#National Commercial Property tax Services

Photo

Jay Treaty

The Jay Treaty, formally known as the Treaty of Amity, Commerce, and Navigation, Between His Britannic Majesty and the United States of America, was a controversial treaty signed by representatives of the United States and Great Britain in November 1794. It sought to resolve issues left over from the American Revolution (1765-1789) and establish trade between the two nations.

At the time of the treaty's signing, the United States appeared to be on the brink of war with Great Britain. Believing the United States to be reneging on agreements made in the Treaty of Paris, Britain refused to evacuate its troops from forts in the Northwest Territory and attacked American shipping in the French West Indies, seizing over 250 American merchant vessels and impressing their crews into service in the Royal Navy. Although many Americans clamored for war, President George Washington (served 1789-1797) believed the young republic was not strong enough to withstand another war with Britain. Instead, he dispatched John Jay, Chief Justice of the United States, to negotiate a treaty that would, hopefully, avert an armed conflict.

Jay succeeded in avoiding war, and even managed to strengthen commercial ties with Britain; the US was granted 'most favored nation' status at British ports, and American merchants were given limited trade rights in the British West Indies. However, the treaty came up short in many respects, as it significantly did not protect American sailors from future impressment. But the most controversial aspect was that the treaty created stronger political and economic ties between the United States and Britain, something that many Americans feared would lead to a re-emergence of aristocracy in the US. Riots broke out in many cities, and Jay was often burned in effigy. Even President Washington was abused in the press. A new political faction, the Democratic-Republican Party, emerged to combat the growing power of the pro-British Federalist Party. Revolutionary France, meanwhile, interpreted the Jay Treaty as an Anglo-American alliance and also began attacking American shipping, eventually resulting in the brief Quasi-War (1798-1800).

Background: The Threat of War

The Treaty of Paris of 1783 ended the American Revolutionary War, creating a state of fragile and uneasy peace between the fledgling United States and its former mother country, Great Britain. The treaty was generally regarded as favorable to the Americans: it more than doubled the size of the United States, whose borders now stretched as far west as the Mississippi River, and the British promised to evacuate their soldiers from these boundaries. In return for these concessions, Britain expected that all prewar debts owed by American borrowers to British lenders would still be paid and that state governments would stop confiscating the properties of Loyalists (Americans who had remained loyal to the British Crown during the Revolution). These were among the main components of the ten articles of the treaty, signed by American and British commissioners on 3 September 1783.

The ink on the treaty was barely dry, however, when troubles began to sprout. For much of its short existence, the United States had been plagued with economic difficulties; indeed, its recent attempt at a national currency, the Continental Currency, had failed after depreciating to the point of near worthlessness. State governments were imposing high taxes to begin paying off their own hefty war debts while Congress – under the terms of the Articles of Confederation – could not raise any taxes at all. Burdened by high taxes and inflation, many American debtors were unable to pay back their British creditors in a timely fashion. Additionally, many state governments were loath to take any pity on Loyalists, who were regarded as traitors; few were compensated for the properties that had been confiscated during the Revolution, with some states even continuing to seize Loyalist estates. Britain pointed to these two examples as evidence that the United States was not holding up its end of the bargain. In retaliation, the British maintained garrisons of troops in a series of forts in the Great Lakes region, which had been ceded to the US in the treaty. When the US complained, Britain promised that it would indeed evacuate these troops as promised – but only once the Americans had paid off all their debts.

Tensions between the two nations continued to simmer for the next decade. Then, in February 1793, Britain declared war on Revolutionary France. By this point, the French Revolution was in full swing; a French Republic had been proclaimed, King Louis XVI of France had lost his head, and hundreds of thousands of French citizen-soldiers were pouring into Europe to deliver liberty, equality, and fraternity at the points of their bayonets. Many Americans were quick to express their support for Revolutionary France, donning tricolor cockades, singing revolutionary songs, and opening political clubs called Democratic-Republican societies, in which they toasted the French Republic and denounced aristocracy. President George Washington, however, was more hesitant to offer support to the revolutionaries; such an act would certainly bring the US into conflict with Britain, a conflict that Washington knew they were not ready for. Instead, he issued a Proclamation of Neutrality on 22 April 1793, in which he promised to keep the United States out of the French Revolutionary Wars.

It did not take long for Britain to disregard this neutrality. Without offering so much as a warning, British ships began seizing American merchant vessels in the French West Indies, considering any ship carrying French cargo to be a valid prize. Over the course of the next year, around 250 American ships were captured and their crews were impressed into service with the Royal Navy.

Impressment of American Sailors into the British Navy

Howard Pyle (Public Domain)

At the same time, the British used their forts in the Great Lakes region to offer support to the Northwest Confederacy, a loose coalition of Native American nations currently at war with the United States. These were blatant acts of aggression that could not be ignored; many Americans, particularly those associated with the Democratic-Republican societies, began to demand war. Other Americans were not so hasty. The Federalist Party, a nationalist political faction led by Alexander Hamilton, was horrified by the chaos and bloodshed of the French Revolution and did not want the US to fall under the influence of Revolutionary France. On the contrary, the Federalists viewed Britain as the natural ally of the United States; they believed stronger ties with the former mother country were vital for the survival of the US. Influenced by these Federalists, and still desirous to avoid war, President Washington agreed to send an envoy to London to hopefully reach an agreement and pull the quarreling countries away from the brink.

Continue reading...

26 notes

·

View notes

Text

O'Connor: Your Trusted Partner for National Commercial Property Tax Reduction

O'Connor for National Commercial Property Tax Reduction – It is your right to challenge the system and lower your property taxes!

