Empower Your Wallet, Unlock Your Dreams: Your Journey to Financial Freedom Ask me Anything!

Don't wanna be here? Send us removal request.

Text

Should You Change Your IRA to a Roth IRA Before You Retire?

If you are getting ready to retire, you may have a question: Should you change your IRA to a Roth IRA? An IRA is a type of account where you save money for retirement. A Roth IRA is a different type of account where you don’t pay taxes when you take out the money. But if you change your IRA to a Roth IRA, you have to pay taxes on the money you move.

Is it a good idea? Well, it depends on your situation and what you want. There are good things and bad things about changing your IRA to a Roth IRA. In this post, we will tell you some of the good things and bad things, and help you decide if it is right for you.

The Good Things About Changing Your IRA to a Roth IRA

Here are some of the good things about changing your IRA to a Roth IRA:

You don’t pay taxes when you take out the money. One of the best things about a Roth IRA is that you don’t pay taxes on the money you make or the money you take out, if you follow the rules. This means you don’t have to worry about how much taxes will be in the future, which could be more than they are now. You also don’t pay taxes in the state where you live, if they don’t tax Roth IRA money.

You don’t have to take out the money when you are a certain age. Unlike an IRA, a Roth IRA doesn’t make you take out some money every year after you turn 72. This means you can keep your money in the account and let it grow more. You can also leave it to your family when you die, and they don’t have to pay taxes on it either.

You can have different types of income in retirement. By changing some of your IRA to a Roth IRA, you can have money that is taxed and money that is not taxed in retirement. This can help you pay less taxes and have more money. For example, you can use your Roth IRA money to pay less taxes on your Social Security money, your pension money, or your other money.

The Bad Things About Changing Your IRA to a Roth IRA

Here are some of the bad things about changing your IRA to a Roth IRA:

You have to pay taxes now. The biggest problem with changing your IRA to a Roth IRA is that you have to pay taxes on the money you move in the year you move it. This can be a lot of money, especially if you move a lot of money or if you are in a high tax bracket. You also have to use money that is not in your IRA to pay the taxes, which means you have less money to save.

You may not save money if your taxes are lower in the future. Changing your IRA to a Roth IRA makes sense if you think your taxes will be higher in the future than they are now. But if your taxes are lower in the future, you may end up paying more taxes than you would have if you had kept your IRA. This could happen if you make less money in retirement, or if the taxes go down in the future.

You have to wait five years to take out the money without a penalty. Even though you can take out the money you put in a Roth IRA at any time without taxes or penalties, you have to wait five years from the year you change your IRA to a Roth IRA to take out the money you make without a 10% penalty, unless you are 59½ or older. This means you have to plan ahead and make sure you have enough money to pay for your needs until then.

How to Decide if Changing Your IRA to a Roth IRA is Right for You

As you can see, there is no easy answer to the question of whether you should change your IRA to a Roth IRA. It depends on your income, taxes, expenses, and goals. Here are some things to think about when making your decision:

Your age and how long until you retire. Generally, the younger you are and the longer you have until you retire, the more likely you are to save money by changing your IRA to a Roth IRA. This is because you have more time to enjoy the tax-free growth and make up for the taxes you paid now. But if you are close to retirement or already retired, you may not have enough time to save money by changing your IRA to a Roth IRA, unless you want to leave the money to your family.

Your taxes now and your taxes in the future. The key to saving money by changing your IRA to a Roth IRA is to pay taxes when they are low and avoid them when they are high. So you need to compare your taxes now with your taxes in retirement. If you think your taxes will be higher in the future, you may want to change now and pay the lower taxes. But if you think your taxes will be lower in the future, you may want to wait and pay the lower taxes later.

Your income now and your income in retirement. Another thing to think about is how your income will change in retirement. If you have a lot of money that is taxed, such as pensions, annuities, or IRA money, you may like having some money that is not taxed from a Roth IRA to balance them out. But if you have a lot of money that is not taxed or taxed later, such as Social Security, municipal bonds, or IRA money, you may not need a Roth IRA as much.

