#Lic Agent In Nagpur

Explore tagged Tumblr posts

Text

1 note

·

View note

Text

Jabalpur P&GS Unit G304 P&GS Branch, Jabalpur DO. JABALPUR,MADAN MAHAL NAGPUR ROAD, JABALPUR 482001

0 notes

Text

THE VISION EXERCISE - Create Your Future from your Future, not Your Past

The following exercise is designed to help you clarify your vision. Although you could do this as a strictly mental exercise by just thinking about the answers and then writing them down, I want to encourage you to go deeper than that. If you do, you will get deeper answers that serve you better.

Start by putting on some relaxing music and sitting quietly in a comfortable environment where you won’t be disturbed. Then, close your eyes and ask your subconscious mind to give you images of what your ideal life would look like if you could have it exactly the way you want it, in each of the following categories.

*1. First, focus on the financial area of your life.*

(This is most important for Financial Services Intermediaries.)

What is your annual income? What does your cash flow look like?

How much money do you have in savings and investments?

What is your total net worth?

Next

How would you like your home look like?

Where should it be located? Does it have a view?

What kind of yard and landscaping you want?

Is there a pool or lake facing your dream house?

What colour should the walls be?

How should the furniture look like?

Are there paintings hanging in the rooms?

What do they look like?

Walk through your dream house, filling in all of the details. At this point, don't worry about how you will get the house. Don't sabotage yourself by saying "I can’t live in imagination because I don’t make enough money" Once you give your mind's eye the picture, your mind will solve the "not enough money" challenge.

Next.

Visualise what kind of car you are driving and any important possessions your finances have provided.

2. Next.

Visualize your ideal job or career.

What is your profession? Where are you working? What are you doing?

With whom are you associated?

What kind of clients or customers do you have? If you are an independent professional what is your earnings like?

3. Then focus on your free time, your recreation time. What are you doing with your family and friends in the free time you have created for yourself?

What hobbies are you pursuing?

What kinds of vacations do you take?

What do you do for fun?

4. Next.

What is your ideal vision of your body and your physical health?

Are you free of all diseases? How long do you want live? Are you open, relaxed, in an ecstatic state of bliss all day long?

Are you full of vitality?

Are you flexible as well as strong?

Do your exercise, eat good food, and drink lots of water.

5. Then move on to your ideal vision of your relationships with your family and friends.

What is your relationship with your family like?

Who are your friends?

What is the quality of your relationships with your friends?

What do those friendships feel like?

Are they loving, supportive, empowering?

What kinds of things do you do together?

6. What about the personal arena of your life?

Do you see yourself going back to school, getting training, attending workshops, seeking therapy for a past hurt, or growing spirituality?

Do you meditate or go on spiritual retreats.

Do you want to learn to play an instrument or write your autobiography?

Do you want to run a marathon or take an art class?

Do you want to travel to other countries?

7. Finally.

Focus on the community you live in, the community you have chosen.

What does it look like when it is operating perfectly? What kinds of community activities take place there?

What about your charitable work?

What do you do to help others and make a difference? How often do you participate in these activities?

Whom are you helping?

You can write down your answers as you go, or you can do the whole exercise first and then open your eyes and write them down. In either case, make unsure you capture everything in writing as soon as you complete the exercise. Everyday, review the vision you have written down. This will keep your conscious and subconscious minds focused on your vision, and as you apply the other principles and tools in the book, you will begin to manifest all the different aspects of your vision.

To know more about THE VISION EXERCISE, you can visit our website http://www.jayantharde.com or contact our representative at +91 712 2282029 or meet us at 51, Gurukripa, Old Sneha Nagar, Wardha Road, Nagpur – 440015.

Source: https://hardejayant.blogspot.com/2021/03/the-vision-exercise-create-your-future.html

2 notes

·

View notes

Link

LIC Jeevan Lakshya is a limited premium paid traditional program that is unlinked and graded as an endowment with-profits scheme. The plan became effective in March 2015.

#LIC Jeevan Lakshya Plan#child education#death benefits#maturity benefits#tax benefits#Premium waiver benefit#life insurance policy#Lic Agent In Nagpur#jayant harde

0 notes

Text

Online Lic Payment In Nagpur

Jayant Harde offering all the LIC India service now online for you at jayantharde.com Check our services just click and go :

Online Lic Payment In Nagpur

Mutual Fund Agent In Nagpur

Child Future In Nagpur

0 notes

Text

Best LIC in Nagpur

We are a team of insurance advisors and our LIC Agent in Nagpur who have been trained by LIC to help you meet your expectations and requirements from their policies. We have experience in advising the best insurance policies and risk cover plans that allow you to enjoy your life without any tension. Insurance is a crucial decision and must be taken with all precautions and our advisors provide the best advice. We have been providing consultation to customers in Nagpur for many years now and have been successful in building trust and long term relationships with them.

86, Oriental Annexe Janpath Rd,

Janpath Connaught Place New Delhi, 110001

8076375399

0 notes

Text

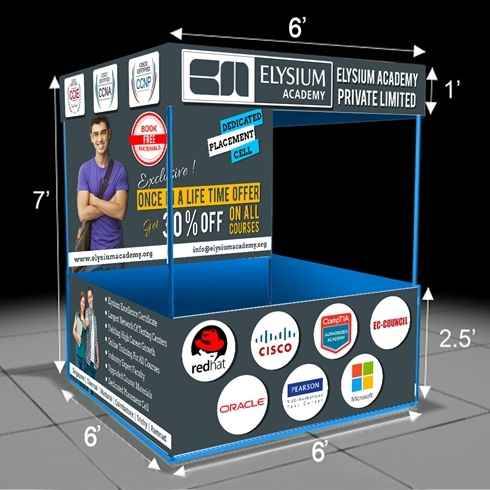

Canopy Tent

Printtrade also deals custom Size Canopy tent As Per Customer Demand. Printtrade makes any type demo tent, Promotional Canopy, Printed Canopy, Plain Canopy, Advertising tents etc.

Being developed with acute skills and precision the Canopy comes in different dimensions which are as follows:

4x4x7 ft canopy- There will be 7 banners in total 3 each in top & bottom and 1 as background. Top banners will be 4x1 ft size each & bottom banners will be 4x2.5 ft each where 4 ft in length. Background banner will be 4x7 ft.

6x6x7 ft canopy - There will be 7 banners in total 3 each in top & bottom and 1 as background. Top banners will be 6x1 ft size each & bottom banners will be 6x2.5 ft each where 6 ft in length. Background banner will be 6x7 ft.

Shipping- The Printed Canopy is dispatched in 2 working days (after finalisation of design) via surface transport.

