#Online Section 8 Company Registration in Bangalore

Explore tagged Tumblr posts

Text

Section 8 Microfinance Company Registration - Fees, Process, Documents

Section 8 Microfinance Company or Micro-finance Institution (MFI) is a financial organisation that provides credit to people and organisations who are denied access to traditional financial institutions due to poverty, occupation, ethnicity, religion, or nationality.

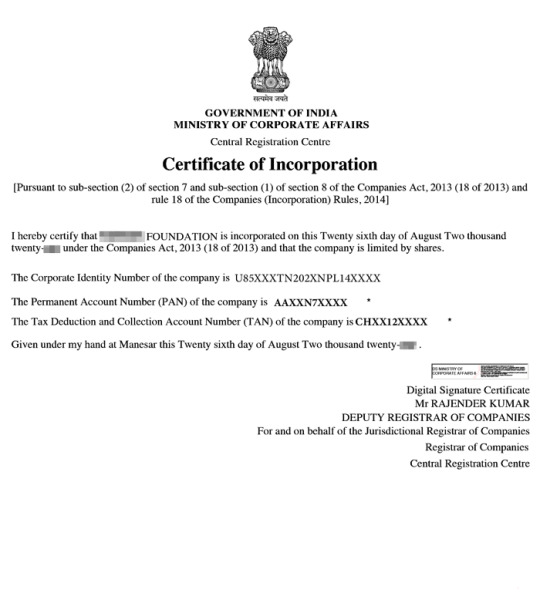

A Microfinance Company is registered with the Registrar of Companies as per Section 8 of the Indian Companies Act, 2013. Thus, it comes under the Ministry of Corporate Affairs (MCA).

Microfinance companies are the most convenient business to register that can provide unsecured loans without RBI approval at rates upto 26% p.a.

Benefits of Section 8 Microfinance Company:

No RBI Approval required

Can lend Unsecured loan

No Demographic Barrier

Best Rate of Interest

Minimum capital not required

Defaulters can be sued for non-payment

Limited Compliances

Documents required for Section 8 Microfinance Company:

PAN & Aadhar Card of both the directors

Bank Statement with the address of both the directors (not older than 2 months)

Passport Size Photo

Email address & Phone number

Utility Bill of the premises

To know more (click here)

#business#startup#india#business growth#manage business#partnership firm registration#nidhi company registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#section 8 microfinance company registratioin#microfinance#section 8 registration

0 notes

Text

Simple Steps for Company Registration in Bangalore

Startup Company Registration in Bangalore? Kanakkupillai offers hassle-free services with a dedicated team for quick, cost-effective registration within 10-15 days: simple process, fast updates, and no hidden fees.

Register your Company Online in Bangalore

Company Registration in Bangalore establishes legal legitimacy, offering benefits for startups. In Bangalore, online registration, especially for private limited companies, can be complex. Private limited companies in India, governed by the Companies Act of 2013, provide limited liability for directors authorised to sell company assets only in default scenarios. Public limited companies operating under the same legal framework differ in characteristics. The Companies Act of 2013 distinguishes between public and private enterprises. Private limited companies can have two to fifty members, and their directors have limited accountability to creditors.

A private corporation, governed by Section 2(68), is owned and managed by a small group, primarily funded from their accounts. It requires a minimum prescribed paid-up share capital as per its articles. Except for a one-person company, a Private Limited Company limits share transfers and has a maximum of two hundred members.

How do you register a company online in Bangalore?

Private limited company registration in Bangalore is straightforward and entirely online. Individuals interested in registering their business can do so through the Ministry of Corporate Affairs (MCA) websites. A corporation must also register with the Registrar of Companies (ROC), which oversees business records across India.

Benefits of Registering Your Company as a Private Limited Company in Bangalore

Registering your company as a Private Limited Company in Bangalore offers several benefits, including:

1. Limited Liability Protection:

Shareholders' liability is limited to their shares, protecting personal assets.

2. Separate Legal Entity:

The company is a distinct legal entity, separate from its owners, providing legal recognition.

3. Fundraising Opportunities:

Easier access to funding through issuing shares to investors and venture capitalists.

4. Perpetual Existence:

Business continuity is not affected by ownership changes or shareholders' death.

5. Credibility and Trust:

Private Limited Companies are often perceived as more credible, enhancing stakeholder trust.

6. Tax Benefits:

Eligibility for various tax benefits and incentives available to corporate entities.

7. Employee Benefits:

Attractive to employees due to the potential for stock options and structured benefits.

8. Easy Transfer of Ownership:

Shares can be transferred quickly, facilitating changes in ownership and investments.

9. Name Protection:

Exclusive rights to the company name, reducing the risk of duplication by competitors.

10. Global Recognition:

Enhances the company's credibility and recognition on a national and global scale.

11. Better Borrowing Capacity:

Easier access to loans and credit facilities compared to unregistered entities.

12. Compliance and Regulation:

Adherence to legal formalities and compliance with the Companies Act enhances transparency.

13. Employee Stock Option Plan (ESOP):

Ability to implement ESOPs to attract and retain talented employees.

14. Succession Planning:

Facilitates smooth succession planning and transfer of ownership.

15. Enhanced Business Opportunities:

Private Limited Companies are often preferred partners in business transactions.

Conclusion:

It's important to note that while Private Limited Companies offer numerous advantages, registering as one should be based on your business's specific needs, goals, and nature. To make informed decisions about company registration, it is best to consult with legal and financial professionals.

0 notes

Text

Requirements for Company Registration in Bangalore

Startup Company Registration in Bangalore? Kanakkupillai offers hassle-free services with a dedicated team for quick, cost-effective registration within 10-15 days: simple process, fast updates, and no hidden fees.

