#Intraday Equity Calls

Explore tagged Tumblr posts

Text

Mastering Intraday Equity Calls: Strategies for Success

Intraday equity trading is an exciting and fast-paced endeavour that allows traders to capitalize on price movements within a single trading day. With the right strategies and techniques, intraday trading can be a profitable venture. In this blog post, we will explore some essential tips and strategies to help you navigate the world of Intraday Equity Calls and increase your chances of success.

1. Conduct Thorough Market Research:

Before initiating any intraday trades, conduct comprehensive market research. Stay updated on the latest news, company announcements, and economic indicators that may impact the stocks you are interested in. Identify potential catalysts such as earnings releases, regulatory changes or product launches. A solid understanding of the market environment will help you make informed trading decisions.

2. Choose the Right Stocks:

Focus on highly liquid stocks with sufficient trading volumes. Liquidity ensures smooth execution of trades and minimizes the impact of bid-ask spreads. Look for stocks that have exhibited volatility in the past, as this provides opportunities for quick price movements and potential profits. Stocks with strong fundamentals and positive market sentiment are generally preferred for intraday trading.

3. Set Realistic Profit Targets and Stop-loss Levels:

Establishing realistic profit targets and stop-loss levels is crucial for managing risk and optimizing your trades. Determine the minimum risk-to-reward ratio you are comfortable with and identify potential entry and exit points based on technical analysis or support and resistance levels. Stick to your predetermined levels and avoid being swayed by short-term market fluctuations.

4. Utilize Technical Analysis Tools:

Technical analysis plays an important role in intraday trading. Use tools such as candlestick patterns, chart patterns, trend lines, and technical indicators to identify potential entry and exit points. Consider using tools like moving averages, relative strength index (RSI), or stochastic oscillators to gauge overbought or oversold conditions. Technical analysis helps in identifying trends, reversals, and potential price targets.

5. Implement Risk Management Strategies:

Effective risk management is crucial in intraday trading. In a single day, never risk more than a predetermined percentage of your trading capital. Use stop-loss orders to limit potential losses and trailing stops to protect profits as the trade moves in your Favor. Consider position sizing techniques to manage your overall risk exposure effectively.

6. Time Your Trades:

Timing is critical in intraday trading. Pay attention to the market open, as it often sets the tone for the day. Look for liquidity and volatility during specific market hours when trading volumes are high. Avoid trading during periods of low volume or when major news announcements are expected, as these can lead to increased volatility and unpredictable price movements.

7. Stay Disciplined:

Maintain discipline and stick to your trading plan. Avoid impulsive trading decisions driven by emotions or the fear of missing out (FOMO). Adhere to your predetermined entry and exit points, profit targets, and stop-loss levels. Maintain a trading journal to review your trades, identify strengths and weaknesses, and continuously refine your strategy.

8. Practice Continual Learning:

Intraday trading is a skill that requires continual learning and adaptation. Stay updated with market trends, attend webinars or seminars, read books, and follow experienced traders. Continuously review and analyse your trades to identify patterns, strengths, and areas for improvement. Consider back testing your strategies on historical data to gain insights into their effectiveness.

Conclusion:

Intraday equity trading offers traders the opportunity to profit from short-term price movements. By conducting thorough market research, choosing the right stocks, setting realistic profit targets and stop-loss levels, utilizing technical analysis tools, implementing effective risk management strategies, timing your trades, maintaining discipline, and continually learning and adapting, you can increase your chances of success by Intraday Equity Calls. Remember, intraday trading involves risks.

0 notes

Text

📣 Find your fortune in the fast-paced world 🌐 of commodity trading. ⚖📈

💸 Trade like a Pro and Unlock 💱 The Potential of your Investments! 💰

💷 Working in Mcx ,, Nse ,, Comex ,, Forex ,, Index ,, Future.💲

💱 Start In Just 4999/- 💸

#dailyprofit#crudekaraja#operator#more#committed#high#real#accuracy#consistent#surecalls#call#helping#whatsapp#commodities#futurestrading#intraday#equity#cryptocurrency

0 notes

Text

Rules to be Followed to do Intraday Trading

Trading stocks intraday may be more profitable during times of market volatility. However, it is a difficult matter overall because there is not enough time to spread the loss out. That's why, if you want to succeed as an intraday trader, you must stick to the basics.

Pick the right stock

In the world of intraday equity tips providers, not all stocks are created equal. Some of its features that make it a good fit are:

The stock can be quickly bought, sold, and turned into cash.

The rate of change in price over time is moderated by its low volatility.

This stock is part of an industry that has been doing well recently.

The stock price tends to move in the same direction as the market as a whole.

Make the proper moves

Contrast this with the approach to long-term investing that is taken in intraday trading. Consider whether this structure is a good fit for your personality before proceeding.

Daily goals are essential for any successful day trader. Keep track of your gains and losses in a journal. You need to figure out if you made money or lost money by the end of the day.

Fix the entry and exit prices

Stocks should be selected for intraday trading at their lowest prices. Setting sales goals at the time of purchase is a good practice. Stop-loss objectives should also be established. If the price falls below a certain threshold, you've committed to selling it at a loss.

Embrace moderate risk-taking

To put it another way, only gamble with money you can afford to lose. This is a high-stakes, potentially lucrative venture. The profits for the entire month could be wiped out by a single trade.

You should only trade with money you can afford to lose.

Put your feelings aside

Intraday trading, keep in mind, is all about strategy. The potential gain or loss is substantial and rapid. Therefore, it's important to maintain a level head. Neither your success nor your failure should cause you to lose perspective.

