#National live hot banker for today

Explore tagged Tumblr posts

Text

Fortune Lotto Live Draw Time today 15/12/2022

Fortune Lotto Live Draw Time today 15/12/2022

Fortune Lotto Live Draw Time today 15/12/2022 Fortune lotto live draw time, Here are the best two sure and banker for Fortune draw on 15 December 2022 for fortune thursday lotto banker with best lotto banker for today. The fortune lotto numbers – Give me banker for thursday fortune lotto today, Here are the best two sure and banker for Fortune draw on 08 December 2022. Hot live fortune thursday ���…

View On WordPress

#2 live banker for today lotto#best lotto banker for today#best two sure for Fortune#Fortune 2 sure today live#Fortune 24 live another day review#Fortune banker for today#fortune black friday 2-sure#Fortune free lotto banker#fortune ghana live banker today#Fortune ghana lotto sure banker#Fortune key lotto prediction#fortune live hot banker for today#Fortune lotto banker 61#fortune lotto key#Fortune lotto live draw time#fortune lotto prediction#fortune national lotto banker#Fortune one live banker for today#Fortune two sure for today#fortune unfailing banker#free lotto banker#Ghana Fortune banker to banker#Ghana Fortune Lotto 2-Sure#Ghana Fortune Lotto 3direct#ghana fortune lotto banker#Ghana Fortune Lotto Long Perm#Ghana Fortune Lotto Perm7#ghana live banker#how to win Fortune lotto#live banker for today fortune

0 notes

Text

Biden should support the UAW

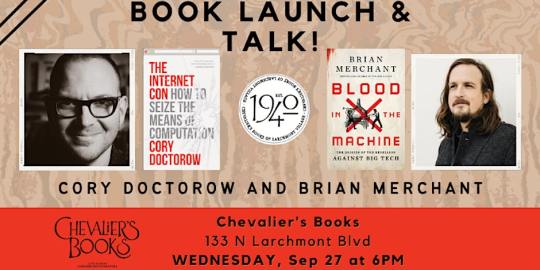

On September 22, I'm (virtually) presenting at the DIG Festival in Modena, Italy. That night, I'll be in person at LA's Book Soup for the launch of Justin C Key's "The World Wasn’t Ready for You." On September 27, I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine.

The UAW are on strike against the Big Three automakers. Biden should be roaring his full-throated support for the strike. Doing so would be both just and shrewd. But instead, the White House is waffling…and if recent history is any indication, they might actually come out against the strike.

The Biden administration is a mix of appointees from the party's left Sanders/Warren wing, and the corporatist, "Third Way" wing associated with Clinton and Obama, which has been ascendant since the Reagan years. The neoliberal wing presided over NAFTA, the foreclosure crisis, charter schools and the bailout for the bankers – but not the people. They voted for the war in Iraq, supported NSA mass-surveillance, failed to use their majorities to codify abortion rights, and waved through mega-merger after mega-merger.

By contrast, the left wing of the party has consistently fought monopoly, war, spying, privatized education and elite impunity – but forever in the shadow of the triangulation wing, who hate the left far more than they hate Republicans. But with the Sanders campaign, the party's left became a force that the party could no longer ignore.

That led to the Biden administration's chimeric approach to key personnel. On the one hand, you have key positions being filled by ghouls who cheered on mass foreclosures under Obama:

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

And on the other, you have shrewd tacticians who are revolutionizing labor law enforcement in America, delivering real, material benefits for American workers:

https://pluralistic.net/2023/09/06/goons-ginks-and-company-finks/#if-blood-be-the-price-of-your-cursed-wealth

Progressives in the Biden administration have often delivered the goods, but they're all-too-often hamstrung by the corporate cheerleaders the party's right wing secured – think of Lina Khan losing her bid to block the Microsoft/Activision merger thanks to a Biden-appointed, big-money-loving judge:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

These self-immolating own-goals are especially visible when it comes to strikes. The Biden admin intervened to clobber railway workers, who were fighting some of the country's cruelest, most reckless monopolists, whose greed threatens the nation:

https://pluralistic.net/2023/02/11/dinah-wont-you-blow/#ecp

The White House didn't have the power to block the Teamsters threat of an historic strike against UPS, but it publicly sided with UPS bosses, fretting about "the economy" while the workers were trying to win a living wage and air conditioning for the roasting ovens they spend all day in.

Now, with the UAW on strike against the monopolistic auto-makers – who received repeated billions in public funds, gave their top execs massive raises, shipped jobs offshore, and used public money to lobby against transit and decarbonization – Biden is sitting on the sidelines, failing to champion the workers' cause.

Writing in his newsletter, labor reporter Hamilton Nolan makes the case that the White House should – must! – stand behind the autoworkers:

https://www.hamiltonnolan.com/p/whose-fault-is-it?

Nolan points out that workers who strike without the support of the government have historically lost their battles. When workers win labor fights, it's typically by first winning political ones, dragging the government to the table to back them. Biden's failure to support workers isn't "neutral" – it's siding with the bosses.

Today, union support is at historic highs not seen in generations. The hot labor summer wasn't a moment, it was a turning point. Backing labor isn't just the moral thing to do, it's also the right political move:

https://pluralistic.net/2023/09/14/prop-22-never-again/#norms-code-laws-markets

Biden is already partway there. He rejected the Clinton/Obama position that workers would have to vote for Democrats because "we are your only choice." Maybe he did that out of personal conviction, but it's also no longer politically possible for Democrats to turn out worker votes while screwing over workers.

The faux-populism of the Republicans' Trump wing has killed that strategy. As Naomi Klein writes in her new book Doppelganger, Steve Bannon's tactical genius is to zero in on the areas where Democrats have failed key blocks and offer faux-populist promises to deliver for those voters:

https://pluralistic.net/2023/09/05/not-that-naomi/#if-the-naomi-be-klein-youre-doing-just-fine

When Democrats fail to bat for workers, they don't just lose worker votes – they send voters to the Republicans. As Nolan writes, "working people know that the class war is real. They are living it. Make the Democratic Party the party that is theirs! Stop equivocating! Draw a line in the sand and stand on the right side of it and make that your message!"

The GOP and Democrats are "sorting themselves around the issue of inequality, because inequality is the issue that defines our time, and that fuels all the other issues that people perceive as a decline in the quality of their own lives." If the Democrats have a future, they need to be on the right side of that issue.

Biden should have allowed a railroad strike. He should have cheered the Teamsters. He should be on the side of the autoworkers. These aren't "isolated squabbles," they're "critical battles in the larger class war." Every union victory transfers funds from the ruling class to the working class, and erodes the power of the wealthy to corrupt our politics.

When Democrats have held legislative majorities, they've refused to use them to strengthen labor law to address inequality and the corruption it engenders. Striking workers are achieving the gains that Democrats couldn't or wouldn't take for themselves. As Nolan writes:

Democratic politicians should be sending the unions thank you notes when they undertake these hard strikes, because the unions are doing the work that the Democrats have failed to accomplish with legislation for the past half fucking century. Say thank you! Say you support the workers! They are striking because the one party that was responsible for ensuring that the rich didn’t take all the money away from the middle class has thoroughly and completely failed to do so.

Republican's can't win elections by fighting on the class war. Democrats should acknowledge that this is the defining issue of our day and lean into it.

Whose fault is a strike at the railroads, or at UPS, or in Hollywood, or at the auto companies? It is the fault of the greedy fuckers who took all the workers’ money for years and years. It is the fault of the executives and investors and corporate boards that treated the people who do the work like shit. When the workers, at great personal risk, strike to take back a measure of what is theirs, they are the right side. There is no winning the class war without accepting this premise.

Autoworkers' strikes have been rare for a half-century, but in their heyday, they Got Shit Done. Writing in The American Prospect, Harold Meyerson tells the tale of the 1945/46 GM strike:

https://prospect.org/labor/2023-09-18-uaw-strikes-built-american-middle-class/

In that strike, the UAW made history: they didn't just demand higher wages for workers, but they also demanded that GM finance these wages with lower profits, not higher prices. This demand was so popular that Harry Truman – hardly a socialist! – stepped in and demanded that GM turn over its books so he could determine whether they could afford to pay a living wage without hiking prices.

