#Initial Load In Central Finance

Explore tagged Tumblr posts

Text

CentralFinanceHelp has information on the Initial Load procedure in Central Finance. Know the main processes in setting up SAP Central Finance, as well as how data is sent.

#Initial Load In Central Finance#SAP Central Finance#Central Finance#Central System#SAP ECC system#Central Finance HELP

0 notes

Text

Why Property Rental Management Software Is a Smart Investment in 2024?

In today’s fast-paced real estate industry, property rental management software offers a robust rental management system for landlords, property owners, and tenants to streamline complex tasks such as Tenant Onboarding, Lease Management, Maintenance Tracking, Accounting, Financial Reporting, Document Management, and Communication. By integrating multiple essential functions, property rental software simplifies rental operations.

What is Property Rental Management Software?

Property rental management software is a digital solution for landlords, property managers, and real estate businesses to efficiently manage residential and commercial property rentals anytime from mobile and desktop. Property Rental Software allows you to manage short-term and long-term property rentals utilizing technology for tenant onboarding, rent collection, lease tracking, and maintenance management from a cloud-based rental management platform.

Additionally, residential and commercial property rental management software empowers businesses with real-time communication, contract management, scheduling inspection, and valuable data insights. Property Rental Software App enables property owners to make data-driven decisions, enhance tenant satisfaction, and improve overall operational efficiency.

Key Features of an Ideal Property Rental Management Software

Ease of Use: An ideal property rental software is user-friendly, featuring an intuitive interface that requires minimal training. Easy navigation allows users to access key functions quickly, ensuring efficient management of day-to-day operations.

Manage Properties: It provides a centralized dashboard to monitor multiple properties, track occupancy rates, schedule inspections, and maintain property data, enabling streamlined oversight of diverse portfolios in one organized space.

Tenant Onboarding: With digital onboarding tools, property rental management software simplifies tenant application, background checks, and lease signings, creating a seamless, efficient experience for tenants and landlords from the initial contact to move-in.

Identity Check: Built-in identity verification ensures secure and reliable tenant vetting. This feature validates applicant information quickly, minimizing risk and enhancing tenant trust through thorough, compliant screenings.

Asset Management: Effective asset management allows property owners to track and maintain all assets, from appliances to infrastructure, prolonging their lifespan and optimizing long-term property value.

Marketing for Tenants or Buyers: Rental marketing tools enable managers to list properties across platforms, attract potential tenants or buyers, and increase occupancy rates, saving time and enhancing property visibility.

Contract Management: Automated contract management facilitates digital lease creation, signing, and storage, ensuring all agreements are compliant, organized, and accessible to both parties for streamlined lease administration.

Manage and Resolve Repair and Maintenance Issues: A dedicated maintenance module lets tenants submit repair requests, track work orders, and monitor task status, ensuring timely responses and well-maintained properties.

Accounting and Tracking Finances: Integrated accounting features track income, expenses, rent payments, and generate financial reports, providing a clear financial overview to support informed budgeting and accurate tax compliance.

Why Should Invest in Property Rental Software?

Property rental management software nowadays is a crucial system for managing rental tasks digitally from mobile and desktop. It simplifies the rental management of residential and commercial properties, making it easier for owners and landlords to manage tenants and property hassle-free. Foremost Rental management app enhances efficiency, allowing rental businesses to manage properties more effectively. By reducing the administrative load, property rental software gives more time to focus on providing high-quality service and scaling their portfolios.

Best Property Rental Management Software in Australia | Free Demo

Property rental management is a primary responsibility for owners, focusing on ensuring that properties are well-maintained and cared for. Effective management helps preserve property value, supports tenant satisfaction, and ultimately benefits the owner's investment. To make things easy try RentAAA property rental management software solution designed to streamline residential and commercial rental operations from mobile and desktop.

RentAAA offers a free demo to showcase its key features, including tenant documentation, property listings, bookings, financial reporting, maintenance management, and inspections. This trial provides users with a hands-on experience of how RentAAA’s rental management app simplifies and enhances every aspect of property management and helps owners focus on maximizing tenant satisfaction and long-term growth.

#property rental management software#property rental software Australia#property management software for landlords#property rental management app#property rental app#property management app#property management software#tenant management software#tenant management app#residential property management software#commercial property management software#short term property rental management software#rental management software australia

0 notes

Text

Forestry and Logging Industry Use of Commerical Equipment Financing and Working Capital

Forestry and Logging Industry

The forestry and logging industry is fundamental to the global economy, providing essential raw materials for construction, paper production, energy, and other sectors. This industry involves harvesting and transporting timber and, often, initial processing before the wood is sold or refined. Contractors in this industry typically operate in rural and forested tracts, where they must manage various complex challenges, including environmental regulations, fluctuating timber prices, and the seasonal nature of work.

Forestry and logging contractors require substantial financial resources to succeed in this demanding environment. The industry’s capital-intensive nature drives commercial financing and fast working capital, as significant upfront investments are required to purchase and maintain equipment, hire skilled labour, and manage operational costs. This article explores how forestry and logging contractors can use commercial financing and fast working capital to sustain and grow their businesses.

Forestry and logging equipment is essential for harvesting, transporting, and processing wood from forests. Here's an overview of key types of equipment used in the industry:

Felling Equipment

Chainsaws: Handheld machines used for cutting down trees manually. They are versatile but require skill and safety precautions.

Feller Bunchers: Heavy machines that cut and gather multiple trees before placing them on the ground. These are used for more efficient and safe tree felling in large-scale operations.

Harvesters are advanced machines that can cut, de-limb, and buck trees into predetermined lengths in one operation. They are often used in combination with forwarders or skidders.

Landing

Yarders: A specialised machine transports fallen trees from the forest to a central location, typically a landing or log deck, where logs are further processed or loaded onto trucks. Yarders are critical in logging operations with steep and rugged terrain, whereas other methods of moving logs, such as skidders and forwarders, are ineffective.

Skidding and Forwarding Equipment

Skidders: Used to drag cut trees or logs from the forest to a landing area where they can be processed. There are two types of skidders:

Cable Skidders: Use cables to pull logs.

Grapple Skidders: Use grapples to grab and lift logs.

Forwarders: Machines that carry logs off the ground to a landing site. Unlike skidders, forwarders do not drag logs but carry them, which reduces soil damage.

Processing and Loading Equipment

Delimbers: Machines that remove branches from felled trees. They can be attached to harvesters or be standalone units.

Log Loaders: These machines load logs onto trucks or trailers for transport. Some are purpose-built, while others are adapted excavators.

Slashers: These cut logs into specific lengths at the landing site, making them ready for transportation.

Wood Chippers

Chippers: Machines used to reduce tree limbs, branches, and smaller trees into wood chips. These chips can be used for biomass energy, mulch, or pulp.

Mulchers and Slashers

Mulchers are used to clear underbrush and small trees, turning them into mulch. They are important in clearing and site preparation.

Slashers: Used for cutting large logs into smaller, manageable sections for further processing.

Transportation Equipment

Log Trailers and Trucks: Specialized trucks with trailers used to transport logs from the logging site to mills or processing plants.

Forwarding Wagons: Designed to carry logs out of dense forests and move them to access roads or landing areas.

Firewood Processors

Machines designed to cut and split logs into firewood often combine chainsaws and hydraulic splitters in a single process.

Other Accessories

Winches: These are used with skidders or logging trucks to pull heavy logs or equipment up slopes.

Grinders and Stumpers: Machines that grind tree stumps into the ground after logging operations to prepare the site for further use.

These machines have revolutionized forestry by making logging safer, faster, and more efficient while allowing for sustainable practices like selective logging.

