#Partnership Firm Registration in India

Explore tagged Tumblr posts

Text

Preserve your brand’s integrity with reliable trademark registration services in Cochin from Bizpole!Without proper protection, your business risks losing its identity and facing legal challenges from competitors. Our expert team navigates the complexities of registration, safeguarding your intellectual property. Don't leave your brand vulnerable—partner with us to protect your future!

#Partnership firm Registration in india#company registration in coimbatore#company registration in belgaum

0 notes

Text

Documents for Partnership Firm Registration

Here is the list of the documents which are required to register a partnership firm in India or you can contact Lawgical India for all your hassle-free online legal services

#registration of partnership firm#partnership firm registration in india#partnership firm registration#partnership firm registration online

0 notes

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

Partnership Firm Registration: A Step-by-Step Guide

Starting a partnership firm is a popular choice for many entrepreneurs looking to start a business with shared responsibilities and profits. Unlike sole proprietorships, a partnership firm involves two or more individuals joining together to conduct business under an agreed-upon partnership deed. This blog will guide you through the process of registering a partnership firm in India, highlighting its benefits and requirements. Additionally, we’ll discuss the role of a practising company secretary in Coimbatore and explore some of the best company secretary firms in India that can assist in the registration process.

What is a Partnership Firm?

A partnership firm is an organization formed by two or more individuals to run a business together, sharing profits and liabilities. The firm is governed by the Indian Partnership Act, 1932, and can be registered or unregistered. However, registering a partnership firm provides additional legal benefits and helps build trust among clients and stakeholders.

Steps to Register a Partnership Firm

Choose a Unique Name: The first step is to select a unique name for your partnership firm. Ensure that the name does not violate any trademarks or intellectual property rights.

Draft a Partnership Deed: A partnership deed is a legal document that outlines the roles, responsibilities, profit-sharing ratios, and other terms agreed upon by the partners. It should be drafted with the help of a professional, such as a practising company secretary in Coimbatore, who can provide expert guidance.

Obtain PAN and TAN: A Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) are essential for taxation purposes. These can be obtained from the Income Tax Department.

Apply for GST Registration (if applicable): If your business’s turnover exceeds the GST threshold, GST registration is required. A company secretary can assist with this process and ensure compliance with tax regulations.

Submit Application to the Registrar of Firms: To register the firm, you must submit the partnership deed, along with the required forms and documents, to the Registrar of Firms in your jurisdiction. The best company secretary firms in India can streamline this process by handling paperwork and documentation.

Pay Registration Fees: A nominal fee must be paid to the Registrar of Firms. Once the fee is paid, the Registrar will verify the documents and issue a Certificate of Registration, officially establishing the firm.

Benefits of Registering a Partnership Firm

Registering a partnership firm provides several benefits:

Legal Recognition: Registration offers legal recognition, which enhances credibility and trust among customers and investors.

Ability to Sue or be Sued: A registered partnership firm can sue other parties and can also be sued in its own name. This protection is not available for unregistered firms.

Access to Credit: Banks and financial institutions are more likely to offer loans and credit facilities to registered firms, providing better financial support for business growth.

Dispute Resolution: In case of disputes between partners, a registered firm can seek legal recourse, as it is recognized as a legal entity.

Role of a Practising Company Secretary in Coimbatore

A practising company secretary plays a crucial role in the registration process by ensuring compliance with legal requirements and handling all necessary documentation. From drafting the partnership deed to assisting with tax registrations, a practising company secretary in Coimbatore can provide valuable support, particularly for first-time entrepreneurs. They are skilled in navigating regulatory requirements, which can save time and prevent costly mistakes.

Choosing the Best Company Secretary Firms in India

When it comes to forming a partnership firm, working with the best company secretary firms in India can make a significant difference. These firms offer comprehensive services, including corporate compliance, tax consulting, and ongoing legal support. Their expertise ensures that your partnership firm remains compliant with all regulatory requirements, allowing you to focus on growing your business.

Conclusion

In conclusion, partnership firm registration is a straightforward process that can be made easier with professional assistance. Whether you choose to work with a practising company secretary in Coimbatore or one of the best company secretary firms in India, the right guidance can help you establish a successful partnership firm. With the proper legal framework in place, you’ll be well-equipped to pursue business opportunities and achieve your entrepreneurial goals.

