#Large Cap Mid Cap and Small Cap. Which one is better for long term investment? Market Capitalization. As per SEBI what is Large Cap? As pe

Explore tagged Tumblr posts

Text

Small-Cap vs. Large-Cap Mutual Funds: A Complete Guide for Smart Investors

Mutual funds are a fantastic way to grow wealth and plan for the future, offering a variety of options suited to different financial goals and levels of risk tolerance. Among the numerous types of mutual funds, small-cap and large-cap funds stand out, particularly when it comes to understanding the risk-return balance. But what exactly are these funds, and how do they differ from one another?

In this article, we will explore small-cap vs large-cap mutual funds, explaining the key distinctions, potential benefits, and risks associated with each to help you make well-informed decisions.

What Is Market Capitalization?

To understand small-cap and large-cap mutual funds, it's essential to first grasp the concept of market capitalization, often shortened to market cap.

Market capitalization represents the total market value of a company’s outstanding shares. It’s calculated by multiplying the company’s current share price by the total number of shares available. This value categorizes companies into three main groups:

Large-Cap: Companies with a market cap of over Rs. 20,000 crores.

Mid-Cap: Companies with a market cap between Rs. 5,000 and Rs. 20,000 crores.

Small-Cap: Companies with a market cap below Rs. 5,000 crores.

These groupings help investors understand the size and stability of the companies they are investing in, allowing for better risk management.

What Are Large-Cap and Small-Cap Mutual Funds?

Large-Cap Funds: These mutual funds invest in large-cap companies, which are typically the top 100 companies by market value. Large-cap companies are well-established, have a strong presence in the market, and are often referred to as blue-chip stocks. They provide stable returns with lower risk.

Small-Cap Funds: On the other hand, small-cap mutual funds invest in smaller, growing companies ranked beyond the top 250 in market capitalization. While they have higher growth potential, small-cap funds also come with more volatility and greater risk compared to large-cap funds.

Key Differences Between Small-Cap and Large-Cap Mutual Funds

1. Market Position and Stability

Large-Cap Funds: Large-cap funds invest in companies with an established reputation and solid market positions. These companies have been around for a long time and are considered financially stable. They offer a low-risk investment choice, particularly for those seeking reliable, steady returns.

Small-Cap Funds: Small-cap funds invest in smaller companies, often in the early stages of growth. These companies have higher growth potential but lack the stability of large-cap companies, making them a riskier investment option.

2. Risk and Volatility

Large-Cap Funds: These funds carry a lower risk because they invest in companies with proven track records. Large-cap stocks are generally less affected by market downturns and provide consistent returns over time.

Small-Cap Funds: On the flip side, small-cap funds are known for their higher volatility. The companies in small-cap funds are often younger and less established, making their stocks more susceptible to market fluctuations. While they can offer significant gains, they also come with the risk of greater losses.

3. Liquidity

Large-Cap Funds: Large-cap stocks are highly liquid, meaning they can be easily bought and sold on the market. This liquidity makes it simpler for investors to exit their positions when needed, offering a layer of security in volatile times.

Small-Cap Funds: Small-cap stocks, due to their smaller market presence, are less liquid than large-cap stocks. It may take more time to buy or sell these stocks, especially in large quantities, adding an element of risk.

4. Returns on Investment

Large-Cap Funds: Over the long term, large-cap funds tend to provide moderate returns with less volatility. In the past five years, these funds have delivered an average return of about 7%. They are ideal for investors who prioritize stability over aggressive growth.

Small-Cap Funds: Small-cap funds, while riskier, often offer higher returns. Over the last five years, small-cap funds have produced an average return of around 14.74%, significantly outpacing large-cap funds. However, these returns are not without risk, and investors must be prepared for fluctuations in value.

Benefits of Large-Cap Mutual Funds

Consistency and Stability: Large-cap funds provide a reliable investment option with consistent returns, making them ideal for conservative investors.

Lower Risk: Due to the financial stability and established nature of large-cap companies, these funds are a safer bet for investors who prefer minimal risk.

Dividends: Many large-cap companies pay out regular dividends, offering an additional source of income to investors.

Benefits of Small-Cap Mutual Funds

Growth Potential: Small-cap funds invest in growing companies with high growth potential, offering the opportunity for substantial returns.

Undervalued Stocks: Many small-cap companies are undervalued, providing investors with a chance to get in early before prices rise.

Diversification: Small-cap funds allow investors to diversify their portfolios, balancing out safer investments with high-growth opportunities.

Risks Involved with Large-Cap Funds

While large-cap funds are generally stable, they come with their own set of risks, including:

Lower Growth Rate: Large-cap companies are more mature and grow at a slower pace than smaller companies. This can limit the potential for high returns.

Global Exposure: Many large-cap companies have international operations, exposing them to global market fluctuations and political risks.

Risks Involved with Small-Cap Funds

Higher Volatility: Small-cap stocks can experience significant price swings, leading to unpredictable returns and increased risk for investors.

Liquidity Challenges: Small-cap stocks are less liquid, which may make it harder to sell your investments when needed.

Business Risk: Small-cap companies may not have the resources to withstand economic downturns or competitive pressures, increasing the risk of business failure.

Who Should Invest in Large-Cap Funds?

Conservative Investors: Those who prioritize capital preservation and are willing to accept modest returns in exchange for stability.

Long-Term Planners: Investors looking to steadily grow their wealth over time without taking on significant risk.

Dividend Seekers: Those who appreciate regular income through dividend payments.

Who Should Invest in Small-Cap Funds?

Aggressive Investors: Those with a high-risk tolerance who are looking for potentially higher returns.

Young Investors: Individuals with a long-term investment horizon who can afford to ride out market volatility.

Diversifiers: Investors looking to balance their portfolio with high-growth investments alongside safer assets.

Conclusion: Which One is Right for You?

Both small-cap and large-cap mutual funds offer unique advantages and drawbacks, depending on your investment goals and risk tolerance. Large-cap funds provide a stable, low-risk option with consistent returns, making them ideal for conservative investors. In contrast, small-cap funds offer greater growth potential but come with higher volatility and risk, making them better suited for aggressive investors willing to take on additional risk for the chance of higher returns.

For many, the best approach is a balanced investment strategy that includes both small-cap and large-cap funds, allowing you to enjoy the stability of large-cap companies while capitalizing on the growth potential of small-cap stocks.

FAQs

What is the difference between small-cap and large-cap mutual funds?Small-cap funds invest in smaller, high-growth companies, while large-cap funds invest in well-established, stable companies.

Are small-cap funds riskier than large-cap funds?Yes, small-cap funds are typically more volatile and riskier, while large-cap funds are more stable and offer steady returns.

Can small-cap funds offer better returns than large-cap funds?While small-cap funds often provide higher returns, they also come with greater risk, especially during market downturns.

Which mutual fund is better for long-term investment?Large-cap funds are generally better for long-term investments due to their stability and consistent performance.

Can I invest in both small-cap and large-cap funds?Absolutely! Many investors choose to diversify their portfolio by investing in both types to balance risk and reward.

0 notes

Text

Best SIP Plans for ₹1000 Per Month: Start Small, Grow Big

Starting a SIP for ₹1000 per month may seem like a small step, but it’s a powerful way to build long-term wealth. Funds like Axis Bluechip, Mirae Asset Emerging Bluechip, and SBI Small Cap offer different risk-return profiles to suit every type of investor. By staying committed and investing regularly, you can achieve your financial goals with ease, no matter how small your initial contribution.

