#Part-time CFO and accounting services

Explore tagged Tumblr posts

Text

Unlock Financial Success with Virtual CFO Services by Pivot Advantage Accounting and Advisory Inc.

youtube

In the dynamic landscape of modern business, staying ahead requires strategic financial management. Small and medium-sized enterprises (SMEs) often face challenges in accessing top-tier financial expertise, which can hinder their growth. Enter Pivot Advantage Accounting and Advisory Inc., a leading player in the industry offering Virtual CFO services tailored to empower businesses in their financial journey.

The Rise of Virtual CFO Services As businesses evolve, so do their financial needs. A Virtual CFO acts as a remote, outsourced chief financial officer, providing expert financial guidance without the need for a full-time, in-house CFO. This innovative approach is gaining traction among businesses of all sizes, offering a cost-effective solution and access to high-level financial expertise.

Why Choose Pivot Advantage Accounting and Advisory Inc.?

Customized Financial Strategies: Pivot Advantage understands that each business is unique. Their team of seasoned financial professionals works closely with clients to create customized financial strategies aligned with their specific goals and challenges. Whether it's optimizing cash flow, managing expenses, or planning for future growth, Pivot Advantage tailors its Virtual CFO services to meet the distinct needs of each client.

Strategic Decision Support: In the fast-paced business environment, timely and informed decision-making is crucial. Pivot Advantage's Virtual CFO services go beyond traditional financial reporting. They provide real-time insights and analysis, empowering business owners to make strategic decisions with confidence. This proactive approach ensures that clients stay ahead of the competition and navigate challenges effectively.

Cost Efficiency: Hiring a full-time CFO can be a significant financial burden for SMEs. Pivot Advantage's Virtual CFO services offer a cost-efficient alternative, allowing businesses to access top-tier financial expertise without the overhead costs associated with a full-time executive. This scalability ensures that businesses only pay for the services they need, optimizing their budget for maximum impact.

Technology Integration: Pivot Advantage leverages cutting-edge financial technology to streamline processes and enhance efficiency. By integrating the latest tools and software, they provide clients with real-time financial data and analytics, fostering transparency and accuracy in financial management. This commitment to technology ensures that clients are equipped with the tools needed to adapt to the ever-changing business landscape.

Risk Management: Navigating financial risks is a key aspect of business success. Pivot Advantage's Virtual CFO services include comprehensive risk management strategies. From identifying potential financial risks to implementing risk mitigation plans, their experts work diligently to safeguard the financial health of their clients' businesses.

How to Get Started Getting started with Pivot Advantage Accounting and Advisory Inc.'s Virtual CFO services is a seamless process. The first step involves a comprehensive consultation to understand the unique needs and goals of the client. From there, Pivot Advantage crafts a tailored plan that aligns with the client's business objectives.

Conclusion In the era of remote work and digital transformation, businesses need agile financial solutions that adapt to their evolving needs. Pivot Advantage Accounting and Advisory Inc.'s Virtual CFO services provide a strategic advantage, combining expertise, cost-efficiency, and technology integration. By partnering with Pivot Advantage, businesses can unlock their full financial potential and pave the way for sustained success in today's competitive market.

#Vancouver accounting company#virtual CFO by Pivot Advantage Accounting and Advisory Inc.#Pivot Advantage Accounting and Advisory Inc. part time CFO#Pivot Advantage Accounting and Advisory Inc. CFO service#online accounting firm in Vancouver#accountant#Youtube

3 notes

·

View notes

Text

0 notes

Text

Why Your Business Needs a Fractional CFO: The Perfect Balance of Expertise and Affordability

The management of finances extends beyond simple bookkeeping in the rapid-fire, demanding business sector of tomorrow. It involves predictions, strategic thinking, and utilizing financial insights to drive expansion. It may not be financially feasible for a lot of small and medium-sized enterprises (SMEs) to hire a permanent Chief Financial Officer (CFO). Here, a Fractional CFO offers an optimal mix between experience and economic benefits, allowing businesses to get quality financial direction without bursting the bank for it.

What Is a Fractional CFO?

A finance expert that provides CFO-level services to businesses on an annual or remote capacity is referred to as a fractional CFO. Fractional CFOs, as compared with full-time CFOs, serve multiple customers and may customize their assistance to suit the particular needs of a company.

Under this collaboration, businesses may acquire the beneficial experience of an expert financial analyst despite having to incur the substantial charges of engaging a full-time staff member.

Benefits of Hiring a Fractional CFO

1. Cost-Effective Financial Expertise

The cost-effectiveness of hiring a part-time CFO is among the biggest benefits. The cost of hiring a full-time CFO can be high and includes overhead, bonuses, perks, and wages. Businesses are able to manage resources more efficiently since a part-time CFO offers the same level of experience at a fraction of the price.

2. Scalability and Flexibility

Fractional CFOs provide scalable services that are adapted to your company's present requirements. You can modify their involvement as your firm develops, whether you need strategic counsel during a capital round or advice on cash flow management and more.

3. Strategic Financial Planning

Bookkeeping and accounting do not constitute the only duties that a fractional CFO performs. Professionals develop estimates, develop over time financial strategies, and assist businesses to become ready for extensions, consolidations, and acquisitions.

4. Access to Advanced Insights and Tools

Proficient fractional CFOs frequently possess the most up-to-date financial instruments and industry expertise. To assist you in making wise judgments, they are able to decipher intricate financial data, evaluate market trends, and offer practical insights.

5. Improved Cash Flow and Profitability

Any organization must manage its cash flow effectively. A fractional CFO finds inefficiencies and areas for cost reduction to guarantee that cash flow is optimized and profitability is maximized.

6. Support During Critical Phases

Whether your company is growing quickly, raising money, or facing financial difficulties, a fractional CFO offers knowledgeable assistance at critical times to ensure seamless transitions and well-informed choices.

7. Risk Management and Compliance

The forecast is occasionally difficult to remain on the forefront of any time altering monetary laws. The fractional CFO eliminates the threat of penalties and audits via verifying that the firm complies alongside regulations from all levels.

Key Responsibilities of a Fractional CFO

Financial Analysis and Reporting

A Fractional CFO provides detailed financial reports and analyses, helping you understand your company's financial health and identify areas for improvement.

Budgeting and Forecasting

They assist in creating realistic budgets and accurate financial forecasts, aligning your business goals with financial planning.

Fundraising and Investor Relations

For businesses seeking funding, a Fractional CFO can craft compelling financial presentations, manage investor relations, and guide fundraising strategies.

Cost Management

A fractional CFO helps identify unnecessary expenditures and implement cost-saving measures to improve overall efficiency.

Growth Strategy Development

By analyzing market trends and financial data, a part-time CFO develops strategies to support sustainable growth.

When Does Your Business Need a Fractional CFO?