Register your Company Online in Bangalore

Company Registration in Bangalore establishes legal legitimacy, offering benefits for startups. In Bangalore, online registration, especially for private limited companies, can be complex. Private limited companies in India, governed by the Companies Act of 2013, provide limited liability for directors authorized to sell company assets only in default scenarios. Public limited companies operating under the same legal framework differ in characteristics. The Companies Act of 2013 distinguishes between public and private enterprises. Private limited companies can have two to fifty members, and their directors have limited accountability to creditors.

A private corporation, governed by Section 2(68), is owned and managed by a small group, primarily funded from their accounts. It requires a minimum prescribed paid-up share capital as per its articles. Except for a one-person company, a Private Limited Company limits share transfers and has a maximum of two hundred members.

How do you register a company online in Bangalore?

Private limited company registration in Bangalore is straightforward and entirely online. Individuals interested in registering their business can do so through the Ministry of Corporate Affairs (MCA) websites. As part of the registration process, a corporation must be registered with the Registrar of Companies (ROC), which oversees business records across India.

Benefits of Registering Your Company as a Private Limited Company in Bangalore

Registering your company as a Private Limited Company in Bangalore offers several benefits, including:

1. Limited Liability Protection:

Shareholders' liability is limited to their shares, protecting personal assets.

2. Separate Legal Entity:

The company is a distinct legal entity, separate from its owners, providing legal recognition.

3. Fundraising Opportunities:

Easier access to funding through issuing shares to investors and venture capitalists.

4. Perpetual Existence:

Business continuity is not affected by ownership changes or shareholders' death.

5. Credibility and Trust:

Private Limited Companies are often perceived as more credible, enhancing stakeholder trust.

6. Tax Benefits:

Eligibility for various tax benefits and incentives available to corporate entities.

7. Employee Benefits:

Attractive to employees due to the potential for stock options and structured benefits.

8. Easy Transfer of Ownership:

Shares can be transferred quickly, facilitating changes in ownership and investments.

9. Name Protection:

Exclusive rights to the company name, reducing the risk of duplication by competitors.

10. Global Recognition:

Enhances the company's credibility and recognition on a national and global scale.

11. Better Borrowing Capacity:

Easier access to loans and credit facilities compared to unregistered entities.

12. Compliance and Regulation:

Adherence to legal formalities and compliance with the Companies Act enhances transparency.

13. Employee Stock Option Plan (ESOP):

Ability to implement ESOPs to attract and retain talented employees.

14. Succession Planning:

Facilitates smooth succession planning and transfer of ownership.

15. Enhanced Business Opportunities:

Private Limited Companies are often preferred partners in business transactions.

Conclusion:

It's important to note that while Private Limited Companies offer numerous advantages, registering as one should be based on your business's specific needs, goals, and nature. Consulting with legal and financial professionals is advisable to make informed decisions regarding company registration.

0 notes

Text

Simplifying the Process of Income Tax Return Filing Online for FY 2023-24

Income Tax Return Filing Online has become a easy way taxpayers fulfill their financial obligations, offering convenience, speed, and accuracy. As we are approaching towards the end of the financial year 2023-24, understanding the process of e-filing ITR is crucial. Here's a detailed roadmap to simplify the journey.

What is Income Tax Return (ITR)?

First of all you should have to understand what actually the Income Tax Return is? Income Tax Return (ITR) is a document filed by the taxpayers with the Income Tax Department, to declare their income, deductions, and taxes paid for a specific financial year.

Who Needs to File ITR?

Individuals and entities whose total income exceeds the basic tax limit that has been specified by the Income Tax Department are required to file ITR including salaried individuals, self-employed professionals, businesses, and freelancers.

Process of Filing Income Tax Return Online

Registration & Login: Firstly, you should have to register yourself on the official Income Tax e-filing portal or authorized third-party platforms. Log in using your credentials to access the e-filing services.

2. Choosing the Right Form: After that, you have to select the appropriate ITR form on the basis of your income sources and category including options from ITR 1 for salaried individuals with income up to ₹50 lakh to ITR 7 for individuals and companies with specific income sources.

3. Preparation and Documentation: Then, you have to gather all the relevant documents including PAN card, Aadhaar card, Form 16/16A, bank statements, investment proofs, and rent receipts and organize your financial records to smoothen the filing process.

4. Entering Income Details: Remember that you should have to provide accurate information about your income from various sources, including salary, interest, dividends, rental income, and capital gains. Ensure the accuracy to avoid errors and discrepancies.

5. Claiming Deductions and Exemptions: Then, you must have to declare the eligible deductions as per different sections of the Income Tax Act to reduce your taxable income. Common deductions include investments in Provident Fund, Life Insurance Premiums, and contributions to pension schemes.

6. Calculating Tax Liability: After that, you should have to utilize the online tax calculator or manually compute your tax liability on the basis of the income and deductions claimed and then verify the accuracy of calculations to prevent any errors.

7. Verification and Submission: At last, you have to verify your return via Electronic Verification Code (EVC), Aadhaar OTP, or by sending a signed physical copy to the Centralized Processing Centre (CPC) in Bangalore and after verification, submit your return electronically.

8. Tracking Refund Status: You can monitor the status of your refund through the e-filing portal. Applicable refunds will be processed by the Income Tax Department and credited to your bank account.

Conclusion

By following the above mentioned step-by-step guide, you can navigate the complexities of the online filing of income tax returns for FY 2023-24 effortlessly, ensuring compliance with tax laws and securing financial well-being.

#income tax#income tax return#Income Tax Return Filing#ITR Filing#ITR Filing Online#Income Tax Return Filing Online

0 notes

Text

Section - 8 Company Registration Process in India

A section-8 company is which spends all its money promoting what they believe in. the company could promote religion, education, sports, social welfare, charity, etc. The company also does not pay any kind of income to its members. These companies are limited companies under the Companies Act. The only difference is that they do not need to use “limited company” at the end of their names. They can either be registered as a “private limited company” or “public limited company”. Section-8 companies are a legal form of NGOs and NPOs. These companies can work in any state of the country; there are no restrictions for them.

