#Metal and Mining Market Analysis

Explore tagged Tumblr posts

Text

Reclamation of FRF

A 1200 MW coal-fired thermal power plant using Indo-Chinese Turbine EHC System in Southern India

Synopsis

Problems

Failure of Moog valve: This was the main reason for the trip of the turbine and breakdown in the power plant.

Poor Oil Analysis Program: An oil analysis is supposed to be done monthly for Particle count & TAN (weekly if the trend is negative) and weekly test for water content but the customer has scheduled these indefinitely.

Inadequate Operation Practices: The solenoid valve of the LVDH (oil purification machine) vacuum line was only 20% closed which failed to generate vacuum.

Solutions

Benefits

1) Extended oil life 2) Reduced TAN value 3) Elimination of oil Replacement cost 4) Protection of Turbine against hunting 5) Increased Turbine reliability.

Subscribe to our WhatsApp Community and be a part of our Journey - Click Here

#frf#oil filtration machine#oil flushing#minimac systems#power#minimac#oil & gas#hydraulic oil#lube oil filter#contamination#hydraulic oil filter#oil filtration systems#oil testing#oil analysis#oil filters#oil industry#oil and gas#turbine oilanalysis maintenance lubrication reliability contaminationcontrol oil powerplants oilfiltration rotatingequipment mechanical#turbinemaintenance#gas turbine market trends#power industry#metal#mining#oil purification system#oil purification machine#oil filtration system#transformer oil#transformer oil cleaning#transformation oil purification#transformer oil filtration

0 notes

Text

Where Can I Trade Gold and Silver?

Looking to invest in gold and silver? Discover the best ways to trade these precious metals! From online brokers and ETFs to mining stocks and precious metal dealers, explore diverse investment options. Stay informed and secure your financial future!

Gold and silver are popular investment forms, and there are various ways to trade these precious metals. Here are some of the most common options: 1. Precious Metal Exchanges Precious metal exchanges are specialized trading venues for buying and selling gold and silver bars and coins. Well-known exchanges include: London Bullion Market Association (LBMA): Regulates international trading in…

#Buying precious metals#Commodity trading#Economic uncertainty#Financial markets#Futures and options#Gold and silver market#Gold coins#Gold ETFs#Gold prices#Gold trading#Inflation hedge#Investing in gold#Investing in silver#market analysis#Market developments#Mining stocks#Online brokers#Physical gold#Physical silver#Portfolio diversification#Precious metal dealers#Precious metal exchanges#Precious metal investments#Precious metals#risk management#Silver bars#Silver ETFs#Silver prices#Silver trading#Store of value

0 notes

Text

The Industrial Explosives Market is trending by boost in mining and infrastructure activities

The industrial explosives market comprises products that are used in mining, quarrying, and infrastructure development activities. Industrial explosives include ammonium nitrate explosives, dynamite, linear shaped charges, water gels, emulsions, and slurries. They are highly efficient and effective at fragmenting and loosening hard surfaces and materials through the exothermic reaction of oxidation. In mining activities, explosives help in loosening and fragmenting rocks to facilitate easy extraction of minerals and ores. In quarrying, they aid in breaking stone fragments of desired sizes. Infrastructure projects involving construction of roads, bridges and buildings rely on controlled blasting using industrial explosives to break and excavate hard surfaces.

The Global Industrial Explosives Market is estimated to be valued at US$ 8.48 Bn in 2024 and is expected to exhibit a CAGR of 5.6% over the forecast period 2024 to 2031. Key Takeaways Key players operating in the Industrial Explosives are Orica Limited, Irish Industrial Explosives Limited, Dyno Nobel Pty Limited/ Incitec Pivot Ltd., NOF Corporation, AEL Mining Services Ltd. / AECI Group, EURENCO, Enaex S.A., Austin Powder Holdings Company, Maxamcorp Holding S.L., and Exsa S.A. The key players are primarily focused on development of innovative and greener explosive products to cater to requirements of diverse end-use industries. The Industrial Explosives Market Demand is growing owing to rise in mining and infrastructure development activities across the globe. Countries like China, India, Indonesia, Russia and Brazil are witnessing elevated demand for minerals and metals to fuel their economic growth leading to increased exploitation of mining reserves. Growing population and urbanization are necessitating new road constructions, airports, dams and bridges worldwide. Government investments in infrastructure development projects acts as a major driver for increasing consumption of industrial explosives in various geographies especially Asia Pacific and Middle East & Africa. Market Key Trends Sustainability and eco-friendliness are the key trends gaining prominence in the industrial explosives market. Stringent environmental regulations regarding usage and storage of conventional explosives have prompted manufacturers to develop alternatives that minimize ecological impact. Some players are invested in R&D of bio-based or green explosives utilizing renewable resources. Specialized emulsions and micro-emulsions that optimize blasting performance while ensuring safety and controlling fumes are also gaining traction. Overall, focus on greener product varieties compliant with environmental norms will continue shaping the industrial explosives industry outlook in the coming years.

Porter's Analysis Threat of new entrants: New entrants face high capital requirements to enter this market due to stringent regulations.

Bargaining power of buyers: Buyers have low bargaining power as there are numerous established producers in the market.

Bargaining power of suppliers: Suppliers have moderate bargaining power as raw materials require specialized handling and transportation.

Threat of new substitutes: Substitute threat is low as explosives have few alternatives for usage in mining, construction and other applications.

Competitive rivalry: Rivalry is high among the top players due to their diversified operations and differentiation in product quality. The industrial explosives market in Asia Pacific holds the largest share globally, in terms of value. This can be attributed to the increasing mineral extractions and infrastructure development activities in countries such as China and India. North America is also a major regional market supported by heavy investments in mining operations, especially in the U.S. and Canada. The Middle East & Africa region is expected to witness the fastest growth during the forecast period. This growth can be attributed to rising mineral extractions and various infrastructure projects underway in GCC countries, South Africa and other African nations. Countries are focusing on industrialization through economic diversification programs involving mining and construction activities. This is fueling demand for industrial explosives in the MEA region.

Get more insights on Industrial Explosives Market

Also read related article on All Wheel Drive Market

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Industrial Explosives Market#Industrial Explosives#High Explosives#Blasting Agents#Metal Mining#Quarrying#Construction#Industrial Explosives Market Demand#Industrial Explosives Market Analysis

0 notes

Text

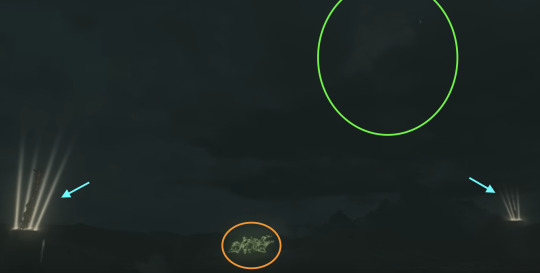

89 Days Until Tears of the Kingdom Release. The Trailer Breakdown is here. Sorry Tumblr killed the image quality. This is Part One of Three.

Warning: This will be obscenely long. I have spent hours of my life on this and I even went around Hyrule in BOTW to double check things. I have also watched only one reaction/analysis video (Limcube) whose ideas I reference a few times but the rest is all me. Now, I know many of the oddities and differences could easily be explained by saying we time travel into the past but I’m going to approach this for the most part as if we are not time traveling because it's more fun this way. Also, the colors refer to the corresponding arrows/circles on the image above it.