0 notes

Text

Zerodha Discount Broker Review 2020: Compare Broker Online

Zerodha with a one of a kind name and significance, Zero + rodha (Barrier in English) is developing as the single largest discount broker in India you will see in this zerodha discount broker review 2020. The reason Zerodha turning into the best trading platform in India is expected to giving “the best internet exchanging stage India”, “low brokerage and high presentation”, “free direct shared reserve venture stage” and “effective client assistance.”

In only a limited capacity to focus time (9+ years) Zerodha top the list to become the best stock broker in India as far as dynamic customers. Zerodha contributions & backing is developing step by step.

The principle contributing exercises offered by Zerodha are exchanging value, value F&O, ware, cash on NSE, BSE, MCX and MCX-SX and interest in Direct Mutual Funds through SIP and single amount, ETFs, Government protections, and securities.

Zerodha offers free exchanging value delivery and charges a low brokerage of Rs 20 or .03% whichever is lower for exchanging value Intraday, F&O, cash, and ware.

The Demat administrations provided are of being a DP of CDSL. Furthermore, there is NRI trading facility at Rs 200 or .1% per request whichever is lower for value conveyance and Rs 100 for each request for value F&O.

Zerodha Mutual Fund Investment

This is the first broker in quite a while to offer a Direct Mutual Fund investment facility to its clients for nothing.

In this, you can put resources into direct shared store plots that give you better returns contrasted with customary common reserve plans.

Fundamentally, there is no commission setting off to the brokerage house from your common store speculation.

Zerodha Account Opening Process and 3-in-1 Account

You would instant be able to open records with them. The advantages of 3-in-1 record are offered in tie-up with IDFC First bank in the structure of Zerodha-IDFC FIRST Bank 3-in-1 record.

The business as usual of the record – a solitary record comprehensive of exchanging, DEMAT and financial balance for consistent and bother free web based banking and contributing experience. It has now become the exchanging and self-clearing part to give customers the advantage of no clearing charges. In addition, Zerodha provides cover request and section request (CO/BO) with trailing stop misfortune include for value and F&O best among the top 10 discount brokers in India.

Zerodha Charge/Fee Structure:

Protections Transaction Tax (STT): This is charged distinctly on the sell side for intraday and F&O exchanges. It’s charged on two sides for Delivery exchanges Equity.

Stamp Duty: Charged according to the condition of the customer’s correspondence address.

Merchandise and Enterprises Tax (GST): This is charged at 18% of the complete expense of brokerage in addition to exchange charges.

Different Charges (Zerodha Hidden Fees):

Call and Trade highlight is accessible at an additional expense of ₹50 per call.

Source - https://medium.com/@deepakcomparebroker/zerodha-discount-broker-review-2020-compare-broker-online-2e0b057bef50

Related - https://comparebrokeronline.com/

#best trading platform in india#top stock broker#best stock broker in india#lowest brokerage charges#top share broker#zerodha review

2 notes

·

View notes

Text

Stock Cash Tips, Equity Market Calls & Intraday Trading Tips: Your Guide to Smarter Trading with Nivesh Research

In the fast-moving world of stock markets, timing is everything. Whether you’re a seasoned trader or a beginner, having access to reliable stock cash tips, equity market calls, and intraday trading advice can make a significant difference in your trading success. With the right guidance and tools, you can maximize your profits and minimize your risks. This is where Nivesh Research comes in, providing high-quality, data-backed trading tips to help you navigate the dynamic world of equity markets.

In this blog, we will discuss the importance of expert stock cash tips, equity market calls, and intraday trading strategies, and how Nivesh Research can empower you to make informed, profitable decisions in the stock market.

The Importance of Stock Cash Tips in Equity Market Trading

Stock cash tips are essentially recommendations for buying or selling specific stocks, typically based on the analysis of current market conditions, technical charts, and stock fundamentals. These tips are particularly useful for traders who want to focus on specific stocks with the potential to deliver short-term gains.

