#Land acquisition loan

Explore tagged Tumblr posts

Text

Build Your Dream Home with SRG Housing Finance Ltd.'s Plot and Construction Loan

Secure your future with SRG Housing Finance Ltd.'s Home Loan for Plot and Construction. Purchase your ideal plot and finance your dream home's construction with our seamless loan process. Experience transparent, supportive financing and turn your dream into reality, building a legacy with SRG Housing Finance Ltd. by your side.

#Plot purchase loan#Construction finance#Home building loan#Land acquisition loan#Real estate development loan#Property construction financing#Residential plot loan

0 notes

Text

Unveiling Chennai's Hidden Gems: TNHB Plots and Houses - Affordable Housing that's Taking the City by Storm!

Unveiling Chennai’s Hidden Gems: TNHB Plots and Houses When it comes to affordable housing options in Chennai, TNHB (Tamil Nadu Housing Board) plots and houses stand out as hidden gems. In a city where real estate prices are soaring, TNHB offers an oasis of affordable housing solutions for individuals and families. Let’s dive into the world of TNHB plots and houses, explore their benefits, and…

View On WordPress

#TNHB allotment process#TNHB application form#TNHB eligibility criteria#TNHB flats in Chennai#TNHB house construction guidelines#TNHB houses for sale#TNHB houses in Chennai#TNHB housing scheme#TNHB land acquisition#TNHB loan scheme#TNHB maintenance charges#TNHB plot layout#TNHB plots for sale#TNHB plots in Chennai#TNHB possession process#TNHB price list#TNHB property tax#TNHB registration process#TNHB resale houses#TNHB upcoming projects

0 notes

Text

The reason you can’t buy a car is the same reason that your health insurer let hackers dox you

On July 14, I'm giving the closing keynote for the fifteenth HACKERS ON PLANET EARTH, in QUEENS, NY. Happy Bastille Day! On July 20, I'm appearing in CHICAGO at Exile in Bookville.

In 2017, Equifax suffered the worst data-breach in world history, leaking the deep, nonconsensual dossiers it had compiled on 148m Americans and 15m Britons, (and 19k Canadians) into the world, to form an immortal, undeletable reservoir of kompromat and premade identity-theft kits:

https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Equifax knew the breach was coming. It wasn't just that their top execs liquidated their stock in Equifax before the announcement of the breach – it was also that they ignored years of increasingly urgent warnings from IT staff about the problems with their server security.

Things didn't improve after the breach. Indeed, the 2017 Equifax breach was the starting gun for a string of more breaches, because Equifax's servers didn't just have one fubared system – it was composed of pure, refined fubar. After one group of hackers breached the main Equifax system, other groups breached other Equifax systems, over and over, and over:

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Doesn't this remind you of Boeing? It reminds me of Boeing. The spectacular 737 Max failures in 2018 weren't the end of the scandal. They weren't even the scandal's start – they were the tipping point, the moment in which a long history of lethally defective planes "breached" from the world of aviation wonks and into the wider public consciousness:

https://en.wikipedia.org/wiki/List_of_accidents_and_incidents_involving_the_Boeing_737

Just like with Equifax, the 737 Max disasters tipped Boeing into a string of increasingly grim catastrophes. Each fresh disaster landed with the grim inevitability of your general contractor texting you that he's just opened up your ceiling and discovered that all your joists had rotted out – and that he won't be able to deal with that until he deals with the termites he found last week, and that they'll have to wait until he gets to the cracks in the foundation slab from the week before, and that those will have to wait until he gets to the asbestos he just discovered in the walls.

Drip, drip, drip, as you realize that the most expensive thing you own – which is also the thing you had hoped to shelter for the rest of your life – isn't even a teardown, it's just a pure liability. Even if you razed the structure, you couldn't start over, because the soil is full of PCBs. It's not a toxic asset, because it's not an asset. It's just toxic.

Equifax isn't just a company: it's infrastructure. It started out as an engine for racial, political and sexual discrimination, paying snoops to collect gossip from nosy neighbors, which was assembled into vast warehouses full of binders that told bank officers which loan applicants should be denied for being queer, or leftists, or, you know, Black:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

This witch-hunts-as-a-service morphed into an official part of the economy, the backbone of the credit industry, with a license to secretly destroy your life with haphazardly assembled "facts" about your life that you had the most minimal, grudging right to appeal (or even see). Turns out there are a lot of customers for this kind of service, and the capital markets showered Equifax with the cash needed to buy almost all of its rivals, in mergers that were waved through by a generation of Reaganomics-sedated antitrust regulators.

There's a direct line from that acquisition spree to the Equifax breach(es). First of all, companies like Equifax were early adopters of technology. They're a database company, so they were the crash-test dummies for ever generation of database. These bug-riddled, heavily patched systems were overlaid with subsequent layers of new tech, with new defects to be patched and then overlaid with the next generation.

These systems are intrinsically fragile, because things fall apart at the seams, and these systems are all seams. They are tech-debt personified. Now, every kind of enterprise will eventually reach this state if it keeps going long enough, but the early digitizers are the bow-wave of that coming infopocalypse, both because they got there first and because the bottom tiers of their systems are composed of layers of punchcards and COBOL, crumbling under the geological stresses of seventy years of subsequent technology.

The single best account of this phenomenon is the British Library's postmortem of their ransomware attack, which is also in the running for "best hard-eyed assessment of how fucked things are":

https://www.bl.uk/home/british-library-cyber-incident-review-8-march-2024.pdf

There's a reason libraries, cities, insurance companies, and other giant institutions keep getting breached: they started accumulating tech debt before anyone else, so they've got more asbestos in the walls, more sagging joists, more foundation cracks and more termites.

That was the starting point for Equifax – a company with a massive tech debt that it would struggle to pay down under the most ideal circumstances.

Then, Equifax deliberately made this situation infinitely worse through a series of mergers in which it bought dozens of other companies that all had their own version of this problem, and duct-taped their failing, fucked up IT systems to its own. The more seams an IT system has, the more brittle and insecure it is. Equifax deliberately added so many seams that you need to be able to visualized additional spatial dimensions to grasp them – they had fractal seams.

But wait, there's more! The reason to merge with your competitors is to create a monopoly position, and the value of a monopoly position is that it makes a company too big to fail, which makes it too big to jail, which makes it too big to care. Each Equifax acquisition took a piece off the game board, making it that much harder to replace Equifax if it fucked up. That, in turn, made it harder to punish Equifax if it fucked up. And that meant that Equifax didn't have to care if it fucked up.

Which is why the increasingly desperate pleas for more resources to shore up Equifax's crumbling IT and security infrastructure went unheeded. Top management could see that they were steaming directly into an iceberg, but they also knew that they had a guaranteed spot on the lifeboats, and that someone else would be responsible for fishing the dead passengers out of the sea. Why turn the wheel?

That's what happened to Boeing, too: the company acquired new layers of technical complexity by merging with rivals (principally McDonnell-Douglas), and then starved the departments that would have to deal with that complexity because it was being managed by execs whose driving passion was to run a company that was too big to care. Those execs then added more complexity by chasing lower costs by firing unionized, competent, senior staff and replacing them with untrained scabs in jurisdictions chosen for their lax labor and environmental enforcement regimes.

(The biggest difference was that Boeing once had a useful, high-quality product, whereas Equifax started off as an irredeemably terrible, if efficient, discrimination machine, and grew to become an equally terrible, but also ferociously incompetent, enterprise.)

This is the American story of the past four decades: accumulate tech debt, merge to monopoly, exponentially compound your tech debt by combining barely functional IT systems. Every corporate behemoth is locked in a race between the eventual discovery of its irreparable structural defects and its ability to become so enmeshed in our lives that we have to assume the costs of fixing those defects. It's a contest between "too rotten to stand" and "too big to care."

