#Payday Loans Market 2022

Explore tagged Tumblr posts

Text

Payday Loans Market Segmented On The Basis Of Type, Marital Status, Customer Age, Region And Forecast 2030: Grand View Research Inc.

Payday Loans Market Segmented On The Basis Of Type, Marital Status, Customer Age, Region And Forecast 2030: Grand View Research Inc.

San Francisco, 30 Dec 2022: The Report Payday Loans Market Size, Share & Trends Analysis Report By Type (Storefront Payday, Online Payday), By Marital Status (Married, Single), By Customer Age, By Region, And Segment Forecasts, 2022 – 2030 The global payday loans market size is anticipated to reach USD 6.8 billion by 2030, registering a CAGR of 3.8% during the forecast period, according to a new…

View On WordPress

#Payday Loans Industry#Payday Loans Market#Payday Loans Market 2022#Payday Loans Market 2030#Payday Loans Market Revenue#Payday Loans Market Share#Payday Loans Market Size

0 notes

Text

Intuit: “Our fraud fights racism”

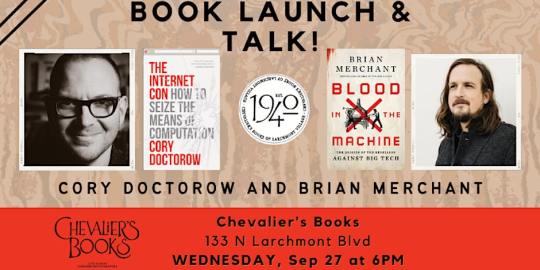

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

On July 26, Russia’s Central Bank decided to raise the key interest rate from 16 to 18 percent. This decision was driven by unexpectedly high lending rates that previous regulatory measures had failed to curb. Russians are borrowing money and spending more, leading to a surge in prices. Inflation over the past year reached nine percent, far exceeding the government’s target of four percent. Meduza explains just how indebted Russians are and if this surge in lending is a serious issue for the authorities.

Why are Russians taking out loans?

According to Russia’s Central Bank, the volume of loans issued in the country has been steadily increasing since the spring of 2022. A few days after Russia launched its full-scale invasion of Ukraine, the bank raised its key rate to a prohibitive 20 percent, effectively halting all lending. However, it soon began bringing it back down. In April of that year, banks across the country issued loans totaling 859 billion rubles ($9.9 billion); by December, this figure had grown to two trillion ($23.1 billion).

In mid-2023, the Central Bank began raising the key rate again. Russians, realizing that loans were becoming more expensive, started applying for them sooner, causing overall loan volumes to jump to 2.4 trillion rubles ($27.8 billion) per month. This growth continued into 2024, driven by further government measures. Early this year, Russian authorities discussed curtailing preferential programs, primarily subsidized mortgages (a highly advantageous program for borrowers: while market rates were around 20 percent, the government offered loans at eight percent). Additionally, the Central Bank signaled a potential key rate increase. In response, Russians rushed to secure loans before rates increased. While the Central Bank has yet to release its official June report, analysts from Frank RG estimated that the volume of loans issued to individuals in that month increased by 13.74 percent (up 202.1 billion rubles, or $2.3 billion, compared to May 2024).

Another significant factor is income growth. Central Bank Head Elvira Nabiullina noted that people take out loans because “they’re confident in their future incomes” and feel they can “finance an improved life now.” According to Russia’s Federal State Statistics Service (Rosstat), real disposable incomes grew by more than five percent in 2023 and continued to grow in 2024. Independent analysts indirectly confirmed this, noting that consumer confidence indices are near historical highs.

The main driver of this income growth is the rapid increase in wages across many sectors of the Russian economy. As of April this year, nominal wages at large and medium-sized companies increased on average by 17 percent compared to April 2023, while real wages, adjusted for inflation, rose by 8.5 percent. Russian companies have to raise wages to attract employees as there’s a severe labor shortage in the job market.

Wages are growing fastest in industries fulfilling government defense orders. For example, in the production of “metal products” (as non-classified military goods are referred to in official statistics), wages increased by 24 percent in the span of a year. In the production of electronic products, which are also mainly supplied to the Russian army, wages rose by 28 percent.

As of May 2024, Russians owed banks more than 35.2 trillion rubles (over $408 billion). According to Meduza’s calculations, this represents an increase of nearly 22 percent in just one year. However, it’s not a record figure: in April, the amount owed was 36.6 trillion rubles ($423.6 billion). The payday loan segment grew even more rapidly, increasing by 28 percent in 2023, with Russians taking out 900 billion rubles ($10.4 billion) in loans. This growth continued into the first quarter of 2024, although the average loan amount remains around 10,000 rubles ($117).

Consumer lending has grown by 18 percent year-on-year, which economists attribute to the popularity of credit cards. Additionally, car loans have increased by 26 percent since the beginning of the year, which isn’t surprising given the record low availability of cars. Even pawnshops are showing positive trends: while there isn’t an increase in contracts, the average sum paid out gone up due to the rise in cost of precious metals.

As a result, the number of Russians with loans has reached 50 million. This is 40 percent of the country’s adult population. Over a quarter of these borrowers have more than three simultaneous loans, according to the Scoring Bureau credit history bureau. And that’s not the limit: 8.6 percent have taken out five or more loans, and the share of such debtors has doubled in two years.

One explanation is the popularity of mortgages. Eight out of 10 people with a mortgage also took out an additional loan, either for the down payment or for renovations. However, Scoring Bureau, attributes the increase to something else: the growing popularity of credit cards. In Russia, 27 million people have opened 91 million credit cards. Still, Central Bank representatives have expressed concern over the high level of indebtedness among Russians and mentioned “extreme cases,” including one person with 27 loans.

So Russians are saddled with debt?

Although more Russians are taking out loans, the average debt burden of the population — the share of household income spent on loan repayments — has remained relatively stable over the past few years. The Central Bank publishes data on this twice a year, and in the latest report from April, it noted that while the average debt burden has increased, it hovers around 11.2 percent. By comparison, in the first quarter of 2022, the average was even higher, peaking at 12.1 percent, and has since fluctuated within a two-percentage-point range. However, it’s important to note that this is an average, and some borrowers’ debt burden is significantly higher. Currently, 56 percent of borrowers in Russia have a debt burden of over 50 percent.

