#Pacific City Escrow

Explore tagged Tumblr posts

Text

Onie Burnett Granville (June 28, 1916 - September 21, 1998) a Los Angeles Realtor, founded two Black-owned and operated state-chartered banks in the 1960s, the Bank of Finance in Los Angeles and the Freedom Bank of Finance in Portland, Oregon. They were the first of their kind in their respective cities and among the earliest Black-owned banks in the West.

Born in Navarro County, Texas, was one of five children born to Antwine and Millie Granville. He graduated from Tillotson College, receiving his BA. He did postgraduate work in real estate appraising, banking, and finance at USC.

He relocated to Berkeley during WWII but soon returned to Los Angeles. He opened Granville & Granville Real Estate with his brother Edward. Granville & Granville was prosperous enough to allow him to become the co-founder of Quality Escrow Company and Burnett Investment with his brother Edward Granville.

He joined six business colleagues to form the Merchants Title Company. He was elected president of the all-Black Consolidated Realty Board. He was appointed to the Office of State Inheritance Tax Appraiser for Los Angeles County. He worked with Governor Pat Brown Sr. on the California Fair Housing Act/Rumford Act of 1963.

While Black-owned Broadway Federal Savings and Loan, provided some home loans, it could not meet the demands of African American would-be homeowners in the area and non-Black savings and loan associations would not work with them. He envisioned a full-service bank that offered checking accounts, certificates of deposit, as well as real estate, vehicle, construction, and personal loans.

He became a co-founder and vice president of the West Adams Community Hospital. He founded the Southern California Minority Capital Corporation. He founded the Inglewood Federal Savings and Loan Association in Inglewood. He, Vernal Claiborne, Elbert Hudson, and Norman Hodge, organized and all were the first directors of the Pacific Coast Regional Job Creation Corporation.

He was married to Theora Groves Granville. The couple had no children. #africanhistory365 #africanexcellence

1 note

·

View note

Text

California Landslide Evacuations

This photo shot with a drone shows damage from earth movement to a property in Rolling Hills Estates, Calif. Monday, July 10, 2023. The homes in the Los Angeles C...

The Associated Press

ROLLING HILLS ESTATES, Calif. -- A landslide tore apart luxury homes on Southern California's Palos Verdes Peninsula on Monday, leaving a confused jumble of collapsed roofs, shattered walls, tilted chimneys and decks dangling over an adjacent canyon.

The slide in the Los Angeles County city of Rolling Hills Estates began Saturday when cracks began appearing in structures and the ground. Twelve homes were red-tagged as unsafe, and residents were given just 20 minutes to evacuate.

The pace of destruction increased through the weekend and into Monday.

“It is moving quickly,” said Janice Hahn, chair of the Los Angeles County Board of Supervisors, who represents the area. “You can actually hear the snap, crackle and pop every minute when you're there as each home is shifting, is moving.”

It was initially believed that all of the red-tagged homes were sliding, but Assistant City Manager Alexa Davis clarified Monday afternoon that 10 were actively moving. An additional 16 were being monitored but had not required evacuation, Davis said in an email.

The cause of the landslide was not known. But a fissure running among the homes raised suspicion that this past winter's heavy rains may be involved, Hahn said.

“We won't know until a geologist and a soil expert really does a post-op on this and tells us what happened,” Hahn said. “But because of that fissure, the initial thinking is that it was because of the heavy rains that we had last year and all that underground water has caused this. But we don't know.”

Hahn said many of the displaced residents were unsure whether they were insured for such loss, including one who moved in two months ago after escrow closed. The county assessor was to meet with the residents to tell them they could apply for property tax waivers.

“My heart goes out to these people," Hahn said. "We gave them 20 minutes Saturday night to evacuate and get their things. Obviously they didn't get everything.”

Damaging landslides have occurred previously on the Palos Verdes Peninsula, which rises high above the Pacific on the county's south coast and offers residents spectacular views of the ocean and greater Los Angeles.

A landslide that began in 1956 destroyed 140 homes in the Portuguese Bend area of the city of Rancho Palos Verdes, and earth continues to move there. The slide coincided with construction of a road through the area, which is atop an ancient landslide.

Among other notable earth movements on the peninsula, a 2011 slide severed the blufftop ocean road near White Point in the San Pedro section of Los Angeles several months after engineers began noticing cracks and fenced off the area for study.

Southern California's complex landscapes contribute to landslides, according to an overview by the U.S. Geological Survey in conjunction with the California Geological Survey.

Some of the many potential factors include earthquakes, steep slopes, sedimentary soil that is not rock hard, and water percolating down into the earth after heavy rains, the report says.

Human-induced landslide factors include construction without proper grading of slopes, alteration of drainage patterns and disturbances of old landslides.

Well, this instability has been a thing that virtually everyone has known all about for well over sixty years. So my heart doesn’t exactly go out towards those affected, in fact I would go so far as to say that there are really no victims here. Folks have known all about this while they were buying and selling homes, repairing homes, compensating for the movement by building water and sewer lines above the ground and constantly rebuilding roads. This latest drama on Portuguese Bend in Rolling Hills isn’t a life threatening natural disaster, this is just bad public policy and rich people’s problems. They chose to live there knowing the facts, and they really should not feel entitled to public money, or even insurance. Evidently they have an excellent press agent, because few of the recent articles and video clips tell the whole story. The LA times did a feature in March 2023 that you might want to look up if you think I’m being unfair.

0 notes

Photo

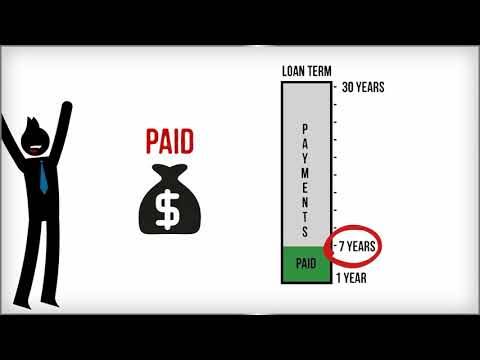

About 203b and 203k FHA Loans | Ultimateonlinemortgage.com

#Closing Costs#Education#Escrow Evolved#HB#home buyer#Huntington Beach#information#mortgage#OC#Orange county#Pacific City Escrow#realtor

0 notes

Text

Chase her tail

You can’t tell me there’s nothing to be gleaned from it, after all.

It’s the big blue book, now. For generations, whatever a generation is, now, but generations, plural, that’s no lie, it’s the one they’ve been using in real estate license prelicensing courses in Hawaii. We all know it, and if you’re not an agent affiliated with one of the brokerage firms here, you’re probably familiar with it, and flipped through it once or twice throughout your time doing whatever it is you do here in downtown Honolulu. Even the students at University of Hawaii, have had their reasons. What can we glean, outside of the world of marketing and advertising (we are all honest about what a broker really is) they’d be teaching at a class at Shidler? It turns out, a lot, and among the many influences for Vitousek and Reilly, whose co-authorship of this book gained them their name recognition in the Hawaii real estate community dating back decades, is the history you’d find taught in a Hawaiian studies course. Terms like “Great Mahele” are instrumental to understanding the various snapshots it presents, directly, in the case of the introduction and its treatment of the history of the kingdom and land use pre-Annexation, or indirectly, by way of it’s walk through the practical day to day work of brokers to escrow agents to surveyors in what would be any ordinary day, today, getting deeds off to Bureau of Conveyances for the first buyers of the dozens of high rise condominiums that in a decade joined the skyline along Kapiolani, in Kakaako, with cranes still at work in Ward Village, and even Waikiki where Lilia begins to take shape in the Title Guaranty right around the corner from the Topa towers closest to the Waterfront, or laying the stakes around a single family home on a .16 acre lot in Makiki as escrow opens, a Hawaii custom of sorts, or as a first year agent with a newly minted RS license from PVL hung with a small brokerage house out of a commercial center in Pearl City and Waimalu and Pearlridge, right up against Pearl Harbor, like one of the several at Harbor Center, putting a Honolulu Board of Realtors’ issued Sentrilock key into a lockbox in Kaimuki and hearing those keys “drop out” that way, and just knowing what to do, on the verge of showing a four bedroom in the heart of Mililani, built in the late 70s or early 80s, as Castle & Cook led the development of the central Oahu suburbs, landscape of private property rights, and its roots in the Hawaiian kingdom. What can we glean by knowing the history and the dare I say “esoteric” knowledge of real estate brokers?