Remember last February, when we all discovered that there was a company called Change Healthcare, and that they were key to processing virtually every prescription filled in America? Remember how we discovered this? Change was hacked, went down, ransomed, and no one could fill a scrip in America for more than a week, until they paid the hackers $22m in Bitcoin?

https://en.wikipedia.org/wiki/2024_Change_Healthcare_ransomware_attack

How did we end up with Change Healthcare as the linchpin of the entire American prescription system? Well, first Unitedhealthcare became the largest health insurer in America by buying all its competitors in a series of mergers that comatose antitrust regulators failed to block. Then it combined all those other companies' IT systems into a cosmic-scale dog's breakfast that barely ran. Then it bought Change and used its monopoly power to ensure that every Rx ran through Change's servers, which were part of that asbestos-filled, termite-infested, crack-foundationed, sag-joisted teardown. Then, it got hacked.

United's execs are the kind of execs on a relentless quest to be too big to care, and so they don't care. Which is why their they had to subsequently announce that they had suffered a breach that turned the complete medical histories of one third of Americans into immortal Darknet kompromat that is – even now – being combined with breach data from Equifax and force-fed to the slaves in Cambodia and Laos's pig-butchering factories:

https://www.cnn.com/2024/05/01/politics/data-stolen-healthcare-hack/index.html

Those slaves are beaten, tortured, and punitively raped in compounds to force them to drain the life's savings of everyone in Canada, Australia, Singapore, the UK and Europe. Remember that they are downstream of the forseeable, inevitable IT failures of companies that set out to be too big to care that this was going to happen.

Failures like Ticketmaster's, which flushed 500 million users' personal information into the identity-theft mills just last month. Ticketmaster, you'll recall, grew to its current scale through (you guessed it), a series of mergers en route to "too big to care" status, that resulted in its IT systems being combined with those of Ticketron, Live Nation, and dozens of others:

https://www.nytimes.com/2024/05/31/business/ticketmaster-hack-data-breach.html

But enough about that. Let's go car-shopping!

Good luck with that. There's a company you've never heard. It's called CDK Global. They provide "dealer management software." They are a monopolist. They got that way after being bought by a private equity fund called Brookfield. You can't complete a car purchase without their systems, and their systems have been hacked. No one can buy a car:

https://www.cnn.com/2024/06/27/business/cdk-global-cyber-attack-update/index.html

Writing for his BIG newsletter, Matt Stoller tells the all-too-familiar story of how CDK Global filled the walls of the nation's auto-dealers with the IT equivalent of termites and asbestos, and lays the blame where it belongs: with a legal and economics establishment that wanted it this way:

https://www.thebignewsletter.com/p/a-supreme-court-justice-is-why-you

The CDK story follows the Equifax/Boeing/Change Healthcare/Ticketmaster pattern, but with an important difference. As CDK was amassing its monopoly power, one of its execs, Dan McCray, told a competitor, Authenticom founder Steve Cottrell that if he didn't sell to CDK that he would "fucking destroy" Authenticom by illegally colluding with the number two dealer management company Reynolds.

Rather than selling out, Cottrell blew the whistle, using Cottrell's own words to convince a district court that CDK had violated antitrust law. The court agreed, and ordered CDK and Reynolds – who controlled 90% of the market – to continue to allow Authenticom to participate in the DMS market.

Dealers cheered this on: CDK/Reynolds had been steadily hiking prices, while ingesting dealer data and using it to gouge the dealers on additional services, while denying dealers access to their own data. The services that Authenticom provided for $35/month cost $735/month from CDK/Reynolds (they justified this price hike by saying they needed the additional funds to cover the costs of increased information security!).

CDK/Reynolds appealed the judgment to the 7th Circuit, where a panel of economists weighed in. As Stoller writes, this panel included monopoly's most notorious (and well-compensated) cheerleader, Frank Easterbrook, and the "legendary" Democrat Diane Wood. They argued for CDK/Reynolds, demanding that the court release them from their obligations to share the market with Authenticom:

https://caselaw.findlaw.com/court/us-7th-circuit/1879150.html

The 7th Circuit bought the argument, overturning the lower court and paving the way for the CDK/Reynolds monopoly, which is how we ended up with one company's objectively shitty IT systems interwoven into the sale of every car, which meant that when Russian hackers looked at that crosseyed, it split wide open, allowing them to halt auto sales nationwide. What happens next is a near-certainty: CDK will pay a multimillion dollar ransom, and the hackers will reward them by breaching the personal details of everyone who's ever bought a car, and the slaves in Cambodian pig-butchering compounds will get a fresh supply of kompromat.

But on the plus side, the need to pay these huge ransoms is key to ensuring liquidity in the cryptocurrency markets, because ransoms are now the only nondiscretionary liability that can only be settled in crypto:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

When the 7th Circuit set up every American car owner to be pig-butchered, they cited one of the most important cases in antitrust history: the 2004 unanimous Supreme Court decision in Verizon v Trinko:

https://www.oyez.org/cases/2003/02-682

Trinko was a case about whether antitrust law could force Verizon, a telcoms monopolist, to share its lines with competitors, something it had been ordered to do and then cheated on. The decision was written by Antonin Scalia, and without it, Big Tech would never have been able to form. Scalia and Trinko gave us the modern, too-big-to-care versions of Google, Meta, Apple, Microsoft and the other tech baronies.

In his Trinko opinion, Scalia said that "possessing monopoly power" and "charging monopoly prices" was "not unlawful" – rather, it was "an important element of the free-market system." Scalia – writing on behalf of a unanimous court! – said that fighting monopolists "may lessen the incentive for the monopolist…to invest in those economically beneficial facilities."

In other words, in order to prevent monopolists from being too big to care, we have to let them have monopolies. No wonder Trinko is the Zelig of shitty antitrust rulings, from the decision to dismiss the antitrust case against Facebook and Apple's defense in its own ongoing case:

https://www.ftc.gov/system/files/documents/cases/073_2021.06.28_mtd_order_memo.pdf

Trinko is the origin node of too big to care. It's the reason that our whole economy is now composed of "infrastructure" that is made of splitting seams, asbestos, termites and dry rot. It's the reason that the entire automotive sector became dependent on companies like Reynolds, whose billionaire owner intentionally and illegally destroyed evidence of his company's crimes, before going on to commit the largest tax fraud in American history:

https://www.wsj.com/articles/billionaire-robert-brockman-accused-of-biggest-tax-fraud-in-u-s-history-dies-at-81-11660226505

Trinko begs companies to become too big to care. It ensures that they will exponentially increase their IT debt while becoming structurally important to whole swathes of the US economy. It guarantees that they will underinvest in IT security. It is the soil in which pig butchering grew.

It's why you can't buy a car.

Now, I am fond of quoting Stein's Law at moments like this: "anything that can't go on forever will eventually stop." As Stoller writes, after two decades of unchallenged rule, Trinko is looking awfully shaky. It was substantially narrowed in 2023 by the 10th Circuit, which had been briefed by Biden's antitrust division:

https://law.justia.com/cases/federal/appellate-courts/ca10/22-1164/22-1164-2023-08-21.html

And the cases of 2024 have something going for them that Trinko lacked in 2004: evidence of what a fucking disaster Trinko is. The wrongness of Trinko is so increasingly undeniable that there's a chance it will be overturned.

But it won't go down easy. As Stoller writes, Trinko didn't emerge from a vacuum: the economic theories that underpinned it come from some of the heroes of orthodox economics, like Joseph Schumpeter, who is positively worshipped. Schumpeter was antitrust's OG hater, who wrote extensively that antitrust law didn't need to exist because any harmful monopoly would be overturned by an inevitable market process dictated by iron laws of economics.

Schumpeter wrote that monopolies could only be sustained by "alertness and energy" – that there would never be a monopoly so secure that its owner became too big to care. But he went further, insisting that the promise of attaining a monopoly was key to investment in great new things, because monopolists had the economic power that let them plan and execute great feats of innovation.

The idea that monopolies are benevolent dictators has pervaded our economic tale for decades. Even today, critics who deplore Facebook and Google do so on the basis that they do not wield their power wisely (say, to stamp out harassment or disinformation). When confronted with the possibility of breaking up these companies or replacing them with smaller platforms, those critics recoil, insisting that without Big Tech's scale, no one will ever have the power to accomplish their goals:

https://pluralistic.net/2023/07/18/urban-wildlife-interface/#combustible-walled-gardens

But they misunderstand the relationship between corporate power and corporate conduct. The reason corporations accumulate power is so that they can be insulated from the consequences of the harms they wreak upon the rest of us. They don't inflict those harms out of sadism: rather, they do so in order to externalize the costs of running a good system, reaping the profits of scale while we pay its costs.