0 notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

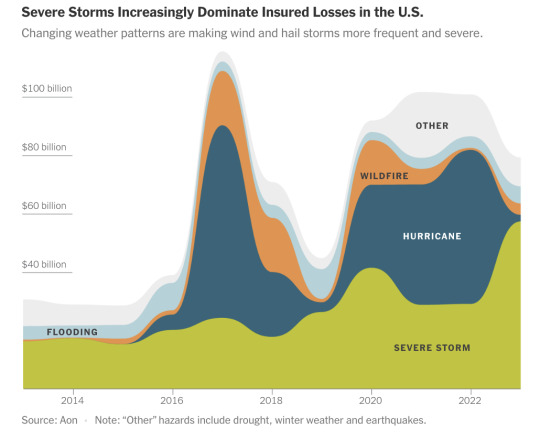

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

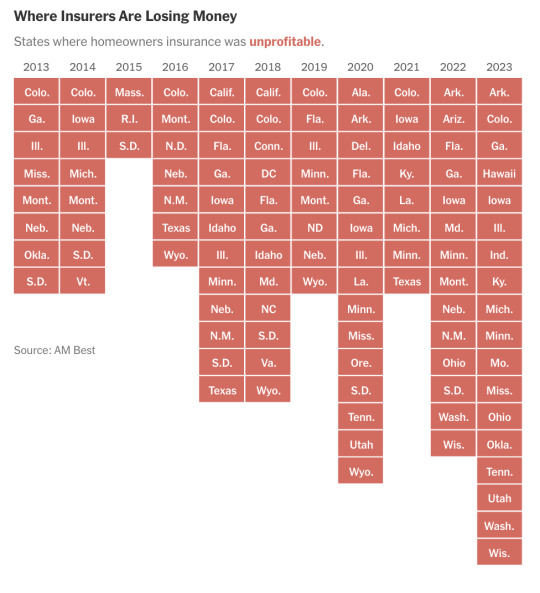

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

Taking the Pain out of High Net Worth mortgages for U.S. Real Estate, without AUM requirements

With inexpensive funding and various tax advantages, everyone should take advantage of the benefits of a mortgage when investing in U.S. real estate regardless of the loan size. However, why do the wealthy often find it increasingly difficult to obtain mortgage financing without AUM?

With a portfolio of assets worth millions of dollars, one may assume that securing credit would be a straightforward task for a high net worth (HNW) individual. Unfortunately, the reality can be quite different especially if you’re a foreign national or U.S. Expat.

The unique nature of a HNW’s wealth – their income, investments, and liquidity – puts this group of people at a surprisingly high risk of being turned away by conventional banks unless they are willing to deposit a significant amount of funds for the bank to manage. This is certainly true in the mortgage market, and what’s more, it is an issue that has become more prevalent post-Covid.

American Mortgages has a dedicated HNW Team that focuses on mortgage solutions for foreign nationals and U.S. expatriate clients.

“As a company, our focus is finding solutions that go beyond what Private Banks can offer was the cornerstone of why this has been so successful. Our goal is to be a viable solutions provider and a trusted partner for the private banks and their clients. None of our loans require AUM, hence there are no funds taken away from their current investments or portfolio.” – Robert Chadwick, co-founder of Global Mortgage Group and America Mortgages.

America Mortgages HNW mortgage loans have a multitude of options when it comes to qualifying for a large mortgage loans regardless of the passport you hold.

Asset Depletion – a surprisingly simple way to establish your income. AM Liquid Portfolio uses a unique view on “asset depletion” to qualify HNW clients using their investment portfolio without an encumbrance or pledge of assets. Essentially, all of your assets are entered into a calculation, and a final number is churned out. The final number is then used as the income to qualify. In most cases, as long as the income is sufficient, no other person’s income documentation is required. This makes an often complicated and tedious process simple, transparent, and painless.

Debt Service Coverage – When it comes to HNW borrowers, one of the most overlooked and misunderstood loan programs is debt service coverage. HNW borrowers tend to own multiple properties in various asset classes. If the property is used as a rental, then there may not be any requirement to go through the tedious process of providing and verifying personal income. Again, as HNW borrowers tend to have very complicated tax returns, this is a straightforward way to show the borrower’s debt serviceability.

Debt service coverage ratio– or DSCR – is a metric that measures the borrower’s ability to service or repay the annual debt service compared to the amount of net operating income (NOI) the property generates. DSCR indicates whether a property is generating enough income to pay the mortgage. For real estate investors, lenders use the debt service coverage ratio as a measurement to determine the maximum loan amount.

Bridge/Asset Based Lending – With Covid still in play, it’s not uncommon for investors to experience a temporary liquidity event. Rather than selling their property, they are using their real estate to release equity. Asset-based lending is an option for both residential (non-owner-occupied) and commercial properties.

Simply stated, HNW bridge loans are used for residential and commercial investment property when more traditional institutional financing sources may not be available. Due to temporary liquidity, many borrowers have capital needs that traditional sources often can’t meet. For example, a borrower purchases property out of bankruptcy or foreclosure and needs to close quickly “same as cash” before long term financing can be arrange.

Simplified Income – HNW borrowers often have personal and business tax returns, which are complicated. The complexity of these returns often turns into an administrative nightmare for the borrower when dealing with a mortgage lender. What makes America Mortgages unique is the fact that 100% of our clients are living and working outside of the U.S. We are dealing with HNW clients from Shanghai to Sydney. Simply put, translations and understanding tax codes, deductions, net income, etc., is painful.

America Mortgages HNW Simplified Income documentation is just that. We do not require years or, in some cases, decades of tax returns, P&L, A&L, bank statements, etc. We take an often complicated process and simplify it; 1. If you’re self-employed, we will request a letter from your accountant stating the last two years’ income and current YTD. 2. If you’re employed, then a letter from your employer on company letterhead stating your last two years’ income and current YTD is sufficient. Yes, it’s that simple and painless.

As 100% of our clients are either Foreign Nationals or U.S. Expats, we understand the intricacies and complexities of this type of lending for our borrowers. It’s as simple as that. Our HNW loan programs are structured to meet our client’s requirements. Providing competitive pricing with the assurance that your loan will close is our only focus, and no one does it better.

For more information, Visit: https://usbridgeloans.com/taking-the-pain-out-of-high-net-worth-mortgages-for-u-s-real-estate-without-aum-requirements/

4 notes

·

View notes

Text

The Key Role of Real Estate Lawyers in Delhi: Why You Need Legal Expertise

Real estate transactions can be complex and filled with legal intricacies, especially in a fast-growing market like Delhi. From purchasing residential properties to handling commercial deals, real estate involves multiple layers of legal documentation, negotiation, and regulatory compliance. This is where hiring real estate lawyers in Delhi becomes essential. These professionals provide expert legal guidance to ensure smooth transactions, minimize risks, and protect your investments. Let’s explore why partnering with a top real estate lawyer in Delhi is a smart decision.

1. Navigating Legal Documentation

One of the primary roles of a real estate lawyer in Delhi is to handle the vast amount of paperwork involved in real estate transactions. These documents include sale agreements, lease contracts, property deeds, title verification papers, and more. Even a minor error in these documents can lead to serious legal issues or financial losses. A qualified lawyer will:

Create, examine, and guarantee that all legal papers are accurate.

Confirm that agreements comply with local and national property laws.

Protect your interests during negotiations.

This attention to detail is crucial, particularly in high-value transactions where even the smallest mistake can have significant repercussions.

