#Online P45

Explore tagged Tumblr posts

Text

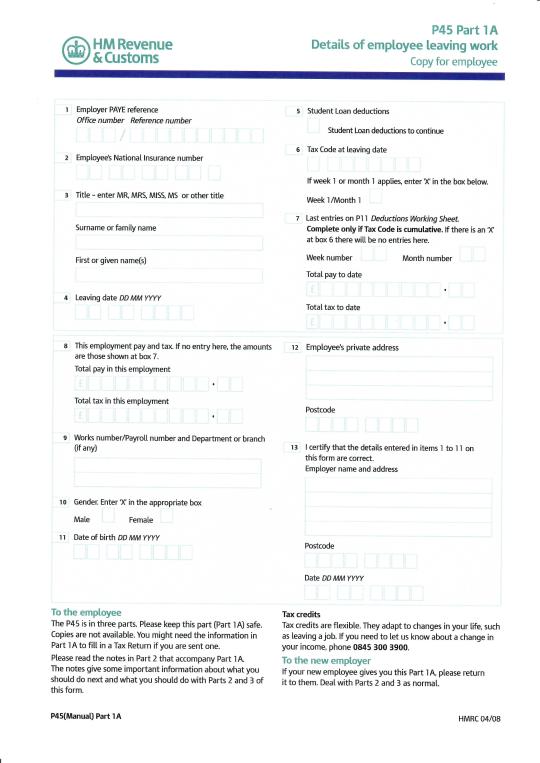

What are the Documents required to generate P45 from Payroll companies in UK?

The generation of a P45 is typically done by an employer or a payroll company when an employee leaves their job. The P45 is a document that summarizes an individual’s pay and deductions for the current tax year up to the date of leaving the job. The information needed to generate a P45 includes: Employee Details: Full name of the employee Address National Insurance Number Date of…

View On WordPress

1 note

·

View note

Text

@aventurine-p45-ipc this is me when your not online

me when they’re not online

5K notes

·

View notes

Text

A Step-by-Step Guide to Completing HS304: A Must-Know for Expats and Taxpayers

If you’ve ever found yourself feeling overwhelmed by tax forms, you’re not alone. For many, the HS304 form can be particularly confusing. If you’re an expatriate or someone leaving the UK, understanding how to complete the HS304 form is essential. It’s a tax document that plays a pivotal role in ensuring you're taxed correctly when you leave the UK, so it’s worth taking the time to understand.

What is the HS304 Form?

The HS304 form is specifically designed for individuals who are leaving the UK and need to complete their tax return for the year of departure. It's part of the Self Assessment process that helps determine whether you're eligible for a tax refund or owe additional taxes after leaving the UK. Essentially, this form helps to ensure that you pay the right amount of tax based on your final year’s earnings and that you're no longer taxed as a UK resident after you’ve left.

Why Is Completing the HS304 Important?

You might be wondering why you can't simply skip the form if you’ve already left the UK. Well, here’s the thing: If you fail to submit the HS304 correctly, you could be overtaxed or even miss out on a tax refund. The form is a necessary step in calculating your exact tax liability during your final year as a UK resident.

By completing this form, you not only ensure you’re paying the right amount of tax, but you also signal to HMRC that you’ve left the UK, preventing them from continuing to tax you as a UK resident. Plus, depending on your situation, you might be entitled to a refund if you’ve overpaid taxes.

Step-by-Step Guide: How to Complete HS304

So, how do you actually complete the HS304 form? The process might seem complicated, but breaking it down step-by-step makes it much easier to follow. Here’s a simple guide:

Gather Necessary Information Before diving into the form, gather all relevant information about your income, tax paid, and details about your departure from the UK. This includes things like your P60 (if you were employed), P45 (if you’ve left a job), and any other documents relating to your earnings during the tax year.

Start with Your Personal Details The first section of the form will ask for your personal information. This includes your name, address, National Insurance number, and details of your departure date. Be sure to include the exact date you left the UK—this is important for determining your residency status.

Provide Income Information In this section, you’ll need to report your income from all sources—employment, self-employment, rental income, or other earnings. If you’ve worked in the UK during the year, provide your gross income and the tax already paid. If you were self-employed, ensure you list your earnings and expenses.

Claiming Tax Relief or Deductions You might be eligible for tax relief depending on your situation. For example, if you’re entitled to claim relief for the part of the year you were a UK resident, or if there are expenses you’ve incurred while working abroad, make sure to detail them in this section.

Complete the Residency Information This part is crucial. You’ll need to indicate whether you’re now a non-resident for tax purposes and provide information on when your UK residency ended. The form asks whether you intend to stay outside the UK permanently, temporarily, or whether you are moving to a country with a double taxation agreement (DTA) with the UK.

Double Check Everything Before submitting the form, make sure that all of your information is accurate. Double-check your income figures, relief claims, and residency status. Errors can delay your refund or lead to penalties, so it's essential that everything is correct.

Submit the Form to HMRC Once you’ve completed the HS304, you can submit it online via your Self Assessment account or send it by post to HMRC. It’s important to submit the form on time to avoid fines. The deadline for submitting your final year’s Self Assessment is generally January 31st following the tax year of departure.

Common Mistakes to Avoid When Completing HS304

While the HS304 form might seem straightforward, there are a few common mistakes that could lead to complications. For example, not reporting all income sources or failing to declare the correct departure date could result in inaccurate tax calculations. Always keep thorough records and seek advice if you’re unsure about any part of the form.

The Bottom Line

Completing the HS304 form might not be the most exciting task, but it’s one that you can’t afford to ignore if you’ve left the UK. Whether you’re claiming a refund or simply ensuring you’ve paid the right amount of tax, the form plays a crucial role in wrapping up your UK tax responsibilities. Take your time, follow the steps carefully, and don’t hesitate to seek professional help if needed.

Key Takeaways:

The HS304 form is crucial for anyone leaving the UK and needs to be completed accurately.

The form helps ensure you're not overtaxed or under-taxed after leaving the UK.

Double-check all your personal, income, and residency information before submitting.

By following these simple steps, you’ll be able to navigate How to complete HS304 with confidence, ensuring that your tax matters are fully sorted when you leave the UK. Whether you're unsure about your residency status or need to report your final income, understanding How to complete HS304 is crucial to ensure you're not overtaxed or under-taxed. The process might seem complicated, but breaking it down into manageable parts makes it easier to handle.

#buytolet#tax refund#investmenttax#rentalincome#taxplanning#united kingdom#60 tax trap calculator#taxfiling#landlordtax#taxseason

0 notes

Text

PDF Bank Statement & Document Editing Services

Are you looking for flawless bank statement editing, PDF corrections, or document modifications? Look no further! With over 10 years of expertise, we provide world-class editing services for all your needs — with full privacy and perfection guaranteed.