Rapid GrowthIf your business is experiencing rapid growth, managing finances becomes more complex. A Fractional CFO can ensure that financial systems are scalable and efficient.

Preparing for InvestmentBefore seeking external funding, businesses need well-organized financial statements and projections. A part-time CFO can help you present your business in the best possible light to investors.

Cash Flow ChallengesStruggling to manage cash flow? A Fractional CFO can implement effective cash flow strategies to stabilize your finances.

Navigating Market UncertaintyIn uncertain economic climates, a part-time CFO provides the expertise needed to make data-driven decisions and mitigate risks.

How to Choose the Right Part-Time CFO

1. Relevant Experience

Look for a part-time CFO with experience in your industry or a similar business size and structure.

2. Proven Track Record

Examine their past achievements and client testimonials to gauge their expertise and reliability.

3. Compatibility

The right part-time CFO should align with your company’s culture and values, ensuring seamless collaboration with your team.

4. Strategic Mindset

Choose someone who can offer strategic insights and align financial planning with your business goals.

How Xcel Accounting Can Help

Xcel Accounting focuses on offering fractional CFO services that are customized to meet the particular requirements of companies. Accurate financial reporting, strategic planning, and cost optimization are guaranteed by Xcel's staff of seasoned financial professionals. Xcel provides adaptable and scalable solutions to support the success of your company, whether you require assistance during a crucial stage of operations or continuous financial advice.

Their proficiency in investor relations, budgeting, cash flow management, and compliance guarantees that your money is always in capable hands. By working with Xcel Accounting, you may get a reliable counsel who is dedicated to your success.

Conclusion

Businesses looking for a high-level financial expert without the expense of a full-time staff will find that a fractional CFO is the ideal option. To promote efficiency and growth, they offer a plethora of experience, cutting-edge insights, and strategic direction. Businesses can attain financial stability, maintain compliance, and concentrate on long-term success by working with a part-time CFO.

Businesses may reach their full potential and confidently handle the challenges of financial management with the help of reliable suppliers like Xcel Accounting. For sustainable growth, you need a part-time CFO to help you scale your business or overcome financial obstacles.

Connect us : [email protected]

#virtual cfo services#business finance#finance and accounting#bookkeping#fractional cfo services#part time CFO#Xcelaccounting#tax filing services

0 notes

Text

Revolutionising Business Finance: The Rise of Outsourced Financial Services

In today's quick business world, companies always look for ways to improve operations and boost productivity. Financial management has changed a lot, and outsourced financial services are now more popular. This post looks at the good things about outsourcing money tasks outsourced CFO services part-time CFO arrangements, and accounting outsourcing companies.

How Financial Management is Changing

It's not like before when every business needed full-time money people in-house. Now big and small companies see the good in getting outside help for their money tasks. This change happens because of a few things:

Saving money

Getting expert help

Growing and adapting

Focusing more on main business

Outsourced CFO Services: On-Call Financial Leadership

A big change in this area is the growth of outsourced CFO services. These services give companies access to top-level money experts without hiring a full-time boss.

Good Things About Outsourced CFO Services:

Planning and looking at finances

Better control of cash coming in and out

Smart advice on getting and using money

Setting up strong systems to manage money

Part-Time CFO Services: Custom Financial Know-How

For companies that need ongoing money management but can't afford a full-time CFO part-time CFO services provide a great answer. This setup lets businesses tap into expert financial know-how on a flexible timetable.

Perks of part time CFO services:

Budget-friendly access to top-level financial guidance

Tailored involvement to match company requirements

New insights from a seasoned pro

Option to expand services as the company grows

Accounting Outsourcing Firms: Full-Scale Money Management Support

Accounting outsourcing firms offer a broad range of options, from basic record-keeping to complex financial reports. These companies use tech and know-how to deliver efficient, precise, and prompt financial oversight.

Services Provided by Accounting Outsourcing Firms:

Bookkeeping and general ledger upkeep

Managing accounts payable and receivable

Getting financial statements ready

Staying on top of taxes and planning for them

Handling payroll

Picking the Best Outsourcing Partner

If you're thinking about outsourcing your money matters, you need to pick the right team. Keep an eye out for providers with:

Know-how in your field

Proven success with companies like yours

Solid tech setup

Clear ways to communicate

Tight data security

In Conclusion

Outsourcing financial services such as outsourced CFO services, part time CFO services, or full accounting support, gives businesses a strong way to boost their money management skills. These services allow companies to tap into top-notch financial know-how, cut down on costs, and zero in on their main business tasks. As the business scene keeps changing outsourced financial services will become more crucial in pushing growth and success.

0 notes

Text

The Importance of Risk Management and the Role of Outsourced CFOs

In the dynamic business environment of today, risk management is now essential to an organisation's success. As financial super heroes, outsourced CFOs are skilled at seeing and averting threats before they become serious problems. These experts offer thorough financial supervision, from managing market swings to strengthening internal controls. In this blog post, we are going to discuss the different options the organisation may have in relation to how to get the best CFO services, including outsourced CFO solutions through expert accounting outsourcing companies.

Flexibility and Scalability with Outsourced Accounting Services

The biggest plus point of working with firms offering account outsourcing services is that they can be very flexible. With businesses changing, the way in which we provide these services must change also. Unlike relying solely on in-house staff, outsourced capabilities can grow with your startup ensuring you always have a 21st-century financial department that fits perfectly within tier operational realities. Which means that the financial systems you use to manage your operations are always in sync with what's best for your business.

Leveraging Technology for Financial Advantage

In the digital age, keeping on top of the latest technology is highly important. A virtual CFO could offer a breadth of adept experience in finance, assisting businesses as they tap into state-of-the-art financial technologies. They use technology from cloud-based accounting software to advanced analytics tools, they bring your business a competitive advantage.

The Bottom Line: Cost-Effectiveness and Expertise

Outsourcing part time CFO services could be a strategic move for a business, which would potentially offer a number of benefits. It is cost-effective, granting access to top-tier expertise without the overhead costs of an in-house team. This approach free you up to concentrate on core business activities and helps guarantee strong financial management. Apart from this, outsourcing reduces risk and offers scalability for enterprises today.

The Future of Outsourced Accounting Services

Outsourced accounting and CFO solutions are an emerging trend in how businesses handle financial administration. With ever-increasing pressure around operational optimisation and growth, this model is only set to become more popular. Outsource payroll involves a significant money saver that will allow companies to grow and rise above the competition.

0 notes

Text

The Rise of Accounting Outsourcing Companies: A Game-Changer for Modern Businesses

Flexibility is essential in the fast-paced corporate environment of today. To remain flexible and competitive, an increasing number of businesses are turning to accounting outsourcing providers. But why is this trend happening? And how is the financial environment changing as a result of outsourced CFO services?

Let's dive in.

