#Lawsuit Financing Market forecast

Explore tagged Tumblr posts

Text

Lawsuit Financing Market to Witness Revolutionary Growth by 2027 | Vannin Capital, Pravati Capital, Burford Capital, Fast Funds

Advance Market Analytics published a new research publication on “Global Lawsuit Financing Market Insights, to 2027” with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Lawsuit Financing market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

Burford Capital Ltd. (United States), Pravati Capital LLC (United States), Harbour Litigation Funding Limited (United Kingdom), Global Funding Solutions LLC (United States), Legalist, Inc. (United States), Lawsuit Financial LLC. (United States), LawCash (United States), Law Finance Group LLC (United States), Vannin Capital PCC (United Kingdom), Fast Funds (United States),

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/124922-global-lawsuit-financing-market#utm_source=DigitalJournalVinay

Scope of the Report of Lawsuit Financing

Lawsuit funding or loan is also called pre settlement loan. It is used by the person who needs to carry on the ongoing lawsuit but requires cash. It is most commonly used in personal injury lawsuit and many other types of cases. After applying for loan, the company evaluates the settlement and then offers money accordingly. Moreover, Lawsuit financing eases the burden and decreases the pressure to settle early and cheap.

On 27th January 2020, GLS capital which is a litigation finance firm has launched with $345 million capital commitments to invest in lawsuits.

The Global Lawsuit Financing Market segments and Market Data Break Down are illuminated below:

by Type (Consumer Litigation Funding, Commercial Litigation Funding), Case Type (Class Action Lawsuit Funding, Settlement Funding, Labor Lawsuit Funding, Workers’ Compensation, Medical Malpractice Lawsuit Funding, Personal Injury Lawsuit Funding), End Users (Individuals, Attorneys, Businesses)

Market Opportunities:

Rising awareness among the individuals about lawsuit financing

Market Drivers:

Advantages of Law Dispute Financing is Driving the Market Growth

Market Trend:

What can be explored with the Lawsuit Financing Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Lawsuit Financing Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Lawsuit Financing

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Lawsuit Financing Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/124922-global-lawsuit-financing-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Lawsuit Financing Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Lawsuit Financing market

Chapter 2: Exclusive Summary – the basic information of the Lawsuit Financing Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Lawsuit Financing

Chapter 4: Presenting the Lawsuit Financing Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Lawsuit Financing market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Lawsuit Financing Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=124922#utm_source=DigitalJournalVinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#Lawsuit Financing market analysis#Lawsuit Financing Market forecast#Lawsuit Financing Market growth#Lawsuit Financing Market Opportunity#Lawsuit Financing Market share#Lawsuit Financing Market trends

0 notes

Text

Franchise Finance Fails: How to Avoid Costly Mistakes

Financial Planning Pitfalls for Franchisors: Avoiding Common Mistakes

Franchisors are integral to the franchise ecosystem, with financial planning being a key aspect of managing a successful franchise. Nevertheless, many franchisors encounter financial errors that can threaten their business's longevity. This article explores typical financial planning mistakes made by franchisors, offers practical advice for creating a robust financial strategy, and provides tips on avoiding budgeting pitfalls within the franchise sector. By grasping these concepts, franchisors can sidestep common setbacks and cultivate a prosperous franchise network.

Critical Financial Planning Errors

An all-too-common mistake franchisors make is the absence of a detailed financial plan. For instance, insufficient budgeting for marketing and advertising often forces franchisors to find funds in other vital areas, leading to cash flow problems. Picture a franchisor launching a new franchise without factoring in extensive marketing costs; soon, the budget overreach puts operational funds under pressure.

Another major misstep is the excessive dependence on franchise fees as the main revenue source. During downturns, such as the COVID-19 pandemic, numerous franchises struggled as franchise fees declined. Franchisors who rely predominantly on these fees can face significant financial challenges during economic downturns. For example, consider a franchise that relied heavily on initial franchise fees for income—during the pandemic, the abrupt decrease in new franchisees delivered a severe blow.

Franchisors also often fail to maintain adequate cash reserves. Insufficient reserves make the business vulnerable to unexpected expenses. Imagine a franchisor facing a lawsuit but lacking the cash to cover legal fees, or needing funds for new technology investments but finding the accounts empty. Such scenarios can seriously affect the business’s competitiveness and viability.

Establishing a Solid Financial Strategy

Developing a thorough financial plan is essential for franchisors. A robust financial plan should include all projected expenses, expected revenue streams, and cash flow forecasts. Regular review and updates to the plan ensure it remains accurate and adaptable to changing conditions. This proactive stance helps identify any potential financial shortfalls early on.

Diversifying revenue streams is another essential strategy. Franchisors should avoid depending too heavily on franchise fees. Instead, exploring various revenue options such as product sales, licensing agreements, or offering consulting services can provide a more comprehensive income base. By diversifying income streams, franchisors protect the business against downturns affecting any single source of revenue.

Maintaining sufficient cash reserves is like having a financial safety net. Franchisors should allocate enough funds to cover unexpected expenses and downturns. This reserve ensures that the franchise can weather financial emergencies without undue stress. For example, ensuring enough funds are available to cover operating costs for several months without incoming franchise fees can provide crucial financial stability.

Advice on Avoiding Budgeting Pitfalls

Regular review and updates of financial projections are essential for precise budgeting. Doing so allows franchisors to identify potential issues before they escalate. Consider a franchisor who routinely updates their financial projections; they can swiftly spot revenue shortfalls and adjust their strategy accordingly.

Consulting with financial experts can offer invaluable insights. Accountants, financial advisors, and other financial professionals can provide guidance tailored to the franchise's specific needs and challenges. Their expertise can assist franchisors in making informed decisions, ensuring the business remains on solid financial ground.

Monitoring industry trends keeps franchisors ahead of potential changes affecting revenue streams or expenses. Staying informed about market shifts allows franchisors to adjust their financial strategies proactively. For instance, if new regulations are expected to increase operational costs, a franchisor tracking industry trends can prepare ahead.

The finance and franchise sectors have extensively discussed the importance of sidestepping financial planning mistakes. For instance, an article in the Franchise Times emphasized the need for thorough financial plans and maintaining cash reserves. Similarly, a Forbes publication highlighted the risks of over-reliance on franchise fees and the benefits of diversifying revenue streams.

Running a successful franchise requires strategic financial planning. By avoiding common mistakes such as neglecting comprehensive planning, overly relying on franchise fees, and lacking sufficient cash reserves, franchisors can build a stable and successful business. Implementing a detailed financial plan, diversifying revenue streams, and maintaining cash reserves ensure long-term franchise success. Regular updates of financial projections, consulting with experts, and staying informed about industry trends further strengthen the franchise's financial health.

#franchisefinance #financialplanning #franchisetips #businessstrategy #franchisegrowth

Optimize your franchise financial planning. Book a call with me: https://thefranchiseadvisor.com

0 notes

Text

FRANKFURT (Reuters) - Deutsche Bank AG posted its first loss in four years in the second quarter after setting aside 1.3 billion euros ($1.41 billion) as provisions for a protracted lawsuit by investors over its acquisition of Postbank.