Your expenses now and your expenses in retirement. You also need to think about how your expenses will change in retirement. If you expect to spend a lot of money in retirement, such as on health care, travel, or hobbies, you may like having a tax-free source of money from a Roth IRA to pay for them. But if you expect to spend less money in retirement, such as living in a paid-off home or getting discounts, you may not need a Roth IRA as much.

Your goals for your money and your family. Finally, you need to think about what you want to do with your money and your family. If you want to leave money to your family, a Roth IRA can be a good way to do so, as it lets you give them tax-free money that they can keep for a long time. But if you don’t care about leaving money to your family, or if you have other ways to do so, such as life insurance or trusts, changing your IRA to a Roth IRA may not be worth it.

The Final Word

Changing your IRA to a Roth IRA can be a good way to save money and taxes in retirement, but it’s not for everyone. You have to think about the good things and the bad things, and how they affect you and your situation. You also have to be ready to pay a lot of taxes now and wait five years to take out the money you make without a penalty.

The best way to decide if changing your IRA to a Roth IRA is right for you is to talk to someone who knows a lot about money and retirement, like a financial advisor. A financial advisor can help you look at your options and make a plan that works for you. A financial advisor can also help you change your IRA to a Roth IRA in a smart way, such as changing a little bit at a time, changing when the taxes are low, or changing when it helps your taxes.

If you want to learn more about changing your IRA to a Roth IRA and how it can help you retire better, contact us today and we’ll help you find a good financial advisor near you.

Remember, you only get one chance to retire, so make it a good one. Changing your IRA to a Roth IRA could be the key to having the retirement you want. Don’t miss this chance.

0 notes

Text

The #1 Killer of Your Business (And How to Avoid It)

Do you know what the number one business killer is? It’s not the pandemic, it’s not the competition, it’s not the market.

It’s the cash crunch.

Yes, you heard me right. The lack of cash flow and the unexpected costs that can hit you like a ton of bricks are the biggest threats to your entrepreneurial dreams.

It’s when you have to deal with unexpected costs that can knock you off your feet. Such as:

A hurricane comes and wrecks everything. Your shop is ruined, your products are gone, and you’re left with a huge bill.

You’re in the middle of a big project, and your computer decides to take a nap. Forever.

You’ve delivered your work to your client, and you’re waiting for your payment. But it never comes.

Don’t believe me? Just ask the 82% of small businesses that fail because of cash flow problems. Or the countless entrepreneurs who had to close shop because of a lawsuit, a natural disaster, or broken equipment.

Here are some of the best strategies that I’ve learned from my experience and from the experts in the field:

Have an emergency fund. This is a no-brainer, but you’d be surprised how many entrepreneurs skip this step. Having a stash of cash that can cover at least 3 to 6 months of your expenses can save you from a lot of headaches and heartaches. Trust me, you’ll sleep better at night knowing that you have a safety net.

Insure your business. This is another must-have for any entrepreneur. You never know when a fire, a flood, a theft, or a lawsuit can strike. Having the right insurance can protect you from losing everything you’ve worked so hard for. Don’t skimp on this, it’s worth every penny.

Seek professional advice. You don’t have to do everything on your own. There are experts, such as myself, who can help you with your finances, your taxes, your legal issues, and more. They can save you time, money, and stress. Plus, they can give you valuable insights and tips that you might not have thought of. Don’t be afraid to ask for help, it’s a sign of strength, not weakness.

Forecast your revenue and expenses. This is a key skill for any entrepreneur. You need to have a clear picture of how much money is coming in and going out of your business, and how that affects your cash flow. You also need to plan ahead for the peaks and valleys of your income and spending. This way, you can avoid running out of cash or overspending.