The Changing Face of Finance

Gone are the days when having an in-house accountant was the only option. Now, businesses of all sizes are exploring alternatives. Why? It's simple. They're looking for ways to cut costs and access top-tier expertise without breaking the bank.

Enter accounting outsourcing companies.

These firms offer a range of services, from basic bookkeeping to complex financial strategy. They're not just number-crunchers. They're partners in your business growth.

The Rise of Outsourced CFO Services

One of the most exciting developments? The growing popularity of outsourced CFO services.

Think about it. CFOs bring a wealth of knowledge to the table. They're strategic thinkers, financial wizards, and business savvy all rolled into one. But for many small and medium-sized businesses, hiring a full-time CFO is out of reach.

That's where outsourced CFO services come in.

These services offer the best of both worlds. You get top-tier financial expertise without the hefty price tag of a full-time executive. It's a win-win.

Why Choose Part Time CFO Services?

Part time CFO services are gaining traction, especially among startups and growing businesses. Here's why:

Cost-effective: You only pay for what you need.

Flexible: Scale up or down based on your business needs.

Expertise on demand: Access specialised knowledge when you need it most.

But it's not just about saving money. It's about adding value.

A part-time CFO can provide strategic insights, help with financial planning, and even guide you through complex processes like mergers and acquisitions. They're not just bean counters. They're strategic partners in your business growth.

The Global Talent Pool

One of the biggest advantages of working with accounting outsourcing companies? Access to a global talent pool.

These firms can tap into expertise from around the world. Need someone with experience in your specific industry? They've got you covered. Looking for a CFO who's navigated multiple IPOs? They can find one.

It's not just about finding the right skills. It's about finding the right fit for your business.

Technology: The Great Enabler

Of course, none of this would be possible without technology. Advanced communication tools have made remote collaboration seamless. Cloud-based accounting software allows real-time access to financial data. AI and machine learning are revolutionising financial analysis.

The result? A more efficient, more accurate, and more insightful financial function.

Challenges and Considerations

But it's not all smooth sailing. Working with accounting outsourcing companies comes with its own set of challenges.

Data security is a top concern. When you're sharing sensitive financial information, you need to be sure it's in safe hands. That's why it's crucial to choose a reputable provider with robust security measures in place.

There's also the question of cultural fit. When you're working with a remote team, building a strong working relationship can take time. Clear communication and regular check-ins are key.

The Future of Finance

So, what's next for accounting outsourcing companies and outsourced CFO services?

We're likely to see even more specialisation. As businesses face increasingly complex financial challenges, they'll need expert guidance more than ever.

We might also see a shift towards more holistic services. It's not just about the numbers anymore. It's about how those numbers can drive business strategy and growth.

One thing's for sure: the trend towards outsourcing isn't slowing down anytime soon.

The Bottom Line

In a world where agility is everything, accounting outsourcing companies offer a compelling solution. They provide access to top-tier talent, cutting-edge technology, and strategic insights – all at a fraction of the cost of building an in-house team.

Whether you're a startup looking for part time CFO services or an established business seeking to optimise your financial function, outsourcing could be the answer.

The future of finance is flexible, global, and powered by technology. Are you ready to embrace it?

0 notes

Text

Navigating Financial Success: Comprehensive CFO Services in Hyderabad

Are you a growing business in Hyderabad looking to navigate the complexities of financial management with precision and foresight? CFO services might just be the missing piece to your entrepreneurial puzzle. In today's dynamic business landscape, having a Chief Financial Officer (CFO) on board can be a game-changer, enabling you to steer your company towards sustainable growth and profitability by cfo service provider company in hyderabad

Understanding CFO Services in Hyderabad

First things first, what exactly do CFO services in Hyderabad? Think of a CFO as your financial strategist in chief, the maestro orchestrating your company's fiscal symphony. They bring to the table a wealth of expertise in financial planning, risk management, and strategic decision making. Whether you're a startup striving for scalability or an established firm seeking optimization, a CFO crafts tailored financial strategies that align with your goals.

Strategic Financial Planning and Chief Financial Officer Services in Hyderabad

One of the primary roles of a CFO is to develop and execute comprehensive financial plans in Hyderabad. This involves forecasting cash flow, budgeting effectively, and setting financial milestones. By meticulously analyzing your company's financial health in Hyderabad, a CFO identifies opportunities for growth and areas needing improvement. Their strategic foresight helps mitigate risks and capitalize on emerging trends, ensuring your financial trajectory remains steady and upward.

Financial Reporting and Analysis, CFO Advisory Services in Hyderabad

Numbers tell a story, and a CFO translates this narrative into actionable insights in Hyderabad. They oversee financial reporting processes, ensuring accuracy and compliance with regulatory standards. Through in depth analysis of financial data and cfo service provider company in hyderabad give clarity on your company's performance metrics. Whether it's profitability margins, cost efficiencies, or revenue growth, their analytical prowess empowers you to make informed decisions that drive bottom line results.

Risk Management Expertise and Chartered Accountant to take up of CFO Services in Hyderabad

Navigating uncertainties is part and parcel of business ownership in Hyderabad. Here's where a CFO shines as your risk management guru. They assess financial risks proactively, implementing strategies to mitigate potential threats. From market volatility to operational challenges in Hyderabad, a CFO develops contingency plans that safeguard your financial stability. This proactive approach not only shields your business from unforeseen crises but also enhances resilience in a competitive marketplace.

Strategic Partnerships and Stakeholder Management, CFO Service Provider Company in Hyderabad

Building bridges is key to business success in Hyderabad, and a CFO serves as your ambassador in financial negotiations. Whether it's forging strategic partnerships or managing relationships with investors and stakeholders in Hyderabad, they articulate your financial strategy with clarity and confidence. Their ability to communicate complex financial insights in a digestible manner fosters trust and credibility, paving the way for collaborative growth opportunities.

Driving Financial Efficiency and CFO Service Providers in Hyderabad

Efficiency is the cornerstone of profitability and a CFO excels in optimizing your financial operations. They streamline processes, identify cost saving opportunities, and enhance resource allocation. By leveraging technology and best CFO Service Providers in Hyderabad, a CFO drives operational efficiency across departments, freeing up resources for strategic initiatives. This operational agility positions your business to adapt swiftly to market changes and capitalize on emerging opportunities.

Scaling for Growth and Best CFO Services for Startups in Hyderabad

As your business scales in Hyderabad, so do its financial complexities. A CFO provides scalability solutions tailored to your evolving needs. Whether it's expanding into new markets, raising capital, or navigating mergers and acquisitions in Hyderabad, they orchestrate financial strategies that support your growth trajectory. Their expertise in financial modeling and forecasting in Hyderabad equips you with a roadmap for sustainable expansion, ensuring every growth milestone is achieved with financial prudence.