Benefits of Section 8 Company Registration Online in India, Delhi, Bangalore, Lucknow

● No minimum capital: For the incorporation of section-8 companies there is no minimum capital required. It can be formed with any minimum capital but yes investors and promoters can be brought in to support the organization.

● Name: Section-8 does not require to put private limited or limited at the end of its name. It can be named as a charity, foundation, club, council, institution, etc.

● Tax benefits: Section-8 companies do not pay tax the same as other companies, they have many tax benefits.

● Membership: Section-8 company can be obtained by a registered partnership firm.

Eligibility criteria for Section-8 company formation

● The company should be registered under the Companies Act, 2013.

● The company needs to get a license from MCA.

● The maximum number of directors can be 15. If a company want to add more director than a request can be made in a general meeting.

● At least one director should be a member of India.

● Whatever initial amount has been proposed for the company, it should be invested in it within 2 months.

Online NGO Registration Online In India, Delhi, Mumbai, Bangalore, Lucknow.

● First, you need to fill in your details online. You will be required to fill in your name, email address, contact number and state.

● Then you will need to fill for DIN and DSC.

● After that the company needs to go through the name approval process. 2 names could be proposed and name availability needs to be checked under “reserve unique name”.

● It is compulsory to attach form INC-12. It is also advisable that you put a note with the forms about what work the company will undertake after its incorporation.

● When you have gained the approval of the central government one can fill SPICe 32 form.

● After all the formalities have been done company will be issues a certificate of incorporation. Which means it has been legally formed.

All the documents needed to register the Section-8 company.

● PAN card copies of all the directors of the company.

● Address proof of directors.

● Contact number, email ID, and passport size photograph of directors.

● Address proof of the company’s registered address.

After all the formalities have been done the company will be formed and it can start working as soon as it wants to.

#Section 8 Company Registration Online India#Section 8 Company Registration Online#Online Section 8 Company Registration#Online India NGO Registration#NGO Registration in India Online#Section 8 Company Registration in Delhi#Online NGO Registration in Mumbai#Online Section 8 Company Registration in Bangalore#Online NGO Registration in Bangalore

0 notes

Text

How to get GST filing returns in Bangalore?

GST files returns in Bangalore offer the simplest services in whole of Bangalore within the field of GST Registration and Filings returns. Consultry is the Top GST filing return Consultants in Bangalore.GST is one in every of the trail breaking reforms within the tax and body system of Republic of India. It’s a supreme result on the money state and even tax structure of the country. A GST return file is a document that contains details of the financial gain that a tax paying individual is meant to pay to the executive system. Underneath merchandise and repair Tax (GST), a registered dealer must file returns which incorporates Purchases, Sales, Output GST, Input step-down. GST returns area unit filed to appear upon the money accounts every year.

Before the introduction of GST, start-ups in Republic of India with a turnover of quite five lakhs area unit speculated to pay a large tax within the kind of price side Tax, however with GST the quantity reduced to twenty lakhs. There exist nearly twenty five returns to be filed by any remunerator. This range can decrease if the remunerator is registered underneath the composition scheme. If you own a business that incorporates a turnover of quite forty lakhs in a year, you're speculated to register the business underneath GST. Although you don’t own a business that exceeds the brink turnover, you'll be able to register voluntarily and file the GST return that is prescribed underneath the law.

Benefits of GST Filing return:

Many Indirect taxes like VAT, Excise Duty, Service Tax, CST, Import- Export, Octroi, Luxury Tax and amusement Tax is currently solely requiring a GST registration. This can lead to less compliance and facilitate businesses to focus a lot of into their business. GST filing return services in Bangalore helps in availing all the benefits that you will get under GST Law.

Different types of GST filing Returns:

GSTR-1: Includes details of all outward supplies, that is sales

GSTR-2: Includes details of all outward supplies, that is sales

GSTR-3: Monthly returns on the basis of windup of details of outward supplies and inward supplies together with the payment of tax.

GSTR-3B: Return in which summary of outward supplies along with input tax credit is declared and payment of tax is affected by the taxpayer.

GSTR-4: Return for a taxpayer registered under the composition scheme under section 10 of the CGST Act.

GSTR-5: Return for a non-resident foreign tax paying individual.

GSTR-6: Return for associate degree input service distributor to distribute the eligible input tax credit to its branches.

GSTR-7: Return for state authorities deducting tax at sources.

GSTR-8: Details of supplies settled through e-commerce operators and also the quantity of tax collected at source by them.

Online GST Filing:

According to the Goods and Service Tax Law each individual/company/LLP Registered underneath the GST Act must furnish the small print of sales, purchases and also the tax paid by filing for GST returns with the executive authorities.

As a business person/ firm, one in every of your 1st priorities are to file a GST return. Hence, knowing the ropes will make you do the filing smoother and simpler, with Best GST filing consultants in Bangalore. Whereas filing a GST returns, you're speculated to offer all the particulars associated with your business activities, just like the liabilities declarations, tax payments and conjointly the other connected info as per directions provided by the Government.

The GST return filing method must be done electronically within the GST portal. A facility must be offered for the manual method of GST return filing tasks. This facility helps the business remunerator in Republic of India to arrange the return offline and so transfer it on GSTN through the facilitation centre. So as to file the GST return, the acquisition invoices and GST compliant sales area unit required.

Consultry helps you in doing the online GST filing, by providing you with the assistance of best GST filing consultants in Bangalore.

How to get GST return Filing in Bangalore?

