#Online Car Insurance Spain

Explore tagged Tumblr posts

Text

Online Car Insurance Spain | Dragoninsure.com

Ensure your car is safe and secure with Dragoninsure.com - the leading online car insurance provider in Spain. Get the peace of mind you deserve and enjoy the highest quality coverage at the best prices.

Online Car Insurance Spain

0 notes

Text

The modern climate of airline travel frays the mind and will drive even the most resolute of men to eventual madness...

Regardless its an evironment I braved manys a times, this piece is a little something I drafted up while I was waiting in the boarding hall in alicante last september, presented here in its entirety for friends to appreciate:

6:18am, 19th september 2024, international speak like a pirate day. I embark on a grim journey to the land I, in a prior age called home. In this entry I feel compelled to engage in the time-honoured tradition of authors to complain about the state of airline travel. My woes naturally start long before the clock struck midnight marking the beginning of this most dour day, wherein i had to strike a fine balance in booking my passage. I was in no short supply of options in terms of times, airlines and spans of my visit, but the constraining factors of: being present for a long distance cycle my mother had planned, being present for a sufficiently long time to compensate for the months i have spent in spain away from her doting presence, not staying so long that i might cause my beloved to expire from a broken heart, and the ever-present question of money. Sadly, all these constraints, combined with my choice of departure airport, Alicante, and eventual destination, Dublin, coalesced into a singular grim realisation, that I would have to travel with the airline known as ryanair. Even as I write this passage the feeble of mind, and weak of will, queue in the priority boarding line for my flight...no matter, I shall air my grievances with them at a measured rate. The process of booking a ryanair flight is an exercise in observation, focus and force of will, their website (being the sole avenue by which you can reliably aquire a booking) is a veritable labyrinth of additional charges, extra luggage, travel insurance, in-flight meal pre-orders, shoe-shining services, proprietary travel insurance, novelty ryanair airplane models, giftcards, snowglobes, at-destination car rentals and priority boarding options. If you can navigate this gauntlet of extra charges you will be asked to give the company a scan of your face via webcam to verify your identity and sell onto third party data brokers, and only then, will you be offered the ticket of your dreams at an affordable price. And for now you are granted reprieve, until the day of your journey.

5am is not an hour I voluntarily awake to any engagement, nay, it is a mark of the clock i reserve for stumbling home after a night of frivolities cut short, or the midway point of an average session of Sid Meiers Civilization. Regardless, this was the time whence I was roused from my slumber. I awake to the sound of hatsune miku singing melodious lyrics over the sound of a percussive instrumentation. I silence the phone alarm and take in the surroundings of the sitting room of a friend of the family who lives nearby. Two hours to take-off, cutting things pretty close in the grand scheme of things, but i am already checked in online to keep check-in desk operators to a minimum, my boarding pass is on my phone to save the cost of ink and paper, and cabin luggage is heavily encouraged to curb the cost of luggage handlers. Indeed with such a barebones itinerary 2 hours might just suffice. Instant coffee, a perfectly fine breakfast, exchanged pleasantries, a short car ride and a sincere adieu. I am on my own, with just my purse and a small backpack to carry me through this journey. One last deep breath of crisp morning air and I enter the terminal. Air travel has changed in hops and skips over the 20 something years ive been cognizant of it, never had the privilege of flying pre-9/11 when you could board a plane with a machette, a loaded gun, a lit cigar and a caraffe of double-proof rum. No no, in this day and age I find myself wondering if security is going to take exception to the baking paper-wrapped bowl of homemade marmalade i intend to take aboard.

And so, bloated with the oversized second coffee i took moments after entering the terminal, i waddle towards the waiting xray machines. My boarding pass persuades the electronic gates, which mercifully stand eight-abreast, as six of them are giving no end of trouble to my fellow travellers, unyielding in their cold logic, that the crumpled piece of home printed paper clutched in hand does not constitute a proper boarding pass. I throw my bag and purse into a scanning tray, just as it is picked up by the rubbery grasp of the conveyor belt, i remember to toss my phone in too, and moments before i walk through the metal detector gate i am beckoned to place my "jacket" in too. I flail my jumper, which contains no metals to speak of, over the plastic divider and cleanly into my second scanning tray, moments before it dissapears into the dark maw of the x-ray machine. I step through the metal detector gate and am spared the indignity of a randomly selected cavity search this time. A hapless gentleman in front of me is halted as his satchel contains contraband, the security officer spends a full eight minutes searching the satchel which seemed to contain a total of three pens, before producing a swiss army knife no bigger than a fig, the officer takes the contraband aside, a beloved family heirloom no doubt, dangles it above the disposal bin, looking towards the man, and with a shrug as if to convey "sorry, we are just doing our job, like the gestappo were" drops the knife into the void. The man seems to utter some words, in protest or resignation, i cannot tell, for his voice seems distant and muffled from the depths of his own personal orwellian inferno. After this charade has held up the line for the better part of half an hour, my bag finally emerges from the machine, a second security officer, perturbed by the queer orientation of my bag and the grey ovoid cast by the silhouette of the marmelade on the x-ray image, enters a prolonged groping session with my luggage, their practiced hands capable of ascertaining the presence of class 5 drugs and plastic explosives alike through up to 20cm of clothing and flesh, with nought but an authoratative squeeze. Seemingly unsatisfied by the thorough molestation of my bag, it is taken to the mouth of the machine and put through again at a more neurotypical angle. And with one final squeeze for the Jansport to remember them by, my luggage is relinquished, and i am set free into the purgatory of duty-free.

Before I am permitted to even gaze upon my boarding gate, I am funneled through a winding path of liquor, cigarettes and chocolates, my senses blinded by the lights of images of naked, impossibly muscled men and cloying scent of their advertised fragrances, allegedly akin to what these bearded millionaires' perspiration must actually smell like. I resist the urge to lick the lcd projection of Adrian Brody's photoshopped abs long enough to escape the duty-free labyrinth. As I make my way towards my gate I pass a sign advertising a meal deal of a sandwhich, drink and packet of crisps for €23.99, and I begin to ponder the feverish pasageway i just exited. For once upon a time, airside retail was a wonderfully novel idea, exploiting a loophole which permitted travellers bound for foreign countries to be sold luxury products without the need to apply value added tax, at least that is my understanding of the practice. For decades, family members arriving from abroad would brandish colossal toblerone bars, 5 liter bottles of gin, and 1000-count cartons of cigarettes to fend off the hordes of encroaching relatives, all at a price that would be foolish to turn down. But at time of writing, i know this to be a mere fantasy, and the duty-free section a relic of a bygone era. Previous excursions would have me noting prices of whiskeys, and calculating value ratios down to the alcVol/ml€^2. But now, not only is it no longer worth it, it is actually more expensive than simply buying the products from your local supermarket. Regardless, I drift into the boarding gate hall.

The term "liminal spaces" has garnered a reputation in recent times as abandoned office buildings crawling with entirely tangible dangerous monsters. But a liminal space is by definition, just an area that you pass through. In this moment, walking the length of the vast boarding hall of Alicante airport, I feel its liminality soothing, the stalls and stands of business and enterprise fade from my mind as the polished tile floors pass beneath my feet, and I in turn pass beneath the grand cupolas of the terminals ceiling high above, as the travellator carries me along like some new fangled machine from turn of the century futurist novel. I pass through a passport check, the man in the booth does not look at either my face or the photo in my maroon passport booklet, simply holds it to a scanner that detects the digital chip in its binding. An obfuscated security system notes my presence in the terminal, and I am allowed through. Before I know it, I am in front of the ryanair boarding gate, and i am once again thoroughly grounded in reality.