Conclusion and CFO Consulting Services in Hyderabad

In essence, CFO services are more than just financial stewardship in Hyderabad they're a strategic imperative for businesses poised for growth. By partnering with a seasoned CFO in Hyderabad, you gain a strategic ally who navigates the complexities of finance with finesse and foresight. Whether you're charting a course for profitability, optimizing operational efficiencies, or forging new pathways for growth in Hyderabad, their expertise fuels your journey towards sustainable success.

Ready to elevate your financial strategy in Hyderabad? Embrace the power of CFO services and unlock the full potential of your business's financial future.

For more information please contact.www.numbro.in

#cfo services in hyderabad#chief financial officer services in hyderabad#cfo advisory services in hyderabad#chartered accountant to take up of cfo services in hyderabad#cfo service provider company in hyderabad#cfo service providers in hyderabad#best cfo services for startups in hyderabad#cfo consulting services in hyderabad#virtual cfo services in hyderabad#interim cfo services in hyderabad#outsourced cfo services in hyderabad#part time cfo services in hyderabad#fractional cfo services in hyderabad#contract cfo services in hyderabad#best fractional cfo companies in hyderabad#temporary cfo services in hyderabad#cfo business advisors in hyderabad#bookkeeper cfo services in hyderabad#shared cfo services in hyderabad#cfo support services in hyderabad#outsourced controller services in hyderabad#fractional controller services in hyderabad

0 notes

Text

Part-Time Accounting Jobs Remote in Dubai

Dive into the world of finance with remote part-time accounting roles in Dubai by Resources Mena. Enjoy the flexibility of working from anywhere while assisting businesses in managing their finances efficiently and effectively. For more information, contact us at +971 4 4515221 or visit our website today!

#Part-Time Accounting Jobs Remote in Dubai#Compliance Officer#Anti Money Laundering Officer#CFO Services in Dubai#Accounting company in Dubai#VAT Accountant#part time finance manager#Outsourced Accountant

0 notes

Text

youtube

At Venture Growth Partners, we understand that every business is different. That’s why our approach is highly collaborative and customized to meet the specific needs of each client. Our CFO consulting partners work hand in hand with executive teams, providing valuable insights and recommendations that empower businesses to make informed decisions and achieve sustainable growth.

Venture Growth Partners 30 Newbury St 3rd floor, Boston, MA 02116 339–214–2913

Official Website:- https://venturegrowthpartners.com/ Google Plus Listing:- https://www.google.com/maps?cid=9918585368088553240

Our Other Link

outsourced cfo boston : https://venturegrowthpartners.com/massachusetts-boston-outsourced-cfo-services/ fractional cfo : https://venturegrowthpartners.com/massachusetts-boston-fractional-cfo-services/ part time cfo boston : https://venturegrowthpartners.com/massachusetts-boston-part-time-cfo-services/ interim cfo : https://venturegrowthpartners.com/massachusetts-boston-interim-cfo-services/

Other Services We Provide:-

outsourced cfo outsourcing cfo function part time cfo cfo services interim cfo fractional cfo cfo consulting

Follow Us On

Twitter:-https://twitter.com/VentureGrowthP2 Pinterest:- https://www.pinterest.com/venturegrowthpartners/ Linkedin:- https://www.linkedin.com/company/vgp-venture-growth-partners/about/ Facebook:- https://www.facebook.com/venturegrowthpartners/ Instagram:- https://www.instagram.com/venturegrowthpartners/

#cfo consulting partners#outsourced accounting services boston#part time cfo services#cfo services#fractional cfo services#Youtube

0 notes

Text

Business Wire: 'Electronic Arts Pre-Announces Preliminary Q3 FY25 Results'

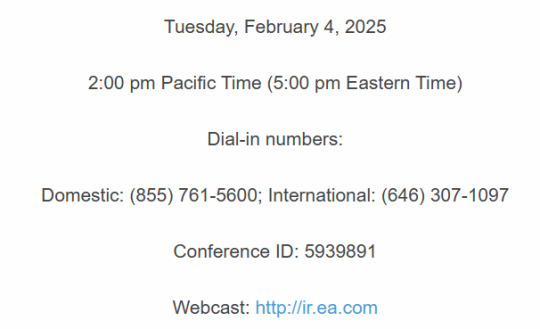

"REDWOOD CITY, Calif.--(BUSINESS WIRE)--Electronic Arts Inc. (NASDAQ: EA) today announced preliminary results for the third fiscal quarter and a revised outlook for the fiscal year ending March 31, 2025. Business Outlook as of January 22, 2025 EA’s initial guidance for fiscal year 2025 anticipated mid-single-digit growth in live services net bookings1. However, the company now projects a mid-single-digit decline, with Global Football accounting for the majority of the change. Global Football had experienced two consecutive fiscal years of double-digit net bookings growth. However, the franchise experienced a slowdown as early momentum in the fiscal third quarter did not sustain through to the end. As a result, EA revises its outlook for Global Football to end the fiscal year down mid-single-digit at the midpoint of the new outlook. Separately, Dragon Age engaged approximately 1.5 million players during the quarter, down nearly 50% from the company’s expectations. As a result, EA is providing preliminary results for its third fiscal quarter and updating its fiscal year 2025 net bookings outlook. It now expects net bookings of approximately $2.215 billion for the third fiscal quarter and an updated range of $7.000 billion to $7.150 billion for fiscal year 2025. For its third fiscal quarter, EA now expects GAAP net revenue to be approximately $1.883 billion and approximately $1.11 in GAAP diluted earnings per share. “During Q3, we continued to deliver high-quality games and experiences across our portfolio; however, Dragon Age and EA SPORTS FC 25 underperformed our net bookings expectations,” said Andrew Wilson, CEO of EA. “This month, our teams delivered a comprehensive gameplay refresh in addition to our annual Team of the Year update in FC 25; positive player feedback and early results are encouraging. We remain confident in our long-term strategy and expect a return to growth in FY26, as we execute against our pipeline.” “We continue to balance investment for future growth with operational discipline, and remain committed to EA’s long-term financial framework,” said Stuart Canfield, CFO of EA. “As we look to FY26, we expect to grow as we launch more of our iconic franchises.” EA will announce its results for the third fiscal quarter ending December 31, 2024 on February 4th, 2025 and will host a conference call at 2:00 pm PT (5:00 pm ET) to discuss its quarterly results and financial outlook. Listeners may access the conference call live via a dial-in number or audio webcast."

