#Muthoot Finance

Explore tagged Tumblr posts

Text

muthoot finance gold loan

1 note

·

View note

Text

youtube

Muthoot Finance - Put Your Gold to Work & Renovate Your Home - Kannada

Your family is growing. And your house can too! An extra room or a car porch is only a step away! Just put your gold to work at Muthoot Finance and get gold loan, for all your home renovation and expansion needs!

0 notes

Text

Muthoot Finance Loan: बिना झंझट के ₹5 लाख का लोन पाएं

Muthoot Finance Loan: मुथूट फाइनेंस भारत में एक प्रतिष्ठित वित्तीय सेवा प्रदाता है, जो ग्राहकों की विविध वित्तीय आवश्यकताओं को पूरा करने के लिए विभिन्न प्रकार के ऋण विकल्प प्रदान करता है। इनमें व्यक्तिगत ऋण एक प्रमुख सेवा है, जो ग्राहकों को उनकी आवश्यकताओं के अनुसार तुरंत धनराशि प्राप्त करने की सुविधा देता है। यह ऋण ₹50,000 से लेकर ₹10 लाख तक की राशि में उपलब्ध है, जिससे यह विभिन्न आय वर्गों के…

#Muthoot Finance Loan#Muthoot Finance Loan: बिना झंझट के ₹5 लाख का लोन पाएं#बिना झंझट के ₹5 लाख का लोन#बिना झंझट के ₹5 लाख का लोन पाएं

0 notes

Text

Muthoot Finance: Your Online Gold Loan At Home Solution

Discover the ease of securing a gold loan at home with Muthoot Finance, India’s leading financial services company. Our online platform offers user-friendly, quick, and reliable gold loan services. Competitive Muthoot Finance gold loan interest ratesare affordable for your immediate financial requirements. Experience the seamless process from application to disbursement, all from the comfort of your home. Trust online Muthoot Finance for transparent, secure, and customer-friendly online gold loan services.

0 notes

Text

Who is known as the mother of Indian microfinance?

Introduction: Microfinance has played a pivotal role in transforming the economic landscape of India, particularly in empowering the financially underserved sections of society. At the forefront of this revolution is a remarkable figure often hailed as the "Mother of Indian Microfinance." In this article, we delve into Who is known as the mother of Indian microfinance?, Section 8 Microfinance Company Registration and explore the significant contributions that have earned her this prestigious title.

Who is known as the Mother of Indian Microfinance? The title "Mother of Indian Microfinance" is bestowed upon Dr. Ela Bhatt, a distinguished social worker and the founder of the Self-Employed Women's Association (SEWA). Dr. Bhatt's unwavering commitment to uplifting the impoverished and marginalized through financial inclusion has left an indelible mark on the microfinance sector in India.

Ela Bhatt's Vision and Achievements: Dr. Ela Bhatt founded SEWA in 1972 with the primary objective of providing support and empowerment to self-employed women workers. Her vision extended beyond mere charity; she aimed to create a sustainable model that would enable these women to become economically self-reliant. Recognizing the transformative potential of microfinance, Dr. Bhatt pioneered the integration of financial services into SEWA's initiatives.

Under her leadership, SEWA's microfinance programs flourished, offering financial assistance, training, and resources to countless women engaged in various small-scale enterprises. Dr. Bhatt's emphasis on self-help and community-driven initiatives became a blueprint for other microfinance institutions across India.

Section 8 Microfinance Company Registration: In the contemporary landscape, the regulatory framework for microfinance entities in India falls under the ambit of Section 8 Companies. Section 8 Microfinance Company Registration of the Companies Act, 2013, allows for the establishment of non-profit organizations with the objective of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, and more.

Microfinance institutions seeking registration under Section 8 benefit from a legal structure that facilitates their mission-driven approach without the mandate of dividend distribution. This aligns with the ethos of organizations like SEWA, which prioritize social impact over profit.

Conclusion: Dr. Ela Bhatt's moniker as the Mother of Indian Microfinance is a testament to her groundbreaking contributions in fostering financial inclusion and empowerment. Her legacy lives on through the countless lives transformed by the microfinance initiatives she pioneered. As India continues to evolve economically, the impact of microfinance and the vision of leaders like Dr. Bhatt remain instrumental in creating a more inclusive and equitable society.