Truman released the figures proving that higher wages didn't have to come with higher prices. GM caved. Workers got their raise. Truman touched the "third rail of American capitalism" – co-determination, the idea that workers should have a say in how their employers ran their businesses.

Co-determination is common in other countries – notably Germany – but American capitalists are violently allergic to the idea. The GM strike of 45/6 didn't lead to co-determination, but it did effectively create the American middle-class. The UAW's contract included cost-of-living allowances, wage hikes that tracked gains in national productivity, health care and a defined-benefits pension.

These provisions were quickly replicated in contracts with other automakers, and then across the entire manufacturing sector. Non-union employers were pressured to match them in order to attract talent. The UAW strike of 45/6 set in motion the entire period of postwar prosperity.

As Meyerson points out, today's press coverage of the UAW strike of 2023 is full of hand-wringing about what a work-stoppage will do to the economy. This is short-sighted indeed: when the UAW prevails against the automakers, they will rescue both the economy and the Democratic party from the neo-feudal Gilded Age the country's ultrawealthy are creating around us:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9?sk=207d6afdb89b0351b92233cc3318ab94

There's a name for a political strategy that seeks to win votes by making voters' lives better – it's called "deliverism." It's the one thing the Trump Republican's won't and can't do – they can talk about bringing back jobs or making life better for American workers, but all they can deliver is cruelty to disfavored minorities and tax-breaks for the ultra-rich:

https://pluralistic.net/2023/07/10/thanks-obama/#triangulation

Deliverism is how the Democrats can win the commanding majorities to deliver the major transformations America and the world need to address the climate emergency and dismantle our new oligarchy. Letting the party's right wing dominate turns the Democrats into caffeine-free Republicans.

When the Dems allowed the Child Tax Credit to lapse – because Joe Manchin insisted that poor people would spend the money on drugs – they killed a program that had done more to lift Americans out of poverty than anything else. Today, American poverty is skyrocketing:

https://thehill.com/opinion/finance/4206837-poverty-made-an-alarming-jump-congress-could-have-stopped-it/

Four million children have fallen back into poverty since the Dems allowed the Child Tax Credit to lapse. The rate of child poverty in America has doubled over the past year.

The triangulators on the party's right insist that they are the adults in the room, realists who don't let sentiment interfere with good politics. They're lying. You don't get working parents to vote Democrat by letting their children starve.

America's workers can defeat its oligarchs. They did it before. Biden says he's a union man. It's time for him to prove it. He should be on TV every night, pounding a podium and demanding that the Big Three give in to their workers. If he doesn't, he's handing the country to Trump.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/18/co-determination/#now-make-me-do-it

#pluralistic#uaw#bidenomics#strikes#united autoworkers#labor#unions#union strong#evs#now make me do it#deliverism#democrats#hamilton nolan

116 notes

·

View notes

Text

Sunday, June 25, 2023

The World’s Empty Office Buildings Have Become a Debt Time Bomb (Bloomberg) In New York and London, owners of gleaming office towers are walking away from their debt rather than pouring good money after bad. The landlords of downtown San Francisco’s largest mall have abandoned it. A new Hong Kong skyscraper is only a quarter leased. The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years. After a long buying binge fueled by cheap debt, owners and lenders are grappling with changes in how and where people work, shop and live in the wake of the pandemic. At the same time, higher interest rates are making it more expensive to buy or refinance buildings. A tipping point is coming: In the US alone, about $1.4 trillion of commercial real estate loans are due this year and next, according to the Mortgage Bankers Association. When the deadline arrives, owners facing large principal payments may prefer to default instead of borrowing again to pay the bill.

Inflation, health costs, partisan cooperation among the nation’s top problems (Pew Research Center) Inflation remains the top concern for Republicans in the U.S., with 77% saying it’s a very big problem. Gun violence is the top issue for Democrats: 81% rank it as a very big problem. When it comes to policy, more Americans agree with the Republican Party than the Democratic Party on the economy, crime and immigration, while the Democratic Party holds the edge on abortion, health care and climate change.

The Brown Bag Lady serves meals and dignity to L.A.’s homeless (USA Today) A Los Angeles woman, known affectionately as the Brown Bag Lady, is serving the city’s unhoused population with enticing meals and a sprinkle of inspiration for dessert. Jacqueline Norvell started cooking meals for people on L.A.’s Skid Row about 10 years ago in her two-bedroom apartment after getting some extra money from her Christmas pay check. She bought several turkeys and prepared all the fixings for about 70 people, driving to one of L.A.’s most high-risk areas to hand out the meals. “We just parked on a corner,” said Norvell. “And we were swarmed.” She says people were grateful and she realized the significant demand. Norvell’s been cooking tasty creations ever since. Norvell garnishes each dish with love and some words of encouragement. In addition to the nourishment, each bag or box has an inspirational quote. “We’ve got to help each other out,” she said. “We have to.”

Facing Brutal Heat, the Texas Electric Grid Has an Ally: Solar Power (NYT) Strafed by powerful storms and superheated by a dome of hot air, Texas has been enduring a dangerous early heat wave this week that has broken temperature records and strained the state’s independent power grid. But the lights and air conditioning have stayed on across the state, in large part because of an unlikely new reality in the nation’s premier oil and gas state: Texas is fast becoming a leader in solar power. The amount of solar energy generated in Texas has doubled since the start of last year. And it is set to roughly double again by the end of next year, according to data from the Electric Reliability Council of Texas. “Solar is producing 15 percent of total energy right now,” Joshua Rhodes, a research scientist at the University of Texas at Austin, said on a sweltering day in the state capital last week, when a larger-than-usual share of power was coming from the sun. So far this year, about 7 percent of the electric power used in Texas has come from solar, and 31 percent from wind. The state’s increasing reliance on renewable energy has caused some Texas lawmakers, mindful of the reliable production and revenues from oil and gas, to worry. “It’s definitely ruffling some feathers,” Dr. Rhodes said.

Guatemalans are fed up with corruption ahead of an election that may draw many protest votes (AP) As Guatemala prepares to elect a new president Sunday, its citizens are fed up with government corruption, on edge about crime and struggling with poverty and malnutrition—all of which drives tens of thousands out of the country each year. And for many disillusioned voters—especially those who supported three candidates who were blocked from running this year—the leading contenders at the close of campaigning Friday seem like the least likely to drive the needed changes. Guatemala’s problems are not new or unusual for the region, but their persistence is generating voter frustration. As many as 13% of eligible voters plan to cast null votes Sunday, according to a poll published by the Prensa Libre newspaper. Some of voters’ cynicism could be the result of years of unfulfilled promises and what has been seen as a weakening of democratic institutions. “The levels of democracy fell substantially, so the (next) president is going to inherit a country whose institutions are quite damaged,” said Lucas Perelló, a political scientist at Marist College in New York and expert on Central America. “We see high levels of corruption and not necessarily the political will to confront or reduce those levels.”

Chile official warns of ‘worst front in a decade’ after floods, evacuations (Reuters) Days of heavy rainfall have swollen Chile’s rivers causing floods that blocked off roads and prompted evacuation in the center of the country, amid what has been described as the worst weather front in a decade. The flooding has led authorities to declare a “red alert” and order preventive evacuations in various towns in the south of Santiago. “This is the worst weather front we have had in 10 years,” Santiago metropolitan area governor Claudio Orego said.

Crisis in Russia (NYT/AP) A long-running feud over the invasion of Ukraine between the Russian military and Yevgeny Prigozhin, the head of Russia’s private Wagner military group, escalated into an open confrontation. Prigozhin accused Russia of attacking his soldiers and appeared to challenge one of President Vladimir Putin’s main justifications for the war, and Russian generals in turn accused him of trying to mount a coup against Putin. Prighozin claimed he had control of Russia’s southern military headquarters in the city of Rostov-on-Don, near the front lines of the war in Ukraine where his fighters had been operating. Video showed him entering the headquarters’ courtyard. Signs of active fighting were also visible near the western Russian city of Voronezh, and convoys of Wagner troops were spotted heading toward Moscow. The Russian military scrambled to defend Russia’s capital. Then the greatest challenge to Russian President Vladimir Putin in his more than two decades in power fizzled out after Prigozhin abruptly reached a deal with the Kremlin to go into exile and sounded the retreat. Under the deal announced Saturday by Kremlin spokesman Dmitry Peskov, Prigozhin will go to neighboring Belarus. Charges against him of mounting an armed rebellion will be dropped. The government also said it would not prosecute Wagner fighters who took part, while those who did not join in were to be offered contracts by the Defense Ministry. Prigozhin ordered his troops back to their field camps in Ukraine, where they have been fighting alongside Russian regular soldiers.

