#Macd Indicator How To Use

Explore tagged Tumblr posts

Text

🔥#Forex #Metatrader4 TRADE #GBPUSD M15 Sell trade +184 Pips. More Info about Non Repaint Trade system in Website.

Forex TRADE EXAMPLE with Cashpower Indicator NON REPAINT Signals. wWw.ForexCashpowerIndicator.com .

🔥Available Indicator Version and EA Auto-Trade Cashpower with Automatic SL, TP & Powerful Trailing Stop = Secure Profits

.

✅ NON REPAINT

✅ Lifetime License

✅ NON LAGGING Non Delay

✅ Less Signs Greater Profits

🔔 Sound And Popup Nofification

✅ Minimizes unprofitable/false signals

🔥 Manual Trade Version & Auto-Trade Versio

.

* Exclusive * : Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his Lifetime License.

.

🏷* Promotion * : Ultimate Version Promotion price 60% off. Lifetime license no monthly fees. Promotion price end at any time. After this offer Price Back to Original.

.

( This Trade image was created at XM image brokerage. Signals may vary slightly from one broker to another ).

.

🛑 Be Careful Warning: A Fake imitation with MACD code reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that NOT are our LEGITIME old Indicator. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

#forexindicators#forexindicator#forexsignals#forex#indicatorforex#cashpowerindicator#forexvolumeindicators#forextradesystem#forexprofits#forexchartindicators#macd indicator how tu use#inducator fibonacci#indicator fibonacci how to use#how trade forex#best forex broker bonus#forex news#forex signals buy and sell

1 note

·

View note

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

12 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the unofficial start of summer ahead and just 4 trading days left in May, equity markets were mixed with tech strong, large caps flat and small caps lower. Elsewhere looked for Gold ($GLD) to continue to consolidate in the uptrend while Crude Oil ($USO) resumed a short term downtrend. The US Dollar Index ($DXY) might resume the short term move lower while US Treasuries ($TLT) remained in a downtrend. The Shanghai Composite ($ASHR) looked to pause in the short term move higher while Emerging Markets ($EEM) might be confirming a failed break out higher.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong, especially on the longer timeframe. On the shorter timeframe the QQQ was also strong with the SPY in consolidation. The $IWM continued to be the outlier, consolidating at a higher range.

The week played out with Gold finding support and holding in a narrow range while Crude Oil consolidated rose early in the week before giving back the gain later. The US Dollar held over support while Treasuries moved higher in the downtrend. The Shanghai Composite held at support while Emerging Markets rocketed to the downside.

Volatility rose up off the recent lows but but only to 14. This put pressure on equities and the large caps and tech names responded with a 4 day move lower. The small caps found support mid week and bounced in consolidation. This resulted in the SPY, IWM and QQQ ending back below their 20 day SMA’s. What does this mean for the coming week? Let’s look at some charts.

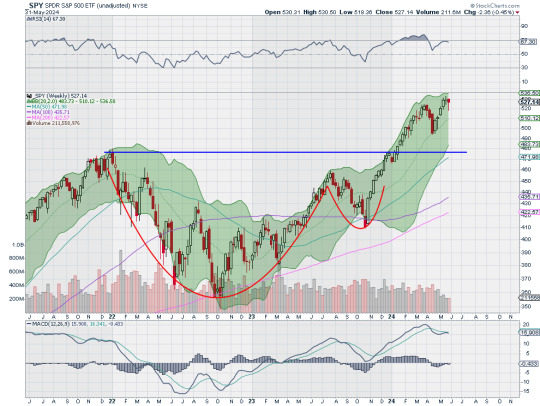

SPY Daily, $SPY

The SPY came into the week consolidating at the all-time high but after a bearish engulfing candle failed to confirm Friday. It held Tuesday and then started to move lower on Wednesday. Thursday it crossed below the 20 day SMA for the first time since May 2nd and dropped again Friday before a strong move higher the last 30 minutes of the day. The RSI is dropping at the midline but in the bullish zone with the MACD crossed down and positive. So far this could just be a momentum reset, with no threat to the uptrend yet.

The weekly chart shows a more damaging pattern as the doji last week is confirmed as a reversal with a move lower this week. This happened as the RSI stalled at a lower high showing a divergence. The price is far from the 20 week SMA and the last pullback found support there. The MACD is crossed down and moving lower but positive. There is support at 520.50 and 517.50 then 513.50 and 510 before 503.50 and 501.50. Resistance higher is at 524.50 and 530. Digestion in Uptrend.

SPY Weekly, $SPY

With the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil consolidates in a narrow range after a pullback. The US Dollar Index continues to drift to in broad consolidation while US Treasuries continue their downtrend. The short term move higher in the Shanghai Composite looks to be at risk of reversing while Emerging Markets enter a short term downtrend.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe both the QQQ and SPY have reset to their 20 day SMA’s where they often find support. How they react next week could tell if this week was meaningful or not. The IWM continues to be the laggard, stalled near the top of a 2 year range. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview May 31, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