🏆 Our Top Services:

🔹 Bank Statement Editing (All Banks Supported) 🔹 Paystub & Payslip Creation and Modification 🔹 Utility Bills Editing (Phone, Gas, Electricity, Water Bills) 🔹 Tax Returns Forms (W-2, 1040, P60, P45) Editing 🔹 PDF to Word/Excel Conversion 🔹 Editing of Scanned Documents and Photos 🔹 Statement Reconciliation Services 🔹 Custom Document Templates Creation

🔒 Why Choose Us?

✅ 10+ Years of Professional Experience ✅ 100% Confidentiality & Secure Handling ✅ Unlimited Revisions Until You Are Satisfied ✅ Fast Delivery (Within 4-24 Hours Available) ✅ High-Quality & Realistic Results (No Visible Editing Signs) ✅ Affordable Pricing with Premium Quality

🏦 We Work with All Major Banks: Bank of America | Wells Fargo | Chase | TD Bank | HSBC | Barclays | Halifax | Capital One | ANZ | NAB

📞 Contact Us:

📲 WhatsApp Now: +92 321 3549046 🚀 Fast Response | Instant Consultation Available

📣 Important Note:

Your Privacy is Our Top Priority. We do not share or misuse your documents — 100% trust and confidentiality.

#Bank Statement Editing #Edit Bank Statement #Paystub Editing Services #PDF Editor Online #Scanned Document Editor #PDF to Excel Converter #Bank Statement Editing #Utility Bills Editor #Tax Forms Editing #Professional PDF Editing

1 note

·

View note

Text

PDF Bank Statement & Document Editing Services

Are you looking for flawless bank statement editing, PDF corrections, or document modifications? Look no further! With over 10 years of expertise, we provide world-class editing services for all your needs — with full privacy and perfection guaranteed.

🏆 Our Top Services:

🔹 Bank Statement Editing (All Banks Supported) 🔹 Paystub & Payslip Creation and Modification 🔹 Utility Bills Editing (Phone, Gas, Electricity, Water Bills) 🔹 Tax Returns Forms (W-2, 1040, P60, P45) Editing 🔹 PDF to Word/Excel Conversion 🔹 Editing of Scanned Documents and Photos 🔹 Statement Reconciliation Services 🔹 Custom Document Templates Creation

🔒 Why Choose Us?

✅ 10+ Years of Professional Experience ✅ 100% Confidentiality & Secure Handling ✅ Unlimited Revisions Until You Are Satisfied ✅ Fast Delivery (Within 4-24 Hours Available) ✅ High-Quality & Realistic Results (No Visible Editing Signs) ✅ Affordable Pricing with Premium Quality

🏦 We Work with All Major Banks: Bank of America | Wells Fargo | Chase | TD Bank | HSBC | Barclays | Halifax | Capital One | ANZ | NAB

📞 Contact Us:

📲 WhatsApp Now: +92 321 3549046 🚀 Fast Response | Instant Consultation Available

📣 Important Note:

Your Privacy is Our Top Priority. We do not share or misuse your documents — 100% trust and confidentiality.

#Bank Statement Editing #Edit Bank Statement #Paystub Editing Services #PDF Editor Online #Scanned Document Editor #PDF to Excel Converter #Bank Statement Editing #Utility Bills Editor #Tax Forms Editing #Professional PDF Editing

1 note

·

View note

Text

From Confused to Confident: Mastering Self Assessment Tax Returns in 2025

Filing your self assessment tax returns can feel overwhelming — especially with changing rules, complex forms, and the risk of errors. Whether you're a UK resident, a non-resident earning UK income, or someone navigating HMRC’s system for the first time, understanding the process is crucial.

With the right guidance, you can move from feeling confused to confident when filing your self assessment tax returns in 2025. In this guide, we’ll walk you through the process, highlight key tips, and explain how tools like the UK tax resident calculator can simplify your filing — especially if you’re submitting a tax return for non resident status.

1. What Are Self Assessment Tax Returns?

A self assessment tax return is HMRC's system for collecting income tax that hasn’t been automatically deducted from your salary, pension, or savings.

Who Needs to File a Self Assessment Tax Return?

✅ Self-Employed Individuals ✅ Freelancers and Contractors ✅ Landlords Earning Rental Income ✅ Company Directors (not paid through PAYE) ✅ High Earners (earning over £100,000 annually) ✅ Non-Residents with UK Income

If you’re unsure whether you need to file, HMRC offers a UK tax resident calculator that helps determine your residency status — a crucial factor in whether your income is taxable in the UK.

2. Key Changes to Self Assessment Tax Returns in 2025

Tax regulations evolve, and 2025 introduces several updates that may affect how you file:

1. Digital by Default

HMRC continues its “Making Tax Digital” initiative, encouraging individuals to file their self assessment tax returns online.

Paper submissions are still accepted but are slower and risk higher error rates.

2. Stricter Penalties for Late Filings

Penalties for late filing now start at £100 immediately after the deadline, with increasing fines for prolonged delays.

3. Enhanced Guidance for Non-Residents

HMRC now provides clearer instructions for those filing a tax return for non resident status, reducing the risk of overpayment.

3. How to Determine Your Residency Status with the UK Tax Resident Calculator

Residency status plays a major role in your tax obligations. If you live abroad but earn UK income, your residency status will determine how much tax you pay.

Using the UK Tax Resident Calculator

The UK tax resident calculator helps assess your status based on key factors:

✅ Number of days spent in the UK during the tax year ✅ Your primary home’s location ✅ Ties to the UK (e.g., family, employment, or property)

Why Is This Important?

If you qualify as a non-resident, you may only be taxed on your UK-sourced income — potentially reducing your overall tax liability. This is crucial when filing a tax return for non resident status.

4. Step-by-Step Guide to Filing Self Assessment Tax Returns

Follow these steps to confidently file your self assessment tax returns in 2025:

Step 1: Register for Self Assessment

First-time filers must register with HMRC.

After registration, you’ll receive a Unique Taxpayer Reference (UTR) — required for filing.

Step 2: Gather Your Financial Information

Ensure you have: ✅ P60/P45 (employment income) ✅ Bank statements (for interest earned) ✅ Rental income records (if you’re a landlord) ✅ Foreign income details (for a tax return for non resident) ✅ Expense receipts (to claim deductions)

Step 3: Use the UK Tax Resident Calculator

Before filing, use the UK tax resident calculator to confirm your residency status and determine which income sources must be reported.

