#MSME registration

Explore tagged Tumblr posts

Text

Consultancy services refer to professional advice and expertise offered by specialized individuals or firms to assist businesses, organizations, or individuals in addressing specific challenges, improving processes, and achieving their goals. Consultants are typically experts in their respective fields and provide unbiased, objective insights and recommendations.

#gst registration#itrfiling#msme registration#food license registration#esic#gem registration#labour license#passport

2 notes

·

View notes

Text

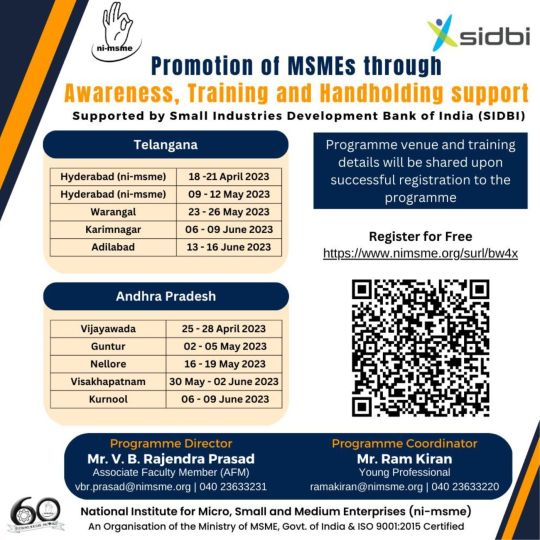

Promotion of MSMEs through Awareness, Training and Handholding support

National Institute for MSMEs (ni-msme) is conducting Free Entrepreneurial Awareness creation &, Entrepreneurship Development Training Programmes (non-residential) followed by handholding support with an objective of Promotion of MSMEs in Telangana and Andhra Pradesh, with the support of Small Industries Development Bank of India (SIDBI)

Entrepreneurial Awareness creation, Entrepreneurship Development Training

Free Entrepreneurial Awareness creation &, Entrepreneurship Development Training Programmes (non-residential) followed by handholding support with an objective of Promotion of MSMEs in Telangana and Andhra Pradesh, with the support of Small Industries Development Bank of India (SIDBI).

https://www.nimsme.org/surl/bw4x

2 notes

·

View notes

Text

Navigating the Journey of a Startup in India with Raaas

India is rapidly emerging as a global hub for startups, offering a dynamic environment filled with opportunities and challenges. Whether you're an aspiring entrepreneur or a seasoned business professional, launching a startup in India requires strategic planning and expert guidance. This is where Raaas (Research, Analysis, and Advisory Services) comes in, providing comprehensive support to help startups succeed in this competitive landscape.

Why Start a Business in India? India's startup ecosystem is thriving, thanks to a combination of factors such as a growing economy, a large pool of skilled talent, and a supportive government policy framework. Here are some key reasons why India is an attractive destination for startups:

Booming Economy: With one of the fastest-growing economies in the world, India offers vast market potential across various sectors.

Government Initiatives: Programs like ‘Startup India’ and various tax incentives are designed to foster innovation and entrepreneurship.

Access to Capital: India has a vibrant venture capital and angel investment network, providing funding opportunities for startups at different stages.

Diverse Talent Pool: India’s large, young, and technically skilled workforce is a significant advantage for startups looking to build innovative solutions.

Challenges Faced by Startups in India While the opportunities are vast, startups in India also face several challenges:

Regulatory Hurdles: Navigating the complex legal and regulatory landscape can be daunting for new businesses.

Funding Gaps: Despite the availability of capital, many startups struggle to secure early-stage funding.

Market Competition: With numerous startups emerging, standing out in a crowded market requires strategic planning and innovation.

Infrastructure Constraints: In some regions, startups may face challenges related to infrastructure, such as logistics and connectivity.

How Raaas Supports Startups in India Raaas offers a range of services tailored to help startups overcome these challenges and thrive in the Indian market. Here’s how Raaas can assist:

Business Strategy Development: Raaas helps startups craft a solid business plan, ensuring they have a clear roadmap to achieve their goals.

Market Research and Analysis: With in-depth market insights, Raaas enables startups to identify opportunities and make informed decisions.

Regulatory Compliance: Navigating legal requirements can be complex. Raaas provides expert guidance to ensure compliance with all regulatory norms.

Funding Assistance: From preparing pitch decks to connecting with potential investors, Raaas supports startups in securing the necessary capital.

Operational Support: Raaas offers ongoing advisory services to help startups optimize their operations and scale efficiently.