GST returns filing in Bangalore cost will depends on many factors like based on your company returns. Costing information can be decided GST consulting experts. Consultry is the best team which can help you to get file your GST returns in Bangalore at affordable cost. If you are looking to get register your GST or looking for file your GST returns in Bangalore for your organization feel free to send your inquiry to [email protected] or feel free to contact: 7975187793 or visit https://www.consultry.in/.

#GST return filing in Bangalore#GST return Filing Consultant in Bangalore#GST Return filing services in Bangalore#GST Return Filing

1 note

·

View note

Link

Company Setup India is a single stop for off-shore company formation, buying an off-the-shelf (readymade) company, entire range of business and legal services, online accounting and all support services concerning foreign investment in India.

The main services we provide:-

· Formation of One Person Company (OPC) in India

· Formation of Private Limited Company in India

· Formation of Public Limited Company in India

· Formation of Limited Liability Partnership in India

· Creation of a NBFC Company in India

· Set up of a Government Company in India

· Set up of a Holding/ Subsidiary Company in India

· Set up of a Foreign Company in India

· Buy a Readymade Company in India in India

· Formation of Company Under Section 8 in India

· Formation of Producer Company in India

· Acquiring a Non-Banking Financial Company (NBFC) in India

· Statutory Records & Compliances

· Mergers, Acquisitions & Demergers

· Amalgamation, Acquisition & Reconstruction

· Open a Branch Office in India

· Open Liaison Office in India

· Foreign Direct Investment in India

· All Post Incorporation Services such as TDS/Withholding Tax Registration, VAT/Sales Tax Registration,

· Service Tax Registration, Import Export Code (IEC) Registration, ESI/PF Registration etc.

· Business and Legal services

· Accounting and Auditing Service

· Service for Filling of Various Statutory Returns

· The law relating to a partnership firm is contained in the Indian Partnership Act, 1932.

Company Setup India is based at New Delhi NCR, India to service clients anywhere in the world. We have our network on PAN India basis & across globe. We have our regional offices at Mumbai, Kolkata, Chennai, Bangalore, Chandigarh, Ranchi and Muzaffarpur.

#Company Incorporation in India#Limited Liability Partnership#FDI in India#Compare Different Business#Conversion of Business#Supp.Co.Incorporation Service#Small Business Registration#Value added services#Post Incorporation Reg.#Consulting Services

1 note

·

View note

Link

Registration as a Pvt Ltd Company in Bangalore is the first step in the corporate journey. For CA services Legalpillers is a great platform that can help your online company registration in India.

#Register Company Bangalore#company registration in bangalore#startup company registration in bangalore

0 notes

Text

How Much Does it Cost for a Grocery App like BigBasket

Online supermarkets are developing rapidly and growing day by day, which is everyone's basic need. The development of innovation has significantly simplified the lives of retailers by allowing them to sell grocery items including food, vegetables, natural products, beverages, staples and much more Internet using this Internet medium.

According to reports, it is said that by 2025 at least 20% of the market will be covered with online shopping and online grocery stores. Such demand leads to developing and making a grocery app like BigBasket and makes it easy for all users to pay attention to order online in one convenient place. For all the women and housewives who take care of the housework, who go out to the crowded market to buy groceries, stand a long time and collect things. So when it comes to Mobile apps development company India for grocery app development, it varies on different factors and reasons. The development cost of the BigBasket application like Grocery includes various products and functions, which is more expensive as it is not as easy as it seems due to the attractive functions it contains.

How does online grocery app development benefit the grocery business?

Grocery app development leveraged both customers and app owners with numerous benefits. We have listed here. Have a look.

For customers

Save time

At the moment we lead a hectic and stressful life. Technology gives millennials a comfortable and convenient experience. In such situations, on-demand grocery apps like BigBasket come into play and save users a lot of time.

Convenient

Grocery delivery top 10 mobile apps development companies India square measure simple to use and efficient. It permits users to order from anyplace, notwithstanding location. All users want square measure their Internet-connected smartphones and that they will use the saved time to try and do different productive tasks.

Avoid excessive purchases

It is natural that every time you visit a mall or grocery store, you end up buying things that are not of great use to you. Due to the problem of temptation. While this is not the case with grocery apps, you will focus on the things that are on your shopping lists and avoid overselling.

Save money

From time to time, grocery apps feature attractive deals and discount schemes, from festival season deals to loyalty programs and discount coupons. Not only does it save users money, but it also attracts more customers to the app.

Read More blogs : cost to develop grocery application

Fast and secure payment processes

Grocery apps like BigBasket.provide the ability to make payments through different available options. You can pay online at the same time while placing an order. Or you can choose cash on delivery and make the payment, either online or offline, when the ordered items are delivered to your doorstep.

Essential functions for the user panel

Registration and user profile

Here the user can register his account using his email id and contact number.

Search and explore products

This section allows the customer to search for a particular product and also helps them navigate through the different item categories.

Add to cart

In the Add to cart option, the customer can add a product of their choice and buy it later.

Payment gateway

You can integrate multiple payment options like debit card, credit card, and digital wallet like PayPal, Paytm, etc. And it can also facilitate users with COD option.

Delivery order scheduling and tracking

The user can schedule the delivery and can also track the status of the order and know when it will be delivered.

Push notifications

Push Notification to send the best deals and discounts, attractive coupons, etc. to your loyal customers.

Scores and reviews

This section allows your customers to write reviews and rate the top 10 mobile apps development companies Bangalore based on their

personal experience.

Customer Support

In addition to email and phone communication, integrate 24x7 online chat options to help customers.

Essential features for the admin panel

1. Dashboard

From the Control Panel, the administrator can manage all orders received from customers.

2. Inventory management

The Inventory Management option helps the administrator to easily manage the large stock of inventory.

3. Assignment of orders

Once the order has been placed and confirmed, the managers of the store can assign a task to the delivery men to deliver the items at the mentioned place.

4. Real-time analysis

Real-time analytics help you keep track of your esteemed customers and also extract vital data when needed.

