#Low interest auto loans

Explore tagged Tumblr posts

Text

How to Secure the Best Auto Financing Deals at Precision Auto Sales & Service

Securing the best auto financing deal can make your car purchase more affordable and stress-free. At Precision Auto Sales & Service, we are committed to helping you find the ideal financing option for your budget and needs. Here’s how you can secure the best auto financing deals with us.

1. Check Your Credit Score

Your credit score plays a significant role in determining the interest rate and terms of your auto loan. Before applying for financing, check your credit score and report. Understanding your credit standing can help you set realistic expectations and identify areas for improvement to secure better loan terms.

2. Set a Realistic Budget

Establishing a clear budget is crucial when financing a car. Consider not only the monthly loan payments but also other associated costs such as insurance, maintenance, fuel, and registration fees. Knowing your budget will help you narrow down your vehicle options and prevent you from overextending your finances.

3. Explore Multiple Financing Options

Don’t settle for the first financing offer you receive. Shop around and compare rates from different lenders, including banks, credit unions, and dealership financing. At Precision Auto Sales & Service, we work with a network of reputable lenders to offer competitive rates and flexible terms. Make sure to explore all available options to find the best deal.

4. Get Pre-Approved

Getting pre-approved for a loan before you start shopping for a car can give you a clear idea of how much you can afford and streamline the buying process. Our easy online application at Precision Auto Sales & Service allows you to get pre-approved quickly, giving you more confidence and bargaining power when selecting your vehicle.

5. Save for a Down Payment

A larger down payment can significantly reduce the amount you need to finance, lowering your monthly payments and the total interest paid over the life of the loan. If possible, try to save up for a substantial down payment to improve your financing terms.

6. Understand the Loan Terms

Make sure you fully understand the terms of your loan agreement, including the interest rate, loan term, monthly payment, and any fees or penalties. Don’t hesitate to ask questions or seek clarification from our finance experts to ensure you’re comfortable with the agreement.

7. Take Advantage of Special Programs and Incentives

Precision Auto Sales & Service regularly offers special financing programs and incentives, such as:

Low-Interest Rates for Qualified Buyers: Helping you save money on interest.

Cash-Back Offers: Putting money back in your pocket.

Extended Warranties: Providing peace of mind with your vehicle purchase.

8. Consider Buy Here, Pay Here (BHPH) Financing

If you have less-than-perfect credit, our Buy Here, Pay Here financing option can be a viable solution. This in-house financing program allows you to make payments directly to us, offering more flexibility and helping you build or rebuild your credit.

9. Consult with Our Finance Experts

Our experienced finance team at Precision Auto Sales & Service is dedicated to helping you find the best financing solution. We take the time to understand your financial situation and tailor a financing package that fits your budget. Whether you have excellent credit, no credit, or are working to rebuild your credit, we have solutions for you.

10. Keep an Eye on Your Long-Term Financial Health

While it’s tempting to focus solely on getting a car quickly, consider your long-term financial health. Ensure the loan you choose fits within your overall financial plan and won’t cause undue strain on your finances down the road.

Conclusion

Securing the best auto financing deal at Precision Auto Sales & Service involves a combination of preparation, research, and leveraging our expertise. By checking your credit score, setting a realistic budget, exploring multiple financing options, and taking advantage of special programs and incentives, you can find a financing solution that fits your needs. Visit us today and let our finance experts help you get behind the wheel of your dream car with a financing package that works for you.

#best auto financing deals#Cheap car financing deals#Low interest auto loans#Affordable car finance options#Best rates on car loans#Car loan specials#No credit check car loans

0 notes

Text

Unlock Cash: Borrow Up to $50,000 with Auto Title Loans in Langley!

Unlock cash quickly with Snap Car Cash! Our Auto Title Loans Langley lets you borrow up to $50,000 using your vehicle as collateral. Whether you need funds for an emergency, home improvement, or debt consolidation, we make the process fast and hassle-free. With flexible repayment terms and no credit checks, you can get the cash you need without the stress. Just fill out our simple application, and our friendly team will assist you every step of the way. Don’t wait—unlock your car's value today and get the cash you deserve with Snap Car Cash!

#Auto Title Loans Langley#Borrow against car title Langley#Fast cash loans Langley#Car collateral loans Langley#Vehicle equity loans Langley#Low-interest auto title loans#Instant approval auto title loans#No credit check title loans#Quick title loans Langley

0 notes

Text

Car Title Loans Nanaimo: Fast Cash Solutions with Your Car Title

Looking for quick financial relief in Nanaimo? Snap Car Cash offers fast cash solutions through Car Title Loans Nanaimo, allowing you to access funds by using your car's title as collateral. Whether you need money for unexpected expenses, bills, or emergencies, Snap Car Cash provides a hassle-free application process with no credit checks. Simply use your vehicle's equity to secure a loan, and keep driving your car while you repay. With competitive interest rates and flexible terms, Snap Car Cash makes it easy to get the cash you need in Nanaimo. Apply today and get fast, reliable financial support!

#Vehicle Title Loans Nanaimo#Car Title Loans Nanaimo#Borrow Money Against Your Car Nanaimo#Fast Cash Loans Nanaimo#Auto Title Loans Nanaimo#No Credit Check Loans Nanaimo#Car Collateral Loans Nanaimo#Quick Cash with Car Title Nanaimo#Low-Interest Title Loans Nanaimo#Instant Car Title Loans Nanaimo

0 notes

Text

Borrow on Your Vehicle: Car Collateral Loans in Kelowna

Looking for a quick financial solution in Kelowna? Snap Car Cash offers Car Collateral Loans Kelowna to help you get the funds you need fast. Our Fast Car Collateral Loans Kelowna are designed to provide you with quick approval and competitive rates. Simply borrow on your vehicle and get the cash you need without the hassle. Whether you have unexpected expenses or are planning a big purchase, our flexible loan options can accommodate your needs. Choose Snap Car Cash for a straightforward, reliable way to access cash. Contact us today and let us help you turn your vehicle into financial power!

#Car Collateral Loans Kelowna#Vehicle Collateral Loans Kelowna#Kelowna Car Equity Loans#Car Title Collateral Loans Kelowna#Borrow Money with Car Collateral Kelowna#Auto Collateral Loans Kelowna#Fast Car Collateral Loans Kelowna#Low-Interest Car Collateral Loans Kelowna#Kelowna Vehicle Title Loans

0 notes

Text

Low Interest Rate Car Loans for Bad Credit

Journey Approved has offered to Canadian people in British Columbia, Alberta, Yukon, and Northwest Territories. So they can apply for low interest rate car loans for bad credit. Get your auto finance today:https://www.journeyapproved.com/low-interest-car-loans/

#bad credit auto loans low interest rate#car loan bad credit low interest#low interest car loan rates

0 notes

Text

The Power of Modern Calculators: Tools for Financial, Health, and Planning Needs

In today's fast-paced world, access to accurate and efficient calculators is a necessity for making informed decisions in various aspects of life. Whether you're managing your finances, planning for the future, or tracking your health and fitness goals, modern calculators play a pivotal role. In this article, we will explore a range of online calculators provided by Modern Calculators, each designed to address specific needs and assist you in making well-informed choices.

