#LoanProcess

Explore tagged Tumblr posts

Text

💰 Gold Loan Made Simple! 💰

Need quick cash? Here’s how a gold loan works:

🔹 Pledge your gold at a bank/NBFC 🔹 Get it valued & loan amount decided 🔹 Submit KYC & complete verification 🔹 Instant loan disbursal! 💸 🔹 Repay & get your gold back

Fast, secure & hassle-free! Would you consider a gold loan? 🤔👇

Click <> https://www.shriramfinance.in/gold-loan

0 notes

Text

Client Communication Tips for Commercial Loan Brokers!

Introduction:

Effective communication is the cornerstone of success in commercial loan brokerage, enabling brokers to build trust, manage expectations, and deliver exceptional service to clients. Clear, consistent, and professional communication fosters positive relationships, enhances transparency, and ensures that clients feel supported throughout the loan process. Here are best practices for commercial loan brokers to master client communication and drive positive outcomes.

1. Establish Clear Communication Channels:

Set clear expectations upfront regarding communication channels, frequency, and preferred methods of contact. Provide clients with multiple ways to reach you, including phone, email, and virtual meetings. Use technology to facilitate seamless communication, such as project management tools for tracking progress and sharing updates in real-time.

2. Listen Actively and Empathetically:

Listening is a fundamental aspect of effective communication. Take the time to listen actively and empathetically to your clients' concerns, questions, and feedback. Demonstrate genuine interest in their needs and priorities, and validate their feelings and perspectives. By listening attentively, you can better understand your clients' expectations and tailor your communication to meet their needs.

3. Communicate Clearly and Concisely:

Communicate information in a clear, concise, and jargon-free manner to ensure that clients understand key concepts and terms. Avoid using technical language or industry-specific terminology that may confuse or overwhelm clients. Break down complex information into digestible chunks, and provide examples or analogies to illustrate important points.

4. Provide Regular Updates and Progress Reports:

Keep clients informed about the status of their loan application and provide regular updates on progress and milestones achieved. Set realistic timelines and milestones, and communicate any delays or challenges proactively. Transparency is key to building trust and confidence with clients, so be honest and forthcoming about any issues or obstacles encountered during the loan process.

5. Be Responsive and Available:

Promptly respond to client inquiries, emails, and phone calls to demonstrate your commitment to their needs and priorities. Set aside dedicated time each day to address client communications and inquiries promptly. Even if you don't have an immediate answer to a question, acknowledge receipt of the inquiry and provide a timeline for follow-up.

6. Anticipate and Address Concerns:

Proactively anticipate potential concerns or questions that clients may have throughout the loan process, and address them preemptively. Provide reassurance and guidance to alleviate any anxieties or uncertainties they may experience. Anticipating and addressing concerns demonstrates your expertise and proactive approach to client service.

7. Seek Feedback and Continuous Improvement:

Solicit feedback from clients on their experience working with you and your team, and use this feedback to identify areas for improvement. Regularly evaluate your communication processes and seek opportunities to streamline and enhance the client experience. By continuously seeking feedback and striving for improvement, you can refine your communication skills and deliver even better service to clients.

Conclusion: Effective communication is a linchpin of success for commercial loan brokers, enabling them to build trust, manage expectations, and deliver exceptional service to clients. By establishing clear communication channels, listening actively and empathetically, communicating clearly and concisely, providing regular updates and progress reports, being responsive and available, anticipating and addressing concerns, and seeking feedback and continuous improvement, brokers can master client communication and drive positive outcomes in the competitive landscape of commercial loan brokerage.

#ClientCommunication#CommercialLoans#LoanBrokers#EffectiveCommunication#BuildingTrust#ClientSuccess#LoanProcess#Transparency#ClientService#ActiveListening#ClientTrust#BusinessFinancing#LoanSolutions#FinancialAdvisors

1 note

·

View note

Text

Looking for funding to fuel your business growth? Look no further! Apply Business Loan is your go-to solution for securing the funds you need. Our seamless application process and competitive interest rates make financing your dreams a reality.

Visit our website link:- https://finaqo.in/

Contact us:- +91 120 479 8145

#businessloanapplication#loanprocess#smallbusinessfunding#financeyourbusiness#businessgrowth#entrepreneurialloans#cashflowmanagement#startuptips#businesscreditoptions

1 note

·

View note

Text

How to get personal loan from phonepe?

To get a personal loan through PhonePe, you can follow these steps:

1. Open the PhonePe App: If you don't have the app already, download and install it from your app store.

2. Login or Register: Sign in to your PhonePe account or create one if you're a new user.

3. Link Your Bank Account: Ensure that your bank account is linked to your PhonePe account. This is important for loan processing and disbursal.

4. Navigate to the 'Apps' Section: In the PhonePe app, go to the 'Apps' or 'Services' section. Here, you'll find various financial services and loan providers.

