#Medicare Advisor Arizona

Explore tagged Tumblr posts

Text

Medicare Advantage Plans: The True Cost of ZERO-PREMIUM

When it comes to Medicare Advantage Plans, the phrase "zero-premium" can sound like a dream come true. After all, who wouldn’t want comprehensive healthcare coverage without paying a monthly premium? However, understanding the true cost of zero-premium Medicare Advantage Plans requires a closer look at the details, particularly for those residing in states like Texas, Florida, and Arizona.

What Does ZERO-PREMIUM Really Mean?

Zero-premium Medicare Advantage Plans are health plans offered by private insurance companies that allow you to forgo a monthly premium while still receiving benefits like hospital, medical, and sometimes even prescription drug coverage. However, the term "zero-premium" can be misleading because it doesn’t mean the plan is entirely free.

Here are a few costs to consider:

Out-of-Pocket Expenses: These can include copayments, coinsurance, and deductibles for services such as doctor visits, hospital stays, and medications.

Network Limitations: Many zero-premium plans require you to use a specific network of doctors and facilities, which may not always align with your preferences, especially in states like Medicare Texas and Medicare Arizona, where healthcare needs vary significantly.

Specialized Services: Additional services such as dental, vision, and hearing may come at an extra cost or have limited coverage.

The Role of Location in Medicare Advantage Plans

Your location plays a significant role in determining the options available to you. For example, residents of Medicare Florida often find a wide range of zero-premium plans due to the state’s large retiree population. Similarly, Medicare Texas and Medicare Arizona offer competitive plans, but the benefits and costs can vary depending on your county or ZIP code.

How to Choose the Right Plan

When evaluating a zero-premium Medicare Advantage Plan, it’s essential to consider the following:

Your Healthcare Needs: Ensure the plan covers your preferred doctors and any necessary treatments.

Prescription Drug Coverage: Check if your medications are included in the plan’s formulary.

Annual Maximum Out-of-Pocket Costs: This is the most you’ll pay in a year for covered services.

By carefully comparing your options, you can find a plan that balances affordability with comprehensive coverage, whether you’re in Texas, Florida, or Arizona.

Final Thoughts

Zero-premium Medicare Advantage Plans can be a great option, but understanding their true cost is key to avoiding surprises. For those navigating their options in Medicare Texas, Medicare Florida, or Medicare Arizona, working with a licensed Medicare advisor can help ensure you make the best decision for your healthcare needs.

Remember, the right plan is one that not only fits your budget but also meets your health requirements. Don't let the allure of "zero-premium" overshadow the importance of a plan that works for you.

Read More...

0 notes

Photo

Best Supplemental Insurance for Medicare in Peoria & Surprise, AZ

The Medicare Supplement Insurance Brokers at The Turning 65 Advisor can help you navigate the complexity and minimize your out-of-pocket expenses! If you live in or near Peoria or Surprise, Arizona, give us a call today to discuss your choices.

https://www.theturning65advisor.com/medicare-supplement/

0 notes

Link

If you are looking for Medicare Advisor Arizona? Coldwater Insurance offers medicare supplement Surprise, Buckeye, Goodyear and Arizona services.

0 notes

Text

Find the best Senior Health Insurance Service in Phoenix!

You will need to go to the hospital frequently at a certain age. That's why senior health insurance in Phoenix is crucial for every senior citizen. Visit us now.

#Medicare private health advisor in Cottonwood#best health insurance for seniors Tempe#covered advisor healthcare Scottsdale#family health insurance advisor Arizona#health care advisors Arizona#best medicare advisors Mesa#best medicare advisors Tempe#individual health insurance advisor Mesa

0 notes

Link

Are you planning to take a Medicare health plan but don't know which one is perfect for your requirement and budget? Get in touch with our health care advisors in Arizona, who will help you choose the right place based on your exact requirements

0 notes

Text

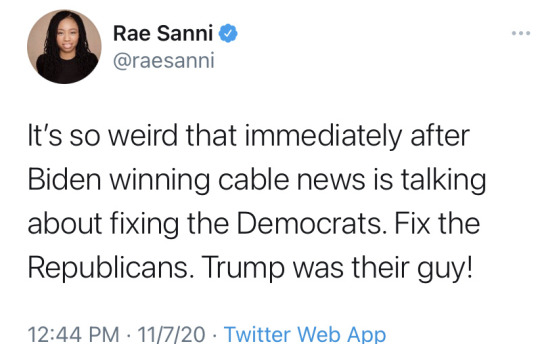

Not only is this take boring and predictable, it’s also just plain wrong.

Democrats won the presidency by approx. 4 million votes and counting.

The Senate was a long shot for Democrats in 2020 in the first place and we flipped two seats (Colorado and Arizona) and Georgia was so close that it went to a runoff, so control of the Senate is still up in the air.

And so the only real “loss” we suffered was that, I believe, 8 Democratic seats in the House were flipped to Republicans. It’s worth noting that Dems still maintain a strong majority.

And as AOC explained on Twitter yesterday, many of the moderate House Dems who lost were the ones who failed to invest in digital advertising. Many politicians and their advisors still cling to TV ads despite the fact that there was a pandemic and everyone was online, like, all the time. As she also pointed out, every House candidate who ran on Medicare for All won their district.

So there is literally no valid argument that being more moderate will help Dems.