The loss for Germany’s largest bank came after 15 straight quarters of profit, dealing a setback to its turnaround plans under Chief Executive Officer Christian Sewing.

The bank’s net loss attributable to shareholders for the quarter was 143 million euros. That compared with a profit of 763 million euros a year earlier and was better than analysts’ expectations for a loss of around 280 million euros.

The bank also raised its full-year credit loss provision forecast and its finance chief told Bloomberg TV it would not conduct a second share buyback this year.

Still, Deutsche Bank executives sought to explain that the quarter’s results were an anomaly and that the company was on track to meet its targets.

In a memo to staff, Sewing wrote that the loss was “entirely due to legal provisions.”

He said "our operational strength is clear" and the bank will achieve its goals.

The bank's quarterly earnings are part of a flurry of reports from Europe's biggest banks, with investors watching whether gains from rising interest rates have lost steam and whether political turmoil in France, Britain and the United States will weigh on sentiment.

Deutsche Bank's legal problems surround the modest Postbank, which has millions of customers and is rooted in the country's postal system, which Deutsche Bank began acquiring during the 2008 global financial crisis.

With the acquisition, Deutsche Bank hoped to increase its footprint in Germany and secure a steady revenue stream after years of rapid international expansion.

Instead, Postbank has morphed into a source of consumer complaints, regulatory scrutiny, labor disputes and long and expensive litigation.

The lawsuits, which claim Deutsche Bank underpaid for its acquisition of Postbank, have been working their way through various courts for years.

Deutsche Bank said in April that it still strongly contests the allegations but has decided to set aside 1.3 billion euros for the cases. The unexpected move caught investors off guard and sent its shares down 9 percent.

The results come as Deutsche Bank's home market remains weak. This week, Germany's central bank warned that the economy is growing slower than expected and hopes for an industrial recovery have faded.

Meanwhile, regulators warned that German banks' profit outlook will be less optimistic in 2024 as they grapple with a real estate crisis and loans go bad.

The bank is also trying to cut costs to meet its 2025 targets, but most analysts think that will be difficult to achieve.

Deutsche Bank's biggest revenue generator in the second quarter was its massive investment bank, which has operations from Sydney to New York. Revenue rose 10% from a year earlier, in line with expectations, but lagged behind the 12% increase reported by BNP Paribas (OTC: BNPQY) on Wednesday and the more than 30% growth of some large U.S. rivals.

In contrast to the investment bank, revenue fell in Deutsche Bank's retail and corporate banking divisions.

As part of a 2019 overhaul, Deutsche Bank had sought to rebalance the bank so that the volatile investment bank, once its problem bank, would bear less of the burden. But the unit is expected to remain the largest for years to come.

Within the investment bank, origination and advisory was a big pillar in the quarter, with revenue up 88%, compared with an expected 66% increase and outpacing growth at major U.S. rivals.

Fixed-income and foreign exchange trading, one of the bank’s biggest businesses, saw revenue fall 3%, slightly less than the expected drop of nearly 2%. Jefferies said fixed-income and foreign exchange trading revenue at the U.S. bank rose 5%.

#michael cera#artists on tumblr#easter#ryan gosling#star wars#wally darling#asexual#barbie#donald trump#margot robbie

1 note

·

View note

Text

The #1 Killer of Your Business (And How to Avoid It)

Do you know what the number one business killer is? It’s not the pandemic, it’s not the competition, it’s not the market.

It’s the cash crunch.

Yes, you heard me right. The lack of cash flow and the unexpected costs that can hit you like a ton of bricks are the biggest threats to your entrepreneurial dreams.

It’s when you have to deal with unexpected costs that can knock you off your feet. Such as:

A hurricane comes and wrecks everything. Your shop is ruined, your products are gone, and you’re left with a huge bill.

You’re in the middle of a big project, and your computer decides to take a nap. Forever.

You’ve delivered your work to your client, and you’re waiting for your payment. But it never comes.

Don’t believe me? Just ask the 82% of small businesses that fail because of cash flow problems. Or the countless entrepreneurs who had to close shop because of a lawsuit, a natural disaster, or broken equipment.

Here are some of the best strategies that I’ve learned from my experience and from the experts in the field:

Have an emergency fund. This is a no-brainer, but you’d be surprised how many entrepreneurs skip this step. Having a stash of cash that can cover at least 3 to 6 months of your expenses can save you from a lot of headaches and heartaches. Trust me, you’ll sleep better at night knowing that you have a safety net.

Insure your business. This is another must-have for any entrepreneur. You never know when a fire, a flood, a theft, or a lawsuit can strike. Having the right insurance can protect you from losing everything you’ve worked so hard for. Don’t skimp on this, it’s worth every penny.

Seek professional advice. You don’t have to do everything on your own. There are experts, such as myself, who can help you with your finances, your taxes, your legal issues, and more. They can save you time, money, and stress. Plus, they can give you valuable insights and tips that you might not have thought of. Don’t be afraid to ask for help, it’s a sign of strength, not weakness.

Forecast your revenue and expenses. This is a key skill for any entrepreneur. You need to have a clear picture of how much money is coming in and going out of your business, and how that affects your cash flow. You also need to plan ahead for the peaks and valleys of your income and spending. This way, you can avoid running out of cash or overspending.

Invoice your customers promptly. This is a simple but effective way to improve your cash flow. The sooner you send your invoices, the sooner you get paid. And the sooner you get paid, the more cash you have to run your business. Don’t delay, don’t procrastinate, don’t forget. Send your invoices as soon as you deliver your products or services.

Offer discounts for early payments. This is a win-win strategy for you and your customers. You get your money faster, and they get a better deal. Plus, you build trust and loyalty with your customers, which can lead to more business and referrals. Just make sure that the discount is reasonable and that you can afford it.

Reduce unnecessary costs. This is a no-brainer, but you’d be surprised how many entrepreneurs waste money on things they don’t need or use. Take a hard look at your expenses and see where you can cut the fat. Do you really need that fancy office, that expensive software, that lavish lunch? Think twice before you spend and save more than you earn.

The cash crunch is a real threat to your business, but you can beat it. Follow these strategies and you’ll have more money, more security, and more success. You’ll be able to grow your business and make your mark in the world.

0 notes

Text

Amid the escalation of the Hamas-Israel war, the cryptocurrency market has turned its eyes to the Middle East’s secular conflicts, while humanity suffers from war crimes and the number of reported victims continues to increase. In this context, the Israeli police were able to freeze and seize crypto accounts on Binance, supposedly linked to Hamas on October 10, according to a local media outlet. As reported, the cyber arm of Israel Police’s Lahav 433 unit worked with the country’s defense ministry, intelligence agencies, and Binance to identify and freeze the crypto accounts they allege were being used to finance Hamas’ terror. Additionally, any funds seized will be kept by the Israeli national treasury, per an official announcement. Hamas-Israel escalation, financing, and crypto seizures Notably, the United States Commodities Futures and Trading Commission (CFTC) filed a lawsuit against Changpeng Zhao (CZ), CEO at Binance, in March 2023 related to accusations of allowing the Palestinian militant group Hamas conduct financial transactions in his crypto exchange. Nevertheless, Binance has a compliance history with Israel in the “combat against terror financing”, according to a report by CoinDesk. In 2021, the Israeli police reportedly seized 190 crypto accounts on Binance, allegedly linked to terrorist groups. “Over the past few days, our team has been working in real-time, around the clock to support ongoing efforts to combat terror financing. We are committed to ensuring the safety and security not just of the blockchain ecosystem, but also the global community, through our proactive work.” — Binance spokesperson to CoinDesk Meanwhile, innocent individuals continue to be killed in Gaza’s crossfire. Investors try to forecast the financial effects of the conflict and discussions about the Hamas-Israel conflicts are trending in all sectors, dividing supporters in polarized heat discussions that somehow are trying to legitimize all the violence escalation seen in the past few days.

