#Low Interest Loan Against Property Delhi

Explore tagged Tumblr posts

Text

Best Loan Against Property in Delhi: Low-Interest Options & Quick Approvals

In today’s fast-paced world, access to quick finance is crucial, whether it’s for fulfilling personal needs, funding a business, or investing in property. Among the many options available, loans against property and instant home loans are some of the most popular choices for those looking to unlock the potential of their assets and secure immediate financial relief. If you're in Delhi and need reliable financial solutions, Loanswala is your go-to platform. In this blog, we will explore the benefits of Loan Against Property in Delhi and Instant Home Loan in Delhi and how Loanswala.in can be your trusted partner in achieving your financial goals.

Understanding Loan Against Property in Delhi

A Loan Against Property (LAP) is a secured loan where the borrower pledges their property as collateral in exchange for funds. This loan type is gaining popularity because it allows individuals to access large sums of money based on the value of their property. It’s a flexible solution that can be used for various purposes like funding business expansion, paying off debts, medical emergencies, or even making personal investments.

Why Opt for a Loan Against Property?

Higher Loan Amount: When you take a loan against property, the loan amount is usually much higher compared to unsecured loans, such as personal loans. This is because the lender has the security of the property, which reduces the risk involved.

Lower Interest Rates: Loans against property tend to have lower interest rates than unsecured loans, as they are secured by real estate. This makes them a more affordable option for those needing large sums of money.

Longer Repayment Tenure: LAPs typically come with longer repayment tenures, which makes it easier for borrowers to manage EMIs without putting too much strain on their finances. Depending on the lender, the tenure can go up to 20 years.

Flexible Usage: You can use the loan amount for virtually any purpose. Whether you're renovating your home, funding your child's education, or expanding your business, the loan is yours to use as needed.

Quick Approval and Disbursement: Loanswala.in offers a seamless process for getting a Loan Against Property in Delhi. With its customer-friendly approach, you can expect faster approval and quick disbursement of funds, ensuring you have access to the money you need in no time.

How Loanswala.in Simplifies the Process

Loanswala.in makes the process of obtaining a Loan Against Property in Delhi hassle-free. By leveraging its online platform, you can apply for a loan, upload necessary documents, and get your loan sanctioned without stepping out of your home or office. The team at Loanswala.in provides personalized advice to help you select the best loan product based on your financial requirements and eligibility. The transparency in their terms and conditions ensures that you have a clear understanding of your repayment obligations, and the efficient process reduces waiting times.

The Growing Demand for Instant Home Loans in Delhi

Buying a home is a dream for many, but the financial barriers often make it a challenging task. Fortunately, with the rise of Instant Home Loans in Delhi, aspiring homeowners now have an easier way to finance their dream property. Instant home loans are tailored to cater to the urgent need for homebuyers who require quick access to funds.

What is an Instant Home Loan?

An Instant Home Loan is a financial product designed to provide immediate funds to purchase a property. As the name suggests, this loan is processed quickly, ensuring that buyers can secure the funds they need without delays. Many leading lenders, including Loanswala.in, have streamlined the home loan application process to ensure that customers receive quick approvals and fast disbursements.

Why Choose an Instant Home Loan?

Quick Processing: One of the biggest advantages of an instant home loan is the speed at which the loan is processed. With technology, online platforms, and minimal paperwork, home loan disbursements can be completed in a matter of days.

Minimal Documentation: Traditional home loans often require significant documentation and verification, which can delay the process. However, Instant Home Loans in Delhi are designed with simplicity in mind. You only need to provide the essential documents to get started.

Lower Interest Rates: Since instant home loans are often secured against the property being purchased, they tend to have lower interest rates compared to unsecured loans, making them a cost-effective option.

Loan for All Purposes: Whether you are purchasing your first home, upgrading your existing property, or investing in real estate, an instant home loan can meet your diverse needs. Loanswala.in provides a wide range of home loan products suited to different financial situations.

Hassle-free Process: Loanswala.in ensures that your experience with applying for an instant home loan is seamless. With their user-friendly online application process, you can apply for a home loan from the comfort of your home or office. The entire journey is designed to be quick and hassle-free.

Why Delhi is a Growing Market for Instant Home Loans

Delhi, being one of the largest metropolitan cities in India, has seen rapid growth in the real estate sector. The demand for housing is ever-increasing, and many individuals are looking to make real estate investments or purchase their first home. This has led to a growing demand for Instant Home Loans in Delhi. In a city with high property prices, immediate access to home loans can significantly reduce the financial strain on homebuyers.

