#LLC Articles of Incorporation

Explore tagged Tumblr posts

Text

Certificate of Incorporation Apostille: A Complete Guide

Recognizing U.S. State Documents Abroad: Apostille for Articles of Incorporation For U.S.-incorporated businesses expanding internationally, the need for document authentication is essential. An Apostille, issued under the 1961 Hague Convention, ensures that U.S. documents like Articles of Incorporation or Articles of Organization are recognized and accepted abroad. This guide will explain the…

#hague apostille convention#Hague Apostille Services#Articles of Incorporation Apostille#apostille for corporate documents#corporate document legalization#expand business abroad#international business setup#LLC Articles of Incorporation

0 notes

Text

Why do they have no problem registering LLCs in Delaware, but they CANNOT ever get a USPTO Filing done correctly? Help me understand it.

They have no issues, whatsoever, filing the paperwork to register LLCs and nonprofits in Delaware, but they fail at registering trademarks for business ventures EVERY. DARN. TIME.? Thinking about that is weird.

According to the Delaware Online, even Meghan's old LLC she originally had in California that registered The Tig was moved to Delaware December 30 2020. The article even has Andrew Meyer mentioned as the secretary. Shannyn Yates was listed as the incorporator, but the address is still in Cali. I find it interesting the article written by Meredith Newman mentions that companies are not required to reveal to their owner's names in Delaware.

Meredith Newman was onto something if the companies in DE can be registered through attorneys and llcs, and they don't have to reveal Meghan or Harry owns them, I guess I can see why they like registering their businesses successfully in Delaware.

Yet, today, on the USPTO website, The Tig has two dead USPTO files with the old Frim Fram in Cali, and then there are two more The Tig results showing the new Delaware Frim Fram LLC listed on the live, pending USPTO results.

The first live USPTO results show the Tig written in her cursive - I mean her calligraphy- (it is cursive). It was originally filed in Feb 2022. Yet, it is Feb 2025 and it is still pending. Danielle Weiss is listed as the attorney for the paperwork filings. However, on October 01, 2024, they were granted a six-month extension to correct the issues. This was the THIRD extension request. It's main description for the Tig is a website "featuring commentary in the field of travel" and then there's also: interior design, food prep, cooking, recipes, commentary in the field of health and wellness, and then last but not least "featuring commentary in the field of personal relationships, fashion, fashion style, personal lifestyle".

SO... The NEW Tig was granted a six-month extension in October 2024. April 2025 is time's up. Maybe by then, the Tig will bring us Meghan elevating our lives with her travel lifestyle. I imagine she's gotten a lot of usage out of the past events for pictures and things for content.

Before... the Tig was SIngle Smeggy. Now, the Tig 2.0 is Married Meggy. She's seasoned, experienced. Grounded. Gutteral (she loves that word). Goofy. Insert fake break serious moment with fake laugh montage in black and white here, please. AH, there, now we have le Teeg.

Listen, I don't care if Meghan relaunches her website. Everyone should have the right to make an income. If she wants to return to what she was doing before she got with Hazbeen, so what? I don't care about that. What I find odd is why they need so many extensions. She could've been building her audience base for going on three years had she just filed right the first time in 2022. But no, she kept stalling. I find that odd. Why does she always seem to self sabotage herself with every turn.

For example, why didn't they film that in their own home for the Netflix show? Why did they have to rent another home? Her's is good enough, and it wasn't security. Did they lose the house and the bank was renting it out? Nah... IDK. But from that moment, when the viewer realizes they weren't trusted to be welcomed into her palatial mansion on the shores in Montecito, well, it makes everything else hard to believe, too.

Think about it. If she doesn't trust the idea of having it filmed in her own home, then how can the viewer trust her back? We cannot. If the house is fake, the recipes aren't hers either. If the recipes weren't her's, it wasn't made by her to look that camera ready. If the food was faked, then the friend eating it was fake. This mouse knows people... why fake any of it?

Filming on a set would've been better than claiming the neighbor's house and garder has her own hard work. COME ON NOW.

Meghan never wants to do the work. She only wants to jump on board if it goes sensational and viral. The problem is, she is infamous now, not famous. Big difference. Maybe she has so many abandonded USPTO ideas because nothing ever takes off like hot cakes, and she takes that as failure instead of accepting success requires hard work.

Harry especially never wants to stick around to do the actual work needed for things to have success. Working one hour a week sounds like a welfare requirement, not something you are passionate about or wanting to succeed. Nothing is handed over to you, you must work.

I find it interesting there are so many pots with sticks in them, but she just jumps kettle first thing.

I think she thinks everything will just be a soap commercial script change and if it's not, it's not worth five minutes.

She barely gives five minutes anymore, I doubt she will be sticking around another five years. Mama knows best, after all... Yall get it? That's the name of the LLC registered in DE that Meghan has her ARO registered to. American Riveria Orchard is registered to Mama Knows Best LLC Delaware. Which is registered to Mama Knows Best Beverly Hills, to the same address Archwell is registered to. A bunch of loops, I say!

This mouse must take a break and will be back shortly, potentially, maybe.

This mouse loves you all! Be safe out there!

16 notes

·

View notes

Text

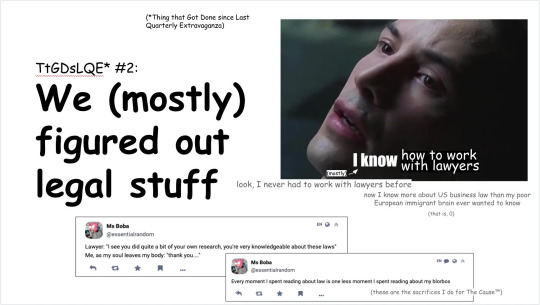

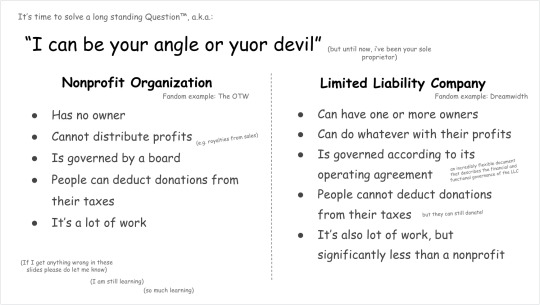

Your angle or yuor devil: choosing between LLC and nonprofit

It's time! For this week's Tuesday Content, I'm cheating a little: first, it's Wednesday; second, instead of new content, I'm "unpaywalling" a section of my $upporters-only "Quarterly Extravaganza".