The only reason to accumulate corporate power is to grow too big to care. Any corporation that amasses enough power that it need not care about us will not care about it. You can't fix Facebook by replacing Zuck with a good unelected social media czar with total power over billions of peoples' lives. We need to abolish Zuck, not fix Zuck.

Zuck is not exceptional: there were a million sociopaths whom investors would have funded to monopolistic dominance if he had balked. A monopoly like Facebook has a Zuck-shaped hole at the top of its org chart, and only someone Zuck-shaped will ever fit through that hole.

Our whole economy is now composed of companies with sociopath-shaped holes at the tops of their org chart. The reason these companies can only be run by sociopaths is the same reason that they have become infrastructure that is crumbling due to sociopathic neglect. The reckless disregard for the risk of combining companies is the source of the market power these companies accumulated, and the market power let them neglect their systems to the point of collapse.

This is the system that Schumpeter, and Easterbrook, and Wood, and Scalia – and the entire Supreme Court of 2004 – set out to make. The fact that you can't buy a car is a feature, not a bug. The pig-butcherers, wallowing in an ocean of breach data, are a feature, not a bug. The point of the system was what it did: create unimaginable wealth for a tiny cohort of the worst people on Earth without regard to the collapse this would provoke, or the plight of those of us trapped and suffocating in the rubble.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/28/dealer-management-software/#antonin-scalia-stole-your-car

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#matt stoller#monopoly#automotive#trinko#antitrust#trustbusting#cdk global#brookfield#private equity#dms#dealer management software#blacksuit#infosec#Authenticom#Dan McCray#Steve Cottrell#Reynolds#frank easterbrook#schumpeter

995 notes

·

View notes

Text

Located 62km north-east of the capital Manila, Daraitan village in Rizal province is home to about 5,700 residents, a majority of whom are members of the Dumagat-Remontado indigenous people who consider vast hectares of the mountain range as part of their ancestral domain.

But the village may soon disappear under the same waters that give it life, once the Philippine government finishes building the Kaliwa Dam – one of 16 flagship infrastructure projects of former president Rodrigo Duterte that is being funded by China.

The new dam is expected to provide Metro Manila with an additional 600 million litres of water daily once it is finished by end-2026. Officials said building the 60m-high reservoir is even more necessary now that the country is starting to feel the impact of the El Nino weather phenomenon.

But it was only in 2021 under Mr Duterte that construction finally broke ground, three years after Manila and Beijing signed the 12 billion peso (S$288 million) loan agreement.

Of the 119 on the list [of flagship projects of the "Build, Build, Build” infrastructure programme], Mr Duterte turned to China to finance 16 big-ticket projects in a bid to cement his legacy by the time his presidency ended in 2022. He embraced Beijing during his term and even downplayed Manila’s claims in the disputed South China Sea in favour of securing loans and grants from China.

Analysts have criticised Mr Duterte’s infrastructure programme as ambitious. Perennial domestic issues like local politics, right-of-way acquisition problems, lack of technology and red tape in bureaucracy led to severe delays in the projects.

The same issues hound the China-funded projects – which come under Beijing’s Belt and Road Initiative (BRI) to build infrastructure in developing nations – with the problems made more severe by Beijing’s high interest rates in its loan agreements and local backlash due to displacement of residents or potential environmental damage.

Critics say the BRI has been detrimental in the long run to some recipient countries, especially those that have been unable to repay their loans, like Sri Lanka and Zambia.

The Duterte government’s failure to take advantage of its BRI loans was a “missed opportunity” for the Philippines, said infrastructure governance specialist Jerik Cruz, a graduate research fellow at the Massachusetts Institute of Technology.

The four completed China-funded projects under Mr Duterte were controversial too. But they came to fruition because they had the support of local politicians allied with Mr Duterte and therefore increased his political capital, said Dr Camba.

Tribal leaders said they were not properly consulted regarding the project that threatens their traditional way of life. Environmentalists from the Stop Kaliwa Dam Network also say the project would destroy 126 species of flora and fauna in the Sierra Madre.

The Philippines’ Indigenous Peoples’ Rights Act states that the government must first secure a tribe’s free, prior and informed consent before building on its ancestral lands.

But Ms Clara Dullas, one of the leaders of the Dumagat-Remontado in Rizal, alleged that the Duterte government had either misinformed or pressured other tribe members into giving their consent.

She could not bear to hold grudges, though, noting that the Dumagat-Remontado organisations that eventually agreed to the Kaliwa Dam were each given 80 million pesos, or $1.9 million, in “disturbance” fees.

“The Kaliwa Dam is the reason why our tribe is divided now. There is a crack in our relationships even if we all come from the same family,” said Ms Dullas. “I can’t blame the others because we lack money. I believe there was bribery involved.”

The government requires them to present identification documents, and only those given passes may enter. Mr Dizon said this is to ensure that no unidentified personnel enter the area [close to the construction zone].

“We feel like we are foreigners in our own home because the Chinese and the people in our own government are now preventing us from entering the lands where we grew up,” said tribe leader Renato Ibanez, 48.

Mr Ibanez also accuses the Philippine authorities of harassing tribe members who are vocal against Kaliwa Dam. Some of them have been accused of working with communist rebels, a charge the tribe vehemently denies.

Unlike his predecessor, Mr Marcos is more aggressive in defending Manila’s overlapping claims with Beijing in the South China Sea, but still fosters economic ties with it.

Geopolitical tensions between the two nations and Mr Marcos’ stance towards Beijing are going to dictate the fate of the pending China-funded projects the President inherited from Mr Duterte, said Mr Cruz.

Tribe members said they would be more amenable if Mr Marcos would revisit Japan’s proposed Kaliwa Intake Weir project that Mr Duterte had set aside.

“We like Japan’s proposal. It would not destroy our forests. It would not affect residents here. The Philippines would not be buried in debt,” said Ms Dullas.

This was among the alternatives the Dumagat-Remontados offered during their nine-day march in February 2023, when some 300 members walked 150km from Quezon and Rizal all the way to Manila to protest against the Kaliwa Dam.

But they failed to secure an audience with Mr Marcos. They remain wary of the President’s position on the Kaliwa Dam and other controversial China-funded deals.

“As much as we want to fully pin our hopes on him, we don’t. We’ve learnt from past efforts to trick us, make us believe a project is about to end, only for it to be resurrected again years later,” said Ms Dullas.

2024 Mar. 3

#philippines#indigenous rights#dumagat-remontado#state violence#red tagging#infrastructure#environmental issues#afp-pnp

57 notes

·

View notes

Note

Warprize Hob, but he’s someone else’s warprize pet when he and Dream meet.

King Dream is visiting another kingdom and is shown the ruler’s newest acquisition, Hob, and apart from being immediately enthralled he can tell that Hob’s situation is…not great.

He’s not being tortured or traumatized, but it’s clear that his pleasure or care is very secondary to his owner’s, and he doesn’t really receive focused attention or aftercare or even rewards for good behavior. Dream’s not even sure Hob received any training in learning to enjoy his position, that any pleasure he gets from pain or humiliation is entirely coincidence and incidental. Even if he wasn’t interested in Hob specifically, Dream would disapprove on principle. He’s now determined to take Hob for himself and give him all the attention he deserves.

Now either this kingdom is small or insignificant enough that Dream feels comfortable just menacing its ruler into handing Hob over, or it’s large or important enough that Dream must negotiate or challenge for Hob and win (if the latter the ruler is probably Lucifer and the challenge is something similar to canon). Either way though, I think beforehand Dream is given an opportunity to win Hob’s personal regard that he takes full advantage of; it’s the practice of this court to essentially loan out their warprizes to particularly important foreign dignitaries for the duration of their stay, and either by lucky chance or manipulation Dream is given Hob.