The convenience of getting quick approval and disbursal, coupled with affordable interest rates, makes Instant Home Loans in Delhi the preferred choice for many. Whether you are a first-time buyer or someone looking to upgrade your living space, getting an instant home loan helps you secure a home without unnecessary delays.

How Loanswala.in Can Help You with Instant Home Loans in Delhi

Loanswala.in offers a fast, transparent, and efficient process for securing Instant Home Loans in Delhi. The platform is designed to help homebuyers find the best possible deal based on their financial profile. Here’s how Loanswala.in makes the process easy:

Simple Online Application: You can easily apply for an instant home loan through the Loanswala.in website. The online application process is straightforward and requires minimal documentation.

Fast Approval: Once your application is submitted, Loanswala.in uses advanced algorithms and credit checks to approve your loan within a short time frame. Their efficient system ensures that you don’t have to wait long to know whether you’re eligible for the loan.

Personalized Assistance: Loanswala.in offers personalized consultation services, where experts analyze your needs and help you choose the right home loan product that suits your financial goals.

Competitive Interest Rates: By partnering with multiple financial institutions, Loanswala.in provides access to some of the most competitive interest rates in the market, ensuring that your home loan is affordable.

End-to-End Support: From the initial application to the disbursement of funds, Loanswala.in provides continuous support throughout the entire process. You can contact their customer service team at any point to resolve queries or get updates.

Conclusion

Both Loan Against Property in Delhi and Instant Home Loan in Delhi are invaluable financial products for individuals and businesses looking to access quick funding. With the convenience and efficiency offered by Loanswala.in, obtaining a loan has never been easier. Whether you're looking to leverage your property for funds or secure an instant loan to purchase a home, Loanswala.in has the tools and expertise to guide you through the process and offer the best loan solutions tailored to your needs.For more about information Car Loan: https://www.loanswala.in/car.php

#Low-Interest Business Loan in Delhi#Urgent Cash Loan in Delhi#Business Loan in Delhi#Best Loan Against Property in Delhi#Low Interest Loan Against Property Delhi#Quick Property Loan in Delhi#Instant Home Loan in Delhi#Home Loan Offers in Delhi#Fast Home Loan in Delhi

0 notes

Text

Get Instant loan against property in delhi online upto 10lakh and secure low interest rates, instant approval, low CIBIL score & flexible EMIs and easy online application in just one click. Get Your Desired Loan in Minutes from Private Financing Company Chintamani Finlease

#loan against property in delhi#loan against property at attractive interest rate#instant loan against property online#online apply for loan against property#loan against property in minutes#low interest loan against property#urgent loan against property in delhi ncr#loan against property online#loan in low cibil score#apply for loan against property

0 notes

Text

Loan Against Property in Delhi: CSL Finance

Unlock Your Property's Potential with CSL Finance: Get Easy Loan Against Property in Delhi with Quick Approvals, Low Interest Rates, and Flexible Terms!

0 notes

Text

INR PLUS Giving Loan Service on Commercial Property

INR PLUS, a leading financial services company, has recently announced its new venture into providing loan services on commercial properties. This strategic move comes in response to the overwhelming demand from business owners and investors seeking financial support to purchase or renovate commercial real estate.

The decision to expand its lending services to commercial properties highlights INR PLUS's commitment to adapt to evolving market demands and provide its clients with comprehensive financial solutions. With an excellent track record in personal loans, mortgages, and consumer credit, it was a natural progression for the company to widen its offerings in the commercial sector.

Commercial real estate is a thriving market with immense potential for growth and profitability. However, securing adequate financing for commercial projects can be a challenging endeavor for many individuals and businesses. Recognizing this need, INR PLUS has tailor-made its loan services to cater to the unique requirements of commercial property owners.

The new loan service by INR PLUS offers competitive interest rates, flexible repayment terms, and a simplified application process. Eligible borrowers can now access loans to fund a wide range of commercial property needs, including property acquisition, construction, expansion, and renovation.

One of the key advantages of choosing INR PLUS for commercial property loans is the company's deep understanding and experience in the financial sector. With a team of highly skilled professionals, INR PLUS has extensive knowledge of the commercial real estate market and can provide expert guidance throughout the loan application process.