Essential features for the delivery panel

1.Geo-location services

Geolocation services will help the delivery person to easily track the customer's location.

2.Chat within the app or calls

Allows the person making the delivery to contact the customer directly via phone or online chat if they cannot trace the address.

3.Accept or reject the delivery request

The driver can accept or decline delivery of the grocery items if the customer's location is too far away and is not within the specified free delivery distance.

4. Delivery notification

Notify the store manager about the order along with the order number.

How much does it cost to create an application like BigBasket?

After the features, model, technology stack, and team structure are finalized, you should arrive at a cost estimate for your grocery development application. The factors that will determine part of the expenses are:

The complexity of the application, including features and functionality.

Choice of developers, hours involved in development.

Technology stack, application model type

Considering the feature list, technology stack, and application model we've discussed, the medium to simple complexity grocery delivery application will cost anywhere from $ 10,000 to $ 30,000. An application with a sophisticated set of functions, custom software, can be budgeted between $ 100,000 and $ 300,000.

The total time the project can take appears to be between 1770 and 2330+ hours. Consider the hourly rates for development teams located in different regions of the world.

If you are searching for the best android apps development company India, India to build an app like Big Basket, please contact fugenx at [email protected] to get on the road to brand building and success.

FuGenx Technologies is a leading mobile application development company in bangalore ,india with over 8 years of experience. We have delivered different mobile app solutions with the help of relevant tools and technologies at the time. At FuGenx Technologies, we offer customized end-to-end iOS application development company India solutions for various vertical industries at an affordable price.

We offer in depth top mobile application development companies in bangalore services like golem app development, iOS app development, React Native, Flutter, NodeJS, PHP development, and lots of additional. Contact us for end-to-end best Mobile app development companies in India services.

we provides services:

a) Mobile application development companies

b) best deep Learning company in India

c) machine learning company India

d) Top data science companies in India

e) best artificial intelligence companies India

F) iot apps development companies Bangalore

G) Web Development

H) machine learning development company Bangalore

i) iPhone app development companies Bangalore

#Mobile apps development India#Mobile application development India#Mobile application development Bangalore#Mobile apps development company Bangalore#Mobile application development companies Bangalore

0 notes

Text

Business Registration Gov Cost in Karnataka

Business Registration Gov Cost in Karnataka

Are you looking for Company Registration in Karnataka, and then this is the right place for you. There are so many different types of business entity, which you can incorporate in Karnataka, like Limited Company, Partnership Company, Sole Proprietorship, Section 8 Foundation, Producer Company, Pvt Ltd Firm, OPC, Nidhi Company, NGO, LLP Firm, etc. Karnataka is one of the fastly developing State of Karnataka and there are various clients in Karnataka who has enrolled Business through FinanceBazaar. Right now FinanceBazaar is the one of the Top Business registration service provider in Karnataka, you can even read FinanceBazaar.com feedback on Google. As you know Karnataka is one of the fastest increasing state in India where you can do your business without any complications. Business formation in Karnataka is not an easy step for each person, because there are so many different formalities that you must need to follow and there are various legal paperwork that you have to fill for entire Firm establishment. But you have not need to stress concerning anything, because Finance Bazaar is providing online Firm registration service in Karnataka which you not need to do anything. you have to submit only papers and Gov Charges and we will look out of rest. Basically Firm formation process takes 7 to 10 working days that rest depends on your collaboration.

In this page you will get Each and Every answer regarding Cost To Register Company in Karnataka

What FinanceBazaar will provide

PAN and TAN

MOA and AOA

Digital Signature Certificate Token For Each Directors

Certificate of Business formation

Share Certificates

GST Number (If want)

Such details need for Business incorporation in Karnataka

Company Name: - The Firm name which you want to register will be committed by your side, but there are so many factors for selecting the Company name. You can't use general words and those words that are already formed or trademarked can't be suitable. Finance Bazaar Top CA will guide you as well in selecting Business name.

Authorized Capital: - At Least 1 Lakh Authorized money is required for Company formation in Karnataka . You can increase it as per your need. But if you will enlarge authorized fund, more than 10 Lakh, then registration duty will even increase.

Paid-up Capital: - You can start your Business from One Rupee paid-up money in Karnataka and you can expand it as you want, but you should informed the paid-up amount amount for life lower than the Authorized money.

Number of Directors: - Minimum two directors required for PVT LTD Company and one director for OPC Pvt Ltd Company. In PVT LTD Company you can increase the number of directors till 15.

Business Activity: - This is an major component of your Business, your business activity will define the business class in which your Firm name will be enrolled and it will as well specified in MOA and AOA.

Office address: - The office location where you required to register your Firm.

Each Directors email and mobile phone number: - Every director mail id and contact number necessary for Digital Signature Certificate (DSC) and Director DIN.

Required Documents for Company incorporation in Karnataka

These are some following documents that you must need to give for Firm formation in Karnataka:

Aadhar Card/Voter Card/Driving License/Passport of Every Directors

Pan Card of Each Directors

One utility bill (Electricity, Gas, Phone, Water Bill of any name) for office address proof

Updated Bank Statement of Each and Every directors/Any Current bill for address proof of Each and Every directors like Mobile Phone Bill, Gas Bill, Electricity Bill, etc.

Photographs of Every directors.

For GST Registration Rent Agreement Between company name and owner of the property where company has registered.

