#Online Payment Processor

Explore tagged Tumblr posts

Text

We provide clients with fast, simple, and reliable merchant card services and processing. Considering our merchant card services, clients can securely and efficiently accept payments from their customers, which can help them grow, expand their business, and make merchant payment processing easy. Additionally, we offer additional features and services, such as fraud protection and chargeback management.

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

it would be cool if websites let you be an adult on them. the advertisers and payment processors need everything to be Family Friendly though and their definitions of family and friendly are absolutely fucked. but since they're in charge of the Internet now, no one is allowed to be an adult. tiktokers say things like "unalive" and "seggs" because they know death and sex are too adult for online. online is for idiot babies only now because they're easier to market to

59K notes

·

View notes

Text

Ecommerce Fraud Prevention for Online Shopping | GPayments

#Ecommerce Fraud Prevention for Online Shopping#risk and fraud management#ecommercefraudprevention#fraud protection for e-commerce payment processors#financial fraud detection software

0 notes

Text

Choosing the Right Payment Gateway in the UAE for Your Business: Why Foloosi Stands Out

The UAE's e-commerce sector is booming, and at the heart of this growth lies the secure and efficient flow of online payments. But with a multitude of payment gateway providers vying for your attention, selecting the right one can be a challenge. This blog post will equip you with the knowledge to make an informed decision, while also highlighting why Foloosi stands out as a compelling option for businesses in the UAE.

Factors to Consider When Choosing a Payment Gateway in the UAE

Supported Payment Methods: UAE customers have diverse payment preferences. Look for a gateway that offers popular options like credit cards (Visa, Mastercard), debit cards, cash on delivery (COD), and digital wallets (Apple Pay, Samsung Pay). Read More..

#payment gateway#uae payment service#best payment service provider in abu dhabi#online payment in sharjah#best payment gateway in dubai#online payment in dubai#uae#online processor uae

0 notes

Text

Choosing the right payment processor is crucial for seamless transactions. Consider factors like security, cost, and scalability to find the best fit for your business needs. #PaymentProcessor #MerchantServices #OnlinePayments

0 notes

Text

Navigating the Maze: Choosing the Right Payment Gateway for Your Business with ClickAims

In today's digital world, seamless and secure online payments are the lifeblood of any successful business. Customers expect a smooth checkout experience, and offering a variety of payment options is crucial for conversion. But with a vast array of payment gateways and processors available, choosing the right one can feel overwhelming. ClickAims, a trusted provider of payment gateway services, is here to help you navigate the maze and find the perfect fit for your business.

Payment Gateways: The Secure Bridge Between Your Business and Customers

Think of a payment gateway as a secure bridge between your online store and your customer's bank account. When a customer makes a purchase, the payment information is encrypted and sent through the payment gateway for authorization. Once approved, the funds are transferred from the customer's account to yours.

Why Choose the Right Payment Gateway Matters

The right payment gateway can significantly impact your business in several ways:

Offering a variety of popular payment options, like credit cards, debit cards, and digital wallets, can encourage customers to complete their purchases.

Reliable payment gateways employ sophisticated security measures to protect your business from fraudulent transactions.

A smooth and secure checkout process builds trust with customers and encourages repeat business.

Integrating your payment gateway with your accounting software can automate tasks and save you valuable time.

ClickAims Can Help You Find the Perfect Payment Gateway:

With so many options available, choosing the right payment gateway can feel like a challenge. ClickAims takes the guesswork out of the process by:

We'll discuss your business model, the types of products or services you offer, and your target audience to identify the features that matter most to you.

Different payment gateways have varying fee structures. We'll help you understand these fees and find a solution that fits your budget.

If you plan to sell internationally, choosing a payment gateway that supports multiple currencies and languages is crucial. ClickAims can guide you towards solutions optimized for international transactions.

ClickAims prioritizes security. We ensure the payment gateway you choose adheres to the highest security standards and complies with relevant regulations.

Popular Payment Gateway Options:

Here's a brief overview of some popular payment gateway choices:

A widely recognized and trusted platform, ideal for businesses with a global customer base.

A user-friendly option with a transparent fee structure, perfect for startups and small businesses.

Offers a wide range of features and integrations, suitable for established businesses with complex needs.

Integrates seamlessly with Amazon accounts, ideal for businesses that sell on the Amazon marketplace.

ClickAims: More Than Just Payment Gateways

ClickAims goes beyond simply recommending a payment gateway. We offer a comprehensive suite of services to manage your online payments:

Our experienced team will seamlessly integrate your chosen payment gateway with your existing website or online store.

ClickAims can help you implement fraud prevention measures to protect your business from fraudulent transactions.

We can analyze your payment processing data and recommend strategies to optimize fees and improve efficiency.

