#J.P. Morgan Reserve Card

Explore tagged Tumblr posts

Text

FintechZoom Best Travel Credit Cards for 2025: Top Picks Revealed

Discover FintechZoom best travel credit cards for 2025, featuring top picks that maximize rewards and benefits for every traveler. Travel credit cards are a game-changer for frequent travelers. The fintechzoom cards stand out for their unique benefits. right credit card can enhance your travel experience significantly.y offer exclusive perks like travel rewards, cash back, and peace of mind…

#Amazon Prime Rewards Visa#American Express Platinum#Apple Card#best card for shopping#best credit card#Black Card#cashback credit cards#cashback rewards#celebrity credit cards#Centurion Card#Chase Sapphire Preferred#credit card recommendations#Credit Cards#credit cards for billionaires#credit cards for millionaires#elite credit cards#elite financial tools.#exclusive credit cards#financial perks#hardest credit card to get#J.P. Morgan Reserve Card#lounge access#luxury credit cards#luxury travel benefits#mobile shopping#mobile shopping credit cards#prestigious credit cards#Travel Credit Cards#Travel Rewards

0 notes

Text

Paper Release: A Discussion on the Release of the New "Uber Eats Index", and including its Rationale (Chicago), and Efficiencies (Los Angeles)

The creator of this paper, after attempting to find the most cost efficient take out order, and order substitution delivery service. And after discovering the ability with the Chase Sapphire Preferred Credit Card. To be able to order, with little to no ad

Uber Eats Index – Courtesy of Kevin Michael Miller Uber Eats Index As A Percentage – Courtesy of Kevin Michael Miller The creator of this paper, after attempting to find the most cost efficient take out order, and order substitution delivery service. And after discovering the ability with the Chase Sapphire Preferred Credit Card. To be able to order, with little to no additional delivery…

View On WordPress

#Caviar Meal Delivery#Chase Sapphire Bank Credit Card#Chase Sapphire Preferred#Chase Sapphire Reserve#Chicago Sales Taxes#Competitive Advantage#Delivery and Meal Delivery Services Industry#DoorDash Meal Delivery Service#DSGE#Grubhub#J.P. Morgan Chase Bank#Los Angeles County Sales Tax Proposal#Lyft#Market Efficiencies#Market Inefficiencies#Meal Delivery Services#Uber Eats#Uber Eats Index#Vector Auto Regression VAR#Vice President of Portfolio Management

0 notes

Text

FRM Salary in India 2025 | Scope, Jobs, Growth

Thinking about a career in finance that’s challenging and well-paid? Financial Risk Management might be the perfect fit. FRMs (Financial Risk Managers) are the professionals who help organisations safeguard their assets and maintain stability in an unpredictable financial world. Whether it’s banking, trading, loan origination, or even marketing — FRMs are in demand across industries.

According to Glassdoor, the average salary of an FRM in India is ₹9 LPA. With experience, that can go as high as ₹33 LPA. On a monthly scale, expect somewhere between ₹66,130 and ₹77,821, depending on your role and experience.

Who is a Financial Risk Manager?

Financial Risk Managers are the people companies trust to keep their money safe. They use a mix of strategy, analysis, and financial tools to reduce exposure to risk like credit defaults, market crashes, or operational hiccups.

An FRM’s job is to anticipate what could go wrong and put systems in place to handle it be it low contingency reserves, poor resource management, or risky financial decisions.

Salary by Job Roles in Financial Risk Management

Here’s a look at common FRM job titles and what you can expect to earn:

1. Risk Qualification Manager

Manages a company’s insurance and risk programs, flagging anything that could threaten financial stability. Salary: ₹3 LPA — ₹30 LPA

2. Credit Risk Analyst

Works with banks, credit card companies, and rating agencies to assess consumer credit risk. Salary: ₹2.4 LPA — ₹21 LPA

3. Operational Risk Analyst

Identifies internal risks caused by weak controls or staffing issues, and reports them to management. Salary: ₹3 LPA — ₹20 LPA

4. Operational Risk Manager

Ensures all potential and existing risks are proactively managed to stay compliant with regulations. Salary: ₹5.5 LPA — ₹30 LPA

FRM Salary in India by Experience

As you’d expect, the more experience you gain, the higher your salary. Certifications like the CFA can also give your resume a serious boost.

Here’s a breakdown based on years of experience:

Years of ExperienceAverage Salary2–3 years₹8.0 LPA3–4 years₹9.0 LPA4–5 years₹10.7 LPA5–6 years₹11.6 LPA6–7 years₹12.0 LPA7–8 years₹9.7 LPA8–9 years₹13.7 LPA9–10 years₹10.5 LPA10–11 years₹14.7 LPA11–12 years₹15.2 LPA

Note: Salaries can vary based on the company, your credentials, and market demand.

Top Companies Hiring FRMs

FRMs are needed just about everywhere money is involved — which is pretty much every business. Here are some top companies actively hiring Financial Risk Managers:

PwC

KPMG

Amazon

EY

HSBC

Deloitte

J.P. Morgan

PayPal

ANZ

Wells Fargo

Goldman Sachs

Axis Bank

Bank of India

Reserve Bank of India

The starting salary for freshers may not blow your mind, but it grows quickly with experience and the right certifications. Pursuing a CFA (Chartered Financial Analyst) alongside your FRM can give your career an extra edge.

Got Questions About the FRM Course?

Conclusion

The demand for Financial Risk Managers is only going up. Companies are constantly on the lookout for professionals who can manage uncertainty and protect their bottom line. If you’re serious about making a career in this field, pairing your FRM certification with a CFA can unlock even better opportunities.

At Zell Education, we guide you through everything you need to become a successful FRM. Get in touch today to explore the course and see how we can help boost your career.

FAQ — Financial Risk Manager Salary

Q. What is the salary of an FRM in India? FRM salaries in India range from ₹3.0 LPA to ₹24.0 LPA, with an average of ₹9.1 LPA.

Q. Does having an FRM certification increase your salary? Absolutely. Certified FRMs are in high demand, and companies are willing to pay more for that expertise.

Q. Is FRM better than CFA? Not better — just different. CFA focuses more on investment and portfolio management, while FRM dives deeper into financial risk. You can even pursue both for a broader skillset.

Q. Are FRMs in demand in India? Yes! As the financial industry grows, more organisations are hiring FRMs to help manage risk and remain compliant.

