#Indian Palm Oil Market Share

Explore tagged Tumblr posts

Text

Palm rises amid widening Mideast conflict, set for best week in 16 months KUALA LUMPUR, Oct 4 (Reuters) - Malaysian palm oil futures surged on Friday, driven by a widening conflict in the Middle East, and were on track for their highest weekly gain since June 2023. The benchmark palm oil contract FCPOc3 for December delivery on the Bursa Malaysia Derivatives Exchange rose 88 ringgit, or 2.1%, to 4,270 ringgit ($1,009.93) a metric ton by the midday break. The contract has so far gained 5.41% this week. The palm oil market is experiencing a bull run, mirroring a rally in crude oil amid the conflict in the Middle East, a Mumbai-based trader with a global trade house said. "Palm oil is now also trading at a premium to soybean and sunflower oil," the trader said. Soyoil prices on the Chicago Board of Trade BOcv1 were up 0.7% to $44.84. Dalian's vegetable oil markets were closed for China's Golden Week holiday. Sunflower oil is currently trading at 1,175.50 rupees ($14.00) per 100 kg on the National Commodity and Derivatives Exchange of India. Palm oil tracks price movements of rival edible oils, as they compete for a share of the global vegetable oils market. The ringgit MYR=, palm's currency of trade, weakened 0.24% against the dollar, making the commodity cheaper for buyers holding foreign currencies. Oil prices were little changed on Friday, but remained on track for strong weekly gains, as investors weighed the prospect of a wider Middle East conflict disrupting crude flows against an amply supplied global market. Stronger crude oil futures make palm a more attractive option for biodiesel feedstock. India's palm oil imports in September fell by nearly a third compared to the previous month, hitting a six-month low as a surge in tropical oil prices made it more expensive than rival oils, forcing refiners to postpone purchases, dealers said. India on Thursday approved a 101 billion-rupee ($1.2 billion) programme to double edible oil production within seven years, aiming to reduce dependence on costlier imports. ($1 = 4.2280 ringgit) ($1 = 83.9540 Indian rupees)

0 notes

Text

India Edible Oil Market Trends, Growth and Size

India, the world's largest importer and second-largest consumer of edible oils, presents a complex and dynamic market. This report summarizes the key trends, challenges, and growth drivers shaping this vital sector.

Market Overview: Size and Growth

The Indian edible oil market boasts a significant size, reaching an estimated value of USD 28.4 billion in 2023. Analysts predict steady growth, with the market projected to reach USD 37.2 billion by 2030, reflecting a CAGR of approximately 5.1%.

Key Drivers:

Rising Population: India's burgeoning population fuels the demand for edible oils, a staple in the country's cuisine.

Urbanization and Changing Lifestyles: Urbanization and busier lifestyles lead to a growing preference for processed foods that utilize significant amounts of edible oils.

Income Levels: Rising disposable incomes allow consumers to explore a wider variety of edible oils beyond the most basic options.

Challenges and Concerns:

Import Dependence: India relies heavily on imports to meet its edible oil needs, making the market susceptible to global price fluctuations.

Price Volatility: Price volatility of imported oils significantly impacts affordability for consumers, particularly lower-income segments.

Health Concerns: The high consumption of palm oil, the dominant imported oil, raises concerns about saturated fat intake and its impact on public health.

Market Segmentation and Trends:

Product Type: The market is segmented by product type, with major categories including:

Palm Oil (holds the largest share)

Soybean Oil

Sunflower Oil

Mustard Oil

Groundnut Oil

Focus on Blending: Manufacturers are increasingly blending different edible oils to offer more affordable and healthier options.

Branding and Packaging: Branded and packaged edible oils are gaining traction, offering convenience and perceived quality.

Government Initiatives:

The Indian government is actively involved in promoting domestic production of oilseeds to reduce import dependence and ensure long-term market stability.

Initiatives like the National Mission on Edible Oils aim to increase self-sufficiency in edible oil production by 2025.

Looking Ahead: Balancing Affordability and Health

The future of India's edible oil market hinges on its ability to address key challenges:

Enhancing Domestic Production: Increasing domestic production of oilseeds like mustard and sunflower will reduce dependence on imports.

Promoting Healthier Options: Educating consumers about healthier oil options and encouraging the use of blended oils with a good fat profile.

Managing Price Volatility: Implementing policies to stabilize domestic edible oil prices and ensure affordability for all segments of the population.

Conclusion: A Sustainable Future for Edible Oils

India's edible oil market faces a multi-faceted challenge. By prioritizing domestic production, promoting healthy choices, and ensuring price stability, India can navigate this complex landscape and ensure a secure and sustainable future for its edible oil needs.