Learn below (or in the blogpost) about the eternal dilemma: should our org be a nonprofit or an LLC?

To support our project (and get early access to this content), support me on Patreon!

The first step to settle the LLC vs nonprofit debate was to look at the path chosen by other fandom-adjacent entities. Turns out, there's historical examples of both!

So, armed with grit, we took the logical next step: get clarity on the legal differences between the two!

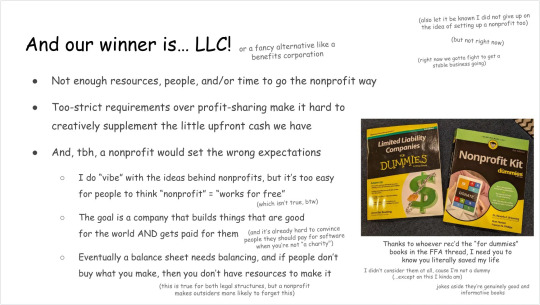

Cutting to the chase, we chose to (very soon) incorporate as an LLC. It was not an easy choice, and we went back and forth–and agonized over it–for quite a while.

However, a few considerations tipped the scales:

First, while our projects have a “charitable intent” that would allow us to qualify for 501c3 status (a.k.a. become a nonprofit), we decided that the procedures required would place a too heavy weight on our already-stretched shoulders.

Next, as we spearhead many ambitious projects with very little budget, we wanted to be able to reward those who took a bet on us with their time and work, should our efforts eventually pay off.

(You can learn about these projects here)

Finally–without mincing words–the online (and fandom) discourse around nonprofits made us uncomfortable: while it’s true that nonprofits have a charitable intent, they still have a balance sheet to balance, and produce work that deserves to be paid for. This is too easy to forget!

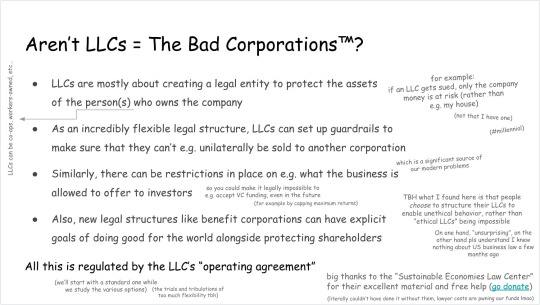

Obviously, given that our projects have a clear “anti-corporate bent”, becoming a for profit corporation came with concerns.

However, we found that LLCs are an incredibly-flexible legal structure that gives us ample power to add ethical guardrails!

There's a lot to say about the various options, and we've just started exploring them. If you want to learn more about these, you can read the article/slides or watch this video by the excellent Sustainable Economies Law Center, whose help has been invaluable throughout all this!

(To be clear: until we have more resources in place and a better understanding of our future, we’re going to keep things simple: at first, our LLC will be what’s called a “single-member LLC”, owned by yours truly (me). We'll keep evaluating options as we work to reach stability!)

...and that is all for this week! Once again, to support this journey towards a better web, you can donate on Patreon or on my own website!

You can also help us by reblogging this post and sharing the blogpost with all your friends and fandom-oriented Discord servers!

We'll keep you updated about this all as the year progresses. Look forward to it!

60 notes

·

View notes

Text

What Are the Legal Requirements and Benefits of Company Registration in Egypt?

Since 1981, YKG Global has helped businesses navigate complex regulatory landscapes, making processes like company registration in Egypt simple and efficient.

Legal Requirements for Company Registration in Egypt Egypt is a gateway to African and Middle Eastern markets, making it an excellent choice for business expansion. Key requirements include:

Selecting the right business structure (LLC, joint stock, etc.). Preparing Articles of Incorporation. Registering with the General Authority for Investment (GAFI). Opening a corporate bank account and fulfilling capital requirements. YKG Global’s team handles these steps efficiently, ensuring compliance with Egyptian laws.

Benefits of Registering in Egypt Access to a growing economy and free trade agreements. Strategic location connecting Africa, Asia, and Europe. Incentives for foreign investors in specific industries. Choose YKG Global for a Seamless Process With a proven track record, YKG Global ensures smooth company registration in Egypt while you focus on growing your business.

Contact Us Today! Let YKG Global simplify your expansion into Egypt. Reach out to our experts now!

#business#consulting#company registration#taxation#finance#accounting#foreign company#business registration#investing#success#egypt business registry#register a company in egypt#company formation in egypt

2 notes

·

View notes

Text

“Maybe you’re a fan of the branding moreso than the articles of incorporation that the LLC wrote at the beginning?”

Kevin Perjurer of Defunctland regarding hardcore fandom, Factually! with Adam Conover

29 notes

·

View notes

Text

Company Registration in Thailand

Thailand, a Southeast Asian gem, offers a lucrative business landscape for both domestic and international entrepreneurs. However, setting up a company in this vibrant nation requires careful consideration of legal and regulatory frameworks. This guide will walk you through the essential steps to successfully register your company in Thailand.

Types of Companies in Thailand

Limited Liability Company (LLC): The most common type for foreign investors, offering limited liability and flexibility.

Public Limited Company (PLC): Suitable for large-scale operations, requiring significant capital and public share offerings.

Key Steps to Company Registration

Reserve a Company Name:

Choose a unique name that complies with Thai regulations.

The Department of Business Development (DBD) will verify the availability.

Prepare Incorporation Documents:

Memorandum of Association (MoA): Outlines the company's objectives, capital structure, and shareholder details.

Articles of Association (AoA): Specifies the company's internal rules, procedures, and management structure.

Appoint Directors and Shareholders:

At least two directors and shareholders are required.

Consider appointing a local director to comply with specific regulations.