Key Features of Canopy Tent

Portable/ Foldable- Light-weight and easily carried around

Waterproof- The material used in manufacturing prevents any damage from the water

Heavy-duty iron frame - Stands tall and rigid due to the sturdy materials used for support

Long-lasting- The fabric of the flex endures normal wear and tear and remains intact over longer periods.

Ideal for outdoor campaigns- The ease of carrying and moving makes it a viable option for advertising and marketing

Free carry bag- A free carry bag is included to add more ease for our customers easy to install and easy to carry with carry bag

Delivery all over India- We ship almost to every corner of India.

canopies always called with many keywords like canopy tent, advertising canopy, canopi, canopies, printed canopies, plain canopies, demo tent, 4x4x7 canopy, canopy wholesale, canopy tent price, canopy tent for sale, promotional canopy tent, 4x4 canopy tent, canopy tent design, canopy standard size , canopy printing , promotional canopy tent, canopy tent pune, canopy tent manufacturers in kolkata, delhi, mumbai, pune , chennai, online canopy design , canopy online purchase, canopy tent design, canopy price list , canopy tent manufacturers in hyderabad, canopy size, canopy designs for marketing, canpoies, canopi tent, flex canopi, plain canopi, printed canopies, flex canopies, canopy. printtrade also sell canopy tent with best price.we also deliverd canopy tent in banglore, delhi & hyderabad. printtrade also sell canopy tent online in india. printtrade also serve canopy tent on rent in mumbai. we also hardwork for canopy tent sale with best quality.

Printtrade canopy tent also called by indian customer with many name like advertising canopy, printed canopy, Plain canopy, promotional canopy tent, canopy 4x4x7 canopy, canopy wholesale, canopies wholesalers, canopy Price, 6x6x7 canopy printing near me, canopy with tent, Canopies, canopy tent online india, outdoor advertising tent, best canopy manufacturer Printtrade makes canopy in many size like 4x4x7 plain canopy tent 4x4x7 printed canopy tent ,canopy tent manufactrer in, canopies small size customised, canopy lic tent for agent, Marketing Tent, Pop Up Tent, canopy for shop, canopy vendor, canopy tent bangalore, canopy tent on sale, folding canopy, promotional canopy tent, pramotional tent 4 * 4, canopy tent price in india, pop up canopy, imc canopy, jio canopy 6×7 canopy, promo canopy, 6×4 canopy, 4×4 canopy, canopy makers near me, canopy tent price, can canopy tent and demo tent manufactrer near me, canopy tent rental, 4x4 canopy, 6x4 canopy, 6x6 canopy, 8x8 canopy, 6x7 canopy, marketing tent, 6x6x7 plain canopy , 6x6x7 printed canopy 6x4x7 canopy make on demand plain canopy make in tetron fabric printed canopy make in three type flex normel flex canopy, star black flex canopy, canopy tent to rent, canopy tent for rent, star white canopy printtrade deals in metro city like DELHI, MUMBAI , KOLKATA, JAMMU & KASHMIR, AGARTALA, AGRA, AHEMDABAD, AIZWAL, AJMER, ALLAHABAD, ALLEPPEY, ALIBAUG, ALMORA, ALSISAR, ALWAR, AMBALA, AMRITSAR, ANAND, ANKLESHWAR, ASHTAMUDI, AULI, AURANGABAD, BADDI, BADRINATH, BALASINOR, BALRAMPUR, BAMBORA, BANDHAVGARH, BANDIPUR, BANGLORE, BARBIL, BEHROR, BAREILLY, BEHROR, BELGAUM, BERHAMPUR, BETALGHAT, BHARATPUR, BHANDARDARA, BHARUCH, BHAVANGADH, BHAVNAGAR, BHILAI, BHIMTAL, BHOPAL, BHUBANESHWAR, BHUJ, BIKANER, BINSAR, BODHGAYABUNDI, CALICUT, CANANNORE, CHAIL, CHAMBA, CHANDIGARH, CHENNAI, CHIKMAGALUR, CHIPLUN, CHITRAKOOT, CHITTORGARH, COIMBATORE, COONNOR, COORG, CORBETT NATIONAL PARK, CUTTACK, DABHOSA, DALHOUSIE, DAMAN, DANDELI, DAPOLI, DARJEELING, DAUSA, DEHRADUN, DHARAMSHALA, DIBRUGARH, DIGHA, DIU, DIVE AGAR, DOOARS, DURGAPUR, DURSHET, DWARKA, FARIDABAD, FIROZABAD, GANGOTRI, GANGTOK, GANAPATIPULE, GANDHIDHAM, GANDHINAGAR, GARHMUKTESHWAR, , GARHWAL, GAYA, GHAZIABAD, GOA, GOKHARNA, GONDAL, GORAKHPUR, GREATER NOIDA, GULMARG, GURGAON, GURUVAYOOR, GUWAHATI, GWALIOR, HALEBID, HAMPI, HANSI, HARIDWAR, HASSAN, HOSPET, HOSUR, HUBLI, HYDERABAD, IDUKKI, IGATPURI, IMPHAL, INDORE, JABALPUR, JAIPUR, JAISALMER, JALANDHAR, JALGAON, JAMBUGODHA, JAMMU, JAMNAGAR, JAMSHEDPUR, JAWHAR, JHANSI, JODHPUR, JOJAWAR, JORHAT, JUNAGADH, KABINI, KALIMPONG, KANATAL, KANCHIPURAM, KANHA, KANPUR, KANYAKUMARI, KARGIL, KARJAT, KARNAL, KARUR, KARWAR, Karnataka, KASARGOD, KASAULI, KASHIPUR, KASHID, KATRA, KAUSANI, KAZA, KAZIRANGA, KEDARNATH, KHAJJIAR, KHAJURAHO, KHANDALA, KHIMSAR, KOCHIN, KODAIKANAL, KOLHAPUR, KOLKATA, KOLLAM, KOTA, KOTAGIRI, KOTTAYAM, KOVALAM, KUFRI, KUMBALGARH, KULLU, KUMARAKOM, KUMBAKONAM, KUMILY, KURSEONG, KUSHINAGAR, LACHUNG, LEH, LAKSHADWEEP, LONAVALA, LOTHAL, LUCKNOW, LUDHIANA, LUMBINI, MADURAI, MAHABALESHWAR, MAHABALIPURAM, MALAPPURAM, MALPE, MALSHEJ GHAT, MALVAN, MANALI, MANDAVI, MANDAWA, MANESAR, MARARRI, MANDORMONI, MANGALORE, MANMAD, MARCHULA, MATHERAN, MATHURA, MCLEODGANJ, MOHALI, MOUNT ABU, MORADABAD, MORBI, MUKTESHWAR, MUMBAI, MUNDRA, MUNNAR, MURUD JANJIRA, MUSSOORIE, MYSORE, NADUKANI, NAGAPATTINAM, NAGARHOLE, NAGAUR FORT, NAGOTHANE, NAGPUR, NAHAN, NAINITAL, NALDHERA, NANDED, NAPNE, NASIK, NAVI MUMBAI, NERAL, NEW DELHI, NILGIRI, NOIDA, O, OOTY, ORCHHA, OSIAN, PACHMARHI, PALAMPUR, PALANPUR, PALI, PAHALGAM, PALITANA, PALLAKAD, PANCHGANI, PANCHKULA, PANNA, PANHALA, PANVEL, PANTNAGAR, PARWANOO, PATIALA, PATHANKOT, PATNA, PATNITOP, PELLING, PENCH, PHAGWARA, PHALODI, PINJORE, PONDICHERRY, POOVAR, PORBANDAR, PORT BLAIR, POSHINA, PRAGPUR, PUNE, PURI, PUSKHAR, PUTTAPARTHI, RAI BAREILLY, RAICHAK, RAIPUR, RAJASTHAN, RAJGIR, RAJKOT, RAJPIPLA, RAJSAMAND, RAJAHMUNDRY, RAMESHWARAM, RAM NAGAR, RAMGARH, RANAKPUR, RANCHI, RANIKHET, RANNY, RANTHAMBORE, RATNAGIRI, RAVANGLA, RISHIKESH, RISHYA, PROHETGARH, ROURKELA, SAJAN, SALEM, SAPUTARA, SASAN GIR, SATTAL, SAWAI MADHOPUR, SAWANTWADI, SATNA, SECUNDERABAD, SHILLONG, SHIMLA, SHIMLIPAL, SHIRDI, SHARAVANBELGOLA, SHIVANASAMUDRA, SIANA, SILIGURI, SILVASSA, SIVAGANGA DISTRICT, SOLAN, SONAULI, SRINAGAR, SUNDERBAN, SURAT, TANJORE, TAPOLA, TARAPITH, THANE, THEKKADY, THIRVANNAMALAI, THIRUVANANTHAPURAM, TIRUCHIRAPALLI, TIRUPUR, TIRUPATI, THRISSUR, UDAIPUR, UDHAMPUR, UDUPI, UJJAIN, UTTARKASHI, VADODARA, VAGAMON, VARKALA, VAPI, VARANASI, VELANKANNI, VELLORE, VERAVAL, VIJAYAWADA, VIKRAMGADH, VISHAKAPATNAM, WAYANAD. WANKANER, YAMUNOTRI, YERCAUD, YUKSOM. & all over india free delivery. Canopy tent deliverd With best packing & approved with all quality testing like banner printing quality testing pipe quality testing printtrade provide one free carry bags in every canopy tent. Printtrade india best wholesaler of Adevertising tent & canopy tent. canopy is Best idea for brand promotions printtrade makes best quality canopy. our canopy price is best with best quality canopy tents. printtrade serve best rate of canopy. promotional canopy is best idea for brand and product promotion printtrade make promotional canopy with coustom print. Canopy tent always packed in thick Carogated box and dispatch via our logistics partner canopy tent delivered all over India any location. promotional canopy tent is best idea for product promotion.