Success Stories with Raaas Several startups have successfully launched and scaled their businesses with the support of Raaas. These success stories highlight the importance of having a trusted partner to navigate the startup journey in India.

Conclusion Starting a business in India offers incredible opportunities, but it requires careful planning and expert support. With Raaas by your side, you can navigate the complexities of the Indian market and set your startup on the path to success. From strategic planning to operational execution, Raaas provides the insights and expertise needed to thrive in India’s dynamic startup ecosystem.

Ready to launch your startup in India? Contact Raaas today and take the first step towards building a successful business!

#cashflow#charted accountant#msme registration#form 16#private limited company registration in india

1 note

·

View note

Text

GST Registration Benefits for Small Businesses

1. Legitimacy and Business Credibility

Customers, suppliers, and other stakeholders will view a small firm as more legitimate if it registers under GST. A company that has registered for GST is seen as adhering to government rules, which increases credibility and trust. When working with larger clients or entering government bids, where GST registration is frequently required, this is extremely advantageous.

Important Points:

enhanced reputation of the brand.

Corporate clientele are easier to reach.

advantage over unregistered companies.

2. Simplified Tax Structure

Before the GST, companies had to manage a convoluted tax system that included several different taxes, including excise duty, service tax, VAT, and others. By combining all taxes into a single system, GST lessens the administrative load and simplifies tax compliance for small enterprises.

Important Points:

The removal of cascading taxes.

uniform state-by-state tax rates.

The online filing made compliance easier.

3. Input Tax Credit (ITC)

The availability of the Input Tax Credit (ITC) is one of the biggest advantages of GST registration. Businesses can use ITC to claim credit for GST paid on inputs or purchases, which can then be deducted from the GST owed on sales. Profitability is increased, and the overall tax burden is decreased via this technique.

Learnmore knowlegde

0 notes

Text

Top MSME Benefits Every Entrepreneur Should Know in 2024

The Micro, Small, and Medium Enterprises (MSME) zone performs a pivotal role in riding economic increase, developing employment, and fostering innovation in India.

Here’s an overview of the MSME benefits:

1. Financial Assistance and Subsidies

MSMEs are eligible for numerous government subsidies, including credit score-linked capital subsidies for generation improvements and other financial assistance schemes. These assist in reducing operational charges and improving profitability.

2. Priority Sector Lending

Banks and economic institutions prioritize lending to MSMEs underneath the Reserve Bank of India's hints, making sure better get admission to credit score. Entrepreneurs can avail of collateral-loose loans through schemes like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

3. Tax Benefits Registered

MSMEs experience several tax advantages, inclusive of exemptions and deductions. For example, MSMEs can declare comfort underneath certain income tax provisions, inclusive of presumptive taxation schemes.

4. Market Access and Procurement

Policy Under the Public Procurement Policy, MSMEs acquire a reservation of 25% of annual procurement through significant government ministries and public sector organizations. Additionally, a 3% sub-reservation is provided for girls entrepreneurs.

5. Technology and Skill Development

MSMEs gain from authorities packages like the Lean Manufacturing Competitiveness Scheme and ZED (Zero Defect Zero Effect) certification, which beautify product excellent and operational performance.

6. Export Promotion Incentives

To raise international competitiveness, MSMEs experience reduced fees for submitting patents and logos, obligation exemptions, and other incentives underneath export-oriented schemes.

7. Ease of Doing Business

The Udyam Registration method simplifies the technique of registering an MSME and availing of benefits. Entrepreneurs also benefit from quicker decisions of disputes and less difficult compliance necessities.

8. Support During Economic

Uncertainty Special relief packages, which include those announced at some point of the COVID-19 pandemic, highlight the government’s dedication to helping MSMEs for the duration of financial crises.

Conclusion

In 2024, MSME advantages remain to empower entrepreneurs with financial aid, market get admission to, and technological help.

Leveraging these MSME benefits isn't always pretty much compliance but approximately driving innovation and sustainability in enterprise operations.

0 notes

Text

Benefits of msme registration

0 notes

Text

How to register an MSME company in India | Process of Registering an MSME

Process of Registration of an MSME – Registering a Micro, Small, or Medium Enterprise (MSME) in India is a straightforward online process facilitated through the Udyam Registration portal. MSMEs benefit from several government schemes, including subsidies, credit facilities, tax exemptions, and more. Here’s a step-by-step guide on how to register an MSME in India: Process of Registration /…

#How to register an MSME in India#MSME Registration#MSME Registration in India#Registering an MSME in India#registration process of MSME

0 notes

Text

Discover the top benefits of MSME registration for Indian entrepreneurs, including tax rebates, easier loans, and priority in government tenders. Learn more here.