9 notes

·

View notes

Text

Master the "Moving Average Convergence Divergence" for Bitcoin-Euro Trading Trading Bitcoin against the Euro can feel like riding a rollercoaster blindfolded: exhilarating, unpredictable, and sometimes nauseating. But with the right tools and strategies, you can turn the chaos into calculated profits. Enter the "Moving Average Convergence Divergence" (MACD) — a powerful yet often misunderstood indicator that can be your secret weapon in navigating this dynamic market. What Is MACD and Why Should Bitcoin-Euro Traders Care? Think of MACD as your market's mood detector. It helps you identify trends, momentum, and potential reversals in price action. Unlike chasing trends blindly (which is like buying that infomercial gadget you never use), MACD provides actionable insights into when to enter and exit trades with precision. For Bitcoin-Euro traders, where volatility reigns supreme, MACD is particularly useful. It cuts through the noise and highlights underlying trends, giving you the clarity of a seasoned trader without the gray hair. Decoding MACD: The Secret Formula Behind the Indicator At its core, MACD consists of three components: - The MACD Line: Calculated by subtracting the 26-period EMA (Exponential Moving Average) from the 12-period EMA. This line shows the difference between two moving averages. - The Signal Line: A 9-period EMA of the MACD line, serving as a trigger for buy and sell signals. - The Histogram: The visual representation of the difference between the MACD line and the Signal line. Let’s break it down: When the MACD line crosses above the Signal line, it’s a bullish signal (a potential buy). When it dips below, it’s bearish (a potential sell). Think of these crossovers as traffic lights: green for go, red for stop, and yellow for “proceed with caution” (or keep an eye on your stop-loss). Why Most Traders Get MACD Wrong (and How You Can Avoid Their Mistakes) Mistake #1: Ignoring Divergence Divergence between MACD and price action can be your best friend. For instance: - Bullish Divergence: Price makes a lower low, but MACD makes a higher low. Translation? Momentum is shifting upward. - Bearish Divergence: Price hits a higher high, but MACD forms a lower high. Warning: the trend may reverse downward. Most traders overlook these subtle cues, but spotting divergence is like finding an unopened box of chocolates in your pantry — sweet and unexpectedly rewarding. Mistake #2: Over-Reliance on Default Settings The default MACD settings (12, 26, 9) work for many assets, but Bitcoin-Euro’s unique volatility calls for customization. Experiment with shorter EMAs (e.g., 8, 21, 5) for faster signals or longer EMAs for a steadier approach. Tailor the settings to your trading style and risk tolerance. Advanced MACD Tactics for Bitcoin-Euro Success 1. Pair MACD with Volume Analysis Volume is the secret handshake of the trading world. When MACD signals align with a surge in volume, it’s like receiving a VIP invitation to a high-probability trade. For example: - MACD bullish crossover + increasing volume = strong buy signal. - MACD bearish crossover + declining volume = weak selling pressure (wait for confirmation). 2. Use MACD on Multiple Timeframes Traders often limit themselves to one timeframe, but that’s like watching a movie through a keyhole. Check MACD signals on: - Higher Timeframes: To confirm the overall trend. - Lower Timeframes: For precise entry and exit points. Example: If the daily MACD shows bullish momentum while the hourly MACD crosses bearish, wait for alignment before committing to a trade. 3. Combine MACD with Fibonacci Retracements Fibonacci levels are like the hidden scaffolding of the market. Use them to confirm MACD signals: - If MACD indicates a bullish reversal near a 61.8% retracement level, it’s a high-probability buy. - Similarly, bearish signals near a 38.2% retracement level can reinforce a sell decision. Real-World Example: MACD in Action with Bitcoin-Euro Imagine BTC/EUR is trading at €25,000. Here’s how you could use MACD: - Identify a Trend: The daily MACD line crosses above the Signal line, signaling bullish momentum. - Check for Divergence: Price makes a lower low, but MACD’s histogram prints higher lows — a bullish divergence. - Confirm with Volume: Volume spikes confirm strong buying interest. - Enter the Trade: Place a buy order at €25,200 with a stop-loss at €24,800 (below recent support). - Set Targets: Use Fibonacci extensions (e.g., 161.8%) to set profit targets around €27,000. Proven Strategies to Enhance Your MACD Edge A. The MACD-Ichimoku Combo Ichimoku Cloud adds depth to MACD analysis. When the MACD gives a bullish signal and price is above the Ichimoku Cloud, it’s a strong buy confirmation. Conversely, bearish MACD signals below the Cloud warn of deeper downtrends. B. Backtest Like a Scientist Blindly trusting MACD without backtesting is like baking a cake without checking the recipe. Use historical data to test how MACD settings perform on BTC/EUR during different market conditions. Tools like TradingView make backtesting easy and insightful. Elite Tactics You Won’t Find Elsewhere - MACD as a Trend Filter: Use MACD to filter trades in the direction of the dominant trend. For instance, only take buy signals when the MACD line is above zero. - Set Alerts for Crossovers: Automate your trading by setting alerts for MACD crossovers on platforms like MetaTrader or TradingView. This reduces the risk of missed opportunities. - Master the Art of Patience: Wait for confirmation across multiple indicators before entering trades. As the old saying goes, “Measure twice, cut once.” Conclusion: The MACD Advantage for Bitcoin-Euro Trading By mastering the MACD indicator, you’re not just trading — you’re strategizing. Whether it’s spotting divergence, customizing settings, or pairing MACD with other tools, these tactics can give you an edge over the market. Ready to elevate your trading game? Explore our exclusive resources at StarseedFX to unlock cutting-edge tools, expert insights, and real-time updates. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Binomo Trading Techniques: The Path to Success

Do you want to succeed in trading on the Binomo platform? The right trading techniques are essential to achieving your financial goals. In this article, we’ll guide you through crucial steps for trading success on Binomo, from understanding the platform basics to applying advanced strategies. By implementing the techniques discussed, you can increase your chances of success while minimizing risks. Let’s start your journey toward trading success on Binomo!

Understanding Binomo Trading Techniques

To succeed in trading on Binomo, it’s important to master a few key techniques:

Market Analysis: A fundamental skill for Binomo trading is accurate market analysis. Learn how to read charts, identify trends, and use technical indicators. Spot candlestick patterns and support/resistance levels to predict price movements effectively.

Risk Management: Effective risk management is crucial. Set a loss limit you’re comfortable with and always use stop-loss orders. Never risk more than 1-2% of your capital on a single trade. Diversifying your trades can also reduce risk.

Entry and Exit Strategies: Develop strong entry and exit strategies. Use solid technical or fundamental signals to determine entry points, and set realistic profit targets for exits. Always evaluate and adjust your strategies based on performance.

Mastering these core techniques provides a strong foundation for your trading success. Remember, consistency and ongoing learning are key.

Fundamental Analysis: Key to Success on Binomo

Incorporating fundamental analysis into your trading strategy can significantly enhance your results on Binomo:

Economic Indicators: Understanding key economic data like unemployment rates, inflation, and GDP can help you predict asset price movements. Skilled traders can interpret these indicators to gain an edge.

Stay Updated with Global Events: News and global events, such as political changes or natural disasters, can influence price changes. Being informed allows you to make more strategic and timely trading decisions.

Sector and Company Analysis: For stock trading on Binomo, understanding industry trends and individual company performance is vital. Analyzing company reports and market positioning can give you insights into potential price movements.

By mastering fundamental analysis, you can improve your ability to predict trends and optimize your Binomo trading strategy.

Best Strategies to Maximize Profits on Binomo

To succeed on Binomo, implementing effective strategies is essential. Here are the best practices to follow:

In-Depth Technical Analysis: Learn and apply technical analysis with indicators like Moving Averages, RSI, and MACD. Recognize candlestick patterns and key support/resistance levels to improve your trading accuracy.