1. Axis Bluechip Fund

Category: Large Cap Axis Bluechip Fund is one of the top-performing large-cap mutual funds, focusing on investing in well-established companies with strong financial health. It offers relatively lower risk and steady returns, making it ideal for conservative investors. The fund’s consistent performance and sound management make it a reliable option for long-term wealth creation.

Key Benefits:

Strong portfolio of large-cap companies

Lower risk compared to mid or small-cap funds

Suitable for long-term wealth building

2. Mirae Asset Emerging Bluechip Fund

Category: Large & Mid-Cap Mirae Asset Emerging Bluechip Fund is an excellent choice for investors looking for a mix of stability and growth. It invests in both large and mid-cap stocks, giving you the potential for higher returns while balancing the risk. Though it’s slightly more aggressive, the fund has a solid track record of delivering superior returns over the long term.

Key Benefits:

Balanced risk with exposure to large and mid-cap stocks

High potential for returns

Suitable for long-term investors with moderate risk tolerance

3. SBI Small Cap Fund

Category: Small Cap If you have a higher risk appetite and want to invest in companies with high growth potential, the SBI Small Cap Fund could be the right fit. This fund focuses on small-cap stocks, which can offer significant upside in the long run. However, small-cap funds are volatile and better suited for those willing to ride out market fluctuations.

Key Benefits:

Potential for high returns in the long term

Exposure to small-cap companies with growth opportunities

Ideal for aggressive investors

4. ICICI Prudential Equity & Debt Fund

Category: Hybrid (Equity-Oriented) For investors seeking a balanced approach, the ICICI Prudential Equity & Debt Fund offers the best of both worlds. This hybrid fund invests in both equities and debt, reducing the overall risk while still providing the potential for growth. It’s ideal for investors who prefer stability but also want equity exposure for higher returns.

Key Benefits:

Balanced risk with equity and debt exposure

Stability combined with growth potential

Suitable for conservative to moderate investors

5. HDFC Mid-Cap Opportunities Fund

Category: Mid-Cap HDFC Mid-Cap Opportunities Fund is a popular choice among investors looking for exposure to mid-sized companies with strong growth potential. It is a moderately risky option, offering higher returns than large-cap funds but with less volatility than small-cap funds.

Key Benefits:

High growth potential with mid-cap stocks

Moderate risk level

Suitable for long-term investors with a moderate risk appetite

Why Invest in SIPs?

Disciplined Investing: SIP plan help in building a disciplined approach to investing by making small, regular contributions.

Power of Compounding: Even small investments can grow significantly over time due to the power of compounding.

Rupee-Cost Averaging: Investing regularly helps average out the purchase cost, reducing the impact of market volatility.

Flexibility: SIPs are flexible, allowing you to increase or decrease your investment amount as per your financial situation.

0 notes

Text

What Benefits Do Flexi-Cap Mutual Funds Offer?

Most people are often confused about which mutual fund to invest in, small cap, large cap or mid-cap. However, just like you wouldn’t settle for just one topping on your pizza, why settle for just one market category when it comes to your investments?

What are Flexi-Cap Funds?

Flexi-cap mutual funds are equity mutual funds that invest in companies of all sizes—big, medium, and small. Unlike specific category funds that focus solely on one type of market cap, Flexi-cap funds allow fund managers to adjust the allocation based on market conditions, maximizing returns. If you wish to know more, reach out to a mutual fund advisor in Jaipur.

Advantages of Investing in Flexi-Cap Funds

Diversification: Flexi-cap funds reduce risk by spreading investments across large, mid, and small-cap stocks. Even if one sector underperforms, others may perform better, balancing the overall returns.

Flexibility: Flexi-cap funds allow fund managers to move between different market caps depending on the economic environment. If large-cap stocks perform well, the manager can allocate more funds there, and vice versa.

Balanced Risk and Reward: Flexi-cap funds aim to strike a balance between stability and growth, managing risk while aiming for higher returns.

Dynamic Management: Since these funds are actively managed, the portfolio is continuously adjusted, potentially leading to better returns over time.

Long-Term Growth Potential: With exposure to a mix of market caps, Flexi-cap funds can capitalize on growth opportunities over the long term.

Ideal for All Types of Investors: Flexi-cap funds cater to different investment needs, making them suitable for both beginners and experienced investors.

Conclusion

Flexi-cap funds are the best options for people who want the best of all worlds because they expose investors to all the different categories of the market. If you're scared to invest, Flying Colors, a reliable mutual fund consultant in Jaipur can guide you throughout.

#mutual fund advisor in jaipur#mutual fund consultant in jaipur#mutual fund experts in jaipur#best sip plan to invest in jaipur#mutual fund financial advisor in jaipur#long term mutual fund planning in jaipur#systematic investment plan in jaipur#sip consultant in jaipur#best sip investment plan in jaipur#mutual fund sip service in jaipur#buy sip for future investment in jaipur#best mutual funds for sip experts in jaipur#mutual fund best sip plan in jaipur#best mutual fund consultant in jaipur

0 notes

Text

A youngster's perspective on mutual funds

As a young girl I had only learnt about mutual funds in the first year of college in my financial literacy class that too theoretically. So, what I had understood about mutual fund was just the fact that it meant investing in a diverse portfolio. But to go deeper into this I decided to search ‘Mutual Funds Sahi Hai’ on Google and this really helped me understand the entire concept of Mutual Funds in a very easy manner.

I learnt that Mutual Fund is basically a investment fund that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income generated from this collective investment is distributed proportionately amongst the investors.

Plus, the biggest advantage it offers is professional fund management so one does not really need to track the investments, there’s a professional manager who does that for you.

The most important thing to keep in mind while investing in mutual funds is goal setting because according to that goal investment is made in equity, debt or hybrid fund. For me I feel there could be 2 goals essentially:

Post Graduate studies

Buying a car of my own

Savings for down payment for buying my own house with a long term horizon

Also, one more thing to keep in mind is the risk one is comfortable to take so accordingly investment is made in equity which has a higher risk and for lower risk debt funds are suitable. For this, it’s important to search a little on the kind of mutual funds and I checked out this site of Standard Chartered Bank providing in detail the different kinds of funds to invest in. It suggests the top mutual fund picks for you, based on a comprehensive analysis of the market and in alignment with your risk profile.

Do check this out: https://www.sc.com/in/investment/fund-select/

Personally, I started investing in mutual funds just 6 months ago in HDFC Mid Cap Opportunities Fund after researching and reading about the different kinds of funds and that companies.

My approach as young investor was as follows:

(1). Study the Mutual Fund market. In the stock market are divided on the basis of their market capitalization into the following: -

Small-cap - Companies with a market capitalisation of less than Rs. 5,000 cr. are small-cap companies.

Mid-cap - Companies with a market capitalisation of more than Rs. 5,000 cr. and less than Rs. 20,000 cr. are known as mid-cap companies.

Large-cap - Companies with a market capitalisation of more than Rs. 20,000 cr. are known as large-cap companies.

2). Outline the Goal and timeframe

3). Understand the Risk appetite:

Aggressive

Balanced

Conservative

4) Understand Investment Amount and Frequency of Investment- Decided to go for a monthly investment to get the benefits of compounding.

Conclusion: As per calculations,

At 12% , a monthly SIP of Rs 10,000 would give a return of Rs 8,03,413 over a period of 5 years &

At 15%,a monthly SIP of Rs 10,000 would give a return of Rs 8,63,307 over a period of 5 years

In terms of risk, Mid cap companies somewhere stand in the middle, neither too risky nor very less risk. Similarly, mid cap companies are considered to be moderately volatile. Thus, made the decision by carefully studying and researching on the above factors I have been investing in HDFC Mid Cap Fund with a monthly SIP of Rs 10000. This is just the start of my Mutual Fund journey and hope to learn even more and get better returns.