2. Property title verification and due diligence

Make sure the title is clean and devoid of any legal difficulties before buying any real estate. Real Estate Lawyers in Delhi are experts in conducting thorough due diligence, which involves:

examining the property's past to make sure there are no outstanding issues or liens

Verifying the legal ownership and ensuring there are no outstanding debts, such as unpaid taxes or loans, tied to the property

Reviewing zoning regulations and land-use permissions to ensure the property can be used for its intended purpose

By performing comprehensive due diligence, these lawyers help prevent legal disputes and ensure that your investment is secure.

3. Handling Complex Regulations and Approvals

India's real estate rules and regulations can be complicated and differ depending on the area. In Delhi, there are specific legal guidelines that govern land transactions, including:

The Delhi Land Reform Act: Governs agricultural land in the capital

The Transfer of Property Act: Ensures property transfers follow legal procedures

Building bylaws and local zoning regulations: Determine what can be built on a particular piece of land.

A knowledgeable real estate lawyer in Delhi understands these regulations and ensures that all legal requirements are met. They can also handle obtaining clearances and permits from government authorities, ensuring that your property deal is fully compliant with the law.

4. Dispute Resolution and Litigation

Disputes over property ownership, boundary issues, and inheritance claims are common in Delhi’s real estate market. Delhi real estate lawyers are adept at settling these disputes by discussion, compromise, or, if required, court action. Their expertise ensures that disputes are handled efficiently, saving you time, stress, and financial resources.

Whether you’re facing legal challenges from previous owners, tenants, or co-owners, an experienced lawyer will defend your rights and work towards a favorable resolution.

5. Preventing Real Estate Fraud

Unfortunately, real estate fraud remains a concern in Delhi. Scams involving fake ownership documents, illegal property claims, and misleading property listings can lead to severe financial losses. Real Estate Lawyers in Delhi play a critical role in preventing fraud by conducting background checks on properties, sellers, and transactions. Their legal expertise helps detect and eliminate any risks before they escalate.

Conclusion

Engaging the services of real estate lawyers in Delhi is essential for safeguarding your property investments. From ensuring legal compliance and verifying titles to resolving disputes and preventing fraud, these lawyers provide invaluable support. If you're involved in any real estate transaction, having a skilled lawyer on your side is the best way to protect your interests and make informed decisions in Delhi’s competitive real estate market.

0 notes

Text

School Plot for Sale in Delhi NCR - An Investment Opportunity

A school plot for sale NCR may be a wise choice if you're seeking an educational investment opportunity. The Delhi NCR, or National Capital Region, comprises the capital city of Delhi and several adjacent districts in Rajasthan, Uttar Pradesh, and Haryana. This area is a center for business and industry, and because of its quick population growth, there is a great need for high-quality education. So, investing in a school site may be worthwhile in the long term.

Purchasing a school land in Delhi NCR might be a wise investment for the following reasons:

Increasing demand for education: As Delhi NCR's population grows, so does the need for high-quality education. The parents in this area are willing to spend a sizeable sum on their schools for sale near me. They favor institutions with cutting-edge facilities, experienced faculty, and comprehensive developmental plans. Investing in a school plot may meet this demand and give the pupils an excellent education.

High returns on investment: As property values in Delhi NCR continue to rise, purchasing a school land may be a wise long-term investment. More pupils may be drawn to a well-built school facility with contemporary amenities, which may boost earnings. Also, if you want to sell the property in the future, the increase in land value will likely result in a sizable profit.

Tax advantages: Investing in a school plot can give investors many tax advantages. The interest paid on loan obtained to buy the property and the depreciation of the structure and other assets is deductible expenses. Also, the tax liability might be decreased by taxing the rental income from the property at a lower rate than the ordinary income.

Social impact: Investment in education has a social impact and financial benefits. You may aid in advancing society and the nation by offering pupils a high-quality education. A school can also serve as a community hub, providing locals with employment possibilities and supporting social and cultural events.

The following suggestions will help you select a top-notch window installation service:

Location: The school plot's background is essential to its success. Look for a simple property for students and their parents to access, has adequate neighborhood connectivity and is situated in a secure region. Also, as it may impact the rules and permits needed for building, determine whether the plot is in a residential or commercial zone.

Size and shape: The type and size of the school building that can be built on the plot will depend on its size and shape. Verify that the property has enough space for playgrounds, parking, and other amenities. Check for any liens or legal challenges on the plot that prevent you from building on it or using it for other purposes.

Financial analysis: Create a thorough economic study of the venture, considering all associated costs, such as those related to staffing, infrastructure, and land purchase. Estimate the revenue and expenses, including depreciation, maintenance, and operational costs, to determine the break-even point and the return on investment.

Conclusion: If you do your homework, evaluate the market, and make wise financial choices, a school for lease near me can be a rewarding endeavor. A well-planned and well-managed school can provide enormous social and economic benefits to investors and the community because of the rising demand for high-quality education, supportive governmental policies, and high returns on investment.

0 notes

Text

Property Tax Services Market is Estimated to Witness High Growth Owing to Growing Complexity in Tax Regulations

Property tax services play a vital role in collecting taxes from businesses and individuals for governments at local, state, and federal levels. Property tax services help in assessing the value of a property, filing tax returns, resolving tax issues, and appealing tax assessments. Property tax consultancies offer solutions like tax calculation, exemption & relief consultation, assessment calculations, tax reporting, and property tax representation. With governments worldwide introducing reforms in property tax laws to increase tax collection and simplify tax compliance, the need for property tax services has increased tremendously.

The Global Property Tax Services Market is estimated to be valued at US$ 3.52 Bn in 2024 and is expected to exhibit a CAGR of 7.3% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the Property Tax Services market are Avalara, Blucora, Canopy Tax, Drake Enterprises, H&R Block, Intuit, Sailotech, SAP SE, Thomson Reuters, Taxback International, TaxJar, TaxSlayer, Vertex, Wolters Kluwer NV, and Xero. These players are focusing on partnerships, mergers, and acquisitions to expand their service offerings and geographic reach.

The key opportunities in the market include compliance management solutions for complex tax regulations across countries and cities, property tax advisory and consultation services for commercial and residential properties, and cloud-based software solutions for tax filing, payment, and refunds.

With increasing globalization of businesses, the Property Tax Services Market Demand for cross-border property tax services is growing. Major players are targeting high growth markets like Asia Pacific and Latin America by establishing offices in these regions to cater to the needs of multinational clients.

Market drivers

The growing complexity in global, national, and local property tax regulations is one of the key drivers for the property tax services market. Frequent changes in tax laws related to categories of properties, exemptions, criteria for tax relief, and filing procedures require continuous updates from tax experts. Property Tax Services Market Size and Trends is increasing the demand for property tax advisory and consultancy services.