First thoughts: Dang the sky is mad. Do not wear metal in this weather. Red: Malice spewing out of Death Mountain. Never not gonna be interested in that. Green: Green swirlies. I’m assuming this is something that lets you travel into the sky. Maybe lets you phase through the ground like one of the past trailers has shown us. Liquifies Link even. Orange: Weird funky rock. Meteorites?? Yeah I’m gonna point these out a lot.

Red: Malice pool right next to the green swirlies. Blue: Tiny glowing dots in the distance. Other green swirlies? If so they seem to dot the landscape like shrines in that you can see the glow far off. Unless they are more of those symbols/drawings inscribed on ground/grass that we see later.

First thoughts: Keese on steroids. My friend suggests calling them Geese. Second thoughts: Actually, they remind me of the flying enemies from Twilight Princess, Twilit Kargarok, only yellow. Hmm yellow and orange… I hope they are not electric or fire although there seems to be a lack of that in the trailer. Note: The area is clearly where the Sheikah Tower near the Korok Forest (Woodland Tower) should be, except well it’s obviously not there.

Blue: Glowing towers that are clearly not Shiekah Towers. I like the spotlights though. They look kinda prehistoric. Orange: Big glowy symbols/drawing. I really want to know what these are for. Green: It’s kinda hard to see but I think it’s a big storm tornado thing in the sky. You can see it much better later in the trailer. Reminds me of the stormhead dome in Skyward Sword.

Blue: Glowing orange thing down there. Can’t tell what it is but maybe a chest? Idk why but I have this idea you might have to jump down from higher and angle yourself to land on it. You had to do this for platforms in Skyward Sword. Red: This island being at a lower altitude from the one taking up most of the shot pleases me. I like the idea of layered sky islands. Might be a nightmare for stamina and paragliders until we can get those vehicles.

General thoughts: Brand new underground area. I’ve never seen anything like this in BOTW. Green: Blue flame spirit things. These are so interesting. I wanna know what these are. They remind me of willow the wisps or maybe the Bluepee. I hope this means more spirit things in this game. I will be quite sad if they are only an environmental design choice. Red: Malice infused Lizalfos. Again I haven’t seen elemental enemies yet. Only malice ones. Huh it’d be pretty funny if they bled black but then that’d be infringing on the Linked Universe and enemies don’t bleed in Zelda games. Pink: Why are they mining? Seriously, Ganondorf, what are you having your minions mine for? You lose something? Do the bokoblins need money or ore for something? Hmm, a bokoblin run market would be interesting. Blue: This glowy snake tree thing kinda looks like a tunnel of some sort. Maybe it’s a way to travel from the surface to this. If so I’d treat it like a slide but then I’d break my knees cause you can bet fall damage is still a thing… hmm can’t wait to see people time how long it takes for Link to fall from the highest island to the ground and go splat

Note: The Bridge of Hylia is the same. Yes, I double checked. Words: “Rise, rise my servants.” I’m fairly sure this is Ganondorf. Red: DRAGON. THREE HEADED FIRE DRAGON. Yeah so this is one of the few elemental enemies shown in the trailer. I want to fight this thing so bad. I’ve heard people say it's a Gleeok possibly (an enemy from the first Legend of Zelda game.) It reminds me of a much cooler version of the Hydra enemies from Skyward Sword. Blue: Vaguely green glow that probably denotes a green swirly thing. Pink: Malice holding up the castle looks sick. I like that you can see it glowing red from far away.

General Thoughts: It’s Hateno and it mostly looks the same but not quite Words: “Sweep over Hyrule.” Yeah, yeah Ganondorf we get you have a grudge. Green: Green swirly thing is new. It’s not quite in the same place as the shrine which is absent from this picture. Blue: Purah’s furnace is gone and so are the blue flame lanterns along the road and the ancient furnace down in the village. Purah’s lab also isn’t glowing. Actually, this makes me wonder about teleportation since no Sheikah slate. Maybe we get so many new vehicles because no instant teleportation.

General thoughts: First time we see Link. Hello buddy. Also sequels and moons as enemies am I right? Words: “Eliminate this kingdom and her allies.” This Ganondorf doesn’t want to rule over people but wipe them out which makes me think about Demise’s anger and hatred. However, Ocarina of Time Ganondorf devastated the land pretty badly so maybe all of the Ganondorfs/Ganons like extreme destruction. Also, I’m pretty sure Hyrule’s allies are all the different races, Zora, Rito, Gerudo (talk about betraying your own people Ganondorf), Shiekah. I’m not holding out hope for other nations/kingdoms getting involved. Blue: You can see islands in the background. I wonder what the long trailing thing is. Pink: The shield is the same one we’ve seen in a past trailer but of course Link had a different outfit then. Also the bow is a brand new one that’s not in BOTW. The sword handle also makes me think it's a new weapon. I like the triforce triangles on the shield and the not-really-Sheikah-eye eye. It’s got eyelashes.

General thoughts: I wonder if we get a super strong blood moon in the beginning and then the cycle returns to normal like BOTW or will we get more frequent blood moons or maybe blood moons are every night but they don’t work quite the same like moon is just red everynight and enemies are stronger but every once and a while we get a super blood moon that respawns enemies. Words: “Leave no survivors.” This part really makes me think more Demise than Ganondorf. The way the VA growled this part also made me think of Pig Ganon or Ganondorf’s beast form. Blue: It's kinda hard to make out but that’s a lot of malice. It’s really consuming the castle there.

Green: Green swirly thing is already present when the Ganon moon starts raining meteors. Does this mean that this footage isn’t from the first cutscene the trailer is alluding to but a later blood moon cycle? Do the swirly things appear as soon as the green seal breaks on Ganon? Or do they appear before and that's why Link and Zelda were exploring underneath the castle? Also this one happens to be in the same spot as the Jee Noh Shrine. Pink: Great plateau walls appear to be fixed and this is the area that should be full of snow. The spot is on the south side of Mount Hylia. Trust me I double checked and Ganon was so helpful as to spawn a blood moon while I was checking out the walls so I accidentally recreated this part of the trailer. Why did the climate on the plateau change so drastically and did Link and Zelda repair the walls?

First thoughts: WTF IS THAT THING??!! Second thoughts: Either it's some form of Ganon or it's a mutated malice guardian enemy. It reminds me of the corrupted evil egg guardian from Age of Calamity. I can’t decide if I want to fight it or run from it. Black: On the third look, it has bone claws/hands. Uhhh weird bone growths line up with the other enemies but this thing is disturbing me the longer I look at it. Time to move on.

General thoughts: So besides the dragon this is the only other elemental enemy. At least I think it's an enemy. Seems like a really massive and powerful Igneo Talus. Unless it's a piece of Death mountain area rising into the sky to become a lava island but that seems like a stretch.

General thoughts: Just wanted to note that since pieces of the castle are breaking off, the layout of the castle is probably gonna be changed from BOTW. Idk how much but it makes sense that they would want to alter the interior map. Not like the Castle wasn’t already a bit of a pain to navigate.

