#Mortage Rates

Explore tagged Tumblr posts

Text

The burden of higher mortgage costs starts to arrive

Over the weekend it seems that the chattering classes and establishment caught up with something we have been noting for a while now. I recall us discussing the UK give-year yield passing 4% with the implication being that higher mortgage rates were on their way. We can also add in one of our longest-running themes. Jeremy Hunt, UK chancellor, has ruled out giving any direct fiscal support to…

View On WordPress

#Bank of England#business#Chancellor Hunt#economy#Finance#fixed-rate mortgages#Help To Buy#Interest Rates#Mortage Rates#Recession#Resolution Foundation#Rishi Sunak#UK

3 notes

·

View notes

Text

Kind of compounded to everything else I hate how we've gone back to basically mandatory calls if you want any info abt anything.

I'm looking for places to move out into, some affordable rents. I'm not even gonna touch on the amount of fucking conditions they put in the way just to rent alone, but simply getting in touch with them?

Email them? Nope, you get bot answers. Call them? Nope, all of them are busy, but leave a message to never get called back. Text them? Sure they'll answer the first two texts and proceed to ignore you.

Like??? Y'all. I don't want to have to personally visit you to your dumbass little hole in a building to deserve your attention. I'm trying to do a transaction here. Take my money and give me my license/apartment

#Right now the only place that consistently responds is the hospital and I'm gonna have to cancel my HRT appointments yet again#Might really have to hold out till July at this rate#the only up of that is that by then I should have enough to perhaps even get in a mortage and have my own fucking place

2 notes

·

View notes

Text

can the housing market actually crash before 2024???

0 notes

Note

This has maybe come up in the discourse already, but do you have a take on where people's perception of the economy being bad at the moment is coming from?

I dont think it's actually a grand mystery: its inflation. People hate inflation, because its price is in your face while its "benefits" (aka the macroeconomic causes) are diffuse. Am mobile so I dont have the graphs, but if you look at economic perceptions globally everywhere that had inflation the economy is bad. In those other places the high inflation paired with low growth, so the perception is pretty spot on. The US is decently unique in having high inflation and even higher growth; people are essentially being tricked into thinking it's bad.

But while that is the lion's share I think there have been real issues as well. Inflation is bad for held assets, for example, and the stock market has been lukewarm; so lots of asset classes took hits or underperformed. To the extent that your net wealth is from savings vs wages, you will see things a bit differently. In addition, the real estate market has been awful for buyers - huge price increases coupled with sky-high mortage rates. And note how most people dont really count the value of their home as an asset-in-the-bank, so a lot of that value increase isn't feeding into sentiment for owners while harshly punishing buyers. These rocky markets give more heft to the 'price of eggs' perception imo, since they are so core to family balance sheets.

21 notes

·

View notes

Text

About us

More than a broker. We put a team of experts together with PropertyGuru's technology and data, to make the mortage market smart, effortless and transparent. At last.

1 Paya Lebar Link, #12-01/04, Paya Lebar Quarter, PLQ, #1, Singapore 408533 (+65) 8769 5300 [email protected]

3 notes

·

View notes

Text

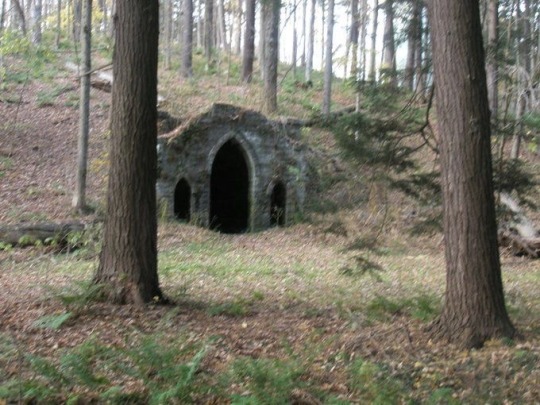

the lair market nowadays is ridiculous, I mean how is the wizard mortage rate over 5%, fucking absurd.

26K notes

·

View notes

Text

Why VA Mortgage Leads Are Crucial for Lenders

Understanding VA Mortgage Leads

A VA mortgage lead refers to a prospect eligible for a VA loan, actively looking for mortgage solutions. These leads can come from various sources, including online inquiries, targeted marketing, and referrals.

Types of VA Mortgage Leads:

VA Loan Leads: Homebuyers or refinancers eligible for VA-backed loans.

VA Mortgage Live Transfers: Real-time, pre-qualified leads directly transferred to a lender for immediate consultation.

VA Refinance Leads: Borrowers looking to lower their interest rates or cash out home equity.