A lot, of course.

But Chapter 4 is packed with a few bonuses that as I walk the stretches of King Street and Hotel Street that Michael Corcoran reminded us was, indeed, called Shit Street, and the ramen restaurant on Fort Street Mall, Honolulu’s Times Square, oh, no, that’s the newly renovated Central Pacific Bank Building’s plaza, so Wall Street with the big bull statue, let’s go with that, and the old Piroscki shop around the corner where indeed cabbage and cheese wrapped with chicken in a delicacy that on the damp sidewalks of the pedestrian mall and the sky blue once more without a cloud in sight, you know Honolulu, takes me back to dreaming of doing business with Russia when I was a ten year old in slacks and a Bishop Street cardboard Hawaiian shirt from Costco at a time when it was definitely, undoubtedly, no match for the silk blend of what the Tori Richard catalog had already started using exclusively, the Piroscki and the steam in 69 degree weekday harbourfront morning from seeming to me to be this thing you have to make last, like something of an hourglass in a Faustus myth or else Satan’s just gonna come in and snatch up and make good on the deal, you know, well this is where I take the soul now, right? Eat the second half from the way we were with offices on Fort Street where the last manual lift still ran and the last elevator man still worked even through the early 2000s past the staples of new Bishop Street, past the “libations” of a Smith and Kings, past a Stewbum and Stonewall, around the corner and back toward Shit Street and whatever year this is, Livestock Tavern, at the end of a row of dive bars that starts down that way with Smith's Union, the one you’d sneak into when you’re a year too young, down through signs for Bar 35, with its own history, some but surely not all of it, minted in bronze, on the plaque right there at the door if you’re more into history than their signature Mexican Lollipops or Miss Chinatowns when the doors open, four hours after Aloha Tower signaled 12 o’clock with its bells. Today, this, then, must be the one. Livestock Tavern. Something about it. The end of the road. They should call it Hemlock or something. The one on the corner where it’s all over but come to think it whose to stop me from darting westbound on Hotel Street from right here and the thing with True North, as with lighthouses in the bleak way Charles Dickens saw them, at least narrating, as Pip, Great Expectations, right from the start, moral compasses, shining examples, they’re just as ugly a part of the landscape as the Prison Hulk over that way and the slime of the Thames embodied that’s got me up to breaking him free now from, who knows what, mortality itself, I guess, Livestock Tavern, the daycap on our well endowed life well lived, where for you and I, platinum hair’s a thing now, right? Remember when we were kids? They’re shuffling in now so I guess we started lunch a little late, but this “Seasonal American Eatery,” that’s what we did it all for, and here we are. There’s no winter of our lives and there’s no True North and there’s no wrong side of the block, when this is square one and the only where that life hasn’t taken us is everywhere and we still have to sneak into the bar when we’re 20, right over there, Smith's Union Bar. It doesn’t worry me that I’ve finished the Piroscki. What else is a Piroscki for? Walking, through all of it, there’s a few things from that Chapter 4, worth noting. You see, the HICENTRAL statewide MLS the agents use for listing properties rightfully structures data fields to reflect the offerings in the local markets, and we know they have a lot of leaseholds here. They list them and sell them and they’re done here unlike a lotta places in the country, in a pretty high ratio to our good old Fee Simple, right? That’s what Chapter 4 is all about.

Vitousek introduces the estate known as a Fee Tail Estate, and is extremely frank about the rationale. It’s history. Though estates and title vesting have been swayed through the last two centuries to be driven by different forces, and new definitions of what constitutes value that we live under in the 21st century, perhaps farther removed from old ideas such as this, rooted in heritability and the use of marriage and family as a means and a gauge of social control, with the attempt to reward certain mating patterns, thereby instituting purportedly “eugenic” pressures, that favor, in the example of Fee Tail Estates, landowners that do it that way, with of course the underlying assumption that the existing elites, the deserving, the well endowed, and well bred are synonymous and the Fee Tail Estate secured their multi-generational wealth, or rather, their stranglehold over the time and identities of those whose lack of title sifted them into a lower strata of existence to serve them. The Bureau of Conveyances Grantor Grantee Index is something we can analyze to better understand the prevalence of certain ideas about marriage and family. I’ve been touting what a treasure trove UH West Oahu’s Uluulu library will prove to be when it’s done archiving all of the multimedia it’s set out to. Though the popular Bishop Street publication Hawaii Business Magazine (I know they’d hate me calling it a Bishop Street publication, Steve can call me and complain personally if he wants to) in recent months seemed to echo my sentiments by taking us inside the efforts at UH West Oahu, I caught up with the librarians in mid 2021 and if you browse the available media in their catalog right now, you’ll see the archives are far from being ready for us. For, say, a sociology student with a Hawaii focus or a journalism student, the entire collection of KHON, KGMB, KHNL, KITV newscasts that Uluulu is poised to have digitized, when all is said and done is an absolute necessity to applying content analysis in the establishment a cultural milieu.

By the way, on that Uluulu deal, when they get that all done, you tell them now, we’re expecting closed captioning and transcriptriptions to make the material mineable by code as well as applying something as simple as a keyword search, and since the project began the addition of this has not only become evidently possible, through the very accurate computer speech to text generated closed captions on YouTube for the shows of a couple friends getting together to talk politics or do comedy on the weekend in a living room or talk gaming in “the basement,” but for any librarian and archivist, very easy to ask for. For a journalism student, PhD theses on the efficacy of certain styles of broadcast presentation or which newsrooms were the most ethical and produced packages of the greatest public interest, even something as the effect of station and newsroom management changes on, say, the quality of news reporting or, say, even an undergraduate research paper on the way in which one of these particular station management changes, the inside baseball, impacted or changed the editorial standards and newsworthiness for better or worse of the packages the station was airing, such a library and such an archive is an absolute necessity to that student’s making an eventual contribution to his discipline, journalism, bettering the public interests.

The problem with morality. In reality, Rich Family is someone that had a father that cared about his son's penis, that simple.

The reasons, for everything, actually, surely must’ve shifted with the social movements of generations now gone, and others we lived and breathed through, bearing witness to shattered glass and broken ceilings and new borderlines to have to cross.