PEST Analysis

Political: Property tax services are highly regulated at local, state, and national levels due to political and economic interests in property taxes. Regulations vary significantly in different jurisdictions.

Economic: Property tax services are dependent on real estate market conditions and property values. When property values rise, expenditures on these services tend to increase as there are higher tax obligations and more disputes.

Social: Property owners are increasingly seeking online assistance and software tools to evaluate tax obligations and ensure accurate and fair treatment. The industry is benefiting from greater social acceptance of online services and automation.

Technological: Advanced software tools are leveraging technologies like AI, machine learning, and big data to provide more personalized guidance and support to property owners. Some platforms utilize public records, satellite imagery, and 3D scans to more accurately assess property characteristics and tax impact. They also support electronic filings and payments.

The North America region accounted for the highest share of the global property tax services market in terms of value in 2021, driven by the large number of residential and commercial properties.

The Asia Pacific region is expected to be the fastest growing regional market for property tax services through 2031, spurred by rising property ownership, increasing urbanization, and developing digital services adoption across major countries like China and India.

Get more insights on Property Tax Services Market

Get More Insights—Access the Report in the Language that Resonates with You

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

#Coherent Market Insights#Property Tax Services Market#Property Tax Services#Tax Assessment#Property Tax Consulting#Tax Appeal#Real Estate Tax#Property Valuation#Tax Reduction#Tax Advisory#Tax Management

0 notes

Text

Unlocking Global Opportunities: A Guide to Residency, Citizenship, and Investment Visas

Global Residency: A Gateway to the World

Global residency programs allow individuals to obtain residency rights in foreign countries through various channels, including investment, employment, and family reunification. These programs are popular among global citizens looking for greater mobility, better lifestyle options, and new business opportunities.

Benefits:

Access to healthcare and education in the host country.

Freedom of travel within the host country and, in some cases, the Schengen Zone.

Tax optimization strategies for high-net-worth individuals.

Visa Consultancy: Your Pathway to Success

Navigating the complex world of immigration laws and visa requirements can be daunting. This is where visa consultancy services come into play. Expert visa consultants guide you through the process, ensuring all documentation is correct and increasing the likelihood of approval.

Key Services:

Personalized advice based on your specific circumstances.

Assistance with paperwork and submission to immigration authorities.

Guidance on the best visa option based on your goals, whether it’s for work, study, or investment.

Citizenship by Investment: A Smart Move for the Future

Citizenship by investment programs offer a fast track to acquiring citizenship in another country by making a significant financial contribution. This could be through real estate investment, government bonds, or other approved avenues.

Advantages:

Dual citizenship, allowing you to hold two passports and enjoy the benefits of both countries.

Global mobility with visa-free or visa-on-arrival access to numerous countries.

Enhanced business opportunities with access to new markets.

Dual Citizenship: Expanding Your Horizons

Holding dual citizenship means being a citizen of two countries simultaneously. This status can provide a range of benefits, including the ability to live and work in both countries, access to social services, and expanded travel options.

Considerations:

Legal obligations such as taxes and military service in both countries.

Understanding the laws of both countries regarding inheritance, property ownership, and other rights.

Immigration Services: Comprehensive Support for Your Journey

Immigration services encompass a wide range of assistance, from initial consultations to legal representation in visa applications and citizenship processes. These Immigration services are essential for anyone considering relocation, whether temporarily or permanently.

What to Expect:

Legal advice on immigration laws and visa requirements.

Document preparation and submission.

Representation in case of legal issues or visa denials.

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2FNszR55k39BI%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3DNszR55k39BI&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2FNszR55k39BI%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtubeUnlocking the Path to Permanent Residency: From F1 Visa to EB-5 Green Card

The EB-5 Visa: Investing in Your Future

The EB-5 visa is a unique program that offers foreign investors a pathway to U.S. permanent residency by making a qualifying investment in a new commercial enterprise. This visa is particularly attractive due to its direct route to a green card.

Requirements:

A minimum investment of $800,000 in a Targeted Employment Area (TEA) or $1,050,000 in other areas.

Creation of at least ten full-time jobs for U.S. workers.

Active involvement in the management of the investment.

Investor Visa USA: A World of Opportunities

The Investor visa USA category includes various visa types, with the EB-5 visa being the most prominent. These visas are designed to attract foreign investors to stimulate the U.S. economy.

Options:

E-2 Treaty Investor Visa: For nationals of countries with a trade agreement with the U.S., requiring a substantial investment in a U.S. business.

L-1 Visa: For intra-company transferees who have been employed abroad in a managerial or executive position and are being transferred to a U.S. office.

Immigration Consultants: Your Trusted Advisors

Immigration consultants play a crucial role in the immigration process. They offer expert guidance, ensure that all requirements are met, and assist with the complexities of visa applications.

Roles and Responsibilities:

Assessment of eligibility for various visa and citizenship programs.

Preparation and submission of visa applications.

Support and representation in case of legal challenges.

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2Fwu8cDFpHLbM%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3Dwu8cDFpHLbM&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2Fwu8cDFpHLbM%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtubeUnlocking the Path to Permanent Residency: From F1 Visa to EB-5 Green Card

Permanent Residency: Establishing Your New Home

Permanent residency allows individuals to live indefinitely in a country without being a citizen. This status is often a stepping stone to full citizenship and comes with many of the same rights as citizens, such as access to healthcare and education.

Pathways:

Family sponsorship.

Employment-based residency.

Investment-based programs like the EB-5 visa.

Investment Opportunities: Building a Global Portfolio

Global investment opportunities are abundant, ranging from real estate in emerging markets to government bonds in stable economies. These investments can serve as a foundation for acquiring residency or citizenship in a new country.

Top Opportunities:

Real estate investments in countries offering residency through property purchase.

Government bonds that qualify for citizenship by investment programs.

Business investments that create jobs and stimulate economic growth.

US Visa: A Spectrum of Choices

The US visa system offers a wide range of options for those looking to live, work, or study in the United States. Whether through employment, family reunification, or investment, there is a visa tailored to your needs.

Common Types:

B-1/B-2 Visitor Visa: For short-term business or tourism.

H-1B Visa: For skilled workers in specialty occupations.

F-1 Visa: For students pursuing academic studies.

EB-5 Immigrant Investor Services: Your Road to the American Dream

EB-5 immigrant investor services provide specialized assistance for those interested in the EB-5 program. These services include everything from initial consultations to project selection and application submission.

Key Services:

Project vetting to ensure the investment meets EB-5 requirements.