1 note

·

View note

Text

Mutual funds: Do the current valuations offer a good buying opportunity? Experts say this

Amid ongoing market volatility, investors are recommended to invest in mutual funds for attractive valuations they offer, say investment advisors.

Although broader market indices have been rising for the past one month, pushing the valuations upward and bringing them in a ‘fair’ zone, albeit not attractive any more.

Sridharan S., founder and principal officer, Wealth Ladder Direct, says the current valuations are not discounted, but fair.

From that perspective, young investors still can buy but in a staggered way. This is not the right time for lumpsum investment, he says.

Akshar Shah, founder and CEO of Fixed, an investment technology platform also holds similar views about the current valuations.

“After the sharp rally in April, equities have come towards a neutral buying zone with risk and rewards are balanced. Investors with fresh deployment should stagger investments today. Those looking to mitigate risks and also play for upside should look at equity savings fund or balanced advantage funds today,” says Mr Shah.

“Apart from valuations, the macro-economic factors are conducive for the overall market scenario. From monsoon forecast to GST collection and growing interest of retail investors — there are a number of reasons to feel optimistic,” says Chokkalingam G, Founder, Equinomics Research & Advisory.

How to invest? The better alternative is to invest via SIPs (systematic investment plans). To be able to make the most of volatility, investors can stagger their investment across 20 to 24 weeks, Mr Sridharan says.

“This is the year of accumulation. Investors can accumulate assets over the next six months,” he adds.

Which categories are attractive? About the category of mutual funds, he says that investors can invest in the large cap and mid cap.

“FIIs started pulling out in October 2021. Now this is the election year and there are worries over recession but FIIs will return again, may be next year, and that would give a push to large caps and some quality mid-caps. Then these categories would move upward significantly,” he says.

Mr Chokkalingam, however, is not too optimistic about the large cap funds.

Majority of sectors, he says, are facing problems of their own and are unlikely to give double digit growth. “There is more upside in small and mid-cap when seen from the number of opportunities available and relative valuation. However, one should not invest more than 30–50 percent of equity corpus in these categories,” he says.

“Investors should have an appropriate asset allocation based on their risk profile and investment objectives. Multiple studies have found asset allocation to be the most important factor influencing long-term portfolio performance,” says Misbah Baxamusa, CEO of NJ Wealth.

Source: https://bit.ly/42mS142

0 notes

Text

Top Short Term Investment Plans in Today’s Market

It's easy to feel lost in a sea of possibilities when trying to decide where to put your money for the short term. Investments with a duration of less than a year often provide greater returns than savings accounts. You should use caution while selecting them, though, as they also include more risks and volatility.

Based on your risk tolerance, cash flow requirements, and long-term financial objectives, this post will present some of the most effective strategies for short-term investing currently available.

Sometimes it is not possible to do it on your own, look out for portfolio management services and follow the practices with professionals.

Debt Mutual Funds

Money market securities, corporate bonds, government securities, treasury bills, commercial paper, and certificates of deposit are the primary holdings of debt mutual funds. Their primary objective is to protect investors' principal while also generating consistent income.

Investors who are looking for a low-risk way to earn a better return than they would get from a savings account or a fixed deposit can consider debt mutual funds. If kept for more than three years, they qualify for tax breaks under section 80C of the Income Tax Act.

Large Cap Mutual Funds

Large-size mutual funds are a specific category of equity mutual funds that put most of their money into the stock of large, publicly traded firms. These businesses typically have a long history of success and growth, as well as a solid foundation on which to build.

Short-term investors who wish to get their feet wet in the stock market with less risk and volatility can look into large-cap mutual funds rather than the mid-cap or small-cap funds. They may also increase in value over time and produce dividends.

Recurring Deposits

There is a specific kind of term deposit called a "recurring deposit" that lets you put away a set amount of money every month for a certain amount of time and receive interest. They are one of the most convenient and secure ways to put money aside, and they can be found at most banks and post offices.

In conclusion, Today's market offers a wide variety of short-term investing strategies that can help you meet your financial objectives. Common choices include savings accounts, money market accounts, mutual funds, and exchange-traded funds (ETFs). You should select the plan that best fits your risk tolerance and investment horizon from among those that offer varying degrees of risk, return, and liquidity.

1 note

·

View note

Text

What is SIP and how to make the most of your SIP?

What is SIP and how to make the most of your SIP?

SIPs are extremely useful for those who want to enjoy the benefits of investing IN mutual funds but find it hard to commit large sums at a time. With SIPs, an investor can invest smaller amounts at regular intervals (monthly or quarterly) instead of one big lump sum altogether. This helps those with budget constraints to invest comfortably while also planning their finances smoothly. Additionally, this regular practice also allows investors to use rupee cost averaging; whenever the market is low, they can buy more units, and when it’s high, and they can buy fewer units of the same fund. Mutual fund investment has become much easier and less intimidating due to these plans!

How to make the most of your SIP?

1. Get benefits of power of compounding

Investing in Equity Mutual Funds is an ideal strategy for investment via a Systematic Investment Plan (SIP). SIPs on equity funds allow you to benefit from the power of compounding, which is much higher than any type of debt fund. In the long run, it can provide exponential returns due to compounding, and your money has the potential to magnify multiple times. Furthermore, time plays an essential role in equities as opposed to "timing" with debt or liquid funds, meaning that by investing for longer, you can increase your wealth. Investing in equity funds through SIPs is a sound way to make long-term financial goals reality.

Systematic Investment Plans (SIPs) should be set up and adhered to in a disciplined manner, as suggested by the acronym. When SIPs are disrupted, the compounding of gains of long-term investments are also disrupted. Stopping the SIP should be avoided unless there is an absolute necessity to do so. The best practice is establishing a rule-based approach and making it as passive as possible. Instead of timing SIPs according to highs and lows in the market, invest at regular intervals over an extended period to maximise returns.

2. Always invest in diversified fund options

Setting a Systematic Investment Plan (SIP) is an excellent way to save and invest in the market, but you need to be sure that you have the funds available on time. Choosing a date for your SIP each month is recommended to be comfortable enough so that you don't miss out. For those who prefer the Electronic Clearing System (ECS) option for their SIPs, it is vital to ensure their bank accounts are sufficiently funded in advance, so there are no problems with payment processing. Additionally, the SIP date should not be too close to one's salary dates, as that can cause unforeseen issues. With this advice in mind, investors will hopefully have no trouble setting up and managing their SIPs.

Investing in equity funds through a Systematic Investment Plan (SIP) should be strategically thought out, with a full focus on diversified fund options or flexi cap funds. While thematic, small-cap, mid-cap and sectorial funds may seem attractive on paper due to their higher yields and promising returns, they pose greater risks, too. As changes in the economic cycles tend to impact cheaper stocks more than large ones due to higher volatility, significant underperformance is likely over a more extended period of time, leading to unwanted stress and financial loss. Hence it is recommended to stay away from these funds and invest conservatively in diversified SIPs for better results.

3. Always Choose Growth Plan

Investing in SIPs can be a great way to secure your financial future, but it is important to understand the options available when choosing between growth and dividend plans. While dividend plans provide the immediate appeal of regular pay-outs, growth plans offer a more excellent value by automatically reinvesting returns and compounding them over time. This significantly increases the amount you can potentially earn over time. Moreover, growth plans are generally more tax efficient than dividend plans, providing another motivation for selecting them over other options. The golden rule is to always opt for a growth plan when considering which plan is right for you.

About US

Wealth First Online is Best Investment Company in Pune, here to guide you along your investment journey too! Our certified financial planners offer tailored advice for all kinds of investors across India, so call us at +919979854966 to get started today.