Moreover, INR PLUS strives to prioritize customer satisfaction and accommodate individual circumstances. The company offers personalized loan solutions that are tailored to meet the specific needs of each borrower. This customer-centric approach sets INR PLUS apart from its competitors and positions it as a trusted partner in the commercial lending space.

INR PLUS has also developed strong relationships with a network of lenders and investors, allowing the company to provide larger loan amounts for commercial properties. This ensures that borrowers can access the financial resources required for various projects, regardless of their scale or complexity.

Through its services of commercial property loans, INR PLUS aims to empower entrepreneurs, investors, and business owners to make their aspirations a reality. By bridging the financial gap and offering competitive loan terms for Low Cibil Score, the company seeks to foster growth and prosperity within the commercial real estate sector.

As the market dynamics continue to evolve, financial institutions need to adapt and diversify their product offerings. INR PLUS's foray into commercial property lending reiterates its commitment to staying ahead of the curve and providing comprehensive solutions that meet the evolving needs of its customers.

If you are an aspiring entrepreneur or a business owner looking to finance your commercial property ventures, INR PLUS is now ready to support you. With their expertise, competitive loan terms for low cibil score, and commitment to customer satisfaction, you can trust INR PLUS to be your financial partner in success.

Contact us for more details:-

Contact Number:- 9891751729 "Rainbow Fincorp 101, Vardhman Prakash Plaza Sector -20 Dwarka Near Hyundai Showroom. New Delhi-110075"

1 note

·

View note

Text

Money Against Property Capified

Money Against Property is more beneficial than any other type of Loan. This gives greater flexibility, lower interest rates, higher loan amount, and longer repayment tenure. This type of loan comes under the category of secured loan. The security in this case is the property of the borrower.

Money Against Property in Delhi

Capified provides money, and property loans against Property services for different types of residential and commercial properties in Delhi. We can assist our clients in obtaining housing loans, commercial property loans, and loans against property or Mortgage loans at the most favorable terms and conditions to our clients. After thoroughly understanding your individual need, our loan advisor will help you to choose a specific product of a specific bank which enables you to meet that need, from the diverse options on our menu. While you obtain and enjoy the interest rates and repayment options that best suit your requirement.

loan against property interest rate

Capified allows you to apply for a loan against your property. We offer the best services for cash against your property that can be a built-up residential or commercial property, an approved vacant land or a rental discounting of residential\commercial property, you can make use of your property to secure funds to expand your existing business or start a new venture or for other purposes.

Apply for Money Loan against Property

Whether you own a residential, commercial or special use property, it is an asset that can be used as collateral against a loan, when you have a financial requirement. Capified is here to solve your problem related to funds, and capital and get money loan against property, residential or with any other collateral as a security purpose.

personal loan against property

Get the personal loan against property from Capified that offers a secured loan in Delhi. This asset can either be an owned land, a house, or any other commercial premises. The asset remains as collateral with the lender until the entire loan against property amount is repaid. The value of your property decides basically the amount of potential loan you will be sanctioned.

READ MORE....Cash Against Property Loan Against Property in Delhi Gurgaon Noida - Capified

0 notes

Text

ATD Money - How to Apply For a Personal Loan with Instant Approval

ATD Money is one of the leading online microfinance solution providers in India. It bestows salaried professionals with a variety of loans including zip loans, advance salary loans, cash loans against property and payday loans in Delhi.

Easy Application Process

If you need money fast, a mini personal loan may be an option for you. These loans are often offered by credit unions and online lenders, and the application process is generally simple. The lender will review your credit history, debt-to-income ratio, and other factors before approving the loan. If you are a good borrower, you should be approved quickly.

Mini-personal loans are also often unsecured, which means you don't have to pledge collateral to get the money. However, the loan approval process can be slow if you don't have a strong credit score or enough income. In addition, you should always compare different banks' terms and conditions. Make sure to read the fine print, and keep copies of all documentation in case there are any problems with your application.

Once you submit your paperwork, the loan application should be processed in one business day. If approved, you will receive a commitment letter with the terms of the loan and an official sign-off. Your cash will then be deposited into your account.

SVDP's Mini Loan program helps people escape cycles of debt and build sustainable financial habits. We offer a low-interest, no-fee loan that provides an alternative to payday or title loans. Our underwriters will listen to your story and help you understand your options for the future. They will work hard to find a solution that fits your needs.