Step 4: Complete Your Self Assessment Online

Log into your HMRC account.

Follow the guided steps, ensuring you declare all income streams, allowable expenses, and deductions.

Step 5: Claim Allowances and Deductions

Key deductions that reduce your tax bill include: ✅ Mortgage interest (for landlords) ✅ Business expenses (for self-employed individuals) ✅ Charitable donations ✅ Pension contributions

Step 6: Submit Your Tax Return and Payment

The filing deadline is 31 January 2026 for online submissions.

Payments must also be made by this deadline to avoid penalties.

5. Special Considerations for Non-Residents

If you’re filing a tax return for non resident status, be aware of these key points:

✅ Declare UK-Sourced Income Only: Non-residents are typically taxed only on UK earnings, not global income. ✅ Claim Double Taxation Relief: If you’re taxed abroad, you may qualify for relief to avoid paying tax twice. ✅ NRLS Registration: Non-resident landlords should register for the Non-Resident Landlord Scheme (NRLS) to prevent tax deductions at source.

Using the UK tax resident calculator ensures you accurately determine your status and avoid paying unnecessary tax.

6. Common Mistakes to Avoid When Filing Self Assessment Tax Returns

Even seasoned filers can make costly mistakes. Here are some pitfalls to watch out for:

❌ Missing the Deadline: The deadline for online filing is 31 January 2026. Late submissions can lead to fines starting at £100. ❌ Forgetting to Declare Side Income: Income from side jobs, freelance work, or investments must be reported. ❌ Failing to Claim Deductions: Missing out on eligible expenses could mean overpaying tax. ❌ Incorrect Residency Status: Misjudging your status using the UK tax resident calculator can result in overpayment or fines. ❌ Incomplete Records: Always keep proof of income, expenses, and deductions for at least 5 years in case of HMRC inquiries.

7. Why Using Tax Software Can Make Filing Easier

Tax software can simplify filing your self assessment tax returns and ensure you meet deadlines while maximizing deductions.

Benefits of Tax Software:

✅ Step-by-Step Guidance: Ensures you don’t miss key entries. ✅ Automatic Calculations: Reduces errors and ensures accurate totals. ✅ Integrated UK Tax Resident Calculator: Helps determine if you should file a tax return for non resident status. ✅ Faster Refunds: Submitting online speeds up refund processing.

Popular platforms like TaxCalc, GoSimpleTax, and Taxfiler provide comprehensive support for UK residents and non-residents alike.

Conclusion

Filing your self assessment tax returns in 2025 doesn’t have to be stressful. By understanding key changes, using tools like the UK tax resident calculator, and staying informed about non-resident tax rules, you can file with confidence.

Whether you’re a freelancer, landlord, or expat handling a tax return for non resident status, following the right steps will ensure accuracy and potentially boost your refund.

Embrace the power of preparation — start your self assessment journey today and secure your financial future!

FAQs

1. When is the deadline for filing my self assessment tax return in 2025?

The deadline for online submissions is 31 January 2026. If you’re filing by paper, the deadline is 31 October 2025.

2. How do I use the UK tax resident calculator?

Visit the official HMRC website and follow the calculator’s prompts. It evaluates your residency status based on the number of days you’ve spent in the UK and your personal ties.

3. Do non-residents need to report foreign income?

Non-residents are generally taxed only on UK-sourced income. However, if you have global earnings that fall under UK tax rules, you may still need to declare them.

4. Can I amend my self assessment tax return after submission?

Yes. You can make changes to your self assessment tax returns online up to 12 months after the filing deadline.

5. What happens if I file my tax return late?

HMRC issues an immediate £100 fine for late submissions, with additional penalties accumulating over time.

#SA109#TaxSavings#TaxAccountant#Finance#Taxd#TaxFiling#TaxReturns#TaxdUK#FinancialPlanning#TaxSeason#Tax#UKTaxSelfAssessment#TaxationServices#TaxReturnOnline#FinancialServices

1 note

·

View note

Text

How Online Payroll Software Ensures Compliance and Accuracy

In today's growing business environment, managing payroll and delivering with frequently changing laws can be quite a task. However with correct tools, like online payroll software, companies can restructure the payroll process which will generate minimum to no errors, making sure they stay rigid with regulations while maintaining accuracy.

Understanding Compliance in Payroll

Payroll compliance refers to a company’s ability to meet legal requirements regarding employee compensation, tax deductions, and various employment laws. This includes staying updated with tax regulations rates, employee benefits, and national insurance contributions.

For many enterprises, particularly small to medium-sized enterprises (SMEs), staying on top of these complex requirements can be overwhelming. This is where online payroll software comes in, offering a solution to keep payroll in line with current laws, tax codes, and employment standards.

How Online Payroll Software Helps Maintain Compliance

Automated Tax Calculations

One of the standout features of online payroll software is its ability to automatically calculate tax deductions, ensuring that every employee’s pay is processed in line with the latest tax rates and regulations. Whether it's Pay As You Earn (PAYE), National Insurance, or other employee-related deductions, payroll management software simplifies the process, eliminating the risk of human error.

Tax Filing and Reporting

Another significant advantage of online payroll software or hr payroll software is its ability to generate accurate tax reports and forms. The software automatically prepares essential documents such as P60s, P45s, and Real-Time Information (RTI) submissions to HMRC. It ensures that these forms are filed correctly and on time, preventing late filing penalties and reducing the administrative burden on HR teams.

Stay Current with Legal Changes

Employment laws are constantly evolving, and failing to keep track of these changes can have serious consequences for businesses. Online payroll software automatically integrates updates related to tax codes, minimum wage changes, and new employee benefit regulations. This reduces the risk of non-compliance and ensures that businesses never miss a crucial update.

Audit Trails

Payroll software helps the businesses to maintain an audit trail of all payroll-related actions. This feature gives a detailed, traceable record of all the transactions, adjustment, and payment made. In an audit event, businesses can provide transparent evidence of compliance by having access to these records, which ultimately reduces the chances of fines or legal issues.

Ensuring Payroll Accuracy

Accurate payroll processing is vital for employee satisfaction and legal compliance. Payroll errors can lead to incorrect payments, causing frustration among employees and potential disputes. Online payroll software significantly reduces the risk of such errors by automating key payroll processes.

Error Reduction

Manual payroll processes are often prone to mistakes, whether it’s miscalculating overtime, holiday pay, or tax deductions. Online payroll software eliminates these errors by automating calculations and ensuring that data is entered consistently and accurately.