To think, to wine and dine a female in one of these establishments, and how high paying sedentary work necessary to be a man in good fortune, despite these establishments and the apparent joy about those doing their mating dances on females in there speaking to a demand for what isn’t being supplied nearly enough, as evidenced by the piss soaked homeless streetwalkers and sidewalk sitters right there. And, yes, I know there are reasons and there are many. I’m talking about work as, say, a banker for Bank of Hawaii on one of the highest floors in their building that I would never say, notwithstanding architecture, real estate isn't everything when the statement that matters is the one you get in the mail, is never overshadowed by the name emblazoned on the highest building in the financial district right across the street at 999 Bishop with a degree in Economics at least from UH, the 30 floor there, is off limits to the low IQ, so-called unskilled laborers whose lot in life it was to keep their eye on the State of Hawaii Civil service job openings to see if they need a new lot of janitors that know the ins and outs of Simple Green and the cheap but sturdy enough, built to last, built to replace with ease, whatever Boeing was saying about the 737-200s, thing will decompress, oxygen masks will drop, you'll do an emergency landing right at LAX your destination out of McCarran in Las Vegas maybe a little wind coming in by then through the roof but that plane's out of service now and Boeing forever changed aviation with the 707 and this is an even bigger revolution, order a couple more of these and they'll always be there to swap out the old ones, hold up LAX for 10 minutes, they gotta bring the equipment out for you, the airport fire guys will have something to do finally in between inaugurating all these new routes the airlines are adding because of this dirty bird, she gets the job done, you'll be right in LA and on time, too, no doubt, we had to wear the masks on this one, a story to tell at the meeting downtown around 7th street this afternoon, the boys down there all know when you thumbs up them through the cockpit window, this baby's ready for the scrapyard. This mop is going into the green dumpster. What could ever go wrong with a 3M engineered plastic yellow pale for the mop with the big handle get a good hold of that with your foot. Really push that in. Now that's how your wring out a mop. Never had one of those fail on my watch yet. We got a couple new ones coming anyway. And you’ve been doing this for 20 years, even. Another walk down the corridor of the countless ones you’ve taken, the people mover isn’t really a good choice when you’ve got the mop and the pale or the cart with simple green and bleach and new rolls of toilet paper for an entire quarter of the inter-island terminal. It’s a little quieter here sometime between four and five you’ve got a few of those Hawaiian 717s pulling up to the gate and the planes are half full on days like these so they board fast and yet the leisurely pace at which it all happens, on days like these, between four and five, is nothing like the other terminal. They’re adding a whole new wing to the airport now and they’ll probably have you doing a lot there, too, so you hear. You walked around there when you got off yesterday and they’re moving fast with it. You hear somewhere that Hawaiian’s probably going to have the whole thing to free up the other concourses, and it’s amid the million images you see and sometimes forget to see, it’s your silhouette with the pale and the mop that stands between the world and those new blue 737s that are coming in now. But that’s behind us. That’s on that side. We’re here. And whole new territories to conquer, right around the corner. Two decades. I lose track of time, sometimes. Is that a long time, is that next to no time? Same yellow pale. Same industrial mop. I remember 737-200s of Aloha Airlines here in this terminal, before. Wasn’t here the day they shuttered. Glad I wasn’t. So much commotion. And I heard people cried over those airplanes. God, what for. They had them out there in storage on one of the taxiways by the cargo hangars for a long time. Such is life. I know a clean floor when I see one. There, that looks good. They’re pushing back a plane that’ll be in Lihue in half an hour and that’s about all that’s going on. Some guy’s wearing a Columbia jacket getting one of those tall white cups at the Starbucks over there and you’re working your way a little closer and he’s mixing Raw Sugar into it with a wooden stirrer, and you’re just close enough to see it, it looks like he’s got a ticket to Kona, and you know that one’s going to board all the way back there right around where you walked in. Right from Vancouver, where else, right? Seattle? The year you started working. That’s right around when he was born. So we take the mop and the pale back to the utility closet right here, right over here, just like always, and I might as well start restocking toilet paper, right? How much money did I make today? I never thought about it before. Well I’ve already made enough this week to hop one of these 717s and I’ve already made enough this month to get myself to San Francisco, or Fairbanks, you know, Main Land kind of thing. To think for once I’m the one thinking if there were anywhere in the world I could go, where would it be. The fourteen year old girls you’ve seen getting off of planes from LA or who knows where made up like Olivia Jade Gianulli or Jon Benet Ramsay, Olivia Jade Gianulli, that’s something my niece taught me at a birthday party I went to in Waimanalo around New Years. The makeup, crop top and felt neck contoured pillows, you just see it in their eyes and such a tender age for the 24k gold earrings. Somehow I know 24k when I see it. Those are the questions they ask. If anywhere in the world kinds of questions. This airport was on their list, so, oh well. I look at my face in the mirror while I spray the sink, here. The thing with time. There are four directions, north, south, east, and west. We all know that. The past. Milestones Ones in aviation history. They've got all these pictures up. I remember some of it, sure. History. Old military planes and WWII imagery and something about supersonic flight. I’ve never seen a Concorde come through here, not once, but what the hell do I know, right? History. Right here at HNL. The past. Yeah, there’s a horizon we aren’t crossing yet. Who knows if it’s a trip shorter than the one they’re on, roaring toward the heavens and slipping this place for good until she’s wheels down right over the horizon of a Makaha sunset or as long as the one to Newark. Some tickets, tickets for that one, they’re not easy to book. If there were anywhere, really, I believe it’s nowhere a compass would point me. Turn on the faucet. Looks good. I know a clean sink when I see one.

1 note

·

View note

Text

Compass raises another $400 million, earns a $4.4 billion valuation

Photo courtesy of HousingWire. Article written by E.B. Solomont for Real Deal LA

Compass is officially a $4.4 billion brokerage.

The New York-based firm said Thursday it closed another mega-round, raising a $400 million Series F led by SoftBank’s Vision Fund and Qatar Investment Authority. Wellington, IVP and Fidelity also participated in the deal, which gives Compass a total capital raise of nearly $1.2 billion, the company said.

Compass said the latest funding, first reported by Bloomberg, will enable it to accelerate plans to control 20 percent market share in 20 U.S. cities by 2020, and to double down on its technology. The firm, which was founded in 2012, also said it plans to expand internationally.

“Real estate is the largest asset class in the world,” founder Ori Allon said in a statement, “and we are excited to bring Compass technology to international markets.”

News of Compass’ latest funding comes less than a year after Softbank poured $450 million into the company in December 2017, at the time valuing the brokerage at $2.2 billion. That round closely followed a $100 million funding from investors including Fidelity Investments.

With nearly $1 billion in new money over the last year, Compass has been on an unabashed growth spree, scooping up agents and brokerage firms nationwide. (On Thursday, SoftBank also announced a $400 million investment in the iBuying platform Opendoor.)

“There’s nothing that will stand in the way of their growth now,” said Steve Murray of Real Trends, a Colorado-based research and data company that values brokerage companies. “With the capital behind them, they can grow as much as they want to. They really can.”

Last month, Compass told The Real Deal it is on track to hit $35.6 billion in sales volume this year, up from $14.8 billion in 2017. This summer, it picked up Pacific Union International, a $14 billion firm in San Francisco. Compass is also projecting $1 billion in 2018 revenue up from $370 million in 2017.

In addition to brokerage revenue, Compass is banking on new tech products, licensing and other money-making ventures to hit that target.

The firm plans to roll out title and escrow services, and this summer it announced its first tech licensing deal — though the partnership fell apart soon after. Some of the latest tools it has introduced to brokers include a CRM (customer relationship management) system and illuminated real estate signs that feature QR codes.

At $4.4 billion, Compass’ valuation blows other residential firms out of the water. Realogy — the New Jersey conglomerate that owns Coldwell Banker, the Corcoran Group and Sotheby’s International Realty — has a market cap of $2.5 billion. Its stock is down 25 percent since the start of the year, with a closing price of $20 per share on Wednesday.

Compass has stayed tight-lipped about its own plans to go public, but some speculated that the Series F would be the last one before an IPO.

#chase campen#larchmontliving#compass#real estate#la news#real estate news#softbank#investment#los angeles#new york#real estate tech

1 note

·

View note

Photo

Illustration Photo: Field workers in a sugar cane farm in Fiji. The sugar industry is major contributor to Fiji's gross domestic product, foreign exchange earnings, and employment. (credits: Asian Development Bank / Flickr Creative Commons Attribution-NonCommercial-NoDerivs 2.0 Generic (CC BY-NC-ND 2.0))

NFTs to address development problems applicable in Asian countries

For Afghanistan, Armenia, Australia, Azerbaijan, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, Cook Islands, Federated States of Micronesia, Fiji, Georgia, Hong Kong China, India, Indonesia, Japan, Kazakhstan, Kiribati, Kyrgyz Republic, Lao PDR, Malaysia, Maldives, Marshall Islands, Mongolia, Myanmar, Nauru, Nepal, New Zealand, Niue, Pakistan, Palau, Papua New Guinea, People's Republic of China, Philippines, Republic of Korea, Samoa, Singapore, Solomon Islands, Sri Lanka, Taipei China, Tajikistan, Thailand, Timor-Leste, Tonga, Turkmenistan, Tuvalu, Uzbekistan, Vanuatu, Viet Nam, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, The Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States

Non-fungible tokens (NFTs) are unique digital identifiers that cannot be copied, substituted, or subdivided, that are recorded in a blockchain, and that are used to certify authenticity and ownership (as of a specific digital asset and specific rights relating to it) of items such as photos, videos, audio, and other types of digital files.

Recently, NFTs have attracted attention for the first tweet tweeted being sold for just under $3 million, a video by the artist Beeple being sold for $6.6 million, and the Nyan Cat meme selling for nearly $600,000.

Transactions recorded on blockchains are reliable because the information cannot be changed. Smart contracts can be used in place of lawyers and escrow accounts to automatically ensure that money and assets are exchanged and the agreement is being honored.