Invoice your customers promptly. This is a simple but effective way to improve your cash flow. The sooner you send your invoices, the sooner you get paid. And the sooner you get paid, the more cash you have to run your business. Don’t delay, don’t procrastinate, don’t forget. Send your invoices as soon as you deliver your products or services.

Offer discounts for early payments. This is a win-win strategy for you and your customers. You get your money faster, and they get a better deal. Plus, you build trust and loyalty with your customers, which can lead to more business and referrals. Just make sure that the discount is reasonable and that you can afford it.

Reduce unnecessary costs. This is a no-brainer, but you’d be surprised how many entrepreneurs waste money on things they don’t need or use. Take a hard look at your expenses and see where you can cut the fat. Do you really need that fancy office, that expensive software, that lavish lunch? Think twice before you spend and save more than you earn.

The cash crunch is a real threat to your business, but you can beat it. Follow these strategies and you’ll have more money, more security, and more success. You’ll be able to grow your business and make your mark in the world.

0 notes

Text

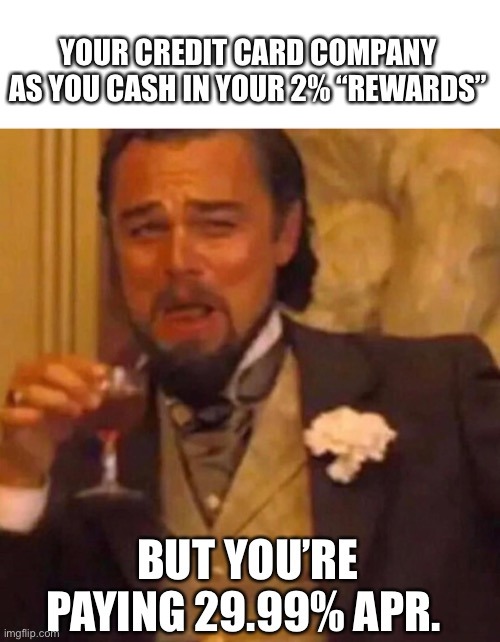

The Basics of Credit

What is a Good Credit Score?

A credit score is a three-digit number that summarizes your credit history and how well you manage your debt. It ranges from 300 to 850, with higher scores indicating better creditworthiness. Lenders use your credit score to decide whether to approve you for loans, credit cards, mortgages, and other forms of credit. Your credit score can also affect the interest rates and fees you pay, as well as your eligibility for certain products and services.

But what is a good credit score? How do you know if your score is high enough to achieve your financial goals? And how do you compare to other people in your age group?

The Credit Score Ranges

There are different models and sources of credit scores, but one of the most widely used is the FICO® Score, which is calculated by the Fair Isaac Corporation. FICO® Scores are based on five factors: payment history, amounts owed, length of credit history, credit mix, and new credit. Each factor has a different weight in the calculation, with payment history being the most important.

According to FICO®, the credit score ranges are as follows:

800 and up: Excellent. You have a long and flawless credit history, and you are likely to qualify for the best terms and rates available.

740 to 799: Very good. You have a strong credit history, and you are likely to get approved for most types of credit with favorable terms and rates.

670 to 739: Good. You have a good credit history, and you are considered an acceptable borrower by most lenders. You may not get the lowest rates, but you should have no trouble getting credit when you need it.

580 to 669: Fair. You have a moderate credit history, and you may have some negative items on your credit report, such as late payments, collections, or bankruptcy. You are considered a subprime borrower by many lenders, and you may face higher interest rates and fees, or lower credit limits.

579 and below: Poor. You have a limited or damaged credit history, and you are considered a high-risk borrower by most lenders. You may have difficulty getting approved for credit, or you may only qualify for secured or high-cost products.

Your credit score can change over time, depending on your financial behavior and life events. Generally, your credit score tends to improve as you get older, because you have more experience and history with credit, and you may have more income and assets to support your debt.