0 notes

Text

0 notes

Text

518: How To Protect Your Construction Company From Bankruptcy

This Podcast Is Episode Number 518, And It's About How To Protect Your Construction Company From Bankruptcy

Starting a construction business is not for the faint of heart. A certain level of stress comes with ensuring your company's success. If things go wrong, it all falls back on you. That said, the freedom and sense of accomplishment of running your own business make the challenges well worth it. With good planning and strong business practices, you can avoid the pitfalls and drive your trade business to financial success. Learn the top reasons why small businesses end up in bankruptcy and what you can do to prevent that from happening to you.

1. Poor cash flow Not bringing enough money in is the main reason why businesses fail. You must have more money coming in than is going out, or you're on the express train to bankruptcy. This might mean increasing your prices, decreasing costs, or combining the two. There might also be different service models you can offer (such as subscription services) or ways to branch out your income.

Work with an accountant or bookkeeper to help you identify issues with your cash flow as soon as you know there's a problem–or to prevent one before it happens. The earlier you catch a cash flow problem, the better.

2. Insufficient initial funding

Don't rely solely on credit to fund your business. If you start in a deficit, climbing out of debt and becoming cash positive will be much harder. It can also be challenging to break the habit of throwing capital investments on credit in an attempt to start making money.

Explore all of your options for initial funding. Ensure you have enough budget to start your business on the right foot.

3. Difficult market conditions

Economic recessions or depressions can negatively affect businesses, especially those relying heavily on consumer spending. Unfortunately, there's not much anyone can do about a poor economic climate but try to budget for the ebbs and flows of the market so you have breathing room if times get tough.

An emergency account with money set aside for unexpected situations will at least give you some cash to survive on if things take a downturn.

4. Poor financial management

Finances can get complicated, so you must ensure you're on top. Failing to keep accurate financial records, not managing expenses effectively, and not correctly forecasting future revenues and costs are all issues that could hurt you financially.

Work with an accountant, bookkeeper, or advisor if you have difficulty managing your finances. They can help you set a plan and show you how to ensure your money is best used.

5. Lack of market research

If you can't compete with your rivals, your construction business may struggle to generate enough revenue to stay afloat. This problem typically comes back to a lack of market research.

Entrepreneur jumps into a market they're passionate about, only to discover that somebody else is already offering the same thing – and they've already got the market cornered. Or maybe there's no need for that particular product or service.

Market research before entering the business and offering a new product or service. The results will tell you whether there's a need for what you're offering.

6. Legal issues

Lawsuits, fines, and penalties can be costly for businesses, draining their financial resources. The best way to avoid this is to ensure you're familiar with the rules and regulations you must follow or get help from a professional advisor when necessary. An ounce of prevention is worth a pound of cure.

Construction Company Failure is Always Preceded by Bad Bookkeeping

The construction company owner who buys QuickBooks and hires a regular bookkeeper to "put stuff into QuickBooks" and then ignores all of the financial and job costing reports generated from their QuickBooks file drives their construction company into economic doom.

Too often, contractors have led down the primrose path into bankruptcy and business failure by relying on inaccurate, false, misleading financial and job costing reports from their QuickBooks file.

Part of the blame rests on Intuit, the maker of QuickBooks because their marketing strategy implies that anyone, regardless of their understanding of accounting principles, can use QuickBooks, and if you are a contractor, all you need is QuickBooks for Contractors. It sets up contractors for failure by playing to their self-image of strong people who are rough and tumble and can do anything. In too many cases, these contractors end up feeling inadequate and experience huge disappointments feeling like they are the only people on earth who cannot figure out how to use QuickBooks.

Most of these contractors give up trying to make QuickBooks do what they want and lower their expectations to just knowing how much money is in the checkbook, Key Performance Indicator #1, and ignoring the other four Key Performance Indicators. Ultimately, it is like driving a car in the pitch-black darkness, on the freeway, with a tiny flashlight at 60 MPH, and being shocked and dismayed when it crashes, rolls in the ditch, and burns.

How to avoid bankruptcy

While the reasons construction businesses end up going bankrupt may seem numerous, there are some specific things you can do to make sure it doesn't happen to you, such as:

Maintain accurate financial records and regularly review your business's performance.

Develop a solid business plan that includes realistic revenue and expense projections.

Diversify your business's revenue streams to reduce reliance on a single source of income.

Stay current on industry trends and market changes.

Reduce unnecessary expenses and manage costs effectively.

Seek professional advice from construction accountants, lawyers, and business consultants when necessary.

Build up an emergency fund to help your business weather tough times.

Avoid taking on too much debt and manage what you already have effectively. By taking these steps, you can reduce the risk of bankruptcy and increase the chances of long-term success.

Final thoughts

A business might end up in bankruptcy for many reasons, but a bit of planning goes a long way. Do your research, be honest when you need help, and work with a financial professional to help you stay profitable. Contact us to discuss further how you can protect your construction business and learn how we can help.

No construction company goes bankrupt that had useful, accurate Financial Statements and Job Costing Reports that they understood and paid attention to because they would have seen bankruptcy coming well enough ahead of time to avoid it.

About The Author:

Sharie DeHart, QPA, co-founded Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or [email protected]

Check out this episode about Contractors Marketing - Accounting - Production (M.A.P.)!

0 notes

Text

Pre Settlement Lawsuit Funding Market to Witness Excellent Revenue Growth Owing to Rapid Increase in Demand

Latest business intelligence report released on Global Pre Settlement Lawsuit Funding Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Pre Settlement Lawsuit Funding market outlook. List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis are:

Harbour Litigation Funding Limited (United Kingdom)

Nova Legal Funding (United States)

Vannin Capital PCC (United Kingdom)

Peachtree Financial Solutions (United States)

Oasis Financial (United States)

DRB Capital (United States)

Law Cash (United States)

High Rise Financial (United States)

Pravati Capital (United States)

Fair Rate Funding (United States)

JG Wentworth (United States)

Mayfield Settlement Funding (United States) Pre-settlement funding, sometimes known as a litigation advance, allows plaintiffs to get funds before a case is concluded in order to cover increasing legal bills. However, the arrangement is contentious, the legalities are murky, and prudence is advised. A litigation advance, also known as pre-settlement financing, happens when plaintiffs are given money from a court award prior to the final verdict. According to the senior line, 53% answered with a 7-8% rate and 26% responded with a 0-5% rate, suggesting a relative gap in real rates (which also depend on individual credit factors). Almost half of the sector anticipates junior debt rates to be higher than 12%. Following that 11-12 percent rate, substantial reactions of 33.3 percent are projected.

