#Latest Nigerian News Online-Nigerian News

Explore tagged Tumblr posts

Text

Dollar to Naira Exchange Rate Today: Black Market and CBN Rates – Friday, November 22, 2024 For Nigerians involved in trade, travel, or investment, keeping up with the latest Dollar to Naira exchange rates is essential. This article provides the current exchange rate for USD to NGN in both the black market and the official Central Bank of Nigeria (CBN) channels, along with insights into rate fluctuations and alternative platforms for currency exchange. Dollar to Naira Black market Exchange Rate Yesterday According to the data obtained from Bureau De Change Operators (BDCs), the black market rate on Thursday, November 21, 2024, closed at: ₦1,747 per US dollar. Dollar to Naira Black Market Rate for Today, November 22, 2024. In the black market, the Dollar to Naira exchange rate often reflects real-time demand and supply, making it an essential metric for those outside formal banking channels. As of today: Buying Rate: ₦1,747 Selling Rate: ₦1,749 CBN Official Dollar to Naira Exchange Rate The official rate from the CBN is typically lower than the black market rate but is limited to certain types of transactions, such as government-approved imports and formal business operations. The official exchange rate today is: Buying Rate: ₦1,700 Selling Rate: ₦1,701 Alternative Platforms for Dollar to Naira Exchange Rates Several online platforms, including Geegpay and Grey, also offer competitive exchange rates and serve as trusted alternatives to the traditional black market: Geegpay Rates: USD: Buying at ₦1,750, Selling at ₦1,753 GBP: Buying at ₦2,120, Selling at ₦2,127 EUR: Buying at ₦1,798.03, Selling at ₦1,800.55 Grey Exchange Rates: USD: Buying at ₦1,755, Selling at ₦1,755 GBP: Buying at ₦2,102, Selling at ₦2,203 EUR: Buying at ₦1,845.03, Selling at ₦1,852 These platforms are regulated and widely used in Nigeria, providing reliable access to foreign exchange without the volatility often seen in the black market. Historical Context: Rising Dollar to Naira Exchange Rate Over the past year, the Dollar to Naira exchange rate has experienced considerable volatility. In October 2023, the black market rate was approximately ₦900 per dollar. Since then, it has nearly doubled, driven by a combination of factors such as inflation, global oil price fluctuations, and foreign currency supply issues in Nigeria. Why Nigerians Use the Black Market for Dollar Exchange The black market, or parallel market, allows for easier access to foreign currency without government-imposed restrictions. Major reasons include: Favorable Rates: Higher exchange rates often mean more Naira for each Dollar exchanged. Accessibility: It is often simpler to access dollars in the black market than through formal banks, which may limit availability. Latest Forex News in Nigeria (November 22 , 2024) Here's the latest Forex news in Nigeria as of November 22, 2024: Naira Depreciates in October Amid FX Crisis: The naira depreciated against the dollar in October 2024, with the spot exchange rate increasing to an average of N1,631.71/$ from N1,592.89/$ in September 2024. The FMDQ Exchange reported a turnover of $10.08 billion in October, a 6.58% increase from September. Naira Shows Volatility: The naira traded within a range of N1,552.92/$ to N1,675.49/$ in October, compared to N1,539.65/$ to N1,667.42/$ in September. The naira closed trading at N1,675.49/$ in October. Foreign Reserves Hit 2-Year High: Nigeria's foreign exchange reserves have risen above $40 billion for the first time in two years, reaching $40.23 billion on November 13, 2024. This increase is attributed to rising oil prices, improved diaspora remittances, and the Central Bank of Nigeria's efforts to stabilize the naira. Understanding the Difference Between Black Market and CBN Rates The black market rate generally runs higher than the CBN rate due to limited official access to dollars, which drives up demand in the parallel market. The CBN rate is regulated, targeting approved business transactions and some personal remittances.

FAQs on Dollar to Naira Exchange Rates Why is there a difference between CBN and black market rates? The black market reflects real-time demand and supply fluctuations, whereas the CBN rate is regulated to control exchange for approved uses. Can everyone use the CBN rate? No, CBN rates are primarily available for government-approved imports and transactions. Many individuals rely on the black market for convenience and access. Are Geegpay and Grey safe platforms for exchange? Yes, both platforms are well-regulated, providing secure, competitive rates for exchanging foreign currency. Will the Naira stabilize in the future? Future trends depend on economic policies, oil prices, and global market conditions, with currency stability reliant on these factors. Conclusion on Dollar to Naira Exchange Rate Today. Staying updated on the Dollar to Naira exchange rate is essential for business, travel, and investment decisions. Regularly checking black market and CBN rates, as well as online exchange platforms like Geegpay and Grey, can help you make informed decisions in Nigeria’s dynamic forex environment

0 notes

Text

Maffyamos ft. Fola - Online

Nigerian singer-songwriter and performer Maffyamos has released a new track titled “Online“. This captivating song marks Maffyamos‘s latest release of the year, following his previous hits. Adding to its appeal, the impressive 2024 song features award-winning artist FOLA, who delivers a stellar verse. Produced by the talented Hemykul, and mixed by Walybeat, the song brings a fresh sound that…

0 notes

Text

Why You Should Shop Fabrics at Jaybecks Store in Nigeria?

