#Professional accounting service

Explore tagged Tumblr posts

Text

Professional Accounting Services | Trusted Bookkeepers in India

Streamline your finances with Paper Tax accounting services for professionals. Get expert support for accurate and stress-free financial management. Explore now! https://bit.ly/4dBnwgn

#accounting#Professional Accounting Service#Accounting Service#Bookkeepers Service India#Bookkeepers Service#Bookkeepers#Accountant and Tax Service Provider#Professional Bookkeeping Services Consultant#Professional Bookkeeping Services#Accounting and Taxation Services India#Accounting and Taxation

0 notes

Text

Top Best Accounting Firm in India

Want to raise equity funds for your business entity or struggling with the ISO certification process for your product or service? Visit Indian Salahkar, one of the Best Accounting Firm in India, to get detailed guidance on your business registration processes at a competitive price.

#best accounting firm in India#Professional accounting service#Business accounting firm in india#Trademark Registration Services

0 notes

Text

I dont know which is worse. A broadcast deal or watching on twitch.

#pwhl#todays game is on twitch again i guess#like i would rather pay for a professional service#i am not making a twitch account#at least a broadcast deal is respectable

5 notes

·

View notes

Text

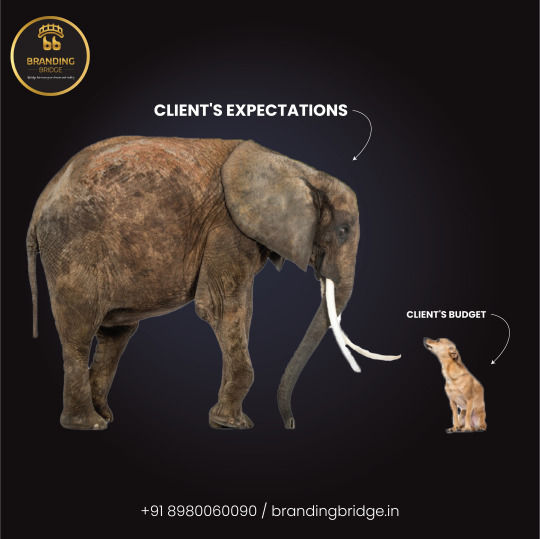

" A brand without discipline is a brand in chaos. "

#business#branding bridge#brand#branding#branding services#branding company#digital services#became brand#digital marketing#web designing#graphic designing#marketing#ecommerce#sales#accounting#skill#skill toy#skill development#professional#tools#hobbies#skill like killer attitude#skill creater#skillful mind#skillful soul#supernatural#successful#successful business#successful life#successful brand

2 notes

·

View notes

Text

Accountant SEO Services: SEO Experts

Elevate your online visibility with accountant SEO services – where SEO experts optimize your digital presence. Harness industry-specific strategies for accountants, ensuring top search engine rankings. From targeted keywords to engaging content, the experts enhance your website's performance, driving traffic and establishing your firm as a trusted authority. Stay ahead in the competitive digital landscape with tailored SEO solutions designed for accounting professionals.

3 notes

·

View notes

Note

Hi Dockter I'm a huge Soup2Nuts/Tom Snyder productions fan myself. Have you ever looked into or watched Hey Monie!, I think it's an exceptional show as well and a great addition to Soup2Nut's productions. Sadly all recordings and archives of it are especially low quality, as are many of Soup2Nut's archived shows on the internet.

Oh and ever head of The Dick and Paula Celebrity Special? I tried getting into it, but I didn't find my self getting attached all that much to the concept or characters.

Best of luck on finding anything else Science Court related! It's one of, if not, my favorite show.

Hello moxie-mallahah! I'm so glad to meet a like-minded fan. I've seen people love one show from mr. snyder and none the rest, so it's always a pleasant surprise to see somebody who's into soup2nuts as a whole!

I actually haven't watched Hey Monie, since I thought it was completely lost to time. I'll have to give it a watch! As for Dick and Paula, I've skimmed through it but never had a full rewatch myself. I'm not sure how I'll feel, but seeing as I love concepts like these (Bill and Ted is one of my favorite movies, after all) I think I'll give it a good rating regardless.

Thank you for your ask! I'll keep searching, for sure. I always wonder what our friends back at the Science Court are up to.