Clearly, NFTs create opportunities for new business models that didn’t exist before around selling and owning digital items but what are the opportunities for development? Could NFTs solve the issues of land ownership and other inequality issues? Can they be used for climate action projects? Could they be used to provide food security?

Strategy 2030 sets seven operational priorities, each having its own operational plan. The operational plans contribute to ADB’s vision to achieve prosperity, inclusion, resilience, and sustainability, and are closely aligned with Strategy 2030 principles and approaches. This challenge is looking for solutions that target one of the following principles:

Addressing remaining poverty and reducing inequalities

Supports the Sustainable Development Goal agenda to tackle poverty and inequality and leave no one behind.

Strategic Operational Priorities Human capital and social protection enhanced for all Quality jobs generated Access to opportunities increased for the most vulnerable

Tackling climate change, building climate and disaster resilience, and enhancing environmental sustainability

Thirteen of the seventeen Sustainable Development Goals are relevant to or will be impacted by actions on climate change, climate and disaster resilience, and the environment.

Strategic Operational Priorities Mitigation of climate change increased Climate and disaster resilience built Environmental sustainability enhanced

Promoting rural development and food security

Although significant progress has been made in meeting food security, in Asia and the Pacific, hunger and malnutrition persist.

Strategic Operational Priorities Rural development Agricultural value chains Food security

Accelerating progress in gender equality

Support for gender equality and women’s empowerment is also central to the 2030 Agenda for Sustainable Development.

Strategic Operational Priorities Women’s economic empowerment increased Gender equality in human development enhanced Gender equality in decision-making and leadership enhanced Women’s time poverty and drudgery reduced Women’s resilience to external shocks strengthened

Making cities more livable

Cities in Asia and the Pacific have unprecedented opportunities to transform the well-being of their citizens and to catalyze economic development through increased urbanization by 2030.

Strategic Operational Priorities Improve access, quality and reliability of services in urban areas Strengthen urban planning and financial sustainability of cities Improve urban environment, climate-resilience and disaster management of cities

Strengthening governance and institutional capacity

Governance and institutional reforms are needed to sustain development momentum in the region and to ensure that the benefits of growth are equitably and widely shared.

Strategic Operational Priorities Strengthened public management and financial stability Enhanced governance and institutional capacity for service delivery Strengthened country systems and standards

Fostering regional cooperation and integration

Operations are expected to enhance connectivity and competitiveness, promote regional public goods, strengthen cooperation in the finance sector, and strengthen subregional initiatives.

Strategic Operational Priorities Greater and higher quality connectivity between economies Global and regional trade and investment opportunities expanded Regional public goods increased and diversified

What’s in it for you?

The selected solution will have potential to develop a proof-of-concept together with ADB with USD 10,000 or more seed funding in the selected ADB's developing member countries.

The shortlisted participants will have access to networking opportunities and mentoring with ADB development practitioners and other experts.

Top projects will be highlighted during ADB Digital X ADB event.

Application Deadline: October 8, 2021 at 23:59 [GMT +8]

Check more https://adalidda.com/posts/pjvTytuNm5C4NpX93/nfts-to-address-development-problems-applicable-in-asian

0 notes

Text

With Tourism Halted, Hawaii’s Housing Market Takes a Big Hit. Can It Bounce Back?

Getty

Even though it sits 2,000 miles from the mainland in the Pacific Ocean, Hawaii hasn’t escaped the economic impacts of COVID-19. Right now, it stands as one of the hardest-hit areas in the country.

Tourism is the 50th state’s largest industry, and the pandemic has put the brakes on vacationers, thrill-seekers, and conventiongoers. Those who do venture to the Aloha State face a mandatory 14-day quarantine, which makes most vacations impossible.

And with the economy reeling, the real estate market is struggling to navigate choppy waters.

“COVID-19 certainly, swiftly, and negatively did impact our housing market, as we expected,” says Tricia Nekota, president of the Honolulu Board of Realtors®. “We saw a decrease in new listings and more escrow cancellations along with more properties being delisted or temporarily taken off the market.”

No tourists, no economy

With no tourists flocking to the sun-soaked island chain, many Hawaiians are out of work. The impacts of high unemployment have cascaded down through the entire economy. Hotels, restaurants, and shops closed during stay-at-home orders are just beginning to reopen with many restrictions.

According to the state’s Department of Business, Economic Development & Tourism, or DBEDT, tourism makes up 36.8% of the economy, with 119,429 people working directly in the industry.

However, those numbers don’t include a large segment of workers whose jobs aren’t directly linked to tourism, but depend on a steady flow of folks making their way to the islands.

Preliminary April numbers from the U.S. Bureau of Labor Statistics show only two states with higher unemployment rates than Hawaii.

National rate: 14.7%

Hawaii: 22.3%

Michigan: 22.7%

Nevada: 28.2%

Hawaii street

R9 Studios

For context: Before the pandemic, unemployment in Hawaii was below 3%.

As for tourism, the numbers are stark and the impacts are huge. In 2019, DBEDT reports found about 25,000 domestic passengers traveling through Hawaiian airports each day. That same trend continued in the early months of 2020.

After travel restrictions went into place in late March, the number of visitors dropped to just a few hundred a day. International passenger counts (not including flights from Canada) were at about 8,000 daily in 2019 and the first months of 2020. Now they are close to zero.

Compared with other world events that have shaken the islands, the pandemic is without parallel. While DBEDT shows past shocks significantly slowing Hawaii tourism, there’s nothing that can compare with the near 100% decrease in its prime economic driver.

Here are the numbers from three previous events, including the number of monthly tourist arrivals and the time it took for the Hawaiian economy to recover to pre-event levels:

Gulf War in 1990-91: 25% decrease,11 months to recover

9/11 attacks: 27% decrease, 29 months to recover

2008 financial crisis: 19% decrease, 41 months to recover

Home buyers pulling back

Losing a job or suffering through a furlough will certainly change home buyers’ plans. The agents we spoke with in Hawaii say homes are falling out of escrow.

“People don’t have any more money, especially those in the service industry. You qualify [for a mortgage] according to your employment,” says Jack Legal, president of Hawaii Realtors®.

Diamond Head

realtor.com

A recent buyer had to extend escrow for a month because of a furlough, says Legal. “He was hoping by the end of the month he was going to regain his job back, and I’m hoping and keeping my fingers crossed that when this pandemic is over, his job will still be there.”

When the pandemic first hit, Nekota saw many more escrow cancellations than she is seeing now, which may be a sign things are stabilizing.

“The buyers that are in the market right now are the ones who will stay in this market,” says Nekota.

New listings are down dramatically

The number of new listings has decreased throughout the state, especially in Honolulu, the state’s most populous city.

According to Nekota, the number of new single-family home listings in Honolulu from March 22 to April 25 was down 42% compared with the same time in 2019. The lack of listings is roughly the same for condos and townhomes.

Home sellers choosing to temporarily remove their listings skyrocketed during the same time period. Nekota says she saw a 71% increase in the number of delistings for single-family homes and 53% for condos.

In addition to being a large financial decision, buying or selling a house is also an emotional decision. The island economy weighs heavily on those who would normally be wading into the housing market during the spring and summer months

“It’s all about perception and what [consumers] see or hear. It weighs on their emotional decision as to whether or not they’re going to remain in a market where our economy seems very turbulent,” Nekota explains.

Hawaii skyline

realtor.com

She adds many islanders who were considering selling are in a holding pattern, and those “who were deciding to list before COVID-19 decided to hold off.” This means there isn’t much out there for buyers to even consider.

Buyers squeezed on supply

Both Nekota and Legal say one thing has remained constant in this crazy time: a limited supply of available real estate usually means high demand. Yes, even in a pandemic. It’s held true in this island market where available homes have always been in short supply.

“Inventory is really, really low. It makes it even more challenging for buyers to purchase homes,” Nekota says. For buyers who haven’t lost a job and still have financial ability to buy a home, options are limited.

Legal says he was working with one property that needed a lot of repairs, which received 17 offers. Another property had six offers.