Are you searching for exquisite fabrics that can transform your wardrobe? If yes, then look no further than Jaybecks Store! This Nigerian fashion haven is the ultimate destination for stunning fabrics that accommodate every taste and occasion. Please check out why you should make Jaybecks Store your go-to destination for all your fabric requirements:

Unparalleled Fabric Selection

JayBecks Store presents an extensive collection of fabrics that will leave you spoilt for choice. From vibrant Ankara prints to luxurious lace, rich brocades, and elegant silks, you'll find everything you need and more at this exclusive Nigerian wholesale fabric store. Whether you want to craft a traditional outfit or design a modern ensemble, you can find the perfect fabric for your preferences.

Unparalleled Quality That Speaks for Itself

Jaybecks Store prioritizes quality fabrics. They source their fabrics from trustworthy suppliers, ensuring that every piece meets the highest standards. You can be sure that the fabrics you purchase from this reliable fabric store look stunning and stand the test of time.

Convenient Shopping Experience

JayBecks Store allows you to take advantage of convenient online shopping. With this online shopping platform, it’s easy to browse and purchase fabrics from the comfort of your home. Their user-friendly website enables you to explore their collection, compare different options, and place your order with just a few clicks conveniently.

Exceptional Customer Service

JayBecks Store is highly committed to providing exceptional standard customer service. Their knowledgeable staffs are always on hand to help you with any questions or concerns you may have. Whether you need help choosing the right designer fabric or placing an order, their friendly team is available to guide you throughout the process.

Exclusive Designs and Trends

You can consider shopping at JayBecks Store to stay ahead of the fashion curve. The fabric store offers a curated selection of exclusive designs and the latest trends, making sure that you always look your best. Whether it's a new Ankara pattern or a unique lace fabric, you will surely find something special at this exclusive fabric store in Nigeria.

Conclusion –

JayBecks Store is your one-stop shop destination for all your fabric requirements in Nigeria. With our extensive selection, exceptional quality, convenient online shopping platform, and outstanding customer service, it's no wonder we are a favorite among fashion enthusiasts.

It’s time to get ready to experience the JayBecks Store difference today. Let us help you discover the perfect fabric to bring your creative vision to life. Please check out our exclusive selection of fabrics today and make the right selection for your needs.

0 notes

Text

We’re Investigating Pastor Jeremiah’s Miracle Water, Soap –NAFDAC - Journal Important Online - BLOGGER https://www.merchant-business.com/were-investigating-pastor-jeremiahs-miracle-water-soap-nafdac/?feed_id=193436&_unique_id=66de3f38a2b53 Posted by African ExaminerFeatured, Latest Headlines, News Across NigeriaSunday, September 8th, 2024(AFRICAN EXAMINER) – The National Agency for Food and Drug Administration and Control (NAFDAC) says miracle water, soap and other products being sold to the public by one Prophet, Jeremiah Omoto are unregistered.This is contained in a statement by the agency’s Resident Media Consultant, Olusayo Akintola, in Abuja on Sunday. According to Akintola, Omoto is operating with Christ MercyLand Delivery Ministries, KM 5, Effurun, Sapele Road, Delta State.He said that the suspect was selling miracle water, miracle soap, and other unregistered products to unsuspected Nigerians, claiming that they were all NAFDAC-approved.He said that NAFDAC got the hint through a series of petitions from concerned citizens about Omoto.He said that the miracle water and soap were advertised to have healing capacity and NAFDAC certification.“The suspect showcased the use of the miracle water and miracle soap on social media.“He claimed that they had the capacity to heal barrenness and that women who used both products would be pregnant with twins.“He openly told his congregation that the soap is NAFDAC registered, which attracted the public to begin to make efforts to verify the claim,” he said.Akintola said that petitioners also submitted some of the products from the church to NAFDAC for verification.He listed the products to include miracle and healing water, River Jordan water, and the miracle water from the pool of Bethsaida.Others are a new beginning Mount Camel miracle water, water of life miracle water from the pool of Bethsaida and father smelled perfume.He said that upon receipt of the petitions, NAFDAC, through its Director of Post Marketing Surveillance (PMS), contacted the Delta State Coordinator to verify the existence of the church.“The state coordinator was also directed to take necessary regulatory action on the production facility in the church where the miracle water and other products were produced. “He covertly bought the miracle water (25cl) for 3000 naira from the church and took pictures of other products,” he said.The NAFDAC media consultant said that on visiting the church, subsequently, the team met the Head of Service (HOS), Ogunleye Fufeyin, and the Chief Security Officer (CSO). He said that officials of the church denied producing miracle and healing water or soap, even with the evidence of the receipt of purchase.“On August 27, a team of investigators and enforcement team of NAFDAC, along with a federal task force on counterfeit and unwholesome foods, visited the church to commence an investigation.“Officials of the church did not cooperate with the team, which prompted the issuing of a letter of invitation for them to report at the NAFDAC office in Asaba for further investigation, but it was not honoured.“Instead of honouring the invitation, they submitted a legal document at NAFDAC headquarters in Abuja on August 28,” he said.Akintola said that a document made available to NAFDAC on Sept. 3 claimed that the church entered a production agreement with one Globod Table Water without the knowledge of NAFDAC.He said that the act was illegal according to the extant rules and regulations on commercial production.He said that the NAFDAC investigation and enforcement team had sealed Globod Table Water.He said that the factory was sealed for aiding and abetting the production, sale, and advertisement of unregistered and unwholesome miracle water with a fake NAFDAC registration number.“NAFDAC wishes to inform the public that none of these products being advertised and sold are registered with NAFDAC.” The public is also advised to stop patronising any of these products. NAFDAC is a scientific organisation that is guided by verifiable facts before registering any product.

