#Overvalued Stocks

Explore tagged Tumblr posts

Text

Know the top overvalued mid-cap stocks that corrected the most in 2024 and Explore insights into overvalued stocks, their impact on investments, and if these corrected stocks can be viable options.

#jarvis ai#stock market ai#overvalued#overvalued stocks#overvalued midcap stocks#best stock market advisor in India#ai stocks in India

0 notes

Text

Which stock is overvalued? Which stock is undervalued? How to identify prices of stocks in the market? Does all this questions make you worry? But not anymore! With our recent blog you'll be able to identify overvalued stocks in the market, why are they overvalued and how to determine them!

0 notes

Text

The Stock Market Crash of 1929: Unveiling the Precursor to the Great Depression

Written by Delvin The year 1929 is etched into the annals of history as the time when the global economy was rocked by a catastrophic event known as the stock market crash. Commonly referred to as “Black Tuesday,” this fateful day marked the onset of the Great Depression, a period of unparalleled economic turmoil. In this blog post, we delve into the causes, consequences, and lasting impact of…

View On WordPress

#1929 Market Crash#Black Tuesday#dailyprompt#Financial#Financial Literacy#Great Depression#knowledge#money#Money Fun Facts#Overvalued Stocks#Speculation#The Stock Market Crash of 1929: Unveiling the Precursor to the Great Depression#US Markets

1 note

·

View note

Text

Is Aris Water Solutions Overvalued? Essential Insights Before You Invest

Explore Aris Water Solutions Inc.'s stock price forecasting. Learn why waiting for a price correction is crucial before investing. #ArisWaterSolutions #ARIS #stockpriceforecasting #growthpotential #investmentstrategy #overvaluedstock #dividendpolicy

Aris Water Solutions Inc is an independent, growth-oriented company headquartered in Houston, Texas. They specialize in developing and operating produced water infrastructure and recycling for the largest operators in the Permian Basin. Their mission is to build sustainable, long-term growth and value through integrated produced water infrastructure systems. This includes high-capacity gathering,…

#ARIS#Aris Water Solutions Inc#Dividend policy#Financial performance#Growth potential#Investment#Investment Insights#Investment strategy#Market Trends#Overvalued stock#Permian Basin#Price correction#Stock Forecast#Stock Insights#Stock price forecasting

0 notes

Text

How Much Money is the Norfolk Southern (NSC) making?

The Norfolk Southern (NSC) has become the most hated company in America because of the East Palestine catastrophe. A Norfolk Southern train derailed in East Palestine, Ohio, on 3 February 2023. The derailment released enormous amounts of toxic chemicals. News reports claim the chemicals are contaminating water, killing wildlife, fish, pets, and livestock, and creating possible health problems…

View On WordPress

#How Much Debt and Value does Northern Southern (NSC) have?#How Much Money is the Norfolk Southern (NSC) making?#Is Norfolk Southern (NSC) Making Money?#Norfolk Southern (NSC)#Norfolk Southern Corporation (NYSE: NSC)#Norfolk Southern is a lousy Stock#Norfolk Southern is an overvalued stock#Norfolk Southern’s Reputation is Suffering#What is the Norfolk Southern (NSC)?

0 notes

Text

How Does 37% Sound?

Image: The Schwab U.S. Large Cap Growth ETF (SCHG) is up more than 37% so far in 2024.

By Brian Nelson, CFA

How does 37% sound? That was the price-only performance of the Schwab U.S. Large Cap Growth ETF (SCHG) thus far in 2024. Over the preceding 5-year period, the SCHG is up over 140%.

For years, I have pounded the table on the theory that there are not value or growth stocks, but rather undervalued, fairly valued, or overvalued stocks. It’s why many growth stocks can be undervalued. It’s the Theory of Universal Valuation found in Value Trap that ties myriad areas of finance to the well-known discounted cash-flow [DCF] model. Growth is a component of value. Hook, line, and sinker.

For years, I have been pounding the table on large cap growth as my favorite area for idea generation (given its Valuentum stock tendencies), and I have put my money where my mouth is, too, with a meaningful portion of my net worth in SCHG. You’ll find that a lot of the top holdings in SCHG are top considerations in the Best Ideas Newsletter portfolio, too, so there’s some good overlap between what I consider Valuentum stocks and where I’m putting my money.