If you require a quick cash loan, consider checking out the new ATD Money app. It is a popular online platform that offers instant loan approval and disbursement of cash in your bank account. ATD Money is not a direct lender and works on technology platforms that facilitate loans from our NBFC partners as per the terms and conditions agreed between NBFC and the customer only. ATD FINTECH SERVICES PRIVATE LIMITED with CIN U65100DL2019PTC344566 is the legal entity behind ATD MONEY. The company is registered under the Indian Companies Act 1956. All the loan transactions are done per the applicable laws of India. ATD MONEY is not responsible for any fraudulent activities by the NBFCs / third-party providers under this agreement.

Instant Approval

If you're looking for a personal loan with instant approval, it means that the lender will approve and disburse funds to you on the same day or within a business day of receiving your loan application. The lenders evaluate your credit score, financial history and other personal information to determine if you're qualified for an instant approval loan. To apply for a personal loan with instant approval, you must fill out an online application on the lender's website. You will typically have to supply your income and debts, social security number and bank account information.

The biggest benefit of a personal loan with instant approval is that you can receive your funds quickly, which can help you cover emergency expenses. In addition, these loans usually have lower interest rates than traditional loans. However, some lenders may charge higher fees and charges, which can increase the cost of the loan. Additionally, some lenders may engage in predatory lending practices, such as hidden fees and unaffordable repayment structures, which can trap borrowers in a cycle of debt.

When comparing personal loans with instant approval, it's important to look at the terms and conditions of each lender. Many lenders offer online applications that allow borrowers to prequalify for a loan and check rates and loan limits before applying. These tools can help you narrow down your options and find the best lender for your unique situation.

Getting a personal loan for bad credit with instant approval can be a great way to cover urgent expenses and meet your financial needs. The key is to choose a lender that offers competitive rates and flexible repayment terms. You can also consider a revolving line of credit that can be used as needed.

ATD Money is one of the leading microfinance solution providers in India, providing salaried individuals with an instant and hassle-free process of loan application and approval. The company offers a variety of loan products, including payday loans, same-day cash loans and unsecured business loans. To learn more about ATD Money, visit its website.

Simple Requirements

Regardless of the reason behind your short-term financial concerns, you can get a quick loan approval with the help of mini personal loans. This type of unsecured credit is available to salaried individuals across India and you don’t have to put any collateral as security. Besides, the loan process is easy and convenient with no paperwork. This kind of loan is perfect for people with poor credit scores and can be used to cover emergency expenses.

Unlike payday or title loans, these personal loan amounts are relatively small and come with fixed interest rates. They also have a set EMI and residency term, which makes them easier to repay. Moreover, you can get this kind of personal loan from several lenders in the market. This includes banks, NBFCs, and private lenders. However, it’s crucial to choose a legitimate lender and make sure that you have the required eligibility criteria.

Many people in the corporate sector don’t get advance salary support from their employers due to policy restrictions. As a result, they face a mid-month cash crunch during the month. Luckily, this problem has now been solved as ATD Finance has partnered with a digital lending platform called ‘ATD Money’ to solve this issue for corporate employees.

Applicants can apply for this type of loan by following the steps listed below:

No Collateral

If you need a loan to settle an emergency situation, you can apply for mini loans. These loans are unsecured, which means you don't have to pledge your assets. However, you should always choose a legitimate lender, such as a bank or NBFC. Moreover, you should also check whether the lender charges any hidden fees. In addition, you should choose a lender that has good customer service.

Personal loans are a great way to meet your short-term financial needs, but they can also lead to debt if you're not careful. This is why it's important to understand how these loans work and how they can affect your credit score.

A mini personal loan is a type of personal loan that's typically used to cover small expenses that don't require a large amount of money. These expenses might include paying medical bills, planning a vacation, or buying a new gadget. Mini-personal loans are typically available to people who have a steady source of income and can afford to repay the loan on time.

To qualify for a mini loan, you will need to have a stable source of income and an excellent credit history. You will also need to provide proof of employment, such as recent pay stubs or W-2 statements. If you have a bad credit score, you may still be eligible for a mini loan, but you will likely pay a higher interest rate.

The application process for a mini loan is simple and convenient, and the bank will usually approve your application if you meet their eligibility criteria. In most cases, you will be able to get your loan approved in just one day. The best way to determine your eligibility is to contact the bank directly and ask for more details.