Benefits of Online Payroll Software for Businesses

Minimising Penalties

By using online payroll software, businesses reduce the likelihood of making errors that could lead to fines or legal trouble. With automated tax calculations, timely filings, and adherence to employment regulations, businesses can avoid costly mistakes and stay in good standing with authorities like HM Revenue & Customs (HMRC).

Time and Cost Efficiency

Online payroll software eliminates the need for manual calculations, significantly reducing the time spent on payroll administration. For HR teams, this means fewer hours spent on processing payroll and more time dedicated to other important tasks, such as employee engagement and development.

Employee Trust and Satisfaction

Employees are dependent on timely and accurate pay to manage their costs. Businesses can make sure that their employees are paid on time without compromising in numbers by using payroll management software, this generates trust and employee satisfaction, which ultimately improves retention and overall workplace morale.

Conclusion

In conclusion, Online payroll software is a vital tool for establishing compliance and accuracy in the process of payroll. Now with this tool, businesses can protect themselves by automating tax calculations, generating accurate reports, keeping themselves updated with legal changes, and reducing the errors. All these processes will reduce the company cost to a certain extent and maintain employee satisfaction at the same time. Subsiding in reliable payroll software will grant your business's long term success and growth. You can check out Opportune HR for online payroll software services as they are a top HRMS provider in India, serving numerous SMEs and MNCs with custom software solutions. Visit their website for more on their software services.

0 notes

Text

Essential Tax Checklists for Self-Assessment Beginners

Self-assessment for the first time can be overwhelming, but having a clear checklist simplifies the process. As a beginner, understanding the requirements, deadlines, and documentation ensures compliance while minimizing stress. However, the expertise of a professional tax filer can make all the difference in ensuring accuracy and maximizing savings.

The Beginner’s Self-Assessment Checklist

Register with HMRC The first step is registering for self-assessment tax filing. Obtain your Unique Taxpayer Reference (UTR) and set up your online account.

Income Records Gather all income-related documentation, such as employment income, self-employment earnings, rental income, or dividends. Accurate reporting is critical to avoid errors.

Expense Documentation Organize receipts and records for allowable expenses, including business costs, mileage, office supplies, and professional services. This is crucial for claiming tax relief and reducing taxable income.

Bank Statements Keep personal and business account statements handy for cross-referencing income and expenses.

Pension and Investment Information Include details of pension contributions, savings accounts, and any gains from investments.

Important Deadlines Mark key self-assessment deadlines on your calendar, such as registration, filing, and payment dates. Missing these deadlines can result in penalties.

Tax Codes and PAYE Forms Ensure you have access to relevant documents like P60s, P45s, and P11Ds, which provide information on your tax codes and income.

Why Seek Professional Help?

While this checklist provides a solid foundation, beginners can still face challenges with understanding tax laws, calculating deductions, and meeting deadlines. Professional support ensures your return is accurate, compliant, and filed on time. Experts help uncover deductions you might overlook, optimize your tax position, and prevent costly penalties.

Achieve Financial Confidence

By working with seasoned professionals in self-assessment tax filing, you gain peace of mind and save time. Whether you’re a sole trader, freelancer, or first-time taxpayer, their guidance ensures your tax return is as efficient and stress-free as possible.

Start your tax journey right,contact expert tax filers today!

0 notes

Text

Understanding Self-Assessment Tax Returns for Individuals in the UK

Self-assessment tax returns are an integral component of the UK system of taxation by allowing individuals to report their income along with capital gains to HMRC. This is important for self-employed persons, landlords, and others out of the realms of PAYE income. Understanding the nuances of self-assessment is critical in ensuring adherence to UK tax law and penalty avoidance. In this article, we show what self-assessment is, who needs to file, key deadlines, the steps involved in filing, and some tips on how to make it easier.

What is a self-assessment tax return?

A self-assessment tax return is HMRC’s method of collecting the income tax. Usually, the tax is deducted automatically from wages, pensions, and savings, but those people and businesses receiving other income are required to report this in a tax return. The whole self-assessment process means that an individual needs to work out his or her own tax liability and then report this to HMRC.

Who must submit a self-assessment tax return?

Not everyone in the UK must submit a self-assessment tax return. Usually, people need to file returns if they are:

Self-employed as a sole trader, and their profits were over £1,000 before deducting anything that they can claim tax relief on.

A partner in a business partnership

Receiving untaxed income-for example, income from letting out a property, tips and commission, savings, investments, and dividends

Have received more than £100,000 in a tax year

Must claim some tax reliefs or allowances

Receive a child benefit and their partner or themselves are earning in excess of £50,000

It’s important to note that even if you are on a PAYE system, you may still need to file a return if you fall into any of these categories. Checking with HMRC or a tax professional can help clarify your specific situation.

Key deadlines for self-assessment

The deadlines for self-assessment are worth remembering to avoid any penalties. The key dates include the following:

5th October: If you are a first time filer you must register for self-assessment.

31st October: Latest date for paper tax returns for the previous tax year.

31st January: Latest date for online tax returns for the previous tax year and latest date for paying any tax owed.

If you miss the deadline, there is a possible penalty of £100 to start with, and this could increase over time in case of failure to submit the return or pay the tax. Interest might also be charged on any late payments.

How to register for self-assessment

If you need to file a self-assessment tax return for the first time, you must register with HMRC. The registration process differs depending on your employment status:

Self-employed individuals or sole traders: Register using the online service.

Partners in a business partnership: Register online or by post.

Individuals needing to declare income or capital gains: Use form SA1 or register online.

Once registered, you will receive a Unique Taxpayer Reference (UTR) and will need to create an account on the Government Gateway. This account will allow you to access the self-assessment portal and file your tax return.

Steps to file a self-assessment tax return

Filing a self-assessment tax return can be straightforward if you follow these steps:

Gather Your Records: Collect all necessary documentation, such as P60s, P45s, and records of income and expenses if self-employed. You will also need details of any other income, such as dividends or rental income.

Sign in to Your Account: Use your Government Gateway credentials to sign in to your HMRC online account.

Complete the Tax Return: Follow the prompts to complete the sections relevant to your situation. These sections will ask for details about your income, expenses, and any reliefs or allowances you are claiming.

Calculate Your Tax: HMRC’s online system will automatically calculate your tax liability based on the information you provide.

Submit Your Return: Review your completed return carefully, ensuring all information is accurate. Submit the return online before the 31st January deadline.

Common mistakes to avoid

There are several common mistakes people make when filing their self-assessment tax returns:

Missing Deadlines: This is the most common error and can result in penalties and interest charges.

Incorrect Information: Providing incorrect or incomplete information can delay the process and result in fines.

Not Keeping Records: It’s vital to keep accurate records for at least five years after the 31st January submission deadline for that tax year.