But why don’t I actually own all the stocks I like? It’s the question I have been asked for more than a decade. Here’s what I wrote back in September 2023. I’m an old school analyst that cut my teeth in this business following the Global Analyst Settlement, meaning I believe that writers should generally not be taking stakes in the individual stocks they write about. Writers with positions in the stocks they write about can lead to biased research, or worse, terrible outcomes.

So what’s the playbook for 2025? You can probably guess that I think large cap growth and big cap tech will continue to lead the markets to new heights. 2024 was a boring year, if a 37% return can be considered boring for large cap growth. Frankly, with the market focusing on macro data and the Fed during 2024, there wasn’t much material to write about. We all already know the story: Inflation is under control, the job market remains healthy, the Fed is cutting, and artificial intelligence will be the name of the game this decade.

I think it’s worth clarifying some of our offerings every now and then, as each one focuses on a unique vertical. For those seeking capital appreciation, the Best Ideas Newsletter portfolio may be of interest. For those seeking dividend growth, the Dividend Growth Newsletter portfolio includes our favorite ideas, while for those seeking high yield, the High Yield Dividend Newsletter may be your cup of tea. Dividend growth focuses on dividend growth potential; high yield focuses on current high yield, and so on and so forth.

The Exclusive publication is one of my favorite publications, where we highlight an income idea, a capital appreciation idea and a short idea consideration each month. You can read more about the Exclusive publication here. As of the date of the release of the December edition of the Exclusive publication, success rates for Capital Appreciation Ideas were 90.1%, while success rates for Short Idea Considerations were 88.1%. If you haven’t yet tried out the Exclusive, please do so.

Okay – so what about dividends? Unfortunately, I think we’re in for another difficult year for dividend growth investing. The SPDR S&P Dividend ETF (SDY) is only up 6% year-to-date, trailing both the equal-weight and market-cap weighted S&P 500 indices by sizable margins. With the 10-year Treasury yield at 4.6% and certificate-of-deposit rates still elevated, dividend-only-focused investors will likely continue to trail the broader markets. Remember: dividends are capital appreciation that otherwise would have been achieved, so don’t let the dividend tail wag the total return dog.

What about Bitcoin? I really don’t know. It’s definitely a greater fool asset like gold, but I have totally underestimated the number of fools there are these days. Haha. Just kidding, but seriously, with the regulatory environment easing with respect to crypto and with President-elect Donald Trump supporting crypto assets, who really knows how high Bitcoin can get or just how volatile the asset may become as institutional money ebbs and flows.

So what about small cap value? Well, year-to-date, the iShares Russell 2000 Value ETF (IWN) is up a meager 6%, and it is up just 28% over the past 5 years, trailing large cap growth considerably. With a near 30% weighting in financials and 10% weighting in real estate in the IWN, for me, it’s a no-brainer to avoid. The only way I believe the gap between large cap growth and small cap value narrows is if large cap growth falls on difficult times, which can never be ruled out. But that said, there’s no reason to believe in the IWN, no matter what the statisticians say about quantitative value. I tackle the issue of the pitfalls of falling in love with historical data in Value Trap, too.

All things considered, 2024 was an absolutely amazing year for our core research exposure (i.e. large cap growth). Do I think the SCHG will repeat its dazzling performance in 2025? Probably not to the same extent, but it’s hard to bet against some of the strongest net-cash-rich, free-cash-flow generating powerhouses on the market today. Give me Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG) any day of the week, especially over any financials-heavy index. Enjoy the rest of 2024 folks!

Leave a comment >>

----------

The High Yield Dividend Newsletter, Best Ideas Newsletter, Dividend Growth Newsletter, Valuentum Exclusive publication, ESG Newsletter, and any reports, data and content found on this website are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of its newsletters, reports, commentary, data or publications and accepts no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a registered investment advisor, and does not offer brokerage or investment banking services. The sources of the data used on this website and reports are believed by Valuentum to be reliable, but the data’s accuracy, completeness or interpretation cannot be guaranteed. Valuentum, its employees, and independent contractors may have long, short or derivative positions in the securities mentioned on this website. The High Yield Dividend Newsletter portfolio, ESG Newsletter portfolio, Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are not real money portfolios. Performance, including that in the Valuentum Exclusive publication and additional options commentary feature, is hypothetical and does not represent actual trading. Actual results may differ from simulated information, results, or performance being presented. For more information about Valuentum and the products and services it offers, please contact us at [email protected].