Michael Oleary is the worst thing to happen to air travel since George Bush. Me and my ilk have tangled with ryanair and their ways in the past, and we have not always come away unscathed. They will humiliate you in front of your loved ones, tear down any semblance of dignity and pride you once held. They will charge you for checking in late, checking in early, not printing your boarding pass, and they will tear you to shreds if you so much as dare to speak out against them. You see, flying with ryanair is not just a test of your administrative ability in procuring a ticket at the advertised price from their labyrinthine website, it is a test of charisma, deception and self-control. "Why yes I believe its quite reasonable to wear a rainjacket, scarf and jumper in these exotic climes. Well what does it matter that I just took them out of my bag? Speaking of, lets check it fits in the sizing box...yes, yes that looks like a good fit, and with minimum groping too." The snootiest of the discount airline flyers have finished their priority boarding, and after a time I step to the line at the boarding gate. My eyes dart frantically from one overburdened boarding staff person to the other, thoughts of 'Does my fanny-pack count as a bag?', 'Surely it would count as a personal item...' and 'Shit, which pocket did I leave my boarding pass in?! Oh right its on my phone...' "I know I was asked to print this out, but I think if I just turn up the screen brightness it-" the staff do not care...this time... I join the masses on the slow march down the finger and into the fuselage, but wait- whats the meaning of this? The finger is cordoned off by a fabric belt!? The crowds descend a stairwell to the barren tarmac below, the finger lies limp and unpiloted as we are ushered through lethal traffic of tarmac buses and luggage trains, to our awaiting aircraft.

Approaching the stairs up to the aircraft doors, I furiously fight the urge to pose alluringly for a photo-op within the aircraft's turbine intake, or to pet the underside of the plane like a beached whale. After another eternity of waiting for everyone in front of me to finish their shuffling about and stowing their seats, I am finally permitted to take my seat in the most cramped space three people have ever been seated abreast in, since the trans-atlantic slave trade. By the end of the flight my leg muscles will have cramped into a gordian knot, that will take months of physiotherapy to recover from. Regardless, it is not too long before we are taxi'd and ready for takeoff. As the turbines engage I feel pressed into the tiny seat by the sudden g-forces of takeoff, I glance out the window as the wings catch the air beneath them. I guess no matter how harrowing they make the experience to get here, I can never get over the novelty of the ground pulling away beneath us. As we ascend to cruising altitude we veer out over the meditteranean in cloudy conditions, and we ascend into the cloud cover of this dreary grey morning. But then, moments later a most curious sight appears out the window. A vista of fields made of clouds like cotton balls, and the colours of a sunrise in dream-like pinks and pale yellows, an incandescing red eye peers through the clouds, the sky above turning a light turqoise as I gaze at this wondrous sight, the alto-stratus clouds in the far distance are painted a gleaming silver, the sun peaks above the cloudline in a blinding flare, the light of its incorrigible fusion reaction uncontested by the overcast sky, the interior of the cabin, moments ago, illuminated by nought but some scant blue LEDs, is now painted by rays of otherworldly gold, ryanairs signature gaudy mustard-stain-yellow on cigarette-smoke-stained-blazer-blue interior furnishings, almost looking good in this majestic illumination. The sunrise continues with a divine indifference to the joy and suffering of the world below, and for a time all the snark and snide is knocked out of me, seemingly left on the tarmac far below, as I beheld the sights no human was ever meant to see, riding on the wings of a man-made miracle.

1 note

·

View note

Text

Wiber Spain Car Hire Discount: The Perfect Solution for Affordable Travel

When it comes to exploring the beauty of Spain, having a reliable and affordable mode of transportation can make all the difference. Wiber, a well-known name in the car rental industry, has emerged as a preferred choice for travelers seeking convenience and cost-effective solutions. With its attractive discounts, Wiber Spain Car Hire Discount is helping tourists and locals alike to discover the wonders of Spain without breaking the bank.

Wiber operates in major cities across Spain, including Alicante, Malaga, and Mallorca, making it a convenient option for anyone traveling to these popular destinations. The company has built a reputation for its seamless rental experience, modern fleet, and excellent customer service. Its discount programs are a significant draw, offering travelers the chance to save money while enjoying top-notch services. Whether you're planning a coastal drive along the Mediterranean, a scenic trip through the countryside, or exploring historic landmarks, Wiber ensures that your journey is smooth and budget-friendly.

One of the key benefits of choosing Wiber is its transparent pricing structure. Unlike many competitors, Wiber prioritizes clarity, ensuring that customers know exactly what they’re paying for. Hidden charges and surprise fees are a common complaint in the car rental industry, but Wiber has taken steps to eliminate these issues. This transparency is particularly evident in their discount schemes, which are straightforward and easy to understand. Travelers can access these deals through Wiber's official website or trusted travel platforms, ensuring maximum accessibility.

Another aspect that makes Wiber stand out is its focus on convenience. The company’s streamlined booking process is designed to save time and effort. Customers can quickly reserve their preferred vehicle online, benefiting from the discounted rates available at the time of booking. Wiber’s “All-Inclusive Rate” is a popular choice among customers, as it covers all necessary insurances and includes unlimited mileage. Combined with a discount, this package provides excellent value for money.

Wiber's modern fleet ensures that customers have a variety of options to choose from. Whether you’re traveling solo, with family, or in a group, there’s a vehicle to suit your needs. From compact cars perfect for city driving to spacious SUVs ideal for road trips, Wiber’s vehicles are well-maintained and equipped with the latest features. Discounts on these rentals make it even more appealing, especially for long-term travelers or those planning extended vacations.

Customer feedback highlights the exceptional service provided by Wiber's staff. Many users praise the efficiency of the pickup and drop-off processes, as well as the helpfulness of the team. This level of service, combined with discounted rates, has earned Wiber Spain Car Rental Discount.

0 notes

Text

https://practicalportugal.blogspot.com/2024/09/earthquakes-in-portugal-our-experience.html

Earthquakes in Portugal - Our Experience and a Seismic History

We experienced our first earthquake in Portugal at 6:11 am on August 26, 2024. It lasted around 10 seconds and felt like a large forestry machine passing by the house. I stepped onto the balcony, thinking we might need to move the car, but was surprised to see no one outside. After checking online, we discovered it was an earthquake off the coast of Lisbon.

The earthquake registered 5.3 on the Richter scale, with the epicenter located 58 kilometers west of Sines in the Atlantic Ocean, at a depth of 21 kilometers, according to the IPMA. The tremors were strongest in the Sines, Lisbon, and Setúbal regions, with reports on social media noting that it was felt as far as France, Spain, and Morocco.

We didn’t have any damage to the house. I was aware of the earthquake risk before moving to Portugal so had added earthquake insurance to our coverage.

Portugal is not typically known for its seismic activity compared to other regions such as Japan or California. However, the country has experienced several significant earthquakes throughout its history, some of which have had profound impacts on its development and culture.

Geological Setting

Portugal's seismic activity is primarily influenced by its position near the boundary between the Eurasian and African tectonic plates. The interaction between these plates, along with the presence of fault lines such as the Azores-Gibraltar Transform Fault, contributes to the region's earthquake risk. The most seismically active areas in Portugal are the Azores islands, due to their proximity to the Mid-Atlantic Ridge, and the southern mainland, particularly around Lisbon and the Algarve region.

Historical Earthquakes

The 1755 Lisbon Earthquake

1755 copper engraving of the Lisbon Earthquake

The 1755 Lisbon earthquake is arguably the most significant and devastating earthquake in Portuguese history. Occurring on November 1, 1755, this earthquake, with an estimated magnitude of 8.5 to 9.0, struck the capital city of Lisbon and had far-reaching impacts on both the city and Europe as a whole.

The earthquake's epicenter was in the Atlantic Ocean, about 200 km west-southwest of Cape St. Vincent. The initial shock was followed by a series of aftershocks and a massive tsunami, which caused widespread destruction along the coasts of Portugal, Spain, and North Africa. Fires that broke out in Lisbon after the earthquake compounded the disaster, leading to an estimated death toll of 30,000 to 50,000 people.

