#Jumbo Loan Refinancing Beverly Hills

Explore tagged Tumblr posts

Text

Carlyle Financial is your trusted jumbo mortgage broker in Beverly Hills, specializing in jumbo home mortgages, super jumbo home loans, and non-conforming loans tailored to high-net-worth borrowers. We offer competitive jumbo mortgage rates, interest-only jumbo loans, and jumbo ARM loans, expertly handling complex financial situations such as RSU income, self-employment income, and loan amounts exceeding $10M. With over 30 years of experience and $2 billion in funded jumbo loans, our team provides expert guidance and streamlined lending solutions. Whether you’re pursuing jumbo loan refinancing or exploring super jumbo mortgage options, Carlyle Financial delivers personalized service to meet your unique financial needs.

#Interest Only Jumbo Loan Beverly Hills#High Net-Worth Borrowers Beverly Hills#Jumbo Loan Refinancing Beverly Hills#Jumbo Mortgage Rates Beverly Hills#Jumbo Mortgage Refinance Beverly Hills#Non Conforming Loan Beverly Hills#Jumbo ARM Loan Beverly Hills

0 notes

Text

Mortgage Market Meltdown: Even The Wealthiest Loan Applicants Are Now Being Turned Down By Lenders

Mortgage Market Meltdown: Even The Wealthiest Loan Applicants Are Now Being Turned Down By Lenders

Mortgage Market Meltdown: Even The Wealthiest Loan Applicants Are Now Being Turned Down By Lenders

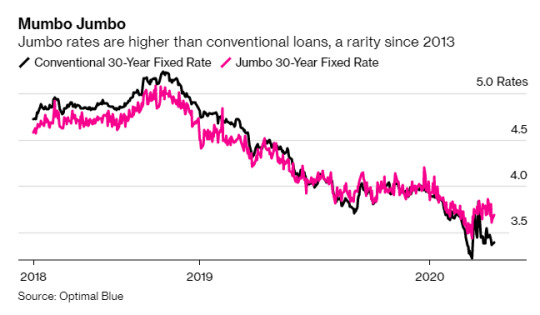

Via Bloomberg The global pandemic has mortgage lenders steering away from even their wealthiest clients, as fears are abound that lost income could turn the industry's best clients into its biggest risks. Jumbo loans, which got their name because they are bigger than most conventional mortgages, have completely fallen out of favor with lenders - a far cry from how they were looked upon just months ago, according to Bloomberg. Availability of jumbo mortgages is down 37% in March, more than double the overall home-loan market. They exceed the limit for government backed mortgages of $510,400. Rates for jumbo loans were 3.68% last week, which is almost 30 bps higher than the average conventional rate. The spread is the highest since 2013. Jumbo borrowers were previously seen as welcome clients, generally with great credit, money in the bank and collateral to put up.

Tendayi Kapfidze, chief economist at LendingTree Inc. said: “Before this crisis hit us, jumbo loans were pretty attractive. But because they don’t have the government guarantee, a lot of those loans end up on the bank balance sheet.” Lenders are charging more for these types of loans than they have in almost seven years. At the same time, they've tightened lending standards, requiring almost pristine credit to get a mortgage. People like David Adler are finding out that refinancing isn't at easy at it seems, either. David, with excellent credit, went to lower his 3.7% rate on his home but his bank's rates were too high to help. Adler said: “I told the guy at the bank, ‘I’m trying to use logic here,’ And he said, ‘That’s your problem.’” Wells Fargo ranks among the highest jumbo loan holders, producing about $70 billion of the mortgages last year.

Over the last couple of weeks, the bank has stopped purchases from other mortgage banks and limited refinancings to customers who have $250,000 or more with the bank. Banks like Truist Financial Corp. and Flagstar Bancorp Inc. have taken similar steps. Stanley Middleman, chief executive officer of Freedom Mortgage Corp. said: "Much of this pullback is because investors who’d normally buy these loans no longer want them. Whether the assets are good or not good is irrelevant because there’s no liquidity to buy them.” And the banks may be on to something. It turns out that wealthier buyers look just as likely to stop paying their mortgages as and regular buyers. 5.5% of jumbo loans, about 131,000 borrowers, have asked to postpone payments due to a loss of income. But the jumbo market hasn't totally dried up - it's just getting more difficult to close loans. Damon Germanides, a broker in Beverly Hills, says you can fall short of qualifying "despite good credit and owning a business that’s doing well during the pandemic because it’s deemed 'essential'." Borrowers that were ready to put up 20% may now need to put up 30%. “A month ago, he was a no-brainer. Now he’s 50-50,” Germanides concluded. Read more https://global.goreds.today/is-another-subprime-mortgage-bubble-just-over-the-horizon-industry-seeks-to-eliminate-debt-to-income-rules-that-caused-the-last-one/ Read the full article

0 notes