69 notes

·

View notes

Quote

U.S. tech stocks are plummeting as China looks to be exposing American companies involved in AI as wildly overvalued. It’s a predictable consequence of how the American government has approached Silicon Valley and vice versa. This isn’t the kind of thing we normally cover, but we don’t quite trust the U.S. media to tell this story accurately.

DeepSeek just proved Lina Khan right

18 notes

·

View notes

Text

What Boeing did to all the guys who remember how to build a plane

by Maureen Tkacik

March 28, 2024

https://prospect.org/infrastructure/transportation/2024-03-28-suicide-mission-boeing/

John Barnett had one of those bosses who seemed to spend most of his waking hours scheming to inflict humiliation upon him. He mocked him in weekly meetings whenever he dared contribute a thought, assigned a fellow manager to spy on him and spread rumors that he did not play nicely with others, and disciplined him for things like “using email to communicate” and pushing for flaws he found on planes to be fixed.

“John is very knowledgeable almost to a fault, as it gets in the way at times when issues arise,” the boss wrote in one of his withering performance reviews, downgrading Barnett’s rating from a 40 all the way to a 15 in an assessment that cast the 26-year quality manager, who was known as “Swampy” for his easy Louisiana drawl, as an anal-retentive prick whose pedantry was antagonizing his colleagues. The truth, by contrast, was self-evident to anyone who spent five minutes in his presence: John Barnett, who raced cars in his spare time and seemed “high on life” according to one former colleague, was a “great, fun boss that loved Boeing and was willing to share his knowledge with everyone,” as one of his former quality technicians would later recall.

More from Maureen Tkacik

But Swampy was mired in an institution that was in a perpetual state of unlearning all the lessons it had absorbed over a 90-year ascent to the pinnacle of global manufacturing. Like most neoliberal institutions, Boeing had come under the spell of a seductive new theory of “knowledge” that essentially reduced the whole concept to a combination of intellectual property, trade secrets, and data, discarding “thought” and “understanding” and “complex reasoning” possessed by a skilled and experienced workforce as essentially not worth the increased health care costs. CEO Jim McNerney, who joined Boeing in 2005, had last helmed 3M, where management as he saw it had “overvalued experience and undervalued leadership” before he purged the veterans into early retirement.

“Prince Jim”—as some long-timers used to call him—repeatedly invoked a slur for longtime engineers and skilled machinists in the obligatory vanity “leadership” book he co-wrote. Those who cared too much about the integrity of the planes and not enough about the stock price were “phenomenally talented assholes,” and he encouraged his deputies to ostracize them into leaving the company. He initially refused to let nearly any of these talented assholes work on the 787 Dreamliner, instead outsourcing the vast majority of the development and engineering design of the brand-new, revolutionary wide-body jet to suppliers, many of which lacked engineering departments. The plan would save money while busting unions, a win-win, he promised investors. Instead, McNerney’s plan burned some $50 billion in excess of its budget and went three and a half years behind schedule.

Swampy belonged to one of the cleanup crews that Boeing detailed to McNerney’s disaster area. The supplier to which Boeing had outsourced part of the 787 fuselage had in turn outsourced the design to an Israeli firm that had botched the job, leaving the supplier strapped for cash in the midst of a global credit crunch. Boeing would have to bail out—and buy out—the private equity firm that controlled the supplier. In 2009, Boeing began recruiting managers from Washington state to move east to the supplier’s non-union plant in Charleston, South Carolina, to train the workforce to properly put together a plane.

39 notes

·

View notes

Text

Genshin ships: stock market update (Fontaine Act 3–4)

(Warning: May contain spoilers for character appearances and dynamics in [Chapter 4 Act 3–4] To the Stars Shining in the Depths and Cataclysm's Quickening. Previously: Act 1)

The Fontainian market is gaining liquidity as of early v4.1. Volatility has settled for Fontainian blue-chips Neuvechi and Clorivia(*), with the expectation of steady returns. Our recommendation: BUY/HOLD

Wriothesley/Neuvillette is expected to join the blue-chips, though the market is yet to come to a consensus here. BUY