The Lisbon earthquake had profound social, economic, and philosophical repercussions. The widespread destruction led to a significant rebuilding effort, spearheaded by the Marquis of Pombal, who implemented modern urban planning and construction techniques to make the city more resilient to future earthquakes. Philosophically, the disaster influenced Enlightenment thinkers such as Voltaire and Rousseau, who debated the implications of such natural disasters on human society and the concept of divine intervention.

The 1969 Earthquake

On February 28, 1969, Portugal experienced another significant earthquake, known as the 1969 Lisbon earthquake. With a magnitude of 7.8, this earthquake struck off the southwestern coast of Portugal, near the Gorringe Bank. Although less devastating than the 1755 earthquake, the 1969 event caused substantial damage in the Algarve region and was felt throughout the country.

The earthquake resulted in the loss of several lives and caused extensive property damage, particularly in older buildings that were not constructed to withstand seismic activity. This event highlighted the ongoing seismic risks in Portugal and prompted further studies and improvements in building codes and earthquake preparedness.

The 1980 Azores Earthquake

The Azores archipelago, located in the Atlantic Ocean, is a seismically active region due to its proximity to the Mid-Atlantic Ridge. On January 1, 1980, the Azores experienced a devastating earthquake with a magnitude of 7.2. The earthquake's epicenter was near Terceira Island, and it caused significant destruction on Terceira, São Jorge, and Graciosa islands.

The 1980 earthquake resulted in the deaths of 73 people and left thousands homeless. The destruction of buildings and infrastructure necessitated a large-scale reconstruction effort. This event underscored the vulnerability of the Azores to seismic activity and led to improved monitoring and preparedness measures in the region.

Recent Seismic Activity

In recent years, Portugal has continued to experience seismic activity, although less severe than the historical earthquakes mentioned above. For example, in January 2010, an earthquake with a magnitude of 6.0 struck near the Madeira Islands, causing minor damage but no fatalities. Similarly, in February 2019, a magnitude 4.4 earthquake occurred in the Algarve region, reminding residents of the ongoing seismic risks.

Causes of Earthquakes in Portugal

The primary cause of earthquakes in Portugal is the tectonic activity associated with the boundary between the Eurasian and African plates. The following factors contribute to seismic activity in the region:

1. **Plate Tectonics:** The convergence and interaction between the Eurasian and African plates generate stress and deformation in the Earth's crust, leading to earthquakes. The Azores-Gibraltar Transform Fault, which runs near the Azores archipelago and towards the Mediterranean, is a significant source of seismic activity.

2. **Mid-Atlantic Ridge:** The Azores islands are situated near the Mid-Atlantic Ridge, a divergent boundary where the Eurasian and North American plates are moving apart. This tectonic setting results in frequent volcanic and seismic activity in the region.

3. **Fault Lines:** Numerous fault lines traverse Portugal, including the Marquês de Pombal fault and the Lower Tagus Valley fault. These faults can generate earthquakes when stress accumulates and is suddenly released along the fault planes.

Earthquake Preparedness and Mitigation

Portugal has made significant strides in improving earthquake preparedness and mitigation measures in response to its seismic history. Key efforts include:

1. Seismic Monitoring and Early Warning Systems: Portugal has established a network of seismic monitoring stations to detect and analyze earthquake activity. Early warning systems are being developed to provide timely alerts to residents and authorities, allowing for rapid response and evacuation if necessary.

2. Building Codes and Construction Standards: Following the lessons learned from past earthquakes, Portugal has implemented strict building codes and construction standards to ensure that new buildings are designed to withstand seismic forces. Retrofitting older buildings to improve their earthquake resilience is also a priority.

3. Public Awareness and Education: Public awareness campaigns and education programs aim to inform residents about earthquake risks and preparedness measures. These initiatives include guidelines on how to secure homes, create emergency plans, and conduct earthquake drills.

4. Emergency Response and Recovery Plans: Portugal has developed comprehensive emergency response and recovery plans to coordinate efforts during and after an earthquake. These plans involve government agencies, emergency services, and community organizations working together to provide immediate assistance and support long-term recovery.

Case Study: The 1755 Lisbon Earthquake

The 1755 Lisbon earthquake serves as a crucial case study in understanding the impacts of seismic events and the importance of preparedness and resilience.

Causes and Characteristics:

The 1755 earthquake occurred on All Saints' Day, a major Catholic holiday, which exacerbated its impact as many people were in churches that collapsed during the quake. The earthquake was followed by a series of aftershocks and a massive tsunami that inundated coastal areas. The fires that broke out in the aftermath caused further destruction.

Impact on Lisbon:

Lisbon, the capital of Portugal, was the hardest hit. The earthquake destroyed much of the city, including nearly all of its major churches and many other buildings. The tsunami and fires compounded the devastation, leaving tens of thousands dead and many more homeless.

Reconstruction and Resilience:

The Marquis of Pombal, who led the reconstruction efforts, implemented a series of measures to rebuild Lisbon with improved resilience. These included:

1. Urban Planning: Pombal introduced modern urban planning principles, with wide streets, large squares, and uniform building heights to facilitate emergency response and reduce fire risk.

2. Building Regulations: New buildings were constructed with anti-seismic features, such as wooden frameworks known as "Pombaline cages" that provided flexibility and strength to withstand future earthquakes.

3. Economic Reforms: Pombal's economic reforms aimed to revive Lisbon's economy, including measures to support commerce, industry, and agriculture.

Philosophical and Cultural Impact:

The 1755 earthquake had a profound impact on European philosophy and culture. Enlightenment thinkers such as Voltaire and Rousseau used the disaster to explore themes of human suffering, divine intervention, and the role of science and reason in understanding natural phenomena. The earthquake influenced debates about the nature of God, the problem of evil, and the ability of humans to control and mitigate natural disasters.

Recent Advances in Seismology and Engineering

Advances in seismology and engineering continue to enhance Portugal's ability to prepare for and respond to earthquakes.

Seismic Hazard Assessment:

Improved seismic hazard assessment techniques, including the use of historical data, geological surveys, and probabilistic models, provide more accurate estimates of earthquake risks in different regions of Portugal. These assessments inform building codes, land-use planning, and emergency preparedness efforts.

Earthquake-Resistant Design:

Modern engineering practices focus on designing structures that can withstand seismic forces. Innovations in materials, construction techniques, and structural design enhance the earthquake resilience of buildings, bridges, and other infrastructure. Retrofitting older buildings to meet current seismic standards is an ongoing priority.

Early Warning Systems:

Earthquake warning systems are advanced technologies designed to detect seismic activity and provide early alerts before the strongest shaking from an earthquake reaches populated areas. These systems are crucial for minimizing damage and saving lives by giving people and organizations precious seconds to take protective actions, such as evacuating buildings, halting transportation systems, and shutting down critical infrastructure like power plants and gas lines.

The basic concept behind earthquake warning systems is to detect the less destructive primary waves (P-waves) that travel faster through the Earth than the more damaging secondary waves (S-waves). P-waves are typically the first signals of an earthquake, and by identifying them, the system can issue a warning before the S-waves, which cause most of the shaking, arrive. The time between the detection and the arrival of the S-waves can range from a few seconds to over a minute, depending on the location of the epicenter and the system's efficiency.

Countries like Japan, Mexico, and the United States have developed sophisticated early warning systems. Japan’s "J-Alert" system and Mexico’s "SASMEX" provide residents with alerts through TV, radio, and mobile networks. The United States, particularly in California, has implemented the "ShakeAlert" system, which is designed to send alerts to smartphones, giving users time to "Drop, Cover, and Hold On."

The effectiveness of earthquake warning systems depends on factors like proximity to the epicenter and the system’s coverage area. While these systems can significantly reduce injuries and deaths, they do have limitations, particularly for earthquakes that occur very close to urban areas, where warning times may be too short. However, as technology continues to improve, these systems are becoming more reliable and accessible, offering a critical layer of protection against the dangers of earthquakes.