Printtrade also make canopy and canopies, demo tent For India Bigest Brands Ex. Lic (Life Insurance Corporation of India), Sbi (State Bank of India), Indian Post, Airtel, Idea, Vodafone, Hero, Honda, Suzuki,Yamaha, Aprilia, BMW, Royal Enfield, Jio, Maruti Suzuki, imc etc.We Make Best Quality Canopy For Best impression. printtrade india best manufacturers of canopies and canopy tent we also sell in wholesale and retail. canopy tent mostly use for road side marketing and brand promotion. printtrade canopy tent sale in india.

printtrade make best quality canopy tent. we make also deals plain and printed canopy tent. printed canopy tent make with best art work. plain canopy tent also plain soild red and blue color. in two sizes 4x4x7 & 6x6x7 feet.

We also make costum size canopies in both type plain canopies and printed canopies. our team also cheak all quality test in canopy tent beafore dispatch. canopy packed in thick carogated carogated box and dispatch via our logistics partner canopy tent very demanded product for advertising and marketing use. Canopy tent is best idea for brand promotion and product marketing.

Printtrade also free delivery via fedex canopy tent in major city like jaipur, nagpur, patna, satna, surat and all over india.

#canopy tent#pop up canopy#canopy tents#flex canopies#printed canopy tent#promotional canopies#promotional canopy tents

0 notes

Video

youtube

IIBM ongoing exam answer sheets provided whatsapp 91 9924764558

INDUSTRIAL RELATIONS AND LABOUR LAWS IIBM ONGOING EXAM ANSWER SHEETS PROVIDED WHATSAPP 91 9924764558

CONTACT:

DR. PRASANTH BE BBA MBA PH.D. MOBILE / WHATSAPP: +91 9924764558 OR +91 9447965521 EMAIL: [email protected] WEBSITE: www.casestudyandprojectreports.com

