#Marketing Management Assignment Help

Explore tagged Tumblr posts

Text

Innovative Segmentation Strategies in Marketing Management Student Study Help

Understanding your targeting customers is a vital factor that makes a very big difference in today’s world of marketing. This is where segmentation comes into play. Segmentation is the process of splitting the market into smaller groups of consumers depending on certain characteristics. Here, market segmentation is defined as the identifiable division of the seemingly large pool of consumers on the basis of their similarity in terms of a certain characteristic to that of other members of the segment. Marketing research is an important tool of marketing management which enables organizations to target particular consumer segments.

It might also be important especially as the global market evolves that old ways of segmentation could be insufficient. This article is focused on new and innovative approaches to segment markets and it is aimed at providing valuable information, helpful case studies, and valuable tips for MBA students. Through acquiring knowledge on these methods, the students can enhance their marketing skills and prepare for well-paying jobs in the field. This post also provides and tips and resources that the student can utilize to excel in their coursework assignments.

Why Segmentation Matters: More Than Just Demographics

Segmentation is much more than the just the division of customers in terms of age, gender, or income. Any company that wishes to be competitive within its markets needs to effectively segment its markets. It also goes further to elaborate on psychographic factors like the way of life and beliefs, as well as behavioural aspects like usage rates and brand preference. It even encompasses emerging factors such as technographics, which deals with how people engage with technology.

Why is this important?

Personalized Marketing: Campaigns that are tailored to specific groups are far more effective than generic ones. When you understand your audience's unique needs and preferences, your messages resonate more.

Resource Optimization: By focusing your efforts on the most promising segments, you can achieve a higher return on investment (ROI). This means you’re not wasting resources on less interested groups.

Competitive Advantage: Segmentation can help you find untapped niches that your competitors might have missed. This gives you a unique edge in the market, allowing you to serve these specific needs better.

In short, segmentation helps you connect more deeply with your audience, use your resources wisely, and stay ahead of the competition.

Innovative Segmentation Strategies

AI and Machine Learning-Driven Segmentation

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing how companies segment their markets. By processing massive amounts of data, AI can identify patterns and categorize customers more precisely than traditional methods.

Example: Netflix uses AI to analyze viewing habits and group users into highly specific categories. This allows for personalized recommendations and content tailored to individual tastes.

Fact: McKinsey reports that companies using AI-driven segmentation experience a 20% increase in sales efficiency.

Behavioral Segmentation with Predictive Analytics

Predictive analytics uses historical data to forecast future consumer behavior, enabling marketers to segment customers based on anticipated actions rather than just past behaviors.

Example: Amazon's recommendation system predicts what customers might buy next, dynamically categorizing them according to their evolving shopping habits.

Case Study: Forrester found that predictive analytics can enhance marketing ROI by 20-30%.

Psychographic Segmentation with Advanced Psychometrics

Psychographic segmentation focuses on the psychological characteristics of consumers, such as their values, attitudes, and lifestyles. Advanced psychometrics allow for the creation of more detailed and accurate consumer profiles.

Example: Harley-Davidson segments its market by lifestyle and personality traits, appealing to individuals who value freedom and adventure.

Fact: Research from the Journal of Consumer Psychology shows that psychographic segmentation can boost customer engagement by up to 50%.

Geodemographic Segmentation with Geolocation Data

Geodemographic segmentation combines geographic and demographic data to create more precise market segments. With the advent of mobile technology, companies can now use real-time geolocation data to enhance their strategies.

Example: Starbucks utilizes geodemographic data to determine new store locations and customize promotions based on local demographics.

Case Study: A Deloitte report indicates that businesses employing geodemographic segmentation see a 15% increase in customer acquisition rates.

Cultural Segmentation in Global Markets

Cultural segmentation considers the diverse cultural factors in global markets, such as language, traditions, and social norms, to segment customers effectively.

Example: McDonald’s adapts its menu to match cultural preferences in different countries, offering items like the McAloo Tikki in India and Teriyaki Burgers in Japan.

Fact: According to Harvard Business Review, culturally adapted marketing can increase sales by up to 30% in international markets.