Benefits of VA Mortgage Live Transfers

1. Higher Conversion Rates

Since VA mortgage live transfers involve real-time engagement, lenders can speak with borrowers at the moment of peak interest.

Advantages:

Direct connection with interested VA loan applicants.

Immediate response enhances trust and credibility.

2. Exclusive and High-Quality Leads

VA loan leads provided through live transfers are exclusive, meaning you are not competing with multiple lenders for the same borrower.

Key Benefits:

Reduced competition.

Better chances of closing deals.

3. Faster Loan Processing

Live transfers ensure that lenders can gather necessary information on the first call, expediting the loan approval process.

Impact:

Shorter loan processing time.

Improved customer satisfaction.

4. Cost-Effective Marketing Strategy

Compared to traditional marketing efforts, investing in VA mortgage leads yields a higher return on investment (ROI) due to increased closing rates.

Strategies to Maximize VA Loan Leads & Live Transfers

1. Partner with a Reliable Lead Provider

Choosing a reputable source for VA loan leads ensures that you receive verified and high-intent borrowers. The Live Lead offers top-tier VA mortgage leads tailored to your needs.

2. Optimize Your Sales Process

Having a structured follow-up system and well-trained sales team ensures that you can capitalize on VA mortgage live transfers effectively.

3. Offer Competitive Loan Programs

Providing attractive loan options, including VA purchase and refinance solutions, can help differentiate your services from competitors.

4. Utilize CRM & Automation Tools

Tracking leads through Customer Relationship Management (CRM) software and automating follow-ups improves engagement and conversion rates.

Why Choose The Live Lead for VA Mortgage Leads?

At The Live Lead, we specialize in delivering:

Exclusive, high-quality VA loan leads tailored to your business.

Pre-screened VA mortgage live transfers ensuring higher intent borrowers.

Custom lead generation solutions to match your lending requirements.

Real-time lead delivery for instant borrower-lender connections.

Conclusion

For mortgage lenders looking to expand their VA loan business, VA mortgage leads and live transfers provide an effective and profitable way to connect with qualified borrowers. By leveraging these high-intent leads, lenders can increase their closing rates, streamline operations, and grow their client base.

Partner with The Live Lead today and gain access to high-quality VA mortgage live transfers and VA loan leads that drive real results. Contact us now to learn more about our industry-leading lead generation services.

0 notes

Text

Top loan agency in Coimbatore

Introduction

Coimbatore is a growing city full of opportunities for business and personal success. To achieve these goals, many people need reliable financial support. Whether it’s to grow a business, pay for education, or handle unexpected expenses, having the right loan can make a big difference. Choosing a good loan agency is important to meet your financial needs without any trouble.

A trusted agency not only provides loans but also helps you make smart financial decisions. This way, you can focus on your dreams and goals with confidence. With the right support, reaching your goals in Coimbatore becomes easier and stress-free.

What Makes a Loan Agency Reliable?

A reliable loan agency is transparent, offering clear terms without hidden fees. It provides a variety of loan options to meet different needs, such as business, education, or personal expenses. Customer-focused services, including quick processing and personalized support, are also key indicators of reliability.

Expert guidance is crucial for making informed financial decisions. Grow Associates excels in this area by offering professional advice and detailed loan comparisons, helping customers select the best solutions for their needs. Their commitment to transparency and personalized service makes them a trusted partner for financial success.

Top 10 loan agency in Coimbatore

1. Grow Associates

Introduction: Grow Associates is a well-established loan agency offering customized personal loan options in Coimbatore.

Key Services:

Personal Loans

Business Loan

Mortage Loan

Home Loan

Why Choose Grow Associates: Partners with over 50 banks and NBFCs to provide the best loan options with expert guidance.

Website: Grow Associates

Contact Number: 063690 95433

Location: 1st Floor, Room No. 4, Subbulakshmi Complex, 49 - A, Sarojini St, Ram Nagar, Coimbatore, Tamil Nadu 641009

2. Shanmugam Associates

Introduction: Shanmugam Associates specializes in debt recovery and offers tailored financial assistance for businesses and individuals in Coimbatore.

Key Services:

Business Loans

Personal Loans

Debt Recovery for Corporate and Bank.

Why Choose Shanmugam Associates: A trusted partner for resolving financial challenges with expertise in debt recovery.

Contact Number: 097864 57234

Location: 102, Trichy Road, Sungam, Coimbatore, Tamil Nadu 641018

3. Homeland India

Introduction: Homeland India is a leading financial service provider in Coimbatore, offering comprehensive solutions including loans and joint ventures.