Another indicator of financial stability is the share of so-called bad debts — those with payments overdue by more than 90 days. In the consumer sector, this remains stable and doesn’t exceed eight percent, according to the Central Bank. According to a forecast from the ACRA rating agency, in 2024, the share of overdue debt in banks’ retail portfolios will not exceed three to four percent. The online lending service Moneyman calculated that Russians who take out payday loans actually repay their debts early in 43 percent of cases.

Frank RG analysts confirmed that the level of overdue debt and indebtedness indicators aren’t increasing. They pointed out that the ratio of the retail credit portfolio to GDP doesn’t exceed 30 percent, whereas in developed countries, the figure can reach up to 100 percent. Ivan Uklein, director of bank ratings at the Expert RA agency, believes that demographic factors alone may be driving the increase in the number of loans: in his opinion, Russia’s “boomer generation,” unaccustomed to living on credit, is starting to make way for bolder millennials

Of course, there are also skeptics. The Communist Party (KPRF) described the level of indebtedness as “catastrophic” and called for a credit amnesty for families with children. The Central Bank has identified problematic mortgage practices, with banks issuing loans to borrowers who already had a high debt burden. Kommersant reported that problematic credit card debt is at an all-time high in Russia, though the publication clarified that this growth is proportional to the increase in the number of credit cards issued. And RBC pointed to the slow but steady growth of debts involving bankrupt or deceased borrowers, where collection is impossible.

Indeed, personal bankruptcies have increased. The Center for Macroeconomic Analysis and Short-Term Forecasting predicts this trend will continue, as current rates prevent borrowers from taking out new loans to repay old ones. According to a survey by the Higher School of Economics, 70 percent of large families in Russia have loans, often can’t save money, and are sometimes forced to forgo essentials due to a lack of funds. The Federal Tax Service also reported issues, stating that 1.3 trillion rubles ($15 billion) in payments for 2023 were overdue.

Is the government worried?

The main risk lies with borrowers who have a high debt burden, those who spend 50 or even 80 percent of their salary on loan repayments. Elizaveta Danilova, the head of the Central Bank’s financial stability department, explained: “When the economy is doing well, [when] there’s work, and wages are rising, people with a high debt burden manage to cope. During crises, everything changes. We saw this during the pandemic. There were many requests for loan payment deferrals and those with the highest debt burdens and off-the-books incomes faced the greatest challenges.”

Last year, the Central Bank set limits on how much banks and payday loan organizations can lend to high-risk clients. Under the updated rules, that amount can be zero in some cases. As a result, the share of new contracts with high-risk borrowers fell to 14 percent in the first quarter of 2024, down from 36 percent in 2022. Additionally, banks must now inform such borrowers about potential risks and difficulties, even if they plan to take out less than 10,000 rubles ($117). For payday loans, the total cost of credit, including principle and interest, has been capped at 292 percent per annum.

The financial authorities claim that the current debt burden of Russians “looks acceptable.” The focus is on gradually slowing down lending: preferential mortgages ended on July 1, and market rates should deter borrowers. Developers have reported that demand for new apartments has already slowed by 14 to 30 percent. Egor Susin, the managing director at Gazprombank Private Banking, wrote that similar trends can be expected in other areas: construction plays an important role in business loans, and consumer loans were growing because people needed to cover down payments.

A survey conducted by Sravni showed that two-thirds of Russians have put off buying real estate due to the end of preferential programs. The United Credit Bureau noted a slowdown in car loans after a recent peak, which was also driven by government support measures. VTB Bank expects a decrease in demand for consumer loans, and Russian banks’ profits have been falling for the second month in a row. Meanwhile, the Russian State Duma is preparing for a possible crisis. Deputies have passed a bill that will safeguard a bankrupt individual’s only home from being seized, even if it’s mortgaged.

3 notes

·

View notes

Text

Rushadvances.com

Rushadvances.com

Hawaii just enacted significant legislation to reform the state’s small-dollar loan market and prohibit balloon-payment payday loans. House Bill 1192 garnered unanimous support in the State Legislature

The measure goes into effect Jan. 1, 2022, and will save borrowers in Hawaii millions of dollars each year by ensuring access to affordable credit from licensed lenders. Under the new law, small installment loans will cost consumers hundreds of dollars less. (See Table 1.) It will make these small loans available with appropriate protections and incorporate proven policies that have garnered bipartisan support in other states.

1 note

·

View note

Text

https://www.kingsresearch.com/payday-loans-market-533

Global Payday Loans Market Report: Trends, Drivers, and Future Growth Prospects

Kings Research has recently published its report on the global Payday Loans market, which finds that the market revenue is expected to reach US$ 45.86 Billion by 2031 from US$ 32.70 Billion in 2022, with a remarkable 4.39% CAGR over the forecast period from 2023 to 2031.

This comprehensive research study on the global Payday Loans market gives detailed insights into the sector, offering a detailed analysis of market trends, prominent drivers, and future growth prospects. In order to make wise business decisions, it gives readers an extensive understanding of the market environment. Furthermore, the report covers several aspects, such as estimated market sizing, strategies employed by leading companies, restraining factors, and challenges faced by market participants.

Gain expert insights and supercharge your growth strategies. Request our market overview sample now

Market Forecast and Trends

The report's precise market forecasts and identification of emerging trends will allow readers to foresee the industry’s future and outline their tactics for the following years accordingly. Understanding market trends can help in gaining a competitive edge and staying ahead in a fast-paced business environment.

Regional and Segment Analysis

The study on the global Payday Loans market will aid industry participants find high-growth regions and profitable market segments through region-specific and segment-by-segment analysis. This information helps in implementing better marketing strategies and product lineups to meet the preferences and needs of various target audiences. The major regions covered in this comprehensive analysis include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Investment and Expansion Opportunities

The research report supports strategic decision-making by revealing prospective areas for investment and business growth in the global Payday Loans market. This report is a great tool for finding markets that are foreseen to grow substantially for aiding readers who want to expand into new and untapped markets or launch new products.

Competitive Analysis

The research report comprises an in-depth competitive analysis, which profiles major market competitors and evaluates their tactics, weaknesses, and market shares. These key players employ top business strategies, such as partnerships, alliances, mergers, acquisitions, product innovations, and product development, to establish a competitive advantage. Industry participants may use this information to measure their business against rivals and develop winning strategies for distinguishing themselves in the market.