Why Opt for Marketing Management Assignment Help?

In this highly competitive world, it is imperative for students to not only learn the basic concepts of marketing but also have a hands on practical exposure to various tools, methods and techniques used by marketers to succeed in acquiring new clients and contribute to business success. Marketing courses in renowned universities have been made compulsorily tough in order to prepare students for the challenging marketing environment. It is often difficult for students to deal with such extensive courses. In such scenario, we extend help to these students in their coursework and marketing assignments. Here are some of the reasons why students prefer to seek marketing management assignment help service:

Expert Guidance: Our marketing experts offer insights and solutions to real life business cases that can be obtained in no other way. They are the experts who are willing to explain the theory and how it may be applied practically to solve specific problems.

Time Management: Having a professional to assist with difficult tasks is relieving and saves time. It further makes it easier for you to manage your time on other necessary aspects related to your course or any personal work.

High-Quality Work: Our professional marketing assignment help is the best way to get assistance in your marketing research assignments and guidance on writing quality papers. This means you can submit work that is both comprehensive and well-written.

Customized Solutions: Our marketing homework help service is focussed on providing customized solutions for every assignment that is as per the university norms and rubric provided.

Benefits of Using Our Marketing Management Homework Services

24/7 Support: Our services are active 24/7 whether it’s a workday, a holiday, or deep in the middle of the night.

Plagiarism-Free Content: We write only custom papers from scratch that can help you to stand out among other students with no similarity. We deliver only plagiarism free and AI free content with plagiarism report on demand.

Confidentiality: Confidentiality of our clients is paramount for us. We ensure that your personal and payment information is kept confidential and secure.

Affordable Pricing: We always aim for meeting our client’s expectation in terms of pricing so that we can achieve our ultimate aim of providing a helping hand to our students at the time of need.

Through these services, the students can make their learning more effective and acquire better grades while at the same time having a better understanding of the different market segmentation strategies in the innovative world. Our support does not only address current problems but also prepares the students for future endeavours in marketing.

Helpful Resources and Textbooks

Books:

"Marketing Management" by Philip Kotler and Kevin Lane Keller

International Marketing Management by Ralph Berndt, Claudia Fantapi, Altobelli, Matthias Sander

Online Resources:

Harvard Business Review articles on market segmentation

Tutorhelpdesk.com for free content on marketing and other management subjects.

0 notes

Text

How Marketing Management Experts Can Help You in Your Assignment

"Discover How Marketing Management Experts Improve Your Assignments" Marketing management experts know a lot and have lots of experience. They make your assignment better by planning and strategizing just for you. They look deeply into things and develop new ideas that grab people's attention. With their help, you finish your assignments on time and make them good. Plus, they teach you stuff along the way, helping you get better at schoolwork. So, let them guide you, and see your assignments do great while you learn more about marketing management.

#Marketing Management Assignment Help#assignment help#quality assignment help#assignment support services#assignment assistance#assignment expert help

0 notes

Text

Marketing Management Assignment Experts

Having trouble with your marketing management assignments? Our marketing management assignment experts are here to assist you. With deep knowledge and hands-on experience, we deliver top-notch solutions tailored to your requirements. From market analysis and strategy creation to case studies, our experts are ready to help you succeed.

#Marketing Management Assignment Help#assignment help#quality assignment help#assignment support services#assignment assistance

0 notes

Text

#Assignment Help#Management Assignment help#Marketing Management Assignment Help#Online Exam help#Online Quiz Help

0 notes

Text

What Is Marketing Management? An Essential Introduction

Managing successful activities, schedules, costs, and resources required to execute campaign marketing is not easy but marketing management has made it possible. The process of marketing management is used for streamlining the marketer's job and helps to reach the base of the customer for accurately and quickly responding to the demands of target customers.

MBA Students face difficulties in learning concepts and theories and this impacts their assignments, dissertations, or projects. They feel stressed as they have to submit assignments within the deadline and do not have time to learn about the topic. In that case, take help from MBA Assignment Writing Services for the best quality assignments.