Wriothesley/Traveller is, like most Traveller ships, a safe bet. HOLD

Unexpected reports of shy Lyney moments have caused modest gains in Lyney/Traveller. BUY OR HOLD

Likewise, Lynette/Traveller is having a very delayed boom thanks to additional solo interaction. ("Almost half a minute's worth," claimed one report.) HOLD OR BUY

Arlecchino/Furina is in the prototype phase. The extremely imbalanced power dynamic makes this somewhat contentious. Our analysts' conclusions include: "The Knave totally would" and "The Knave totally wouldn't" and "You're both wrong". Analysts all agree that Furina's opinion is irrelevant here. BUY OR SELL OR HOLD we have no idea, consult your financial advisor.

Rarepairs

The small-cap market, aka "rarepairs", is hard to predict as always.

Marette/Madeleine — SELL OR HOLD. Our analysts want it to be a thing but note that Marette really is 100% idgaf about everything.

Cuistot/Laverune — BUY OR HOLD duh.

Jurieu/Lourvine — unconvincing. If anything, they're exes, with a full lovers-to-enemies offscreen. SELL. Well, unless you specifically mean smut, in which case BUY.

Wriothesley/Clorinde has good camaraderie but market testing warns it lacks sufficient chemistry. HOLD.

(If going long anyway, make sure to hedge with some platonic content involving "dorky colleagues" and "tea parties". Include Siegwinne where applicable.)

Wriothesley/Ningguang — a weak BUY, appropriately diversified.

This one has legs. Two pairs, even. Our analysts note that "nobody, repeat, nobody, is going to write an epistolary macroeconomics treatise + romance fic for those two. Yes, it's technically possible, but no way." Our analysts are cowards.

(Also, I'm calling it, those two are bait for the Glowfic community, don't @ me)

Furina/Lynette — oh, because they both find stray cats heartwarming? Sure, why not. HOLD

simultaneous Lyney/Traveller + Traveller/Lynette — SELL, good fundamentals but overvalued at current prices.

Returns contingent on suspending disbelief of the twins risking their relationship over a shared crush. Not to mention Traveller spent most of Act 3 half-expecting those two to stab them in the back :(

Charlotte/truth — abstract concept ships are inherently crackships, and rarely meet revenue projections. Still, this one is absolutely true, and continually supported every time she appears on screen, so HOLD

Arlelumi — Latest reports suggest something major is in the works, but what exactly remains to be seen. HOLD OR BUY

Siegwinne/gun — !??!?!??!??!? BUY BUY BUY but in moderation BUY BUY BUY

no but seriously I'd give even odds she beats Clorinde in a pistol duel

-----

And, unrelated to the AQ:

Chevreuse — Who?

Jakob/Alain and Jakob/Rene — BUY. May take years to find a target audience but the essentials are there.

Lyris/Egeria — YOU DO YOU. wait was that a pun

(*) Clorivia paid out a small but unexpected dividend. Our analysts remind readers not to expect any serious focus on the pairing in Act 5.

Future returns may differ from past returns. This column is not financial advice. Consult a financial shipping advisor about what ships are appropriate for your situation.

#genshin impact#fontaine#genshin ship market update#to the stars shining in the depths#cataclysm's quickening#silly headcanons#doylist shipping#shitpost

35 notes

·

View notes

Text

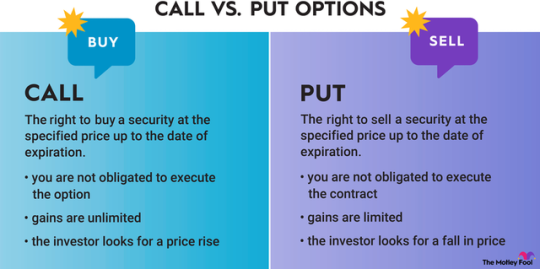

Call vs. Put Options

This guide will give you a complete rundown of call options and put options.

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date.

That's the short summary of these options contracts. Now, let's take a closer look at how call and put options work, as well as the risks involved with options trading.

How does a call option work?

A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known as the strike price, at any point until the contract's expiration date.

You're not obligated to execute the option. If the price of the stock increases enough, then you can execute it or sell the contract itself for a profit. If it doesn't, then you can let the contract expire and only lose the premium you paid.