Key Services:

Mortgage Loans

Joint Ventures

Business Loans

Personal Loans

Why Choose Homeland India: Offers a wide range of financial services backed by expert advice and support.

Key Services:

Contact Number: 098756 21456

Location: 14, Avinashi Road, Peelamedu, Coimbatore, Tamil Nadu 641004

4. R S Associates

Introduction: R S Associates is a prominent loan agency in Coimbatore known for providing flexible financial solutions.

Key Services:

Personal Loans

Business Loans

Home Loans

Why Choose R S Associates: Reliable and efficient services with a focus on customer satisfaction.

Contact Number: 081234 56789

Location: 18, Race Course Road, Coimbatore, Tamil Nadu 641018

5. Samruthi Fincredit Pvt. Ltd.

Introduction: Samruthi Fincredit Pvt. Ltd. is a financial services company offering customized loan solutions to individuals and businesses in Coimbatore.

Key Services:

Personal Loans

Business Loans

Gold Loans

Why Choose Samruthi Fincredit Pvt. Ltd.: Competitive interest rates and a hassle-free application process make it a popular choice.

Contact Number: 098765 43210

Location: 25, Gandhipuram, Coimbatore, Tamil Nadu 641012

6. Hero FinCorp

Introduction: Hero FinCorp is a trusted name in providing fast and reliable personal loans with competitive rates in Coimbatore.

Key Services:

Instant Personal Loans

Why Choose Hero FinCorp: Low interest rates and quick processing make it a popular choice for personal loans.

Contact Number: 1800 212 8800

Location: 6th Floor - 1547, Classic Towers, Trichy Rd, Sukrawar Pettai, R.S. Puram, Coimbatore, Tamil Nadu 641018

7. We Win Associates

Introduction: We Win Associates, established in 2021, offers a variety of loan services to meet individual and business needs in Coimbatore.

Key Services:

Vehicle Loans

Home Loans

Business Loans

Personal Loans

Mortgage Loans

Why Choose We Win Associates: Known for personalized service and transparent processes, catering to diverse financial needs.

Contact Number: 098946 99909

Location: 21-B, Ground Floor, Ganga Naidu St, Venkitapuram, Coimbatore, Tamil Nadu 641025

8. V2S Fin Assist

Introduction: V2S Fin Assist specializes in providing efficient financial solutions for businesses and individuals in Coimbatore.

Key Services:

Business Loans

Vehicle Loans

Why Choose V2S Fin Assist: Quick response time, customer satisfaction, and reliable service.

Contact Number: 098656 01234

Location: 205, 2nd Floor, Dhruvatara Apartment, 1, Dr. Rajendra Prasad Rd, Varuthiangara Palayam, Seth Narang Das Layout, Tatabad, Coimbatore, Tamil Nadu 641012

9. Protium Finance Limited

Introduction: Protium Finance offers tailored financial solutions for small and medium-sized enterprises (SMEs) in Coimbatore.

Key Services:

Business Loans

MSME Loans

Consumer Financing

Why Choose Protium Finance Limited: Fast approvals with minimal documentation and flexible loan options.

Contact Number: 088288 20004

Location: 1st Floor, 79/1 A, Sir Shanmugam Rd, R.S. Puram, Coimbatore, Tamil Nadu 641002

10. Sri Hari Associates

Introduction: Sri Hari Associates is a trusted loan agency in Coimbatore offering tailored financial solutions to meet diverse customer needs. Key Services:

Personal Loans

Business Loans

Loan Against Property

Spot Cash for Credit Card Holder

Why Choose Sri Hari Associates: Known for quick processing and customized loan options, they cater to both individual and business clients effectively.

Contact Number: 090430 0302

Location: 52, Nehru Street, Ram Nagar, Coimbatore, Tamil Nadu 641009

Conclusion

Grow Associates is the perfect choice for anyone looking for help with loans in Coimbatore. They offer expert advice to help you choose the best loan for your needs, making the loan process easy and stress-free. Whether you're looking for a personal loan, a business loan, or funds for any other purpose, Grow Associates ensures you get the right option for your situation.

Visit the Grow Associates website today for more information. You can easily explore different loan options and apply online with expert help to guide you every step of the way. Let Grow Associates make your loan process simple and smooth.