5. Choose a Loan Provider: Browse through the loan providers available on PhonePe. Select one that suits your requirements. Many loan providers partner with PhonePe to offer their services.

6. Complete the Loan Application: Click on the loan provider of your choice and follow their application process. You'll need to provide personal and financial information as required by the provider.

7. Approval and Disbursal: After submitting your application, the loan provider will review your information. If your application is granted approval, the loan sum will be transferred to your associated bank account.

Remember to carefully read the terms and conditions, interest rates, and repayment terms before applying for a loan through PhonePe. If you'd like more detailed information and tips on getting a personal loan through PhonePe, I have written a comprehensive blog post on this topic. You can find it here: How to get personal loan from phonepe

#phonepe#PersonalLoan#PhonePeLoan#DigitalFinance#LoanApplication#FinancialServices#MoneyManagement#LoanApproval#BankingApp#LoanProcess#OnlineLending#FinancialTips#CreditScore#LoanProviders#FinancialPlanning#InstantLoan#LoanDisbursal#MobileApp#LoanOptions#LoanApprovalProcess#FinancialResources

0 notes

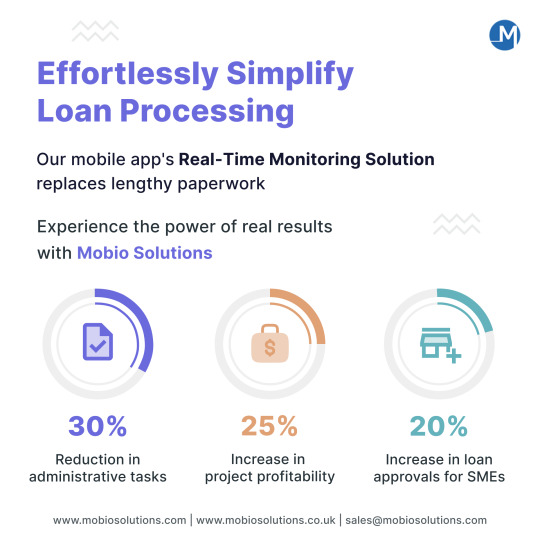

Photo

Don't miss out on this opportunity to transform your fintech business. See how our real-time monitoring mobile app solution for a leading fintech firm saved their time and money and gave them a competitive edge in the market. Don't settle for less than exceptional with Mobio Solutions!

#loanprocessing#fintech#technology#automation#startups#Business#banking#finance#financial management#payments#applicationsoftware#mobileapp#MobileAppDevelopmentCompany#mobiosolutions

8 notes

·

View notes

Text

#MicrofinanceSoftware#CreditManagement#CorporateLoans#LoanPortfolio#RiskAssessment#NBFCSoftware#DigitalLending#FinancialTechnology#FintechSolutions#LoanProcessing

0 notes

Text

#MicrofinanceSoftware#CorporateLoans#CreditManagement#LoanPortfolio#RiskAssessment#NBFCSoftware#DigitalLending#FinancialInclusion#FintechSolutions#LoanProcessing

0 notes

Text

Simplifying Data Extraction from Loan Documents with AI

Extracting data from various types of loan forms, ID cards, financial statements, and other documents for financial institutions is a challenging task, especially when dealing with bulk documents and diverse formats. The traditional manual data extraction method is outdated due to its poor accuracy, slow speed, and high rate of human error. However, technologies such as Intelligent Document Processing (IDP), Artificial Intelligence (AI), and Machine Learning (ML) revolutionize this process, offering super accuracy, fast speeds, and minimal errors. Let's explore how banks and financial institutions can leverage IDP and AI to enhance data extraction from loan documents, and discover how AlgoDocs AI stands out as an exceptional tool for this purpose. Read our guide to learn more.

0 notes

Text

Enhance your lending operations with advanced loan management software that streamlines the entire loan lifecycle—from application to repayment. By automating tasks like data collection and storage, it reduces errors and accelerates processing times, leading to increased customer satisfaction. Embrace digital transformation to stay competitive and meet the evolving expectations of borrowers.

#LoanManagementSoftware#Fintech#DigitalTransformation#LendingSolutions#FinancialServices#LoanProcessing#CreditManagement#SoftwareSolutions#BusinessAutomation#RiskManagement#CustomerExperience#DataAnalytics#FinancialTechnology#LoanOrigination#Compliance#DebtManagement#SmallBusinessLoans#EnterpriseSoftware#Innovation#TechForFinance#SaaS#FinancialInclusion#Investment#BusinessGrowth#Efficiency#Automation#LoanServicing

0 notes

Text

💡 What I’ve Learned From Helping People Navigate the Loan Process Successfully 💡

Navigating the loan process doesn’t have to be complicated. Over the years, I've learned that it’s not just about offering financial solutions but truly understanding each person’s unique needs and goals. With clear communication, a transparent approach, and quick, easy processes, the loan journey becomes stress-free for everyone involved.