General thoughts: The red lighting looks extremely intimidating. 10/10 Pink: Malice pools where the Magnesis Shrine should be. Did Ganon’s malice eat the shrines? Where is it even coming from? Is it bubbling From underground or from the blood moon? Considering it’s so close to that bit of water near the shrine, it makes me wonder if certain water sources will be infected with malice and what that will do to the Zora. Green: Glowy symbols again. I really really want to know more about those. Yellow: The plateau walls here are damaged unlike the more fortified ones in the previous plateau picture. I also double checked and as far as I can tell this is the same exact damage that exists in BOTW. Maybe Link and Zelda didn’t get around to fixing it yet? Also if I acknowledge the time travel possibility then this just tells me that the blood moons happen in both time periods.

General thoughts: So Ganon is spawning these guys in. What does this mean for the regular bokoblins? Were they all cleared out by Link, Zelda, and a recovering Hyrule so Ganon just spawned in evolved versions? Also I can’t quite tell where this is (unless this is on the plateau walls, the nice fixed up ones we saw earlier considering the trees in the background). Oh well.

Blue: First off this is a Redead. This is a hundred percent a Redead and I give Nintendo 15/10 for scary design. Redeads are always meant to be terrifying. That being said, I will ancient arrow these things (that is if ancient arrows still exist.) Of course this begs the question. Which unlucky dead person got resurrected and mutated to be a Redead? Did Ganon turn dead Yiga into Redeads or is he using the dead Hylians that he killed during the Calamity? I wonder what the lore on these things is gonna be. Green: Big guy. A very large dude. Reminds me of the Moblins from Skyward Sword. Yellow: Bone growth on the red Moblin reminds me of a Pachycephalosaurus (dinosaur.)

Orange: Big storm in the sky but much better shot. As I said before it reminds me of the storm dome thing from Skyward Sword. Blue: Again I really like the way the malice looks streaming up and out from under the castle. It looks sufficiently ominous enough for my taste. Like that’s an evil castle right there. Green: I hunted for this area since there aren’t exactly many paved/cobbled roads in BOTW. The best I can tell is that this is the road between the Sacred Ground Ruins and the Mabe Village Ruins. Yes, I zoomed around Hyrule Field on my motorbike dodging guardian blasts every five seconds. Yeah, I felt pretty cool right up until I failed to dodge but then I murdered those two guardian stalkers so all was well.

General Thoughts: Looks like the area where the golfing minigame is in BOTW, that same valley that leads to the Forgotten Temple. Blue: There is a Molduga in that avalanche. What the heck is that about?

Green: What is that arm holding? I know it's likely a mechanical part of some sort but I thought it was a brush at first lmao Red: Makes me think of Purah and/or Robbie but this area is definitely brand new. Maybe one or both remodeled. Or it’s neither of them but a secret third option. Still the blue glow also makes me think of teleportation so maybe it's not completely go

General thoughts: Poor Link getting accosted by Doctor Octopus arms. Blue: That’s the Shiekah eye so this is probably a Shiekah place. Still, why does this place give me Yiga vibes? Pink: Let me just appreciate actual chainmail under that Champion's tunic. Green: Clawed ancient hand. I’m very fascinated by it so just noting that it’s not glowing here.

Blue: The strange rocks. They make me think of meteorites but also the big guardian pillars that surround the castle and the material that make up the shines. Did Ganon explode those pillars and pieces of them are now littered across Hyrule? Did they just emerge out of the ground? Or, if we’re thinking about time travel, are these the materials that the Shiehka later use to make the shrines and those pillars.? Green: Big dude has a large horn. The skulls on him remind me of the bokoblin skulls that you could collect from defeated bokoblins in Skyward Sword. Also does he have an ax on his head? Pink: I went to check all the areas I could with this type of tree (Taoba Grasslands, Oseira Plains, and the area right beneath the words Gerudo Canyon which by the way has fairies lurking around) but not a single one has greenish grass with flowers. Maybe the grass literally grew greener after Calamity was defeated for a bit. Hyrule restoring itself and all that jazz.

General thoughts: Hehe look at that Hinox with his dumb little hat. Also we are in a cave. We are totally getting underground sections. Pink: This green orb looks like the one you find on the Thundra plateau. It’s also making me think of the three orbs you have to collect in Wind Waker and place in those statues. Farore vibes. Red: What is this glow? Is it the orb or something else?

General thoughts: Yes, another one of the Hinox chase. I want you to appreciate Link’s running animation… jk. I’m just noting that I’ve never seen those plants in BOTW. You must be telling yourself OP how could you expect to know every little plant in BOTW but I’m telling you I’ve played the game for somewhere around 1000 hours and I’ve watched too many BOTW videos to count. Also there are plants growing on the cave walls in the back. (I kept an eye out while I was double checking other things for this breakdown and still couldn’t find these plants. Pls correct me if I’m wrong)

General thoughts: New paraglider, yay. I mean it doesn’t seem that different but I now know we can customize it with different fabrics. I hope there are in-game customizations as well as the amiibo ones. Also, no Ridgeland Tower. I really wonder where the heck all of them went. Red: I like that you can see all these islands in the sky from down here. Also what the heck is that cube island? Limcube said he thought it was related to the mazes but I don’t wanna think of dealing with a rubix cube maze that's vertical and horizontal. I’m gonna be lost for weeks.

General thoughts: Obviously, the symbols are driving me nuts. I wanna know what they are for so badly. I do think it's funny we can just ride a horse right through them. I just know someone is gonna try and set this grass on fire to see what happens. Red: What is this thing? It’s hard to make out but it looks like it has four limbs, a tail, and tusks maybe? Yeah it looks kinda like an elephant. I wonder if it's another new enemy. Blue: Just think it's funny that there’s a random rock here.

Blue: They are like the Twilight Princess Kargarok. I know I’m not the only one getting flashbacks to that one minigame where you had to hit those fruit balloons while the Kargarok was carrying Wolf Link similar to this. Green: New weapon that looks like a primitive hatchet. Yellow: So in BOTW this is the area that’s covered in darkness (Typhlo Ruins). I wonder why it isn’t covered in shadow here. Pink: Storm in the sky. I just like pointing this out. I wanna explore the storm tornado cause I just know something is interesting there. LET ME IN!

Pink: This guy has bull horns like a Longhorn (sorry it's hard to see here). I like this design. I didn’t get a picture of it but he slams his head into the ground so I’m assuming it's a new type of attack. So that means, even if the enemies look mostly the same, we should watch out for new attack patterns. Yellow: This is the Wooden shield so not new. Green: again looks like the Pachycephalosaurus (dinosaur).

General thoughts: They really just stacked stuff on top of the enemy skull camps. Blue: What is this stick weapon? Maybe, it's at an odd angle but it doesn’t look long enough to be a wooden spear and it’s definitely not a regular BOTW stick. It’s like a slightly heavier stick lol.

General thoughts: Whoa this is such a cube enemy, a block man. Square. Obviously, it reminds me of both Tetris and Minecraft. Also I really like that it’s so bright because the islands are closer to the sun. Red: Probably very much a glowing weakness. I hope we can break that specific block. It also glows the same shade as Link’s new arm so Zonai tech?? Blue: Pointing out the sky islands again. I really like the variety of shapes and altitudes. I can’t wait to explore these.