1. Online Loan Calculators

Online Loan Calculators are invaluable tools for individuals seeking loans. These calculators help you estimate monthly payments, interest rates, and repayment schedules, ensuring that you choose the loan that best fits your financial situation.

2. Debt to Income Ratio Calculator

Managing your debt is crucial for financial stability. The Debt to Income Ratio Calculator allows you to determine your DTI ratio, aiding in better decision-making when it comes to taking on new debts.

3. Depreciation Calculator

For business owners and individuals with assets, the Depreciation Calculator is a valuable tool. It assists in understanding how assets depreciate over time, aiding in financial planning and tax considerations.

4. Discount Calculators

Whether you're a shopper or a business owner, Discount Calculators help you calculate discounts, savings, and final prices, ensuring you get the best deals.

5. Due Date Calculator

Expecting parents can rely on the Due Date Calculator to estimate their baby's due date based on various factors.

6. EER Calculator or Estimated Energy Requirement Calculator

Maintaining a healthy diet is easier with the EER Calculator. It helps you determine your daily calorie needs based on factors like age, gender, and activity level.

7. Future Value Calculator

Planning for retirement or long-term savings? The Future Value Calculator aids in estimating the future value of your investments, allowing you to set achievable financial goals.

8. Healthy Weight Calculator

Achieving and maintaining a healthy weight is essential for overall well-being. The Healthy Weight Calculator helps you determine a healthy weight range for your height.

9. Height to Waist Ratio Calculator

Assessing your health risks is made easier with the Height to Waist Ratio Calculator, which provides insights into your abdominal obesity risk.

10. Debt Consolidation Calculator

Those looking to simplify their debt repayment strategy can turn to the Debt Consolidation Calculator to explore consolidation options.

11. Home Loan Affordability Calculator

Before purchasing a home, use the Home Loan Affordability Calculator to determine what you can afford and avoid overextending your finances.

12. Home Loan Calculator with Down Payment

When buying a home, calculating the down payment is essential. The Home Loan Calculator with Down Payment simplifies this process.

13. Ideal Body Fat Percentage Calculator

Maintaining a healthy body composition is vital. The Ideal Body Fat Percentage Calculator helps you set realistic fitness goals.

14. Ideal Body Weight Calculator

Determine your healthy weight range with the Ideal Body Weight Calculator, making it easier to manage your weight.

15. Ideal Calorie Intake Calculator

Achieving your fitness goals requires a balanced diet. The Ideal Calorie Intake Calculator assists in determining your daily calorie needs.

16. Inflation Calculator

Planning for future expenses is essential. The Inflation Calculator helps you understand the impact of inflation on your finances.

17. Skipping Rope Calories Burned Calculator

Stay fit with the Skipping Rope Calories Burned Calculator, which estimates calories burned during jump rope workouts.

18. LDL Calculator

Monitor your cardiovascular health with the LDL Calculator, helping you understand your low-density lipoprotein levels.

19. Lean Body Mass Calculator

Fitness enthusiasts can track their progress with the Lean Body Mass Calculator, which calculates lean body mass and body fat percentage.

20. Loan Down Payment Calculator

Planning to buy a car or home? The Loan Down Payment Calculator helps you determine the down payment required for your purchase.

21. Loan Payments Calculator

Manage your loan repayment schedule efficiently using the Loan Payments Calculator.

22. Macronutrient Calculator

Tailor your diet to your nutritional needs with the Macronutrient Calculator.

23. Meal Calories Calculator

Keep track of your calorie intake with the Meal Calories Calculator, aiding in weight management.

24. Mortgage Payoff Calculator

Accelerate your mortgage repayment strategy using the Mortgage Payoff Calculator.

25. Conception Calculator

For those planning to expand their families, the Conception Calculator helps estimate conception dates.

26. One Rep Max Calculator or 1RM Max Calculator

Fitness enthusiasts can gauge their strength using the One Rep Max Calculator.

27. Ovulation Calculator

Couples trying to conceive can benefit from the Ovulation Calculator to determine fertile periods.

28. Savings Calculator

Whether you're saving for a rainy day or a specific goal, the Savings Calculator helps you track your savings progress.

29. SIP Calculator or SIP Return Calculator

Investment planning becomes more accessible with the SIP Calculator, allowing you to estimate returns on Systematic Investment Plans.

30. Period Due Date Calculator

The Period Due Date Calculator aids in tracking menstrual cycles and predicting due dates.

31. Personal Loan Calculator

Evaluate personal loan options efficiently with the Personal Loan Calculator.

32. Pregnancy Conception Date Calculator

Expecting parents can use the Pregnancy Conception Date Calculator to estimate conception dates.

33. Pregnancy Timeline Calculator

Monitor your pregnancy progress with the Pregnancy Timeline Calculator, providing insights into the stages of pregnancy.

34. Present Value Calculator

Financial planning often requires understanding the present value of future cash flows. The Present Value Calculator simplifies this calculation.

35. Real Estate Calculators

For property investors, the Real Estate Calculators offer valuable tools to assess property yield and rental returns.

36. Rent Calculator

Choosing between renting and buying a home is a significant decision. The Rent Calculator helps you analyze the financial aspects of renting.

37. Rent vs Buy Calculator

Make an informed decision about homeownership with the Rent vs Buy Calculator.

38. Rental Property Calculator

Property investors can assess the potential income from rental properties using the Rental Property Calculator.

39. Retirement Plan Calculator

Plan for your retirement with confidence using the Retirement Plan Calculator.

40. RMR Calculator or Resting Metabolism Calculator

Understand your basal metabolic rate with the RMR Calculator to optimize your calorie intake for weight management.

41. Return on Investment Calculator or ROI Calculator

Evaluate investment opportunities using the Return on Investment Calculator, ensuring your investments yield desirable returns.

42. Simple Interest Rate Calculator

Calculate the interest on loans or investments with the Simple Interest Rate Calculator.

43. Squat One Rep Max Calculator

Fitness enthusiasts can track their strength gains with the Squat One Rep Max Calculator.

44. Steps to Miles Calculator

Keep your fitness goals on track by converting your daily steps to miles using the Steps to Miles Calculator.

45. Student Loan Calculator

Plan your student loan repayment strategy with the Student Loan Calculator.

46. VO2 Max Calculator

Assess your cardiovascular fitness with the VO2 Max Calculator.

47. Waist to Hip Calculator

Monitor your waist-to-hip ratio, a key indicator of cardiovascular health, using the Waist to Hip Calculator.