Mini loans are a perfect solution for anyone who needs a little extra cash for an unexpected expense. These loans are easy to obtain, quick to process, and do not require any collateral. In addition, they are a safe and secure alternative to payday loans or auto title loans.

#payday loans#quick cash loans#personal loans#instant loan#cash loans#loan app in india#payday loans in india#advance salary loan#fast cash loans online#loan apps

0 notes

Text

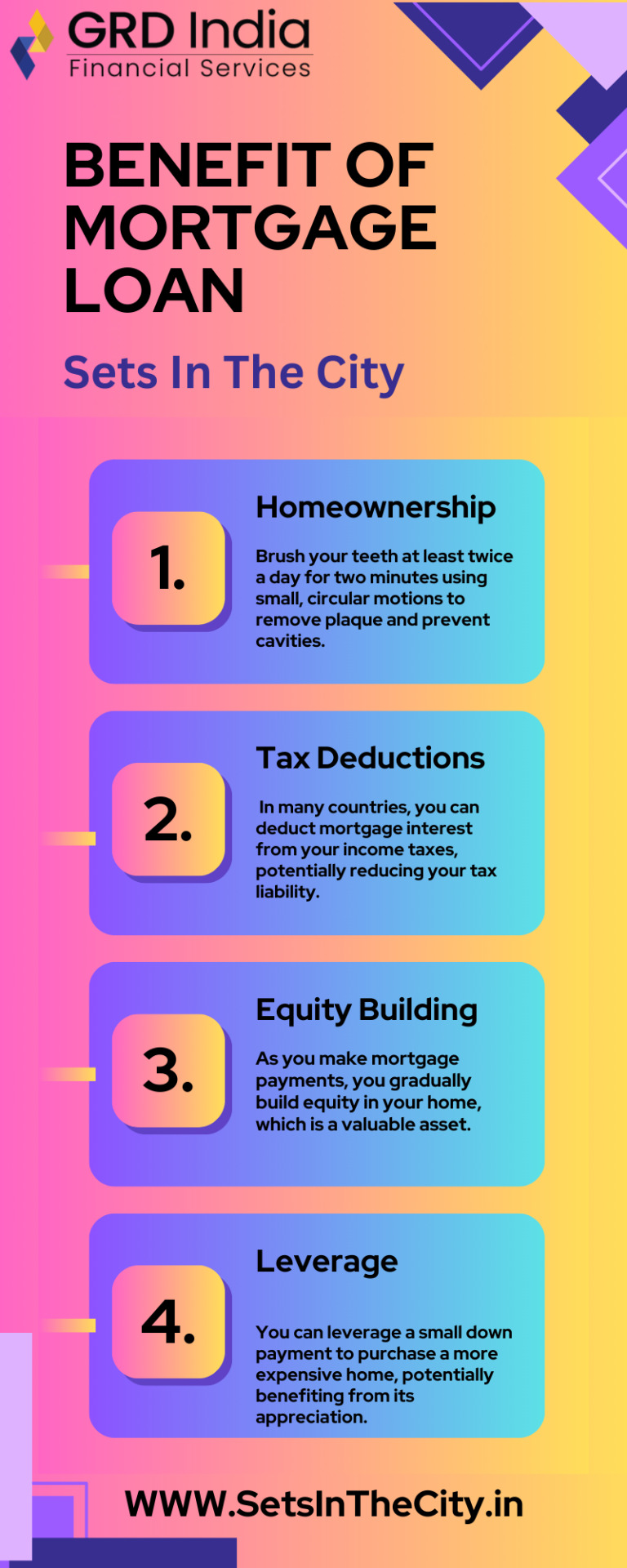

A "Mortgage Loan in Delhi" refers to a financial arrangement in which individuals or property buyers in the National Capital Territory of Delhi, India, borrow funds from a financial institution, usually a bank or a mortgage lender, to purchase or refinance a property, with the property itself serving as collateral for the loan. Delhi, being the capital city of India, has a dynamic real estate market, and mortgage loans play a significant role in enabling residents to buy homes or invest in property

0 notes

Link

Loan Against Property Land

Loan against property (LAP) can be avail by anyone for your personal or business needs. Both residential and commercial properties can be mortgaged for availing a loan against property at low interest rate in delhi ncr. Banks and financial institutes provide loans at attractive interest rates. A loan against property is a simple solution to your financial needs. Lenders provide loans to anyone who owns any piece of land and uses collateral as security for loans. To get a smooth & hassle-free loan against property to both salaried and self-employed individuals, you can apply online for the loan. Nowadays, most lenders are providing their services online. The interest rate of loan against land property is 11.10%, it may vary from lender to lender. Generally, loan against property eligibility criteria depends on numerous factors like age of the individual, monthly salary or business income, total work experience & CIBIL (Credit Information Bureau India Limited) Score, etc. The required criteria are mostly common; some lenders may ask for some other condition for eligibility.