"Tuesday, February 4, 2025 2:00 pm Pacific Time (5:00 pm Eastern Time) Dial-in numbers: Domestic: (855) 761-5600; International: (646) 307-1097 Conference ID: 5939891 Webcast: http://ir.ea.com"

"EA’s financial results release will be available after the close of market on February 4, 2025 on EA’s website at http://ir.ea.com. A dial-in replay of the conference call will be available until February 11, 2025 at (800) 770-2030 (domestic) or (609) 800-9909 (international) using pin code 5939891. An audio webcast replay of the conference call will be available for one year at http://ir.ea.com. Forward-Looking Statements Some statements set forth in this release, including the information relating to EA’s expectations under the heading “Business Outlook as of January 22, 2025” are forward-looking statements that are subject to change. These forward-looking statements are current as of January 22, 2025. These forward-looking statements are not guarantees of future performance and reflect management’s current expectations. Actual results could differ materially from those discussed in the forward-looking statements. Factors that might cause or contribute to such differences include those discussed in Part II, Item 1A of Electronic Arts’ latest Quarterly Report on Form 10-Q under the heading “Risk Factors”, as well as in other documents EA has filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended March 31, 2024. EA assumes no obligation to revise or update any forward-looking statement, except as required by law. In addition, the preliminary results set forth in this release are estimates based on information currently available to EA. While EA believes these estimates are meaningful, they could differ from the actual amounts that EA ultimately reports in its Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2024."

[source]

#dragon age: the veilguard#dragon age: dreadwolf#dragon age 4#the dread wolf rises#da4#dragon age#bioware#mass effect#mass effect 5#dragon age 5#video games#long post#longpost

11 notes

·

View notes

Text

Pivot Advantage Accounting and Advisory Inc.

Pivot Advantage Accounting and Advisory Inc. stands out as a forward-thinking cloud accounting firm in Vancouver, BC. We specialize in delivering proven, efficient cloud accounting and virtual CFO solutions tailored to your financial and tax requirements. Beyond ensuring compliance, our tech-savvy approach empowers businesses to optimize cash flow, boost profits, and automate workflows using cutting-edge cloud toolkits. Our track record showcases our ability to provide high-quality financial planning and money management services, helping clients achieve their financial goals. Partner with us to experience the benefits of modern financial expertise, ensuring your business thrives in the ever-evolving financial landscape.

Visit Our Website

#Vancouver accounting company#virtual CFO by Pivot Advantage Accounting and Advisory Inc.#Pivot Advantage Accounting and Advisory Inc. part time CFO#Pivot Advantage Accounting and Advisory Inc. CFO service#online accounting firm in Vancouver#accountant

0 notes

Text

Leveraging Part-Time CFO Services: A Strategic Advantage for Businesses

Seeking professional advice in the business environment is quite alien these days, almost as if it has become a silver bullet. While hiring a full-time Chief Financial Officer (CFO) is costly for most small businesses and keeping one on your staff lightens the owner's burdens further. Fortunately, the part time CFO services offer a practical solution that would deliver your business with a cost-effective financial expertise needed.

Understanding Part-Time CFO Services

Outsourced CFO services are just a fancy term for either fractional or outsourced CFO resource. That is what enables companies to access experienced finance professionals as and when needed. We are a staffing platform for highly educated, experienced industry CFOs who provide no FTE financial advisory and analysis support.

Key Benefits of Part-Time CFO Services

Save Money: A part-time CFO can save you the cost of a full-time executive — often more than 60%. Now, this is interesting for all businesses.

Flexibility: Part-time CFO services can be customised to meet the individual requirements of a business and can also scale up or down as needed. This means companies are not overpaying for the financial support.

Experience: Part-time CFOs are typically tried-and-tested professionals who have experience across multiple industries and company sizes. They also bring significant expertise and insights to the table.

An additional advantage of using part-time CFOs is that by managing more sophisticated financial duties and strategic planning, business owners and management can spend time on essential operations as well as growth.

Better Decision Making: This allows business owners to make better financial decisions, lowering risks and improving the performance of their organisation.

Services Offered by Part-Time CFOs

Imagine having a financial wizard at your fingertips, but only when you need them. That's essentially what a part-time CFO brings to the table. They're like your personal financial Swiss Army knife, ready to tackle a whole array of money matters.

Need someone to help chart your company's financial future? Accounting outsourcing companies got you covered with strategic planning that aligns perfectly with your business goals. They're also expert number-crunchers, diving deep into your financial data to spot trends, uncover hidden opportunities, and flag potential risks before they become real headaches.

Cash flow keeping you up at night? A part-time CFO can help you optimize it, ensuring your business stays liquid and financially stable. They're also wizards at budgeting and forecasting, giving you the crystal ball you need to make informed decisions.

But wait, there's more! They're like financial bodyguards, always on the lookout for risks that could harm your business. And if you're thinking about mergers, acquisitions, or selling off parts of your business, they're there to guide you through the financial maze.

Of course, they'll make sure you're playing by the rules too, preparing all those necessary financial reports that keep the regulators happy. And if you're drowning in outdated financial systems, they can help you pick and implement new software that'll make your life easier.

In essence, a part-time CFO is like having a financial superhero on speed dial, ready to swoop in and save the day whenever you need them.

Choosing the Right Part-Time CFO

The following elements should be taken into account by companies when choosing a part-time CFO:

expertise and Requirements: Seek a CFO with a track record of accomplishment and expertise in the related business.Compatibility: Make sure the CFO's disposition and manner of working mesh well with the dynamics of the team and the corporate culture.Cost: To get the greatest deal, compare the fees and price structures offered by various suppliers.Service Scope: Clearly state which particular financial services are needed in order for the CFO to be able to satisfy the demands of the business.References: To evaluate the CFO's performance and reputation, get references from prior clients.

Summary

Businesses may obtain top-notch financial knowledge without having to make the large financial commitment of hiring a full-time executive by using part-time CFO services. Organisations may enhance their financial management, make better decisions, and promote sustainable growth by utilising the expertise of a part-time CFO.

#part time CFO services#outsourced CFO services#virtual CFO services#accounting outsourcing services

0 notes

Text

Virtul CFO services in Mumbai

CFO CRAFT offers a range of services, which includes Financial Management, Accounting, Taxation and Compliances. We provide regular Financial Reports and Projections, allowing you to stay on top of your financial position and make informed decisions.Our CFO services are designed to help you increase profitability and reduce costs, ensuring that your business is on track for long-term success. CFO CRAFT is Virtul CFO services in Mumbai.View more…https://cfocraft.com/

Virtual CFO Services: A Strategic Approach to Financial Management

In today’s rapidly evolving business landscape, companies are seeking innovative solutions to optimize their financial management processes. One such solution gaining traction is the concept of virtual CFO services. A virtual CFO acts as a strategic partner, providing expert financial guidance and insights to businesses without the need for a full-time, in-house CFO. In this blog post, we explore the potential of virtual CFO services and how they can transform the way businesses approach financial management.

The Benefits of Virtual CFO Services: One of the key advantages of hiring a virtual CFO is cost savings. Traditional CFOs come with a hefty price tag, including salary, benefits, and overhead costs. Virtual CFO services provide an affordable alternative, offering businesses access to experienced financial professionals on a flexible and scalable basis. This cost efficiency allows companies to allocate their financial resources strategically, investing in critical areas that drive growth.