According to Experian, one of the three major credit bureaus, the average FICO® Score in the U.S. as of the second quarter of 2021 was 716, which falls into the good range. However, the average score varies by generation, as shown in the table below:

As you can see, the older generations have higher average scores than the younger ones, reflecting their longer and more established credit histories. However, the younger generations are not far behind, and they have plenty of room to improve their scores as they grow older and more financially savvy.

Tips to Build Your Credit Score

If you want to improve your credit score, or maintain a good one, there are some simple steps you can take, such as:

Pay your bills on time and in full. This is the most important factor in your credit score, and it shows that you are responsible and reliable with your debt. Even one late payment can hurt your score, so make sure you pay at least the minimum amount due by the due date every month. Setting up automatic payments or reminders can help you avoid missing a payment.

Maintain a low utilization rate. This is the percentage of your available credit that you are using at any given time. For example, if you have a credit card with a $1,000 limit and a $300 balance, your utilization rate is 30%. A low utilization rate shows that you are not overextending yourself with debt, and it can boost your score. A good rule of thumb is to keep your utilization rate below 30%, but lower is better. You can lower your utilization rate by paying down your balances, increasing your credit limits, or using fewer cards.

Become an authorized user. This is a way to piggyback on someone else’s credit history, such as a parent, spouse, or friend. If you become an authorized user on their credit card account, you can use their card and benefit from their positive payment history and credit age. However, you are not legally responsible for paying the bill, and you can be removed from the account at any time. This can be a good option for people who have no credit or bad credit, but make sure you choose someone who has good credit and trusts you to use their card responsibly.

Get a secured credit card. This is a type of credit card that requires a cash deposit as collateral, which acts as your credit limit. For example, if you deposit $200, you can use the card up to $200. A secured credit card can help you build credit, as long as you pay the bill on time and in full every month. The card issuer will report your activity to the credit bureaus, and after a period of time, you may be able to upgrade to an unsecured card and get your deposit back.

Get a credit-builder loan. This is a type of loan that is designed to help you build credit. You borrow a small amount of money, usually between $300 and $1,000, and the lender holds it in a savings account until you pay it back in monthly installments. The lender reports your payments to the credit bureaus, and when you finish paying the loan, you get access to the money in the savings account, plus any interest earned. A credit-builder loan can help you establish a positive payment history and diversify your credit mix, which can boost your score.

You Can Do This!

In the beginning, it's tough.

If you have to start over again, it's even tougher.

But it's worth it.

Paying more dollars for less credit is how it all starts, but soon you'll be able to tap into more and more credit for less interest.

Building a good credit score can take time and effort, but it is not impossible. Even if your score is not where you want it to be, you can always take steps to improve it and achieve your financial goals. Remember that your credit score is not a reflection of your worth as a person, and it does not define you. It is just a tool that can help you access better opportunities and save money in the long run.

Don’t be discouraged by your credit score, but rather use it as a motivation to improve your financial habits and well-being. You are not alone in this journey, and I’m here to chat with you and support you along the way. You can always ask me any questions you have about your credit score, or share your thoughts and feelings with me. I’m always happy to listen and help. 😊

You have the power to change your credit score, and you can do it. Just be patient, consistent, and proactive, and you will see the results. You got this! 💪

0 notes

Text

I stopped wasting money on crap I don’t need.

(Here’s how I did it in 5 steps)

At 25, I was a shopaholic, always buying things that didn’t make me happy.

But then I realized I was throwing away money that could be used for better things.

So I changed my habits and mindset to get good at money.

And you know what?

It was easier than I thought.

Here’s how I did it:

1. I focused on what I wanted, not what I didn’t want.

I said “I can have a healthy and delicious meal” instead of “I can’t have pizza”.

This way, I felt motivated and excited, not deprived or resentful.

2. I built a spending plan that included my guilty pleasures.

I didn’t cut out all the fun from my budget.

That’s just setting myself up for failure.

I allocated some money for the things that I enjoyed, such as coffee, pizza, and online shopping.