Obtain Necessary Approvals:

For certain industries, additional approvals from relevant government agencies may be necessary.

Register with the DBD:

Submit the required documents and pay registration fees.

The DBD will issue a Certificate of Incorporation upon successful registration.

Open a Corporate Bank Account:

Establish a bank account to facilitate financial transactions.

Register for Taxes:

Register with the Revenue Department for corporate income tax and value-added tax (VAT).

Essential Considerations

Foreign Business Act (FBA): If your business activities are restricted under the FBA, you may need additional licenses and permits.

Board of Investment (BOI): Consider applying for BOI privileges to enjoy tax incentives and other benefits.

Work Permits: Ensure compliance with work permit regulations for foreign employees.

Local Partner: In certain industries, a local partner may be required.

Seeking Professional Assistance

While it's possible to navigate the company registration process independently, engaging a legal and accounting firm specializing in Thai business law is highly recommended. They can provide expert guidance, streamline the process, and ensure compliance with all legal requirements.

By carefully following these steps and seeking professional advice, you can successfully establish your business in Thailand and capitalize on the country's thriving economy.

#company registration in thailand#thailand#corporate in thailand#business#business in thailand#businessthailand

2 notes

·

View notes

Text

How to Register a Company in the EU: A Step-by-Step Guide by Euro Company Formations

The European Union (EU) is an attractive location for entrepreneurs looking to expand their businesses into a market of over 450 million consumers. The EU's seamless internal market, robust legal framework, and favorable business environment make it a hotspot for both startups and established businesses.

At Euro Company Formations, we help businesses navigate the complexities of EU company registration, offering expertise and guidance every step of the way. This article provides an overview of the EU registration process and the benefits of incorporating within the EU.

Why Register a Company in the EU?

Register a company in the EU offers numerous advantages:

Access to a Large Market: With 27 member countries, the EU is one of the world's largest markets, providing ample opportunity for business growth.

Favorable Business Regulations: The EU provides clear regulations on trade, intellectual property, and consumer protection, giving businesses a stable environment.

Free Movement of Goods, Services, and Capital: Once established in one EU country, your business can trade freely across the entire EU without additional tariffs or complex regulatory barriers.

Tax Benefits: Many EU countries offer tax incentives and advantages to new businesses, especially those in innovation and technology sectors.

Steps to Registering a Company in the EU

1. Choose Your Business Structure

The EU allows different types of business structures, including Limited Liability Companies (LLCs), Sole Proprietorships, and Public Limited Companies. Choosing the right structure impacts your tax liabilities, personal liability, and reporting requirements. Euro Company Formations can help you select the structure that best suits your business model.

2. Choose a Country for Registration

Each EU country has its own regulations, so it’s essential to choose a country that aligns with your business goals. For instance, Ireland and Estonia are popular for tech startups due to favorable tax regimes and online accessibility.

3. Register Your Business Name

You’ll need to check that your desired business name is available in the chosen country’s commercial register. The name must be unique and comply with any naming conventions.

4. Prepare Required Documents

Most countries require basic documents, including:

Articles of association (company bylaws)

Proof of identity for directors and shareholders

Proof of registered office address

In many cases, you’ll also need to provide proof of funds if starting a capital-intensive business. Euro Company Formations offers services to help organize these documents and ensure compliance with local regulations.

5. Register with Tax Authorities

Once your company is legally established, you must register with the relevant tax authorities for VAT, corporation tax, and, in some cases, employee payroll taxes.

6. Obtain Necessary Licenses and Permits

Depending on your industry, you may need specific licenses to operate legally within the EU. This includes permits for regulated sectors like finance, healthcare, and pharmaceuticals.

7. Open a Business Bank Account

Opening a business bank account in the EU simplifies transactions and helps establish credibility. Many banks require proof of company registration, identification of the company's directors, and sometimes even a business plan.

Why Choose Euro Company Formations?

At Euro Company Formations, we simplify the process by offering personalized guidance and support tailored to your business needs. Our experienced team has in-depth knowledge of each EU country’s specific requirements, ensuring your company registration is smooth and hassle-free.

Benefits of Partnering with Euro Company Formations:

Personalized Assistance: From choosing the best jurisdiction to completing paperwork, we offer end-to-end support.

Quick and Reliable Service: We handle all the paperwork and liaise with local authorities, reducing your waiting time.

Cost-Effective Solutions: Our services are designed to save you both time and money.

Long-Term Compliance Support: We offer ongoing support to help you stay compliant with EU regulations.

Conclusion

Registering a company in the EU is a strategic step towards expanding your business. By working with Euro Company Formations, you can navigate the complexities of the EU market with ease and focus on what matters most—growing your business. Let us help you unlock the opportunities of the European market today!

#euro company formations#register company in eu#company formations europe#europe company registration

2 notes

·

View notes

Text

How to Open a Company in the US for Non-Citizens in 2024

Starting a business in the United States as a non-citizen might seem like a daunting task, but it's more accessible than you might think. Whether you're an entrepreneur with a groundbreaking idea or a small business owner looking to expand into new markets, the US offers a wealth of opportunities. This guide will walk you through the process of company registration in the US, breaking it down into simple steps that anyone can follow. By the end of this article, you'll feel confident in your ability to navigate the US business landscape and take your first step toward success.

Why Start a Business in the US?

It is true that the US market is among the largest and most active worldwide, which makes it a desirable location for entrepreneurs. Why should non-citizens think about establishing a business with a company in the US? In the first place it is because the US provides a steady economic climate, solid legal protections for companies as well as access to an extensive population of consumers. Furthermore the majority of investors prefer dealing with US-registered businesses, and incorporating within the US can boost your business's standing on the international scene.

Understanding the Legal Structure

Before you begin how to register, it's important to be aware of the different kinds of legal structures that are available to companies within the US. These structures will define the legal obligations of your business as well as tax and personal responsibility. Most commonly used options include:

Sole Proprietorship

Partnership

Limited Liability Company (LLC)

Corporation (C-Corp or S-Corp)

Each structure comes with pros and cons, based on your specific business requirements and requirements. It's important to select the one that is most suitable for your needs.