Flexibility is another compelling benefit of virtual CFO services. Businesses can tailor the level of support they need, whether it’s on a part-time, project-based, or ongoing basis. Virtual CFOs can adapt to changing business requirements, scale their services as the company grows, and provide focused expertise where it’s most needed.

Strategic Financial Insights: A virtual CFO brings a wealth of experience and strategic insight to the table. They work closely with business leaders to develop and execute financial strategies that align with overall business objectives. From financial planning and budgeting to forecasting and risk management, virtual CFOs provide guidance and analysis that enables businesses to make informed decisions.

Additionally, virtual CFOs bring an objective and independent perspective to financial management. Their expertise spans across various industries and business models, allowing them to offer valuable insights and best practices. With a virtual CFO on board, businesses gain access to a broad range of financial knowledge that can be tailored to their specific needs.

View more…https://cfocraft.com/

0 notes

Text

The Rise and Fall of Enron: A Story of Greed, Deception, and Corporate Collapse

The Birth of Enron

Enron Corporation was formed in 1985 after a merger between Houston Natural Gas and InterNorth, a natural gas pipeline company. The newly combined company was led by Kenneth Lay, who quickly transformed it into one of the largest energy companies in the world.

Throughout the late 1980s and early 1990s, Enron expanded aggressively, shifting from a traditional energy company into a trader of energy and commodities. It became a major player in the natural gas and electricity markets, thanks in part to the deregulation of the energy industry. Deregulation allowed companies like Enron to trade energy as a commodity rather than just supplying it.

Enron's Innovations and Expansion

Enron was known for its innovations in the energy sector. The company launched EnronOnline in 1999, an internet-based trading platform for buying and selling energy contracts. This made Enron a dominant force in energy trading, allowing it to profit from price fluctuations in gas and electricity.

Enron also diversified into telecommunications, water utilities, and broadband services, attempting to position itself as a technology-driven company similar to the rising dot-com firms.

By the late 1990s, Enron was one of the most admired companies in America. Its stock price skyrocketed, and investors believed it was a revolutionary company that could continue growing indefinitely. Fortune magazine named Enron "America’s Most Innovative Company" for six consecutive years.

The Seeds of Corruption: Mark-to-Market Accounting

Behind the scenes, however, Enron’s financial health was far worse than it appeared. One of the key drivers of its eventual downfall was its use of mark-to-market accounting.

Normally, companies report revenue based on actual earnings over time. However, Enron used mark-to-market accounting to report projected future profits as if they were real, present-day earnings. This meant that Enron could enter into a long-term contract and immediately count all the expected revenue from that contract, even if the actual cash would be received years later.

If an energy project turned out to be less profitable than expected, Enron did not adjust its earnings reports downward. Instead, it often transferred losses into off-the-books partnerships so that they wouldn’t appear on the company’s financial statements.

The Role of Special Purpose Entities (SPEs)

To hide its debts and failing investments, Enron executives—most notably Chief Financial Officer (CFO) Andrew Fastow—created Special Purpose Entities (SPEs), also known as offshore shell companies. These entities were designed to appear as separate businesses, but in reality, they were controlled by Enron.

The SPEs served several purposes:

Hiding Debt – Enron would transfer its liabilities to these entities so that its balance sheet appeared healthier.

Inflating Profits – Enron would "sell" assets to these SPEs at inflated prices and record them as actual revenue, even though the transactions were just internal accounting tricks.

Misleading Investors – Because the debt was hidden off the books, Enron appeared far more profitable than it actually was.

The Role of Arthur Andersen

Arthur Andersen, one of the "Big Five" accounting firms, served as Enron’s auditor. Instead of exposing Enron’s fraudulent accounting, Andersen helped conceal it. The firm shredded thousands of documents to cover up evidence once investigations began.

The House of Cards Begins to Collapse

By mid-2001, cracks in Enron’s financial facade began to show:

Stock Price Decline – Investors started losing confidence, and Enron’s stock, which had once traded above $90 per share, began dropping.

Failed Investments – Enron had expanded aggressively into fiber optics and broadband but failed to make these ventures profitable.

Executives Cash Out – While Enron executives assured investors that the company was strong, they were secretly selling off their own stock, making millions while employees and shareholders suffered.

The Whistleblower: Sherron Watkins

In August 2001, Sherron Watkins, a vice president at Enron, sent an internal memo to Kenneth Lay, warning that Enron could "implode in a wave of accounting scandals." Her warning was ignored, and Enron executives continued deceiving investors.

The Public Unraveling

In October 2001, Enron announced a $638 million loss for the third quarter and admitted that it had been using off-the-books partnerships to hide debt. This revelation sent its stock price into a free fall.

In November 2001:

The Securities and Exchange Commission (SEC) launched an investigation.

Enron restated its earnings, admitting that it had overstated profits by nearly $600 million from 1997 to 2001.

Dynegy, another energy company, initially agreed to buy Enron for a fraction of its former value but backed out as more fraudulent activity was uncovered.

The Bankruptcy and Fallout

On December 2, 2001, Enron filed for bankruptcy—the largest corporate bankruptcy in U.S. history at the time.

Consequences:

Shareholders lost over $74 billion.

Thousands of employees lost their jobs and retirement savings. Enron had encouraged employees to invest their 401(k) savings in Enron stock, which became worthless.

Arthur Andersen was found guilty of obstruction of justice for shredding Enron-related documents. Although the conviction was later overturned, the scandal destroyed Andersen’s reputation, leading to its collapse.

Criminal Trials and Sentences

Many Enron executives faced legal consequences:

Jeffrey Skilling (CEO) – Convicted of fraud and insider trading, sentenced to 24 years in prison (later reduced to 14).

Andrew Fastow (CFO) – The mastermind behind Enron’s accounting fraud, sentenced to 6 years in prison.

Kenneth Lay (Founder & Chairman) – Convicted of multiple fraud charges but died of a heart attack before sentencing.

Arthur Andersen (Accounting Firm) – Effectively dismantled, as clients abandoned it.

Aftermath and Reforms

In response to the Enron scandal, Congress passed the Sarbanes-Oxley Act of 2002, which introduced stricter accounting regulations to prevent similar corporate fraud. It:

Required CEOs and CFOs to personally certify financial statements.

Increased penalties for fraudulent accounting.

Strengthened protections for whistleblowers.

Created the Public Company Accounting Oversight Board (PCAOB) to regulate auditing firms.

The Enron-Bush Connection: A Story of Politics and Corporate Influence

1. Enron’s Support for George W. Bush’s Political Career

Enron and its executives, especially Kenneth Lay (Enron’s founder and CEO), were major supporters of George W. Bush from his early political days.