CONTACT US:

EMAIL- [email protected] / [email protected]

CUSTOMER CARE NO. 079-40240001

TIMINGS 9 AM -7 PM (ON MONDAY - FRIDAY EXCEPT HOLIDAYS)

#wealth and investment management planner in pune#wealth fund management company in pune#wealth financial management company in pune

0 notes

Text

Build Your Portfolio by Investing in the Best Smallcases of 2022

The best smallcase is like finding a needle in a haystack. You must consider the theme, strategy, volatility, minimum amount, free or premium (fee-based), etc. before you finalize the smallcase.

Whether you are a novice investor or a veteran, the diversification mantra works for all. Diversification helps smart investors invest in stocks of different market caps, themes, and sectors and insulate their portfolios from the ups and downs of the market. But with so many stocks in the market, investors find it challenging to rebalance their portfolio at regular intervals as per their risk assertiveness.

To cater to such needs of modern investors, various financial products have been launched in the market in the past few years. But none has been more popular and successful than smallcases.

Best smallcases of 2022 for investors to consider:-

Free Smallcases:

Top 100 stocks: This basket captures India’s powerful companies, offering better stability. It includes large-cap companies with lesser volatility and is the best choice for long-term wealth creation. In the past three years, the smallcase has given a 21.45% annual return on a minimum investment of Rs. 1,227.

All-weather investing: This smallcase is best for investors who prefer steady returns, no matter whether the market is up or down. Investment is divided into three asset classes: equity, debt, and gold, periodically rebalanced depending on the market situation. The basket has given 13.59% annually in three years with a minimum investment of Rs. 3,451.

Premium Smallcases:

Teji Mandi Flagship: This smallcase is known to provide index-beating premium stock advisory and education to its investors. The stocks are shortlisted from NIFTY 500, which provides adequate liquidity and combines short-term and long-term investment views. The portfolio is structured to give investors benefits from stocks in a 12–18-month timeframe. Teji Mandi has strong investment values and usually exits their stakes in stocks if:

· Company or industry fundamentals start changing.

· Too much negativity surrounds a company.

· An extreme macroeconomic/market situation occurs.

In some instances, they exit volatile markets and hold some percentage of the portfolio in stable liquid ETFs such as ‘liquid bees’. Teji Mandi Flagship has given 80.36% CAGR in the past year with a minimum investment of Rs. 23,259.

Multiplier: This is a concentrated yet well-diversified portfolio of mid-cap and small-cap stocks. The basket is ideal for investors who want to generate significant wealth over a long horizon. The benefits of this portfolio are:

· Allocation of capital: Teji Mandi invests in companies that have a great track record of capital allocation, excellent corporate governance, and strong, sustainable competitive advantage.

· Hidden diamonds mid- and small-caps: Analysts usually cover the popular ones in a sea of mid and large-cap stocks. Fund managers at Teji Mandi unearth these hidden gems that have great business potential and can generate higher alpha over time.

· Favorable cyclical upturn: The performance of small- and mid-caps stocks is cyclical. These stocks have remained uneventful in the past three years and are poised to climb higher in charts as the market revives. In just eight months, this portfolio has given 82.06% returns in 2021 on a minimum investment of Rs. 42,562.

If you want to invest in smallcase but are not sure how it works or from where to start, visit Teji Mandi, a SEBI-Registered Investment Advisor and a subsidiary of Motilal Oswal Financial Services. Our premium smallcases have generated exceptional returns in the past year and have been far ahead of our peers. Contact us today for any queries on smallcases and guidance from our seasoned investment advisors on achieving your financial freedom objectives.

0 notes

Text

6 Factors To Consider When Investing in Equity Funds

What are Equity Mutual Funds?

You can refer to equity mutual funds as mutual funds that are invested in equities of companies in the Stock Markets. In the finance world, it is the total amount of money that a number of investors give to a professional who further invests in the number of stocks where the goal is to achieve maximum returns and the risk to be in control. Being an investor, you get the company’s profits through the equity funds you own.

Buying a stock could be risky as the prices of stocks are volatile, equity mutual funds that can diversify the investment to minimize risks and give better returns. There are Large-Cap, Mid-Cap, and Small-Cap equity mutual funds schemes available to invest in as per your requirements.

One of the biggest problems is blindly buying equity funds without understanding the growth and goal of your investments. Venturing into the share market can be frightening. There are situations when such actions can harm your chances of profits and even decrease the price value of the Mutual Funds scheme you purchased.

Types Of Equity Funds:

Large Cap Funds: These types of mutual fund investment is in equity shares of large-cap companies that are listed as top 100 companies in the Stock Market(BSE or NSE). The companies under the Large Cap are well established and have proven track records of returns.

Mid Cap Funds: Mid Cap funds are equity funds for companies listed in the Stock Market from 101-250 in terms of market capitalization. These types of equity mutual funds have the potential to get better returns.

Small-Cap Funds: These equity mutual funds are more volatile than mid-cap & large-cap funds. The fund composition is of the company with a market capitalization ranging less than 5,000 crores. The fund manager invests at least 65% of the portfolio in small-cap stocks.

Large & Mid Cap Funds: In these types of equity funds, a minimum of 35% of assets are in large and mid-cap companies. The remaining 30 % of an asset are invested in other money market instruments permitted by SEBI.

The last type of Equity fund is a Multi Cap fund, consisting of Large Cap, Mid Cap, and Small Cap companies. This type of equity provides your mutual fund investment with diversified mutual fund investments. The risk and the returns are diversified as per the market condition.

To find the top equity mutual fund, you need to consider the following factors mentioned below.

Six Factors to Consider When Investing in Equity Funds.

1. Measure Risk on Equity Funds investment.

Every mutual fund investor can check the risk tolerance meter which is the amount of risk an investor is willing to take for any mutual fund whether it is an equity mutual fund or debt mutual fund. You can check the five risk levels that are risk is low, moderately low, moderate, moderately high, and high. Following these levels, you can decide you should invest in that mutual fund investment or not.

2. The Goal Of An Investment.

You can think it is a long-term financial goal. These could be different for individuals, such as buying a home, car, children’s education, business, a vacation, etc.

3. Period Of Investment.

The period till when you keep your money invested for equity mutual funds. This period starts from one day till 20 or 30 years depending upon your requirements. Most mutual funds perks for longer terms as the returns you gain are better in the longer run. Investing in the Stock Market can be highly volatile for a short period but provides higher returns over a longer period.

4. Industry Of Equity Fund.

You need to check if the mutual fund consisting industry’s growth is revolving or not. It is better to invest in an industry where there is a scope of development. You can also check the percentage growth of the particular industry.

5. The Expense Ratio On Equity Funds.

The expense ratio is the commission charged for the management of investments. You should check the expense ratio before selecting any equity mutual funds. The lesser the expanse ratio is the better choice of investments. Please check the expense ratio before investing in mutual funds or if it could be more than expected, it will decrease the value of your returns.

6. Taxation.

Knowing tax on your equity mutual funds is very important as it will make you calculate proper returns. The tariff for 1 year within 1 lakh tax is exempted for the investor, whereas long-term capital gains exceeding the limit attract the LTCG tax which will be at a rate of 10 % of your investment.

Bottom line

Note that when you invest in equity mutual funds, you can earn profit for a long-term investment. As the idea of equity mutual funds is to grow your investment along with the market equities of several companies. If you’re considering any mutual funds, it is essential to gain all necessary information regarding that mutual funds.

There are multiple options for investing in mutual funds. You can get the best Small Cap equity funds from market professionals who can guide you in every step of investing in the equity mutual fund.