#microfinance#india#indian institute of management#amul taste of indians#taste of india#theekholms mermaid secrets of the deep#mother#microfinance (industry)#muthoot finance ke malik kaun the#microfinance (invention)#loan recovery process after death of person taking the loan#microwave indian recipes#mermaids secrets of the deep#indian dance#career in finance in india#finance jobs india#mother mother#secrets of the deep#mother helpage kashmir

0 notes

Text

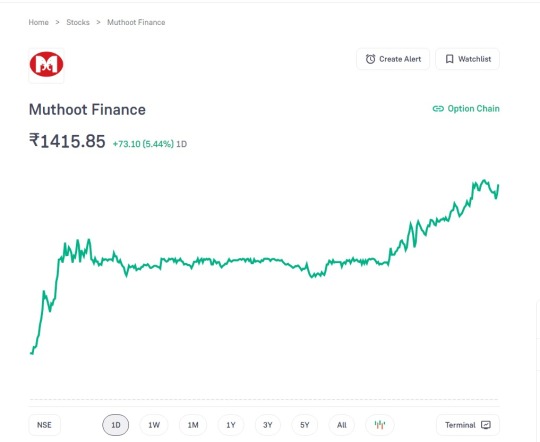

Muthoot Finance Share Price 2023

Muthoot Finance Share Price 2023 Muthoot Finance Share Price 2023 https://groww.in/stocks/user/explore Hanji dosto kya haal hai aap sabhi ka, jaisa ki aap sabhi jante hi hai ke hum apni website par har roz market se ek share leke ate hai aur aap logo ke sath share karte hai ke yeh stock kaisa hai investment karne ke liye. yeh stock hum jyadatar market ke gainers stocks se uthate hai. humara…

View On WordPress

0 notes

Text

Muthoot Fincorp NCD: Get Up to 9.44% Interest Rate on Your Investment

0 notes

Video

youtube

Muthoot Finance - Gold Loan is Good - 7 Unique Aspects of Gold Loan

Gold Loan Is Good is the latest multimedia campaign from Muthoot Finance – India’s No. 1, most trusted financial services brand as per Brand Trust Report. It highlights all the wonderful advantages and benefits available with muthoot finance Gold Loan, while trying to eliminate the prejudices in people’s minds.

0 notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

The Digital Flix | AI Powered Digital Marketing Company and Institute in Bhopal

Welcome to TheDigitalFlix, the Best Digital Marketing Company in Bhopal, providing 360° digital marketing solutions and AI-powered digital marketing education. We offer high-performance marketing services for businesses, helping them grow with expert strategies in SEO, PPC, Social Media Marketing, Website Development, and Lead Generation. Our Best Digital Marketing Agency in Bhopal ensures customized, data-driven solutions for real business impact.

At TheDigitalFlix Institute of Digital Marketing, recognized as the Best Digital Marketing Institute in Bhopal, we provide practical, AI-integrated courses covering SEO, Google Ads, Social Media Marketing, Email Marketing, Content Strategy, and more. With hands-on experience, live projects, and industry-leading tools, we prepare students, professionals, and entrepreneurs for success.

Why Choose TheDigitalFlix? ✅ Best Digital Marketing Services in Bhopal – Customized marketing solutions tailored to your business. ✅ AI-Powered Digital Growth – Cutting-edge technology for SEO, PPC & Lead Generation. ✅ High-ROI Marketing – Maximize conversions and sales with proven marketing strategies. ✅ Industry-Leading Training – Live projects, practical learning & expert mentorship. ✅ Recognized Certifications – Get certified by Google, HubSpot, and leading platforms. ✅ Business Growth & Career Success – Learn from the Best Digital Marketing Institute in Bhopal to kickstart your journey.

🚀 Whether you need digital marketing services or want to learn from the Best Digital Marketing Institute in Bhopal, TheDigitalFlix is your go-to destination!

📞 Call us: +91 9201457156 / +91 7987999491 / 0755-3162670

🌐 Visit us: www.thedigitalflix.com

📍 Address: The DigitalFlix Company and Institute of Digital Marketing, B1, Kamla Nagar, Near Harish Chowk, Next to Muthoot Finance, Kotra Sultanabad, Bhopal, M.P. (462003)

#artificial intelligence#digital marketing#social media#technology#seo#ai powered#social media marketing#digitalmarketing101#digitalgrowth#thedigitalflix

1 note

·

View note

Text

🌟 From Government Job Prep to a Thriving Banking Career! 🌟

Aniket Sonone once focused on securing a government job, but life had other plans! A friend introduced him to IPB, and today, he’s excelling as a Cashier at Muthoot Finance, Amravati Branch after completing the PGCRB course.

If you’re looking to transform your career, take the first step today! Comment "Interested" to begin your journey in banking.