Legal representation throughout the application process.

Ongoing support to ensure the creation of the required jobs and fulfillment of all program conditions.

Conclusion

In today’s globalized world, having the ability to move, invest, and live in multiple countries is a powerful tool for personal and financial growth. Whether you’re interested in global residency, citizenship by investment, or investor visa USA programs, the options are vast and varied. Engaging with expert visa consultants and immigration services can streamline your journey, ensuring that you make informed decisions that align with your goals.

Key Takeaways:

Global residency programs offer access to new markets and better lifestyle options.

Visa consultancy services provide crucial guidance through complex immigration processes.

Citizenship by investment allows for quick acquisition of citizenship in exchange for significant investment.

EB-5 visa is a direct path to U.S. permanent residency through investment.

Immigration consultants are essential partners in navigating visa and citizenship processes.

FAQs

Q1: What is the EB-5 visa?

A1: The EB-5 visa is a U.S. program that offers permanent residency to foreign investors who invest a minimum of $800,000 in a targeted employment area or $1,050,000 in other areas, creating at least ten full-time jobs.

Q2: What is dual citizenship?

A2: Dual citizenship allows an individual to be a citizen of two countries simultaneously, enjoying the rights and obligations of both.

Q3: How can I obtain global residency?

A3: Global residency can be obtained through various means, including investment, employment, or family reunification, depending on the country’s specific programs.

Q4: What services do immigration consultants offer?

A4: Immigration consultants provide services such as eligibility assessment, document preparation, visa application submission, and legal representation.

Q5: What are the benefits of citizenship by investment?

A5: Citizenship by investment offers benefits like dual citizenship, global mobility, and enhanced business opportunities.

This guide provides a comprehensive overview of global residency, investment visas, and the various pathways to citizenship. Whether you are considering the EB-5 visa or exploring other investment opportunities, the right guidance can make all the difference in achieving your goals.

0 notes

Text

A Comprehensive Guide to Buying Commercial Property in DC

Purchasing commercial property for sale in dc offers exciting opportunities for investors and businesses alike. However, the process of buying commercial real estate can be complex, involving numerous considerations and steps. This comprehensive guide will walk you through the essential aspects of buying commercial property in DC, from understanding market dynamics to finalizing your purchase.

Understanding the Commercial Real Estate Market in DC

1. Market Overview

Washington, DC, is a vibrant and diverse real estate market. As the nation's capital, it offers a range of commercial properties, including office spaces, retail locations, industrial buildings, and mixed-use developments. The market is influenced by various factors, including political dynamics, economic conditions, and demographic trends.

2. Key Market Trends

Economic Impact: DC's economy is bolstered by federal government activities, non-profit organizations, and a growing tech sector. These factors drive demand for office spaces and other commercial properties.

Neighborhood Development: Different neighborhoods in DC offer varying opportunities. Areas like the Central Business District, Capitol Hill, and Georgetown each have unique characteristics and potential.

Investment Hotspots: Emerging areas and redevelopment projects often present lucrative investment opportunities. Stay informed about new developments and neighborhood revitalization efforts.

Key Considerations When Buying Commercial Property

1. Define Your Objectives

Before starting your property search, clarify your investment goals. Are you looking for a property to house your business, lease to tenants, or as a long-term investment? Your objectives will guide your property search and decision-making process.

2. Property Types

Commercial properties come in various types, including:

Office Space: Ideal for businesses looking for professional environments. Consider factors like location, amenities, and lease terms.

Retail Space: Suitable for businesses that rely on foot traffic. Evaluate the property’s visibility, accessibility, and surrounding retail environment.

Industrial Property: Includes warehouses and manufacturing facilities. Key factors are location, size, and logistics.

Mixed-Use Developments: Combine residential, retail, and office spaces. These properties offer diverse revenue streams and are often located in vibrant areas.

3. Location and Accessibility

Location is crucial in commercial real estate. Assess the following aspects:

Proximity to Key Services: Consider the property's proximity to transportation links, business centers, and amenities.

Accessibility: Ensure the property is easily accessible to employees, clients, and customers. Check for adequate parking and public transportation options.

Neighborhood Dynamics: Research the neighborhood’s demographics, crime rates, and future development plans. A growing or revitalizing area can enhance the property’s value.

4. Financial Analysis

Conduct a thorough financial analysis to determine the property's investment potential:

Price and Value: Compare the asking price with similar properties in the area. Use recent sales data and appraisals to gauge the property's fair market value.

Revenue Potential: For rental properties, estimate potential rental income based on current market rates and property condition. Consider occupancy rates and tenant demand.

Expenses and Costs: Account for all expenses, including property taxes, insurance, maintenance, and management fees. Factor these into your investment calculations to ensure profitability.

5. Legal and Regulatory Considerations

Ensure that the property complies with all legal and regulatory requirements:

Zoning Laws: Verify that the property’s zoning designation aligns with your intended use. Zoning laws govern how properties can be used and developed.

Building Codes: Check that the property meets all local building codes and regulations. This includes safety standards, accessibility requirements, and environmental regulations.

Lease Agreements: If purchasing a rental property, review existing lease agreements and tenant obligations. Ensure that lease terms are favorable and align with your investment strategy.

The Buying Process

1. Research and Selection

Identify Potential Properties: Use online listings, real estate agencies, and market research to identify properties that meet your criteria.

Visit Properties: Schedule site visits to evaluate the property’s condition, layout, and suitability. Pay attention to details like maintenance issues, infrastructure, and overall appeal.

Conduct Due Diligence: Perform comprehensive due diligence, including property inspections, title searches, and environmental assessments. This helps identify any potential issues or liabilities.

2. Financing Your Purchase

Secure Financing: Explore financing options, including commercial mortgages, lines of credit, or partnerships. Work with financial institutions to understand your borrowing capacity and interest rates.

Prepare Financial Documents: Gather necessary financial documentation, including personal and business financial statements, tax returns, and credit reports. These documents are essential for securing financing and proving your ability to manage the property.

3. Making an Offer

Submit an Offer: Once you’ve identified a property, submit a formal offer to the seller. Include your proposed purchase price, terms, and any contingencies (e.g., financing, inspections).

Negotiate Terms: Be prepared to negotiate terms with the seller. This may include the purchase price, closing date, or property conditions. A skilled real estate advisor can assist with negotiations to ensure favorable terms.

4. Finalizing the Purchase

Conduct Final Inspections: Before closing, perform final inspections to ensure that the property meets your expectations and any agreed-upon repairs or conditions have been addressed.