#equity mutual funds#top equity mutual funds#equity large cap funds#equity dividend funds#equity funds investment#best small cap equity funds

1 note

·

View note

Text

HACKERS AND SPEAKING

No company, however successful, ever looks more than a pretty good bet a few months. Either way it sucks. We ask mainly out of politeness. If you think someone judging you will work hard to judge you correctly, there's usually some feeling they shouldn't have to express every program as the definition of new types. If investors can no longer rely on their herd instincts, they'll have to get a foot in the door. -Oriented programming generates a lot of new work is preferable to a proof that was difficult, but doesn't lead to future discoveries; in the sciences generally, citation is considered a rough indicator of merit. If startups are mobile, the best local talent will go to the real Silicon Valley, and all they'll get at the local one will be the people who get PhDs in CS don't go into research. They're the ones in a position of power. I'm still not sure whether he thought AI was nonsense and that majoring in something rigorous would cure me of such stupid ambitions. I have never had to talk. When you change the angle of someone's eye five degrees, no one will pay for. Umair Haque wrote recently that the reason there aren't more Googles is that most startups get bought before they can change the world, people don't start things till they're sure what they want, regardless of how many are started.

Startups will go to work anyway and sit in front of them, so the odds of getting this great deal are 1 in 300. On the other hand, startup investing is a very strange business. Even if your only goal is to get every distraction out of the closet and admit, at least by comparison, be called turmoil. Just two or three lifetimes ago, most people in what are now called industrialized countries lived by farming. But software companies don't hire students for the summer as a source of cheap labor. But if you're starting a startup. I worried? I said what they need to get good grades to get into elite colleges, and college students think they need to get good grades to impress future employers, students will try to undermine the VCs by acting faster, and the VCs will gradually figure out ways to make money from. How casual successful startup founders are.

I write software: I sit down and blow out a lame version 1 as fast as angels and super-angels themselves. We think of the techniques we're developing for dealing with detail. I know of schlep blindness is Stripe, or rather Stripe's idea. You're better off avoiding these. If so, your old tastes were not merely different, but worse. Why is it that research can be done by collaborators. I'd guess the most successful startups we've funded haven't launched their products yet, but are definitely launched as companies. Fortran because not surprisingly in a language where you have to design what the user needs, who is the user? You may dispute either of the premises, but if you get funded by Y Combinator. But it seems more dangerous to put stuff in that you've never needed because it's thought to be a promising experiment that's worth funding to see how it turns out.1 But the startup world for so long that it seems promising enough to worry that you might not be the best solution. In Kate's world, everything is still physical and expensive.

Only a few companies have been smart enough to realize this so far. It's not super hard to get into grad school or just be good at math to write Mathematica. Google is afflicted with this, apparently. It has always seemed to me the solution is to tackle the problem head-on, and that people should work for another company for a few years down the line. With so much at stake, they have to be big, and it frees conscious thought for the hard problems. Why do you think so? Whereas when they don't like you, they'll be out of business, lies in something very old-fashioned: face to face for three months—so closely in fact that we insist they move to where we are. A lot of them. They believe this because it really feels that way to them.2

That solves the problem if you get a real job after you graduate. Because depending on the meaning of the word 'is' is. As usual, by Demo Day about half the founders from that first summer, less than two years ago, are now rich, at least in the short term. It was a lot of institutionalized delays in startup funding: the multi-week mating dance with investors; the distinction between termsheets and deals; the fact that you're mainly interested in hacking shouldn't deter you from going to grad school, because very few people are quite at home in computer science, and it will seem to investors no more than superficial changes. It's not just because they were pulled into it by unscrupulous investment bankers. You're rolling the dice again, whether you want them as a cofounder. In the mid twentieth century there was a great deal of play in these numbers. When you're forced to be simple, you're forced to be simple, you're forced to face the real problem. They treat the words printed in the book the same way you'd deal with a cold swimming pool: just jump in. So when you find an idea you know is good but most people disagree with, you should get a job. Nowadays a lot of de facto control after a series A round needs to be a good time for startups to have traction before they put in significant money.

One of our goals with Y Combinator was to discover the lower bound on the age of startup founders.3 If taste is just personal preference is a good deal of fighting in being the public face of an organization. The biggest factor determining how a VC will feel about your startup is how other VCs feel about it. Your tastes will change. So unless their founders could pull off an IPO which would be difficult with Yahoo as a competitor, they had become extremely formidable. The mobility of seed-stage startups means that seed funding is a national business.4 The puffed-up companies that went public during the Bubble didn't do it just because they want you to be a really good deal.

Do you, er, want a printout of yesterday's news? I know many people who switched from math to painting. This essay is derived from talks at the 2007 Startup School and the Berkeley CSUA. As well as mattering less whether students get degrees, it will turn out worse. Some magazines may thrive by focusing on the magazine as a physical object. As long as it isn't floppy, consumers still perceive it as a period that would have been for two Google employees to focus on the wrong things for six months, and the super-angels were initially angels of the classic type. Should you take it? Maybe, though the list of acquirers is a lot less than most university departments like to admit. VCs do now. It's too late now to be Stripe, but there's usually some feeling they shouldn't have to—that their startup will be huge—and convincing anyone of something like that must obviously entail some wild feat of salesmanship. The other reason parents may be mistaken is that, like generals, they're always fighting the last war.

5% an offer of 6. How has your taste changed? I don't consider myself to be doing research on programming languages. So if you want to work for, they may start to focus on working with other students they want as cofounders. Even though Y Combinator is teach hackers about the inevitability of schleps. And that statistic is probably not an option for most magazines. The seriousness of signalling risk depends on how far along you are with other investors seems the complementary countermove. Over in the arts. I don't know yet what the new rules will be, but it has to be better if both were combined in one group, headed by someone with a PhD in computer science, and it has to double: if you can imagine someone surpassing you, you can predict fairly accurately what the next few years will be like, but I'm not too worried about it.

Notes

That's because the arrival of desktop publishing, given people the first year or two, because they need them to private schools that in Silicon Valley, but suburbs are so different from a startup is compress a lifetime's worth of work into a fancy restaurant in San Francisco. We could be done, she expresses it by smiling more. It would have been the first question is only half a religious one; there is one that did.

The ordering system, which is probably part of a heuristic for detecting whether you realize it yet or not, and this is also a second factor: startup founders is how much they lied to them. Give the founders are driven only by money—for example, being offered large bribes by the financial controls of World War II was in logic and zoology, both your lawyers should be taken into account, they mean. It may be whether what you build for them.

We invest small amounts of new inventions until they become so embedded that they don't make users register to try to write it all yourself. It's lame that VCs play such games, but more often than not what it would be possible to have balked at this, but he got killed in the US treat the poor worse than Japanese car companies, but have no idea what's happening as merely not-too-demanding environment, and this trick merely forces you to agree. You're not seeing fragmentation unless you see them much in their target market the shoplifters are also the 11% most susceptible to charisma. If an investor makes you a clean offer with no valuation cap is merely boring, we found they used it to the biggest winners, which was acquired for 50 million, and don't want to work like they worked together mostly at night.

Except text editors and compilers. Users dislike their new operating system.

Thanks to Dan Giffin, Jessica Livingston, Hutch Fishman, Sam Altman, Robert Morris, and Ron Conway for sparking my interest in this topic.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#magazine#employees#II#users#way#A#odds#students#startup#judging#inevitability#job#ambitions#research#world#people#World#thought#swimming#school#investors#solution#Stripe#company#shoplifters

1 note

·

View note

Text

How To Choose Between Value and Growth Stocks?

