#MSME Certification Online

Explore tagged Tumblr posts

Text

A guide to enhance your business growth

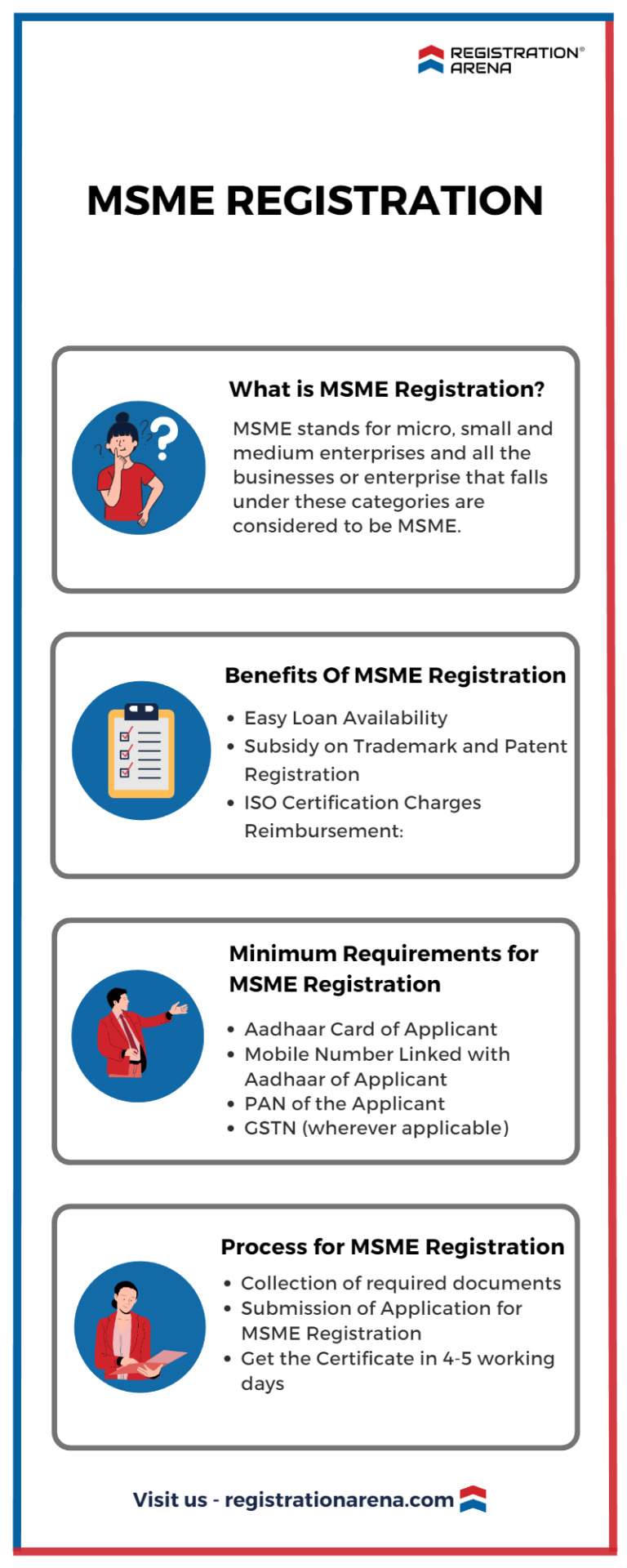

Running a business is akin to navigating a complex maze, and every entrepreneur dreams of not just surviving but thriving. In the Indian business landscape, the government has laid out a golden path for micro, small, and medium enterprises (MSMEs) through a simple yet powerful tool – MSME registration. In this guide, let's explore how this seemingly mundane registration process can be your ticket to unparalleled business growth.

Understanding the MSME Advantage

The Heartbeat of the Economy:

Micro, Small, and Medium Enterprises collectively form the heartbeat of the Indian economy. From local grocery stores to innovative startups, these businesses contribute not only to economic development but also to job creation, fostering a robust and inclusive growth environment.

Unlocking Financial Avenues:

One of the immediate perks of MSME registration is the access to financial assistance and credit facilities. Financial institutions offer tailored loans at favorable terms, recognizing the importance of these enterprises in driving economic progress.

The MSME Registration Journey

A Simpler Path Than You Think:

Contrary to popular belief, the MSME registration process is not a bureaucratic labyrinth. It's a straightforward journey that involves providing essential details about your business, such as PAN, Aadhaar, and other relevant information. Whether you choose the online portal or opt for the traditional route at District Industries Centres, the process is designed to be accessible.

Documents: Your Passport to Opportunities:

The importance of documentation in the registration process cannot be overstated. Your Aadhaar card, PAN card, business address proof, and details of your plant and machinery are the keys that unlock the door to a myriad of government schemes and subsidies.

The MSME Advantage Unveiled

Market Access and Procurement Preferences:

Once you've acquired your MSME registration, you find yourself in a prime position in government procurement. MSMEs are often given preference in government tenders, providing a golden opportunity to secure contracts and expand your market reach.

Technology Upgradation and Subsidies:

In the rapidly evolving business landscape, technology is the differentiator. MSME registration brings with it the chance to upgrade your technology with subsidies for adopting new and advanced processes. This not only boosts efficiency but also enhances your competitiveness.

Navigating the Schemes and Subsidies Landscape

Credit Linked Capital Subsidy Scheme (CLCSS):

At the forefront of government schemes is CLCSS, a game-changer for technology upgradation. It provides capital subsidies to MSMEs, facilitating access to credit for purchasing new machinery and equipment.

Pradhan Mantri Employment Generation Programme (PMEGP):

For those looking to embark on the entrepreneurial journey, PMEGP is the beacon. This credit-linked subsidy program promotes self-employment, creating not just businesses but livelihoods.

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE):

The fear of collateral is a common hurdle for many small businesses. CGMSE eliminates this barrier by offering collateral-free credit facilities, making it easier for MSMEs to access the capital needed for growth.

Tailoring Your Approach

District Industries Centres (DIC) and National Small Industries Corporation (NSIC):

Think of DIC and NSIC as your business allies. DIC, as a local agency, offers guidance and support, while NSIC provides a range of services from marketing assistance to credit facilitation. Engaging with these institutions can significantly enhance your MSME journey.