0 notes

Text

[ad_1] 5 min read Last Updated : Oct 11 2024 | 10:01 AM IST Shares of TCS fell as much as 2.09 per cent at Rs 4,140 per share on the BSE in Friday’s intraday deals after the company posted a modest quarterly earnings for the second quarter of the financial year 2024-25 (Q2FY25). Analysts believe that the earnings were satisfactory and were in line with their estimates, with an optimistic management waiting for a turnaround in the near future. This is based on the management's confidence on positive demand outlook, and improvement in the macro environment. However, analysts expect TCS as well as the sector to see a material uptick in growth from Q4FY25 onwards. Click here to connect with us on WhatsApp In the quarter under review all verticals recorded growth sequentially for TCS, except two including healthcare that declined 3.4 per cent and the telecom segment which also remained weak, said analysts at Nuvama Institutional Equities. “Growth was primarily driven by the BSNL ramp-up. The decline in North America was surprising, but this was attributable to client-specific issues in healthcare and persistent weakness in the communications vertical,” said analysts at Motilal Oswal Financial Services (MOFSL). On the other hand BFSI continued to show signs of recovery, particularly in North America, growing 1.9 per cent quarter-on-quarter Q-o-Q. Growth markets and E&U surged 13.1 per cent and 4 per cent Q-o-Q, respectively. Vital signs Despite a subpar quarter, the company’s management remains optimistic about Gen AI, noting increased investments and a rise in client engagements to 600 in Q2 (up from 275 in Q1), with 86 projects going live compared to eight in Q1. They anticipate discretionary spending to improve in the coming quarters, with BFSI expected to continue its recovery, retail rebounding after a strong holiday season, and manufacturing addressing temporary supply chain issues. Additionally, investments in the travel vertical are also returning. The company’s total contract value or deal wins came in soft at $8.6 billion, but within management’s comfort range of $7–9 billion. Overall pipeline and qualified pipeline is at an all-time high, analysts noted. “Management remains optimistic about demand revival as they see a recovery in BFSI and bottoming out of the retail vertical. We are cutting FY25E/26E EPS by -4.9 per cent/-3.9 per cent factoring in slightly lower growth and margins. We continue to value TCS at 30x Sep-26E PE. Maintain ‘Buy’ with a revised target price of Rs 5,100 (earlier Rs 5,250),” Vibhor Singhal, Nikhil Choudhary, and Yukti Khemani of Nuvama wrote in their result review note. Analysts at Nomura also highlighted some positives on the IT sector, calling onset of the interest rate-cutting cycle and a potential thaw in decision-making by US corporates post US elections which may provide fillip to demand. They expect TCS’s revenue growth of 6.3-7.5 per cent year-on-year in FY25-26F (versus 4.1 per cent in FY24), adding that this depends on an improvement in deal wins. However, not everyone is onboard with a positive outlook for TCS, as analysts at Emkay said that weak discretionary spending, client-specific challenges, slower decision-making, and client’s cautious behaviour amid macro uncertainties still weighed on revenue growth of the company in the September quarter. The brokerage firm reduced its earnings estimates by 1.2-2.4 per cent for FY25-27 considering the Q2 miss. Nomura, too, cut its earning per share (EPS) estimates by 1.6 per cent and 2.4 per cent for FY25 and FY26F, respectively driven largely by margin cut."Given the lack of any near-term trigger, we retain ‘Reduce’ with target of Rs 4,500/sh at 28x Sep-25E EPS,” said those at Emkay.Globally, most brokerages stayed bullish on TCS for the long term, highlighting steady hiring trends and continued recovery in BFSI as positive factors. Jeffries maintained its ‘Buy’ rating on the stock with a target price of Rs 4,735.

Those at JP Morgan, too, maintained their overweight stance on the stock with a target of Rs 5,100. Meanwhile, Japanese brokerage firm Nomura gave a ‘Neutral’ call on the stock with a target of Rs 4,150. Financial print in Q2 TCS reported a net profit of Rs 11,909 crore for the quarter, a 5 per cent increase from Rs 11,342 crore in the same quarter last year, although it dipped 1.08 per cent sequentially. Revenue rose 7.6 per cent year-on-year to Rs 64,259 crore, with a sequential growth of 2.62 per cent. In constant currency, revenue increased by 5.5 per cent, while net income saw a 3.8 per cent year-on-year rise. The total contract value (TCV) of new deals for the September quarter edged up to $8.6 billion from $8.3 billion in Q1, but this marked a 23 per cent decline from $11.2 billion in Q2FY24. The EBIT margin for 2QFY25 was 24.1 per cent, reflecting a 60 basis point drop quarter-on-quarter and a 20 basis point decline year-on-year.At 09:40; the share price of TCS was trading 0.67 per cent lower at Rs 4,200 a piece. By comparison, the BSE Sensex was down 0.23 per cent at 81,425 level. First Published: Oct 11 2024 | 9:52 AM IST [ad_2] Source link

0 notes

Text

[ad_1] 5 min read Last Updated : Oct 11 2024 | 10:01 AM IST Shares of TCS fell as much as 2.09 per cent at Rs 4,140 per share on the BSE in Friday’s intraday deals after the company posted a modest quarterly earnings for the second quarter of the financial year 2024-25 (Q2FY25). Analysts believe that the earnings were satisfactory and were in line with their estimates, with an optimistic management waiting for a turnaround in the near future. This is based on the management's confidence on positive demand outlook, and improvement in the macro environment. However, analysts expect TCS as well as the sector to see a material uptick in growth from Q4FY25 onwards. Click here to connect with us on WhatsApp In the quarter under review all verticals recorded growth sequentially for TCS, except two including healthcare that declined 3.4 per cent and the telecom segment which also remained weak, said analysts at Nuvama Institutional Equities. “Growth was primarily driven by the BSNL ramp-up. The decline in North America was surprising, but this was attributable to client-specific issues in healthcare and persistent weakness in the communications vertical,” said analysts at Motilal Oswal Financial Services (MOFSL). On the other hand BFSI continued to show signs of recovery, particularly in North America, growing 1.9 per cent quarter-on-quarter Q-o-Q. Growth markets and E&U surged 13.1 per cent and 4 per cent Q-o-Q, respectively. Vital signs Despite a subpar quarter, the company’s management remains optimistic about Gen AI, noting increased investments and a rise in client engagements to 600 in Q2 (up from 275 in Q1), with 86 projects going live compared to eight in Q1. They anticipate discretionary spending to improve in the coming quarters, with BFSI expected to continue its recovery, retail rebounding after a strong holiday season, and manufacturing addressing temporary supply chain issues. Additionally, investments in the travel vertical are also returning. The company’s total contract value or deal wins came in soft at $8.6 billion, but within management’s comfort range of $7–9 billion. Overall pipeline and qualified pipeline is at an all-time high, analysts noted. “Management remains optimistic about demand revival as they see a recovery in BFSI and bottoming out of the retail vertical. We are cutting FY25E/26E EPS by -4.9 per cent/-3.9 per cent factoring in slightly lower growth and margins. We continue to value TCS at 30x Sep-26E PE. Maintain ‘Buy’ with a revised target price of Rs 5,100 (earlier Rs 5,250),” Vibhor Singhal, Nikhil Choudhary, and Yukti Khemani of Nuvama wrote in their result review note. Analysts at Nomura also highlighted some positives on the IT sector, calling onset of the interest rate-cutting cycle and a potential thaw in decision-making by US corporates post US elections which may provide fillip to demand. They expect TCS’s revenue growth of 6.3-7.5 per cent year-on-year in FY25-26F (versus 4.1 per cent in FY24), adding that this depends on an improvement in deal wins. However, not everyone is onboard with a positive outlook for TCS, as analysts at Emkay said that weak discretionary spending, client-specific challenges, slower decision-making, and client’s cautious behaviour amid macro uncertainties still weighed on revenue growth of the company in the September quarter. The brokerage firm reduced its earnings estimates by 1.2-2.4 per cent for FY25-27 considering the Q2 miss. Nomura, too, cut its earning per share (EPS) estimates by 1.6 per cent and 2.4 per cent for FY25 and FY26F, respectively driven largely by margin cut."Given the lack of any near-term trigger, we retain ‘Reduce’ with target of Rs 4,500/sh at 28x Sep-25E EPS,” said those at Emkay.Globally, most brokerages stayed bullish on TCS for the long term, highlighting steady hiring trends and continued recovery in BFSI as positive factors. Jeffries maintained its ‘Buy’ rating on the stock with a target price of Rs 4,735.