48. Weight Gain Pregnancy Calculator

Expectant mothers can track their weight gain during pregnancy with the Weight Gain Pregnancy Calculator.

In conclusion, Modern Calculators provides a diverse range of online tools that cater to various financial, health, and planning needs. These calculators empower individuals to make informed decisions, manage their finances, and lead healthier lives. Whether you're a fitness enthusiast, a homeowner, or an investor, these calculators are valuable assets in your quest for success and well-being.

#bmi calculator#bmr calculator or basal metabolism calculator#alc calculator#amortization loan calculator#anc calculator#annual interest rate calculator#annualized percentage rate calculator#auto loan calculator#bench press one rep max calculator#refinance calculator#tdee calculator#body shape calculator#bsa calculator or body surface area calculator#business loan calculator#weight loss calculator#calories burned calculator#carbohydrate calculator or carb intake calculator#cash back or low interest calculator#compound investment calculator#compound Interest rate calculator#credit cards calculator credit cards payoff calculator#daily protein intake calculator#daily water intake calculator#deadlift one rep max calculator#debt consolidation calculator#debt to income ratio calculator#depreciation calculator#discount calculators#due date calculator#eer calculator or estimated energy requirement calculator

1 note

·

View note

Text

Ko-fi prompt from @thisarenotarealblog:

There's a street near me that has eight car dealerships all on the same lot- i counted. it mystifies me that even one gets enough sales to keep going- but 8?? is there something you can tell me that demystifies this aspect of capitalism for me?

I had a few theories going in, but had to do some research. Here is my primary hypothesis, and then I'll run through what they mean and whether research agrees with me:

Sales make up only part of a dealership's income, so whether or not the dealership sells much is secondary to other factors.

Dealerships are put near each other for similar reasons to grouping clothing stores in a mall or restaurants on a single street.

Zoning laws impact where a car dealership can exist.

Let's start with how revenue works for a car dealership, as you mentioned 'that even one gets enough sales to keep going' is confusing. For this, I'm going to be using the Sharpsheets finance example, this NYU spreadsheet, and this Motor1 article.

This example notes that the profit margin (i.e. the percentage of revenue that comes out after paying all salaries, rent, supply, etc) for a car dealership is comparatively low, which is confirmed by the NYC sheet. The gross profit margin (that is to say, profits on the car sale before salaries, rent, taxes) is under 15% in both sources, which is significantly lower than, say, the 50% or so that one sees in apparel or cable tv.

Cars are expensive to purchase, and can't be sold for much more than you did purchase them. However, a low gross profit margin on an item that costs tens of thousands of dollars is still a hefty chunk of cash. 15% gross profit of a $20,000 car is still $3,000 profit. On top of that, the dealership will charge fees, sell warranties, and offer upgrades. They may also have paid deals to advertise or push certain brands of tire, maintenance fluids, and of course, banks that offer auto loans. So if a dealership sells one car a day, well, that's still several thousand dollars coming in, which is enough to pay the salaries of most of the employees. According to the Motor1 article, "the average gross profit per new vehicle sits at $6,244" in early 2022.

There is also a much less volatile, if also much smaller, source of revenue in attaching a repairs and checkup service to a dealership. If the location offers repairs (either under warranty or at a 'discounted' rate compared to a local, non-dealership mechanic), state inspections, and software updates, that's a recurring source of revenue from customers that aren't interested in purchasing a car more than once a decade.

This also all varies based on whether it's a brand location, used vs new, luxury vs standards, and so on.

I was mistaken as to how large a part of the revenue is the repairs and services section, but the income for a single dealership, on average, does work out math-wise. Hypothesis disproven, but we've learned something, and confirmed that income across the field does seem to be holding steady.

I'm going to handle the zoning and consolidation together, since they overlap:

Consolidation is a pretty easy one: this is a tactic called clustering. The expectation is that if you're going to, say, a Honda dealership to look at a midsize sedan, and there's a Nissan right next door, and a Ford across the street, and a Honda right around the corner, you might as well hit up the others to see if they have better deals. This tactic works for some businesses but not others. In the case of auto dealerships, the marketing advantage of clustering mixes with the restrictions of zoning laws.

Zoning laws vary by state, county, and township. Auto dealerships can generally only be opened on commercially zoned property.

I am going to use an area I have been to as an example/case study.

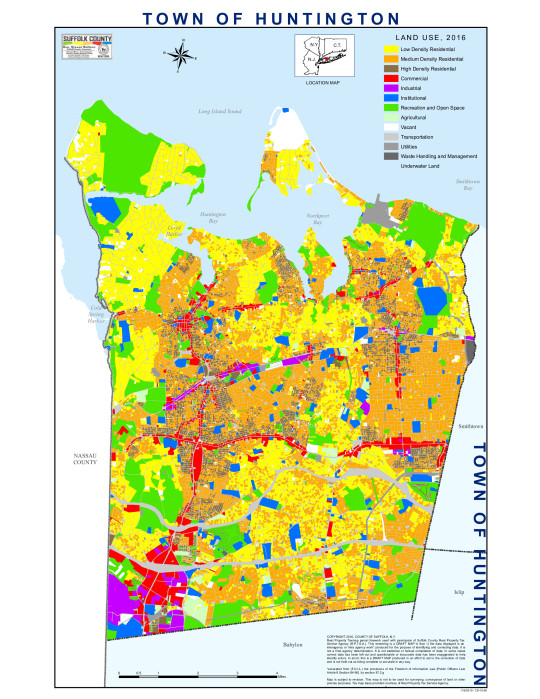

This pdf is a set of zoning regulations for Suffolk County, New York, published 2018, reviewing land use in the county during 2016. I'm going to paste in the map of the Town of Huntington, page 62, a region I worked in sporadically a few years ago, and know mostly for its mall and cutesy town center.

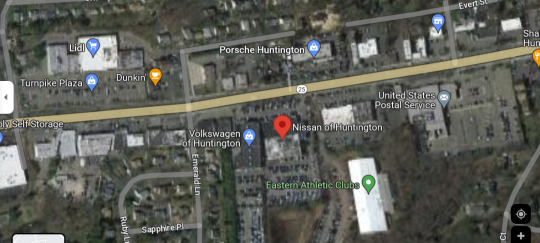

Those red sections are Commercially Zoned areas, and they largely follow some large stroads, most notably Jericho Turnpike (the horizontal line halfway down) and Walt Whitman Road (the vertical line on the left). The bulge where they intersect is Walt Whitman Mall, and the big red chunk in the bottom left is... mostly parking. That central strip, Jericho Turnpike, and its intersection with Walt Whitman... looks like this:

All those red spots are auto dealerships, one after another.

So zoning laws indicate that a dealership (and many other types of commercial properties) can only exist in that little red strip on the land use map, and dealerships take up a lot of space. Not only do they need places to put all of the cars they are selling, but they also need places to park all their customers and employees.