The breakeven point on a call option is the sum of the strike price and the premium. When you have a call option, you can calculate your profit or loss at any point by subtracting the current price from the breakeven point.

As an example, let's say that you're bullish on Apple (AAPL -0.54%) and it's trading at $150 per share. You buy a call option with a strike price of $170 and an expiration date six months from now. The call option costs you a premium of $15 per share. Since options contracts cover 100 shares, the total cost would be $1,500.

The breakeven point would be $185 since that's the sum of the $170 strike price and the $15 premium. If Apple reaches a price of $195, your profit would be $10 per share, which is $1,000 total. If it only goes to $175, you'd have a loss of $10 per share. Your maximum potential loss would be the $1,500 you paid for the premium.

How does a put option work?

A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to execute the contract at any point until its expiration date.

If the price of the stock decreases enough, then you can sell your put option for a profit. You're not obligated to execute the contract, so if the price of the asset doesn't drop enough, you can let the contract expire.

The breakeven point on a put option is the difference between the strike price and the premium. When you have a put option, you can calculate your profit or loss at any point by subtracting the breakeven point from the current price, or by using the calculator at the bottom of this page.

To give you an example, imagine Netflix (NFLX -0.51%) trades at $500 per share. You think it's overvalued, so you buy a put option with a strike price of $450 and an expiration date three months away. The premium costs $10 per share, which is a total price of $1,000 for the contract.

The breakeven point would be $440, the difference between the $450 strike price and the $10 premium. If Netflix plummets to $400, then you're up $40 per share ($4,000 total) on your put option. If it doesn't drop below $450 at all, then you'd only be able to let the option expire and eat the cost of the premium.

Risks of call vs. put options

The risk of buying both call and put options is that they expire worthless because the stock doesn't reach the breakeven point. In that case, you lose the amount you paid for the premium.

It's also possible to sell call and put options, which means another party would pay you a premium for an options contract. Selling calls and puts is much riskier than buying them because it carries greater potential losses. If the stock price passes the breakeven point and the buyer executes the option, then you're responsible for fulfilling the contract.

The benefit of buying options is that you know from the beginning the maximum amount you can lose. This makes options safer than other types of leveraged instruments such as futures contracts.

However, options can be riskier than simply buying and selling stocks because there's a greater possibility of coming away with nothing. When investing in stocks, you only need to predict whether the stock goes up or down. For options trading, you need to predict three things correctly:

The direction the stock will move.

The amount the stock will move.

The time period of the stock movement.

If you're wrong about any of those, then the options contract will be worthless. While there's the potential for greater returns with options, they're also harder to trade successfully.

Despite the challenge of successfully trading call and put options, they provide an opportunity to amplify your returns. That can make them a valuable addition to a balanced portfolio. For investors interested in options, there are also more advanced strategies that go beyond buying calls and puts.

#kemetic dreams#call option#options#put options#money#stocks#stock market#markets#investing stocks#stock trading#nasdaq#balanced portfolio#money talk

13 notes

·

View notes

Text

Stocks are on track to end 2024 on a high note.

The S&P is up nearly 30% so far, having hit new record highs all throughout the year.

Will the party continue into the New Year?

Or will 2025 be a less enjoyable one for investors?

To find out, we're fortunate today to talk with money manager Michael Pento, president of Pento Portfolio Strategies.

He maintains a 20-point model that guides his portfolio allocation. And today we'll hear what it's advising him to do right now.

The punchline?

Stocks have the momentum to run higher here in the short term. But when the rally peters out, they will be dangerously overvalued.

To hear how Michael is positioning his clients for what lies ahead, click here or on the video below:

2 notes

·

View notes

Text

My understanding of stocks, which could be wrong, is that a stock being overvalued can last for a long time, but will eventually drop if the company doesn't actually perform well at business.

Making the trick with tech companies and over-hyped start ups knowing when that shoe's about to drop (and, I suppose, knowing that the shoe is going to drop at all).

5 notes

·

View notes

Text

Also lmao going from 'well, I'm skeptical too, but surely it's possible?' to 'how can a stock be overvalued anyways, don't you know the EMH?' is very funny. Are you a skeptic or not? No, you're right, there is zero possibility that a 90+ P/E ratio might be a touch high

2 notes

·

View notes

Text

Eh mental health is annoying. Buying & cooking cheap low-FODMAP diet is annoying. My best top note for now is I'm using this blog to practice writing. I need more practice in it. I only know business, accounting & economics stuff. Its stupid stuff. Theres too much actual fraud everywhere that its annoying

Also I use mobile so formatting sucks cause Nvidia GPUs, or Arch dont like tumblr site. Or tumblr site dont like tumbkr site

Also also I 100,000% support all my fellow ones-and-zeros and their identity. Everyone is welcome here.