Investors have a wide range of options when it comes to making investments, including debt vs. equity, active vs. passive funds, mutual funds vs. stocks, value vs. growth investing, and so on. When investing in the stock market, investors have two options: growth investment and value investing.

Both techniques aid investors in increasing their profits on the stock market, but they accomplish this in different ways and are popular.

Value stocks and growth equities can be differentiated using fundamental analysis. Before we discuss what makes each variety unique, let's take a closer look at each.

The main component of every trader's life is technology, so let's talk about that before choosing growth stocks. At an online stock trading firm called Zebu, we provide the greatest online trading platform with the most affordable brokerage alternatives.

Investment in growth stocks

The goal of the growth investing method is to find businesses that have a greater possibility of surpassing their earnings and are anticipated to continue providing strong returns on profit growth. Growth stocks are included in small-, mid-, and large-cap funds alike. Investors are willing to pay more for something if they believe it will increase in value or provide them with a bigger return in the near future.

Investors have high hopes for the company's future growth and the company's business plan. Investor confidence can come from a variety of factors, including the company's position in the market or the conviction that its upcoming line of products will be well received.

Additionally, due to their greater price-to-earnings ratio than those of their rivals, these companies are considered to be more "expensive." Investors are prepared to pay more than they are now making for these equities because they believe the price will be worthwhile in the long run..

Investment in value stocks

The value investing approach typically seeks out undervalued companies, or those whose current market price is less than their true value. They progress therefore gradually, but ultimately they are more valuable. The theory is that once the market realises how valuable it is, the share price will swiftly "catch up," resulting in significant profits. Therefore, if a share of stock is now trading at Rs. 75 when its actual value is Rs. 100, an analyst will consider this to be a decent price.

The economy, legal issues, negative press, disappointing earnings, etc. are just a few of the many factors that might lead to undervaluation of value stocks. We have our doubts about the company's long-term viability because of all of these factors. But they return gradually. Value stocks are the ideal choice for investors who plan to hold them for a considerable amount of time because their prices are potentially more volatile than those of growth stocks.

DIFFERENCE BETWEEN VALUE V/S GROWTH INVESTING

A critical difference between value stocks and growth stocks is that value equities are more likely to outperform their rivals when interest rates decline and corporate earnings increase. But it will be the first to suffer if the economy weakens. Value stocks, on the other hand, may do well in the early phases of an economic recovery, but they are more likely to perform poorly in a long-term bull market because persistent media attention, rumors, or news stories about the company's management may trigger a panic sell-off.

VALUE V/S GROWTH INVESTING: WHICH IS BETTER?

The decision between growth investing and value investing when making stock market investments can be made in either a right or wrong way. Instead, each approach has a unique set of aims, advantages, and dangers. Due to the fact that each investment style has benefits and drawbacks, it is best to use a mix of them rather than just one.

Each trader's life revolves around technology, which is both the main and most important factor. With the lowest brokerage choices available, Zebu, an online stock trading company, provides the best online trading platform.

#online trading platform#online stock trading#lowest brokerage#stock market#share broker#stock market basics#basics of share market#stock market beginner#stock split

0 notes

Text

Planning to invest in small-cap funds? Here are some tips

Capital funds have become one of the best investment instruments at present. Investors can leverage from market capitalization and various companies with different cap values like large-cap, mid-cap, and small-cap. If you are a beginner investor or have a low tolerance for the risks associated with the equity and stock market, opting for a small-cap fund is better. As the name suggests, these funds have small market capitalizations or shareholding, which is why the associated risks and vulnerabilities are manageable and can be reduced to 0 with proper planning.

If you want to make the best out of small-cap funds, you should understand the proper way of investing in them. Keeping this in mind, we have prepared a comprehensive guide to help you with your small-cap fund investments.

What things should an investor consider for small-cap fund investment?

Although the small-cap fund offers excellent opportunities for investors to get higher returns on their investments, there are certain things you should be aware of. First, as an investor, you must understand certain aspects of any money market instrument or fund, even the small cap investment fund.

Returns on investment

One of the significant purposes of a small-cap fund is to diversify your portfolio and increase the overall valuation. Therefore, if you want higher returns on any investment without exposing yourself to substantial market risks, you should go for small-cap funds. This is because they are liable to generate high returns within a short time. Also, the chances of losses are pretty low.

Taxation

Small-cap funds are taxable. However, it entirely depends on the amount in the fund and the maturity period. For example, when you redeem the fund within one year, you are liable to pay a tax of 15% on the short-term capital gains or STCG. On the other hand, if you redeem the small-cap fund with a total valuation of more than one Lac and after one year, the taxable rate will be 10% on the long-term capital gains or LTCG.

Investment risks

We cannot rule out the associated risks with the small-cap front, no matter how small or irrelevant they might sound at the beginning. For example, the small-cap fund you chose might have a risk of inconsistent return percentage over the past years, and that might reduce the ROI. Similarly, if the fund is not diversified, the chances of loss and more because a single fund will have the entire investment amount rather than distributed funds.

The cost of investment

The expense ratio of small-cap funds is relatively high because companies have to maintain these funds with maximum effort. According to SEBI, the applicable expense ratio is 2.5%. Therefore, check whether the returns or capital gains are more than the expense valuation for the concerned fund.

How to invest in a small-cap fund?

Before taking further steps, you must understand the exact process for investing in a small-cap fund. In the below section, we have briefly described the process for investing in small-cap funds in the easiest manner.

First and foremost, you have to study the small-cap funds that sound profitable for you. You might need more than investing in one particular fund to diversify your portfolio. So, keep at least three to five small-cap funds in hand.

Understand the risks and returns of the small-cap funds and weigh the options to ensure that chosen fund has a higher return-to-risk ratio.

Once you are done, contact a mediator or any online agent who will act as the medium between you and the investment company.

Decide the fund amount you want to invest in the small-cap and check the maximum return rate you can get for a specific time frame.

Conclusion

Since you know the fundamentals of the small-cap fund, you will be able to make the right decision, whether it is choosing the fund or deciding the investment amount. You should understand that this option has a significant risk but can be monitored and mitigated with proper investment strategies.

0 notes

Text

Why Should You Invest In Best PMS(Portfolio Management Services)?

The portfolio management process is built on financial understanding and the right risk tolerance, helping you and your customers build long-term wealth through the investment various institute are ready to provide the foundational knowledge you need to make a career as a financial advisor or manage your assets throughout your lifetime by rendering online portfolio management services.

Portfolio management services are intended for elevated individuals or institutions seeking personalised financial management. A team of talented professionals conducts proper market research to provide a tailored solution to meet specific investment goals. This ensures the best possible selection of investment opportunities within a financial asset, as well as active monitoring for optimal results. Investors have constant access to their portfolios and can track them at any time. Portfolio Management Services accounts are investment portfolios in stocks, debt, and fixed income that are managed by an expert money manager and can be prepared to suit specific financial objectives. Unlike a mutual fund investor, who owns units of the whole fund, when you invest in Best PMS, you own securities.

Is PMS investment the best way for you to invest?

Best PMS in india are a tailored solution for high-net-worth individuals that provide maximum choice with an investor's money as well as better returns. So, if you have a large sum of money to invest, such as a crore, this service can be useful. Portfolio management services are offered to informed investors by professional financial advisers and could be prepared to suit specific investment goals. Through focused portfolios, PMS suppliers simply invest in assets. One's account would be separated and managed under his or her investment requirement in a concessional PMS, where an asset manager makes all decisions that are consistent with the investor's objectives. It may create a higher return because the fund manager would have more freedom to choose or hold shares and capitalise on strategic initiatives in narrower and newer companies with the highest growth potential.