Honolulu home

realtor.com

“Even though there’s less buyers out there, there’s just not enough property for buyers to be putting in offers on,” Nekota explains. “So, oddly enough, we’re still seeing multiple offers being put on homes because there’s not a lot out there to choose from.”

The lack of inventory has pushed the median home price up. Legal says that even though homes sales in April dropped more than 20% compared with the same period last year, the median price for a single family home rose 5% year over year.

Nekota says it’s a good time to be a seller in Hawaii, and she thinks the few buyers unaffected by the state’s downturn are hungry to leap into the market.

“There are buyers that are still out there looking for that right home,” she says. “If their job is stable … they’re creditworthy, [then] they can make this purchase and take advantage of the record-low mortgage rates. And for sellers, because inventory is so low, you’re still going to have attraction to your property.”

The post With Tourism Halted, Hawaii’s Housing Market Takes a Big Hit. Can It Bounce Back? appeared first on Real Estate News & Insights | realtor.com®.

from https://www.realtor.com/news/trends/tourism-halted-hawaii-housing-market/

0 notes

Photo

It’s been whirlwind 10-days for me and my real estate practice! On Friday, 05/17/19, I executed contract on my first residence in the neighborhood of Pacific Beach while simultaneously attaining an accepted contract on a condo in Escondido with a 15-day close. A week later, on Friday, 05/24/19, I listed my first home in the neighborhood of San Carlos. Pleased to present my latest listing for 2019! The sellers are repeat offenders . . . I mean, repeat clients! I sold a home for them in 2018 in the neighborhood of Carmel Valley. I thank these clients for the continued trust and patronage of my business and with my team at WFG and Elite Escrow. OK people, it's time for us to roll up our sleeves! My MLS write-up, “Fantastic opportunity to move into the nature conducive neighborhood of San Carlos. Nestled at the foothill of Cowles Mountain. Evoking a cozy attitude of living, it's just walking distance from Mission Trails Regional Park/Golf Course/Lake Murray. Minutes away from SDSU. The location allows you to remain close enough to enjoy all the amenities of the city & beach areas while allowing for the ability to stretch ones arms & legs when you want to get away from it all. Come see you future!” #sosandiego #jumpermedia #realtorlifestyle #sdrealproducers #usnavyveteran #veteranownedbusiness #spinclass #outdoorspin #fitness (at San Carlos, San Diego) https://www.instagram.com/p/Bx_NfgqnUth/?igshid=y679m3c0xjcl

#sosandiego#jumpermedia#realtorlifestyle#sdrealproducers#usnavyveteran#veteranownedbusiness#spinclass#outdoorspin#fitness

0 notes

Text

Property Slowdown Beckons as Next Risk for Emerging Markets

(Bloomberg) — As growth worries and trade war jitters threaten to spoil any rebound for emerging markets in 2019, property markets are shaping up as a critical element to monitor for further signs of gloom.

Some developing economies from Thailand to Dubai and Brazil are facing double-digit real estate sales declines on the back of weakening domestic growth. Developed countries already have shown some of the pain — including Australia, the U.K., Switzerland and Singapore — and made all the more worrisome as borrowing costs remain relatively low.

“There are different factors driving the various markets; real estate tends to be to a large extent a localized market,” said Todd Schubert, head of fixed-income research at Bank of Singapore Ltd. “However, the one over-riding theme is decelerating economic growth momentum, which is continuing to be a headwind for all markets and preventing a recovery in markets, such as Dubai, which have faced multi-year downturns.”

The weakness isn’t universal with China’s real estate market showing signs of green shoots again, while low rates have supported Poland’s real-estate market.

Here’s how some emerging-economy property markets are shaping up.

EMEA:

DUBAI

An oil-price slump, fiscal austerity in Saudi Arabia and a strong dollar have driven away potential buyers in Dubai. The government’s Land Department has been focusing on promoting Dubai’s real estate to investors abroad, mostly in the U.S., U.K., China, India and Russia, and last year announced a long-term visa program meant to help boost property demand. Residential property prices in Dubai are set to decline by less than 10 percent this year, after sliding about 25 percent from the 2014 peak, said Craig Plumb, the head of Middle East research at broker Jones Lang LaSalle.

POLAND

Record-low unemployment and fast wage gains, together with record-low interest rates, also spur demand for houses, with sales at a record high in Poland last year. That’s bringing residential property investment funds to a roaring market that used to be mostly retail-oriented. Poland’s relatively low debt and modest fiscal deficit are giving the government room to support the economy, allowing for real estate there to be especially attractive against its neighbors, said Sebastian Zilles, a London-based fund manager at Pacific Investment Management Co.

RUSSIA

Russia’s residential construction is on a three-year losing streak, and regulations from July 1 that will require builders to keep money earned from pre-sales of apartments in escrow add one more hurdle. The sector has stalled despite a boom in the mortgage market, which grew by nearly half in 2018 as rates fell to historic lows. While the state mortgage development institution DOM.RF forecasts continued lending growth and sees no signs of a bubble, a low base means that housing loans won’t save developers from their prolonged slump.

TURKEY

Turkey’s property market, hit by rising borrowing costs following the August currency crash, is one of the biggest losers of EMEA region in 2018. Home prices rose 7.6 percent in the year through January, the slowest annual increase in central bank data back to 2011. When adjusted for inflation, home prices fell by over 10 percent. Even amid the real decline in home prices, sales during the first two months of the year dropped by one-fifth from a year earlier, according to official data released by Turkstat.

SOUTH AFRICA

South Africa’s mortgage market looks to have started 2019 on very weak footing, with the value of new mortgage loans having plunged in the third quarter from a year earlier, according to central bank data. Growth is likely to remain weak until at least after the 2019 elections amid souring business and consumer sentiment and concerns over policy direction, including on land expropriation without compensation.

Asia:

CHINA

New-home price growth in China snapped a four-month weakening streak, one of the first official signs there may be a widespread recovery in the nation’s housing market. The recovery has been more evident in Tier 2 and Tier 3 cities, where local governments have increasingly sought to use so-called stealth easing to offset reduced support from shanty-town renovation projects. Investors also are assessing the impact of recent high-profile financial troubles among some Chinese real-estate entities including Citic Guoan Group Co. and Goocoo Investment Co.

THAILAND

The Bank of Thailand issued plans in October to impose stricter mortgage-lending rules in 2019 as the officials saw a frothy housing market ahead. That’s already kept residential development plans in check, with an increasingly gloomy global growth picture weighing now also. Colliers International said in a fourth-quarter report that it sees new condominiums falling by 24 percent this year as unsold properties pile up, while Bloomberg Economics sees Chinese investor interest keeping a floor under demand.

INDONESIA

The property market in Southeast Asia’s biggest economy is in a funk, with residential property sales contracting 5.78 percent in the fourth quarter compared to the previous three months, according to central bank data. Fitch Ratings has cited rising interest rates, currency volatility, weak commodity prices and looming elections as weights on first-half demand. In an April 24 report, Fitch Ratings said that post-election uncertainty would likely have “minimal impact in the medium term on infrastructure execution and contractors’ profitability,” with the 2019 budget prioritizing such development.

INDIA

India’s top seven cities recorded 12 percent increase in home sales and 27 percent jump in residential launches during the first quarter, according to Anarock Property Consultants. While the sector was hit by a liquidity crisis late last year, government measures including a reduction in GST and central bank interest-rate cuts boosted sales and launches in the March quarter. Investor confidence was rocked last year by a series of defaults at IL&FS Group, which pushed up costs for borrowers, including builders looking to refinance debt that fueled a construction boom. Read more: A Manager Who Saw India Credit Crisis Now Warns of Realty Stress

Latin America:

BRAZIL

For Brazil, the fresh government of President Jair Bolsonaro hasn’t yet been able to deliver on high hopes for a real-estate turnaround. Housing prices in Sao Paulo, the most-populous state, grew at an annual pace of 2 percent in February, compared with less than 1 percent a year ago, according to an index by FipeZap. That’s still far below the double-digit growth levels seen in 2014 before the economy went into recession.

MEXICO

Mexico’s property sector has remained relatively resilient amid the uncertainty generated by Andres Manuel Lopez Obrador’s new administration. Construction is signaling an earlier-than-expected recovery, according to BBVA research. Interest in cheap Mexican real estate remains strong, and home prices across the country rose over the course of last year, according to the most recent available data from Mexico’s Federal Mortgage Company.