Tech and Quality Upgradation Support:

The government's emphasis on quality is evident through schemes like Lean Manufacturing Competitiveness Scheme (LMCS) and Quality Management Standards & Quality Technology Tools (QMS/QTT). These initiatives not only boost competitiveness but also position your business as a paragon of quality in the market.

Export Promotion and Market Development:

Venturing into global markets can seem daunting, but the Market Development Assistance Scheme for MSMEs is a trustworthy companion. It provides financial support for participating in international trade fairs, opening doors to new business horizons.

Overcoming Challenges for Seamless Growth

Lack of Awareness:

One of the challenges MSMEs often face is the lack of awareness about available schemes. Entrepreneurs can overcome this by actively seeking information through government portals, industry associations, and local MSME support cells.

Complex Application Processes:

Cumbersome application procedures can be discouraging, but persistence pays off. Simplifying the application process and seeking assistance from dedicated facilitation services or MSME support agencies can make the journey smoother.

Continuous Evaluation and Adaptation

Performance and Credit Rating Scheme:

Enhancing your creditworthiness is an ongoing process. The Performance and Credit Rating Scheme allows MSMEs to undergo assessments, showcasing financial stability to potential investors and lenders.

Embracing Continuous Improvement:

The business landscape is dynamic, and your approach should be too. Regularly assess the impact of government schemes on your operations, adapt to changes, and stay informed about updates to maximize benefits continually.

Conclusion: Your Journey to Unprecedented Growth

In conclusion, MSME registration in India is not just a formality; it's your gateway to a realm of opportunities. By understanding the classifications, embracing government schemes, and overcoming challenges, you position your business for sustainable growth. The government's commitment to fostering MSMEs is a testament to the integral role these enterprises play in shaping the nation's economic future. So, don't just register – embark on a journey of growth, innovation, and success. The path is laid; it's time to walk it.

Learn more at : https://msme-registration.in/

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update#msme registration online#msme loan#online business#msme

2 notes

·

View notes

Text

Udyam Registration’s Role in Skill Development for MSMEs

Micro, Small, and Medium Enterprises (MSME) are the heartbeat of India's economy as they provide a lot of employment and their role in economic development is very important. About millions of people work in it. As we know industries are evolving, to remain competitive, not only innovative ideas are needed, but the demand for skilled workers also increases.

Hence, there is an immense role of Udyam registration. It not only drives formalization of businesses but also the skills in the hands.

In this article, we are going to understand how Udyam registration has played a key role in the skilling of MSMEs and why it acts as a pivotal step for a business to sustain itself in a competitive marketplace.

Skill Challenges for MSMEs:

MSMEs face challenges when it comes to workforce skills. Unlike large companies, they do not have the resources available to invest in extension training programs. But to survive in this competitive landscape, their businesses must adopt new technology, improve efficiency, and meet customer expectations, for which skilled talent is needed.

Udyam registration solves all these problems so that MSMEs can take advantage of all the skill development initiatives by the government. Let's understand it.

How does Udyam Registration help in skill development?

Access to Government Training Programs: Once the MSMESs is registered with udyam registration it becomes eligible to access training programs launched by the government. There are many skill development initiatives launched by the Government of India, such as Skill India Mission, Pradhan Mantri Kaushal Vikas Yojana, and many sector-specific training schemes that are available only to udyam registered businesses.

These programs focus on updating the skills of employees, introducing modern tools to them, and increasing their productivity. Whether it is digital marketing, advanced manufacturing techniques, or financial management, there is something for every business.

Industry-Specific Skill Enhancement: MSMEs who have properly done their Udyam Registration can participate in several industry-specific skill development workshops and training sessions ranging from manufacturing units to IT services and meet the unique needs of different sectors.

For example, if there is a small manufacturing unit, if they get skills in automation technology, it helps them a lot and if it is the IT sector, if they get soft skills, their customer service improves.

Financial assistance for training: As we know, providing training to employees all the time is costly, especially for small businesses. Udyam registered as MSMEs are eligible for financial assistance and subsidies on training costs. This reduces the financial burden and makes it easier for businesses to develop skills.

Promoting Entrepreneurship Skills: Skills development is not just for workers but also business owners. Udyam registration connects entrepreneurs to government-run programs and enhances their entrepreneurial skills.

How to get your MSMEs Udyam Registration done?

First of all, visit our website udyamindia.in.

After that click on new Udyam Registration.

You will get a form open, fill it out properly.

Enter the verification code and tick mark on terms and conditions and declaration.

At last, send the application.

You will be landed into the direct payment gateway. After making a successful payment you'll get an appropriate confirmation message into your e-mail ID.

Case Study: Skills Development through MSMEs

Here is one practical example wherein IT startup company was situated at Jamshedpur took the advantages of digital marketing trainings for teams with which their potential clients increased and increased scales of the activities. Through which MSME's are showing capability to be utilised via the Udyam registration of Skills Development.

Conclusion:

This world is constantly evolving, so being competitive means keeping yourself skilled. Udyam registration acts as a catalyst for MSMEs and ensures that they can leverage their resources and opportunities to skill their workforce and meet industry demands.

By investing in skill development, MSMEs can survive and also thrive. So, if you are an MSME owner, don’t wait and get your MSME to udyam registered and all the benefits of skill development.

#udyam certificate#udyog aadhar registration#udyog aadhar#msme certificate#aadhar udyog#aadhar udyog registration#udyam certificate registration#udyog aadhar certificate#msme certificate registration#msme online registration

0 notes

Text

Advantages of Udyam Registration for Small Businesses

Introduction:

Many small businesses, especially in India, are found to be under the Udyam Registration category. This registration is a pre-requisite for all MSMEs, especially Micro, Small, and Medium Enterprises. All in all, it can only be said that Udyam Registration opens up a floodgate of government-funded financial benefits and more opportunities for business expansion for the entrepreneur. So let's break them down on why it might just be the boost your business needs.