The Role of Commercial Financing

Commercial financing is a relief and a lifeline for the forestry and logging industry. It plays a pivotal role in providing the necessary capital for contractors to run their operations effectively. With the industry’s heavy machinery, long payment cycles, and the need to manage liquidity during off-peak seasons, adequate financing is necessary. It allows contractors to confidently meet these demands, reducing the stress and risk to their business’s viability.

Types of Commercial Financing for Forestry and Logging Contractors

Equipment Loans and Leases:

Purpose: Forestry and logging require expensive machinery such as harvesters, skidders, loaders, and trucks. Equipment loans allow contractors to purchase this equipment without paying the total cost upfront, spreading the expense over several years.

Structure: Equipment loans typically cover up to 100% of the equipment’s purchase price, with repayment terms ranging from 3 to 7 years. Leasing is another option, allowing contractors to use the equipment while making regular payments, often with the option to purchase the machinery at the end of the lease term.

Working Capital Loans:

Purpose: These loans provide immediate funds to cover daily operational expenses, such as payroll, fuel, and maintenance. Working capital loans are beneficial when cash flow is tight, such as between large contracts or during off-seasons.

Structure: These loans are usually short-term, with repayment terms ranging from 6 months to 2 years. They can be structured as either a lump sum loan or a line of credit, providing flexibility to draw funds as needed.

Lines of Credit:

Purpose: A line of credit offers contractors flexible access to funds, which can be drawn upon as required and repaid when cash flow improves. This is ideal for managing unexpected expenses or bridging gaps between contract payments.

Structure: Lines of credit are revolving, meaning that as contractors repay borrowed amounts, those funds become available to borrow again. Interest is only charged on the amount borrowed, making this a cost-effective option for managing short-term needs.

Invoice Factoring:

Purpose: Invoice factoring allows contractors to sell their outstanding invoices to a factoring company in exchange for immediate cash. This mainly benefits contractors who face long payment terms but need cash flow to continue operations.

Structure: The factoring company advances a percentage of the invoice value (usually 70-90%) and then collects the payment from the contractor’s customer. Once the customer pays, the factoring company remits the balance to the contractor minus a fee.

Merchant Cash Advances (MCAs):

Purpose: MCAs provide quick access to cash by advancing funds based on future sales or receivables. This type of financing is suitable for contractors who may not qualify for traditional loans due to credit issues or who need immediate funds.

Structure: Contractors receive a lump sum and repay it through a percentage of daily sales or receivables. MCAs have higher costs but offer flexibility and fast approval, especially for high-volume yard stores.

Project-Specific Financing:

Purpose: For large-scale projects, such as land clearing or extensive timber harvesting, contractors may need project-specific financing to cover all associated costs, including labour, equipment, and transportation.

Structure: Project financing is typically secured by the future revenue generated by the project. This complex financing arrangement may involve multiple lenders and require detailed financial and operational plans.

The Importance of Working Capital

Working capital, the lifeblood of day-to-day operations, is a fundamental aspect of financial management for forestry and logging contractors. It is calculated as current assets minus current liabilities. This capital is not just necessary; it’s essential for covering operating expenses, managing cash flow fluctuations, and ensuring the smooth operation of the business.

Why Working Capital is Critical

Managing Cash Flow Gaps:

Forestry and logging operations often involve long payment cycles, especially with large corporate or government clients. These delays can create significant cash flow gaps, during which contractors must pay wages, fuel costs, and equipment maintenance. Working capital helps bridge these gaps, ensuring the business can continue operating while waiting for payments.

Seasonal Operations:

The forestry and logging industry is highly seasonal, with peak periods during certain times of the year. Even when revenue is low, contractors must ensure sufficient working capital to cover off-season expenses, such as storage fees, equipment maintenance, and salaries.

Unexpected Expenses:

Unexpected expenses are ordinary in the forestry industry, whether due to equipment breakdowns, weather-related disruptions, or regulatory changes. Adequate working capital allows contractors to handle these unforeseen costs without compromising their operations.

Expansion Opportunities:

Having sufficient working capital enables contractors to take advantage of new business opportunities, such as bidding on larger contracts or expanding into new tracts. With adequate funds, contractors may experience these growth opportunities.

Benefits of Commercial Financing and Working Capital

Sustained Operations:

Commercial financing and working capital ensure that forestry and logging contractors can maintain their operations even during periods of low revenue or high expenses. This stability is crucial for long-term success in the industry.

Growth and Expansion:

Access to financing allows contractors to invest in new equipment, hire additional staff, and take on larger projects. This capacity to grow is essential for staying competitive in the forestry and logging industry.

Flexibility:

Contractors can manage their finances according to their business needs with options like lines of credit and working capital loans. This flexibility helps them adapt to changing market conditions and operational challenges.

Risk Management:

By securing financing and maintaining adequate working capital, contractors can better manage the financial risks associated with their business. This includes preparing for unexpected costs, seasonal fluctuations, and market volatility.

Challenges of Securing Commercial Financing

While commercial financing offers numerous benefits, forestry and logging contractors may face several challenges in securing it:

High-Risk Perception:

Lenders often see the forestry and logging industry as high-risk due to market volatility, environmental regulations, and the physical dangers of logging. This perception can make it more difficult for contractors to secure financing, especially at favourable terms.

Collateral Requirements:

Lenders typically require collateral to secure loans, which can be challenging for contractors who may need more assets to pledge. This is particularly an issue for newer contractors or those who have leveraged their equipment for previous loans.

Cash Flow Constraints:

The industry's extended payment cycles and seasonal nature can lead to cash flow constraints, making it difficult for contractors to meet lenders’ financial requirements. This can result in higher interest rates or more stringent loan terms.

Complex Application Processes:

Applying for commercial financing can be time-consuming and complex, requiring detailed financial statements, business plans, and credit evaluations. This can be a barrier for smaller contractors who may need more resources to manage the application process effectively. ComFiNow, make it easy!

Strategies for Overcoming Financing Challenges

Building Strong Relationships with Lenders:

Developing solid relationships with lenders who understand the forestry and logging industry can improve financing chances. Contractors should seek out brokers with industry experience who can offer tailored financing solutions.

Improving Financial Management:

Maintaining accurate and up-to-date financial records is essential for demonstrating financial stability to lenders. Contractors should invest in good accounting practices and consider working with financial advisors to strengthen their financial management.

Exploring Alternative Financing Options:

Suppose traditional bank loans are not an option. In that case, contractors should explore alternative financing options such as equipment leasing, invoice factoring, or merchant cash advances. These options offer more flexible terms and faster access to funds.

Diversifying Revenue Streams:

Contractors can reduce their financial risk by diversifying their revenue streams and offering additional services like land clearing, tree planting, or consulting. This diversification can stabilize cash flow and make the business more attractive to lenders.

Planning for Seasonality:

Contractors should develop financial plans that account for the seasonal nature of their business, ensuring they have sufficient working capital to cover expenses during off-peak periods. This planning can help avoid cash flow crises and make it easier to secure financing.

Conclusion

Forestry and logging contractors operate in a challenging and capital-intensive industry where access to commercial financing and working capital is crucial for success. By understanding the various financing options, contractors can better manage their cash flow, invest in necessary equipment, and take on new projects. While there are challenges in securing financing, mainly due to the high-risk nature of the industry, contractors can overcome these obstacles through strong financial management, building relationships with lenders, and exploring alternative financing solutions.

In an industry marked by seasonal fluctuations, long payment cycles, and significant upfront costs, having access to reliable financing can be the difference between sustaining operations and facing financial difficulties. By leveraging commercial funding and maintaining adequate cash reserves, forestry and logging contractors can navigate the industry’s challenges and position themselves for long-term success.