#SuccessStory#IPB#1lakhbankersby2030#PGCRB#FutureInBanking#instituteofprofessionalbanking#BankingCareer#CareerGrowth#MuthootFinance#JobSuccess#BankingTransformation#FinanceCareer#CareerChange#ProfessionalGrowth

0 notes

Text

youtube

Muthoot Finance - Put Your Gold to Work & Make Your Dreams a Reality - Kannada

Don’t Skip This Ad And Make Your Dreams a Reality! Just put your gold to work at Muthoot Finance in from of gold loan and build that home, buy that car, pay those bills and so much more!

0 notes

Text

Branch Executive Internship in Multiple locations at Muthoot Finance

About the internship Selected intern’s day-to-day responsibilities include: 1. Manage branch operations to ensure…. are available for full time (in-office) internship 2. can start the internship between 11th Feb’25 and 18th Mar’25 3… Apply Now

0 notes

Text

Unlocking Financial Flexibility: Muthoot Finance Today Gold Rate and Gold Loan Interest Rates

Discover the latest gold rates and gold loan interest rates offered by Muthoot Finance today. At Gold LoanatHome, you will get valuable insights into Muthoot Finance's gold loan services, empowering you to make informed financial decisions. Whether you're looking to leverage your gold assets or seeking flexible borrowing options, our platform offers convenient access to Muthoot Finance's current gold rates and competitive gold loan interest rates.

0 notes

Text

Gym Will Transform Your Body FAST! Get Shredded & Strong Now!

Are you tired of staring at the mirror, wishing for a stronger, shredded physique? It’s time to stop dreaming and take action! Hitting the gym is the fastest and most effective way to transform your body, boost your confidence, and become the best version of yourself. Whether you're a beginner or someone who's returning to fitness, this guide will show you how to get toned and strong fast!

Why the gym is your best bet for a transformation

A fitness center has everything you need to get in shape – weights, cardio machines, personal trainers, and an environment that motivates you to work out harder. With persistence and the right strategy, you’ll see significant changes in just a few weeks. Here's what makes the gym unbeatable:

Targets every muscle group: Builds strength and muscle symmetry.

Structured training: Perform a variety of exercises using equipment and free weights.

Community support: Stay motivated with like-minded fitness enthusiasts.

A Plan for a Strong Body

Set Clear Goals

Decide what you want to do – lose weight, gain muscle, or improve strength. Clear goals will help you stay focused and track your progress. Follow the proven training routine

Aerobic training, strength training and mobility exercises to get the best results.

Day 1: breast and triceps

Day 2: Back and biceps

Day 3: Relax or actively recover (easy aerobic training or stages)

Day 4: Ben

Day 5: shoulders and core

Eat as a master

Nutrition plays a key role in your conversion. Focus on a protein-rich diet that is rich in healthy fats, complex carbohydrates, and vegetables. Don’t forget to stay hydrated!

Foods to watch out for: chicken, fish, eggs, quinoa, sweet potatoes, broccoli, and nuts.

Track Your Progress Keep a journal of your workouts, meals, and body measurements. Seeing progress, even small changes, will keep you motivated. Take photos every 2–4 weeks to document your transformation.

Rest and Recovery Muscle growth happens during recovery, not during your workouts. Ensure you get 7–8 hours of sleep per night and incorporate rest days to prevent injury.

Common mistakes to avoid

Skipping warm-up and cool-down – this can lead to injury.

Not following form and technique – proper form is crucial for results and safety. Overtraining – more is not always better. Give your body time to recover. Consistency is key

Remember, your body doesn't change overnight. But with dedication and discipline, you'll be amazed at how quickly your body changes. Be consistent, push your limits, and keep your eyes on the prize. The gym is your playground - use it to get the body of your dreams. Take the first step today, and watch your transformation unfold.

Common mistakes to avoid

Skipping the warm-up and cool-down – this can lead to injury.

Not following form and technique – proper form is crucial for results and safety. Overtraining – more is not always better. Give your body time to recover. Be consistent, push your limits, and keep your eyes on the prize. The gym is your playground - use it to get the body of your dreams. Let's be strong. Let's do it!

Click here for your free course!

Are you ready to stop dreaming and start taking action? The most powerful thing you can do is wait for us - let's do it!

Join the movement. Feel the energy. View the results. Visit My Gym Fitness Studio today and take control of your fitness journey!

If you need any further customization like special promotions, suggestions or event information, let me know!

Phone Number: 9020710009

Address: Akkulam Road near muthoot

Finance, Trivandrum

695011

1 note

·

View note

Text

Stockmarket #tradingtips- #Muthoot #Finance zooms on getting nod to raise Rs 21,063.50 crore via #NCDs

1 note

·

View note