ClickAims is here for you every step of the way, offering ongoing support and troubleshooting to ensure your payment system runs smoothly.

Choosing the Right Partner for Your Payment Needs

ClickAims understands that your business is unique, and your online payment needs will be too. We are dedicated to providing you with personalized solutions and expert guidance to ensure your online transactions are secure, efficient, and contribute to your business success.

Ready to Streamline Your Online Payments?

Contact ClickAims today for a free consultation! We'll help you navigate the world of payment gateways, answer your questions, and find the perfect solution to power your online sales and take your business to the next level. Don't let complex payment options hold you back from achieving your business goals. Let ClickAims be your trusted partner in creating a seamless and secure online payment experience for your customers.

#payment gateway services#best payment gateway for international transactions#best online payment processor for business#payment platforms for businesses#best payment processor for business#ClickAims

0 notes

Text

Offshore Company Registrations with Bank Account?

In today's globalized economy, businesses are increasingly looking beyond domestic borders to "optimize their operations", reduce costs, and gain access to international markets. One strategy that has gained popularity among entrepreneurs and investors is the establishment of offshore companies. In this comprehensive guide, we'll explore the concept of "offshore company registrations", their benefits, considerations, and the process of setting up an offshore company with a bank account.

Understanding Offshore Companies

Definition and characteristics of offshore companies

"Offshore companies are entities registered" in a jurisdiction different from where they conduct their primary business activities or where their owners reside. These companies often enjoy favorable tax treatment, regulatory advantages, and enhanced privacy compared to domestic entities.

Reasons why businesses choose to register offshore Businesses may opt for "offshore company registrations" for various reasons, including tax optimization, asset protection, confidentiality, access to global markets, and simplified regulatory requirements.

Legal and financial implications of offshore company registration While offshore companies offer several benefits, they also come with legal and financial considerations. It's crucial to understand the regulatory environment, tax implications, and compliance requirements associated with offshore operations.

Benefits of Offshore Company Registrations

Tax advantages Offshore companies often benefit from low or zero corporate tax rates, allowing businesses to minimize their tax liabilities and retain more profits.

Asset protection By holding assets offshore, businesses can shield them from potential legal claims, creditors, or other financial risks.

Privacy and confidentiality Offshore jurisdictions typically offer strict confidentiality laws, ensuring the privacy of company ownership and financial information.

Access to global markets Offshore companies can facilitate international trade and investment by providing a platform to conduct business across borders more efficiently.

Simplified regulatory requirements Some offshore jurisdictions have lenient regulatory frameworks, reducing administrative burdens and compliance costs for businesses.

Considerations Before Registering an Offshore Company

Jurisdiction selection Choosing the right jurisdiction is critical, as it determines the regulatory environment, tax implications, and overall suitability for the business's objectives.

Legal requirements and regulations Businesses must comply with the legal and regulatory requirements of both the offshore jurisdiction and their home country to avoid legal issues and potential penalties.

Banking and financial considerations Access to banking services is essential for offshore companies. However, some jurisdictions may have restrictions or challenges in opening and maintaining bank accounts.

Costs involved in setting up and maintaining an offshore company While "offshore company registrations" offer potential cost savings, businesses should consider the upfront and ongoing expenses associated with incorporation, administration, and compliance.

Risks and challenges associated with offshore operations Offshore companies may face risks such as regulatory changes, political instability, reputational damage, and increased scrutiny from tax authorities.

Steps to Register an Offshore Company with Bank Account

Conducting thorough research Before proceeding with offshore company registration, businesses should conduct comprehensive research on potential jurisdictions, legal requirements, and service providers.

Choosing the right jurisdiction Selecting a jurisdiction that aligns with the business's objectives, preferences, and industry requirements is crucial for successful offshore operations.

Hiring professional services Engaging legal, financial, and other professional services is advisable to navigate the complexities of "offshore company registrations" and ensure compliance with relevant laws and regulations.

Preparing and submitting necessary documents Businesses must gather and submit the required documents, such as identification proofs, business plans, and incorporation forms, to the offshore jurisdiction's authorities.

Opening a bank account for the offshore company Securing banking services is an integral part of "offshore company registrations in UK". Businesses should approach reputable banks in the chosen jurisdiction and fulfill their account opening requirements.

Compliance with ongoing regulatory requirements Once the "offshore company" is registered and the bank account is opened, it's essential to maintain compliance with ongoing regulatory requirements, including filing annual reports, tax returns, and other obligations.

Common Challenges and Solutions

Regulatory compliance issues Navigating complex regulatory frameworks and staying compliant with evolving laws and "regulations can be challenging for offshore companies". Seeking professional advice and regular updates on regulatory changes is essential.