I made sure that I could afford these expenses without compromising my other financial goals.

3. I saved first, spent later.

I saved money before I spent it.

This is a simple but powerful habit that can transform your finances.

I set up an automatic transfer to a separate savings account every month.

This way, I didn’t see the money in my checking account, so I wasn’t tempted to spend it.

I only used my checking account for my planned expenses and occasional treats.

4. I thought about the value of my purchases.

Before I bought something, I asked myself: Is this worth it?

Will this add value to my life?

How often will I use it?

Can I resell it later?

These questions helped me avoid impulse buying and make smarter choices.

I preferred to buy things that had a high value, such as quality clothes, books, or experiences.

5. I treated myself to something meaningful.

Sometimes, I spent money on things I didn’t need because I was bored, stressed, or unhappy.

But these things didn’t make me feel better.

They only provided a temporary distraction.

And they made me feel guilty afterwards, which led to more spending to cope with the guilt.

It was a vicious cycle.

Instead of wasting money on things that didn’t matter, I treated myself to something that did.

For example, I saved up for a fine dining experience with a loved one.

This way, I got more satisfaction and happiness from my money.

I also created memories that lasted longer than any material thing.

I hope this text helps you stop spending money on things you don’t need and start saving money for the things that matter.

Trust me, I’ve been there.

And I can tell you that nothing feels better than being in control of your money and your life.

If you liked this text, please share it with your friends and follow me for more tips on how to get good at money. 😊

PS ♻️ Reblog this text & share your story.

0 notes

Text

What is Compound Interest? Why should you diversify assets? Investment Lessons from a Marigold Garden

Compound interest is when you earn interest on your money and on the interest you have already earned. It is like planting more flowers with the seeds you get from your existing flowers.

Let's say you receive a marigold from a friend. It's a lovely flower and very easy to take care of.

You see, marigolds are not only beautiful but also prolific. They produce many seeds that can be planted again and again, creating more and more flowers over time. This is similar to how compound interest works: you invest some money, earn interest on it, and then reinvest the interest to earn even more. The longer you do this, the faster your money grows, just like a marigold garden.

You can see how your number of marigolds grows exponentially over time. This is similar to how your money grows when you earn compound interest. The more marigolds you have, the more seeds you get. The more money you have, the more interest you get.

You could of course eat the seeds or sell them, but you decide to reinvest them.

But there's a catch: you have to be patient and consistent. You can't expect to see results overnight, or to skip watering your plants and hope they survive. You have to nurture your garden and your investments with care and attention and trust that they will reward you in the long run. If you do this, you will be surprised by how much wealth you can create from a small initial investment, or how many flowers you can grow from a single seed packet. Or how many bees you can attract. Seriously, watch out for the bees. Now, let's make it more complex and trade those seeds for different flower seeds that could grow in different periods and see flowers all year round. Let's say you have a friend who has sunflowers. They produce 100 seeds every 12 weeks. You decide to trade 10 of your marigold seeds for one sunflower seed. You plant the sunflower seed and wait for it to grow. After 12 weeks, you have one sunflower and 10 marigolds. The sunflower produces 100 seeds and the marigolds produce 100 seeds. You trade 10 of your sunflower seeds for one rose seed. You plant the rose seed and wait for it to grow. After 24 weeks, you have one sunflower, one rose, and 10 marigolds. The sunflower produces 100 seeds, the rose produces 5 seeds, and the marigolds produce 100 seeds. You trade 10 of your sunflower seeds for one orchid seed. You plant the orchid seed and wait for it to grow. You can see how your variety of flowers increases over time. This is similar to how your money grows when you invest in different assets that have different returns and risks. The more flowers you have, the more seeds you can trade. The more money you have, the more options you have to invest.

0 notes

Text

Money Talks: How To Make Your Money Say What You Want It to Say

Do you know the difference between cost and value?

