#Outsourced Sales Tax Services

Explore tagged Tumblr posts

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

In the competitive landscape of Delhi NCR, finding the right talent for non-IT roles can be a daunting task. This is where Job24by7 Recruitment Consultancy Services steps in as your trusted partner. Specializing in non-IT recruitment, we connect businesses with skilled professionals across industries like construction, HVAC, MEP, sales, and engineering.

Our tailored approach ensures that every candidate not only meets technical requirements but also aligns with your company's values and culture. With access to a vast talent pool and industry-specific expertise, we streamline the hiring process—saving you time, effort, and cost.

From sourcing to onboarding, Job24by7 handles it all, offering flexible recruitment solutions that cater to single-project needs or long-term staffing. Our insights into market trends and salary benchmarks give businesses a competitive edge in attracting top-tier talent.

Partner with Job24by7 Recruitment Consultancy Services and experience the difference in quality, speed, and precision in non-IT hiring across Delhi NCR. Visit Job24by7.com today to explore opportunities and find your perfect match!

#it recruitment#it recruitment services#recruiters#it recruitment agency#recruitment#recruitment process outsourcing#mep consultants#electrical#mep engineer#tax accountant#accountant jim#online accountant#sales#tumblr milestone#artists on tumblr

0 notes

Text

Sales tax is the cost of doing business in the United States. Every time you make a sale, you're required to pay taxes on that income. You can become compliant with sales tax regulations by utilizing our services. We provide businesses with the peace of mind that comes from knowing they are staying within compliance regulations. Here are some of the benefits you'll enjoy when you partner with us for your sales tax needs. For more information visit Glocal Accounting .

0 notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing finances efficiently is the backbone of any successful business. Whether you are a startup, a small business, or a large enterprise, having a proper bookkeeping system in place is essential to ensure financial health and compliance with tax regulations. If you are looking for bookkeeping services in Delhi, SC Bhagat & Co. is a trusted partner to help streamline your financial records.

Why Bookkeeping is Essential for Your Business Bookkeeping involves the systematic recording, organizing, and tracking of all financial transactions made by a business. It provides a clear view of your business's financial status, helping you make informed decisions. Effective bookkeeping helps in:

Financial Analysis: By maintaining up-to-date financial records, businesses can regularly assess their financial health. Tax Compliance: Proper bookkeeping ensures all financial documents are in order for accurate and timely tax filing. Cash Flow Management: Tracking cash flow helps in maintaining sufficient funds for daily operations. Budgeting: It provides accurate data for future budgeting, reducing financial risks. Benefits of Outsourcing Bookkeeping Services Outsourcing bookkeeping tasks to professionals like SC Bhagat & Co. brings numerous benefits:

Cost Savings: You eliminate the need for an in-house accounting team, which saves on salaries, office space, and other resources. Accuracy: Professional bookkeepers have the experience and tools to ensure accuracy in your financial records. Time Efficiency: Outsourcing allows you to focus on core business activities while the experts handle your books. Compliance and Expertise: SC Bhagat & Co. ensures that your business complies with all financial and tax regulations, helping you avoid penalties. SC Bhagat & Co. – Your Reliable Bookkeeping Partner SC Bhagat & Co. is a renowned firm in Delhi offering comprehensive bookkeeping services. With years of experience, they cater to businesses across various industries. Here’s why SC Bhagat & Co. stands out:

Customized Solutions: They understand that every business has unique needs and provide tailored bookkeeping services. Expert Team: Their team of certified professionals is well-versed in the latest accounting software and bookkeeping practices. Accuracy and Timeliness: They ensure that all financial records are accurate and delivered on time, helping you stay ahead in your financial management. Confidentiality: The firm maintains high levels of data security to ensure your sensitive financial information is protected. Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a wide range of bookkeeping and accounting services, including:

Daily Transaction Recording: Keeping track of daily sales, purchases, payments, and receipts. Bank Reconciliation: Ensuring that your bank statements match your business's financial records. Expense Tracking: Managing all expenses to help reduce overheads and increase profits. Financial Reporting: Providing comprehensive financial reports, including balance sheets, income statements, and cash flow statements. Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filings. Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi? SC Bhagat & Co. is a reliable name for bookkeeping services in Delhi, offering a combination of expertise, experience, and excellent customer service. By choosing them, you ensure:

Accurate and Timely Reports Comprehensive Bookkeeping Solutions Cost-effective Services Compliance with Latest Financial Regulations Final Thoughts Keeping accurate financial records is critical for the success and growth of your business. By outsourcing your bookkeeping services in Delhi to SC Bhagat & Co., you not only ensure compliance and accuracy but also gain access to expert advice, allowing you to focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

EMS and ODM, Global Market Size Forecast, Top 8 Players Rank and Market Share

EMS and ODM Market Summary

Electronics manufacturing services (EMS) is a term used for companies that test, manufacture, distribute, and provide return/repair services for electronic components and assemblies for original equipment manufacturers (OEMs).

The concept is also referred to as electronics contract manufacturing (ECM).

An original design manufacturer (ODM) is a company that designs and manufactures a product as specified and eventually rebranded by another firm for sale. Such companies allow the firm that owns or licenses the Company to produce products (either as a supplement or solely) without having to engage in the organization or running of a factory.

According to the new market research report “Global EMS and ODM Market Report 2023-2029”, published by QYResearch, the global EMS and ODM market size is projected to reach USD 855210 million by 2029, at a CAGR of 4.1% during the forecast period.