Smart Risk Management: Limit your trade investments to 1-2% of your total capital. Always use Stop Loss to minimize potential losses and Take Profit to lock in profits. Diversify your trades to spread risk.

Use a Demo Account: Before trading with real money, make the most of Binomo’s demo account. Practice strategies and familiarize yourself with the platform without risking real funds.

By consistently applying these strategies, you can optimize your chances of success and minimize risks.

Risk Management: A Crucial Step in Binomo Trading

Effective risk management is vital for long-term success on Binomo. Here are key practices to manage risk:

Set Loss Limits: Determine the maximum loss you’re willing to accept and stick to it. Limit each trade to 1-2% of your total capital to avoid significant losses.

Diversify Your Portfolio: Don’t focus on a single asset. Explore different asset types, such as currencies, commodities, and stock indices, to reduce risk and increase opportunities.

Use Stop Loss Features: Always set a stop loss for each trade to protect yourself from larger losses. This feature automatically closes your position when a price hits a specific level, helping to limit losses.

By applying these risk management principles, you’ll enhance your chances of long-term success on Binomo.

Practical Tips for Improving Your Binomo Trading Performance

To excel at Binomo, mastering a few practical tips can improve your trading results:

Learn and Apply Technical Analysis: Master technical analysis to better understand charts, trends, and indicators like RSI, MACD, and Bollinger Bands. This will help you predict price movements with greater accuracy.

Manage Risk Wisely: Set appropriate loss limits, use stop-loss orders, and avoid risking more than 1-2% of your capital per trade.

Practice Discipline and Emotional Control: Stick to your strategy and avoid making emotional decisions. If you face losses, don’t rush to recover by increasing trade size drastically.

By consistently following these tips, you’ll improve your chances of success and profitability on Binomo.

Conclusion

Mastering Binomo trading techniques brings you closer to achieving financial success. Remember, consistency, discipline, and continuous learning are the keys. Always manage risk wisely and avoid emotional decisions. Binomo offers great opportunities, but also comes with risks. With a solid approach and the right techniques, you can maximize your potential for profits. Happy trading, and best of luck on your investment journey with Binomo!

Perfect Binary Mentor

0 notes

Text

How to Use Candlestick Patterns for Successful Day Trading

Day trading is a fast-paced, high-stakes strategy that requires traders to make split-second decisions in volatile markets. One of the most powerful tools for predicting market movements in day trading is the use of candlestick patterns. These visual indicators not only reveal potential price action but also provide valuable insights into market sentiment. In this article, we will explore how to use candlestick patterns for successful day trading, with expert tips and techniques to help you make smarter, more informed trading decisions.

What Are Candlestick Patterns?

Candlestick patterns are visual representations of price action over a specific period, typically within a single trading session. Each candlestick consists of a body and two wicks (also called shadows). The body represents the range between the open and close prices, while the wicks show the high and low prices for that time period.

Candlestick patterns are created by the interaction of these candlesticks over a series of time frames and can indicate the direction and strength of a trend. By recognizing and interpreting these patterns, traders can anticipate potential price movements, making them an essential tool in day trading.

Why Candlestick Patterns Are Crucial for Day Trading

In day trading, every second counts. Successful day traders need to quickly analyze market conditions and identify profitable opportunities. Candlestick patterns provide several benefits that make them a powerful tool for traders, including:

Clear Visual Indicators: Candlestick patterns are easy to identify and interpret, providing a quick visual reference for making decisions.

Market Sentiment Insights: Patterns reveal the psychology of market participants, helping you gauge bullish or bearish sentiment.

Reversal and Continuation Signals: Candlestick patterns can indicate potential market reversals or the continuation of trends, giving you an edge in predicting price movements.

Adaptability: Candlestick patterns can be used across different timeframes, from one-minute charts to daily charts, making them versatile for various trading strategies.

How to Effectively Use Candlestick Patterns for Day Trading

While recognizing candlestick patterns is an important skill, knowing how to effectively use them in your day trading strategy is essential for success. Here are some tips to make the most of candlestick patterns:

1. Combine Patterns with Other Indicators

Candlestick patterns are not foolproof, and relying solely on them for trade decisions can lead to mistakes. For more accurate predictions, combine candlestick patterns with other technical indicators like moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). This multi-indicator approach helps validate signals and reduces the risk of false entries.

2. Understand Market Context

It’s important to consider the broader market context when using candlestick patterns. For example, a reversal pattern may be more reliable when it forms near a key support or resistance level. Always analyze the broader trend and market conditions to determine whether a pattern is signaling a valid trade opportunity.

3. Focus on Short Timeframes

Since day trading involves taking advantage of small price movements throughout the day, focusing on shorter timeframes (such as 1-minute, 5-minute, or 15-minute charts) is crucial. Candlestick patterns on these timeframes can provide quick insights into price action and help you make more informed trades.

4. Manage Your Risk

Day trading can be risky, especially if you're relying on candlestick patterns alone. Always set stop-loss orders to limit potential losses and use proper risk management techniques. Never risk more than a small percentage of your trading capital on any single trade.

5. Practice and Refine Your Skills

Like any trading strategy, mastering candlestick patterns takes time and practice. Spend time studying real market charts, backtest your strategies, and continuously refine your understanding of candlestick patterns. The more experience you gain, the more effectively you’ll be able to use candlestick patterns in your day trading strategy.

Conclusion

Candlestick patterns are a powerful tool for any day trader looking to gain an edge in the market. By learning how to recognize these patterns and understanding their significance, you can enhance your ability to predict price movements and make smarter trade decisions. Remember, while candlestick patterns are valuable, they should be used in conjunction with other technical analysis tools, and always manage your risk effectively.

At FuturesElite, we understand the importance of utilizing the right tools for successful trading. By incorporating candlestick patterns into your day trading strategy, you’ll be well on your way to maximizing profits and navigating the fast-paced world of day trading with confidence.

0 notes

Text

How Can Share Market Gurukul Trading Simplify Your Investment Journey with Software?

Investing in the stock market can be complex, but the right tools can simplify the process. best share market course offers trading software designed to streamline and enhance your investment journey.

1. User-Friendly Interface

SMG’s trading software is designed with simplicity in mind:

Intuitive Design: Easy-to-navigate dashboards help traders focus on decision-making.