Banking restrictions and challenges Some offshore jurisdictions may "face banking restrictions" or challenges due to regulatory scrutiny or international sanctions. Exploring alternative banking options or engaging specialized banking services can help overcome these challenges.

Tax implications and controversies Offshore companies may face scrutiny and controversies related to tax avoidance or evasion. Maintaining accurate records, adhering to tax laws, and seeking tax advice from experts can mitigate tax-related risks.

Reputation risks associated with offshore entities Offshore companies often face stigma and negative perceptions due to associations with tax evasion, money laundering, or illicit activities. Maintaining transparency, ethical business practices, and good corporate governance can help mitigate reputational risks.

#Offshore Company Registration#Offshore payment processors#Offshore high risk payment gateway#Offshore payment gateway high risk#Offshore online payment processing#Offshore payment service provider#Offshore merchant payment services#Offshore bitcoin debit card#Offshore Company#Offshore companies#Offshore company in UK#Offshore company in USA#Offshore company Registration in UK#Offshore company Registration in USA#Offshore company formation#Offshore incorporation services

0 notes

Text

Navigating Excellence: The Unseen Power of Nyrapay Payment Gateway's Email Support

Embark on a journey of unrivaled customer support with our latest blog post, shedding light on the impactful role of Nyrapay Payment Gateway’s Email Support. Explore how this essential channel provides users with the guidance and assistance they need, ensuring a seamless and reliable payment experience.

1) The Pillars of Nyrapay’s Email Support Dive into the core of Nyrapay Payment Gateway’s email support, understanding its fundamental role in delivering timely and comprehensive assistance to users. Explore how this communication channel acts as a bridge, connecting users with the support team for inquiries, concerns, and technical issues.

2) Timely and Thoughtful Responses Delve into Nyrapay’s commitment to providing timely and thoughtful responses through email support. Discover how the dedicated support team ensures that users receive the assistance they need promptly, contributing to a positive and efficient user experience.

3) Integration Guidance and Expert Advice Explore how Nyrapay’s email support goes beyond addressing issues, offering expert guidance for businesses integrating the payment gateway. Learn about the step-by-step assistance provided, ensuring a smooth integration process and empowering users with the necessary knowledge.

4) Transactional Support and Issue Resolution Uncover the versatility of Nyrapay’s email support in providing transactional assistance and issue resolution. Learn how the support team navigates users through transaction-related queries, ensuring a secure and reliable payment environment.

5) User Feedback and Continuous Improvement Explore Nyrapay’s commitment to continuous improvement through user feedback received via email support. Discover how insights from users contribute to refining the platform, creating an evolving ecosystem that adapts to the dynamic needs of businesses and consumers.

Conclusion: Join us in acknowledging the unseen power of Nyrapay Payment Gateway’s Email Support. Discover how this crucial support channel ensures users receive the assistance they need, fostering trust, reliability, and a seamless payment experience. Read our blog post now and unlock the potential of exceptional customer support!

#payment gateway#payment gateway providers#best payment processor for small business#online payment processors#online payment gateway

0 notes

Text

Navigating High-Risk: The Advantages of Using High-Risk Payment Processors for High-Transaction…

#Navigating High-Risk: The Advantages of Using High-Risk Payment Processors for High-Transaction…#high risk payment processors#payment processor#high-risk payment processing#payment processing#high risk payment processing#high risk payment processor#high risk payment gateway#high-risk payment gateway#online payment processing company#payment gateway#online payment processing#high-risk payment processing for cbd business#payment processor for high risk merchants#payment processors#merchant account for high risk business

1 note

·

View note

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Best Online Payment Processor

Wetranxact is the best online payment processor in the market today. We offer the most comprehensive suite of payment processing services to businesses of all sizes, including: credit card processing, ACH and eCheck processing, and wire transfer payments. We also provide our clients with fraud protection and chargeback management services, to help them protect their businesses and bottom lines.

0 notes

Text

Credit Card Fraud Prevention with 3D Secure | GPayments

#Credit Card Fraud Prevention with 3D Secure#ecommerce fraud prevention for online shopping#ecommercefraudprevention#detectionsoftware#fraud protection for e-commerce payment processors

0 notes

Text

The last couple of years have been tough on most of us mainly because of the pandemic and the change in life it brought for us all. However, you will be surprised to know that during the pandemic, e-commerce thrived since most customers couldn’t leave their homes and relied on online shopping for their needs. Needless to say, the popularity of e-commerce websites isn’t going to fade anytime soon. If anything, such businesses are constantly getting bigger. So if you own a business and are wondering how to keep up with the competition while catering to a wider audience, e-commerce could be the key. However, when it comes to making sure that your business is equipped to accept online payments, you need online merchant accounts and will have to get in touch with payment processing companies.