Texas Governorship (1994-2000):

Kenneth Lay and Enron were among Bush’s largest political donors when he ran for governor of Texas in 1994.

Once in office, Bush supported energy deregulation, a policy that benefited Enron tremendously, as it allowed them to manipulate energy markets more freely.

Lay even served as an energy policy advisor to Bush while he was governor.

Presidential Campaign (2000 Election):

Enron was one of the top corporate donors to Bush’s campaign, contributing over $1 million to Republican causes during the election.

Kenneth Lay personally donated hundreds of thousands to Bush and the Republican National Committee.

Enron executives had privileged access to the Bush campaign, influencing policy discussions.

2. Influence on the Bush White House

After Bush won the 2000 presidential election, Enron’s influence in Washington expanded.

Energy Policy Influence (2001):

Kenneth Lay and Enron helped shape Bush’s national energy policy.

Lay had multiple private meetings with Vice President Dick Cheney while the administration crafted its energy plan.

The plan promoted energy deregulation—the same policies that allowed Enron to manipulate energy markets.

Appointments of Enron Allies:

Several former Enron executives were appointed to key government positions:

Thomas White, a former Enron executive, was named Secretary of the Army.

Other Enron-connected officials were placed in regulatory agencies.

3. The California Energy Crisis (2000-2001)

One of the most controversial aspects of Enron’s influence under Bush was its role in the California energy crisis.

Enron manipulated electricity markets, causing massive blackouts and price spikes.

Californians suffered, but the Bush administration refused to intervene.

Many believed Bush’s reluctance to act was due to his close ties to Enron and Kenneth Lay.

4. Bush Distances Himself After Enron’s Collapse

As Enron unraveled in late 2001, Bush and his administration tried to distance themselves from the scandal.

Bush claimed that Kenneth Lay was just "a supporter," despite their long friendship.

The White House denied that Enron had any special influence over policy decisions.

However, records showed that Lay had direct access to Bush and Cheney, especially regarding energy policies.

5. The Investigation and Aftermath

After Enron declared bankruptcy in December 2001, a major congressional investigation began.

Democrats accused the Bush administration of favoring corporate interests and failing to regulate financial fraud.

The Bush Justice Department eventually prosecuted Enron executives, including Lay, but not for political corruption—only for corporate fraud.

Some critics believed the administration covered up the full extent of Enron’s influence.

The California Energy Crisis (2000-2001): Enron’s Market Manipulation and the Bush Administration’s Response

One of the most infamous aspects of Enron’s fraud was its deliberate manipulation of California’s electricity market, which led to rolling blackouts, skyrocketing energy prices, and billions in economic damage. The Bush administration, despite repeated calls for intervention, refused to take action—a decision many believe was influenced by Enron’s deep political ties to Bush and Dick Cheney.

How Did Enron Manipulate California’s Energy Market?

California had partially deregulated its electricity market in the 1990s, allowing companies like Enron to buy and sell electricity at fluctuating market prices. However, Enron exploited the system through various trading schemes designed to artificially limit supply and drive up prices.

Some of the most notorious schemes included:

"Ricochet" (a.k.a. "Megawatt Laundering")

Enron bought power in California, then sold it out of state, only to re-import it at a higher price.

This allowed Enron to bypass price caps that California had placed on in-state electricity sales.

"Death Star"

Enron created the illusion of congestion in California’s power grid by routing energy through out-of-state lines.

The company then charged the state huge fees to "relieve" the congestion—even though no actual electricity was being transmitted.

"Fat Boy"

Enron traders withheld electricity from California’s grid, causing artificial shortages.

This led to rolling blackouts, which panicked the public and drove up electricity prices—benefiting Enron.

"Get Shorty"

Enron sold electricity contracts for power it never actually had, knowing it could later buy power at a lower price to fulfill the contracts.

The Impact on California: Blackouts and Financial Devastation

By 2000 and 2001, these manipulations crippled California’s energy market, leading to:

Rolling blackouts that affected millions of people.

Electricity prices skyrocketing by over 300%, forcing utilities into financial distress.

The bankruptcy of Pacific Gas & Electric (PG&E), one of the state’s largest utility companies.

$40-$45 billion in economic damage, devastating businesses and households.

The crisis outraged Californians, and Governor Gray Davis pleaded for federal intervention, asking the Bush administration to impose price controls on electricity.

Dick Cheney and the Bush Administration’s Refusal to Act

Despite overwhelming evidence of market manipulation, the Bush administration sided with Enron and refused to intervene.

Vice President Dick Cheney, who was leading Bush’s energy task force, dismissed California’s crisis as the state’s own fault due to "bad regulatory policies".

The Federal Energy Regulatory Commission (FERC)—staffed with Bush-appointed officials—refused to impose price caps, allowing Enron’s price-gouging to continue.

Cheney and Lay were known to have a close relationship, and Lay had privileged access to Cheney’s energy policy meetings in 2001. Enron was pushing for even more deregulation nationwide, which Bush and Cheney were actively promoting.

Only after Enron’s collapse in late 2001 did FERC finally impose electricity price controls—but by then, California had already suffered billions in losses.

2. Enron’s Influence on Cheney’s Secret Energy Task Force

While California was suffering, Enron was actively shaping U.S. energy policy through Vice President Dick Cheney’s secret energy task force.

In early 2001, Kenneth Lay met privately with Cheney and provided a list of recommendations that Enron wanted in federal energy policy.

Cheney’s final energy policy report (released in May 2001) included many of Enron’s suggestions, including:

Further deregulation of electricity markets (despite California’s crisis).

Reduced oversight of energy traders.

More lenient environmental regulations for energy companies.

The Bush administration fought hard to keep details of these meetings secret, refusing to release full records even after lawsuits were filed. However, later investigations confirmed Enron’s deep involvement.

The Fallout: Enron’s Collapse Exposes the Truth

After Enron collapsed in late 2001, its role in the California energy crisis and Cheney’s energy policy came under intense scrutiny.

Multiple investigations confirmed that Enron traders openly bragged about manipulating California’s power supply in recorded phone calls.

FERC finally cracked down, forcing energy companies to refund billions to California for their fraudulent activities.

Cheney and Bush never admitted wrongdoing, but their refusal to act—and their close ties to Enron—tarnished their reputations.

Conclusion:

Enron’s collapse was a landmark event that shattered investor confidence and exposed the dangers of unchecked corporate greed and financial deception. It serves as a cautionary tale of how a culture of fraud, enabled by lax oversight, can bring down even the most powerful companies. Enron and George W. Bush had a long and close relationship, built on campaign donations and shared economic policies. Enron benefited from Bush’s energy deregulation policies, while Bush’s political career was boosted by Enron’s financial support. However, when the scandal exploded, Bush distanced himself, and Enron’s executives took the fall. The Enron-Bush-Cheney connection showed how corporate corruption and political influence can devastate an entire state’s economy. Enron profited immensely while Californians suffered blackouts, financial ruin, and economic collapse—all while the Bush administration protected Enron’s interests rather than the public.