Customizable Layouts: Tailor the interface to display the most relevant data.

One-Click Trades: Execute trades quickly without complex steps.

2. Advanced Analytical Tools

The software provides powerful analysis features for better decision-making:

Real-Time Charts: Track stock movements and spot trends.

Screeners and Filters: Identify stocks that match your investment criteria.

Indicator Integration: Access technical best share market course indicators like RSI, MACD, and Bollinger Bands .

3. Automation Capabilities

Save time and reduce errors with automated features:

Predefined Alerts: Get notified about price changes or specific conditions.

Automated Orders: Set rules for buying or selling stocks automatically.

Portfolio Management: Track your investments and returns in one place.

4. Educational Support

SMG integrates learning with trading:

Tutorials: Guides on using the software effectively.

Live Market Practice: Simulated trading environments for beginners.

Conclusion

best share market course simplifies investing by combining ease of use, advanced tools, and automation. It’s the perfect companion for both beginners and seasoned traders.

0 notes

Text

📈 How to Choose the Right Stocks for Trading 💹✨

Successful trading begins with selecting the right stocks. Here's a step-by-step guide to help you make informed choices:

1️⃣ Identify Trends: Look for stocks in sectors showing strong momentum or news-driven movements. 2️⃣ Volume Matters: Focus on stocks with high trading volumes—liquidity ensures smoother entry and exit. 3️⃣ Check Volatility: Pick stocks with moderate to high volatility for better opportunities but manage the risk. 4️⃣ Use Technical Indicators: Analyze moving averages, RSI, and MACD to spot potential trades. 5️⃣ Study News & Events: Stay updated on earnings reports, mergers, and other market-moving news. 6️⃣ Set Your Goals: Choose stocks that align with your strategy—day trading, swing trading, or positional.

💡 Pro Tip: Always perform both technical and fundamental analysis to validate your decisions and reduce risks.

🌟 The Key to Winning: Stock selection is an art and a science. Combine data-driven strategies with market insights to trade like a pro.

#StockSelection#TradingTips#ASJVentures#SmartTrading#stockmarketeducation

#free stock market classes#free classes#freesharemarketclasses#free stock market courses#stock market courses#stock market#stock trading#finance#pune#asj ventures

0 notes

Text

Effective Technical Indicators and Swing Stock Screener for Successful Swing Trading

Swing trading is a strategy that focuses on capturing short to medium-term price movements. To maximize success, traders need to use reliable technical indicators and effective tools like a swing stock screener to identify the best stocks to trade. This article provides insights into the best technical indicators for swing trading and explains how to use a swing stock screener to streamline your trading process.

Key Technical Indicators for Swing Trading

Moving Averages (MA):

Moving averages help smooth out price data and reveal the underlying trend. Traders commonly use the 50-day and 200-day moving averages to identify bullish or bearish trends. A common signal is when a short-term moving average crosses above a long-term moving average, signaling a potential buy.

Relative Strength Index (RSI):

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 indicating that a stock is overbought and readings below 30 signaling an oversold condition. Traders use these levels to identify potential reversals.

MACD (Moving Average Convergence Divergence):

The MACD is a trend-following momentum indicator that helps traders identify shifts in market direction. When the MACD line crosses above the signal line, it suggests bullish momentum, while a crossover below the signal line may indicate bearish conditions.

Bollinger Bands:

Bollinger Bands consist of a moving average and two standard deviation bands that adjust based on market volatility. When the price moves close to the upper or lower bands, it suggests the stock is overbought or oversold, signaling a potential reversal or breakout.

Volume Analysis:

Volume plays a key role in confirming trends. A significant increase in volume often precedes price movements. Indicators like On-Balance Volume (OBV) help assess whether the stock is being accumulated or distributed, providing insight into the strength of the trend.

How to Use a Swing Stock Screener to Find Opportunities

A swing stock screener is an essential tool for traders looking to identify stocks with high potential for swing trading. By applying filters based on key criteria, you can narrow down the list of stocks and focus on the most promising opportunities.

Filter by Volatility:

For swing trading, volatility is essential, as larger price movements provide greater profit potential. Use your screener to find stocks with a high average true range (ATR) or stocks that have shown significant price fluctuations in recent periods.

Use Trend Filters:

Focus on stocks that are trending in a specific direction. Use the screener to find stocks that are above or below their moving averages, indicating they are in an uptrend or downtrend. This allows you to target stocks that align with your trading strategy.

Incorporate Technical Indicators in Screening:

Use the screener to filter stocks based on technical indicators such as RSI, MACD, or Bollinger Bands. For example, you can filter for stocks with an RSI below 30, indicating they are oversold and may present a buying opportunity.

Volume Filters:

Volume is crucial for confirming price movements. Ensure that the stocks selected have sufficient volume to facilitate smooth execution of trades. A stock with low volume may experience high slippage, making it harder to trade effectively.

Timeframe Settings:

Adjust your screener to focus on timeframes that suit your swing trading strategy. This might include stocks with specific price movements over the past week or month. These settings will help you target stocks that have the right characteristics for swing trading.

Combining Technical Indicators with a Swing Stock Screener

By integrating technical indicators with a swing stock screener, you can refine your trading strategy and make more informed decisions. For instance, you can use the screener to find stocks that are in a strong trend, then apply indicators like the RSI and MACD to pinpoint the best entry and exit points.

Using a swing stock screener to filter stocks with strong technical signals, such as an RSI below 30 (indicating an oversold condition) or a MACD crossover, can help you find high-potential trades with reduced risk.

Conclusion

To be successful in swing trading, you need to use the right technical indicators and tools like a swing stock screener. By combining moving averages, RSI, MACD, and other key indicators with a well-structured screening process, you can identify stocks with the highest potential for profit. With the right strategy, swing trading can become a highly rewarding approach to navigating the stock market.

0 notes

Text

How to Start Trading: A Step-by-Step Guide for Beginners By Traders Edge

If you're fascinated by the world of trading and want to explore live trading and the share market, you’re in the right place. At Traders Edge, we aim to simplify live trading for beginners so you can take your first steps confidently. This guide covers all the basics you need to know before starting your trading journey.

What is Trading?

Trading involves buying and selling financial ins truments like stocks, bonds, or commodities with the goal of making a profit. The share market is where these trades take place, and it operates on the principles of demand and supply.

Types of Trading:

Intraday Trading: Buying and selling within the same day.