This is where we get into the issue of parking minimums. There is a recent video from Climate Town, with a guest spot by NotJustBikes. If you want to know more about this aspect of zoning law, I'd recommend watching this video and the one linked in the description.

Suffolk county does not have parking minimums. Those are decided on a town or village level. In this case, this means we are looking at the code set for the town of Huntington. (I was originally looking on the county level, and then cut the knot by just asking my real estate agent mom if she knew where I could find minimum parking regulations. She said to look up e360 by town, and lo and behold! There they are.)

(There is also this arcgis map, which shows that they are all within the C6 subset of commercial districting, the General Business District.)

Furniture or appliance store, machinery or new auto sales - 1 per 500 square feet of gross floor area

Used auto sales, boat sales, commercial nurseries selling at retail - 5 spaces for each use (to be specifically designated for customer parking) - Plus 1 for each 5,000 square feet of lot area

This is a bit odd, at first glance, as the requirements are actually much lower than that of other businesses, like drive-in restaurants (1 per 35 sqft) or department stores (1 per 200 sqft). I could not find confirmation on whether the 'gross floor area' of the dealership included only indoor spaces or also the parking lot space allotted to the objects for sale, but I think we can assume that any parking spaces used by merchandise do not qualify as part of the minimum. Some dealerships can have up to 20,000 gross sqft, so those would require 40 parking spaces reserved solely for customers and employees. Smaller dealerships would naturally need less. One dealership in this area is currently offering 65 cars of varying makes and models; some may be held inside the building, but most will be on the lot, and the number may go higher in other seasons. If we assume they need 30 parking spaces for customers and employees, and can have up to 70 cars in the lot itself, they are likely to have 100 parking spaces total.

That's a lot of parking.

Other businesses that require that kind of parking requirement are generally seeing much higher visitation. Consider this wider section of the map:

The other buildings with comparative parking are a grocery store (Lidl) and a post office (can get some pretty high visitation in the holiday season, but also just at random).

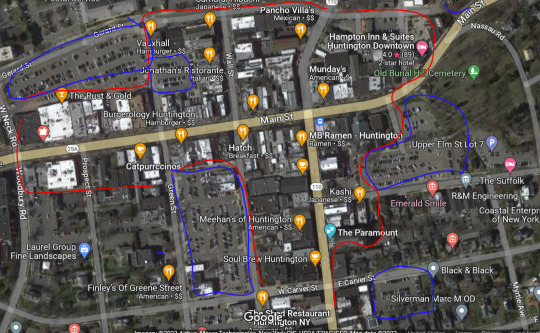

Compare them, then, to the "old town" section of the same town.

There are a handful of public parking areas nearby (lined in blue), whereas the bulk of the businesses are put together along this set of streets. While there is a lot of foot traffic and vehicle passage, which is appealing for almost any business, opening a car dealership in this area would require not only buying a building, but also the buildings surrounding it. You would need to bulldoze them for the necessary parking, which would be prohibitively expensive due to the cost of local real estate... and would probably get shot down in the application process by city planners and town councils and so on. Much easier to just buy land over in the strip where everyone's got giant parking lots and you can just add a few extra cramped lanes for the merchandise.

Car dealerships also tend to be very brightly lit, which hits a lot of NIMBY sore spots. It's much easier to go to sleep if you aren't right next to a glaring floodlight at a car dealership, so it's best if we just shove them all away from expensive residential, which means towards the loud stroads, which means... all along these two major roads/highways.

And if they're all limited to a narrow type of zoning already, they might as well take advantage of cluster marketing and just all set up shop near each other in hopes of stealing one of the other's customers.

As consumers, it's also better for us, because if we want to try out a few different cars from a few different brands, it's pretty easy to just go one building down to try out the Hyundai and see if it's better than a Chevy in the same price group.

(Prompt me on ko-fi!)

#economics prompts#marketing#zoning laws#ko fi prompts#ko fi#auto industry#automotive dealerships#car dealerships#phoenix posts

110 notes

·

View notes

Text

Personal Loan Pitfalls to Avoid in 2025

A personal loan can be a great financial tool when used wisely, offering quick access to funds for emergencies, home renovation, education, or debt consolidation. However, many borrowers make avoidable mistakes that lead to higher costs, financial stress, and repayment issues.

To ensure you make the most of a personal loan in 2025, let’s explore the common pitfalls to avoid and the best strategies to manage your loan effectively.

🔗 Looking for a Personal Loan? Apply Here: Check Personal Loan Options

1. Borrowing More Than You Can Afford

One of the biggest mistakes borrowers make is taking a loan amount higher than their repayment capacity.

✔ Solution: Always assess your finances and ensure your EMIs do not exceed 30-40% of your monthly income.

🔗 Check Affordable Loan Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

2. Ignoring Interest Rates & Loan Terms

Many borrowers overlook the actual cost of borrowing by not comparing interest rates, fees, and loan tenures.

✔ Solution: Compare interest rates, processing fees, and hidden charges before finalizing a lender.

🔗 Best Personal Loans with Low Interest Rates:

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

3. Overlooking the Impact of a Low Credit Score

Your credit score directly affects your loan approval and interest rates. A low credit score can lead to loan rejection or higher interest costs.

✔ Solution: Maintain a credit score of 700+ by making timely payments and avoiding unnecessary debt.

4. Falling for Pre-Approved Loan Scams

Many fraudsters send fake pre-approved loan offers that require advance payments before disbursing the loan.

✔ Solution: Always apply for loans through official bank websites or verified financial institutions.

🔗 Apply for a Personal Loan from Trusted Lenders:

Axis Finance Personal Loan

5. Not Reading Loan Terms & Hidden Fees

Many borrowers focus only on the interest rate and ignore charges such as: ✔ Processing Fees ✔ Prepayment Penalties ✔ Late Payment Charges

✔ Solution: Read the loan agreement carefully and ask about hidden charges before signing.

6. Choosing a Longer Tenure Without Considering Interest Costs

A longer loan tenure reduces your EMI, but it significantly increases the total interest paid over time.

✔ Solution: Choose the shortest tenure possible that allows comfortable EMI payments.

7. Defaulting on EMI Payments

Missing EMIs can lead to: ❌ Penalty charges ❌ A lower credit score ❌ Legal action in extreme cases

✔ Solution: Set up auto-debit for EMIs and maintain an emergency fund for loan repayments.

🔗 Learn How to Set Up Auto-Debit for Loan EMIs: Check Loan Repayment Options

8. Using Personal Loans for Non-Essential Expenses

Avoid using personal loans for: ❌ Luxury vacations ❌ Gambling or risky investments ❌ Unplanned shopping sprees

✔ Solution: Use personal loans only for necessary expenses like medical emergencies, home improvement, or debt consolidation.