Features of the loan against property

Loan against land property or commercial properties for: Business Needs; Marriage, medical expenses, and other personal needs.

You can transfer your outstanding loan availed from another Bank / Financial Institution

You may pay your payments for the loan over a maximum term of 15 years.

Smaller EMIs (Equated Monthly Installment)

Attractive interest rates

Easy and hassle-free documentation

Simple repayments through monthly instalments

#loan against property land#loan against property#loan property without map#loan against bank guarantee#loan against securities#bank guarantee#business loan#financeseva

1 note

·

View note

Text

Loan Against School Property: What You Need to Know

When we think to run a school, there are so many expenses involved. From paying staff to purchasing supplies and maintaining the facility, it can be a challenge to keep everything funded. This is where loans against school property can come in handy.

What is a Loan Against School Property?

A loan against school property is a type of loan that is secured by the school's property or assets. It includes the school property, other assets that the school owns as well as any land and the school building itself. A variety of lenders offer these loans, including banks and other financial institutions. Loan Town understands schools have unique financing needs. A team of experienced professionals can help you explore your options for a loan against school property and guide you through the process of securing financing.

Purpose of Loan Against School Property:

Having a loan against school property in Delhi can provide the school with access to funding that may not be available otherwise. A loan against school property from Loan Town can be particularly helpful for schools facing financial difficulties or requiring significant investments in their facilities.

There are many benefits of having a Loan Against School Property;

To finance the maintenance, renovation, or construction

To pay for additional staff, teachers, and other personnel

To pay for student programs and activities

To finance educational programs

To purchase textbooks for students

To provide funds for student scholarships

However, it is important to note that there are risks involved in obtaining a loan against school property. Kindly keep in mind, if the school is unable to repay the loan, the lender may be able to foreclose on the property used as collateral. This can clearly have significant consequences for the school and its ability to operate.

Benefits of Applying For Loan Against School Property:

Tax Benefits: Interest paid on loan against school property is eligible for tax deductions.

Low-Interest Rates: Interest rates on loans against school property are usually lower than other forms of borrowing.

Flexible Repayment Options: This loan type comes with flexible repayment options.

Quick Disbursal: It can be disbursed quickly, making it an ideal option for organizations in need of quick cash.

Easier Documentation: Documentation for loans against school property is straightforward compared to other forms of borrowing.

Security: It is secured by the school property, reducing the risk of defaulting on the loan.

Low Credit Score Required: It may not require a high credit score for approval.

In order to minimize these risks, it's important for schools to carefully consider their options before taking out a loan against their property. This may involve working with financial advisors or consultants to evaluate the school's financial situation and determine whether a loan is the best option.

Additionally, schools should also take steps to ensure that they are able to repay the loan on time and in full. This may involve developing a detailed budget and financial plan, as well as exploring alternative sources of funding if necessary. But don't worry, you can feel happy and relax with Loan Town. As we offer flexible repayment terms and competitive interest rates, so you can be sure you're getting the best possible deal for Loan Against School Property Near Me.

Reasons Why You Should Opt For Loan Providers Like Us:-

We provide lower Interest rate

We make smooth and hassle-free loan processing

We guide you to the best loan that suits your financial requirement

No restriction to using the loan amount for business expansion or personal needs

We do not have any hidden charges

Low-cost EMI

We also provide services at your door-step

Conclusion

Finally, a loan against property in Delhi can be the most suitable option for schools that need to access additional funding. This is very important for schools to carefully consider their options. Taking the right decision is crucial to lessening your risks and providing you with a loan in a hassle-free manner. But don't worry, Our team of experts will help you make the right decision and guide you to reduce your risks. A loan against school property can help schools to continue providing high-quality education to their students for years to come with the right planning and preparation.

#finance#loan against school property#loan against property#mortgage loan#loan against property in Delhi#home loan in Delhi

0 notes

Text

Factors to Consider Before Choosing Home Loan Offer.