0 notes

Text

On 5 October 2023, Marko Kolanovic, the Chief Global Market Strategist and co-head of Global Research at J.P. Morgan, appeared on CNBC’s “Fast Money” to discuss a range of topics, including his views on the stock market, the Federal Reserve’s stance on interest rates, and the performance of mega-cap stocks compared to mid-sized stocks. Holding a Ph.D. in theoretical high-energy physics from New York University, Kolanovic brings a quantitative lens to market analysis. His team has earned top rankings in Institutional Investor surveys globally, and he personally ranks #1 in Americas Equity Derivatives. Prior to J.P. Morgan, he held key roles at Bear Stearns and Merrill Lynch. Known for his accurate short-term market forecasts, he has been labeled ‘The Man who moves Markets’ by CNBC and ‘Gandalf’ by Bloomberg. In 2020, he joined the Institutional Investor Hall of Fame. Market Outlook Kolanovic opened by stating that he has a somewhat negative outlook on the stock market. While he did not explicitly say a recession is inevitable, he did mention that he thinks a recession will “eventually happen.” He also pointed out that the upside versus downside in stocks is not particularly favorable at the moment. Economic Indicators Kolanovic noted that the job market is strong but highlighted signs of stress in the consumer sector, such as rising delinquencies in credit cards and auto loans. He suggested that these could be early indicators of economic challenges, although he did not specifically say that consumer sentiment is eroding. Interest Rates Kolanovic discussed the current level of interest rates, particularly the 4.7% yield on the ten-year Treasury. He stated that these rates don’t align with historical market multiples and mentioned that they could rise a bit more. However, he did not express explicit concern about the current rate levels. Market Dynamics Kolanovic talked about the divergence between the NASDAQ and other markets. He noted that while the NASDAQ and mega-cap stocks have performed well, other markets have been flat or down. He offered two courses of action: either invest in lagging stocks if one believes a recession won’t happen or avoid mega-cap stocks if a recession is expected. Positioning and Sentiment Kolanovic emphasized that market positioning matters and has been a significant factor this year. He noted that volatility has been decreasing, which has been a tailwind for the market. However, he did not specifically say that rising volatility is a sign of more challenging times ahead. Volatility as an Asset Class Kolanovic briefly touched on the topic of volatility as an asset class. He mentioned that it’s challenging to own just volatility because it’s generally negative. He suggested that investors could use it to generate yield by selling short-term options. [embed]https://www.youtube.com/watch?v=K-v02Xfj_Ys[/embed]

0 notes

Text

Location: King’s Head. Time: Early Evening. Status: Open to everyone @devinstonestarters

Solitude seemed to be the new normal for Taylor these days; between an empty house in Ellington and bustling lecture halls filled with half-wits that loved to think they knew everything after scoring a barely satisfactory 150 on their LSATs to scrap by into Harvard Law, there was a many interactions that he had had outright skipped out on for preservation of his own sanity. His way home from the latter to the former seemed to be the breaking point for him on this specific day, compelling Taylor into the King’s Head instead, entirely overdressed in an exorbitantly expensive suit and tie, too. The initial attention that he stirred walking in did not deter him so much, as he made his way down to a seat at the bar, knowing it would either die down or he’d deal with whatever was thrown at him after his first drink. Just enough time to feel like normalcy had not completely abandoned him.

“Know what? Whatever’s everyone else’s having next is on me, too.” Just as his decision to stay with the one drink paid in cash crashed and burned with his J.P. Morgan Reserve Card slid across the counter, so did Taylor’s reluctance to train his eyes on anything or anywhere else than the back of his bartender or the remnants of said drink. Though the gesture had not been decided on the basis of having an audience, meeting the eyes of someone else after speaking the magic invitation of a free drink seemed too easy by a lot. “Got something to say, say it.”

17 notes

·

View notes

Text

10 Biggest Middle Market Investment Banks In The World

As you'll be able to imagine, funding banking wasn’t exactly a popular selection back then. Pursuing an investment banking career is a good way to earn a very decent revenue early on in a single’s life. It can even allow you to get off to a operating start on a journey to monetary independence. The Bulge Bracket is a time period in the financial world for a few of the world’s largest and most profitable investment banks go here.

Financial Analyst Certification

This establishment supplies bank cards and loans, financing for companies, and money management services for companies and excessive net value individuals. Yet, despite their collective financial might, individual middle market companies face daunting challenges, together with difficulties in hiring and retaining talent, controlling prices, and heading off competitors from larger entities. In addition, on a strategic level middle market investment bank, middle market businesses often need help to determine tips on how to preserve profitable development while preserving pace with changing market conditions and customer demands. JPMorgan has diversified revenues streams with funding banking enterprise contributing almost 7% of total revenues over the past decade.

<h3>Advantages Of Working In Investment Banking At The Elite Boutiques:</h3>

On the opposite hand, Goldman Sachs is more dependent on funding banking enterprise which accounted for greater than 18% of its revenues. This implies that Goldman Sachs is heavily dependent on the funding banking enterprise, as in comparison with its peer, which has a way more diversified enterprise mannequin with a huge shopper as well as custody banking presence. Tier three capital is tertiary capital, which many banks maintain to help their market threat, commodities risk, and international foreign money risk, derived from buying and selling actions.

Banks are financial institutions providing a breadth of products and services, together with managing deposits, lending, wealth management, foreign money exchange, and investment banking.

Middle market firms are mid-size businesses having annual revenues from $10 million as much as $500 million and 100 to 2,000 staff.

Are financial establishments or intermediaries that deal largely with mid-market firms, specifically for raising debt or equity capital as well as mergers and acquisitions.

Some of essentially the most well-identified center-market funding banks are Robert W. Baird, Piper Jaffray & Co, Needham & Co, and Stifel Financial Corp.

The definition of a commercial bank has advanced dramatically in the past a number of many years.

These banks' customers include particular person consumers, companies, and many other kinds of institutional shoppers.

Canadian excessive-progress firms are current in each financial sector and usually are not simply concentrated in knowledge-primarily based industries. Nonetheless, they had been answerable for $a hundred and fifty billion, or about forty one.zero percent, of Canada's whole value of exports. As you’d likely think about, funding bankers at bulge-brackets – or tier one banks – earn extra money than their U.S. friends at other giant companies. But what actually stands out is the differences in pay as you progress up the ladder toward administration.

This list is proscribed to corporations which are publicly traded within the U.S. or Canada, both directly or through ADRs. Some corporations outside the U.S. report profits semi-annually as a substitute of quarterly, so the 12-month trailing information may be older than it is for firms that report quarterly.

The abbreviation "SME" is utilized by international organizations such because the World Bank, the European Union, the United Nations and the World Trade Organization . Goldman Sachs has been named probably the most prestigious investment financial institution in Vault's Guide to the Top 50 Banking Employersfor the tenth consecutive yr.