0 notes

Text

How Do Smart Contracts Work on the Coinbase Platform?

Introduction:

Smart contracts refer to self-executing contracts  based on the blockchain technology, which is employed in decentralized applications (DApp) and the overall blockchain transactions. In Coinbase specifically, smart contracts provide client the opportunity to engage with decentralized finance (DeFi) protocols, to conduct automatic transactions, and manage property in a more secure and efficient way.

Here's a breakdown of how smart contracts work on the Coinbase platform:Here's a breakdown of how smart contracts work on the Coinbase platform:

1. Integration with Ethereum and EVM-Compatible Blockchains:

Coinbase mainly works with Ethereum and other chains built on Ethereum Virtual Machine (EVM), which was developed to execute smart contracts. Smart contract features offered by the platform are available through the Coinbase wallet and enable users to engage with dApps and perform operations without third parties’ involvement.

2. Smart Contract Execution:

Whenever a user interacts with a smart contract on Coinbase (for instance by engaging with a DeFi application, staking cryptocurrency, or making trades,) the smart contract initiates without human intervention according to pre-programmed instructions etched into the blockchain. These conditions are open and fixed; this means that once these conditions have been deployed on the blockchain, they cannot be altered by any central authority.

3. Trustless Transactions:

At Coinbase, smart contracts help people complete transactions that have no need for a third party. This means that two transactors can communicate or exchange an asset where the middleman who vouches for each of the transactors or guarantors them is not necessary in this form of transaction. For instance, if you are using Coinbase’s wallet to transact with a lending and borrowing DeFi platform, the smart contract will facilitate loan agreements and repayment.

4. Gas Fees and Costs:

To run a smart contract on Coinbase, the user has to make a payment referred to as the “gas fee” which is the cost incurred when executing the smart contract on the ethereum network. The fees for gas depend on the solidity’s contract and the current load of the network.

5. Security and Transparency:

To this end, Coinbase guarantees that smart contracts executed on its platform are clear to users and free from risks. This basically means that every stage of the contract is encrypted on block chain which is hard to be altered. This is especially good because it means the users can check the terms and conditions of the contract before contract engagement whereby once certain conditions are met, the contract automatically executes.

6. DeFi and DApp Integration:

It is possible to integrate Coinbase wallets with numerous DApps and DeFi applications without any difficulties. Currently, to carry out transactions within decentralized exchanges or staking or lending platforms, users can engage with them through smart contracts. For instance, a smart contract designed for a DEX can facilitate token exchange of coins on specific and predetermined terms reducing the risks associated with the process.

7. Coinbase Wallet for Smart Contracts:

Smart contracts on Coinbase require the Coinbase Wallet for interaction. By creating a place where everyone can safely store their assets, and also communicate with DApps and the blockchain protocols. The wallet allows the users total control over their private keys meaning that the users solely own their funds and interactions with smart contracts.

Conclusion:

The smart contracts featured in the Coinbase platform provide the users with an efficient, safe, and computerized means of participating in transactions on the blockchain. This is because no matter if the user is engaged with DeFi, staking or simply using DApp, Smart Contracts guarantee a secure, transparent and efficient transaction. Meanwhile, Web3 evolution provides Coinbase as a connection where clients who want to exploit smart contracts and DeFi solutions start their journey.

#justtrytechnologies#smart contracts#web3 smart contract#web3.0#web3 development#blockchaintechnology#blockchaindevelopment#blockchaintechnologies#blockchaindevelopmentcompany

0 notes

Text

Sharding in Blockchain: A Comprehensive Guide to Scalability and Efficiency

Sharding in Blockchain: Making Networks Faster and More Efficient

Imagine being tasked with building a giant Lego structure all by yourself — it’s an overwhelming and daunting challenge. This scenario is very similar to managing a large blockchain network without the help of sharding technology.

What is Sharding?

Sharding in blockchain refers to the process of dividing the network into smaller, autonomous segments called shards. Each shard handles its share of data and transactions independently, increasing the overall efficiency of the network. For example, Ethereum 2.0, which is in the midst of implementing sharding, aims to reach an impressive 100,000 transactions per second (TPS) by the end of 2024. This is a significant leap from its previous capacity of 15 TPS, a milestone made possible by the combination of sharding and Layer 2 scaling solutions. Sharding enables the network to scale efficiently without encountering bottlenecks, even as the number of users continues to grow. With the number of blockchain users expected to exceed 1 billion by 2030, sharding will play a critical role in maintaining the speed and adaptability required to support this expansive growth.

Sharding And The Landscape of Blockchain Expansion

The blockchain industry is on an extraordinary growth trajectory, with the global market size expected to exceed $67 billion by 2026, up from $5.85 billion in 2021. This remarkable rise reflects the increasing adoption of blockchain technology across various sectors, including finance, supply chain management, healthcare and more.

By August 2024, blockchain networks have made significant progress in both adoption and technological advancement, with sharding playing a central role in these developments. For example, Ethereum, one of the most widely used blockchain platforms, has seen its daily transaction volume exceed 1.2 million transactions per day by mid-2024. This surge in demand has highlighted the need for efficient scaling mechanisms, such as sharding. In addition, the rapid expansion of decentralized finance (DeFi) and non-fungible tokens (NFTs) has highlighted the need for scalable and efficient networks capable of handling increasing transaction volumes. DeFi platforms alone have locked in over $60 billion in total value, indicating the immense transaction load on networks such as Ethereum that sharding aims to alleviate.

The Critical Role of Sharding in Blockchain

Sharding is essential for the sustainable growth of blockchain ecosystems. Without sharding, networks could experience significant slowdowns, similar to a motorway clogged with traffic. Sharding distributes the network’s workload across multiple shards, ensuring that the system remains nimble and responsive even under heavy loads. For example, Ethereum 2.0’s goal of reaching 100,000 TPS in 2024 is a clear demonstration of the transformative power of sharding. This ambitious leap from the previous capacity of 15 TPS illustrates how sharding can significantly improve network efficiency, making it a fundamental element of future blockchain developments.

Adoption in the Industry and Sharding’s Rising Significance

As of August 2024, sharding has evolved from a theoretical concept to an integral part of many leading blockchain projects. Beyond Ethereum, platforms such as Polkadot and Zilliqa are using sharding to enhance their network architectures. Polkadot is ready to support up to 10,000 TPS with its innovative parachain model. This model allows multiple blockchains to operate in parallel, significantly improving operational efficiency and transaction throughput. Zilliqa, a pioneer in the adoption of sharding, currently processes approximately 2,828 TPS, which is approximately 400 times more efficient than Bitcoin’s 7 TPS.

Furthermore, industry research suggests that over 70% of new blockchain initiatives will incorporate some form of sharding. This trend underscores the growing importance of sharding in enabling networks to scale efficiently and handle increasing transaction volumes without compromising speed or security.

Sharding’s Impact on Various Blockchains

Zilliqa

Zilliqa is at the forefront of sharding implementation, currently handling around 2,828 transactions per second. This is approximately 400 times more efficient than Bitcoin, which only processes 7 transactions per second. Zilliqa’s approach to sharding has proven to be a pragmatic and effective strategy for increasing network scalability and transaction throughput.

Polkadot

Polkadot’s unique parachain architecture is on track to support up to 10,000 TPS. This model allows multiple blockchains to operate simultaneously, significantly increasing operational efficiency and scalability. Polkadot’s use of sharding is an example of how this technology can be adapted to meet the growing needs of blockchain networks.