Key Market Trends: Growing Demand for Avoid Bankruptcy Opportunities: Rising Awareness Among the Individuals About Lawsuit Funding Market Growth Drivers: Advantages of Law Dispute Funding is Driving the Market Growth Challenges: Data Privacy, Compliance and Cyber Security The Global Pre Settlement Lawsuit Funding Market segments and Market Data Break Down by Type (Personal Injury, Auto Accidents, Public Transit Accidents, Premises Liability, Medical Malpractice, Elevator Accident, Wrongful Death, Others), Application (Common-Law Courts, Civil Law Courts), Debt (Senior Debt Financing, Junior Debt Financing)

Presented By

AMA Research & Media LLP

0 notes

Text

Bobby Kotick promises 'Death' to the United Kingdom, Nintendo raises salaries by 10%, Tears of the Kingdom to cost $70!

🕹️ The Console War Rages On

Nintendo Wins Class Action Suit Regarding Switch Joy-Con Drift

Last November, a federal judge sided with Nintendo in the Sanchez et al. v. Nintendo of America case. The Switch's EULA "disallows lawsuits" and requires legal arbitration, so Nintendo was able to stop the case. Nintendo prevailed when the parents were recognized as the systems' owners instead of the children the units were purchased for. Nintendo president Shuntaro Furukawa has apologized for Joy-Con drift and launched a free repair program. Recently, Nintendo America president Doug Bowser has discussed the "battle against" Joy-Con drift, saying Nintendo is improving. (Source)

Nintendo to Raise Worker's Salaries by 10%

Nintendo Co Ltd increased base pay by 10% on Tuesday despite lowering its full-year profit forecast due to a stronger yen. As Japan prepares for its annual spring labour negotiations, Prime Minister Fumio Kishida has urged companies to pay workers more as inflation rises in an economy used to deflation and stagnant wages. In an earnings briefing, Nintendo President Shuntaro Furukawa said, "Securing our workforce is crucial for our long-term growth." Japan has severe labour shortages due to a declining birth rate and low immigration. Companies that can afford higher salaries may help. The maker of "Super Mario Bros." and "Legend of Zelda" cut its operating profit by 4% to 480 billion yen ($3.6 billion) for the fiscal year ending 31st March. Refinitiv predicted a 582 billion yen profit. Nintendo also lowered its annual software sales forecast from 210 million to 205 million and its Switch console sales target from 19 million to 18 million. Furukawa said the Kyoto-based company would consider raising software and game console prices if necessary. He declined to tell if the company was considering replacing the six-year-old Switch. (Source)

Bobby Kotick Promises to make the United Kingdom the 'Valley of Death' if they continue to block Microsoft's acquisition of Activision-Blizzard-King.

Bobby Kotick, the chief executive officer of Activision Blizzard, stated that blocking Microsoft's acquisition of the Call of Duty publisher would significantly setback the United Kingdom's aspirations to become a technological superpower. This week, the UK's Competition and Markets Authority (CMA) is expected to release its provisional findings on the $69 billion transaction and notify the relevant parties of potential antitrust concerns and potential remedies. "They will not be Silicon Valley. They will be Death Valley," Kotick told CNBC in a televised interview on Tuesday, the same day that UK prime minister Rishi Sunak announced the creation of a new government department for science, innovation, and technology. Microsoft is rumoured to have paid close attention to the CMA, as it is perceived to be less predictable than regulators in the EU and USA. It could potentially influence their decisions regarding Microsoft's proposed merger. (Source)

The Legend Of Zelda: Tears Of The Kingdom Costs $70

In a Nintendo Direct press release, Nintendo announced that the upcoming Zelda instalment would cost $69.99. This makes Nintendo the most recent major publisher in recent years to test the pricing waters for its triple-A titles. With the beginning of the next console generation in 2020, other major publishers, such as 2K Games and PlayStation, began pricing their major releases at $70. Both Xbox and Ubisoft announced a year ago that their triple-A games would cost $70 in the future. The following day Nintendo clarified that the Zelda price change was on a 'case-by-case' basis, and they would also be assessing the price change for their future games on a 'case-by-case' basis. (Source)

📈 Financing the Bits & Bytes

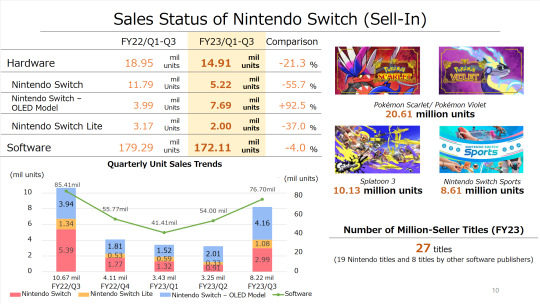

Nintendo Quarterly Financial Report Ending December 2022.

Nintendo's revenue for the nine months ended 31st December reached ¥1.29 trillion ($9.8 billion), down 1.9% year-over-year. The company's net profit was ¥346.2 billion ($2.6 billion), down 5.8% year-over-year.

Sales of the Nintendo Switch reached nearly 15 million units (down 21.3% year-over-year), while game sales reached 172.1 million copies (down 4% year-over-year).

The nine months' best-selling games were Pokémon Scarlet / Violet, Splatoon 3, and Nintendo Switch Sports, with sales of 20.61 million, 10.1 million, and 8.6 million units.

Given the decline in revenue and profit, Nintendo has lowered its financial forecast for the entire year ending 31st March.

The company anticipates revenue of 1.6 trillion ($12.1 billion) and net income of 370 billion ($2.8 billion), decreases of 3% and 7.5%, respectively, from its previous projections. (Source)

✨ Going to Events Spiritually

Xbox Game Pass

Madden NFL 23, Atomic Heart, Mount & Blade II: Bannerlord.

Nintendo Direct

Games in Bold & Italics are the games I'll be getting.

Pikmin 4 - 21st of July, 2023

Xenoblade chrones 3: Volume 3 of DLC will be available on 15th February 2023. Volume 4 was announced as well.

Samba de Amigo: Party Central - Summer 2023

Fashion Dreamer - Summer 2023

Dead Cells: Return to Castlevania on 5th March 2023.

Tron: identity - April 2023

Ghost Trick: Phantom- summer 2023

Deca Police - 2023

Bayonetta Origins: Cereza and the Lost Demon - 17th March 2023.

Splatoon 3 Expansion - Available on 8th February 2023. Wave 1 Sping 2023, Wave 2: Side Order coming later.

Disney Illusion island - 28th July 2023.

Fire Emblem Engage - New information about Expansion Pass. Wave 2 will arrive on 8th February 2023. Wave 4 will come at a later date and have a new story.

Harmony: The Fall of Reverie - June 2023

Octopath Traveller 2 - Demo launches on 8th February 2023. The game itself will launch on 24th February 2023.