9. Not Exploring Balance Transfer Options

If you already have a high-interest personal loan, you can transfer it to another lender offering a lower interest rate.

✔ Solution: Consider a personal loan balance transfer to reduce your EMI burden.

🔗 Best Lenders for Balance Transfers:

InCred Personal Loan

10. Applying for Multiple Loans Simultaneously

Multiple loan applications can: ❌ Lower your credit score ❌ Make lenders view you as a high-risk borrower

✔ Solution: Compare lenders carefully and apply for only one loan at a time.

11. Not Checking Prepayment & Foreclosure Charges

Some lenders charge high penalties for prepayment or foreclosure, making early repayment expensive.

✔ Solution: Choose a lender that offers low or no prepayment penalties.

12. Relying on Unverified Lenders or Loan Apps

There are many fraudulent loan apps that charge excessive interest rates and misuse borrower data.

✔ Solution: Apply only through recognized banks, NBFCs, or verified fintech platforms.

🔗 Apply Safely for a Personal Loan Here: Check Verified Loan Options

Final Thoughts: Avoid These Mistakes for a Smart Borrowing Experience

A personal loan is a valuable financial tool when used responsibly. Avoiding these common pitfalls will help you save money, protect your credit score, and reduce financial stress in 2025.

Key Takeaways:

✔ Borrow within your repayment capacity ✔ Compare interest rates & hidden charges before applying ✔ Pay EMIs on time to avoid penalties ✔ Beware of loan scams and fake lenders ✔ Use personal loans only for essential needs

🔗 Looking for a Reliable Personal Loan? Apply Here: Check Personal Loan Offers

By following these tips, you can make smarter financial decisions and ensure a hassle-free borrowing experience in 2025!

#Personal loan pitfalls to avoid in 2025#Common mistakes when taking a personal loan#Personal loan mistakes borrowers make#How to avoid personal loan scams in 2025#Things to check before taking a personal loan#finance#personal loan online#loan services#personal loans#nbfc personal loan#bank#fincrif#personal loan#personal laon#loan apps#fincrif india#Personal loan repayment mistakes#Hidden charges in personal loans#Best practices for personal loan management#Why personal loans get rejected#Personal loan EMI management tips#How to compare personal loan interest rates#Personal loan default consequences#Loan balance transfer benefits#How to reduce personal loan EMI burden#Personal loan credit score impact#Fake loan approval scams#Should you prepay a personal loan?#Personal loan tenure selection tips#Loan agreement hidden clauses

2 notes

·

View notes

Text

Chapter 9 Part 5: Lute and Vanessa <3

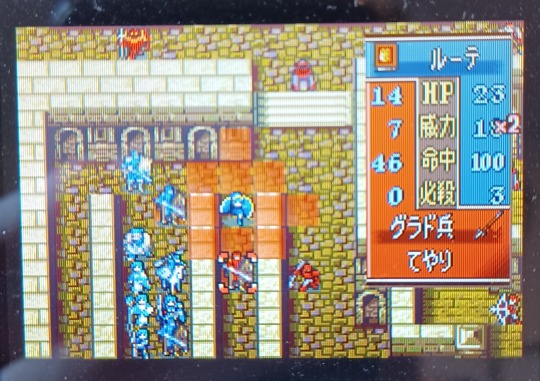

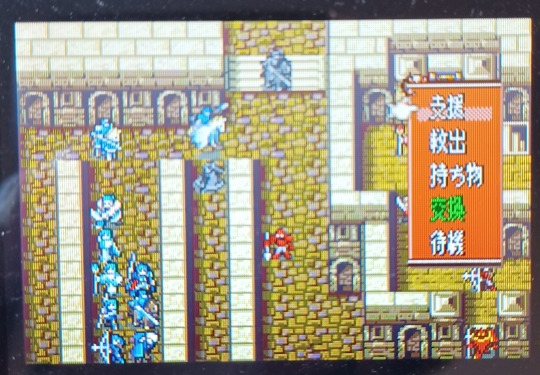

To start us off, Lute gets rid of this last reinforcement. After this, we can finally start moving up to the chests and Tana above, and to the boss room entrance down and to the right.

Franz gets the Luna mage.

I mentioned Luna's bad hit rates and 0 might before, but here we can see just how dire it is. 28 is awful hit, and since all the attack comes from the user's magic stat with no added might from the tome itself, it isn't even that dangerous in a low-level enemy's hands. Even if this guy actually did hit and crit Franz, he still wouldn't kill him.

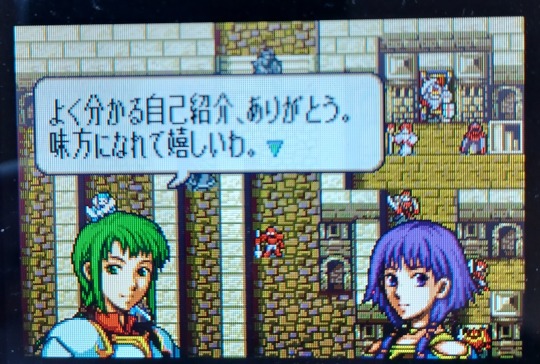

I start to move Vanessa forward, and...Oh! What's this? A support conversation?

...with Lute???

So, some of you may have been able to guess from the very tiny and subtle clues I've dropped here and there, but I absolutely love Lute, so I'm actually going to look at this support a bit.

It starts off with Vanessa saying, "Ah, you're...Lute, right?"

I remember at least a couple of other Lute supports start off with the other person not being sure of what her name is. It's consistent enough a factor that we can guess that Lute doesn't really socialize a whole lot with people in the army. It's not surprising given her personality and her obsessive interest in specific things.

After introducing herself, Vanessa introduces her pegasus, Titania.

At which point, Vanessa has stumbled on one of Lute's interests: creatures.

So Lute proceeds to monopolize the conversation and info dump on Vanessa.

She starts by talking about the different names for pegasus. This part in Japanese involves her not only using the katakana, foreign-derived word "pegasus", but also two kanji-based words, "sky horse" and "has wings horse".

Kind of like how we often use Latin or Greek based words in English when we want to sound fancy, or for technical terms (due to the history of Europe's obsession with the Greeks and Romans often being viewed as the "initiators of European civilization") in Japanese there is a tendency for words made up of combined Chinese characters to sound more stiff, or like technical terms. In many cases, this is because these are literal loan words that Japanese educated people adopted into their language, sometimes a couple hundred-thousand years ago when China was viewed as a center of culture and learning.