Choosing the Right Business Structure

The right structure for your business is akin to laying the groundwork for a structure. It must be strong and well-suited for the future plans you have. For the majority of non-citizens, creating an LLC is a common option because of its flexibility, a lower liability and management ease. However C-Corps are more suitable C-Corp could be more appropriate for those who plan to raise funds through investors.

LLC offers the flexibility, ease of use and security from personal responsibility.

C-Corp is a great option for companies that want to grow dramatically and draw investors.

Think about your goals for the business as well as the degree of control you would like to maintain, and also the tax implications in making the decision.

Registering Your Business Name

After you've decided on your business's structure The next step is to register your business name. Your company name is more than an identifier for your brand. It's your identity. Make sure that it's unique and memorable. For registration of your business name:

Do a search for names: Make sure your business's name isn't already used.

Register Your Name If you're not yet ready to sign up You can reserve your name for a certain time.

Create Your Own Business Name Name: Register your name with appropriate authorities of the state. The process is slightly different from state to state.

This ensures that your business name is legally recognized.

Obtaining a Federal Employer Identification Number (EIN)

An EIN is a type of identification number used by your business. It's vital to use for tax purposes, when hiring employees or opening a company bank account. Non-citizens are able to easily get an EIN through the IRS without the need for an Social Security Number (SSN). Here's how:

Apply online Apply Online: Visit the IRS website and fill out the EIN application form.

Apply via Mail Alternately, you could send Form SS-4 through either fax or mail.

After you've obtained your EIN You'll be officially acknowledged by the IRS and then you're able to proceed to the next steps.

Opening a US Business Bank Account

A US corporate bank account can be essential to control finances, accepting payments, and establishing credibility with clients and partners. Non-residents are able to create an US commercial bank account relatively easily and with the aid of fintech solutions such as Mercury, Wise, Relay Financial and Payoneer. What you'll need to do:

EIN The reason for this is that, as we mentioned earlier it is necessary to create the bank account.

Documentation of Business Registration Documentation proving that your company is registered legally within the US.

Personal Identification Passport or any other type of ID issued by the government.

Selecting the best bank for you will be based on your specific business needs So, look into your options thoroughly.

Navigating Taxes and Compliance

US Tax laws are a bit shady However, staying on top of tax laws is not a matter of choice. If you're a non-citizen owner of a business it is essential to know the federal and state tax regulations. Generally speaking, you'll need to comply with:

Annual Reports in HTML0 Based on your business's structure and your location.

pay federal taxes This includes tax on income, taxes for employment and perhaps excise taxes.

State taxes The tax rates vary state-by-state and some states don't have a tax on income.

A tax professional that specializes in taxation for non-residents can be an investment that will ensure that you're fulfilling all your obligations.

Hiring Employees in the US

If you're planning to employ employees from the US There are many legal procedures you'll need comply with. They include:

Registration to State Employment Agencies: For unemployment insurance as well as workers' compensation.

Conforming to Labor Laws: Including minimum wage, overtime and laws on non-discrimination.

Payment Taxes Payroll Taxes: You'll have to withhold these taxes and pay them on behalf of employees.

Knowing these rules is essential to avoid legal problems and penalty.

Managing Your Business Remotely

Being able to run a business from outside of the US is now possible thanks to the advancement of technology. Tools for project management, communication as well as financial administration make it much easier than ever before to run your company remotely. Consider using:

Cloud-based Accounting Software to keep on top of tax and financial obligations.

Tool for Project Management to coordinate with your team in the US or your partners.

Virtual Offices If you require an office in the US for business or legal reasons.

These tools will help you keep control of your business, regardless of where you are located in the world.

Maintaining good standing with US Authorities

When your business is established in operation, it's important to remain in good relations with the state or federal agencies. This includes:

Annual Reports and Filing as legally required in the jurisdiction in which your company is registered.

Renewal of Licenses and Permits Based on your sector, this could be a requirement that is ongoing.

Documenting exact Records for both tax and legal compliance.

Being on top of your obligations will allow you to avoid penalties and fines.

Establishing a business operating in the US as a non-citizen might be a daunting task, but by following the steps laid out in this article to help you make it through the process confidently. From choosing the appropriate company structure and understanding your tax obligations, and running your enterprise remotely every stage is vital to your success. The US provides a wide array of opportunities. If you have the right planning your business will be able to thrive in this competitive market.

FAQs

1. Can a non-US citizen own an enterprise inside the US? non-US citizens can also run a business within the US. There are no limitations on foreign ownership and you can select between various business structures such as LLC and C-Corp.

2. Do I require an US address for registering a business? You'll require an US address to register your business. It could be an actual address or a virtual office address, based on the requirements of your business.

3. What's the price to establish a company within the US? The cost is determined by the state and the business structure. In general, the cost is between $100 and $800 for registration costs.

4. Can I create an account with a US commercial bank account with out going to the US? Yes, a lot of fintech companies such as Mercury, Wise, and Payoneer permit non-US citizens to open US business bank accounts online.

5. What tax do I have in order to be a business owner? You'll be liable for state and federal taxes such as the tax on income, employment as well as excise tax in accordance with your business design and its location.

6. Do I require an authorization to begin an enterprise within the US? You do not require a visa in order to establish or run a business in the US. If you intend to work and live in the US then you'll need to get a visa.

7. What is the ideal business structure for non-citizens? A lot of non-citizens choose to form an LLC because of its flexibility and management ease. If you are planning to raise a significant amount of capital it is suggested that a C-Corp might be better suited.

8. Can I employ employees from the US as an owner of a business that is not a citizen? Yes, you are able to employ workers within the US. It is necessary to follow all state and federal employment laws, such as paying payroll taxes and offering workers with 'comp insurance.

9. What is the time frame to register a business to the US? The length of time varies according to state and business structure. It could take between a few days up to several weeks to finish your registration.

10. Can I run my US business remotely from a different country? Yes, you are able to manage your US company remotely by using online tools for project management, communication as well as financial administration. Many business owners who are not citizens successfully manage their US-based enterprises via their home countries.