Registration is equivalent to the little identity card provided by the government under the MSME Development Act, 2006, to small businesses. It is a recognition of your business in official books as a micro, small, or medium enterprise based on investment and turnover.

Why is it so important? After this registration, you get more ease of accessing loan benefits, subsidies, tax benefits, and much more. In case one is an entrepreneur or small business or startup, then this is the golden ticket for unlocking aid by the government.

Benefits of Udyam Registration- Small-scale Businesses:

1. Increased Access to Government Schemes:

Since you are registered under Udyam, you'll be eligible for a variety of government schemes uniquely designed to help MSME grow. You'll get subsidies for patent registration, financial aid for upgrading technology, and even for the promotion of industry.

Best part? All these programs are designed for your business to enhance your competitive and innovative capability with less pecuniary pressures.

2. Greater Access to Finance:

If you ever found yourself in such a difficult loan, then it is okay because there have been so many small business proprietors who have faced problems related to raising funds. Udyam Registration has changed everything. With the Udyam, banks, and other financial institutions provide collateral-free loans for all such registered businesses. Furthermore, the interest rates are reduced. That can be a relief when you need to raise a lot of cash to expand, hire more staff, or buy new equipment.

3. Tax Benefits:

Of course, saving on taxes is a big deal with any business, more so for small businesses. Udyam Registration brings its exemption from tax that could lighten the load further. If you happen to be the kind of business that this is, then you are likely eligible for exemptions from direct tax and excise duties. So, that would mean more money in your pocket to reinvest in the business.

4. Protection against delayed payments:

Delayed payment by clients is one of the toughest challenges a small business faces. It messes up your cash flow and financial strain on you. You are in luck since businesses registered under Udyam have law protection under the MSME Act. In case the buyer delays his payment, he is liable to pay interest on it.

5. Priority in Government Tenders:

For that, you also get a bonus benefit: The government often keeps some contracts and tenders exclusively for MSMEs. And if you are a Udyam-registered business, you would enjoy an upper hand in the tenders' bidding process for these specific government tenders. It will provide you with considerable revenue growth, assuming that the primary target market is mostly government contracting parties.

“Documents Needed for Udyam Registration”

The good news? Udyam Registration is free and entirely online. Here's what you would require:

Aadhaar Number- tied to the business owner.

PAN Card- tied to the business owner.

Basic details about the business, including investment and turnover information.

It's pretty much a streamlined process, and you can follow it just by filling out a few forms on the official Udyam Registration Portal.

Conclusion:

Moreover, for small businesses and MSMEs, registration under Udyam is mandatory for growth and securing benefits from government aid. There are countless reasons why registration under Udyam is important for ease of access to finance to safeguarding against delayed payments. If you have a small business and haven't yet registered, now it's time to do the same and enjoy all these great opportunities.

#aadhar udyog#aadhar udyog registration#udyam certificate registration#udyog aadhar certificate#msme certificate registration#msme online registration#aadhar udyam

0 notes

Text

KVR TAX Services is the Udyam Registration services in Hyderabad. Apply now for the new udyam aadhar registration, in Gachibowli, Flimnagar, Kondapur, Lingampally.

#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#register a business in hyderabad#register company in hyderabad#firm gst registration process in hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in hyderabad#Msme Registration Consultants in hyderabad#MSME Registration Online in hyderabad#iec code registration in hyderabad#export and import registration in hyderabad

0 notes

Text

MSME Registration in Delhi: A Pathway to Growth and Opportunities

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in the economic development of India, particularly in a bustling metropolis like Delhi. MSME registration in Delhi provides numerous benefits that can significantly enhance the growth prospects of small businesses. From access to government schemes and subsidies to easier credit facilities, the advantages of registering as an MSME are substantial. In this vibrant and competitive market, securing MSME status can be a game-changer for entrepreneurs looking to scale their operations.

Benefits of MSME Registration

One of the primary benefits of MSME registration in Delhi is the access to various government schemes designed to promote small businesses. Registered MSMEs can avail themselves of subsidies on patent registration, reduced interest rates on loans, and tax benefits. Furthermore, MSMEs are often given preference in government procurement processes, opening up a vast array of opportunities for contracts and projects. These benefits collectively reduce operational costs and enhance the competitive edge of MSMEs in the market.

Simplified Registration Process

The process of MSME registration in Delhi has been streamlined to encourage more businesses to formalize their operations. Entrepreneurs can register their MSME online through the Udyam Registration portal, which simplifies the procedure with minimal documentation. The essential details required include Aadhar number, PAN card, and business information such as the type of organization and investment in plant and machinery. This hassle-free registration process ensures that even small business owners without extensive administrative resources can complete their registration efficiently.

Financial Support and Credit Access

One of the significant challenges faced by small businesses is accessing credit. MSME registration in Delhi can alleviate this issue by making it easier for businesses to secure loans and financing. Banks and financial institutions often offer preferential lending rates and collateral-free loans to registered MSMEs. Additionally, the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) provides credit guarantees to banks, thereby reducing the risk and encouraging them to lend more readily to MSMEs. This improved access to finance enables small businesses to invest in their growth and expansion.

Market Expansion and Business Growth

MSME registration also facilitates market expansion and business growth. Registered MSMEs in Delhi can participate in international trade fairs and exhibitions, often with financial assistance from the government. These events provide invaluable exposure to global markets and opportunities for networking and collaboration. Furthermore, registered MSMEs can leverage their status to build credibility and trust with clients and partners, enhancing their reputation and market position. This strategic advantage is particularly beneficial in a competitive market like Delhi, where establishing a strong market presence is essential for long-term success.

Conclusion:

In conclusion, MSME registration in Delhi offers a plethora of benefits that can significantly boost the growth and sustainability of small businesses. The process is straightforward and accessible, making it easier for entrepreneurs to formalize their operations and reap the associated benefits. From financial support and easier credit access to market expansion opportunities, MSME registration provides a solid foundation for business success. For entrepreneurs in Delhi, taking this step can open doors to new opportunities and pave the way for sustained growth in a dynamic economic environment.