Cost is the amount of money you pay for something, while value is the benefit or satisfaction you get from it. Sometimes, the cost and value of something are not the same. For example, you may pay a high rent for the roof above your head, but that doesn’t build any equity or wealth for you. You are just giving your money away to your landlord every month.

On the other hand, you may find a thrifted wool shirt for 20 bucks that will last you forever and that is very different in value than a polyester shirt of the same cost that’s in the trash by next year. You are getting more quality and durability for your money.

Cost is the amount you pay, value is what you get out of it. But what if you could get more value out of the same amount of money? What if you could make your money do more than just buy things? What if you could make your money grow and multiply, just like the banks do?

The goal is to make sure that the same dollar can do multiple things at the same time. What you want to do is save and buy the item, but continue to compound on that money just like banks do. That way, you are not only spending your money, but also investing it and earning interest on it.

But how can you do that? How can you make your money work for you, instead of working for your money? How can you avoid being penny wise and dollar foolish?

The answer is simple: you need to learn the secrets of fractional banking and infinite banking. Fractional banking is the system under which all banks function. Infinite banking is a strategy that allows you to create your own private banking system, using a specially designed life insurance policy. By using these two concepts, you can turn your liabilities into assets, and your expenses into income. You can be the bank, instead of being the customer.

You deserve to have more control over your money and your future. Let me show you how you can achieve that with fractional banking and infinite banking.

0 notes

Text

Money is not about luck.

Money is a skill, and you can learn it too.

I did.

And I’m going to show you how.

But before I do, let me make one thing clear:

This is not a guide for billionaires.

This is not a guide for people who want to exploit others, hoard wealth, or evade taxes.

This is a guide for people who want to live a rich life.

A rich life is not just about having money.

It’s about having freedom, happiness, and purpose.

It’s about using money as a tool, not a goal.

It’s about making a positive impact, not a negative one.

It’s about creating your own luck, not relying on it.

If that sounds like you, then keep reading.

Here are the 7 rules that I followed to make my own luck with money:

Rule 1: Save before you spend

The first rule is simple: save some money every month.

Don’t wait until the end of the month to save what’s left.

Pay yourself first.

Automate your savings and invest them in a high-interest account.

Then spend guilt-free on the things you love.

Saving before you spend will help you build a strong financial foundation.

It will also help you avoid debt, stress, and regret.

Rule 2: Be ready for anything

The second rule is to be prepared for the unexpected.

Life is full of surprises, and not all of them are good.

You never know when you might face a medical emergency, a job loss, or a natural disaster.

That’s why you need to have an emergency fund.

An emergency fund is a separate account that covers at least 6 months of your living expenses.

It’s not for vacations, gifts, or splurges.

It’s for real emergencies.

Having an emergency fund will give you peace of mind and security.

It will also prevent you from dipping into your savings or going into debt.

Rule 3: Invest for the long term

The third rule is to invest your money wisely.

Don’t chase the hot stocks or the market trends.

Don’t gamble your money on risky schemes or scams.

Invest in quality companies that have a proven track record and a competitive edge.

Hold them for the long term and let the magic of compounding work for you.

Investing for the long term will help you grow your wealth and beat inflation.

It will also help you avoid fees, taxes, and emotions.

Rule 4: Use your mortgage well

The fourth rule is to use your mortgage to your advantage.

Don’t pay off your mortgage early.

Instead, use the low interest rate and the tax deduction to your benefit.

Invest the extra money in a diversified portfolio that earns more than your mortgage rate.

This way, you build wealth faster and have more flexibility, even to later on pay off your mortgage with way more money in hands if that truly is your goal.

Using your mortgage well will help you leverage your debt and optimize your cash flow.

It will also help you diversify your assets and reduce your risk.

Rule 5: Plan your dream life

The fifth rule is to design your dream life.

Don’t settle for a life you don’t love.

Think big and be specific.

Know what you want to do, have, and be.

Know how much money you need to make it happen.

Make a plan and take action.

Break down your goals into manageable steps and track your progress.