We Love Katamari REROLL+ Royal Reverie - 2nd June 2023.

Sea of Stars - Launches 29th August 2023. A free demo will be available from 8th February 2023.

Omega Strikers - 29th April 2023.

Etrian Odessey Origins Collection - 1st June 2023. Each game is available separately as well.

Advanced Wars 1+2: Reboot Camp - 21st April 2023.

Kirby's Return to Dreamland Deluxe - 24th February 2023. Demo available from 8th February 2023.

Gameboy games are being added to Nintendoswitch online - Tetris, Super Marioland 2, The Legend of Zelda: Links Awakening DX, Gargoyle's Quest, Game & Watch Gallery 3, Alone in the dark, The New Nightmare, Metroid 2 - Return of Samus, Wario land 3, Kirby's Dreamland.

Gameboy Advance is being added - Super Mario Advance 4: Mario Bros 3, WarioWare inc: Mega Microgames, Kurkurkuruin, Mario Kart Super Circuit, Mario & Luigi Superstar Saga, Legend of Zelda Minish Cap.

Metroid Prime Remastered - eShop version launches 8th February 2023. The physical version will launch on 22nd February 2023.

Master Detective Archives Raincode - 30th June 2023.

Baten Kaitos 1 & 2 HD - Summer 2023

Fantasy Life I - The Girl who steals time - 2023

Professor Laton and the World of Steam

Mario Kart 8 - Wave 4, Spring 2023

Minecraft Legends - 18th April 2023

Blanc - 14th February 2023.

Megaman Battle Network Collection - 14th April 2023.

Have a lovely death - 22nd March 2023.

WBSC eBaseball: power pros - 8th February 2023.

Disney Dreamlight Valley - April 2023

Tales of Symponia Remastered - 17th February 2023.

The Legend of Zelda: Tears of The Kingdom - 12th March 2023.

🎮 Where's My Controller?

IXION still has my attention. I want to complete this game.

I played the Kirby Return to Dreamland Deluxe, and I am hyped.

📝I don't know what a pen looks like.

This week had a lot of stuff to sift through.

💖 Enjoy this newsletter?

Forward to a friend and let them know where they can subscribe (hint: it's here).

#nintendo#activision#blizzard#bobby kotick#microsoft#united kingdom#uk#direct#metroid#kirby#ixion#gameboy#switch

0 notes

Text

Talisman Casualty Insurance Company - Claims Lawsuit Avoidance

Talisman Casualty Insurance Company, based in Las Vegas, Nevada, has revealed that they can offer help to businesses on how to avoid claims lawsuits. This is because when businesses participate in their cell captive insurance business model, they are able to benefit from their efficient claims processing because of their application of advanced cutting-edge claims technology for their captive cells. The Talisman Casualty lawsuit avoidance strategy is to use claims technology that substantially boosts the efficiency of the claims process because it can be streamlined within the cell, providing participants a high level of service.

Talisman Casualty Insurance Company uses a protected cell captive insurance business model. These protected cells are offered to insurers with seasoned books of business and require a regulated vehicle for transferring risk and directing access to capacity through reinsurance and alternative risk finance markets. Cell captives are made up of a core and a number of cell entities that are kept legally separate from each other. Each cell has certain dedicated assets and liabilities that are ascribed to it. Since the cells are legally separate, the assets of one cell cannot be used for meeting the liabilities of another cell.

Talisman Casualty Insurance ensures that different claims management service providers are used to ensure efficient claims processing for each of their cell programs. They also make sure that the delegated claims authority is only given to those service providers that have a wide range of experience in claims management, are the best in terms of integrity and ethics, and are well-versed with the local markets where the claims are made. Through this arrangement, the efficiencies of the claims technology can be streamlined within each protected cell, thus providing participants a high level of claims service.

One of the programs offered by Talisman Casualty Insurance Company is the marine program. This is cell captive insurance designed specifically for marine contractors, fishing operations, and other business owners who own assets that are on the water. This marine program is specifically designed for the small to medium sized marine accounts and provides Marine Employers Liability, Hull and Protection & Indemnity, and Comprehensive General Liability. In this marine program, the company’s goal is to establish long term relationships with maritime clients to fully understand their business, their risk management methods, and the business forecast so that the insurance coverage provided can be tailor-fitted to fluctuating exposures.

Talisman Casualty Insurance Company also offers a cell program for pet professionals. This is a general liability program designed for small business owners who are in the pet industry. These include pet sitters, pet trainer, pet groomers and other pet-related services. This program allows these pet professionals to operate their business risk at a cost that permits them to remain competitive.

Another cell program offered is the surety program that provides surety bonds. The surety bond is a guarantee issued by a surety or guarantor to pay a certain amount of money to the obligee in case the principal is unable to comply with an obligation, such as fulfilling the terms of a contract. Thus, the surety bond protects the obligee against losses resulting from the failure of the principal to meet the obligation. The captive insurance model offers an important benefit for surety bonds. This is because there is a smaller number of principals participating in the coverage.

There are three types of surety bonds that can be offered. These are the compliance and licensing bonds, payment and performance bonds, and court and legal bonds. Compliance and licensing bonds are used in getting permits or for maintaining a professional license. There are conventional statutory requirements for this kind of bond. Payment and performance bonds are used often in the construction industry to protect the property owner in case the contractor does not complete the job according to the contract and neglects to pay all of his subcontractors and suppliers. Court and legal bonds are used for a wide range of court actions, such as bail, adverse cost judgment, the release of lien, and more.

People who are interested in the services offered by Talisman Casualty Insurance can visit their website or contact them on the telephone or through email. They may also want to check on the Talisman Casualty rating.

For more information about Talisman Casualty Insurance Company, contact the company here: Talisman Casualty Insurance Company 800-318-5317 7881 W. Charleston Blvd, Suite 210 Las Vegas, NV 89117

1 note

·

View note

Text

Talisman Casualty Insurance Company - Claims Lawsuit Avoidance

Talisman Casualty Insurance Company uses a protected cell captive insurance business model. These protected cells are offered to insurers with seasoned books of business and require a regulated vehicle for transferring risk and directing access to capacity through reinsurance and alternative risk finance markets. Cell captives are made up of a core and a number of cell entities that are kept legally separate from each other. Each cell has certain dedicated assets and liabilities that are ascribed to it. Since the cells are legally separate, the assets of one cell cannot be used for meeting the liabilities of another cell. Talisman Casualty Insurance Company, has revealed that they can offer help to businesses on how to avoid claims lawsuits. This is because when businesses participate in their cell captive insurance business model, they are able to benefit from their efficient claims processing because of their application of advanced cutting-edge claims technology for their captive cells. The Talisman Casualty lawsuit avoidance strategy is to use claims technology that substantially boosts the efficiency of the claims process because it can be streamlined within the cell, providing participants a high level of service.