Marketing Management And Its Importance

The marketing management process is used for planning, tracking, and executing the organisation’s marketing strategy. This includes tactics, campaigns, and a plan of marketing used for creating as well as meeting the demands and needs of all target customers to gain profitability and growth. To ensure that you are taking the right decisions, it is important to do market research to understand the marketplace.

This helps in determining needs that have not been met and how the opportunities can be exploited that have not served. MBA is a difficult subject and students face issues in assignments or dissertations. They require proper research skills and knowledge and to learn the structuring of assignments take a guide from online Marketing Dissertation Writing Help.

Key Elements Of Marketing Management

There are some key elements that help to understand the accomplishment of marketing management in a better way:

Marketing Mix:- There are 4Ps around which marketing revolves: Product, Place, Promotion, and Price.

Marketing Plan:- It is a document form that outlines the company’s marketing strategy. This includes a budget for marketing that covers all activities with cost.

Marketing Strategy:- It is a plan that covers how the company can approach its target customers including marketing functions aspects like branding, advertising, market research, pricing, and distribution channels. It also encompasses marketing budgets, campaigns, and plans.

Marketing Campaign:- It consists of tactics and activities that are presented in the plan of marketing. Marketing campaigns are of different types with varying budgets and scopes. It is developed mainly for promoting a brand, product, or corporation.

Marketing Budget:- This element describes money that is required for covering all marketing activities included in the company. Always plan an estimation of the cost of all activities before specifying the budget and this avoids overruns of cost in marketing campaigns.

For further information and to know how to complete the assignments with the best quality and at the deadline then contact Marketing Assignment Help Australia.

Take Management Assignment Help To Learn 7 Functions Of Marketing Management

There are 7 functions that are important for marketing management to satisfy the needs and demands of customers:

Promotion

Selling

Pricing

Product Management

Financing and Budgeting

Market Research

Distribution

Conclusion

Marketing Management is the best process for planning, implementing, and creating strategies to achieve business objectives. MBA Assignment Writing Services provide the best services similar to Treat Assignment Help AU for assignments.

Author:- Eli Norris

#Marketing Management Assignment Help#Marketing Assignment Help#Assignment Help#Management Assignment Help#Online Assignment Help#Best Online Assignments Help

0 notes

Text

#assignmentwriting#college student#online learning#criminal law assignment topics#criminal law assignment examples#help with criminal law assignment#online tutoring#do my criminal law assignment#5cs marketing assignment#cipd assignment examples cipd level 3 cipd level 5 cipd level 7 cipd assignment question and answers cipd essays cipd uk cipd uae cipd leve#assignment help#domyhomework#essayhelp#homeworkhelper#homework helper#summer courses#management courses#nursing courses#IT courses#technical IT papers#exams#quizzes#quick quizzes

3 notes

·

View notes

Text

How to Use Derivatives to Hedge Market Risk in Finance Assignments

Introduction: Why Hedging Market Risk with Derivatives is a Must-Know

If you’re studying finance or financial management you’ve probably come across derivatives—options, futures, forwards and swaps. These are pretty complex and can feel overwhelming especially when you’re asked to use them to hedge market risk in your assignments. Many students struggle with this topic because it involves both theoretical concepts and real world calculations.

Derivatives are essential for managing risk whether you’re an investor, trader or business owner. But let’s be honest—figuring out how to hedge risk with derivatives is a nightmare. If you’ve ever searched for risk management homework help you know exactly what we mean!

In this post we’ll break it down into simple, step by step so you can use derivatives to hedge market risk in your finance homework.

Why Students Struggle With Using Derivatives for Hedging in Risk Management Homework

Derivatives are considered one of the toughest topics in finance. Here’s why:

∙ Complexity of Financial Instruments – Options, futures and swaps are hard to understand.

∙ Mathematical Calculations – Hedging strategies involve pricing models, probability and risk quantification.

∙ Market Understanding Required – You need to understand market movements, volatility and pricing changes to hedge.

∙ Interpretation – Even if you do the calculations right, explaining how they impact risk management is another hurdle.