#msme registration#msme certificate registration#msme certificate#nsic registration#nsic certificate

0 notes

Text

How MSME Registration Can Unlock New Business Opportunities for Steel Manufacturers

India’s steel manufacturing industry has been growing rapidly, driven by strong demand in sectors like construction, automotive, infrastructure, and energy. However, many steel manufacturers, especially small and medium-sized enterprises (SMEs), face challenges such as high costs, limited access to financing, and stiff competition.

One powerful solution to these challenges is registering as a Micro, Small, and Medium Enterprise (MSME) under the Government of India’s MSME Act. MSME online registration can unlock new business opportunities and provide significant benefits that can help steel manufacturers level up their operations.

So, why not explore how MSME registration can be a game-changer for steel manufacturers looking to grow their business.

1. Access to Financial Support and Credit Facilities

One of the biggest benefits of MSMEs registration for steel manufacturers is improved access to finance. Many steel businesses struggle with working capital management due to the high upfront costs of raw materials, machinery, and technology. MSME registration can ease these concerns by providing access to several government schemes that offer loans at lower interest rates and longer repayment periods.

Key Benefits:

Priority lending: Banks are mandated to prioritise lending to MSMEs, making it easier to secure financing.

Subsidised interest rates: Registered MSMEs are eligible for loans with interest rates that are significantly lower than market rates, reducing financial burdens.

Collateral-free loans: MSMEs can also avail themselves of collateral-free loans under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). This can be a huge benefit for steel manufacturers with limited assets to pledge as security.

2. Government Subsidies and Incentives

The government of India offers various subsidies, rebates, and incentives to MSMEs. These financial benefits are aimed at encouraging small businesses to invest in new technology, energy-efficient practices, and research and development, all of which can be crucial for a steel manufacturer looking to stay competitive.

Available Schemes Include:

Technology Upgradation Scheme: Helps MSMEs modernise their technology and production processes by offering capital subsidies.

Subsidies on Patent Registration: MSMEs can get up to 50% subsidy on fees for patent and trademark registrations, encouraging innovation and protecting intellectual property.

Market Development Assistance (MDA): MSMEs can benefit from financial assistance to participate in international trade fairs and exhibitions, expanding their market reach globally.

3. Tax Benefits and Concessions

Another key advantage of MSME registration is the tax benefits that are available. Steel manufacturers who register their business under MSME can avail tax deductions that reduce their overall tax liability. Some of the tax-related benefits include:

Tax exemptions for newly established MSMEs: If your steel manufacturing unit qualifies as a small or medium enterprise, you may be eligible for certain tax holidays for a specific period.

Deductions on expenses related to R&D: For businesses investing in research and development (R&D) to create innovative products or improve processes, deductions on R&D expenditures can provide significant tax relief.

Reimbursement of ISO certification expenses: Steel manufacturers seeking ISO certification can receive up to 75% reimbursement of the certification costs, further reducing operational expenses.

JSW Steel – Your Trusted Partner for MSME Success

For MSMEs in the steel industry, registering under the MSME Act is just the beginning of unlocking growth. To truly succeed, you need the right partner, and JSW Steel is here to help. With a specialised range of products and services, JSW MSME offerings ensures that small and medium businesses can operate at their best capacity.

JSW Steel offers high-quality steel products designed to meet the specific needs of MSMEs, helping you improve efficiency and deliver better end-consumer products. Additionally, JSW Steel’s dedicated sales team provides personalised support to ensure your business gets exactly what it needs to grow.

By partnering with JSW Steel, MSMEs can overcome challenges, optimise their processes, and take full advantage of the opportunities provided by MSME registration. Explore JSW Steel’s MSME-focused services today and see how they can help you achieve greater success.

0 notes

Text

The Benefits of Udyam Registration for Small Businesses

Introduction: India is home to millions of Micro, Small, and Medium Enterprises (MSMEs) that form the backbone of the country's economy. To support the growth of these enterprises, the government introduced Udyam Registration, a streamlined process that offers a host of benefits to small business owners. Whether you're an entrepreneur, artisan, or small-scale manufacturer, Udyam Registration provides significant advantages that can help propel your business to new heights. Let’s explore the key benefits of registering under Udyam and why it’s essential for MSMEs in today’s business environment. for more information go to : https://udyam.webinfinix.in/

1. Access to Government Schemes and Subsidies

One of the biggest advantages of Udyam Registration is the access it provides to a variety of government schemes tailored specifically for MSMEs. Registered businesses can avail themselves of numerous subsidies, such as:

Capital and interest subsidies on loans, making it easier and more affordable for MSMEs to access financing.