I think a good example could be the word she uses for "sky horse". The two characters are jammed together, and usually in those cases, the "Chinese" reading is used, which is true here too, "Tenma". (Like I mentioned above, the "Chinese" reading is based on the pronunciation of the characters that some Japanese guy got from the Asian mainland at some point in history. Many kanji have multiple readings like this since there are many different Chinese languages in different areas of what's now China, languages also change over time, and of course, Japanese phonology is radically different from any Chinese phonology, so the pronunciations are more like approximations of how some group of Chinese people read the character at some point in time. If you look in a detailed kanji dictionary, it will often tell you the Chinese dynasty/ies in power at the time the character's reading(s) was/were adopted into Japanese.)

If this word were using "Japanese" readings of the characters, it would probably be "Sora no uma". Just based on feels, "Tenma" sounds a bit fancier and stiffer, whereas "Sora no uma" sounds very straightforward because the words "sora" (sky) and "uma" (horse) are used in everyday conversation, whereas the parts of "Tenma", "ten" and "ma" are not used on their own usually.

I explain all of this because it's interesting how it's coincidently very similar to something we can see in English too. Take a word like "autograph". It's two Greek words, "self" and "write" jammed together. These words aren't used on their own usually. (I mean, maybe this is a bad example since these two parts both are used on their own, but that's only because "auto" can be short for "automobile", and "graph" can also mean a table or chart. What I really mean is, we don't use "graph" as the word "write" in English on its own. No one says, "Please graph your name on this line here.") But these parts are frequently used to express meaning as parts of words.

Imagine how "self write" (both Germanic words) would sound in place of "autograph"? It sounds very basic, almost too straightforward. This same thing that we do in English all the time with Latin/Greek/Norman based words is similar to what they do in Japanese with the distinction between words with an "original Japanese" origin versus a "Chinese" origin.

In English, germanic words often sound straightforward and basic. In Japanese, Japanese origin words often sound more straightforward. In the same way, in English, words made up of Latin/Greek/Norman French parts often sound more educated or technical. And in Japanese, that's often the case for words made up of combined kanji using the "Chinese" readings.

----END INFO DUMP---

At any rate, now that I've info dumped at you, you may see why I like Lute so much.

Lute goes on to explain to Vanessa (who rides a pegasus literally every single day) how they fly by kicking the air, not by flapping their wings, and that their wings are used more for gliding.

To which Vanessa kindly responds that, yes, it would be really hard to ride them if they flapped their wings all the time.

She responds like this instead of, you know, getting all prickly about this random girl lecturing her about the animal she knows better than any other.

God bless you, Vanessa. You're a saint.

Lute also continues to talk about the origin of the word "pegasus" and its connections to "springs" and "oceans", and basically, go look at Wikipedia if you want to see the rest of what she said. :)

Vanessa continues to be an absolute sweety and says, "Thank you for the very clear introduction. I'm glad we're allies."

And then Lute says, "I look forward to working with you, Titania!"

Vanessa: "I'm Vanessa!"

Like a lot of people, I've jumped on the Dungeon Meshi bandwagon recently, and it's hard not to get flavors of Laius from Lute.

At any rate, the original reason I moved Vanessa there was to block the soldier from hitting Lute, and Vanessa does an admirable job of that during enemy phase.

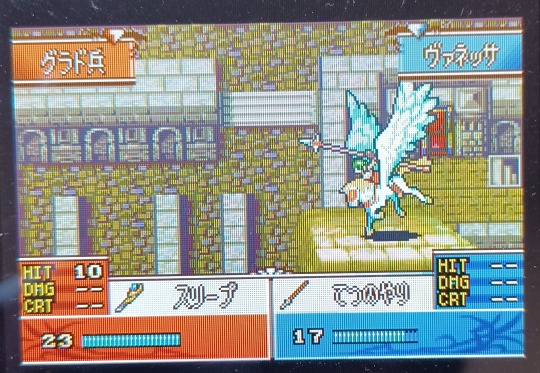

I also discover that there is another guy with a sleep staff in the throne room. He misses Vanessa though.

You can see how low his hit is on her, with her good res.

It's this guy, here.

I start sending people up to deal with the enemies around the chests and Tana. I leave Vanessa in range of the mercenary, and Ephraim in range of the armor, though it later on turns out that that guy doesn't move.

Next time: More reinforcements, more sleep staff nonsense, and maybe we'll finally save Tana

#fire emblem#sacred stones#fire emblem the sacred stones#fe8#ファイアエンブレム#聖魔の光石#dunmeshi#dungeon meshi#delicious in dungeon#japanese#japanese language#fire emblem lute#fire emblem vanessa#lute x vanessa

14 notes

·

View notes

Text

Affordable Auto Title Loans in Vancouver, British Columbia

Unlock the financial flexibility you need with Snap Car Cash's Auto Title Loans Vancouver, British Columbia. Whether you're dealing with unexpected expenses or need quick cash, Snap Car Cash is here to help. Using your vehicle as collateral, you can secure a loan with competitive interest rates and flexible repayment terms. Even if you have bad credit or no credit history, Snap Car Cash offers a hassle-free application process with no credit checks required. Drive your car while you repay the loan, and get the funds you need within hours. Get started today with Snap Car Cash and experience a quick, easy solution to your financial needs.

#Auto Title Loans Vancouver#Car Title Loans Vancouver#Vehicle Title Loans Vancouver#Instant Auto Title Loans Vancouver#Quick Cash Auto Title Loans Vancouver#No Credit Check Auto Title Loans Vancouver#Fast Approval Car Title Loans Vancouver#Online Auto Title Loans Vancouver#Low Interest Auto Title Loans Vancouver#Auto Title Loans

0 notes

Text

Important Requirements to Meet in Order to Apply for a Short Term Loans UK

These days, a lot of businesses advertise online loans services. In addition to these, there are yet additional banks and financial institutions that offer short term loans UK to people in need. Short term loans UK direct lender have the option to apply online or in person at the lending institution. The following requirements must be met in order to qualify for quick loans:

Candidates or borrowers must have a reliable source of income from employment. Their citizenship must be in effect. They need to have an active bank account. At least eighteen years old is required of applicants. Options for Payday Loans

Payday loans are high-interest loans; therefore borrowers who are unable to repay them might choose low-interest 12-month loans for individuals receiving assistance instead. Short term cash loans are accessible for a 12-month period, which makes it simpler for consumers to repay the debt.

Do you now require a loan? You will undoubtedly receive the fund you need right away. Our loan application process is all online, so there is no need for documents. We are a contemporary lender that is committed to providing only short term loans UK that are reasonably priced. Since you are receiving what is rightfully yours, managing our debts out of your monthly income should be simple.

Personalized and specially designed loans for today only

Online loans are quite helpful for those who need immediate cash in an emergency. It can be an urgent medical issue or a need for auto repair. Pre-approval from us will help you and pave the path for rapid loan approval. Now is the right moment to take out a loan in the UK from an online private lender like us, since your chances of getting approved for a loan even with bad credit are higher. Compared to traditional lenders, we maintain more lenient lending standards, such as the absence of guarantor requirements for applications. The following loan products are attached to those facilities by us.