Those at JP Morgan, too, maintained their overweight stance on the stock with a target of Rs 5,100. Meanwhile, Japanese brokerage firm Nomura gave a ‘Neutral’ call on the stock with a target of Rs 4,150. Financial print in Q2 TCS reported a net profit of Rs 11,909 crore for the quarter, a 5 per cent increase from Rs 11,342 crore in the same quarter last year, although it dipped 1.08 per cent sequentially. Revenue rose 7.6 per cent year-on-year to Rs 64,259 crore, with a sequential growth of 2.62 per cent. In constant currency, revenue increased by 5.5 per cent, while net income saw a 3.8 per cent year-on-year rise. The total contract value (TCV) of new deals for the September quarter edged up to $8.6 billion from $8.3 billion in Q1, but this marked a 23 per cent decline from $11.2 billion in Q2FY24. The EBIT margin for 2QFY25 was 24.1 per cent, reflecting a 60 basis point drop quarter-on-quarter and a 20 basis point decline year-on-year.At 09:40; the share price of TCS was trading 0.67 per cent lower at Rs 4,200 a piece. By comparison, the BSE Sensex was down 0.23 per cent at 81,425 level. First Published: Oct 11 2024 | 9:52 AM IST [ad_2] Source link

0 notes

Text

Bharat Dynamics limited (BDL) Share Price Correction: Profit Booking Ends 10-Day Rally

Bharat Dynamics Limited (BDL), a Miniratna public sector undertaking (PSU) in India, witnessed a sharp correction in its share price. The stock plunged by a significant 7%, snapping a ten-day winning streak that saw it climb steadily. This sudden drop can be attributed to profit booking by investors who had capitalized on the recent surge.

A Look Back at the 10-Day Rally

The past ten days were a period of significant gains for Bharat Dynamics. The stock price witnessed a continuous upward trend, fueled by investor optimism surrounding the Indian government's "Make in India" initiative. This initiative aims to promote domestic manufacturing, including the defense sector, and investors anticipated Bharat Dynamics to be a key beneficiary. The positive sentiment surrounding "Make in India" led to a buying spree, pushing the stock price higher.

Profit Booking Takes Hold

However, the 7% drop and indicates a shift in investor behavior. Profit booking refers to the practice of selling a stock after it has experienced a price increase. Investors who bought shares during the 10-day rally likely saw this as an opportune moment to lock in their profits. This selling pressure caused the stock price to decline.

Is the "Make in India" Dream Fading?

While the correction in Bharat Dynamics' share price might seem concerning, it's important to note that not all defense stocks are experiencing a similar drop. This suggests that the broader investor interest in the Indian defense sector, driven by "Make in India," remains intact. Bharat Dynamics' specific correction could be due to a combination of factors, including profit booking and technical reasons related to short-term trading strategies.

Looking Ahead: What's Next for Bharat Dynamics?

The long-term prospects for Bharat Dynamics depend on several factors beyond short-term fluctuations. The company's ability to secure new contracts under the "Make in India" initiative will be crucial for its future growth. Additionally, its overall financial performance, operational efficiency, and product development efforts will all play a role in determining its future share price.

Bharat Dynamics Share Price Correction * Share price fell by 7% due to profit booking. * Investors cashing in on gains from recent 10-day rally. * Stock surge attributed to optimism about Indian government's "Make in India" initiative. * Not all defense stocks experiencing surge, indicating broader investor interest in Indian defense sector.

Have you invested in BDL shares?

Join us at demiumresearch.com or call 7030916716 today. Let's make your money work smart!

Conclusion

The recent correction in Bharat Dynamics' share price serves as a reminder of the inherent volatility associated with stock markets. While profit booking caused the 7% drop, the broader investor interest in the Indian defense sector, fueled by "Make in India," remains positive. Investors should carefully consider the company's fundamentals, future prospects under "Make in India," and overall market conditions before making any investment decisions.