Other Notable Advisory And Capital Markets Firms

According to the regulations, banks should preserve a certain amount of money and/or different forms of liquid belongings available in order to meet their obligations. No greater than 25% of a financial institution's capital requirements could be comprised of Tier 2 capital.

While some authorities look to revenue generated by corporations to define the center market, other sources regard either asset size or number of employees as a greater metric for comparing firm sizes. It operates all over the world with main centers in Hong Kong, London, and New York. Bank of America is the second greatest US financial institution with $2.3 trillion in assets.

These monetary corporations may be a part of a bigger firm that additionally presents business banking services, however they take a unique position in the monetary system that influences the complete economy. Robert W. Baird & Co. – An employee-owned funding banking agency with 3,a hundred professionals. Offers its providers to quite a lot of firms within the healthcare, actual property, know-how, shopper, power distribution, and power and industrial know-how sectors. Dena Jalbert is founder and CEO of Align Business Advisory Services, a mergers and acquisitions (M&A) and enterprise advisory agency.

Lower-level Tier 2 capital consists of subordinated debt and is mostly inexpensive for a financial institution to issue. Bank capital is divided into two layers—Tier 1 or core capital and Tier 2 or supplementary capital. A financial institution's capital ratio is calculated by dividing its capital by its complete threat-based mostly property. The minimal capital ratio reserve requirement for a bank is set at eight%—6% of which should be supplied by Tier 1 capital. Along with Tier 1 capital, it supplies a bank with a financial cushion in case it needs to liquidate its assets.

You Are Probably Not Working For A Top Tier Investment Bank

ACG encourages the expansion and growth of middle-market companies by supporting insurance policies that foster and incentivize non-public capital funding. Combined, the middle market within the four European international locations contributes €1.11 trillion ($1.forty eight trillion) to the EU-4 GDP. This makes the center market within the EU-four one of many prime 10 economies on the planet, ahead of India and Russia. The almost one hundred fifty-year-old institution is a public firm with $917 billion in property as of 2017. Multiple excessive-rating government officers hung out at Goldman, together with U.S. Treasury secretaries, White House advisors, and management roles in central banks and governments all over the world.

The lower middle market is classified as companies with annual revenues between $5 million and $100 million. The lower revenue valuations for the decrease middle market are balanced against the exponentially larger volume of alternatives.

This decline of seven% in Goldman’s investment banking revenues would have been driven by decrease fairness underwriting deal volume and negative development in debt origination deal volume. Analysts at banks on each lists earned across the same last 12 months ($151k vs. $147k in total compensation – base plus bonus). However, the difference in pay grew to nearly 9%, on common, for associates. At the vp level, funding bankers at tier 1 companies made 18% more than friends at tier 2 banks, resulting in an almost $100k variance in take-house pay. While offers for junior bankers don’t range much agency to firm, the bigger-name banks appear rather more beneficiant with experienced employees.

National full-service middle market firms – Expand their companies to combine funding banking, wealth administration, fairness research, and brokerage and private fairness providers. Some main companies and divisions embrace monetary advisory and underwriting, its own investing and lending portfolios, institutional investor services, funding administration, and personal equity.

It turned itself round after 2008 and today lives as much as the lengthy historical past as a leader in company buyouts. William Blair & Co. – Provides a variety of monetary services corresponding to equity research and brokerage services, asset management, personal fairness, and investment banking. Focus is unfold across numerous market sectors, such as financial services, technology, healthcare, energy, and retail. An investment partner ought to convey a variety of experience to the desk including a very sturdy observe record of professionals who've efficiently built middle market corporations across a range of industries.

This capital helps a financial institution take in any losses so it can proceed its day-to-day operations. Because this degree is composed of a financial institution's core capital, Tier 1 is an excellent indicator of its financial health. The assets that fall into this class are additionally a lot easier to liquidate. The repeal of the 1933 Glass-Steagall Act that saved investment banks and business banks separate led to significant consolidation.

Since the monetary crisis in 2008, banks are sometimes called belonging to either Tier One, Tier Two or Tier Three. Tier One (J.P. Morgan, Bank of America Merrill Lynch, Goldman Sachs, Citi and Morgan Stanley) and Tier Two are the equal of the Bulge Bracket. The Bulge Bracket includes the world's most influential funding banks.

Don’t get me incorrect – there may be completely nothing incorrect with NOT being an investment banker. I would simply favor that this determination was based mostly on facts and never influenced by the picture painted in well-liked culture and the reputational bashing that persists more than a decade after the monetary crisis.

The History Of The Bulge Bracket

Jalbert holds a Master of Business Administration from Florida State University and a Bachelor of Arts in public accounting from Illinois Wesleyan University. The 10-12 months common purchase price multiple for leveraged buyouts of companies with enterprise values below $250 million is presently 7.3 occasions EBITDA, the highest it’s ever been. While it is increasingly competitive as a purchaser, new firms are born day by day, growing up, and are prepared for funding. In turn, traders are finding elevated value in decrease middle market portfolios, attracted to them for their returns, as these platforms can generate upwards of 50 % invested capital return.

Many of the largest investment banks are thought of among the "bulge bracket banks" and as such underwrite the vast majority of monetary transactions on the planet. Additionally, banks in search of more deal flow with smaller-sized deals with comparable profitability are known as "center market investment banks" .

Both of these market dynamics imply that deal move and valuations will remain sturdy. Policy makers and educational researchers can actually do a greater job of understanding the vital role of center market companies. Evercore Partners was based in 1996 by Roger Altman and has a broader funding banking enterprise than most independent firms, together with equity research and underwriting companies. Like other investment banks, the advisory services of Bank of America Merrill Lynch are important for corporations seeking to increase funds in public markets.

It is estimated that approximately 28% of New Zealand's gross home product is produced by corporations with fewer than 20 staff. Microbusinesses have 1–four workers, small businesses 5–19, medium companies 20–199, and huge businesses 200+. Australian SMEs make up 98% of all Australian businesses, produced one third of whole GDP, and make use of four.7 million folks. SMEs represent ninety per cent of all items exporters and over 60% of providers exporters.

Tier 3 capital features a greater variety of debt than tier 1 and tier 2 capital however is of a a lot lower quality than both of the two. Under the Basel III accords, tier three capital is being fully abolished. Unlike Tier 2 capital, Tier 1 capital is a financial institution's core capital or the first source of funding for a bank. As such, it consists of almost all of an establishment's funds together with all of its disclosed reserves and any fairness capital like frequent stock.

Single-trade specialists – Focus their services on middle market firms within a single business, such as actual property management companies or retail stores. Lower center-market companies operate in highly fragmented and really profitable industries, making them prime targets for acquisition and consolidation.

2 notes

·

View notes

Video

youtube

J.P. Morgan Reserve Card Prototype Model Making || Prototype Model Makin...