Participation in government-sponsored programs such as the Credit Guarantee Fund Scheme, which offers collateral-free loans.

Being a registered MSME under Udyam ensures that you’re eligible to take full advantage of these schemes.

2. Priority Lending and Lower Interest Rates

Small businesses often face challenges in obtaining affordable financing. Udyam-registered businesses are given priority by banks and financial institutions when applying for loans. This means faster processing, fewer documentation requirements, and, most importantly, lower interest rates. Additionally, Udyam registration makes your business eligible for the Credit Linked Capital Subsidy Scheme (CLCSS), which helps reduce interest costs on loans for purchasing machinery and technology upgrades.

3. Ease of Access to Government Tenders

Udyam-registered MSMEs enjoy preferential treatment when bidding for government tenders. This gives small businesses a competitive edge by reserving a portion of government procurement contracts exclusively for registered MSMEs. Moreover, tender-related expenses such as application fees or earnest money deposits are often reduced or waived entirely for Udyam-registered businesses. This increases the chance of securing lucrative government contracts, enabling businesses to grow in scale and revenue.

4. Protection Against Delayed Payments

Small businesses often struggle with delayed payments from clients, which can lead to cash flow problems. The MSME Development Act provides protection to Udyam-registered businesses against such delays. If payments are not cleared within the stipulated time frame, buyers are required to pay interest on the outstanding amount, ensuring a better financial position for the business owner.

5. Tax Benefits and Concessions

Udyam Registration opens doors to several tax benefits for small businesses, helping them reduce their tax liabilities and increase profitability. For example, registered MSMEs can benefit from direct tax exemptions and reduced GST rates under certain schemes. Additionally, businesses can claim subsidies on the cost of ISO certifications and patent registrations, further lowering operational costs.

6. Access to Credit and Financial Assistance

A major challenge for many MSMEs is the lack of access to formal credit. With Udyam Registration, small businesses can take advantage of the government’s focus on providing easier access to credit. MSMEs can also benefit from the Credit Guarantee Fund Scheme for collateral-free loans. This enables businesses to secure much-needed capital without the pressure of providing collateral, making it easier to grow and invest in their business.

7. Skill Development and Technology Upgradation

The government is keen on modernizing India’s MSME sector. Through Udyam Registration, businesses become eligible for skill development programs, technology upgradation schemes, and workshops designed to boost productivity and innovation. These programs offer training in digital marketing, export management, financial planning, and more, enabling small businesses to stay competitive in a global market.

8. Global Market Access and Export Promotion

Udyam Registration is a stepping stone for businesses looking to expand internationally. Registered MSMEs are given special access to export promotion programs, trade fairs, and international exhibitions where they can showcase their products. Additionally, MSMEs are supported in navigating export documentation and logistics, giving them an advantage in tapping into global markets.

9. ISO Certification Subsidy

Achieving ISO certification can significantly boost the credibility of a business. Udyam-registered MSMEs can benefit from a subsidy on the cost of obtaining ISO certification, which is critical for enhancing product quality, improving operational efficiency, and increasing marketability.

10. Cluster Development Initiatives

Another advantage of Udyam Registration is the ability to participate in cluster development programs. These programs bring together similar businesses within a geographic region, allowing them to collaborate, share resources, and collectively address common challenges. Cluster development initiatives are particularly helpful in sectors such as handicrafts, textiles, and food processing, where pooling resources can significantly reduce operational costs and improve market access.

Conclusion:

Udyam Registration is much more than just a formalization process—it’s a gateway to a range of financial, operational, and market benefits. From easy access to government schemes and credit facilities to tax exemptions and cluster development, the advantages of Udyam Registration can significantly transform a small business’s growth trajectory. Whether you're a startup, artisan, or established MSME, the benefits of registering under Udyam are undeniable. By leveraging these benefits, businesses can thrive in a competitive environment, scale operations, and contribute to India’s economic development.

FOR APPLY UDYAM GO TO : https://udyam.webinfinix.in/

#udyam apply#udyam registration#udyam certificate#get udyam#msme registration#msme loan#msme business#msme lending

1 note

·

View note

Text

Online Company Registration India

Simplifying Company Registration Online in India. Register your company easily with LegalChalo and secure your business name quickly.