Stock Recommendation, Commodity Recommendation, Intraday Stock Recommendation, Equity Recommendation, Options Trading Recommendation, Nifty Futures Recommendation, Stock Futures Recommendation, Nifty Futures Recommendation

About Us Demium Research Demium Research Analyst is a Top-notch SEBI Registered Research Analyst (SEBI Registration Number - INH000009409 and Best Research Analyst company in India. We are Equity research analyst & service provider which provides top-notch services with unique and advanced features. We are customer oriented company in this industry. We have best business model which offer better platform and services to investors and traders of the Indian stock market. Demium Research offers the first of its kind reward points style services which are result-oriented services. Our all services come with standard features like personalized and customized services, Dedicated Relationship manager, In-depth analysis of stocks and many more. We have carefully chosen and developed range of financial and research services in order to support and provide our clients with the solutions as they need. We seek to produce healthy financial rewards for our clients in their trading and Investments. Our company puts emphasis on helping investors to gain high profit out of their invested wealth to attain their short-term and long-term financial goals. The experienced, analyst experts give their unparalleled service to upgrade the skills and adhere to the incomparable height of knowledge of traders. WHO WE ARE Demium Research is best SEBI registered Research Analyst and a team of highly skilled professionals which has a vast experience of stock market research and analysis. We believe in power of innovation, creativity and knowledge. Our thorough research and analysis are not only powerful and result oriented but also giving our clients' satisfactory results. … is amongst Top Stock advisory companies in India and we as a team always believe in to provide best in class service experience to our clients. Our client retention ratio is highest in this industry and client satisfaction is our top priority. WHY US Values We value our clients and put their interest in the forefront.

Join us at Stock Recommendation, Commodity Recommendation, Intraday Stock Recommendation, Equity Recommendation, Options Trading Recommendation, Nifty Futures Recommendation, Stock Futures Recommendation, Nifty Futures Recommendation or call 7030916716 today. Let's make your money work smart!

0 notes

Text

Best Option Trading Telegram Channels

If you’re confused about which skills to learn in 2024 to earn up to Rs 50,000 a day, trading can be a great way to make good money. You might be wondering how to learn trading. This article has the solution for you! I’ve put together a list of the Best Telegram channels for option trading in 2024.

Top 10 Telegram channels for Option Trading

1.Honest Stock Traders 2. Trading Master 3. Trade Onomics 4. Ghanshyam tech Analysis 5. Option Trading Masters 6. Option Tradex 7. NSE STOCK PRO 8. Mehul Option Trading 9. Stock market Ninjas 10. Stockpro Official

Best Telegram Channels for Option Trading in 2024 (Free Calls)

Honest Stock Traders

If you’re not very familiar with option trading but still want to make money from it, consider joining the Honest Stock Traders channel. Here, you’ll get free option trading calls, trading setups, and chart analysis for Bank Nifty and Nifty. With over 31k subscribers, this channel provides valuable insights at no cost.

Option Trading Bulls

Option Trading Bulls is a legit Telegram channel that offers investment ideas, free Banknifty option calls, and detailed information on stock, equity, future, and options trading. With over 20k members, this channel can help you recover your losses.

Stock Market Ninjas

Stock Market Ninjas is a SEBI-registered Telegram channel that offers trading tips for option trading, crypto trading, intraday trading, and swing trading. The owner has a lot of experience in trading, making it a great resource if you want to learn how to make money from trading.

Bull vs Bears Traders

Bull vs Bears Traders helps you set targets and achieve daily profits of Rs 3000 to 5000+. It offers live chart analysis, ideal setups for trading, buying, and selling ideas, along with free Bank Nifty calls. Join now to increase your profits.

Trading Wallah

Trading Wallah is famous for option trading. It provides stock market views, Nifty investment calls, chart indicators, and free trading calls. There’s also a premium membership plan available.

Stock Gainers

Stock Gainers is a popular SEBI-registered Telegram channel offering free materials on stock market and option trading calls. You get 1–2 intraday option trading calls with proper strategies. With over 80k members, this channel can help you make over 10k profit daily.

Option Trading Hub

This channel provides free stock market tips, trading tips, and free intraday calls. They also offer premium services like live training and free webinars. If you want to invest your money wisely in 2024.

StockPro®Official (SEBI Registered)

StockPro Official, run by Seema Jain, is a trusted SEBI-registered channel. It offers free Bank Nifty training and free videos on share market and trading on YouTube. With over 300k members, it’s a great community to join if you want to learn and trade.

Growth Trading

Growth Trading is a great channel to learn about investing in trading. It offers regular intraday trading tips on equity, futures, options trading, and stock market news. If you want 1–2 free calls daily with 90% accuracy.

Trading Phoenix

Trading Phoenix covers option trading, intraday, crypto, and swing trading. It’s one of the fastest-growing channels, offering investment and financial advice.

Option Trading Masters

Option Trading Masters is an authentic channel focused on educating beginners. It provides detailed information on stock market and trading, along with free trading calls, Bank Nifty calls, chart analysis, and risk management services.

GHANSHYAM TECH ANALYSIS

GHANSHYAM TECH ANALYSIS provides free Bank Nifty, intraday, and option trading calls. It also offers free YouTube videos for beginners to learn trading in simple language. For stock market tips, free trading knowledge, and more

Elite Traders

Elite Traders offers information on the stock market, trading, business news, and investment ideas. It provides Nifty and Bank Nifty calls, intraday calls, and stock options calls.

Option Trade Order

Option Trade Order is a great channel for short-term or long-term investment ideas. It provides fundamental stock market analysis, free investment ideas, risk management, and chart analysis. With over 40k active members, this channel is worth joining.

Option Trading Gainers

If you want to build a career in the stock market and trading, this channel offers online trading classes. It covers chart analysis, risk management, and more. Join today to learn trading from start to finish.

Bull’s Thrive

Bull’s Thrive is a fast-growing channel known for its option trading tips and tricks, free live chart analysis, and ideal setups for trading. Join this channel in 2024 to make money from trading.