Planning your dream life will help you align your money with your values and vision.

It will also help you stay motivated, focused, and inspired.

Rule 6: Keep your money tidy

The sixth rule is to organize your money.

Don’t let your money papers and things clutter your space and your mind.

Sort them by category and keep only the essential and useful ones.

Scan or shred the rest and thank them for their service.

Then, create a system to monitor and manage your money.

Use a spreadsheet, an app, or a book to track your income, expenses, debts, savings, investments, and taxes.

Assign a place for each type of your money, such as a bank, a jar, a box, or a bag.

Store your money papers and things in a safe and easy place, such as a folder, a drawer, or a cloud service.

Keeping your money tidy will help you simplify your finances and reduce your stress.

It will also help you stay on top of your money and make better decisions.

Rule 7: Buy value, not price

The seventh and final rule is to seek value, not price.

Don’t buy things just for their price tags or popularity.

Focus on the benefits and quality that they offer.

Choose things that are lasting, useful, and enjoyable.

Align your spending with your needs, wants, and goals.

Buying value, not price will help you get more bang for your buck and avoid waste.

It will also help you enjoy your money and live a rich life.

These are the 7 rules that I followed to make my own luck with money.

They helped me create my rich life.

They can help you too.

What do you think? If you found that helpful, reblog. If you have questions, DM me or let's schedule a call!

0 notes

Text

Why You Need to Plan Ahead for Long-Term Care

Long-term care is something that many people don’t think about until they need it. But by then, it may be too late to make the best decisions for yourself and your family. That’s why it’s important to plan ahead for long-term care, even if you’re healthy and independent right now.

Long-term care refers to the services and support that help people with chronic health conditions or disabilities perform daily activities, such as bathing, dressing, eating, and managing medications. Long-term care can be provided at home, in a community setting, or in a facility. The cost of long-term care can vary depending on the type, duration, and location of care, but it is usually expensive and not fully covered by Medicare or other health insurance.

According to the U.S. Department of Health and Human Services, about 70% of people turning 65 today will need some form of long-term care in their lifetime, and the average duration of care is about three years. However, many people are not prepared for this possibility and the consequences it may have on their finances, health, and quality of life.

But for every reason why people do not plan in advance for long-term care, there is a reason why they should:

Independence and choice: Advanced planning for future care needs will allow for greater independence and choice as to where and how the care is delivered. You can express your preferences and values, and select the options that best suit your needs and budget. You can also involve your family and loved ones in the planning process, and make sure they understand and respect your wishes.

Financial security: Advanced planning can mean greater financial security, not only for those who may need care but also for their family and loved ones. You can explore the various ways to pay for long-term care, such as savings, insurance, government programs, and other resources, and choose the one that works best for you. You can also protect your assets and income from being depleted by the high cost of care, and preserve your legacy for your heirs.

Family well-being: Advanced planning can ease the financial and emotional toll on one’s family and release them from the burden of providing the care, if and when it is needed. You can spare your family from the stress and conflict that may arise from having to make difficult decisions on your behalf, without knowing what you would want. You can also ensure that your family members have the support and resources they need to cope with the challenges of caregiving, and maintain their own health and well-being.

Peace of mind: Advanced planning will avoid the uncertainty, confusion, and mistakes that could arise in the event of a health care need. You can have the confidence that you have done everything you can to prepare for the future, and that you have a plan in place that reflects your wishes and needs. You can also have the peace of mind that you have taken care of yourself and your family, and that you can focus on enjoying your life and living it to the fullest.

Quality of life: Advanced planning will promote a continued quality of life, as the person defines it, when care is needed. You can ensure that your physical, emotional, social, and spiritual needs are met, and that you have access to the best possible care and services. You can also maintain your dignity, autonomy, and personal values, and live your life according to your own standards and goals.

As you can see, planning ahead for long-term care is not only a smart move, but also a necessary one. It can make a huge difference in your life and the lives of those you love. So don’t wait until it’s too late. Start planning today, and enjoy the benefits of being prepared for tomorrow.

