#Invoicing solutions

Explore tagged Tumblr posts

Text

Simplify your accounts receivable with Collab Accounting. We offer professional services to help streamline invoicing, payment tracking, and collections. Boost your cash flow and stay on top of your finances effortlessly. Learn more about our solutions today!

0 notes

Text

Courier Service Management Software by @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

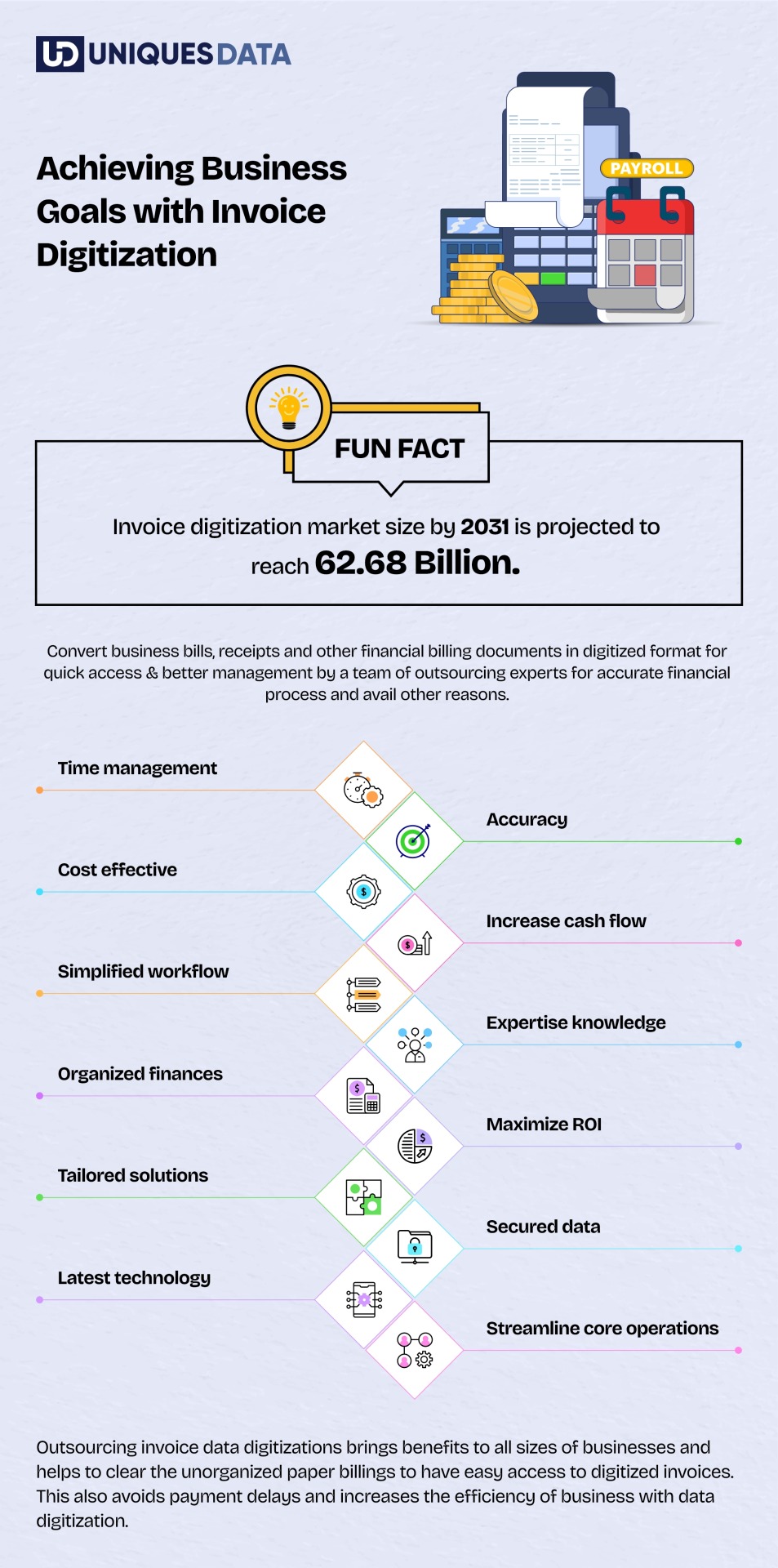

Achieving Business Goals with Invoice Digitization

Outsourcing invoice digitization is profitable for businesses as it allows them to manage their financial documents while streamlining business operations. Uniquesdata is a renowned outsourcing data entry partner with a team of professionals and years of experience.