#travel#usa#travkes#startusacompany#registeryourcompanyintheusa#businessconsultant#businessconsulting#companyformation#usacompanyregistration#uscompanyregistration#uscompanyformation#growyourbusiness#companyformationservices#companyformationservice#businessconsultingservices#uscompanyformationfornonresident

2 notes

·

View notes

Text

Simplifying the Formation and Incorporation of Your Company with MASLLP

Introduction: Starting a new business is an exciting journey, but the process of formation and incorporation can be complex and daunting. Fortunately, MASLLP is here to simplify this process for you. Specializing in the Formation and Incorporation of Company, MASLLP ensures that your business is set up efficiently and in compliance with all legal requirements. In this blog, we'll explore the steps involved in forming and incorporating a company and how MASLLP can assist you every step of the way. What is Formation and Incorporation of Company? Company formation refers to the process of legally creating a new business entity. Incorporation is the subsequent step, which involves registering the company as a legal corporation. This process provides your business with a legal identity separate from its owners, offering benefits such as limited liability, credibility, and potential tax advantages.

Why Choose MASLLP for Formation and Incorporation of Company? Expertise and Experience MASLLP has a team of experienced professionals who specialize in company formation and incorporation. Our experts understand the intricacies of the legal requirements and paperwork involved, ensuring that your business is set up correctly from the start. Comprehensive Services From selecting the appropriate business structure to filing the necessary documents, MASLLP provides a full range of services to streamline the formation and incorporation process. Our services include:

Business Structure Consultation

Name Reservation and Registration

Preparation and Filing of Incorporation Documents

Obtaining Necessary Licenses and Permits

Compliance with Local, State, and Federal Regulations

Steps Involved in the Formation and Incorporation of Company

Choosing the Right Business Structure The first step in forming a company is selecting the appropriate business structure. Common structures include sole proprietorship, partnership, limited liability company (LLC), and corporation. MASLLP helps you understand the advantages and disadvantages of each structure, ensuring you choose the one that best suits your business needs.

Name Reservation and Registration Choosing a unique and legally compliant name for your company is crucial. MASLLP assists you in conducting a name availability search and reserving your chosen name, ensuring it meets all legal requirements.

Preparing Incorporation Documents Incorporation requires the preparation and filing of several key documents, such as the Articles of Incorporation or Certificate of Incorporation. MASLLP ensures that all necessary documents are accurately prepared and filed with the appropriate authorities.

Obtaining Licenses and Permits Depending on your business type and location, you may need various licenses and permits to operate legally. MASLLP helps you identify and obtain all required licenses and permits, ensuring full compliance with regulatory requirements.

Compliance and Ongoing Support Incorporation is just the beginning. MASLLP provides ongoing support to ensure your business remains compliant with all legal and regulatory obligations. From annual filings to corporate governance, we offer comprehensive compliance services to keep your business on track. Benefits of Incorporating Your Company with MASLLP Legal Protection and Limited Liability Incorporating your company provides legal protection to its owners by separating personal and business liabilities. This means that in the event of financial or legal issues, your personal assets are protected. Credibility and Trust An incorporated company often enjoys greater credibility and trust from customers, suppliers, and investors. It signals that your business is established and operates within a regulated framework. Tax Advantages Incorporation can offer significant tax benefits, depending on your business structure and location. MASLLP helps you navigate the complex tax landscape to maximize your potential savings. Access to Capital Incorporated companies often find it easier to raise capital through the sale of stocks or other investment opportunities. This can be crucial for business growth and expansion. Conclusion The formation and incorporation of a company are critical steps in establishing a successful business. With MASLLP's expertise and comprehensive services, you can navigate this complex process with confidence and ease. From choosing the right business structure to ensuring ongoing compliance, MASLLP is your trusted partner in building a strong foundation for your business. Contact MASLLP today to learn more about how we can assist you in the Formation and Incorporation of Company. Let's turn your business vision into reality, starting with a solid and legally sound foundation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#ajsh#auditor#taxation#ap management services

3 notes

·

View notes

Text

Flower Gifts to Say Thank You: Gratitude in Bloom

In our fast-paced lives, it's important to pause and express gratitude to those who make a difference. Saying "thank you" is a simple yet powerful gesture that can brighten someone's day and strengthen our connections. And what better way to convey gratitude than through the beauty and symbolism of flowers? In this article we will explore the art of expressing gratitude with flower gifts. From understanding the language of flowers to selecting the perfect blooms, let's delve into the world of floral appreciation and discover how flowers can convey heartfelt thanks in the most beautiful way.

Whether you're located in UAE or anywhere else, you can order flower gifts online in UAE to say 'thank you' with just a few clicks. Floral Allure Flowers & Gifts LLC offers a wide selection of fresh and vibrant flowers, allowing you to choose the perfect blooms for your expression of gratitude.

1.The Language of Gratitude:

Flowers have long been associated with emotions and sentiments, and each bloom carries its own symbolic meaning. When selecting flower gifts to say 'thank you,' consider the symbolism behind different flowers. For instance, yellow roses symbolize friendship and gratitude, while pink carnations represent appreciation. By understanding the language of flowers, you can choose blooms that truly convey your gratitude.

2.Classic Choices for Gratitude:

Some flowers have become timeless symbols of gratitude. For example, sunflowers with their vibrant yellow petals and cheerful demeanor radiate gratitude and happiness. Lilies, with their elegant blooms and fragrant scent, also make a thoughtful choice to express gratitude. Additionally, daisies, gerberas, and tulips are known for their association with appreciation and gratitude.

3. Customizing Your Flower Gift:

To make your flower gift even more personal, consider the recipient's preferences and personality. Do they have a favorite flower or color? Incorporating these elements into your gift will demonstrate that you value and appreciate their uniqueness. Adding a handwritten note expressing your gratitude will further enhance the sentiment and make the gift even more meaningful.

4. Thoughtful Flower Arrangements:

When presenting a flower gift to say 'thank you,' the arrangement itself can add an extra touch of thoughtfulness. Opt for a beautiful bouquet or a floral arrangement that suits the occasion and the recipient's taste. A professionally arranged bouquet can create a stunning visual impact, while a DIY arrangement can showcase your personal touch and creativity.