That’s why many students search for risk management help—because derivatives require more than just theory. Let’s break it down so it makes sense.

What Are Derivatives and How Do They Help in Hedging Market Risk?

Financial instruments named derivatives get their value from an underlying asset that could be stocks, bonds, commodities or interest rates. The fundamental derivatives utilized during hedging operations consist of three core types.

Future Contracts are agreements that allow parties to transact an asset through a defined price at a particular upcoming date.

Derivatives under Options Contracts provide ownership of purchasing or selling rights to a specified property but do not enforce any obligation to transact.

Derivatives in the form of swaps enable two parties to exchange cash flows, such as interest rate swaps or currency swaps.

Forward contracts operate similarly to futures through OTC markets instead of traditional exchange trading.

📌 Why Use Them for Hedging?

Players in business and investment use derivatives as tools to decrease market-related uncertainty thus protecting their financial assets against price changes. The proper derivative selection enables you to shield yourself from:

Stock price volatility

Interest rate changes

Currency exchange rate fluctuations

Commodity price swings

The following section contains concrete examples about how derivatives function as risk mitigating instruments in practical situations.

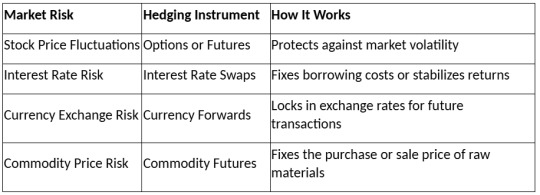

Step-by-Step Guide: How to Hedge Market Risk in Finance Assignments with Derivatives

Step 1: What Market Risk Do You Need to Hedge

Before you use derivatives you need to define the specific market risk. Ask yourself:

∙ Is the company exposed to price movements? (Use options or futures)

∙ Is it exposed to interest rate changes? (Use interest rate swaps)

∙ Is it exposed to foreign exchange risk? (Use currency forwards or options)

∙ Is it exposed to commodity price movements? (Use commodity futures)

Example: A company imports raw materials and pays suppliers in euros but gets revenue in US dollars. If the euro strengthens, costs go up. This is a currency risk and can be hedged with a currency forward.

Step 2: Choose the Right Derivative to Hedge the Risk

Once you’ve defined the risk, pick the right derivative:

Example: A US investor holding European stocks fears the euro will drop. To hedge they buy a currency put option, which allows them to sell euros at a fixed price later and protect against a loss.

Step 3: Calculate the Hedge and How It Works

For your finance assignment you may need to calculate:

∙ The hedge ratio (how much of the position to hedge)

∙ The cost of the hedge (option premiums or swap rates)

The profit/loss from hedging vs not hedging

Example: A company imports €1 million in 3 months. Current rate is 1 EUR = 1.10 USD but they think it will go to 1 EUR = 1.20 USD. They enter a currency forward to lock in the rate at 1.10.

If the euro strengthens the company is protected as they still pay the locked in rate and avoid extra costs. This is a good hedge.

Step 4: Interpret the Results and Explain the Hedge

Once you’ve done your calculations you need to interpret what the hedge means. Here’s how you can present your findings in your finance homework:

Did the hedge reduce risk? Compare with and without the hedge. Was the hedging cost justified? Was the cost of the derivative worth the protection.

What if market conditions changed? What if?

Example: In the currency hedge example above if the euro had gone the other way (1 EUR = 1.05 USD) the company would have lost out on a better rate. This is the trade off in hedging—you get protection but give up benefits.

Conclusion: Why Hedging with Derivatives is a Must-Know for Finance Students

Hedging market risk with derivatives is a key skill in finance. Whether you’re analyzing risk for a corporate client, managing a stock portfolio or handling international transactions, knowing how to use futures, options, swaps and forwards is crucial.

Got a finance homework and need risk management help? Focus on identifying risks, choosing the right derivative, calculating its impact and interpreting the results.Stuck? You’re not alone! Many students look for help with risk management when dealing with complex hedging problems. The best way to master it is through real-life examples, practical calculations and step by step analysis. Keep practicing and soon you’ll be a pro at derivative based risk management!