Dream wastes no time dedicating every spare moment he has on Hob, on treating him right, and showering him with every bit of pleasure and care he could ever want. By the time Dream turns his attention to claiming Hob from his soon-to-be-previous owner, Hob is at least halfway in love and dearly hoping for Dream’s success.

Dream starts heading home with Hob tucked into his side, and he’s already sent word ahead to prepare clothing and accessories and sex toys for his new prize.

-🪽anon

I ABSOLUTELY love this. Yes Dream, steal that traumatised hottie and take him home!!!

Kinda love the idea that Lucifer has been keeping Hob up to now and showing him off as a prize from the latest land they conquered. Hob was just a random soldier who happened to survive but Lucifer likes telling people that he was a prince. They dress Hob in chains and rags and generally humiliate him, which Hob isn’t super into to be honest, not when he hasn't had a decent meal in 3 months.

Dream gets the dubious honour of having Hob all to himself for the duration of the visit. Lucifer gives him permission to do anything short of killing Hob, but Dream is generally horrified by the whole situation. He gives Hob a bath, dresses him properly and feeds him!!! Which pretty much endears him to Hob for life. Dream is genuinely captivated by the lovely doe eyed warprize and is determined to have him - but he knows that Lucifer won't give in without a fight.

For the entirety of Dream’s visit they spend time together, and Dream bestows as much pleasure on Hob as possible. He sucks his little cock, fucks him, even lets Hob switch and fuck him. He learns about Hob secret little kinks and makes him cum at least four times every day. Hob is suddenly in sensory heaven, and he begs Dream not to leave him.

And of course Dream doesn't. He challenges Lucifer for the ownship of their prize, and he WINS - in front of the entire assembled court. And he makes a quick exit with Hob in tow. He's aware that Lucifer is now seriously pissed off.

Oh, but it's worth it. Hob is a treasure. Endlessly loyal and eager to please, he would do absolutely anything to make Dream happy. He curls up at the foot of Dream’s bed each night and Dream can hear him thanking the gods for his rescuer. Such a sweet little thing. And he's quite the slut too, when he's treated right.

He loves to be allowed to cum multiple times over the day, but really his favourite thing is to have Dream’s cum on his skin. Whether Dream gives him a facial, or paints the lovely swell of his arse with release, Hob is bound to moan ecstatically. It reminds him that he belongs to Dream, now. He methodically rubs Dream’s cum into his flesh until the entire palace knows that he's been fucked.

And Dream loves him more with every passing day.

68 notes

·

View notes

Text

𝐁𝐀𝐒𝐈𝐂𝐒

Name: Edgar Michael Yang-Fortier

Age: 38

Occupation: Manager of Desert Bloom Winery

Affiliation: Donor for Obsidian Holdings

Gender & Pronouns: Man (he/him)

Languages spoken: English; French; Mandarin

DOB: March 18, 1986

Zodiac: Pisces

Blood type: AB+

Alignment: chaotic neutral

Gender: Cisgender man

Pronouns: he/him

Sexuality: demiromantic bisexual

Height: 6’2”

Eye color: Hazel

Hair color: Dark Brown

Religious affiliation: Buddhist

Scars: small scar bisecting left eyebrow

Tattoos: Many (including the majority of FC’s actual tattoos), mostly small. Most notable: snake on right forearm; fleur de lis on left ankle; koi fish on side of left wrist.

Faceclaim: Lewis Tan

𝐁𝐈𝐎𝐆𝐑𝐀𝐏𝐇𝐘

tw death

Edgar Yang-Fortier had sold his soul to the devil. How else was he supposed to feel when the only thing he’d ever wanted, ever worked for, had been bought and sold through bribery and extortion?

Edgar Yang-Fortier had grown up in relative luxury. For generations, the Fortier family had been renowned vintners. They’d started out in southern France only to immigrate to Paxton, Arizona a few decades back. It was then that Desert Bloom Winery was born, when Xavier Fortier met and married Daiyu Yang, the daughter of a local farmer. On paper, the match appeared to be blessed – Xavier had been born and bred into wine making knowledge, and Daiyu came from a long line of people who’d loved and cared for their parcel of land. Their two expertises, then, could be nothing less that fruitful. In practice, though, the match was ill fated from the start.

Xavier Fortier was something of a monster who terrorized his young family behind closed doors. On top of that, over the years, he developed a gambling habit, often finding himself indebted to a variety of sources. So, it came as no surprise, then, when, on the occasion of his death a mere year ago, it was discovered that Desert Bloom Winery was so steeped in debt that there was simply no other option than to sell.

It was then that Obsidian Holdings came knocking. Edgar had met and had a brief fling with Lindsey Gallagher during their college days, but college had ended and he’d returned to Paxton with the intent of taking over the winery, and had hardly thought twice about the woman in the years that followed. Finding her on his doorstep days after his father’s funeral had come as a surprise, but her offer had felt like an inevitability.

Without the knowledge of his siblings, Edgar accepted the offer – sell the winery in all but name to Obsidian Holdings and continue to operate business as usual. The winery would host events when Obsidian needed and the Fortier-Yang family would become donors to the cause, but in the way that it counted – for pride’s sake – they would be able to hold on to their legacy.

The offer was clearly extortionary. Edgar could see all of the ways this could go up in flames, but he’d been given an opportunity to redeem and secure his family’s legacy and he would take it even if it required making a deal with the devil. His siblings aren’t aware of the inner workings of the deal. In their minds, he’s simply accepted a loan which has allowed him to push off some of the business’s debt for the time being, but Edgar knows better – he’s doomed himself all for the chance to save his family, and he’d do it again if he had to.

𝐏𝐋𝐎𝐓 𝐀𝐑𝐂

Edgar likes to believe that he’s a neutral party. He’d grown up in this town, known both Randall and Alicia, but had never allowed himself to become enmeshed in the goings on of the Cowboy Mafia. As a donor to Obsidian Holdings, though, and the face of their newest acquisition, it’s difficult to remain neutral in this fight. He hates everything Obsidian stands for, hates who he has become, but recognizes that to save his family’s legacy, he would take that deal every sing time.

2 notes

·

View notes

Text

Buying Property in Thailand

Thailand is an attractive destination for property buyers due to its scenic landscapes, vibrant cities, and welcoming culture. However, purchasing property in Thailand, especially as a foreigner, involves navigating a complex legal framework and understanding the local market intricacies. This comprehensive guide will provide detailed insights, enhancing expertise and credibility by delving into the legalities, procedures, and best practices for buying property in Thailand.

1. Understanding the Legal Framework

Key Legal Restrictions:

Land Code Act B.E. 2497 (1954): Foreigners cannot own land in Thailand except under specific conditions.

Condominium Act B.E. 2522 (1979): Foreigners can own up to 49% of the total floor area of a condominium building.

Foreign Business Act B.E. 2542 (1999): Regulates foreign business activities and investments, impacting property purchases for business purposes.

Exceptions and Alternatives:

Board of Investment (BOI) Projects: Foreigners investing in BOI-promoted projects can acquire land under specific conditions.

Long-Term Leases: Foreigners can lease land for up to 30 years, with options to renew.

Thai Company Ownership: Forming a Thai company where foreigners hold less than 50% of shares allows indirect land ownership.

2. Types of Property Available for Purchase

Condominiums:

Freehold Ownership: Foreigners can own condominium units outright.

Ownership Percentage: The foreign ownership quota in a condominium building should not exceed 49%.

Leasehold Properties:

Land and Houses: Foreigners can lease land and houses for up to 30 years, with potential for renewal.

Registration: Leases exceeding three years must be registered at the Land Department to be legally enforceable.

Investment Properties:

Commercial Real Estate: Foreigners can invest in commercial properties through long-term leases or joint ventures with Thai partners.

Resort and Hotel Investments: Special regulations apply to foreign investments in resort and hotel properties, often requiring joint ventures.

3. Due Diligence and Legal Processes

Conducting Due Diligence:

Title Search: Verify the property’s legal status, ownership history, and any encumbrances or disputes.

Zoning and Land Use: Ensure the property complies with local zoning laws and land use regulations.

Environmental Compliance: Check for any environmental restrictions or issues affecting the property.