Order beautiful flower arrangements online in UAE from Floral Allure

5. Beyond Blooms: Flowering Plants and Gifts:

While fresh cut flowers are a popular choice for expressing gratitude, consider other options as well. Flowering plants, such as orchids, peace lilies, or azaleas, are not only beautiful but also serve as a lasting reminder of your appreciation. Additionally, you can pair your flower gift with a small token or gesture that complements the message of gratitude, such as a handwritten thank-you card, a box of chocolates, or a thoughtful book.

So, the next time you wish to express gratitude, let flowers be your messenger, allowing gratitude to bloom and create moments of joy for both the giver and the recipient. Say 'thank you' with flowers and let your appreciation flourish in the hearts of those you cherish.

2 notes

·

View notes

Text

Register Offshore Company

How to Register an Offshore Company: A Comprehensive Guide

Register Offshore Company is a strategic move for businesses looking to benefit from tax advantages, enhanced privacy, and global expansion opportunities. Offshore companies are legal entities incorporated in a jurisdiction different from where their principal operations are conducted. Here is a step-by-step guide to help you understand the process of setting up an offshore company.

1. Understand the Benefits

Before proceeding, it is crucial to understand the benefits of registering an offshore company. These may include:

Tax Efficiency: Many offshore jurisdictions offer low or zero corporate tax rates.

Asset Protection: Offshore companies can help protect assets from lawsuits or creditors.

Privacy: Some jurisdictions allow minimal public disclosure of ownership and financial details.

Ease of Operations: Streamlined regulations make incorporation and ongoing compliance simpler.

Global Expansion: Operating offshore can provide access to international markets and customers.

2. Choose a Suitable Jurisdiction

Selecting the right jurisdiction is a critical step. Popular offshore jurisdictions include the British Virgin Islands (BVI), Cayman Islands, Seychelles, and Hong Kong. When choosing a jurisdiction, consider:

Tax policies

Regulatory requirements

Reputation and political stability

Ease of doing business

Costs of incorporation and maintenance

3. Determine the Type of Company

Offshore jurisdictions offer different types of business entities, such as:

International Business Companies (IBCs)

Limited Liability Companies (LLCs)

Trusts and Foundations

Select the structure that aligns with your business goals and operational needs.

4. Engage a Registered Agent

Most jurisdictions require offshore companies to appoint a registered agent. These agents assist with the incorporation process and ensure compliance with local regulations. They also provide a registered office address for the company.

5. Prepare Required Documentation

Typical documentation required includes:

Completed application forms

Certified copies of passports and proof of address for directors and shareholders

Memorandum and Articles of Association

Business plan or activity details

Ensure that all documents are notarized or apostilled, as per jurisdictional requirements.

6. Register the Company

Submit the required documents to the relevant authority in the chosen jurisdiction. Once approved, you will receive a certificate of incorporation, signifying the company’s legal existence.

7. Open a Bank Account

An offshore company needs a corporate bank account to conduct financial transactions. Many jurisdictions offer banking services tailored to offshore entities. Be prepared to provide detailed information about the company’s activities and ownership structure.

8. Comply with Legal Obligations

After incorporation, maintain compliance by adhering to local laws, including:

Filing annual reports

Renewing licenses

Keeping accurate financial records

Failure to comply with these requirements can result in penalties or loss of company status.

9. Consult Professionals

Engage legal and financial professionals with expertise in offshore company registration. They can provide tailored advice and ensure the process runs smoothly.

Conclusion

Register Offshore Company can offer significant advantages for businesses, but it requires careful planning and compliance. By understanding the benefits, choosing the right jurisdiction, and following the required steps, you can successfully establish an offshore entity to support your business goals.

0 notes

Text

Certificate of Incorporation Apostille: A Complete Guide

Certificate of Incorporation Apostille: A Guide for International Use A Certificate of Incorporation plays a vital role in the formation and recognition of a corporation or business entity. Whether you’re establishing a corporation, LLC, or partnership, this document serves as official proof that the company has been legally formed and approved by the state. However, when presenting this…

#hague apostille convention#Hague Apostille Services#Articles of Incorporation Apostille#apostille for corporate documents#corporate document legalization#expand business abroad#international business setup#LLC Articles of Incorporation

0 notes

Text

A Guide to Setting Up and Forming Your Company

Starting a business is an exciting endeavor, but navigating through the complexities of company formation can be challenging. A smooth and well-structured setting up companies service is essential for entrepreneurs who want to ensure their business starts off on the right foot. Understanding the process and knowing where to get professional help can make all the difference. In this article, we will explore the process of company formation and discuss the importance of getting professional assistance when setting up your business.

Why You Need a Professional Company Formation Service When you're ready to launch your business, the first step is registering your company. This is where a company formation service comes into play. These services simplify the process by providing expert knowledge on local regulations and ensuring that your business complies with all legal requirements. The complexity of business laws in different regions can be overwhelming, but a company formation expert will guide you through the registration process, saving you time and stress.

In addition to legal assistance, these services offer support with other important steps such as obtaining necessary permits and licenses, drafting incorporation documents, and setting up the right structure for your company. They also provide assistance with tax registrations and employee setup.

Understanding the Different Types of Company Formation The type of company structure you choose has a significant impact on your business operations. Whether you're forming a limited liability company (LLC), a corporation, or a sole proprietorship, each structure comes with its own benefits and drawbacks. Professional company formation services can help you select the best option based on your business goals, financial needs, and liability concerns.

For instance, a limited liability company (LLC) offers the benefit of protecting your personal assets from business liabilities, making it a popular choice for many small business owners. A corporation, on the other hand, is suitable for businesses that plan to expand and raise capital through the issuance of stock. A professional service will take the time to assess your specific needs and recommend the best structure for your business.

How Company Formation Services Simplify Your Journey One of the main reasons to consider using a company formation service is the convenience it offers. Starting a business requires filling out multiple forms, dealing with legal jargon, and meeting deadlines. A professional service can handle all of these tasks on your behalf, making the process far less time-consuming and much more straightforward.