#Dockter's Notes#Buzz-Ins#dropping the professionalism for a minute im sorry this account has been a little dead!#I do still really care about science court and the lost episodes and I make a note to hunt for it but i've sort of run out of options#but I'll look around again and see if I can get any new stuff on the table!#plus i need to add more stuff than just......science court LOL#this is technically a soup2nuts archive blog as a whole#but science court is like my little service animal i love it a lot

9 notes

·

View notes

Text

#Gmail is the most popular email service in the world of Google. Are you looking to Buy old Gmail accounts for your business and personal pur#it’s becoming increasingly difficult to stand out from the competition. That’s why many businesses are turning to the purchase of Gmail to#Old Gmail accounts can purchase from third-party websites#but it’s important to be cautious when buying from third-party websites. It’s important to make sure the site is reputable and safe. Additi#it’s important to read the terms and conditions of the purchase and make sure you understand what you are buying.#Once you have old Gmail accounts#you can use them to boost your online presence. Old Gmail accounts can be used to create a more professional-looking email address for your#you can use them to target your advertising more precisely to people who are likely to be interested in your product or service.

2 notes

·

View notes

Text

Saskpo – Expert Accounting Outsourcing Services for Accountants & Firms

Streamline your accounting workload with Saskpo, a trusted provider of accounting outsourcing services for accountants and firms in the UK. From personal tax outsourcing to year-end accounts, corporation tax, VAT returns, and iXBRL tagging, we help you save time and improve efficiency. Focus on growing your practice while we handle the numbers!

#Accounting Outsourcing Services#Professional Accounting Outsourcing Services#Expert Accounting Outsourcing Services

0 notes

Text

Accounting firm in the UAE

BMS Auditing offers expert accounting, bookkeeping, and audit services in the UAE, ensuring compliance, efficiency, and growth for businesses of all sizes. You can manage your workflows, develop your financial circumstances, and improve your business technologies which is essential for this current scenario.

Accounting services in UAE is growing day by day and different modes of accounting practices are going on. This includes the activities related measuring, processing, and communicating a company's financial data.

#best accounting firms in dubai#accounting firms in abu dhabi#top accounting firms in dubai#accounting firms in sharjah#top accounting companies in dubai#professional accounting services in dubai

1 note

·

View note

Text

Professional Bookkeeping Services USA

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

To know more: https://www.outsourcedbookeeping.com/contact-us/

#outsourced bookkeeping#professional bookkeeping services#bookkeeping services for small business#outsource accounting#small business accounting

0 notes

Text

#Telecommunications BPO Services#Telecom Process Outsourcing#Bpo solutions for telecom industry#Professional Accounting services#Bookkeeping services#Corporate travel management services#Travel & Hospitality Solutions Worldwide

0 notes

Text

Get Professional Accounting Service - IndianSalahkar

Well, you have reached the right place; welcome to Indian Salahkar, one of the leading business consultancy firms in India that provide quality Professional Accounting Service. A globally acknowledged certification or a private limited company registration for any company is an essential and primary requirement to stabilize its credibility.

#Professional accounting service#Business accounting firm in india#best accounting firm in India#Trademark Registration Services#Brand Registration#GST registration service provider#partnership firm registration online#company registration in India#Income tax return filing service

0 notes

Text

How to Choose the Best Accounting Firm in Milwaukee

Finding the right accounting firm in Milwaukee can significantly impact your business or personal finances. Whether you need tax preparation, financial planning, or bookkeeping, selecting the best firm ensures accuracy, compliance, and peace of mind. Here are key factors to consider when choosing an accounting firm in Milwaukee.

1. Determine Your Needs

Before selecting an accounting firm, outline your specific needs. Do you require business tax services, payroll management, or financial advisory? Some firms specialize in corporate accounting, while others focus on individual tax planning.

2. Verify Credentials & Experience

Ensure the firm has Certified Public Accountants (CPAs) or Enrolled Agents (EAs) with relevant experience. Look for industry-specific expertise, especially if your business operates in sectors like healthcare, real estate, or manufacturing.

3. Check Reputation & Reviews

Research online reviews and testimonials to gauge the firm's reputation. Websites like Google, Yelp, and the Better Business Bureau (BBB) provide insights into customer experiences and potential red flags.