Review Closing Documents: Review all closing documents, including the purchase agreement, title transfer documents, and financial statements. Ensure that all terms and conditions are accurately reflected.

Close the Deal: Complete the transaction by signing the necessary documents, transferring funds, and officially taking ownership of the property.

Post-Purchase Considerations

1. Property Management

Manage or Hire a Manager: Decide whether you will manage the property yourself or hire a property management company. Consider factors such as tenant relations, maintenance, and lease management.

Maintain the Property: Regular maintenance is essential for preserving property value and attracting tenants. Implement a maintenance schedule and address issues promptly.

Monitor Investment Performance

Track Financial Performance: Regularly review the property’s financial performance, including rental income, expenses, and return on investment. Adjust your strategy as needed to optimize results.

Stay Informed: Keep up-to-date with market trends, local developments, and regulatory changes that may impact your property’s performance and value.

Conclusion

Buying commercial property in DC can be a rewarding investment, offering opportunities for growth and profitability. By understanding the market, defining your objectives, and carefully evaluating potential properties, you can make informed decisions and achieve your investment goals.

A thorough financial analysis, legal compliance, and a strategic approach to the buying process are key to a successful transaction. Once you acquire your property, effective management and ongoing performance monitoring will help you maximize your investment and achieve long-term success. Whether you’re expanding your business, investing in rental properties, or exploring new opportunities, a well-informed approach to buying commercial property in DC will set you on the path to success.

0 notes

Text

Expert Solutions from National Commercial Property tax Services

An experienced consultant, property tax attorney, and property tax appraiser, supported by massive resource data, are crucial for a successful property tax appeal. Our national commercial property tax services provide comprehensive expertise and resources to ensure the best possible outcome. Find more from https://www.nationalpropertytax.com/

0 notes

Text

The Ultimate Guide to Property Investment Planning

Investing in property is a popular way to build wealth, but like any investment, it requires careful planning and strategy. A property investment planner can help navigate the complexities of the real estate market and maximize returns. This guide will cover the essentials of property investment planning, from understanding market dynamics to crafting a personalized investment strategy.

Understanding the Basics of Property Investment

1. Types of Property Investments:

Residential Properties: Single-family homes, condominiums, and multi-family units.

Commercial Properties: Office buildings, retail spaces, warehouses, and industrial properties.

Land Investments: Raw land, agricultural land, and land development opportunities.

REITs (Real Estate Investment Trusts): Companies that own, operate, or finance income-generating real estate.

2. Key Investment Strategies:

Buy and Hold: Purchasing property to rent out and hold for long-term appreciation.

Flipping: Buying properties at a lower price, renovating them, and selling them at a higher price.

Wholesaling: Contracting a property and selling the contract to another buyer.

REITs: Investing in real estate through publicly traded or private REITs.

The Role of a Property Investment Planner

A property investment planner is a professional who helps investors develop and execute a real estate investment strategy. Their services can include:

1. Market Analysis:

Conducting thorough research to identify lucrative markets.

Understanding economic indicators, population trends, and employment rates.

Analyzing neighborhood statistics, such as crime rates, school quality, and future development plans.

2. Financial Planning:

Assessing the investor’s financial situation and risk tolerance.

Creating a budget and financing plan.

Advising on mortgage options, interest rates, and loan terms.

3. Property Selection:

Identifying properties that align with the investor’s goals.

Evaluating property conditions, potential rental income, and future appreciation.

Conducting due diligence, including property inspections and title searches.

4. Portfolio Management:

Diversifying the investment portfolio to mitigate risks.

Monitoring property performance and market trends.

Recommending adjustments to the investment strategy as needed.

Steps to Effective Property Investment Planning

1. Define Your Goals:

Determine your investment objectives, whether it’s income generation, capital appreciation, or portfolio diversification.

Set realistic timelines for achieving your goals.

2. Conduct Market Research:

Analyze national and local market trends.

Identify areas with strong growth potential and low vacancy rates.

Keep abreast of economic factors that could impact the real estate market.

3. Create a Financial Plan:

Assess your current financial situation, including assets, liabilities, and credit score.

Determine how much capital you can invest and what financing options are available.

Factor in ongoing costs such as maintenance, property management fees, and taxes.

4. Choose the Right Properties:

Look for properties that meet your investment criteria.

Conduct a thorough property analysis, considering factors like location, condition, and market demand.

Negotiate the best possible purchase price and terms.

5. Implement and Monitor Your Strategy:

Acquire the selected properties and implement your investment plan.

Regularly review your portfolio’s performance and make adjustments as necessary.

Stay informed about market changes and emerging opportunities.

0 notes

Text

Saudi Arabia Real Estate Market Scope, Demand, Report 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the Saudi Arabia Real Estate Market size at USD 169.23 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the Saudi Arabia Real Estate Market size to expand at a CAGR of 5.56% reaching a value of USD 247.18 billion by 2030. Growing housing demand and an increase in residential building construction in the Kingdom are key drivers of the Saudi Arabia Real Estate Market. The Saudi Government's goal of economic diversification is fueling the country's real estate sector overall by increasing demand for commercial and industrial premises.

Opportunity – Government’s support and favorable policies

The Saudi Government’s support and favorable regulations are major driving factors influencing the growth of the Saudi Arabia Real Estate Market. The economic diversification plan of Saudi Arabia, Vision 2030, is shifting the government’s focus from the oil sector to other infrastructural development, such as the construction of residential and commercial facilities. The Saudi Government aims to boost house ownership by Saudi nationals from 63.74% in 2023 to 70% by 2030, as reported by Economy Middle East. Riyadh is also planning to open the purchase of property by foreigners, according to local media, which is anticipated to drive the Saudi Arabia Real Estate Market during the period in analysis.

Sample Request @ https://www.blueweaveconsulting.com/report/saudi-arabia-real-estate-market/report-sample

Saudi Arabia Real Estate Market

Segmental Coverage

Saudi Arabia Real Estate Market – By Service

Based on service, the Saudi Arabia Real Estate Market is segmented into property management, valuation services, and other services (advisory services and leasing). The property management segment dominates the Saudi Arabia Real Estate Market. Property management services act as a link between the landlord and the renter and overlook various responsibilities, such as financial management, legal compliance, property maintenance, screening tenants, and handling taxes. The increasing demand for housing elevates the need for property management to handle these operations, which drives the segment’s growth.

Competitive Landscape

Major players operating in the Saudi Arabia Real Estate Market include Jenan Real Estate Company, Sedco Development, Jabal Omar, Kingdom Holding Company, Abdul Latif Jameel, Dar Ar Alkan, JLL Riyadh, Century21 Saudi Arabia, and Saudi Real Estate Company.