NEAR Protocol

The NEAR Protocol uses state sharding, a method that divides the state of the blockchain across multiple shards, reducing storage load and increasing efficiency. The NEAR Protocol is expected to reduce storage costs by nearly 40%, positioning it as a leading example of how sharding can optimize resource allocation in blockchain networks.

The Necessity of Sharding for Ethereum 2.0

Ethereum 2.0’s goal of reaching 100,000 TPS is not only ambitious — it is essential to the network’s continued growth. As the network supports an increasing number of decentralised applications (dApps) and DeFi initiatives, the demand for scalable and efficient transaction processing continues to grow. Without sharding, Ethereum would struggle to meet user demand, resulting in delays and higher transaction fees. Conversely, networks without sharding, such as Bitcoin, are limited to processing only 7 TPS, making them less suitable for widespread adoption. As more individuals enter the blockchain space, the importance of sharding will become increasingly apparent. It is a technology that will shape the future of blockchain, allowing networks to expand without encountering performance bottlenecks.

Types of Sharding

1. Network Sharding

This method involves segmenting the network into smaller clusters, with each cluster managing a fraction of the network. This segmentation reduces the load on individual nodes, thereby speeding up network operations. Network sharding is expected to reduce node workload by over 70%.

2. Transaction Sharding

This technique distributes transactions across different shards to speed up processing. Polkadot, for example, uses transaction sharding to manage multiple projects simultaneously, with the aim of supporting up to 10,000 TPS.

3. State Sharding

This approach distributes data storage responsibilities across shards, with each shard managing only a fraction of the network’s state. This distribution reduces storage utilization and increases overall efficiency. For example, the NEAR protocol is expected to reduce storage costs by nearly 40% through the implementation of state sharding.

Sharding’s Benefits

Scaling Up

Sharding is a revolutionary approach that allows blockchains to scale without experiencing the slowdowns typically associated with increased user activity. For example, Ethereum 2.0 aims to handle up to 100,000 TPS, a significant increase from its previous capacity of 15 TPS. This transformation is akin to upgrading from a bicycle to a rocket, and illustrates how sharding allows networks to accommodate a larger user base without sacrificing speed.

Accelerating Transactions

Sharding significantly increases the speed of transaction processing.

Optimizing Resource Allocation

Sharding optimizes the distribution of resources by spreading the workload across the network, preventing any one shard from becoming overwhelmed. This approach can be likened to spreading the weight of a heavy load across multiple carriers, making the task more manageable.

Networks like Polkadot use this method to maintain both speed and efficiency, while supporting a variety of blockchain applications.

Polkadot’s parachain model is expected to support over 500 blockchains working in harmony, demonstrating how sharding can facilitate complex operations at scale.

Challenges and Solutions

Security Considerations

Sharding presents unique security challenges due to the autonomous nature of each shard. If one shard is compromised, there’s a risk that the entire network could be exposed. To mitigate these risks, developers are incorporating advanced cryptographic techniques such as Zero-Knowledge Proofs (ZK-SNARKs) and Verifiable Delay Functions (VDFs). These techniques are expected to reduce disk specific risks by nearly 80% by 2024. In addition, new security protocols are being developed to monitor the health of each shard, reducing the probability of successful attacks by 65%.

Shard Communication

Efficient communication between shards is critical to the successful implementation of sharding. Without seamless data exchange, the network risks fragmentation, which could destabilize operations. Developers are focusing on creating robust protocols that ensure smooth communication between shards. By 2024, new protocols such as Cross-Chain Message Passing (XCMP) and Inter-Shard Messaging (ISM) are expected to significantly improve data transfer speeds, enabling shards and parachains to exchange information in less than two seconds. This improvement is expected to reduce latency by 50% compared to previous methods.

Development Complexities

Developing a shard blockchain is a complex process, requiring careful planning and advanced engineering skills. As the number of shards increases, so does the complexity of ensuring that they all integrate seamlessly. Despite these challenges, the benefits of sharding — such as increased speed, scalability and resource efficiency — make the effort worthwhile. By 2024, more than 60% of new blockchain projects are expected to incorporate some form of sharding, highlighting its growing importance in the industry. In addition, new development tools and frameworks specifically designed for sharding are expected to emerge, reducing development time by around 30%.

Real-World Sharding Applications

Ethereum 2.0

Ethereum 2.0 represents a monumental advancement in blockchain technology, largely due to the implementation of sharding. Ethereum 2.0 is expected to process over 100,000 TPS, a dramatic improvement from its previous capacity of just 15 TPS. This upgrade will enable Ethereum to serve as the backbone for leading decentralized finance (DeFi) platforms, significantly reducing delays and transaction costs. Platforms such as Uniswap, which facilitates millions of trades daily, will benefit enormously from this increased capacity, allowing them to operate more efficiently and with greater scalability.

Zilliqa

Zilliqa has pioneered the practical application of sharding, becoming one of the first blockchains to successfully implement both network and transaction sharding. As of 2024, Zilliqa manages approximately 2,828 TPS, positioning it as one of the fastest blockchains in operation today. Zilliqa’s high transaction speed is expected to make it an ideal platform to support large-scale decentralized applications such as Xcademy, proving that sharding is not just a theoretical concept, but a practical solution to real-world blockchain challenges. Zilliqa’s success highlights the competitive advantage that sharding can provide in an increasingly crowded marketplace.

Polkadot

Polkadot uses a unique sharding model known as parachains, where each parachain operates independently while remaining connected to a central relay chain. This model allows Polkadot to support multiple blockchains that work seamlessly together. Polkadot is expected to support over 500 parachains, managing a wide range of projects from decentralised finance (DeFi) to gaming. Projects like Moonbeam, which involve complex smart contracts and interoperability with Ethereum, are likely to gravitate towards Polkadot due to the scalability and efficiency benefits of sharding.

The Future of Sharding

The future of sharding in blockchain technology is incredibly promising. By August 2024, more than 70% of top blockchain networks are expected to adopt sharding, highlighting its critical role in maintaining the efficiency and scalability of blockchain ecosystems. Developers are continuously refining shard security to minimize vulnerabilities, integrating sophisticated cryptographic techniques such as zero-knowledge proofs (zk-SNARKs), which are expected to reduce shard-specific risks by up to 85% by 2024.

Shard communication is also expected to improve significantly, with new protocols such as Cross-Chain Message Passing (XCMP) reducing latency to less than a second. These advances will be essential for the smooth operation of complex, multi-shard systems. As blockchain technology continues to evolve, these innovations will ensure that sharding remains a key component of blockchain networks, supporting unprecedented levels of scalability and efficiency.

Global blockchain usage is expected to exceed 1.5 billion users by 2025, further emphasizing the importance of sharding. With more than 90% of new blockchain projects expected to implement sharding by 2025, the technology is poised to become a cornerstone of the industry. Sharding will enable networks to handle massive transaction volumes with ease, allowing them to keep pace with growing demand. For example, Ethereum 2.0’s goal of processing over 100,000 TPS by the end of 2024 represents a 6,667% increase from its original capacity, highlighting the transformative impact sharding can have on blockchain performance.

As sharding continues to gain traction, its role in the blockchain landscape will only become more significant. Networks that fail to implement sharding may struggle to cope with increasing traffic and user demands, while those that embrace it will be well positioned to lead the way in blockchain innovation. In conclusion, sharding will be the foundation of the next generation of blockchain networks, offering unparalleled performance, security and scalability.

Conclusion

Sharding Accelerates Blockchain Performance: Sharding acts as a turboboost for blockchain networks, making them faster and more scalable. It transforms a congested network into a high-speed highway, enabling the network to process more transactions simultaneously without slowdowns.

Efficient Network Management: Sharding divides the blockchain into smaller, more manageable segments, each operating independently. This ensures that no single part of the network becomes overwhelmed, allowing for smoother operations and improved efficiency across the board.