Next

#part one of trailer breakdown#tears of the kingdom#totk#botw2#botw link#botw totk#loz botw2#loz totk#loz link#legend of zelda#totk trailer#loz#princess zelda#ganondorf#picture

72 notes

·

View notes

Text

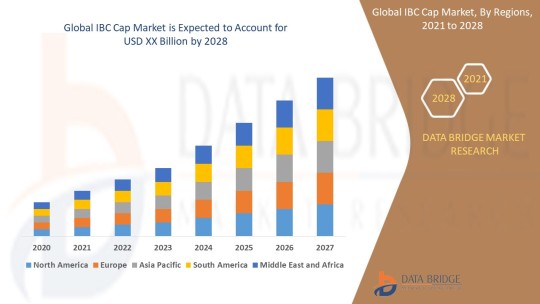

IBC Cap Market Size, Share, Trends, Growth and Competitive Analysis

"IBC Cap Market – Industry Trends and Forecast to 2028

Global IBC Cap Market, By Product Type (Flange, Plugs, Vent-in Plug, Vent-out Plug and Screw closure), Type (Plastic IBC, Metal IBC and Composite IBCs), Material Type (Plastics, Metal, Aluminium and Steel), End Use (Chemicals & Fertilizers, Petroleum & Lubricants, Paints, Inks & Dyes, Food & Beverage, Agriculture, Building & Construction, Healthcare & Pharmaceuticals and Mining), Application (Food And Drinks, Chemical Industry, Oil and Agriculture), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Access Full 350 Pages PDF Report @

The global IBC cap market is expected to witness significant growth over the forecast period due to the increasing demand for intermediate bulk containers (IBCs) in various industries such as chemicals, food and beverages, pharmaceuticals, and others. The IBC caps play a crucial role in ensuring the safe storage and transportation of liquid products. The market growth is also being driven by technological advancements in IBC cap designs, such as tamper-evident seals and spouts for easy dispensing. Additionally, the growing focus on sustainability and recyclability of packaging materials is further boosting the adoption of IBC caps made from eco-friendly materials.

**Segments**

- Based on material type, the IBC cap market can be segmented into plastic, metal, and others. Plastic caps are widely used due to their lightweight nature and cost-effectiveness. - By cap type, the market can be categorized into screw caps, snap-on caps, and flip-top caps. Screw caps are preferred for their secure sealing properties. - On the basis of end-user industry, the market can be divided into chemicals, food and beverages, pharmaceuticals, and others. The chemicals segment is anticipated to hold a significant market share due to the widespread use of IBCs for storing chemical products.

**Market Players**

- TPS Industrial Srl - Schuetz GmbH & Co. KGaA - Mauser Packaging Solutions - Time Technoplast Ltd - Berry Global Inc. - THIELMANN UCON AG - Precision IBC, Inc. - Peninsula Packaging LLC

These market players are actively involved in strategic initiatives such as product launches, partnerships, and acquisitions to strengthen their market presence and expand their product offerings. The competitive landscape of the IBC cap market is characterized by intense competition, prompting companies to focus on innovation and quality to gain a competitive edge.

The Asia-Pacific region is expected to witness substantial growth in the IBC cap market, driven by the rapid industrialization and the increasing adoption of IBCsThe Asia-Pacific region represents a significant growth opportunity for the global IBC cap market due to several key factors. With rapid industrialization and the expanding manufacturing sector in countries like China, India, and Southeast Asia, there is a growing demand for efficient storage and transportation solutions, including IBCs and their associated caps. The increased focus on chemical production, food processing, and pharmaceutical manufacturing in the region further fuels the need for reliable packaging solutions like IBC caps. As these industries continue to grow, the adoption of IBC caps is expected to rise, driving market expansion in the Asia-Pacific region.

Moreover, the emphasis on enhancing safety standards and ensuring product integrity is a crucial factor contributing to the growth of the IBC cap market in Asia-Pacific. Regulations regarding the safe handling and transportation of hazardous chemicals and pharmaceuticals necessitate the use of high-quality caps that can effectively seal and protect the contents of IBCs. As companies in the region strive to comply with stringent regulatory requirements, the demand for advanced and secure IBC caps is projected to increase significantly.

Additionally, the shift towards sustainability and eco-friendly practices is another trend shaping the IBC cap market in Asia-Pacific. With growing environmental concerns and increasing awareness about plastic pollution, there is a rising preference for IBC caps made from recyclable and biodegradable materials. Market players in the region are focusing on developing sustainable packaging solutions to meet the evolving consumer demands and align with global sustainability goals. This shift towards eco-friendly IBC caps not only addresses environmental concerns but also presents market players with opportunities to differentiate their offerings and attract environmentally conscious customers.

Furthermore, the competitive landscape of the IBC cap market in Asia-Pacific is characterized by the presence of both local manufacturers and international players. Local companies often have a strong understanding of regional market dynamics and customer preferences, giving them a competitive advantage in catering to specific industry needs. On the other hand, multinational companies bring technological expertise and a wide product portfolio, which can appeal to a broader customer base seeking innovative and**Global IBC Cap Market, By Product Type**

- Flange - Plugs - Vent-in Plug - Vent-out Plug - Screw closure

**Type**

- Plastic IBC - Metal IBC - Composite IBCs

**Material Type**

- Plastics - Metal - Aluminium - Steel

**End Use**

- Chemicals & Fertilizers - Petroleum & Lubricants - Paints, Inks & Dyes - Food & Beverage - Agriculture - Building & Construction - Healthcare & Pharmaceuticals - Mining

**Application**

- Food And Drinks - Chemical Industry - Oil and Agriculture

The Global IBC Cap market is experiencing significant growth due to the rising demand for intermediate bulk containers across various industries. Plastic caps are increasingly preferred for their lightweight and cost-effective nature, driving market growth within the material type segment. Screw caps, known for their secure sealing properties, dominate the cap type category. The chemicals segment is anticipated to hold a substantial market share among end-user industries, attributed to the widespread use of IBCs for chemical storage. The market players in the industry are focusing on strategic initiatives like product launches and partnerships to enhance their market presence and offerings. The competitive landscape is intense, spurring companies to innovate and prioritize quality for a competitive advantage.

In Asia-Pacific, the IBC cap market is poised for robust growth fueled by rapid industrialization and the expanding manufacturing sector, particularly in countries like China,

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Key Coverage in the IBC Cap Market Report:

Detailed analysis of IBC Cap Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the IBC Cap industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse Trending Reports:

Calcium Glycinate Market Retinal Biologics Market Facial Fat Transfer Market Angio Suites Diagnostic Imaging Market Adoption Of Benelux Power Tools Market De Quervains Tenosynovitis Treatment Market Biodetectors And Accessories Market Colposcope Market Sports Medicine Market Automotive Adhesives Market Infrared Imaging Market Vapour Deposition Market Professional Diagnostics Market Ct Scanner Market Programmable Application Specific Integrated Circuit Asic Market Hospital Operating Room Or Products And Solutions Market Castor Oil Market Zika Virus Infection Drug Market Toluene Diisocynate Market Antibiotic Resistance Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

2 notes

·

View notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Tungsten Prices, News, Trend, Graph, Chart, Forecast and Historical

Tungsten prices are a key indicator of market trends and industrial demand, making the tungsten market an essential topic for analysis. Tungsten, known for its remarkable density, high melting point, and exceptional durability, is a critical material in various industrial applications, ranging from aerospace and automotive to electronics and construction. The price dynamics of tungsten are influenced by a combination of supply and demand factors, geopolitical developments, and advancements in technology. Over recent years, fluctuations in tungsten prices have garnered attention from industry stakeholders, manufacturers, and investors alike, as the material’s strategic importance continues to grow.