1 note

·

View note

Link

1 note

·

View note

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2021/08/southwest-airlines-says-delta-variant-is-hurting-its-business

Southwest Airlines Says Delta Variant Is Hurting Its Business

Southwest Airlines Co. said the recent surge in Covid-19 cases is causing bookings to slow and cancellations to rise, showing how quickly the Delta variant is denting economic activity.

The airline said Wednesday that while demand for the key Labor Day weekend remained healthy, the recent slowdown would make it difficult to turn a profit in the third quarter, excluding the impact of government payroll assistance. That is even after a fare sale designed to stoke the return of business traffic in the fall.

Southwest’s move reverses airline executives’ bullish tone just a few weeks ago, with rising Delta-variant infections prompting the cancellation of festivals and trade events such as the New York Auto Show planned for later this month.

Some consumers are reconsidering activities like travel and eating at restaurants as the surge leads certain retailers and municipalities to reimpose mask mandates.

The weekly average number of seated diners tracked on restaurant reservation platform OpenTable was down 8% from 2019 levels for the week that ended Aug. 10, a reversal since late June, when dining activity surpassed 2019 levels. Credit-card spending tracked by Chase shows that air-travel purchases have slipped in recent weeks while restaurants spending has leveled off, J.P. Morgan analysts said in a note Tuesday.

0 notes

Text

O que é CVV do cartão de crédito? Onde fica o CVV

Se você tentou realizar uma compra com o cartão de crédito pela internet, mas quando chegou o momento de informar o número do CVV, ficou perdido e acabou desistindo de fazer a compra ou se ocorreu algo parecido com isso, no artigo de hoje você poderá tirar as suas dúvidas sobre o CVV do cartão de crédito. Veja também: Quais são os cartões Visa? Solicitar cartão Quais são os cartões Mastercard? Solicite o seu Cartão de Crédito J.P Morgan Reserve Card Além de saber o que significa o CVV do cartão de crédito, você poderá descobrir onde é que ele está localizado no cartão, para que exatamente serve o CVV do cartão de crédito, poderá obter dicas para ficar atento ao realizar compras pela internet, além de diversas outras informações importantes sobre o assunto. Se deseja saber um pouco mais sobre tudo isso, basta que você continue lendo o artigo e esclareça todas as suas dúvidas. Tenha uma boa leitura! O que é CVV do cartão de crédito? A sigla da palavra CVV, significa Código de Verificação do Cartão, porém a abreviação foi criada para a facilitação na hora da solicitação desse dado. O CVV do cartão de crédito é muito importante e solicitado, muitas das vezes, sempre que você, que possui um cartão de crédito com a bandeira VISA, realiza uma compra em um site online. O número do CVV, ou o Código de Segurança do Cartão (CSC), serve para que a loja tenha a certeza de que você tem em mãos, o seu cartão físico. Read the full article

0 notes

Text

Những loại thẻ tín dụng ngân hàng mà người siêu giàu sử dụng

Người siêu giàu trên thế giới sở hữu các loại thẻ tín dụng riêng với những đặc quyền xa xỉ vượt trội khác hẳn với chúng ta.

Thẻ American Express Centurion Black Card:

American Express đã từ chối cung cấp chi tiết về thẻ Centurion cũng như số lượng thẻ đã phát hành. Tuy nhiên, họ tiết lộ rằng việc đăng ký thành viên chỉ mất 7.500 USD phí ban đầu và 2.500 USD phí thường niên. Theo đó, quyền lợi và tiện ích của thẻ sẽ được điều chỉnh tùy theo nhu cầu của chủ thẻ.

Được biết, khách hàng mục tiêu của loại thẻ này cần phải tiêu từ 250.000 USD - 450.000 USD mỗi năm đối với thẻ American Express thông thường. Thẻ Centurion cũng được cung cấp các quyền lợi tương tự thẻ American Express Platium, bao gồm các đặc quyền về vé máy bay cũng như dịch vụ khách sạn. Có thể nói, người sở hữu thẻ Centurion có thể mua mọi thứ mà họ muốn.

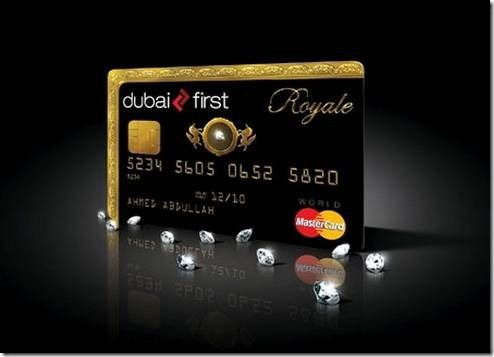

Thẻ Dubai First Royale MasterCard:

là một loại thẻ tín dụng khá đặc biệt. Cũng giống như sự giàu có ở Dubai, thẻ này được làm bằng vàng thật và đính kim cương 0,235 carat. “Khi có trong tay chiếc thẻ này, bạn có thể tận hưởng mọi thứ theo lối sống hoàng gia và như có một người quản lý chuyên nghiệp dành riêng cho bạn”, theo cam kết của Dubai First - công ty tín dụng có trụ sở tại Các tiểu vương quốc Ả Rập thống nhất.

Thẻ J.P. Morgan Reserve (Palladium):

Loại thẻ này là phiên bản mới của thẻ The Chase Palladium - loại thẻ mà cựu Tổng thống Mỹ Barack Obama được cho là từng sở hữu. Theo Bloomberg, đây là thẻ tín dụng chỉ dành cho giới siêu giàu.

Yêu cầu để được mở thẻ là bạn phải là thành viên của Chase Private Bank - là những khách hàng phải có ít nhất 10 triệu USD trong tài khoản. Cũng tương tự thẻ Chase Sapphire Reserve dành cho những người ưa thích du lịch, thẻ J.P. Morgan Reserve thường yêu cầu mức phí phải trả khoảng 450 USD, chủ thẻ có thể tích điểm thưởng cho mỗi lần đi du lịch, ăn uống tại nhà hàng hay đi mua sắm. Chưa dừng lại ở đó, chủ thẻ còn được hưởng những quyền lợi xa xỉ khác về phòng chờ sân bay, dịch vụ vé máy bay…

Loại thẻ tín dụng Hoàng gia này không có hạn mức và điều kiện ràng buộc. "Bất kỳ thứ gì khách hàng muốn, đơn giản như mua một chiếc du thuyền thì chỉ cần quẹt thẻ là xong", cựu giám đốc truyền thông Amit Marawah của Dubai First cho biết. Và tất nhiên, chỉ những người thuộc giới siêu giàu mới có đủ điều kiện để được mời mở thẻ. Đây có lẽ cũng là loại thẻ có nhiều đặc quyền nhất thế giới.

