#Jumbo Loans Omaha

Explore tagged Tumblr posts

Text

How Jumbo Loans in Omaha Help You Buy Your Dream Luxury Home

There's no denying that buying a luxury home can be a daunting task, especially when it comes to securing financing. You've likely spent years saving and searching for the perfect property, and now you're ready to take the plunge. However, traditional mortgage loans often have limits that can make it difficult to purchase high-value properties. This is where jumbo loans come in - a type of loan that allows you to borrow more money to purchase your dream home. In Omaha, jumbo loans are a popular option for those looking to buy luxury properties, and for good reason.

As far as qualifying for a jumbo loan in Omaha, you'll need to meet certain requirements. Your credit score, down payment, and income will all be taken into consideration. Typically, you'll need a credit score of 700 or higher, a down payment of at least 10%, and a stable income that can support the monthly mortgage payments. If you meet these requirements, you may be eligible for a jumbo loan that can help you purchase your dream home. You can work with a reputable mortgage broker, such as Shotbolt Mortgage Corporation, located at 17310 Wright St # 104, Omaha, NE 68130, to determine if you qualify and to explore your options.

The advantages of jumbo loans are numerous. For one, they offer higher loan limits, allowing you to borrow more money to purchase a luxury property. You'll also have access to competitive rates and flexible terms, which can help make your monthly mortgage payments more manageable. Additionally, jumbo loans can be used to purchase a variety of properties, including single-family homes, condos, and townhouses. With a jumbo loan, you'll have the freedom to choose the property that's right for you, without being limited by traditional loan limits.

To secure a jumbo loan, you'll want to work with a mortgage broker who has experience with these types of loans. They can help you navigate the application process and ensure that you get the best deal possible. You can book an appointment with Shotbolt Mortgage Corporation by visiting their website at www.shotboltmortgage.com. By working with a reputable broker, you'll be able to explore your options and find a jumbo loan that meets your needs and budget.

In essence, if you're in the market for a luxury home in Omaha, a jumbo loan may be the perfect solution. With higher loan limits, competitive rates, and flexible terms, you'll have the freedom to purchase the property of your dreams. Don't let traditional loan limits hold you back - explore jumbo loans in Omaha today and take the first step towards owning your dream home. Contact Shotbolt Mortgage Corporation to learn more and to schedule a consultation. With their expertise and guidance, you'll be well on your way to securing the financing you need to purchase your luxury home.

0 notes

Text

What are the Eligibility Criteria and Application Methods of Jumbo Reverse Mortgage?

For most seniors, retirement means living on a fixed earning. This, in turn, limits their options and makes it hard for them to support their lifestyle. But what if there was a method for retirees to access the equity in their homes without making monthly payments? That's where a jumbo reverse mortgage comes in, but what are this financial product's eligibility rules and application methods? In this blog, we'll answer those questions and more, so keep reading!

What is a Jumbo Reverse Mortgage?

A jumbo reverse mortgage is a financial product that lets homeowners aged 62 and older utilize the equity in their houses without making monthly payments. Unlike a standard mortgage, the homeowner can only pay back the loan once they sell the home or pass away. The portion of equity a homeowner can access depends on their age, the value of the house, and the overall interest rates.

Eligibility Criteria

To qualify for the jumbo reverse mortgage loan, you must meet the following criteria:

- You must be 62 years or older

- You must possess your home outright or have a noteworthy amount of equity in it

- Your home must be your primary residence

- You must be capable to disburse your property taxes, insurance, and maintenance costs

- You must undertake a counseling session with a HUD-approved counselor

Additionally, some lenders may have their eligibility criteria, such as a least credit score or earnings requirements. Contact Ken Kennedy at Mutual of Omaha Mortgage to know exactly about the eligibility criteria of the loan.

Application MethodS

Applying for a jumbo reverse mortgage is similar to applying for a regular mortgage. Here are the steps involved:

Research and contact trusted lenders and find out about the application process and documents required for approval. Always choose the one which is highly reputable and experienced.

Choose a trusted lender and meet their application form. You must provide your income, expenses, assets, and home value information. Then do your documentation precisely

Complete a counseling session with a HUD-approved counselor. The counselor will elucidate and highlight the pros and cons of jumbo reverse mortgage and help you understand how they work.

The lender will order an assessment to determine your home's value and appraise your eligibility for the loan.

The lender will check your application and make a decision. You'll receive a loan estimate outlining the terms and costs if sanctioned.

If both sides agree on the terms and costs, the lender will close the loan and expend the funds.