#risk management homework help#risk management assignment help#help with risk management#swaps#Complexity of Financial Instruments#Market Risk with Derivatives

0 notes

Text

Kotler defines it as "the satisfaction of human needs and wants through exchange". Stanton says that "marketing comprises a system of business activities designed to plan, price, promote and distribute want satisfying products and services to present and potential consumer segments.

0 notes

Text

Explore some valuable insights to help you steer your project toward success. Whether you are embarking on this academic journey for the first time or looking to enhance your research skills, these recommendations will serve as a guiding light to illuminate your path to excellence. Let's explore key strategies, common errors to avoid, and practical advice to ensure your Marketing Management dissertation stands out and makes a lasting impact in the field.

#Marketing Management Desertation#Marketing Disertation#Help with your marketing distertation#dissertation writing#Common Pitfalls#Dissertation help#Assignment expert#online assignment expert

0 notes

Text

Need assistance with your marketing assignments? Our expert team offers tailored marketing assignment help to ensure academic success. From strategic analysis to market research, trust our dedicated support and timely delivery. Elevate your grades with comprehensive assistance designed to meet your specific needs.

1 note

·

View note

Text

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

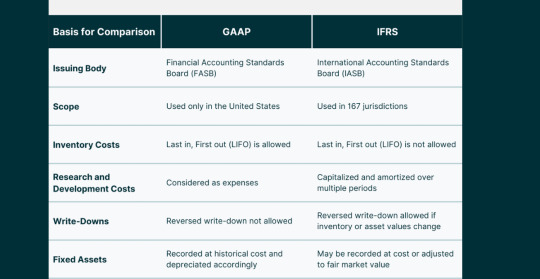

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

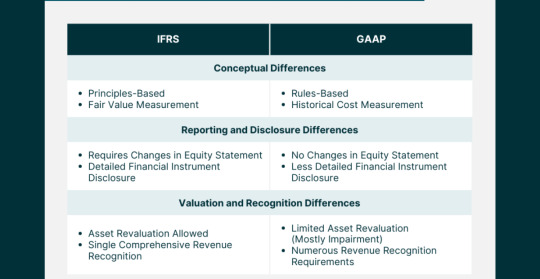

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development

Collaborative approaches to skill development involve partnerships between educational institutions, professional organizations, and industry players. The goal is to create comprehensive training programs that equip professionals with the knowledge and skills necessary for successful compliance. Standard-setters and regulators can play a pivotal role in promoting and endorsing such collaborative initiatives, fostering a culture of continuous learning within the accounting profession.

10. Legal Implications for Corporations

10.1. Legal Challenges in GAAP Compliance

a. Litigation Risks in GAAP Adherence

The legal challenges associated with GAAP compliance include litigation risks arising from alleged non-compliance. Companies adhering to GAAP must navigate the complexities of the legal landscape, ensuring that their financial statements withstand scrutiny. Implementing robust internal controls, engaging in transparent communication, and staying abreast of legal developments are essential strategies for mitigating litigation risks.

b. Strategies for Legal Compliance in GAAP

Strategies for legal compliance in GAAP involve proactive measures to minimize litigation risks. This includes fostering a culture of compliance within the organization, conducting regular internal audits, and seeking legal counsel to ensure alignment with evolving regulations. Companies that prioritize legal compliance contribute to the overall stability and trustworthiness of the financial reporting ecosystem.

10.2. Legal Battles in IFRS Adoption

a. Navigating Legal Challenges in IFRS Transition

The transition to IFRS introduces legal battles that companies must navigate effectively. Disputes may arise over interpretations of IFRS standards, potentially leading to litigation. Companies must engage in comprehensive risk assessments, understanding the legal implications of IFRS adoption, and implementing measures to mitigate potential legal challenges.

b. Legal Safeguards for Companies Adopting IFRS

Legal safeguards for companies adopting IFRS involve proactive steps to minimize legal risks. This includes engaging legal experts in the transition process, conducting impact assessments, and implementing robust governance structures. Companies that prioritize legal safeguards position themselves to navigate the complexities of IFRS adoption with resilience and integrity.