“In the meantime, we will continue with our investigation into the activities of this faith organisation,” he said.NANShort URL: https://www.africanexaminer.com/?p=97680“AFRICAN EXAMINER) – The National Agency for Food and Drug Administration and Control (NAFDAC) says miracle water, soap and other products being sold to the public by one Prophet, Jeremiah…”Source Link: https://www.africanexaminer.com/were-investigating-pastor-jeremiahs-miracle-water-soap-nafdac/ http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/Con3.jpg #GLOBAL - BLOGGER Posted by African ExaminerFeatured,... BLOGGER - #GLOBAL

0 notes

Text

Dollar to Naira Exchange Rate Today: Black Market and CBN Rates – Thursday, November 21, 2024 For Nigerians involved in trade, travel, or investment, keeping up with the latest Dollar to Naira exchange rates is essential. This article provides the current exchange rate for USD to NGN in both the black market and the official Central Bank of Nigeria (CBN) channels, along with insights into rate fluctuations and alternative platforms for currency exchange. Dollar to Naira Black market Exchange Rate Yesterday According to the data obtained from Bureau De Change Operators (BDCs), the black market rate on Wednesday, November 20, 2024, closed at: ₦1,750 per US dollar. Dollar to Naira Black Market Rate for Today, November 21, 2024. In the black market, the Dollar to Naira exchange rate often reflects real-time demand and supply, making it an essential metric for those outside formal banking channels. As of today: Buying Rate: ₦1,745 Selling Rate: ₦1,750 CBN Official Dollar to Naira Exchange Rate The official rate from the CBN is typically lower than the black market rate but is limited to certain types of transactions, such as government-approved imports and formal business operations. The official exchange rate today is: Buying Rate: ₦1,687 Selling Rate: ₦1,689 Alternative Platforms for Dollar to Naira Exchange Rates Several online platforms, including Geegpay and Grey, also offer competitive exchange rates and serve as trusted alternatives to the traditional black market: Geegpay Rates: USD: Buying at ₦1,750, Selling at ₦1,753 GBP: Buying at ₦2,120, Selling at ₦2,127 EUR: Buying at ₦1,798.03, Selling at ₦1,800.55 Grey Exchange Rates: USD: Buying at ₦1,755, Selling at ₦1,755 GBP: Buying at ₦2,102, Selling at ₦2,203 EUR: Buying at ₦1,845.03, Selling at ₦1,852 These platforms are regulated and widely used in Nigeria, providing reliable access to foreign exchange without the volatility often seen in the black market. Historical Context: Rising Dollar to Naira Exchange Rate Over the past year, the Dollar to Naira exchange rate has experienced considerable volatility. In October 2023, the black market rate was approximately ₦900 per dollar. Since then, it has nearly doubled, driven by a combination of factors such as inflation, global oil price fluctuations, and foreign currency supply issues in Nigeria. Why Nigerians Use the Black Market for Dollar Exchange The black market, or parallel market, allows for easier access to foreign currency without government-imposed restrictions. Major reasons include: Favorable Rates: Higher exchange rates often mean more Naira for each Dollar exchanged. Accessibility: It is often simpler to access dollars in the black market than through formal banks, which may limit availability. Latest Forex News in Nigeria (November 21 , 2024) Here's the latest Forex news in Nigeria as of November 21, 2024: Bank Chiefs Lobby Presidency Over N1tn Forex Gain: Executives of seven Deposit Money Banks are lobbying President Bola Tinubu over the 70% mandatory windfall tax on profits generated from foreign exchange transactions. The banks are advocating for a review or reduction in the tax, which was introduced to generate additional revenue for infrastructure, education, and healthcare projects. Naira Pressured Despite Record-High FX Turnover: Despite a record-high $1.4 billion turnover in the forex market and rising external reserves, the naira traded at N1,740 per dollar in the parallel market. This represents a slight depreciation from the previous day's rate of N1,732 per dollar. Nigeria's Foreign Reserves Hit 2-Year High: Nigeria's foreign exchange reserves have risen above $40 billion for the first time in two years. This increase is attributed to rising oil prices, improved diaspora remittances, and the Central Bank of Nigeria's efforts to stabilize the naira. CBN Caps Forex Profit for BDCs: The Central Bank of Nigeria has directed Bureau De Change operators to cap their forex profit margin at 1.5% to correct market distortions.