Rate of Interest: Some home loan providers charge fixed and some floating rates of interest on home loans. Fixed interest rates are considered ideal for loans with shorter tenure while floating is suitable for loans with longer tenure. Some lenders even offer hybrid home loan service providers in Delhi. which the borrower can enjoy the benefit of both fixed and floating interest rates.

visit @ https://cfseasymoney.com/

visit @ [email protected]

visit @ +919990088208

#Home Loan Provider In Delhi#Home Loan Provider In Delhi NCR#Home Loan Provider In Haryana#Home Loan Provider In Mumbai#Home Loan Provider In Gurgaon#Home Loan Provider In Pune#Home Loan Provider In Maharashtra#Home Loan Provider In Noida#Home Loan#Loan Against Properties#Loan Calculator#Low Cibil Loan#Rate Of Interest#home loan service provider in delhi

0 notes

Text

How to make repaying home loans easier?

Dreaming is an essential part of being human. When we are kids, we aspire to become like our heroes. When we grow up, those dreams start to change into more practical ones though. We start focusing more on practical things, like acquiring one’s own vehicle, equipment and most importantly – a house! Living in rented accommodation can be very taxing. The continuous struggle of having to shift places is just too much – not to mention the rent keeps increasing every year as well. As soon as you grow used to living in a place, you are told by your landlord that you have to vacate the premises for one reason or the other. Eventually, you end up craving for a place that can be yours and yours only, where you wouldn’t have to worry about moving or paying rent. Where you relax and enjoy your life the way you want, without having to worry about unnecessary restrictions.

This is why many people these days are opting for home loan in Delhi, so as to have a place to call their own. The reason for taking loans is that given the current state of the world, especially for middle class families, it is impossible to sustain the standard of living of the 21st century while also saving substantial money. The cost of the property is also increasing with every passing day. Therefore low interest home loans are by far the best way of accomplishing your lifelong goals.

But taking a loan is something that should be done very responsibly, because it is one of those decisions that have the power to change the course of your entire life. Therefore, you need to be extra careful while taking loans, whether you’re going for regular banks or NBFCs (Non Banking Financial Companies). Repaying home loan through Equated Monthly Installments (EMIs) is never an easy task, regardless of whether you’re taking loan against property or going for low interest home loans. Therefore, there are certain things that you should keep in mind before you decide to borrow a home loan in Delhi.

Longer tenure is better than the shorter tenure: People often tend to go for the shorter tenure for the repayment of home loans, because they want to get rid of the loan as fast as possible. But financial decisions should never be made based on impulsive behavior. The math is quite simple actually: the shorter the duration of repayment, the higher will be the monthly EMI. This might become a problem for you in the future if an unforeseen financial expenditure arises out of nowhere. Therefore you need to go for longer tenure with low EMI. Any excess money that you save can be invested to create more money for you in the future.

Become a cautious spender: Now that you have a loan to repay, you need to spend your money very cautiously so that you don’t end up becoming a defaulter – because if you do, you’ll have to pay extra charges for that as well besides your monthly EMI.

Know about foreclosure:

You need to keep an eye on the changing RBI norms in order to make the most of your loan. Foreclosing your loan by paying back the remainder amount before the agreed upon tenure can help you save substantial money in terms of interest.

1 note

·

View note

Text

Get instant approval for a low-interest loan against property in Delhi from Chintamani Finlease, with flexible EMIs and an easy online application. Apply now!

0 notes

Link

Search and find best loan provider in Delhi NCR with KDI Advisors at low interest rates. We provide all types of loan such as home loan, business loan, loan against property and many more. Apply for loan now.

#Financial Service in Delhi#financial service agency#loan Provider Company in Delhi#loan provider in Delhi ncr#loan provider in Delhi

1 note

·

View note

Text

Loan against Property in Delhi NCR Easily and Quickly

Financial needs are of many kinds, business operating expenses, purchasing self-owned house, construction/ renovation/extension of industrial or office premises, insurance and many others. To meet the current financial demand, people requires money and in turn they pay interest at certain rate. Banks and financial institutions help them to meet their current demand and charge fixed interest rate.

To get the loan, people need to meet their requirements that significantly include proper documents and eligibility of applicant. Homeshed is one of the financial institutions that provides all kinds of loans to people easily and quickly.