Pros of the loan

Let's take a look at the benefits of the loan:

Access to funds without having to make monthly payments

No credit review or income validation is needed

Tax-free earnings

Flexibility in how the funds are used

A jumbo reverse mortgage can be a helpful financial tool for seniors, but it's important to understand the eligibility criteria and application method before deciding. By researching, working with a reputable lender, and completing counseling, you can decide whether the loan is right for you. Call the financial experts of Ken Kennedy at Mutual of Omaha Mortgage, as they have an expertise of 100 years for approving home reverse, HECM, and jumbo mortgage loans.

0 notes

Text

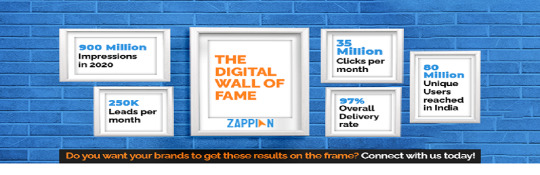

Top 5 Mortgage Loan offers 2022 (High Paying)

In this article we have listed top 5 Mortgage Loan offers for 2022 currently available in the market. As the pandemic is ending and people are getting back to normal life, people have started investing in real estate.

There are various mortgage lenders in the market but our goal is to get the best Mortgage Loan offers for 2022 to the customer looking for Mortgage Loans. Homeowners know how important it is to select the right mortgage loan.

What is a Mortgage Loan?

It is referred to as the process of offering something as a guarantee against a loan. Globally there are different types of Mortgages but some of the popular ones are Conventional Mortgages, Fixed-Rate Mortgages, Adjustable-Rate Mortgages, FHA Loans, VA Loans and Jumbo Loans. All mentioned mortgages are considered either conforming or non-conforming loans.The two main factors affecting a mortgage are principal and Interest charged. Here the principal is the loan amount the lender gives to the customer whereas the interest is the additional amount by the lender on the principal amount.

In this advanced era, we easily calculate the Monthly Payment depending on the amount of home price on various websites. These websites allow you to track the down payment, homeowners insurance, interest rate on the loan and other details with ease.

Your monthly mortgage payment will depend on your home price, down payment, loan term, property taxes, homeowners insurance, and interest rate on the loan (which is highly dependent on your credit score). Use the inputs below to get a sense of what your monthly mortgage payment could end up being.

Companies like Quicken Loans, AmeriSave Mortgage, Omaha Reverse Mortgage, Lendgo Mortgage, and E Mortgage Capital give their customers ability to get quick loans, affordability, along with various loan options as well as speed to funding.

Mortgage Loan affiliate offers but the lenders below will help you generate high commissions. So, if you have a good presence on different social media platforms and have a network related to selling or buying houses, this is the right time. Take advantage of home loan affiliate offers and sign up with mortgage affiliate programs to make money as a mortgage affiliate marketer.

Here are high paying mortgage loan offers 2022

1. Quicken Loans

Quicken Loans (Rocket Mortgage) is one of America’s largest mortgage lenders in the market. They help clients understand various mortgage loan options and processes.

In the past they have helped millions achieve the dream of home ownership and their goal is to make the complicated home financing process simpler using technology, education and customer service. The Mortgage loan affiliate offer by Quicken Loans helps you receive good commissions and benefits.

We all know that mortgage rates change on a daily basis in the market. This is the reason why Quicken Loans publishes Today’s Mortgage Rates on their website for customer convenience and transparency.

2. AmeriSave Mortgage

The AmeriSave Mortgage Corporation for the past 20 years has helped people get 390,000+ homes financed and become happy homeowners.

They offer different types of mortgage loans to homebuyers & owners. These Mortgage Loans include Fixed Rate Loans, FHA Loans, VA Loans, USDA Loans, Cash Out Refinance and Adjustable Rate Loans.

As an affiliate marketer you can easily avail various home loan affiliate offers by AmeriSave Mortgage. In addition, buyers can dream of a bigger house with AmeriSave as they can customize loan rates to fit your needs as well as payment requirements.

3. Mutual of Omaha Reverse Mortgage

Mutual of Omaha Mortgage Company helps its clients protect what they care about and simultaneously achieve their financial goals. Unlike various traditional home mortgage loans, it offers a safe and secure way to its homeowners of 62 years and older. The clients can cash out the equity in their home without the requirement of a monthly loan payment.

By using a reverse mortgage loan you can meet long-term goals while incurring no monthly mortgage payments on your new home loan.

Besides that Mutual of Omaha Mortgage provides various reverse mortgage affiliate offers that can be a great source of particle income for affiliate marketers.

4. Lendgo Mortgage

Lendgo Mortgage offers an advanced online platform which provides homeowners a powerful online tool which helps them save big on their home loan and get the lowest rates. With Lendgo Mortgage you can secure the lowest rates and get the best mortgage as well as refinance offers online.

