#Indirect taxation in India

Text

Demystifying Indirect Taxation in India: Expert Insights from Neeraj Bhagat & Co.

n the complex and ever-changing landscape of Indian taxation, navigating the intricacies of indirect taxation requires expertise, insight, and a deep understanding of regulatory frameworks. As a leading accounting and advisory firm, Neeraj Bhagat & Co. is committed to providing clients with comprehensive guidance and strategic solutions to effectively manage their indirect tax obligations in India.

Here's a closer look at the nuances of indirect taxation in India and how Neeraj Bhagat & Co. can help businesses navigate this challenging terrain:

Understanding Indirect Taxation in India:

Indirect taxation in India encompasses a wide range of taxes levied on goods and services at various stages of production, distribution, and consumption. Some of the key components of indirect taxation in India include:

Goods and Services Tax (GST): Introduced in 2017, GST is a comprehensive indirect tax levied on the supply of goods and services across India. It replaced a multitude of indirect taxes, including central excise duty, service tax, and value-added tax (VAT), bringing about significant reforms in the Indian tax landscape. GST is governed by a dual structure, with both the central and state governments having the authority to levy and administer GST on intra-state and inter-state supplies.

Customs Duties: Customs duties are levied on the import and export of goods into and out of India. These duties include basic customs duty, additional customs duty (countervailing duty), and special additional duty. Customs duties play a crucial role in regulating trade, protecting domestic industries, and generating revenue for the government.

Excise Duties: Excise duties are indirect taxes levied on the manufacture or production of goods in India. These duties are imposed at the point of manufacture and are typically included in the price of the goods. Excise duties are levied by the central government and are an important source of revenue for the exchequer.

How Neeraj Bhagat & Co. Can Help:

Compliance Management: Neeraj Bhagat & Co. provides end-to-end compliance management services to help businesses meet their indirect tax obligations in India. Our team assists clients with GST registration, filing of returns, reconciliation of credits, and compliance with customs and excise duty regulations.

Advisory Services: Our experts offer strategic advisory services to help businesses optimize their indirect tax strategy, minimize tax liabilities, and ensure compliance with regulatory requirements. We provide insights into the latest developments in Indirect taxation in India, including changes in GST rates, exemptions, and compliance procedures.

Representation and Advocacy: Neeraj Bhagat & Co. represents clients before tax authorities and appellate forums, helping them navigate disputes, audits, and assessments related to Indirect taxation in India. Our team advocates on behalf of clients to ensure fair treatment and resolution of tax issues.

4.Technology Solutions: We leverage technology-driven solutions to streamline tax compliance processes, enhance accuracy, and improve efficiency. Our advanced software tools and platforms enable clients to manage their indirect tax obligations more effectively, reducing manual errors and ensuring timely compliance.

Training and Education: Neeraj Bhagat & Co. offers training and education programs to help clients understand the intricacies of Indirect taxation in India. Our workshops and seminars cover topics such as GST compliance, customs and excise duties, and recent developments in indirect tax laws.

Conclusion:

Navigating indirect taxation in India requires a deep understanding of regulatory requirements, compliance procedures, and strategic considerations. With Neeraj Bhagat & Co. as your trusted partner, you can gain access to expert guidance, insights, and solutions to effectively manage your indirect tax obligations and achieve your business objectives with confidence.

Contact us today to learn more about our Indirect taxation in India services and how we can help your business thrive in the complex Indian tax landscape.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#nonprofits#quotes#photography#Indirect taxation in India

1 note

·

View note

Text

2024 Book Review #39 – Inglorious Empire: What the British Did To India by Shashi Tharoor

I honestly forget who first recommended this book to me – quite possible I just googled ‘good indian history books’ and found it that way? - but it’s been on my TBR list for functionally forever at this point. Which meant I went into it essentially blind, with no memory of what if any details I’d been given with the recommendation. Which meant I had a moderately disappointing reading experience just because I was hoping for a narrative history and not an explicit polemical/persuasive text. Still, taken on its own merits as one of those, it’s really quite a good one.

The book is an adaptation and expansion of a performance the author gave at an Oxford debate (arguing against the notion that the British Empire was a good thing) which was recorded and went viral enough to make it a commercially viable prospect. The origin story shines through in the form – aside from an introduction and conclusion, each chapter is a clear and specific argument against some specific justification offered for the British conquest and colonization of India, full to bursting with statistics and quotations buttressing every point.

I would very much like to say that most of it is devoted to stuff the average reader will know anyway (if illustrated with clear and affecting examples), but, going by the apparent public response to the original debate and some polling cited in the conclusion, apparently not! The YouGov polls about the English public’s knowledge and opinion of the Empire are bleak enough that yeah this probably is a direly needed work of public education, if mostly for people who will not at any point read it.

Still, the fact that the British Raj was explicitly and institutionally racist and reserved functionally all positions of real power and authority for white men shouldn’t be much of a surprise, nor the fact that the ‘rule of law’ was basically a sick joke as far as crimes across the colour line went, nor the fact that the extraction of wealth from India to make fortunes in Britain was the explicit goal of policy, nor the fact that resistance (especially resistance successful enough to spook the authorities) was responded to with utter and excessive brutality. All that is basically the meat of what having been a colony means.

That said, I was taken a bit aback by the sheer rapaciousness of early Company government – it’s one thing to hear about oppressive taxation, another to get quoted the census figures of how they were so extreme that enough peasants fleeing their land and homes to look for greener pastures to show up as overall population decline in the areas under HEIC control. Similarly, my understanding of how India was turned into a captive market for British goods was much more subtle and indirect than the outright smashing of looms and legal prohibition of any attempts to compete with British industries that were actually used.

Whereas I did know about the deadly famines that kept occurring throughout the Raj, but the sheer cartoonish malevolence of colonial authorities when faced with them always manages to shock me a bit. ‘Nature’s solution to overpopulation’ was a really horrifyingly opinion at the time.

The audience of the debate performance the book’s based on definitely shines through in the choice of sources – wherever possible, Tharoor quotes from or cites western (Anglo-American, generally) sources for his eye-witness accounts and always takes care to introduce and ground them in terms of western governments or academia. The quotes themselves are all helpful illustrations, though there’s probably slightly more than are really strictly necessary – I’m pretty sure by wordcount at least a chapter of the book was actually written by Will Durant.

I’m not sure if it’s because of the original format or just how Tharoor writes, but the book also just has a great love of adjectives. Seemingly every source referenced is ‘historic’ or ‘path-breaking’ unless it is merely ‘compendious’ or outright ‘invidious’. Not a bad thing, but once I noticed it I was totally unable to stop doing so.

The book is straightforward polemic and Tharoor makes no bones about his position, so I take his verging-on-idyllic descriptions of pre-colonial Indian governance (especially regarding land tenure and caste) and the probability that India would have unified into a modern nation state without colonialism a dose pour of salt. There’s a few other inaccuracies I noticed (referring to the East India Company’s theft of Chinese tea plans as the ‘birth of agricultural espionage), for example), but it was all in the realm of little asides or colourful anecdotes rather than anything load-bearing.

It is rather funny that the book repeatedly draws comparisons with French colonies to argue that India was worst off, on the grounds that Paris at least made gestures towards integrating Indochina or Algeria and their peoples into France (however inadequate and hypocritical those efforts were), whereas in India the maintenance of total domination and the clear policy that India and Indians were things to be exploited for the benefit of England never changed. Funny, because from the book of Vietnamese history I read a few months ago the perspective of nationalists in Indochina was quite the reverse, seeing the English as at least somewhat honest brokers who were willing to grant some level of (limited and inadequate) self-government, compared to the French. Grass is always greener, I guess.