Additionally, these services help you avoid costly mistakes that could delay your business launch or lead to compliance issues down the road. By utilizing the expertise of professionals who are familiar with local and international business laws, you can rest assured that everything is being handled efficiently and correctly.

The Benefits of Setting Up Your Company with Professional Help Choosing to set up your company with the help of an expert offers several advantages. It can minimize the risks of errors during the registration process, ensuring that all paperwork is submitted correctly. Professional services also have access to resources and tools that streamline the process, such as online registration systems and automated forms.

Another key benefit is that professional formation services often offer ongoing support, even after your business is set up. They can assist with future changes, such as altering your company structure, adding partners, or filing taxes. This long-term support makes it easier to grow and manage your business with peace of mind.

Conclusion Establishing a company is a major milestone in the entrepreneurial journey, and utilizing a company formation service can help ensure that this process goes smoothly. The expertise and support offered by professionals in setting up companies provide entrepreneurs with the peace of mind they need to focus on running their business. When you choose to work with experts, you're not just setting up your company—you're setting it up for long-term success.

0 notes

Text

Everything About Company Registration in Myanmar

Myanmar’s rapidly growing economy and abundant resources make it a promising destination for business expansion. Whether you're an entrepreneur or an established business looking to enter a new market, understanding company registration in Myanmar is the first step toward success.

Steps for Company Registration in Myanmar:

Select a Business Structure: Decide between Limited Liability Company (LLC), Branch Office, or Joint Venture, depending on your operational needs. Company Name Approval: Ensure the chosen name is unique and adheres to local regulations. Prepare Documentation: Draft and submit the Memorandum of Association (MOA) and Articles of Association (AOA) alongside other required documents, such as director and shareholder details. Obtain Incorporation Certificate: Once your application is processed and approved by the Directorate of Investment and Company Administration (DICA), you'll receive the certificate. Tax Registration and Licensing: Secure a Taxpayer Identification Number (TIN) and apply for any industry-specific licenses. Why Choose Myanmar? Myanmar offers a strategic location between South and Southeast Asia, along with access to emerging markets. Its investment-friendly reforms and incentives for foreign businesses add further appeal.

At YKG Global, we specialize in navigating the complexities of the registration process, ensuring your business is established smoothly and legally. With decades of experience, we are committed to helping you succeed in this dynamic market.

For professional guidance, visit YKG Global.

#business#consulting#company registration#taxation#success#investing#business registration#foreign company#finance#accounting#myanmar company registration list#company registration form in myanmar#register company in myanmar#online company registration myanmar#myanmar company registration

0 notes

Text

2025 Inauguration Day Schedule and Leading Mobile App Development in Missouri

Top mobile application development company in Missouri, As the nation eagerly anticipates the 2025 presidential inauguration, the day promises to be filled with a blend of tradition, unity, and forward-looking aspirations. This historic occasion is not only a time for political renewal but also a moment to reflect on innovation and growth across various sectors. One such standout in the field of technology is Avigma Tech LLC, a leading mobile app development company based in Missouri. This article provides an overview of the 2025 Inauguration Day schedule alongside insights into Avigma Tech LLC’s contributions to the tech industry in Missouri, Website development company in Missouri.

2025 Inauguration Day Schedule

According to recent updates, the 2025 presidential inauguration will follow the time-honored customs that have defined this significant event in American democracy. Here’s a glimpse of the day’s schedule:

Morning Worship Service: The day begins with an interfaith worship service, attended by the president-elect and vice president-elect, symbolizing the unity of diverse faiths in the nation.

Arrival at the Capitol: Around mid-morning, the president-elect and vice president-elect will arrive at the U.S. Capitol for the formal ceremony.

Swearing-In Ceremony: The cornerstone of the day, the swearing-in ceremony, is expected to take place at noon. The Chief Justice of the United States will administer the oath of office to the president-elect, marking the official start of their term, Top mobile app development company in Missouri.

Inaugural Address: Following the oath, the president will deliver the inaugural address, outlining their vision and priorities for the next four years.

Parade and Celebrations: After the formal proceedings, a celebratory parade will take place, showcasing the country’s diversity, followed by evening balls and receptions to commemorate the occasion.

For more detailed information about the inauguration schedule, you can visit CBS News.

Avigma Tech LLC: A Leader in Mobile App Development in Missouri

While the nation’s attention is focused on Washington, D.C., Missouri is making waves in the tech world, thanks to companies like Avigma Tech LLC. Renowned as one of the top mobile app development firms in the state, Avigma Tech LLC has carved a niche for itself by delivering cutting-edge solutions tailored to the needs of modern businesses, Mobile app development company in Missouri.

Key Services Offered by Avigma Tech LLC:

Custom Mobile App Development: Avigma specializes in creating user-friendly, high-performing mobile applications for iOS and Android platforms. Their solutions are designed to enhance user engagement and drive business growth.

UI/UX Design: The company’s design team ensures that every app not only functions seamlessly but also provides an intuitive and visually appealing user experience.

Enterprise Solutions: Avigma develops scalable and secure applications for businesses, helping them streamline operations and improve productivity.

Maintenance and Support: Beyond development, Avigma offers ongoing support to ensure that their clients’ apps remain up-to-date and perform optimally.

Why Choose Avigma Tech LLC?

Innovation-Driven Approach: Avigma Tech LLC stays ahead of industry trends, incorporating the latest technologies like AI, IoT, and blockchain into their projects, Best mobile application development company in Missouri.

Client-Centric Philosophy: The company prioritizes understanding client needs and delivering solutions that align with their objectives.

Proven Track Record: With numerous successful projects under their belt, Avigma has earned a reputation for excellence in the tech community.

As the nation looks forward to a new chapter in its political journey with the 2025 inauguration, it’s inspiring to see Missouri’s tech industry thriving through companies like Avigma Tech LLC. This juxtaposition of tradition and innovation underscores the dynamic spirit of progress that defines America.

For more information about Avigma Tech LLC’s services, visit their official website and explore how they can transform your digital vision into reality, Mobile application development company in Missouri.