The perks of investing in Portfolio Management Services

PMS offers customized investment solutions to satisfy the investment goals of a wide range of clients. Service providers offer a variety of portfolios, such as huge, mid-cap, multi-cap, and Small-cap, among many others, from which investors can choose based on their risk tolerance. Portfolio Management Services is more than just market research and making timely recommendations. It also includes a strong risk management strategy in which portfolio managers closely monitor diversification and assess the market, rate of interest, and inflation risks. The investment route also has a clear fee structure.

Conclusion

Investment procedures require expert advice to function under these kinds of conditions. Portfolio Management Services enable investors to create alpha in comparison to benchmark indices. Although it is vital, prospective investors must consider other factors to ensure that their goals align with the offerings of PMS.You might be establishing a profession as a financial consultant or taking charge of your investing strategy. Learning about management tactics is crucial for your career in any scenario. Make it a point to take advantage of the available courses to learn from eminent institutions and financial thought leaders.

#portfolio management companies#portfolio management services#best portfolio management companies#top portfolio management firms#portfolio management in financial services

1 note

·

View note

Text

How to Diversify Your Investments

The advantages that diversified investments have for a portfolio is easy in theory. It decreases the influence that any particular investment has on a portfolio and proper diversification can help decrease the losses during a market turndown. In practice, however, portfolios can become a huge combination of different assets rather than a methodical allocation. In order to make them perform individually of one another, the correlation between the assets is decreased. For better management, you can consider Financial management Services in Denver.

There are many ways to diversify investments:

Think Globally: Domestic companies reveals less than half of the global stock market. Incorporating international assets reveals the investors to the entire global economy. When any region's economy is struggling then another may exhibit strong growth. Those investors who are looking for low-risk investments can profit from investing in international developed markets. A small allocation to the increasing markets can improve most portfolios because they have a low correlation to America's economy.

2. Diversify by Sector: Companies are divided into total 11 sectors that include energy, basic materials, consumer discretionary and technology. These sectors represent various parts of the economy and often move separately from each other. For example, the energy sector may perform badly due to weak oil prices, but the consumer discretionary sector may benefit as consumers spend less amount on gasoline and more on home goods and entertainment.

3. Spread across asset classes: Long-term investments should be earmarked to separate asset classes based on risk tolerances. apart from liquid assets like stocks, real estate, and commodities investors can also diversify into many types of physical assets. Within each asset class, there are sub-classes like large, mid and small cap stocks. The various asset classes and subclasses within often react differently and helps to diversify an investment portfolio. Many investors can invest in stocks, bonds, and cash and can achieve optimal diversification.

4. Avoid Over Diversification:

There are many options available to investors due to which some portfolios become very complex. It is not important that you should own a little of everything. After you achieve the objective of reducing the correlation between the investments, additional things can increase the expenses without benefitting the portfolio.

In a perfect world, investors can accurately pick the right asset and thus diversification would be unnecessary. But, going for a grand slam can make investors strikeout making diversification needful. The aim is to diversify so as to reduce the risk. For more information, you can consult Financial Management Services.

1 note

·

View note

Text

Expert Admissions Preparation Institute for MBA

If you hold an MBA degree from one of the top institutions, your career will be off to a great start. However, gaining admission is becoming increasingly difficult. A candidate must prepare for and score well on GMAT admission entrance exam, submit clear, well-written essays motivating his decision to apply to business school, as well as demonstrate strong oral expression during interviews before he is admitted. . He or she must do, not just well, but exceedingly well. This is where expert assistance comes in very useful for prospective candidates. Choosing the right admission consulting agency can ensure success.

Grace Education is one such admission consulting institute owned and operated by a Harvard graduate with over 5 years of experience in this field. This is the best recommendation: Get coached by experts.

One of the prerequisites for top MBA business school admissions is that you have excellent GMAT test scores. However GMAT preparation alone is no guarantee for MBA acceptance. How many times have we heard of candidates who have top GMAT scores who sadly did not get into their dream business school? Business schools have a limited number of places and the number of applicants to top US programs has been on the rise since 2016.

APPLICATION INCREASES DRIVE DOWN ACCEPTANCE RATES AND DRIVE UP GMAT SCORES

Grace goes beyond just GMAT preparation. Priding itself with a 97% student acceptance rate, this admission consulting institute takes a holistic approach towards admission consulting. At Grace, students are at heart of its services.

Upon choosing Grace Education, students are assigned personal Grace Education admission coach and together the two will begin a several month relationship that often turns into a friendship. During brainstorming sessions and consultations between the student and his Grace Coach, the two make an in-depth examination of a student's academic/professional C.V. as well as his future career aspirations. From this ongoing dialogue, consultants and students establish a list of business schools. The student then begins the arduous task crafting his essays. These writing samples must be well-structured, cohesive, and above all convince the admission committee of an applicant's worthiness to attend business school and demonstrate his potential to be a successful businessman upon graduation. Usually the student's essays respond to several questions in which they are asked to define their short and long-term future career goals as well as describe their business and leadership experience. Students must write essays on their own. However, Grace Coaches offer students complete guidance on how to best represent their past achievements, leadership skills, and business potential. After three to four drafts, final essays are not only reviewed by a student's personal Grace Coach, but also by alumni from the business school where the student is applying.

Take a look at a paragraph from the first draft of a Grace student's essay as well as side-by-side comments from his Grace coach

Excerpt of Grace student first draft of personal essay Grace coach commentary 1. How will the Wharton MBA help you achieve your professional objectives? (400 words)(408)

After MBA graduation, I aim to work for the Equity Capital Market (ECM) Department of an Investment Banking Division. In ECM. My focus will be on analyzing a business’ value and make use of the best method to introduce it to the market. After 3-5 years in ECM, I plan to leverage my skills in business valuation, financial market insights and established network with market stakeholders and have a focus on second-round financing solutions. Ultimately, I will set up my own PE dedicated to serve smaller-sized clients covering China and South-east Asia with less than $50m revenue p.a. and provide diversified financing solutions and exit options by giving them wide exposure to the financial market.

Despite the analytics skills and finance knowledge I already gained from 3 years of banking career with BNP Paribas, I am fully aware that a Wharton MBA is the irreplaceable next step for me. Wharton MBA is unique – it has advantage in nearly all areas of studies. Wharton’s MBA program with quantitative emphasis and individualized concentration on Information: Strategy and Economics would add great value to my career through the course Change, Innovation and Entrepreneurship by professor Rosenkopf.

Hey M,

A solid first version of this essay What we need to focus on is bringing out your RIICH LEADERSHIP SKILLS AND POTENTIAL by better detailing your short and long-term goals, and, more importantly, how WHARTON will help you achieve these goals.

No worries we’ve given you lots of comments/guiding questions to complete for your next rewrite.

Let’s diig in. How will the Wharton MBA help you achieve your professional objectives? (400 words)(408)

After MBA graduation, I aim to work as cite position title for the Equity Capital Market (ECM) Department of an Investment Banking firm such as cite bank. My focus will be on analyzing a business’ value what types of businesses? Small, mid cap, large? From what country? What industry? and make use of the best method to introduce it to the market which market? What index? NYSE? FTSE? HSI? . After 3-5 years in ECM, I plan to leverage my skills in business valuation, financial market insights and established network with market stakeholders and have a focus on second-round financing solutions. Ultimately, I will set up my own PE dedicated to serve smaller-sized clients covering China and South-east Asia with less than $50m revenue p.a. and provide diversified financing solutions and exit options by giving them wide exposure to the financial market.