Why Buy This Report?

Obtain an in-depth understanding of market trends and growth catalysts.

Utilize precise market forecasts for informed decision-making.

Outperform competitors through extensive competitive analysis.

Identify and leverage profitable regional and segment prospects.

Strategically plan investments and expansions in the global Payday Loans market

The major players in the Payday Loans Market are:

Cash America International

Check `n Go

MoneyGram

CashNetUSA

Check City Online

Moneytree, Inc.

Advance Financial

TMG Loan Processing, LLC

EZ Money

LENDUP.com

1 note

·

View note

Text

The first day of the criminal trial of FTX founder Sam Bankman-Fried saw mentions of cryptocurrencies like Bitcoin BTC/USD, Ethereum ETH/USD, Dogecoin DOGE/USD, and Solana SOL/USD, but notably excluded FTX’s native token, FTT FTT/USD.What Happened: Federal prosecutors portrayed Bankman-Fried as someone who stole billions of dollars from numerous individuals and misused their funds for personal gain. According to a press release posted by the Justice Department, Bankman-Fried is being charged with “two counts of wire fraud conspiracy, two counts of wire fraud, and one count of conspiracy to commit money laundering, each of which carries a maximum sentence of 20 years. He was also charged with conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to defraud the United States and commit campaign finance violations, each of which carries a maximum sentence of five years.”During the trial’s opening, the government’s first witnesses introduced the concept of cryptocurrencies to the jury. Commodities trader Marc-Antoine Julliard, who suffered losses due to FTX’s failure, mentioned Bitcoin and Ethereum as the main cryptocurrencies. He also recalled depositing Dogecoin into his FTX account.The government’s second witness, Adam Yedidia, a former employee of Alameda and FTX, testified that he resigned upon discovering that FTX customer deposits were used to repay Alameda’s loan to creditors, reported Decrypt.Despite the mention of popular cryptocurrencies, the FTT token received minimal attention throughout the proceedings.Will The SEC Finally Approve Long-Awaited Bitcoin Spot ETF? secure early bird discounted tickets now!A Stay At The Floating Palace From James Bond's ‘OctopussyWhy It Matters: The collapse of FTX, the cryptocurrency exchange, and its partner hedge fund Alameda Research in November 2022 was not a typical tale of crypto market volatility or investor risk. Following his arrest, Bankman-Fried was granted release on a $250 million bond. However, in August 2023, his bail was revoked due to interference with a witness, resulting in his confinement at a Brooklyn jail. While the ongoing trial addresses the current charges against him, a separate trial in March 2024 awaits him. Bankman-Fried has pleaded not guilty. His defense lawyer, Mark Cohen, argued that FTX’s downfall resulted from a “perfect storm,” despite Bankman-Fried’s good intentions and sound business practices.Price Action: At the time of writing, BTC was trading at $27,362.22, down 0.86% in the last 24 hours, according to Benzinga Pro. Here’s How Much You Should Invest In Shiba Inu Today For A $1M Payday If SHIB Hits 1 Cent?

0 notes

Text

Your Guide to Manitoba's Cost of Living: Budgeting Tips for Success

Ah, Manitoba—the region in the center of Canada, where prairies and lakes converge, and bustling cities coexist with the tranquil countryside.

Understanding the cost of living in Manitoba is important, whether you're a local trying to settle down or a newcomer considering making this province your home. Let's dissect the financial structure of this province, from housing to daily costs, and provide you with crucial budgeting advice for a well-balanced lifestyle.

What Is the Cost of Living In Manitoba, and Where Should I Live?

There are many different ways to live in Manitoba, each with a different cost. The vibrant capital of Winnipeg combines urban comforts with ethnic diversity.

A one-bedroom apartment typically costs $1011 per month to rent, with some regional variations. For products here, you will have to spend approximately $370 per month per person.

Brandon offers a peaceful alternative for people who seek a calmer pace. This city has a strong sense of community and relatively low living expenses. Housing expenses are frequently even more reasonable in rural areas; however, you might have to give up some conveniences.

Supports and Initiatives from the Federal Government In Manitoba

It makes sense to take advantage of the support networks the federal government has built for provincial residents instead of payday loans Manitoba before delving further into budgets. As safety nets, the Canada Child Benefit (CCB), Old Age Security (OAS), and the Guaranteed Income Supplement (GIS) offer financial assistance when required.

The CCB helps families by providing tax-free monthly payments to help with childcare costs. OAS and GIS, which provide financial padding for seniors during their golden years, can provide comfort. Being aware of these may have a significant impact on your financial planning.

Another program, the Canada Workers Benefit (CWB), is made to help the lowest-paid workers, who frequently fill crucial roles in the economy, supplement their income.

Through the current tax return payment, the CWB may offer as much as $1,428 CAD for lone employees or as much as $2,461 CAD for families. This will significantly contribute to reducing the rising expense of living.

Thanks to state and provincial programs, Manitoba has now become a more attractive place to live. The estimated population of Manitoba in 2022 was 1.41 million, nearly 300,000 more than in 2000.

5 Budgeting Tips and Insights for Living in Manitoba

Harmony in Housing

Your home may be your biggest expenditure. Make sure everything fits into your budget, whether it's buying a lovely house or renting a pleasant apartment. Consider roommates, look into the neighborhood, and strike a balance between comfort and expense.

Navigating Transportation

The cost of transportation can change depending on where you live and work. Public transportation in Winnipeg is effective, but having a car may be necessary if you live in a more remote region. Consider the cost of fuel, insurance, and maintenance as a whole.

The Basics of Necessities

Your budget is impacted by electricity and groceries. Even though Manitoba offers a good quality of life at an affordable price, you still need to budget properly. Be savvy when you shop, choose regional markets, and embrace meal preparation. Similarly, conserve energy to reduce your electricity costs.

Health Comes First

Although Manitoba's healthcare system is impressive, unexpected medical costs can still happen. To be ready, set aside money for prescription drugs, dental cleanings, and eye care.

Finding Fun on a Tight Budget

A balanced existence requires both leisure and entertainment. Several activities are inexpensive or free in Manitoba. Discover your neighborhood parks, attend neighborhood gatherings, and take advantage of nature's marvels without breaking the bank.