Enhanced Transaction Speed: Each shard processes its data independently, resulting in significantly faster transaction times. This is similar to multiple teams working on separate tasks simultaneously, resulting in faster overall processing and a more efficient network.

Resource Optimization: Sharding distributes the workload across the network, reducing the load on individual resources. This leads to better resource utilization, lower energy consumption and increased efficiency, making the network more sustainable and capable of handling higher transaction volumes.

Adoption by Leading Blockchains: Top blockchain networks such as Ethereum 2.0, Zilliqa and Polkadot have adopted sharding to improve their performance. Sharding is expected to be an integral part of more than 70% of new blockchain projects, highlighting its critical role in the industry’s future.

The Future of Sharding: Sharding is set to become a key component of blockchain growth, with more than 70% of new projects expected to adopt the technology by 2024. Sharding will be essential to the development of faster, more scalable blockchains, ensuring the continued evolution and success of the industry as it expands to accommodate billions of users worldwide.

https://l.ecos.finance/3ZjQSvD

1 note

·

View note

Text

7th July 2024 Factories of the Future: What to Expect When you think of industrial factories, what is the first thing that comes to mind? Big, grey, and boring are probably it. Unlike residential and commercial properties where the “fun” and “measurable” factor of amenities and designs play a crucial role, there are many factors that determine what makes a good industrial factory as well. While residential and commercial properties serve as shelters and venues for business operations, industrial properties play a pivotal role in a growing nation. The emergence of Malaysia's Digital Free Trade Zone, touted as the world's first, aims to bolster interest in the country’s industrial properties. This initiative facilitates seamless cross-border trade, positions Malaysia as a regional e-commerce and e-fulfillment hub, and boosts exports of Malaysian SMEs via e-commerce. Comprising three components, it includes an e-Fulfilment hub aiding SMEs to export goods easily with leading fulfillment service providers, a Satellite Services Hub connecting SMEs with services like financing and last-mile fulfillment insurance, and a non-physical e-Services Platform managing cargo clearance and other processes digitally. Alibaba Group's acquisition of a free-trade zone in KLIA Aeropolis underscores its potential to handle up to US$65 billion worth of goods, highlighting the crucial synergy between digital operations and physical factories. What Sets Apart a Good Industrial Factory? 1. Mega Storage Facility Advanced software applications enable manufacturers and logistics companies to catalog and locate items efficiently. The rise of e-commerce has heightened demand for storage space, resulting in larger warehouses with multiple levels of mezzanine floors and external access points to maximize navigable space. 2. Super Computers Centralized systems employing real-time tracking coordinate with RFID chips and barcodes, ensuring efficiency and precision in increasingly complex operations. Future warehouses will rely on integrated inventory management, optimizing production-to-supply chain processes to fulfill customer orders just in time. 3. Conversion of Commercial Buildings into Last-Mile Delivery Centers The demand for immediate deliveries prompts e-commerce and logistics companies to convert less vibrant commercial buildings into last-mile delivery centers. Urban warehouses are evolving vertically and horizontally, potentially reshaping warehouse design. 4. Last-Mile Cold Storage Currently limited to hypermarkets and wholesalers, there's potential for online grocery shopping and meal delivery services to expand into this sector. Efficient cold storage solutions are essential to maintain product quality and reduce energy consumption. 5. Smart Design Warehouses Future warehouse designs will feature multiple entry points for parallel vehicle access, numerous loading bays, onsite security and firefighting services, fleet and warehouse management integration, technical support teams, and refueling areas. Automation and drone technologies promise further advancements in warehouse operations. 6. Other Key Considerations High-speed internet connectivity, proximity to labor supply and talent pools in the manufacturing industry, and the development of smart factories with automated processes are becoming essential in modern industrial settings. In conclusion, as competition intensifies in online businesses, differentiation in service, particularly speed of delivery, is crucial for customer retention. The integration of cutting-edge technologies and efficient logistical setups will define the factories of the future, supporting both digital and physical business operations. Our expertise ensures you get a property that meets your specifications and budget. We stay updated on the latest trends and insights, helping you spot strategic locations and suitable industrial properties. Contact

0 notes

Text

Rise of Edge Computing: Redefining Connectivity in Computer Science Engineering

Edge computing is rapidly transforming the landscape of computer science engineering, offering new ways to manage data, enhance connectivity, and improve overall system performance. As educators at St. Mary's, widely regarded as the best engineering college in India, we recognize the importance of this technology and its potential impact on future engineers.

Understanding Edge Computing

Edge computing is a distributed computing paradigm that brings computation and data storage closer to the sources of data. Instead of relying on centralized data centers, edge computing processes data at the "edge" of the network, near the data source. This approach reduces latency, conserves bandwidth, and enhances real-time data processing.

Benefits of Edge Computing

Reduced LatencyBy processing data locally, edge computing significantly reduces the time it takes for data to travel to a centralized server and back. This reduced latency is crucial for applications requiring real-time responses, such as autonomous vehicles, industrial automation, and healthcare monitoring systems.

Bandwidth EfficiencyEdge computing minimizes the need to transmit large volumes of data to and from centralized data centers. By filtering and processing data locally, it conserves bandwidth and reduces the overall load on network infrastructure. This efficiency is especially beneficial in environments with limited or expensive bandwidth.

Enhanced Security and PrivacyWith edge computing, sensitive data can be processed and stored locally, reducing the risk of exposure during transmission. This enhanced security is vital for applications in healthcare, finance, and critical infrastructure, where data privacy and protection are paramount.

ScalabilityEdge computing enables more scalable solutions by distributing computational tasks across multiple edge devices. This decentralization allows for efficient handling of increasing data volumes and growing computational demands without overloading centralized systems.

Applications of Edge Computing

Autonomous VehiclesAutonomous vehicles rely on real-time data processing for navigation, obstacle detection, and decision-making. Edge computing enables these vehicles to process sensor data locally, reducing latency and improving safety and efficiency on the road.

Industrial AutomationIn manufacturing and industrial settings, edge computing facilitates real-time monitoring and control of machinery. By processing data locally, it enhances predictive maintenance, reduces downtime, and optimizes production processes.

HealthcareEdge computing supports advanced healthcare applications, such as remote patient monitoring and telemedicine. By processing data at the edge, healthcare providers can deliver timely interventions and personalized care while ensuring data privacy and security.

Smart CitiesEdge computing powers smart city initiatives by enabling real-time analysis of data from sensors and IoT devices. This capability enhances traffic management, energy efficiency, public safety, and environmental monitoring.

RetailIn the retail sector, edge computing supports personalized customer experiences, inventory management, and supply chain optimization. By processing data locally, retailers can respond quickly to customer needs and market trends.

Preparing Students at St. Mary's

At St. Mary's, we are committed to providing our students with a comprehensive education in edge computing. Our curriculum is designed to cover the theoretical foundations and practical applications of this transformative technology, ensuring that students are well-prepared for the challenges and opportunities in this field.

Comprehensive CurriculumOur edge computing curriculum includes courses on distributed computing, IoT, network security, and data analytics. Students gain a deep understanding of the principles and techniques used in modern edge computing systems.

Hands-On ProjectsWe emphasize hands-on learning through projects and laboratory work. Students have access to state-of-the-art labs equipped with the latest edge computing technologies. They work on real-world projects, designing and implementing edge solutions for various applications.

Research OpportunitiesSt. Mary's encourages students to engage in cutting-edge research. Our faculty members, who are experts in their fields, guide students in exploring new frontiers in edge computing. Research areas include AI integration, autonomous systems, and smart city applications.