Industrial Relations & Labour Laws Section A: Objective Type & Short Questions (30 marks) This section consists of Multiple choices a nd Short Notes type questions. Answer all the questions. Part one carries 1 mark each & Part Two carries 5 marks each. Part One: Multiple choices: 1. Workers participation in management decision-making is a highly________ concept. a. Duplex b. Complex c. Simplex d. None of the above 2. The origin of industrial relations in India can be traced in to the: a. Second world war b. First world war c. Third world war d. British rule 3. Under the payment of wages act, 1936, no wages period shall exceed for one. a. Four month b. Two month c. One month d. None of the above 4. Collective bargaining is the process of bargaining between________ a. employees & employer b. workers & workers c. employees & employees d. None of the above 5. Layoff can also cause a ________ a. Retirement b. Grievance c. Conflict d. None of the above 6. As per payment of bonus act, accounting year for a company is ________ a. One year b. Period for which balance sheet is prepared c. Period for which cash flow is prepared 5 IIBM Institute of Business Management Examination Paper of Human Resource Management d. Period for which profit and loss account is prepared 7. WPM stands for_________ a. Workers’ Participation in Management b. Workers’ Payment of Management c. Well fare Payment of Management d. None of the above 8. Causes of Industrial disputes are_________ a. Economic causes b. Political causes c. Technological causes d. All of the above 9. Trade unions of workers in an organization formed by workers to protect their________ a. Working condition b. Interest c. Both a & b d. None of the above 10. A grievance causes in any organization are_________ a. Work environment b. Supervision c. Work group d. All of the above Part two: 1. What are the steps of Grievances handling Process? Explain it. 2. What are the objectives of ‘Industrial Relations’? 3. Briefly explain the term ‘evolution of Trade unions in India’. 4. Explain the ‘workers’ participation in management’. END OF SECTION A Section B: Case lets (40 marks) This section consists of Caselets. Answer all the questions. Each Caselet carries 20 marks. Detailed information should form the part of your answer (Word limit 150 to 200 words). Case let 1 6 IIBM Institute of Business Management Examination Paper of Human Resource Management Star Automobiles Ltd. Pimpary is in the field of manufacturing of two wheelers. They manufacture and market mopeds. These are available in the brand names ‘arrow’ and ‘double arrow’ where ‘arrow’ is their traditional product and ‘double arrow’ is the improved version. The company was started about 20 yrs ago. Their product ‘arrow’ enjoys a reasonably good reputation and they were comfortable in the market. However, with the entry of the new generation of fuel-efficient mopeds the company started loosing its market. They immediately started developing the improved ‘double arrow’ but by the time they came out with this new model the competitors had already strengthened their position in the market. The arrow model was still acceptable by a segment of the market as it was cheapest vehicle. ‘Double arrow’ is new generation vehicle. It was costlier than Jet but its performance was much superior. It is compared favorably with the competitors’ products; however it was yet to gain a foot hold in the market. The company had to refurbish the marketing activities in order to get back their market share. They employed young sales engineer to launch a strong sales drive. Mr. Ramesh Tiwari, Btech and a diploma holder in marketing got selected and was put on the job. Mr. Ramesh Tiwari started well in his new job. He was given a territory to contact the prospective customers’ and to book the orders. The company had introduced a new financial assistance scheme. Under this scheme, buyers were given easy loans. It was particularly advantageous for group booking by employees working in an organization. Mr. Ramesh Tiwari was able to contact people in different organization, arrange for group bookings and facilitate the loans. His performance was good in the first year and in the second year of his service. The company had its own system of rewarding those whose performance happened to be good. They usually arranged a paid holiday trip for the good performer along with his wife. Mr. Ramesh Tiwari was accordingly informed by the marketing manager to go to Chennai with his wife on company expenses. Mr. Ramesh Tiwari asked him as to how much it would cost to the company. The marketing manager calculated and told him that it would cost about 8000/-. He quickly asked him whether he could get that 8000/- in cash instead of the trip as he had better plans. The marketing manager countered this saying that it might not be possible to doso. It was not the trading of the company, however he would check with the personnel manager. After a couple of days, Mr. Tiwari was informed that it would not be possible to give him a cash reward. Mr. Tiwari grudgingly went for the trip and returned. On his return, he was heard complaining to one of his colleagues his little daughter was also along with him. The marketing manager and the personnel manager thought he was a bit too fusy about the money and some of his colleagues also thought so. During the subsequent days Mr. Ramesh Tiwari’s performance was not all that satisfactory this showed his lukewarm attitude towards his job and the subordinates. Questions: 1. Did the personnel manager handle the issue properly? 2. What is your recommendation to avoid such situations in future? Case let 2 In 1950, with the enactment of the Insurance Act, Government of India decided to bring all the insurance companies under one umbrella of the Life Insurance Corporation of India (LIC). Despite the monopoly of LIC, the insurance sector was not doing well. Till 1995, only 12% of the country’s people had insurance cover. The need for exploring the insurance market was felt and consequently the Government of India set up the Malhotra Committee. On the basis of their recommendation, Insurance Development and Regulatory Authority (IRDA) Act was passed in parliament in 2000. This moved allowed the private insurers in the market with the strong foreign partners with 74:26% stakes. XYZMoon life was one of the first three private players getting the license to operate in India in the year 7 IIBM Institute of Business Management Examination Paper of Human Resource Management 2000. XYZ Moon life Insurance was a joint venture between the XYZ Group and Moon Inc. of US. XYZ started off its operations in 1965, providing finance for industrial development and since then it had diversified in to housing finance, consumer finance, mutual funds and now its latest venture was Life Insurance. Its foreign partner Moon Inc. had its presence in Asia since the past 75 years catering to over 1 million customers across 11Asian countries. Within a span of two years, twelve private players obtained the license from IRDA.IRDA had provided certain base policies like, Endowment Policies, Money back Policies, Retirement Policies, Team Policies, Whole Life Policies, and Health Policies. They were free to customize their products by adding on the riders. In the year 2003, the company becomes one of the market leaders amongst the private players. Till 2003, total market share of private insurers was about 4%, but Moon Life was performing well and had the market share of about 30% of the private insurance business. In June 2002, XYZ Moon Life started its operations at Nagpur with one Sales Manager(SM) and ten Development Officers (DO). The role of a DO was to recruit the agents and sell a career to those who have an inclination towards insurance and could work either on part time or full time basis. They were very specific in recruiting the agents, because their contribution directly reflected their performance. All DOs faced three challenges such as Case Rate (number of policies), case size (amount of premium), and recruitment of advisors by natural market, personal observations, nominators, and centre of influence. Incentive of offered by the company to development officers and agents were based on their performance, which resulted in to internal competition and finally converted into rivalry. In August 2002, a branch manager joined along with one more sales manager and ten development officers. Initially, the branch was performing well and was able to build their image in the local market. As the industry was dynamic in nature, there were frequent opportunities bubbling in the market. In order to capitalize the outside opportunities, one sales manager left the organization in January 2003. As the sales manager was a real performer, he was able to convince all the good performers at XYZ Moon Life Insurance to join the new company. In april 2004, the company faceda grave problem, when the Branch Manager left the organization for greener pastures. To fill the position, in May 2004, the company appointed a new branch manager, Shashank Malik, and a sales manager, Rohit pandey. The branch manager in his early mthirties had an experience of sales and training of about 12 years and was looking after two branches i.e., Nagpur and Nasik. Malik was given one Assistant Manager and 25 Development Officers. Out of that, ten were reporting to him. He was given the responsibility of handling all the operations and the authority to make all the decisions, while informing the Branch Manager. Malik opined that the insurance industry is a sunrise industry where manpower plays an important role as the business is based on relationship. He wanted to encourage one-to-one interaction, transparency and discipline in his organization. While managing his team, he wanted his co-workers to analyze themselves i.e., to understand their own strengths and weaknesses. He wanted them to be result-oriented and was willing to extend his full support. Finally, he wanted to introduce weekly analysis in his game plan along with inflow of new blood in his organization. Using his vast experience, he began informal interactions among the employees, by organizing outings and parties, to inculcate the feelings of friendliness and belonging. He wanted to increase the commitment level and integrity of his young dynamic team by facilitating proper channelization of their energy. He believed that proper training could give his team a proper understanding of the business and the dynamics of insurance industry. Questions: 1. If you were Malik, what strategies would you adopt to solve the problem? 2. With high employee turnover in insurance industry, how can the company retain a person like Malik? END F SECTION B 8 IIBM Institute of Business Management Examination Paper of Human Resource Management Section C: Applied Theory (30 marks) This section consists o f Applied Theory Questions. Answer all the questions. Each question carries 15 marks. Detailed information should form the part of your answer (Word limit 200 to 250 words). 1. What is the Collective Bargaining? Explain the Characteristics and types of Collective Bargaining and write down the different levels of Collective Bargaining? 2. Discuss the wage policy in India with reference to detailed evaluation of the act.