In Myanmar, Birthday Wishes for Aung San Suu Kyi Lead to a Wave of Arrests (NYT) In military-ruled Myanmar, there seemed to be a new criminal offense this week: wearing a flower in one’s hair on June 19. Pro-democracy activists say more than 130 people, most of them women, have been arrested for participating in a “flower strike” marking the birthday of Daw Aung San Suu Kyi, the civilian leader who was ousted by Myanmar’s military in a February 2021 coup. Imprisoned by the junta since then, she turned 78 on Monday. The protest—a clear, if unspoken, rebuke of the junta—drew nationwide support, and many shops were reported to have sold all their flowers. Most of the arrests occurred on Monday, but they continued through the week as the military tracked down participants and supporters. In some cities and towns, soldiers seized women in the streets for holding a flower or wearing one in their hair. Some were beaten, witnesses said. The police have also been rounding up people who took to Facebook to post a birthday greeting or a photo of themselves with a flower. Phil Robertson, the deputy Asia director for Human Rights Watch, called the campaign the latest example of the “paranoia and intolerance” of Myanmar’s military rulers.

Sweltering Beijingers turn to bean soup and cushion fans to combat heat (Washington Post) China’s national weather forecaster issued an unconventional outlook this week: “Hot, really hot, extremely hot [melting smiley face],” it wrote Tuesday night on Weibo, China’s answer to Twitter. It was imprecise, but it wasn’t wrong. The temperature in Beijing hit 106 degrees Fahrenheit on Thursday, a public holiday for the Dragon Boat Festival. It was the highest June recording since 1961. Visiting the Great Wall was “like being in an oven,” said Lin Yun-chan, a Taiwanese graduate student on her first trip to Beijing. The heat wave is almost the only thing anyone can talk about. Much of the online discussion revolves around food. People are sharing advice about the most hydrating snacks for the hot weather: mung bean soup and sour plum drink are popular options. Entrepreneurs looked for ways to capitalize on the heat wave: One promoted a seat-cushion fan designed to combat a sweaty butt, while tourism companies touted trips to the south of the country, which is usually hotter but currently less so.

Your next medical treatment could be a healthier diet (WSJ) Food and insurance companies are exploring ways to link health coverage to diets, increasingly positioning food as a preventive measure to protect human health and treat disease. Insurance companies and startups are developing meals tailored to help treat existing medical conditions, industry executives said, while promoting nutritious diets as a way to help ward off diet-related disease and health problems. “We know that for adults, around 45% of those who die from heart disease, Type 2 diabetes, stroke, that poor nutrition is a major contributing factor,” said Gail Boudreaux, chief executive of insurance provider Elevance Health speaking at The Wall Street Journal Global Food Forum. “Healthy food is a real opportunity.”

2 notes

·

View notes

Text

- agent 14/agent haines; the heart wants what it wants

Somewhere sirens are going off, howling with the steady, racing heartbeat of the city. They sweep to Steve's ears but they do not manage to reach his brain - currently oddly occupied with keeping his eyes locked on a figure a few meters away.

The man sits alone, smoking his third cigarette in under seven and a half minutes. Dark circles under his eyes, framing his face delightfully, only adding to his typical Los Santos appearance: stressed face, five o'clock shadow, chain smoking and the shakes of visible caffeine abuse.

Steve had never seen him before.

"Boss?"

"Yeah?", he just can't bring himself to look away. The man takes his phone out, seemingly picking up a call, his face immediately crunching up in annoyance.

"We're heading back in, are you coming with us?"

He lits another cigarette. Steve wants to lick the smoke from his lips, wants to know if he tastes like it too, wants to taste the fire of his lighter, to bury his hands in his dark locks and never let go of him again -

"Yeah, fuck. Sure."

Steve gets up, chair screeching loudly over the concrete, getting his hopes up that the stranger would look up at the noise, react to it in any way. But the loud screeeech is like any other noise in this goddamn city really, one that citizens get used to over time and eventually grow to ignore it completely. Thus he doesn't look up at all, continues to hiss into his phone and Steve retreats, like a beaten dog, back into his office.

_

It takes him thirty minutes to realize - a government offical and a highly decorated one, too - that his office's windows head towards the terrace. But when he peeks through the blinds the plaza's already deserted.

-

It takes a whole week full of nerve-wrecking lunch breaks and one or two bombings somewhere in Europe, before he sees him again. He doesn't wear a suit this time and Steve is convinced that he has to be a banker, taking his break here instead of his office's cantine.

He feels like he's struck by lightning. He wants to walk over there and introduce himself, but he also just wants to sit, admire from afar, to never move again. The man lights a cigarette and that also ignites a fluttering feeling in Steve's stomach and his chest, sending tingles straight to his fingers. The small butterflies leave a burning sensation and he wants to tear his chest apart, grab them by their wings and riiiip them out, until blood spills everywhere. Dave and Sanchez are arguing, but he can't hear them anymore, the pounding of his heart too loud, a static noise filling his ears. His body is releasing all the build-up tension worth the week's wait, and his hands grab the armrests of his chair.

This is crazy. He's crazy. This man is a complete stranger and here he is, highly decorated Special Agent Steve Haines, national hero and model employee of the FIB, and its his own body that's suddendly betraying him.

The man looks up and Steve's world stops. The noises fade, maybe his heart even stops pounding - he really can't be sure.

The man has pretty eyes, all blue and green like the atlantic ocean far out on the sea, in the shimmering sunlight. He's pretty. Very much so. He's maybe around his own age, maybe a little younger, high cheekbones that probably (Steve's uncannily sure about that) deliver quite a show once the man laughs. He looks good in his clothes. A little too good.

Steve wants to get up and leave. Steve wants to sit and continue to stare. Steve wants to rip his clothes of his body - wants to disappear, because he can't stand the other man's eyes on him. Checking him out. Judging him.

It's quite the stare, really. One that could send him to his knees or make his blood boil.

Steve's phone rings on the table, the take-away cups vibrate with it and he nearly jumps in his chair. He picks his phone up hastily and the stranger throws him an arrogant smile, one brow cocked up and looks down at his laptop again. Steve gets up and leaves the table.

_

It's Friday and it's been a week since he felt like his body was completely failing him. Since then the stranger had spent every lunch break at the plaza and Steve had locked eyes with him multiple times, had bathed in the soaring tingles of his body.

Today, he's finally alone, with Norton on a trip to Liberty City and Sanchez having called in sick yesterday. He takes the elevator down to the ground floor and checks his hair in its mirror one last time, until the doors swing open with a loud diiing. He steps out, passing through the entry hall like a conqueror and then he's outside, the air all warm and mushy around him. His gaze falls upon the terrace.

The man is not there. His table is empty and so is his chair. Steve's shoulders slump.

He sits down and chugs down a cup of coffee and then another one and suddendly someone behind him clear's their throat.

"Got some fire?"

He turns around and his heart skips a beat. It's him.

_

He does taste like smoke. And a little sweet, a little spicy. It makes his lips tingle and burn, his groin growing hot.

He breaks their lips apart, as he presses the smaller man against the tiles of the bathroom.

"What's your name, huh?"

"Warren", his cheeks are red. He's so hot, his hands are hot against Steve's scalp and he presses himself against the other man, rolls his name around with his tongue.

"Warren. I'm Steve." The answer is another heated kiss and a hand that rushes to the fly of his trousers.

_

He doesn't see him again after this, not during his lunch break nor anywhere else in the city. The weeks turn into months and sometime inbetween Steve stops to care.