0 notes

Link

Owning a successful business is something most of us desire. However, the real challenge here is to make sure that the business model you start transforms into a profit making business. In recent times, customers are often looking for convenience when it comes to purchasing goods and services.

0 notes

Text

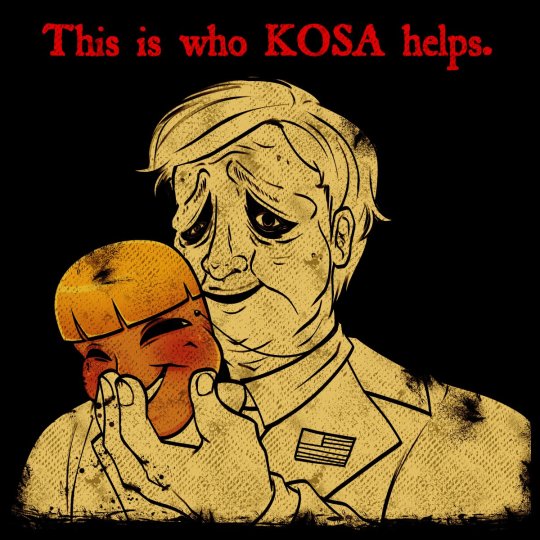

URGENT! Stop KOSA!

Hey all, this is BáiYù and Sauce here with something that isn't necessarily SnaccPop related, but it's important nonetheless. For those of you who follow US politics, The Kids Online Safety Act passed the Senate yesterday and is moving forward.

This is bad news for everyone on the internet, even outside of the USA.

What is KOSA?

While it's officially known as "The Kids Online Safety Act," KOSA is an internet censorship masquerading as another "protect the children" bill, much in the same way SESTA/FOSTA claimed that it would stop illegal sex trafficking but instead hurt sex workers and their safety. KOSA was originally introduced by Sen. Edward Markey, D-Mass. and Bill Cassidy, R-La. as a way to update the 1998 Children’s Online Privacy Act, raising the age of consent for data collection to 16 among other things. You can read the original press release of KOSA here, while you can read the full updated text of the bill on the official USA Congress website.

You can read the following articles about KOSA here:

EFF: The Kids Online Safety Act is Still A Huge Danger to Our Rights Online

CyberScoop: Children’s online safety bills clear Senate hurdle despite strong civil liberties pushback

TeenVogue: The Kids Online Safety Act Would Harm LGBTQ+ Youth, Restrict Access to Information and Community

The quick TL;DR:

KOSA authorizes an individual state attorneys general to decide what might harm minors

Websites will likely preemptively remove and ban content to avoid upsetting state attorneys generals (this will likely be topics such as abortion, queerness, feminism, sexual content, and others)

In order for a platform to know which users are minors, they'll require a more invasive age and personal data verification method

Parents will be granted more surveillance tools to see what their children are doing on the web

KOSA is supported by Christofascists and those seeking to harm the LGBTQ+ community

If a website holding personally identifying information and government documents is hacked, that's a major cybersecurity breach waiting to happen

What Does This Mean?

You don't have to look far to see or hear about the violence being done to the neurodivergent and LGBTQ+ communities worldwide, who are oftentimes one and the same. Social media sites censoring discussion of these topics would stand to do even further harm to folks who lack access to local resources to understand themselves and the hardships they face; in addition, the fact that websites would likely store personally identifying information and government documents means the death of any notion of privacy.

Sex workers and those living in certain countries already are at risk of losing their ways of life, living in a reality where their online activities are closely surveilled; if KOSA officially becomes law, this will become a reality for many more people and endanger those at the fringes of society even worse than it already is.

Why This Matters Outside of The USA

I previously mentioned SESTA/FOSTA, which passed and became US law in 2018. This bill enabled many of the anti-adult content attitudes that many popular websites are taking these days as well as the tightening of restrictions laid down by payment processors. Companies and sites hosted in the USA have to follow US laws even if they're accessible worldwide, meaning that folks overseas suffer as well.

What Can You Do?

If you're a US citizen, contact your Senators and tell them that you oppose KOSA. This can be as an email, letter, or phone call that you make to your state Senator.

For resources on how to do so, view the following links:

https://www.badinternetbills.com/#kosa

https://www.stopkosa.com/

https://linktr.ee/stopkosa

If you live outside of the US or cannot vote, the best thing you can do is sign the petition at the Stop KOSA website, alert your US friends about what's happening, and raise some noise.

Above all else, don’t panic. By staying informed by what’s going on, you can prepare for the legal battles ahead.

#stop KOSA#KOSA#censorship#us law#somethings wrong with sunny day jack#the groom of gallagher mansion#dachabo

2K notes

·

View notes