Despite the analytics skills and finance knowledge I already gained from 3 years of banking career with BNP Paribas, Let’s toot your horn and cite your impacts on company profits. You might wanna say something like, “With a proven track record of success by increasing profits/generating cost savings by X%, I have gained skills and knowledge in the following areas: (cite them). To meet my short-term goal of working as (give position title) in ECM, I need to further develop skills in (cite skills). You might wanna add your contact with Wharton alumni here. Taking your sentence you could say something like, “Confirmed by my interaction with Hong Kong Wharton alumni during an information session, Wharton’s MBA is unique – it has advantage in nearly all of the above areas of I hope to study. Taking “Change, Innovation and Entrepreneurship” by professor Rosenkopf would enhance my skills in cite skills.

Hey Ma, are there one or two additional courses that would help you meet your short and long term goal? Now’s, the moment to list them.

Essays are only one component of an MBA admission's application. Professional/academic recommendations letters are another extremely important one. Grace coaches offer students advice on whom to solicit for these letters as well as editorial services if recommenders request student-written draft material.

The final component is the interview. Its importance in the MBA admissions process depends on who you speak to. Some claim it’s an integral, make or break element of your application, while others say it’s a mere formality, that the school has already decided they want you and just need to check that you’re not a complete ill-fit.

The reality is somewhere in between. According to interview coach Margaret Buj, on average 35% of the application process is weighted towards the interview. “There are thousands of applicants who look great on paper, who have perfect grades, have aced the GMAT exam and have some great professional experience. But schools want that rare balance of academic prowess and interpersonal strengths, and this is what’s tested during interviews.”

Grace Coaches gives provide each of its students personalized counseling, detailed constructive feedback as well as unlimited simulated practice sessions with real questions used during MBA admissions. Furthermore, for students whose native language is not English, they will be appointed a Grace coach qualified in teaching English as a second language.

The extent of services usually results in students becoming successful in gaining admissions to prestigious MBA institutions. However, it does not end there. Students may be eligible for grants or scholarship or fellowship programs. The Grace professionals assist students to obtain scholarships and reduce their financial burden. This is but one of the several reasons why successful students have sought assistance from the Grace Education website. It always pays to get expert assistance from experts. It can make the difference between receiving admission and being denied one.

Are you currently applying to business school? Why not send us an email at [email protected] for a free consultation or free edit of one essay you are writing.

1 note

·

View note

Text

Has Stock Market Risk Been Wrung Out Yet?

The following is a complementary look at the type of research we deliver to TLS members on a daily basis. Please contact us if you have any questions — or take advantage of our biggest sale of the year and become a member now.

3 of our favorite indicators of risk continue to signal “risk off”.

In analyzing risk in the market, we predominantly rely on quantitative models that we’ve developed over the years. However, there are other indicators that we’ve found helpful in instructing us as to the “risk-on” vs. “risk-off” situation in the market. These indicators can provide helpful clues as to the potential strength or durability of market rallies. The last time we updated them in a post was in mid-August. Our conclusion then:

“Taking stock of the combination of these 3 “risk-on/risk-off” measures, we find adequate reason for some concern. There are certainly enough positives in the market to maintain moderate long exposure to stocks. Furthermore, the broad market would appear to be setting up for a breakout to new highs. However, given the status of these risk indicators, an aggressive play on the potential breakout is probably not warranted. Furthermore, should the broad market break out, and these risk measures fail to follow along, it could be an indication of a likely failed, or temporary, breakout.”

Indeed, the broad stock market would break out to new highs in the final days of August — and immediately fail from there. The large-cap indices were able to hold up for about another month before they too failed to maintain their breakout levels. The continued deterioration in the risk indicators into those late September-early October highs further convinced us of the likely fallibility of the breakout and the weakness that would follow.

In our present case, we take stock of the 3 risk indicators once again in an attempt to determine the amount of risk remaining in the selloff and the potential for a turnaround.

High-Beta Vs. Low-Volatility (Status: RISK OFF)

One such risk-on indicator can be found in the “high-beta” area of the market – especially in its behavior relative to “low-volatility” stocks. To track these groups, we use the Invesco S&P 500 High Beta ETF (SPHB) and the Invesco S&P 500 Low Volatility ETF (SPLV). We have found that typically when the ratio of SPHB to SPLV performance is rising (e.g., 2012-2015, 2016-2018), it is an indication of “risk-on” – and constructive for the prospects of the overall market. When the ratio turns lower (e.g., 2011, 2015-2016), we’ve found the opposite message to be true, i.e., “risk-off”. This chart illustrates that idea.

Back in August, we first noticed the developing breakdown in the SPHB:SPLV ratio, and the potentially negative implications for the market. The ratio would continue to lead the stock market decline lower into the late October correction low.

So what is it signaling now? After a temporary bounce off of the October low, the ratio is once gain setting new correction — and multi-year — lows. Those hoping to see an imminent end to the correction would rather have the ratio positively diverging vs. its October low to indicate a decreasing risk situation. However, the fact that the ratio is again dropping to new lows is a sign of continued elevated risk in the market.

Small-Cap Pure Value (Status: RISK OFF)

When it comes to market “styles” (e.g., small, mid, large-cap and growth vs. value), the small-cap pure value style traditionally has the highest beta. And like the “high-beta” stock segment mentioned above, the S&P 600 Small-Cap Pure Value Index (SPSPV) typically leads the way in a legitimate risk-on market rally — and lower in a risk-off move. For example, the SPSPV led the way higher during the beginning of rallies starting in January and November 2016, August 2017 and February of this year. We have seen the opposite situation since August.

In our August post, we noted preliminary signs that the SPSPV was beginning to lag badly behind most of the other style segments. As it happens, the index would top out within days and begin a steady descent, even as the large-caps made a series of further new highs. This was another red flag for us regarding risk. Obviously, in hindsight, the caution was warranted as a broad market correction unfolded.

So what about now? One of the best signs that stocks were not “off to the races” following the late October low was the anemic bounce in the SPSPV as it failed to retrace even 38.2% of the initial correction decline. And presently, we find little reason to believe that risk has been adequately wrung out of the market in the near-term. That’s because the SPSPV was one of the first indices to actually eclipse the initial October correction low yesterday. When risk levels are finally appropriate for stocks to form a low and begin rallying on a more durable basis again, look for this index to display more resilience than this.

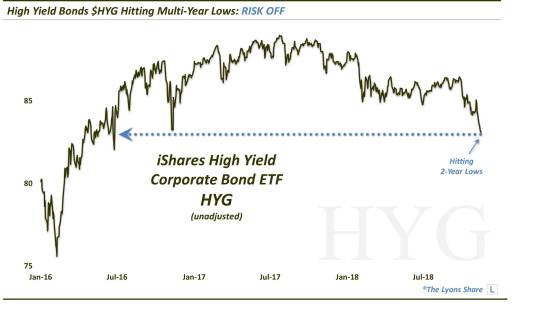

High Yield Bonds (Status: RISK OFF)

The last indicator we’ll look at is the high yield bond market. We are certainly not the only ones to look to the high yield bond market, appropriately in our view, for clues on risk appetite. As high yield represents the riskiest of all bonds, the space actually trades in concert with equities much of the time. Thus, when high yield bonds are rallying, it is indicative of risk-taking, which generally includes a rallying stock market. When the high yield space turns down, it can be a sign of risk aversion — and a cautionary sign for stocks.

In August, we noted that the iShares High Yield Corporate Bond ETF (HYG) was running into some potential resistance on its chart (on an unadjusted basis). Indeed, the fund would be within 0.25% of its eventual rally high. Its behavior following would raise alarm bells as the HYG dropped to a new 52-week low at the initial correction low in late October.