1 note

·

View note

Text

Starting a Partnership Firm in India: Your Essential Guide

A partnership firm stands as a cornerstone of the business landscape in India, offering a unique blend of collaboration and shared responsibility. In this structure, partners join forces, pooling their resources, skills, and ideas to run a venture while enjoying the flexibility that comes with shared decision-making. The essence of a partnership lies in cooperation; each partner contributes capital and expertise, fostering an environment ripe for innovation and growth.

The partnership deed plays a crucial role in defining the dynamics within the firm. It details crucial elements like profit-sharing ratios, partner roles and responsibilities, and methods for resolving disputes. This clarity helps minimize misunderstandings among partners and ensures smooth operations within the business. Moreover, the Indian Partnership Act of 1932 provides legal backing to these arrangements, offering protections vital for maintaining stability in collaborative enterprises. For aspiring entrepreneurs considering this model, it's not just about forming a business; it’s about building long-lasting relationships that can adapt to challenges while driving success together.

At Uks Associates, our primary mission is to contribute to the success and growth of your business by providing expert guidance and support in transitioning your firm into a partnership structure. We understand that transforming your business model into a partnership can offer numerous advantages, including enhanced collaboration, shared responsibilities, and a more robust foundation for future growth. Our dedicated team of professionals is here to assist you every step of the way, from the initial consultation and strategic planning to the final implementation of the partnership firm structure.

Process for Setting Up a Partnership Firm in India

Drafting the Partnership Deed

Partnership Deed: This is a critical document outlining the terms agreed upon by the partners. Key components include:

Name and address of the firm

Names and addresses of all partners

Nature of the business

Initial capital contributions by each partner

Profit and loss sharing ratio

Rights and duties of each partner

Terms for adding or removing partners

Dispute resolution procedures

Legal Advice: Consulting with a legal expert is advisable to ensure the deed is comprehensive and legally sound.

2. Registering the Partnership Firm

Registration: The Indian Partnership Act of 1932 does not make registration mandatory, it is highly recommended for its legal and practical advantages.

3. Process:

Application Form: File Form A with the Registrar of Firms (RoF) in the relevant state.

Documents Required:

Partnership Deed

Proof of the firm’s address (e.g., utility bill, lease agreement)

Identity and address proof of all partners (e.g., Aadhar card, passport)

PAN card of the firm and partners

Fee Payment: Pay the registration fee, which varies depending on the state.

Verification: The Registrar will review the documents and issue a Certificate of Registration if everything is in order.

4. Obtaining PAN and TAN

PAN (Permanent Account Number): Apply for a PAN card for the partnership firm through the Income Tax Department to facilitate tax compliance.

TAN (Tax Deduction and Collection Account Number): Obtain TAN if the firm will be deducting tax at source (TDS) from payments to employees or contractors.

5. Opening a Bank Account

Bank Account: Set up a bank account under the firm's name. The necessary documents for this include the Partnership Deed, PAN card, and Certificate of Registration.

6. Compliance with Other Legal Requirements

GST Registration: Obtain GST registration if the firm’s turnover exceeds the threshold limit or if it engages in inter-state transactions.

Professional Tax: Register and pay professional tax as per state regulations if applicable.

Shops and Establishment Act: If required in your state, register under this act, which regulates working conditions and employment practices in commercial establishments.

7. Maintaining Proper Records

Books of Accounts: Maintain accurate and up-to-date books of accounts as required under the Partnership Act and other relevant laws.

Annual Filing: Ensure timely filing of annual returns and tax returns to meet regulatory requirements.

8. Adhering to Additional Regulations

Labor Laws: Comply with labor laws if employing staff, including regulations related to wages, working conditions, and employee benefits.

Industry-Specific Licenses: Acquire any extra licenses or permits required for your particular industry or business operations.

9. Amendments and Updates

Partnership Deed Amendments: Update the partnership deed and notify the Registrar of any changes such as new partners, removal of partners, changes in capital, or profit-sharing ratios.

This is the whole process that a firm needs to follow while registering as a partnership firm in India. At Uks Associates, we help you with every step of the process till the end of the process. We are helping firms in every way possible in the process with our expertise in this field.

Benefits of a partnership firm

Diverse Ideas and Creativity

Partners contribute diverse skills and ideas, aiding the business in developing innovative solutions and addressing challenges more effectively.