0 notes

Text

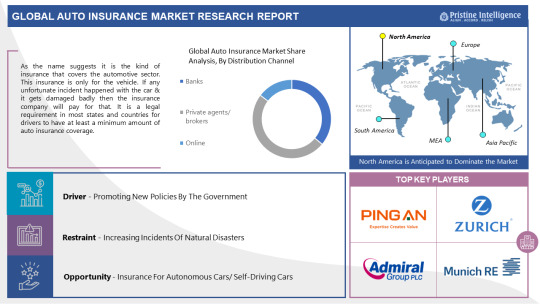

Auto Insurance Market Outlook for Forecast Period (2023 to 2030)

The Global Auto Insurance Market size is expected to grow from USD 7,68,198.17 Million in 2023 to USD 13,59,820.03 Million by 2030, at a CAGR of 8.50% during the forecast period (2023-2030).

As the name suggests it is the kind of insurance that covers the automotive sector. This insurance is only for the vehicle. If any unfortunate incident happened with the car & it gets damaged badly then the insurance company will pay for that. It is a legal requirement in most states and countries for drivers to have at least a minimum amount of auto insurance coverage. It covers several policies which include liability of car, collision/ accident, and comprehensive. This coverage pays for damages or injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability. This coverage pays for damages to your vehicle that result from a collision with another vehicle or object.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://pristineintelligence.com/request-sample/auto-insurance-market-48

The latest research on the Auto Insurance market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Auto Insurance industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Auto Insurance market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Auto Insurance Market include:

"State Farm (USA), GEICO (USA), Progressive (USA), Allstate (USA), USAA (USA), Nationwide (USA), Travelers (USA), Liberty Mutual (USA), Farmers Insurance (USA), American Family Insurance (USA), AIG (USA), Zurich Insurance Group (Switzerland), AXA (France), Aviva (United Kingdom), Admiral Group (United Kingdom), Munich Re (Germany), Berkshire Hathaway (USA), Tokio Marine (Japan), Ping An Insurance (China), PICC (China) and Other Major Players."

If You Have Any Query Auto Insurance Market Report, Visit:

https://pristineintelligence.com/inquiry/auto-insurance-market-48

Segmentation of Auto Insurance Market:

By Vehicle age

Old

New

By Type

Commercial

Personal

By Distribution Channel

Banks

Private Agents/ Brokers

Online

An in-depth study of the Auto Insurance industry for the years 2023–2030 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report's segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers' values, needs, and buying inclinations, are integral parts of any thorough market analysis.

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Reasons to Purchase this Market Report:

Market forecast analysis through recent trends and SWOT analysis

Auto Insurance Market Dynamics Scenarios with Market Growth Opportunities over the Next Year

Market segmentation analysis, including qualitative and quantitative studies that include economic and non-economic impacts

Auto Insurance Market Regional and country-level analysis that integrates demand and supply forces that impact the growth of the market.

Competitive environment related to the Auto Insurance market share for key players, along with new projects and strategies that players have adopted over the past five years

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#Auto Insurance#Auto Insurance Market#Auto Insurance Market Size#Auto Insurance Market Share#Auto Insurance Market Growth#Auto Insurance Market Trend#Auto Insurance Market segment#Auto Insurance Market Opportunity#Auto Insurance Market Analysis 2023#US Auto Insurance Market#Auto Insurance Market Forecast#Auto Insurance Industry#Auto Insurance Industry Size#china Auto Insurance Market#UK Auto Insurance Market

0 notes

Text

Why Choose Yerevan Car Rental?

Yerevan, nestled amidst the lofty mountains of Armenia, presents an enticing blend of tourism and business opportunities. Exploring its fusion of ancient and modern architecture promises a trove of delightful memories. Hence, opting for car rental Yerevan ensures ample time to traverse all the famed destinations highlighted in your guidebook.

With its delectable cuisine, rich historical landmarks, ancient edifices, and an array of options for active pursuits, Yerevan guarantees a worthwhile investment of your time and resources.

Embark on your adventure without delay by availing of Yerevan airport car rentals today. Secure your booking now to unlock the best deals on the market.

What Car Rentals are Available in Yerevan?

While the Armenian vehicle market remains relatively insular, limiting the presence of international companies, selecting a suitable rental car in Yerevan isn't without its challenges. However, you can anticipate a diverse range of options based on your preferred body type:

Convertible: Breathe in the crisp mountain air and soak in the panoramic vistas with a convertible roof.

SUV: Conquer off-road terrain effortlessly and chart your course with boundless freedom.

Sedan: Blend practicality and comfort at a reasonable price point.

Economy: Opt for nimble, cost-effective wheels ideal for extended Yerevan car rentals.

Identify your preferred body type and effortlessly find a model that aligns with your travel itinerary.

Yerevan Car Rental Prices

Prepare yourself for the nuances of Yerevan car rental prices. While resort cities in Spain or Italy might have seemed steep, Armenia may catch you off guard. Anticipate rates as high as $100 per day for a modest sedan, even one a decade old.

While the cultural allure of the region is undeniable, the value proposition is subjective. Nevertheless, consider these prudent saving strategies:

Opt for reputable rental companies exclusively.

Secure bookings well in advance.

Compact and mid-size cars offer the best value.

Long-term rentals trump single-day arrangements.

Exercise caution when browsing online options to avoid troublesome local agencies. Explore our offerings for a seamless journey.

Yerevan Car Rental Options

Despite limited model choices and elevated prices, Yerevan boasts an array of supplemental options to enhance your rental experience. Trustworthy rental company personnel are on hand to guide your selection and recommend practical add-ons tailored to your itinerary:

Child seats

Additional drivers

Mobile and Wi-Fi connectivity

Satellite navigation systems

Comprehensive insurance packages.

While Collision Damage Waiver (CDW) isn't mandatory, it alleviates financial liabilities amidst unpredictable road conditions. Benefit from hassle-free transactions sans deposits, with free cancellations (1-2 days prior), and flexible payment options via card or cash.

Which Rental Companies Operate in Yerevan?

While lesser-known rental entities abound, prominent brands like Localiza, Rent Motors, Naniko, Europcar, Localrent, and Alamo dominate the Armenian market. Opting for a reputable, established company ensures a seamless Yerevan car rental experience.

Price doesn't necessarily correlate with quality. Local agencies may offer competitive rates, yet be prepared for potential vehicle unavailability or price adjustments upon arrival. Exercise diligence in your selection process. Refer to the "Rent a car Yerevan reviews" section for comprehensive insights.

Simplify your decision-making process by opting for a renowned international brand. Set forth on your Armenian journey with confidence.

Yerevan Car Rental Reviews

Peer experiences play a pivotal role in shaping one's travel narrative. Ideally, Yerevan car hire should elicit favorable reviews, given its myriad attractions. Or does it?

Key Takeaways from Online Reviews: Top 5 Insights

Cheap car rentals in Yerevan are elusive, with prices often soaring to several hundred dollars for standard sedans.

Some local agencies may attempt to hold renters liable for pre-existing damages, emphasizing the importance of meticulous vehicle inspections upon pickup.

A sojourn to the mountains promises unparalleled splendor, warranting the expenditure.

Exercise prudence when selecting optional add-ons, as certain amenities may inflate overall costs significantly.

Opting for a reputable brand mitigates risks associated with dubious entities. Avoid impromptu transactions and prioritize reputable establishments.

Secure your booking with us today and bid adieu to the dilemma of selecting a reliable vehicle.

What Documents are Required for Car Rental in Yerevan?

Unlike some destinations, an International Driving License isn't compulsory for renting a car in Yerevan. Essential documents include:

Passport

Driver's license

Discount certificates or reservations may yield attractive savings, while credit card payments alleviate concerns regarding local service expenses. Wishing you a memorable journey amidst the Armenian mountains.