This is not to say that progressive candidates can win in every district! But moderate Dems have no right to say that progressive campaigns aren’t working, and until they fully invest in digital advertising, good polling, and join the rest of us in the 21st century, they can’t claim that they lost just because their colleagues made them look too progressive. That’s just pointing fingers when they need to do some self-reflection and improve their campaign instead.

broke: asking Democrats why they didn’t win back the racist white people

woke: demanding that Republicans explain why they elected and stood behind an unpopular fascist whose lies and incompetence cost the lives of over 200,000 Americans, and why they can’t win a majority of voters making under $100,000/year, and how they will make amends to voters of color, and

(...Like. Biden won by approx. 4 million votes. That’s a mandate to carry out his broadly popular agenda.

Republicans lost. They’re the ones who should be asking themselves where they go from here.)

#election 2020#LOTS to say about this but ultimately i think it's a healthy debate between centrists & progressives#and fair on both sides!#there are valid criticisms of both sides within the democratic party#but moderates blaming progressives for their own loss is just sad#and wrong

580 notes

·

View notes

Video

tumblr

Education and Choices for Medicare and Insurance in the Phoenix, Arizona Area.

www.theturning65advisor.com – Helping You Understand your Medicare Options, and Insurance Choices For Your Future. We will help you take a safe and creative approach to establishing the right plan for your needs. The Turning 65 Advisor is knowledgeable and experienced about the many programs and plans that are available to you, from Medicare Plans, prescription drug plans, to other insurance plans such as life insurance and long-term care insurance.

For More Information Contact Us: 10559 N 99th Ave. Suite 2 Peoria, AZ 85345 Phone: 623-289-3007 Email: [email protected]

#Medicare-Insurance#Medicare-Supplement-Insurance#Medigap#Medicare-Prescriptions#Medicare-Advantage#Life-Insurance#Asset-Protection#Medicare

1 note

·

View note

Link

If you are looking for Medicare Advisor Arizona? Coldwater Insurance is leading medicare advisor Buckeye, Goodyear, Arizona. Call 623.210.5940

0 notes

Link

One might say that it is truly necessary to take a policy plan for an individual to take care of themselves or for a better future for their families; in such terrible circumstances, everybody is confronting these days with occupied timetables in their day-to-day existence. Visit our website now.

#Health insurance consulting services Chandler#health insurance advisors Chandler#family health insurance advisor Arizona#best health insurance for seniors Tempe#Medicare private health advisor in Cottonwood#health care advisors Arizona

0 notes

Text

life insurance for 60 year old male

BEST ANSWER: Try this site where you can compare quotes from different companies :cheapinsurancequotes1.info

life insurance for 60 year old male

life insurance for 60 year old male and female. We made a base insurance plan to be used if we had to cancel our term policy. It s easy, free, and therefor free. The next step is to ask about the company. Make a list to where you think they are and send it. Some companies may require you to send a copy of your policy and insurance card, but there is no rule. In fact, you may have to contact the carrier to make changes to your policy. I ve never needed to send a letter to the bank to be sure that people don t have too many or no issues with my credit card, insurance, etc. Any insurance carrier will have their policies and have a process that can help people. However I would ask them to explain the reasons for cancellation and you should just give the time to make a call. This is a great question. It might make sense to ask, but in the absence of a specific number. In this scenario I usually have to wait a little over a. life insurance for 60 year old male with good driving record and our friendly agency can help you get coverage. If you have young driver or want to avoid the hassle of an SR-22 for certain vehicles, we can provide insurance for you. In addition to the minimum required, we recommend you consider purchasing a motor vehicle liability insurance policy. If you are currently involved in an accident with a driver who is disabled and cannot drive, the Motor Vehicle Insurance Program (MVA) may offer a discounted rate for this type of policy. Our team is licensed in Arizona and has been in the Insurance business for over 40 years. We are a non-for-profit insurance agency. As independent agents we have the ability to quote from multiple insurance carriers including our competitors in the market. This allows us to get to know you to get you on the right insurance program for you and your property. If there is any doubt on a vehicle owner, it is not necessary to file a claim for at least $200 dollars to take care of the vehicles.. life insurance for 60 year old male. $300,000/accident $6000,000/death $25,000 payout $5,000/month (personal) $300,000/month (personal) $100,000 payout $50,000 premium $100,000 supplemental life insurance for 60 year old female. $300,000/month (personal) $100,000 payout $50,000 supplemental life insurance for 60 year old male. $300,000/month (personal) $100,000 payout $50,000 supplemental life insurance for 60 year old male. $300,000/month (personal) $100,000 payout $50,000 supplemental life insurance for 60 year old female. For Life Insurance For 60-Year Old: $2,000,000/30,000,000/30,000,000/60,000/15,000,000/10,.

Term Life Insurance Rates Chart Ages 20 to 30

Term Life Insurance Rates Chart Ages 20 to 30 are usually considered the beginning of life insurance. Age 40 to 50 is generally considered the starting point of any life insurance. Age 60 to 80 is generally considered the beginning stage of most life insurance. Age 85 to 100 is generally considered as the beginning stage of most life insurance. Age 90 to 100 is considered the beginning stage of most life insurance. Age 95 to 100 is generally considered the starting point of most life insurance. Age 120 to 150 is often considered the starting point of most life insurance. Age 160 to 90 is generally considered as the starting point of most life insurance. Age 180 to 95 is considered the beginning stage of most life insurance. Age 180 to 95 is considered the beginning stage of most life insurance. The chart below describes how some type of permanent life insurance decreases in price. A guaranteed universal life insurance policy is essentially the opposite of whole life insurance. The reason is that always pays out more than a term life insurance policy. Whole life insurance has fixed premium payments. Your premiums don.