Engaging Legal and Financial Advisors:

Real Estate Lawyer: Hire a reputable lawyer specializing in Thai real estate to guide you through the legal processes.

Financial Advisor: Consult a financial advisor to understand tax implications, financing options, and investment strategies.

Steps in the Buying Process:

Reservation Agreement: Sign a reservation agreement and pay a reservation fee to secure the property.

Due Diligence: Conduct thorough due diligence with the help of legal advisors.

Sale and Purchase Agreement (SPA): Draft and sign the SPA, detailing the terms and conditions of the sale.

Deposit Payment: Pay a deposit, typically 10-30% of the purchase price.

Transfer of Ownership: Complete the transfer at the Land Department, paying the remaining balance and associated fees.

4. Costs and Taxes Involved

Purchase Costs:

Transfer Fee: 2% of the appraised property value.

Stamp Duty: 0.5% of the purchase price or appraised value, whichever is higher.

Withholding Tax: 1% of the appraised value or the actual sale price, whichever is higher.

Specific Business Tax (SBT): 3.3% of the appraised or actual sale price, applicable if the property is sold within five years of acquisition.

Ongoing Costs:

Common Area Fees: Monthly fees for maintenance of common areas in condominiums.

Property Tax: Annual property tax based on the assessed value of the property.

Utilities and Maintenance: Regular expenses for utilities, repairs, and maintenance.

5. Financing Options

Local Financing:

Thai Banks: Some Thai banks offer mortgage loans to foreigners for condominium purchases.

Eligibility Criteria: Generally, borrowers need to have a work permit, proof of income, and a good credit history.

Foreign Financing:

Home Country Banks: Some buyers secure financing from banks in their home countries, leveraging their assets abroad.

International Mortgage Providers: Specialized financial institutions provide mortgages for international property purchases.

Payment Plans:

Developer Financing: Some developers offer financing plans with staggered payments during the construction period.

Installment Payments: Buyers can negotiate installment payments directly with sellers or developers.

6. Common Pitfalls and How to Avoid Them

Legal Complications:

Unclear Title: Always verify the title to avoid disputes and ensure clear ownership.

Zoning Issues: Confirm zoning regulations to ensure the property can be used as intended.

Contractual Disputes: Have all agreements reviewed by a lawyer to prevent misunderstandings and ensure enforceability.

Financial Risks:

Currency Fluctuations: Be aware of exchange rate risks when making payments in foreign currency.

Hidden Costs: Account for all additional costs such as taxes, fees, and maintenance expenses.

Financing Challenges: Ensure you have a clear financing plan and understand the terms of any loans or payment plans.

7. Enhancing Expertise and Credibility

Demonstrating Professional Credentials:

Legal Qualifications: Highlight the legal qualifications and experience of your advisors and partners.

Professional Experience: Detail your experience in handling property transactions in Thailand.

Memberships and Affiliations: Include memberships in professional organizations like the Thai Bar Association, the Real Estate Broker Association, or international property associations.

Providing Authoritative References:

Cite Legal Documents: Reference specific sections of the Land Code Act and Condominium Act to support your points.

Expert Opinions: Incorporate insights from recognized experts in Thai real estate law and property investment.

Including Detailed Case Studies:

Client Testimonials: Feature testimonials from clients who have successfully purchased property in Thailand with your assistance.

Real-Life Examples: Provide detailed examples of successful transactions, highlighting any challenges overcome and solutions implemented.

Visual Aids and Infographics:

Process Flowcharts: Use flowcharts to depict the steps involved in the property buying process.

Diagrams: Create diagrams to visually explain key legal concepts and ownership structures.

#buying property in thailand#property in thailand#property lawyers in thailand#thailand#property#lawyers in thailand

2 notes

·

View notes

Text

DavysStreams

@davysstreams

A Tumblr blog for my streams, Sports, TV Shows and Movies, give me a shout if you want anything posted.

Blog settingsAsk me anythingFollowing

Posts

Pinned Post

davysstreams

Jan 18, 2022

If you don’t want to miss a game why not go for an IPTV set up. DM @Gabbo1980 on Twitter, and mention my name, you get ALL the games and more the costs just £10 a month or £70 for a full year, it is the way forward and in my eyes a bargain. You’ll need an Android box or better still a Amazon Firestick, which costs around £30, but you wont regret it. Some TV’s have also got Android on them nowadays. As well as sports you get loads of other stuff, all the Sky Cinema channels, documentaries, kids channels, channels from around the world including Irish TV channels, USA Movies, if you were paying for this through Sky, BT, Virgin etc it would be over £100 per month.

4 notes

davysstreams

4m ago

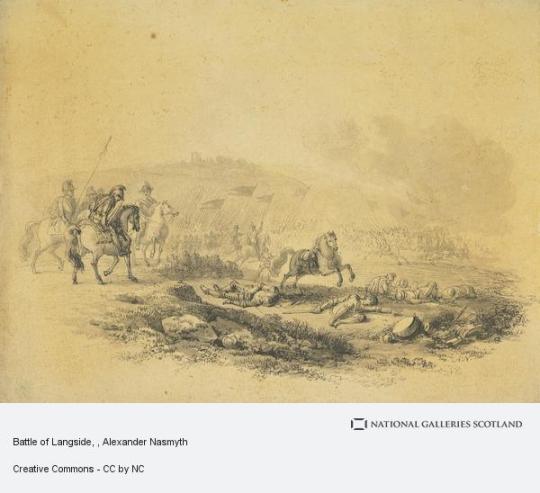

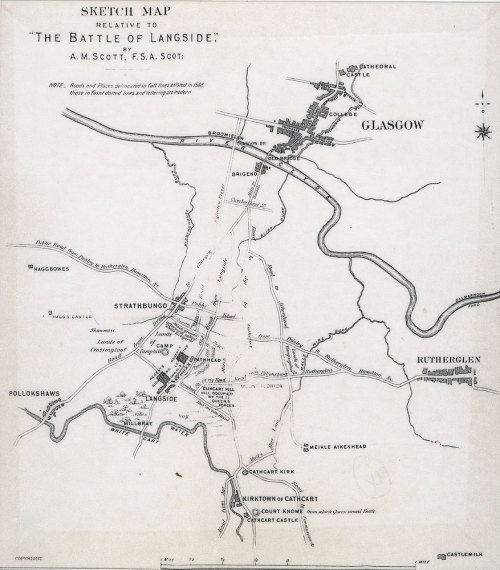

May 13th 1568 saw the Battle of Langside.

The army under King James VI name was under the command of the Regent and Mary’s half brother James Stewart, Earl of Moray whilst his deputy and commander of the vanguard was James Douglas, Earl of Morton. The army consisted of troops hastily assembled but included some experienced soldiers - notably William Kirkcaldy of Grange. Furthermore the Regent’s cause was widely supported amongst the Scottish nobility, many of whom had profited from the Reformation not least from the cheap acquisition of former church lands.

The Queen’s army, whilst nominally headed by the Mary, was under the military command of Archibald Campbell, Earl of Argyll. It included a number of a notable magnates amongst them the Earls of Eglinton, Casselis and Rothes.

With The Earl of Morton in command of his main force, Moray appointed Kirkcaldy to have ‘special care as an experimented captain to oversee every danger‘. Kirkcaldy took two hundred hagbutters “musketeers” forward to occupy cottages on each side of Long Loan, where garden walls offered protection from cannon fire, and he reserved two hundred pikemen and cavalry on the west side of the village.

Realising the danger, Mary sent Maitland to negotiaite with Moray, but the Hamilton’s were spoiling for a fight and jumped the gun. Kirkcaldy rode from wing to wing to supervise the defences, while the twenty-five-year-old Lord Claud Hamilton advanced with Mary’s main army of 2,000 men supported by and George, 5th Lord Seton’s cavalry. They stormed into Long Loan, where Kirkcaldy picked them off easily with his hagbutters backed by Ker of Cessford and Home, on foot with pike in hand, leading his six hundred spearmen. Mary’s troops fought their way forward bravely despite the cost, and almost turned Moray’s right flank, but Kirkcaldy, ever vigilant, saw the danger. He called up the rear-guard led by Sir William Douglas and Lindsay as reinforcement.