_

He's at a bar with some guys he still knows from college. They bore him but one of them pays for the drinks so he decides he could survive a few more hours. They talk and talk and talk and Steve can't bring himself to care and then he sees it.

A familiar leather jacket and suddendly their gazes lock. Warren smiles and Steve can't stop himself from smiling back.

_

They are in a bathroom again, hungrier this time. "I am sorry", Warren breaks the kiss, only for Steve to dive back in, "I had to leave. Work-related."

"Where'you working?", Steve's lips nibble at his throat, taking in is taste and his scent. He feels high with it.

"Maze Bank. I-I'm a banker", bingo.

"Looked the part", Steve grabs his hips and they stumble backwards against the stall's door and Warren presses himself between Steve's opened legs.

" 'n you?", he's slurring as Steve's hands wander underneath his shirt, up up up his back. He doesn't feel like lying, trying to would be uselss anyway. Steve knows what he and his colleagues look like.

"Government." Warren looks at him, a second too long, and Steve isn't quite sure what to make of it. But then their lips lock again and he choses not to think about it too much.

_

A week and three hook-ups later and Steve's locked in in his office. He feels horrible, but some things about Warren just don't add up and his paranoia is slowly kicking in. And so is his curiosity. He types the name into the blinking field, letter by letter. Slowly, so he won't make a mistake.

No data found.

Steve runs another program. And another.

He does not exist. Warren simply doesn't exist.

Steve leans back and rubs his eyes. He's so fucked.

_

Steve doesn't remember how he ended up on the living room of Warren's appartment, button-down torn and nose bleeding heavily. The cut above Warren's eyebrow bleeds as well, warm blood tickling down his cheeks and onto Steves neck.

Warren's hard and pressing against him as he raises his fist for another blow. Steve can't stop himself and laughter bubbles out of him, his ribs aching and hurt shooting, spiraling through his body. Warren, one ocean eye blue and lilac and a nasty scratch on his forearm, looks at him baffled.

"What is it, Haines?"

"The fuck", he's gasping for air, Warren's hard dick still poking his hip, "Do I know."

They look at each other while Steve's laugh is slowly ebbing away and Warren clenches his teeth. "I hate you, you fucking FIB-maggot."

"No, you don't", Steve rolls his hips up and Warrens eyelids flutter, "Not as much as I hate you, you fucking spy."

Warren rolls his hips against Steve's and his body falls forward, one hand lazily holding his weight, right next to Steve's head. He tilts his chin towards it and places soft kisses on the warm, thin skin that's between his teeth and Warren's veins. They both moan. He should kill him on the spot, getting rid of a potential threat and the competition all in one, but he can't bring himself to stop.

"Fuck me like you mean it", Warrens lips are pressed against his ear and his fingers claw hungrily at his chest, as he sighs needily into Steve's ear. He's ready to oblige.

_

The next time he sees Warren the sun's up again and the air is crisp and cold. He's wearing his leather jacket again and Steve wants to get up, head over to his table and tear it from his shoulders. Sanchez lights a cigarette and Dave says something stupid again, but Steve can't bring himself to care.

He looks at Warren, Fourteen, and his white shirt. The opened collar exposes his neck and the dark-red bitemarks. He inhales the smoke of his cigarette and as his lips wrap around it again he locks his gaze with Steve. His stomach tingles and 14 raises a brow. Cocky, arrogant, inviting and challenging. Steve feels one corner of his mouth tilting upwards as he leans back into his chair, legs spread wide.

Oh, this would be one fine game.

#i am liTERALLY LOSING CONTROL#my writing#steve haines/agent 14#agent steve haines#agent 14#gtao#gta online#gta v

27 notes

·

View notes

Text

the one you’ll love forever

(also on ao3 // kofi)

lena’s had the envelope for as long as she can remember; it’s thick and padded and the very last thing her father gave to her before he killed himself. though it’s yellowed with age, lionel’s immaculate script still stands out, the ink as black as when he first wrote on it.

open when you find the one you’ll love forever

she had almost opened it once before, young and reckless and hopelessly in love with her high school girlfriend. part of her is glad she caught her cheating before she decided to open it, part of her - a much larger, more bitter part - still hates veronica sinclair with a fiery passion.

but now she knows it’s finally time.

it’s been a long time since she and kara first met. it’s been a long time since they said ‘i love you’ for the first time, since she cleared a drawer for kara at her place. their lives are so far intertwined that lena can no longer imagine what life would be like without kara by her side.

but this morning, lena rolls over in bed and although kara’s side lies empty, she can smell the coffee percolating and she sees a note scribbled in kara’s messy scrawl.

bad guys who start before 8 are evil guys. coffee and bagels waiting for u -- love u!

and somehow, lena knows. she knows, as a peaceful warmth spreads through her body, that this is all she’ll need forever.

kara is the only person she ever wants to love.

she stretches as she stands up, her neck annoyingly stiff, and heads to the safe that sits in the very back of her closet.

and then, as she drinks her morning coffee she finally opens the envelope. there’s no long letter like she used to dream of, but instead she finds a key and a piece of paper with an address. a quick google search later, she’s already scheduled her private, ridiculously fast Luthorcorp jet to leave for switzerland in a couple of hours.

she’s already on board and sitting across from jess when she gets a call from kara.

‘hello, sweetheart,’ she says, blushing as she sees the little smirk on jess’s face.

‘i called your office and they said you’re out for the day,’ kara says quickly. ‘everything okay?’

‘just a last minute meeting in switzerland,’ lena lies easily. ‘thought it would be easier to convince them to sign the contract if i was there in person.’

‘do you want me to meet you for lunch?’

‘that little place in zurich?’ lena offers.

‘you read my mind. okay. gotta run, love you.’

‘love you, too,’ lena replies, this time whispering into the phone, lest jess smirk at her expense one more time.

it’s only when they’re in the air, each with a drink in their hand that jess says,

‘strange, i don’t remember seeing a meeting on the books for today.’

lena laughs nervously. ‘how very strange indeed.’

///

zurich is much colder than national city, but lena welcomes the change in weather. she wishes she could go skiing or sightseeing, but instead the car takes her straight from the airport to a bank in the middle of the old town. the building is aging, yet beautiful, and as soon as lena steps inside she is greeted by a woman who takes her coat and leads her to a counter.

‘my name is lena luthor--’

‘of course, ms. luthor,’ the concierge cuts her off. ‘we’ve been expecting you since this morning!’

lena frowns; she hadn’t informed them of her impending visit. but she bites her tongue as she’s led through the building. eventually, she finds herself on the seventh floor in an empty office.

‘ms. luthor!’ says an older man walking in after her, and going to stand behind his desk. ‘my name is rudy, i’m an old associate of your father’s. it is a pleasure to meet you.’ he shakes her hand warmly, and despite the instincts she’s spent a lifetime refining, she decides she can trust him.

‘i’ve got this,’ she says, skipping pleasantries and holding up the key.

‘i know,’ he says, and lena manages to hide her surprise. ‘there is a sensor in the key that lets us know when it has been held by a person. it was advanced technology back in the day, courtesy of mr luthor.’

so that’s how they knew she was coming.

‘that key, as you may have guessed, opens a safety deposit box that has been held here for you for a very long time.’ he buzzes the intercom and doesn’t even say anything. moments later, a young banker walks in with the box.

‘and it’s never been opened?’

‘not since your father closed it.’ he regards her for just a moment, in an almost grandfatherly way. ‘you know, you don’t look a thing like him. but there is a kindness in your eyes that i fondly remember was in his as well.’

lena doesn’t know how to respond; she can’t remember the last time somebody said something nice about her family to her face. rudy senses her awkwardness, and smiles graciously.