Though that does get at Tharoor’s argument as to why the British were worse not just in degree but in kind to the Mughals and any other empire-builders from outside South Asia who had come before them. The Mughals became Indian, both in the simple material sense that all their taxes didn’t end up back in Samarkand and Indian merchants were intentionally ruined for the benefit of traditional central asia trade routes, and in the more cultural sense that the ruling class set down roots and intermarried with their subjects rather than establishing a cloistered ruling class. Instead, the Raj was more akin to Tamerlane’s sack of Delhi, extended across 200 years. (One gets the sense Tharoor thinks a permanent settler population moving into stolen palaces would have been preferable to the rotation of soldiers and officials arriving from the metropole for long enough to get rich before heading back to build mansions in the Home Counties.)

Also, speaking of Vietnamese history, I only have a sample size of two but it’s interesting how in both cases a class of liberal (in the western sense) intellectuals and bourgeois emerged who tried to take the colonial propaganda at its word and enter some sustainable partnership with the imperial power – and in both cases got at best ignored and at worst imprisoned, tortured and executed for their trouble.

Anyways, interesting read, if one that makes me want something more specific and rigorous about basically any specific section of it (though, not to jump up and yell ‘Canada Mentioned!’ but every time Trudeau was used as an example of a colonial power’s leader handling the apologizing and acknowledging stuff gracefully and well I had to really try not to laugh).

39 notes

·

View notes

Note

Would you put Louis XIV as overrated?

Oof, that's a tough one.

It's particularly hard to answer because the reign of the Sun King also saw the tenure of some of the most influential chief ministers in French history: Mazarin, and Colbert.

While perhaps not quite as famous as a certain cardinal whose schemes kept getting foiled by the Three Musketeers, these guys were world-historically important.

Mazarin was Richelieu's political heir, and brought his predecessor's policy of using the Thirty Years War as a way to break the back of Hapsburg dominance to a successful conclusion. The Peace of Westphalia not only served as the foundation for modern international relations, but also expanded France's position in Alsace and the Rhineland - especially when Mazarin pulled off an anti-Hapsburg alliance with the new League of the Rhine.

At the same time that France was winning the Franco-Spanish War, which won them a big chunk of territory in the Low Countries around Artois, Luxembourg, and parts of Flanders, and all of the territory north of the Pyrenees Mountains including French Catalonia. It also got Louis XIV the hand of Maria Teresa, which would eventually create the catalyst for the War of Spanish Succession and the War of Austrian Succession...

And while Mazarin was doing all of this, he was also busy crushing the Fronde uprising led by le Grand Condé, which he eventually accomplished in 1653, and creating a formidble system of centralized royal government through the intendants that ended the power of the feudal nobility.

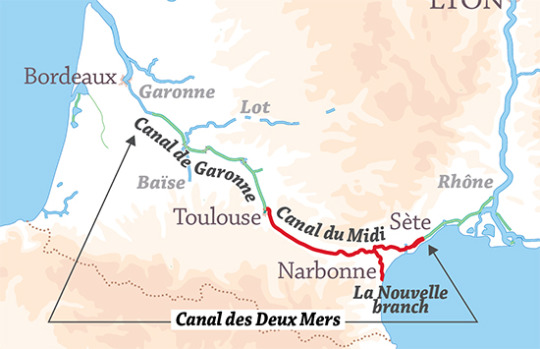

As for Colbert, he was the guy who figured out how to pay for all of this. The single biggest reason why economists need to shut the fuck up when they talk about mercantilism, Colbert was the financial and economic genius of his age. Remember all those canals I'm so crazy about? Colbert built them. Specifically, he was responsible for the Canal des Deux Mers, transforming France's economy by linking the Mediterranean to the Atlantic.

He also turbo-charged France's economic development by restructing public debt to reduce interest payments and cracking down on tax farmers, reforming (although not ultimately solving) the taxation system of the Ancien Régime by using indirect taxes to get around tax evasion by the First and Second Estate, equalizing (but not ending) internal customs duties, and putting the power of the state into supporting French commerce and manufacturing. This included significant tariffs to support domestic producers, direct public investments into lace and silk manufacturing, and the creation of joint-stock corporations like the French East India Company. (This also meant Colbert's direct promotion of the slave trade and the Code Noir in order to generate hugely profitable investments in Haitian sugar and tobacco plantations for import into France and the rest of Europe.)

This makes it a little difficult to separate out what credit belongs to these guys versus the guy who hired them. What I can say is that Louis was directly responsible for Versailles, but also for the revocation of the Edict of Nantes.

#history#historical analysis#cardinal richelieu#cardinal mazarin#jean baptise colbert#louis xiv#versailles#french history#early modern history#economic development#mercantilism#political economy#early modern state-building#early modern period#early modern europe

42 notes

·

View notes

Text

Introduction🌿

Hello Community! You can call me Ashi.

(Pronounced as "Aa-Shi")

Occupation:

Finance Intern/Industrial Trainee.

Hybrid work structure, remotely and on site (3:2 weekdays).

(Not mentioning the name of the firm to maintain the confidentiality of my organization's clients and abide by the ethics of my professional governing bodies)

Academic Journey:

Currently pursuing ACCA with a focus on Financial Reporting and Audit and Assurance.

Also, preparing for the CA Final, due in November 2026.

Graduated BCom and pursuing BSc in Applied Accounting and Finance from Oxford University as my second and international undergraduate program—weekend classes, online—Faculty of Eastern Studies (starting October 2024).

Global prize winner for all three ACCA knowledge level exams.

Qualified CA Inter in November 2023.

About Me:

INFJ, 22-Year-Old - Born in May 2002

Languages: English, Hindi.

Place: India

Interests: Reading, writing, philosophy, and aspiring content creation in the future.

Hobbies and Personal Pursuits:

Though currently focused on my academic goals, I have a passion for philosophy and literature, particularly the works of Nietzsche, Kafka, and Marcus Aurelius, as well as Eastern philosophies like Advaita, Taoism, and the Bhagavad Gita. These are my best friends for solitude.

I see myself as a poet and writer at heart, though I rarely write anymore due to my academic and professional commitments.

Whenever I get time, I love to read about human motivation, drive, and desires, essentially human behavior and motivation science.

One can say, I'm inclined towards understanding myself and the world, through the Lense of data and experiment driven studies.

Basic Inclination:

I have a great inclination towards thinking and seeing things from different perspectives. I think and think and think a lot. If I could ask for anything, it would be a room full of books where I can read endlessly, without thinking about the corporate ladder. Thanks to capitalism for making me a finance bro. :D

Future Goals:

Current Pursuits: While my immediate goals include becoming a Chartered Accountant affiliated with two different accounting bodies, ACCA and ICAI, and advancing in the accounting & finance domain, I aspire to explore teaching and educational content creation in the future.

Short-Term Goals: Passing my exams. 😄

Aspiration: Interested in teaching and content creation, mainly educational and philosophical; aspire to pursue these someday. I also hope to engage in social commentary on life, politics, policies, psychology, etc., as a part-time hobby.

Perspective on Goals: I believe that as we move forward in life, our plans evolve with the new data we acquire. I strive to learn everything I can without deeply identifying with any materialistic profession or possession.

Subjects I'm Dealing with in the ACCA Coursework:

Knowledge Level:

Business and Technology (BT) - 100/100

Management Accounting (MA) - 98/100

Financial Accounting (FA) - 97/100

Skills Level (Yet to Appear):

Corporate and Business Law (LW)

Performance Management (PM)

Taxation (TX)

Financial Reporting (FR) - (IFRS, IAS, and GAP)

Audit and Assurance (AA)

Financial Management (FM)

Strategic Professional Level (Yet to Appear):

Strategic Business Leader (SBL)

Strategic Business Reporting (SBR)

Options - 2 of these: (yet to decide).