Talisman Casualty Insurance ensures that different claims management service providers are used to ensure efficient claims processing for each of their cell programs. They also make sure that the delegated claims authority is only given to those service providers that have a wide range of experience in claims management, are the best in terms of integrity and ethics, and are well-versed with the local markets where the claims are made. Through this arrangement, the efficiencies of the claims technology can be streamlined within each protected cell, thus providing participants a high level of claims service. One of the programs offered by Talisman Casualty Insurance Company is the marine program. This is cell captive insurance designed specifically for marine contractors, fishing operations, and other business owners who own assets that are on the water. This marine program is specifically designed for the small to medium sized marine accounts and provides Marine Employers Liability, Hull and Protection & Indemnity, and Comprehensive General Liability. In this marine program, the company’s goal is to establish long term relationships with maritime clients to fully understand their business, their risk management methods, and the business forecast so that the insurance coverage provided can be tailor-fitted to fluctuating exposures. Talisman Casualty Insurance Company also offers a cell program for pet professionals. This is a general liability program designed for small business owners who are in the pet industry. These include pet sitters, pet trainer, pet groomers and other pet-related services. This program allows these pet professionals to operate their business risk at a cost that permits them to remain competitive.

Another cell program offered is the surety program that provides surety bonds. The surety bond is a guarantee issued by a surety or guarantor to pay a certain amount of money to the obligee in case the principal is unable to comply with an obligation, such as fulfilling the terms of a contract. Thus, the surety bond protects the obligee against losses resulting from the failure of the principal to meet the obligation. The captive insurance model offers an important benefit for surety bonds. This is because there is a smaller number of principals participating in the coverage. There are three types of surety bonds that can be offered. These are the compliance and licensing bonds, payment and performance bonds, and court and legal bonds. Compliance and licensing bonds are used in getting permits or for maintaining a professional license. There are conventional statutory requirements for this kind of bond. Payment and performance bonds are used often in the construction industry to protect the property owner in case the contractor does not complete the job according to the contract and neglects to pay all of his subcontractors and suppliers. Court and legal bonds are used for a wide range of court actions, such as bail, adverse cost judgment, the release of lien, and more. People who are interested in the services offered by Talisman Casualty Insurance can visit their website or contact them on the telephone or through email. They may also want to check on the Talisman Casualty rating. For more information about Talisman Casualty Insurance Company, contact the company here: Talisman Casualty Insurance Company 800-318-5317 7881 W. Charleston Blvd, Suite 210 Las Vegas, NV 89117

1 note

·

View note

Text

Talisman Casualty Insurance - Lawsuit Avoidance

Talisman Casualty Insurance Company, has revealed that they can offer help to businesses on how to avoid claims lawsuits. This is because when businesses participate in their cell captive insurance business model, they are able to benefit from their efficient claims processing because of their application of advanced cutting-edge claims technology for their captive cells. The Talisman Casualty lawsuit avoidance strategy is to use claims technology that substantially boosts the efficiency of the claims process because it can be streamlined within the cell, providing participants a high level of service.

Talisman Casualty Insurance Company uses a protected cell captive insurance business model. These protected cells are offered to insurers with seasoned books of business and require a regulated vehicle for transferring risk and directing access to capacity through reinsurance and alternative risk finance markets. Cell captives are made up of a core and a number of cell entities that are kept legally separate from each other. Each cell has certain dedicated assets and liabilities that are ascribed to it. Since the cells are legally separate, the assets of one cell cannot be used for meeting the liabilities of another cell.

Talisman Casualty Insurance ensures that different claims management service providers are used to ensure efficient claims processing for each of their cell programs. They also make sure that the delegated claims authority is only given to those service providers that have a wide range of experience in claims management, are the best in terms of integrity and ethics, and are well-versed with the local markets where the claims are made. Through this arrangement, the efficiencies of the claims technology can be streamlined within each protected cell, thus providing participants a high level of claims service.

One of the programs offered by Talisman Casualty Insurance Company is the marine program. This is cell captive insurance designed specifically for marine contractors, fishing operations, and other business owners who own assets that are on the water. This marine program is specifically designed for the small to medium sized marine accounts and provides Marine Employers Liability, Hull and Protection & Indemnity, and Comprehensive General Liability. In this marine program, the company’s goal is to establish long term relationships with maritime clients to fully understand their business, their risk management methods, and the business forecast so that the insurance coverage provided can be tailor-fitted to fluctuating exposures.

Talisman Casualty Insurance Company also offers a cell program for pet professionals. This is a general liability program designed for small business owners who are in the pet industry. These include pet sitters, pet trainer, pet groomers and other pet-related services. This program allows these pet professionals to operate their business risk at a cost that permits them to remain competitive.

Another cell program offered is the surety program that provides surety bonds. The surety bond is a guarantee issued by a surety or guarantor to pay a certain amount of money to the obligee in case the principal is unable to comply with an obligation, such as fulfilling the terms of a contract. Thus, the surety bond protects the obligee against losses resulting from the failure of the principal to meet the obligation. The captive insurance model offers an important benefit for surety bonds. This is because there is a smaller number of principals participating in the coverage.

There are three types of surety bonds that can be offered. These are the compliance and licensing bonds, payment and performance bonds, and court and legal bonds. Compliance and licensing bonds are used in getting permits or for maintaining a professional license. There are conventional statutory requirements for this kind of bond. Payment and performance bonds are used often in the construction industry to protect the property owner in case the contractor does not complete the job according to the contract and neglects to pay all of his subcontractors and suppliers. Court and legal bonds are used for a wide range of court actions, such as bail, adverse cost judgment, the release of lien, and more.

People who are interested in the services offered by Talisman Casualty Insurance can visit their website or contact them on the telephone or through email. They may also want to check on the Talisman Casualty rating.

For more information about Talisman Casualty Insurance Company, contact the company here:

Talisman Casualty Insurance Company 800-318-5317 7881 W. Charleston Blvd, Suite 210 Las Vegas, NV 89117

1 note

·

View note

Text

Talisman Casualty Insurance Company | Claims Lawsuit Avoidance

Talisman Casualty Insurance Company, based in Las Vegas, Nevada, has revealed that they can offer help to businesses on how to avoid claims lawsuits. This is because when businesses participate in their cell captive insurance business model, they are able to benefit from their efficient claims processing because of their application of advanced cutting-edge claims technology for their captive cells. The Talisman Casualty lawsuit avoidance strategy is to use claims technology that substantially boosts the efficiency of the claims process because it can be streamlined within the cell, providing participants a high level of service.

Talisman Casualty Insurance Company uses a protected cell captive insurance business model. These protected cells are offered to insurers with seasoned books of business and require a regulated vehicle for transferring risk and directing access to capacity through reinsurance and alternative risk finance markets. Cell captives are made up of a core and a number of cell entities that are kept legally separate from each other. Each cell has certain dedicated assets and liabilities that are ascribed to it. Since the cells are legally separate, the assets of one cell cannot be used for meeting the liabilities of another cell.

Talisman Casualty Insurance ensures that different claims management service providers are used to ensure efficient claims processing for each of their cell programs. They also make sure that the delegated claims authority is only given to those service providers that have a wide range of experience in claims management, are the best in terms of integrity and ethics, and are well-versed with the local markets where the claims are made. Through this arrangement, the efficiencies of the claims technology can be streamlined within each protected cell, thus providing participants a high level of claims service.