Market Master

Market Master is a SEBI-certified channel that helps you become financially free. It offers various investment ideas, stock market research, Bank Nifty, expiry levels, breakouts, and more.

0 notes

Text

TIPS TO INVEST IN INTRADAY TRADING📈

To succeed in intraday trading, one must employ strategic approaches and adhere to sound investment principles. In this article, we'll delve into some essential tips for investing in intraday trading while highlighting the significance of staying informed, setting clear goals, managing risks effectively, selecting the right stocks, and embracing continuous learning.

Tips for Intraday Trading Success:

1. Stay Informed

Monitor market trends and use reliable sources for information.

2. Set Clear Goals

Define profit targets and establish risk limits.

3. Manage Risks Effectively

Use stop-loss orders and diversify investments.

4. Choose the Right Stocks

Prioritise liquidity and identify volatility.

5. Keep Learning

Stay updated with new strategies and seek mentorship.

Intraday Trading Call Provider in India

Options Master is renowned as one of the best intraday trading call providers in India, offering high-quality research and actionable trading recommendations to its clients. With a team of seasoned analysts and proprietary trading algorithms, Options Master delivers timely and accurate intraday calls across various asset classes, including equities, derivatives, and commodities. Whether you're a novice trader or a seasoned investor, Options Master provides comprehensive support and guidance to help you navigate the markets with confidence and achieve your financial goals.

Conclusion

Intraday trading presents lucrative opportunities for traders to profit from short-term price fluctuations in the financial markets. By staying informed, setting clear goals, managing risks effectively, selecting the right stocks, and embracing continuous learning, traders can enhance their chances of success and achieve consistent profitability over time. With the guidance of reputable service providers like Options Master, traders can access reliable research and expert insights to optimise their trading strategies and maximise returns.

#bank nifty#niftytrading#intraday trading#day trading#stock market#nifty50#investing stocks#stock trading#stock

1 note

·

View note

Text

Why the Nifty dropped to 3-week low after hitting fresh highs

Market chatter on changes to capital gains taxes on equities—piling on to prevailing election jitters—dragged India’s benchmark equity indices to their lowest in three weeks, before finance minister Nirmala Sitharaman dismissed what she called “pure speculation". This, after the Nifty50 opened higher on Friday, clocking a record intraday high of 22,794.7 points, until it ended the day’s trading in the red. The India VIX index—the fear gauge—ended 9% higher on Friday, indicative of the heightened volatility in the market.

There has been some anxiety in the market with investors taking some money off the table ahead of and during the ongoing national election. Over the past month, both the Nifty50 and the S&P BSE Sensex have remained almost unchanged, suggesting a cautious sentiment among investors. But profit-booking on Friday was mainly triggered by rumours of changes to the capital gains treatment of equities post the election results, souring investor sentiment further.

“On Friday, rumours of adverse STCG (short-term capital gains) tax changes post the formation of new government and of some cooling of the margin of victory by NDA alliance caused a minor selloff," said Deepak Jasani, head of retail research at HDFC Securities Ltd.

0 notes

Text

Intraday Equity Calls: Tips for Profitable Trading

Intraday equity trading involves buying and selling stocks within the same trading day to take advantage of short-term price fluctuations. It offers potential opportunities for quick profits but also carries inherent risks. To succeed in intraday equity trading, it is essential to have a well-defined strategy and follow some key Intraday Equity Calls tips. In this blog post, we will discuss valuable tips for making profitable intraday equity calls.

1. Conduct Technical Analysis

Technical analysis is a vital tool for intraday traders. Analyse price charts, indicators, and patterns to identify potential entry and exit points. Pay attention to support and resistance levels, trend lines, and moving averages. Utilize indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator to validate your trading decisions. Technical analysis helps you make informed choices based on historical price data.

2. Set Clear Entry and Exit Points

Before entering a trade, define your entry and exit points based on your analysis. Set a specific price level at which you will enter the trade, known as the entry point. Similarly, determine your profit target and stop-loss level, which will protect you from excessive losses. Stick to your predefined levels and avoid making impulsive decisions based on emotions or market noise.

3. Manage Risk with Stop-Loss Orders

Implementing stop-loss orders is crucial in intraday trading. A stop-loss order is an instruction to sell a stock when it reaches a specified price level, limiting potential losses. Determine your acceptable loss per trade based on your risk appetite and set stop-loss orders accordingly. This helps protect your capital and prevents substantial losses if the market moves against your position.

4. Utilize Limit Orders

Intraday traders often use limit orders to enter or exit trades at specific prices. A limit order allows you to buy or sell a stock only at the desired price or a better price. By using limit orders, you have more control over the execution price, reducing the impact of sudden price fluctuations and slippage. Place limit orders to ensure that you enter or exit trades at your intended price levels.

5. Stay Updated with Market News

Intraday traders need to stay updated with the latest market news and events. Economic indicators, corporate announcements, and global news can significantly impact stock prices. Monitor news sources, financial websites, and company announcements to stay informed about factors that may influence the stocks you trade. Being aware of market news helps you make informed trading decisions and adapt your strategy accordingly.

6. Use Volume and Liquidity as Criteria

When selecting stocks for intraday trading, consider the volume and liquidity of the stock. Stocks with high trading volume and liquidity are more likely to have tight bid-ask spreads, allowing for smoother entry and exit from trades. High-volume stocks also tend to have more reliable price movements and are less prone to manipulation. Focus on liquid stocks to ensure efficient execution of your intraday equity calls.