Best Guaranteed Issue Life Insurance Companies for Seniors

Best Guaranteed Issue Life Insurance Companies for Seniors The Guaranteed Issue Life Insurance Company of Texas offers the most affordable guaranteed issue whole life policy available. There are no medical exams or medical exams for this policy because this company has no medical exams or medical exams for seniors. You can even buy a policy from the day you apply online. Guaranteed issue is the best place to start looking at whole life insurance for seniors. The application process is fairly easy: you just answer a phone questionnaire or fax all of your questions online. The application process can be completed pretty quick. You can actually buy your policy online or over the phone. Guaranteed issue life insurance companies are very unique in their coverage. We compare policies from as many companies as possible, then match you with one company that has the best coverage possible at a competitive price. With that said, most guaranteed issue life insurance companies offer additional riders. Below is a video review of the additional riders available for our guaranteed insurance policy. Most guaranteed issue life insurance carriers look at your health.

Life Insurance Rates by Age 20s & 30s

Life Insurance Rates by Age 20s & 30s 20 Insurance Companies to Compare by Consumer Reports, J.D Power, Consumer Reports, etc. If you turn 30, then pick a different insurance company because you’re deemed a no frills rider When you do your first year, consider the costs of getting insured at an older age. Now, if you have a baby, you may want to switch to a grand plan or you can take it to . I just found out that my daughter needs a car to get to work, which I ve already paid for it in January 2017… (I have coverage, and I have been in the car rental business for about 7 months now.) Can I get cheaper auto insurance? I don t want to let people drive me to work without insurance (for just $100 per month, but I might consider it even cheaper). However, most drivers are likely very careful, and drivers who are buying a car will have their premiums.

How much does term life insurance cost for a 60-year-old?

How much does term life insurance cost for a 60-year-old? For a 60-year-old, I would typically ask one of my insurance advisors if they could offer a lower monthly rate that was within budget; if they could, they might be able to provide an affordable rate. Most people can afford lower term life insurance costs in their 60s with a better understanding of their life style, goals, and financial needs. Term life insurance is most affordable, typically only being available for 10, 15, 20, 25, 25, or 30 years. Term life insurance is not a form of permanent protection for the insured. This is important because some people are better served with term life insurance than with permanent life insurance. Term life insurance has few features that make it attractive to younger buyers. It is often available for a set period of time, usually 10 years; 10 or 15 years; 20 years; 15 years; 20 years; 20 years; 25 years; 30 years; 35 years; 40 years; 30 years; 10 years; 15 years; 20 years.

Life Insurance Quotes for Seniors

Life Insurance Quotes for Seniors Age Auto Home Life Medicare Health 25 50 75 77 88 100 110 115 125 138 140 155 160 180 176 190 185 190 185 196 190 195 205 211 214 215 218 232 234 234 235 235 235 235 237 237 235 235 241 242 246 241 242 246 246 252 252 252 252 252 252 252 252 256 253 255 271 255 276 273 274 275 275 282 312 342 374 384 384 390 394 394 405 415 426 442 436 437 442 440 454 464 473 474 474 475 470 472 477 478.

Average Cost of Life Insurance - How Much Does Term Insurance Cost?

Average Cost of Life Insurance - How Much Does Term Insurance Cost? What happens after a term expires? In order to determine what types of insurance coverage are cheapest and which ones can help save you money on your term, we looked at what you get for term life insurance and the companies offering them. The good news is, the numbers show that term life insurance is not nearly as pricey as it may seem. Life insurance is more than just an investment; it can provide for you in case of the unexpected. However, a more just way to protect your loved ones, if you are the type who loves to help out with expenses or for the funeral. It is true that all of life insurance policies have exclusions, which may include deaths due to natural causes or for non-accidental causes, but there are things to consider when shopping for . In general, term life insurance provides you enough coverage in addition to the death benefit to ensure a financially secure future. In the case of term life, there are a few things you can do to ensure that you are not.

20 Year Term Life Insurance Rates By Age

20 Year Term Life Insurance Rates By Age 20: 20-year term life insurance rate $871.00 $944.00 The following are monthly rates for 40-year term life insurance policy for 40-year-old male and female drivers who meet the below criteria: Average Rates By Age 20 Term Life Insurance Rate By Age 20 Term Life Insurance Rate By Gender: 50-year-old male and female drivers with no accidents or violations in recent past with annual mileage spent on the road (5,000+). Average Rates By Age 20 Term Life Insurance Rate By Age 20 Term Life Insurance Rate By Year: 20-year term life insurance rate $1,077.60 $1,080.80 Average Rates By Age 20 Term Life Insurance Rate By Year: 20-year term life insurance rate $1,080.80 Average Rates By Age 30: 15 Year Term Life Insurance Rate By Age 30: 15 Year Term Life Insurance Rate By Year: 30-year-old male and female drivers with no recent accidents.

Average cost of life insurance by term length

Average cost of life insurance by term length with all life insurance product categories and life insurance company rates based on age of your policy. This can save you thousands on your policy. Here are the most and least expensive life insurance rates for a 50-year-old with term life insurance. The list is updated annually on each life insurance product. Life insurance rates are determined by a number of factors, including . While you may pay the same rates for different life insurance products, risk factors, locations and other factors have nothing to do with your life insurance rate class. It’s recommended to shop around and compare rates from several different online insurers to find the best rate for you. Your age, type of policy, gender and coverage amount may also play a factor. To get the best rates on life insurance for you, check out our top five picks. One of the most well known online resources for the life insurance industry is a website devoted to helping individuals find the best policies and rates for life insurance. This site has information on different.

Average annual life insurance spend per household, per state

Average annual life insurance spend per household, per state, and basic premiums is more or lower, depending on your age, insurance needs, and other factors. The financial impact of a low income on your monthly policy payments may vary depending on the amount, quality of coverage, and company you choose. Every insurance company advertises its savings. But as with any product, you may get a larger discount if you pay your.