They also promise information security as the data shared with Lendgo Mortgage is fully protected as well as mortgage inquiry on their platform will not affect customers credit score.

You as an affiliate marketer can get the best possible home mortgage affiliate offers by bringing homeowners and first-time buyers to a simple, streamlined, unbiased, online platform for home loans.

5. E Mortgage Capital

E Mortgage Capital is an award-winning and one of the best Mortgage Lenders headquartered in Irvine, California. They offer extensive options for residential mortgage along with class leading service.

Whether you are buying a new home or looking for a refinance E Mortgage Capital will provide you tailor-made loans. These loans will come with a list of benefits and will offer fixed or variable interest rates to match customers financing needs.

They can help you save money on your current mortgage as well as get the most competitive rates for a home loan. Mortgage Loan affiliate offers by E Mortgage Capital are really very competitive and hassle-free.

Conclusion

I hope people who are looking for Mortgage loans will find some of the best mortgage lenders as well as affiliate marketers can get nice home loan affiliate offers. We suggest all home buyers compare the lowest home loan interest with the companies listed above. Apply for the best home loan.

We all know that affiliate marketing is a great source of income and the thing is that mortgage industry is growing at a fast pace. There are numerous opportunities for brokers as well as affiliate marketers as mortgage lenders provide high commissions if you get them the right customers who are looking for mortgage loans.

Source- https://www.zappian.com/top-5-mortgage-loan-offers-2022-high-paying/

0 notes

Text

Real estate daily market update: January 18, 2018

http://ift.tt/2sBaOIk

We’ll add more market news briefs throughout the day. Check back to read the latest.

Most recent market news

Thursday, January 18

Freddie Mac Primary Mortgage Market Survey

30-year fixed-rate mortgage (FRM) averaged 4.04 percent with an average 0.6 point for the week ending January 18, 2018, up from last week when it averaged 3.99 percent. A year ago at this time, the 30-year FRM averaged 4.09 percent.

15-year FRM this week averaged 3.49 percent with an average 0.5 point, up from last week when it averaged 3.44 percent. A year ago at this time, the 15-year FRM averaged 3.34 percent.

5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.46 percent this week with an average 0.3 point, unchanged from last week. A year ago at this time, the 5-year ARM averaged 3.21 percent.

Len Kiefer, deputy chief economist at Freddie Mac, said: “The U.S. weekly average for the 30-year fixed mortgage rate rose above 4 percent for the first time since last summer to 4.04 percent in this week’s survey. This is the highest weekly average for the 30-year fixed rate mortgage since May of 2017.

“Some may be wondering if this is the last time we’ll see a three handle on the 30-year mortgage rate. Never say never, but inflation is firming, the Federal Reserve’s Beige Book indicates broad-based economic growth and labor markets are tightening. This means upward pressure on long-term rates, like the 30-year fixed-rate mortgage, is building.”

What to expect in the housing market in 2018

Learn more about current trends and how to tap them to expand your business READ MORE

U.S. Census Bureau and the U.S. Department of Housing and Urban Development Monthly New Residential Construction, December 2017

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,302,000. This is 0.1 percent (±1.4 percent)* below the revised November rate of 1,303,000, but is 2.8 percent (±1.9 percent) above the December 2016 rate of 1,266,000.

Single-family authorizations in December were at a rate of 881,000; this is 1.8 percent (±1.2 percent) above the revised November figure of 865,000. Authorizations of units in buildings with five units or more were at a rate of 382,000 in December.

An estimated 1,263,400 housing units were authorized by building permits in 2017. This is 4.7 percent (±0.6%) above the 2016 figure of 1,206,600.

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,192,000. This is 8.2 percent (±7.7 percent) below the revised November estimate of 1,299,000 and is 6.0 percent (±11.7 percent)* below the December 2016 rate of 1,268,000.

Single-family housing starts in December were at a rate of 836,000; this is 11.8 percent (±6.5 percent) below the revised November figure of 948,000.

The December rate for units in buildings with five units or more was 352,000. An estimated 1,202,100 housing units were started in 2017. This is 2.4 percent (±2.3%) above the 2016 figure of 1,173,800.

Housing Completions:

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,177,000. This is 2.2 percent (±17.8 percent)* above the revised November estimate of 1,152,000 and is 7.4 percent (±13.0 percent)* above the December 2016 rate of 1,096,000.

Single-family housing completions in December were at a rate of 818,000; this is 4.3 percent (±20.5 percent)* above the revised November rate of 784,000.