Swing Trading: Holding stocks for a few days or weeks.

Positional Trading: Long-term trading for months or years.

Live Trading: Real-time trading where decisions are made based on current market trends.

Step-by-Step Guide to Start Trading

1. Understand the Basics of Trading

Before diving in, familiarize yourself with key trading concepts:

Shares: Units of ownership in a company.

Stock Exchange: A platform for buying and selling shares (e.g., NSE, BSE).

Broker: An intermediary that connects traders to the stock exchange.

Market Orders: Trades executed immediately at the current market price.

2. Open a Trading and Demat Account

To start trading, you'll need:

Demat Account: Holds your shares in electronic form.

Trading Account: Allows you to place buy/sell orders. Choose a reliable broker that offers user-friendly platforms and live trading features.

3. Learn to Read the Market

Understanding market trends is crucial:

Use candlestick charts to analyze price movements.

Study market indices like Nifty 50 or Sensex.

Stay updated with financial news and reports.

4. Practice with a Virtual Trading Platform

If you’re new, practice live trading on virtual platforms before investing real money. These platforms simulate the market and help you gain experience without financial risks.

5. Start with Small Investments

Avoid risking large amounts initially. Invest small to minimize losses while you learn.

6. Develop a Trading Plan

A trading plan ensures discipline:

Set Goals: Decide your profit targets and risk limits.

Choose a Strategy: Intraday, swing, or positional trading.

Risk Management: Never risk more than 2% of your total capital on a single trade.

7. Use Stop-Loss and Take-Profit Orders

These tools help automate your trades and minimize losses.

Stop-Loss: Exits a trade when the price drops to a specific level.

Take-Profit: Locks in profits when a target price is reached.

8. Stay Consistent and Keep Learning

Trading is a continuous learning process. Watch tutorials, read books, and follow experts. For live trading tips and strategies, subscribe to our YouTube channel, Traders Edge.

Key Tips for Beginner Traders

Never trade based on emotions; always rely on analysis.

Avoid following the crowd; do your research.

Keep a trading journal to analyze your successes and mistakes.

Learn about technical indicators like RSI, MACD, and moving averages.

FAQs

1. What is live trading?

Live trading refers to real-time buying and selling of financial instruments based on current market conditions. Traders make decisions instantly as prices fluctuate.

2. How much money do I need to start trading?

You can start trading with as little as ₹500 to ₹1,000. However, it's advisable to begin with an amount you can afford to lose.

3. What is the difference between trading and investing?

Trading focuses on short-term gains by buying and selling frequently, while investing is about long-term wealth creation by holding assets for years.

4. Is trading risky?

Yes, trading involves risks. However, with proper knowledge, a trading plan, and risk management strategies, you can minimize losses.

5. Can I trade without a Demat account?

No, a Demat account is mandatory for trading shares in India. It holds your securities in electronic form.

6. How do I choose the best stocks for trading?

Look for stocks with high liquidity, good trading volume, and strong fundamentals. Analyze their price trends and past performance.

Conclusion

Starting your trading journey can be exciting and rewarding if done correctly. With this step-by-step guide and the right mindset, you’re on your way to mastering the share market. Don’t forget to follow Traders Edge on YouTube for live trading tips, tutorials, and expert insights.

Happy Trading! 🚀

Would you like me to help refine this further or add any other details?

0 notes

Text

Why is it important to learn Forex trading before jumping straight into it?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global financial market. It is the largest and most liquid financial market, with a daily trading volume exceeding $6 trillion. For many, Forex trading offers the promise of financial independence, flexibility, and significant profits. However, without proper knowledge and preparation, it can also lead to substantial financial losses. This article highlights the importance of learning Forex trading the right way before diving into the market.

The Importance of Learning Forex Trading Properly

Forex trading is often perceived as a quick way to make money, but this perception is misleading. The market’s high leverage and volatility can turn small mistakes into significant losses. Understanding the nuances of Forex trading is crucial for avoiding common pitfalls.

Risks of Ignorance

High Leverage: While leverage can amplify profits, it also magnifies losses.

Market Volatility: Currency prices fluctuate rapidly, requiring traders to stay informed.

Emotional Decisions: Lack of knowledge often leads to impulsive and poorly thought-out trades.

Proper education equips traders with the tools to navigate these challenges, manage risks effectively, and make informed decisions.

Key Aspects to Learn

To succeed in Forex trading, aspiring traders must focus on several critical areas:

Market Fundamentals

Understanding the basics is essential. This includes:

Currency pairs and how they work.

The role of central banks, interest rates, and economic indicators in influencing exchange rates.

The importance of liquidity and market hours.

Technical Analysis

Technical analysis involves using charts, patterns, and indicators to predict price movements. Key topics include:

Candlestick patterns.

Moving averages, RSI, MACD, and other indicators.

Support and resistance levels.

Risk Management

Without proper risk management, even a successful strategy can fail. Important practices include:

Setting stop-loss and take-profit levels.

Calculating position sizes based on account size and risk tolerance.

Avoiding over-leveraging.

Trading Psychology

Mastering emotions is often overlooked but crucial. Successful traders maintain:

Discipline to stick to their strategy.

Patience to wait for the right opportunities.

Resilience to handle losses without deviating from their plan.

Ways to Learn Forex Trading

There are numerous resources available to help traders build a solid foundation:

Online Courses

Many platforms offer comprehensive courses tailored to different skill levels. These courses often include video lessons, quizzes, and real-world examples.

Demo Accounts

Most brokers provide demo accounts where traders can practice in a risk-free environment. This is an excellent way to test strategies and understand market dynamics without financial pressure.

Books and Blogs

Some of the most successful traders have shared their insights through books. Blogs and forums also offer valuable tips and real-time updates.

Community and Mentorship

Engaging with other traders through forums or social media can provide new perspectives. Finding a mentor can accelerate the learning process by offering personalized guidance and feedback.

Benefits of Proper Education in Forex Trading

Investing in proper education yields long-term benefits, such as:

Increased Confidence: A well-informed trader is more confident in their decisions.

Reduced Losses: Understanding the market reduces the likelihood of costly mistakes.

Sustainable Growth: Knowledge fosters consistent profits over time.

Conclusion

Forex trading offers immense opportunities, but success requires more than luck or intuition. By prioritizing education and practicing diligently, traders can navigate the complexities of the Forex market with confidence. Take the time to learn, understand the risks, and approach trading with discipline. Remember, the journey to becoming a successful Forex trader begins with a commitment to learning.