How do I buy the best life insurance in my 60s?

How do I buy the best life insurance in my 60s? The best time to shop for life insurance is when you are at age 59. The older you are getting the best rates and coverage for the best value, the better the rates will be. You should compare life insurance quotes online and learn a bit about the underwriting process before making a purchase. You never know what insurance company you will be applying to, and when it comes to finding the best rate, there isn t one right answer. With so many options, it can take a complete journey to understand what factors will impact your life insurance premiums. It s important to take time to learn the early on in the process of evaluating your policy as it can help you learn more about the different life insurance companies. Many people have heard that the best life insurance rates are with companies with a history of great policies that have high financial ratings. Life insurance underwriting is the process that most people use when choosing an insurance company. You will need to understand one major thing when deciding on your premium rates..

0 notes

Photo

EOIR Swears in 27 New Immigration Judges (Oct. 11, 2019)

Introduction

On October 11, 2019, the Executive Office for Immigration Review (EOIR) held an investiture ceremony to swear in 27 new immigration judges [PDF version]. The ceremony was presided over by Deputy Chief Immigration Judge Mary Cheung. The 27 new immigration judges were selected by U.S. Attorney General William Barr.

The 27 new immigration judges will sit on 17 immigration courts and adjudication centers across the United States. In this post, we will provide brief biographical information for each of the new immigration judges with reference to their professional profiles provided by EOIR. We will examine the courts receiving new immigration judges in alphabetical order after first examining the new judges in New Jersey and New York City immigration courts.

Please see our growing index article to learn about previous appointments to the immigration courts and the Board of Immigration Appeals (BIA) [see index].

Common Abbreviations

Department of Homeland Security (DHS)

Immigration and Naturalization Service (INS)

U.S. Department of Justice (DOJ)

U.S. Immigration and Customs Enforcement (ICE)

United States Citizenship and Immigration Services (USCIS)

Office of the Principal Legal Advisor (OLPA)

List of Immigration Courts Receiving New Immigration Judges

Elizabeth Immigration Court (New Jersey)

New York — Federal Plaza Immigration Court (New York)

New York — Varick Immigration Court (New York)

Bloomington Immigration Court (Minnesota)

Chicago Immigration Court (Illinois)

Dallas Immigration Court (Texas)

Fort Worth Immigration Adjudication Center (Texas)

Houston Immigration Court (Texas)

Miami Immigration Court (Florida)

Miami (Krome) Immigration Court (Florida)

Omaha Immigration Court (Nebraska)

Philadelphia Immigration Court (Pennsylvania)

Phoenix Immigration Court (Arizona)

San Diego Immigration Court (California)

San Francisco Immigration Court (California)

San Juan Immigration Court (Puerto Rico)

Elizabeth Immigration Court (New Jersey)

One new immigration judge has begun hearing cases at the Elizabeth Immigration Court.

Pallavi S. Shirole, Immigration Judge, Elizabeth Immigration Court

2017-2019: Associate legal advisor for the National Security Law Section, OLPA, ICE, DHS, in the District of Columbia.

2016-2017: Assistant chief counsel, OLPA, ICE, DHS, in Portland, Oregon.

2015-2017: Director of law program at a high school.

2010-2015: Assistant state's attorney for the Office of the State's Attorney, in Baltimore.

Law degree from University of Baltimore School of Law in 2009.

New York — Federal Plaza Immigration Court (New York)

Five new immigration judges were sworn in to sit on the New York — Federal Plaza Immigration Court.

L. Batya Schwartz Eherens, Immigration Judge, New York — Federal Plaza Immigration Court

2012-2019: Private practice as partner in New York-based immigration law firm.

2006-2012: Private practice as immigration attorney in New York.

Law degree from American University Washington College of Law in 2003.

Deborah E. Klahr, Immigration Judge, New York — Federal Plaza Immigration Court

2018-2019: Supervisory immigration officer and then section chief with the New York City Field Office, USCIS, DHS, in New York.

2017-2018: Senior immigration services officer with the Newark Field Office, USCIS, DHS, in Newark, New Jersey.

2013-2017: Asylum officer and supervisory asylum officer with the Newark Asylum Office, USCIS, DHS, in Lyndhurst, New Jersey.

2000-2013: Private practice as an immigration attorney at various New York and New Jersey law firms.

1997-1999: Staff attorney for the Bar Association for the City of New York, in New York.

1992-1996: Private practice in New York.

Law degree from the Benjamin N. Cardozo School of Law in 1992.

Thomas N. Kouris, Immigration Judge, New York — Federal Plaza Immigration Court

2010-2019: Private practice in New York.

Law degree from Boston College Law School in 2009.

Laura N. Pierro, Immigration Judge, New York — Federal Plaza Immigration Court

1999-2018: Prosecutor in various capacities for the Ocean County Prosecutor's Office, in Toms River, New Jersey.

1997-1998: Law clerk to three criminal judges of the Superior Court of New Jersey, Monmouth Vicinage, and the Monmouth County Prosecutor's Office.

Law degree from Wake Forest University School of Law in 1997.

Cathy Sagesse, Immigration Judge, New York — Federal Plaza Immigration Court

2016-2019: Assistant chief counsel, Office of the General Counsel, OLPA, ICE, DHS, in Miami, Florida.

2007-2016: Assistant state attorney for the Miami-Dade County State Attorney's Office in Miami, Florida.

Law degree from Stetson University College of Law in 2007.