Những quyền lợi khác bao gồm dịch vụ quản lý cá nhân, giảm giá chuyến bay điều lệ, dịch vụ xe hơi, nâng cấp phòng khách sạn sang trọng, giảm giá hàng hóa và tư vấn tâm lý. Thẻ có phí hàng năm là 1.500 USD. Stratus Awards Visa là một loại thẻ khá đặc biệt so với các loại thẻ “cao cấp” khác. Thẻ được cung cấp có sẵn cho các cá nhân có tài sản cao chỉ thông qua lời mời. Tuy nhiên, những người giàu có này có thể gộp các điểm thưởng của họ lại với nhau để sử dụng đặc quyền lớn như máy bay riêng và các quyền lợi dành riêng cho thẻ này.

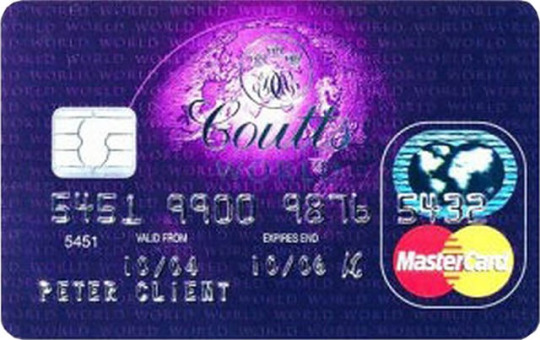

Ngoài Nữ hoàng Elizabeth II là người sử dụng thẻ Coutts World Silk Card, những người có từ 1 triệu USD trở lên trong tài khoản đều đủ điều kiện sở hữu tấm thẻ này. Được biết đến là thẻ tín dụng độc quyền nhất của Anh, thẻ Coutts World Silk đi kèm với dịch vụ trợ giúp 24/7, quyền sử dụng phòng chờ độc quyền tại sân bay và mua sắm riêng tại các cửa hàng độc quyền thiết kế.

Theo Zing.vn

0 notes

Text

Reduce Your Debt So You Can Save for Your Future

On May 7, 2010, USA Today, citing information from the Federal Reserve Board's month-to-month G-19 report, reported that US credit card debt fell once again in March, marking the 18th month in a row that credit card financial obligation has actually decreased. It should be noted that customer costs has increased for 6 months straight. A boost in costs and a reduction in credit card debt might suggest a significant modification in the intake pattern of the typical American, however that is not the only aspect involved. A part of that charge card debt reduction is because of credit card lenders crossing out uncollectable debts, losses that make certain to be felt in the overall economy.

In his current short article, "Is It The End of The United States Customer's Love Affair With Credit Cards?", Richard Bialek, CEO of BialekGroup, kept in mind that "over the previous 18 months the level of customer credit card debt has been up to $852.2 billion, a decline of 12.6 percent." While definitely, American costs practices do appear to be altering, this reduction of credit card financial obligation is not simply the outcome of a new-found fascination with frugality, nor is it altogether excellent news concerning the overall health and wellness of the economy.

Time Publication, in a current article, noted the continuing pattern of customers that, when required to decide by monetary circumstances, are picking to pay their credit card bill instead of their mortgage. On April 15, 2010, weighed in on the subject, relating this unusual trend to falling house worths resulting in underwater mortgages and a lesser commitment to houses that no longer make financial sense. With the foreclosure backlog allowing lots of to stay in houses for months, even years, prior to being officially put out, it makes more sense to lots of people to pay the credit card costs, because that charge card is increasingly being utilized for essentials in between incomes, in addition to for the unforeseen emergency, such as a vehicle repair work.

Not all of the reduction in consumer debt is because of a decrease in charge card use by customers or to people making the paying down of their charge card financial obligation more of a fiscal priority than it has been in the recent past. According to March 9, 2010, CBS Cash Watch report, when the numbers are run, it ends up that the decrease in charge card debt is far less associated to consumers paying down their financial obligation than it is to lending institutions writing off bad loans. Once the lending institution acknowledges that the cardholder is not going to settle the debt, and the charge-off becomes official, the amount is deducted from the total charge card debt figures.

youtube

This reduction in charge card financial obligation, then, holds substantial ramifications concerning the state of the economy and its general health and well-being. According to a short article published in the Washington Post on May 30, 2010, "the three biggest card-issuing banks lost at least $7.3 billion on cards in 2009. Bank of America, after making $4.3 billion on cards in 2007-- a third of its overall earnings-- swung to a $5.5 billion loss in 2009. J.P. Morgan Chase lost $2.2 billion last year on cards and, in mid-April, reported a $303 million loss for the first quarter." It should be kept in mind that these banks, as are many other loan providers presently experiencing record levels of card charge off losses, are still dealing with the wreckage of the home mortgage and financing melt-down, consisting of the resulting sharp increase in foreclosures.

" We have a business that is hemorrhaging cash," stated the chief executive of Citigroup's card system, Paul Galant, as priced quote in the Washington Post. According to the short article, "Citi-branded cards lost $75 million in 2015." The post likewise cited information amassed from R.K. Hammer Financial investment Bankers, suggesting that "U.S. charge card companies wrote off a record overall of $89 billion in card financial obligation in 2009 after losing $56 billion in 2008." In addition, with the new charge card guidelines that came into impact in 2010, lending institutions anticipate to see revenue margins tighten up further as a few of the practices that had been big profits raisers in the industry are now restricted.

" J.P. Morgan chief executive Jamie Dimon," as discussed by the Washington Post short article, "said during an incomes teleconference in April that the changes will cost his bank up to $750 million in 2010. Banks in general could lose $50 billion in profits during the next five years, stated Robert Hammer, primary executive of R.K. Hammer Financial Investment Bankers." Naturally, in reaction to straight-out losses and decreased revenue potentials, "the big 6 companies have cut total credit readily available to their clients by about 25 percent partly by diminishing credit lines and not renewing expired cards, said Moshe Orenbuch, a bank analyst at Credit Suisse Group in New York City."

This contraction of credit will impact customer costs pacific national funding reddit to a considerable degree. In the existing structure of the American economy, in which a complete 70 percent of it depends on consumer spending, that decrease does not bode well for a currently miserable work scenario. Services that are not profiting will not be working with employees. Indeed, lay-offs can be anticipated. More task losses and increased job stability issues can rationally be expected to encourage mindful spending on the part of the consumer, begetting a cycle that is difficult to break out of.