Except transphobes/zionist/long list of others but you get it. I'll help harrass any of those types endlessly if someone wants to tag me, and bring me in on an argument like that friend you call for backup with fights

Im unhinged so who's to say exactly what will end up here but this is also a completely public blog to me friends, family, hell, even acquaintances i dont give a fuc.

Blog should be expected to be roughly as child-friendly as simpsons or bobs burgers. But also boring like a civics/economics lesson sometimes. Yay

--------

I (and my husband) am ex mormon. Its a weird thing. Look into it if you havent recently. Realllllyyyy look into. Takes time to figure it all out in this fuckin fucked up world.

I just moved a year ago. Didnt watch the US stock market as much as I normally do. Had my first snowstorm 10 weeks ago, that was.. fun to handle while ill prepared. About 6 weeks ago I was hopping back on the market and notice its a huge tech bubble about to pop and all the conditions Ive been warned about my whole career imply this is not good. Just took a little more thinking & digging and I'm a little too confident to stop talking about it now.

(Oh I'm also care-free as fuc so I dont really read or desire to change past posts more than lil-nitpicks. More informative for the reader & myself-in-the-future-reading that way)

And I'm not kidding I do love feedback & questions. Its a very public blog tho so I get that part for sure.

If you search "life story" in my tags I had that pinned for a min Im just moving shit around rn

Being poor sucks. Will write more on that later.

---------------

First of all-- the exact timeline of an "economic shock" is literal insanity. Dont worry about the exact timing of any of this-- just know its doomed to happen soon.

Here are some effects I predict of this upcoming economic downturn

If anyone comes across any sources for these events that support my arguments please feel free to add in comments, reblogs, etc.

This concise list is mainly for my own reference, but it would be great to add to it if any one has something to add!

0.5. US Stock market collapse-- I have no desire to try and predict this one exactly. Too many conspiracies are actually correct about this big guy. Lets just say 7 US Tech stocks are worth 25% of the entire worlds market, roughly. "Too big to fail"-- I believe is the phrase

1. Corporate (slightly later will be residential by extension) real estate crisis: currently way too overvalued. Most of the houses, land, & urban corporate property we see could stand to decrease by about 60-90% from its current price.

2. Bankruptcy crisis: similar to the after-effects of the 70s inflation-- we can expect to see a huge wave of bankruptcies affecting a variety of business: from the micro-self employed; to the small business with leased buildings; to the largest corporations who commit massive accounting fraud & hope to escape accountability in time

3. Bank runs-- there is an extremely high overreliance on the Federal Reserve, who does not have good control over this situation. Once it becomes clear that there is a crisis (we call this a catalyst event)-- bank runs for physical cash are a surety. Hard to say how long a crisis like this might last. I should ask my siblings who lived near the SVB bank crisis hotspot (but those were rich fucks they do their "bank runs" over the phone)

3.5. Global currency collapse, which takes effect in every single local, state, & national economy at slightly different times. This means prices lower. Much lower. But takes time

4. Whatever the fuck the geopolitics is gonna do???. Its weird. You got Russia wanting to invade Europe? (Look at global economic forum 2024) Trump wants to let them. Biden wants to be an establishment corporate ass. North Korea has changed its #1 public enemy to South Korea (dont remember my source but it was a couple months ago). USA is stationing more troops in Taiwan, but probably only because of semiconductor technology?