0 notes

Text

NG and Associates' Expertise in Nidhi Company Registration

In the ever-evolving landscape of financial services, establishing a Nidhi Company can be a strategic move for those seeking to promote savings and mutual benefit among their members. NG and Associates, a distinguished player in the domain of corporate consultancy, stands out for its expertise in facilitating Nidhi Company Registration, providing businesses with the necessary foundation to foster community-driven financial growth.

Understanding Nidhi Companies:

Before delving into NG and Associates' role, let's grasp the concept of Nidhi Companies. These entities are a unique form of non-banking financial institutions in India, primarily established to cultivate the habit of thrift and savings amongst its members. Nidhi Companies function on the principle of mutual benefit, encouraging members to contribute to a common fund that is then utilized to provide financial assistance to its members.

NG and Associates: A Trusted Partner in Nidhi Company Registration:

NG and Associates have carved a niche for themselves in the corporate consultancy sector, offering comprehensive services in company registration, compliance, and financial advisory. Their specialized focus on Nidhi Company Registration showcases their commitment to assisting businesses in establishing a solid foundation for community-centric financial endeavors.

The company's team of seasoned professionals possesses in-depth knowledge of the legalities and intricacies involved in Nidhi Company Registration. From document preparation to liaising with regulatory authorities, NG and Associates streamline the entire registration process, ensuring a hassle-free experience for their clients.

Why Choose NG and Associates for Nidhi Company Registration?

Expert Guidance: NG and Associates boast a team of experts well-versed in the nuances of company registration, particularly in the realm of Nidhi Companies.

Tailored Solutions: Recognizing that each business is unique, the consultancy provides personalized solutions that align with the specific needs and goals of the client.

Timely Execution: With a commitment to efficiency, NG and Associates ensure that the Nidhi Company Registration process is executed promptly, allowing businesses to embark on their financial ventures without unnecessary delays.

Compliance Assurance: Staying abreast of the ever-changing regulatory landscape, NG and Associates ensure that their clients remain compliant with all legal requirements post-registration.

Conclusion:

NG and Associates' prowess in facilitating Nidhi Company Registration positions them as a reliable partner for businesses aspiring to create a financial ecosystem based on mutual benefit. As the corporate world continues to evolve, the establishment of Nidhi Companies remains a promising avenue for those seeking to foster community-driven financial growth. With NG and Associates by your side, the journey towards building a thriving Nidhi Company becomes not just a goal but a seamlessly achievable reality.

#Company Registration in india#Private Limited Company Registration#Nidhi Company Registration#Trademark Registration Online#Copyright Registration Online In India#GST Registration Online#Startup Registration India#MSME Registration In India#FSSAI License and Registration#One Person Company Registration#ISO Certification in India#labour license registration#Professional Tax Registration#Business Tax Returns Filing#Gem registration

0 notes

Text

NG and Associates Spearheading Effortless MSME Company Registration in India

In the intricate world of business, especially for small and medium enterprises (SMEs), the process of MSME registration in India can be a daunting task. NG and Associates, a distinguished consultancy firm, stands out as a guiding force, facilitating a seamless journey through the complexities of MSME company registration.

NG and Associates: Your Gateway to Streamlined MSME Registration

NG and Associates has emerged as a trusted partner for entrepreneurs and businesses seeking to register as Micro, Small, or Medium Enterprises (MSMEs) in India. With a dedicated team of experts well-versed in the nuances of MSME regulations, the firm ensures a hassle-free and expedited process for clients looking to establish their businesses with the official MSME tag.

Understanding the Essence of MSME Registration in India

MSME registration in India holds pivotal importance for businesses aiming to enjoy the various benefits extended by the government. These benefits include financial assistance, access to subsidies, and a plethora of opportunities in government tenders. NG and Associates recognizes the significance of MSME Registration In India and acts as a guiding beacon for businesses, ensuring they capitalize on these advantages.

Navigating MSME Regulations with NG and Associates

NG and Associates excels in simplifying the complex web of legal formalities associated with MSME registration. From documentation to liaising with regulatory bodies, the firm's seasoned professionals guide clients through each step, ensuring compliance with MSME regulations. Their in-depth knowledge of the sector positions them as a reliable partner for businesses of all sizes seeking MSME registration.

Tailored Solutions for Diverse MSME Needs

What sets NG and Associates apart is their ability to provide personalized solutions tailored to the unique needs and aspirations of each client. Whether it's a micro-enterprise or a medium-sized business, the firm adapts its services to ensure a smooth MSME registration process, fostering growth and sustainability.

Incorporating Technology for Efficiency

NG and Associates leverages state-of-the-art technology to expedite the MSME registration process. By embracing digital solutions, the firm ensures a streamlined and efficient journey, reducing paperwork and accelerating the overall turnaround time. This commitment to technological advancement sets them apart in the realm of MSME consultancy.

The NG and Associates Advantage: Nurturing Growth, Ensuring Compliance

In an environment where MSMEs play a crucial role in the economic landscape, NG and Associates emerges as a trusted ally for entrepreneurs looking to formalize their businesses. With a commitment to nurturing growth, ensuring compliance, and providing comprehensive MSME registration solutions, the firm stands as a beacon of reliability and excellence.

Conclusion

For businesses seeking the coveted MSME status in India, NG and Associates represents a bridge to streamlined registration and a gateway to unparalleled support. Trust in NG and Associates to navigate the intricacies of MSME registration, unlocking a world of opportunities and advantages for your business in the dynamic Indian market. Partner with NG and Associates – where efficiency meets expertise – to empower your business journey.

#MSME Registration In India#Startup Registration India#GST Registration Online#Copyright Registration Online In India#FSSAI License and Registration#One Person Company Registration#ISO Certification in India#labour license registration#Professional Tax Registration#Business Tax Returns Filing#Gem registration

0 notes

Text

Embrace the Power of MSME Registration for Udyog Aadhaar

In a competitive business environment, gaining a competitive edge is paramount. Obtaining an MSME registration certificate under the Udyog Aadhaar initiative can open doors to a plethora of benefits that can drive business growth and sustainability. It streamlines operations, enhances credibility, and provides access to financial resources that can propel your business to new heights.