Conclusion

As you welcome the idea of relocating to Manitoba, keep in mind that wise budgeting is the secret to achieving financial stability. Every part of Manitoba has something special to offer, from the metropolitan attraction of Winnipeg to the peaceful beauty of country life.

Consider government assistance, exercise fiscal restraint, and update your budget as circumstances change. You can live a life that is both full of experiences and financially secure by finding a balance between taking advantage of the many different things this province has to offer and managing your funds wisely.

Although the expense of living in Manitoba is a problem, it may be resolved with careful preparation and a dash of ingenuity. Therefore, start your new chapter with the confidence that you are prepared to understand Manitoba's financial complexities and make the most of everything this beautiful province offers.

1 note

·

View note

Text

Global Digital Lending Market is Estimated To Witness High Growth Owing To Increasing Adoption of Online Loans and Rising Trend of Peer-to-Peer Lending

The global digital lending market is estimated to be valued at USD 334.7 million in 2021 and is expected to exhibit a CAGR of 26.9% over the forecast period 2022-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Digital lending refers to the process of lending money through online platforms or mobile applications. It eliminates the need for traditional banking methods and offers convenient and efficient loan solutions to borrowers. The key products associated with the digital lending market include online payday loans, peer-to-peer lending, crowdfunding, and online installment loans. These platforms offer quick loan approvals, flexible repayment options, and competitive interest rates.

B) Market Dynamics:

1) Driver: Increasing Adoption of Online Loans

The growing adoption of online loans is one of the major drivers for the digital lending market. Consumers are increasingly preferring online loan platforms as they offer convenience, speed, and transparency. Online loan applications can be completed within minutes, and borrowers can receive funds directly into their bank accounts. This eliminates the need for lengthy paperwork and multiple visits to the bank. The online loan process also provides easy access to loans for individuals who may not have a good credit score or are overlooked by traditional lenders.

2) Trend: Rising Trend of Peer-to-Peer Lending

Peer-to-peer lending, also known as P2P lending, is gaining traction in the digital lending market. It connects borrowers directly with investors through online platforms, eliminating the need for intermediaries like banks. P2P lending offers attractive interest rates for borrowers and higher returns for investors. It also provides an opportunity for individuals to lend money and earn interest on their idle funds. The decentralized nature of P2P lending platforms ensures transparency and reduces the cost of lending, benefiting both borrowers and investors.

C) Market Key Trends:

One major key trend in the digital lending market is the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enable lenders to assess creditworthiness, predict default rates, and personalize loan offers based on individual borrower profiles. For example, AI algorithms can analyze vast amounts of data to make accurate lending decisions and identify potential risks. This trend is revolutionizing the lending process by making it faster, more efficient, and less prone to human error.

D) SWOT Analysis:

Strengths:

1) Increasing adoption of online loans

2) Rising trend of peer-to-peer lending

Weaknesses:

1) Lack of physical presence and face-to-face interaction

2) Concerns regarding data security and privacy

Opportunities:

1) Growing demand for small business loans

2) Expansion of digital lending services in emerging economies

Threats:

1) Regulatory challenges and government interventions

2) Competition from traditional banking institutions

E) Key Takeaways:

- The global Digital Lending Market is expected to witness high growth, exhibiting a CAGR of 26.9% over the forecast period, due to increasing adoption of online loans and the rising trend of peer-to-peer lending.

- In terms of regional analysis, North America is expected to be the fastest-growing and dominating region in the digital lending market. The region has a well-established fintech ecosystem, favorable regulatory environment, and high smartphone penetration rate, contributing to the growth of digital lending platforms.

- Key players operating in the global digital lending market include On Deck Capital Inc., Lendingclub Corp., and Social Finance Inc. (SoFi). These players are focusing on technological advancements, strategic partnerships, and expanding their product portfolios to gain a competitive edge in the market.

#Digital Lending#Digital Lending Market#Digital Lending Market Demand#Digital Lending Market Insights#Digital Lending Market Growth#Smart Technologies

0 notes

Text

0 notes

Text

CFPB uncovers illegal junk fees on bank accounts, mortgages, and student and auto loans

The CFPB released a special edition of our Supervisory Highlights that reports on unlawful junk fees uncovered in deposit accounts and in multiple loan servicing markets, including mortgage, student, and payday lending. These unlawful fees corrode family finances, force up families’ banking and borrowing costs, and are not easily avoided – even by financially savvy consumers.

This Supervisory Highlights special edition covers unlawful junk fees – found during examinations between July 1, 2022, and February 1, 2023 – in the areas of:

Bank account deposits

Auto loan servicing

Mortgage loan servicing

Payday lending

Student loan servicing

Supervisory examinations review whether companies are complying with federal consumer financial protection law. When CFPB examiners uncover problems, they share their findings with companies to help them remediate violations. Typically, as with many of the instances identified within today’s report, companies take actions to fix the identified problems. For more serious violations or when companies fail to take corrective actions, the CFPB opens investigations for potential enforcement actions.

Read the Supervisory Highlights special edition

5 notes

·

View notes

Link

Payday Loans Market is valued at around USD 33.5 billion in 2022 and is expected to reach USD 42.6 billion by 2030, registering a CAGR of 4.1% over the forecast period.

0 notes

Text

Friday, November 18, 2022

Republicans capture control of the House (NYT) Republicans secured a slender majority in the House of Representatives on Wednesday, a delayed yet consequential finish to the 2022 midterm elections that will reorder the balance of power in Washington and is expected to effectively give the party a veto on President Biden’s agenda for the next two years. After more than a week of vote counting, the Republican Party formally captured the 218 House seats needed to claim the majority after just four years out of power. The outcomes in six close races that remain undecided will determine the final size of a slim Republican majority that will be far narrower than party leaders had expected, though Republicans still cheered the achievement.

One billion young people risk hearing loss from loud music (Guardian) More than 1 billion teenagers and young adults may be at risk of hearing loss because of their use of headphones, earphones and earbuds and attendance at loud music venues, a study suggests. An international team of researchers estimate that 24% of 12- to 34-year-olds are listening to music on personal listening devices at an “unsafe level”. The findings were published in the journal BMJ Global Health. The World Health Organization (WHO) estimates that more than 430 million people of all ages worldwide currently have disabling hearing loss. Young people are particularly vulnerable because of their use of personal listening devices (PLDs), such as smartphones, headphones and earbuds, and from visiting loud music venues, amid poor regulatory enforcement. “Damage from unsafe listening can compound over the life course, and noise exposure earlier in life may make individuals more vulnerable to age-related hearing loss,” researchers said.