The December rate for units in buildings with five units or more was 346,000. An estimated 1,152,300 housing units were completed in 2017. This is 8.7 percent (±3.1%) above the 2016 figure of 1,059,700.

News from earlier this week

Wednesday, January 17

Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 4.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 32 percent compared with the previous week.

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 35 percent compared with the previous week and was 7 percent higher than the same week one year ago.

The refinance share of mortgage activity decreased to 52.2 percent of total applications from 52.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 5.2 percent of total applications.

The FHA share of total applications increased to 11.7 percent from 11.1 percent the week prior. The VA share of total applications decreased to 10.7 percent from 11.4 percent the week prior. The USDA share of total applications increased to 0.8 percent from 0.7 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since March 2017, 4.33 percent, from 4.23 percent, with points increasing to 0.54 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100) increased to its highest level since March 2017, 4.25 percent, from 4.16 percent, with points increasing to 0.36 from 0.23 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to its highest level since March 2017, 4.30 percent, from 4.16 percent, with points increasing to 0.65 from 0.42 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to its highest level since January 2014, 3.77 percent, from 3.66 percent, with points increasing to 0.44 from 0.42 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs increased to its highest level since April 2011, 3.62 percent, from 3.50 percent, with points decreasing to 0.48 from 0.51 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

Tuesday, January 16

January 2018 RE/MAX National Housing Report

While sales dropped slightly from a year ago, December capped off a 2017 of record home prices, speedy sales and low inventory.

The median home price rose 8.1 percent year-over-year, with 50 of the report’s 54 markets posting increases. At the same time, December sales dropped 3.3 percent from December 2016, with 39 markets reporting fewer transactions.

Making sales harder was a Months Supply of Inventory of 3.7 which is the lowest December figure in the nine-year history of the report. That corresponds with a 14.6 percent decline in inventory, lengthening a streak of monthly declines that began in November 2008.

Also setting a report record for December was the speed of home sales: 57 days. That figured into an overall 2017 median for Days on Market of 52.5 — nearly a week less than the 2016 median of 58.5 days.

Homebuyers paid record prices in 2017, led by June’s Median Price Sold of $245,000. Prices increased year-over-year in every month of 2017, with December marking the 21st consecutive month of year-over-year price increases dating back to April 2016.

“We see the median sales price of homes across the country rising every month, year-over-year, but the days on market and the supply of homes for sale hit record lows in December,” said Adam Contos, Re/Max Co-CEO. “If inventory keeps getting tighter across the country it’ll be interesting to see how it might affect sales.”

Closed Transactions:

Of the 54 metro areas surveyed in December 2017, the overall average number of home sales decreased 2.5 percent compared to November 2017 and decreased 3.3 percent compared to December 2016.

Fifteen of the 54 metro areas experienced an increase in sales year-over-year including, Trenton, NJ, +13.9 percent, Richmond, VA, +10.9 percent, Burlington, VT, +8.1 percent, and Raleigh-Durham, NC, +5.4 percent.

Median Sales Price – Median of 54 metro median prices:

In December 2017, the median of all 54 metro Median Sales Prices was $232,500, up 3.1 percent from November 2017 and up 8.1 percent from December 2016.

Only four metro areas saw a year-over-year decrease in Median Sales Price; Anchorage, AK, -6.5 percent, Wichita, KS, -3.9 percent, Fargo, ND, -1.8 percent and Wilmington/Dover, DE, -.90 percent. Ten metro areas increased year-over-year by double-digit percentages, with the largest increases seen in San Francisco, CA, +17.8 percent, Las Vegas, NV, +17.1 percent, Seattle, WA, +13 percent and Boise, ID, +12.8 percent.

Days on Market – Average of 54 metro areas:

The average Days on Market for homes sold in December 2017 was 57, up three days from the average in November 2017, and down five days from the December 2016 average.

The four metro areas with the lowest Days on Market were Omaha, NE and San Francisco, CA, at 27, Nashville, TN, at 31 and Seattle, WA, at 34.

The highest Days on Market averages were in Augusta, ME, at 122 and Chicago, IL, and Miami, FL, at 86.

Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed

Months Supply of Inventory – Average of 54 metro areas:

The number of homes for sale in December 2017 was down 14 percent from November 2017, and down 14.6 percent from December 2016.

Based on the rate of home sales in December, the Months Supply of Inventory increased to 3.7 from November 2017 at 3.6, but decreased compared to December 2016 at 4.2.

A 6.0-months supply indicates a market balanced equally between buyers and sellers.

In December 2017, 52 of the 54 metro areas surveyed reported a months supply at or less than 6.0, which is typically considered a seller’s market.