Payday Loan If you have made multiple credit errors in the past, don't worry too much. The moment has come to strengthen it with one of our payday loans. You'll receive reasonable lending rates free of unforeseen expenses. Short-Term Credit Our modest short term loans UK direct lender choices, which have rapid approval, will be of great assistance to you if you run into financial difficulties when making a purchase or need urgent cash in an emergency. Fast Loans You will only receive the money you urgently require here. These online short term loans direct lenders are readily available and have the ability to provide funds for the following day right away. Rates of interest are also fair.

How does your loan application process operate?

Online money lending encompasses the most straightforward application process. It takes only a few steps to finish and will only take five to ten minutes. Our main goal is to swiftly turn our financial help into something positive for you. As a result, if everything goes according to plan, we expedite the processing of your short term loans UK direct lender application.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Moneyvers's Home Loan

Moneyverss banks provide a comprehensive range of home loan products designed to cater to diverse financial needs and aspirations. With competitive interest rates, flexible repayment terms, and personalized customer service, Moneyverss ensures that prospective homeowners can find a loan that suits their specific requirements.

By offering a variety of options such as fixed-rate mortgages for stability and adjustable-rate mortgages for flexibility, Moneyverss empowers borrowers to choose a loan that aligns with their financial goals and circumstances. The application process is streamlined, with efficient handling of documentation and expert guidance throughout, ensuring clarity and ease for applicants.

Moreover, Moneyvers banks understand the importance of affordability and transparency in home financing. They provide clear information on fees, interest rates, and repayment schedules, enabling borrowers to make informed decisions confidently.

In conclusion, Moneyverss banks strive to make homeownership accessible and rewarding through their commitment to competitive rates, personalized service, and reliable support.

Whether it is to fulfill the needs of the family for the education of the children or to increase the business, and sometimes there is an emergency, at that time the person needs immediate money, in such situations, a loan against property is the easiest and most popular among all the other loan options.

The loan that we take at that time by mortgaging the property is called a mortgage loan.

If it is necessary to take a loan, then only apply for the loan, there is no need to do otherwise. And before applying for a loan, we need to know all the things,

By saving a lot on your EMI, you will be able to reduce the extra burden.

The loan that we take on a property is called a record loan. You are given a loan according to the property. And this loan becomes a good option for personal loans because the person taking it is safe.

In addition, the interest rates of property loans are low as compared to any personal loan.

The interest rates of property loans are low. Loan against property can be availed for marriage, higher education, and other medical expenses.

You should apply for a loan against property instead of a personal loan.

Benefits of loan against property

Loan amount:-

You can get up to 55% of the market value of your property as loan amount.

Documents:-

Loans against property are secured loans, interest on a loan against property is less than a personal loan, and due to the low interest rate you can save more on EMI.

Easiest process:-

Getting a loan against property is much easier than other loans.

Long-term and less:-

common home mortgage loans have loan amounts and loan tenure of up to 15 years.

How to apply for a mortgage loan:-

You can apply online and nationally for a loan against the estate.

We don’t

just

offer home loans

We provide a range of financial products designed to meet your diverse needs. Whether you’re looking for personal loans, auto loans, or credit card options, we have solutions tailored to help you achieve your financial goals.

2 notes

·

View notes

Text

How to Pay Off These 4 Types of Debt

Getting and staying out of debt is tough. Many people try and fail, or they succeed only to become ensnared the vicious cycle over and over again. Eliminating debt takes lots of grit and determination, and strategically attacking your debt will save you time, energy, and money. Before you get started, you should know that each type of debt requires a slightly different strategy. Here's how to tackle different types of debt, and get rid of it once and for all. Credit card debt The best way to attack credit card debt is by using the debt snowball. With this method, you begin by attacking the smallest debt while paying the minimum on everything else. Once one debt is paid, you take all the money you were paying on the first card and apply it to the second biggest balance. Rinse and repeat. You may be tempted to attack them based on interest rate, which is also known as the debt avalanche. And that will work. However, you must keep in mind that debt is more mental than it is logical. You probably didn't use a ton of logic to get into debt. And logic won't inspire you to get out of debt. The debt snowball approach allows you to get quick wins by conquering smaller debts before taking on the larger ones, which require more time and patience. Winning becomes a contagious habit that helps you build momentum. You also may want to contact your credit card companies and request that they lower your interest rate. Some will and some won't, but it doesn't hurt to ask. (See also: 2-Minute Guide: How to Use Balance Transfers to Pay Off Credit Card Debt) Car and personal loans Auto and personal loans are a little different from credit card debt. However, they follow the same principle for repayment. First, make sure you understand the repayment terms and then contact the lender and ask them to reduce your interest rate. In addition to using the debt snowball, a great repayment strategy for this type of debt is to call the lending agency and set up bi-weekly payments instead of paying monthly. The minimum payment doesn't change, you just make 26 payments a year versus 12. This lowers the total amount of interest you will pay over the life of the loan. When you pay more than the minimum payment, you'll slash months — even years — off the total repayment time. Student loans Despite how it may feel, paying off student loans is possible. You just need some discipline, patience, and a plan. For most folks, student loan debt is one of the most significant debts owed — second only to a mortgage. The first thing you want to do is determine the total amount owed. You can do this by visiting the National Student Loan Data System or contacting your lender. From there, visit the Federal Student Loan Website to see if your loans can be consolidated, if your interest rate can be lowered, and if you qualify for any loan forgiveness programs. The Department of Education offers eight different repayment plans that may be able to assist you if you're considered low income or have special circumstances. They also provide repayment calculators and a host of other information and resources that can assist you in repaying your loans quicker. Once you know the total amount owed, and have found a repayment plan that works for you, it's time to get busy. You want to throw ever extra dollar you have at this debt and make multiple payments a month, if possible. Mortgage The term "mortgage," translated from old French, literally means "death pledge." How fitting. There are several schools of thought on whether you should pay off your home early. For some people paying it off early makes sense, for others it doesn't. If you do want to knock the mortgage off your debt list, there are a few things you can do to expedite repayment. Make bi-weekly payments By simply splitting your monthly mortgage payment into equal parts where it's paid every two weeks, you can shave years of payments off a 30-year mortgage. If you pay more than the… http://dlvr.it/T3qJwX As seen on Wisebread.comsincerely yours Persofina: Personal Finance Hacks

2 notes

·

View notes

Text

Short Term Loans UK: Use Debit Cards to Manage Emergencies

Do you require money for an emergency? Are you eager for pay day? You can therefore apply for short term loans UK in these situations. Emergencies don't happen when you plan ahead. Therefore, in order to meet these obligations, you must have enough money on hand. However, if you don't have any cash on hand, don't worry—this plan can easily provide you with immediate financial assistance.