Fees for Business enrollment in Karnataka

Company Registration Charges in Karnataka is roughly Rs 6999/- (Six Thousand Nine Hundred Ninety Nine Rupees Only/-), but it can differ as per your condition. If we speak about fee structure, then from the start 1000 rupees goes to the Gov for Business name applying and you have two opportunities for your Firm name reservation, if your Firm name is exceptional, then it can be approved in first shot. If two times your Firm name has declined, then you must to pay 1000 rupees once again to the Gov for again apply other name application. After Firm name authorization you need to pay Government registration costs that can be vary as per your Authorized capital or state rules. Every Single states have particular rules also Karnataka in terms of registration costs for Company incorporation. If you required two directors in your Company, then roughly 500 Rupees Each and Every director Fees for DSC, if directors will increase, then the Digital Signature Certificate Fees will also increase correspondingly. PAN & TAN Fees also collect by Government that will not be vary. And lastly our registration charges includes for doing and preparation all documents, documentations and alternative work.

financebazaar.com providing These services in Karnataka

Public Limited Company Registration

GST Registration

NGO Registration

Nidhi Company Compliances

Director KYC Verification

12A 80G Registration

DIN Activation

MSME Udyog Aadhaar Registration

Partnership Firm Registration

Change Company Address or Registered Office

Startup India Registration

Private Limited Compliance

Society Registration

Commencement of Business Certificate

NGO Compliances

Company Registration

Nidhi Company Registration

Producer Company Registration

Copyright Registration

LLP Annual Compliance Service

ISO Certification

Digital Signature Certificate

LLP Registration

Sole Proprietor Registration

Chartered Accountant Consultation

Private Limited Company Registration

Import Export Code | IEC Certification

Producer Company Compliances

One Person Company Registration

Public Limited Company Compliances

Food License (FSSAI) Registration

Change Company Name

FCRA Registration

One Person Company Compliances

Section 8 Foundation Registration

Change, Add or Remove Company Director

Close or Winding Up Of a Company

Income Tax Return Filing

Section 8 Company Compliances

GST Return Filing

GST Surrender

Trust Registration

Trademark Registration

FinanceBazaar providing Each and Every services all over in India including Karnataka in All locations like Gulbarga, Ramanagaram, Kolar, Savanur, Mysuru, Sidlaghatta, Chikkamagaluru, Shiggaon, Belagavi, Afzalpur, Shrirangapattana, Tekkalakote, Dakshina Kannada, Tiptur, Madhugiri, Bidar, Wadi, Saundatti-Yellamma, Mulbagal, Lingsugur, Sira, Maddur, Ballari, Sindhnur, Malavalli, Hubballi-Dharwad, Magadi, Mundargi, Gokak, Udupi, Ramanagara, Hospet, Muddebihal, Belgaum, Piriyapatna, Haveri, Talikota, Chikkaballapur, Ramdurg, Nargund, Mahalingapura, Pavagada, Bangalore, Terdal, Puttur, Hassan, Kalaburagi, Tarikere, Surapura, Nanjangud, Mysore, Karnataka, Mudalagi, Bengaluru Rural, Sindhagi, Mandya, Madikeri, Ron, Shahpur, Sakaleshapura, Kodagu, Bijapur, Navalgund, Rabkavi Banhatti, Sedam, Lakshmeshwar, Dharwad, Raichur, Ranibennur, Davanagere, Gadag, Koppal, Sirsi, Sagara, Mangalore, Uttara Kannada, Arsikere, Chitradurga, Srinivaspur, Tumakuru, Bellary, Shivamogga, Bagalkot, Vijayapura, Bengaluru Urban, Siruguppa, Adyar, Shahabad, Yadgir, Malur, Nelamangala, Mudhol, Chamarajnagar, Manvi, Sindagi, Athni, Sanduru, Shikaripur, Tumkur, Mudabidri, Sankeshwara, etc.

0 notes

Text

MSME Registration in Bangalore:

Nowadays, there are a few reasons regarding why various little and medium endeavours (SMEs) are being shaped in Karnataka just as different places of the nation. You can be viewed as qualified for lower paces of revenue on credits, you can get endowments on power taxes and charge sponsorships, and you can turn into a piece of capital exception conspires and get capital speculation appropriations also. You can likewise be allowed exclusions from direct assessment laws.

MSME Registration in Bangalore

Taking everything into account they are decentralization without a doubt. All the advantages that gather to a SME get through the MSMED Demonstration that has been passed by the Administration of India. Furthermore, its enlistment is liberated from cost, no compelling reason to pay any charges to Service of MSME office; yet it is critical to be enrolled as a MSME to get the unique advantages from focal and state legislature of India. This is an activity program of govt. to quicken and advance the simple of working together.

All in all, indeed where to enrol your business? For this, you have to do enlistment of your undertaking in Udyog Aadhaar official site which viewed as the MSME enrolment entry of legislature of India. Furthermore, it is otherwise called Udyog Aadhaar enrolment gateway for micro, little and medium-sized undertakings.

MSME Registration Online in Bangalore

Documents/ Information Required for MSME Registration in Bangalore Karnataka

PAN and GSTIN of the Company/ Individual

Aadhaar card of the applicant

Total capital investment

Date of Incorporation of Company

Registered office address of the company

Bank details like IFSC Code and Account Number

Nature of business

Number of employees

For what reason should a venture register under the Udyog Aadhaar and what are the offices it will get from MSMED?

Thusly, we clarified quickly some significant favorable circumstances on MSMEs underneath:

To energize the development of MSME both State and Focal Govt. are colossally focusing on their impetuses, sponsorships, and plans and backing bundles to the enrolled MSMEs through MSMED Act, 2006. After enlistment, any venture can be able to assemble or profit the advantages offered under the MSMED Demonstration.

So the preferences or advantages will be offered to the MSMEs as per their characterizations and seriousness.

Here gander at some vital advantages of MSME enlistment under the Demonstration of government to the undertakings.

https://www.consultry.in/msme-registration-in-bangalore/

1. Simple Accessibility of Advances from Banks: All banks are prepared to loan the business areas as per their arrangement and separated from this, MSMEs are perceived by banks, they offer money related help with lower financing cost when contrasted with normal business rate.