Forgetting to claim allowances or reliefs: Ensure that you are aware of all the allowances and reliefs available to you, such as the Personal Allowance, Marriage Allowance, and expenses for self-employed individuals.

Pay Your Tax: Once submitted, you will be informed of the amount of tax due. Payment can be made online via various methods, including direct debit, credit card, or bank transfer.

Conclusion

Understanding self-assessment tax returns is of essence to UK individuals who derive income that is not PAYE or from another source that may be subject to taxation. The more one knows about the process, keeps good records, and observes deadlines, the better such a person complies with the requirements set forth by HMRC and avoids heavy fines. Since laws and regulations on tax are subject to change, it is very important to maintain one’s tax affairs up to date and seek professional advice where necessary.

Do you find the self-assessment process overwhelming and complicated? Let Integra Global Solutions help you with that. With qualified accountants, Integra gives full-service tax preparation with accounting services, which can be tailored to your needs. Be it self-employed, a landlord, or one with multiple sources of income, Integra will be able to provide the necessary guidance to enable you to prepare an appropriate tax return within the given time, so that you may well avoid any unnecessary penalty and optimise your tax position. For more information, please visit our website today at www.globalintegra.co.uk and let us assist you in any aspect of your self-assessment tax return and any other accounting need you may have.

0 notes

Text

P45 Form in Ireland – A Guide for what is a p45

When it comes to employment documentation in Ireland, one of the most important forms you’ll encounter is the P45. Whether you’re leaving a job or starting a new one, understanding what a P45 is and how to obtain it is crucial. In this comprehensive guide, we will delve into the meaning of the P45, its significance, and the steps to request and obtain it.

What is a P45?

A P45 is an essential document in Ireland that an employer provides to an employee upon the termination of their employment. The form outlines the details of the employee’s earnings and the taxes deducted during their employment period. Essentially, the P45 serves as a record of your income and tax contributions up until the point you leave a job.

P45 Meaning

The P45 contains several parts:

Part 1: Sent to Revenue (the Irish tax authority) by the employer.

Part 2 and Part 3: Given to the employee. Part 3 is used when the employee starts a new job to ensure that the correct tax details are transferred.

Part 4: Retained by the employer for their records.

The P45 is crucial for both tax and social welfare purposes. It ensures that you are taxed correctly when you start a new job and helps in claiming any social welfare benefits you may be entitled to.

How Can I Get a P45?

How to Obtain a P45

The process of obtaining a P45 is straightforward:

Upon Leaving Employment: When you leave your job, your employer is required to provide you with your P45. This is typically done on your last working day or shortly thereafter.

Requesting from Employer: If you do not receive your P45, you should request it directly from your employer. Employers are legally obliged to provide this document.

Contacting Revenue: If your employer fails to provide your P45, you can contact Revenue for assistance. They may be able to intervene on your behalf.

How to Request a P45

If you need to request a P45, here are the steps to follow:

Write a Formal Request: Draft a formal request to your employer’s HR department or payroll services officer, specifying your need for the P45.

Email or Mail the Request: Send your request via email or mail. Ensure you keep a copy of the communication for your records.

Follow Up: If you do not receive a response within a reasonable time frame, follow up with a phone call or a second written request.

Why is the P45 Important?

The P45 serves several critical functions:

Taxation: It ensures that your tax information is up-to-date, preventing overpayment or underpayment of taxes.

Social Welfare: Required when claiming social welfare benefits, such as Jobseeker’s Allowance.

Employment: Needed when starting a new job to provide your new employer with accurate tax details.

Starting a New Job

When you start a new job, you will give Part 3 of your P45 to your new employer. This ensures that your tax deductions continue correctly and that you avoid emergency tax rates, which can be significantly higher.

Claiming Social Welfare Benefits

If you are claiming social welfare benefits, such as Jobseeker’s Allowance, you need to present your P45 to the Department of Social Protection. This document provides evidence of your previous employment and earnings, which is necessary for calculating your benefit entitlements.

What If You Lose Your P45?

If you lose your P45, you cannot get a duplicate from your former employer as they are not allowed to issue copies. However, you can still manage your tax affairs:

Contact Revenue: Inform them about the lost P45. Revenue can provide the necessary information to your new employer or for social welfare claims.

Use Online Services: You can access your employment and tax details through Revenue’s online services, myAccount, where you can view your pay and tax records.

Changes to the P45 System

As of January 1, 2019, Ireland introduced the PAYE Modernisation system, which means that real-time reporting of pay and deductions has been implemented. This change means that while the concept of the P45 remains, the actual process has evolved with more emphasis on digital records.

PAYE Modernisation

Under the PAYE Modernisation system:

Employers report employee pay and deductions to Revenue in real-time.

When you leave a job, this information is immediately available to Revenue, streamlining the transition between jobs and simplifying the tax process.

Despite these changes, understanding the traditional P45 form and its functions remains important, especially for historical records and clarity on tax matters.

Conclusion

The P45 form is a critical piece of documentation for anyone employed in Ireland. It ensures that your tax records are accurate and up-to-date, whether you are transitioning to a new job or claiming social welfare benefits. Knowing how to obtain a P45, request it if necessary, and understanding its role can help you navigate your employment and tax obligations with ease. Always keep your P45 safe and ensure you understand its importance in your financial and employment records.

Resource URL : https://osservi.ie/understanding-the-p45-form-in-ireland-a-guide-for-what-is-a-p45/

0 notes

Text

What Is a Self Assessment Tax Return (SA100)?

When it comes to managing your finances in the UK, navigating the world of taxes can often feel like a daunting task. One of the key documents in this process is the SA100 tax return form. Whether you're a seasoned taxpayer or new to the process, understanding what an SA100 entails and how to manage it efficiently is crucial. In this comprehensive guide, we'll delve into everything you need to know about the SA100 form, from its purpose and deadlines to practical tips on filling it out correctly.

What is an SA100 Tax Return?

The SA100 form is the cornerstone of the self-assessment tax system in the United Kingdom. It is used by individuals to report their income, capital gains, and any other relevant financial information to HM Revenue and Customs (HMRC). This form is essential for calculating how much tax you owe or if you are due a tax refund.

Purpose of the SA100 Form

The primary purpose of the SA100 form is to ensure that taxpayers accurately report their income and pay the correct amount of tax. It covers various types of income, including employment income, self-employment income, rental income, and investment income. Additionally, it includes sections for claiming tax reliefs, deductions, and allowances that may reduce your overall tax liability.