The metro areas that saw a months supply above 6.0, which is typically considered a buyer’s market, were Augusta, ME, at 9.5 and Miami, FL, at 8.7.

The markets with the lowest Months Supply of Inventory continued to be in the west with San Francisco, CA, at 0.9, Seattle, WA, at 1.4, and Denver, CO, 1.5.

CoreLogic Loan Performance Insights Report

The 30 days or more delinquency rate for October 2016 was 5.2 percent. In October 2017, 5.1 percent of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 0.1 percentage point decline in the overall delinquency rate compared with October 2016.

As of October 2017, the foreclosure inventory rate was 0.6 percent down from 0.6 percent in October 2016.

The share of mortgages that transitioned from current to 30-days past due was 1.1 percent in October 2017, up from 1 percent in October 2016.

Source: CoreLogic

Source: CoreLogic

“After rising in September, early-stage delinquencies declined by 0.1 percentage points month over month in October,” said Frank Nothaft, chief economist at CoreLogic. “The temporary rise in September’s early-stage delinquencies reflected the impact of the hurricanes in Texas, Florida and Puerto Rico, but now the impact from the hurricanes is fading from a national perspective.

“While the national impact is waning, the local impact remains. Some Florida markets continue to see increases in early-stage delinquency transition rates in October, reaching 5 percent, on average, in Miami, Orlando, Tampa, Naples and Cape Coral.

“Texas markets such as Houston, Beaumont, Victoria and Corpus Christie peaked at over 7 percent in September, but are on the mend and improving in October.”

Email market reports to [email protected].

from Inman http://ift.tt/2DfUtxJ via IFTTT

0 notes

Text

Frontier Bank

He spent the last nine years as a Mortgage Loan Officer at Mutual of Omaha Bank. Vaughan assists clients with all their mortgage needs through a full suite of products including conventional fixed rate mortgages, jumbo mortgages, portfolio mortgages, VA and FHA mortgages, as well as construction ...

0 notes

Text

Jumbo Loans in Omaha: Is a Jumbo Loan Right for Your Dream Home?

There's no denying that buying a dream home can be a significant investment, and for many, it requires a substantial amount of financing. If you're looking to purchase a high-end property in Omaha, you may need to consider a jumbo loan. You're probably wondering what jumbo loans are and whether they're the right fit for your financial situation. A jumbo loan is a type of mortgage that exceeds the conventional loan limits set by Fannie Mae and Freddie Mac, typically above $510,400 in most areas. You'll need a jumbo loan if you're looking to purchase a luxury home or a property in a high-cost area, and you're not alone in this pursuit.

In the context of jumbo loan requirements in Omaha, you'll need to meet specific criteria to qualify. Your credit score, income, and down payment will be carefully evaluated. You'll typically need a credit score of 700 or higher, a stable income, and a significant down payment, usually 10% to 20% of the purchase price. You should also be prepared to provide extensive financial documentation, including tax returns, bank statements, and investment accounts. By understanding these requirements, you can better prepare yourself for the application process and increase your chances of approval.

As with any loan, there are pros and cons to consider when it comes to jumbo loans. On the plus side, you'll have access to more financing options, allowing you to purchase your dream home. You may also enjoy more flexible repayment terms and potentially lower interest rates. However, you should be aware of the risks involved, including higher monthly payments, stricter qualification requirements, and potentially higher interest rates. You should carefully weigh these factors to determine if a jumbo loan is right for you.

If you've decided that a jumbo loan is the way to go, you'll need to know how to apply. The process typically involves pre-approval, where you'll provide financial documentation to determine how much you can borrow. You'll then need to find a lender, such as Shotbolt Mortgage Corporation, and submit a formal application. You can visit their website at www.shotboltmortgage.com to book an appointment and get started. From there, you'll work with a loan officer to finalize your application and close on your loan.

So, how do jumbo loans compare to conventional loans? The key differences lie in the loan limits, interest rates, and qualification requirements. Jumbo loans often have stricter requirements and higher interest rates, but they offer more financing options for high-end properties. You should consider your financial situation and goals to determine which type of loan is best for you. By understanding the differences, you can make an informed decision and find the perfect loan for your dream home.

To conclude, jumbo loans can be a great option for those looking to purchase a luxury home in Omaha. You should carefully consider the requirements, pros, and cons before making a decision. If you're ready to take the next step, visit Shotbolt Mortgage Corporation at 17310 Wright St # 104, Omaha, NE 68130, or book an appointment online at www.shotboltmortgage.com. You can find out if you qualify for jumbo loans in Omaha today and make your dream home a reality.

0 notes