New York — Varick Immigration Court (New York)

One new judge began hearing cases at the New York — Varick Immigration Court.

Forrest W. Hoover III, Immigration Judge, New York — Varick Immigration Court

2008-2019: Judge advocate, defense counsel, prosecutor, and military judge for the U.S. Marine Corps in Camp Lejeune, North Carolina, and Okinawa, Japan.

1999-2005: Logistics officer for the U.S. Marine Corps in Camp Lejeune, North Carolina; Okinawa, Japan; and Quantico, Virginia.

Retired from the U.S. Marine Corps in 2019 with the rank of lieutenant colonel.

Law degree from Temple University Beasley School of Law in 2008; Master of Criminal Law Degree from the Judge Advocate General's Legal Center and School in 2012.

Bloomington Immigration Court (Minnesota)

One new judge began hearing cases at the Bloomington Immigration Court.

Monte G. Miller, Immigration Judge, Bloomington Immigration Court

2001-2019: Assistant and senior attorney with the Hennepin County Attorney's Office, Criminal Division, in Minneapolis.

2017-2019: Trial judge with the Navy-Marine Corps Trial Judiciary.

2012-2017: Appellate judge with the Navy-Marine Corps Court of Criminal Appeals.

1994-2019: Judge advocate and military judge for the U.S. Navy in many locations.

Remains captain and judge advocate in the U.S. Navy Reserve.

Law degree from the William Mitchell College of Law in 1993.

Chicago Immigration Court (Illinois)

One new Judge began hearing cases at the Chicago Immigration Court.

Jushua D. Luskin, Immigration Judge, Chicago Immigration Court

2015-2019: Commissioner at the Illinois Workers' Compensation Commission.

2011-2015: Arbitrator at the Illinois Workers' Compensation Commission.

2003-2011: Private practice in Illinois.

2000-2003: Judge advocate for the U.S. Navy.

1999-1999: Of counsel to the State's Attorney's Appellate Prosecutor's Office, in Illinois.

1998-1998: Assistant state's attorney, in Champaign County, Illinois.

Law degree from the University of Michigan in 1997.

Dallas Immigration Court (Texas)

One new judge began hearing cases at the Dallas Immigration Court.

Jason D. Ferguson, Immigration Judge, Dallas Immigration Court

2016-2019: First assistant district attorney for the 119th Judicial District of Texas, in San Angelo, Texas.

2012-2016: Assistant district attorney for the 51st and 119th Judicial Districts of Texas, in San Angelo.

2010-2012: Assistant district attorney for the 31st Judicial District of Texas, in Pampa, Texas.

Law degree from the University of Houston Law Center in 2009.

Fort Worth Immigration Adjudication Center (Texas)

One new judge began hearing cases at the Fort Worth Immigration Adjudication Center.

Shelly W. Schools, Immigration Judge, Fort Worth Immigration Adjudication Center

1997-2019: Judge advocate, prosecutor, defense counsel at the trial and appellate level, staff judge advocate, and trial judge in the U.S. Air Force at many locations.

Retired from the Air Force with the rank of Colonel in 2019.

Law degree from the University of Mississippi in 1997.

Houston Immigration Court (Texas)

One new judge began hearing cases at the Houston Immigration Court.

Erica J. McGuirk, Immigration Judge, Houston Immigration Court

2012-2019: Associate counsel with USCIS, DHS, in Houston, Texas.

2003-2012: Senior attorney and assistant chief counsel, Office of Chief Counsel, ICE, DHS, in Houston.

2002-2003: Assistant chief counsel, Office of the District Counsel, with the former INS, DOJ, in Houston.

1998-2002: Trial attorney with the Office of the Solicitor, Department of Labor, in Dallas, Texas.

Law degree from the University of Iowa College of Law in 1998.

Miami Immigration Court (Florida)

Three new judges began hearing cases at the Miami Immigration Court.

Christina M. Martyak, Immigration Judge, Miami Immigration Court

2006-2019: Assistant chief counsel, Office of Chief Counsel, ICE, DHS, in Miami, Florida.

2005-2006: Assistant statewide prosecutor for the Florida Office of the Attorney General, in Miami.

2000-2004: Assistant state attorney for the Miami-Dade State Attorney's Office, in Miami.

Law degree from St. Thomas University in 2000.

Ian D. Midgley, Immigration Judge, Miami Immigration Court

2014-2019: Supervisory administrative law judge with the Office of Medicare Hearing and Appeals, Department of Health and Human Services, in Miami.

2008-2014: Assistant chief counsel, OLPA, ICE, DHS, in Orlando, Florida.

2006-2008: Active duty judge advocate for the U.S. Navy, in Yokosuka, Japan.

2001-2006: Active duty judge advocate for the U.S. Army, in Kitzingen, Germany, and at Patrick Air Force Base, Florida.

Serves as judge advocate for the U.S. Navy Reserve (since 2009).

Law degree from Case Western Reserve University School of Law in 1998.

Irene M. Recio, Immigration Judge, Miami Immigration Court

2014-2019: Branch chief at the Administrative Appeals Office (AAO), USCIS, DHS.

2013-2014: Adjudications officer and supervisor at the Immigrant Investor Program Office, USCIS, DHS, in the District of Columbia.

2012-2013: Adjudications officer at AAO, USCIS, DHS, in the District of Columbia.

1997-2011: Private practice in various capacities in Washington D.C.

Law degree from the University of Miami School of Law in 1995.

Miami (Krome) Immigration Court (Florida)

One new judge began hearing cases at the Miami (Krome) Immigration Court.