SA100 Deadline: Key Dates to Remember

Filing your SA100 online in the UK on time is crucial to avoid penalties and ensure compliance with HMRC regulations. The deadline for submitting your paper tax return is 31 October following the end of the tax year. If you prefer to file online, you have until 31 January after the end of the tax year. It's important to mark these dates on your calendar and start preparing your tax information well in advance to avoid any last-minute rush.

How to Fill Out the SA100 Form

Filling out the SA100 form may seem complex at first glance, but with proper guidance, it can be straightforward. Here's a step-by-step guide to help you navigate the process:

Gather Your Information: Collect all relevant documents, including P60s, P45s, bank statements, and receipts for expenses.

Register for Online Filing: Consider filing your SA100 online, which offers benefits such as automatic calculations and instant submission confirmation.

Navigate Each Section: The SA100 is divided into sections that correspond to different types of income and allowances. Take your time to fill in each section accurately.

Claiming Deductions and Allowances: Make sure to claim any applicable tax reliefs, deductions, or allowances, such as charitable donations or pension contributions, to reduce your tax liability.

Review and Submit: Before submitting your SA100 form, review all information carefully to ensure accuracy. Incorrect information may result in penalties or delays in processing.

SA100 Form Guide: Tips for Smooth Completion

To make the process of completing your SA100 form as smooth as possible, consider the following tips:

Keep Records: Maintain organised records throughout the year to simplify the process of filling out your tax return.

Seek Professional Advice: If you're unsure about any aspect of your tax return, seek advice from a qualified accountant or tax advisor.

Use HMRC Resources: HMRC provides detailed guidance and support materials online, including video tutorials and FAQs, which can help clarify specific questions.

SA100 Form Online: Benefits and How to Access

Filing your SA100 online offers several advantages over the paper form, including:

Accuracy: Built-in checks and calculations reduce the likelihood of errors.

Speed: Instant submission and confirmation save time compared to postal filing.

Accessibility: You can access your tax account and previous submissions online at any time.

To file your SA100 online, visit the HMRC website and follow the instructions for registering and submitting your tax return electronically.

Conclusion

In conclusion, understanding what is an SA100 tax return form is essential for every taxpayer in the UK. By familiarising yourself with its purpose, deadlines, and how to fill it out correctly, you can navigate the tax filing process with confidence. Remember to gather your information well in advance, consider filing online for convenience, and seek professional advice when needed. By staying informed and proactive, you can effectively manage your tax obligations and ensure compliance with HMRC regulations.

0 notes

Text

Lost your P45? No worries! Secure a copy hassle-free with us. Whether you're changing jobs or need it for official transactions, we've got your back.

Order P45 Online from UK's Top Payroll Company Payslips Online Order Now Replacement P45

1 note

·

View note

Text

Tax Return on Leaving UK

New Post has been published on https://www.fastaccountant.co.uk/tax-return-on-leaving-uk/

Tax Return on Leaving UK

If you’re thinking about leaving UK to live abroad, it’s important to understand the implications for your taxes. HM Revenue and Customs (HMRC) must be informed if you’re planning to permanently leave the country or work abroad full-time for at least one tax year. You have the responsibility to let HMRC know, and the process varies depending on whether you typically complete a self-assessment tax return or not. It’s crucial to be aware of the deadlines and penalties, and to understand how your residency status may affect your tax obligations. Additionally, you may need to consider National Insurance payments and how your departure may impact any UK benefits you are entitled to.

Tax obligations when leaving the UK

If you are planning on leaving UK to live abroad permanently or to work abroad full-time for at least one full tax year, it is important that you inform HM Revenue and Customs (HMRC) of your departure. Notifying HMRC helps ensure that your tax affairs are in order and that you comply with your obligations as a taxpayer.

Informing HM Revenue and Customs (HMRC)

When leaving the UK, you must let HMRC know by either filling in a tax return or completing the necessary forms. However, if you are leaving the UK for holidays or business trips, there is no need to inform HMRC.

How to inform HMRC

The method of informing HMRC about your departure depends on whether or not you usually complete a Self Assessment tax return.

youtube

If you do not usually complete a Self Assessment tax return, there are two options for informing HMRC:

If you have already left the UK, you can fill in form P85 online.

If you have not yet left the UK, you can download and fill in form P85 offline. In addition, you will need to include Parts 2 and 3 of your P45 form, which you can obtain from your employer or Jobcentre Plus if you have been claiming Jobseeker’s Allowance.

If you usually complete a Self Assessment tax return, you can inform HMRC of your departure through your tax return. You will need to complete the ‘resident’ section (form SA109) and send it by post. It is important to note that HMRC’s online services cannot be used to inform them of your departure. If you prefer, you can also seek assistance from a professional, such as an accountant, or use commercial software to complete your Self Assessment tax return.

Self Assessment tax return

If you are leaving UK permanently or working abroad full-time for at least one full tax year, it is important to understand the implications for your tax return. Failure to meet the deadline can result in penalties. The deadline for sending your tax return by post is 31 October. Therefore, it is crucial to ensure that you are aware of the different tax obligations that may arise when leaving the UK.

Penalties for not meeting the deadline

To avoid penalties, it is essential to meet the deadline for submitting your tax return. Failure to do so can result in fines imposed by HMRC. It is therefore important that you are aware of the deadline and ensure that you submit your tax return on time.

Notifying other agencies and organizations

In addition to informing HMRC, there may be other agencies and organizations that you need to notify about your departure from the UK. For example, you may need to inform your local council to stop paying Council Tax. It is important to check with the relevant organizations to ensure that you have fulfilled all necessary obligations and have a smooth transition when leaving the UK.

Tax implications for non-residents

As a non-resident, there are specific tax obligations and implications that you need to understand. Here are some important points to consider:

Non-residents and their tax obligations

As a non-resident, you are not required to pay UK tax on income or gains that you receive outside the UK. However, if you have UK income, you may be subject to UK tax. It is important to familiarize yourself with the rules and regulations regarding non-resident taxation to ensure compliance and avoid any unintended tax liabilities.

Exemption from UK tax on income and gains

If you are a non-resident, you are generally exempt from paying UK tax on income or gains that you receive outside the UK. This means that if you have income from other countries, you will not be subject to UK tax on that income.

Taxation of UK income for non-residents

If you are a non-resident and have UK income, such as rental income from a property in the UK, you may be required to pay UK tax on that income. It is important to understand the rules and regulations surrounding non-resident taxation to ensure you are compliant.

Double taxation agreements

The UK has entered into double taxation agreements with many countries to prevent taxpayers from being subject to tax on the same income in two different countries. These agreements aim to ensure that individuals are not taxed twice on the same income and that they are not at a disadvantage due to the difference in tax rules between countries. It is important to check if there is a double taxation agreement between the UK and your country of residence to understand how it impacts your tax obligations.