So, whether you're a budding entrepreneur or an established business owner, take advantage of the Udyog Aadhaar platform to secure your MSME registration certificate and unlock a world of opportunities. Remember, in the journey of business, every advantage counts – and an MSME registration certificate is a powerful advantage that can shape your success story.

0 notes

Text

MSMEs, which include micro, small, and medium-sized businesses, have emerged as a flourishing sector of the Indian economy in recent years, playing an essential role in the country's socioeconomic improvement. These businesses are very helpful in creating jobs, producing goods, and exporting products. The duty of promoting and encouraging the growth of MSMEs mainly falls under the state governments

#llp registration#private limited company registration#opc registration#nidhi company registration#msme registration#trademark registration#startup india registration#sole proprietorship#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#iso certification online#legal consultation#legal advisers#legal services

0 notes

Text

Best PMEGP loan : Government Support for Starting Your Own Business.

At sharda Associates The Prime Minister's Employment Generation Programme (PMEGP) is a government scheme in India that gives financial help to individuals who want to create small companies. It aims to create jobs and encourage self-employment, particularly in rural and semi-urban areas. Here's a simplified view of the scheme

What is PMEGP?

PMEGP Loan provides financial assistance to people starting new small enterprises by offering a loan with a subsidy. The Ministry of Micro, Small, and Medium Enterprises (MSME) manages it, while the Khadi and Village Industries Commission (KVIC) oversees its implementation.

Key Features:

1 Loan Amount

Manufacturing enterprises might receive up to ₹25 lakh.

Service enterprises, such as beauty salons or repair shops, can receive up to ₹10 lakh.

2 Government subsidy:

Rural areas:

25% of general category applications.

35% for special categories (such as SC/ST, women, and those from the Northeast).

Urban areas

15% for general category applications.

Special categories are eligible for 25% off.

Who can apply?

1 Eligibility:

Any Indian citizen above the age of 18.

Applicants for projects costing more than ₹10 lakh (manufacturing) or ₹5 lakh (services) must have finished 8th grade.

Self-help groups (SHGs), cooperative organizations, and charitable trusts can all apply.

2 Personal Investments:

General candidates must invest 10% of the project cost themselves.

Special category applicants must invest only 5%.

How do I apply?

1 Application Process:\

Apply online using the PMEGP portal at Official kvic Main.

Upload documents such as ID, address verification, educational certificates, and a business plan.

2 Selection and Loan approval:

A District-Level Task Force Committee will contact you to schedule an interview.

Once approved, the bank sanctions the loan and credits the government subsidy to your loan account.

3 Repayment:

The loan must be repaid within 3-7 years, however the subsidy does not have to be paid back.

4 Training:

All PMEGP grantees are required to complete a brief company management training program.

Example of How PMEGP Loans Work

Suppose you wish to start a small manufacturing plant in a rural region for ₹20 lakh.

For those in the general category, the government will provide a 25% subsidy, amounting to ₹5 lakh.

The bank offers a loan of ₹15 lakh, and you simply need to invest ₹2 lakh from your savings.

Why is PMEGP beneficial?

project report for PMEGP loan assists people in starting enterprises without the requirement for a large initial investment. This loan is ideal for young enterprises as it requires no collateral (up to ₹10 lakh) and offers long payback terms.

Summary

The PMEGP initiative is a useful approach to start a small business with government assistance, particularly if you come from a rural or underprivileged background. It encourages employment generation and economic development. For additional information, please visit the official PMEGP website or contact your nearest KVIC office.

PMEGP: Helping You Start Your Own Business with Government Support. For details and to reach us, visit https://shardaassociates.in/ contact us : 91 79870 21896 , address : HIG B-59, Sector A, Vidya Nagar, Bhopal, Madhya Pradesh 462026

2 notes

·

View notes

Text

Post Udyam Registration Compliance for Registered Udyam Enterprises

It is the doorway through which MSMEs can access schemes and government aid. However, to be eligible for such schemes and with its license to continue carrying on the same, an enterprise needs to observe several post-registration compliances in the following pages. As such, this document outlines key compliance obligations assumed by Udyam-registrants, which the latter may henceforth be abundantly clear about the regulatory obligations, ensuring continued eligibility under the MSME Scheme.

Advantages of Udyam Registration:

Once a business is registered under the Udyam system, compliance is mandatory to ensure that the status and benefits do not go away. The moment compliances are not maintained, benefits get suspended along with some penalties. At times, the Udyam Registration even gets canceled. The accuracy in maintaining data on the Udyam portal also calls for compliance with applicable regulations about every fiscal year.

Major Reasons to Maintain Compliances:

• This benefit of Udyam Registration can be enjoyed only by those eligible businesses.

• It is sure to make all this legal and rules out all possibilities of penalty, fine, or even any kind of legal implications.

• Creditability: The compliant firms are believed to be the most creditable by most clients, investors, and partners and have an indirect effect on growth.

Responsibility Liabilities of Business under Udyam Registration:

Some of the fundamental responsibility liabilities of businesses enrolled on their own under the Udyam registration process fall into that.

a) Annual Renewal of Information Relating to Udyam Registration:

The Self-declared Udyam registration has no annual obligation personally. Each information relating to the Udyam should receive an annual renewal in the database of its department. Renewal for the next needs, inter alia, occur:

• Business name or arrangement of composition

• Investments taken in plants along with machinery and also other equipment

• Level of turnover

Recommendation: Update the Udyam Registration at the very start of every financial year so that you will not miss any gaps

b) Financial reporting compliance:

MSME shall prepare and provide its annual return with financial statements under ordinary corporate procedure before a particular due date. Such a return is filed for tax assessment purposes and would reflect the fact whether an MSME continued to qualify to run as it had crossed above both turnover and investment levels.

• Income Tax Return: The submission within time keeps away the penalties and business action remains transparent.

• GST Returns: GST-registered businesses under Udyam have to lodge periodical GST returns so that the registration can be allowed to continue valid.

Hint: The majority of the MSMEs possess accounting software by which financial reporting easily and also automatically comply

c) Industry-wise compliances:

Manufacturing, food, and pharmaceutical businesses shall be registered under the Udyam and shall strictly follow the licenses issued by the central and state governments, certifications, or environmental compliances. That relates to labor laws concerning hiring laborers, minimum wage compliances, and worker safety compliances.