2. Lower Financial Barrier to Entry

Sharing start-up costs makes it cheaper to start a business. It also makes it easier to raise money and get loans because there are more resources combined.

3. Potential Tax Savings

Partnerships can save on taxes by splitting income among partners. This can mean paying less in taxes compared to other business structures.

4. Privacy and Flexibility

Partnerships have fewer rules and regulations, so they can operate more privately and make decisions faster. It’s also easier to change the business structure if needed.

5. Adaptability

Partnerships can quickly adjust their setup and operations to meet new market demands or challenges, helping them stay competitive.

Disadvantages of a Partnership:

Unlimited Liability:

Partners are personally liable for the business’s debts, putting their assets at risk if the business incurs financial problems.

2. Joint and Several Liability:

Each partner is responsible not only for their share of the debts but also for the entire amount. This means that a partner could be held liable for more than their proportional share of the debt.

3. Potential for Conflict:

Disputes and disagreements among partners can arise, potentially disrupting business operations and management.

4. Liability for Actions of Others:

Each partner is an agent of the partnership and can be held accountable for the actions and decisions made by other partners.

5. Costly Asset Valuation:

When partners enter or exit the partnership, it often requires a valuation of all assets, which can be a complicated and expensive process.

0 notes

Text

Although it is not a compulsion for partnership firms to get registered, however, you may choose to get registered in order to enjoy various government benefits.

0 notes

Text

A Partnership firm is an association of two or more persons formed in order to carry on a business in the capacity of co-owners. The co-owners are referred to as partners of the business and share the profits and losses in the proportion of their respective ownership, or as agreed between them.

Get experts to register your Partnership Firm along with GST registration and related services at EazyBahi Solution in India and enjoy the benefits of a legal partnership.

0 notes

Text

Get Professional Accounting Service - IndianSalahkar

Well, you have reached the right place; welcome to Indian Salahkar, one of the leading business consultancy firms in India that provide quality Professional Accounting Service. A globally acknowledged certification or a private limited company registration for any company is an essential and primary requirement to stabilize its credibility.

#Professional accounting service#Business accounting firm in india#best accounting firm in India#Trademark Registration Services#Brand Registration#GST registration service provider#partnership firm registration online#company registration in India#Income tax return filing service