7. Avoid Overtrading

Overtrading is a common mistake made by novice intraday traders. It refers to excessive trading, either in terms of the number of trades or the position size. Overtrading can lead to increased transaction costs, emotional stress, and poor decision-making. Be selective in your trades and focus on quality setups rather than trying to trade every opportunity that arises. Maintain discipline and stick to your trading plan.

8. Learn from Your Trades

Every trade offers an opportunity to learn and improve your trading skills. Maintain a trading journal to record your trades, including entry and exit points, reasons for the trade, and the outcome. Regularly review your trades and analyse your performance. Identify patterns, strengths, and weaknesses in your trading strategy. Learning from your trades and making necessary adjustments will contribute.

Conclusion

Intraday equity trading can be highly rewarding for traders who approach it with the right mindset and strategy. By conducting thorough research, identifying liquid stocks, utilizing technical analysis, setting realistic profit targets and stop loss levels, staying disciplined, monitoring market trends, implementing risk management strategies, and keeping emotions in check, you can increase your chances of success in Intraday equity calls. Remember that practice, continuous learning, and adaptability are key to refining your skills and achieving consistent profitability in this dynamic trading style.

0 notes

Text

📣 Find your fortune in the fast-paced world 🌐 of commodity trading. ⚖📈

💸 Trade like a Pro and Unlock 💱 The Potential of your Investments! 💰

💷 Working in Mcx ,, Nse ,, Comex ,, Forex ,, Index ,, Future.💲 💱 Start In Just 4999/- 💸

#dailyprofit#crudekaraja#operator#more#committed#high#real#accuracy#consistent#surecalls#call#helping#whatsapp#commodities#futurestrading#intraday#equity#cryptocurrency#technicalanalysis#eurusd#commoditytrading

0 notes

Text

Streamlined Ways of Wide Range Production in Securities Market

Equity is taken into consideration to be among the most distinct and also phenomenal methods to create resources in the securities market. Some people have massively increased their shares and also riches with the help of equity investments. On the other hand, several other individuals have experienced devastating losses in the same procedure. To avoid these losses you can take the help of portfolio management services.

Nonetheless, a terrific Supply Advisory Firm establishes that both of these concerns do not hinder the growth of riches production for capitalists. Equity financial investments are always profitable methods, however, you need to be careful. A large little good luck is likewise most likely to do marvels for you in this instance.

What is Equity?

In simple words, equity is the investment spent or had by distinguished people in the organization. Mathematically, equity is obtained when we locate the distinction between overall properties from that of overall liabilities. Suppose you acquire a car and truck with a rate of P, yet you likewise owe a rate of Q for the very same cars and trucks to someone. After that, your equity will certainly be P-Q. It is a determining consider major monetary issues like debt, fund procedures, as well as possession analysis.

Just How To Develop Riches In Stock Market Structure?

If you are brand-new to the stock market, you first require to assess certain principles associated with the capabilities. To efficiently develop wealth using equity, you need to have a clear suggestion concerning the market structure. Equity is additionally appropriate based on the existing rate worths, so maintain a close sight of them. Right here are some equity suggestions with which you can quickly as well as conveniently create riches in the securities market:

Make varied buddies: Adopt the two-way technique while associating with service about equities. Firstly, you need to develop solid connections with significant organization heads today. They will certainly aid you to conquer the losses in a short time. Their links will enable you to perform smooth organization consistently. On the other hand, you additionally need to preserve good relations with every firm associated with this company. You can not demean a person even if their present scenario is unpredictable. This is because they can promptly benefit from the scenario and also rise to fantastic heights.

Do not dig deep into service: Indeed, you frequently need to maintain your rate in service to do well. However, this does not imply that you will certainly surrender all your resources in one supply and also await it to provide you with profits. You have to keep several choices open because this is the method the market features. In case one of your equity investments fails to do well, the others will jump in to make amends. This way, you will likewise be able to create a strong base for your organization and also riches creation.

Concentrate on your end goal: In the preliminary financial investments, it is very typical for proprietors of a business to obtain influenced by other services. However, you should maintain your objective taken care of to make sure that you can profit over time. At first, your investment might not look as gleaming as well as enthusiastic as the others, but you need to continue. Very soon, you will be able to boost your wealth in the stock market based on intraday equity tips.

Beginning with easy financial investments: In case the equity investments are becoming excessive for you currently, you can make use of financial investment techniques like index funds as well as others. It will help you pick up from business markets, such that you can opt for far better investments in the future. While you comprehend the appropriate technique for buying stocks, you must likewise understand when to offer. For instance, when your equity financial investments are not working out for the best, you can market them right at the onset. It will certainly prevent additional losses.

Equities are efficient in developing a wide range over a short period. Nonetheless, you must additionally understand the technicalities involved, to make sure that you can earn maximum profits. The means you deal with points will establish whether you will certainly develop a tremendously wide range of experiences and terrible losses. The above-mentioned equity trading tips can show to be distinguished guides for you as you start your trip of efficient wide-range development.

0 notes

Text

Market Comment

The Magnificent Nvidia market continues, yet NVDA may have left some near term exhaustion clues with Friday's close below its intraday volume shelf that also formed a daily doji candlestick. Weekly volume was great however, so any pullback, even a re-test of the 670 area, should likely be corrective. But I'm increasingly sensing NVDA's limelight could be waning.

It remains in a highly cyclical and competitive business, and there is the nontrivial possibility that NVDA's moonshot might simply be the result of pull-forward demand from frantic customers triple ordering chips Covid-style.