#Car Rental Yerevan#Rental Car Yerevan#Rent a car Yerevan#cheap car rental Yerevan#rent a car Yerevan cheap#rent a car Yerevan long term#rent a car Yerevan cheap price#rent a car Yerevan per day#rent a car in Yerevan for one day#how to rent a car in Yerevan#rent a car business in Yerevan#rent a car online Yerevan

1 note

·

View note

Text

Applying for Car Insurance in Spain

Car insurance for both UK and Spanish registered vehicles, from Fully comprehensive cover to third party all including full breakdown cover, any driver over 26 with more than 2 years of European Driving Licence including UK.

FILL IN OUR EASY, ONLINE FORM FOR A FAST QUOTE TODAY!

1 note

·

View note

Text

How to travel Europe from Delhi

Europe is a dream destination for many people, and with good reason. It is a continent with a rich history and culture, stunning scenery, and delicious food. However, planning a trip to Europe from Delhi can seem daunting. There are so many different countries to visit, and it can be difficult to know where to start.

Here is a step-by-step guide on how to travel Europe from Delhi:

Choose your destinations

The first step is to decide where you want to go. Europe is a large continent with many different countries to choose from. Some of the most popular tourist destinations in Europe include France, Italy, Spain, Germany, and the United Kingdom. If you are short on time, you may want to focus on visiting a few key countries. However, if you have more time, you can explore a wider range of destinations.

Get a visa

Most European countries require Indian citizens to obtain a visa before they can travel. There are different types of visas available, depending on the length of your stay and your purpose of travel. You can apply for a visa online or at the embassy or consulate of the country you want to visit.

Book your flights

Once you have your visa, you can start booking your flights. There are a number of airlines that offer direct flights from Delhi to major European cities. You can also consider booking a multi-city flight that will allow you to visit multiple destinations.

Book your accommodation

There are a variety of accommodation options available in Europe, from hotels and hostels to apartments and vacation rentals. The type of accommodation you choose will depend on your budget and preferences.

Plan your transportation

Europe has a well-developed transportation system, so you have a number of options for getting around. You can travel by train, bus, car, or plane. The best way to travel will depend on your itinerary and budget.

Get travel insurance

It is important to get travel insurance before you travel to Europe. Travel insurance will protect you in case of medical emergencies, trip cancellation, or lost luggage.

Pack your bags

When packing for your trip to Europe, be sure to pack light. You will be doing a lot of walking, so you don't want to be weighed down by heavy luggage. Be sure to pack comfortable shoes and clothes that are appropriate for the weather. Don't forget to pack your camera, sunscreen, and a travel adapter.

Learn a few basic phrases in the languages of the countries you will be visiting

Learning a few basic phrases in the local language will go a long way in helping you communicate with locals. Even if you don't speak the language fluently, people will appreciate your effort to learn.

Be patient and flexible

Things don't always go according to plan when you are traveling. Be patient and flexible, and go with the flow.

Enjoy your trip!

Europe is a beautiful and fascinating continent with a lot to offer visitors. Take your time to explore and enjoy all that Europe has to offer.

Europe Tour Packages from Delhi

If you are looking for a hassle-free way to travel to Europe, consider booking a tour package. There are a number of tour operators that offer packages from Delhi to Europe. Tour packages typically include flights, accommodation, transportation, and some activities. This can be a great way to save money and time, and it can also help take the stress out of planning your trip.

Here are some of the things to consider when choosing a Europe tour packages from Delhi:

The length of your trip: Tour packages range from a few days to a few weeks. Choose a package that fits your time frame and budget.

The destinations you want to visit: Make sure the package includes the destinations you are interested in visiting.

The activities you want to do: Some packages include activities such as sightseeing tours, museum visits, and wine tastings. Choose a package that includes the activities you are interested in.

The price: Tour packages can vary in price depending on the length of the trip, the destinations, and the activities included. Get quotes from a few different tour operators before making a decision.

Conclusion

Traveling to Europe from Delhi can be an exciting and rewarding experience. With careful planning and preparation, you can make the most of your trip and create unforgettable memories. By following the tips in this guide, you can plan a successful and enjoyable trip to Europe from Delhi.

0 notes

Text

cheap rental cars in Madrid - An Overview

Exploring Madrid is made easier with car rentals in Madrid. Numerous providers provide numerous vehicles, meeting all needs. Affordable vehicle options are great for economical travelers. Ease of reserving a car online eases the experience. With cheap car hire in Madrid, exploring the area is enjoyable. Selecting the right car improves your travel experience. Customizable rental options suit diverse travel schedules.

Navigating the Heart of Spain: Securing the Best Car Hire in Madrid

Securing a car hire in Madrid offers freedom to explore. Looking at costs guarantees you get the most affordable option. Being aware of the rental terms is critical for a hassle-free experience. Added services like sat nav can enhance your trip. Insurance coverage give safety. Prolonged car hires are often cost-effective. Support is crucial in addressing any concerns. Advance reservations usually leads to more savings. Choosing a trusted company assures quality service. Don't forget, cheap car rentals in Madrid car hire in Madrid doesn't imply lowering service.

0 notes

Text

Global B2B2C Insurance Market Unidentified Segments – The Biggest Opportunity Of 2023

Advance Market Analytics released a new market study on Global B2B2C Insurance Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global B2B2C Insurance Forecast till 2028*.

The B2B2C insurance concept is defined as insurance products (life, non-life, and health) offered through any non-insurance and/or non-financial intermediaries excluding the traditional insurance intermediaries. Insurance offering through the B2B2C channel covers an extensive range of potential partners including retailers, utility providers, telecom companies, retailers, e-commerce, and other digital players. Traditionally B2B2C was focused on selling insurance products as supplements to the partner’s core product like motor insurance for a car sale, creditor insurance for a mortgage, extended warrant for white goods. Key Players included in the Research Coverage of B2B2C Insurance Market are:

AXA (France)

Zurich Insurance Group (Switzerland)

China Life Insurance (China)

Berkshire Hathaway (United States)

Prudential (United States)

UnitedHealth Group (United States)

Munich Re Group (Germany)

Assicurazioni Generali S.p.A. (Italy)

Japan Post Holding (Japan)

Allianz (Germany)

Assurant (United States)

BNP Paribas Cardif (France)

Chubb (United States)

What's Trending in Market: Adoption of Digital Solutions for Insurance Distribution

Challenges: The Main Challenge of B2B2C Insurance Is To Manage and Maintain Value through the Full Partnership Cycle

Opportunities: Growing Demand from Developing Countries such as China and India

Market Growth Drivers: Rise in Consumer Awareness about Latent Demand for Insurance

Increase in Insurance Companies across the Globe

Upsurging Demand for More Channels to Distribute Insurance Products

The Global B2B2C Insurance Market segments and Market Data Break Down by Type (Life Insurance, Non-Life Insurance), Application (Banks and Financial Institutions, Automotive, Retailers, Education, Healthcare, Post Office, Transportation, Telecom, Utilities, Real Estate, Others), Organization Size (SMEs, Large Enterprises), Distribution Channel (Online, Offline)

To comprehend Global B2B2C Insurance market dynamics in the world mainly, the worldwide B2B2C Insurance market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas. • North America: United States, Canada, and Mexico. • South & Central America: Argentina, Chile, Colombia and Brazil. • Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa. • Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia. • Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia. Presented By

AMA Research & Media LLP

0 notes

Text

Menorca Car Hire – From Economy to Luxury Cars

Introduction

Menorca, one of Spain’s most breathtaking Balearic Islands, offers travelers pristine beaches, historic towns, and picturesque landscapes. The best way to explore this stunning island is through car hire Menorca. Whether you need an economical car for budget-friendly travel or a luxury vehicle for a premium experience, renting a car provides the ultimate convenience and freedom to explore at your own pace.