The primary factor driving tungsten prices is its supply chain, which is heavily reliant on mining operations concentrated in specific regions. China is the dominant producer of tungsten, accounting for a significant portion of global supply. This concentration of production means that any disruptions in Chinese mining operations or export policies can have profound effects on the global market. For instance, stringent environmental regulations or export quotas imposed by China can lead to supply shortages, driving up prices. On the other hand, the discovery of new tungsten reserves or advancements in recycling technologies can help stabilize prices by diversifying the supply base.

Get Real time Prices for Tungsten : https://www.chemanalyst.com/Pricing-data/tungsten-1606

Demand for tungsten is another critical element influencing its market prices. The metal is widely used in manufacturing hard metals, such as tungsten carbide, which are essential for cutting tools, mining equipment, and wear-resistant applications. Economic growth and industrial expansion often correlate with increased demand for tungsten, as industries ramp up production activities. For example, the construction boom in developing countries has fueled the demand for tungsten-based materials used in heavy machinery and infrastructure projects. Additionally, tungsten's role in high-tech applications, such as in semiconductors, batteries, and renewable energy systems, is driving further interest, particularly as global efforts toward sustainability and energy efficiency gain momentum.

Geopolitical factors also play a pivotal role in shaping tungsten prices. Trade disputes, tariffs, and restrictions on critical minerals have the potential to disrupt the tungsten supply chain. The growing emphasis on securing domestic supplies of critical materials has led countries to explore alternative sources of tungsten or invest in recycling initiatives. The United States and European Union, for example, have identified tungsten as a critical mineral and are actively seeking ways to reduce reliance on imports. This strategic shift may impact long-term price trends as new supply chains are developed and diversified.

Advancements in technology are contributing to changes in the tungsten market, with significant implications for prices. Innovations in recycling and material substitution are helping industries reduce their dependence on virgin tungsten, thereby easing pressure on primary supply. For instance, the development of efficient recycling techniques for tungsten scrap is not only reducing waste but also creating a secondary supply stream, which can act as a buffer against price volatility. Similarly, research into alternative materials for certain applications may reduce tungsten consumption, potentially leading to a stabilization or even a decline in prices over time.

Market speculation and investment trends also influence tungsten pricing. As tungsten is classified as a strategic and critical mineral, it attracts interest from investors looking to hedge against supply chain risks or capitalize on its growing demand in emerging industries. Speculative activities can lead to short-term price spikes or dips, adding a layer of complexity to the market. Moreover, the integration of tungsten into green technologies, such as wind turbines and electric vehicles, has positioned it as a material of the future, further increasing its attractiveness to investors.

Environmental and sustainability concerns are reshaping the tungsten market, with implications for prices. The mining and processing of tungsten have environmental impacts that are coming under increasing scrutiny from regulators and advocacy groups. Companies are being pushed to adopt greener practices, which can increase production costs and, consequently, market prices. On the flip side, the emphasis on sustainability is driving innovation, as companies look for ways to optimize resource use and minimize environmental footprints, potentially mitigating cost increases over the long term.

Global economic conditions remain a fundamental driver of tungsten prices. Periods of economic expansion typically result in increased industrial activity and higher demand for tungsten, pushing prices upward. Conversely, economic downturns can lead to reduced demand and lower prices. The COVID-19 pandemic, for instance, disrupted global supply chains and dampened industrial activity, resulting in significant volatility in tungsten prices. As economies recover and industrial production resumes, demand for tungsten is expected to rebound, although uncertainties remain regarding the pace and sustainability of this recovery.

The outlook for tungsten prices is closely tied to macroeconomic trends, technological advancements, and policy developments. With increasing demand from high-tech and green industries, the long-term prospects for tungsten remain robust. However, challenges such as geopolitical risks, environmental regulations, and market volatility require careful navigation by industry stakeholders. Monitoring these factors and adopting proactive strategies will be essential for businesses and investors aiming to capitalize on opportunities in the tungsten market.

In conclusion, tungsten prices reflect a complex interplay of supply and demand dynamics, geopolitical influences, technological advancements, and environmental considerations. As a critical material with applications across a wide range of industries, tungsten's market trends are indicative of broader economic and technological shifts. By understanding the factors driving tungsten prices, stakeholders can better position themselves to navigate this dynamic market, ensuring resilience and competitiveness in the face of evolving challenges and opportunities.

Get Real time Prices for Tungsten : https://www.chemanalyst.com/Pricing-data/tungsten-1606

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Tungsten#Tungsten Price#Tungsten Prices#Tungsten Pricing#Tungsten News#india#united kingdom#united states#germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Dental Ozone Therapy Units Market Analysis 2025-2033: Demand, Innovation, and Competitive Landscape

Dental Ozone Therapy Units Market

The Global Dental Ozone Therapy Units Market size is projected to grow at a CAGR of XX% during the forecast period.

Research Methodology

Our research methodology constitutes a mix of secondary & primary research which ideally starts from exhaustive data mining, conducting primary interviews (suppliers/distributors/end-users), and formulating insights, estimates, growth rates accordingly. Final primary validation is a mandate to confirm our research findings with Key Opinion Leaders (KoLs), Industry Experts, Mining and Metal Filtration includes major supplies & Independent Consultants among others.

The Global Dental Ozone Therapy Units Market Report provides a 360-degree view of the latest trends, insights, and predictions for the global market, along with detailed analysis of various regional market conditions, market trends, and forecasts for the various segments and sub-segments.

Get Sample Report: https://marketstrides.com/request-sample/dental-ozone-therapy-units-market

LIST OF KEY COMPANIES PROFILED:

Carbotech

DGE Gmbh

DMT Environmental Technology

Kohler & Ziegler

Prometheus Energy

Acrona Systems

Envirotech

SEGMENTATION

By Type

Table-Top

Trolley-Mounted

By Application

Hospital

Dental Clinic

Other

Get In-Detail : https://marketstrides.com/report/dental-ozone-therapy-units-market

Dental Ozone Therapy Units Market REGIONAL INSIGHTS

North America

United States: The U.S. economy has shown resilience post-pandemic but faces inflationary pressures, particularly in housing and consumer goods. The Federal Reserve's interest rate policies remain a focus, as the balance between controlling inflation and avoiding recession has impacted spending, borrowing, and business growth. Key sectors like tech, finance, and renewable energy are experiencing dynamic changes, with AI, fintech, and green technology receiving heavy investments.

Canada: Economic stability remains a hallmark of Canada’s economy, although housing affordability and household debt are pressing issues. Canada continues to emphasize a green energy transition, investing in hydroelectric, wind, and solar power. The nation is also focused on attracting skilled labor, especially in technology, healthcare, and energy, as part of its economic strategy.

Mexico: Mexico has benefited from a nearshoring trend, as companies look to relocate manufacturing closer to the U.S. market. With a strong trade relationship via USMCA (the U.S.-Mexico-Canada Agreement), Mexico is seeing investments in its automotive, aerospace, and electronics industries. However, inflation, interest rates, and a need for infrastructure development remain areas of focus.