#invoice data entry service#outsource invoice data entry service#invoice data solutions#invoice form data entry service#invoice data service#data entry invoices#data entry of invoices#invoice data entry#data digitization service

4 notes

·

View notes

Text

www.HRsoftBD.com offers OMR Service for MCQ Exam

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

2 notes

·

View notes

Text

HRsoftBD offer Bluk SMS

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

2 notes

·

View notes

Text

#financing for marketplace sellers#Financing solutions for Amazon Sellers#amazon seller financing#amazon invoice financing

2 notes

·

View notes

Text

Invoice funding proves to be a vital financial lifeline for businesses contending with cash flow challenges. This innovative solution allows companies to unlock the value of their outstanding invoices by partnering with specialized institutions like Invoice Funding Limited. By leveraging invoice finance, businesses can expedite access to funds that would otherwise be tied up in unpaid invoices, providing a timely injection of capital to navigate immediate operational needs. Invoice Funding Limited, with its expertise in this domain, stands out as a reliable partner for businesses seeking tailored solutions to address their unique cash flow challenges. Through their comprehensive invoice finance services, Invoice Funding Limited assists businesses in bridging the gap between invoicing and payment, enabling them to maintain financial stability, meet obligations, and pursue growth opportunities with greater confidence.

Website: https://invoice-funding.co.uk

Address: Future House, South place, Chesterfield, Derbyshire, S40 1SZ

Phone Number: 01246 233108

Contact Email ID: [email protected]

Business Hours: Monday - Friday : 09:00 AM - 05:30 PM

2 notes

·

View notes

Text

Expanding your business to multiple locations can be a great way to increase sales, reach new customers, and grow your brand. However, it can also be a challenge to manage multiple locations effectively. Suvit is an all-in-one accounting automation platform that strives to make finance cool again! Suvit is more than just a platform; it's a financial game-changer.

#tally solutions#automation for accountants#accounting automation software#automated bank statement processing#1950s#e invoice in tally#tally on cloud#tally automation

2 notes

·

View notes

Text

#melio#business software#b2b payment solution#accounts payable#pay invoices#small business#online payment solutions

0 notes

Text

Say Goodbye to ZRA Tax Hassles with Ecuenta!

Take control of your business finances effortlessly with Ecuenta Accounting Software, fully integrated with ZRA for seamless tax compliance. Enjoy a smarter way to manage your operations with: 1) Smart Invoicing for accurate billing. 2) Efficient POS to streamline sales. 3) Easy Payroll Management for hassle-free salary processing. 4) Inventory Control to track stock in real-time. 5) Advanced CRM to enhance customer relationships.

#smart invoice#smart invoice solution#smart invoice software#zra accounting software#pos software#payroll management#CRM

0 notes

Text

Say Goodbye to ZRA Tax Hassles with Ecuenta!

Take control of your business finances effortlessly with Ecuenta Accounting Software, fully integrated with ZRA for seamless tax compliance. Enjoy a smarter way to manage your operations with: 1) Smart Invoicing for accurate billing. 2) Efficient POS to streamline sales. 3) Easy Payroll Management for hassle-free salary processing. 4) Inventory Control to track stock in real-time. 5) Advanced CRM to enhance customer relationships.

#smart invoice#smart invoice solution#smart invoice software#zra accounting software#pos software#payroll management#CRM

0 notes

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

www.HRsoftBD.com offers Domain & Hosting Service

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

2 notes

·

View notes

Text

Streamlining Operations with PDQ Docs: The Best Document Generation Software for Small Business

In today’s fast-paced business environment, efficiency and accuracy are key to staying ahead of the competition. Small businesses, in particular, need reliable tools that can automate processes, save time, and reduce human error. One such essential tool is document generation software, which helps small businesses create documents quickly and accurately. PDQ Docs offers an intuitive solution for small businesses looking to streamline their operations and improve productivity.

What is Document Generation Software and Why is it Essential for Small Businesses?

Document generation software is a tool that automates the creation of business documents, such as contracts, invoices, proposals, and reports. By using templates and pre-filled data, businesses can quickly generate accurate and professional-looking documents without having to manually input information each time. This not only saves valuable time but also reduces the chances of errors that could lead to costly mistakes.

For small businesses, time and resources are often limited. Document generation software for small business provides an efficient way to handle repetitive tasks, allowing businesses to focus more on growth and customer service. PDQ Docs, in particular, is designed to meet the needs of small business owners by offering a user-friendly interface, customizable templates, and seamless integration with other software tools.

Why PDQ Docs is the Best Document Generation Software for Small Business

PDQ Docs, the best document generation software for small business, offers a wide range of features that can help automate and simplify document creation. One of the key benefits of PDQ Docs is its simplicity. The software is easy to use, with an intuitive design that allows users to create documents in just a few clicks. There’s no need for extensive training or technical expertise, making it accessible to small business owners and their teams.

Another significant advantage of PDQ Docs is its flexibility. The software offers customizable templates, which means you can tailor the look and feel of your documents to match your brand identity. Whether you need to generate invoices, contracts, or marketing materials, PDQ Docs ensures that every document reflects your business’s professionalism and style.

Save Time and Reduce Errors

One of the most significant advantages of PDQ Docs is the amount of time it saves. Small business owners often juggle multiple tasks, and manually creating documents can be time-consuming and prone to errors. PDQ Docs automates much of the document creation process, so you can generate accurate, professional documents in a fraction of the time.