The scope of our global financial woes are larger than can be explained in any of our lifetimes. Its much, much closer to pre-revolution France or the late 1920s. Big change is coming. Itll be soon

5. More to come

#anti capitalism#economics#geopolitics#real estate#bankruptcy#banks#corporate fucks#pinned post#mental health sucks ball sacks#arch linux#nvidia is a scam bubble like enron#simpsons#bobs burgers#intro post#will change it more later

7 notes

·

View notes

Text

Is DXP Enterprises Stock Overvalued? Discover the Investment Opportunity

Explore DXP Enterprises Inc. 's strong growth potential. Learn why investors should wait for a price correction before buying shares. #DXPEnterprises #DXPE #stockpriceforecasting #growthpotential #investmentopportunity #stockmarketanalysis #overvaluestock

DXP Enterprises Inc is a publicly traded professional distribution management company. They provide products and services to various industries through their Innovative Pumping Solutions (IPS), Supply Chain Services, and Maintenance, Repair, Operating, and Production (MROP) Products and Services. Their specialties include bearings and power transmission, industrial supplies, rotating equipment,…

#Dividend policy#DXP Enterprises Inc#DXPE#Financial performance#Growth potential#Investment#Investment Insights#Investment opportunity#Overvalued stock#Price correction#Reinvestment strategy#Stock Forecast#Stock Insights#Stock market analysis#Stock price forecasting

0 notes

Text

The Pentagon is weighing whether to tap into the last remaining source of funding it has for military aid to support Ukraine’s war effort against Russia even without guarantees that those funds will be replenished by Congress, multiple defense officials told CNN.

The Defense Department still has around $4 billion in presidential drawdown authority funds available for Ukraine, which allows the Pentagon to draw from its own stockpiles to send military equipment to Kyiv.

But the Pentagon had previously been reluctant to spend any of that remaining money without assurances it would be reimbursed by Congress through the administration’s $60 billion supplemental funding request, because taking from DoD stockpiles with no plan to replenish that equipment could impact US military readiness.

But with Ukraine growing increasingly desperate for US military aid and Republican leadership in the House refusing to hold a vote on providing more funding, senior defense officials are discussing whether there is any financial cushion internally that would allow the department to spend at least part of that remaining $4 billion to help Ukraine fight Russia.

No decisions have been made yet, officials emphasized. But the conversations about that option and other potential plan Bs have become increasingly urgent over the last several weeks as the situation on the battlefield in Ukraine has become more dire, the officials said.

Ukrainian troops have been forced to ration ammunition and have lost some ground in the east, including the key city of Avdiivka, which fell to the Russians earlier this month.

Asked about the possibility of tapping into the remaining $4 billion, Defense Department spokesman Lt. Col. Garron Garn said in a statement, “The DoD continues to urge Congress to pass a supplemental to support Ukraine in its time of need and to replenish our stocks.”

Officials said the department could go ahead and spend part of that $4 billion even without finding money internally that could be used to replenish it. But it would not be unprecedented for the Pentagon to find additional, unexpected sources of funding.

Last year, the Defense Department announced that it had discovered an accounting error that led to DoD overvaluing the amount of aid it was providing to Ukraine by $6.2 billion. That extra money provided a cushion to the department that allowed it to draw out military assistance to Ukraine for longer than anticipated, CNN previously reported.

Asked on Tuesday whether the department was considering spending some of the remaining money, Pentagon press secretary Gen. Patrick Ryder said he had nothing to announce but that the Pentagon was continuing to explore ways to keep supporting Ukraine.

“We’re going to continue to look at ways that we can support Ukraine in their fight for freedom and to preserve their sovereignty,” Ryder said.

Last month, however, Ryder spoke about some of the concerns the department had in tapping into those funds.

“At issue here again is the question of impacting our own readiness, as a nation, and the responsibilities that we have,” he said last month when asked about the money. “And so, yes, while we do have that $4.2 billion in authority, we don’t have the funds available to us to replenish those stocks should we expend that. And with no timeline in sight, we have to make those hard decisions.”

A separate defense official told CNN that the next aid package to Ukraine, if it comes, “will absolutely include critical munitions.” There are also discussions about how and where to preposition military equipment so that it can be sent as quickly as possible to Ukraine once additional funding sources are identified, the official said.

The last Ukraine security package, worth up to $250 million, was announced on December 27. Some weapons and equipment from previous drawdown packages and Ukraine Security Assistance Initiative (USAI) packages are still flowing into Ukraine, but the US has not announced any new packages since then.

Ukrainian President Volodymyr Zelensky told CNN this week that Ukraine will not win the war without continued US support.

“People will be prepared, but ammunition will not be prepared and brigades will not be ready… not only for our counter-offensive, they will not be ready to defend, to stay strong. It will be very difficult,” he said.

8 notes

·

View notes