2. Duty Refunds under the MSMED Demonstration, 2006: MSME enlisted business may appreciate numerous assessment exception plan and capital addition charge endowments from the legislature.

3. Simple Admittance to Credit: Mudra Yojana Plan has presented by PM Modi which gives advances to MSMEs without security. Furthermore, undertakings can exploit from this plan to raise their business.

4. Get Advantages from State Governments: Those endeavors that have enrolled under MSMED Represent them the vast majority of the states and association domains offers appropriations on power, charges, section to state-run industrials, capital venture sponsorships and furthermore excluded from deals charge.

5. Get Advantages from Focal Governments: Ventures can get simple assent of bank credits on need area loaning, extract exclusion plot, the exception under direct expense law, bring down the paces of revenue and backing, for example, reservation, and so forth Aside from this focal government reports different plans now and then for MSMEs where they can get advantage from it and establishes a climate for circumstances.

6. half Rebate on IP Security: Government will monetarily support to innovative new businesses for Global Patent Insurance in Gadgets and IT (Taste EIT) by repayment up to half of absolute patent expense, with Rs. 15 lakh limit.

7. Credit Assurance Asset Plan: This credit will be qualified to miniature and little undertakings covering as far as possible per borrower from Rs. 100 lakh to Rs. 200 lakh as in late update on twentieth February 2018 by Credit Assurance Asset Trust for Miniature and Little Endeavors (CGTMSE).

8. Capital Appropriation for Mechanical Upgradation: This plan is working for modernization of innovative up-gradation of Little Scope Enterprises (SSI) through the Credit Connected Capital Sponsorship Plan (CLCSS). A venture can get roof credits under this plan from Rs. 40 lakh to Rs. 1 crore and the pace of sponsorship from 12% to 15%.

9. Market Advancement Help for Miniature, Little and Medium Ventures: This plan helps to subsidize for partaking worldwide reasonable, exchange assignments, exposure, and so on The Administration will reimburse 75% of air admission in financial class and half of room rental charge for general classification and 100% of the air passage in monetary class and space lease for Ladies/SC/ST business visionary.

0 notes

Text

GST Registration

SOLE PROPRIETORSHIP OR GST REGISTRATION

The sole proprietorship is the simplest business form under which one can operate a business. The sole proprietorship is not a legal entity. It simply refers to a person who owns the business and is personally responsible for its debts. A sole proprietorship can operate under the name of its owner or it can do business under any other name which he wishes to register.

The sole proprietorship is a popular business form due to its simplicity, ease of setup, and nominal cost. A sole proprietor need only register his or her name and secure local licenses, and the sole proprietor is ready for business.

Advantages PROPRIETORSHIP REGISTRATION OR GST REGISTRATION:

· It is the simplest and easiest form of business

· There is no legal distinction between the owner and the business.

· Easy to register.

· There are less legal compliances and regulation in comparison to company

· Only Income tax is required to be filed.

Documents required PROPRIETORSHIP REGISTRATION OR GST REGISTRATION

· Identity and Address Proof of the Proprietor

· Email id / Contact No of the Proprietor

· Passport Size Photo of the Proprietor

· Utility Bill for the registered Office (not more than 2 months)