Swipe through to see the key lessons I’ve learned and how they can make your loan experience smoother and more successful.

👉 Ready to start your financial journey? Let’s make it simple together!

📞 Call: 9743739944 🌐 Visit: www.bhsinstantloans.in

#LoanProcess#PersonalLoans#BusinessLoans#LoanTips#FinancialGuidance#LoanSuccess#DebtSolutions#LoanApproval#FinancialEducation#HassleFreeLoans#LoanSupport#CustomerFocused#TrustAndTransparency#FinancialJourney#EasyLoans#personalloan#financialfreedom#bhsinstantloans#bhsinstantloansolutions#bhsinstantloan#instantloanservices

0 notes

Text

#LoanApproval#FinancialServices#LoanDisbursement#ApprovedLoan#Fintech#NihalFintech#BusinessLoan#LoanApplication#FastLoans#MoneyTransfer#PersonalLoan#LoanProcessing#Finance

0 notes

Text

Navigating the Commercial Loan Application Process: Step-by-Step Tips for Brokers!

Introduction:

The commercial loan application process can be a complex and daunting journey, filled with potential pitfalls and challenges. For brokers, efficiently managing this process is essential for delivering value to clients and securing successful outcomes. By following a systematic approach and leveraging key strategies, brokers can streamline the commercial loan application process and navigate it with confidence. Here's a step-by-step guide on how to do just that. 1. Initial Client Consultation:

The journey begins with an initial consultation with the client. Take the time to understand their financing needs, business objectives, and financial situation. Gather relevant documentation, such as financial statements, tax returns, and business plans, to assess their eligibility and determine the most suitable loan options.

2. Prequalification and Preapproval:

Before diving into the formal application process, brokers should work with clients to obtain prequalification and preapproval from lenders. This involves submitting preliminary financial information to lenders to assess the client's creditworthiness and determine their borrowing capacity. Prequalification and preapproval can help streamline the application process and strengthen the client's negotiating position.

3. Loan Application Submission:

Once prequalified or preapproved, it's time to submit the formal loan application to selected lenders. Brokers should carefully review the application package to ensure it is complete, accurate, and tailored to the lender's requirements. Provide supporting documentation and financial projections to strengthen the application and increase the likelihood of approval.

4. Negotiation and Due Diligence:

As lenders review the loan application, brokers should be prepared to negotiate terms and conditions on behalf of their clients. This may involve discussing interest rates, loan terms, collateral requirements, and other key aspects of the loan agreement. Conduct thorough due diligence on behalf of the client to assess the risks and benefits associated with each lender's offer.

5. Closing and Funding:

Once terms are agreed upon, brokers play a crucial role in facilitating the closing and funding process. Coordinate with lenders, attorneys, and other relevant parties to ensure a smooth and timely closing. Review loan documents with the client to ensure they understand their obligations and rights under the agreement. Celebrate the successful funding of the loan and continue to provide support and guidance to the client as needed.

Conclusion:

Navigating the commercial loan application process requires careful planning, attention to detail, and effective communication. By following these step-by-step tips, brokers can efficiently manage the application process, minimize delays, and maximize the likelihood of success for their clients. By serving as trusted advisors and advocates, brokers can help clients achieve their financing goals and propel their businesses forward.

#CommercialLoan#LoanApplication#Brokers#FinancialServices#Prequalification#LoanApproval#BusinessFunding#FinancialConsulting#LoanProcess#BrokersGuide#SmallBusinessFinance#LoanSuccess

1 note

·

View note

Text

Navigate loan processing with clear steps! Our straightforward process ensures you get the loan you need quickly and easily. Apply now!

0 notes

Text

0 notes

Text

#LoanOriginationSystem#LoanOriginationSoftware#CreditOriginationSystem#RetailLoanOriginationSystem#RetailLending#Automation#AI#MachineLearning#LoanProcessing

0 notes

Video

youtube

How to Cash Out a 401k with an Outstanding Loan Balance

When You Can Withdraw

You can take money out for big needs like medical bills or college fees.

You need to show proof of why you need the money.

The Catch with Multiple Withdrawals

Taking out money multiple times? It can cost you in taxes and penalties.

Getting Approval

Your employer or the people managing your 401(k) must say it’s okay to withdraw.

They’ll check your proof first.

What If You Lie?

Lying about needing a hardship withdrawal can lead to big trouble, including legal actions.

Quick FAQs

What if I cash out my 401(k) with a loan? You get less cash, and the loan amount becomes taxable.

Does not paying back a 401(k) loan hurt my credit? No, it doesn’t affect your credit score.

What’s needed for a hardship withdrawal? Proof of big financial needs like medical bills.

#youtube#401kLoan RetirementPlanning PersonalFinance 401kLoanApproval FinancialAdvice InvestmentTips LoanProcessing RetirementSavings 401kTips Financ

0 notes