The post Property Slowdown Beckons as Next Risk for Emerging Markets appeared first on Businessliveme.com.

from WordPress http://bit.ly/2Vafpyv via IFTTT

0 notes

Photo

What Are The Steps In FHA Loans | Ultimateonlinemortgage.com

#Closing Costs#Education#Escrow Evolved#HB#home buyer#Huntington Beach#information#mortgage#OC#Orange county#Pacific City Escrow#realtor

0 notes

Text

Want to come to spend three days and two nights in Beverly Hills? Watch this video to find out how.

youtube

Enter our agent referral drawing to win an all expense paid trip to beautiful Beverly Hills California. For any buyer or seller referral you send us that closes escrow, in addition to your referral fee you will be entered into a drawing to come visit me in Beverly Hills. Including:

Round trip first class airfare. Two nights at the iconic Beverly Hills Hotel. Lunch at Spago or Villa Blanca in Beverly Hills. You will also get to spend a day with me shadowing me at work and touring luxury properties in Beverly Hills & Los Angeles. We appreciate all of your referrals and look forward to receiving yours! See you in Beverly Hills. Thank you! . . . #Wantchoo #iwantchoo #christophechoo #choo #hirechoo #choosechoo #listwithchoo #sellwithchoo #buywithchoo #lovebevhills #beverlyhills #realestate #realtor #referral

The Beverly Hills Hotel Spago Beverly Hills

Christophe Choo Real Estate Group – Coldwell Banker Global Luxury

*You must be a licensed agent to participate in this referral contest and drawing and one winner will be chosen.

Christophe Choo is in the top 1% of Realtors internationally with 31+ years experience as the President & Broker for the Christophe Choo Real Estate Group at Coldwell Banker Global Luxury in Beverly Hills. The #1 Coldwell Banker Real Estate in the United States for 24 years and is the most comprehensive source for luxury real estate listings, from estate homes to luxury condominiums, incredible tear down opportunities and investment properties. Christophe was voted as the #1 Real Estate Video Influencer for North America in 2018.

Based in beautiful Beverly Hills, California 90210, the Christophe Choo Real Estate Group provides exclusive luxury homes for sale on a local, global and international stage. Hence the tagline: “Locally Known – Globally Connected”.

Search for luxury properties in your area, whether in the “Platinum Triangle” areas of the Westside of Los Angeles of Beverly Hills, Holmby Hills and Bel Air or in The Sunset Strip, Hollywood Hills, Brentwood, Westwood, the Wilshire Corridor, Century City, Pacific Palisades, Santa Monica, Malibu, Venice, Marina Del Rey, Cheviot Hills, Hancock Park, Los Feliz and the key Westside areas of Los Angeles, the Christophe Choo is the luxury Realtor that can help you achieve your selling or buying goals in Los Angeles.

Call or email me today! Christophe Choo 310-777-6342 The Christophe Choo Real Estate Group Coldwell Banker Global Luxury Beverly Hills Realtor – Luxury Real Estate Agent Email: [email protected]

DON’T FORGET TO FOLLOW ME: Instagram: http://bit.ly/cchooinstagram Facebook: http://bit.ly/cchoofacebook Twitter: http://bit.ly/cchootwitter Website: http://bit.ly/cchoowebsite

Subscribe to my YouTube Channel! Click here: http://bit.ly/cchooyoutube

Looking to sell your home? Click here: http://bit.ly/cchoowebsite

How much is your home worth? Click here: http://bit.ly/cchooHomeValues

Search homes in Los Angeles Click here: http://hirechoo.com/SearchLA

Meet Christophe Choo & his team Click here: http://hirechoo.com/MeettheTeam

What do Christophe’s customers say? Click here: http://hirechoo.com/Testimonials

Communities in Beverly Hills & Los Angeles Click here: http://hirechoo.com/LAcommunities

Christophe’s Blog Click here: http://bit.ly/cchooblog

Book Christophe for a Speaking Engagement Click here: http://hirechoo.com/Speaking-Engagements

Coldwell Banker Residential Brokerage Coldwell Banker Global Luxury Real Estate

The post Want to come to spend three days and two nights in Beverly Hills? Watch this video to find out how. appeared first here.

from Beverly Hills Real Estate-Beverly Hills Homes For Sale Luxury http://www.christophechoo.com/want-to-come-to-spend-three-days-and-two-nights-in-beverly-hills-watch-this-video-to-find-out-how-2/

0 notes

Link

Compass, the New York startup that has built a tech-first platform to take on the antiquated market of real estate, is building up its own house today. To double down on domestic growth, build out its tech, and to finally open up for business outside the US, the company has raised another $400 million of funding.

Jointly led by SoftBank’s Vision Fund and the Qatar Investment Authority, this Series F — likely to be the last before it goes public — now values Compass at a whopping $4.4 billion.

(Other investors in this round include Wellington, IVP and Fidelity, with the total raised by Compass now at $1.2 billion to date.)

Compass has been on nothing less than a funding roll. (Part of a wider one for the real estate startup market: today SoftBank also led a $400 million round into Opendoor, and last week Zumper raised $46 million.)

Compass’s money comes on the heels of the startup raising $450 million less than a year ago at a $2.2 billion valuation, also led by the Vision Fund, and picking up $100 million just before that, totalling $900 million for this year.

These sums underscore just how far and fast the company has leaped since first being founded as Urban Compass in 2012. Indeed, while the real estate market has had its ups and downs, you could argue that Compass has been witnessing a boom of its own.

The company cleared $34 billion in sales in 2018 ($14.8 billion in 2017) and is on track to make $1 billion in revenues. It already claims to be the biggest independent brokerage in California. This, it should be said, was partly due to inorganic growth: it acquired Pacific Union International in August, and although Compass doesn’t rule out more M&A, this will never replace organic growth, according to Ori Allon, the co-founder (with CEO Robert Reffkin) and executive chairman of the startup.

Allon would not say whether Compass is currently profitable, but it sounds like an intentional no. “We are in a strong financial position and continue to heavily invest in growth,” Allon — a search engineer himself who previously sold companies to Google and Twitter — said in an interview.

Compass at its most basic offers a clear and easy way for property owners to list, market and sell properties, as well as follow through on the many pieces of complex transactional data that occur before and after the deal is made. But it has also built its business in a quite traditional way, too: by adding people.

The company says it now has more than 7,000 agents on the ground, triple the number it had in 2017, and is on track with a strategy to control 20 percent of all residential property sales in the US’s top 20 markets. (In addition to big cities like New York, Washington, Boston and San Francisco, it’s been expanding into the next wave of markets, including San Diego, Dallas, Seattle, Philadelphia and Atlanta, and soon Austin, Nashville and Houston).

In Allon’s view, the tech and human elements are essentially two sides to the same coin.

“We are continuing to build an end-to-end technology platform that services agents and their clients through every step of the real estate journey,” Allon said. “This is why so many agents make the transition to Compass. Our vision is for Compass to be everywhere, and we are excited to expand internationally in 2019.”

Compass is not the only company trying to disrupt (and improve) real estate with tech. In addition to the now-established guard of sites like Redfin and Zillow that aggregate listings and provide a way to view properties from a range of agencies, there are startups like Zumper looking to tackle the rental market.

“We’re all trying to make the whole ecosystem better, but are focusing on fundamentally different parts of the ecosystem,” Allon said of Zumper (which itself raised a round just last week). “It’s great to see other companies investing in innovation for the real estate industry. Our industry will be better for the changes these companies are making and it will prepare us all to thrive for many years to come.”

That’s not to say that Zumper — and others — might not one day become more direct competition. “Our goal is to eventually service all aspects of real estate, ultimately creating a single platform for the industry, with agents at the center of the referral economy,” Allon said in response to a question of whether it would tackle more short-term lettings a la Airbnb. This would be a market you could imagine might be interesting, given how many property investors specifically buy to rent out the spaces.

The Adyen of real estate?