Heat, Fuel, Solar (WSJ) A surge in heating-oil prices is hitting the Northeast U.S. as it braces for colder weather, putting the squeeze on household budgets and potentially accelerating the region’s shift toward other fuels. An average household that burns heating oil could spend 45% more for it this winter, according to a base-case forecast by the U.S. Energy Information Administration, translating to hundreds more dollars apiece. Dwindling stockpiles of diesel have driven prices to a record premium over gasoline and crude oil, showing how war, weather and other disruptions to globalized energy markets are still producing price shocks and potential shortages. The U.S. wants to boost solar power generation–a lot. To make that happen, though, the U.S. would need to build a supply chain almost from scratch. At the moment, the U.S. has little or no manufacturing for almost any component needed to produce solar energy. China controls more than 80% of the supply chain.

Bailing Out El Salvador (Guardian) After betting big on crypto, El Salvador is being bailed out by China as the bitcoin bubble collapses. The superpower has offered to buy out El Salvador’s national debts of $21 billion in exchange for the Central American nation signing a trade deal with Beijing. El Salvador was the first ever country to make bitcoin legal tender, and earlier this year president Nayib Bukele announced that it would be issuing bitcoin-denominated “volcano bonds” in order to pay off the national debt, but those bonds never materialized. Bukele also personally invested over $107 million on 2,381 bitcoins, which today are worth a little over $40 million. According to Evan Ellis, a senior associate at the Washington DC based Centre for Strategic & International Studies, the deal might spare El Salvador from debtors, but that bailout will come at a cost. “China acts as a payday lender, they make good money off of these deals,” he says, “but they often find a way to tie the loans to long-term commercial and strategic benefits opening the way for Chinese companies.” The deal also brings El Salvador closer to China, possibly harming its relationship with the U.S.

As Russian Strikes Mount, Ukraine Works to Keep the Lights On (NYT) Russia is turning winter into a weapon, even as its soldiers flail on the battlefield. In a relentless and intensifying barrage of missiles fired from ships at sea, batteries on land and planes in the sky, Moscow is destroying Ukraine’s critical infrastructure, depriving millions of heat, light and clean water. Keeping the lights on for the majority of the millions of people who live in cities and towns far from the front—and keeping those places functioning through the winter—is now one of the greatest challenges Ukraine faces. With at least 15 energy facilities hit on Tuesday—some for the fifth or sixth time—the waves of Russian assaults have left about 40 percent of Ukraine’s critical energy infrastructure damaged or destroyed. The attacks are also damaging water-supply systems that are essential to energy production as well as daily survival.

Missile in Poland was accident, NATO says. But spillover fear remains. (Washington Post) The missile that landed in Poland, killing two people Tuesday, was not part of a Russian attack, the leaders of NATO and Poland said Wednesday, easing fears of an escalation with Moscow after more than 20 hours of intense worry and speculation. Moscow called initial responses to the attack blaming Russia “another hysterical, frenzied Russophobic reaction … without having any idea of what had happened.” NATO Secretary General Jens Stoltenberg said Wednesday that an explosion in the town of Przewodow was probably caused by an errant Ukrainian air defense missile launched in response to Russian strikes. Regardless, Tuesday’s episode served as a reminder of the enduring potential for the conflict to snowball, intentionally or not. “This is the first time that citizens of a NATO country have been killed in a NATO country in this war,” said Michal Baranowski, director of the German Marshall Fund’s Warsaw office. “And this is a big deal.”

Myanmar amnesty (Reuters) Myanmar's military rulers have granted amnesty to almost 6,000 prisoners to mark a national holiday, state media reported. Sean Turnell, an Australian economist and former adviser to democracy icon Aung San Suu Kyi, was among those to be released.

Collective crawling (Washington Post) Life’s tribulations have Chinese students crawling—literally. To relieve stress after almost three years of a pandemic lockdown exhaustion, the toughest job market in decades and uncertainty of the future, students across universities in China are engaging in “collective crawling.” “The loss of meaning is adding to young people’s sense of existential crisis,” Chongqing University student Lin Shihou wrote. Crawling is a collective “ritual for young people to release that feeling of being repressed” or using “meaninglessness to resist meaninglessness,” Lin added.

We’re Allies ... Right? (BBC) Israel’s government has described the U.S. Department of Justice’s decision to investigate the circumstances around the death of Palestinian-American reporter Shireen Abu Aqla as a “mistake.” Abu Aqla had been reporting on an Israeli army raid in the occupied West Bank earlier this year when she was shot in the head, likely by a member of the Israel Defense Forces (IDF). Abu Aqla, 51, was walking through the Jenin refugee camp on May 11 this year in order to report on an Israeli army raid which had lead to gunshots being traded between IDF and Palestinian soldiers. According to a report verified by the U.N. Human Rights Office and multiple other media outlets, she was walking along a road with other journalists, wearing a helmet and blue flak jacket marked with the word “press” before IDF troops stationed roughly 200m (656ft) away opened fire, shooting her in the head and shooting and wounding another journalist. The IDF claims that it’s impossible to know who killed Abu Aqla, though it was likely that she was shot “by mistake by an IDF soldier, and of course he didn’t identify her as a journalist.” Israeli Defence Minister Benny Gantz stated that “the decision taken by the US justice department to conduct an investigation into the tragic passing of Shireen Abu Aqla is a mistake,” and that he “delivered a message to US representatives that we stand by the IDF’s soldiers, that we will not co-operate with an external investigation, and will not enable intervention to internal investigations.”

Culture clash? Conservative Qatar preps for World Cup party (AP) On the Instagram accounts of fashion models and superstars last month, the sheikhdom of Qatar looked like one glittering party. High-heeled designers descended on exhibition openings and fashion shows in downtown Doha. Celebrities, including a prominent gay rights campaigner, snapped selfies on a pulsing dance floor. The backlash was swift. Qataris went online to vent their anger about what they called a dangerous and depraved revelry, saying it threatened Qatar’s traditional values ahead of the 2022 FIFA World Cup. The Arabic hashtag, Stop the Destruction of Our Values, trended for days. The episode underscores the tensions tearing at Qatar, a conservative Muslim emirate that restricts alcohol, bans drugs and suppresses free speech, as it prepares to welcome possibly rowdy crowds for the first World Cup in the Middle East.