Advanced Financial Management (AFM)

Advanced Performance Management (APM)

Advanced Taxation (ATX)

Advanced Audit and Assurance (AAA)

Subjects I'm Dealing with in My Undergraduate Coursework:

Financial Accounting

Management Accounting

Corporate Finance

Business Law

Economics

Quantitative Methods

Financial Markets and Institutions

Auditing and Assurance

Taxation

Business Ethics and Corporate Governance

Subjects I'm Dealing with in My CA Final Coursework:

Financial Reporting (IND-AS)

Advanced Financial Management

Advanced Auditing and Assurance, and Professional Ethics

Direct Tax Laws & International Taxation (UK Tax)

Indirect Tax Laws

Customs and Foreign Trade Policy

Integrated Business Solutions (Multi-Disciplinary Case Study with Strategic Management)

Why Studyblr?

Studying remotely, working remotely, and visiting the office twice a week is an isolated journey. I want to ensure I’m seeing my progress visually and can get feedback on my performance. This often builds self-efficacy because learning takes a tangible form.

What You’ll Find Here:

A mix of my raw thoughts, reflections, and study progress.

Daily check-ins on productivity. I often record my study hours and focused office hours where I’m working on some projects together because what I learn at work often helps me in my academic journey.

Insights into my academic journey and personal growth.

Occasional musings on philosophical ideas and life’s reflections.

I don't promote perfect schedules and manufactured productivity as humans are prone to make errors, and imperfection is a part of life.

Philosophy:

Inspired by the concept of Vairagya, I believe in taking actions that satisfy the soul rather than just the senses. Everything comes with a sense of duty and not for personal pursuits, as personal pursuits often gives rise to ego, attachment, and fears.

Connect:

Feel free to join me on this journey. Let’s learn and grow together!

PS: Let’s keep moving on the journey.

Last updated - 30/07/24

#introduction#intro post#know me#studygram#accounting studyblr#yeolpumta#study accountability#studyblr#student#studyhub#infj#accounting major#finance major#introductory post#introducing myself#acca#study#student life#accounting#finance#finance bro#hey#forest app#franz kafka#philosophy#student for life#life

5 notes

·

View notes

Text

Simplify Your Business with GST Registration Services in Delhi by SC Bhagat & Co.

Introduction:

Navigating the complexities of GST registration can be daunting for businesses. Whether you’re a startup or an established enterprise, having a reliable partner to guide you through the process is essential. SC Bhagat & Co. offers top-notch GST registration services in Delhi, ensuring that your business remains compliant with the latest tax regulations. In this blog, we will explore the importance of GST registration, the services provided by SC Bhagat & Co., and why you should choose us for your GST needs.

Why is GST Registration Important?

GST (Goods and Services Tax) is a comprehensive tax levied on the supply of goods and services in India. It has replaced various indirect taxes, creating a unified tax structure. Here’s why GST registration is crucial for your business:

Legal Compliance

GST registration is mandatory for businesses with an annual turnover exceeding the specified threshold. Non-compliance can result in hefty penalties and legal issues. Ensuring that your business is GST-registered keeps you on the right side of the law.

Input Tax Credit

One of the significant advantages of GST is the ability to claim input tax credit on purchases. This reduces the overall tax burden and enhances the profitability of your business.

Competitive Advantage

Being GST-compliant enhances your business's credibility. It reassures your clients and partners that you adhere to regulatory requirements, giving you a competitive edge in the market.

GST Registration Services by SC Bhagat & Co.

At SC Bhagat & Co., we understand the intricacies of GST registration and offer a range of services to simplify the process for you. Here’s how we can help:

Expert Consultation

Our team of experienced professionals provides expert consultation to help you understand the GST registration process. We assess your business needs and guide you on the best course of action.

Documentation Assistance

GST registration involves submitting various documents, including PAN, proof of business registration, identity, and address proof of promoters, and bank account details. We assist you in preparing and submitting all necessary documents accurately.

Registration Process

We handle the entire registration process on your behalf. From filling out the application to obtaining the GSTIN (Goods and Services Tax Identification Number), our team ensures a hassle-free experience.

Post-Registration Support

Our services don’t end with registration. We provide ongoing support to help you comply with GST regulations, file returns, and manage any issues that may arise.

Why Choose SC Bhagat & Co.?

Experienced Professionals

With years of experience in the field of taxation, our team at SC Bhagat & Co. is well-versed in GST laws and procedures. We ensure that your registration process is smooth and efficient.

Personalized Service

We understand that each business is unique. Our personalized approach ensures that we cater to your specific requirements, providing customized solutions that best fit your business needs.

Hassle-Free Process

We take the stress out of GST registration by handling all aspects of the process. Our streamlined procedures ensure that your registration is completed without any delays or complications.

Client-Centric Approach

At SC Bhagat & Co., client satisfaction is our top priority. We are dedicated to providing high-quality services that meet your expectations and help your business thrive.

Conclusion

GST registration is a critical step for any business operating in India. With SC Bhagat & Co., you can simplify this process and ensure compliance with ease. Our expert team, personalized services, and client-centric approach make us the ideal partner for your GST registration needs in Delhi. Contact us today to learn more about our services and take the first step towards hassle-free GST compliance.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances#beauty#actors

2 notes

·

View notes

Text

Demystifying the Process of GST Registration

Navigating the world of taxation can often feel like traversing a labyrinth, especially for business owners. However, understanding and complying with the Goods and Services Tax (GST) registration process is crucial for businesses operating in India. In this guide, we'll unravel the complexities surrounding GST registration, making it easy to grasp and implement for your business needs.

1. Introduction to GST Registration

Before we delve into the intricacies of the registration process, let's grasp the fundamentals of GST registration. GST, introduced in India in 2017, aims to streamline the taxation system by amalgamating various indirect taxes. GST registration is the process by which businesses register themselves under this unified tax regime.

2. Importance of GST Registration

2.1 Compliance with Tax Laws

First and foremost, GST registration is a legal requirement for businesses whose turnover exceeds the prescribed threshold. By registering for GST, businesses ensure compliance with tax laws, avoiding penalties and legal consequences.

2.2 Access to Input Tax Credit

One of the significant benefits of GST registration is the ability to claim Input Tax Credit (ITC). Registered businesses can offset the taxes paid on inputs against the taxes collected on outputs, reducing their overall tax liability.

2.3 Legitimacy in Business Operations

GST registration lends credibility and legitimacy to business operations. It provides a unique identification number, known as the GSTIN, which is essential for conducting business transactions seamlessly.

3. Understanding the GST Registration Process

3.1 Eligibility Criteria

Before initiating the registration process, businesses must determine their eligibility for GST registration. Generally, businesses with an annual turnover exceeding the prescribed threshold are required to register for GST.

3.2 Documentation Required

To complete the GST registration process, businesses need to provide certain documents and information, including PAN card, Aadhaar card, proof of business ownership, bank account details, and address proof.

3.3 Step-by-Step Registration Procedure

The registration process involves several steps, including online application submission, verification of documents, and issuance of the GSTIN. Businesses can register for GST through the GST portal by following a simple and user-friendly registration interface.

4. Conclusion

In conclusion, GST registration is a critical aspect of tax compliance for businesses operating in India. By understanding the importance and intricacies of the registration process, businesses can ensure legal compliance, access input tax credit, and foster legitimacy in their business operations.

Follow Our FB Page: https://www.facebook.com/bizadviseconsultancy/

2 notes

·

View notes

Text

Indirect Tax CA Final Classes: Step-by-Step Guide toward Success

Indirect tax is one of the many topics that students have to handle since the Chartered Accountancy final examination is one of the most stringent professional examinations held in India. Mastering this subject is quite essential for a bright career in finance, taxation, and accounting. Given this, various institutes and educators offer special indirect tax CA final classes to the students for adequate knowledge and strategies regarding this testing subject.