Understanding the Difference Between Black Market and CBN Rates The black market rate generally runs higher than the CBN rate due to limited official access to dollars, which drives up demand in the parallel market. The CBN rate is regulated, targeting approved business transactions and some personal remittances. FAQs on Dollar to Naira Exchange Rates Why is there a difference between CBN and black market rates? The black market reflects real-time demand and supply fluctuations, whereas the CBN rate is regulated to control exchange for approved uses. Can everyone use the CBN rate? No, CBN rates are primarily available for government-approved imports and transactions. Many individuals rely on the black market for convenience and access. Are Geegpay and Grey safe platforms for exchange? Yes, both platforms are well-regulated, providing secure, competitive rates for exchanging foreign currency. Will the Naira stabilize in the future? Future trends depend on economic policies, oil prices, and global market conditions, with currency stability reliant on these factors. Conclusion on Dollar to Naira Exchange Rate Today. Staying updated on the Dollar to Naira exchange rate is essential for business, travel, and investment decisions. Regularly checking black market and CBN rates, as well as online exchange platforms like Geegpay and Grey, can help you make informed decisions in Nigeria’s dynamic forex environment

0 notes

Text

Dollar to Naira Exchange site,

Dollar to Naira Exchange site,

In today’s interconnected global economy, currency exchange rates play a crucial role in both personal and business financial decisions. For individuals and businesses dealing with the Nigerian Naira (NGN) and the US Dollar (USD), understanding the nuances of the Dollar to Naira exchange rate is essential.

What is the Dollar to Naira Exchange Rate?

The Dollar to Naira exchange rate represents the value of one US Dollar in terms of Nigerian Naira. This rate fluctuates due to various factors, including economic conditions, market demand, and geopolitical events. A higher exchange rate indicates that the Naira is weaker compared to the Dollar, meaning it takes more Naira to purchase one Dollar.

Why Does the Exchange Rate Fluctuate?

Several factors influence the Dollar to Naira exchange rate:

Economic Indicators: Economic health indicators such as GDP growth, inflation rates, and unemployment rates can impact currency values. A robust Nigerian economy can strengthen the Naira, while economic instability may weaken it.

Supply and Demand: The demand for US Dollars in Nigeria, whether for trade, investment, or travel, affects the exchange rate. A higher demand for Dollars typically leads to a higher exchange rate.

Monetary Policy: Decisions by the Central Bank of Nigeria, including interest rates and foreign exchange reserves management, influence the Naira’s strength. Conversely, US Federal Reserve policies can also impact the Dollar's value.

Political Stability: Political events and stability play a significant role. Political uncertainty or instability can lead to fluctuations in currency values.

Global Market Trends: Global economic conditions and market trends can affect exchange rates. For example, international oil prices, as a significant export for Nigeria, can impact the Naira’s value.

How to Track the Dollar to Naira Exchange Rate

Keeping an eye on the exchange rate is crucial for anyone involved in international transactions. Here are some ways to stay updated:

Financial News Websites: Many financial news platforms provide real-time exchange rate data and market analysis.

Currency Converter Tools: Online currency converters can provide instant exchange rate information and help with conversions.

Bank Websites and Apps: Most banks offer exchange rate information on their websites or mobile apps, reflecting their own rates for currency exchange.

Forex Market Platforms: For those actively trading currencies, forex market platforms offer detailed and real-time exchange rate data.

Conclusion

Understanding the Dollar to Naira exchange rate is vital for making informed financial decisions, whether you’re traveling, investing, or managing business operations. By staying informed about the factors influencing exchange rates and utilizing available resources, you can better navigate the complexities of currency conversion and make strategic financial choices.

Stay tuned to our site for the latest updates and accurate exchange rate information to help you manage your currency exchange needs effectively.

Feel free to adjust any details or add specific features of your site that you’d like to highlight!

0 notes

Text

Dollar to Naira Exchange Rate Today: Black Market and CBN Rates – Tuesday, November 19, 2024 For Nigerians involved in trade, travel, or investment, keeping up with the latest Dollar to Naira exchange rates is essential. This article provides the current exchange rate for USD to NGN in both the black market and the official Central Bank of Nigeria (CBN) channels, along with insights into rate fluctuations and alternative platforms for currency exchange. Dollar to Naira Black market Exchange Rate Yesterday According to the data obtained from Bureau De Change Operators (BDCs), the black market rate on Monday, November 18, 2024, closed at: ₦1,740 per US dollar. Dollar to Naira Black Market Rate for Today, November 19, 2024. In the black market, the Dollar to Naira exchange rate often reflects real-time demand and supply, making it an essential metric for those outside formal banking channels. As of today: Buying Rate: ₦1,742 Selling Rate: ₦1,745 CBN Official Dollar to Naira Exchange Rate The official rate from the CBN is typically lower than the black market rate but is limited to certain types of transactions, such as government-approved imports and formal business operations. The official exchange rate today is: Buying Rate: ₦1,681 Selling Rate: ₦1,683 Alternative Platforms for Dollar to Naira Exchange Rates Several online platforms, including Geegpay and Grey, also offer competitive exchange rates and serve as trusted alternatives to the traditional black market: Geegpay Rates: USD: Buying at ₦1,749, Selling at ₦1,753 GBP: Buying at ₦2,120, Selling at ₦2,127 EUR: Buying at ₦1,798.03, Selling at ₦1,800.55 Grey Exchange Rates: USD: Buying at ₦1,755, Selling at ₦1,755 GBP: Buying at ₦2,102, Selling at ₦2,203 EUR: Buying at ₦1,845.03, Selling at ₦1,852 These platforms are regulated and widely used in Nigeria, providing reliable access to foreign exchange without the volatility often seen in the black market. Historical Context: Rising Dollar to Naira Exchange Rate Over the past year, the Dollar to Naira exchange rate has experienced considerable volatility. In October 2023, the black market rate was approximately ₦900 per dollar. Since then, it has nearly doubled, driven by a combination of factors such as inflation, global oil price fluctuations, and foreign currency supply issues in Nigeria. Why Nigerians Use the Black Market for Dollar Exchange The black market, or parallel market, allows for easier access to foreign currency without government-imposed restrictions. Major reasons include: Favorable Rates: Higher exchange rates often mean more Naira for each Dollar exchanged. Accessibility: It is often simpler to access dollars in the black market than through formal banks, which may limit availability. Latest Forex News in Nigeria (November 19 , 2024) Here's the latest Forex news in Nigeria as of November 19, 2024: Naira Devaluation Impact on 2025 Budget: Economists have indicated that the 2025 budget, while nominally higher, is worth less in dollar terms due to the naira's devaluation. The budget is pegged at N47.9 trillion, translating to approximately $34.14 billion at the current exchange rate of N1,400/$. CBN Caps Forex Profit for BDCs: The Central Bank of Nigeria (CBN) has directed Bureau De Change (BDC) operators to cap their forex profit margin at 1.5% to correct market distortions. Increased Forex Turnover: The Nigerian foreign exchange market continues to see high activity, with daily turnover hitting $1.4 billion at the Nigerian Autonomous Foreign Exchange Market (NAFEM). Surge in Forex Inflows: Nigeria's foreign exchange inflows have surged by 57% in the past year, contributing to some stability in the naira's value. Understanding the Difference Between Black Market and CBN Rates The black market rate generally runs higher than the CBN rate due to limited official access to dollars, which drives up demand in the parallel market. The CBN rate is regulated, targeting approved business transactions and some personal remittances.