• Environmental Norms: If the business is causing harm to the environment then it should adhere to standards regarding waste disposal or emission standards so that there is no punitive measure against it.

Tip: Continuously keep track of the regulatory changes going on in your industrial sector as this will make sure that your business does not miss out on what is legally coming around for its practice.

Best Practices to Always Be in Compliance:

It would never become a problem if a couple of proactive steps were followed ahead of time. Here are some best practices for Udyam-registered businesses to keep abreast of compliance:

a) Compliance Checklist:

The compliance checklist is to ascertain every activity that would be made during its time. Essential contents for the checklist are

• Data updations in the Udyam portal

• Income tax and GST filing

• Financial statements

• Industry-specific certifications or licenses

b) Professional Advice:

An accountant or compliance expert can make the MSME aware of the various changes in the rules or even make it easier to function in compliance.

• Compliance Audits: Audits periodically for review and put everything into compliance shape.

• Advisory Services: Major service providers are generally compliance experts regarding MSME regulations and should have plans that suit the business registered under Udyam.

c) Invest in Accounting and Compliance Software:

Compliance management software and accounting software have followed due dates automatic tax submittal and an order book of accounts of all financial records. The tool does not let humans go wrong or be out of compliance with timelines once they have been engaged in doing some compliance work.

Effects of Non-Compliance:

Some of the specific implications of not complying with the procedures Udyam Registration brings along with the losses of all MSME benefits. In general, implications include,

• Loss of Benefits: Defaulting businesses will face the loss of subsidies, tax exemptions, and other government programs

• Legal Penalties: Delinquent filings also can invoke penalties or fines which range from tax returns to even GST returns or financial statements.

• Loss of Credibility: This situation will be bound to throw a business reputation into tatters; the level of confidence with which customers and investors' interest in the firm erodes.

Pitfalls in compliance not to be missed

• Ledger of Financial Statements: You are supposed to have an orderly ledger of your financial statements. Therefore you are supposed to ensure that you file proper and timely reports.

• Eligibility review: Keep reviewing your eligibility for the MSME status as your business grows in terms of turnover and investment limit.

Conclusion:

Now, compliance post-Udyam registration is the need for MSMEs so that they can sustain these benefits being accorded through governmental help and construct an authentic, compliant business setting. Annual updation and adapting towards sector-specific regulation while adopting compliance tools or professional advisement to help operations become compliant would ensure the stability of the operation while giving them an extended edge in growth in a highly competitive market arena.

That would make a huge difference for entrepreneurs and businesses the professional help or online compliance solutions applied for Udyam Registration will surely keep your business compliant with its regulatory duties, thus enjoying government support schemes for MSMEs.

#udyam certificate registration#udyog aadhar certificate#msme certificate registration#msme online registration#udyog aadhar#msme certificate#aadhar udyog#udyog aadhar registration#aadhar udyog registration

0 notes

Text

The Role of Udyam Registration in Strengthening the "Make in India" Initiative

India initiated a very strong "Make in India" Scheme in 2014 with a clear vision to become a large global manufacturing hub. This slogan encourages domestic manufacturing, decreases importing, and enhances economic growth. MSME stands as the foundation of India's economy. A number of the fundamental pillars are establishing as well as enhancing the MSMEs. In this connection, Udyam Registrationhas been one of the most significant enablers that have helped transform the efficiency as well as the competitiveness quotient of MSMEs in line with the objectives of "Make in India".

Understanding Udyam Registration:

This scheme, initiated by the government under the Ministry of MSME, provides easy, paperless registration for MSMEs to avail of many benefits. The procedures that followed were cumbersome; Udyam Registration is purely online and lesser document-intensive. After successful registration, a Udyam Certificate is issued, which acts as proof of their MSME status.

The above-streamlined process is time-saving while including a lot more, allowing small and even rural entrepreneurs to get their enterprises registered and bring themselves within the reach of governments' schemes and policies.

Major Udyam Registration Features:

Streamlined process: It will take only minimum information, that is, a person's details related to their UID card or PAN. Registration will be purely an online affair with no mediator needed.

Special Udyam Registration Certificate: A business shall be issued a unique Udyam Certificate on registration which carries a QR Code. It thus makes the authenticity verification and enables an entity to easily establish its MSME status.

Lifetime Valid: Valid for a life period and does not need renewal in periodic cycles that save huge amounts of administrative expenses.

Linkage to other Databases: Udyam Registration is linked with the GST and IT databases so that the process is smooth and there is transparency.

Nominal Cost: The nominal cost of the registration process that any entrepreneur can afford without worrying about the availability of finances.

"Make in India" and MSME

The "Make in India" plan is to make the country a large-scale manufacturing destination but also to attract investments in the country both nationally and internationally. MSME accounts for about 30% of the Indian GDP and employs over 110 million people in the country, hence forming the central unit to achieve the above objectives.

MSME is significantly important for the following reasons

Encouraging entrepreneurship in every sector.

Creation of employment in rural and sub-rural areas

Increasing exports: It produces internationally competitive, good quality goods and exports.

Drive in-house innovation; and production.

Nevertheless, to flourish in full glee, the MSMEs require institutional backup, access to finance, and market-based competitiveness in the world scenario. It is in this that comes into play by Udyam Registration process, an essential initiative to boost this scheme.

Udyam Registration - Strengthening the 'Make in India' Initiative

Government Benefits Access Under the Udyam registration scheme, MSMEs can access several government schemes and incentives, which include subsidies, tax rebates, and credit guarantees. These facilitate a reduction in the financial burden on small businesses so that more money can be invested in technology, infrastructure, and workforce development.

Ease Credit Access One of the key issues that MSMEs face is access to low-cost credit. Udyam Certificate holders are eligible for CGTMSE loans, which provide collateral-free access to loans. In addition, registered entities benefit from a relatively lower interest rate, thus making it possible to expand their businesses and "Make in India."