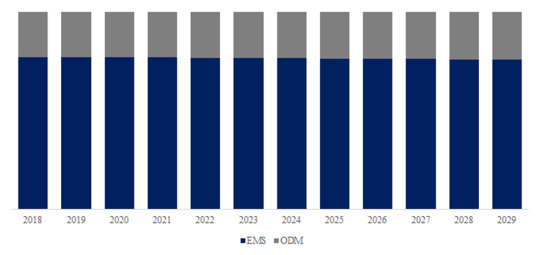

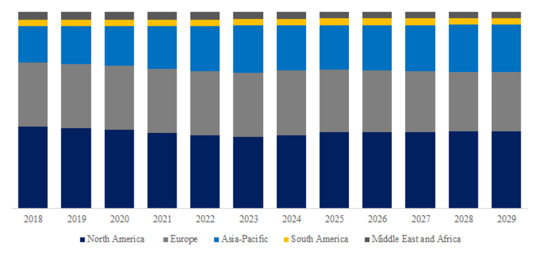

Figure. Global EMS and ODM Market Size (US$ Million), 2018-2029

Based on or includes research from QYResearch: Global EMS and ODM Market Report 2023-2029.

Market Trends:

In a short period of time, markets and consumers’ behaviours have undergone drastic changes due to the outbreak of the coronavirus (COVID-19). From people raiding grocery store aisles to the cancelation of the world’s most significant events and mandates for “non-essential” businesses to temporarily close, this pandemic is having a substantial impact on the economy and society as we knew it.

1. Despite all of the negatives that have come from the COVID-19 pandemic, it has led to several positive outcomes. For example if your product or service can be marketed to coronavirus patients, it is most likely doing well. With the development of the epidemic, there will still be considerable development in the medical industry in 2021.

2. Most of the traditional EMS centres in Southeast Asia will see above trend growth from 2021 – 2025 in response to both trade tensions, and real and perceived excess concentration of manufacturing in China by some leading western OEMs.

3. Over the next 5 years, a number of low-cost Asian countries will see new investments in their nascent tech manufacturing industries. This likely includes Laos, Cambodia, Myanmar, and Bangladesh. Much of this investment will be based on the size of existing labor force, as well as growth rates of the labor force and the burgeoning local consumer markets. EMS and ODM companies from Foxconn to Flex realize that these large investments in new manufacturing centers often take 15 years or more before they really become a competitive force at meaningful scale.

4. A new breed of mid-sized, China based/China only EMS providers will find their wings and expand outside of China to compete with larger multi-national EMS providers from Taiwan and the US.

Market Drivers:

The key driver for the electronics contract manufacturing industry (EMS and ODM) is costs.

High-volume manufacturing in the form of EMS / ODM can be attracted to countries by offering low-cost labor and availability of components

The critical success factors for an EMS / ODM model able to offer real outsourcing cost reductions and benefits that actually help OEMs reduce costs and save money, include:

Low cost geographic destinations

Component costs

Intellectual property (IP) protection

Government tax incentives

Figure. EMS and ODM, Global Market Size, Ranking of Major Manufacturers 2022

Based on or includes research from QYResearch: Global EMS and ODM Market Report 2023-2029.

The global key manufacturers of EMS and ODM include HONHAI, Compal, Pegatron, Quanta, Jabil, Flextronics, Luxshare, Wistron, Inventec, BYD Electronics, etc. In 2022, the share of top 5 players exceeds 52.68%.

Figure. EMS and ODM, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global EMS and ODM Market Report 2023-2029.

In 2022, EMS accounted US$ 493771 million in the global EMS and ODM market. And this type segment is poised to reach US$ 646661 million by 2029.

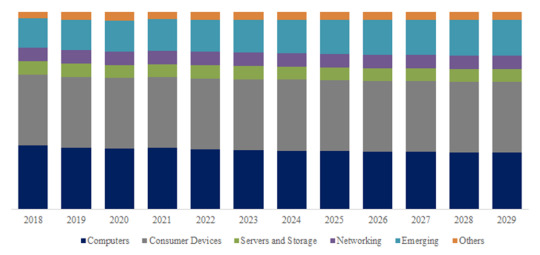

Figure. EMS and ODM, Global Market Size, Split by Application Segment

Based on or includes research from QYResearch: Global EMS and ODM Market Report 2023-2029.

In 2022, Consumer Devices accounted US$ 231053 million in the global EMS and ODM market, share the largest. And this type segment is poised to reach US$ 306990 million by 2029.

Figure. EMS and ODM, Global Market Size, Split by Region

Based on or includes research from QYResearch: Global EMS and ODM Market Report 2023-2029.

In EMS and ODM market, North America occupies an important share, with a market share of 36% in 2022, and the market size is expected to reach US$ 191775 million by 2029.

About The Authors

ShiYuanyuan - Lead Author

Email: [email protected]

Shi Yuanyuan is a senior technology and market analyst, specializing in chemical industry, agriculture, consumer goods, etc. Analyst Shi Yuanyuan has 3 years of experience in the chemical industry and consumer goods industry, focusing on APIs, chemical intermediates, household appliances, wearable devices, 3C products, etc. She can provide the development of technical and market reports and also participate in custom projects.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

3 notes

·

View notes

Text

Sunflower Community Centre

Sunflower Centre: What they do --- what the social centre provides for those within its walls, is the chance to learn and how to adapt. Depending on the age they are; the workers can and will help with any and every day tasks. Below are some of the services the workers provide without any outside help.

Household - for teenagers / young adults

Cleaning with the correct bleaches and chemical solutions.

Laundry / Tumble drying machine usage.

Scheduling their days with various activities and acts they wish to do

Medication Schedules - a lot easier for those with multiple types.

Verbal Communication skills & Written Communication skills.

Technology lessons eg; Computers, Phones, Tablets - anything electronic. ( This also includes Safety on the Internet. )

Taxes and Money Keeping / Saving / Spending tips and tricks.

Mental Illness discussions. ( They can do their best to listen; but to give advice or if asked to bring in help; they are 110% on your side for calling someone in to talk to. )

Interview techniques, CV writing, Job applications, Benefits Applications.

Household - for children

Basics of Math, English and Arts & Crafts

Homework help.

Technology ( Including Safety on the internet. )

Chore help. ( With small reward systems to keep them going. )

Playtime scheduling / Chore scheduling.