‘i’ll give you some privacy.’

he retreats from the room and suddenly lena is alone with the mystery that’s been with her for most of her life. she inserts the key into the lock, and turns it. with a satisfying click, the latch opens.

inside, she finds a ring box, and a handwritten note, again in her father’s writing.

it was your mother’s, and her mother’s before that. i’m sure you know by now, but her name was Anne, and she was absolutely wonderful in every way imaginable. she loved you more than life itself, and i know she would’ve wanted you to have this.

lena knows that her mother’s name was anne -- she had hired a private investigator a long time ago. but seeing it confirmed in her father’s handwriting brings tears to her eyes, and suddenly she feels like a child again, lost without the parents for whom she so desperately yearns. there’s a polaroid attached to the note. in it, anne sits on a window ledge, staring out at the view. her hand grasps the sill she sits on, and a ring sparkles on her finger, catching the light in a glorious way.

she opens the ring box, and is surprised (yet again that day) to find, not a claddagh ring, but a simple silver band with a modest diamond set in it. it’s so unlike any of the luthor jewelry she has - big and extravagant and worth millions.

and yet, it is priceless.

she slips the box into her purse, along with the note and polaroid. she thanks rudy for his kindness.

and then she meets her girlfriend for lunch.

///

‘so the meeting went well?’ kara asks an oddly quiet lena. they’ve finished lunch, and slowly work on the hot chocolates kara decided they both needed. lena decides she doesn’t want to lie to her.

‘i didn’t have a meeting,’ lena says. ‘i was emptying a safety deposit box.’

‘oh,’ kara says with a frown. ‘why didn’t you tell me?’

‘i wasn’t sure what i was going to find.’

a beat passes.

‘well? what was it?’

lena hesitates for just a moment.

and then she puts the box on the table between them, and flips it open.

‘oh my god.’

‘i know this moment is supposed to be thought out and planned and romantic or whatever. i don’t know. this ring was my mom’s and-and my father left it for me to give to ‘the one i’ll love forever.’’

‘lena--’

‘i know we haven’t talked about marriage much, and i don’t want to make you feel pressured in any way. but i know that my love for you feels... it feels steady. it feels like i’ve had it in my heart forever. and i know that this ring is meant for you, if you want it.’

kara smiles. she smiles and lena feels as though she wants to cry because of the overwhelming love that aches in her chest.

‘there’s a ring sitting in my old room in midvale that eliza’s been keeping safe for me. my mother heard me talking about you when i was last on argo city and handed it to me almost immediately.’

‘a ring?’ lena asks, her voice breaking.

‘i love you, lena. i plan on loving you forever, if you’ll let me.’

‘forever doesn’t seem long enough,’ lena says, and kara laughs. she leans across the table and kisses her deeply.

‘i’m sure we can figure something out, then.’

736 notes

·

View notes

Video

youtube

Brad Smotherman on Flipping Real Estate

https://www.jayconner.com/brad-smotherman-on-flipping-real-estate/

Brad Smotherman manages a 7 figure flipping business, and hold notes across Middle Tennessee. We invest in multiple states, and have houses from Michigan to Georgia right now.

Real Estate Cashflow Conference: https://www.jayconner.com/learnrealestate/

Free Webinar: https://www.jayconner.com/training/wtgtmn-webinar-rev2-podcast/?oprid=&ref=42135

Jay Conner is a proven real estate investment leader. Without using his own money or credit, Jay maximizes creative methods to buy and sell properties with profits averaging $64,000 per deal.

The Private Money Academy http://www.JayConner.com/Trial

———————————————————————-

Jay Conner (00:01): Well, hello there! And welcome to another exciting episode of Real Estate Investing with Jay Conner. I’m Jay Conner, your host of the show. Also known as The Private Money Authority. And if you’re brand new to the show, here on this show, we talk about all things that relate to real estate investing. We talk about investing in single family houses, commercial projects, small apartments, self storage, land deals, notes. And we also talk about how to get funding for those deals creatively and with private money. Now, if you’re brand new to this show, I’m known as The Private Money Authority, because from 2003 to 2009, I relied on the local banks and mortgage companies to fund my deals. But then I got cut off with no notice in 2009, but it was one of the biggest blessing in disguise. I was introduced to this wonderful world of private money.

Jay Conner (01:02): Since that time I’ve never missed out on a deal. I’ve rehabbed over 400 houses. Done even more deals creatively. And the reason I’ve never missed out on a deal since 2009 is because I got the cash ready to buy those all cash deals. And as we know, most of the sellers require all the money. So I’ve got a brand new free gift for everybody that’s tuning here on the show. And that is, I just launched The Private Money Academy. Which is a monthly membership where we actually have two live zoom conference a month with yes, yours truly me. For at least an hour to an hour and a half answering all your real estate investing questions. Getting you plugged into private money and funding for your deals. And we also have a hot seat session where we will take one of the members of the Academy, put you in the hot seat, analyze your business, and create a plan to take you and your business to the next level.

Jay Conner (01:57): So I have a free gift for everybody tuning in, and that is four weeks absolute free access to The Private Money Academy. And you get to come on the next two live shows for the Academy membership. Absolutely for free! You can take advantage of that and learn all about it after the show today at http://www.JayConner.com/Trial that’s http://JayConner.com/Trial Be sure and check that out, come on in to the membership for free, and I’ll see you on the inside of those live zoom conference coaching calls.

Jay Conner (02:41): Well, as you know, if you’ve been tuning in to Real Estate Investing with Jay Conner, we have amazing guests and experts here on the show. And today is no exception. Before I bring my special guest out of the green room and here to the forefront. Let me tell you just a little bit about him. Well, my guest today is a real estate investor and a mentor. And he owns and manages a seven figure per year flipping business. So my guest and I, we’ve got a lot in common. Well, his passion is being a top house flipper in the nation. And his other passion is also helping other newer investors build a sustainable real estate investing company. Well, with 11 years, he started back in 2010 on the real estate investing side. With 11 years in the real estate investing business, he’s invested in over 15 States. And yes, today on today’s show, we’re going to be talking about how do you do this business remotely and totally virtually.

Jay Conner (03:41): He also has houses all the way from Michigan to Georgia. And today he has completed over 550 transactions today. Yes, he knows what he’s talking about from experience. In addition to that, he focuses on buying single family flips creatively. Using both subject to the existing note strategy, and he buys a lot with owner financing. In fact, he is known as the Owner Finance Guy. He also uses the strategy of selling retail or with owner financing, with creating wrap around notes. I know you’ve heard that terminology. Wrapping around a note. And if that’s sort of a new term to you or an old term, and you don’t know what it means, we’re going to talk about that on today’s show as well and how you can utilize that strategy as well.

Jay Conner (04:34): Well, he is also the host of one of the top 100 business podcasts in the nation. And the name of his podcast is Investor Creator. And there on the podcast, he teaches new and seasoned real estate investors. How to take their house flipping business to a multiple six or even seven figure income without sacrificing freedom. After all, what do we want in this real estate investing world is, wealth and freedom. And my guest today is an expert in that area. My guest lives in Nashville, Tennessee. And with that, welcome to the show, my friend and expert, Mr. Brad Smotherman! Brad, welcome to the show!

Brad Smotherman (05:18): Jay, I appreciate you having me on. I have a feeling we’re going to have so much fun with this. I’m just going to have to take a nap after we get done.

Jay Conner (05:24): Yes, you are! My lands! Brad, I’m so excited to have you on. And I know just by your intro, your bio and the short period of time that we’ve been around each other, we’ve got a lot in common. In fact, my best guess, one of your core values, and one of your secrets to success is having the mindset and the framework of putting other people first, having their interests ahead of your interest. Would you agree with that?

Brad Smotherman (05:52): Hundred percent! A hundred percent!

Jay Conner (05:54): So Brad, first of all, you look entirely too young to be this successful, but anyway, I’ll go beyond that statement pretty quickly. You’re from Nashville, Tennessee. You grow up in Nashville?

Brad Smotherman (06:06): I did. Born and raised.

Jay Conner (06:08): You’re sing country?

Brad Smotherman (06:10): No. I don’t see anything. And that’s a good thing for everybody that would have to listen. So for the people that know how to sing it I’ll just listen politely like everyone else.

Jay Conner (06:20): But now you enjoy going to the Grand Ole Opry, right?

Brad Smotherman (06:22): Oh, certainly! And like I was telling you guys before I’m out taking my grandmother to see Merle Haggard there twice, and we saw George Jones once and just had a great time. So, absolutely!