Udyam makes the registration process easier for informal enterprises to become formalized, thus increasing the count of MSMEs, but at the same time representing those units in the formal economy to boost the growth of the Indian economy.

Enhancing Export Competitiveness MSMEs registered under Udyam enjoy several export-related benefits, including lower export duties and access to export promotion councils. This would allow small enterprises to compete with the best in the world, hence enhancing India's export growth.

This will promote indigenous innovation. Udyam Registration pushes the MSMEs for investment research and development by giving them financial and taxation benefits. This is a direction for "Make in India," supporting indigenous production and lesser dependence on foreign technology.

In return, the government saves a considerable percentage of procurements for the MSME sector. In simpler terms, MSMEs are constituents of public sector projects. Due to this fact, the holder of the Udyam Certificate can avail preferential treatment wherein the scope is greatly broadened towards growth.

Steps for Udyam Certificate Registration:

Open Udyam India Portal: Go to the official Udyam Registration portal.

Enter Aadhaar Details: Enter the details of the Aadhaar card of the businessman or authorized signatory.

Verification of PAN Number: Enter the PAN number and verify it from the income tax records.

Business Information Fill in the required details of investment and turnover.

Submit and Generate Certificate After verification, the Udyam Certificate is generated instantaneously.

Difference Between Udyam Registration vs. Udyog Aadhar Registration

While Udyog Aadhar Registration was a step towards formalizing MSMEs, it lacked the efficiency and inclusivity of the current Udyam system. Here's how Udyam Registration improves upon its predecessor:

Integration with Databases: Udyam Registration integrates perfectly with the GST and IT databases, thereby reducing redundancy and enhancing transparency.

Automated Classification: The new system automatically classifies enterprises based on their investment and turnover, hence no manual intervention.

Lifetime Validity: Unlike Udyog Aadhar, where periodic updation is done, the Udyam Certificate is lifetime valid and thus eases compliance.

Global Acceptance: The simplified process and rigorous authentication make Udyam Registration more authentic and recognized globally as compared to Udyog Aadhar.

Conclusion:

Udyam Registration plays a critical role that helps in "Make in India" by surpassing the barriers of age that MSMEs face and gaining global competitiveness. With easy procedures and direct financial incentives and incorporating the registration into government initiatives, Udyam Registration has now become a catalyst for the growth of the manufacturing sector.

For entrepreneurs and small business owners, the Udyam Certificate is not a formality but a strategic move to unlock the benefits of government support and align with India's broader economic objectives. As "Make in India" continues to drive the country's industrial growth, Udyam Registration ensures that MSMEs remain at the heart of this transformative journey.

#udyam certificate#udyog aadhar registration#udyog aadhar#msme certificate#aadhar udyog#aadhar udyog registration#udyam certificate registration#udyog aadhar certificate#msme certificate registration#msme online registration

1 note

·

View note

Text

Unlock the Secrets of Udyam Registration for Partnership Firms

The Udyam Registration, previously known as Udyog Aadhaar Memorandum (UAM), has been a transformative initiative by the Indian government to support and empower micro, small, and medium-sized enterprises (MSMEs). For partnership firms, this registration offers a host of benefits and opportunities.

Update Udyam Certificate: One of the key advantages of Udyam Registration is the ability to Update Udyam Registration online. Business details may change over time, and this feature allows you to keep your registration accurate and up-to-date, reflecting the current state of your partnership firm.

Apply Online for Udyam Partnership Firm: The online application process for partnership firms is user-friendly and efficient. You can easily submit the necessary documents and information online, reducing the time and effort required for registration.

Online Enquiry for Udyam: The digital platform has simplified the process of making inquiries related to Udyam Registration. You can get information, clarification, and assistance regarding the registration process, making it easier to navigate.

Print UAM Registration Online: Once your partnership firm's Udyam Registration is approved, you can conveniently print your Udyam Certificate online. This certificate is not just a document; it's your ticket to a plethora of benefits and opportunities reserved for MSMEs.

Print Udyam Certificate: After successfully obtaining your Udyam Registration, you can print the Udyam Certificate, which serves as proof of your registration. Displaying this certificate can build trust among clients and partners, enhancing your firm's credibility.

Access to Government Schemes: Udyam Registration opens the door to various government schemes and incentives specifically designed for MSMEs. These schemes can provide financial assistance, subsidies, and priority in procurement, giving your partnership firm a competitive edge.

Financial Benefits: Banks and financial institutions often offer preferential treatment to Udyam-registered businesses. This includes easier access to credit facilities and lower interest rates, which can be advantageous for managing finances and expansion.

Global Opportunities: Udyam Registration can also pave the way for international collaborations and exports. Many foreign companies prefer to engage with Udyam-registered Indian businesses, offering the potential for global growth.

Simplified Compliance: Udyam Registration streamlines the compliance process by consolidating various government-related registrations into one. This reduces the administrative burden on your partnership firm.

Competitive Advantage: Displaying your Udyam Certificate on your website and marketing materials can enhance your firm's reputation and attract clients who prefer working with registered MSMEs.

Conclusion

Udyam Registration is a game-changer for partnership firms in India. It offers numerous benefits, ranging from financial advantages to global opportunities. By utilizing online services such as updating your Udyam Certificate, applying online, making online inquiries, and printing your Udyam Certificate, you can unlock the full potential of this registration and take your partnership firm to new heights of success. Don't miss out on the secrets of Udyam Registration; embrace them and witness the transformation in your business.

2 notes

·

View notes

Text

Streamline Your Business with KVR TAX: Your Go-To Partner in Hyderabad

Starting and managing a business in Hyderabad involves several critical steps, from registration to tax filing. Navigating the complex regulatory landscape can be overwhelming, but with the right guidance, it becomes a seamless process. At KVR TAX, we specialize in offering comprehensive solutions for all your business needs, including gst registration certificate in hyderabad, income tax filing in Hyderabad, and much more.

Goods and Service Tax Registration in Hyderabad

One of the primary requirements for any business in India is the goods and service tax registration in hyderabad. GST is a crucial tax that every business dealing in goods or services must comply with. Our team at KVR TAX ensures a smooth and hassle-free firm gst registration process in hyderabad. From understanding the legal requirements to completing the paperwork, we assist you at every step.