0 notes

Text

Jabalpur Branch Office 401 Jeevan Prakash, Nagpur Road Madan Mahal Jablapur 482001

0 notes

Text

Jabalpur Branch Office 37A BO-3, Jabalpur NAGPUR ROAD, MADAN MAHAL JABALPUR 482001

0 notes

Text

How to choose best Mutual Funds scheme?

How simple is it selecting the best funds from approximately 40 mutual funds and hundreds of schemes? It’s certainly not simple.

Suppose we’re choosing a few. Is those funds going to be the best? Not Sure.

So how do we select the best funds in this challenging and uncertain task?

Therefore, don’t go to the Best. Select the right thing for you.

Let’s see an instance for a better understanding of things. Consider that you went for Apparels shopping. You’re not just choosing what looks great. First, you’re looking for what kind of clothes you need. Whether formal or casual. You then choose your size. Then you see the one that looks best. The question then is whether or not the pricing is justified. Finally, you’re going for the one that’s right for you. This is how you’re shopping for the correct thing for you.

The choice of the fund should be based on your goals, time horizon, risk appetite that informs you what asset allocation and categories to look for and then select the one that best fits the categories set.

Investment Objectives:

It describes the objective you are investing for. It gives an idea whether you are looking for accumulation of wealth over-diversification or maximization of wealth over the long term. It would offer you an idea of how much you should invest in achieving your objectives and how much you can spend on the basis of your expenditures and other commitments.

Time Horizon:

This is related to your goal. Your horizon of time indicates which approach suits you best, whether conservative, moderate or aggressive. You can select the percentage of debt in your portfolio based on your time horizon, for e.g. If your time frame is 3-4 years, you can earn full debt in the category of low maturity. You can add Equity to your portfolio as you increase the time horizon.

Risk-Appetite:

Whether you’re fine with less liquidity and suffering a short-term loss for long-term advantages or loss of capital in moments of volatility, this is where you judge yourself that scares you. Then you can decide which of the correct Debt-Equity combination is intended for you.

Now, once you understand how much debt and equity you need and which categories you need to include in the portfolio, you are starting to look for the resources in those categories. This will help you to pursue a focused approach and avoid diversification.

So next time you don’t need to look for those 100s of funds to invest more or monitor you know you’re modeling your key portfolio and you’re following it until you think it’s time to go for some other plan.

To know more about Mutual Fund, you can visit our website

http://www.jayantharde.com

or contact our representative at

+91 712 2282029

or meet us at

51, Gurukripa, Old Sneha Nagar, Wardha Road, Nagpur – 440015

.

#insurance agent#insurance agent in nagpur#jayant harde#lic agent in nagpur#lic jeevan anand#life insurance#mutual funds#sip investment#sip investment tips

1 note

·

View note

Text

Married Women's Property Act - Implications on Life Insurance Policies

The Married Women's Property (MWP) Act was enacted with a view to protect the properties of women against the creditors.

Under MWP Act all the properties that belong to the women gets insulated and protected from all the other court attachments or any income tax department attachments that the husband has run up. Let's take an example of a business family; the family could be a trader or a manufacturer or any other business. In due course of business there are some credit limits or there are bank loans, which have been taken by the business. The bank secures these credit limits against the assets of the business and also takes a personal guarantee of the owner of the business which could be the husband or the family.

In case of the untimely death of the husband the bank starts recovering their loans and in the process they liquidate the assets of the business and also they attach the properties that belong to the guarantor, which in this case is the husband.

In order to protect the family; the wife and the children, the life insurance policies that the husband takes; he should make sure that these policies at the time of taking the policies should be taken under the MWP Act because life insurance policies are also entitled to be attached, which means that the claims that paid out on the death of the husband, goes to the bank and not to the surviving members.

The process of taking the policy under MWP is very simple. At the time of making an application one has to fill in MWP addendum. This form is also provided by life insurance companies. In the form one has to fill in the details of his wife and children, whoever he wishes to make beneficiaries in the policy. In case of death, the policy proceeds do not go to anybody else other than the beneficiary as named by you in the policy. There is no attachment because the policy does not belong to the husband.

We talk about life insurance as means of financial protection. What is the sense if the money does not go to the family and gets attached for some other reasons? Let me make a point here, all kind of life insurance policies whether online term policies or any other form of life insurance policies are entitled to be issued under MWP Act and one should definitely make a point that he issues a policy under MWP Act to protect his family.

*How To Protect Insurance Claims From Creditors*

From time immemorial, our society has put the onus of being the primary bread winner for the family on men. Even with the rising women workforce where women are building a career for themselves, men are still considered to be the financial anchor for a lot of families for various reasons. Hence comes the importance of life insurance policies wherein it acts as a Plan B for the family’s financial future.

That is what motivates a lot of men to often invest in life insurance policies so that in case of their premature death the policy benefit would provide financial support to their family. But is this financial support guaranteed? What if there are creditors waiting to get their accounts settled? Can the husband ensure that the policy benefits would be used by his wife and/or children only?

Though it is a bitter pill to swallow, the truth is that the proceeds of a life insurance policy can be claimed by creditors who are owed money. In fact, the proceeds can be claimed by any individual who can prove a legal right of ownership of the money. If that happens, the wife and/or kids would not get the benefit and the whole purpose for which the husband had bought the policy would be wasted. How can you prevent it?

There is a Married Women’s Property clause under life insurance policies which, if selected, would ensure that the proceeds from a life insurance policy would go to the wife and/or child ONLY and cannot be attached for any other purpose.

Let’s understand what the clause is all about.