FAQs on Dollar to Naira Exchange Rates Why is there a difference between CBN and black market rates? The black market reflects real-time demand and supply fluctuations, whereas the CBN rate is regulated to control exchange for approved uses. Can everyone use the CBN rate? No, CBN rates are primarily available for government-approved imports and transactions. Many individuals rely on the black market for convenience and access. Are Geegpay and Grey safe platforms for exchange? Yes, both platforms are well-regulated, providing secure, competitive rates for exchanging foreign currency. Will the Naira stabilize in the future? Future trends depend on economic policies, oil prices, and global market conditions, with currency stability reliant on these factors. Conclusion on Dollar to Naira Exchange Rate Today. Staying updated on the Dollar to Naira exchange rate is essential for business, travel, and investment decisions. Regularly checking black market and CBN rates, as well as online exchange platforms like Geegpay and Grey, can help you make informed decisions in Nigeria’s dynamic forex environment

0 notes

Text

Keeping Up with Banking and Finance News in Nigeria

Staying informed about the latest developments in the world of banking and finance is crucial, especially in a dynamic and rapidly evolving economy like Nigeria. Today brings a mix of updates that have a significant impact on the financial landscape of the country.

1. Central Bank’s Monetary Policy Announcement

In a much-anticipated move, the Central Bank of Nigeria (CBN) released its latest monetary policy decisions. The key highlight is a slight adjustment in the benchmark interest rate, aimed at balancing economic growth and inflation control. This decision comes as a response to the changing domestic and global economic conditions. Experts are closely analyzing the potential implications of this adjustment on borrowing costs, investment, and overall economic activity.

2. Fintech Startup Secures Funding

In a sign of the growing importance of the fintech sector, a Nigerian fintech startup successfully raised a substantial amount of funding in its latest investment round. The startup, focused on providing innovative digital payment solutions, attracted interest from both local and international investors. This infusion of capital is expected to fuel the company’s expansion plans and contribute to the modernization of the financial services industry in Nigeria.

3. Foreign Investment in Nigerian Bonds

Nigeria’s sovereign bonds continue to attract attention from foreign investors. Today, it was announced that a major international investment firm has increased its holdings of Nigerian government bonds. This move reflects growing confidence in Nigeria’s economic prospects and the steps taken to enhance fiscal discipline. The increased foreign investment not only strengthens Nigeria’s external reserves but also signals positive sentiment toward the country’s financial stability.

4. Digital Transformation of Banking Services

In line with the global trend of digital transformation, several Nigerian banks announced new initiatives to enhance their digital banking services. These initiatives include the rollout of advanced mobile banking apps, the expansion of online customer support, and the introduction of personalized financial management tools. The aim is to provide customers with more convenient and efficient ways to manage their finances, while also adapting to changing consumer preferences.

5. Non-Performing Loan Recovery Efforts

Efforts to address non-performing loans (NPLs) in Nigeria’s banking sector continue to make progress. The Asset Management Corporation of Nigeria (AMCON) reported a significant milestone in its ongoing efforts to recover NPLs from various financial institutions. This development contributes to the overall health of the banking industry by reducing financial risks and improving the availability of credit for productive economic activities.

Well, today’s banking and finance news in Nigeria showcases the diverse range of activities shaping the financial landscape. From monetary policy adjustments to fintech innovation and international investments, these developments collectively contribute to the growth and stability of Nigeria’s economy. As the nation progresses on its financial journey, staying attuned to these updates remains a valuable practice for individuals, businesses, and investors alike.

0 notes

Text

Nigeria Government News

Now get confirmed and complete Nigeria government news on daily bases. Naijnaira offers complete, verified information based on facts for your daily updates on news, politics, entertainment, sports, and much more.

