#Muthoot finance

Explore tagged Tumblr posts

Text

muthoot finance gold loan

1 note

·

View note

Text

youtube

Muthoot Finance - Put Your Gold to Work & Renovate Your Home - Kannada

Your family is growing. And your house can too! An extra room or a car porch is only a step away! Just put your gold to work at Muthoot Finance and get gold loan, for all your home renovation and expansion needs!

0 notes

Link

In India, Muthoot Finance is the most trusted financial services brand. As ranked #1 in The Brand Trust Report 2023 and the country’s leading gold loan NBFC, Madhuri Dixit has signed on as its brand ambassador. She is widely loved, multi-talented, and highly award-winning.

0 notes

Text

Muthoot Finance Loan: बिना झंझट के ₹5 लाख का लोन पाएं

Muthoot Finance Loan: मुथूट फाइनेंस भारत में एक प्रतिष्ठित वित्तीय सेवा प्रदाता है, जो ग्राहकों की विविध वित्तीय आवश्यकताओं को पूरा करने के लिए विभिन्न प्रकार के ऋण विकल्प प्रदान करता है। इनमें व्यक्तिगत ऋण एक प्रमुख सेवा है, जो ग्राहकों को उनकी आवश्यकताओं के अनुसार तुरंत धनराशि प्राप्त करने की सुविधा देता है। यह ऋण ₹50,000 से लेकर ₹10 लाख तक की राशि में उपलब्ध है, जिससे यह विभिन्न आय वर्गों के…

#Muthoot Finance Loan#Muthoot Finance Loan: बिना झंझट के ₹5 लाख का लोन पाएं#बिना झंझट के ₹5 लाख का लोन#बिना झंझट के ₹5 लाख का लोन पाएं

0 notes

Text

Muthoot Finance: Your Online Gold Loan At Home Solution

Discover the ease of securing a gold loan at home with Muthoot Finance, India’s leading financial services company. Our online platform offers user-friendly, quick, and reliable gold loan services. Competitive Muthoot Finance gold loan interest ratesare affordable for your immediate financial requirements. Experience the seamless process from application to disbursement, all from the comfort of your home. Trust online Muthoot Finance for transparent, secure, and customer-friendly online gold loan services.

0 notes

Text

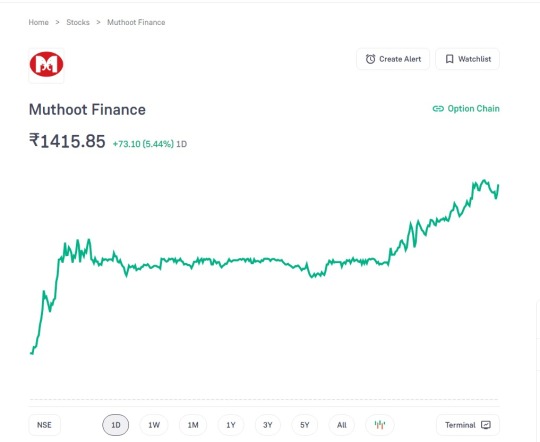

Muthoot Finance Share Price 2023

Muthoot Finance Share Price 2023 Muthoot Finance Share Price 2023 https://groww.in/stocks/user/explore Hanji dosto kya haal hai aap sabhi ka, jaisa ki aap sabhi jante hi hai ke hum apni website par har roz market se ek share leke ate hai aur aap logo ke sath share karte hai ke yeh stock kaisa hai investment karne ke liye. yeh stock hum jyadatar market ke gainers stocks se uthate hai. humara…

View On WordPress

0 notes

Text

Muthoot Fincorp NCD: Get Up to 9.44% Interest Rate on Your Investment

0 notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

Eight stocks to buy and sell today—14 February

Two stocks to buy, recommended by MarketSmith India MarketSmith India has recommended two stocks to buy, with a potential for significant returns over the next 2-3 months. The two stocks are: Muthoot Finance Ltd: The current market price of Muthoot Finance is ₹2,317.8. The recommended buy range is ₹2,270-2,330, with a profit goal of ₹2,730 and a stop loss of ₹2,120. This stock has the potential…

0 notes

Text

Stockmarket #tradingtips- #Muthoot #Finance zooms on getting nod to raise Rs 21,063.50 crore via #NCDs

1 note

·

View note

Text

youtube

Muthoot Finance - Put Your Gold to Work & Make Your Dreams a Reality - Kannada

Don’t Skip This Ad And Make Your Dreams a Reality! Just put your gold to work at Muthoot Finance in from of gold loan and build that home, buy that car, pay those bills and so much more!

0 notes

Video

youtube

Muthoot Finance - Gold Loan is Good - 7 Unique Aspects of Gold Loan

Gold Loan Is Good is the latest multimedia campaign from Muthoot Finance – India’s No. 1, most trusted financial services brand as per Brand Trust Report. It highlights all the wonderful advantages and benefits available with muthoot finance Gold Loan, while trying to eliminate the prejudices in people’s minds.

0 notes

Text

Unlocking Financial Flexibility: Muthoot Finance Today Gold Rate and Gold Loan Interest Rates

Discover the latest gold rates and gold loan interest rates offered by Muthoot Finance today. At Gold LoanatHome, you will get valuable insights into Muthoot Finance's gold loan services, empowering you to make informed financial decisions. Whether you're looking to leverage your gold assets or seeking flexible borrowing options, our platform offers convenient access to Muthoot Finance's current gold rates and competitive gold loan interest rates.