Industry CollaborationWe collaborate with leading companies and research institutions to provide students with internship opportunities and exposure to current industry practices. These collaborations ensure that our students are well-prepared for the professional world and stay updated with the latest trends in edge computing.

Workshops and CompetitionsWe organize workshops, seminars, and competitions to foster a culture of innovation and creativity. These events provide students with a platform to showcase their skills, learn from experts, and collaborate with peers.

Real-World Impact

Edge computing is poised to revolutionize various industries by providing faster, more efficient, and secure data processing solutions. For instance, in the healthcare industry, wearable devices equipped with edge computing capabilities can monitor vital signs in real time and alert healthcare providers to potential issues immediately. In the manufacturing sector, edge computing can enhance predictive maintenance by analyzing data from machinery sensors locally, preventing costly breakdowns and improving operational efficiency.

Future Prospects

The future of edge computing is bright, with continued advancements in AI, machine learning, and IoT driving its evolution. As the number of connected devices grows, the demand for efficient, low-latency data processing will only increase. Edge computing will play a crucial role in meeting this demand, enabling new applications and services that were previously unattainable.

At St. Mary's, we are dedicated to staying at the forefront of these technological advancements. Our commitment to excellence in education ensures that our students are not only well-versed in current technologies but also prepared to drive future innovations. By providing a robust education in edge computing, we empower our students to become leaders in this transformative field.

0 notes

Text

What Is The Cost Of Installing Solar Panels In Delhi

Solar panels have become popular in Delhi as residents seek sustainable energy solutions to combat pollution and rising electricity costs. These photovoltaic systems harness sunlight to generate electricity, providing a clean and renewable energy source for homes, businesses, and institutions across the city. With Delhi’s abundant sunlight throughout the year, solar panels offer an efficient means of reducing carbon emissions and reliance on fossil fuels. Rooftop solar installations have gained popularity among homeowners, enabling them to generate their electricity and reduce their environmental footprint. Additionally, commercial and industrial sectors are embracing solar power to lower operational costs and demonstrate corporate social responsibility. As Delhi continues to prioritize sustainability and clean energy initiatives, the adoption of solar panels is expected to grow, contributing to a greener and more sustainable future for the city and its residents.

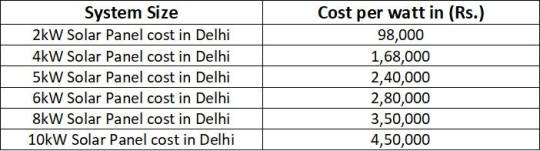

Cost of solar panel

To obtain accurate pricing information for solar panels price in delhi. it is recommended to contact local solar installers or companies for customized quotations based on your specific needs and site conditions. They can provide insights into available financing options, incentives, and rebates that may further offset the cost of solar panel installation in delhi.

Benefits of solar panels in delhi

There are several benefits of installing solar panels in Delhi:

Cost Savings: Solar panels can help homeowners and businesses in Delhi reduce their electricity bills by generating clean energy from sunlight. With abundant sunlight throughout the year, solar energy can provide significant savings on electricity costs over the long term.

Environmental Sustainability: By harnessing solar energy, residents of Delhi can reduce their carbon footprint and contribute to environmental sustainability. Solar panels generate electricity without emitting greenhouse gases or pollutants, helping to mitigate climate change and improve air quality.

Energy Independence: Solar panels provide homeowners and businesses with energy independence by allowing them to generate their own electricity on-site. This reduces reliance on the grid and fossil fuels, providing greater control over energy consumption and costs.

Grid Stability: Solar panels can help improve grid stability in Delhi by reducing the strain on the electrical grid during peak demand periods. Distributed solar generation can help balance supply and demand, reducing the risk of power outages and grid failures.

Financial Incentives: The government of Delhi and central government of India offer various financial incentives, subsidies, and tax credits to promote solar energy adoption. These incentives can help offset the upfront costs of solar panel installation and make solar energy more affordable for residents and businesses.

Job Creation: The solar industry in Delhi is a growing sector that creates jobs and stimulates economic growth. Solar panel installation, maintenance, and manufacturing activities contribute to job creation and provide employment opportunities for local residents.

Resilience: Solar panels can provide backup power during grid outages or emergencies, ensuring continuity of electricity supply for critical loads such as lighting, refrigeration, and communication devices.

Types of solar Panels in delhi

In Delhi, various types of solar panels are available to suit different applications and preferences. Some common types include:

Monocrystalline Solar Panels: These panels are made from single-crystal silicon, known for their high efficiency and sleek appearance. Monocrystalline panels are ideal for applications where space is limited or maximum energy production is desired.

Polycrystalline Solar Panels: Polycrystalline panels are made from multiple silicon crystals melted together, offering a cost-effective alternative to monocrystalline solar panels. While slightly less efficient, polycrystalline panels are suitable for applications where cost is a primary consideration.

Bifacial Solar Panels: Bifacial panels can generate electricity from both the front and rear sides, capturing sunlight reflected off the ground or surrounding surfaces. These panels offer increased energy production and are suitable for installations with reflective surfaces or elevated mounting.

Thin-Film Solar Panels: Thin-film panels are made by depositing thin layers of photovoltaic material onto a substrate, such as glass or metal. These panels are lightweight, flexible, and suitable for applications where traditional solar panels may not be feasible.

Building-Integrated Photovoltaics (BIPV): BIPV systems integrate solar panels directly into building materials, such as roof tiles or facades, providing both energy generation and architectural functionality.

Solar Roof Tiles: Solar roof tiles resemble traditional roofing materials but contain integrated solar cells to generate electricity. These tiles offer a seamless and aesthetically pleasing solar solution for residential and commercial buildings.

How to install solar panels in delhi

Installing solar panels in Delhi typically involves several steps:

Site Assessment: Begin by assessing your site to determine its suitability for solar panel installation. Factors to consider include roof orientation, shading, structural integrity, and available space for solar panels. It’s also important to check local regulations and building codes governing solar installations in Delhi.

Design and Planning: Work with a solar installer or consultant to design a solar system tailored to your specific needs and site conditions. This involves determining the optimal size and configuration of the solar array, selecting appropriate solar panels and mounting equipment, and designing the electrical layout.

Permitting and Approvals: Obtain any necessary permits and approvals required for solar panel installation in Delhi. This may include building permits, electrical permits, and approval from your local utility or electricity provider.

Procurement: Purchase solar panels, inverters, mounting hardware, and other necessary equipment from reputable suppliers or manufacturers. Ensure that the equipment meets quality standards and is compatible with your solar system design.

Installation: Hire a qualified solar installer or contractor to install the solar panels on your roof or property. The installation process typically involves mounting the panels, connecting them to the electrical wiring, and installing the inverter and other system components.

Electrical Connection: Once the solar panels are installed, they need to be connected to your home’s electrical system. This involves wiring the solar panels to the inverter, which converts the DC electricity generated by the panels into usable AC electricity for your home.

Grid Connection (for On-Grid Systems): If you’re installing an on-grid solar system, you’ll need to coordinate with your local utility or electricity provider to connect your solar system to the grid. This may involve installing a net metering arrangement to track electricity production and consumption.

Commissioning and Testing: After the solar system is installed and connected, it needs to be commissioned and tested to ensure that it is functioning correctly and safely. This may involve performing system checks, verifying electrical connections, and testing the performance of individual components.

Monitoring and Maintenance: Once your solar system is up and running, it’s essential to monitor its performance regularly and perform routine maintenance to ensure optimal operation. This may include cleaning the solar panels, inspecting electrical connections, and checking for any signs of damage or malfunction.