#New Latest News in Nigeria#News Today Headlines in Nigeria#News on Politics in Nigeria#News Update in Nigeria#World News in Nigeria#Breaking Latest News in Nigeria#Online Newspapers in Nigeria#Today Nigerian News#News Today Sports in Nigeria#Today Political News in Nigeria#Latest Headline News for Today in Nigeria#Politics Today News in Nigeria#Today News Papers in Nigeria#Online News Paper in Nigeria#Newspaper Headline in Nigeria#Nigeria News Online#Nigeria Latest News#Channel News in Nigeria#Nigeria Politics News#Nigeria Government News

0 notes

Text

Dollar to Naira Exchange Rate Today: Black Market and CBN Rates – Monday, November 18, 2024 For Nigerians involved in trade, travel, or investment, keeping up with the latest Dollar to Naira exchange rates is essential. This article provides the current exchange rate for USD to NGN in both the black market and the official Central Bank of Nigeria (CBN) channels, along with insights into rate fluctuations and alternative platforms for currency exchange. Dollar to Naira Black market Exchange Rate Yesterday According to the data obtained from Bureau De Change Operators (BDCs), the black market rate on Thursday, November 14, 2024, closed at: ₦1,740 per USD, slightly higher than today’s rate, reflecting a minor gain in Naira value over recent days. Dollar to Naira Black Market Rate for Today In the black market, the Dollar to Naira exchange rate often reflects real-time demand and supply, making it an essential metric for those outside formal banking channels. As of today: Buying Rate: ₦1,738 Selling Rate: ₦1,740 CBN Official Dollar to Naira Exchange Rate The official rate from the CBN is typically lower than the black market rate but is limited to certain types of transactions, such as government-approved imports and formal business operations. The official exchange rate today is: Buying Rate: ₦1,673 Selling Rate: ₦1,675 Alternative Platforms for Dollar to Naira Exchange Rates Several online platforms, including Geegpay and Grey, also offer competitive exchange rates and serve as trusted alternatives to the traditional black market: Geegpay Rates: USD: Buying at ₦1,749, Selling at ₦1,753 GBP: Buying at ₦2,120, Selling at ₦2,127 EUR: Buying at ₦1,798.03, Selling at ₦1,800.55 Grey Exchange Rates: USD: Buying at ���1,755, Selling at ₦1,755 GBP: Buying at ₦2,102, Selling at ₦2,203 EUR: Buying at ₦1,845.03, Selling at ₦1,852 These platforms are regulated and widely used in Nigeria, providing reliable access to foreign exchange without the volatility often seen in the black market. Historical Context: Rising Dollar to Naira Exchange Rate Over the past year, the Dollar to Naira exchange rate has experienced considerable volatility. In October 2023, the black market rate was approximately ₦900 per dollar. Since then, it has nearly doubled, driven by a combination of factors such as inflation, global oil price fluctuations, and foreign currency supply issues in Nigeria. Why Nigerians Use the Black Market for Dollar Exchange The black market, or parallel market, allows for easier access to foreign currency without government-imposed restrictions. Major reasons include: Favorable Rates: Higher exchange rates often mean more Naira for each Dollar exchanged. Accessibility: It is often simpler to access dollars in the black market than through formal banks, which may limit availability. Latest Forex News in Nigeria (November 18 , 2024) Here's the latest Forex news in Nigeria as of November 18, 2024: Local Input Sourcing Rises Due to Forex Scarcity: Nigerian manufacturers have increased local sourcing of raw materials by 17% over the past decade due to foreign exchange scarcity. This shift is driven by the need to reduce dependence on imported materials. Naira Shows Signs of Stability: Nigeria's foreign exchange inflows have surged by 57% in the past year, contributing to some stability in the naira's value. This increase in inflows is helping to meet the high demand for dollars . CBN Caps Forex Profit for BDCs: The Central Bank of Nigeria (CBN) has directed Bureau De Change (BDC) operators to cap their forex profit margin at 1.5% to correct market distortions. Record High Forex Turnover: The Nigerian foreign exchange market continues to see high activity, with daily turnover hitting $1.4 billion at the Nigerian Autonomous Foreign Exchange Market (NAFEM). Understanding the Difference Between Black Market and CBN Rates The black market rate generally runs higher than the CBN rate due to limited official access to dollars, which drives up demand in the parallel market.

The CBN rate is regulated, targeting approved business transactions and some personal remittances. FAQs on Dollar to Naira Exchange Rates Why is there a difference between CBN and black market rates? The black market reflects real-time demand and supply fluctuations, whereas the CBN rate is regulated to control exchange for approved uses. Can everyone use the CBN rate? No, CBN rates are primarily available for government-approved imports and transactions. Many individuals rely on the black market for convenience and access. Are Geegpay and Grey safe platforms for exchange? Yes, both platforms are well-regulated, providing secure, competitive rates for exchanging foreign currency. Will the Naira stabilize in the future? Future trends depend on economic policies, oil prices, and global market conditions, with currency stability reliant on these factors. Conclusion on Dollar to Naira Exchange Rate Today. Staying updated on the Dollar to Naira exchange rate is essential for business, travel, and investment decisions. Regularly checking black market and CBN rates, as well as online exchange platforms like Geegpay and Grey, can help you make informed decisions in Nigeria’s dynamic forex environment

0 notes

Text

Nigeria Breaking News on Local Brands: A Spotlight on Innovation and Growth

In a landscape defined by dynamic evolution and rapid growth, the narrative around Nigerian businesses has become increasingly captivating. This week, Nigeria breaking news on local brands highlights significant milestones, showcasing how these enterprises are making waves not only domestically but also on the global stage.