A guide to contemporary doomsday scenarios (Washington Post Magazine) There are so many potential doomsdays. This is not the cheeriest topic, to be sure, but it’s endlessly fascinating if you can stomach it. What are our biggest existential risks? Should we feel more threatened by low-probability but high-consequence risks, such as asteroid impacts and runaway artificial intelligence (robot overlords and whatnot), or should we focus on less exotic, here-and-now threats such as climate change, viral pandemics and weapons of mass destruction? And should we even worry about low-probability risks when hundreds of millions of people right now lack adequate food, water, and shelter and are living off less than $2 a day? We are not being paranoid when we recognize that human civilization has become increasingly complex and simultaneously armed with techniques for self-destruction. There are bad omens everywhere, and not just the melting glaciers and dying polar bears. We’re all still unnerved by the pandemic. Meanwhile, there’s this ancient threat called war. Vladimir Putin and his advisers keep rattling the nuclear saber. A nuclear holocaust is the classic apocalyptic scenario that never went away. People who think about “existential risk” are focused on the collapse of civilization as we know it. One of their recurring themes is that there has never been a moment as pivotal as this one.

1 note

·

View note

Text

No, payday lenders aren't nice guys

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.” That quote from Upton Sinclair reveals the ideological underpinnings of consequential errors by economists that lead to material, negative consequences for poor people.

Here’s one of those errors. A pair of economists, one associated with the the far-right Scalia Center at George Mason University, performed a deeply flawed analysis of payday lenders that concluded that, far from being loan-sharks, payday lenders are good-natured slobs who offer generous terms to desperate, poor people.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3935920

Specifically, the researchers claimed that payday lenders routinely charge lower fees and interest rates than state law permits, offering discounts to borrowers with nowhere else to go. The researchers were dead wrong.

As Adam Levitin writes on Credit Slips, the researchers committed a basic, fundamental error in their analysis: they assumed that the state caps on payday loans under $100 were the same as the caps on larger loans. In reality, most states impose higher caps on higher-value loans. The reason payday lenders don’t charge as much on those loans is that they’re not allowed to.

https://www.creditslips.org/creditslips/2022/01/the-miscalculations-underlying-miller-zywickis-payday-loan-paper.html

Now, it’s possible that this is just one of those mistakes that we all make — after all, pobody’s nerfect. But this is a mistake that supports an ideological position: the position that markets are efficient, that lenders are performing a public service, and that regulation interferes with the market’s capacity to reach efficient equilibria.

Payday lenders have a well-deserved reputation for abusive and predatory practices. Any self-respecting Bayesian thinker whose research concluded that an industry with a long history of regulatory capture, falsifying data about its practices, and ruining peoples lives was actually remarkably generous should go back to the data and triple-check before publishing.

I mean, payday lenders are really bad. Their 300% APR loans trap poor people in a cycle of constantly rolling over their debts, creating unpayable, mounting debts that lead to ruin.

https://stoppaydaypredators.org/

They have a long history of paying researchers to falsify the data about their conduct to sanitize it:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

They openly bribed Trump in a bid to remove the minimal regulation on their industry, turning millions in bribes into billions in profits:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

The Trump administration loved usury. First, it killed the regulation on payday lenders:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

Then it got rid of the remaining regulations under cover of providing aid to poor people who lost their jobs to covid:

https://theintercept.com/2020/08/12/cfpb-coronavirus-predatory-payday-loans/

Today, Biden’s Consumer Finance Protection Bureau is taking the first steps toward reining in payday lenders with rules requiring fair disclosures and interest rate caps to prevent inescapable, spiraling debt-traps. And the authors of this flawed research took to the pages of the WSJ to condemn the CFPB’s plans, citing their flawed paper as evidence that payday lenders don’t need external controls on their businesses.

https://www.wsj.com/articles/the-cfpb-arbitrary-attacks-on-payday-loans-short-term-consumer-protection-welfare-rohit-chopra-11641153287

“Once is happenstance, twice is coincidence, the third time it’s enemy action.” There’s a difference between making a gross coding oversight in a research paper, failing to exercise the commonsense that would have surfaced that oversight, and weaponizing the incorrect conclusions to support a predatory industry.

Levitin’s analysis of the paper is scorching. The authors didn’t just make a coding error in their data, and didn’t merely mobilize the resulting erroneous conclusion to support a corrupt and predatory industry — they also published their data in a way that makes it impossible to verify their conclusions.

Levitin calls for the paper to be withdrawn and for the WSJ to publish a correction. At the same time, he’s somewhat sympathetic to the authors, pointing out that “calculating usury caps is not always an easy thing.” He should know: he wrote the definitive text on consumer finance and included pages of exercises on this to help students avoid falling into the same errors:

https://www.aspenpublishing.com/Levitin-Consumer1

But he doesn’t bend over backwards for them. As he writes, there’s a “[troubling] lack of discussion in the paper of the most obvious distinction in patterns on a state-based level, especially given the authors’ apparent awareness of state-based distinctions on all kinds of other issues throughout the paper.”