Bargaining nap times and sleeping curfews.

Daily Tasks - Outside etiquette

Using bus, train, taxi and/or any other public transport with confidence.

Shopping etiquette, money handling in stores / in public eye, using card instead of cash.

Exercise overall. ( Walks, charity runs, car boot sales. )

Panic attack self-help ( A worker will always be at their side; however, they aren’t going to be forever, so in order to ween them from relying on someone 24/7. The worker will give them ten-fifteen minutes to sit in a café on their own, to shop on their own, and to brave a few minutes of their own time and self. If a panic attack occurs, they are to try and practice methods of breathing, seeking a moment of their self and explaining their condition the best they can without the Worker stepping on in. However, the worker will know instantly if their person is finding it too hard and will step in to help them out instantly. )

Social Anxiety trials ( Walking / shopping / going to eat with their worker in public areas. During, mornings, afternoons and evenings. Attending small social events and leading up to bigger and bolder events. Slowly again weening off the 24/7 worker. )

--- another service the centre provide is a free of charge aid to those who need a professional to come and talk too. the centre is more than happy to bring someone in or recommend someone to visit in a doctors or gp office. all sessions can be within a group or one-to-one, and will be confidential unless you don’t want that. some services are listed below:

With professional help - aka outsourced - for all ages.

Diet balancing - a nutritionist will visit every few months to help with those with either eating disorders, questions and the obese / anorexic.

Understanding the human body. ( Important talks about Puberty and Changes to the body. These talks can be separated by sex and taught by a Male or Female worker, or can be in one group with two teachers. It is wholeheartedly up to the children that want to know what’s going on with their bodies and they can ask questions. These sessions will always have a Doctor on hand, however. )

Street and Online safety talks with Police Officers.

Emergency talks with Fire and Ambulance staff members.

Ambulance staff will also teach them how to help fellow friends in the centre; in any case; slipping in the shower, hitting one's head, an epileptic fit, disassociating �� how to move them into recovery positions, how to keep one's head still, how to check for a pulse - etc etc.

Muses that work here : Julian ( Inherited Owner of SCC ) Shane ( Employee, Qualified Home Nurse ) Noah ( Employee, Front Desk Secretary ) Hanazaki ( Employee, Fitness Group ) Fleur ( Employee, Nursery Teacher ) Toby ( Employee, Nursery Teacher )

7 notes

·

View notes

Text

Start-up Business Tips

Can you detect issues that require bookkeeping services when there are so many business responsibilities and worries? And what are they specifically? Continue reading to learn more!

#1 Inefficient Financial Statements

Frequently, brought by inaccurate financial reporting and inconsistent data, one issue that small business owners deal with is inaccurate financial records. It could make your business appear prosperous when it is actually struggling financially!

Inaccurate financial reporting can have major, expensive risks, including losing investors, financial loss, and fraud risk.

They also make sure to give you a clearer, more complete picture of your company’s financial situation. You can get reasonably priced recordkeeping services in Los Angeles to get precise

#2 Overlooked Efforts

The possibility of making mistakes that cost you a lot of money is high if bookkeeping is not really your area of expertise. Sometimes, it may even take a lot of time and effort to correct!

Being in charge of everything yourself as a business owner may appear easier and more natural. But if you give it too much attention, you might forego other important business opportunities.

Hire The Bookkeepers R Us’s qualified and experienced bookkeepers to complete your books promptly and efficiently instead. Let our trustworthy recordkeepers in LA handle your bookkeeping needs so that you can focus your time and effort on running your business.

#3 Ineffective Cash Flow Management

Tracking your small business’s cash inflows and outflows can be challenging. Particularly if it starts to have an impact on your finances, such as by causing misaligned sales goals, huge loans, and other high expenditures

However, professional bookkeepers make sure that your cash flow is consistently tracked and that the priority is on profitability which boosts cash flow. The greatest solution for poor cash flow management is to outsource the skills of a bookkeeper. It is best to steer clear of recurring financial problems once a positive cash flow has been established!

The Bookkeepers R Us’ financial experts offer fresh ways to maintain your company’s financial stability and make sure your small business has enough ability to cover expenses like operations, renovations, and payroll.

#4 Overlapping Personal and Business Accounts

Combining two accounts might lead to significant losses and financial problems. So this is considered one of the major errors that small business owners make.

Combining personal and business financial accounts has consequences. Where there will be an instance where you may spend your personal funds on business expenses and vice versa.

Generally speaking, being in this kind of financial condition can limit your ability to expand your business to its best potential. Because you will fail to keep proper financial records and be unable to calculate your company’s profit margins with accuracy.

Consider opening a separate business bank account to prevent issues! Employ reputable LA bookkeepers to keep track of your company’s assets and offer you the best financial advice at every turn.

and updated accounting for all daily transactions, which will help you maintain organized financial reports.

#5 Ineffective Utilization of Accounting Software

Selecting the wrong accounting software could result in unwise business choices!

Although technology has made bookkeeping simpler, not all small business owners have the time or the expertise to use accounting software.

Even small businesses must use accounting software, such as various Inventory Management Systems, to operate at their peak efficiency. Why? Because it makes it simple to track spending, manage taxes, create balance sheets, and execute basic invoicing and billing.

4 notes

·

View notes

Text

How to Choose the Right eCommerce Development Partner

The article was initially published in WebMeridian blog.

Nasdaq previously projected that by 2040, 95% of all purchases will be through eCommerce. As the global eCommerce industry continues to grow, businesses are increasingly expected to keep up with the competition by having a strong online presence.

In the digital age, slow websites and poorly-constructed user interfaces can spell disaster for an eCommerce retailer. As people’s attention spans continue to wane, so does the likelihood of them returning to a website if they have had a bad experience. Experts reveal that it only takes a little over three seconds for the average person to abandon a slow webpage — that’s bad news for any eCommerce retailer’s bottom line.