0 notes

Text

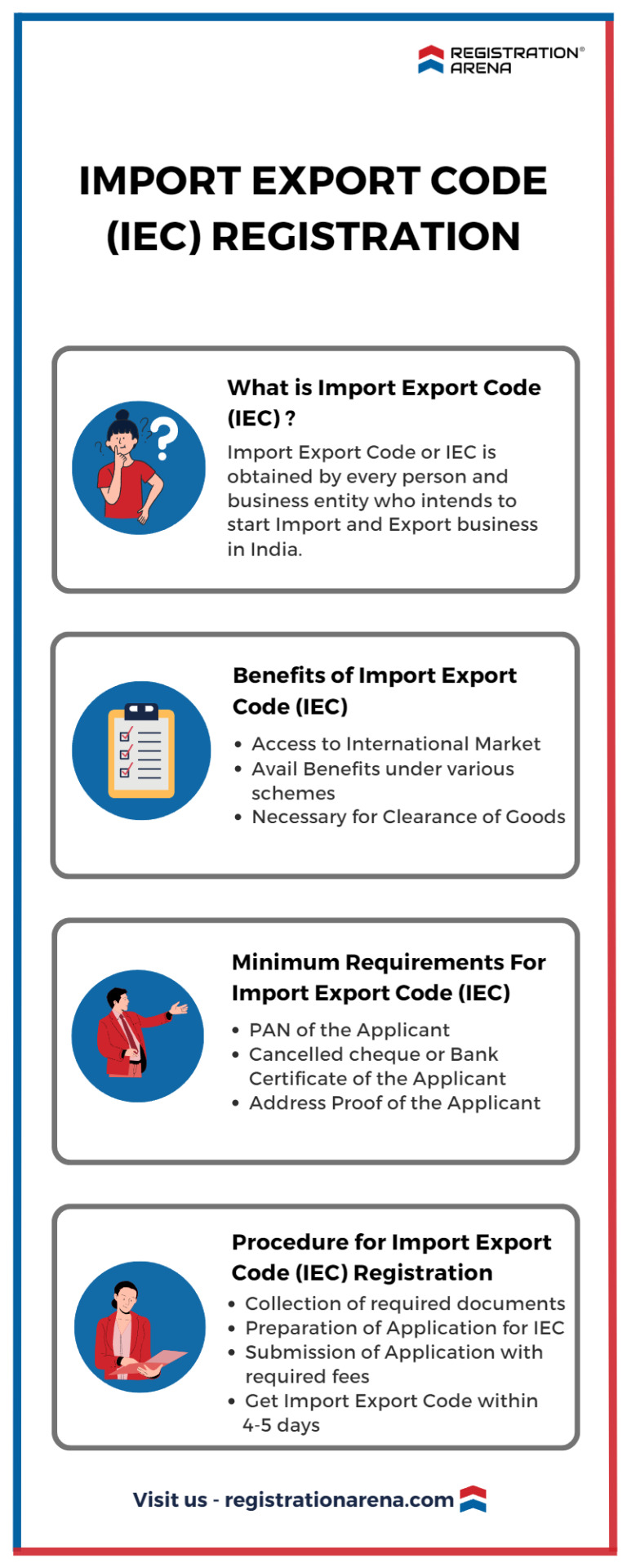

To engage in importing or exporting goods, all business entities are required to obtain a 10-digit identification number known as the Importer-Exporter Code (IEC). Without a valid IEC number, a person or entity is not permitted to conduct any import or export activities. In India, the Director General of Foreign Trade (DGFT) is responsible for granting IECs. IEC registration is a completely online process and can be finished within 4-5 days. IEC once issued shall be valid for a lifetime.

#legal advisers#legal consultation#legal services#llp registration#private limited company registration#sole proprietorship#public limited company#annual compliances of llp#annual compliance of private limited company#startup india registration#trademark registration#partnership firm registration#tds return filing#itr filing#Import-export code#opc registration

0 notes

Text

#Proprietorship Tax Return File Online#Cancel GST Registration#Online GST Registration in India#Partnership Firm Tax Return Filing#Online Professional Tax Registration#Draft Shareholders' Agreement Form Online#Online File for Founder Agreement

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

Startup India Registration - Benefits, Eligibility, Documents Required, Process, Fees

The government of India launched the "Startup India Initiative'' to ensure that the growing number of Startups in the country have the right resources and support to grow. Under the Startup India program, eligible companies can get recognized as Startups by DPIIT to get tax benefits, easier compliance, IPR fast-tracking, special benefits & more.

What is Startup india dpiit recognition?

The Startup India is a program to encourage and support the startup ecosystem in India. It aims to promote new businesses by providing them various benefits & exemptions. Such as tax holidays & access to government funding and incubator programs. The benefits of the program can be accessed by startups through DPIIT recognition.

*If you want to know about EPR Registration_ click here

#startup#business#india#business growth#manage business#partnership firm registration#private limited company registration in chennai#taxes#income tax#epr authorization

1 note

·

View note

Text

Company Formation by MASLLP: Your Partner in Starting a Business

Starting a company is an exciting venture, but the process can be complex and time-consuming. This is where professional guidance comes in handy. MASLLP offers expert company formation services, designed to streamline the process and ensure compliance with all legal requirements. Whether you are a local entrepreneur or an international business looking to establish a presence in India, MASLLP has the expertise to assist you at every step.

Why Choose MASLLP for Company Formation? Expertise in Legal Procedures MASLLP specializes in handling the intricate legal requirements involved in setting up a company. From filing necessary documents to obtaining essential licenses, MASLLP ensures that your business is established in compliance with India's regulatory framework.

Customized Solutions Every business has unique needs, and MASLLP tailors its services to meet your specific goals. Whether you're forming a private limited company, a public limited company, or a limited liability partnership (LLP), MASLLP provides guidance based on your business model and objectives.

End-to-End Support MASLLP offers comprehensive services from the initial consultation through to post-formation compliance. This includes drafting Memorandum of Association (MOA) and Articles of Association (AOA), securing digital signatures, and helping with PAN/TAN registration.

The Company Formation Process Setting up a company in India requires a series of steps that MASLLP manages efficiently:

Choosing the Right Structure The first step is determining the right business structure—Private Limited, LLP, or a One-Person Company (OPC). MASLLP provides advice on the best structure based on liability, tax, and regulatory requirements.