Image: Taber Andrew Bain https://www.flickr.com/photos/andrewbain/524195139/

CC BY 2.0: https://creativecommons.org/licenses/by/2.0/

43 notes

·

View notes

Text

0 notes

Text

This article is featured in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.A PDF pamphlet of this article is available for download.“The reason that we are focused on financial institutions and payment processors is because they are the so-called bottlenecks, or choke-points, in the fraud committed by so many merchants that victimize consumers and launder their illegal proceeds,” Bresnickat explained to the club. “We hope to close the access to the banking system that mass marketing fraudsters enjoy — effectively putting a choke hold on it…”This concerted effort, later labeled “Operation Choke Point”, targeted a wide range of business categories, including ammunition sales, drug paraphernalia, payday loans, dating services, pornography, telemarketing, tobacco sales, and government grants. This broad application of financial exclusion ultimately prompted multiple lawsuits and federal investigations into the conduct of both the DOJ and the Federal Deposit Insurance Corporation (FDIC), as well as harsh criticism from all corners.“The clandestine Operation Choke Point had more in common with a purge of ideological foes than a regulatory enforcement action”, wrote Frank Keating, a former governor of Oklahoma who served in the DOJ during the Reagan administration, in a 2018 editorial for The Hill. “It targeted wide swaths of businesses with little regard for whether legal businesses were swept up and harmed. In fact, that seemed to be the goal.”In 2017, the Trump administration’s DOJ wrote a letter to Congress indicating that Operation Choke Point was officially over. In 2018, the FDIC promised to limit its personnel’s ability to “terminate account relationships” and to put “additional training” into place for its examiners.But in the years since the federal government so blatantly demonstrated its interest in dictating access to banking services and its power to do so deliberately with little or no consequences, many feel that little has changed. Bank Runs, With BiasOn March 8, 2023, it was announced that the cryptocurrency-focused institution Silvergate Bank would be voluntarily liquidated by its holding company. The bank had been focused on serving cryptocurrency clients since 2013 when its CEO Alan Lane first invested in bitcoin. In 2022, it had acquired the technology behind Meta’s failed stablecoin project, Diem, with hopes of launching its own dollar-backed token. As the cryptocurrency market declined in late 2022, marked by the collapse of one of its biggest clients in cryptocurrency exchange FTX, the bank’s stock price plummeted. It likely did not help that at the same time, U.S. Senators Elizabeth Warren, Roger Marshall, and John Kennedy asked Silvergate to disclose details of its financial relationship with collapsed cryptocurrency exchange FTX. Soon after, on March 10, 2023, almost ten years to the day from Bresnickat’s public detailing of Operation Choke Point, Silicon Valley Bank (SVB) was seized by the California Department of Financial Protection and Innovation and placed under FDIC receivership, marking what was then the second-largest bank failure in U.S. history. Since 2021, the bank had been increasing its long-term securities holdings but, as the market value of these assets deteriorated amid U.S. dollar inflation and Federal Reserve interest rate hikes, it was left with unrealized losses. Simultaneously, its customers, many of whom were prominent businesses within the cryptocurrency industry and were similarly strained by economic conditions, were withdrawing their money. On March 8, 2023, SVB announced that it had sold more than $21 billion worth of securities, borrowed another $15 billion, and was planning an emergency sale to raise yet another $2.25 billion. Perhaps unsurprisingly, this sparked a run on its remaining funds, totaling some $42 billion in withdrawals by March 9, 2023. On Sunday, March 12, state and federal authorities stepped in; customers of Signature Bank had withdrawn more than $10 billion.

Since 2018, Signature Bank had maintained a focus on cryptocurrency businesses, with some 30% of its deposits coming from the sector by early 2023. Signature Bank had also accrued a large proportion of uninsured deposits, worth some $79.5 billion and constituting almost 90% of its total deposits. It was holding relatively little cash on hand — only about 5% of its total assets (compared to an industry average of 13%) — so it was poorly prepared for a run on crypto-friendly banks spurred by SVB’s issues. On March 12, 2023, the New York State Department of Financial Services closed Signature Bank and placed it under FDIC receivership as it faced a mountain of withdrawal requests. At the time, this represented the third-largest bank failure in U.S. history.Following their seizures of SVB and Signature Bank, the U.S. Department of the Treasury, Federal Reserve, and FDIC described the takeovers as “decisive actions to protect the U.S. economy by strengthening public confidence in our banking system”. But others suggested the actions, particularly against Signature Bank, signified a blatant reemergence of the prejudice displayed during Operation Choke Point and connected to a larger effort to stymie cryptocurrency businesses.“I think part of what happened was that regulators wanted to send a very strong anti-crypto message”, Barney Frank, a Signature Bank Board member and former congressman who helped draft the seminal “Dodd-Frank Act” to overhaul financial regulation following the Great Recession, told CNBC in March 2023. “We became the poster boy because there was no insolvency based on the fundamentals.”Following an FDIC announcement that Flagstar Bank would assume all of Signature Bank’s cash deposits except for those “related to the digital-asset banking businesses”, the editorial board of The Wall Street Journal announced that Frank was right to call out this bias.“This confirms Mr. Frank’s suspicions — and ours — that Signature’s seizure was motivated by regulators’ hostility toward crypto”, the board wrote. “That means crypto companies will have to find another bank to safeguard their deposits. Many say that government warnings to banks about doing business with crypto customers is making that hard.”Targeting A New Choke PointPublic officials, financial professionals, and Bitcoin advocates had been pointing out an apparent bias against cryptocurrency businesses from the Biden administration well before the March 2023 bank runs. There were numerous policy events in the early part of 2023 to back up those sentiments.A January 3, 2023, “Joint Statement on Crypto-Asset Risks to Banking Organizations” from the Federal Reserve, FDIC, and Office of the Comptroller of the Currency (OCC) noted that, “The events of the past year have been marked by significant volatility and the exposure of vulnerabilities in the crypto-asset sector. These events highlight a number of key risks associated with crypto-assets and crypto-asset sector participants that banking organizations should be aware of…”, effectively serving to dissuade financial institutions from taking on those risks.A White House “Roadmap to Mitigate Cryptocurrencies’ Risks” released on January 27, 2023, indicated that the Biden administration sees the proliferation of cryptocurrencies as a threat to the country’s financial system and warned against the prospect of granting cryptocurrencies more access to mainstream financial products.“As an administration, our focus is on continuing to ensure that cryptocurrencies cannot undermine financial stability, to protect investors, and to hold bad actors accountable”, per the roadmap. “Legislation should not greenlight mainstream institutions, like pension funds, to dive headlong into cryptocurrency markets… It would be a grave mistake to enact legislation that reverses course and deepens the ties between cryptocurrencies and the broader financial system.”On February 7, 2023, the Federal Reserve pushed a rule to the Federal Register clarifying