Happy trading!

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere looked for Gold ($GLD) to continue its consolidation in the uptrend while Crude Oil ($USO) consolidated in a narrow range after a pullback. The US Dollar Index ($DXY) continued to drift to in broad consolidation while US Treasuries ($TLT) continued their downtrend. The short term move higher in the Shanghai Composite ($ASHR) looked to be at risk of reversing while Emerging Markets ($EEM) entered a short term downtrend.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe, both the QQQ and SPY had reset to their 20 day SMA’s where they often find support. How they react during the week could tell if last week was meaningful or not. The $IWM continued to be the laggard, stalled near the top of a 2 year range.

The week played out with Gold pushing out of consolidation to the upside before dropping back Friday while Crude Oil dropped out of consolidation early but found support and recovered much of the drop. The US Dollar also dropped early before it found support and rebounded to end higher on the week while Treasuries broke trend resistance to the upside and then fell back to retest it as support. The Shanghai Composite continued to move lower while Emerging Markets held in short term consolidation at last week’s gap move lower.

Volatility inched lower relieving pressure on equities and the large cap and tech names. They responded mid-week with a 2 day move higher to new all-time highs on the S&P 500 and Nasdaq 100. All paused Thursday ahead of the payroll report Friday. Then the SPY and QQQ held just under the new highs while the IWM remained in a narrow range. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week holding over the rising 20 day SMA on the daily chart after a shallow pullback from an all-time high. It continued to ride the 20 day SMA on Monday and Tuesday and then broke higher Wednesday, ending at a new all-time high. It held there Thursday and probed to the upside Friday before pulling back to finish unchanged on the day. The RSI on the daily chart shows a push back higher leveling which could lead to a momentum divergence should it not continue up next week. The MACD crossed up Friday and is positive though with the Bollinger Bands® squeezing but shifting to point higher.

The weekly chart shows the break of the small consolidation to the upside. The RSI is on the edge of overbought, very strong, suggesting any weakness on the daily chart may be short lived or corrected through time, not price. The MACD is also high and positive and moving sideways. There is resistance at 535 and the target from the Cup and Handle above at 560. Support is now at 530 and 524.50 then 520.50 and 517.50 before 513.50 and 510. Uptrend.

SPY Weekly, $SPY

With the first week of June in the books, equity markets were mixed with the large caps and tech heavy Nasdaq showing renewed strength while small caps continue to flounder. Elsewhere look for Gold to continue to consolidate the long move higher while Crude Oil moves lower in a consolidation range. The US Dollar Index continues in broad consolidation while US Treasuries continue their long term downtrend. The Shanghai Composite looks to continue the short term move lower while Emerging Markets continue the short term move lower in a consolidation channel.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY continue to step higher and look strong as well with an eye on potential momentum divergences. The IWM continues to be dead money, as it has been for the past 2½ years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview June 7, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

7 notes

·

View notes

Text

Leveraging Candlestick Patterns and Entry Strategies in Forex

Reminder

As the markets have officially resumed, it is expected that trading volume will take a few days to return to normal levels. The market activity will likely pick up during the second or third week of January, coinciding with the inauguration of President Donald Trump. However, unless unexpected events arise or key data releases significantly deviate from expectations, there will likely be a period of cautious trading. General market expectations could change rapidly due to sudden geopolitical events or other unexpected news outside of the usual data cycles. It’s important to remain vigilant and flexible, as the market sentiment could shift quickly depending on how these external factors unfold.

Candlestick patterns are particularly crucial during these periods of market uncertainty. Recognizing and analyzing these patterns can offer traders clearer entry point strategies, helping them navigate fluctuating trends effectively.

Thus, even though the market is resuming, it’s wise to approach with caution in the short term, awaiting the confirmation of trends and the return of stability in trading volume.

Market Overview

The upcoming week is expected to be pivotal for the markets, as several key financial data releases are scheduled to shape market expectations. Starting on Tuesday, the US will report the ISM Services PMI and JOLTS Job Openings data for December, followed by ADP Non-Farm Payrolls (NFP) and Unemployment Claims on Wednesday. Thursday’s release of the FOMC meeting minutes will provide insight into the Federal Reserve's 2025 policy expectations, while Friday brings critical data, including NFP, the Unemployment Rate, and earnings reports.

Alongside the US data, global forex patterns will also focus on key data from Europe and other regions. German Preliminary CPI is set for today, Swiss CPI on Tuesday, and Australian CPI on Wednesday. On Friday, Canadian employment numbers will be released. These reports are expected to trigger significant market movements as they provide a clearer picture of global economic conditions.

The geopolitical landscape, particularly with Trump’s upcoming inauguration on January 20, is expected to further influence market sentiment. The financial world is preparing for major price movements as markets adjust to the potential implications of a Trump administration and the resulting shifts in fiscal policies. As economic data flows in, increased buying pressure in gold is anticipated, potentially coupled with a rise in the US dollar. The Euro and the Pound are likely to see notable weakness, while the Japanese Yen will remain uncertain, with its movement contingent on economic policy decisions from the Bank of Japan.

Integrating auto trade alerts into portfolio allocation strategies can provide an edge for traders, ensuring they remain aligned with evolving market dynamics and capitalizing on opportunities as they arise. For traders looking to enhance their strategies, websites like richsmartfx offer useful resources for signal trading, while axelprivatemarket can help traders understand risk management in volatile times.

Market Analysis

GOLDGold’s price action last Friday showed weakness after failing to break the key level of $2,670.882. While the market is currently showing signs of bearish momentum, there remains a higher likelihood of price moving upward due to the proximity of the previous swing low. However, the Relative Strength Index (RSI) suggests bearish continuation with increased selling pressure indicated by the MACD. Traders can follow updates on dbgmfx for timely gold market insights.

SILVERGiven the current market conditions, it is likely that silver prices will continue to the downside, testing the lower boundary of this range. The MACD is showing increased selling momentum and volume, although the RSI hints at potential buying strength. Despite the divergence in the RSI, the overall price action suggests that silver may continue to face downward pressure. Silver traders can access deeper analysis at gfs-markets.