· No Objection Certificate from the Owner

company registration cleartax

company registration bangladesh

company registration under section 8

how can check company registration number

company registration linkedin

company registration date

company registration act 1956

what is company registration certificate

company registration form 1

company registration act 2013

to check company registration

company registration hong kong search

how to company registration in delhi

company registration estonia

get payment gateway without company registration

company registration and filing

company registration cost in delhi

company registration with virtual office

company registration and trademark

company registration office in chennai

company registration on emi

company registration jobs

company registration johannesburg

company registration charges in delhi

company registration enquiry

company registration and incorporation

company registration belgium

company registration websites in india

company registration process online

company registration time

company registration help

company registration bc

company registration and gst

company registration worldwide

company registration with gst

company registration expenses

company registration under msme

company registration under startup india

for company registration

company registration msme

company registration maldives

how much does company registration cost

company registration portal

company registration renewal

company registration expenses accounting

company registration new york

company registration guide

company registration zambia

company registration extract

which documents required for company registration

company registration kenya

company registration tracking

company registration ernakulam kochi kerala

company registration rules

company registration bhubaneswar odisha

company registration zimbabwe

company registration law

company registration roc

what are company registration documents

what is company registration number usa

what is company registration number uk

company registration eswatini

company registration address proof

company registration benefits

company registration with cipc

company registration under gst

company registration quebec

company registration gov

company registration on google

company registration document sample

company registration data

company registration lookup

company registration license

is company registration necessary

what is company registration no

why company registration is important

where to get company registration number

company registration and monitoring department

company registration quora

company registration list

company registration verification in india

company registration botswana

company registration logo

where to get company registration certificate

company registration form 18

company registration act 2017

company registration under companies act 2013

where is my company registration number

where to check company registration number

company registration definition

company registration no means

where to find company registration number

how many digits in company registration number

where to check company registration

is company registration number vat number

company registration 123

myanmar company registration 2018

company registration requirements in india

company registration qld

company registration virginia

check company with registration number

company registration with fnb

company registration 247

company registration house

where to check company registration number in malaysia

to check company registration number

company registration records

how much is company registration in nigeria

company registration vakilsearch

company registration login

company registration number ending with 07

company registration form 9

company registration east london

company registration number vs ein

pvt ltd company registration

registration of pvt ltd company

pvt ltd company registration in mumbai

registration of pvt ltd company in mumbai

new pvt ltd company registration

pvt ltd company registration charges

pvt ltd company registration procedure

documents required for pvt ltd company registration in india

pvt ltd company registration in odisha

how to pvt ltd company registration in india

msme registration of pvt ltd company

gst registration process for pvt ltd company

documents required for pvt ltd company gst registration

private ltd company registration cost in india

new pvt ltd company registration fees

pvt ltd company registration in delhi fees

pvt ltd company registration in nepal

pvt ltd company registration process in delhi

pvt ltd company registration free

pvt ltd company registration process in pune

how to create pvt ltd company registration in india

pvt ltd company registration consultants

how to check pvt ltd company registration

how to check pvt ltd company registration in india

how to verify pvt ltd company registration in india

cost for pvt ltd company registration

pvt ltd company registration cost

pvt ltd company registration bangalore

pvt ltd company registration delhi

pvt ltd company registration process

pvt ltd company registration name availability

private limited company registration online

pvt ltd company registration documents required

pvt ltd registration online

pvt ltd registration cost

pvt ltd company registration mumbai

pvt ltd company registration kolkata

pvt ltd registration fees

0 notes

Link

Register Section 8 company in Bangalore with in 10 days, Fast and easy registration , Quick online process, Legal Experts, Transparent Pricing, Free Consultation, No Hidden Fee. Call Today 78100-01800

0 notes

Text

Medical/Health Care Web Design Services in India

We design websites with your goal in mind. Whether you’re looking for more patients, more customers, or to build your online presence, we tailor your site to accomplish this goal. Zinavo is more than a healthcare web design agency - we’re a trusted partner who will help you grow your business.

We offer a number of packages and custom solutions for enterprise-level businesses from across the healthcare industry. Custom design options mean more flexibility for your business, and you’ll enjoy full transparency and efficient communication with our team every step of the way.

Medical/Health Care Web Design Services in Bangalore,India:

Zinavo with creating a robust online presence and ensuring HIPAA compliance for your business. Since 2012, we’ve been providing custom healthcare web design and development solutions for hospitals, medical software/EHRs & medical device companies, HIEs, and other B2B healthcare businesses. Our experience and industry knowledge shows in our work and in our clients’ success.

When Medical Center noted that they were experiencing decreased website conversions, our evaluation of the community hospital’s website revealed issues with site navigation and functionality, especially on mobile devices. To solve the problem, Zinavo designed, developed, and implemented a brand new 500-page mobile responsive website for this client. In addition to optimal UI/UX across devices, new site focused on highlighting the functionalities patients consider most important and provided patient portal integration, while closely aligning with the hospital’s branding and organizational goals. Additionally, SEO optimization drove a higher volume of traffic to the site.

As a result, Health Care saw a 27% increase in organic traffic, 14% increase in mobile and tablet traffic, 8% reduction in bounce rate, and happy patients and hospital staff.

Responsive Medical Website Design:

Responsive Website Design automatically adjusts your website for tablets and mobile devices resulting in easy reading, navigation, and browsing with minimum need for resizing, panning, and scrolling. We makes dynamic changes to the appearance of your website based on the screen size and orientation of the device used to view it.

Automatic text size adjustments

Dynamic layout changes

Improved mobile usability

THE HOSPITAL NEEDED A WEBSITE WITH:

Improved functionality and usability, including a mobile-responsive design.

Easy navigation that would reduce the number of clicks to key sections of the site.

SEO optimization.

Social media integration.

THE SOLUTION:

A comprehensive website with 150 static pages and over 450 dynamic pages and a mobile friendly-version. The features of the new site include:

Tailored, industry insights-driven home page with the functionalities patients consider most important when they visit a hospital website in mind.

Unique design focused on the hospital’s branding and organizational goals.

Find a Doctor tool with physician profiles that display doctors’ bios, locations, and contact information.

SEO optimization

Featured online services like events and classes registration and bill pay.

Mobile-responsive design that works across all devices and browsers, with reduced page depth for critical functionalities and an overall optimized user experience.

Integration with the hospital’s Content Management System and Patient Portal.

If You Need Web Design Company Contact US (or) Get Free Quote (or) Call US Now: 080-32323100

More Detail About US:

Best Web Design Company Bangalore | Website Developers in Bangalore | Web Designing Companies Bangalore | Web Design Companies Bangalore | Website Designing Companies Bangalore

0 notes

Link

Get some knowledge from the NeuSource Startup Minds, how to do Section 8 Company Registration Online India. Our branches in Delhi NCR, Lucknow, Bangalore, Hyderabad, Mumbai and all major cities in India.

#Section 8 Company Registration Online India#NGO Registration in India Online#Section 8 Company Registration in Delhi#Section 8 Company Registration in Lucknow#Section 8 Company Registration in Mumbai#Section 8 Company Registration in Bangalore

0 notes

Audio

Before we get to know about the Step by step procedure to register company in Bangalore let’s understand different types of company formations. Here are some of them listed for your reference:

Types of Company Registration-

Pvt Ltd Company

OPC Company

Limited Liability

Foreign Company

Nidhi Company

Limited Company

NBFC

Producers

Micro-Finance

Section 8 Company

The process of registration of companies with the permission of MCA is an online company registration process. It will help to make a way to the company and also saves time and energy.

Once you register with our company, our specialists will guide you in the process of registration. Firstly, we will analyze your business structure and then provide the right type of registration that suits your needs for business.

The registration process can be controlled by our team online. We can give you a surety of best service with proper skills and knowledge.

Steps to start Business:

1. Evaluation

Connect with our experts to assess your business needs and determine the best business and legal structure for you.

2. Documentation

By completing a few simple questions about your company, you can get a feel for how smooth our documentation process is.

3. Select services

Select the services you want us to manage while you concentrate on your business.

4. Make payment and get started

Just one more step to complete your payment and our team will take care of the rest.

#Step by step procedure to register company in Bangalore?#LLPcompanyregistrationBangalore#LLP registration firm#BestCompanyRegistrationCompany#LLP Registration Consultant#Best accounting companies#register public limited company#New LLP registration in India

0 notes