Buy Now : https://marketstrides.com/buyNow/dental-ozone-therapy-units-market?price=single_price

FAQ

+ What are the years considered for the study?

+ Can the report be customized based on my requirements?

+ When was the Research conducted/published?

+ What are the mixed proportions of Primary and Secondary Interviews conducted for the study?

+ When will the report be updated?

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬

Market Strides is a Global aggregator and publisher of Market intelligence research reports, equity reports, database directories, and economic reports. Our repository is diverse, spanning virtually every industrial sector and even more every category and sub-category within the industry. Our market research reports provide market sizing analysis, insights on promising industry segments, competition, future outlook and growth drivers in the space. The company is engaged in data analytics and aids clients in due-diligence, product expansion, plant setup, acquisition intelligence to all the other gamut of objectives through our research focus.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:[email protected]

#Dental Ozone Therapy Units Market Size#Dental Ozone Therapy Units Market Share#Dental Ozone Therapy Units Market Growth#Dental Ozone Therapy Units Market Trends#Dental Ozone Therapy Units Market Players

0 notes

Text

Degaussing System Market Size, Share, Overview & Competitive Analysis by 2032

In 2022, the global degaussing system market was valued at $881.7 million and is projected to grow steadily, reaching $1,164.6 million by 2030 with an annual growth rate of 3.7%. Degaussing systems play a critical role in naval defense by reducing the magnetic signatures of ships and submarines, making them harder to detect and less vulnerable to attacks. These systems work by identifying and neutralizing magnetic anomalies caused by metal components in vessels. The rising threat of naval mines is expected to drive market growth in the coming years.

Get a Free Sample Research PDF:+

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/degaussing-system-market-108153

Key Players in the Market

The market is dominated by several leading companies, including:

Wärtsilä Corporation (Finland)

Larsen & Toubro Limited (India)

Ultra Electronics Holdings plc (U.K.)

L3 Harris Technologies, Inc. (U.S.)

American Superconductor Corporation (U.S.)

Polyamp AB (Sweden)

Raytheon Technologies Corporation (U.S.)

Groupe Gorgé (France)

STL Systems AG (Switzerland)

Hensoldt AG (Germany)

Market Segments and Growth Drivers

1. By Component

The market is divided into power supplies, degaussing coils, control units, monitoring systems, and others. Among these, degaussing coils are expected to grow the fastest. This is largely due to the increasing demand for retrofitting, maintenance, and servicing of naval vessels.

2. By Solution

The market includes degaussing, deperming, and ranging solutions. The degaussing segment leads the market, driven by the growing demand for onboard demagnetizing systems that help protect naval vessels from threats.

3. By Vessel Type

The market is segmented into amphibious ships, destroyers, frigates, landing craft, Offshore Patrol Vessels (OPVs), mine warfare ships, submarines, and others. Frigates are expected to experience the highest growth, driven by the increasing demand for surface combatants equipped with advanced capabilities.

4. By End User

The market includes OEMs, aftermarket, and services. The aftermarket segment is projected to grow the fastest due to the rising need for maintenance and calibration of degaussing systems to ensure optimal performance.

Regional Insights

Asia Pacific

This region dominated the market in 2022, thanks to a large naval fleet and initiatives like the Royal Australian Navy’s plan to establish a magnetic treatment facility in Western Australia. This facility aims to streamline the process of reducing ships' magnetic signatures.

Europe

Europe held the second-largest market share in 2022, driven by increasing maritime security concerns and investments in advanced naval defense systems.

Drivers and Challenges

The demand for advanced degaussing systems is rising as naval defense evolves to counter threats like magnetic mines. These systems are becoming essential in electronic warfare, providing critical protection for naval fleets. However, their maintenance and servicing require specialized expertise, which can be costly, potentially hindering market growth.

Competitive Landscape

The market includes prominent players such as Wärtsilä Corporation, Ultra Electronics, and L3 Harris Technologies, which focus on innovation and strategic partnerships to strengthen their market positions.

Recent Development: In January 2022, American Superconductor Corporation delivered a high-temperature superconductor-based ship protection system for deployment on the USS Fort Lauderdale, a San Antonio-class amphibious transport dock ship.

0 notes

Text

Key Drivers Influencing the Tunable Diode Laser Analyzer Market

Key Drivers Influencing the Tunable Diode Laser Analyzer Market

Straits Research is pleased to announce the release of its comprehensive report on the Tunable Diode Laser Analyzer Market, which provides an in-depth analysis of market dynamics, trends, and projections for the coming years. This report is essential for stakeholders looking to navigate the evolving landscape of this critical technology.

Tunable Diode Laser Analyzers utilize advanced laser absorption spectroscopy techniques to measure the concentration of specific gases in a mixture. This non-contact method allows for rapid and accurate measurements, making TDLA an essential tool in applications ranging from ambient air quality monitoring to stack emissions testing. The technology’s capability to provide continuous measurements with minimal interference from other gases enhances its appeal in industries that require high precision and reliability.

Market Overview

The global tunable diode laser analyzer market was valued at USD 605.48 million in 2023. It is estimated to reach USD 1,089.96 million by 2032, growing at a CAGR of 6.75% during the forecast period (2024–2032). The increasing demand for accurate gas analysis in various industries, particularly in the chemical and pharmaceutical sectors, is a key driver of this growth. TDLA technology is crucial for ensuring safety and compliance with environmental regulations by monitoring hazardous gases and emissions effectively.

Request sample linK:https://straitsresearch.com/report/tunable-diode-laser-analyzer-market/request-sample

Definition and Latest Trends

Tunable Diode Laser Analyzers are advanced instruments used for precise measurement of gas concentrations in various applications, including environmental monitoring, process control, and emissions testing. These analyzers utilize tunable diode laser technology to provide real-time data with high sensitivity and specificity, making them indispensable in industries where gas composition is critical.Recent trends indicate a rising focus on environmental monitoring due to stringent regulatory standards aimed at reducing emissions. Additionally, advancements in automation technologies are leading to increased adoption of TDLA systems across various sectors. The integration of these analyzers into process control systems enhances operational efficiency and safety, further driving market growth.

Market Segmentation

The report segments the Tunable Diode Laser Analyzer market into several categories:

By Type

In-Situ

Extractive

By Gas Analyzer Type

Oxygen Analyzers

Ammonia Analyzers

COx Analyzers

Moisture Analyzers

Hx Analyzers

CxHx Analyzers

Others

By Device Type

Fixed

Portable

By Applications

Power Industry

Oil and Gas

Mining and Metal

Chemical and Pharmaceutical

Pulp and Paper

Electronic and Semiconductor

Others

By End-Use Industry

Cement

Chemical & Pharmaceutical

Electrical and Electronics

Metal & Mining

Oil & Gas

Power

Pulp & Paper

Others

Growth Factors and Opportunities

The growth of the TDLA market is primarily driven by the increasing demand for real-time gas monitoring solutions across various industries. The rise in industrial automation, coupled with a growing focus on environmental sustainability, presents significant opportunities for market expansion. Furthermore, advancements in TDLA technology that enhance measurement accuracy and reduce operational costs are likely to attract more users.In particular, the oil and gas sector remains a dominant application area due to its need for stringent emission controls and safety measures. As industries continue to evolve, the demand for innovative solutions like TDLA will only increase.