Jay Conner (06:33): That’s awesome. Well, I’m excited to have you here on the show today. Brad, because you’re known as the owner financed guy. You’re an expert in the area of buying houses on terms controlling them creatively or whatever. So first of all, if you would explain to the audience, what is your business model look like?

Brad Smotherman (06:59): Well, I think my business model is a little bit different than most because everybody out there, especially the past five or six years, what they wanted to do is, you know, they wanted to wholesale something. They wanted to fix something and flip it. And you know, the past 10 years we’ve had an explosion of these fix and flip TV shows. And frankly, Jay, those shows just give me anxiety. Like I can’t watch them. Literally. I went to the dentist the other day and asked me what I wanted to watch as I’m sitting there in the chair. I was like anything, but this HGTV stuff, right?

Jay Conner (07:25): Well, wait a minute, Brad. Now, why would I, why would a reality show that I’m sure is real, that shows you how to make a hundred grand in 30 minutes with no headaches. Why would that give you anxiety?

Brad Smotherman (07:36): Well, just like, you know, I mean, it’s not real. And then, you know, secondly, I’m looking at what they’re spending on the kitchen. I’m thinking I could do it for a sixth of that. And then the person buying the house, it’s like, well, what do you do for a living? And they say, well, we catch butterflies and rainbows all day. And our budget’s 2 million bucks and it’s just like, it just doesn’t seem exactly genuine to me. But maybe they’re just in a different market, a better market than I’ve ever seen. Let’s just say that.

Jay Conner (08:01): Yeah! I get it, Brother, I get it. Sorry to interrupt. What’s your business model looks like?

Brad Smotherman (08:04): Yeah. And that’s a hundred percent fine. So, you know, I started in 2010 and my background was very similar to yours in a certain way, although I didn’t live it. So I worked for a builder developer. Well, I sold real estate through college and everything was going really, really well up until the crash of ’08. And in 2009, the bankers came in and said, well, sorry, we’re going to have to call your loan. You have 30 days to pay us off. And as you know, during that time, there’s really no way to refinance commercial lending, you know, especially a development loan. And so it bankrupted them. And luckily I was able to learn the lessons from the crash without actually having to be involved in the crash. And so when that happened, I realized very quickly, I didn’t want bank money in my business. Very similar to what you’re dealing with. Right?

Brad Smotherman (08:46): So it’s like, guys, being able to raise private money is paramount to this business. Like what Jay is talking about is super, super important. But, so I got started in 2010 and back then, you really couldn’t wholesale because no, very few people had an equity position that was big enough to where you could wholesale it. And then also the fix and flip model was very difficult because that couldn’t get money. And so I had to find another way. Well, what I found worked. Has always worked and what I feel will always work is creating owner financing. And so what we do is we buy creatively when we buy and then we sell with owner financing and a vast majority of our transactions. We still go retail at times and that’s okay. But what we want to do is we want to create longterm cash flow with longterm capital assets. And for me, I’d rather have that in mortgage notes. I feel like it’s far more scalable than rentals. We’re able to get paid to take the note in most of our transactions. It’s not like I’m putting cash out there to invest. We’re getting longterm assets given to us. And I just had to find another way because I couldn’t, I didn’t want to wholesale, I couldn’t wholesale. And the fix and flip model looked like really difficult to me during that time. And so we’ve been pretty much doing a similar model ever since.

Jay Conner (09:53): So to recap what you just said, tell me if I got it right. Your core model is buy on terms, buy with owner financing, buy with subject to, buying creatively without paying all the cash. Take that same property, turn around and sell it creatively to a new buyer with owner financing or what have you. So let’s break that down. First of all, you said, the reason you do that is because you want to build longterm wealth by leveraging an asset that’s going to continue to pay you monthly for a long time. Is that right?

Brad Smotherman (10:38): A hundred percent. That’s right.

Jay Conner (10:40): So in today’s market, I know from my own business, I know from my students’ businesses that finding a deal today in the multiple listing service is a bonus. The deals are not in the multiple listing service buying large. So we have to find our deals off market. We have to find houses that are not in the multiple listing service. So if you don’t mind pulling back the curtain for us just a little bit and give us a little sneak peek as to what is working for you today to find these people that have houses for sale, or maybe they haven’t considered selling their house. How do you find these deals?

Brad Smotherman (11:30): That’s a great question. Well, I mean, as we know, everything starts with a motivated seller. So the foundation of the business is marketing for motivated sellers. Now for me, real estate is a means to an end. I mean, if I can do this business with dump trucks or swimming pools, I would do that. I’m not in love with houses. They break, they smell bad. Some of them. One of my apprentices yesterday in San Antonio, he’s buying a house that has 70 cats in it. And I can’t imagine how bad that is, but you know, at the end of the day, marketing comes down to two different avenues. We can do sweat marketing, or we can do paid marketing. Man. When I started, I didn’t have any money. So I had to do the sweat marketing side of things. And so the examples of that would be, you know, putting out bandit signs, you know, although you’re paying for the sign, what I would do is I would put them out Friday night and pull them up early Monday morning.

Brad Smotherman (12:13): And so a hundred signs, a couple of hundred bucks would last me three or four months, right? So that’s more of a sweat technique as opposed to leaving them out. Another one that were having a lot of success with is actually networking with wholesalers because wholesalers are slave to the 70% rule. We’re able to go in and do deals that they can’t do, right? Because we buy creatively as opposed to just throwing cash offers around all over the place. Right? So I’ve got an apprentice in Texas. He’s done three transactions this month, where wholesalers are bringing him the deal. You know, one of them is at a 0% owner finance rate. Now why a wholesaler would want to make a $5,000 assignment fee on a deal where we’ve got like four years and this thing is going to be paid off and we’ve got an $80,000 note on it.

Brad Smotherman (12:55): I don’t really understand. Okay. So that’s a couple of options in terms of sweat marketing. What I hope for people is that they understand that marketing is an investment. It’s not a cost. So effective marketing should at a minimum of 25 X. So if you’re spending a thousand dollars in effective marketing per month, you should over time buy at $25,000 per month in equity. Right? As an average. Now, what I hope for people is that if you have to start with the sweat side, that you go to the paid marketing side, as soon as you can. Okay? So in my world, the best paid marketing that we can do is Pay-per-Click so being there on Google ads, whenever they’re there, like people are searching for us. Searching, sell my house fast, or companies that buy houses. We want to be there. When people have already realized that they have a problem and we can be there to offer a solution, but it has to be done very well. I know a lot of people that have lost a lot of money when it comes to doing Pay-per-Click campaigns, because they don’t understand how to drive traffic number one, and how to create conversion. Once someone is, has landed on a page number two, but those are examples of sweat marketing paid marketing that we use in our business.

Jay Conner (13:57): Excellent! So as we know, and most of our audience here knows. When talking to an off market seller, a person that owns a single family house, you know, they don’t have it in the multiple listing service. They have some type of motivation. Most of these people are going to be anticipating when you’re starting that conversation with them of you buying their house. Most of these people like 99% of them are more having their mind that, well, if I sell my house, I’m going to get all the money, right? I mean, it’s like, that’s the traditional way. I sell a house, I get all the money. But now, you come along and you are going to be talking to them about creative selling or them becoming the bank. Or there’s a note and they’re going to get payments. What are your secrets? And as our friend Eddie would say, talk off points. Well, what are you, what are your secrets or scraping that takes a person that’s never considered selling on terms and waiting for all their money over time, from the point of then expecting to get all the cash up front?

Brad Smotherman (15:06): That’s a great question. And what I would submit to you is the first thing that we can’t do is make offers. So in my world, I really feel like an offer is a commodity to shop. And I can’t even begin to tell you how many houses that we’ve gone in and bought because, you know, two or three other investors had gone in and left an offer behind for them to think about. And then we come in because we won’t give them our price. They’re giving us a price. We’re making sure that that’s the least that they will take. And then we’re going to switch it to terms. So let’s say that someone says, well, and we talk about things in terms of cash at closing. So if somebody owes a hundred thousand dollars and they want to sell the property for 115, then I’m going to switch it and say, well, so your cash at closing is $15,000.