Name Approval MASLLP assists in selecting a suitable name for your business and ensures it complies with the Ministry of Corporate Affairs (MCA) guidelines.

Incorporation Documentation The legal team at MASLLP helps prepare and file all necessary documents, such as the Director Identification Number (DIN), Digital Signature Certificate (DSC), and incorporation forms with the MCA.

Post-Incorporation Compliance Once your company is established, MASLLP ensures you meet all post-incorporation compliance requirements, such as obtaining necessary licenses, registering for Goods and Services Tax (GST), and maintaining statutory records.

Benefits of Company Formation with MASLLP Time Efficiency: With MASLLP managing the paperwork, you can focus on growing your business rather than worrying about legal hurdles. Compliance Assurance: Ensures that your company is set up in full compliance with Indian law. Professional Expertise: MASLLP’s team of legal and financial experts guide you through every phase of company formation. Conclusion For entrepreneurs looking to establish a company in India, MASLLP offers a seamless, efficient, and expert-driven service. Their deep understanding of the legalities involved in company formation makes them the ideal partner for anyone looking to start a business. Whether you're a startup, an established business, or an international firm, MASLLP ensures your company formation process is smooth and compliant.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

3 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Unlock the Secrets of Udyam Registration for Partnership Firms

The Udyam Registration, previously known as Udyog Aadhaar Memorandum (UAM), has been a transformative initiative by the Indian government to support and empower micro, small, and medium-sized enterprises (MSMEs). For partnership firms, this registration offers a host of benefits and opportunities.

Update Udyam Certificate: One of the key advantages of Udyam Registration is the ability to Update Udyam Registration online. Business details may change over time, and this feature allows you to keep your registration accurate and up-to-date, reflecting the current state of your partnership firm.

Apply Online for Udyam Partnership Firm: The online application process for partnership firms is user-friendly and efficient. You can easily submit the necessary documents and information online, reducing the time and effort required for registration.

Online Enquiry for Udyam: The digital platform has simplified the process of making inquiries related to Udyam Registration. You can get information, clarification, and assistance regarding the registration process, making it easier to navigate.

Print UAM Registration Online: Once your partnership firm's Udyam Registration is approved, you can conveniently print your Udyam Certificate online. This certificate is not just a document; it's your ticket to a plethora of benefits and opportunities reserved for MSMEs.

Print Udyam Certificate: After successfully obtaining your Udyam Registration, you can print the Udyam Certificate, which serves as proof of your registration. Displaying this certificate can build trust among clients and partners, enhancing your firm's credibility.

Access to Government Schemes: Udyam Registration opens the door to various government schemes and incentives specifically designed for MSMEs. These schemes can provide financial assistance, subsidies, and priority in procurement, giving your partnership firm a competitive edge.

Financial Benefits: Banks and financial institutions often offer preferential treatment to Udyam-registered businesses. This includes easier access to credit facilities and lower interest rates, which can be advantageous for managing finances and expansion.

Global Opportunities: Udyam Registration can also pave the way for international collaborations and exports. Many foreign companies prefer to engage with Udyam-registered Indian businesses, offering the potential for global growth.

Simplified Compliance: Udyam Registration streamlines the compliance process by consolidating various government-related registrations into one. This reduces the administrative burden on your partnership firm.

Competitive Advantage: Displaying your Udyam Certificate on your website and marketing materials can enhance your firm's reputation and attract clients who prefer working with registered MSMEs.

Conclusion

Udyam Registration is a game-changer for partnership firms in India. It offers numerous benefits, ranging from financial advantages to global opportunities. By utilizing online services such as updating your Udyam Certificate, applying online, making online inquiries, and printing your Udyam Certificate, you can unlock the full potential of this registration and take your partnership firm to new heights of success. Don't miss out on the secrets of Udyam Registration; embrace them and witness the transformation in your business.

2 notes

·

View notes

Text

register proprietorship firm online

Get online partenership firm registration in India with GST & IT Buddies. Find step-by-step process for how to register partnership firm in India.

Accounting, Taxation & Registration

GST & IT Buddies is a company with experience in Accounting, Taxation & Registration, that also caters to all other financial requirements.

GST & IT Buddies

2 notes

·

View notes