National Insurance contributions

As a non-resident, you may have the option to pay National Insurance contributions if you plan to return to the UK or claim the State Pension later. However, if you leave the UK permanently, you cannot claim back any National Insurance contributions you have paid. It is important to understand the rules and regulations surrounding National Insurance contributions for non-residents to ensure compliance and make informed decisions about your contributions.

National Insurance contributions

National Insurance contributions are an important aspect of your financial responsibilities. Here are some key points to consider regarding National Insurance contributions:

Paying National Insurance contributions abroad

If you are planning to work abroad but intend to return to the UK or claim the State Pension later, you may be able to continue paying National Insurance contributions while you are abroad. It is important to understand the requirements and eligibility criteria for paying National Insurance contributions abroad to ensure compliance.

Claiming back National Insurance contributions

If you leave the UK permanently, you cannot claim back any National Insurance contributions you have made. However, the contributions you have paid may count towards benefits in the country you are moving to if there is a social security agreement with the UK. It is important to understand the rules and regulations regarding claiming back National Insurance contributions to ensure you are aware of your entitlements and limitations.

Social security agreements

The UK has social security agreements with various countries to ensure that individuals are not disadvantaged when it comes to social security benefits. These agreements aim to coordinate the social security systems of different countries and protect individuals’ rights to benefits. It is important to familiarize yourself with the social security agreement between the UK and your country of residence to understand how it may impact your National Insurance contributions and entitlements.

Claiming UK benefits while living abroad

If you are living in the EU, Iceland, Liechtenstein, Norway, or Switzerland, you may be able to claim certain UK benefits, such as Jobseeker’s Allowance. However, eligibility depends on the agreement between the UK and the country you are moving to. It is important to check the specific rules and regulations regarding claiming UK benefits while living abroad to ensure compliance and that you are aware of your entitlements.

Reporting changes in circumstances

It is important to inform HMRC if there are any changes in your circumstances while you are abroad. This includes changes such as moving house or changes in marital status. It is crucial to keep HMRC updated with your current information to ensure that you are complying with your tax and National Insurance obligations.

Visiting the UK

If you plan to visit the UK without becoming a resident again, it is important to understand the restrictions and implications. Here are some key points to consider:

Visiting the UK without becoming a resident

If you work full-time abroad, you can typically visit the UK for up to 90 days, as long as you work no more than 30 of these days. It is important to understand the rules and regulations surrounding visiting the UK without becoming a resident to ensure compliance with immigration and tax laws.

Restrictions on visiting the UK

While you can visit the UK without becoming a resident again, there may be restrictions and limitations based on immigration and tax laws. It is important to familiarize yourself with these restrictions to ensure compliance and to avoid any unintended legal issues.

Becoming a UK resident again

If you engage in new activities in the UK after leaving, such as starting a business or purchasing property, you may become a UK resident again. It is crucial to understand the rules and regulations regarding residence status to determine how your activities in the UK may impact your residency status.

Checking residence status

If you are unsure how your activities in the UK affect your residence status, it is advisable to check with the relevant authorities or seek professional advice. Understanding your residence status is crucial for ensuring compliance with tax and immigration laws.

Conclusion

In conclusion, when leaving the UK to live abroad, it is essential to inform HM Revenue and Customs (HMRC) of your departure to comply with your tax obligations. Understanding the tax implications for non-residents, National Insurance contributions, visiting the UK, and related content can help ensure smooth transitions and compliance with the relevant laws and regulations. Additional resources are available for further information and guidance on specific situations.

0 notes

Text

A Step-by-Step Guide: How to File Your Self Assessment Tax Return

Filing your self assessment tax return can be a daunting task, but it is a necessary one if you are self-employed or receive income from other sources. In this comprehensive guide, we will walk you through the process of filing your self assessment tax return, step by step. By the end of this article, you will have a clear understanding of what is required and how to avoid common mistakes.

Who needs to file a self assessment tax return?

Not everyone is required to file a self assessment tax return. If you are an employee and your income is solely from your salary, taxes are usually deducted automatically through the PAYE (Pay As You Earn) system. However, if you are self-employed, a sole trader, a partner in a partnership, a company director, or have income from other sources such as rental properties or investments, you will need to file a self assessment tax return.

Filing a self assessment tax return allows you to declare your income and expenses, claim any tax deductions or reliefs you may be entitled to, and calculate the amount of tax you owe. It is important to determine whether you fall under the category of individuals who need to file a self assessment tax return to avoid any penalties or fines.

Benefits of filing a self assessment tax return

Filing a self assessment tax return has several benefits, even if you are not required to do so. Firstly, it allows you to ensure that you are paying the correct amount of tax based on your income and expenses. By accurately reporting your financial details, you can avoid overpaying or underpaying taxes.

Secondly, filing a self assessment tax return provides an opportunity to claim tax deductions and reliefs. If you are eligible for any tax breaks, such as business expenses or charitable donations, you can offset these against your taxable income, potentially reducing your overall tax liability.

Additionally, filing a self assessment tax return can help you build a comprehensive financial record. This can be useful for various purposes, such as applying for loans or mortgages, as it demonstrates your income and financial stability.

Important dates and deadlines for self assessment tax returns

Before diving into the process of filing your self assessment tax return, it is crucial to be aware of the important dates and deadlines. The tax year in the United Kingdom runs from April 6th to April 5th of the following year. Here are some key dates to keep in mind:

October 5th: Deadline for registering for self assessment if you are self-employed or have other untaxed income.

October 31st: Deadline for filing a paper tax return.

January 31st: Final deadline for filing your self assessment tax return online and making any tax payments.

It is advisable to start preparing your tax return well in advance to ensure you have enough time to gather all the necessary documents and information. Waiting until the last minute can lead to unnecessary stress and potential mistakes.

Gathering the necessary documents and information

Before you begin the process of filing your self assessment tax return, it is essential to gather all the necessary documents and information. This will help streamline the process and ensure you have accurate data to report on your tax return. Here are some key documents and information you may need:

Personal information: Your National Insurance number, Unique Taxpayer Reference (UTR), and contact details.

Income details: Details of all your sources of income, including self-employment income, employment income, rental income, dividends, and interest.

Expense records: Receipts and records of any allowable business expenses, such as office supplies, travel expenses, and professional fees.

Pensions and benefits: Details of any pensions, state benefits, or other taxable income.

Tax documents: P60 forms from your employer and any other relevant tax documents, such as P45 or P11D.

By gathering these documents and information beforehand, you can ensure a smooth and accurate filing process.