Kirkcaldy had orders from Moray to minimise bloodshed, and his forces struck the enemy on their flanks and faces, throwing them into confusion. Mary’s van needed support from the main body of her troops under Argyll, but it is said that at this critical moment he fainted, possibly with an epileptic fit, and the leaderless Argylls refused to budge without him. According to a French source, Mary rode forward from a nearby hill to lead them into battle herself, but the Argylls continued to quarrel among themselves and would not listen to her ‘eloquence’. Yet it is more probable that she made good her escape.

Kirkcaldy now moved forward, sending in pikemen against the Hamilton’s, but obeying Moray’s instruction to avoid loss of life and to capture as many as he could. Mary’s troops were routed, and the Argyll’s broke away, fleeing back to the Highlands. Argyll, the unwitting cause of Mary’s disaster, escaped to Dunoon, and would not submit to Moray. Only a hundred of Mary’s men were slain but three hundred, including Seton, James, 4th Lord Ross, and Sir James Hamilton of Finnart, were taken prisoner. Robert Melville, who had not been involved in the fighting, was also captured, but, with Kirkcaldy as his brother-in-law and two brothers supporting Moray, he was soon freed. The whole skirmish that sealed Mary’s fate, and it was little more than this, took three-quarters of an hour.

A couple of interesting asides is the map’s depiction of Glasgow at this period. Despite its cathedral and university, it was little more than a town surrounding its castle. And William Kirkcaldy of Grange, who basically won the battle for King James as the only experienced “general”, went on to support Mary suggesting a peaceful settlement with her was possible

Grange went on to hold Edinburgh Castle in her name in what is known as the “lang siege” after surrendering he was hanged on 3rd August 1573.

9 notes

·

View notes

Text

Tumblr’s Favorite Cog: Round 2

I thought it’d be fun to take the results from my other polls and put them against each other to get a final winner, so go ahead and vote for your favorite cog out of these options!

(The street manager poll ended in a tie so I flipped a coin to get Duck Shuffler, sorry Firestarter enjoyers)

3 notes

·

View notes

Text

World Bank set to approve $1bn loan for Dasu project expansion

Loan expected after approval of revised PC-1, which has new timelines for completion An view of under-construction Dasu Hydropower Project. — Dasu dam website Official reveals cost of phase I shot up by 190.1% to Rs1,700bn. Rise attributed to various factors such including in land acquisition. After erection of stage II, Dasu project would generate 4,320 MWs. The World Bank (WB) is set to…

0 notes

Text

Best Agriculture Loan Services of Andhra Pradesh

Agriculture remains the backbone of Andhra Pradesh's economy, with a significant portion of the population relying on farming for their livelihoods. As the state works towards enhancing its agricultural sector, one of the critical aspects that farmers require is access to financial support. Agriculture loans play an essential role in facilitating growth, innovation, and sustainability in the agricultural industry. The best agriculture loan services in Andhra Pradesh are designed to cater to the diverse needs of farmers, offering them the opportunity to invest in their land, crops, and farming equipment.

The Importance of Agriculture Loans in Andhra Pradesh

Agriculture in Andhra Pradesh has diverse requirements, ranging from seasonal crop cultivation to the acquisition of advanced farming tools and machinery. Given the challenges that farmers often face — such as unpredictable weather conditions, market price fluctuations, and lack of modern equipment — agriculture loans serve as a vital support system. These loans enable farmers to:

Enhance Productivity: With proper funding, farmers can invest in quality seeds, fertilizers, and technology that increase crop yield.

Sustain Livelihoods: Agriculture loans ensure that farmers have enough capital during low-income periods, such as during the off-season or in the aftermath of natural calamities.

Invest in Infrastructure: Farmers can build essential infrastructure like irrigation systems, storage facilities, and greenhouses to improve their farming practices and increase efficiency.

Adopt Technological Advancements: The adoption of new farming techniques and machinery is often capital intensive. Agriculture loans help in procuring state-of-the-art equipment that enhances farming productivity.

Ensure Livelihood Security: With the right financial backing, farmers can face adversities like droughts or floods, which are common in Andhra Pradesh.

What Makes the Best Agriculture Loan Services in Andhra Pradesh?

While there are several sources of agriculture loans in Andhra Pradesh, not all services are equal in terms of accessibility, interest rates, and repayment flexibility. The best agriculture loan services stand out in various ways, addressing the unique needs of farmers. Here's a breakdown of what makes these services ideal for the farmers of Andhra Pradesh:

1. Tailored Loan Products

The best agriculture loan services offer a range of loan products specifically designed for different agricultural needs. These loans cater to both short-term and long-term financial requirements, including crop loans, farm mechanization loans, and loans for setting up irrigation systems. Tailored products help farmers choose the right loan according to their specific situation, ensuring they get the required financial support without burdening them with unnecessary debt.

2. Affordable Interest Rates

Interest rates are one of the most crucial factors when determining the suitability of an agriculture loan. High-interest rates can make it difficult for farmers to repay the loan and deter them from seeking financial help. The best agriculture loan services in Andhra Pradesh understand this concern and offer competitive interest rates that are lower than what might be found in the private lending sector. By providing low-interest rates, these services allow farmers to borrow money affordably, ensuring the loan doesn’t become a burden.

3. Flexible Repayment Terms

Farming is subject to seasonal fluctuations, and income can vary throughout the year. Therefore, flexible repayment terms are a significant advantage of the best agriculture loan services. Farmers may need extended time frames for repayment or seasonal repayment options based on crop harvest cycles. Offering flexible terms ensures that farmers are not under pressure and can repay the loan once they have generated sufficient income from their agricultural activities.

4. Government-backed Schemes and Subsidies

Many of the best agriculture loan services in Andhra Pradesh are closely aligned with government initiatives aimed at promoting agricultural growth. These services often provide access to government-backed schemes that offer subsidies, reduced interest rates, or loan waivers under specific conditions. For instance, loans under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) or the Kisan Credit Card (KCC) scheme make it easier for farmers to access affordable credit and increase their agricultural productivity.

#home loan#mortgage loan#loan against property#agriculture loan#new startup business loan#new startup project loan#new start up company loan#business loan#unsecured loan#secured loan

0 notes

Text

Challenges Faced by Real Estate Startups for Flats in Kochi

The real estate sector, particularly the apartment segment, provides opportunities for startups. However, this promising opportunity is accompanied by a specific set of challenges that can test the determination of newcomers. Startups in the real estate sector face numerous obstacles, from financial limitations to regulatory requirements, as they work to establish their presence in a competitive and rapidly changing industry. For those looking to build or invest in Flats in Kochi, these challenges can be even more complex. This blog explores these challenges and offers guidance on how to effectively address them.

The Struggle for Capital

Financial stability is vital for any real estate project. Startups, especially, struggle with challenges in securing sufficient funding for land acquisition, construction, marketing, and operational costs. The high capital requirements for entering the apartment market present a challenge for many startups. Traditional financial institutions are generally cautious when considering loans for new and unproven players due to the risks involved. Startups must effectively balance their resources while aiming for profitability. Mismanagement of financial resources or challenges in raising capital can result in project delays, which may harm their reputation. Ensuring financial transparency and developing a strong business plan can attract investors and build trust in their projects.

Overcoming Regulatory Barriers

Securing appropriate land is among the most complicated challenges faced when entering the apartment market. The scarcity of prime locations, raising land prices, and legal uncertainties often create challenges for startups. The process of navigating the regulatory landscape, which involves obtaining permits, clearances, and compliance with zoning laws, adds another layer of complexity. The introduction of regulations such as the Real Estate Regulation and Development Act (RERA) has contributed to increased transparency, but it has also raised the bar for compliance requirements. These laws are intended to protect consumers and ensure accountability; however, they can be challenging for startups that are not familiar with complex legal environments. Building a dedicated team of legal and compliance experts is crucial to avoid costly delays and maintain credibility in the market.