It is a tough financial situation. Nevertheless, it is does not need to be a financially ravaging one for the country. The banks will continue to battle, and banks will continue to stop working. Credit is likely to continue to agreement, however that may be a much healthier thing for the typical consumer-- and thus the country - as people end up being more careful with their costs and the economy establishes in brand-new methods to accommodate that shift, lessening its dependence on the sort poor cash management that leads to heavy debt loads for simply consumptive spending, rather than that which is productive and practical.

0 notes

Text

How to Locate a Legitimate Debt Settlement Company and Come Out of the Debt Issues?

On May 7, 2010, U.S.A. Today, pointing out data from the Federal Reserve Board's month-to-month G-19 report, reported that United States charge card debt fell once again in March, marking the 18th month in a row that credit card financial obligation has actually decreased. It should be kept in mind that customer spending has increased for 6 months straight. A boost in costs and a decrease in charge card debt may indicate a significant modification in the intake pattern of the typical American, however that is not the only element involved. A portion of that credit card debt reduction is due to credit card lending institutions crossing out uncollectable debts, losses that make certain to be felt in the total economy.

In his recent post, "Is It Completion of The United States Customer's Love Affair With Credit Cards?", Richard Bialek, CEO of BialekGroup, kept in mind that "over the previous 18 months the level of customer credit card debt has actually fallen to $852.2 billion, a decline of 12.6 percent." While certainly, American spending practices do appear to be changing, this reduction of credit card debt is not simply the outcome of a new-found fascination with frugality, nor is it completely great news regarding the overall health and wellness of the economy.

Time Magazine, in a recent article, kept in mind the continuing pattern of customers that, when required to make a choice by financial scenarios, are picking to pay their charge card costs instead of their mortgage. On April 15, 2010, weighed in on the topic, relating this uncommon pattern to falling home worths resulting in underwater mortgages and a lesser commitment to houses that no longer make monetary sense. With the foreclosure stockpile allowing lots of to stay in homes for months, even years, before being formally put out, it makes more sense to lots of people to pay the charge card costs, because that credit card is significantly being used for fundamentals between incomes, as well as for the unexpected emergency situation, such as an auto repair work.

Not all of the decrease in consumer financial obligation is because of a decrease in charge card usage by consumers or to individuals making the paying for of their charge card financial obligation more of a fiscal priority than it has been in the recent past. According to March 9, 2010, CBS Money Watch report, when the numbers are run, it turns out that the reduction in credit card debt is far less associated to customers paying down their debt than it is to lending institutions crossing out bad loans. As soon as the lending institution acknowledges that the cardholder is not going to pay off the financial obligation, and the charge-off becomes formal, the amount is deducted from the overall credit card debt figures.

youtube

This reduction in credit card debt, then, holds considerable ramifications worrying the state of the economy and its total health and well-being. According to a post released in the Washington Post on Might 30, 2010, "the 3 biggest card-issuing banks lost at least $7.3 billion on cards in 2009. Bank of America, after making $4.3 billion on cards in 2007-- a third of its overall earnings-- swung to a $5.5 billion loss in 2009. J.P. Morgan Chase pacific national funding debt consolidation lost $2.2 billion last year on cards and, in mid-April, reported a $303 million loss for the very first quarter." It should be kept in mind that these banks, as are lots of other lenders currently struggling with record levels of card charge off losses, are still dealing with the wreckage of the mortgage and financing melt-down, including the resulting sharp increase in foreclosures.

" We have an organisation that is hemorrhaging money," said the president of Citigroup's card system, Paul Galant, as quoted in the Washington Post. According to the article, "Citi-branded cards lost $75 million in 2015." The short article also cited information garnered from R.K. Hammer Financial investment Bankers, showing that "U.S. charge card companies crossed out a record overall of $89 billion in card debt in 2009 after losing $56 billion in 2008." Additionally, with the new charge card policies that came into impact in 2010, lenders anticipate to see revenue margins tighten up further as a few of the practices that had actually been big earnings raisers in the industry are now restricted.

" J.P. Morgan president Jamie Dimon," as discussed by the Washington Post post, "said throughout an earnings teleconference in April that the modifications will cost his bank up to $750 million in 2010. Banks overall might lose $50 billion in income throughout the next five years, stated Robert Hammer, president of R.K. Hammer Financial Investment Bankers." Naturally, in reaction to outright losses and minimized earnings potentials, "the big six providers have cut total credit offered to their clients by about 25 percent partially by diminishing credit limit and not restoring expired cards, said Moshe Orenbuch, a bank analyst at Credit Suisse Group in New York."

This contraction of credit will affect consumer costs to a significant degree. In the present structure of the American economy, in which a full 70 percent of it relies on customer spending, that decrease does not bode well for a currently dismal employment circumstance. Services that are not profiting will not be employing workers. Certainly, lay-offs can be anticipated. Further job losses and increased job stability issues can realistically be anticipated to motivate mindful spending on the part of the consumer, begetting a cycle that is tough to break out of.

It is a tough economic circumstance. However, it is does not have to be an economically ravaging one for the country. The banks will continue to battle, and banks will continue to stop working. Credit is likely to continue to contract, however that may be a healthier thing for the average consumer-- and thus the country - as individuals end up being more mindful with their costs and the economy develops in brand-new methods to accommodate that shift, decreasing its dependence on the sort bad finance that leads to heavy financial obligation loads for purely consumptive spending, rather than that which is efficient and practical.

0 notes

Text

What Is the Credit Card Forgiveness Act?

On May 7, 2010, U.S.A. Today, pointing out information from the Federal Reserve Board's regular monthly G-19 report, reported that US credit card debt fell once again in March, marking the 18th month in a row that credit card financial obligation has decreased. It should be noted that customer spending has actually increased for 6 months directly. A boost in costs and a decline in charge card debt pacific national funding reviews might show a significant modification in the consumption pattern of the typical American, however that is not the only element included. A part of that credit card debt reduction is due to charge card loan providers crossing out uncollectable financial obligations, losses that are sure to be felt in the general economy.

In his current short article, "Is It Completion of The United States Customer's Love Affair With Credit Cards?", Richard Bialek, CEO of BialekGroup, kept in mind that "over the past 18 months the level of customer credit card debt has actually been up to $852.2 billion, a decrease of 12.6 percent." While definitely, American costs practices do appear to be altering, this reduction of credit card financial obligation is not merely the result of a new-found fascination with thriftiness, nor is it completely good news concerning the total health and wellness of the economy.

Time Magazine, in a recent article, noted the continuing pattern of customers that, when required to choose by monetary situations, are choosing to pay their charge card costs rather of their home mortgage. On April 15, 2010, weighed in on the topic, relating this unusual pattern to falling home values leading to undersea mortgages and a lower dedication to homes that no longer make monetary sense. With the foreclosure stockpile permitting lots of to remain in houses for months, even years, before being officially put out, it makes more sense to lots of people to pay the credit card costs, since that credit card is progressively being utilized for essentials in between incomes, in addition to for the unexpected emergency situation, such as a car repair work.