Step 1: Registering for self assessment

The first step in filing your self assessment tax return is to register for self assessment with HM Revenue and Customs (HMRC). If you are self-employed or have other untaxed income, you are required to register by October 5th of the tax year following the year in which you became liable for self assessment.

To register, you will need to visit the HMRC website and create a Government Gateway account. Once you have registered, you will receive a Unique Taxpayer Reference (UTR) and be able to access the online self assessment system. It is important to register as soon as possible to avoid any penalties for late registration.

Step 2: Calculating your income and expenses

Before completing your self assessment tax return, you need to calculate your income and expenses for the tax year. This involves gathering all the relevant financial information and determining your taxable income.

Start by compiling all your income sources, including self-employment income, employment income, rental income, dividends, and interest. Ensure you have accurate records and supporting documentation for each source of income.

Next, deduct any allowable business expenses from your income. These may include office rent, utilities, travel expenses, professional fees, and other costs directly related to your business. Keep in mind that not all expenses are allowable, so it is important to refer to HMRC guidelines or consult a tax professional if you are unsure.

Once you have calculated your taxable income, you can determine the amount of tax you owe. This can be done using the tax rates and allowances applicable to your income bracket. HMRC provides online calculators and resources to help you with this process.

Step 3: Completing the self assessment tax return form

Now that you have gathered all the necessary documents and calculated your income and expenses, it is time to complete the self assessment tax return form. HMRC provides an online system called "Self Assessment" where you can complete and submit your tax return electronically.

The online form is divided into sections, each corresponding to different types of income and expenses. It is important to complete each section accurately and provide all the required information. The form will guide you through the process, asking relevant questions based on your individual circumstances.

As you complete each section, double-check your entries for accuracy and ensure you have included all the necessary details. Mistakes or omissions can lead to delays in processing your tax return or even penalties for incorrect filing.

Step 4: Submitting your self assessment tax return

Once you have completed the self assessment tax return form, it is time to submit it to HMRC. If you are using the online system, you can submit your tax return electronically. The system will provide a confirmation once your tax return has been successfully submitted.

If you prefer to file a paper tax return, you must do so by October 31st. However, it is recommended to file your tax return online as it is faster, more secure, and provides instant confirmation of receipt.

After submitting your tax return, HMRC will calculate the amount of tax you owe based on the information provided. You will receive a tax calculation (also known as a "tax calculation letter") outlining the amount due. It is important to review this calculation to ensure its accuracy.

Common mistakes to avoid when filing your self assessment tax return

Filing a self assessment tax return can be complex, and there are several common mistakes that individuals make. By being aware of these mistakes, you can avoid them and ensure a smooth filing process. Here are some common mistakes to avoid:

Incorrectly reporting income: Ensure you include all your sources of income and report them accurately. Failure to do so can result in penalties or fines.

Forgetting to claim tax deductions: Keep track of your business expenses and other allowable deductions to reduce your overall tax liability. Neglecting to claim these deductions can lead to paying more tax than necessary.

Missing filing deadlines: Be aware of the important dates and deadlines for filing your self assessment tax return. Failing to meet these deadlines can result in penalties and interest charges.

Incomplete or inaccurate records: Maintain accurate and up-to-date records of your income, expenses, and other financial details. This will help ensure the accuracy of your tax return and simplify the filing process.

By avoiding these common mistakes, you can save time, money, and stress when filing your self assessment tax return.

Understanding the penalties for late or incorrect filing

Filing your self assessment tax return late or with incorrect information can result in penalties from HMRC. It is important to understand the consequences of non-compliance and take steps to avoid any penalties. Here are some key penalties to be aware of:

Late filing penalty: If you fail to file your self assessment tax return by the deadline, you will incur an initial penalty of £100. Additional penalties may apply for further delays.

Late payment penalty: If you do not pay your tax bill by the deadline, you will be charged interest on the outstanding amount. The interest rate is currently set at 2.6%.

Incorrect filing penalty: If HMRC discovers that your tax return contains errors or inaccuracies, you may be subject to penalties based on the severity of the errors. Deliberate attempts to evade tax can result in higher penalties and potential criminal charges.

It is important to take these penalties seriously and ensure you file your self assessment tax return correctly and on time. If you require assistance or are unsure about any aspect of the filing process, it is advisable to seek professional advice.

Getting help with filing your self assessment tax return

Filing a self assessment tax return can be a complex task, especially if you have multiple sources of income or complicated financial arrangements. If you find yourself overwhelmed or unsure about any aspect of the filing process, it is advisable to seek help from a tax professional.

A tax professional can provide expert guidance, help you navigate the complexities of self assessment, and ensure you comply with all relevant tax laws and regulations. They can also assist with tax planning, identify potential deductions or reliefs, and help you minimize your tax liability.

By seeking professional help, you can have peace of mind knowing that your self assessment tax return is accurate, complete, and filed on time.

Conclusion

Filing your self assessment tax return does not have to be a daunting task. By following this step-by-step guide, you can navigate the process with confidence and avoid common mistakes. Remember to gather all the necessary documents, register for self assessment, calculate your income and expenses, complete the tax return form accurately, and submit it to HMRC on time.

Understanding the important dates and deadlines, as well as the potential penalties for late or incorrect filing, is crucial. By staying organized, seeking professional help if needed, and taking the necessary steps to comply with tax regulations, you can ensure a smooth and hassle-free self assessment tax return filing process.

So, don't wait until the last minute. Start early and file your self assessment tax return with ease. By doing so, you can take advantage of the benefits of early tax filing and avoid unnecessary stress.

1 note

·

View note

Text

you will only need identifying documents if you are unable to provide a National Insurance Number.

instead of a NINo, you can provide one piece of photo ID such as a passport or photo driving licence.

however, if you do not want to or can't provide a NINo or photo ID, you can instead use multiple non-photo identifying documents. these can include marriage/birth/adoption certificates, non-photo firearms or driving licences, a P45/P60, bills, council tax statements, etc

you can register here: https://www.gov.uk/apply-postal-vote

there's a plain english guide available here: https://assets.publishing.service.gov.uk/media/65b12752f2718c000dfb1c93/Postal_vote_online_application_guide.pdf

you have to be registered to vote before you apply for a postal vote. if you try to apply online without being registered, it will redirect you to the site where you can register. if you try to register by post, they won't be able to do this and best-case scenario the council will try to get a hold of you to let you know you need to register

3K notes

·

View notes

Text

There is no provision within the #legislation to issue another P45 if the original is lost or misplaced. But don't #Worry we are at GetPayslips Generate #Replacement P45 on Behalf of you at Lowest Price and its Approved by #HMRC. Get order Replacement P45 UK

0 notes