*The Married Women’s Property (MWP) Act, 1874*

The Married Women’s Property Act was passed in the year 1874 with a view to safeguard the rights of married women and children. Section 6 of the Act states that if a married man buys a life insurance policy on his life and wants the policy’s benefits to be utilised by his wife and/or children, the policy would be considered a trust. The policy cannot be controlled by the man himself, his creditors, court attachments or anyone. The policy shall be deemed to benefit only his wife and/or children.

As per the rulings of the Act, if your client chooses the MWP clause in the life insurance policy that he opts for, the policy benefits would be earmarked for his wife and/or children.

*Must-know facts about MWP in life insurance policies:*

Here are some things which you should know about MWP in the context of life insurance policies.

The beneficiary of the policy can be any of the following.

Only the wife

Only the children

The wife and children jointly. (In this case, the husband can specify the percentage of benefit which should be paid to each beneficiary. He can also specify the benefit to be paid jointly to all or to the survivors).

Nomination is not required in a policy which has a MWP clause. In case of death, the policy benefit is paid to the trustee who acts as a custodian of the money for the beneficiaries (if the trustee and beneficiary are different).

Divorced or widowed men can also opt for this clause. In such cases, the beneficiary would be the children.

In case of Hindu men, adopted children can also be made beneficiaries.

In case of Muslims, the beneficiaries are called ‘Persona Designata’. The beneficiaries are required to be named when the policy is being bought. Moreover, the beneficiaries should exist at the time the policy is being bought. If there are two or more beneficiaries, the share of each beneficiary should be expressly stated.

The policy should be bought by a married man on his own life.

Every policy is treated as a separate trust and it should have a trustee. The wife of the individual or his child, who should be more than 18 years old, should be appointed as a trustee.

Multiple trustees can also be appointed.

The consent of the trustee to act as such is required. This consent should be attached to the life insurance policy document.

If no trustee is appointed, a competent Government Authority would appoint Official Trustees.

The trustee, once appointed, can be changed any time during the term of the policy.

The life insurance policy under which the MWP clause has been opted cannot be surrendered before the completion of the tenure. The husband cannot even assign the policy to someone else’s name.

The MWP clause can be chosen ONLY at the time of buying the policy and not later.

*Most Important Benefit of MWP policies*

By choosing MWP clause in a life insurance policy, a married man can ensure the policy proceeds to reach his wife and/or children for their financial needs. The policy, therefore, becomes a financial cushion for the man’s family. Moreover, no additional charge is levied when the MWP clause is chosen. It is a simple addition to the policy’s terms and conditions which ensures that a man’s family is taken care of even in his absence.

Most importantly MWP is an important clause that can be attached to a life insurance policy if your client has a big loan, so that in case the client dies before the loan is repaid, the proceeds are not attached to the creditors.

So, if your clients have existing life insurance policies check whether they have selected the MWP clause or not. If not, advise them to buy a separate policy and select the clause. Over and above working hard to make sure that their family has the financial means to survive, choosing the MWP clause ensures the financial security of the family even after the death of the husband. So, understand the MWP clause and educate your clients about its benefits so that they get a better financial future.

*FAQs*

Q: Is the woman's stridhan only protected what she inherits from her father's family or is her own salary and investments and earnings are also protected and second, if her husband were to default on his home loan then the wife's salary cannot be attached when the house is foreclosed or a default is declared?

A: The answer to your first question, we are talking about a loan taken on the business, which the husband runs and he has given his personal guarantee towards those loans. So, all the attachments that we refer to are restricted only to the business and the assets of the husband. So, in the first part of your question, the income that the wife is generating, if she has not given her personal guarantee and the stridhan that she inherited from her parents do not get attached in this case.

The second part of your question is, if wife is not a co-borrower in the loan, if she has not given her personal guarantees then her property, her assets, her incomes cannot be attached, just by the virtue of her being the wife of the person who has taken the loan.

Q: Is the converse true, if a wife were to defaults, the husband's property is safe?

A: Not really. The property goes; let's take the example of a housing loan. The house is going to be attached by the bank and they can ask the wife to vacate and vise versa. The idea behind MWP Act is that the entitlement of life insurance proceeds is for the protection of the family and in this case the bank attaches it. So, under MWP Act, they cannot do that.

Q: What are the disadvantages of this policy because it doesn't see too much acceptance or the sales etc are not too good according to what I have read in reports? Are there any disadvantages?

A: The reason why this is not popular because people are not aware that this kind of a facility is available.

Q: Can I get an addendum to an existing life insurance policy?

A: No. The MWP addendum can be attached only at the time of taking the policy. However, to answer the question, if one still wants to protect his family against this then he can do an absolute assignment of the policy even today; after taking the policy even if he is five-ten years down the policy, he can make an absolute assignment of the policy in favour of his wife. So, it does not anymore belong to him, it is not his property and so it cannot be attached.

To know more about Married Women's Property Act, kindly contact Jayant Harde on 9373284136 or +91 7122282029. You can also visit our website: www.jayantharde.com

0 notes

Text

How to turbocharge your Retirement kitty

The standard retirement advice is save as much as you can, right from the start. But there is another aspect that you must look into – your lifestyle. Here’s a brief run down on both these aspects.

Always look to increase the quantum of your savings.

We talk of compounding, but there is an unfortunate reality which is the mathematics of it. If you had a couple of thousand rupees and you earn an extra 1% of returns, it may sound great, but the extra 1% of return on a few thousand rupees won’t get you far. It doesn't have a big impact because the account balance just isn't as big yet. But that extra 1% return on Rs 10 lakh is much more impressive.

As you get closer and closer to retirement, that equation starts to flip around. Even a thousand or so every month towards getting a big nest egg doesn't really actually move the needle very much anymore. But if you've got crore in savings already, a 1% change in your returns could be a year or two worth of savings, all at once.

*Whether you save and create the savings habit is overwhelmingly, dominatingly the biggest factor that drives the outcome.*

There's this kind of balancing shift; it's mostly about whether you save at the beginning but how you invest starts to really, really matter by the end. Those that allow their lifestyle to creep higher over time, means that they are saving a little bit less and because their spending is moving up as their income moves up. And, they now need more in order to retire because the lifestyle has gotten more expensive. This means they've got further to go on this journey.

You say, I'm making more money. I'm going to upgrade a little. I'm going to get a nicer car. The expenses start creeping up. Once it becomes a part of our lifestyle, it's hard to go backward. I used to mow the lawn, but now I got a little more money. So, I'm going to pay someone to mow my lawn. Once I pay someone to mow my lawn, I rarely go back and mow lawn again. We do it with cars. We do it with houses. We do it with a lot of kind of lifestyle maintenance oriented things.