Conclusion

PDQ Docs is the ideal document generation software for small businesses looking to streamline their operations and improve efficiency. Its ease of use, customizable templates, time-saving automation, and seamless integration with other tools make it a powerful solution for businesses of all sizes. By using PDQ Docs, small business owners can focus on what matters most: growing their business and serving their customers.

#document generation software for small business#document automation software#small business document management#customizable document templates#automated document creation#business document generation tools#template based document software#invoice and contract generation software#esignature solutions for small business

0 notes

Text

In this case study, you will discover how a custom copilot solution built on Copilot Studio helped a leading pharma company transform invoice query management and strengthen customer relationships.

0 notes

Text

The Importance of Invoice Validation for Amazon Delivery Service Partners

Why Invoice Validation Matters

For Amazon Delivery Service Partners (DSPs), managing invoices is a daily challenge. With multiple transactions tied to vehicle leasing, driver salaries, fuel expenses, and more, errors in invoices can lead to unnecessary costs and compliance issues. This is where invoice validation becomes indispensable. By ensuring that every invoice is accurate, DSPs can streamline their financial operations and focus on delivering excellence.

In this blog, we’ll delve into what invoice validation is, why it’s crucial for DSPs, and how leveraging professional invoice validation services can make all the difference.

Table of Contents

Defining Invoice Validation

Key Challenges in Invoice Management for Amazon DSPs

How Invoice Validation Services Work

Benefits of Invoice Validation for DSP Operations

Top Features to Look for in Invoice Validation Tools

How Invoice Validation Boosts Financial Accuracy

Role of Automation in Invoice Validation

Outsourcing Invoice Validation: A Strategic Move

Common Mistakes in Invoice Management and How to Avoid Them

The Future of Invoice Validation for DSPs

1. Defining Invoice Validation

Invoice validation involves reviewing, cross-checking, and verifying the accuracy of invoices against contracts, purchase orders, and delivery records. For Amazon DSPs, this process ensures that payments align with contractual terms and eliminates errors like duplicate or overpayments.

2. Key Challenges in Invoice Management for Amazon DSPs

Managing invoices comes with its fair share of hurdles:

High Transaction Volume: DSPs deal with numerous vendors and recurring expenses, leading to invoice overload.

Human Error: Manual invoice processing is prone to mistakes.

Fraud Risk: Without validation, fraudulent invoices can slip through undetected.

Time-Consuming Processes: Validating invoices manually takes up valuable resources.

3. How Invoice Validation Services Work

Professional invoice validation services follow a structured process:

Data Capture: Extracting invoice data manually or via automation tools.

Verification: Cross-referencing invoice details with vendor agreements and delivery records.

Compliance Check: Ensuring invoices meet tax regulations and company policies.

Approval Process: Flagging discrepancies and approving error-free invoices.

4. Benefits of Invoice Validation for DSP Operations

Reduced Errors: Validation catches mistakes before they escalate.

Cost Savings: Prevents duplicate payments and overcharges.

Enhanced Compliance: Keeps financial processes aligned with regulations.

Improved Vendor Relationships: Ensures timely and accurate payments.

5. Top Features to Look for in Invoice Validation Tools

When choosing an invoice validation solution, DSPs should prioritize features like:

Automated data extraction and verification.

Real-time error detection.

Integration with accounting software.

Customizable workflows tailored to DSP needs.

6. How Invoice Validation Boosts Financial Accuracy

Accurate financial records are crucial for any business. Invoice validation eliminates discrepancies and ensures that financial statements reflect the true state of operations, enabling better decision-making for DSPs.

7. Role of Automation in Invoice Validation

Automation is transforming the way businesses handle invoices. AI-powered tools can:

Detect patterns and anomalies in real-time.

Automate repetitive tasks like data entry.

Flag discrepancies faster than manual methods.

8. Outsourcing Invoice Validation: A Strategic Move

For DSPs, outsourcing invoice validation services offers several advantages:

Access to expert teams with industry-specific knowledge.

Reduced overhead costs for in-house staff and technology.

Faster processing times and fewer errors.

9. Common Mistakes in Invoice Management and How to Avoid Them

Some common pitfalls include:

Neglecting to validate small invoices, which can accumulate errors over time.

Relying solely on manual processes.

Failing to audit invoices regularly.

Avoid these mistakes by implementing robust validation processes and leveraging professional services.

10. The Future of Invoice Validation for DSPs

The future lies in fully automated, AI-driven invoice validation services. With predictive analytics and machine learning, these tools will not only validate invoices but also anticipate discrepancies before they occur, making DSP operations even more efficient.

Conclusion: Why DSPs Need Invoice Validation

For Amazon Delivery Service Partners, invoice validation isn’t just a process—it’s a strategic necessity. By adopting advanced validation services, DSPs can eliminate financial risks, improve compliance, and focus on their core mission of delivering exceptional service.

Invest in invoice validation today and experience the difference it makes for your operations!

Also read:

Best Invoice Validation Company in the USA for DSPs

0 notes