#indirecttaxCAfinalclasses#CAinteraccountsclasses#CAinteraccountsfasttrackclasses#CAinterdirecttax#CAinterauditfasttrack

0 notes

Text

Comprehensive Business Solutions by DMC Global LLP

In today’s dynamic business environment, companies are continually seeking reliable partners to manage their financial and regulatory needs. One such trusted partner is DMC Global LLP, a leading CPA firm in India that offers a wide range of professional services tailored to the unique requirements of its clients. Whether you're a small business, a growing enterprise, or a multinational company, DMC Global LLP provides expert solutions across diverse financial and business sectors.

1. Accounting Services

Efficient and accurate accounting is the backbone of any business. At DMC Global LLP, the focus is on providing comprehensive Accounting Services that ensure transparency, accuracy, and compliance. From day-to-day bookkeeping to complex financial statements, the firm uses cutting-edge technology and skilled professionals to streamline your accounting processes, helping you make informed financial decisions.

2. Audit and Assurance Services

Audits are crucial to maintaining the credibility of a company’s financial health. DMC Global LLP’s Audit and Assurance Services ensure that your financial records are precise and meet all regulatory requirements. Their audit processes are designed to provide insights into your business, helping you identify areas for improvement, minimize risks, and ensure compliance with the latest accounting standards.

3. Taxation Services

Navigating the intricate tax laws in India can be challenging. DMC Global LLP offers comprehensive Taxation Services, covering everything from income tax, indirect taxes, and GST compliance to international taxation and transfer pricing. With their expert team, you can rest assured that your tax strategies are optimized, compliant, and aligned with the latest regulations, helping you reduce tax liabilities and avoid penalties.

4. BPO Services

Business Process Outsourcing (BPO) is a critical component for companies looking to streamline operations and reduce costs. DMC Global LLP provides top-notch BPO Services, including finance and accounting outsourcing, payroll processing, and transaction processing. By outsourcing these functions to a trusted partner, businesses can focus on their core activities, boost efficiency, and improve their bottom line.

5. Specialist Services

Every business has unique needs, and DMC Global LLP’s Specialist Services are tailored to address specific challenges faced by your organization. Whether it’s forensic accounting, due diligence, or corporate restructuring, their team of professionals brings in-depth knowledge and expertise to provide bespoke solutions. They help businesses navigate complex issues, ensuring sustainable growth and profitability.

Conclusion

DMC Global LLP stands out as a one-stop solution for all your accounting, auditing, taxation, BPO, and specialized business needs. With a commitment to excellence and a client-centric approach, they continue to be a trusted partner for businesses across industries in India. Let DMC Global LLP take care of your financial and regulatory needs so that you can focus on growing your business.

0 notes

Text

GST Software in India: Your Essential Tool for Seamless Tax Compliance

The Goods and Services Tax (GST) revolutionized India's indirect tax landscape, creating a unified system for goods and services. While it simplifies taxation overall, navigating the intricacies of GST compliance can be challenging for businesses of all sizes.

https://friichat.com/read-blog/31245

0 notes

Text

Online GST Filing Services: Simple Guide

One of the very basic requirements for efficiently running businesses in today's fast-paced business world is taxation management, particularly on GST. Many small and medium-sized businesses find these latest GST compliances rather complicated and hence seek Online GST Filing Services to simplify things for them. The online GST filing services are hassle-free and efficient, and the demand for the same is prevalent in Kolkata. All of this technicality can be understood with the help of GST course in Kolkata for preparing less error-prone returns.

What is GST and Why Is It Important?

The reform has made tax collection far more transparent and improved compliance, having the biggest tax reform in India amalgamate a number of indirect taxes into one. For commercial entities, making it compliant under GST is legally binding and also stable financial record requirements. For most small-scale business owners, though, GST filing could be yet another crucial hassle. That is where easy and user-friendly Online GST Filing Services come in the picture.

What Are Online GST Filing Services?

Online GST Filing Services enable e-filing of GST returns. Major features include the following:

Automated Return Filing: The service gathers financial data, computes GST liability, and files the return to the government.

Real-Time Alerts: Reminder of the deadline of filing so that penalties could be sidestepped.

Error Detection: Apprise you of errors in the data while filing so you can correct them appropriately.

Data Security: Your bank account information is kept safe as data protection policies are rigorous.

Expert Support: There are available tax experts who can support you in case of any complexity in GST questions and rules.

Benefits of Filing GST Return E-Filing Using Online GST Filing Services

Convenience: You can file from the comfort of your corner with a computer or mobile device, saving all your precious time.

Cost-Effective: This service is more cost-effective than hiring an in-house tax professional, especially for small business concerns.

Accuracy: Automation reduces human error, thereby penalty chances reduce

Financial Knowledge: Those that provide you with proper awareness about your GST liabilities in addition to cash inflow helps an individual make suitable financial decisions

Proper Documentation: These services have assisted you in organizing all your financial records within proper guidelines while ensuring tax regulations.

Choosing an Online GST Filing Service in Kolkata

The following factors must be taken into consideration when one decides to choose an online GST filing service in Kolkata.

Easy-to-use Interface: Ensure that the service has a simple and easy user interface.

Efficient Customer Support: Ensure that there is reliable customer support that answers all your questions.

Linking to Accounting Software: The service should connect easily to all leading accounting software, such as Tally or QuickBooks.

Reputation: Always check review and testimonial for its reliability.

Most Popular Online GST Filings of Kolkata

There are various reliable online GST filing services available in Kolkata, which have been created to meet the specific needs of local businesses.

Importance of Taxation and Accounting Courses on GST Filing

Although it is very crucial to know what GST is, there is equally importance of understanding the root in taxation and accounting. A Taxation course in Kolkata or an accounting Course in Kolkata will equip professionals with adequate knowledge about financial tasks, including GST filing as well as a better understanding of tax laws, compliance procedures, and accounting principles.

Benefit of tax and accounting courses

Deep knowledge- learn about the tax laws, compliance, and filing.

High demand- GST and tax experts are always in demand, and thus the skills you gain from these courses will make you a very valuable candidate in the job market.

Networking opportunities: You get to meet industry experts and connect with other professionals within the field.

Conclusion

The online GST filing services save time, provide accuracy, and manage financial data securely. Utilizing such services may make a lot of difference for businesses, more particularly in a busy city like Kolkata. Furthermore, taking a course in taxation or accounting can also be of great help for professionals to master GST filing and develop their overall skill of financial management.

0 notes

Text

How to Choose the Best Chartered Accountant in Karnal for Personal and Corporate Tax Solutions

Selecting the right chartered accountant (CA) is a critical decision for both individuals and businesses.

Whether you're a salaried professional seeking tax advice or a business owner needing corporate tax solutions, a knowledgeable and experienced CA can help you navigate the complexities of India's tax laws and financial regulations.

For residents and business owners in Karnal, finding the best CA is essential for effective tax planning, financial management, and compliance with legal requirements.

In this guide, we’ll discuss how to choose the best CA in Karnal to meet your personal and corporate tax needs, what qualities to look for, and how the right CA can provide solutions that maximize savings and ensure compliance.

Why You Need a CA in Karnal for Tax Solutions

A chartered accountant offers more than just tax filing services. A skilled CA in Karnal can provide:

Personal Tax Planning: They help individuals optimize their tax filings by identifying deductions, exemptions, and rebates to reduce tax liabilities legally.

Corporate Tax Management: For businesses, a CA ensures accurate corporate tax filings and advises on strategies to reduce tax burdens while complying with all laws.

GST and Indirect Taxes: CAs in Karnal also assist with Goods and Services Tax (GST) filings, compliance, and audits, ensuring that your business remains on the right side of the law.