#Inauguration Day#avigma#missouri#united states#top mobile app development company in missouri#trending#news#technology#trending news#Trump

0 notes

Text

Virtual Reality — What's the next cutting edge?

With virtual Reality being one of the most innovative technologies of the 21st century, it has changed how we engage with a wide range of services. In today’s world, Spiral LLC has proved itself as the finest app development company thanks to all the advancements made in the technology. This technology has brought forth a slew of new possibilities. It allows users to immerse themselves in a 3D virtual world, enabling them to engage with objects and scenarios in ways that are impractical in real life. As the industry progresses, further questions also appear. What disruptive technological breaks will emerge with the virtual reality world? What will be the proper conceptual outlook such as “Mars Bermuda Unicorn”? In this article, we showcase its current trends, its effects on various industries, and its likely growth in the future.

What’s the Current Status of Virtual Reality?

It is a technology that everyone can experience. It brings to its users close to lifelike simulations with impeccable graphics and limitless interactivity. Commercial use and professional training are some of the areas that can utilize virtual reality systems, for instance, the Oculus Quest or the HTC Vive to mention a few. There is a wide range of industries with varying levels of acceptance towards it; however, the marketing industry and the design industry have taken a keen interest in its usage. For starters, in the healthcare and education sectors, it is being used to substitute students for the actual ocean so that they can explore deeper rather than being inside a classroom. In the design industry, it allows customers to step into a lifelike building, allowing them to have a look around before it is even built; this, alongside its gaming, has become extremely popular. All of the above are just the bare minimum when comparing to what the future holds for it; it can only get better and better, enhancing the gaming and marketing experience for all users.

What are its emerging technologies?

1. Haptic Feedback

Haptic technology enables users to experience the real touch and sensations such as pressure, texture, and temperature while being in this world. For example, while touching the bark of a tree in a 3D environment, someone can feel a sense of realism, and this sort of innovation is expected to provide haptic feedback to its users in the EMT world. Furthermore, this technology has been useful in gaming, therapy for patients suffering from PTSD, as well as training simulations.

2. AI Integration

Its experiences, with the help of AI-driven virtual avatars, can be further enhanced through sustained interaction, which can help adapt lessons according to the user. For instance, AI modifications enable the avatars to transform during interactions on educational platforms. Moreover, AI technology being used in interactive virtual Reality, AI tutorees, can further enhance its experience by pacing the tutorials according to the convenience of the user, subsequently greatly improving traditional learning techniques.

3. Eye Tracking Technology and Facial Recognition

Cutting latency time and improving graphic quality, eye-tracking technology has been identified as another revolutionary innovation in its sphere. Additionally, bringing the user’s facial features and expressions to life by employing facial recognition is likely to make interactions in the metaverse more engaging. Importantly, auto-teaching devices coupled with these technologies can help revolutionise the education training sector.

4. 5G and Cloud Virtual Reality

The introduction of 5G networks will soon eliminate one of its major barriers: latency. The possibility of incorporating it in cloud-based applications is increased due to low-latency, high-speed connections, which eliminates the need for heavy setups. An improved range of lightweight devices can be used to provide access to its complex and high-quality content.

5. Exploration of Other Areas Outside of Earth

The projects termed “Mars Bermuda Unicorn” are now broadening the horizons of what they could accomplish. Consider its use to recreate Mars and train astronauts during their missions, and then allow ordinary people to virtually travel into space. Such initiatives have the potential to change the way humanity engages with space.

By using this technology, what are the real-world applications of the future?

1. Education and Training

It is reinventing education in ways never seen before. Expect a world where a medical student can practice performing intricate surgery within this safe environment or an aspiring pilot being able to use an ultra-realistic simulator to perfect flying. As this technology increases, classrooms expect children across the world to be able to attend their lessons in a 3D virtual world.

2. Healthcare

Pain management and mental health therapies are a couple of its uses, along with surgical simulations. In exposure therapy, for example, the patients have the chance to tackle their strong fears in a safe, controlled virtual environment. Instead, imagine a day in the near future where AI assists doctors in creating custom plans and helps monitor a patient's physical status in real-time.

3. Entertainment and Social Interaction

The entertainment industry is set for a major disruption brought on by its advent. People have already begun to utilize it to attend concerts, watch films, play video games, and so on. Other users can get in on the action through social-VR platforms such as VRChat, which enable users to communicate and interact with others in shared 3D virtual settings.

4. Retail and E-Commerce

Picture surfing the internet to buy clothes, getting to try them on, or even going to look at a home for sale without stepping outside your house. By allowing customers to try on clothes without having to physically go to a store, it is changing the face of retail. Shopping assistants powered by AI will undoubtedly be among the future breakthroughs that these virtual environments may have.

5. Workplace Collaboration

There has been an increase in remote work, and it is helping to solve that problem. Virtual meeting rooms allow coworkers to work together in a shared virtual room with 3D presentations and realistic avatars. Improving this technology could make these virtual workspaces even more intuitive and fruitful.

For its growth, what challenges will have to be faced?

Although there are some who claim that it has potential, a number of problems, which include:

Price: Quality hardware is still pricey, which makes it difficult for many to utilise.

Sickness: Quite a lot of users get sick while using it for long periods.

Content Creation: Creating its modules that are of great quality and are appealing to users is both resource- and time-consuming.

Ethics: With this technology being more available and growing, concepts such as privacy or addiction are becoming more and more applicable.

To properly resolve the above problems would require visionary thinking as well as cooperation and some form of regulation.

What’s its future?

With its further advancement, new applications will also arise that we cannot fully comprehend today. The scope for creating fully immersive 3D virtual worlds or even recreating extraterrestrial territories, such as Mars, knows no boundaries. Ideas such as the "Mars Bermuda Unicoits may help foster new breakthroughs by integrating its interface and AI, robotics, and all other modern inventions conceived in this century. With more and more powerful hardware available at lower prices and capable software being developed, virtual Reality will, most probably, become an integral part of the virtual and tangible worlds that we inhabit.

Source

0 notes