Not all of the reduction in customer debt is because of a reduction in credit card use by consumers or to people making the paying down of their charge card financial obligation more of a fiscal priority than it has been in the recent past. According to March 9, 2010, CBS Cash Watch report, when the numbers are run, it ends up that the decrease in credit card financial obligation is far less related to consumers paying down their financial obligation than it is to lenders crossing out bad loans. As soon as the loan provider acknowledges that the cardholder is not going to pay off the debt, and the charge-off becomes official, the quantity is deducted from the total charge card debt figures.

This reduction in credit card debt, then, holds substantial implications worrying the state of the economy and its total health and wellness. According to a short article released in the Washington Post on May 30, 2010, "the three biggest card-issuing banks lost at least $7.3 billion on cards in 2009. Bank of America, after earning $4.3 billion on cards in 2007-- a 3rd of its total revenue-- swung to a $5.5 billion loss in 2009. J.P. Morgan Chase lost $2.2 billion last year on cards and, in mid-April, reported a $303 million loss for the first quarter." It needs to be kept in mind that these banks, as are numerous other lending institutions presently struggling with record levels of card charge off losses, are still dealing with the wreckage of the home mortgage and lending melt-down, including the resulting sharp rise in foreclosures.

" We have a business that is hemorrhaging money," said the primary executive of Citigroup's card unit, Paul Galant, as priced quote in the Washington Post. According to the short article, "Citi-branded cards lost $75 million in 2015." The post also cited details gathered from R.K. Hammer Investment Bankers, indicating that "U.S. charge card providers wrote off a record overall of $89 billion in card financial obligation in 2009 after losing $56 billion in 2008." Additionally, with the brand-new credit card policies that entered into result in 2010, lenders expect to see profit margins tighten up further as a few of the practices that had been big revenue raisers in the market are now prohibited.

" J.P. Morgan president Jamie Dimon," as described by the Washington Post post, "said throughout an incomes teleconference in April that the changes will cost his bank up to $750 million in 2010. Banks overall could lose $50 billion in income throughout the next five years, said Robert Hammer, primary executive of R.K. Hammer Financial Investment Bankers." Naturally, in reaction to outright losses and minimized earnings capacities, "the huge six providers have trimmed total credit available to their customers by about 25 percent partially by shrinking credit limit and not renewing ended cards, stated Moshe Orenbuch, a bank expert at Credit Suisse Group in New York."

youtube

This contraction of credit will impact customer costs to a considerable degree. In the present structure of the American economy, in which a complete 70 percent of it counts on consumer spending, that reduction does not bode well for an already miserable work circumstance. Companies that are not profiting will not be employing workers. Indeed, lay-offs can be anticipated. Additional job losses and increased task stability issues can logically be expected to encourage cautious spending on the part of the consumer, begetting a cycle that is challenging to break out of.

It is a tough economic circumstance. Nevertheless, it is does not need to be an economically devastating one for the nation. The banks will continue to battle, and banks will continue to fail. Credit is most likely to continue to contract, but that may be a healthier thing for the typical consumer-- and hence the country - as individuals become more mindful with their spending and the economy establishes in new ways to accommodate that shift, lessening its reliance on the sort poor finance that results in heavy debt loads for simply consumptive spending, instead of that which is productive and useful.

0 notes

Text

Debt Relief Options - Get Better at Debt Management With These Relief Options

On May 7, 2010, U.S.A. Today, mentioning data from the Federal Reserve Board's month-to-month G-19 report, reported that US charge card financial obligation fell again in March, marking the 18th month in a row that charge card debt has actually reduced. It should be kept in mind that consumer spending has actually increased for 6 months directly. An increase in costs and a decrease in credit card financial obligation might indicate a significant modification in the consumption pattern of the average American, however that is not the only aspect involved. A part of that charge card debt decrease is because of charge card loan providers composing off uncollectable debts, losses that make sure to be felt in the general economy.

In his recent post, "Is It Completion of The United States Consumer's Love Affair With Credit Cards?", Richard Bialek, CEO of BialekGroup, kept in mind that "over the past 18 months the level of consumer credit card debt has actually been up to $852.2 billion, a decline of 12.6 percent." While definitely, American spending routines do appear to be changing, this decrease of charge card financial obligation is not merely the result of a new-found fascination with thriftiness, nor is it altogether great news concerning the overall health and wellness of the pacific national funding reddit economy.

Time Magazine, in a recent short article, kept in mind the continuing pattern of customers that, when forced to make a choice by monetary scenarios, are picking to pay their charge card bill instead of their home mortgage. On April 15, 2010, weighed in on the subject, relating this uncommon pattern to falling home worths resulting in underwater home mortgages and a lesser dedication to homes that no longer make monetary sense. With the foreclosure stockpile permitting many to remain in homes for months, even years, before being formally put out, it makes more sense to lots of people to pay the charge card bill, because that credit card is progressively being used for basics between paychecks, as well as for the unexpected emergency situation, such as an auto repair work.

Not all of the reduction in customer financial obligation is because of a reduction in charge card use by customers or to individuals making the paying down of their credit card financial obligation more of a financial concern than it has been in the recent past. According to March 9, 2010, CBS Money Watch report, when the numbers are run, it ends up that the decrease in charge card financial obligation is far less related to consumers paying for their financial obligation than it is to lending institutions writing off bad loans. Once the lending institution acknowledges that the cardholder is not going to pay off the financial obligation, and the charge-off becomes formal, the quantity is subtracted from the total charge card financial obligation figures.

This reduction in charge card debt, then, holds substantial implications concerning the state of the economy and its general health and well-being. According to a post released in the Washington Post on May 30, 2010, "the 3 biggest card-issuing banks lost at least $7.3 billion on cards in 2009. Bank of America, after earning $4.3 billion on cards in 2007-- a 3rd of its total revenue-- swung to a $5.5 billion loss in 2009. J.P. Morgan Chase lost $2.2 billion in 2015 on cards and, in mid-April, reported a $303 million loss for the first quarter." It should be kept in mind that these banks, as are numerous other lending institutions currently suffering from record levels of card charge off losses, are still handling the wreckage of the home loan and lending melt-down, including the resulting sharp rise in foreclosures.