that the institution would “presumptively prohibit” state member banks from holding crypto assets as principal in any amount and that “issuing tokens on open, public, and/or decentralized networks, or similar systems is highly likely to be inconsistent with safe and sound banking practices”.And on May 2, 2023, the Biden administration proposed a Digital Asset Mining Energy (DAME) excise tax, suggested as a way to force cryptocurrency mining operations to financially compensate the government for the “economic and environmental costs” of their practices with a 30% tax on the electricity they use.For Brian Morgenstern, the head of public policy at Riot Platforms, one of the largest, publicly traded bitcoin miners based in the U.S., these policy suggestions, updates, and rule changes clearly indicate a larger attempt to hinder Bitcoin advancement by targeting financial choke points.“The White House has proposed an excise tax on electricity use by Bitcoin mining businesses specifically — an admitted attempt to control legal activity they do not like, in the name of environmental protection”, Morgenstern explained in an interview with Bitcoin Magazine. “The only explanation for such inexplicable behavior is deep-rooted bias in favor of the status quo and against decentralization.”Collectively, this behavior could influence the conduct of regulated banks, just as the pressure applied by the DOJ in the 2010s unduly limited the businesses in its crosshairs back then. For many, it’s clear that Operation Choke Point has been reinstated.“‘Operation Choke Point 2.0’ refers to the coordinated effort by the Biden administration’s financial regulators to suffocate our domestic crypto economy by de-banking the industry and severing entrepreneurs from the capital necessary to invest here in America”, U.S. Senator Bill Hagerty, a member of the committees on banking and appropriations, told Bitcoin Magazine. “It appears that financial regulators have bought into the false narrative that cryptocurrency-focused businesses solely exist to facilitate or conduct illicit activities, and they seem blind to the opportunities for the potential innovations and new businesses that can be built.” Pressure Where It HurtsIt may be fairly obvious how such a pressure campaign by federal regulators would hurt cryptocurrency-focused projects that depend on access to banks. But the larger ramifications of such financial prohibitions for retail customers and the advancement of Bitcoin in particular may not be.Why should proponents of Bitcoin, a decentralized financial rail designed to function outside of the legacy system, care about a choke point in regulated financial institutions?Caitlin Long, the founder of Custodia Bank, which is focused on bridging the gap between digital assets and legacy financial services, recognizes that for users in the U.S. to legitimately participate in Bitcoin, the regulatory landscape must be accommodating.“I’ve been working for years to help enable laws to be enacted, in multiple U.S. states and federally, precisely because in the absence of legal clarity about Bitcoin, legal systems can become attack vectors on Bitcoiners”, she said in an interview with Bitcoin Magazine. “All of us live under legal regimes of some sort, and we should be aware of legal attack vectors and work toward resolving them in an enabling way.”Long’s advocacy may best represent the potential that favorable or even just equitable financial access could mean for Bitcoin adoption and the advancement of its technology for everyone. Through her work, Custodia (then under the name Avanti) obtained a 2020 bank charter in its home state of Wyoming that made it a special-purpose depository institution capable of custodying bitcoin and other cryptocurrencies on behalf of clients. But, following a prolonged delay in approval of Custodia’s application for a master account with the Federal Reserve that would allow it to leverage the FedWire network and facilitate

large transactions for clients without enrolling intermediaries, Custodia filed a lawsuit against the Fed last year.“Operation Choke Point 2.0 is real — Custodia learned about its existence in late January when press leaks hit and reporters started calling Custodia to say they learned that all bank charter applicants at the Fed and OCC with digital assets in their business models, including Custodia, were recently asked to withdraw their pending applications”, Long said. “Reporters told us that the Fed’s vote on Custodia’s application would be a foregone conclusion before the Fed governors actually voted.”But, more than just stifling innovators who seek to build bridges between Bitcoin and legacy financial services, targeting the choke points of Bitcoin platforms will only push these platforms outside of the scope of regulators, giving those with malicious intent an advantage over those who are attempting to play by the rules.“Internet-native money exists. It won’t be uninvented”, Long added. “If federal bank regulators have a prayer of controlling its impact on the traditional U.S. dollar banking system, they will wake up and realize it’s in their interest to enable regulatory-compliant bridges. Otherwise, just as with other industries that the internet has disrupted — corporate media, for example — the internet will just go around them and they will face even bigger problems down the road.”As was laid bare by the collapse of cryptocurrency exchange FTX, Bitcoin is still very much tied to the world of cryptocurrency at large in the portfolios of investors and the eyes of most people around the world. Indeed, the revelations around FTX’s criminal operations have been a case in point for regulators who seek the financial prohibition of cryptocurrency businesses. But this very prohibition may have enabled FTX’s operators to fleece billions in customer funds: Based on a Caribbean island, the vast majority of FTX’s business was outside of the jurisdiction of U.S. regulators. As U.S. regulators limit the growth of domestic businesses, offshore alternatives like FTX benefit.And while many Bitcoiners may think that policymakers are powerless to determine the success of this permissionless technology, adverse or absent regulations can limit Bitcoin-specific businesses just as harshly as they do broader, cryptocurrency-related ones. In fact, it may be Bitcoin’s unique properties that make the current regulatory landscape such a daunting one for growth.“Bitcoiners should care about Operation Choke Point 2.0 because certain policymakers are trying to take away our ability to participate in the Bitcoin network”, Morgenstern argued. “Moreover, Bitcoin is different. It is not only the oldest and most tested asset in this space, it is perhaps the only one that everyone agrees is a digital commodity. That means the on-ramp for inclusion into any policy frameworks will have less friction inherently, and Bitcoiners need to understand this.”Relieving The Choke PointsReviewing the recent, hostile policy updates from federal regulators, it seems clear that Bitcoin is firmly entrenched along with “crypto” in their minds. And, Bitcoin proponents in particular will agree, many businesses focused on other cryptocurrencies are apt to hurt investors. But some in the Bitcoin sector think that more education could help underscore the distinctions between Bitcoin and altcoins, and better protect Bitcoin from more justified regulatory limits on manipulated tokens and vaporware. “Engage with your elected officials”, Morgenstern encouraged. “Help them understand that Bitcoin’s decentralized ledger technology is democratizing finance, creating faster and cheaper transactions and providing much-needed optionality for consumers at a time when the centralized finance system is experiencing distress. This will take time, effort and a lot of communication, but we must work together to help our leaders appreciate how many votes and how much prosperity is at stake.”Indeed,

for those elected officials who do recognize this bias as unduly harmful to innovation, continued advocacy from Bitcoin’s supporters is the best way out of the choke hold.“This isn’t an issue where people can afford to be on the sidelines anymore”, Hagerty concluded. “I encourage those who want to see digital assets flourish in the United States to make your voice heard, whether that is at the ballot box or by contacting your lawmakers and urging them to support constructive policy proposals.”This article is featured in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.A PDF pamphlet of this article is available for download. Source

0 notes

Text

CFPB Rulemaking Table Simplification and Potential Registration of Nonbanks