4. Evaluate Technology & Services

Modern accounting firms leverage technology to streamline operations. Ask if they offer cloud-based accounting, automated reporting, and digital tax filing. Firms using up-to-date software can improve efficiency and security.

5. Compare Pricing & Fees

Accounting firms charge differently—some use hourly rates, while others offer flat fees. Request a clear breakdown of costs to avoid hidden charges. Choose a firm that provides quality service within your budget.

6. Assess Communication & Accessibility

A responsive accounting firm is essential for timely financial decisions. Determine how often you’ll have contact and whether they offer virtual consultations. Good communication ensures seamless financial management.

7. Look for Personalized Services

Avoid one-size-fits-all approaches. The best accounting firms tailor their services to fit your financial situation, providing strategic guidance beyond basic bookkeeping.

8. Schedule a Consultation

Before committing, schedule a consultation to discuss your needs. This meeting helps assess their professionalism, expertise, and compatibility with your goals.

Conclusion

Choosing the best accounting firm in Milwaukee requires research and careful consideration. By evaluating experience, services, reputation, and pricing, you can find a trusted partner to support your financial success. Whether you need tax services or business accounting, the right firm will provide value and long-term financial security.

#accounting services for small business#professional accountants#tax accountant milwaukee wi#accounting services in milwaukee

0 notes

Text

" Products are made ; brands are created. "

#business#branding bridge#brand#branding#branding services#branding company#digital services#became brand#digital marketing#web designing#graphic designing#marketing#ecommerce#sales#accounting#skill#skill toy#skill development#professional#tools#hobbies#skill like killer attitude#skill creater#skillful mind#skillful soul#supernatural#successful#successful business#successful life#successful brand

2 notes

·

View notes

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes

Text

Unlocking Sustainable Growth: Proven Strategies for Business Expansion

For good business growth strategies to work, you must balance effort and sustainability with care. Businesses that manage to expand their operations know that development is not only about boosting income – it's about creating a strong base that can hold up extended growth while keeping quality in operations.

Strategic Market Positioning

Positioning in the market is a fundamental part of development strategies for business success. Businesses should discern their unique value and use it to set them apart from rivals. This requires comprehension of customer requirements, examination of spaces within the market, and creation of solutions that respond precisely to problems not yet tackled by competitors.

Data-Driven Decision Making

Today's businesses use data analysis a lot for making decisions about growing. By studying how customers behave, what trends are in the market, and measures of operations, companies can find opportunities to grow more accurately. This method focused on data helps lessen risks and enables organizations to distribute resources better.

Building Scalable Systems

Putting in place systems and processes that can grow is very important for continuous growth. Often, good strategies to make businesses larger include putting money in technology and automatic machines. This helps manage more work without needing many new resources or people.

Customer-Centric Innovation

Innovation must always be directed by the needs of customers, not by our own guesses inside the company. Companies that keep a strong bond with their clients can predict better what market requires and change their products to suit these demands. This method focusing on customers makes sure business tactics for growth stay in line with what the market wants.

Financial Management and Resource Allocation

Management of finances in a proper manner is very important for continuous growth. Organizations need to keep good cash flow while they spend on opportunities for expansion. This requires thoughtful planning, intelligent distribution of resources and holding onto emergency savings to manage unforeseeable problems.

Building Strong Teams

The growth possibility of a company frequently relies on the quality of its team. Investing in getting talent, training them and keeping them is helpful to make a workforce that can carry out difficult expansion plans. Strong leadership and unmistakable lines for communication guarantee all team members comprehend and labor towards shared objectives.

Measuring Success and Adapting

Monitoring of performance regularly and readiness to modify strategies are important for success over a lengthy period. Companies need to set clear measures for assessing growth advancement, also they should be ready to change their method depending on the results and alterations in market situations.

Final Words

For a business to grow sustainably, it needs an all-inclusive approach combining strategic planning, superb operations and flexibility. If companies concentrate on these important areas while keeping equilibrium between swift growth and stable operations, they can establish a robust base for continuing success. The secret is seeing growth not like a short race but more as being in it for the longest haul where continual advancements with flexibility finally result in sustainable development. Visit us now to know more about business growth strategies.

#business growth strategies#ca#tax professionals#chartered accountants auckland#chartered accountant firm#accounting consulting services#management accounting services#strategy development consultants#strategic business management and planning#corporate strategic planning

0 notes