0 notes

Text

As the year ends, it's time to consider your successes and focus on what truly matters to you. Success shouldn't derail the life of your dreams.

That's the opposite of what you want, right? Aligning your passions, skills, and decisions can help you have it all. In 2024, let's ditch the idea of keeping up with the Joneses and promise ourselves to put time and energy into the things that truly matter.

0 notes

Text

So many people are afraid of making changes because of how old they are or how old they will be and they think it's embarrassing to work on themselves at the age that they are at. Yet every year, you get a little bit older, and every year you convince yourself to not get started, is another year that you will regret it and keep wishing you had done it last year or earlier.

0 notes

Text

"Good heavens, potatoes are worth more than gold!"

"Surely not!"

"If you were shipwrecked on a desert island, what would you prefer, a bag of potatoes or a bag of gold?"

"Yes, but a desert island isn't Ankh-Morpork!"

"And that proves gold is only valuable because we agree it is, right? It's just a dream. But a potato is always worth a potato, anywhere. Add a knob of butter and a pinch of salt and you've got a meal, anywhere. Bury gold in the ground and you'll be worrying about thieves forever. Bury a potato and in due season you could be looking at a dividend of a thousand percent."

Terry Pratchett, Making Money

15K notes

·

View notes

Text

Are you in the USA? I cannot stress this enough: search your state's unclaimed property site to see if there is anything in your name.

I just got a check for nearly $900 that I didn't know about. Apparently it was sent to me at the end of 2019 and I never got it, so it was sent on to Unclaimed Property.

My friend checked the state he used to live in. He didn't have any unclaimed property of his own. But his dad, who died 20 years ago, had over $10,000 in unclaimed property. My friend is the heir, so he gets that money.

It involves a little paperwork to get the money but it's so worth it!

You can search ALL states using MissingMoney.com. And I recommend that you search ALL states - sometimes you might get a surprise about post property in another state (as my friend did with his dad!)

25K notes

·

View notes

Text

Financial Planning Checklists for Businesses & Personal Finances

Successful financial planning is a critical component of both business success and personal well-being. The same principles that apply to businesses often directly impact your personal financial journey. Here's a short checklist to demonstrate their interconnectedness:

1. Budgeting:

Business: Create a budget to manage expenses and allocate resources efficiently.

Personal: Apply budgeting skills to control personal spending and save for your financial goals.

2. Emergency Fund:

Business: Maintain a cash reserve to handle unexpected expenses or downturns.

Personal: Build your personal emergency fund to weather life's unforeseen challenges.

3. Investment Strategies:

Business: Invest in opportunities that yield growth and profitability.

Personal: Invest in assets that help your wealth grow over time, such as stocks, real estate, or retirement accounts.

4. Debt Management:

Business: Manage corporate debt wisely to avoid financial strain.

Personal: Handle personal debt responsibly and work towards reducing high-interest loans.

5. Tax Planning:

Business: Optimize tax strategies to minimize corporate tax liability.

Personal: Plan your taxes efficiently to keep more of your income.

6. Retirement Planning:

Business: Provide retirement benefits for employees.

Personal: Save and invest for your own retirement to secure your financial future.

7. Risk Management:

Business: Mitigate risks through insurance and contingency plans.

Personal: Protect your family and assets with adequate insurance coverage.

8. Goal Setting:

Business: Set clear objectives for growth and profitability.

Personal: Define financial goals and a roadmap to achieve them.

9. Regular Financial Reviews:

Business: Conduct periodic financial assessments and make necessary adjustments.

Personal: Review your financial status regularly and adapt your plans as needed.

Both businesses and individuals benefit from sound financial planning, creating a strong foundation for financial security, growth, and peace of mind.

That is why some of the most sound financial advice you can find, was often about entrepreneurship and managing a business.

1 note

·

View note