There is an interesting trend in the tech world of businesses that are tackling what some would describe as “unsexy” problems: in many industries, there are too many pieces that need to work together to get something done, and this slows down not only the overall industry’s growth, but how smaller players can engage and use it. Adyen has built a solution to tie up and simplify working with the many moving parts of the payments space, and it seems that this too is what Compass wants to build for the real estate industry.

“As we build new tech and tools, our goal is seamless integration — of our tech, tools and backend data,” Allon said. “There is not one company that has seamlessly integrated the real estate journey for agents or consumers on an end-to-end platform. Our current focus is on creating a seamless experience that allows agents to complete daily tasks more intelligently, which will eventually extend beyond close, to title, insurance, mortgage, escrow, and more.”

In terms of investors, Allon describes SoftBank as “an incredible partner” — not least, I’m guessing, because it has been so willing to back Compass (twice!). Notably, he said that Compass is in a position where it didn’t need to raise — words that must be some of the most welcome ones that any investor hears as the term sheets are drawn up — but “this latest round of funding gets us steps closer, faster.”

“Compass’s continued growth is being driven by their commitment to empowering agents with best-in-class technology that helps them expand their business and better serve consumers,” said Justin Wilson, SoftBank Investment Adviser’s board representative. “We’re excited to continue to support Compass as they further invest in their data and technology capabilities to create a next generation platform for home transactions and ownership.”

QIA, meanwhile, is an interesting and likely strategic investor, given its holdings also in real estate globally. (It’s a very prominent player in my town of London, for example, with stakes or full ownership of some of the city’s most iconic properties.)

“We believe Compass is well positioned in the real estate brokerage sector driven by technology. We look forward to partnering with Compass and existing shareholders in the next stage of the company’s growth. Our investment marks QIA’s ongoing commitment to investing in high quality technology, media and telecommunications assets.” said a spokesperson for the QIA, in a statement.

via TechCrunch

0 notes

Link

Recognizing the uniqueness of infill properties in established communities and progressive cities, Capital Pacific Real Estate recently closed escrow on a 1.22 acre multi-family site in the City of Carson, Los Angeles County. Part of the South Bay group of cities, Carson is home to a population of about 100,000 southlanders, and is ideally located near the confluence of the 91, 110 and 405 freeways. The city is also home to the Los Angeles Galaxy and C.D Chivas USA soccer teams at the StubHub Center, California State University, Dominquez Hills, and most notably, the Goodyear Blimp and its landing pad just east of the 405 freeway.

0 notes

Text

Mobile payment firms struggle to dethrone cash in Southeast Asia

SINGAPORE/HANOI (Reuters) – Bui Mai Phuong is an avid online shopper, ordering anything from clothing to personal-care products from her smartphone. But she prefers to pay with cash.

Signs accepting WeChat Pay and AliPay are displayed at a shop in Singapore May 22, 2018. Picture taken May 22, 2018. REUTERS/Edgar Su

She is among hundreds of millions of people whom firms such as Softbank Group-backed Grab and China’s Tencent want to win over as they try to tap into Southeast Asia’s burgeoning internet sector.

More than 70 percent of the region’s 600 million-plus people do not use banks – higher than the global average of about 30 percent – and e-commerce is projected to hit $88 billion by 2025.

But convincing consumers like Phuong, who lives in Hanoi, could be tricky.

“I have never tried using mobile payments because I don’t know how to use it and it seems a bit complicated to use,” said Phuong, 36, a manager at a construction material supplier in Vietnam.

Mobile payments are ubiquitous in China; a consumer can spend a day without using cash at all in Beijing or Shanghai, and even some beggars accept mobile payments. But cash remains king in Southeast Asia.

Hard currency, paid on delivery, accounted for 44 percent of total e-commerce transactions last year and is likely to remain the most popular payment option for at least the next three years, according to data by research firm IDC.

“The biggest challenge for users and merchants to adopt cashless is the fact that cash remains ubiquitous, easy to use and inexpensive,” said ride-hailing firm Grab, which has ventured into e-wallets.

And the mobile payment marketplace in Southeast Asia remains wide open, with no dominant players.

Indonesia’s ride-hailing firm Go-Jek’s Go-Pay, Singapore-based Grab’s GrabPay, Japan’s messaging app Line’s Line Pay, Momo e-wallet owner M_Service in Vietnam and Voyager Innovations, which operates Paymaya in the Philippines, have all entered the fray. The gaming company Razer Inc has also indicated it is eager to play a role.

Cash on delivery costs e-commerce businesses more than other payment methods, said Alibaba Group Holding-backed e-retailer Lazada Group.

For example, sometimes a customer does not have enough cash on hand, or is not home to pay for the delivery. In those cases, the product must be sent back to the seller, adding logistical costs, Lazada said.

Mobile payments address some of those problems. They can also benefit buyers by keeping payment in escrow and releasing it only on delivery.

But it can be difficult to persuade users to switch from cash when they earn about $200 on average a month in economies like Vietnam and Indonesia, according to economic data provider CEIC.

“To break habits of using cash, Grab is creating more daily use cases for cashless payment – commuting, food delivery, paying at food and retail stalls – to drive more usage of the GrabPay e-wallet,” Grab said in an email.

Mobile payment companies bet they can transform their platforms into financial supermarkets, offering everything from loans to insurance on top of payment options.

SLOW GOING

At the moment, usage is spotty. E-wallets will account for 16 percent of total e-commerce transactions in Southeast Asia by 2021, up from last year’s 9 percent, according to IDC.

In countries like Vietnam, where the informal economy has long been a key part of the social fabric, many consumers do not bother to get a bank account.

Some want to stay under the taxman’s radar or, like Quang Thi Si, simply do not see the need for a bank.

Si, a 48-year-old scrap collector near Ho Chi Minh City, said her business is all cash.

“Sometimes I need to send money to my relatives at home, and I often send in cash through my friends,” she said. “I don’t think I will have a bank account in the future because I don’t think I need it.”

But Si does have a smartphone. More than 90 percent of Southeast Asia’s internet access comes through mobile devices, according to a Google-Temasek study.

Even so, in countries like the Philippines, which is known for having some of the slowest Internet speeds in Asia-Pacific, connectivity is a major hurdle for digital payments to clear.

‘LATE TO THE PARTY’

Such challenges are likely to pose a setback to Ant Financial and Tencent, which are looking outside China for growth.

Ant, which has 600 million customers and aims to reach 2 billion worldwide in the next decade, has stepped up investments in the region, including a stake in Thai financial technology firm Ascend Money.

But its services are largely limited to Chinese tourists.

“Most of our customers are from China and they are usually very happy to know that we accept AliPay and WeChat Pay. This makes them more willing to spend money too,” said Daphne Tan, a staff member at a shop selling durian-flavored coffee and snacks in Singapore’s Chinatown.

Tencent plans to make its first foray outside China with an e-payment license in Malaysia for local transactions.

The Chinese players are “kind of late to the party,” said Michael Yeo, research manager for IDC.

“By the time they come in with a local version, if they do, the local players will have a significant advantage,” said Yeo.

Razer, which said last month it would buy the remaining stake in payments processor MOL Global that it did not already own, also signed a deal with Singtel to link its e-payments network with that of the telco.

Other recent deals in the sector include Go-Jek’s acquisition of three financial technology businesses, while Grab’s purchase of a handful of companies as well.

“It’s a highly fragmented market. Later on, there will be acquisitions, there will be shutdowns, there will be mergers,” IDC’s Yeo said. “The market will consolidate.”

Additional reporting by James Pearson in HANOI, Cindy Silviana in JAKARTA, Neil Jerome Morales in MANILA, Chayut Setboonsarng in BANGKOK, Dewey Sim in SINGAPORE; Editing by Miyoung Kim and Gerry Doyle

The post Mobile payment firms struggle to dethrone cash in Southeast Asia appeared first on World The News.

from World The News https://ift.tt/2kmQS97 via Breaking News

0 notes

Text

Mobile payment firms struggle to dethrone cash in Southeast Asia

SINGAPORE/HANOI (Reuters) – Bui Mai Phuong is an avid online shopper, ordering anything from clothing to personal-care products from her smartphone. But she prefers to pay with cash.