0 notes

Text

Unlocking Success: The Remote CFO and CFO Services

In the world of finance, the Chief Financial Officer (CFO) plays a pivotal role in steering the financial ship of an organisation. But what happens when the CFO's desk moves from the corner office to the home office? This blog post explores the dynamic world of remote CFOs and how they navigate the digital landscape, including part-time CFO services and outsourced CFO services, as well as providing valuable insights for accountants for entrepreneurs.

What is a CFO?

First, let's clarify what a CFO does. The CFO is the financial leader of an organisation, responsible for overseeing financial operations, strategy, and reporting. Traditionally confined to the corporate headquarters, the CFO role is now breaking free from the cubicle.

Benefits of Remote Work for CFOs

Increased Flexibility: One significant perk of remote work for CFOs, including those offering part-time CFO services, is flexibility. The ability to structure their workday around their most productive hours is a game-changer.

Improved Work-Life Balance: Remote work often brings a better work-life balance. CFOs, whether full-time or offering outsourced CFO services, can seamlessly integrate their personal and professional lives.

Reduced Costs: Remote work can translate to cost savings. No more daily commutes or office space expenses, which is particularly attractive for part-time CFO services.

Access to a Wider Pool of Talent: With remote work, CFOs can tap into a global talent pool. It's easier to find the perfect fit for specialised roles, whether for full-time or part-time CFO services, as well as for accountants for entrepreneurs.

Challenges of Remote Work for CFOs

Maintaining Communication and Collaboration: While technology connects us, it's crucial for CFOs, including those providing outsourced CFO services, to keep communication and collaboration channels open to ensure the finance team stays in sync.

Managing Cybersecurity Risks: The virtual office brings cybersecurity concerns. CFOs must safeguard sensitive financial data from digital threats, whether working full-time or offering part-time CFO services.

Ensuring Compliance: Staying compliant with financial regulations is non-negotiable for all CFOs, including those offering outsourced CFO services. Robust systems and processes are essential.

How to Be a Successful Remote CFO

Set Clear Expectations and Goals: Define expectations for yourself and your team, whether you're a full-time CFO or providing part-time CFO services, as well as for accountants for entrepreneurs. Establish clear goals and benchmarks for measuring success.

Communicate Regularly with Your Team: Effective communication is key for all CFOs, whether offering outsourced CFO services or working in-house. Regular check-ins, virtual meetings, and team updates keep everyone on the same page.

Use the Right Tools and Technology: Invest in the right tools for remote collaboration, financial analysis, and reporting, whether you're a full-time CFO or providing part-time CFO services. Technology can be a CFO's best ally, as well as for accountants for entrepreneurs.

Create a Dedicated Workspace: A dedicated workspace at home fosters focus and productivity for all CFOs, whether working full-time or offering outsourced CFO services, as well as for accountants for entrepreneurs. It's the CFO's command centre for financial strategy.

Take Breaks and Maintain a Healthy Work-Life Balance: Burnout is the enemy of productivity for all CFOs, whether full-time or providing part-time CFO services, as well as for accountants for entrepreneurs. Encourage regular breaks and remember that work is just one part of life.

Case Study: Insights from a Remote CFO

To get real insights into the world of remote CFOs, we sat down with a seasoned professional. In our interview, we discussed the benefits and challenges of remote work, including part-time CFO services and outsourced CFO services, and gathered valuable tips for success.

Conclusion

In conclusion, the world of outsourced accounting services is evolving, and remote work is at the forefront of this transformation. With the right balance of flexibility, technology, and communication, CFOs can thrive in a remote work environment, whether they're full-time, part-time, or offering outsourced CFO services, as well as for accountants for entrepreneurs. The future of finance is remote, and embracing it can unlock a world of possibilities.

0 notes

Text

Key Metrics A Fractional CFO Tracks For Business Success

A fractional CFO plays a crucial role in guiding businesses toward financial stability and growth. Unlike a full-time CFO, a Fractional CFO provides strategic financial oversight on a part-time or contract basis, making their expertise accessible to small and medium-sized businesses. One of their primary responsibilities is tracking key financial metrics that impact profitability, cash flow, and long-term sustainability.

Here are some of the key metrics they monitor to ensure business success:-

1. Revenue and Profitability Metrics

Revenue Growth Rate – This metric tracks the percentage increase or decrease in revenue over a specific period. It helps assess whether the company is expanding or facing stagnation.

Gross Profit Margin – Calculated as (Revenue – Cost of Goods Sold) / Revenue, this ratio indicates how efficiently a company is producing its goods or services.

Net Profit Margin – This metric measures how much of each dollar earned translates into profit after accounting for all expenses. A declining net profit margin may signal inefficiencies in cost management.

2. Cash Flow and Liquidity Metrics

Operating Cash Flow – The cash generated from core business activities is a strong indicator of a company’s financial health. A Fractional CFO ensures that a business has enough cash to cover daily operations.

Current Ratio – Defined as Current Assets / Current Liabilities, this metric determines a company’s ability to meet short-term obligations. A ratio below 1 can indicate liquidity issues.

Accounts Receivable Turnover – A measure of how efficiently a business collects payments, a high turnover rate means faster cash conversion and better liquidity management.

3. Expense and Cost Efficiency Metrics

Burn Rate – Especially relevant for startups, this metric shows how quickly a company is spending its available cash. A high burn rate without corresponding revenue growth can lead to financial instability.

Operating Expense Ratio (OER) – This metric, calculated as Operating Expenses / Revenue, helps businesses control overhead costs and optimize spending.

Cost of Customer Acquisition (CAC) – The amount spent to acquire a new customer, including marketing and sales costs. This should be compared with Customer Lifetime Value (CLV) to ensure a sustainable business model.

4. Financial Stability and Risk Management Metrics

Debt-to-Equity Ratio – A measure of a company’s financial leverage, this ratio helps a Fractional CFO assess whether a business is relying too heavily on debt financing.

Break-even Point – The level of sales required to cover total costs. Tracking this ensures businesses can anticipate when they will become profitable.

Return on Investment (ROI) – Evaluating the ROI on different business initiatives ensures capital is allocated efficiently for growth.

5. Business Growth and Strategic Metrics

Customer Lifetime Value (CLV) – The projected revenue a business expects from a single customer. This metric helps in pricing and marketing strategies.

Churn Rate – The percentage of customers who stop using a service or product. A high churn rate can signal issues with customer satisfaction or market fit.

Revenue per Employee – Helps gauge workforce efficiency and whether additional hiring is necessary for scaling.

By tracking these key metrics, a Fractional CFO helps businesses make data-driven decisions, improve financial stability, and achieve long-term success.

0 notes