DXY (US Dollar Index)The US dollar, after a period of sustained growth, its rise has begun to show signs of slowing. The MACD is indicating lighter selling volume, while the RSI shows the market is approaching oversold conditions, suggesting the potential for a continuation in the upward direction. For DXY-focused strategies, traders may find helpful signals at topmaxglobal.

GBPUSDThe British Pound has shown strength recently, with buying momentum continuing from a brief pause in the dollar’s rise. The RSI and MACD both reflect increased volume and momentum in favor of the pound, but overall price action still remains some distance away from signaling a clear shift in momentum. Forex analysts can review strategies on platforms like worldquestfx for further insights.

AUDUSDThe Australian Dollar continues to struggle, even in the face of a weaker dollar. Prices remain largely stagnant between key levels, suggesting a lack of direction.

NZDUSDSimilarly, the New Zealand Dollar faces heightened selling pressure, with price action stuck within a consolidation zone.

EURUSDThe Euro is anticipated to continue its weakness, particularly as the year progresses. Current price action suggests a temporary pullback before the Euro tests the 1.03311 level, where it is expected to continue its downward movement.

USDJPYThe Japanese Yen remains under pressure due to the Bank of Japan's hesitancy to raise interest rates.

USDCHFThe Swiss Franc is currently experiencing increased buying, with price action respecting the bullish momentum.

USDCADThe Canadian Dollar is still consolidating at the 1.44440 level. Traders can follow up on technical patterns and auto trade alerts at richsmart.net to stay updated on potential breakout opportunities.

0 notes

Text

The Secret Sauce of GBP/CHF and Broadening Formations: Unveiling Hidden Forex Gems If you’ve ever looked at the British Pound/Swiss Franc (GBP/CHF) currency pair and thought, “What’s the deal here?” you’re not alone. This pair—often overlooked in the shadow of more popular combos like EUR/USD—has a sneaky way of rewarding those who dare to explore its quirks. But let’s not stop at the surface. We’re diving deep into a game-changing technical pattern known as the Broadening Formation, an unsung hero in the Forex world. Think of it as the financial equivalent of a “choose-your-own-adventure” book—but with fewer dragons and more Swiss precision. Why GBP/CHF Deserves a Spot on Your Radar GBP/CHF is like that underrated indie movie that turns out to be a masterpiece—quirky, challenging, but oh-so-rewarding. Here’s why: - Volatility Goldmine: The GBP/CHF pair combines the Pound’s tendency to act like it’s had one too many espressos with the Franc’s stable-but-secretly-sassy personality. The result? A pair that dances to its own rhythm, offering both intrigue and opportunity. - Central Bank Dynamics: The Bank of England’s bold moves often contrast sharply with the Swiss National Bank’s (SNB) cautious precision. Keeping tabs on these monetary policies can give you an edge in predicting directional shifts. - Safe Haven Flair: During geopolitical turmoil, the Franc shines as a safe-haven currency. Pairing it with the Pound creates a unique dynamic where both risk-on and risk-off sentiments are amplified. Broadening Formations: The Market’s Hidden Language Imagine a megaphone—starting small and growing wider. That’s what a Broadening Formation looks like on your charts. This pattern, characterized by higher highs and lower lows, signals market indecision on steroids. Here’s why you should care: - Psychological Insight: Broadening formations reveal heightened market emotions—a tug-of-war between bulls and bears. - Breakout Potential: The eventual resolution of this pattern often leads to explosive breakouts, offering traders juicy profit opportunities. How to Identify a Broadening Formation - Spot the Megaphone: Look for a series of higher highs and lower lows. - Volume Clues: Watch for increasing volume as the pattern develops. It’s like the market’s way of shouting, “Something big is coming!” - Time Frame Matters: These patterns appear across multiple time frames, but they’re particularly impactful on the 4-hour and daily charts. GBP/CHF Meets Broadening Formations: A Killer Combo Let’s bring it all together. The GBP/CHF pair’s natural volatility makes it an ideal candidate for exploiting broadening formations. Here’s how you can harness this: Step 1: Use Fundamentals to Set the Stage Keep an eye on: - UK Economic Data: Look for high-impact events like GDP releases or inflation reports. - Swiss Franc’s Safe-Haven Role: Monitor geopolitical headlines and SNB interventions. Step 2: Chart the Broadening Formation - Use tools like Fibonacci retracements to identify key support and resistance levels within the pattern. - Overlay momentum indicators (e.g., RSI or MACD) to confirm potential breakout directions. Step 3: Trade Like a Pro - Enter Smart: Wait for a breakout confirmation—typically a candle closing outside the pattern with strong volume. - Set Stops Wisely: Place your stop-loss slightly beyond the most recent high or low within the formation. - Target Ambitiously: Aim for the breakout’s measured move by calculating the pattern’s height and projecting it. Common Pitfalls (And How to Sidestep Them) - Ignoring Fundamentals: Broadening formations thrive on volatility, often triggered by news. Don’t trade in a vacuum. - Chasing False Breakouts: Use confirmation tools to avoid falling for fake-outs. Think of it as double-checking your parachute before a skydive. - Overleveraging: The GBP/CHF’s volatility can amplify losses. Use proper risk management—because nobody likes a margin call. Real-Life Example: A Broadening Formation in Action Let’s take a hypothetical scenario: - Date: March 2024 - Event: A surprise SNB rate hike causes the GBP/CHF pair to enter a broadening formation on the daily chart. - Setup: The pair exhibits widening price swings between 1.1500 and 1.2000. Volume spikes during each touch of these levels. - Trade: A breakout above 1.2000, confirmed by RSI divergence, leads to a rally toward 1.2500—a 500-pip move. Proven Tools to Elevate Your Trading Game Take your GBP/CHF and broadening formation trades to the next level with these resources: - Forex News Today: Stay updated on GBP and CHF market movers. - Free Forex Courses: Master technical patterns like broadening formations. - Smart Trading Tool: Automate lot size calculations and optimize trade entries. Conclusion: The Power of Pairing Patterns with Precision Trading the GBP/CHF with broadening formations isn’t just about spotting patterns—it’s about understanding the psychology behind them. By combining technical insights with a solid grasp of market fundamentals, you can uncover hidden opportunities and turn volatility into your ally. Ready to take your trading to the next level? Dive into our community for daily alerts and elite tactics—because mastery starts with connection. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Stock Market Courses

The Best Stock Market Courses in Mumbai – Your Gateway to Financial Freedom

Are you ready to dive into the world of the stock market and explore opportunities for wealth creation? If you're searching for the best stock market courses in Mumbai, then you've come to the right place. Whether you're a beginner or an experienced trader, investing in quality share market training in Mumbai can provide you with the knowledge, skills, and strategies necessary to succeed in the stock market.