The solution to this problem is simple — hire an eCommerce partner with the right expertise, experience, and skillset to create an amazing online presence that resonates with one’s target audience. An eCommerce partner agency can provide businesses with the necessary expertise and resources to create an online platform that is robust, secure, and suited to their needs.

But how do you find the right eCommerce solution partner? Below, we’ll take a deep dive into the steps to find the best eCommerce partner for your business. Let’s get started.

What Are the Benefits of eCommerce Outsourcing?

Choosing the right eCommerce development agency can help an online business transform its operations by highlighting all the features on its website that are driving engagement and sales.

Here are some of the benefits of outsourcing for eCommerce development:

Access to a Variety of Skills and Specializations

Developing one’s eCommerce website in-house can help businesses initially save on costs but investing in eCommerce outsourcing services can give businesses access to a full suite of resources that are not easily accessible in-house.

Software development partners typically have a wide range of skills and specializations, such as UI/UX (user interface/user experience) design, product photography, web hosting, and content writing — all services necessary for creating a strong online presence.

Better Productivity

Choosing the right eCommerce partner also means one can rely on clearly-defined cost estimates and project delivery timelines. Outsourced eCommerce development teams typically charge by the hour, depending on the size and complexity of an eCommerce development project. This allows for more effective planning and project management, as well as higher productivity.

Scalability and Flexibility

eCommerce solution providers can also help businesses scale their operations up or down quickly and effectively. This means that businesses can easily adjust to the unexpected challenges of the online business landscape, such as sudden spikes in traffic or customizations in product offerings.

Bigger Savings

While outsourcing one’s eCommerce development project by the hour may seem costlier, quite the contrary is true, as an experienced software development partner can provide businesses with cost savings and quality assurance in the long run.

As opposed to paying the salaries of full-time in-house developers, outsourcing helps businesses save on overhead costs such as payroll taxes and benefits — especially if one doesn’t need to have developers on board permanently.

How to Choose the Right eCommerce Development Partner

It’s easy to find eCommerce developers promising stellar results — but finding the right eCommerce partner can help take an online business from good to great. Below are some guidelines to consider when searching for the perfect eCommerce web development partner:

1. Check Out Their Website

The website of an eCommerce agency should reflect their own expertise and experience — if they can’t develop their own website effectively, that’s a red flag. Take some time to explore their online presence and assess how well-developed it is. Check for site speed and get a feel for their design skills, as well as the user experience of their site.

Additionally, visit their blog or resource center to see if it’s up to date. A relevant knowledge center proves that an agency is abreast of the latest trends in the industry and is updated on technological developments in the field.

2. Look at Reviews from Various Sources

Online reviews are essential when assessing an eCommerce solution provider as they give you an honest look at what customers and industry experts think about their services. Reviews can provide great insights into the quality of customer service, project delivery timelines, and product capabilities.

Review websites specifically dedicated to reviewing development services and related products may be helpful for this purpose. Check out sites like Clutch, CrowdReviews, and C2CReview for in-depth, reliable reviews about a potential web development partner.

3. Analyze Their Technical Expertise

Make sure to ask potential software development partners for their portfolio as well as additional case studies or samples of their work. This can help gauge their level of technical expertise, as well as the range of eCommerce solutions they are familiar with.

Additionally, find out what processes and technologies a potential partner is comfortable working with. Check through their portfolio and review the types of eCommerce platforms they build on (WordPress, Shopify, Magento, etc.) — and whether or not these platforms align with your technical requirements.

4. Set a Budget in Advance

Begin negotiations from a position of knowledge. Have a budget in mind, and ensure that it is realistic for the scope of your project. Talk about the project’s total cost of ownership (TOC), which will cover all costs arising from the project including post-production upgrades and maintenance costs.

Having a clear budget and timeline well in advance allows you to adjust expectations accordingly and ensures that everyone is on the same page throughout the development process.

5. Beware of “Yes-Man” Agencies

Finding the right eCommerce agency also means not going with the first agency that promises to deliver on every technical requirement you have with zero questions asked. By nature, an eCommerce developer will have the expertise needed to provide you with salient advice on what can and cannot be done within the time and budget you agreed on.

This means they should be vocal about their opinions and provide constructive feedback to help you develop a better website. If an agency only says yes to everything, it could be a sign of inexperience or lack of knowledge.

6. Revisit their Core Values

An agency’s core values should be in line with your own values and goals. Consider if they are offering the same level of commitment, accountability, and professionalism as you expect from them. If their core values don’t feel like a match, it could be challenging to build a successful and productive working relationship.

7. Pick an eCommerce Partner that Understands Your Business Goals

A proactive eCommerce development agency should take the initiative to understand your business before offering any solutions. This includes assessing where you are now and helping you determine the strategy to get from here to there.

Rarely is eCommerce development ever disconnected from a brand’s larger goals, so if you find that your development agency only treats your project as a one-and-done task, then it’s time to look for a more suitable partner.

A strong eCommerce partner should have a clear understanding of your brand, target audiences, and product offerings in order to provide effective insights into how best to launch or grow your online store.

What to Look For in an eCommerce Development Partner

Finding the right eCommerce development company is easier when you know what to look for in a provider. These include technical expertise, clear communication, realistic pricing, and a shared understanding of your needs.

Here are some things to look out for when searching for the best eCommerce service provider:

Extensive Experience

eCommerce is an ever-changing field, and your chosen eCommerce development team should have a solid track record of success with a wide range of clients and platforms. Look for an agency that:

Has significant technical experience from delivering successful B2B and B2C eCommerce projects across various industries;

Has ideally delivered local and global eCommerce projects using a range of technologies;

Is well-versed in providing effective eCommerce development services — from website design to hosting and integration.

These attributes will ensure that your chosen vendor is capable of delivering meaningful value from their eCommerce development services.