When you save, take into account the cost of lifestyle.

We routinely see situations where people who are saving are further from retirement in their late 30s and early 40s than they were on day one. Because their lifestyle increased at a much faster rate than their income and savings.

All those little items individually may not really be budget breakers. But you start adding here and there regularly and suddenly the cost your lifestyle is much higher than it was. Consequently, the money you need to retire now is much more than it was because you got to replace this much heavier lifestyle that you sort of unwillingly adopted or crept into.

Higher savings increases retirement preparedness and reduces retirement need.

A person makes Rs. 10 lakhs/year at age 35, take home about Rs. 8.00 lakhs after taxes and deductions, starts saving for retirement now. His income grows at 3% per annum. If he starts saving 15% of his income, then by age 60, he can save over Rs. 3 crores plus compounded interest thereon.

The takeaway:

Save aggressively. The more aggressively you save, the less you spend since there is only so much money that comes in. The more aggressively you save, the less you spend, the less goes in upgrading your lifestyle.

There is a double-edged impact when you save more. People who are the best at savings also are the ones who need the least to retire.

To know more about Retirement advice, you can visit our website http://www.jayantharde.com or contact our representative at +91 712 2282029 or meet us at 51, Gurukripa, Old Sneha Nagar, Wardha Road, Nagpur – 440015.

Source: https://hardejayant.blogspot.com/2021/02/how-to-turbocharge-your-retirement-kitty.html

0 notes

Text

Planning Retirement - A practical approach and road map

*Four Wrong Retirement Assumptions*

Most of us work hard so that we can retire in a financially comfortable position. But interestingly, once we retire, it requires a tremendous shift in mindset, to move from aggressive saving, to eventually shift from savings to spending. Having said that, the entire exercise is based on a number of assumptions. Let's look at a few common ones.

*Assumption 1: Retirement is a destination*.: All along retirement has been viewed as a destination, as an end-of-the-road milestone. Nothing could be farther from the truth. The road could be long and winding as the journey keeps unfolding. Rather than a destination, it should be viewed as a transition. We should realize that the concept of retirement is undergoing a fundamental change. Seldom do people just stop work and start drawing a pension. Earlier, it was the case of being shoved off the demographic cliff and being forced to leave the company, saying goodbye to the 9-to-5 lifestyle. Today, the concept of retirement is being reconfigured, and it could be a phased retirement.

It could mean just slowing down and working 3 days a week, or, working 5 days a week but just for a few hours each day. It could be opting for just project-based work or going off the salaried payroll to that of a consultant. It could also be the conventional “giving up work” altogether to pursue your hobbies. Neither does it have to be at a particular age. You could be retiring way before the set mark, out of choice. Or may be, a golden handshake was offered, and you were asked to move on.

*Point to note:* Retirement is now a much looser definition. There is no right or wrong. There is no one-size-fits-all. But how you choose to interpret retirement is what will form the basis of your retirement plan. Have clarity on your plan so you can build on it.

*Assumption 2: I won't live for long.* Don’t be conservative when estimating your retirement period. We can’t know how long we’ll live. So as a foundation, use life expectancies. The expected length of your retirement should definitely be longer than your life expectancy, since you want a cushion should you live longer than average. So for a 65-year-old today in average health, keep a period of 25 years in mind. For a couple, both age 65 and in average health, I think the minimum period should be 30 years. If you are much younger, say age 25, you need to really pad up on life expectancy number because by the time you eventually retire, life expectancies will be even higher (something actuaries call expected improvement in mortality rates).

According to the latest Sample Registration Survey (SRS) of India, overall life expectancy at birth for women is 70.4 years and 67.8 years for men. But do remember, life expectancies are just an average. If you have not suffered from malnutrition (as the lower economic classes might) and are in excellent health, chances are you will live longer. Look at your family history. How long did your parents live? Be practical.

*Point to note*: Do remember, that if your money has to last for decades, you cannot have a retirement kitty that has zero exposure to equity. Your money has to grow to provide you with a kitty, and growth of the kitty during your retirement phase.

*Assumption 3: Retirement is stable*. Your entire “retirement phase” won’t be one dimensional. It will be packed with events and transitions into different life phases. At the start of your retirement, you may travel a lot. During another phase, you may deal with numerous health issues. There are six descriptive phases of retirement that represent a transitional process individuals go through when they permanently exit the workforce. While they do not apply to everyone, they do convey the message that to view retirement as one long life phase is rather naïve. It could be a short or very long stage, depending on the age you actually retire and your life span, but a multi-phase journey depending on your health, the health of your spouse, death in the family, the state of your finances, and so on and so forth.

*Point to note*: It would be very wise to avail of the services of a financial planner. Your retirement could easily last for a few decades, your money must last too. Also, you will have to figure out the withdrawal rate during the initial phase so that you have ample funds to keep you going. For instance, you cannot overdo the travel at the start and deplete your kitty.

*Assumption 4: My spouse will always manage the finances.* If you are married, be prepared for the eventuality that you might not be so for your entire life. Don’t plan on your spouse always being around. Unless you and your spouse pass away at the same time (which you don’t need to be told is very highly unlikely), one of you will experience being single at some point.

*Point to note*: Ensure that Wills are drawn up and nominees are in place. Also, don’t leave all the money management to one spouse; both must be active or at least very aware of the financial situation.

Having said that how do you go about?

*Saving For Retirement*

You should absolutely save up a nest egg for your retirement. But with all the downsides to relying on savings for your retirement, you need to take the passive income approach as well.

Your first step is to figure out how much money you need to have in passive income—money you receive REGULARLY and AUTOMATICALLY whether you’re working or not.

I will take you through each step of the process, and leave you with a space to add in your own personal costs. When you get to the bottom, the sheet will have calculated your unique financial freedom number.

You’ll need to know exactly how much is needed for you to keep a roof over your head.

If you have a mortgage, put your monthly EMI Rs............

Associated property taxes Rs.........

Repairs expenses for your house, if you own one Rs..........

If in a rented house downsized to an apartment in the future, your monthly rent payment Rs...........

Rental or homeowners insurance cost Rs.......

Utility expenses (electricity, gas, sewer, water, and trash) Rs............

Any subscription services, such as cable TV, phone services, and/or internet Rs.......

Home maintenance expenses (HOA dues, gardening service, housekeeping, etc) Rs...........

Monthly food budget, along with any monthly purchases for clothing, personal care items, and toiletries Rs........

If you have any left-over loans or credit cards, those won’t go away post retirement. EMIs on loan and credit payments Rs.........

Supporting any family member, add the monthly cost here Rs..........