In this article, we will explore the advantages of car hire Menorca, how to find the best deals, essential tips for a smooth rental experience, and top places to visit on the island. No matter what type of traveler you are, having a rental car will make your Menorcan adventure seamless and enjoyable.

Why Choose Car Hire in Menorca?

With its diverse landscapes, hidden beaches, and charming towns, Menorca is best explored with a rental car. Here’s why opting for car hire Menorca is the best choice:

Flexibility & Freedom: Travel at your own pace without relying on public transport schedules.

Comfort & Convenience: Skip the hassle of waiting for taxis or buses and enjoy private transportation.

Cost-Effective: Hiring a car can be more economical than frequently using taxis, especially for groups or families.

Access to Remote Locations: Many of Menorca’s most breathtaking beaches and natural wonders are only accessible by car.

Customizable Options: Choose from a range of economy cars, SUVs, or luxury vehicles to suit your travel needs.

Best Deals on Car Hire in Menorca

To get the best car hire Menorca deals, consider the following tips:

1. Book in Advance

Car rental prices can increase significantly during peak tourist seasons (June to September). Booking early ensures availability and lower rates.

2. Compare Prices Online

There are multiple websites where you can compare prices and secure the best deals, including:

Rentalcars.com

Expedia

Kayak

Skyscanner

3. Choose the Right Vehicle

Your choice of car depends on your travel plans:

Economy Cars – Ideal for budget travelers and city driving.

Compact Cars – Great for small families and easy parking.

SUVs – Perfect for off-road adventures and remote beaches.

Luxury Cars – For travelers seeking a premium and stylish experience.

4. Look for Discounts and Promotions

Many car rental companies offer seasonal promotions, discounts for early bookings, or special rates for long-term rentals.

5. Opt for a Full-to-Full Fuel Policy

A full-to-full fuel policy ensures that you only pay for the fuel you use, avoiding extra charges.

6. Check Insurance Coverage

Before purchasing extra insurance, check if your travel insurance or credit card provides rental car coverage. This can save you money on unnecessary add-ons.

Essential Tips for a Hassle-Free Car Rental in Menorca

1. Understand the Rental Terms

Before signing your contract, make sure you understand:

Mileage limits

Additional driver fees

Fuel policies

Insurance coverage

2. Inspect the Vehicle Before Driving Off

Take photos or videos of the car’s condition before leaving to avoid being charged for pre-existing damages.

3. Know the Driving Rules in Menorca

Drive on the right-hand side of the road.

Speed limits are generally:

50 km/h in urban areas

90 km/h on open roads

120 km/h on highways

Seat belts are mandatory for all passengers.

Spain has strict DUI laws, so avoid drinking and driving.

4. Plan for Parking

Blue zones: Paid parking areas that require a ticket.

White zones: Free parking areas.

Yellow lines: No parking allowed.

Arrive early at popular beaches and tourist sites to secure parking spots.

5. Return the Car on Time

Avoid late return fees by checking the rental company’s return policy and ensuring you drop off the vehicle on time.

Must-Visit Places with Your Rental Car in Menorca

With your car hire Menorca, you can explore these top destinations:

Ciutadella – A charming historic town known for its cobbled streets, beautiful architecture, and vibrant port area.

Mahon – The capital city of Menorca, home to one of the world’s largest natural harbors.

Cala Macarella & Cala Macarelleta – Stunning turquoise beaches perfect for relaxation and photography.

Monte Toro – The highest point on the island, offering panoramic views.

Binibeca Vell – A picturesque white-washed fishing village, ideal for a leisurely stroll.

Fornells – A coastal town famous for its seafood and water sports.

Albufera des Grau Natural Park – A paradise for nature lovers and bird watchers.

Conclusion

Choosing car hire Menorca is the best way to explore the island’s breathtaking landscapes, hidden beaches, and charming towns. Whether you opt for an economy car or a luxury vehicle, having a rental car provides the ultimate convenience and flexibility to make the most of your trip. By following the tips outlined in this guide, you can secure the best deals, avoid common rental pitfalls, and enjoy a hassle-free experience.

Book your car hire Menorca today and get ready to discover the stunning beauty of this Mediterranean paradise at your own pace!

0 notes

Text

Get Affordable and Reliable Car Insurance in Spain with Ease

Car insurance is significant for anybody who claims or drives a vehicle in Spain. It gives security and true serenity if there should arise an occurrence of mishaps or other surprising occasions. Luckily, getting car insurance in Spain is simple and direct.

One of the main benefits of simple car insurance in Spain is that it gives comprehensive inclusion at a reasonable cost. With the right arrangement, you should rest assured that you are safeguarded if mishaps, robberies, or other unexpected occasions occur. The expense of car insurance shifts depending on elements, for example, the sort of vehicle you drive, your age, and your driving history. Nonetheless, by comparing various arrangements and suppliers, you can find one that accommodates your financial plan and gives satisfactory inclusion.

One more advantage of simple car insurance in Spain is that it is easy to obtain. Most insurance suppliers offer online statements and applications, making the interaction quick and helpful. You can get a message and buy a strategy in only a couple of moments without having to leave your home or office. This is particularly useful for ex-pats or unfamiliar inhabitants who may not know about the Spanish language or insurance market.

By working with a respectable insurance supplier like dragoninsure.com, Easy car insurance in spain is possible, where our English, Spanish, and German-speaking staff members ensure that there is always someone available to assist you with your specific need. You can fit your strategy to your precise necessities and guarantee security.

It is also critical to note that car insurance is required in Spain. All drivers are expected to host somewhere around third-get-together risk inclusion, which covers harms and injuries you might cause to others if a mishap arises. Assuming you neglect to have insurance, you might confront fines, legitimate punishments, and, surprisingly, the seizure of your vehicle. This way, it is fundamental to have simple car insurance in Spain to avoid any fair or financial outcomes.

Choosing an insurance supplier for your car in Spain is pivotal to working with a legitimate company. Dragoninsure.com is a confided-in supplier of Car insurance in Spain, offering its clients comprehensive inclusion and customized administration. Our helpful staff is always here to help and provide you with the most fantastic insurance advice in Spain, whether you need vehicle insurance, home insurance building & contents, health insurance, life insurance, or travel insurance. We are always accessible to respond to any inquiries and direct you through the most common way of obtaining car insurance in Spain.

Overall, simple car insurance in Spain gives comprehensive inclusion, adaptability, and comfort. By working with a believed insurance supplier like dragoninsure.com, you can guarantee suitable inclusion for your necessities and spending plan. Furthermore, you can avoid any lawful or financial outcomes of not having insurance. Thus, if you want simple car insurance in Spain, visit dragoninsure.com today to get a statement and begin protecting yourself and your vehicle.

For more info :-

Home Insurance In Spain

Life Insurance In Spain

Funeral Insurance In Spain

Travel Insurance In Spain

Source Url :-

0 notes

Text

Unlock Affordable Adventures: Maximize Savings with Wiber Car Rental in Spain

Exploring the scenic beauty, historic landmarks, and vibrant culture of Spain is a dream come true for many travelers. Having a reliable vehicle at your disposal makes the journey smoother, and that’s where Wiber Rent A Car Promo becomes your key to unlocking unbeatable deals. With the added advantage of a Wiber Spain Car Rental Discount, tourists and locals alike can enjoy affordable, hassle-free car rental services tailored to every travel need. Whether you plan to visit the sun-drenched beaches of Costa del Sol or the bustling streets of Madrid, saving on transportation gives you more freedom to explore.

Why Choose Wiber for Your Next Spanish Adventure?

Travelers need more than just a car; they seek flexibility, convenience, and reliability. Wiber delivers exactly that, with a focus on transparent pricing, no hidden fees, and top-notch customer service. By offering a range of modern vehicles suitable for both short city trips and long countryside adventures, Wiber ensures its customers have a seamless travel experience.