Jorge L. Pereira, Immigration Judge, Miami (Krome) Immigration Court

2008-2019: Assistant chief counsel, Office of the Chief Counsel, OLPA, ICE, DHS, in Miami, Florida.

1996-2008: Private practice at two law firms in Miami.

1995-1996: Assistant state attorney for the Miami-Dade State Attorney's Office in Miami.

Law degree from St. Thomas University School of Law in 1995.

Omaha Immigration Court (Nebraska)

One new judge began hearing cases at the Omaha Immigration Court.

Alexandra Larsen, Immigration Judge, Omaha Immigration Court

2004-2019: Assistant chief counsel, OLPA, ICE, DHS, in Omaha, Nebraska.

2012-2014: Assistant chief counsel, OLPA, ICE, DHS, in Saint Paul, Minnesota.

2011-2012: Deputy chief and chief of OLPA, District Court Litigation Division (DCLD), ICE, DHS, in the District of Columbia.

2008-2011: Associate legal advisor for the DLCL, ICE, DHS, in the District of Colimbia.

2007-2008: Judicial law clerk for Judge Donald E. O'Brien in the United States District Court for the District of Iowa, in Sioux City, Iowa.

2002-2007: Private practice in Nebraska and Washington D.C.

Law degree from Creighton University School of Law in 2002.

Philadelphia Immigration Court (Pennsylvania)

One new judge began hearing cases at the Philadelphia Immigration Court.

Bao Q. Nguyen, Immigration Judge, Philadelphia Immigration Court

2016-2019: Assistant chief counsel, OLPA, ICE, DHS, in San Antonio and Pearsall, Texas.

2006-2016: Private practice in Nevada, Pennsylvania, Ohio, and Utah.

Law degree from the Temple University School of Law in 2005.

Phoenix Immigration Court (Arizona)

Three new judges began hearing cases at the Phoenix Immigration Court.

Robert C. Bartlemay Sr., Immigration Judge, Phoenix Immigration Court

2010-2019: Senior attorney with OLPA, ICE, DHS, in Phoenix.

2007-2010: Assistant chief counsel, OLPA, ICE, DHS.

1983-2007: Judge advocate for the U.S. Air Force in many locations.

Law degree from the University of Toledo in 1983.

Joseph S. Imburgia, Immigration Judge, Phoenix Immigration Court

2002-2019: Attorney and military judge, including Chief Circuit Military Judge for the Pacific Circuit, with the U.S. Air Force at many locations.

Retired from the U.S. Air Force in 2019 with the rank of colonel.

Law degree from the University of Tennessee College of Law in 2002; Master of Laws in 2009 from the Judge Advocate General's Legal Center and School.

Melissa B. Karlen, Immigration Judge, Phoenix Immigration Court

2008-2019: Assistant U.S. attorney with the U.S. Attorney's Office for the District of Arizona, DOJ, in Phoenix, Arizona.

Assistant chief counsel, Office of the Chief Counsel, OLPA, ICE, DHS, in Los Angeles, California.

2002-2007: Deputy prosecuting attorney with the City and County of Honolulu Prosecutor's Office, in Honolulu, Hawaii.

2001-2002: Private practice.

Law degree from the University of San Francisco School of Law in 2001.

San Diego Immigration Court (California)

One new judge began hearing cases at the San Diego Immigration Court.

Guy G. Grande, Immigration Judge, San Diego Immigration Court

2015-2019: Assistant chief counsel, OLPA, ICE, DHS, at the Otay Mesa Detention Center, in San Diego, California.

1994-2015: Private immigration practice.

Law degree from the University of San Diego in 1994.

San Francisco Immigration Court (California)

Two new judges began hearing cases at the San Francisco Immigration Court.

Andrew J. Caborn, Immigration Judge, San Francisco Immigration Court

2015-2019: Assistant chief counsel, Office of the Chief Counsel, OLPA, ICE, DHS, in San Francisco, California.

2008-2014: Senior deputy district attorney and deputy district attorney for the Tulare County District Attorney's Office, in Tulare, California.

2008-2008: Private practice in Los Angeles, California.

Law degree from Whittier College in 2007; Master of Laws degree from the University of California, Berkley, in 2015.

Gregory L. Simmons, Immigration Judge, San Francisco Immigration Court

2009-2013: General courts-martial trial judge, in California.

1989-2009: Judge advocate for the U.S. Marine Corps in many locations.

Retired from the U.S. Marine Corps in 2013.

Law degree from Baylor University School of Law in 1989; Master of Laws degree in 1996 from the U.S. Army Judge Advocate General's Legal Center and School in 1996.

San Juan Immigration Court (Puerto Rico)

One new judge began hearing cases at the San Juan Immigration Court.

Pedro J. Espinal, Immigration Judge, San Juan Immigration Court

2016-2019: Deputy chief counsel, OLPA, ICE, DHS, in San Juan, Puerto Rico.

2009-2011: Adjudications services officer, USCIS, DHS, in San Juan.

2007-2009: Adjudications services officer, USCIS, DHS, in New York.

2004-2007: Private practice in San Juan.

Law degree from the University of Puerto Rico School of Law in 2004.

Please visit the nyc immigration lawyers website for further information. The Law Offices of Grinberg & Segal, PLLC focuses vast segment of its practice on immigration law. This steadfast dedication has resulted in thousands of immigrants throughout the United States.

Lawyer website: http://myattorneyusa.com

0 notes

Photo

Best Insurance Agency in Peoria & Surprise AZ

The Turning 65 Advisor helps Seniors in Phoenix, Surprise, and Peoria Arizona to find the right options for Medicare, Medicare Supplement, & Medicare Advantage insurance. Call today for a consultation.

https://www.theturning65advisor.com/

0 notes

Link

If you are looking for Medicare Advisor Arizona? Coldwater Insurance offers Medicare supplement Surprise, Buckeye, Goodyear and Arizona services.