While you can’t plan for any surprise medical expenses, you can plan around the ones you already have. Put the monthly cost of your medications, health insurance payments, and any other health supplies or supplements you take, along with your life insurance payments, if any, and the cost of any regular medical appointments Rs...........

To know more about Planning Retirement, kindly contact Jayant Harde on 9373284136 or +91 7122282029. You can also visit our website: www.jayantharde.com

Source: https://hardejayant.blogspot.com/2020/11/planning-retirement-practical-approach.html

#health insurance payments#retirement planning#financial planner#life insurance payments#insurance cost#Lic Agent In Nagpur#jayant harde

0 notes

Text

Valuable tips for Effective Selling

*1. LEAD CALLS*

Don’t call someone more than twice continuously. If he does not respond, it simply means that he is doing something more important.

*2. PUNCTUALITY*

Let us understand that we are into Life Insurance business where competition is highest. PUNCTUALITY plays a very important role in image building which is essential ingredient of this business. If you have made a commitment to a prospect, honour it at any cost. For certain unavoidable reason if you are unable to honour the commitment, inform the prospect well in advance. Don't keep the prospect waiting.

*3. MANNERISM*

PERSONALITY SPEAKS ABOUT THE STYLES WE DISPLAY, BUT CHARACTER IS THE SUBSTANCE WITHIN. IN THE LONG RUN SUBSTANCE WILL ALWAYS OUTLAST STYLE.

*4. CAUSING EMBARASSMENT*

Don’t ask questions which will embarass the prospect. Avoid questions which are personal in nature like his marital status, owning a house etc. "why are you not married? Why don’t you have your own house? etc. For god’s sake these are not your problems.

*5. BEHAVIOR*

Success will elude you if your behaviour is erratic. Behavioural Science holds a very important function in your day-to-day interaction with clients. Give respect and gain respect.

*6. RECIPROCATION*

Reciprocation is a very important factor in selling. Remember, a client is not obliged to you. Rather we are obliged to him for giving us an opportunity to serve him. So reciprocate your obligation to him by sending New Year and Festival greetings. Call him up and personally wish him on his birth day. Anniversary etc and through him wish his spouse and off-springs on their birthdays. Give small gifts during festivals. Such actions will go a long way in building a personal relationship with the client.

*7. RESPECT*

Never enter into political squabbling especially when you engage in political discussion. Respect different political opinions. Remember it is wiser to lose an argument and gain a friend rather than going the other way.

*8. INTERRUPTION*

Never interrupt people talking. If you have a point, raise your finger and wait for your turn.

*9. HUMOUR*

To be humorous while talking to clients enhances your stature so long as it doesn't hurt the feelings of the person to whom you are talking to. Be careful on this.

*10. COURTESY*:

Thanking someone for his help does not make you small. Use it at every occasion.

*11. HUMANITY*

Don't deprecate anyone in public. If you've to, do it in private. Applaud in public for the good work done by someone.

*12. MODESTY*

Never comment on someone's physique. Always say, *“You look fantastic.”*

*13. PRIVACY*

Never encroach others' privacy by meddling their gadgets like mobile phone. You never know what’s stored within.

*14. INTERFERENCE*

If a colleague tells you that he has a medical appointment, don’t ask further details. Just say "hope everything is fine". If he wishes, he will come on his own to detail it further.

*15. GIVE RESPECT TO GAIN RESPECT*

Maintain parity while dealing with people. Treat everyone equally, be he is in highest echeleon or lowest in cadre. Nobody is impressed at how rudely you can treat someone below you but people will notice if you treat them with respect.

*16. ATTENTIVENESS*

If someone is in conversation with you, be attentive. Don’t be indifferent by tapping your phone. Understand that *if you want to be listened you should learn to be a good listener too.*

*17. FREE ADVICE*

Never give advice until you’re asked.

*18. POACHING*

When meeting someone after a long time, unless he wants to talk about it, don’t ask him his age, income and present status.

*19. INQUISITIVENESS*

Don’t be too inquisitive. Mind your own business unless anything involves you directly — just stay out of it.

*20. EYE CONTACT*

Take off your sunglasses if you are talking to anyone in the street. It is a sign of respect and more so eye contact is as important as your speech.

To know more about Valuable tips for Effective Selling, kindly contact Jayant Harde on 9373284136 or +91 7122282029. You can also visit our website: www.jayantharde.com

Source: https://hardejayant.blogspot.com/2020/10/valuable-tips-for-effective-selling.html

0 notes

Text

What are the benefits of LIC’s Jeevan Tarun Plan?

LIC’s JEEVAN TARUN is a participating, unlinked, restricted premium payment plan that offers an attractive combination of protection and saving features for children. This plan is specifically designed to meet growing children’s educational and other needs through annual Survival Benefit payments from ages 20 to 24 years and Maturity Benefit at age 25. It is a flexible plan in which the proposer can select the proportion of Survival Benefits to be used during the policy period as per the following four options at the proposal stage:

Benefits available under an in-force policy:

Death Benefit:

On death during the policy term (before the commencement of risk):

In the event of the Life Assured ‘s death, premium / s return paid, except taxes, extra premium, and rider premium, if any, shall be payable without interest.

On death during the policy term (after the commencement of risk):

Death Benefit, defined as the sum of “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable in case of death during the policy term provided all due premiums have been paid. Where “Sum Assured on Death” is defined as Higher of 10 times of annualized premium or Absolute amount Assured to be paid on Death i.e. 125% Sum Assured.

This Death Benefit is not less than 105% of the total premiums paid as at the date of death.

The premiums -mentioned rates exclude, where any, taxes, extra premium, and rider premium.

Survival benefit :

Survival benefit provides a fixed percentage of the assured sum that can be chosen during the proposal stage. That amount will be payable on each of the next four policy anniversaries at the end of 20 years and thereafter.

Maturity benefit :

If the life assured survives the term of the policy a fixed percentage of the assured sum is paid upon maturity. The fixed percentage of the various options is explained in the following table.

Participation in Profits benefit :

This scheme is entitled to share incorporation profits and receive Basic Reversion Bonuses or other ultimate additional incentives when a claim is made either by death or maturity given the program is in place.

To know more about life Insurance, you can visit our website https://www.jayantharde.com or contact our representative at +91 712 2282029 or meet us at 51, Gurukripa, Old Sneha Nagar, Wardha Road, Nagpur – 440015.

Source: https://jayantharde.wordpress.com/2020/06/16/what-are-the-benefits-of-lics-jeevan-tarun-plan/

#lic jeevan tarun plan#death benefits#maturity benefits#survival benefits#lic agent in nagpur#jayant harde#life insurance plan

0 notes