Audit Services: Whether it’s statutory, internal, or compliance audits, a CA can ensure that your financial records are accurate and in accordance with regulatory requirements.

Financial Advice and Wealth Management: Beyond taxes, CAs provide financial guidance, helping individuals and businesses make sound investment decisions and manage their finances efficiently.

With these critical services, choosing the right CA in Karnal becomes essential for your financial success.

Key Qualities to Look for in a Chartered Accountant in Karnal

When selecting a CA in Karnal for personal or corporate tax solutions, there are several key factors to consider.

These qualities will help ensure that the CA you choose can meet your specific financial needs and provide excellent service.

1. Qualifications and Certifications

The first thing to check when selecting a CA is their qualifications. Ensure that the chartered accountant is certified by the Institute of Chartered Accountants of India (ICAI), which guarantees that they have met all the necessary educational and professional standards.

Additionally, look for any specialized certifications or training that indicate expertise in specific areas, such as GST, international taxation, or corporate finance.

2. Experience and Industry Knowledge

Experience is one of the most important factors when choosing a CA. An experienced CA in Karnal will have a thorough understanding of local tax laws and regulations, as well as knowledge of different industries.

A CA who has worked with a diverse client base, including individuals, small businesses, and large corporations, will be well-equipped to handle your unique tax and financial challenges.

For corporate tax solutions, look for a CA who has experience with businesses of a similar size and industry as yours. They will be familiar with sector-specific tax strategies, regulatory requirements, and best practices, ensuring you receive tailored advice that suits your business model.

3. Reputation and Client Reviews

A CA's reputation is a good indicator of their professionalism and quality of service. Look for reviews, testimonials, and word-of-mouth recommendations from current or former clients.

The best CAs in Karnal will have a track record of delivering timely, accurate, and reliable tax solutions. You can also ask for references from other local business owners or individuals who have used their services.

4. Proactive and Problem-Solving Approach

The ideal CA is not just reactive; they are proactive in providing financial solutions. A CA in Karnal should keep up with changes in tax laws and inform you of any updates that may impact your financial situation. They should offer creative and strategic solutions to help reduce your tax burden, plan for the future, and prevent financial problems before they arise.

A proactive approach is especially important for businesses that require year-round tax planning and compliance.

Your CA should regularly communicate any opportunities for tax savings, identify potential risks, and help you stay compliant with evolving regulations.

5. Communication Skills and Transparency

Clear and effective communication is essential when working with a CA. Financial jargon and complex tax laws can be confusing, so you want a CA who can explain things in a way that’s easy to understand.

They should be transparent about their processes, fees, and timelines, ensuring that there are no hidden surprises. Regular updates and open channels of communication will give you peace of mind, knowing that your tax matters are being handled professionally.

6. Technological Expertise

In 2024, a modern CA needs to be well-versed in using accounting software, cloud-based systems, and other technological tools. Technology can help streamline financial processes, improve accuracy, and ensure timely filings.

Make sure the CA you choose uses the latest tools and platforms to enhance their services. This is particularly important for corporate clients who deal with large volumes of financial data.

7. Cost-Effectiveness

While it’s important to hire a CA with the right expertise, you also want to ensure their services are cost-effective. Legalari Compare the fees of different CAs in Karnal and see what services are included.

The best CA should offer value for money, providing a comprehensive range of services without overcharging.

How a CA in Karnal Can Help with Corporate and Personal Tax Solutions

The right CA in Karnal can offer invaluable support for both individuals and businesses. Here’s how:

For Individuals:

Income Tax Filing: Ensure accurate filing and take advantage of all available deductions and exemptions.

Wealth Management: Assist with investment planning, retirement strategies, and estate management to maximize long-term financial growth.

Tax Planning: Develop strategies that minimize your tax liability while staying fully compliant with the law.

For Businesses:

Corporate Tax Compliance: Handle all corporate tax filings, ensuring compliance with local, state, and national tax regulations.

GST Compliance: Assist with GST registrations, filings, and audits, ensuring your business avoids penalties.

Business Structuring: Offer advice on the optimal legal structure for your business to minimize taxes and streamline operations.

Audits and Financial Reviews: Provide comprehensive audit services that ensure your financial statements are accurate and compliant.

Final Thoughts

Choosing the best CA in Karnal is a crucial step in managing your finances effectively, whether for personal or corporate tax solutions. The ideal CA should have a combination of expertise, experience, and strong communication skills.

They should be proactive in offering financial solutions, transparent about their processes, and technologically adept to meet modern financial challenges.

By taking the time to research and evaluate your options, you can find a trusted financial partner who will help you achieve both short-term and long-term financial success.

Whether you need help with personal tax planning or corporate tax management, the right CA in Karnal can make all the difference in optimizing your finances and ensuring compliance with tax laws.

1 note

·

View note

Text

The Importance of GST Registration for E-Commerce Businesses in Bangalore

Introduction

The e-commerce industry in India has seen exponential growth, particularly in urban centres like Bangalore. With this growth comes the necessity for compliance with various regulations, one of which is Goods and Services Tax (GST) registration in Bangalore. This blog post explores the importance of GST registration for e-commerce businesses in Bangalore, detailing its benefits, requirements, and implications for business operations.

What is GST?

Goods and Services Tax (GST) is an indirect tax that has replaced multiple older taxes in India. It is applicable to the supply of goods and services and aims to simplify the tax structure by creating a single tax regime across the country. For e-commerce businesses, GST is significant as it affects pricing, compliance, and overall business strategy.

Why is GST Registration Necessary?

Legal Requirement: In India, any business with an annual turnover exceeding ₹20 lakhs (₹10 lakhs for particular category states) is required to obtain GST registration. This legal requirement ensures that businesses contribute to the national revenue system.

Input Tax Credit: Registered businesses can claim input tax credit on purchases made for their business operations. This means that the GST paid on inputs can be deducted from the GST collected on sales, reducing overall tax liability.

Credibility: Having a GST registration for importers and exporters enhances a business's credibility with customers and suppliers. It signals that the company is compliant with tax regulations, which can be a deciding factor for many consumers.

Benefits of GST Registration for E-Commerce Businesses

1. Simplified Taxation

GST has streamlined the taxation process by consolidating various taxes into one. This simplification reduces the complexity involved in tax compliance, making it easier for e-commerce businesses to manage their finances.

2. Broader Market Access

With GST registration, e-commerce businesses can sell their products across state lines without facing additional taxes or barriers. This opens up new markets and customer bases, which are essential for growth in a competitive landscape.

3. Increased Customer Trust

Consumers are more likely to trust businesses that are registered under GST. It assures them that the business operates legally and adheres to the necessary regulations.

4. Better Compliance Management

Registered businesses must adhere to specific compliance requirements, including filing returns regularly. This encourages better financial management and transparency within the organisation.

The Process of Obtaining GST Registration

Step 1: Determine Eligibility

Before applying for GST registration, assess whether your business meets the turnover threshold required for registration.

Step 2: Gather Required Documents

The following documents are typically required for GST registration:

PAN card of the business

Proof of business registration

Identity and address proof of promoters/directors

Bank account statement or cancelled cheque

Business address proof

Step 3: Apply Online

The application for GST registration can be completed online through the Goods and Services Tax Network (GSTN) portal. Fill out Form GST REG-01 with accurate details.

Step 4: ARN Generation

After submitting your application, an Application Reference Number (ARN) will be generated. This number can be used to track the status of your application.

Step 5: Verification and Approval

The tax authorities will verify your application and documents. If everything is in order, you will receive your GST registration certificate.

Common Challenges Faced by E-Commerce Businesses

1. Understanding Compliance Requirements

Many e-commerce businesses need help understanding the various compliance requirements associated with GST registration. Regular training or hiring a consultant can help navigate these complexities.