Promo Codes that Make a Difference When planning a trip, budget-conscious travelers often look for ways to reduce costs. Through exclusive Wiber Rent A Car Promo offers, visitors can enjoy substantial savings. These promotions apply to various car categories, giving travelers the flexibility to choose vehicles that suit their preferences, whether it’s a compact car for city driving or a spacious SUV for family vacations.

Features That Make Wiber Stand Out

Easy Online Booking System Wiber’s intuitive online booking platform allows users to select their preferred vehicle, apply discounts easily, and confirm reservations within minutes. This convenience ensures travelers can focus on planning their itinerary instead of worrying about transportation logistics.

Transparent Pricing Without Surprises One of the most frustrating aspects of renting cars abroad is dealing with unexpected charges. Wiber ensures transparency by including all mandatory fees upfront, so the price you see is the price you pay.

Flexible Pick-up and Drop-off Locations Wiber offers car rental services at major airports and city centers, giving travelers the flexibility to pick up their vehicle from one location and drop it off at another. This feature is especially convenient for road-trippers exploring multiple destinations.

Comprehensive Insurance Options For peace of mind, Wiber provides flexible insurance packages that cover everything from basic liability to full-coverage plans. This ensures travelers can enjoy their trip without worrying about unforeseen issues.

How to Use a Wiber Spain Car Rental Discount Effectively

To make the most of the available discounts, it’s essential to plan ahead. Here are some tips:

Book Early: Car rental prices tend to rise closer to the travel date, so securing a rental early helps lock in lower rates.

Apply Promo Codes at Checkout: Always enter the promo code during the booking process to activate your discount.

Check Seasonal Promotions: Wiber frequently offers discounts for off-peak seasons or limited-time events.

Final Thoughts

Spain’s diverse attractions, from the historic Alhambra to the vibrant La Rambla, are best explored with the freedom a rental car offers. Leveraging the Wiber Rent A Car Promo or a Wiber Spain Car Rental Discount makes the experience even more enjoyable by keeping travel costs manageable. With Wiber’s commitment to customer satisfaction, transparent pricing, and modern fleet, your journey through Spain will be nothing short of spectacular.

0 notes

Text

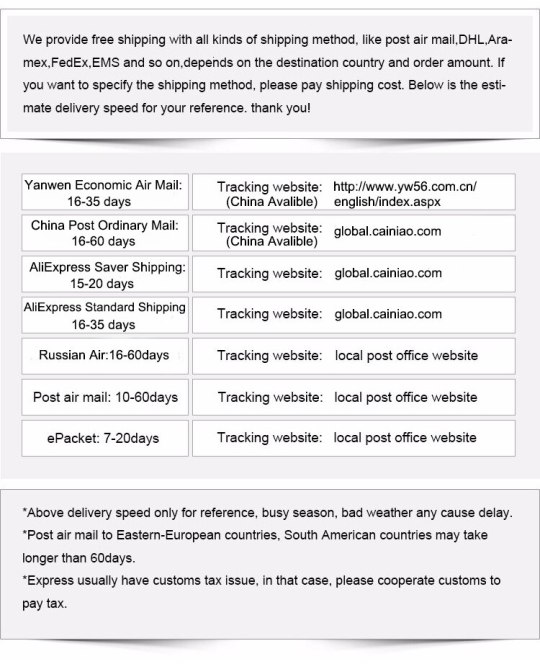

China Post Air Mail Website

ePacket is one of the shipping options offered on eBay, AliExpress, Wish and other online marketplaces. There, while placing an order, you may choose from several postal services, including this one. Delivery time for these parcels is almost always within 30 days. You can trace the status of the order once you get a tracking code.

Air Mail Tracking

Tracking From China To Usa

China Post Air Mail Website Philippines

China Post Air Mail Website Business

Contents

Track China Post Packages. At RapidTrack.net you can quickly find the status of your shipment/package with just a few clicks of the mouse. We are able to easily track shipments from hundreds of carriers. Package tracking has never been easier! Track your shipments and get updates all from one location. China post For the article on the postal system based in the People's Republic of China, see China Post. Registered Put one's name on an official list under such terms (of animals) officially recorded with or certified by a recognized breed association; especially in a.

What is ePacket delivery from China?

ePacket delivery is a subsidiary of China EMS. It is suitable for light-weight packages (under 2 kg). The service was formed specifically for e-commerce purposes, namely for eBay merchants shipping from China to the USA. Many merchants select ePacket by default as it is an affordable and reliable way of delivery.

Some Chinese sellers also use another word for ePacket, which is EUB or e-Youbao (e邮宝). Alternative names for ePacket also include Suzhou EUB, SZ-EUB, FY-GZ EUB, HZ-EUB, ePacket-PT, and ePacket-YW.

What are the requirements for ePacket shipping?

Car and driver best midsize suv. The requirements are as follows:

You can ship to the following countries: Australia, Austria, Belgium, Brazil, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Hungary. Ireland, Indonesia (currently in a trial run), Israel, Italy, Japan, Kazakhstan (in a trial run), Korea, Luxembourg, Malaysia, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Russia, Saudi Arabia, Singapore, Spain, Sweden, Switzerland, Thailand (presently in a trial run), Turkey, Ukraine, United Kingdom, United States, Vietnam (in a trial run).

A package must not exceed 2 kg in weight. The exception to this rule is Israel, where a parcel can be under 3 kg.

There are allowed dimensions for a parcel:

The sum of the length, width and thickness cannot be greater than 90 cm, and the longest side of a package cannot be more than 60 cm.

Flat mail pieces must be more than 14 cm long and 9 cm tall.

The permissible dimensions for rolled-up packages are under 104 cm (in length and diameter), and the length must not exceed 90 cm.

Small- and medium-sized packages may contain fillers — spare parts, accessories, tools and household appliances (please note that they must meet safety requirements).

The value of the package must be less than $400.

One can track an order using a tracking number (Shipment ID).

Freight rate depends on the weight of a package. For instance, the minimum threshold is 50 g for the US, New Zealand, Russia and Japan, and 10 g for Ukraine.

Are there any restrictions for ePacket shipping?

Yes, there are some restrictions for this shipping option. According to Universal Postal Convention, items like aerosols, explosives, gasoline, poison, etc. are forbidden (unless shipped by licensed dealers).

Who delivers ePacket?

First, China Post EMS delivers a parcel to the Chinese border and then forwards it to the destination country. Upon arrival at the sorting center, the items are picked up by national postal services (e.g. USPS in US, Canada Post in Canada, etc.) and finally delivered to the post office that is closest to the customer.

Where can I get an ePacket delivery?

Once you get delivery confirmation, you can pick up your ePacket at a local post office or check your PO box. The package can also be delivered right to your door if your national postal service offers such mode of delivery.

Does ePacket deliver to my door?

ePacket only guarantees fast delivery to the customs of the destination country. From this point forward, the national postal service deals with the order. You can get your shipment delivered to your door if the local postal service allows this option.

Is ePacket delivery free?

Not really. Whenever you place an order and see free shipping option, that means the merchant has incorporated the delivery cost into the price of the item. Sophos xg active directory. On average, it is $1-3 for small-sized packages and $4-6 for oversized ones.

Can I track an ePacket?

ePacket delivery provides customers with the option of end-to-end tracking. You can check the delivery status on the China Post EMS official website, which is both in English and Chinese, or track it here on Postal Ninja.

As a rule, ePacket tracking number starts with LM, BZ, LX, LN, LZ, LW, LF, LK, KQ, LO or LL, followed with nine digits and CN, e.g.:

LS039769770CN

LT947052932CN

LN832125508CN

LW910983731CN

My ePacket is lost — what should I do?

A false tracking number may be the reason. While tracking your order, you may see a wrong location, which means it refers to another package. Get in touch with the merchant to get an actual tracking code.

If your ePacket goes missing completely, ask the merchant to report the lost package.

How long does it take to get an ePacket from China?