0 notes

Link

The cost just ascensions for more major ailments like malignant growth — care can frequently add up to countless dollars. Thus, taking the advice of medicare insurance consultants in Arizona is always a beneficial and effective solution for your betterment. Contact us now.

#health care advisors Arizona#family health insurance advisor Arizona#covered advisor healthcare Scottsdale#best health insurance for seniors Tempe#Medicare private health advisor in Cottonwood#Health insurance consulting services Chandler#health insurance advisors Chandler

0 notes

Text

Democratic campaign arm accused of trying to hinder progressive candidates in key Senate primaries

Two progressive Senate candidates say political operatives won't work with them because a key Democratic election committee has warned them of political retribution. Want to nominate a candidate for endorsement with the Progressive Party? Start Nominating Here

WASHINGTON — Progressive Senate candidates in at least two states are accusing a key Democratic Party campaign arm of actively working against them in primaries to help more moderate rivals favored by leadership as having a better shot of ousting GOP incumbents. The efforts by the Democratic Senatorial Campaign Committee come as the party seeks to retake the Senate majority from Republicans in 2020. But while early intervention may help prevent ugly primary battles, it is already heightening internal tensions between the party’s centrists and progressives, and rekindling allegations of unfair meddling by party leadership. Progressive candidates in Colorado and Maine — two of the most competitive 2020 Senate races — say political consultants and vendors have refused to work on their campaigns after being warned that doing so would risk a future boycott by the DSCC, which endorsed other Democrats for those primaries. “They want to blackball us,” said Andrew Romanoff, a Democrat who is hoping to take on GOP Sen. Cory Gardner in Colorado in next year’s election. “We heard the same from enough firms. It’s not an accident.”

Create a Petition on Issues that Matter to You

Gather Signatures - Become publicly searchable START HERE The DSCC threw its support behind former Colorado Gov. John Hickenlooper, a pro-fracking moderate, almost immediately after he announced his bid for the Senate seat late last month. Romanoff, who backs “Medicare for all” and aggressively combating climate change, said at least five political vendors that had expressed interest in working with him later told his campaign that officials at the DSCC, which helps recruit and finance Democratic candidates, said the vendors would get no other business from the committee if they worked for Romanoff’s campaign. A political consultant at one of those firms confirmed the account but refused to be named for fear of retribution, saying that the firm was told by an intermediary for Senate Minority Leader Charles E. Schumer (D-N.Y.) that “under no circumstances were we to work with Andrew Romanoff.” If it did, the firm would get no more DSCC-related business, including lucrative referrals to work on other campaigns or to put together outside political advertisements. Romanoff’s account was first published Thursday by the Intercept, a left-leaning online publication. Since then, Romanoff said he’s received offers from several firms offering to help his campaign, including one that he said wants to “get banned by Schumer.” Schumer’s office referred questions to the DSCC. DSCC spokeswoman Lauren Passalacqua said the committee has no policy that forbids vendors from working with Democratic candidates that it does not support. But she added: “In our role as a campaign committee focused on winning Senate seats, we have ongoing conversations with strategists and advisors about battleground races.” Maine Senate hopeful Betsy Sweet said she’s had similar trouble hiring finance staffers for her primary campaign. And Iowa Senate primary candidate Eddie Mauro said one vendor indicated that Washington Democrats “put pressure on them not to work with people like me” although he did not name the DSCC. As in Colorado, the DSCC has endorsed more moderate Democrats in Maine and Iowa who they hope will beat sitting Republican senators in November 2020. Vendors initially “are saying they’re excited and then they say they can’t do it,” Sweet said. “If you’re part of the political industrial complex and you’re making a career out of it, whether it is implicit or explicit, you don’t want to go up against that machine.” The DSCC has endorsed Sara Gideon to take on GOP Sen. Susan Collins in Maine. The intervention does not appear to be nationwide. Senate candidates in other races around the country said in interviews that they have seen no such interference in their campaign hiring. But Sweet likened the DSCC’s meddling in her campaign to efforts made behind the scenes by the Democratic National Committee to bolster Hillary Clinton for president over Bernie Sanders in the 2016 primaries, moves that bitterly split the party. “We in Maine have done a lot of work to reunify . This has just made it really hard,” she said. “It adds to the cynicism of people getting involved in politics.” The DSCC’s counterpart for the House, the Democratic Congressional Campaign Committee, adopted a new written policy on vendors this year. The committee forbids vendors from getting DCCC business if they work on a primary challenge to a sitting Democratic House member. In that situation, the DCCC is trying to avoid Democrats trying to kick a sitting Democrat out of office. For Democrats, the stakes in the Senate couldn’t be higher. Both Democrats and Republicans admit there is a window for Democrats to take control of the chamber by flipping Republican-held seats in Colorado, Arizona and Maine. They’re hoping additional challengers in Iowa and North Carolina take off. And their chances became a little more positive last week when a Georgia seat came into play upon the sudden retirement of Sen. Johnny Isakson. Democrats need to win three or four seats to take control of the Senate in the 2020 election. (The figure depends on which party controls the White House and with it, the ability to break a 50-50 tie in the Senate.) So far this year, the DSCC has endorsed candidates in Democratic primaries in nearly all of the marquee Senate races. Dan Sena, a Democratic operative who ran the House’s DCCC in the last cycle, said early endorsements can help donors and political supporters prioritize which candidates to back and which races look promising. “If we’re going to stop Mitch McConnell from gutting access to affordable health care, confirming partisan judges to lifetime appointments on the federal bench and Supreme Court, and attacking reproductive rights, then we need to win Senate seats,” Passalacqua said. “We’re working with candidates who will do exactly that and help Democrats take back the Senate.” Many of the Democratic candidates, even those who said the DSCC is not interfering with their hiring process, said they resented the committee’s endorsement in their race instead of letting a primary play out among voters. That anger is most acute in Colorado, where a competitive Democratic primary between a dozen candidates was well underway when Hickenlooper dropped out of the presidential primary contest and announced he would run for the Senate. The DSCC’s quick endorsement incensed candidates who were already in the race, an anger undoubtedly fueled by Hickenlooper’s prior comments that he didn’t want the Senate seat and wouldn’t be good at the job. Several of the self-identified liberal Democrats in the race say Hickenlooper — who opposes progressive standard-bearers such as Medicare for all and the Green New Deal — is too centrist for Colorado. They argue that Gardner is so vulnerable that almost any Democratic candidate can beat him. “It’s hard for me to get in their head on this because a blue rock beats Cory Gardner by 10%,” said Alice Madden, one of the Democratic hopefuls. Madden and the five other Democratic women in the race signed a letter last week asking the DSCC to reconsider the endorsement, arguing that it implies “that we should defer to a male candidate because you seem to believe he is ‘more electable.’” Schumer had long made no secret that he wanted Hickenlooper, who has tremendous name recognition in the state, to take on Gardner next year. Democratic strategists say polling shows that Hickenlooper’s popularity would survive intense negative messaging, making him the strongest candidate in both the primary and general election. On Tuesday, 314 Action, a group that promotes electing Democrats with scientific backgrounds, touted a poll that showed 72% of Democratic primary voters have a favorable opinion of Hickenlooper — a former geologist — besting all other Democrats by more than 30 percentage points. For his part, Hickenlooper “believes anyone should be able to work for anyone they want to,” according to his spokesperson, Jacque Montgomery. “And anyone who wants to throw their hat in the ring should step up and run for office.” This Piece Originally Appeared in Los Angeles Times Read the full article