2. Filing Returns on Time

Timely filing of returns is crucial to avoid penalties. E-commerce businesses should maintain organised records of sales and purchases to facilitate smooth filing processes.

3. Managing Input Tax Credit

Claiming input tax credit requires meticulous record-keeping of all purchases made under GST. Businesses must ensure they have valid invoices to claim these credits effectively.

Conclusion

For e-commerce businesses, GST registration in Bangalore, obtaining is not just a legal obligation but also a strategic advantage that can enhance credibility, simplify taxation processes, and expand market reach. As the e-commerce landscape continues to evolve, staying compliant with regulations like GST will be vital for sustainable growth and success.

By understanding the importance of GST registration and navigating its complexities effectively, e-commerce entrepreneurs can position themselves favourably in this competitive market landscape. Embracing these practices will not only ensure compliance but also contribute significantly to long-term business viability in Bangalore's thriving e-commerce sector.

0 notes

Text

GST in Gurgaon: A Comprehensive Guide to Compliance and Benefits

The Goods and Services Tax (GST) has revolutionized the tax machine in India, simplifying the complex internet of indirect taxes. For companies in Gurgaon, one of the maximum unexpectedly developing industrial hubs, information the nuances of GST is essential for seamless operation & increase. Adya Financial 'll provide a complete guide on GST in Gurgaon, along with its implications for businesses, registration approaches, and the way it is able to affect the hospitality industry, including luxury inn rooms in Dehradun and similar establishments.

Introduction to GST in India

The Goods and Services Tax (GST) become added in India on July 1, 2017, to unify a couple of oblique taxes right into unmarried, complete machine. It replaced taxes like Value Added Tax (VAT), Central Excise Duty, Service Tax, and different local levies. This simplification has made the tax machine greater obvious & less difficult to control, particularly for groups with multi-state operations like the ones in Gurgaon.

GST is levied at the supply of goods & offerings at every degree of the supply chain, from production to the final consumer. Its middle idea is to get rid of the "cascading effect" of taxes, because of this product is taxed most effective on the point of consumption.

Types of GST

Before diving into the specifics for Gurgaon, it’s essential to understand the 4 most important types of GST:

CGST (Central Goods and Services Tax): Levied by using the important government on intra-state transactions.

SGST (State Goods and Services Tax): Levied by using the kingdom authorities on intra-country transactions.

IGST (Integrated Goods and Services Tax): Levied on inter-country transactions.

UTGST (Union Territory Goods and Services Tax): Applicable for Union Territories like Chandigarh, Andaman and Nicobar Islands, & so forth.

Why GST is Important for Businesses in Gurgaon

Gurgaon, now formally known as Gurugram, has emerged as a chief enterprise hub, home to several multinational groups, startups, and industries spanning throughout IT, actual estate, finance, and hospitality. The advent of GST in Gurgaonplays essential position inside the ease of doing commercial enterprise on this metropolis by using:

Simplifying Taxation: GST has replaced a multitude of indirect taxes with one uniform tax, considerably lowering compliance burden for corporations in Gurgaon.

Increased Transparency: With GST, groups can now avail Input Tax Credit (ITC) for taxes paid on items & offerings used in their operations, reducing their usual tax legal responsibility.

Boost to the Hospitality Sector: Hotels & lodges, such as the ones imparting luxurious hotel rooms in Dehradun, enjoy the GST regime. GST simplifies the tax structure for hotels, ensuring that each agencies and customers understand their tax liabilities more truely.

GST Registration Process for Businesses in Gurgaon

Any enterprise operating in Gurgaon, with an annual turnover exceeding ₹40 lakh (₹20 lakh for service vendors), should check in for GST. The technique is entirely on line, making it less complicated for organizations to conform without travelling tax offices.

Steps to Register for GST:

Visit the GST Portal: Begin online gst registration in gurgaon by using journeying the reliable GST internet site (www.Gst.Gov.In).

Filing the Application: You will want to fill out Form GST REG-01. Ensure all info which includes the commercial enterprise name, sort of enterprise, & PAN are entered successfully.

Submission of Documents: Provide important documents like PAN card, Aadhaar card, enterprise registration proof, bank account information, and photos of the owner or enterprise companions.

Verification and Approval: Once submitted, the utility may be proven by means of tax authorities. Upon approval, you'll be issued unique GST Identification Number (GSTIN).

Completion: After acquiring your GSTIN, you are required to record GST returns often.

GST Compliances for Businesses in Gurgaon

Complying with GST guidelines is vital for groups to keep away from penalties and make certain clean operations. Here are some key compliances for GST in Gurgaon:

Monthly/Quarterly Filing of Returns: Depending on the enterprise length and turnover, groups need to report both monthly or quarterly GST returns. The paperwork consist of GSTR-1 (sales info), GSTR-3B (summary return), & GSTR-9 (annual return).

Payment of Taxes: GST is payable month-to-month or quarterly, relying at the form of enterprise. Delayed payments can result in interest & penalties.

Input Tax Credit (ITC): One of the foremost advantages of GST is the capacity to assert credit score for taxes paid on purchases. However, to claim ITC, businesses have to safeguard right document-preserving and matching of buy and income invoices.

Compliance with E-invoicing: For huge organizations, e-invoicing is mandatory. This ensures transparency & curbs tax evasion by means of digitizing the invoicing method.

GST Rates for Various Sectors in Gurgaon

GST quotes vary across industries, making it vital for businesses to live up to date. For groups in Gurgaon, mainly in hospitality, manufacturing, & IT, knowledge those costs is crucial for accurate tax compliance.

Hospitality Sector: Hotels with room price lists underneath ₹1,000 are exempt from GST. For room tariffs among ₹1,000 & ₹7,500, the GST charge is 12%, at the same time as tariffs above ₹7,500 are taxed at 18%. Resorts & comfort hotels, consisting of those providing luxury motel rooms in Dehradun, fall into this class.

Manufacturing Sector: The fashionable GST charge for production groups in Gurgaon is 18%. However, vital objects and meals merchandise may additionally attract a decrease price of 5%.

Information Technology (IT): The GST fee for IT services is 18%, making it vital for tech companies in Gurgaon to conform with this fee structure for software and IT-associated services.

The Role of GST in Boosting the Hospitality Industry

Gurgaon, being a major business & leisure destination, has seen its hospitality industry thrive under GST. The tax structure has brought transparency to hotel tariffs and increased accountability. Moreover, businesses in the hospitality sector, such as those managing luxury hotel rooms in Dehradun, can easily calculate & charge GST, ensuring that guests have a clear understanding of the tax component in their bills.

Additionally, the availability of Input Tax Credit (ITC) on goods and services used by hotels (like food, maintenance, & utilities) has led to cost reductions, allowing hotels to offer competitive pricing without compromising on quality.

Common Challenges for Businesses in Gurgaon Under GST

While GST has simplified the taxation system, agencies in Gurgaon face some demanding situations:

Frequent Updates to GST Laws: The Indian GST system undergoes common adjustments, which may be difficult for agencies to preserve track of. Staying up to date with the modern-day adjustments in tax slabs, ITC guidelines, and compliance requirements is vital.

Mismatch of Invoices: Many organizations face difficulties with invoice matching in the course of ITC claims. This can put off the refund manner & result in coins float troubles.

Penalties for Non-Compliance: Failing to comply with GST submitting or charge deadlines can cause consequences, which can also have an effect on small & medium-sized businesses the most.

Benefits of GST for Gurgaon’s Economy

Despite those demanding situations, GST has positively impacted Gurgaon’s economic system in numerous approaches:

Increased Efficiency: The streamlined tax process beneath GST has decreased paperwork and administrative hurdles for businesses.

Reduced Tax Evasion: GST’s digital infrastructure has curtailed tax evasion by making each transaction traceable.