Conclusion — solar panels offer a promising solution to address energy needs in Delhi, India’s bustling capital. With its abundant sunlight and growing energy demands, Delhi benefits significantly from adopting solar power. Solar panels provide residents and businesses with a clean, renewable energy source that reduces reliance on fossil fuels, mitigates air pollution, and contributes to environmental sustainability. Despite initial upfront costs, the long-term financial savings, coupled with government incentives and rebates, make solar panel installations an attractive investment in Delhi.

#solar panel for home#solar panel price in delhi#ujjawalsolar#solar panel installation in delhi#solar system

0 notes

Text

Are you looking for self-learning course in S4 HANA Central Finance? We are providing this course with a doubt-clearing live session. Check course details: https://www.gauravconsulting.com/.../sap-central-finance...

What will you learn in this course: - Overview of SAP Central Finance in SAP S/4HANA - Project Execution for SAP Central Finance - SAP Central Finance Landscape Architecture - Basic Setup and Configuration - Initial Load and Real-time Replication - Error Handling - Corporate Finance Processes supported by SAP Central Finance - Run Phase - Validation and Reconciliation - Reporting (incl. Side Panel)

Contact us for more details: Website: www.gauravconsulting.com E-mail: [email protected] Call/ WhatsApp Us: +91 7499355564/ 9158397940

#CFIN#GLS#VikramFotani#GauravLearningSolutions#sapcfin#sapmm#sapsd#sapconsultant#ficoconsultant#mmconsultant#sapcentralfinance#CFINVideos

0 notes

Text

CentralFinanceHelp has information on the Initial Load procedure in Central Finance. Know the main processes in setting up SAP Central Finance, as well as how data is sent.

#Initial Load in Central Finance#SAP Central Finance#Central Finance#Central System#SAP ECC system#Central Finance HELP

0 notes

Text

Subsquid’s integration with Flare paves the way for greater innovation and collaboration in the blockchain ecosystem. Flare Network, an EVM smart contract platform, has announced its collaboration with Subsquid, a full-stack blockchain indexing solution to make historical data stored on the Flare blockchain readily available to developers utilizing the Subsquid network. Subsquid: A Game-Changer for Blockchain Data Access Subsquid is a full-stack blockchain indexing solution equipped with an open-source Software Development Kit (SDK), specialized data lakes designed for on-chain data, and a hosted service. Its mission is to empower developers to build Decentralized Finance (DeFi) based applications by granting them seamless access to a wealth of historical on-chain data via Subsquid’s distributed data lake. What sets Subsquid apart is its commitment to the principles of decentralization and accessibility. The platform operates as a repository for structured and unstructured data, currently housing data from over 5,000 projects. Impressive as this may be, Subsquid’s data lake processes a staggering 30 billion requests, aiming to become the largest decentralized data lake in the Web3 ecosystem. Central to Subsquid’s offering is its open-source SDK, which features a highly customizable ETL (Extract, Transform, Load) query stack. This stack is immensely beneficial for indexing blockchain events, transactions, and traces. Developers can use the SDK to build bespoke data pipelines and Application Programming Interfaces (APIs) that retrieve data from the Flare ecosystem. Another key advantage of the Subsquid SDK is its ability to make external API calls. This means that developers can aggregate data not only from Subsquid’s data lakes but also from Flare APIs, further expanding their access to valuable historical data. Hugo Philion, Co-Founder and CEO of Flare expressed his enthusiasm for Subsquid’s open-source approach, saying: “As we look to provide developers with the best possible tools, we have been very impressed with Subsquid’s commitment to an open-source approach and the speed of the indexing system they have built from the ground up.” Flare and Subsquid to Unlock the Potential of Decentralized Data Access Subsquid’s integration with Flare paves the way for greater innovation and collaboration in the blockchain ecosystem. By bringing Flare into its decentralized data lake, Subsquid now serves as a data provider in the ecosystem, facilitating rapid and permissionless data retrieval for developers without the need for an archive node. A senior executive from Subsquid expressed excitement about this collaboration, stating, “We are thrilled to bring Flare into our decentralized data lake, serving as a data provider in the ecosystem and enabling developers to rapidly and permissionlessly retrieve data from the network without having to use an archive node.” Both parties express their anticipation for multiple developer engagement initiatives, highlighting their shared commitment to driving innovation and accessibility in the blockchain space. As they collaborate and continue to enhance data accessibility, users can expect to see a flourishing ecosystem of dApps and solutions that leverage the power of historical data for the benefit of all. The future of blockchain development has just become even more promising. Thank you! You have successfully joined our subscriber list.

0 notes

Text

Empowering Indian Digital Lenders: The Role of Data Engineering in Fintech

The financial services industry is experiencing a whirlwind of transformation, and nowhere is this more evident than in India's Banking and Non-Banking Financial Companies (NBFCs). At the heart of this profound shift lies the intersection of finance and technology, commonly referred to as Fintech. And what underpins this fintech revolution? It's none other than the field of data engineering.

Why Data Engineering?

Data engineering, in essence, is the discipline dedicated to designing, constructing, and maintaining the architecture that enables the effective collection, storage, processing, and utilization of data. In an era where data has risen to prominence as the "new oil," the role of data engineering in facilitating data-driven decision-making, ensuring regulatory compliance, and enhancing the customer experience has never been more critical for all players in India's Fintech landscape.

The Foundation of Fintech: Building a Resilient Data Architecture

The initial step toward harnessing the potential of data involves the establishment of a robust data architecture. This architecture encompasses essential elements such as data pipelines, ETL (Extract, Transform, Load) processes, and data warehousing. An efficient data pipeline ensures that data flows seamlessly from diverse sources to a centralized data warehouse, where it undergoes cleaning, organization, and preparation for analysis.

Within the fintech realm, data flows in from a multitude of sources, including customer interactions, transactions, social media, and more. By implementing scalable cloud-based solutions like AWS Redshift, Google BigQuery, or Azure Data Lake, Fintechs can efficiently manage the staggering volume of data, extracting real-time insights that drive strategic decisions.

Data Governance and Compliance

Data governance serves as the second pillar of a robust data engineering strategy. It involves overseeing data availability, usability, integrity, and security within enterprise systems. In the context of India's Banks and NBFCs, which operate under strict regulatory guidelines set by the Reserve Bank of India (RBI), data governance assumes paramount importance.

Effective data governance necessitates the deployment of advanced data management solutions, such as Apache Atlas or Collibra, which ensure data lineage, quality, and metadata management. These tools empower Financial Institutions to meet RBI's regulatory compliance requirements, providing a comprehensive audit trail for every data point and safeguarding against potential risks and liabilities.

Enhancing Customer Experiences through Data Engineering

Finally, data engineering stands as the linchpin for optimizing customer experiences. Machine learning (ML) and Artificial Intelligence (AI) thrive on large volumes of high-quality data. By virtue of well-structured data engineering strategies, Fintechs can provide these algorithms with the right data, thereby enabling personalized customer interactions and services.

AI/ML applications extend across diverse areas, including customer segmentation, credit scoring, fraud detection, and targeted marketing. Data engineering paves the way for these advanced analytics capabilities, which directly impact the bottom line.

The Bottom Line: A Competitive Edge Through Data Engineering

In the fiercely competitive fintech landscape, those who harness data engineering effectively gain a strategic advantage. Enhanced decision-making, regulatory adherence, and elevated customer experiences contribute to expanded market presence, reduced costs, and heightened profitability.

While the technical intricacies of data engineering may appear formidable, its business implications are resoundingly clear and far-reaching. By strategically investing in data engineering capabilities, Financial Institutions can transition into fully data-driven entities. This becomes a pivotal differentiator in the next phase of the fintech revolution in India, laying the foundation for the future of financial services.