Competition With Market Giants

The apartment market is dominated by well-established companies that have extensive resources, strong brand presence, and wide-ranging networks. For startups, the challenge of competing with these industry leaders can be quite challenging, especially in terms of gaining the trust of prospective buyers. Established developers often hold the upper hand by offering attractive pricing, superior amenities, and a proven track record of success. Building consumer trust is a major challenge faced by startups in the apartment industry. Many buyers are skeptical of new developers, fearing delays in project completion, poor construction standards, or a lack of transparency. To effectively convince buyers to invest in their projects, startups are required to take extra effort to build their credibility.

Managing Risks and Delays

Effective construction serves as the foundation for any real estate project, yet it presents a series of challenges for startups. Delays caused by weather conditions, labor shortages, or poor project management can lead to delays and increased expenses. The unpredictable nature of raw material prices introduces an additional element of uncertainty, complicating the task of budget management. A dependable supply chain is crucial for ensuring the timely delivery of materials and services. Startups must prioritize the establishment of strong relationships with suppliers and contractors to reduce risks and maintain smooth operations.

Conclusion

Although there are challenges present, the apartment market provides remarkable growth opportunities for startups that are ready to innovate and adapt. At Kent Constructions, we acknowledge the complexities of the apartment market and aim to set a benchmark for excellence in design, execution, and customer satisfaction. As the best construction company in Kochi, our dedication to quality and innovation aims to motivate new participants to address these challenges and contribute to the growth of the industry.

0 notes

Text

Construction Finance in Coral Gables

Coral Gables is a thriving hub for residential, commercial, and mixed-use developments, making construction finance in Coral Gables a critical topic for developers, contractors, and property owners in the area. Understanding how to secure the right financing for your construction project is essential to ensuring its success. This guide explores everything you need to know about construction finance in Coral Gables, from the types of loans available to tips for managing your budget effectively.

What is Construction Finance?

Construction finance in Coral Gables refers to the funding required to cover the costs associated with constructing a building or infrastructure project. These costs include land acquisition, materials, labor, permits, and other associated expenses.

Whether you're building a custom home, a commercial property, or a large-scale development in Coral Gables, construction finance in Coral Gables provides the financial foundation to bring your vision to life.

Types of Construction Loans in Coral Gables

1. Construction-to-Permanent Loans

This type of loan combines the financing for construction with a permanent mortgage. Once the construction is complete, the loan automatically converts into a standard mortgage. This option is ideal for homeowners or developers looking for a seamless financing solution.

Key Features:

Single application and closing process.

Fixed or variable interest rates.

Suitable for long-term property ownership.

2. Stand-Alone Construction Loans

Stand-alone loans are short-term loans designed specifically for the construction phase. After construction is complete, you'll need to secure a separate mortgage to pay off the loan.

Key Features:

Lower initial payments.

Flexibility to shop for the best mortgage rates later.

Higher overall costs due to multiple closings.

3. Owner-Builder Construction Loans

For individuals planning to act as their own general contractor, owner-builder loans provide financing to cover construction costs. These loans are often harder to qualify for and may require extensive documentation.

Key Features:

Cost savings if you have construction expertise.

Increased responsibility for project management.

Benefits of Construction Finance in Coral Gables

Flexibility: Tailored loan structures to meet the unique needs of your project.

Competitive Rates: Access to competitive interest rates from local lenders and national institutions.

Improved Cash Flow: Spread out large construction expenses over time.

Specialized Support: Many lenders in Coral Gables specialize in construction finance and offer expert advice.

Steps to Secure Construction Financing

Step 1: Define Your Project Scope

Before approaching lenders, have a clear plan that includes:

Project timeline

Detailed budget

Architectural designs

Contractor agreements

Step 2: Choose the Right Lender

Research local and national lenders with experience in construction finance in Coral Gables. Some top options in Coral Gables include community banks, credit unions, and specialized financial institutions.

Step 3: Prepare Documentation

Ensure you have all necessary documents, such as:

Proof of income

Credit score reports

Project blueprints

Contractor qualifications

Step 4: Apply for Pre-Approval

Get pre-approved to understand how much you can borrow and the associated terms. This helps set realistic expectations for your project.

Tips for Managing Construction Budgets

Track Costs Regularly: Use construction management software to monitor expenses.

Build a Contingency Fund: Allocate 10-15% of your budget for unexpected costs.

Negotiate with Suppliers: Leverage bulk purchasing for materials to reduce costs.

Hire Experienced Professionals: Skilled contractors can prevent costly mistakes.

Why Choose Coral Gables for Your Construction Project?

Coral Gables offers a unique blend of historical charm and modern amenities, making it a prime location for construction finance projects. With its:

Strong Real Estate Market: High demand for both residential and commercial properties.

Architectural Diversity: Opportunities to create unique designs that complement the city’s aesthetic.

Pro-Business Environment: Supportive local government policies for new developments.

FAQs About Construction Finance in Coral Gables

1. What is the typical interest rate for construction loans in Coral Gables?

Interest rates for construction loans in Coral Gables typically range from 4% to 10%, depending on the lender and borrower’s credit profile.

2. How long does it take to get approved for a construction loan?

Approval for a construction loan in Coral Gables can take anywhere from 2 to 6 weeks, depending on the complexity of the project and the lender's requirements.

3. Can I use a construction loan to purchase land in Coral Gables?

Yes, many construction loans in Coral Gables allow you to include land acquisition costs, provided the land is part of the construction project.

4. Do I need a down payment for a construction loan?

Most construction loans in Coral Gables require a down payment of 20% to 30% of the total project cost.

5. What happens if construction costs exceed the loan amount?

If construction costs in Coral Gables exceed the loan amount, you’ll need to cover the additional expenses out of pocket or negotiate with your lender for additional funding.

6. Are there tax benefits for using construction loans?

Interest paid on construction loans in Coral Gables may be tax-deductible if the loan converts into a permanent mortgage and the property is used as your primary or secondary residence. Consult a tax advisor for details.

Conclusion

Construction finance in Coral Gables is an essential tool for turning ambitious projects into reality. By understanding the types of loans available, the benefits of construction finance, and the steps to secure funding, you can make informed decisions for your next project. For expert assistance with budgeting and cost estimation, reach out to Estimate Florida Consulting at 561-530-2845. Let us help you bring your vision to life in the vibrant city of Coral Gables.

0 notes

Text

How Challis Capital Supports Your Property Development Projects

At Challis Capital, we specialize in Development Finance solutions tailored to the real estate market. Our services include:

Tailored Loan Structures: Flexible financing that aligns with your project timeline and goals.

Access to a Diverse Lender Network: Collaborations with banks, private lenders, and institutional investors to secure the best terms.

Expert Guidance: Comprehensive support from project planning to loan settlement, ensuring a seamless experience.

Competitive Rates: Transparent and affordable interest rates tailored to your financial needs.

Types of Projects We Finance

Residential Developments: Apartments, townhouses, and single-family homes.

Commercial Properties: Office buildings, retail spaces, and mixed-use developments.

Land Subdivisions: Financing for land acquisition and subdivision projects.

Specialized Projects: Aged care facilities, student housing, and industrial developments.

Steps to Secure Property Development Finance with Challis Capital

Initial Consultation: Share your project details, including feasibility studies, budgets, and timelines.

Tailored Loan Proposal: We craft a customized financing solution based on your project’s specific requirements.

Lender Selection: Access a wide network of lenders offering competitive terms.

Funding Approval: Streamlined processes ensure timely approval and fund disbursement.

Ongoing Support: Receive expert guidance throughout the project lifecycle.

Why Choose Challis Capital?

With years of experience in the real estate finance industry, Challis Capital is a trusted partner for property developers. Our deep understanding of the Australian property market, combined with our commitment to client success, ensures we deliver tailored financial solutions that empower developers to achieve their goals.

Start Your Development Journey Today

Whether you’re planning a small residential development or a large-scale commercial project, Challis Capital has the expertise and resources to provide you with the ideal Property Development Finance solution.

0 notes

Text

How to Get Jobs for Freshers in Banking and Financial Services

Introduction:

Breaking into the banking and financial services sector as a fresher can seem daunting, but with the right strategy and preparation, it is entirely achievable. The industry offers abundant opportunities for young talent, ranging from customer service roles to financial analysis and investment management. This guide will outline the essential steps freshers can take to kickstart their careers in banking and financial services.