Brad Smotherman (15:48): So assuming that they would sell to me for that $15,000 cash at closing, then I’m going to say, well, you know, I can do that. If we can do it another way, and this is how we can make it work. So I’ve never given them a price and they’ve given me the price. So I mean, what we’ve done there is we’ve made it very difficult for them at that point to really begin to pull back and think about it because we’re giving them their number. We never give a price ever. Now, Jay, there’s some times that we do pay cash for properties, we just bought one outside of Huntsville, Alabama, about a month ago that the people had paid $160,000 cash for it in 2012, we paid 15,000 for it. And, you know, it’s like at that price, I don’t really feel the need to negotiate terms.

Brad Smotherman (16:29): You know, it’s like, we’ll just pay the 15K. And I thought about it. It kinda hurt my feelings to not get 0% owner financing on that 15. But I was like, you know, they need the money. They need the 15 grand we’ll just go ahead and pay it. But the short answer is I think the real skill is to, to be able to negotiate with people, without giving them a price, giving them an offer. I feel like if you give an offer, it’s a commodity, a commodity for them to shop. I also think it’s kind of acrimonious. People feel like they’re good negotiators because somebody can say, well, I want $200,000 from our house. And you can say, well, how does a hundred thousand sound? I don’t think that’s negotiation at all. I think that’s horse trading. And like my family came from the agriculture world.

Brad Smotherman (17:09): So, I mean, we were pig farmers. I mean, and I saw that growing up all the time, you know, that doesn’t work for houses as well. Like if we can make people realize that we’re not there to take advantage, if we can make the number work, then we will make it work. But there’s equity. There’s two types of equity. There’s equity at price and equity in terms. So if we can create equity in terms, a lot of times that’s a better equity position for us to have as a longterm play, as opposed to just like really working in the 70%. If that makes sense.

Jay Conner (17:37): Do you ever offer or give multiple offers or multiple strategies of saying, okay, if you want your price, we can do it this way. If you’ve got to have all cash, we can do it this way. And if you want a third option, we can do it this way. Or do you, most of the time stay with say the the terms negotiation and conversation?

Brad Smotherman (18:02): And that’s a great question. So we don’t do like the three offer strategy of like, we can do it this way, this way, or this way, this way, because what I’ve found, at least in my own personal experiences that I had people say, well, I want this price with that term.

Jay Conner (18:14): They want to pick and choose the way they want it.

Brad Smotherman (18:18): Yeah. It was like, we’ll take this closing date. We’ll take that price with those terms. It’s like, well, that’s not really how it works. What I’ll say to that is it’s really common for us to, to bounce back and forth between price and terms. So if someone says, okay, this is the price that we want, they’ll say, well, if you want it like that, here’s how we can make that work. And they said, well, that doesn’t work for us. And then we’ll go back and say, well, is that price the least you would take? And so we start talking about pricing in. And I’ve had situations where we have to kind of go back and forth three or four times before we land somewhere. And it’s generally somewhere kind of in the middle that we find that people will work within kind of the median based on what they’re hoping for. You know, if we can substantiate pricing and values and costs to where we can show like, Hey, these are the numbers that you’re working with. Like, this is the value. This is the cost to get it there. Here’s my breakeven number. You know, what are you hoping for your cash at closing people generally tend to be a little bit more reasonable if we can substantiate why they should accept a lower price and what they were hoping for.

Jay Conner (19:15): When you have someone that is agreeable or at least open. They’re open to the idea Terms and, you know, taking payments or equity over time or whatever. Do you, in your, in your conversation, do you tell them how long or how long the term of the note would be? Or do you ask them what’s the longest they could go? Or how do you get to that agreeable length of the note?

Brad Smotherman (19:51): Yeah. So what we talk about is in terms of some now and some later, so we’re going to talk about it and say, okay, how much cash do you need at closing to make it work? And they’ll give us a number and we’ll kind of negotiate that. It’s like, okay, if I can get you X at closing, then how soon were you hoping to get, no, we do it this way. We can either do payments every month, like an annuity or retirement plan, or we can do a lump sum in the future, which were you hoping for? Generally, people kind of gravitate towards the payments per month. But the thing that we never mentioned is interest. Okay. We never really talk about terms. We’re going to talk about it in terms of, you know, $20,000 at closing and $500 per month until paid.

Brad Smotherman (20:27): And so people are kind of looking at that and saying, especially if they’re a landlord. Guys, if you’re, if you’re dealing with a landlord that has free and clear property and they’re tired landlord, you should absolutely be able to negotiate owner financing because these people are open to receiving payments. That’s what they bought the property for in the first place. Well, if we can just kind of segment it to being like, well, how much do you need at closing? What would you like a lump sum in the future? Or would you like monthly payments? Generally, they’re going to say, well, I’d love monthly payments and we can negotiate something, but we never really talk about it in terms of, well, it’s a 10 year loan and here’s the rate we never mentioned. Certainly we’d never mentioned interest. We don’t really ever talk about the term as well.

Jay Conner (21:03): So you would agree that most of the terms that you structure are payments with no interests?

Brad Smotherman (21:10): Correct. A hundred percent. I’ve only paid interest twice on owner finance deals. And both of those were properties I wanted. They were both lake properties and I was like, I’ve gotta have this. I think I paid a 3% rate on one and four and a half on the others.

Jay Conner (21:24): I love it! I love it! Well, Brad, now let’s really change gears from the owner financing thing and the term thing to this world that you’re in of investing remotely. My lands! You are in, you’ve invested in 15 States. You invest from Michigan to Georgia. And when I asked you a question that could take you three days to answer, but you got about three minutes instead.

Brad Smotherman (21:55): We’ll work with that.

Jay Conner (21:55): But how in the world do you invest remotely in 15 different States? And we know what, we know everybody’s concerns are. I mean, how do you find those deals, you know, out there in a different state, what’s your boots on the ground? How do you make sure you’re not being taken to the cleaners? How do you manage all that stuff remotely? And you know, my land! You can’t drive by it and see what’s happening to the property. I mean, what does that world look like?

Brad Smotherman (22:24): Yeah. And you’re right. That would be about a three hour answer. But to put it into three minutes, the first fundamental that we have to understand is that the farther away we are from our own personal market, the cheaper the property must be. So we have to have a higher discount. Now, I’ll buy something at 60 cents on the dollar cash in my backyard, but I’m definitely not going to do that, you know two States away, right. So we have to have a greater discount because you’re a hundred percent, right. We’re going to have issues that we don’t expect right now. We don’t have, you know, a large amount of like workforce that can help us in these deals generally. Right. So what we’re going to do is we market to areas that we like, okay. And because we’re marketing in big geographic areas, our lead cost is actually quite a bit lower.

Brad Smotherman (23:12): It’s substantially lower. So we can do one of two things. We can either have a lower ad budget, or we can keep our ad budget the same and have maybe three or four times a lead flow. Okay. So let’s just say we have four times the lead flow. Well, what that means is that, that deal that comes around twice a year, three times a year is going to happen for me roughly every two months. Or, you know, the deal that happens every four months is going to happen for me every month. So I can be a little bit more picky based on what I’m looking at. And so in terms of the value, the decisions are very easy, actually. So I mean, case in point, we just bought one in Montgomery, Alabama. The property had a comp across the street that sold in in February for 76,000, we bought this one for 13, so we have it under contract.

Brad Smotherman (23:59): And so once we have an under contract, we go into due diligence. So the first thing we’re going to look at is value. So what is the value based on what we expect right now? So we feel like roughly this thing’s worth $75,000 and I can probably owner finance it for 89 or maybe 99,000 with a 10K down payment. You know, at a minimum 10K. So with that, we’re gonna talk to two or three brokers in that market, real estate agents that are gonna give us CMAs. Give us an idea of value. And then we’re going to then once the value looks okay, we’re going to switch to condition. So we’re going to get actually a home inspection on this property. Okay guys, once we have three different CMAs from agents and they all kind of make sense for one another, like there’s congruency in those three CMAs, and then we go and we get the home inspection, we’re going to know really everything that we need to know in terms of that property, especially with the discounts that we’re buying.