Homeshed is here to help you instantly for your loan requirements! We understand the financial needs of people and so provides jotted down loan types at low interest rates:

Personal Loan- for the salaried person, who may require money in lump sum and can pay in installment, Personal loans are helpful.

Home Loan – Purchasing own house is still a dream of many! To help in fulfilling their dream, we provide easy home loans at low interest rates. You can also get home loan against property by keeping your property as collateral.

Industrial Loan – Need to extend or renovate your industry or premises? Get instant loan approval at Homeshed. We provide easy loan to meet industrial needs of people all over Delhi.

Loan against Property – In Loan against property, property is used as collateral by the lender and in turn they give money and charge some interest. We provide loan against property in Delhi NCR that you may use to meet your financial requirements.

So, if you are facing any difficulty in getting loan from any other agency, Homeshed provides you amazing opportunity to get loans with less documentary formalities, low interest rates and time period that you may prefer.

For More information visit here… http://homeshed.in

Contact us… 9818801889

#home loan against property#home loan in Delhi#home loan agents in Delhi#home loan interest rate in Delhi#property loan Delhi#loan against property in Delhi NCR

1 note

·

View note

Text

Loan Against Residential Land Loan Against Residential Land in Delhi Noida Gurgaon Capified

Loan Against Residential Land

When you own a plot of land, you can build a space that is uniquely yours. Plot loans help you to acquire the land for your home so that you can start turning your dream home into reality. Availability of a property loan is not a big task in today’s era, but it involves choosing a reliable source providing loans at low interest rates. We are associated with the major financial institutions offering services related to property loans. Being the ideal housing loan advisor, we assist you well in getting loans according to your budget and requirements.

Loan Against Residential Land in Delhi

With our vast experience and knowledge of prevailing market trends we can easily guide you in the process of getting a loan for your residential property, commercial property, plot purchase loan as well as loan against property. We are among the most trusted loans against residential land consultants in Delhi who are always available with their cost effective services. We are known for working in a professional way to efficiently sort out all the problems of the clients. Thus, we are one of the well-established real estate agents offering you appropriate solutions for obtaining loans and getting you closer to your dream property.

Plot Loan for Land Purchase

Capified is an outstanding organization for plot loan for land purchase in Delhi. The administrations are cultivated by industry confirmed experts who utilize the trend-setting innovation. Inferable from good conduct, right business technique and sensible rates, we have gathered wide supporters everywhere throughout the country.

loan against property documents required

You need address proof of both residence and office-aadhaar card\ voter ID or a copy of any utility bill like electricity bill. Salary slips for the last three months. A copy of the last 3 years from 16. Bank statements for the previous 6 months reflecting salary obtained and current repayments. You have to submit copies of documents of the property to move further with your loan application process. You have to provide the bank with the copies of the sale deed, copy of agreement, maintenance bill, etc.

Avail Mortgage Loans on Property

Capified is an outstanding organization for Mortgage loan on Property in India. The administrations are cultivated by industry confirmed experts who utilize the trend-setting innovation. Inferable from good conduct, right business technique and sensible rates, we have gathered wide supporters everywhere throughout the country.

READ MORE....Cash Against Property Loan Against Property in Delhi Gurgaon Noida - Capified

#Plot Loan for Land Purchase#Avail Mortgage Loans on Property#Loan Against Residential Land in Delhi

1 note

·

View note

Text

Apply Housing construction loan at 8.35%* low ROI

Visit: https://finvestfortune.in/house-construction-loan-home-low-rate/ Contact: +91–8882314503 Mail At: [email protected] Finvest Fortune H4/21, Bengali Colony, Mahavir Enclave Sector 1 Dwarka, New Delhi – 110045

Looking to apply for a Housing construction loan with a low ROI of 8.35%*? Look no further than Finvest Fortune! Our Housing construction loans are designed to help you build your dream Home with ease. With competitive interest rates and flexible repayment options, we make financing your construction project affordable and convenient.

we understand the importance of timely disbursements and transparent processes, ensuring that your construction plans stay on track.

Finvest Fortune is the best Home loan service provider in Delhi -NCR, dealing into home loan, home loan balance transfer , plot loan, loan against property, business loan , personal loan, top-up loan, construction loan, project loan, OD/CC, etc.

#CONSTRUCTIONLOAN#APPLYLOWROICONSTRUCTIONLOAN#INASTANTLOANAPPROVAL#QUICKLOANDISBURSAL#MORTGAGELOANTRANSFER

0 notes