A Proactive Approach

There are few things more frustrating than working with an agency that doesn’t take the initiative to understand your business. You want an eCommerce development team who takes ownership of their own responsibilities and is willing to go the extra mile for you, even if it means taking on additional tasks or offering fresh perspectives.

Ultimately, you want to work with an agency that understands your needs and objectives from the start and is willing to provide the level of planning and support necessary to ensure success.

Excellent Communication Skills

The best eCommerce agencies have excellent communication skills, both written and verbal. They should be able to clearly explain their processes, procedures, and decisions in ways that are easy to understand.

Confusion or miscommunication can quickly lead to a breakdown between client and agency, so make sure to vet the communication skills of any potential eCommerce partner.

Realistic Pricing

While it may be tempting to choose an agency based on cost alone, it’s important to remember that you usually get what you pay for. It’s better to invest in a quality eCommerce development team than settle for a lesser-quality solution that’s cheaper in the short run but will cost you more money and time in the long run.

Make sure to evaluate all of your options before committing to an agency, as this will ensure you receive value for every dollar spent.

Openness to Innovations

Developers should always be open to new ideas and be willing to experiment with the latest technologies. The best eCommerce development teams are always looking for ways to improve their services and provide value to their clients — whether that’s through experimenting with different platforms or integrating innovative features into your existing store.

Complete Transparency

A successful eCommerce partner should be open and honest with their clients throughout the development process. They should provide regular updates on progress and be willing to answer any questions you may have in a timely manner.

Furthermore, they should also offer access to project timelines and other documents so that you can easily track the status of your store.

Responsibility for Results

Related to transparency, a good eCommerce development team should be willing to stand behind their work and take responsibility for any issues that may arise during the course of the project. They should also be open to discussing how they can fix them in order to ensure the best possible outcome.

Customer-First Approach

As previously mentioned, a reliable eCommerce development provider should keep your business goals in mind throughout the entire process. They should have an understanding of your target markets, and use this knowledge to create a user experience that resonates with customers.

This also means giving you expert advice on features you may want added but may not necessarily be the best solution for your business.

Conclusion

Ultimately, finding an effective eCommerce development team or vendor is essential for achieving success in the digital economy. Taking into account all the factors listed above can help you make informed decisions when selecting a provider to work with.

If you’re looking for an experienced and reliable vendor providing e-commerce development services, WebMeridian is here to help! We are a full-service Magento development agency comprised of eCommerce experts and tech professionals dedicated to helping clients build successful online stores.

With years of experience in this field and well-established processes, our team has the skills you need to make your digital store a success. Contact us today to get started!

2 notes

·

View notes

Text

Why Accurate Property Accounting is Crucial for Investors

Property accounting plays a pivotal role in the financial success of real estate investors. Properly tracking the financial performance of investments helps investors make informed decisions and ensures that they are maximizing returns.

For real estate investors, the accuracy of their property accounting is critical not only for day-to-day operations but also for long-term profitability, tax compliance, and investment planning. With the assistance of professional property accounting services, investors can ensure their financial records are managed efficiently, giving them peace of mind and the ability to focus on growing their portfolios.

The Importance of Accurate Property Accounting

At its core, property accounting is about keeping track of all financial transactions related to real estate investments. These include rental income, property expenses, maintenance costs, taxes, and any other financial activities that affect the profitability of an investment property. Whether managing a single unit or a large portfolio, accurate property accounting is essential for several reasons:

Informed Decision-Making: Accurate property accounting allows investors to understand how each property is performing. By tracking income, expenses, and profits, investors can determine which properties are yielding the best returns and which may require more attention or adjustments. Without proper financial tracking, investors may not realize they are losing money on a property until it is too late.

Cash Flow Management: Real estate investments are primarily cash flow-driven, and managing cash flow is essential for covering operational costs, mortgages, and unexpected repairs. Accurate property accounting ensures that investors have a clear view of income and expenses, allowing them to manage cash flow efficiently and avoid liquidity problems.

Tax Compliance and Planning: Real estate investors are subject to a variety of tax obligations, including property taxes, income taxes, and deductions for expenses such as repairs and property management fees. Accurate accounting ensures that all eligible deductions are recorded and that tax filings are correct, avoiding potential penalties or audits. It also helps investors make tax-planning decisions that can minimize their tax liabilities in the future.

How Property Accounting Services Help Investors

For investors managing multiple properties or complex portfolios, keeping up with the demands of property accounting can be overwhelming. This is where professional property accounting services come in. By outsourcing accounting tasks to experts, investors can benefit from:

Expertise and Precision: Property accounting services are staffed with professionals who understand the intricacies of real estate financial management. They ensure that all transactions are properly recorded and that financial statements are accurate, reducing the risk of errors that could affect the overall performance of investments.

Comprehensive Financial Reporting: Property accounting services provide detailed financial reports that break down income and expenses for each property. These reports give investors a clear snapshot of their portfolio’s performance, highlighting areas that need attention. These insights help investors make strategic decisions about property sales, acquisitions, or investments in improvements.

Time Savings: By outsourcing property accounting tasks to professionals, investors can save valuable time that would otherwise be spent on managing paperwork, tracking payments, or reconciling accounts. This time savings allows investors to focus on other areas of their business, such as finding new opportunities or managing tenant relationships.

Scalability and Growth: As investors expand their portfolios, the complexity of property accounting can grow quickly. Property accounting services scale with investors’ needs, ensuring that their accounting processes remain organized and manageable as they acquire more properties. This scalability ensures that accounting remains a reliable tool for managing the portfolio effectively.

Conclusion

Accurate property accounting is a cornerstone of successful real estate investing. By maintaining precise financial records, investors can make informed decisions, improve cash flow, ensure tax compliance, and ultimately increase profitability. For those seeking to streamline their accounting processes and improve the accuracy of their financial records, property accounting services offer invaluable support. With the help of professionals, investors can focus on growing their portfolios, knowing that their financial records are in good hands. Investing in proper property accounting is an investment in long-term success.