0 notes

Text

Astra Security Raises $2.7M to Revolutionize Cybersecurity with AI-Driven Pentesting

New Post has been published on https://thedigitalinsider.com/astra-security-raises-2-7m-to-revolutionize-cybersecurity-with-ai-driven-pentesting/

Astra Security Raises $2.7M to Revolutionize Cybersecurity with AI-Driven Pentesting

Astra Security, a cutting-edge cybersecurity SaaS company, has announced the successful closure of a $2.7 million growth capital round led by Emergent Ventures, with participation from Neon Fund, Better Capital, Blume Ventures, and PointOne Capital. The fresh capital will accelerate Astra Security’s mission to redefine penetration testing (pentesting) through AI-powered solutions, helping businesses stay ahead of evolving cyber threats.

AI-Powered Security for the Modern Digital Landscape

Astra Security is transforming the cybersecurity industry with its AI-driven pentesting platform, which mimics hacker behavior to identify vulnerabilities at an unprecedented scale. Over 800 engineering teams across 70+ countries rely on Astra Security’s technology to safeguard their applications, infrastructure, and APIs from cyber threats.

Last year alone, the company uncovered nearly 5,500 vulnerabilities per day. With AI enabling faster code deployment, the attack surface for cybercriminals continues to expand. Astra Security anticipates that by the end of the year, its platform will triple its vulnerability detection capacity.

“The cybercrime landscape is becoming increasingly complex with AI-based attacks,” said Shikhil Sharma, co-founder and CEO of Astra Security. “Traditional, periodic pentesting is no longer enough in today’s threat environment, and Astra Security is moving more businesses to continuous pentesting to stay ahead of hackers. The engineering world has become agile, collaborative, and automation-driven, but the cybersecurity industry has lagged behind. It’s our mission to breathe life into the security space by integrating AI, adopting a hacker’s mindset, and making the tech easy and accessible.”

Bringing Continuous Pentesting to Security Teams

Astra Security’s platform operates at the intersection of offensive security and automation, providing a comprehensive solution that includes Penetration Testing as a Service (PTaaS), a DAST vulnerability scanner, and an API security platform. These tools work in unison to uncover over 13,000 vulnerabilities, ensuring that businesses remain secure while reducing manual effort.

“Security is increasingly shifting to the hands of developers, while security teams find themselves more overwhelmed than ever,” said Ananda Krishna, co-founder and CTO of Astra Security. “While pentests have been around for over a decade, they are overdue for an AI-first update—simplifying and streamlining the process. We’re focused on removing the frustration of continuous security monitoring so businesses can get on with everything else.”

From Hackers to Cybersecurity Innovators

Astra Security’s foundation is deeply rooted in offensive security. Founders Shikhil Sharma and Ananda Krishna have spent over a decade identifying vulnerabilities for global tech giants such as Microsoft, Adobe, AT&T, Yahoo, and Blackberry. Their expertise led to the creation of Astra Security in 2018, with a vision to modernize pentesting by leveraging AI and automation.

A Growing Customer Base and Industry Recognition

Astra Security’s impact is already evident among mid-sized and large enterprises. Over 25% of its customers include well-known organizations such as Loom, HackerRank, ITC, Olx Autos, Mamaearth, Muthoot Finance, Bonusly, Singapore Trade Exchange, Oscilar, University of Cambridge, CompTIA, and Prime Healthcare. The company’s rapid adoption among leading brands is a testament to its effectiveness in providing fast, actionable security insights.

Solving the Complexity of Modern Cybersecurity

As modern cloud infrastructures become increasingly complex—incorporating APIs, integrations, and multi-AI models—organizations face mounting security challenges. Astra Security is designed to be the single source of security trust, ensuring that businesses can onboard vendors, integrate APIs, and expand their digital footprint without compromising security.

With AI-driven pentesting, businesses can shift left from DevOps to DevSecOps, seamlessly integrating security into their development workflows. Astra Security’s CI/CD integrations enable engineering and security teams to remediate vulnerabilities in record time, minimizing risk and potential financial losses.

In 2023 alone, Astra Security identified and helped remediate over two million vulnerabilities, saving its customers an estimated $69 million in potential losses due to security breaches.

What’s Next for Astra Security?

The newly secured funding will enable Astra Security to further enhance its AI capabilities, expand its detection capabilities into cloud environments, and continue simplifying security for developers and security engineers. As cyber threats grow in complexity, Astra Security remains committed to staying ahead of attackers and ensuring businesses remain protected.

With AI making pentesting continuous, scalable, and developer-friendly, Astra Security is set to redefine cybersecurity standards for the future.

#000#2023#adobe#adoption#agile#ai#AI models#AI-powered#amp#API#APIs#applications#as a service#astra#Astra Security#Attack surface#attackers#automation#Behavior#brands#CEO#CI/CD#Cloud#code#collaborative#complexity#comprehensive#comptia#continuous#CTO

0 notes

Text

0 notes

Text

Stocks to buy: Top stock recommendations for January 23, 2025

Stock market recommendations: According to Aakash K Hindocha, Deputy Vice President – WM Research, Nuvama Professional Clients Group, Bajaj Finserv, Muthoot Finance, and ABDL are the top stock picks for today. Here’s his view on Nifty, Bank Nifty and the top stock picks for January 23, 2025:Index View: NiftyPressure on Nifty eased out in the last hour of trade after it failed to break its…

0 notes