0 notes

Text

What happens next for mortgage lenders after the Fed rate cut? https://www.housingwire.com/articles/what-happens-next-for-mortage-lenders-after-fed-rate-cut/

0 notes

Text

Steps to Securing a Home Loan🏠💸 - Get finances in order - Decide what kind of mortage you want - Compare rates with lenders - Get pre-approved - Compare loan estimates

Contact us now to get instant home loan

0 notes

Text

Calculate Your Mortgage for a $200,000 Loan Amount

Buying your first home can be exhilarating and daunting. One of the most crucial steps in the home-buying process is accurately calculating your mortgage payments. Understanding how much you'll need to pay each month ensures you can comfortably afford your new home without jeopardizing your financial stability. In this guide, we'll break down the process of mortage calculator for loan amount 200000 providing tips for first-time homebuyers and insights from financial planners.

Understanding the Factors Affecting Mortgage Payments

Several key factors influence your monthly mortgage payments:

Loan Amount: The total amount borrowed from the lender, in this case, $200,000.

Interest Rate: The percentage of the loan amount charged by the lender for borrowing the money.

Loan Term: The duration over which you’ll repay the loan, typically 15, 20, or 30 years.

Down Payment: The initial amount paid upfront, reducing the total loan amount.

Property Taxes: Taxes levied by the local government on the property.

Homeowners Insurance: Insurance covering potential damages to your home.

Private Mortgage Insurance (PMI): Required if your down payment is less than 20% of the loan amount.

Step-by-Step Guide to Calculating Mortgage for a $200,000 Loan Amount

Determine Your Interest Rate and Loan Term:

Interest Rate: Let's assume an interest rate of 4%.

Loan Term: We'll use a 30-year loan term for this calculation.

Calculate Monthly Interest Rate:

Monthly interest rate = Annual interest rate / 12

Example: 4% / 12 = 0.0033 (or 0.33%)

Add Property Taxes and Insurance:

Property taxes and insurance vary based on location and policy, so add these amounts to your monthly payment for an accurate total.

Tips for First-time Homebuyers on Managing Mortgage Payments

Create a Budget:

Track your income and expenses to understand how much you can comfortably allocate to mortgage payments.

Save for a Larger Down Payment:

A larger down payment reduces the loan amount and can eliminate the need for PMI, lowering monthly payments.

Shop Around for the Best Interest Rates:

Compare rates from multiple lenders to secure the best deal.

Consider Loan Term Options:

While a 30-year loan offers lower monthly payments, a 15-year loan saves money on interest over time.

Plan for Additional Costs:

Factor in closing costs, maintenance, and potential property tax increases.

Insights from Financial Planners on Smart Mortgage Strategies

Stick to the 28/36 Rule:

Financial planners recommend that your mortgage payment should not exceed 28% of your gross monthly income, and total debt payments should not exceed 36%.

Build an Emergency Fund:

Maintain 3-6 months’ worth of expenses in an emergency fund to cover unexpected financial setbacks.

Refinance When Possible:

Consider refinancing your mortgage if interest rates drop significantly, reducing your monthly payment and overall interest paid.

Make Extra Payments:

Apply extra funds towards your mortgage principal to reduce the loan term and save on interest.

Real-life Examples

Meet Sarah, a first-time homebuyer who recently purchased a home with a $200,000 loan. By securing an interest rate of 3.5% and opting for a 20-year term, her monthly payments are lower, and she will pay off her mortgage faster, saving thousands in interest. Sarah also set up an emergency fund and makes extra payments whenever possible, ensuring financial security.

On the other hand, Tom, another first-time buyer, opted for a 30-year loan with a 5% interest rate. By refinancing his mortgage after five years when rates dropped to 3.8%, Tom significantly reduced his monthly payments and saved on interest.

Accurately calculating your mortgage loan calculator for amount 200000 is essential for making informed financial decisions when purchasing a home. Understanding the factors that affect your mortgage payments and following practical tips can help you manage your finances effectively. Take advantage of financial planners' insights to make smart mortgage decisions.

0 notes

Text

Light blue black disciple

Dark blue gangster disciple

Red P stone swag Murder Rate Kill

Coulter & Paimon

Ghost Town

Gangs like 16 buildings (including elementary school) Lil Chiraq

The Clique

West town/Ukraine Village/noble square

GS9

CITY BLOCS

ChildPlay gHettO

P stone/Lilwoe/Almighty

Cottage Grove

PLuTOniUm - 305

38 Tons Tritium polterGeiSt

enable core trillionth // Interfax

Department of Energy (DOE) @ NDA Lil Chiraq

Uranium 347

Fatal o.f fairy (THE) (The) (the) Insurance Corporation

TruPaC - ll container mathematically millirem

U.S & IT Government/Government Land Estate Surplus excess Term Further Condition

Auction Foreclosure Forfeiture Commercial Farms Ranches Government own(ed) excess property *letter 4L letter*Step4LStep*

Fannie Mae HomePath THE Msft inc.