One of the programs offered by Talisman Casualty Insurance Company is the marine program. This is cell captive insurance designed specifically for marine contractors, fishing operations, and other business owners who own assets that are on the water. This marine program is specifically designed for the small to medium sized marine accounts and provides Marine Employers Liability, Hull and Protection & Indemnity, and Comprehensive General Liability. In this marine program, the company’s goal is to establish long term relationships with maritime clients to fully understand their business, their risk management methods, and the business forecast so that the insurance coverage provided can be tailor-fitted to fluctuating exposures.

Talisman Casualty Insurance Company also offers a cell program for pet professionals. This is a general liability program designed for small business owners who are in the pet industry. These include pet sitters, pet trainer, pet groomers and other pet-related services. This program allows these pet professionals to operate their business risk at a cost that permits them to remain competitive.

Another cell program offered is the surety program that provides surety bonds. The surety bond is a guarantee issued by a surety or guarantor to pay a certain amount of money to the obligee in case the principal is unable to comply with an obligation, such as fulfilling the terms of a contract. Thus, the surety bond protects the obligee against losses resulting from the failure of the principal to meet the obligation. The captive insurance model offers an important benefit for surety bonds. This is because there is a smaller number of principals participating in the coverage.

There are three types of surety bonds that can be offered. These are the compliance and licensing bonds, payment and performance bonds, and court and legal bonds. Compliance and licensing bonds are used in getting permits or for maintaining a professional license. There are conventional statutory requirements for this kind of bond. Payment and performance bonds are used often in the construction industry to protect the property owner in case the contractor does not complete the job according to the contract and neglects to pay all of his subcontractors and suppliers. Court and legal bonds are used for a wide range of court actions, such as bail, adverse cost judgment, the release of lien, and more.

People who are interested in the services offered by Talisman Casualty Insurance can visit their website or contact them on the telephone or through email. They may also want to check on the Talisman Casualty rating.

For more information about Talisman Casualty Insurance Company, contact the company here:

Talisman Casualty Insurance Company 800-318-5317 7881 W. Charleston Blvd, Suite 210 Las Vegas, NV 89117

1 note

·

View note

Text

Talisman Casualty Insurance Company - Claims Lawsuit Avoidance

What Can We Offer to Help Businesses?

Talisman Casualty Insurance Company, has revealed that they can offer help to businesses on how to avoid claims lawsuits. This is because when businesses participate in their cell captive insurance business model, they are able to benefit from their efficient claims processing because of their application of advanced cutting-edge claims technology for their captive cells. The Talisman Casualty lawsuit avoidance strategy is to use claims technology that substantially boosts the efficiency of the claims process because it can be streamlined within the cell, providing participants a high level of service.

Talisman Casualty Insurance Company uses a protected cell captive insurance business model. These protected cells are offered to insurers with seasoned books of business and require a regulated vehicle for transferring risk and directing access to capacity through reinsurance and alternative risk finance markets. Cell captives are made up of a core and a number of cell entities that are kept legally separate from each other. Each cell has certain dedicated assets and liabilities that are ascribed to it. Since the cells are legally separate, the assets of one cell cannot be used for meeting the liabilities of another cell.

Talisman Casualty Insurance ensures that different claims management service providers are used to ensure efficient claims processing for each of their cell programs. They also make sure that the delegated claims authority is only given to those service providers that have a wide range of experience in claims management, are the best in terms of integrity and ethics, and are well-versed with the local markets where the claims are made. Through this arrangement, the efficiencies of the claims technology can be streamlined within each protected cell, thus providing participants a high level of claims service.

One of the programs offered by Talisman Casualty Insurance Company is the marine program. This is cell captive insurance designed specifically for marine contractors, fishing operations, and other business owners who own assets that are on the water. This marine program is specifically designed for the small to medium sized marine accounts and provides Marine Employers Liability, Hull and Protection & Indemnity, and Comprehensive General Liability. In this marine program, the company’s goal is to establish long term relationships with maritime clients to fully understand their business, their risk management methods, and the business forecast so that the insurance coverage provided can be tailor-fitted to fluctuating exposures.

Talisman Casualty Insurance Company also offers a cell program for pet professionals. This is a general liability program designed for small business owners who are in the pet industry. These include pet sitters, pet trainer, pet groomers and other pet-related services. This program allows these pet professionals to operate their business risk at a cost that permits them to remain competitive.

Another cell program offered is the surety program that provides surety bonds. The surety bond is a guarantee issued by a surety or guarantor to pay a certain amount of money to the obligee in case the principal is unable to comply with an obligation, such as fulfilling the terms of a contract. Thus, the surety bond protects the obligee against losses resulting from the failure of the principal to meet the obligation. The captive insurance model offers an important benefit for surety bonds. This is because there is a smaller number of principals participating in the coverage.

There are three types of surety bonds that can be offered. These are the compliance and licensing bonds, payment and performance bonds, and court and legal bonds. Compliance and licensing bonds are used in getting permits or for maintaining a professional license. There are conventional statutory requirements for this kind of bond. Payment and performance bonds are used often in the construction industry to protect the property owner in case the contractor does not complete the job according to the contract and neglects to pay all of his subcontractors and suppliers. Court and legal bonds are used for a wide range of court actions, such as bail, adverse cost judgment, the release of lien, and more.

People who are interested in the services offered by Talisman Casualty Insurance can visit their website or contact them on the telephone or through email. They may also want to check on the Talisman Casualty rating.

For more information about Talisman Casualty Insurance Company, contact the company here:

Talisman Casualty Insurance Company

800-318-5317

7881 W. Charleston Blvd, Suite 210 Las Vegas, NV 89117

1 note

·

View note

Text

Talisman Casualty Insurance Company LLC - Claims Lawsuit Avoidance

Talisman Casualty Insurance Company, based in Las Vegas, Nevada, has revealed that they can offer help to businesses on how to avoid claims involving lawsuits. This is because when businesses participate in their cell captive insurance business model, they are able to benefit from their efficient claims processing because of their application of advanced cutting-edge claims technology for their captive cells. The Talisman Casualty lawsuit avoidance strategy is to use claims technology that substantially boosts the efficiency of the claims process because it can be streamlined within the cell, providing participants a high level of service. Participants in the cell captive are owners, and the close relationship between the insured participant and claims professionals allows quicker response and resolution to claims which could lead to litigation.

Talisman Casualty Business Model

Talisman Casualty Insurance Company uses a protected cell captive insurance business model. These protected cells are offered to agents with seasoned books of business and require a regulated vehicle for transferring risk and directing access to capacity through reinsurance and alternative risk finance markets. Cell captives are made up of a core, which is a type of central fund that protects the solvency of each cell that are kept legally separate from each other. Each cell has certain dedicated assets and liabilities that are ascribed to it. Since the cells are legally separate, the assets of one cell cannot be used for meeting the liabilities of another cell. This allows each cell to be set up with it’s own unique underwriting and claims structure and increases the responsiveness that may not exist in insurance companies with vertical corporate structures.