10.3. Risk Mitigation Strategies

a. Legal Safeguards: Mitigating Risks in Regulatory Compliance

Legal safeguards play a pivotal role in mitigating risks associated with regulatory compliance. Companies must implement effective risk management strategies, including regular legal audits, compliance training, and a responsive approach to legal developments. A proactive stance towards legal safeguards enhances a company’s ability to navigate the intricate landscape of financial reporting standards.

b. Strategies for Minimizing Legal Challenges in Reporting Standards

Strategies for minimizing legal challenges in reporting standards involve a holistic approach to risk management. This includes collaboration with legal professionals, staying informed about evolving regulations, and fostering a culture of compliance within the organization. Companies that prioritize these strategies not only mitigate legal challenges but also contribute to the overall reliability and credibility of financial reporting standards.

11. Investor Perspectives

11.1. Investor Preferences

a. Surveying Investor Preferences: GAAP or IFRS?

Understanding investor preferences is crucial in the GAAP vs. IFRS discourse. Surveys play a valuable role in gauging investor sentiment and preferences regarding financial reporting standards. The insights gleaned from such surveys inform standard-setters, regulators, and companies in aligning financial reporting practices with investor expectations.

b. Implications of Investor Preferences on Reporting Standards

The implications of investor preferences on reporting standards are far-reaching. Companies that align with investor preferences enhance transparency and communication, fostering trust and confidence. Standard-setters and regulators, informed by investor feedback, can shape standards that not only meet regulatory requirements but also cater to the information needs of investors in a dynamic and competitive market.

11.2. Impact on Investment Decision-Making

a. Investor Decision Dynamics: GAAP vs IFRS

Investor decision dynamics are influenced by the choice between GAAP and IFRS. Differences in financial reporting standards can impact the comparability of financial statements, influencing investment decisions. Investors must consider the implications of these standards on key metrics, risk assessments, and overall financial analysis to make informed and strategic investment decisions.

b. Strategic Impacts on Investment Choices

The strategic impacts of financial reporting standards on investment choices go beyond compliance. Companies that recognize the link between transparent financial reporting and investor confidence gain a strategic advantage. Similarly, investors who factor in the nuances of GAAP and IFRS differences in their decision-making processes navigate the complexities of the investment landscape more effectively.

11.3. Investor Education Initiatives

a. The Imperative of Investor Education

The imperative of investor education underscores the need for initiatives that enhance investor understanding of financial reporting standards. Educational programs, informational resources, and collaborative efforts between financial institutions and regulatory bodies contribute to a more informed investor community. An educated investor base not only demands higher standards of transparency but also actively participates in shaping the future trajectory of financial reporting.

b. Educating Investors on GAAP vs IFRS Implications

Educating investors on GAAP vs. IFRS implications involves demystifying the complexities of these frameworks. Providing accessible information, conducting investor workshops, and leveraging digital platforms for educational outreach are essential components. Investors empowered with a deeper understanding of financial reporting standards contribute to market efficiency and hold companies accountable for transparent and reliable reporting.

12. Ethical Considerations

12.1. Ethical Dimensions in Financial Reporting

a. Ethics in Financial Reporting Standards

Ethical considerations are integral to the formulation and adherence to financial reporting standards. The principles of integrity, objectivity, and transparency underpin ethical financial reporting. Standard-setters, regulators, and companies must navigate ethical dimensions to ensure that financial reporting serves the interests of investors and the broader public.

b. Upholding Integrity and Objectivity in Reporting

Upholding integrity and objectivity in reporting requires a commitment to ethical conduct. Companies must prioritize accurate representation over short-term gains, fostering a culture that values transparency. Regulators play a crucial role in setting the ethical tone, emphasizing the importance of unbiased and principled financial reporting in maintaining the integrity of capital markets.