0 notes

Text

How to Prepare for an IRS Audit: Tips and Strategies for Business Owners

Facing an IRS audit can be a daunting experience for any business owner. The prospect of combing through financial records, dealing with government agents, and potentially owing additional taxes can be a stressful ordeal. However, with proper preparation and a clear understanding of the audit process, you can navigate the situation with confidence. In this article, we'll explore tips and strategies on how to prepare for an IRS audit, helping you protect your business and ensure a smooth audit process.

Understand the Types of IRS Audits

The first step in preparing for an IRS audit is to understand the various types of audits. The IRS conducts three main types of audits:

a. Correspondence Audit: This is the least intrusive type of audit and is conducted via mail. The IRS will request specific documents or information, and you'll need to respond promptly.

b. Office Audit: An office audit is conducted at an IRS office and is more comprehensive than a correspondence audit. It typically involves a review of specific items on your tax return, and you may be asked to bring supporting documents.

c. Field Audit: This is the most comprehensive and intrusive audit, where an IRS agent visits your place of business. They will examine a wide range of financial records and conduct interviews.

Understanding the type of audit you're facing will help you prepare for the specific requirements and expectations of the IRS.

Organize Your Financial Records

Proper record-keeping is essential for any business, and it becomes crucial when facing an IRS audit. Organize all your financial records, including tax returns, invoices, receipts, bank statements, and any other relevant documents. Make sure these records are complete, accurate, and well-organized. This will save you time and reduce stress during the audit.

Seek Professional Help

Consider hiring a tax professional or a Certified Public Accountant (CPA) experienced in dealing with IRS audits. They can provide valuable guidance, ensure compliance with tax laws, and represent you during the audit. Having a knowledgeable professional by your side can significantly improve your chances of a favorable outcome.

Review and Correct Errors

Before submitting your records to the IRS, carefully review your tax returns for any errors or discrepancies. It's essential to identify and correct any mistakes, as these can trigger further scrutiny. Correcting errors upfront demonstrates your commitment to accuracy and can help mitigate potential penalties.

Maintain Clear Documentation

Ensure that you can support every item on your tax return with clear, organized documentation. The burden of proof lies with you during an audit. Document your expenses, deductions, and income meticulously to substantiate your claims. This may include contracts, receipts, invoices, and financial statements.

Be Prepared to Explain Discrepancies

It's not uncommon for discrepancies to arise during an audit. Be prepared to provide a clear and reasonable explanation for any inconsistencies between your records and the IRS's findings. Honesty and transparency can go a long way in establishing trust with the IRS.

Stay Calm and Professional

Dealing with an IRS audit can be stressful, but it's essential to remain calm and professional throughout the process. Avoid becoming confrontational or emotional with the IRS agent. Maintain a respectful and cooperative demeanor, as this can help the audit progress more smoothly.

Know Your Rights

Business owners have rights during an IRS audit. It's crucial to be aware of these rights, including the right to representation, the right to confidentiality, and the right to appeal an unfavorable decision. Your tax professional can guide you on how to exercise these rights effectively.

Respond to IRS Requests Promptly

If the IRS requests additional information or documentation, respond promptly and within the specified time frame. Failure to do so can lead to further complications and potentially more severe consequences.

Consider a Settlement or Offer in Compromise

In some cases, it may be possible to negotiate a settlement with the IRS or explore an Offer in Compromise (OIC). An OIC allows you to settle your tax debt for less than the full amount owed. While not always an option, it's worth exploring if you're facing a significant tax liability.

Audit Reconsideration and Appeals

If the initial audit results are unfavorable, you have the option to request an audit reconsideration or file an appeal. This gives you a chance to present additional evidence or argue your case before a different IRS authority. Your tax professional can guide you through these processes.

Implement Preventative Measures

Once the audit is complete, take steps to prevent future audits. This includes updating and improving your record-keeping practices, staying informed about tax laws, and seeking advice from tax professionals. By proactively addressing potential issues, you can reduce the risk of future audits.

Stay Informed about Tax Laws

Tax laws and regulations are subject to change. It's essential for business owners to stay informed about any updates or modifications to tax laws that may affect their industry. Regularly consulting with a tax professional can help ensure that you remain compliant with the latest requirements.

Consider an IRS Audit Insurance Policy

Some insurance companies offer audit insurance policies that can help cover the costs associated with an IRS audit. While not a guarantee against audits, having such a policy in place can provide financial protection in case an audit does occur.

Maintain Open Communication with the IRS

Throughout the audit process, maintain open communication with the IRS agent or auditor. If you have concerns or questions, don't hesitate to ask for clarification. Building a professional and cooperative relationship can facilitate a smoother audit.

conclusion facing an IRS audit as a business owner 360 accounting pro can be a challenging experience, but with proper preparation and the right approach, you can navigate it successfully. By understanding the audit process, organizing your financial records, seeking professional assistance, and maintaining open communication with the IRS, you can improve your chances of a favorable outcome. Remember that compliance with tax laws and a commitment to accuracy are your best defenses against potential audits, and staying informed about tax laws can help you avoid future complications. While an IRS audit may seem daunting, it can also be an opportunity to demonstrate your commitment to following the rules and maintaining a financially healthy business.

0 notes

Text

Sales Tax Outsourcing Solutions USA.

0 notes

Text

Accounting Outsourcing India by MAS LLP: Streamline Your Business Operations

In today’s competitive business landscape, companies are constantly seeking ways to optimize costs and enhance efficiency. Accounting outsourcing in India has emerged as a highly effective solution for businesses worldwide. MAS LLP, a trusted name in financial services, offers expert accounting outsourcing solutions tailored to meet the unique needs of businesses across industries.