Flourish of the Fashion Industry

Nigeria’s fashion industry continues to gain international recognition, with brands like Tiffany Amber and Deola Sagoe leading the charge. These designers are not only celebrated for their unique designs that blend traditional African aesthetics with modern trends but also for their commitment to sustainable practices. Recently, Tiffany Amber launched a new collection made entirely from locally sourced materials, reinforcing the brand's dedication to supporting the Nigerian economy.

In other news, Orange Culture, another prominent Nigerian fashion house, made headlines by securing a collaboration with a major global retail chain. This partnership is set to introduce Nigerian designs to a broader audience, further establishing the country’s presence in the global fashion arena. Such developments underscore the vibrancy and potential of the Nigerian fashion sector.

Tech Startups Redefining the Digital Space

The tech ecosystem in Nigeria is a hotbed of innovation, with local startups gaining significant traction. This week’s Nigeria breaking news on local brands spotlights Flutterwave, a fintech company that has revolutionized payment solutions across Africa. Flutterwave recently announced a new partnership with Amazon, enabling seamless payment solutions for Nigerian merchants on the global platform. This move is expected to bolster cross-border commerce and provide Nigerian businesses with unprecedented access to international markets.

Another tech giant making waves is Paystack, which has continued to expand its influence after being acquired by Stripe. Paystack’s latest initiative focuses on enhancing financial inclusion by simplifying the process for small and medium enterprises to accept online payments. Their efforts are not just reshaping the financial landscape but also empowering countless local businesses.

Agricultural Innovations Leading the Way

In the agricultural sector, Nigerian brands are pioneering sustainable practices and innovative solutions to address food security challenges. Farmcrowdy, an agritech company, recently introduced a new digital platform designed to connect farmers directly with consumers. This initiative aims to reduce the supply chain bottlenecks and ensure farmers receive fair prices for their produce. Farmcrowdy's efforts are pivotal in transforming agriculture into a more lucrative and sustainable industry in Nigeria.

Additionally, Thrive Agric, another key player, has been in the news for its groundbreaking work in providing farmers with access to affordable financing. Their latest funding round, which attracted significant foreign investment, underscores the growing confidence in Nigeria's agritech potential.

A Promising Horizon

The narrative of Nigerian local brands is one of resilience, innovation, and an unwavering spirit. As these brands continue to break new ground, they not only contribute to the nation’s economic growth but also set a powerful example of African excellence on the world stage. This week's Nigeria breaking news on local brands serves as a testament to the incredible strides being made across various sectors, reflecting a future filled with promise and potential for the nation's entrepreneurs and businesses.

As we celebrate these achievements, it’s clear that the story of Nigerian brands is one of relentless pursuit of growth, innovation, and global impact. With every milestone, these brands are not just making headlines—they're creating legacies that will inspire generations to come.

0 notes

Text

Biodun Stephen’s ‘Sista’ wins big at NollywoodWeek Film Festival

Biodun Stephen’s widely-celebrated drama, SISTÀ, released on Amazon Prime, has made an impact at the 11th annual NollywoodWeek Film Festival in Paris.

The NollywoodWeek Film Festival (NOW) was launched in 2013 in Paris, France, by film enthusiasts and curators Nadira Shakur and Serge Noukoue, who noticed a lack of films appealing to the large and diverse Black community in France and Europe.

The festival showcases films from Nigeria and bridges the gap between Francophone and Anglophone Africa.

The film won the Audience Choice and Jury Prize awards for best movie, highlighting its ability to resonate with viewers across cultural boundaries.

SISTÀ, inspired by Stephen’s upbringing with a single mother, sparked thought-provoking discussions and deep emotional satisfaction among a wide range of movie fans when it was released.

She said: “Single mothers are a blessing to this world. Being one myself, I can relate to every one of her pain. I wept all through because I knew that feeling and realised that our stories may differ, but our strength is the same everywhere. I believe the reason most men flee is the same as the man in the movie. I hope men in similar situations find the courage to do the same, rich or not. These children need you! It was as real as it gets,’ a viewer, Adekitan’s online review underscores SISTÀ’s emotional impact.

SISTÀ wasn’t Stephen’s only success at NollywoodWeek Paris. Her film “ATIKO”, co-produced with Adediwura Blackgold, had the honour of opening the festival.

More laurels

Her NollywoodWeek victories are merely the latest in many successes, and critics say her films consistently explore universal themes—love, loss, family, and societal challenges—encapsulated within uniquely Nigerian narratives.

These new awards follow SISTÀ’s impressive track record, having previously won Best Nollywood Drama at the Toronto International Nollywood Film Festival (TINFF) and Best Original Score at the International Independent Film Awards.

Stephen’s talent has consistently been recognised. In 2022, she won the Best Writer award at the AMVCA for her work on “The Kujus.” Last year, her movie The Wildflower won the Audience Choice award at the NollywoodWeek Festival in Paris.