12.2. Ethical Challenges for Accountants

a. Common Ethical Dilemmas in GAAP and IFRS

Accountants face common ethical dilemmas in navigating the intricacies of GAAP and IFRS. Issues such as revenue recognition, asset valuation, and disclosure requirements present challenges where ethical considerations intersect with professional responsibilities. Accountants must navigate these dilemmas with a commitment to ethical conduct, considering the broader impact on stakeholders and financial markets.

b. Navigating Ethical Challenges in Reporting Standards

Navigating ethical challenges in reporting standards involves equipping accountants with the tools and guidance needed for principled decision-making. Ongoing professional development, ethical training programs, and mentorship initiatives contribute to a culture of ethical awareness within the accounting profession. Companies, in turn, benefit from the assurance that financial reporting is not only compliant but also aligns with the highest ethical standards.

12.3. Regulatory Measures for Integrity

a. Regulatory Safeguards: Ensuring Ethical Conduct

Regulatory safeguards play a crucial role in ensuring ethical conduct in financial reporting. Regulatory bodies must establish and enforce ethical standards, conduct regular audits, and impose sanctions for non-compliance. A robust regulatory framework promotes integrity in financial reporting, reinforcing public trust in the accuracy and reliability of financial statements.

b. Maintaining the Integrity of Financial Reporting Standards

Maintaining the integrity of financial reporting standards requires a collaborative effort between regulators, standard-setters, and industry stakeholders. Periodic reviews, stakeholder consultations, and responsiveness to emerging ethical challenges contribute to the ongoing refinement of standards. The commitment to upholding ethical principles ensures that financial reporting continues to serve as a cornerstone of trust in the global business landscape.

13. Future Trajectories

13.1. The Evolution of Reporting Standards

a. Anticipating Future Changes

Anticipating future changes in reporting standards involves considering the dynamic nature of global business, technological advancements, and shifts in investor expectations. Standard-setters must adopt a forward-looking approach, engaging in scenario planning and staying attuned to emerging trends. The ability to anticipate future changes ensures that reporting standards remain relevant and adaptive to the evolving needs of the business environment.

b. Technological Innovations and Reporting

Technological innovations are poised to shape the future trajectory of reporting standards. The integration of artificial intelligence, blockchain, and data analytics introduces opportunities for enhanced accuracy, efficiency, and transparency in financial reporting. Standard-setters and companies must embrace these innovations responsibly, balancing the benefits of technology with the imperative of maintaining ethical and transparent financial practices.

13.2. Convergence vs. Divergence

a. Assessing Convergence Prospects

The prospects of convergence between GAAP and IFRS continue to be a topic of consideration. While convergence offers the promise of a more standardized global approach, challenges such as differing legal frameworks and regulatory philosophies persist. Assessing convergence prospects involves a nuanced examination of global trends, regulatory developments, and ongoing efforts by standard-setters to bridge divergences.

b. Navigating Divergences in Global Standards

Navigating divergences in global standards requires a pragmatic approach that acknowledges the unique needs of individual jurisdictions. The coexistence of multiple standards necessitates effective communication, education, and cross-border collaboration. Standard-setters can play a pivotal role in facilitating harmonization efforts, fostering a global financial reporting landscape that balances convergence with the flexibility needed to accommodate diverse economic and regulatory environments.

13.3. Sustainable Reporting Paradigms

a. The Rise of Sustainable Reporting

The rise of sustainable reporting reflects a paradigm shift in the broader understanding of corporate performance. Investors, regulators, and the public increasingly recognize the importance of environmental, social, and governance (ESG) factors. Future reporting standards are likely to integrate sustainable reporting paradigms, providing a more comprehensive view of a company’s long-term value creation and societal impact.

b. Integrating ESG Metrics into Reporting Standards

Integrating ESG metrics into reporting standards requires a collaborative effort between standard-setters, regulators, and industry stakeholders. The development of clear guidelines, standardized metrics, and transparent disclosure requirements enhances the credibility of sustainable reporting. Companies embracing ESG considerations in their financial reporting contribute to a more informed and responsible investment landscape.

14. Conclusion

Financial reporting standards, whether grounded in GAAP or IFRS, serve as the bedrock of transparency, trust, and accountability in the global business landscape. The evolution of these standards reflects a journey of adaptation to changing business dynamics, regulatory landscapes, and investor expectations. While GAAP and IFRS diverge in certain philosophies and approaches, they share a common goal – to provide reliable and relevant information for decision-making.