" We have a service that is hemorrhaging cash," stated the president of Citigroup's card system, Paul Galant, as estimated in the Washington Post. According to the article, "Citi-branded cards lost $75 million in 2015." The article also cited info amassed from R.K. Hammer Investment Bankers, showing that "U.S. charge card issuers composed off a record overall of $89 billion in card financial obligation in 2009 after losing $56 billion in 2008." Moreover, with the new credit card regulations that entered impact in 2010, lending institutions expect to see profit margins tighten even more as a few of the practices that had been big income raisers in the industry are now prohibited.

" J.P. Morgan chief executive Jamie Dimon," as explained by the Washington Post article, "stated throughout an incomes conference call in April that the modifications will cost his bank up to $750 million in 2010. Banks overall might lose $50 billion in income during the next five years, stated Robert Hammer, chief executive of R.K. Hammer Investment Bankers." Naturally, in reaction to straight-out losses and lowered profit capacities, "the big 6 issuers have cut total credit offered to their consumers by about 25 percent partly by shrinking credit limit and not renewing expired cards, stated Moshe Orenbuch, a bank expert at Credit Suisse Group in New York City."

This contraction of credit will impact customer costs to a considerable degree. In the current structure of the American economy, in which a full 70 percent of it counts on customer costs, that decrease does not bode well for a currently depressing work scenario. Companies that are not profiting will not be hiring workers. Certainly, lay-offs can be expected. More job losses and increased task stability issues can logically be anticipated to encourage cautious spending on the part of the customer, begetting a cycle that is tough to break out of.

youtube

It is a challenging economic circumstance. Nevertheless, it is does not have to be a financially ravaging one for the country. The banks will continue to struggle, and banks will continue to stop working. Credit is likely to continue to agreement, but that might be a healthier thing for the average customer-- and hence the country - as people end up being more careful with their spending and the economy establishes in new methods to accommodate that shift, lessening its reliance on the sort poor finance that results in heavy financial obligation loads for simply consumptive spending, rather than that which is productive and practical.

0 notes

Text

Debt Management Tips - How To Get Out of Debt Quickly!

On May 7, 2010, U.S.A. Today, mentioning data from the Federal Reserve Board's monthly G-19 report, reported that United States credit card debt fell again in March, marking the 18th month in a row that credit card debt has actually decreased. It ought to be kept in mind that consumer spending has increased for 6 months straight. A boost in spending and a reduction in credit card financial obligation might suggest a considerable change in the consumption pattern of the average American, however that is not the only aspect included. A portion of that charge card financial obligation decrease is due to credit card lenders writing off uncollectable debts, losses that make certain to be felt in the total economy.

In his recent post, "Is It Completion of The US Consumer's Love Affair With Credit Cards?", Richard Bialek, CEO of BialekGroup, kept in mind that "over the previous 18 months the level of consumer credit card debt has fallen to $852.2 billion, a decline of 12.6 percent." While certainly, American costs practices do seem to be changing, this reduction of charge card financial obligation is not merely the outcome of a new-found fascination with thriftiness, nor is it entirely good news relating to the overall health and well-being of the economy.

Time Magazine, in a recent post, noted the continuing pattern of customers that, when forced to choose by financial scenarios, are picking to pay their charge card costs rather of their home mortgage. On April 15, 2010, weighed in on the subject, relating this unusual pattern to falling home worths resulting in underwater mortgages and a lesser commitment to homes that no longer make monetary sense. With the foreclosure backlog enabling lots of to remain in homes for months, even years, prior to being officially put out, it makes more sense to numerous individuals to pay the charge card bill, since that charge card is progressively being utilized for fundamentals in between incomes, in addition to for the unexpected emergency situation, such as an auto repair work.

youtube

Not all of the reduction in customer financial obligation is due to a reduction in charge card use by consumers or to individuals making the paying down of their charge card debt more of a fiscal concern than it has been in the current past. According to March 9, 2010, CBS Money Watch report, when the numbers are run, it turns out that the reduction in charge card debt is far less associated to customers paying for their debt than it is to lending institutions crossing out bad loans. As soon as the lender acknowledges that the cardholder is not going to pay off the debt, and the charge-off ends up being official, the quantity is subtracted from the overall credit card debt figures.

This decrease in credit card financial obligation, then, holds significant implications concerning the state of the economy and its general health and wellness. According to a short article published in the Washington Post on Might 30, 2010, "the three most significant card-issuing banks lost a minimum of $7.3 billion on cards in 2009. Bank of America, after earning $4.3 billion on cards in 2007-- a third of its total earnings-- swung to a $5.5 billion loss in 2009. J.P. Morgan Chase lost $2.2 billion in 2015 on cards and, in mid-April, reported a $303 million loss for the very first quarter." It must be kept in mind that these banks, as are numerous other lending institutions currently struggling with record levels of card charge off losses, are still handling the wreckage of the home loan and loaning melt-down, consisting of the resulting sharp rise in foreclosures.

" We have an organisation that is hemorrhaging cash," said the primary executive of Citigroup's card system, Paul Galant, as estimated in the Washington Post. According to the post, "Citi-branded cards lost $75 million last year." The post also cited info amassed from R.K. Hammer Investment Bankers, showing that "U.S. charge card providers composed off a record pacific national funding address total of $89 billion in card debt in 2009 after losing $56 billion in 2008." Additionally, with the new credit card guidelines that entered into effect in 2010, lending institutions expect to see profit margins tighten further as some of the practices that had been huge income raisers in the industry are now prohibited.

" J.P. Morgan president Jamie Dimon," as explained by the Washington Post article, "said throughout a profits conference call in April that the changes will cost his bank up to $750 million in 2010. Banks overall might lose $50 billion in revenue throughout the next 5 years, stated Robert Hammer, president of R.K. Hammer Investment Bankers." Naturally, in action to outright losses and decreased profit potentials, "the huge 6 companies have actually cut total credit readily available to their clients by about 25 percent partly by diminishing line of credit and not renewing expired cards, said Moshe Orenbuch, a bank analyst at Credit Suisse Group in New York."

This contraction of credit will impact consumer costs to a substantial degree. In the existing structure of the American economy, in which a full 70 percent of it depends on consumer spending, that decrease does not bode well for an already depressing employment circumstance. Organisations that are not benefiting will not be hiring employees. Indeed, lay-offs can be expected. Additional task losses and increased task stability issues can logically be anticipated to encourage careful spending on the part of the customer, begetting a cycle that is difficult to break out of.

It is a tough economic situation. However, it is does not have to be a financially devastating one for the nation. The banks will continue to battle, and banks will continue to fail. Credit is likely to continue to agreement, however that may be a healthier thing for the average consumer-- and hence the country - as people end up being more careful with their costs and the economy develops in brand-new ways to accommodate that shift, minimizing its dependence on the sort poor finance that results in heavy financial obligation loads for simply consumptive costs, as opposed to that which is productive and practical.

0 notes