Register Your Business Effortlessly

If you're planning to register a business in hyderabad, KVR TAX is your reliable partner. Whether you want to register a company in Hyderabad or set up a small firm, we provide end-to-end services. The registration of firm process in hyderabad can be daunting, but our experts make it simple and straightforward. We guide you through each phase, ensuring that your business complies with all necessary regulations.

Income Tax Filing Made Easy

Tax filing is another essential aspect of running a business. Whether you're an individual or a corporate entity, timely and accurate tax filing is crucial. KVR TAX offers expert services in income tax filing in hyderabad. Our professionals are well-versed in the latest tax laws and help you with incometax return filing in hyderabad, ensuring compliance and minimizing liabilities.

MSME Registration Consultants in Hyderabad

For small and medium enterprises, obtaining MSME registration is vital for availing various benefits. At

#gst registration certificate in hyderabad#goods and service tax registration in Hyderabad#register a business in hyderabad#register company in Hyderabad#firm gst registration process in Hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in Hyderabad#Msme Registration Consultants in Hyderabad#MSME Registration Online in hyderabad#iec code registration in Hyderabad#export and import registration in hyderabad

0 notes

Text

Technical Training

We Techiesoft Educational Services is a young, energetic company started in the year 2018 in the field of Sakill Development Training & Technical Training Education.

We provide training with Govt. of India Certificate. We got inspired from many entrepreneurs to start our business & thereby succeeded in inspiring our students to start their own venture.

We focus on development of students & unemployed by providing skill development programmes.

Why Choose Us?

We provide 100% relevant, practical & best learning experience.

Place to invest your time & energy in learning new contents.

We build the confidence of our students over the courses and to start their career relevant to it.

We provide guidance to start their own business & with marketing techniques.

We provide guidance on PMEGP loan for availing subsidy form 15% to 35%.

We also support on registration of new company in MSME.

Providing guidance on material procurement.

Providing Skill Development Training & Technical Training

Our Mission

Our Company's objective move towards the objective of our country "SKILL INDIA" is providing industry relevant skill training for a better living standard. For the question of many youngsters that, 'Even after completing their graduation, why do they struggle to get jobs related to what they studied' - We provide the key to bridge the gap between their education & career selection by providing Entrepreneurship Development Training.

All the courses available with us mostly focus on skill development & we induce our students to start their own business & thereby to provide better livelihood for all younsters.

Our Vision

Currently, We focus on school dropped out, students, passed outs, people searching for job, people unhappy with current job & also those who shows interest towards starting their own business in our state and from different parts of our country. In long run, our vision is to contribute our services to the maximum level in achieving the vision of our nation.

Our Goal

" Eradication of Unemployment in India"

"Skill Development Training"

"Technical Training"

"Entrepreneurship Development"

Our Courses

Solar Panel Installation Training | Digital Marketing Training | Share/Stock Market Training | Two Wheeler Repair Training | Mobile Repair Training | Website Design | SAP Training | Maths Tution | Website Building Course | EDP Program | Tally | GST Practioner | Accounting & Taxation | CCTV Installation Etc.

We are providing both Weekdays & Weekends Flexible Batches - Offline & Online Training

We are Collabrated with KVIC | MSME | MHRD | OFIL | NSDC | SKILL INDIA

Thanks & Regards

Techiesoft Educational Services

https://techiesoftedu.com/

No.2, Pazhamudir Choolai Complex, Thulukanathamman Koil Street

Pallikaranai, Chennai - 600 100

Mobile: +91 63817 05045

3 notes

·

View notes

Text

NG and Associates Leading the Way in Company Copyright Registration Online in India

In the dynamic landscape of business, safeguarding intellectual property is paramount for sustained success. NG and Associates, a trusted name in legal services, has emerged as a key player in facilitating Company Copyright Registration Online in India. This blog explores the significance of copyright registration, the role of NG and Associates, and why securing your creative assets is crucial in today's competitive market.

Understanding the Importance of Copyright Registration:

Copyright registration is a legal process that provides creators with exclusive rights to their original works. In the realm of business, this encompasses everything from artistic creations to software codes and innovative designs. Securing copyright not only protects the creator's intellectual property but also establishes a legal framework for potential disputes.

NG and Associates: Pioneers in Legal Services:

NG and Associates have carved a niche for themselves in the legal domain, offering comprehensive services that cater to the evolving needs of businesses. With a team of seasoned legal experts, they specialize in guiding businesses through the intricacies of copyright registration, ensuring a seamless process from start to finish.

Why Choose NG and Associates for Company Copyright Registration Online in India?

Expertise: NG and Associates boast a team of legal professionals with extensive knowledge and experience in copyright laws. They stay abreast of the latest developments, ensuring that clients receive the most accurate and up-to-date advice.

Efficiency: Recognizing the fast-paced nature of business, NG and Associates streamline the copyright registration process. Their online platform makes it convenient for businesses to initiate and complete the registration process with minimal hassle.

Customized Solutions: Every business is unique, and so are its intellectual property needs. NG and Associates tailor their services to suit the specific requirements of each client, ensuring a personalized and effective approach to copyright registration.

Securing Your Creative Assets Today:

In a world driven by innovation, securing your creative assets is not just a choice; it's a necessity. NG and Associates empower businesses to protect their intellectual property, fostering an environment conducive to growth and prosperity.

Company Copyright Registration Online in India: A Seamless Experience with NG and Associates

In conclusion, as businesses navigate the intricate web of intellectual property laws, NG and Associates stand as a reliable partner, facilitating Company Copyright Registration Online in India. With their expertise, efficiency, and commitment to client success, NG and Associates ensure that your creative endeavors are safeguarded, paving the way for a thriving and secure business future.

#Company Registration in india#Private Limited Company Registration#Nidhi Company Registration#Trademark Registration Online#Copyright Registration Online In India#GST Registration Online#Startup Registration India#MSME Registration In India#FSSAI License and Registration#One Person Company Registration#ISO Certification in India#labour license registration#Professional Tax Registration#Business Tax Returns Filing#Gem registration

1 note

·

View note