Talisman Casualty Insurance ensures that different claims management service providers are used to ensure efficient claims processing for each of their cell programs. They also make sure that the delegated claims authority is only given to those service providers that have a wide range of experience in claims management, are the best in terms of integrity and ethics, and are well-versed with the local markets where the claims are made. Through this arrangement, the efficiencies of the claims technology can be streamlined within each protected cell, thus providing participants a high level of claims service.

Talisman Casualty Programs

One of the programs offered by Talisman Casualty Insurance Company is the marine program. This is cell captive insurance designed specifically for marine contractors, fishing operations, tug and barge companies, and other business owners who own assets that are on the water. This marine program is specifically designed for the small to medium sized marine accounts and provides Marine Employers Liability, Hull and Protection & Indemnity, and Comprehensive General Liability. This sector of the marine market is often referred to as brown water. In this marine program, the company’s goal is to establish long term relationships with maritime clients to fully understand their business, their risk management methods, and the business forecast so that the insurance coverage provided can be tailor-fit to fluctuating exposures. When the marine market experiences volatility, the cell captive approach gives marine businesses flexibility to quickly adjust their insurance program to meet the challenges of changing cash flow and exposure.

Talisman Casualty Insurance Company also offers a cell program for pet professionals. This is a general liability program designed for small business owners who are in the pet industry. These include pet sitters, pet trainers, pet groomers, canine detection, therapy animals, hunting clubs who utilize dogs, and many other pet and working animal related services. Management of the pet program is made up of insurance professionals who have personal experience in pet fields and that niche gives Talisman a responsive, service oriented program which has been very popular within the rapidly expanding “pet economy”. The Talisman pet professional program gives businesses a competitive advantage with cost effective, comprehensive, and when needed, specialized coverages that may not be available through the general insurance products they may find elsewhere.

Another cell program offered is the surety program that provides surety bonds. The surety bond is a guarantee issued by a surety or guarantor to pay a certain amount of money to the obligee in case the principal is unable to comply with an obligation, such as fulfilling the terms of a contract. Thus, the surety bond protects the obligee against losses resulting from the failure of the principal to meet the obligation. In the event of a claim, the surety assumes the rights of the principal and can perform on their behalf, tender their obligations to the owner, or in the event that the principal has been wrongfully defaulted, mount a defense. For this reason, surety is not considered insurance and is viewed as a type of co-signing on a contract. Due to the unique nature of this product, the captive cell model is a good fit for those principals who are building credit, performing unique contractual work, or who require additional oversite or risk management attention.

There are three types of surety bonds that can be offered. These are the compliance and licensing bonds, payment and performance bonds, and court and legal bonds. Compliance and licensing bonds are used in getting permits or for maintaining a professional license. There are conventional statutory requirements for this kind of bond. Payment and performance bonds are used often in the construction industry to protect the property owner in case the contractor does not complete the job according to the contract and neglects to pay all of his subcontractors and suppliers or to other professionals who must provide security for the performance of their contracts. Court and legal bonds are used for a wide range of court actions, such as bail, adverse cost judgment, release of lien, and more.

People who are interested in the services offered by Talisman Casualty Insurance can visit their website or contact them on the telephone or through email. They may also want to check on the Talisman Casualty rating

.For more information, you can contact them here:

Talisman Casualty Insurance Company

7881 W Charleston Blvd Suite 210, Las Vegas, NV 89117, United States

800-318-5317

1 note

·

View note

Text

The cryptocurrency market has experienced a notable downturn recently, with the total market capitalization falling by 10% between August 14 and August 23, reaching its lowest point in over two months at $1.04 trillion. This movement has triggered significant liquidations on futures contracts, the largest since the FTX collapse in November 2022. Total cryptocurrency market capitalization, USD. Source: TradingViewSeveral economic factors have contributed to this decline. As interest rates have surpassed the 5% mark and inflation remains above the targeted 2%, finance costs for both families and businesses have risen, placing pressure on consumer spending and economic expansion. That causes less money available for savings and could force people to let go of their investments just to cover monthly bills.Since inflation expectations for 2024 stands at 3.6% and average hourly earnings increased by 5.5% year-over-year, at the fastest pace since 2020, the Federal Reserve (Fed) is likely to maintain or even raise interest rates in the coming months. Consequently, a high interest rate scenario favors fixed-income investments, which is detrimental for cryptocurrencies.Inflation has receded from its peak of 9% to the current 3%, while the S&P 500 index is only 9% below its all-time high. This could indicate a "soft landing" orchestrated by the Federal Reserve, suggesting that the likelihood of an extended and profound recession is diminishing, temporarily undermining Bitcoin's investment thesis as a hedge.Factors emerging from the cryptocurrency industryInvestor expectations had been high for the approval of a spot Bitcoin exchange-traded fund (ETF), particularly with heavyweight endorsements from BlackRock and Fidelity. However, these hopes were dashed as the SEC continued to delay its decision, citing concerns over insufficient safeguards against manipulation. Complicating matters, a substantial volume of trading continues to occur on non-regulated offshore exchanges based in stablecoins, raising questions about the authenticity of market activity.Financial difficulties within the Digital Currency Group (DCG) have also had a negative impact. A subsidiary of DCG is grappling with a debt exceeding $1.2 billion to the Gemini exchange. Additionally, Genesis Global Trading recently declared bankruptcy due to losses stemming from the collapses of Terra and FTX. This precarious situation could lead to forced selling positions in the Grayscale GBTC funds if DCG fails to meet its obligations.Further compounding the market's woes is regulatory tightening. The Securities and Exchange Commission (SEC) has leveled a series of charges against Binance exchange and its CEO Changpeng "CZ" Zhao, alleging misleading practices and the operation of an unregistered exchange. Similarly, Coinbase faces regulatory scrutiny and a lawsuit centered on the classification of certain cryptocurrencies as securities, highlighting the ambiguity in US securities policy.U.S. Dollar strengthening despite global economic slowdownSigns of trouble stemming from lower growth in China have also emerged. Economists have revised down their growth forecasts for the country, with both imports and exports experiencing declines in recent months. Foreign investment into China dropped by over 80% in the second quarter compared to the previous year. Worryingly, unpaid bills from private Chinese developers amount to a staggering $390 billion, posing a significant threat to the economy.Despite the prospect of a deteriorating global economy, which could potentially bolster Bitcoin's appeal due to its scarcity and fixed monetary policy, investors are showing a propensity to flock to the perceived safety of U.S. dollars. This is evident in the movement of the DXY dollar index, which has surged from its July 17 low of 99.5 to its current level of 103.8, marking its highest point in more than two months. U.S. Dollar Strength (DXY) Index. Source: TradingViewAs the cryptocurrency market navigates

through these multifaceted challenges, the ebb and flow of various economic factors and regulatory developments will undoubtedly continue to shape its trajectory in the coming months.Such a situation could possibly be an outcome of excessive optimism following the submission of multiple spot Bitcoin ETF requests in mid-June, so instead of focusing on what caused the recent 10% correction, one could question whether the rally in mid-July from $1.0 trillion market capitalization to $1.18 trillion was justified in the first place.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. Source

0 notes