Delivery times vary by the destination country:

Kill sophos process mac. Recovery Instructions: Your options. In the Application Control policy, applications are allowed by default. System administrators choose applications that they wish to block. You can check out who is the parent process: select the process in activity monitor and use the Info button, or via terminal with ps -ax -O ppid if I recall correctly. It might be another process by Sophos but with a stealth name, or maybe even your VPN software. In that case you can just kill 'em all.

Air Mail Tracking

Delivery time to the USA: 10-20 working days;

To Russia, Saudi Arabia and Ukraine: 7-20 working days;

To other countries: 7-30 working days.

It should be pointed out that holidays, bad weather and other factors may delay the shipment.

My ePacket takes too long — what should I do?

First off, contact the merchant to specify the details. It is necessary to extend package insurance and wait for the item to be delivered. In the worst-case scenario, that is if you call your packet a loss, you can ask for a refund. Marketplaces oblige merchants to issue a full refund of missing packages.

ePacket vs China Post Air Mail

ePacket is a fast and convenient shipping option. Most items get delivered safely within 2-3 weeks. In contrast, some packages shipped by China Post get delayed, get stuck at customs, arrive damaged or even get lost.

British Eurosport has today (May 29) launched on Sky Go, the multiplatform service enabling Sky customers to watch live and on-demand television on multiple devices. The Sky Go app is available for all Sky TV customers at no extra cost, so you can watch Sky on the go on your mobile, tablet or laptop. Eurosport su sky go. Watch all 7 Sky Sports channels live on your mobile, laptop or tablet on Sky Go. At no extra cost for Sky Sports TV customers With Sky Go you can watch entertainment, movies and sports live and on. Access all the channels available on Sky Go while you're waiting. Once you're up and running, you'll only be able to watch the channels available in line with your TV package. Sky Go channels. Movies / Sports Entertainment Kids Docs News / International. All Sky Cinema channels.

ePacket vs Aliexpress Standard Shipping

Tracking From China To Usa

The apparent advantage of AliExpress Standard Shipping lies in customer security. In the course of the transaction, a merchant first passes an item to the AliExpress logistics department, where it gets a tracking code, and then a package is forwarded to courier services. In the case of standard delivery, the merchant bears all costs and estimated delivery time is 20-40 days. A customer can choose between paying extra (which ensures fast delivery) or having a package shipped for free but with a slight delay.

China Post Air Mail Website Philippines

In short, here are the pros and cons of ePacket (in comparison to Aliexpress Standard Shipping):

China Post Air Mail Website Business

ProsConsless risk of package lossweight up to 2 kgfaster package processinghigher delivery cost

6 notes

·

View notes

Text

car insurance : 10 questions with answers

Dear reader, we are honored to visit

our site

and hope to find everything you need in this article.

1.How does classic car insurance differ from conventional car insurance ?Classic car insurance will give you what the car is actually worth and or what you feel the car is worth. Conventional insurance will not. Let’s say you have a beautiful 1965 split window corvette. Maybe it’s worth a $100,000. Collection insurance will want photos of the car and maybe an inspection of the vehicle. Once they agree on the value your good to go. However there are rules, like limited miles you can drive, garage kept, they can be very picky. Regular insurance last I heard will give you blue book value. Do the research. There are some very good collection companies around.

Insurance companies and having fun with this.

The UK MOT test now has public information data about current and historical mileage.

Thus now we can see/prove/audit that there are many tens of thousands of old cherished cars - that literally do not move for years on end. (Less than 500 miles every 5 years).

Big data analysis will show clearly to insurance companies which classic cars are massively profitable to insure.

A mainstream loved semi-classic car has a market value of £4,000 or less. (eg. 18 year old Mercedes convertible) driven by a busy,, employed, 50 year old with 2+ cars

On fully comprehensive insurance - the risk held by the insurance company is £3.5K for total write off of the car and any 3rd party claims (on a vehicle that hardly moves). The risk to the policy owner is loss of 4 years no claims bonus and a 10+ year claim free profile.

Big data will show to the insurance companies that these are very profitable policies

2.Does the wrong address invalidate car insurance ?

That depends on why it is wrong. If you move, while you should notify your insurance company, but don’t you are more likely to get cancelled because you didn’t pay your mailed bill (assuming that is the option that you selected).

But if say that you live in Miami, Florida (the most expensive place in the state to get auto insurance, and you claim that you live just outside of DeFuniak Springs, Florida and then have an accident in Miami, Florida, the insurance company could say FRAUD and VOID your policy as if it never existed. Because you had an uninsured accident, you would probably lose your driver’s license until you made the other driver whole again! Short of that, it usually wouldn’t be considered Material, and they would back bill you for premium OR give you a refund.

3.Is rental car insurance a rip-off ?

yes and no.

if you are using your insurance and crash the rental car, you can be liable for the complete cost of repairs AND lost revenue while it is being repaired. this can be full price of the rental all the time it is being repaired. this can be a ton of cash. also if you chip the windshield the rental co can charge you for a complete new windshield or repair the that one. your insurance may or may not cover any or all of this. needless to say you will have to deal with it one way or another.

if you buy the EXPENSIVE rental car insurance you are covered for all damages including all the “little scratches”

i was 21 and rented a car to go to a job interview 2 day rental. well i put almost 1600 miles on the car. when i returned the rental agent was mad i had put that many miles on an unlimited rental. so she went out and nitpicked everything …. i just watched as she pointed bugs out as dents and everything else. when we went in she disappeared a returned with a 2400.00 repair dollar bill. and demanded how i was going to pay. i just said i paid the 15.00 for the full insurance and that would cover it , she grabbed the rental agreement and read it, her face turned red. and i left….

4.Is it okay to not have car insurance for a few months ?

Probably expecting a bit of heat for this one but here goes.. lol.

I live in Spain and about 14 years ago or so I was forced under pressure to get rid of the Suzuki jeep… which looked a fair bit like this I suppose. No power steering and the uncanny ability to just spin right around on itself in slightly greasy roads….

which had the widest back tyres I think I have ever seen on a car.., anyway, it had to go, saw an ad for a Mitsubishi Shogun , a lot like this

UK plates and only came with an export certificate from UK. Seems the guy who brought it over was intending to change it over to Spanish plates but never got round to it. Swapped the Suzuki plus 3 grand and off we went. First time I had driven an automatic, was a joy and no mistake…proper built like a tank too.. awesome car.

Drove that car for almost 8 years on that export certificate, no MOT and insurance papers I made my self on the computer by copying a mates documents and changing the pertinent details. Spanish cops had at that time.. and possibly still now, no way of actually checking the veracity of insurance papers, if they looked legit, they were accepted.

I understand that in the last few years DVLA having softened a little and offer a yes or no answer to Spanish enquiries as to whether a UK registered car has a valid MOT or not… no other info is given. I assume thats data protection at work or some such. Its that yes or no that has gotten rid of a load of UK plated cars from Spanish roads, now you actually have to have one, so either you know someone who has an MOT garage and can produce one for you or you drive back to get it done, which isnt usually viable.

So ye, its ok to not have insurance for a few months or even a few years, as long as you can get away with it.

5.Can realtors write off car insurance ?

It depends on the method they choose to use to write off their car expenses. If their car is used less than 50% for business, they must use the mileage method which includes all operating expenses including insurance. If they use it more than 50% they may choose to use the actual expense method or the mileage method. If they use the actual expense method they can deduct the business % of gas, repairs, interest, insurance, depreciation, etc. Either method requires them to keep a mileage log.

6.Does my car insurance cover my friend when they borrow my car for a day?

In the UK read your certifcate of motor insurance.

If it says

“Any person driving on the policyholder’s behalf or with their permission” or WTTE then they will be covered. (There may be age limits in the schedule of insurance but these cannot appear on the certificate). (Also cover will be for pleasure use only unless the wording on the certificate specifically includes business use by your friend).

If it does not say that then, unless your friend is named on the certificate of insurance, they are not covered under your policy.