The success of “SISTÀ” and “ATIKO” at NollywoodWeek Paris, combined with Stephen’s impressive portfolio, underscore a burgeoning era for Nigerian cinema.

“I always love to tell stories that resonate and look real while subtly adding comedy to douse emotional purge. I am thrilled that my films are recognised for their authentic portrayal of African narratives and their ability to connect with global viewers. It’s a victory, not just for me but for Nollywood,” she said.

She is also notable for films like Breaded Life, Big Love, Finding Baami, and Picture Perfect.

0 notes

Text

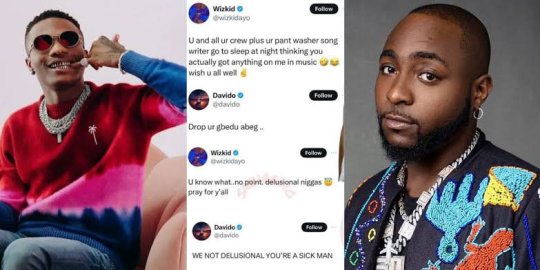

Two of Nigeria’s top musicians, David ‘Davido’ Adeleke and Ayo Balogun, aka Wizkid, have been at loggerheads for the past 24 hours, and the drama has taken a new turn with domestic violence allegations. The longstanding rivalry between Nigerian top artistes Davido and Wizkid appears far from over. Seven years after supposedly settling their supremacy rift on stage at Wizkid’s concert, they are back at it again. Both artistes reconciled during Wizkid’s concert at the Eko Convention Center in Lagos. To the audience’s delight, Wizkid made the first move by inviting Davido to share the stage and spotlight with him. With that gesture, Wizkid debunked speculations that he had an age-long beef with Davido as they performed the latter’s hit track, Fia. It was the first time both singers would perform together. Davido and Wizkid, touted as Nigeria’s biggest music acts, have engaged in a cold war fueled by their die-hard fan base for over a decade. As both artistes continue to lock horns, the 30 Billion gang and Wizkid FC have refused to back down and have taken the fight to the next level. Wizkid and Davido reignited their long-standing feud with a fiery exchange on social media, which began on Monday. The latest chapter in their saga started with a diss video uploaded by Wizkid, apparently a subtle jab at Davido. The Ojuelegba crooner posted a leaked video of Davido on his knees, crying and begging an alleged female associate. The video surfaced online in April. Wizkid, 33, posted the video, seemingly suggesting his fans needed to plead for a new song as intensely as the person in the video (implying Davido). Wizkid said fan requests alone wouldn’t convince him to release a new song, but seeing video proof of their passionate pleas (like Davido does) could sway him. The post sparked a social media firestorm and ignited a frenzy among the 30 Billion gang and Wizkid FC. It also caused friction between singers Kizz Daniel, Tekno, and other artistes. However, Davido felt slight and clapped back at Wizkid on Monday night. In his clapback, Davido said Wizkid’s songs are no longer recognised. He boasted that since he entered the music industry, Wizkid and others have not experienced peace of mind. He said, “That’s what I thought. Nothing to say, exactly why I stopped wasting my clout and jeopardising my millions of USD of endorsements on someone whose career was resurrected a few years ago just to die again.” The ‘Unavailable’ crooner said he would find somewhere with a beach to relax because when there’s light, darkness vanishes. I have hits; he doesn’t. Tell him to let’s drop it. Darkness vanishes, and they give birth to him. Very well, he should drop. I’m ready. I’ve got 80 hits ready to go. Ayo, please activate me. He didn’t fit, solo short, bitch.” “It’s so funny how the whole industry is scared of a 4-foot guy like him. I’m short too, but if you see him in person, you’ll just giggle, idiot.” The Grammy-nominated singer expressed disappointment that the tour he was scheduled to embark on with Wizkid would no longer take place. On 18 January 2023, Wizkid announced on his Instagram page that he would embark on a tour with Davido after his ‘MLLE (More Love, Less Ego)’ tour. Moreover, Davido clarified that he wouldn’t let Wizkid’s illness derail his focus or distract him. He said, “In 2024, let’s all get active. We’ll see. I can’t wait until 20 years from now. E, enjoy your time.” In response to Davido, Wizkid stated that he (Davido) was not superior to him in the music industry. Wizkid shared the same video with diss Davido, stating, “There’s no point. Delusional guys, I’ll pray for you all.” “You (Davido) and all your crew, plus your pant washer songwriter, sleep at night thinking you’ve got anything on me in music. I wish you all well,” Wizkid tweeted. In addition to Davido, Wizkid also took shots at Don Jazzy, the boss of Mavin Records, whom he labels an ‘influencer’. His jab at Don Jazzy was targeted at his (...

View On WordPress

0 notes

Text

Video - Nigerian arrested for stealing employer’s car to fund travel to Ghana for greener pastures

Ghana News Online; home for all trending news, sports and entertainment insights. We break all latest news as it happens. check out the new exclusive below. The Lagos State Command has apprehended a Nigerian man who attempted to sell his employer’s car to finance his family’s relocation to Ghana. The arrest was announced by the Command’s Public Relations Officer, SP Benjamin Hundeyin, on…

View On WordPress

0 notes

Text

Russia Reopens Embassy In Burkina Faso Closed In 1992 • Channels Television

Robert Kraft

0 notes