1. Understand the Banking and Financial Services Landscape:

The first step is to familiarize yourself with the industry. Banking and financial services encompass various sectors, such as:

Retail Banking: Services offered to individual customers, including loans, deposits, and savings accounts.

Corporate Banking: Financial services provided to businesses, including credit, treasury management, and trade finance.

Investment Banking: Involves raising capital for companies, mergers, acquisitions, and financial advisory.

Financial Planning: Helping individuals and organizations manage their wealth and investments.

By understanding these sectors, you can identify the area that best aligns with your skills and interests.

2. Acquire Relevant Qualifications:

For freshers, the right qualifications are crucial to breaking into the banking and financial services sector. Here are key educational steps to consider:

Bachelor’s Degree: Most entry-level roles require a degree in finance, accounting, economics, or business administration.

Certifications: Obtaining certifications like the Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or certifications in anti-money laundering (AML) can give you an edge.

Computer Skills: Familiarity with tools like Microsoft Excel, financial modeling software, and data analysis tools is essential.

Soft Skills: Develop skills like communication, problem-solving, and teamwork, which are highly valued in the industry.

3. Gain Practical Experience:

Internships and part-time roles are invaluable for freshers. They not only provide practical exposure but also help in building a strong resume. Here are ways to gain experience:

Internships: Apply for internships at banks, financial institutions, or related organizations.

Campus Placement Programs: Many banks recruit directly from college campuses, so participate actively in these drives.

Volunteer Work: Working with financial literacy programs or NGOs that require financial expertise can add value to your profile.

4. Prepare for Bank Exams:

Many entry-level roles in the banking sector require candidates to pass competitive exams. These exams test your knowledge of quantitative aptitude, reasoning, English, and general awareness. Some popular exams include:

IBPS Exams: Institute of Banking Personnel Selection exams for various public sector banks.

SBI Exams: State Bank of India conducts its exams for clerks and probationary officers.

Private Bank Exams: Some private banks also conduct their exams or use assessment centers for hiring.

To excel in these exams, enrolling in a coaching center can be highly beneficial. Look for coaching centers that offer:

Comprehensive study materials.

Mock tests and practice sessions.

Guidance from experienced mentors.

Regular performance assessments.

5. Build a Strong Resume:

A well-crafted resume is vital to making a great first impression. Focus on:

Highlighting relevant qualifications, certifications, and internships.

Including skills that align with the job requirements.

Quantifying your achievements

Keeping the format clean, concise, and professional.

6. Leverage Networking Opportunities:

Networking plays a significant role in landing your first job. Here’s how to build connections:

LinkedIn: Optimize your profile and connect with professionals in the banking sector.

Alumni Networks: Reach out to alumni working in banks or financial institutions.

Industry Events: Attend seminars, job fairs, and workshops to meet potential employers.

Mentorship Programs: Seek guidance from mentors who can provide career advice and recommendations.

7. Excel the Interview Process:

Interviews for banking and financial services roles can be competitive, so preparation is key. Follow these tips:

Research the Company: Understand the bank’s services, mission, and recent developments.

Practice Common Questions: Prepare answers to frequently asked questions, such as your career goals, strengths, and reasons for choosing banking.

Mock Interviews: Practice with a mentor or career counselor to refine your responses.

Dress Professionally: Appear neat and presentable to create a positive impression.

8. Stay Updated on Industry Trends:

Staying informed about the latest trends in banking and financial services can set you apart from other candidates. Follow industry news, read financial blogs, and understand topics like digital banking, blockchain, and fintech advancements.

Conclusion: Choose Bank Zone for the Best Start to Your Banking Career

Navigating the job market as a fresher in the banking and financial services sector can be challenging, but with the right guidance, success is within reach. Bank Zone the best private bank exam coaching center in Karur, is here to help you achieve your career goals. We offer comprehensive coaching, personalized career guidance, and access to exclusive job opportunities in the banking sector.

At Bank Zone, we are committed to empowering freshers with the knowledge and skills needed to excel in competitive exams and interviews. Let us help you take the first step toward a rewarding career in banking and financial services.

For more information:

Email Us:[email protected]

Phone Number:(+91) 9629995828

Office Address:21 NRS Complex, 1st Floor, Sathyanarayana Salai, Swarnapuri Salem 636004

Website:https://bankzonejobs.com/

0 notes

Text

Boost Your Real Estate Projects with Development Finance in Tauranga

Tauranga, located on New Zealand's picturesque Bay of Plenty coastline, has quickly emerged as one of the country's most dynamic property markets. Thanks to its flourishing economy and expanding population - not to mention an attractive mix of residential, commercial, and mixed-use development opportunities - Tauranga attracts both experienced developers and new investors. However, turning a real estate vision into reality requires more than just a solid business plan — it requires the right financial backing. Development finance Tauranga is the crucial tool that can provide the capital necessary to fund your real estate projects from start to finish, ensuring your success in Tauranga’s competitive market.

What is Development Finance?

Development finance Tauranga is a short- to medium-term financing solution designed to help property developers fund projects through various stages. Unlike traditional mortgages, which are generally based on the current value of a property, development finance is structured around the projected value of the completed project. It covers essential expenses such as land acquisition, construction costs, contractor payments, and more.

One of the key features of development finance is its stage-based disbursement. Funds are released as the project progresses — from land purchase through construction phases and up to project completion. This staged approach ensures developers maintain liquidity throughout the development process and stay on schedule without cash flow interruptions.

Why Choose Development Finance for Your Tauranga Projects?

Tailored to Your Project’s Needs

Every real estate development is unique, and development finance Tauranga is highly flexible to accommodate the specifics of each project. Whether you are building residential properties, commercial spaces, or a mixed-use development, this type of financing allows you to structure the loan around your project's needs. From land acquisition to final construction, development finance is designed to provide funding based on the projected value of the completed property, not just the land’s current market value.

Faster Access to Capital

Time is of the utmost importance in Tauranga's fast-moving real estate market. Development finance provides fast approval and access to the capital you need - essential when capitalizing on prime land or development opportunities that don't wait for traditional loan approval processes. Faster access ensures you don't miss out on potential growth potential in this rapidly expanding city.

Higher Loan-to-Value (LTV) Ratios

Development finance offers several key advantages over traditional loans, the primary one being its higher loan-to-value (LTV) ratios compared to traditional loans. In Tauranga's competitive property market, this can be invaluable; lenders typically provide financing up to 85% of total development cost, thus reducing upfront capital requirements and permitting you to undertake larger and more lucrative projects with reduced financial investment outlay.

Risk Mitigation with Staged Payments

Development finance Tauranga is typically dispersed in stages, aligned with key project milestones. This method helps developers manage cash flow more effectively, as payments are made at different stages of the development process (e.g., land acquisition, foundation work, structural work, and final finishes). By tying payments to project progress, you reduce the risk of financial strain and ensure that the project remains on schedule and within budget.

Supports Large-Scale Developments

Due to Tauranga's thriving economy and growing population, there is a significant demand for both residential and commercial real estate development products. To take advantage of this boom, development finance gives you access to bigger projects. Whether you want to build mixed-use developments, residential subdivisions, or commercial buildings, development finance offers the money to realize your vision.

Expert Guidance and Support

Utilizing the expertise of an experienced Tauranga development finance provider provides more than capital. Experts understand the nuances of the local property market, can offer invaluable advice regarding project management, market trends, and regulations, and can help your project stay on course while reaching its full potential.

Key Types of Development Finance in Tauranga

Depending on your development goals, you can explore various types of development finance Tauranga:

Build-to-Sell Finance

Build-to-sell financing can be the ideal solution if you aim to turn completed properties into profit, as this type of finance relies on pre-sales and market demand rather than anticipated rental income to ensure your project will be financially sustainable before going on the market.

Build-to-Hold Finance

If you plan to hold onto the properties and generate rental income, build-to-hold finance may be more suitable. This type of finance focuses on the rental income potential of your completed units. It may require additional contingency funds to cover unexpected costs during construction.