Why Choose Accounting Outsourcing India? Outsourcing accounting services to India has gained immense popularity due to several key advantages:

Cost Efficiency India offers high-quality accounting services at a fraction of the cost compared to Western countries. Businesses can save significantly on overheads like salaries, training, and infrastructure by outsourcing to skilled professionals in India.

Access to Skilled Professionals India is home to a vast pool of certified accountants and financial experts. By partnering with an experienced firm like MAS LLP, you gain access to knowledgeable professionals who ensure accuracy and compliance.

Focus on Core Business Activities Outsourcing accounting tasks allows businesses to focus on their core operations, such as sales, marketing, and product development, while leaving the financial complexities to experts.

Scalability Whether you're a startup or a large enterprise, accounting outsourcing India offers flexibility to scale services as your business grows.

Services Offered by MAS LLP As a leading provider of accounting outsourcing India, MAS LLP offers a comprehensive range of services, including:

Bookkeeping and Accounting Accurate bookkeeping is the foundation of effective financial management. MAS LLP ensures your records are maintained meticulously, allowing you to make informed decisions.

Payroll Management Outsource your payroll processing to MAS LLP for timely and error-free salary disbursements, tax calculations, and compliance with labor laws.

Taxation Services From GST filings to corporate tax returns, MAS LLP provides end-to-end taxation support to ensure compliance with Indian tax laws.

Financial Reporting Receive detailed financial statements and reports that provide a clear picture of your business's financial health, helping you strategize effectively.

Compliance and Regulatory Support MAS LLP ensures your business adheres to all regulatory requirements, minimizing the risk of penalties and legal complications.

Why MAS LLP Stands Out MAS LLP is not just another outsourcing firm—it’s a partner committed to your success. Here’s why they’re the preferred choice for accounting outsourcing India:

Client-Centric Approach: MAS LLP focuses on understanding your business needs and providing personalized solutions. Timely Delivery: They prioritize deadlines, ensuring your financial tasks are completed on time. Proven Track Record: MAS LLP has a long list of satisfied clients who have experienced significant growth through their services.

Conclusion Accounting outsourcing India is a smart choice for businesses looking to reduce costs, improve efficiency, and achieve financial accuracy. With MAS LLP as your trusted partner, you can rest assured that your accounting needs are in expert hands.

Take the next step toward streamlining your business operations—partner with MAS LLP today for reliable and professional accounting outsourcing India!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Outsourcing Accounting Services in India: Benefits and Challenges

Accounting is the process of recording, summarising, and analysing a business's financial transactions to provide clear and actionable insights. It serves as the foundation for decision-making, financial planning, and compliance with legal obligations. This article delves into the core aspects of accounting, its types, and why it is essential for businesses, especially in the Indian context.

What Is Accounting?

Accounting involves the systematic recording of financial data, ensuring its accuracy, organisation, and accessibility. It helps businesses understand their financial health and helps them comply with tax regulations. It also prepares financial statements and facilitates audits.

Key Components of Accounting

Bookkeeping Bookkeeping is the primary step in accounting. It focuses on recording day-to-day transactions such as sales, purchases, receipts, and payments.

Financial ReportingThis involves preparing financial statements, including the balance sheet, income statement, and cash flow statement, which summarise a company’s financial position.

AuditingAudits verify the accuracy and fairness of a company's financial statements and ensure compliance with accounting standards and laws.

Tax AccountingTax accounting focuses on preparing and filing tax returns while ensuring adherence to government tax regulations.

Management AccountingThis provides management with data-driven insights for planning, decision-making, and optimising operational efficiency.

Types of Accounting

Financial Accounting: Deals with the preparation of financial statements for external stakeholders.

Managerial Accounting: Focuses on internal use, helping management in planning and decision-making.

Cost Accounting: Assesses the cost of production and operations to improve efficiency.

Tax Accounting: Ensures compliance with tax laws and minimises tax liabilities.

Forensic Accounting: Involves investigating financial discrepancies and fraud.

Importance of Accounting for Businesses

Compliance with RegulationsIn India, businesses must comply with laws such as the Companies Act, Income Tax Act, and GST regulations. Proper accounting ensures adherence to these laws.

Financial Planning and BudgetingAccurate financial data helps businesses forecast revenues, plan budgets, and manage resources effectively.

Transparency and TrustReliable financial records build trust with investors, lenders, and stakeholders.

Tax EfficiencyProper accounting minimises tax liabilities and ensures the timely filing of returns to avoid penalties.

Business GrowthInsights from accounting help identify areas of growth and investment opportunities.

Accounting Services in India

Accounting Services in India are diverse and cater to the needs of small businesses, startups, and large enterprises. Common services include:

Bookkeeping and payroll management

Tax planning and filing

GST compliance

Financial analysis and reporting

Audit and assurance

Conclusion

Accounting is more than just number crunching; it is a strategic tool for business growth and sustainability. In India, where regulatory compliance is intricate, professional accounting services can save businesses time, resources, and potential legal hassles. Whether you're a small entrepreneur or a corporate giant, a solid accounting foundation is key to long-term success.

0 notes

Text

What Can Outsourced AP Accountants Do for Your Business?

The range of services and solutions offered by accounts payable outsourcing firms varies. However, no two providers are the same.

Differentiation comes with comprehensive suites or selective offerings, standard packages or custom solutions, pricing policies, and online or offshore delivery models. So, choose keeping your exact needs and budget in mind while contracting out.

Some of the things accounts payable services outsourcing can help you with are:

Vendor/Supplier Administration: Expert vendor onboarding, verification, and coding, along with purchase order tracking, sets the foundation for a seamless payment process.

Vendor Invoice Management: Providers receive, code, and verify invoices against purchase orders, employing 2-3-way matching to ensure accuracy. Exception invoices are promptly identified and resolved, minimizing delays.

Supplier Payment Processing: Daily payments and accounts payable transactions are executed with precision, preventing delays and supply chain disruptions. High-volume transactions are handled with ease, ensuring timely payments.