Boost to Trade and Commerce: The ease of doing commercial enterprise in Gurgaon has stepped forward because of GST, attracting foreign investments & increasing the nearby financial system.

Enhanced Consumer Confidence: For purchasers, GST brings clarity to the tax shape, as they now recognize the precise amount of tax being paid on goods and services.

Conclusion

For corporations in Gurgaon, know-how & complying with gst registration in Gurgaon isn't always just a felony duty but vital issue of smooth operations and increase. Whether you’re walking a small startup or dealing with a series of luxury inn rooms in Dehradun, staying up to date with GST guidelines will make sure your commercial enterprise prospers on this competitive landscape.

By simplifying the tax shape, reducing redundancies, & bringing transparency, GST has paved the manner for corporations in Gurgaon to enlarge & flourish. With the right techniques in area, organizations can leverage GST for each compliance and profitability.

0 notes

Text

Discover the Top 10 CA Firms in Hitech City: Your Guide to Excellence

If you're searching for expert financial services in Madhapur, Hyderabad, you're in the right place. The bustling area of Hitech City is home to some of the best Chartered Accountant (CA) firms in India. Whether you're a startup, an established business, or an individual seeking tax advice, these firms can help you navigate the complexities of finance, taxation, and compliance. In this blog, we’ll explore the top 10 CA firms in Hitech City, ensuring you find the right partner for your financial needs.

1. SBC

At the forefront of our list is SBC, renowned for its comprehensive range of services, including auditing, taxation, and advisory. With a team of experienced professionals, SBC ensures that clients receive tailored solutions that align with their business goals. Their commitment to excellence and client satisfaction makes them a top choice in Hitech City. For inquiries, you can reach them at 040-48555182.

2. XYZ & Co.

XYZ & Co. has built a strong reputation for its expertise in corporate tax planning and compliance. Their client-centric approach ensures that businesses receive personalized services designed to maximize efficiency and minimize tax liabilities.

3. ABC Associates

ABC Associates is known for its robust accounting and auditing services. Their experienced team assists both small and large businesses, making them a reliable choice for any enterprise. They emphasize transparency and accuracy in all their dealings.

4. PQR Advisory

PQR Advisory specializes in startup consulting, offering a range of services from registration to financial management. Their deep understanding of the challenges startups face makes them an invaluable partner for new businesses in Hitech City.

5. MNO Finance

MNO Finance provides exceptional financial advisory services, including investment strategies and wealth management. Their holistic approach ensures that clients are well-prepared for future financial challenges and opportunities.

6. DEF Partners

Known for their exceptional client service, DEF Partners offers a range of CA services, including GST compliance and financial audits. Their meticulous attention to detail ensures that all financial activities are handled with the utmost care.

7. GHI Financial Services

GHI Financial Services has carved a niche in taxation services, providing expert advice on direct and indirect taxes. Their proactive approach to compliance helps clients avoid potential pitfalls while maximizing tax benefits.

8. JKL Chartered Accountants

With a strong focus on technology and innovation, JKL Chartered Accountants leverages digital tools to enhance their service delivery. Their tech-savvy approach sets them apart in a rapidly changing financial landscape.

9. RST Group

RST Group excels in corporate finance and mergers & acquisitions. Their strategic insight and deep industry knowledge make them an ideal partner for businesses looking to expand or optimize their financial operations.

10. UVW Consultancies

Last but not least, UVW Consultancies offers a wide array of services, including forensic auditing and risk assessment. Their expertise helps clients safeguard their assets and ensure compliance with regulatory requirements.

Why Choose a Top CA Firm?

Partnering with one of the top 10 CA firms in Hitech City means you’ll benefit from expert advice, comprehensive services, and a focus on your unique needs. These firms bring years of experience and industry knowledge to the table, providing you with the confidence that your financial matters are in capable hands.

Conclusion

Choosing the right CA firm can significantly impact your financial success. Whether you’re looking for personalized services or expertise in a specific area, the firms listed above represent the best that Hitech City has to offer. Consider reaching out to SBC or any of the other top firms to explore how they can assist you in achieving your financial goals. Don’t hesitate to call 040-48555182 for more information!

#top 10 ca firms in hitech city#top 10 ca firms in hitech city for articleship#top 10 ca firms in hyderabad#top 10 ca firms in hyderabad for articleship#top 10 ca firms in madhapur

0 notes

Text

GST Compliance Solutions Simplifying Complex Tax Regulations

In an era of rapid cross-border business growth, understanding and complying with tax laws has become more difficult than ever. The Goods and Services Tax (GST) is one such tax regime that is changing the way business is done, especially in countries like India, Australia and Canada. However, complex GST rules can often overwhelm business owners, especially small and medium enterprises (SMEs). This is where GST compliance solutions come in, helping businesses navigate the complexity of tax compliance with ease.

In this article, we will explore various aspects of GST compliance, challenges faced by businesses and how GST compliance solutions can simplify this complex tax law. Whether you are a business owner, an accountant, or just anyone interested in understanding GST, this comprehensive guide will provide valuable insight.

Understanding GST: A Brief Overview

GST or Goods and Services Tax is an indirect tax on the supply of goods and services. It is a comprehensive, multi-channel, destination-based tax that has replaced earlier indirect taxation by both the central and state governments The main objective of GST is to provide the tax system facilitated and created a single market by increasing taxes.

Key Features of GST:

Exceptions: GST includes VAT, service tax, excise duty, and various other taxes.

Multi-stage: GST is collected at every stage of the supply chain from manufacturing to end-consumption.

Destination: Taxes are collected where goods are consumed rather than produced, ensuring that revenue is distributed based on consumption.

Importance of GST Compliance

Complying with GST rules is important for businesses to avoid penalties, maintain good reputation and ensure smooth operations. Non-compliance can result in significant fines, legal challenges, and business outages. Therefore, companies need to understand the intricacies of GST and abide by the rules and deadlines.

Highlights of GST Compliance:

Timely filing of GST Returns: Companies must file GST returns on a regular basis, based on their income and other factors. Missing the deadline can result in penalties and interest.

Accurate Records: Maintaining accurate records of all transactions, invoices and returns is essential for GST compliance. This ensures that the Investment Tax Credit (ITC) has been properly claimed.

Proper Tax Accounting: To avoid underpaying or overpaying tax, businesses should accurately account for GST on their goods and services.

E-invoicing Compliance: E-invoicing is a must for businesses with fixed invoices. It involves the generation of invoices in a standardized manner, which are then uploaded to an official channel for verification.

Common Challenges in GST Compliance

Despite the benefits of GST, compliance can be a challenge for businesses, especially SMEs. Some common complications are:

Complex Tax Laws: GST laws can be complex, and are frequently amended and updated. Keeping up with these changes can be challenging, especially for small businesses with limited resources.

Multiple Registrations: Multinational companies may need to register for GST in each country, increasing the administrative burden.

Input Tax Credit (ITC) Reconciliation: Reconciling input tax credits with supplier data can be time consuming and errors are prone.

Costs of Compliance: The costs of hiring staff, investing in software and managing compliance processes can be high, especially for SMEs.

Technology Implementation: Adopting new technologies such as e-invoice compliance software can be challenging for businesses that are not tech savvy.

How GST Compliance Solutions can Help

The GST compliance solution is designed to simplify the process of GST compliance. This solution uses technology to automate aspects of GST compliance, reducing the burden on businesses and ensuring consistency.

Benefits of GST Compliance Solution:

Automation of Processes: GST compliance solutions automate tasks such as return filing, invoice generation, tax calculation etc., reducing the risk of human error.

Real-time Updates: This solution provides real-time updates on changes in GST laws, ensuring that businesses are in compliance with the latest regulations.