0 notes

Text

What is Adobe Commerce Intelligence?

In today’s rapidly evolving landscape, managing and harnessing the power of data has become increasingly challenging. As a business owner, you constantly seek data-driven strategies to tackle the complexities arising from vast amounts of information.

This is where Adobe Commerce Intelligence comes into play. By incorporating Adobe Commerce Business Intelligence, you can rapidly examine vital business data and make informed decisions with ease.

The ability to analyze data is vital in establishing a competitive edge. Retailers can leverage Adobe Commerce Intelligence to seamlessly integrate cloud-based data warehousing technology into their operations, effectively monitoring their business’s overall performance.

With Adobe Commerce Business Intelligence, you gain centralized access to all your essential business data in a single location.

If you require assistance with Magento 2 Integration, we are here to help!

Let’s delve into the details of incorporating Adobe Commerce Business Intelligence, exploring its features and the benefits it brings to your organization.

About Adobe Commerce Intelligence

Formerly recognized as Magento Business Intelligence, Adobe Commerce Intelligence is a cloud-based software platform designed for data management and analysis. It offers capabilities to consolidate and oversee multiple data sources, conduct data analysis, generate charts and reports, and ensure data consistency.

Adobe Commerce Intelligence, an integral part of Adobe Commerce, empowers businesses to extract valuable insights from diverse data streams. By leveraging factual data, businesses can make informed decisions and take appropriate actions based on that knowledge.

Business Intelligence: How Does It Work?

In the current era of business intelligence platforms like Adobe Commerce (formerly Magento), it is now achievable to consolidate all your business data into a single centralized location. This data is then stored and synchronized within a cloud-based warehouse, enabling the storage, synchronization, and analysis of all business information. This accumulated data can be thoroughly examined and utilized to drive profitable actions based on the insights gathered.

The process of Business Intelligence can be summarized as follows:

The initial step involves gathering and loading data into a data warehouse dedicated to analytics.

The data sets are then organized into well-structured analytics data models, ensuring they are prepared for analysis.

Skilled business intelligence analysts and relevant personnel within the organization can perform analytical queries on the data.

The results are compiled into cloud-based dashboards, graphs, tables, bubble charts, and reports.

This insightful data is then shared with team members and business executives, providing them with valuable insights to support strategic planning and decision-making.

In essence, the utilization of business intelligence enables businesses to harness the power of data, facilitating informed actions and driving organizational success.

Users of Adobe Commerce Intelligence

Adobe Commerce Intelligence software finds widespread usage across departments such as finance, sales, marketing, and operations. Its versatility allows for smooth integration into processes, enabling predictions and performance tracking across various industries. Moreover, eCommerce brands leverage business intelligence to monitor and analyze their performance effectively.

Key Features of Adobe Commerce Intelligence

The core focus of Adobe Commerce Intelligence is data inspection and monitoring. In addition, it offers a range of advanced features that help businesses generate a consistent stream of conversions.

Analysing Metrics

Metric Analysis in Adobe Commerce Intelligence serves as a fundamental feature. It enables businesses to evaluate various metrics such as conversion rate, product sales, average order value, customer lifetime value, and acquisition cost. By closely monitoring these metrics, businesses gain insights into the performance of their online commerce strategies, identify areas for improvement, and optimize their operations accordingly.

Enhance Visualization with Dynamic Scatter and Bubble Charts in Adobe Commerce Intelligence

Adobe Commerce Intelligence stands out with its remarkable ability to provide compelling business visualization through dynamic scatter and bubble charts. By incorporating a third dimension, these charts make reports more insightful. In addition to representing values a and b, it is possible to depict a third value, c, which corresponds to the size of the bubbles. Moreover, the bubbles can be enriched with additional attributes and their colors can be customized to create a more segmented appearance, enhancing the visual representation of data.

Monitoring Goals and Facilitating Rapid Decision-Making

With its user-friendly and adaptable dashboards, Adobe Commerce Intelligence ensures you are constantly informed about the state of your business. It efficiently collects data from all aspects of your operations and presents it in an appealing and comprehensible format.

Enhancing Operational Efficiency

Identifying the essential elements that contribute to the success of every transaction can be effortlessly and virtually automated. Streamlining and enhancing actions through Adobe Commerce Intelligence will be more straightforward and highly efficient.

A more effective internal communication system

The organization’s structural framework will be easily accessible to all members of your organization through a user-friendly interface. This system facilitates faster and smoother internal communication as managers and employees gain simultaneous access to information.

Data Editing Management

By utilizing Adobe Commerce Business Intelligence permission levels, you can effectively manage the security and control of your analytics systems. Once an administrator is assigned, you gain the ability to modify your store’s metrics, dashboards, reports, and data using the Admin tool. More Info: https://www.evrig.com/blog/what-is-adobe-commerce-intelligence/

#magento#magento 2#adobe commerce#adobe commerce intelligence#ecommerce#ecommerce business#EvrigSolutions

0 notes

Text

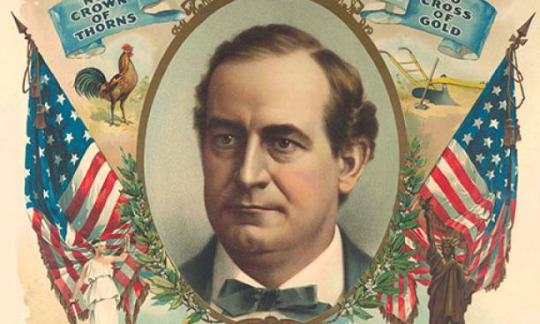

"From Bryan to Stalin,"by William Z. Foster

A Marxist analysis of William Jennings Bryan.

The Bryan Free Silver Campaign

While the workers were thus resisting American capitalism so militantly. the small farmers of the Middle West were also ta a high state of political discontent. They were suffering many hardships: their erstwhile free homestead lands had become loaded with mortgages, tenancy was rapidly on the increase among them, and they were heavily burdened with taxes and increasingly falling under the pressure of the rail- roads and various trusts which preyed upon them. To make their conditions unendurable came the great economic crisis of the nineties, which knocked the bottom out of agricultural prices.

There was also much discontent among the urban petty bourgeoisie, or small manufacturers, merchants, etc. They were feeling the crushing power of the growing trusts and monopolies. Already they had succeeded in having the Sherman Anti-Trust Law passed in 1890 in a vain attempt to stifle the growth of monopoly. Their cup of unrest was also filled to overflowing by the deep industrial crisis of this period.

It was upon this general background of discontent of the workers, farmers and city middle class that the Bryan Demo¬ cratic Party campaign of 1896 developed. It originated in the Populist Party of the farmers, and the farmers remained the backbone of the movement, although large numbers of workers and city middle class elements also participated in it.

The program of the Bryan movement showed that it was basically of a petty bourgeois character, a fruitless attempt to stem the swift advance of the trusts and finance capital and to maintain the traditional competitive system and civil liberties. Its central plank, the free coinage of silver at the rate of sixteen ounces of silver to one of gold, was an inflationary scheme of the farmers to rid themselves of their increasing debts by creating cheap money, an illusion that still prevails among them. Other planks of Bryan called for government owner¬ ship of the railroads and telegraphs, abolition of the national

banks, tariff for revenue only, graduated income tax, postal savings bank, government loans on real estate, popular elec¬ tion of U. S. Senators, initiative and referendum, Australian ballot system, one term for the President, eight hours for government employees, abolition of detective agencies, re¬ striction of immigration, abolition of injunctions in labor disputes. But the center of the whole movement was "free silver,” the rest of the program being largely ignored in the election agitation.