Signs accepting WeChat Pay and AliPay are displayed at a shop in Singapore May 22, 2018. Picture taken May 22, 2018. REUTERS/Edgar Su

She is among hundreds of millions of people whom firms such as Softbank Group-backed Grab and China’s Tencent want to win over as they try to tap into Southeast Asia’s burgeoning internet sector.

More than 70 percent of the region’s 600 million-plus people do not use banks – higher than the global average of about 30 percent – and e-commerce is projected to hit $88 billion by 2025.

But convincing consumers like Phuong, who lives in Hanoi, could be tricky.

“I have never tried using mobile payments because I don’t know how to use it and it seems a bit complicated to use,” said Phuong, 36, a manager at a construction material supplier in Vietnam.

Mobile payments are ubiquitous in China; a consumer can spend a day without using cash at all in Beijing or Shanghai, and even some beggars accept mobile payments. But cash remains king in Southeast Asia.

Hard currency, paid on delivery, accounted for 44 percent of total e-commerce transactions last year and is likely to remain the most popular payment option for at least the next three years, according to data by research firm IDC.

“The biggest challenge for users and merchants to adopt cashless is the fact that cash remains ubiquitous, easy to use and inexpensive,” said ride-hailing firm Grab, which has ventured into e-wallets.

And the mobile payment marketplace in Southeast Asia remains wide open, with no dominant players.

Indonesia’s ride-hailing firm Go-Jek’s Go-Pay, Singapore-based Grab’s GrabPay, Japan’s messaging app Line’s Line Pay, Momo e-wallet owner M_Service in Vietnam and Voyager Innovations, which operates Paymaya in the Philippines, have all entered the fray. The gaming company Razer Inc has also indicated it is eager to play a role.

Cash on delivery costs e-commerce businesses more than other payment methods, said Alibaba Group Holding-backed e-retailer Lazada Group.

For example, sometimes a customer does not have enough cash on hand, or is not home to pay for the delivery. In those cases, the product must be sent back to the seller, adding logistical costs, Lazada said.

Mobile payments address some of those problems. They can also benefit buyers by keeping payment in escrow and releasing it only on delivery.

But it can be difficult to persuade users to switch from cash when they earn about $200 on average a month in economies like Vietnam and Indonesia, according to economic data provider CEIC.

“To break habits of using cash, Grab is creating more daily use cases for cashless payment – commuting, food delivery, paying at food and retail stalls – to drive more usage of the GrabPay e-wallet,” Grab said in an email.

Mobile payment companies bet they can transform their platforms into financial supermarkets, offering everything from loans to insurance on top of payment options.

SLOW GOING

At the moment, usage is spotty. E-wallets will account for 16 percent of total e-commerce transactions in Southeast Asia by 2021, up from last year’s 9 percent, according to IDC.

In countries like Vietnam, where the informal economy has long been a key part of the social fabric, many consumers do not bother to get a bank account.

Some want to stay under the taxman’s radar or, like Quang Thi Si, simply do not see the need for a bank.

Si, a 48-year-old scrap collector near Ho Chi Minh City, said her business is all cash.

“Sometimes I need to send money to my relatives at home, and I often send in cash through my friends,” she said. “I don’t think I will have a bank account in the future because I don’t think I need it.”

But Si does have a smartphone. More than 90 percent of Southeast Asia’s internet access comes through mobile devices, according to a Google-Temasek study.

Even so, in countries like the Philippines, which is known for having some of the slowest Internet speeds in Asia-Pacific, connectivity is a major hurdle for digital payments to clear.

‘LATE TO THE PARTY’

Such challenges are likely to pose a setback to Ant Financial and Tencent, which are looking outside China for growth.

Ant, which has 600 million customers and aims to reach 2 billion worldwide in the next decade, has stepped up investments in the region, including a stake in Thai financial technology firm Ascend Money.

But its services are largely limited to Chinese tourists.

“Most of our customers are from China and they are usually very happy to know that we accept AliPay and WeChat Pay. This makes them more willing to spend money too,” said Daphne Tan, a staff member at a shop selling durian-flavored coffee and snacks in Singapore’s Chinatown.

Tencent plans to make its first foray outside China with an e-payment license in Malaysia for local transactions.

The Chinese players are “kind of late to the party,” said Michael Yeo, research manager for IDC.

“By the time they come in with a local version, if they do, the local players will have a significant advantage,” said Yeo.

Razer, which said last month it would buy the remaining stake in payments processor MOL Global that it did not already own, also signed a deal with Singtel to link its e-payments network with that of the telco.

Other recent deals in the sector include Go-Jek’s acquisition of three financial technology businesses, while Grab’s purchase of a handful of companies as well.

“It’s a highly fragmented market. Later on, there will be acquisitions, there will be shutdowns, there will be mergers,” IDC’s Yeo said. “The market will consolidate.”

Additional reporting by James Pearson in HANOI, Cindy Silviana in JAKARTA, Neil Jerome Morales in MANILA, Chayut Setboonsarng in BANGKOK, Dewey Sim in SINGAPORE; Editing by Miyoung Kim and Gerry Doyle

The post Mobile payment firms struggle to dethrone cash in Southeast Asia appeared first on World The News.

from World The News https://ift.tt/2kmQS97 via News of World

0 notes

Text

Over-the-Top Oasis: This California Backyard Makes a Huge Splash

realtor.com

Many properties claim to be an oasis, but this fascinating home in La Mesa, CA, truly delivers on pure relief from the outside world. The tropical island–themed backyard of the home (now pending sale) has tiered waterfalls, bridges, paths, palm trees, grottoes, barbecues, a swim-up bar, 70-foot waterslide, and more.

“When you close that gate, you’re in Jamaica,” says listing agent Laura Lothian of Pacific Sotheby’s International Realty.

An intriguing house demands an interesting backstory, and this home doesn’t disappoint. Built in 1955, it was sold for $325,000 in 2002 to a man with a grand imagination. He set out to build a dreamy backyard resort, and had professionals begin work. However, he failed to get permits for his fancy improvements.

youtube

A bank was about to take the home in 2013, before Lothian stepped in and convinced the bank that it didn’t need the hassle of getting permits for the backyard renovations. The agent had buyers who would take over any legal problems and battle with city hall if necessary. The bank made the deal, and the house changed hands for $370,000.

The new owners spent over $300,000 in the ensuing years and brought the place up to code.

“La Mesa has tough building standards,” says Lothian. It’s a small Southern California city about 10 minutes away from downtown San Diego, and the new owners believed the additional work would be worth the effort—they intended to use the property as a vacation rental. A tropical oasis near one of the country’s most popular tourist towns? A savvy bet!

La Mesa, CA, home with amazing backyard

realtor.com

And it was. There’s currently a renter in the home who is signed up for several months at $12,000 a month. When you hear those numbers, the home’s nearly million-dollar list price sounds like a screaming deal. What gives?

“The biggest thing working against it is that it’s close to the freeway,” says Lothian. The busy thoroughfare can be seen and heard from the home, unless the waterfalls are flowing—the rushing waters completely block the sound.

The agent, who fielded inquiries about the utilities involved in running a virtual water park, broke down the numbers per month: Water averages $250, pool maintenance is $140, gas and electric run about $450, and landscaping is about $250.

Waterslide

realtor.com

But it isn’t just about the backyard. The property also includes a remodeled four-bedroom, three-bath home. The 3,182-square-foot property features an open floor plan, beamed and vaulted ceilings, multiple french doors leading out to the pool, a new HVAC system, and wood flooring.

Out by the pool there’s a Tiki house with a kitchen and a game area with pingpong and billiard tables.

Great room

realtor.com

Master bedroom with fireplace

realtor.com

Tiki house

realtor.com

Lothian says more than 200 people attended the first open house, and an additional 100 dropped by for the second. The property has been in and out of escrow once already, and currently there’s an offer pending.

The lucky buyer won’t have to fly all the way to Hawaii for a tropical vacation. We recommend keeping an eye on VRBO or Airbnb if you want to spend the night in this bonkers backyard.

Front exterior

realtor.com

The post Over-the-Top Oasis: This California Backyard Makes a Huge Splash appeared first on Real Estate News & Insights | realtor.com®.

from https://www.realtor.com/news/unique-homes/backyard-makes-a-big-splash/

0 notes