To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

Contact Us:

BlueWeave Consulting & Research Pvt Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

The Role of Real Estate Developers in Ghaziabad’s Economic Growth

Ghaziabad, often referred to as the "Gateway of Uttar Pradesh," has seen remarkable transformation over the past few decades. As part of the National Capital Region (NCR), it has become a bustling urban center, attracting residents and businesses alike. A significant driver of this growth has been the proactive role played by real estate developers. Here’s a closer look at how real estate developers in Ghaziabad have contributed to economic growth.

1. Infrastructure Development

Real estate developers have been instrumental in enhancing Ghaziabad's infrastructure. By constructing residential complexes, commercial spaces, and mixed-use developments, they have transformed the city’s landscape. These projects not only provide housing and office spaces but also include essential infrastructure such as roads, sewage systems, and power supply networks. This comprehensive development attracts more residents and businesses, further fueling economic growth.

2. Job Creation

The real estate sector is a significant employment generator. Construction projects require a vast workforce, including architects, engineers, laborers, and project managers. Additionally, once these projects are completed, they create job opportunities in various sectors such as retail, hospitality, and maintenance services. The influx of jobs boosts the local economy, leading to increased spending and economic activity.

3. Boosting Local Businesses

Real estate developments lead to the creation of numerous commercial spaces such as malls, retail stores, and office complexes. This surge in commercial infrastructure encourages the establishment of new businesses and the expansion of existing ones. Local businesses benefit from the increased footfall and improved accessibility, leading to higher revenues and further economic growth.

4. Attracting Investment

The development of high-quality residential and commercial properties makes Ghaziabad an attractive destination for investors. Both domestic and international investors see the potential for high returns in the city’s growing real estate market. This influx of investment funds further development projects, creating a positive cycle of growth and prosperity.

5. Improving Quality of Life

Real estate developers focus on creating not just buildings but entire communities. Modern residential projects often include amenities such as parks, schools, healthcare facilities, and recreational centers. These amenities improve the quality of life for residents, making Ghaziabad a desirable place to live. A higher quality of life attracts more people to the city, boosting demand for housing and services, and thus driving economic growth.

6. Enhancing Connectivity

Developers often work closely with government agencies to improve the connectivity of their projects. This includes the construction of roads, bridges, and public transportation systems. Enhanced connectivity makes it easier for people to commute, facilitates the movement of goods, and attracts businesses that rely on efficient logistics. Improved transportation infrastructure is a crucial factor in sustaining long-term economic growth.

7. Urbanization and Modernization

The work of real estate developers has been pivotal in the urbanization and modernization of Ghaziabad. By introducing contemporary architectural designs, smart home technologies, and sustainable building practices, developers are setting new standards for urban living. These advancements attract a progressive and skilled population, which in turn fosters innovation and economic dynamism in the city.

8. Government Revenue

The real estate sector contributes significantly to government revenue through various taxes and fees. Property taxes, registration fees, and development charges provide a substantial financial boost to local and state governments. This revenue can be reinvested into public infrastructure, education, healthcare, and other vital sectors, further promoting economic development.

Conclusion

Real estate developers play a multifaceted role in Ghaziabad’s economic growth. From building critical infrastructure and creating jobs to attracting investment and enhancing the quality of life, their contributions are indispensable. As Ghaziabad continues to evolve, the collaboration between real estate developers, government bodies, and the community will be key to sustaining and accelerating this growth. For residents and investors alike, the ongoing development in Ghaziabad promises a prosperous and vibrant future.

0 notes

Text

https://firstnte.com/

https://firstnte.com/rhode-island-real-estate-attorney/

The First National Title and Escrow team wants to be your trusted real estate attorney in Rhode Island. However, we understand that most people only need a real estate attorney a few times. That can lead to people being unaware of their services or when they may need a real estate attorney. Read this guide to learn more about Rhode Island real estate attorneys’ common services.

Drafting and Reviewing Documents

One of the key services of real estate attorneys is the drafting and review of real estate documents. From purchase agreements to lease contracts, their expertise ensures that all documents adhere to legal standards. They can also review documents on behalf of clients to protect their rights and interests.

Property Title Clearance

Buyers might hire a real estate attorney in Rhode Island to clear a property title. Attorneys do this by performing a title examination. A title examination includes a public records search to verify ownership and discover potential title defects. The attorney will also verify the property’s tax records and search for any judgments that may impact ownership.

Closing Services

Real estate attorneys help buyers and sellers finalize real estate transactions. They’ll review and prepare documents to ensure everything is in order. A real estate attorney may also serve as the escrow agent for a transaction. They will provide a neutral account for holding funds and documents in this role. As the escrow agent, they will also handle the disbursal of funds.

Landlord and Tenant Matters

Landlords and tenants may also need a real estate attorney in Rhode Island. One common service is helping landlords draft lease agreements. Businesses may hire a real estate attorney to review commercial lease agreements. Advice from an attorney can also be invaluable to landlords as they navigate tenants’ rights and issues like evictions.

Zoning and Land Use Laws

Builders, developers, and businesses may need assistance navigating zoning and land use laws. Advising clients on zoning issues, permits, and variances ensures compliance with legal requirements. Their expertise can help clients make informed decisions or offer solutions to legal issues associated with a property.

Foreclosure Defense

Homeowners facing foreclosure might hire a real estate attorney for advice and legal defense. They can use their knowledge to develop strategies to help clients save their homes. For example, the attorney may find a portion of the contract unenforceable. It could also be a mistake the mortgage company made concerning giving notice or servicing the loan.

Your Rhode Island Real Estate Attorney

First National Title and Escrow attorneys have extensive experience with Rhode Island real estate law. Reach out now to learn more about the legal services we provide.

0 notes

Text

Hard money North Carolina

Understanding Real Estate Loans: A Comprehensive Guide

Real estate loans, also known as mortgages, are fundamental financial instruments that facilitate the purchase of property. These Hard money North Carolina are essential for most individuals and businesses, allowing them to acquire residential, commercial, or investment properties without paying the full purchase price upfront. This article provides an overview of real estate loans, their types, processes, and key considerations for borrowers.

Types of Real Estate Loans

Conventional Loans:

Conventional loans are not insured by the federal government and typically require a higher credit score and a substantial down payment. They come in two forms: conforming loans, which adhere to the guidelines set by Fannie Mae and Freddie Mac, and non-conforming loans, which do not meet these criteria.

FHA Loans:

Insured by the Federal Housing Administration, FHA loans are designed for low-to-moderate-income borrowers who may have lower credit scores. They offer lower down payment requirements and are popular among first-time homebuyers.