Key Players in the Market

The report identifies several key players who are leading the Tunable Diode Laser Analyzer market:

ABB Ltd.

Siemens AG.

Yokogawa Electric Corporation.

Endress+Hauser Group Services AG.

Ametek Inc.

Mettler-Toledo International Inc.

Teledyne Analytical Incorporated.

Spectris Plc (Servomex Group Limited).

SICK AG.

Campbell Scientific, Inc.

Gabr Industrial & Petroleum Services.

Pine Environmental Services, Inc.

Mark Maidman Co., Inc.

Buy Now:https://straitsresearch.com/buy-now/tunable-diode-laser-analyzer-market

These companies are actively engaged in strategies such as product development, partnerships, and acquisitions to strengthen their market position.

About Straits Research:

Straits Research stands out in the market research landscape due to its robust methodologies, extensive industry expertise, and client-focused approach. By leveraging their insights, businesses can navigate complex market environments effectively and capitalize on emerging trends to achieve sustainable growth.

#Tunable Diode Laser Analyzer Market#Tunable Diode Laser Analyzer Market Share#Tunable Diode Laser Analyzer Market Size#Tunable Diode Laser Analyzer Industry

0 notes

Text

Top ASX Stocks to Watch in January 2025: Experts' Picks

As the ball of January 2025 rolls in, the state of the Australian Securities Exchange (ASX) has been dynamic for investors. The very first and most important aspect of making the right investment decisions is knowing what stocks have a likelihood of growing. Here are some of the top ASX stock market picks to keep an eye on this month, based on recent market analysis and expert opinions.

1. Commonwealth Bank of Australia (ASX: CBA)

Commonwealth Bank has, while showing great strength, now emerged as the country's most valuable company. During 2024, the stock value of the bank soared to almost 39%, due to good earnings and investor confidence. Analysts even stated that such solid financial support and strategic moves would continue propelling growth for this bank into 2025.

2. BHP Group Ltd (ASX: BHP)

BHP is a global resources company that stands to benefit the most from the predicted increase in commodity demand, like copper, used for renewable energy and technological growth. According to market analysts, CSL Limited's diversified portfolio and strategic investments could help its growth in the coming year.

3. CSL Limited (ASX: CSL)

CSL, a biotechnology company that specializes in biotherapeutics, is likely to have good earnings growth going forward. Being on the way to innovation and more products, it is also a good company for investors who are looking into the Australian stock market's healthcare space.

4. Woodside Energy Group Ltd (ASX: WDS)

Woodside Energy has the energy sector coming back to normal with growth of companies. Now, as energy demand is moving globally, with Woodside Energy's strategic projects and focus on sustainable energy solutions, it holds a position amongst the most prominent players in the market.

5. ResMed Inc. (ASX: RMD)

ResMed, an electronics company that designs and manufactures medical devices for respiratory conditions, has reported revenue growth of 11% compared to last year to $1.2 billion for the quarter ended September 30, 2024. The firm bases its strategy around scaling operations and investing in organic growth-a part of the company taking cues from the recovery in the Australian economy, making it a stock to keep watch on.

6. Fortescue Metals Group Ltd (ASX: FMG)

Good fortune at Fortescue Metals is the positive momentum the iron ore majors are witnessing while other mining behemoths reap gains. Economic policies of China can influence demand for commodities and hence, an eye must be kept on how the iron ore market is doing well for Fortescue.

7. Goodman Group (ASX: GMG)

Goodman Group-the firm specializing in industrial property and logistics, recorded an increase of 1.4% in stock value. The current upsurge in the e-commerce market promises to continue such increases.

8. Liontown Resources Limited-(ASX: LTR)

Liontown Resources, a mining company of lithium, had 7.62% increase in its stock. The increasing use of lithium for battery technology and electric vehicles means that Liontown's projects would be an excellent growth opportunity especially in the Australian stock market.

9. Paladin Energy Ltd (ASX: PDN)

Paladin Energy is a uranium producing company whose shares increased by 4.497%. The temporary halt of the production at Kazakhstan's major mine has caused the uranium stocks to go up. This may represent a good future for the nuclear power industry.

10. National Australia Bank Ltd (ASX: NAB)

NAB has been positive on trading performance and is expected to be influenced by possible interest rate cuts by the Reserve Bank of Australia, which may influence valuations in the banking sector. As monetary policy changes, opportunities may arise for investors within the stock trading and financial space.

Conclusion

Investing in the ASX stock market requires careful consideration of current market trends, company performance, and economic indicators. The stocks mentioned above have shown promising signs as of January 2025, but it's crucial to conduct thorough research and consider your financial goals before making investment decisions. Consulting with a financial advisor can provide personalized guidance tailored to your investment strategy. Disclaimer: This article is for information purposes only and is not financial advice. Investing in the Australian stock market is always fraught with risks, and past performance does not necessarily translate to future results. Therefore, do your own research or seek a licensed financial advisor before investing.

1 note

·

View note

Text

Lithium and Copper: The Metals That Will Shape the Future

🔋🌍 Lithium and copper are set to revolutionize the economy as the demand for electric vehicles and renewable energy soars! 🌱✨ With innovations in battery tech and sustainable materials, the future looks bright for clean energy.

In the coming years, certain metals are poised to fundamentally change the global economy—foremost among them are lithium and copper. These two raw materials are becoming increasingly indispensable for the energy and transportation industries as the world shifts towards renewable energy and electric vehicles. Lithium: The Fuel of the Energy Transition Lithium plays a central role in the…

#battery technology innovations#climate change solutions#copper demand forecast#eco-friendly materials#electric vehicle batteries#electrification of transportation#energy efficiency technologies#energy transition strategies#environmental impact of mining#future of electrification#innovations in renewable energy#Lithium market trends#Make money online#market analysis of lithium#metals for clean energy#nickel applications in batteries#Online business#Passive income#perovskite solar cells#renewable energy investment#renewable energy sources#sustainable metals#sustainable resource management

0 notes

Text

U.S. Barite Market Analysis: Regional Insights and Industry Trends

The U.S. barite market size was estimated at USD 513.6 million in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. The market is primarily driven by the increasing offshore oil and gas drilling activities. Barite is added to the fluid used for drilling oil and natural gas wells to increase its density. The U.S. oil & gas industry is one of the largest markets for barite. A steady rise in tight oil production has played a pivotal role in driving market growth. According to the U.S. Energy Information Administration (EIA), U.S. crude oil production was at a record high of 13.3 million barrels per day (b/d) in December 2023. However, it is projected to experience a slight dip in the middle of 2024 and will surpass the December 2023 record by February 2025.

Barite is a versatile mineral that has several important uses in the healthcare industry. Barite is widely used as a radiopaque agent in diagnostic medical tests including X-rays and CT scans to generate clear images of the gastrointestinal tract and other parts of the body. It is also used as a filler in tablets and capsules to help maintain their shape and size.

