notes

Text

We offer a comprehensive, efficient, and reliable solution for payroll compliance, helping you navigate the complexities of regulatory requirements.

#StatutoryCompliance #LabourlawCompliance #HRCompliance #PayrollCompliance #Talentpro

0 notes

Text

Top Corporate Services in Labour Law Compliance

a) Labour Law Advisory Services

Labour law consultants provide expert guidance on compliance with various acts such as:

The Factories Act, 1948

The Minimum Wages Act, 1948

The Shops and Establishments Act

The Maternity Benefit Act, 1961

They assist businesses in policy drafting, regulatory updates, and dispute resolution to ensure smooth HR operations.

b) Payroll & Statutory Compliance

Managing payroll while ensuring statutory compliance is a significant challenge for businesses. Professional service providers assist in:

Provident Fund (PF) and Employee State Insurance (ESI) filings.

Professional Tax (PT) remittances.

Labour Welfare Fund (LWF) contributions.

Bonus, gratuity, and leave encashment calculations.

c) Compliance Audits & Inspections

Periodic compliance audits help companies stay ahead of regulatory changes. Labour law service providers conduct:

Compliance gap analysis to identify risks.

Labour department inspections and documentation support.

Remedial action plans to rectify compliance violations.

d) End-to-End Labour Law Compliance Management

Some corporate firms offer comprehensive labour law management, ensuring businesses remain compliant across multiple locations. Services include:

Registrations & Licensing – Obtaining factory, shop, and contract labour licenses.

Record Maintenance – Managing registers, muster rolls, and wage records.

Monthly/Annual Returns Filing – Submission of statutory returns to labour authorities.

e) Contract Labour & Vendor Compliance

Companies engaging contract workers must comply with:

The Contract Labour (Regulation & Abolition) Act, 1970

The Building & Other Construction Workers Act, 1996

Compliance Service providers help in registration, contractor audits, and compliance documentation for smooth contract workforce management.

#LabourLawCompliance#EmploymentLaws#CorporateCompliance#LabourLawIndia#WorkplaceRegulations#HRCompliance#Industry-Specific Hashtags:#PayrollCompliance#StatutoryCompliance#LabourLawConsulting#ContractLabourManagement#ESIPFCompliance#MinimumWagesAct#CorporateServices#BusinessConsulting#ComplianceManagement#HRSolutions#LegalCompliance#IndianBusiness#Brand & Engagement Hashtags:#SankhlaCorporateServices#SankhlaCo#ComplianceExperts#LabourLawAdvisory#StayCompliant

0 notes

Text

Simplify your business operations with payrollOutsourcing! Get rid of the time-consuming payroll process and ensure compliance with tax regulations. Let experts handle payroll processing so you can focus on growing your business without worrying about errors or missed deadlines. https://www.hr.com.bd/blog/payroll/how-outsourcing-payroll-can-save-your-business-time-and-money/ #PayrollManagement #OutsourcingServices #BusinessEfficiency #PayrollCompliance

0 notes

Text

Empower Your Startup with Effortless Payroll! Our efficient services ensure seamless payroll operations, providing the accuracy and compliance your startup needs to thrive. Focus on driving innovation and growth, knowing your payroll is handled expertly and efficiently. Let us support your startup’s success today. https://www.payroll2bangladesh.com/blog/payroll/payroll-for-startups-learn-how-we-simplify-your-payroll/ #PayrollForStartups #PayrollCompany #BusinessPayroll #PayrollCompliance

0 notes

Text

Compliance and regulations making payroll a headache? You're not alone! Drop your biggest challenges below and let's find solutions together. . . . #payrollcompliance #payrollmanagement #businesschallenges #pagaarsoftware #pagaar #payrollregulations

0 notes

Text

Payroll Processing Services Cosultants

"Looking to streamline your company's payroll process? Look no further! Our expert payroll processing services ensure accuracy, compliance, and efficiency,

so you can focus on what matters most – growing your business. With customization solutions tailored to your needs, we handle everything from time tracking

to tax filings, leaving you free from payroll headaches. Let's elevate your payroll game together!

G&CC is one of the best payroll outsourcing company Pan India. We provide error-free payroll processing while delivering the output in time. The companies have to make some strategies so that the cost remains low and up-gradation of technology should be done at an affordable amount, and this the

point where many companies face the problem. Here, G&CC comes in and provide cost-effective payroll services.

payrollservices #payrollmanagement #payrolloutsourcing

payrolljobs #payrollsolutions #payrolltaxes #payrollaudit

payrollprocessing #payrolladministration #payrollcompliance

payrollprocessingingurgaon #payrollprocessingindelhincr

payrollprocessinginnoida #payrollprcossinginfaridabad

payrollprocessingservicesjaipur #payrollprocessingservicesingujrat

payrollprocessinginchennai#payrollprocessingservicesinmumbai

payrolloutsourcingservices#PayrollProcessing #Efficiency #BusinessGrowth"

www.guptaconsultants.com [email protected] Contact:8744079902

0 notes

Photo

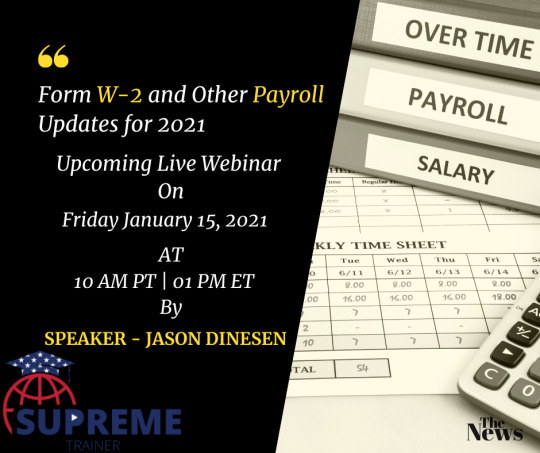

Ready to fill the form W-2 in 2021. To know what's the latest updates on form W-2. Register yourself by clicking the link: https://bit.ly/3hRjBzW to join our live training course on "Form W-2 and Other Payroll Updates" by #JasonDineson.

#training#hr#payrollcompliance#legalprofessionals#hrmanagers#payrollprofessionals#payrollupdates2021#miscupdates#supremetrainer#1099updates#form941#1099form#w2form

1 note

·

View note

Text

Payroll Compliance Services. Payroll Compliance. A corporation could get into problems if there are any gaps in the management of payroll compliance services and employee salary rights. With its knowledge, suitable skill sets, presence across all of India, clearly defined process, and suitable technical assistance, Aparajitha may make Payroll Compliance services for your business easier.

0 notes