VA Loans:

Available to veterans, active-duty service members, and certain members of the National Guard and Reserves, VA loans are guaranteed by the Department of Veterans Affairs. These loans often require no down payment and offer competitive interest rates.

USDA Loans:

These loans are backed by the U.S. Department of Agriculture and are aimed at rural property buyers. USDA loans typically require no down payment and offer favorable terms to promote homeownership in rural areas.

Jumbo Loans:

Jumbo loans exceed the conforming Hard money North Carolina loan limits set by Fannie Mae and Freddie Mac. They are used to finance luxury homes or properties in high-cost areas and require a higher credit score and larger down payment.

The Loan Process

The process of obtaining a real estate loan involves several key steps:

Pre-Approval:

Before house hunting, potential buyers should seek pre-approval from a lender. This involves an evaluation of their credit score, income, debts, and assets to determine how much they can borrow.

House Hunting and Offer:

With pre-approval in hand, buyers can search for homes within their budget. Once they find a suitable property, they make an offer, which, if accepted, leads to a purchase agreement.

Loan Application:

The formal loan application involves submitting detailed financial information to the lender, including proof of income, tax returns, and details of the property being purchased.

Underwriting:

During underwriting, the lender assesses the borrower’s financial health and the property’s value to ensure they meet the loan criteria. This step may involve an appraisal and further documentation.

Closing:

If the loan is approved, the closing process begins, involving the signing of documents, payment of closing costs, and transfer of property ownership. The borrower receives the loan funds to complete the property purchase.

Key Considerations for Borrowers

Borrowers should consider several factors when applying for a real estate loan:

Interest Rates:

The interest rate affects the overall cost of the loan. Fixed-rate mortgages offer stability with a consistent interest rate, while adjustable-rate mortgages may start with lower rates that can change over time.

Loan Term:

Common loan terms are 15, 20, and 30 years. Shorter terms usually have higher monthly payments but lower total interest costs.

Down Payment:

A larger down payment reduces the loan amount and may eliminate the need for private mortgage insurance (PMI).

Credit Score:

A higher credit score typically results in better loan terms and lower interest rates.

Debt-to-Income Ratio (DTI):

Lenders evaluate the DTI ratio to ensure borrowers can manage their monthly payments alongside other debts.

In conclusion, Hard money North Carolina loans are crucial for enabling property ownership, and understanding the types, process, and key considerations can help borrowers make informed decisions. By carefully evaluating their financial situation and loan options, borrowers can secure favorable terms and successfully navigate the complex real estate market.

0 notes

Text

Frequently Asked Questions About the Cayman Real Estate

Understanding the local market, investment areas and real estate procedures in the Cayman Islands is essential for both investors and individuals to make informed decisions. That’s why we recently created this guide on the most frequently asked questions regarding Cayman real estate's various clients with the help of the Cayman Islands Real Estate Brokers Association (CIREBA).

Cayman Real Estate FAQs

Can foreigners buy property in the Cayman Islands?

Yes, foreigners are welcome to buy real estate in the Cayman Islands! But first, you'll have to apply for a government license.

The number of these permits that may be obtained annually is capped, and they are often granted for residential real estate or residential development projects. Certain properties, such as farms, may also have further limitations on foreign ownership.

Seeking advice from regional specialists is essential for navigating the procedure and Cayman Islands housing market. This will allow you to purchase your ideal Cayman property with confidence.

What are the additional costs while investing in Cayman real estate?

In addition to the property price, purchasing a property in the Cayman Islands involves stamp duty, legal fees, broker commission, and other costs.

What is the process for buying property in the Cayman Islands?

The process typically involves various steps, from finding property to contracting with the assistance of legal professionals. Buying property in the Cayman Islands involves these steps:

Step 1 - Find a property

Step 2 - Make an offer

Step 3 - Negotiate terms

Step 4 - Check the property

Step 5- Sign a contract

Step 6- Get financing (if needed)

Step 7 - Close the deal

Step 8 - Take ownership

Are there any residence restrictions for Cayman Islands property owners?

No, citizens of the Cayman Islands do not need to own property there. Everyone can own property without residing in the Cayman Islands, regardless of nationality. Thus, you don't need to be a resident to invest in or own a vacation property. If you intend to remain for an extended period, there are alternatives for residency.

Which Cayman Islands real estate markets are the most well-liked ones?

Investing in real estate in the Cayman Islands provides opportunities in locations such as Seven Mile Beach, recognized for its luxury residences and tourists, and George Town, a commercial powerhouse. Emerging communities like West Bay and South Sound also show growth potential. Conduct extensive research, get advice from local experts, and visit suitable places to make well-informed investment selections that correspond with your goals.

How do the Cayman Islands tax property?

There is no property tax in the Cayman Islands. Instead, the government uses import and stamp charges as a source of income. The buyer typically pays a 7.5% stamp duty when purchasing or selling real estate. Legal fees and real estate agent charges could be additional expenses. Due to the absence of property taxes, owning real estate in the Cayman Islands is more alluring for investors and owners alike.

How much do CIREBA real estate brokers charge as commission?

In the Cayman Islands, real estate brokers typically charge a commission of 5-7% of the property price. This agent commission covers services like marketing, property visits, negotiations, and other things during the buying or selling of the property. The location, property value, and current market demand are some factors that could impact the commission. Before proceeding, we suggest you discuss the commission with the agent or real estate agency.

What are some of the best real estate options to purchase in Cayman?

The Cayman Islands real estate offers a vast range of properties to invest in, such as homes, condos, waterfront villas, rental properties, undeveloped land, commercial spaces, and luxury residential properties for vacation rentals. Cayman has something for everyone, regardless of preferences, budget, or location.

What are the best locations or areas in the Cayman Islands to invest in?

There are numerous popular destinations for real estate investors and individuals looking to purchase a house in this paradise. West Bay offers breathtaking views and brand-new condominiums and luxury residential properties, George Town offers business opportunities, and Seven Mile Beach offers magnificent condos.

What is the stamp duty amount for real estate transactions in the Cayman Islands?

The stamp duty rate is usually 7.5% of the purchase price or the property's market value, whichever is greater. For clarity, this is calculated in the local currency. Various factors affect stamp duty, such as the property's price, residency status of the buyer or seller (local or foreigner), whether it's a first-time purchase or multiple properties, and whether the property is developed or undeveloped.

Can I buy land and build my dream home in Cayman?

Yes, you can buy land and build your ideal home. We have numerous qualified architects and constructors. Ask your CIREBA agent for some references so you can interview them.

0 notes