Barite mining has potential adverse effects on the environment, causing habitat destruction, soil erosion, and water pollution. This has impelled the mining companies to comply with stringent environmental regulations and mitigate the risks. In the U.S., laws and regulations are authorized by the United States Environmental Protection Agency (EPA). Under the regulations, the metal sector is included in the manufacturing sector (NAICS 31 - 33). It includes the nonferrous metals industry and the metal industry. The presence of strict regulatory norms is aiding ethical manufacturing activities.

U.S. Barite Market Report Highlights

The oil & gas segment accounted for the largest revenue share of over 82.7% in 2023 owing to the rising crude oil extraction in the country. As per the EIA, the U.S. crude oil production broke record with an average production of 12.9 million barrels per day. This strengthens the country’s position in the global oil & gas industry.

The fillers segment is expected to expand at the fastest CAGR from 2024 to 2030. Barite as filler is widely adopted due to its nontoxicity, high specific gravity, and chemical inertness. It is an excellent substitute for materials such as titanium dioxide, basofor, and crypton, which are also used as fillers in paints & coatings, and other industries.

U.S. Barite Market Report Segmentation

This report forecasts revenue & volume growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. barite market report based on application:

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Oil & Gas

Chemicals

Fillers

Others

Order a free sample PDF of the U.S. Barite Market Intelligence Study, published by Grand View Research.

0 notes

Text

Understanding Canadian Gold Prices: A Key to Smart Investment

Gold has been a precious commodity for centuries, sought after for its beauty, rarity, and value. For investors, gold has always been a safe haven during economic uncertainties. If you're considering investing in gold, it's essential to understand how Canadian gold prices fluctuate and what factors influence them. In this article, we’ll delve into the factors affecting gold prices in Canada and where to find the most accurate gold rate in Canada.

Factors Influencing Canadian Gold Prices

The price of gold can be influenced by a variety of factors, from global economic trends to geopolitical tensions. In Canada, gold prices are often impacted by the following:

Global Economic Conditions: The health of the global economy plays a crucial role in determining the value of gold. During periods of economic uncertainty or inflation, investors tend to flock towards gold as a safe investment.

Currency Value: Since gold is traded in U.S. dollars globally, fluctuations in the value of the Canadian dollar can directly impact the gold rate in Canada. When the Canadian dollar weakens against the U.S. dollar, gold becomes more expensive for Canadian investors.

Gold Supply and Demand: The availability of gold and the demand from various sectors such as jewelry, electronics, and central banks can cause significant shifts in the price.

Interest Rates: Higher interest rates make non-yielding investments like gold less attractive, leading to a decrease in its price. Conversely, when interest rates are low, gold prices tend to rise as it becomes a more appealing investment option.

How to Track the Gold Rate in Canada

To stay updated with the latest gold rate in Canada, it’s crucial to follow reliable sources that provide real-time price information. One such trusted platform is Gold Stock Canada. This website offers comprehensive information on Canadian gold prices, including charts, historical data, and expert analysis. Whether you're looking to buy or sell gold, having access to the most accurate prices ensures that you make informed decisions.

Why Invest in Gold in Canada?

Canada is home to some of the world's most prominent gold mines, making it a top producer of this precious metal. Gold investments in Canada are not only a way to preserve wealth but also a means to profit from the country's thriving gold industry. Understanding Canadian gold prices is a first step in ensuring that your investments remain profitable.

Conclusion

When it comes to investing in gold, having access to reliable and up-to-date information is essential. By staying informed on the gold rate in Canada, you can make better decisions whether you're buying, selling, or holding gold as part of your portfolio. Don't forget to check Gold Stock Canada for the latest price updates and expert insights on the Canadian gold market. With the right knowledge, you can take advantage of opportunities in the gold market to safeguard your financial future.

0 notes

Text

Mining Logistics Market Opportunity, Driving Factors And Highlights of The Market

The global mining logistics market size was estimated at USD 28.86 billion in 2023 and is projected to grow at a CAGR of 14.9% from 2024 to 2030. The market growth can be attributed to the increasing demand for metals and minerals, expansion of mining activities in remote areas, and technological advancements. Countries, like China, India, and Brazil are witnessing rapid industrialization and urbanization, leading to increased consumption of raw materials. This in turn, is driving the demand for efficient logistics solutions to transport these materials from mines to processing plants and end-users.

The expansion of mining activities in remote and hard-to-reach areas is another key market growth driver. As easily accessible mineral deposits are depleted, mining companies are exploring new regions, often located in challenging terrains with limited infrastructure. This necessitates the development of specialized logistics solutions to ensure the smooth transportation of raw materials. Furthermore, government policies and infrastructure development initiatives are playing a crucial role in shaping the mining logistics market. Governments across the globe are investing in the development of transportation networks, including road, railways, and ports, to support the mining industry.

One of the most significant trends in the market for mining logistics is the shift towards automation and smart logistics. Companies are increasingly adopting automated vehicles, drones, and robotics to streamline operations, reduce labor costs, and improve safety. Furthermore, integration of AI and machine learning in supply chain management enable companies in the market to optimize logistics operations by predicting demand, managing inventory, and identifying potential disruptions in real-time.

Gather more insights about the market drivers, restrains and growth of the Mining Logistics Market

Key Mining Logistics Company Insights

Some of the key companies operating in the mining logistics market include A.P. Moller - Maersk, ATG Australian Transit Group, Bis Industries, Blue Water Shipping, Centurion, Linfox Pty Ltd., PLS Logistics, TIBA, Tranz Logistics, and Vale.

• Blue Water Shipping is a provider of logistics services across the globe. The company’s logistics expertise includes aerospace logistics, mining logistics, chemical logistics, energy logistics, and solar energy logistics, among others. The company’s capacity for bulk cargo, cost-effectiveness, and access to specialized port infrastructure make it the most reliable and economical option for moving mined materials internationally.

• CSM Tech is engaged in providing specialized technology solutions for industries including agriculture, mining, education, healthcare, hospitality, and food security, among others. The company drives digital transformation through IoT, AI, and data analytics, offering innovative, customizable services tailored to mining companies’ needs.

Recent Developments

• In May 2024, Bralorne Gold Mines Ltd., a subsidiary of Talisker Resources Ltd signed an ore hauling agreement with Stromsten Enterprises, a trucking service provider, in partnership with Bridge River Management Corporation. Through the agreement the material from Mustang Mine will be transported to Craigmont milling facility.

• In March 2024, TIBA starts operations in Turkey. The operation in Turkey helps the company to strengthen the traffic between Turkey/Europe and Asia/Turkey, and also connect Turkey with Latin America and Africa.

Global Mining Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mining logistics market report based on type, application, and region:

Type Outlook (Revenue, USD Million, 2017 - 2030)

• Transportation Service

• Warehousing & Storage Service

• Value-added Service

Application Outlook (Revenue, USD Million, 2017 - 2030)

• Iron Ore

• Metals

• Coal

• Gold

• Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

• Asia Pacific

o India

o China

o Japan

o South Korea

o Australia

• Latin America

o Brazil

• Middle East and Africa (MEA)

o Kingdom of Saudi Arabia (KSA)

o UAE

o South Africa

Order a free sample PDF of the Mining Logistics Market Intelligence Study, published by Grand View Research.

#Mining Logistics Market#Mining Logistics Market Size#Mining Logistics Market Share#Mining Logistics Market Analysis#Mining Logistics Market Growth

0 notes

Link

0 notes