0 notes

Text

Medicare Enrollment

For FREE help finding a Medicare plan, Click here or call 1-800-729-9590.

#Medicare #Enrollment is underway! Gary Abely, CFP®, AIF®, CPA discusses your Medicare enrollment options on Fox 35 Orlando. The enrollment deadline is December 7, 2018.

Gary Abely, CFP®, AIF®, CPA has been a financial planning professional since 1990. He is a Certified Financial Planner

(CFP®) professional and an Accredited Investment Fiduciary® (AIF®). He is also a Certified Public Accountant and an Investment Advisory Representative of Certified Advisory Corp, a Registered Investment Advisor.

Gary graduated Summa Cum Laude from Arizona State University in 1987 with a Bachelor of Science degree in Accounting. He became a CPA in 1988 and a CFP® professional in 1995. After working for the CPA firm, Arthur Andersen & Co., out of college, Gary opened a private financial planning and accounting firm in 1990.

As a graduate of the AIF® program, Gary is specially trained in investment fiduciary responsibility and portfolio management. He offers three services to individual and business clients: Asset Management, ERISA 3(38) investment management services for 401(k) and other retirement plans, and general financial planning to individuals and couples.

He is keen on explaining to his clients, “It’s not what you make, but what you keep that matters”, emphasizing tax efficient portfolio asset allocation strategies.

Gary also holds a Life and Health Insurance and Variable Annuities license with the State of Florida.

Having grown up in Winter Park, Florida, Gary is married with twin daughters and resides in Maitland, Florida.

Disclaimer: Fee-Based Planning and Asset Management through Certified Advisory Corp, an SEC-Registered Investment Advisory Firm.

SEC registration does not constitute an endorsement of the firm. Certified Financial Planner Board of Standards Inc. owns the certification mark CFP®.

This website is for informational purposes only and does not constitute a complete description of our services. This website is not a solicitation or offer to sell securities or investment advisory services.

Visit the Company Website for Certified Financial Group, Inc to review the following information:

-States where are our various member firms are registered in to offer Securities.

-Web Disclosures

-Business Continuity Plan

-Code of Ethics

-Privacy Statement

youtube

.huge-it-share-buttons { border:0px solid #0FB5D6; border-radius:5px; background:#3BD8FF; text-align:center; } #huge-it-share-buttons-top {margin-bottom:0px;} #huge-it-share-buttons-bottom {margin-top:0px;} .huge-it-share-buttons h3 { font-size:25px ; font-family:Arial,Helvetica Neue,Helvetica,sans-serif; color:#666666; display:block; line-height:25px ; text-align:center; } .huge-it-share-buttons ul { margin:0px auto !important;text-align:center; } .huge-it-share-buttons ul li { margin-left:3px; margin-right:3px; padding:0px; border:0px ridge #E6354C; border-radius:11px; background-color:#14CC9B; } .huge-it-share-buttons ul li #backforunical13206 { border-bottom: 0; background-image:url('http://bit.ly/2AaZoAp); width:40px; height:40px; } .front-shares-count { position: absolute; text-align: center; display: block; } .shares_size20 .front-shares-count { font-size: 10px; top: 10px; width: 20px; } .shares_size30 .front-shares-count { font-size: 11px; top: 15px; width: 30px; } .shares_size40 .front-shares-count { font-size: 12px; top: 21px; width: 40px; }

Share This:

The post Medicare Enrollment appeared first on Medicare Supplement News.

from WordPress http://bit.ly/2Mskd37 via IFTTT

0 notes