Debit cards for short term loans UK are an easy and quick way to receive cash when you need it. You can meet a number of needs with the money earned, including unpaid bills, school fees, household expenses, home renovations, auto repairs, modest parties, etc. You should also do some online research because, because of the short term nature of the loan, the interest rates are a little bit high.

Since there are no restrictions on this credit, you can use the sanctioned amount without first obtaining authorization. You can use the money for a variety of things, like your child's tuition, small-scale home or auto repairs, unforeseen medical needs, grocery expenses, quick getaways, and the purchase of furnishings for your home, among other things. This helps you avoid all the time-consuming and stressful formalities. This means you must upload the necessary and fundamental paperwork here.

Qualification standards

Should be a UK citizen

Regular income is required to make loan payments on time.

The minimum age should be eighteen.

Should own a current bank account

People with low credit scores frequently experience rejection. The person feels anxious and panicked as a result. Assuming you are experiencing a similar situation, you need to be conscious of the discomfort and abuse during that motion. Due to their prior credit history, no lender will be willing to work with such people. There's no need to worry in this situation because you may apply for short term loans UK direct lender without having to worry about a credit check. The creditor will assess your present financial situation and, if approved, credit will be issued directly to your account.

You can source the cash against acceptable terms and circumstances even before you choose an offer if you conduct thorough study and compare rate quotations. This implies that you won't ever have to worry about repaying the cash you were given.

Everybody encounters an unforeseen emergency at some moment, which could leave them in a difficult situation. Fortunately, borrowers with poor credit and those in need of a short term loans direct lenders have options. Loans for cash advances are a good choice for people who need money right away. The same day they are authorized, the funds are transferred.

Similar to payday loans, same day loans UK are modest, short-term loans that offer a simple, quick way to receive cash with fewer restrictions than a standard quick loan. Usually, these loans have brief durations for repayment. They are typically utilized in times of emergency when finances are tight. Generally speaking, you can borrow between £100 and £2500. You can get short term cash loans of up to £5,000 from certain UK lenders.

https://paydayquid.co.uk/

3 notes

·

View notes

Text

Get flexible and low interest rate personal loan

Get flexible and low interest rate personal loan

In today's fast-paced world, financial flexibility is often essential. Whether you want to consolidate debt, cover unexpected expenses, or fund a dream vacation, personal loans can provide the necessary financial support. This comprehensive guide will walk you through the ins and outs of personal loans, helping you make informed decisions about borrowing money. Arenafincorp is the top-notch financial company in jaipur

Understanding Personal Loans -

A personal loan in jaipur is an unsecured loan typically offered by banks, credit unions, or online lenders. Unlike secured loans, such as mortgages or auto loans, personal loans don't require collateral. Instead, they're personal loans in jaipur based on your creditworthiness, income, and financial history.

Types of Personal Loans -

1. Traditional Personal Loans:

These are the most common types of personal loans. They come with fixed interest rates and a predetermined repayment schedule. Borrowers receive a lump sum upfront and repay it in instalments over the loan term, usually ranging from 1 to 5 years.

2. Lines of Credit:

A personal line of credit provides flexibility. It works like a credit card, allowing you to borrow up to a specified limit and repay it as needed. Interest is charged only on the amount you use.

Key Factors to Consider Before applying for a personal loan in jaipur, it's crucial to consider the following factors:

1. Interest Rate:

The interest rate, often expressed as an Annual Percentage Rate (APR), determines the cost of borrowing. A lower APR means you'll pay less in interest over the life of the loan.

2. Loan Term:

The loan term affects your monthly payments. Shorter terms result in higher monthly payments but lower overall interest costs, while longer terms reduce monthly payments but increase total interest expenses.

3. Fees:

Be aware of any origination fees, prepayment penalties, or other charges associated with the loan.

4. Credit Score:

Your credit score plays a significant role in the interest rate you'll qualify for. A higher credit score can lead to better loan terms.

5. Repayment Plan:

Ensure that the monthly payment aligns with your budget and financial goals.

Applying for a Personal Loan in jaipur

1. Check Your Credit Report:

Obtain a free copy of your credit report from each of the major credit bureaus (Experian, Equifax, and TransUnion) and review it for accuracy.

2.Compare Lenders:

Shop around and compare offers from different lenders to find the best terms and rates for your needs.

3. Gather Documentation:

Lenders may require proof of income, employment, and other financial information. Prepare these documents in advance to streamline the application process.

4.Submit Your Application:

Complete the loan application with your chosen lender. Be honest and accurate with your information.

Managing Your Personal Loan

Once you've secured a personal loan in jaipur, it's essential to manage it wisely:

1. Create a Budget:

Incorporate your loan payments into your budget to ensure you can comfortably meet your obligations.

2. Automatic Payments:

Consider setting up automatic payments to avoid missing due dates and incurring late fees.

3. Avoid Additional Debt:

Resist the temptation to accumulate more debt while repaying your personal loan. This can lead to a cycle of debt.

4. Emergency Fund:

Build or maintain an emergency fund to cover unexpected expenses, reducing the need for future loans.

Conclusion

Personal loans can be valuable financial tools when used responsibly. By understanding the different types of personal loans, considering key factors, and managing your loan wisely, you can make borrowing money work for you. Always do your research and choose the loan that best aligns with your financial goals and capabilities.

2 notes

·

View notes

Text

Martin Luther King Jr had more books and speeches than were taught about in school and had more books than we were taught about in school in his collection that you must reads is chaos or community where do we go from here and then my favorite which my job is built helping and carrying his mission and I hope I did a great job while on this platform is this book all labor has dignity you have got to read it you will enjoy the page a lot more

Create more credit unions for more low income demographically defined neighborhoods - Issuing loans at a 2 % interest on the principal amount and 0.05% interest payments for interest rate while yielding 7 % annual and monthly compounding interest on savings and checking accounts thus creating more business for credit unions and everyday banking with the ultimate return of putting more people to work and their money working for them instead of against them with more people going back to work and investing in their banks helps to build their immediate environment this in turn is creating more business chances for employment and employment opportunities on a communal mass scale .

The good points is being made by the fact that credit unions and banks can then beautify their neighborhoods town , city and state create a better environmental infrastructure for their neighborhood by bringing more businesses to that environment and chances for employment and progress .

Chase Bank Bank of America And other banks

Issuing loans rates at a 2 % interest on the principal amount and 0.05% interest payments for interest rate while yielding 7 % compounding interest on savings and checking accounts .

Services credit unions frequently offer include :

Automatic payroll deductions

Individual retirement accounts

Savings certificates ( often at higher yields than at banks or savings and loans )

Personal and auto loans

Lines of credit

Checking accounts

Christmas Club accounts

Only state charted credit unions are allowed to add new companies and community to their membership rosters . To find a credit union that will accept your company and community and neighborhoods , call your states league of credit union association , or call a few local credit unions .

youtube

5 notes

·

View notes