Harnessing Technology: Modern AP accountants leverage cutting-edge technology to unlock the full potential of account payable software and automation, driving efficiency and reducing errors.

Trade Credit Data Management: Providers manage data entry and updates, digitize incoming bills and invoices, and store them securely, ensuring easy access and compliance.

Vendor Account Management: From account opening to closing, providers expertly manage vendor accounts, including month-end and year-end processes.

Accounts Payables Reporting: Comprehensive reports, including payable aging, cash flow summaries, and forecasting, provide valuable insights, enabling informed decision-making.

Notably, some payable accounting service providers can also manage utility bill and travel charge payments for you. Some businesses may also outsource tax payments, such as sales and VAT or GST, to external services.

However, certain processes, like petty cash management and short-term debt GL entries, are typically handled internally.

Enhancing Your AP Process Efficiencies with Centelli

If you’re looking for a professional firm that works as an extension of your team, we could be your ideal partner. We provide a comprehensive range of finance and accounting services, including accounts payable solutions.

From P2P to reconciliations to reporting and analysis, our AP accountants are sticklers for accuracy and timeliness. We work with a wide range of market-leading accounts payables software.

Partnering with us brings in these benefits (and value!):

Quick onboarding/smooth transition

High accounts payables process accuracy

Timely deliveries and reporting

Bespoke solutions; 35–65% cost savings

Global reach; 24X7 Support

Don’t let accounting challenges hold you back. Contact us today for more info about our accounts payable outsourcing services and pricing.

#Accounting Services#Outsourcing Accounting#Bookkeeping Services#small business#finance#Atlanta#Centelli#USA#hire accountants#Sage Accounting#Account Payable Services

0 notes

Text

The Ultimate Guide to Bookkeeping in Los Angeles for Small Businesses

Introduction

Bookkeeping is an essential part of running a successful small business. It involves keeping accurate records of financial transactions, managing cash flows, and ensuring compliance with tax regulations. For small businesses in Los Angeles, effective bookkeeping is not just a legal requirement but a strategic tool that can help drive business growth. This ultimate guide will explore everything you need to know about bookkeeping in Los Angeles, providing insights and tips to manage your business finances efficiently.

Understanding Bookkeeping

What is Bookkeeping?

Bookkeeping refers to the systematic recording and organizing of financial transactions. It's the foundation of your business's accounting process, providing crucial data for financial analysis and decision making.

Importance of Bookkeeping for Small Businesses

Bookkeeping helps in tracking income and expenses, measuring financial performance, preparing for tax obligations, and supporting strategic planning. For small businesses in Los Angeles, effective bookkeeping can make the difference between success and failure.

Bookkeeping in Los Angeles: Local Considerations

Compliance with Local Regulations

Los Angeles has specific tax laws and business regulations that require meticulous bookkeeping. Staying compliant helps avoid penalties and ensures that your business operates smoothly.

Cultural and Economic Factors

Understanding the local market dynamics and economic conditions is crucial for tailoring your bookkeeping practices to suit Los Angeles's unique business landscape.

Essential Bookkeeping Practices for Small Businesses

Maintaining Accurate Records

Accurate record-keeping is vital. It involves tracking all financial transactions, including sales, purchases, income, and payments.

Organizing Financial Documents

Proper organization of invoices, receipts, and bank statements is essential for efficient bookkeeping and easy access during audits or tax filings.

Utilizing Technology

Modern bookkeeping software can streamline processes and improve accuracy. Tools like QuickBooks, Xero, and FreshBooks are popular among Los Angeles businesses.

Common Bookkeeping Challenges and Solutions

Managing Cash Flow

Cash flow management is a critical challenge for small businesses. Using cash flow projections and regular monitoring can help maintain liquidity.

Handling Payroll

Payroll can be complex, especially with changing tax laws. Outsourcing payroll services or using payroll software can be highly beneficial.

Preparing for Tax Season

Tax preparation requires comprehensive bookkeeping. Staying organized throughout the year ensures you're ready for tax season without stress.

How Bookkeeping in Los Angeles Supports Business Growth

Financial Analysis and Planning

Bookkeeping provides valuable insights into financial health, enabling strategic planning and informed decision-making.

Building Trust with Stakeholders

Transparent financial reporting builds trust with investors, partners, and customers, which is vital for business growth.

Ensuring Sustainability

Effective bookkeeping helps manage costs and optimize resources, ensuring long-term sustainability in a competitive market.

Conclusion

For small businesses in Los Angeles, bookkeeping is not just about maintaining financial records—it's a strategic asset that supports growth and compliance. By implementing effective bookkeeping practices, you can ensure accurate financial management and focus on expanding your business. LA Business specializes in bookkeeping in Los Angeles, offering tailored services to help your business thrive in this dynamic market.

FAQs:

What are the key components of bookkeeping in Los Angeles for small businesses?

The key components include accurate record-keeping, compliance with local tax laws, cash flow management, and financial reporting.

How can a small business in Los Angeles benefit from professional bookkeeping services?

Professional bookkeeping services provide expertise in managing finances, ensuring compliance, and freeing up time for business owners to focus on growth.

Why is it important to use bookkeeping software in Los Angeles?

Bookkeeping software enhances accuracy, efficiency, and ease of access to financial data, vital in a fast-paced business environment like Los Angeles.

What should I look for when choosing a bookkeeping service in Los Angeles?

Look for experience, expertise in local regulations, technology proficiency, and a tailored approach to meet your business needs.

How does bookkeeping impact tax preparation for a business in Los Angeles?

Proper bookkeeping ensures that all financial transactions are recorded accurately, facilitating smooth and accurate tax preparation and filing.

Can bookkeeping services help in managing payroll for small businesses in Los Angeles?

Yes, many bookkeeping services offer payroll management as part of their offerings, ensuring compliance with tax laws and accurate payroll processing.

0 notes