If so, and if momentum is indeed waning, even a simple correction could clip hundreds of points. There is even the May 2023 unfilled gap at 305.38 to contend with should it want to. A whopping 60.97 points wide. Some stocks barely move that much in a year.

Sentiment wise, upside call speculation has wildly skewed NVDA's options chain. Dealers, after selling those calls to buyers, neutralize their resulting negative delta by buying EQ and NQ futures, further adding to the upward pressure.

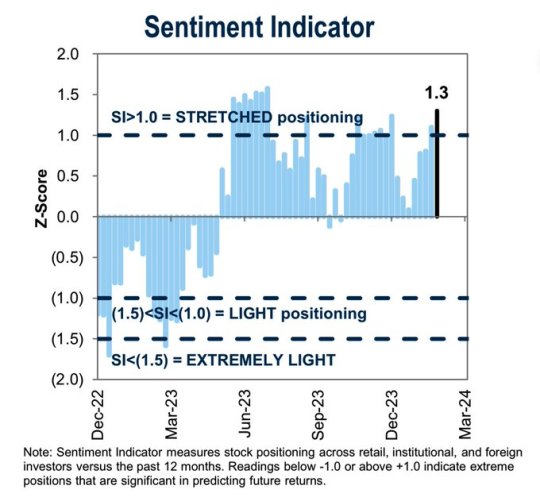

Notice the crowded long positioning, via Goldman. This will end only when animal spirits cease for whatever reason.

Speaking of sentiment, Private Equity is still up to its old tricks.

KKR-Owned April Seeks Traditional Loan to Refinance Private Deal

French insurance broker April Group is turning to traditional lenders for a €1.2 billion syndicated loan to help refinance debt that it took out from private creditors just over a year ago. ~Bloomberg

Debt to refinance debt, yet again.

And, ICYMI, investing has gotten so easy that The Whiz Kids are back.

These Teenagers Know More About Investing Than You Do

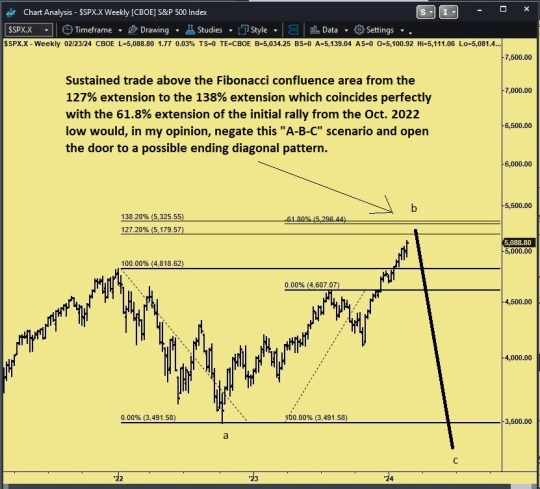

Regarding the S&P 500, the clock is ticking on the B-wave thesis. The usual target of an overthrow such as this is the 127% Fib extension (5179.57). Yet just above is a juicy confluence area, 5296.44-5325.55.

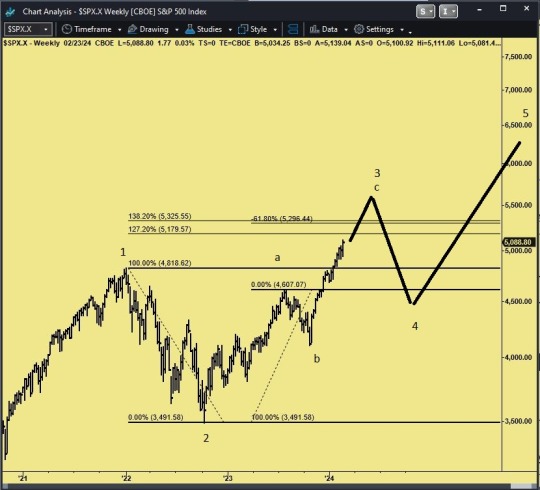

Any sustained trade above 5325.55 would trigger, for me, a different scenario: an ending diagonal.

The ending diagonal scenario interests me because it would explain the "relentless" nature of the current rally -- relentless being an unconscious social mood description of third waves that I have noticed over the years (and it might not be finished yet).

An ending diagonal would also provide for a re-test of the SPX 4400 "November 13th" area that has been previously covered here at Mood Report with the charts of UPS, NKE, FDX, and now PANW.

For now I play only with options -- NVDA call spreads against very short-dated SPY puts and OTM NVDA puts.

NVDA now has a $2T market cap and a 50% Implied Vol, multiples higher than its peers, which effectively makes it the most dangerous stock in the market.

Caveat emptor.

0 notes

Text

Stock Cash Tips, Equity Market Calls & Intraday Trading Tips: Your Guide to Smarter Trading with Nivesh Research

In the fast-moving world of stock markets, timing is everything. Whether you’re a seasoned trader or a beginner, having access to reliable stock cash tips, equity market calls, and intraday trading advice can make a significant difference in your trading success. With the right guidance and tools, you can maximize your profits and minimize your risks. This is where Nivesh Research comes in, providing high-quality, data-backed trading tips to help you navigate the dynamic world of equity markets.

In this blog, we will discuss the importance of expert stock cash tips, equity market calls, and intraday trading strategies, and how Nivesh Research can empower you to make informed, profitable decisions in the stock market.

The Importance of Stock Cash Tips in Equity Market Trading

Stock cash tips are essentially recommendations for buying or selling specific stocks, typically based on the analysis of current market conditions, technical charts, and stock fundamentals. These tips are particularly useful for traders who want to focus on specific stocks with the potential to deliver short-term gains.

0 notes