Simplified ITC Reconciliation: GST compliance solutions simplify the process of matching input tax with supplier data, reducing the chances of contradiction will come to him.

Lower Costs: By automating compliance processes, companies can reduce hiring costs and control manual processes.

Ease of Use: Many GST compliance solutions are user-friendly, making it easy for businesses to adopt and integrate into their existing systems.

Top Features to Look for in a GST Compliance Solution

When choosing a GST compliance solution, it’s important to consider the features that will best meet your business needs. Here are some of the top things to look for:

Return Filing Automation: Look for solutions that automate GST returns, reducing the time and effort required to meet compliance deadlines.

Invoice Integration: Make sure the solution supports e-invoicing, so you can create and upload invoices in the required format.

ITC Reconciliation: A good GST compliance solution should provide tools to reconcile input tax with supplier data, thereby reducing errors.

Real-time Compliance Alerts: Choose a solution that provides real-time alerts of compliance deadlines, regulatory changes, and important updates.

Easy-to-use Interface: The solution should be easy to use, with an intuitive interface that allows regulatory tasks to be picked up and managed efficiently.

Options: Look for customizable solutions to meet the specific needs of your business, such as handling multiple GST registrations or integration with your existing accounting software.

Data Security: Make sure the solution offers robust data security features such as encryption and regular backups to protect your sensitive information.

Choosing the Right GST Compliance Solution for your Business

Choosing the right GST compliance solution is important to ensure your business is GST compliant. Here are some tips for making the right choice:

Determine your Business Needs: Start by looking at the specific compliance requirements of your business, such as the number of transactions, the complexity of your business, and the level of expertise required.

Compare Features: Compare features of various GST compliance solutions and find one that provides you with the functionalities you need, such as return filing, e-invoicing, and ITC matching.

Ensure Scalability: Ensure the solution can scale with your business as it grows, accommodates increased transaction volumes and other compliance requirements.

Consider Costs: Determine the cost of the solution, including any setup fees, subscription fees, and ongoing maintenance costs. Find solutions that provide value for money without compromising quality.

Read Reviews and Testimonials: Look for reviews and testimonials from other companies that have implemented the solution. This provides insight into the effectiveness and reliability of the solution.

Request a Demo: If possible, request a demo of the solution to see how it works and whether it meets your business needs.

GST Compliance Solutions: Best Practices

Once you’ve identified a GST compliance solution, it’s important to use it effectively to maximize your returns. Here are some best practices to follow.

Train Your Team: Make sure your team is properly trained on how to implement GST compliance solutions. This will guide them through the process more effectively and reduce the chances of error.

Integrate Existing Systems: Integrate GST compliance solutions into your existing accounting and ERP systems to streamline processes and improve data accuracy.

Check Compliance Regularly: Check your GST compliance process regularly to make sure everything is running smoothly. Use the reporting features of the solution to track compliance status and identify any issues.

Stay Updated On Changes: Stay up-to-date with any changes to GST laws and regulations, and ensure your GST compliance solutions are updated accordingly.

Take Professional Advice: If you are unfamiliar with any aspect of GST compliance, seek advice from a tax professional. They can help you navigate complex regulations and ensure your business stays compliant.

Future GST Compliance: Trends to Watch

As technology continues to evolve, so will the tools and solutions available to comply with GST. Here are some things to watch out for in the future in terms of GST compliance:

AI and Machine Learning: AI and machine learning are set to play a key role in automating GST compliance processes, improving accuracy and reducing the time required for compliance tasks.

Blockchain Technology: Blockchain has the potential to transform GST compliance by providing a secure, transparent and immutable record of transactions. This can reduce fraud and improve the accuracy of compliance data.

Cloud-Based Solutions: Cloud-based GST compliance solutions provide flexibility, scalability and accessibility, making it easy for businesses to manage compliance from anywhere.

Enhanced Government Digitization: Governments are increasingly adopting digital technologies for tax collection and compliance. Companies will need to stay updated on these developments and ensure their compliance solutions align with government policy.

Enhanced Data Analytics: Advanced data analytics tools will help businesses gain deeper insights into their GST compliance processes, allowing them to spot trends, identify issues and make informed decisions.

Conclusion

GST compliance is key to running a successful business, but it can be difficult and time-consuming. Fortunately, GST compliance solutions are available to simplify the process, reduce errors and ensure your business remains compliant with the latest regulations. By understanding the basics and applying best practices when looking for GST compliance solutions, you can confidently navigate the complexities of GST and focus on growing your business.

0 notes

Text

GST Registration in Bangalore: Key Benefits for Local Businesses

GST Registration in Bangalore: A Comprehensive Guide

Introduction

Goods and Services Tax (GST) has revolutionised the taxation system in India, unifying various indirect taxes into a single tax structure. Understanding GST registration is crucial for legal compliance and smooth business operations for businesses operating in Bangalore and Karnataka. This article delves into the essentials of GST registration in Bangalore, outlining the process, requirements, and benefits.

What is GST Registration?

GST registration is the process by which a business obtains a unique GST Identification Number (GSTIN) from the tax authorities. This number is mandatory for companies whose turnover exceeds the prescribed threshold limit or those who engage in inter-state supply of goods or services. It ensures that businesses are legally recognised and are compliant with GST laws.

Who Needs GST Registration?

Businesses with Annual Turnover Exceeding Threshold Limit: GST registration is mandatory for companies with an annual turnover exceeding ₹40 lakhs (₹20 lakhs for unique category states).

Inter-State Suppliers: If a business supplies goods or services across state borders, GST registration is required regardless of turnover.

E-commerce Sellers: Sellers on e-commerce platforms must obtain GST registration irrespective of turnover.

Businesses Involved in Import/Export: Businesses dealing with the import or export of goods and services need to be registered under GST.

Benefits of GST Registration

Legal Recognition: GST registration provides legal recognition to businesses, facilitating smoother operations and transactions.

Input Tax Credit (ITC): Registered businesses can claim input tax credit on taxes paid on their purchases, reducing the overall tax burden.

Inter-State Transactions: With GST registration, businesses can freely engage in inter-state transactions without additional tax complications.

Enhanced Credibility: GST registration enhances a business's credibility, making it more attractive to potential clients and partners.

Compliance: It helps you stay compliant with tax regulations, avoiding penalties and legal issues.

The GST Registration Process in Bangalore

Determine Eligibility: Assess whether your business needs GST registration based on the turnover and nature of transactions.

Gather Documents: Prepare the necessary documents, which typically include:

PAN card of the business and its proprietor/partners/directors

Proof of business registration or incorporation

Address proof of the business premises

Bank statement/cancelled cheque

Identity and address proof of the proprietor/partners/directors

Apply Online: Visit the GST portal (www.gst.gov.in) and complete the online application form. Provide all the required details and upload the necessary documents.

Verification: After submission, the GST officer will verify the application. If everything is in order, the GSTIN will be issued.

Receive GSTIN: Once verified, you will receive your GST Identification Number (GSTIN) via email or the GST portal.

Compliance and Filing: After registration, businesses must comply with regular GST filing requirements, including monthly or quarterly returns, as applicable.

Common Challenges and Solutions

Document Verification Delays: Ensure all documents are accurate and complete to avoid delays in verification. Consider consulting a tax professional if needed.

Understanding GST Laws: GST laws can be complex. Businesses should seek professional advice or attend workshops to stay updated.

Maintaining Compliance: Regularly update your knowledge of GST rules and deadlines to ensure timely and accurate compliance.

Conclusion

GST registration in Bangalore is crucial for businesses to ensure legal compliance and operational efficiency. By understanding the requirements and following the registration process diligently, companies can benefit from the unified tax structure, claim input tax credits, and enhance their credibility. For a seamless GST registration experience, consider consulting with a tax expert or service provider to navigate the complexities and comply with GST regulations.

0 notes