Mortage The Service Sale Right

Facilitate THE disposition LLC estate secure

Portion THE Potion bid seal auction

Belaya Tserkov Sighetu Marmatiei State THE sugar (intheform) EnergyMinistry

Укренерго Gretcha 818 Ivano Frankivsk Raion 6 Three phase THE

0 notes

Text

Here, we explore why VA mortgage live transfers are a must-have tool for loan providers and how they can transform your lead generation efforts.

What Are VA Mortgage Live Transfers?

A VA mortgage live transfer is a process where qualified leads — veterans, active-duty military members, or eligible spouses interested in VA loans — are screened and then directly transferred to your sales team in real time. Unlike traditional lead generation methods, live transfers allow you to engage with prospects while they’re actively seeking information about VA loans, increasing the likelihood of conversion.

The Process:

Leads are generated through targeted marketing campaigns.

Each lead is pre-screened to ensure they meet VA loan eligibility criteria.

The lead is transferred directly to your loan officers for immediate consultation.

Why VA Mortgage Live Transfers Are Essential for Loan Providers

1. High-Intent Leads

The most significant advantage of VA mortgage live transfers is that they connect you with highly motivated individuals who are actively seeking VA loans. These leads are ready to discuss their needs, making them far more likely to convert than cold or shared leads.

Benefit:

Increased efficiency for your sales team.

Higher conversion rates.

2. Exclusive VA Loan Leads

Live transfers are exclusive, meaning the lead is connected only to your business. This eliminates competition and gives your team a better chance to establish trust and close the deal.

Key Advantage:

Higher ROI due to exclusivity.

More personalized customer interactions.

3. Real-Time Engagement

Timing is everything in lead conversion. VA mortgage live transfers allow you to connect with prospects at the peak of their interest, making it easier to address their questions and guide them toward a decision.

Impact:

Shorter sales cycles.

Stronger rapport with potential clients.

4. Tailored Solutions for Veterans

Veterans and active-duty service members often have unique financial situations. Engaging with them in real time enables your team to offer customized solutions that align with their needs, enhancing the overall customer experience.

Result:

Increased customer satisfaction.

Higher chances of referrals and repeat business.

Strategies for Maximizing VA Loan Leads with Live Transfers

To get the most out of VA mortgage live transfers, it’s essential to have a clear strategy. Here are some tips:

1. Partner with a Trusted Lead Provider

Choose a reliable lead generation company that specializes in VA loan leads to ensure you receive pre-screened, high-quality prospects. Providers like The Live Lead offer tailored solutions that match your business’s specific criteria.

2. Train Your Sales Team

Equip your team with the knowledge and skills needed to address veterans’ unique concerns, such as eligibility requirements, benefits, and loan terms. A well-trained team can turn inquiries into approvals.

3. Leverage Technology

Use CRM systems to track and manage live transfers efficiently. Automated tools can help streamline follow-ups, ensuring no opportunity slips through the cracks.

4. Focus on Personalization

When dealing with VA loan leads, a personalized approach goes a long way. Understand their goals, provide tailored solutions, and build trust by emphasizing your expertise in VA loans.

Why Choose The Live Lead for VA Mortgage Live Transfers?

At The Live Lead, we specialize in delivering exclusive, high-quality VA mortgage live transfers to help loan providers achieve their sales goals. Here’s why we’re the preferred partner for many in the industry:

Exclusive VA Loan Leads: Our leads are pre-screened and delivered to you in real time, ensuring the highest quality and intent.

Customized Solutions: We tailor our services to meet your business’s unique needs and goals.

Expert Support: Our team works closely with you to optimize lead conversion and maximize ROI.

Conclusion

For mortgage professionals, VA mortgage live transfers represent a powerful tool to grow your business and connect with high-quality prospects. By engaging with veterans and service members in real time, you can build trust, close deals faster, and secure a competitive edge in the market.

Ready to transform your lead generation strategy? Partner with The Live Lead to access exclusive VA loan leads and take your business to new heights. Contact us today to learn more about our tailored solutions for mortgage professionals.

0 notes

Text

Florida Mortgage Loan Originator jobs

For Florida Mortgage Loan Originator jobs, US Mortgage Lenders LLC is hiring remote Mortage Loan Originators. As a self-sufficient loan officer offering distinctive loan plans and specialized services, join our prestigious mortgage company. With access to our more than 100 lending systems, you can work from home with independence. We value independence above all else and provide the highest mortgage commissions without sacrificing incredibly low rates. Come work with us and enjoy a high-paying, supportive atmosphere.

1 note

·

View note