At Finowings Training Academy, we offer comprehensive share market courses in Mumbai that are designed to equip you with everything you need to start your journey in trading and investing. Here’s why our stock market classes in Mumbai are regarded as some of the best in the industry.

Why Choose Finowings for Stock Market Classes in Mumbai?

1. Expert Trainers with Real-World Experience

When you enroll in our share market training in Mumbai, you gain access to industry experts who bring years of experience to the table. Our trainers are seasoned professionals with extensive experience in stock trading, market analysis, and investment strategies. With their real-time insights, you’ll learn how to navigate the complexities of the stock market with confidence.

2. Comprehensive Curriculum

Our best stock market classes in Mumbai offer a curriculum that covers all aspects of the stock market. Whether you're looking to learn the basics of stock trading or advanced strategies, we have courses tailored to meet your needs. Topics include:

Introduction to Stock Markets

Technical Analysis & Chart Reading

Fundamental Analysis

Stock Trading Strategies

Options and Futures Trading

Risk Management Techniques

Psychology of Trading

Real-Time Market Scenarios

Our structured approach ensures that you receive both theoretical knowledge and practical exposure to real-world market situations.

3. Hands-On Training

One of the key advantages of our share market training in Mumbai is that we emphasize practical learning. You’ll have the opportunity to practice live trading under the guidance of our experts, allowing you to implement what you’ve learned in real-time.

4. Personalized Attention

At Finowings Training Academy, we believe in the success of every individual. Our classes are designed to ensure that you get personalized attention from the instructors, enabling you to clarify doubts, learn at your own pace, and make the most of the training experience.

5. State-of-the-Art Learning Environment

We believe that an ideal learning environment is crucial to your success. That’s why our training center in Mumbai is equipped with the latest tools, resources, and technology to ensure you receive the best possible learning experience. Our facilities allow you to interact with real-time data, practice trades, and develop a deep understanding of market trends.

Our Share Market Courses in Mumbai: What’s Included

Our best share market classes in Mumbai are designed to cover all the essential concepts you need to become a successful trader or investor. What you will get when you enroll:

1. Stock Market Fundamentals

You’ll start with the basics, learning how the stock market operates, key terminologies, types of investments, and trading platforms. This foundation will prepare you for advanced topics in the future.

2. Technical Analysis & Charting

Learn how to read stock charts, identify trends, and use indicators such as Moving Averages, RSI, MACD, and Bollinger Bands to make informed trading decisions.

3. Fundamental Analysis

Understand how to analyze the financial health of a company using key financial ratios, income statements, balance sheets, and more. This will help you evaluate stocks and make long-term investment decisions.

4. Trading Strategies & Risk Management

Our share market courses in Mumbai cover a wide range of strategies such as day trading, swing trading, position trading, and investing. Learn how to effectively manage risks, reduce losses, and maximize returns.

5. Live Market Exposure

Get hands-on experience by observing live market sessions and trading with real-time data. Our instructors will walk you through the live market analysis, helping you gain a deeper understanding of market movements.

Benefits of Stock Market Classes in Mumbai at Finowings

1. Learn from the Best

Our instructors are not just teachers—they are active market participants who understand the latest trends and techniques. With their guidance, you’ll learn how to spot trading opportunities and manage risks effectively.

2. Flexible Course Options

We offer both online stock market classes in Mumbai and in-person sessions, making it easier for you to learn at your own convenience. You can choose a learning format that suits your schedule.

3. Networking Opportunities

Joining our share market training in Mumbai gives you access to a network of like-minded individuals, helping you connect with fellow traders and investors. This can be a great platform for discussing market trends, sharing insights, and staying updated.

4. Lifetime Access to Learning Material

When you enroll in our best stock market classes in Mumbai, you gain lifetime access to all course materials, video recordings, and market analysis tools. This ensures that you can refresh your knowledge at any time.

5. Proven Track Record of Success

Finowings Training Academy has helped thousands of students achieve their stock market goals. Many of our graduates have gone on to become successful traders and investors. Our focus on practical skills and expert insights gives you the best chance of achieving success.

Why the Stock Market in Mumbai?

Mumbai is the financial capital of India and home to the Bombay Stock Exchange (BSE), making it the perfect city for anyone looking to learn about the stock market. Mumbai offers unmatched access to the world of trading, and by taking our share market courses in Mumbai, you place yourself at the heart of the Indian stock market.

Whether you're an aspiring trader or investor, learning in Mumbai gives you direct access to one of the largest stock exchanges in the world. Moreover, Mumbai is home to a dynamic and growing financial services sector, which presents plenty of opportunities for those who are well-versed in stock trading.

0 notes

Text

Advanced Technical Analysis Techniques at Share Market Gurukul

Share Market Gurukul Courses are renowned for their in-depth focus on advanced trading strategies and techniques. Here’s an overview of how these courses equip participants with the tools to excel in the stock market.

1. Charting Methods

Advanced charting techniques form the foundation of technical analysis.

Candlestick Patterns: Identify market trends and potential reversals.

Trend Channels: Highlight support and resistance levels within price movements.

Fibonacci Retracements: Measure potential reversal levels in an ongoing trend.

2. Key Indicators and Oscillators

Gurukul courses delve into technical indicators that aid in market predictions.

Moving Averages: Detect trend directions and reversals.

MACD (Moving Average Convergence Divergence): Measures momentum and changes in trends.

RSI (Relative Strength Index): Identifies overbought or oversold conditions Share Market Gurukul Courses.

3. Trading Strategies

Participants learn actionable strategies to capitalize on market movements.

Breakout Trading: Identify and act on price movements beyond support or resistance levels.

Swing Trading: Capitalize on short- to medium-term price trends.

Volume Analysis: Use volume data to confirm the strength of market trends.

4. Practical Training

The courses emphasize real-world application:

Simulated Trading: Practice strategies in a risk-free environment.

Live Sessions: Gain insights from market experts through interactive workshops.

Conclusion

Share Market Gurukul Courses offer a comprehensive understanding of advanced technical analysis, making them a valuable resource for traders looking to refine their skills and improve their market performance.

0 notes