As we navigate the complexities of GAAP vs. IFRS, it is imperative to recognize the strengths and limitations of each framework. GAAP, with its historical cost emphasis and rule-based approach, offers stability and comparability. In contrast, IFRS, operating under a principles-based approach, provides flexibility and a global perspective. Understanding the variances in revenue recognition, asset valuation, and consolidation methods is essential for investors, analysts, and companies alike.

Looking ahead, the trajectory of reporting standards involves a delicate balance – between convergence and divergence, between technological innovation and ethical considerations, and between traditional financial metrics and sustainable reporting paradigms. The future holds the promise of more standardized, adaptive, and responsible reporting standards that cater to the diverse needs of a dynamic global economy.

In conclusion, as the landscape of financial reporting continues to evolve, stakeholders must remain vigilant, adaptive, and collaborative. Whether one adheres to GAAP or IFRS, the shared commitment to integrity, transparency, and accountability ensures that financial reporting remains a cornerstone of trust in the interconnected world of business and finance.

#cfo#banking#accounting#finance#investment#personal finance#international finance assignment help service#financial management#financial markets#financial modeling#financial planning#financial dominance#financial services#financial literacy#financial drain#management#business#entrepreneur

0 notes

Text

#language#teacher#studyspo#studyblr#study motivation#teaching#textbooks#100 days of productivity#studying#student life#student#study blog#study aesthetic#learning#online#online diary#online marketing#online business#management assignment help#management consulting firms#management courses#management consultancy#management software#course#entrepreneur#accounting#development#finance#finance expert warns#economics assignment help

0 notes

Text

Human resource management assignments help

Human resource management assignment help is an online service by tutorhelp4you to ease the success path of students. Students must be aware of managing people and the organization’s resources. Human resource management does planning, executing, controlling, and directing related to human resources. Complex concepts can trouble students in preparing their work on time. Our expert team can make your project on time with accurate solutions at affordable prices. We have a deep understanding of your concepts and can effortlessly convey them in simple and understandable language. Our help can provide editing, proofreading, and improvement if needed. We are the most authentic and best way to support students and help them to grow.

#Human resource management assignments help#online tutoring help#programming assignment help#college#finance#graphic design#books#language#logo design#academia#marketing

0 notes

Text

Marketing Management Assignment Help

Stuck on your marketing management assignment? Get the help you need from our expert tutors. We provide customized Marketing Management Assignment Help on all aspects of marketing management coursework. Our tutors can help with analyzing the marketing environment, segmentation, targeting and positioning strategies, developing effective marketing plans, managing marketing channels and communications, branding, pricing models, and measuring marketing performance. With extensive experience in marketing and academic writing, our tutors understand exactly what you need to do to produce high-quality work that meets the requirements. Work one-on-one with a tutor who will guide you through the concepts and give you feedback to help improve your skills. Submit your marketing management assignment on time with confidence by getting the personalized help and support you need from our service.

#Marketing Management#Assignment Help#Management Tutors#Assignment Support#Homework Assistance#Online#Marketing Tutors#Management Tips

0 notes

Text

International Marketing Management Assignment Help

International Marketing Management Assignment Help is a valuable resource for students seeking guidance in the complex field of global marketing. As businesses expand their reach across borders, understanding international marketing becomes crucial. This academic assistance offers support in various aspects of the subject.

#International Marketing Management Assignment Help#accounting assignment help#childcare assignment help#management assignment help#assignment help#xero assignment help#online exam help#finance assignment help#economics assignment help#nursing assignment help#cdr report writing help

0 notes

Text

Quantitative Techniques For Management

In modern business quantitative techniques in management plays a very crucial role and in regard to this students are provided with these types of assignments. With this, if you require the best marketing assignment help in Australia hire Treat Assignment Help Australia and get the best academic services. For More Visit Here

#Marketing Management Assignment Help#Marketing Assignment Help#Assignment Help#Management Assignment Help#Online Assignment Help#Best Online Assignments Help

0 notes