#business#startup#gst registration#company registration#marketing#success#trademark registr#trust#solutions#msme registration#msmes#business loan#plc#llp registration

1 note

·

View note

Text

How to Register a Proprietorship Firm in Delhi

One of the most basic and prevalent types of business structure in India is a proprietorship. One of the most basic and prevalent types of business structure in India is a proprietorship. Because it is solely owned and operated by one person, it is a great option for startups, freelancers, and small enterprises. Compared to other business forms, registering a proprietorship is less complicated and requires less legal compliance. Here is a detailed guide to help you comprehend the procedure.

Understand the Basics of a Proprietorship Firm

It is crucial to comprehend what a proprietorship firm comprises before beginning the registration process:

One Ownership: One individual owns and runs the company.

Unlimited Liability: All obligations and debts of the business are directly owed by the owner.

No Different Legal Entity: The owner and the proprietorship share the same legal identity.

Formation and Closure Ease: Establishing the business is easy, and shutting it down is a breeze.

Benefits of a Proprietorship Firm

Low Compliance Requirements: Unlike corporations or limited liability partnerships, proprietorships are subject to fewer regulatory requirements.

Total Authority: The owner has total authority over all corporate choices.

Tax Benefits: Small enterprises may benefit from the fact that income is taxed according to the individual’s income tax bracket.

Banking Ease: It is simple for proprietorships to open a current account in their name.

Prerequisites for Registration

Make sure you possess the following in order to form a proprietorship firm:

Business Name: Give your company a distinctive name that captures its essence and core principles.

Proof of Address: A proof of business address, such as a utility bill or rent agreement, is necessary.

Identity Proof: The owner’s voter ID, PAN card, or Aadhaar card.

Bank Account: An account currently held in the proprietorship’s name.

Learnmore

#gst registration#msme registration#income tax return#passive income#earn money online#money#income inequality#income tax

0 notes

Text

MSME Registration: Unlocking Government Benefits for Your Business

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in India's economic growth and development. These enterprises contribute significantly to employment generation, industrial output, and exports. Recognising their importance, the Government of India has implemented various policies and schemes to support and promote MSMEs, including the process of MSME Registration.

What is MSME Registration?

MSME registration is an official recognition provided by the Ministry of Micro, Small, and Medium Enterprises, Government of India, to businesses in the MSME sector. The registration process categorises firms based on their investment in plant, machinery, or equipment and turnover.

Benefits of MSME Registration:

Access to Subsidized Loans and Credit Facilities:

Registered MSMEs are eligible for various financial schemes and credit facilities offered by banks and financial institutions at lower interest rates. This promotes more straightforward access to capital for business expansion and modernisation.

Government Subsidies and Incentives:

MSMEs enjoy subsidies on patent and trademark registration fees. They also benefit from incentives provided under various government schemes to promote entrepreneurship and industrial growth.

Protection Against Delayed Payments:

The Micro, Small and Medium Enterprises Development Act of 2006 mandates timely payment to MSMEs for goods and services supplied to larger corporations and government agencies. Non-compliance may attract penalties and interest payments to the MSME supplier.

Preference in Government Tenders:

MSME-registered enterprises receive preference in the allocation of government tenders, which gives them opportunities to secure contracts and projects from government agencies and public-sector undertakings.

Market Access and Promotion:

Registration enhances MSMEs' visibility and credibility, facilitating market access and partnerships with larger companies. It also allows them to participate in trade fairs, exhibitions, and other promotional events.

Technology Upgradation and Skill Development:

MSMEs can benefit from government initiatives to promote technology adoption and skill development through specialised training workshops.

Eligibility Criteria for MSME Registration:

Micro Enterprises: Investment in plant, machinery, or equipment does not exceed INR 1 crore, and turnover does not exceed INR 5 crore.

Small Enterprises: Investment in plant, machinery, or equipment is between INR 1 crore and INR 10 crore, and turnover is between INR 5 crore and INR 50 crore.

Medium Enterprises: Investment in plant and machinery or equipment is between INR 10 crore and INR 50 crore, and turnover is between INR 50 crore and INR 250 crore.

How to Register as an MSME:

Online Registration: The MSME registration process is straightforward and can be completed online through the Udyam Registration portal (https://udyamregistration.gov.in/).

Documentation: Basic documents such as an Aadhaar card, PAN card, and proof of business address are required for registration.

Conclusion:

MSME Registration empowers small and medium-sized enterprises in India by providing them with financial assistance, market opportunities, and legal protection. It fosters entrepreneurship, innovation, and economic growth, positioning MSMEs as key drivers of India’s inclusive development agenda. As MSMEs continue to evolve and contribute to various sectors of the economy, the government's support through registration and policy measures remains pivotal in nurturing their growth and sustainability.

0 notes