Brad Smotherman (24:48): So, I mean, the question being is that a little bit more risky than buying it around backyard? It certainly is. Whenever, if you were paying dollar for dollar the same amount, but if you’re paying 60 cents in your own backyard or 20 cents in another state, then I would ask you, well, which is more risky at that point. Okay. So short answer, we’re going to get things under contract that we feel pretty comfortable with. Then we’re going to verify and find the facts that we know and what we don’t know. At that point, we’re going to make a final decision. Sometimes we have to renegotiate price most of the time we don’t, because it’s just such a severe discount on the front end. And I mean, in terms of management, the thing is that we’re owner financing most of these, almost all. And so if we’re owner financing things, we’re serving the least served in the most underserved buyer pool in the country.

Brad Smotherman (25:32): There’s a lot of people that need owner financing. And since March, this is what I heard from Eddie Speed yesterday. And Jay, I know, you know, Eddie. So he said that if a hundred people could get a mortgage in March before this COVID thing hit, then right now there’s 64 people that can get a mortgage that’s left out of those hundred. Well, what happened to those other 36 people? Did they just decide not to buy? Well, no, they need owner financing at this point. So we’re serving a very needed, a very underserved buyer pool that needs owner financing. So sell the house with owner financing, create the note. I don’t want ownership and property. I feel like property is liability. We want to own the paper. Okay. So we create owner financing. So the house owner financing to have a longterm cash flowing asset. And in a nutshell, that’s how we buy remotely.

Jay Conner (26:18): To what extent do you buy houses remotely with owner financing? To what extent is, are you comfortable with the amount of repairs or rehabbing involved?

Brad Smotherman (26:33): Yeah. I mean, we’re not going to rehab anything. So if the property means that the grass cut, somebody better go cut the grass because we’re going to buy it. We’re going to sell it as is, you know, the best example that I have with this. I had a house that I bought for $2,000 one time. And now I don’t understand why people do what they do sometimes. Jay, I know that doesn’t resonate with you. I’m sure that you’ve never seen anything that didn’t make sense. But for me, I see a lot of things that don’t make sense in my world. And this lady sold me the house for $2,000 and she had just done new vinyl and new windows on the exterior. They surely looked great, but she said, I don’t want you to go in the house because I’m afraid you won’t buy it.

Brad Smotherman (27:07): This was maybe six or seven years ago. And I’m actually going to look at houses. I said, well, respectfully, I have to go look at, you know, I have to go inside. And so this lady, the roof look kind of bad, but I didn’t realize how bad the roof was. She did new vinyl, new windows. She didn’t do the roof. And so water had been pouring into this house for like four or five years. And so like, literally the back half of this thing was gone. I mean, it was like molded. It was soft, the subfloor, you couldn’t stand in the kitchen, all this, it was a mess! But we sold it with owner financing. As is! Like, I’m not going to do that kind of construction. I’m not a construction guy. Literally I had to come over. I had to have a handyman come to my house and replace the doorknobs because I don’t know how to do any of that stuff. So like, I’m terrible.

Jay Conner (27:46): You and I have something else in common, my friend!

Brad Smotherman (27:49): Glad to hear that, man! I think we’re like kindered souls just, probably not from the same parents, just generationally, but you know what I’m saying? We’re cut from the same cloth.

Jay Conner (28:00): A brother from another mother.

Brad Smotherman (28:04): For sure.

Jay Conner (28:07): So you’re not gonna do any, you’re not gonna do any major rehabs. I get it. So my lands! How do you find, so are you finding most of these deals remotely in other States? Again, as you mentioned using Pay-Per-Click. Google Pay-per-Click.

Brad Smotherman (28:25): A hundred percent. So, I mean, these are people that are actively searching to solve a problem and we’re there when they need to be.

Jay Conner (28:30): I love it when people are looking for me and I’m not looking for them.

Brad Smotherman (28:34): Big difference because people don’t understand the difference in the negotiation structure. So, I mean, if I’m contacting someone to sell me something, versus someone contacting me to buy something, that’s a huge difference in the frame of negotiation. And so we always want to be where someone is searching for us. If we can be, of course, there’s always exceptions. You know, like anything works some of the times. So we can do the text, we can do the direct mail. I used to do 70,000 direct mailers a month. I don’t do any of that anymore because it comes down to, I don’t want to contact someone to sell something. I want people contacting me to buy something.

Jay Conner (29:08): Final question, Brad. At least almost final question I have to, I have to precursor that. So we know how you’re finding these deals. You got all these people that need owner financing. They don’t know there’s a way. So how in the world do you get the word out to all these people that you’ve got owner-financed terms available? How do you find the buyers?

Brad Smotherman (29:29): And that’s a great question. So our big three are Craigslist, Facebook marketplace, and then putting yard signs out that say owner financing. And so…

Jay Conner (29:38): My number one on a, so I sell, I don’t do owner financing out here in this market. That’s another conversation. I do a lot of rent to own. I love your model. Regardless. It’s the same buyer, whether they’re buying owner financing or they’re buying rent to own. But with that, Facebook marketplace, hands down. Is my best lead source for finding these owner finance buyers.

Brad Smotherman (30:04): Yeah. It’s really amazing. I’ve got a, I’d say she’s at least half time and probably closer to three quarter time. And the poor girl, she probably has carpal tunnel by now because like you post a house for sale with owner financing and all of these buy-sell-trade groups. And like, you can see like the computer almost begin to melt because it’s overheating from all the people responding. And it makes sense. I mean, it’s really common in a market. So I’m in Nashville, Tennessee. The last time I checked, there were 2,700 houses on the market on the MLS to service everyone that could get mortgage financing. Well, there were three that were offered with owner financing and they were mine. And so it’s like, if that’s the case, you can see the disparity in the supply demand curve. You have a huge group of demand for very, very little inventory. And so selling the houses never really been a problem.

Jay Conner (30:53): I love it! Brad, I know my audience wants to stay connected with you. How can they stay connected with Brad Smotherman?

Brad Smotherman (31:00): Yeah. So for those that are interested more on owner financing and what we do, then you can listen to my podcast, Investor Creator, on iTunes and the various other platforms. And if anybody wants to reach out to me directly, feel free to do so. At http://BradSmotherman.com

Jay Conner (31:13): That’s awesome, Brad! It’s so great to have you here on the show, Brad, I really enjoyed our conversation. I know the audience did as well. And so let me give it to you for parting comments and final advice.

Brad Smotherman (31:26): You know, the thing that I want to say to people is, always would try to instill the amount of hope that I can, you know, I think a lot of people want to do this business and they have a lot of fear. And I remember how that was in 2010 when I started, because you know, I started in the brokerage business. I was a realtor and not a super successful one at that. I made a living, but you know, whenever I decided to be an investor, I thought, gosh, like nobody’s going to leave a loan in place. Nobody’s going to sell out a discount. Nobody’s, you know, and it’s the same thing that I’ve heard, you know, and here’s kind of like the hierarchy of beliefs that fell down for me. I thought nobody would leave alone in place. Well, that happened.

Brad Smotherman (32:01): And then I thought, well, nobody’s going to sell at 50 cents on the dollar. And then that happened. And then I thought, well, nobody’s going to give me 0% owner financing. And then that happened. And then I thought, well, all of this is because we’re that good in person. We can’t do it on the phone. And then we started buying all of those on the phone. And so at the end of the day, I mean, this business works. It’s an amazing business. It changes lives. And if you feel compelled, you have a passion for the business and you have a passion to help people with their problems and you can do very well in this business. Stay with it.

Jay Conner (32:28): That’s awesome! Brad, thank you so much. And thank you! My audience for tuning in. It’s always great to have you here. And I know you found this episode very valuable. I’m Jay Conner, The Private Money Authority. Wishing you all the best and here is to taking your real estate investing business to the next level. And I’ll see you on the next show. Bye for now!

#Jay Conner#Private Money Lender#Real Estate Business#Real Estate#Real Estate Investing#Real Estate Investor#Real Estate Profit#The Private Money Authority#The Private Money Academy

23 notes

·

View notes

Text

514 Dad Jokes