0 notes

Text

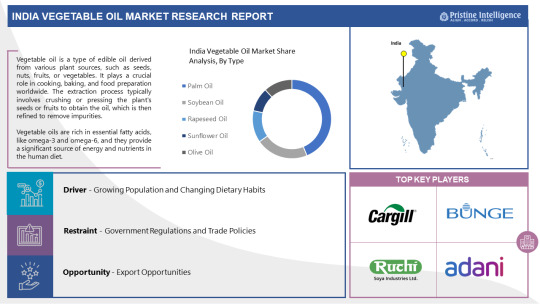

India Vegetable Oil Market: Forthcoming Trends and Share Analysis by 2030

The India Vegetable Oil is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The Indian vegetable oil market is one of the largest and most dynamic sectors in the country's food industry. Vegetable oils are essential ingredients in Indian cuisine, catering to diverse cooking practices and cultural preferences across the nation. India ranks among the top consumers and importers of vegetable oils globally due to its massive population and culinary diversity. Key players in the market include both domestic producers and multinational corporations, offering a wide range of oils such as palm oil, soybean oil, sunflower oil, and mustard oil, among others.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

The latest research on the India Vegetable Oil market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global India Vegetable Oil industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the India Vegetable Oil market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the India Vegetable Oil Market include:

Adani Wilmar Limited (India), Ruchi Soya Industries Limited (India), Bunge India Private Limited (India), Cargill India Pvt. Ltd. (India), Marico Limited (India), Godrej Agrovet Limited (India), Emami Agrotech Limited (India), Dalmia Continental Private Limited (India), 3F Industries Limited (India), Liberty Oil Mills Limited (India), Pepsico India Holdings Pvt. Ltd. (Quaker Oats) (India), B.L. Agro Oils Ltd. (India), Agro Tech Foods Ltd. (India), Gemini Edibles & Fats India Pvt. Ltd. (India), Vimal Oil & Foods Limited (India), VVF (India) Limited (India) and Other Major Players.

Market Driver:

One significant driver propelling the growth of the Indian vegetable oil market is the increasing awareness of health benefits associated with consuming healthier oils. With rising health consciousness among consumers, there has been a noticeable shift towards oils perceived to be healthier, such as olive oil, avocado oil, and rice bran oil. This shift is primarily driven by concerns over heart health, cholesterol levels, and overall well-being, leading consumers to seek out oils with higher unsaturated fat content and lower levels of trans fats.

Market Opportunity:

An emerging opportunity within the Indian vegetable oil market lies in the growing demand for organic and cold-pressed oils. As consumers become more conscious about the origin and processing methods of their food products, there is a rising trend towards organic and minimally processed oils. This presents an opportunity for both existing and new players in the market to capitalize on the demand for premium, high-quality oils that cater to health-conscious consumers seeking natural and sustainable alternatives.

If You Have Any Query India Vegetable Oil Market Report, Visit:

https://pristineintelligence.com/inquiry/india-vegetable-oil-market-83

Segmentation of India Vegetable Oil Market:

By Type

Palm Oil

Soybean Oil

Rapeseed Oil

Sunflower Oil

Olive Oil

Others

By Nature

Organic

Conventional

By Packaging Type

Cans

Bottles

Pouches

Others

By Application

Food Industry

Pharmaceutical

Cosmetics & Personal

Animal Feed

Industrial

By Distribution Channels

Hypermarkets/Supermarkets

Convenience Stores

Online Retail

Wholesale Distributors

Specialty Stores

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global India Vegetable Oil Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

India Vegetable Oil Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#India Vegetable Oil#India Vegetable Oil Market#India Vegetable Oil Market Size#India Vegetable Oil Market Share#India Vegetable Oil Market Growth#India Vegetable Oil Market Trend#India Vegetable Oil Market segment#India Vegetable Oil Market Opportunity#India Vegetable Oil Market Analysis 2023

0 notes

Text

Weathering the Storm: Resilience and Adaptation in the Aviation Fuel Market 2019-2026

The aviation fuel market is driven by rising air travelers and increasing spend on air travel from emerging economies, especially from the Asia-Pacific region. The most commonly used Jet A1 fuel will dominate the market during the forecast period while biofuels will gain a significant share owing to several investments being made towards sustainable aviation fuel (SAF) and the commitment of the aviation industry to reduce carbon emissions to 50% by 2040. The global aviation fuel market size was valued at $179.2 billion in 2018 and is anticipated to generate $238.5 billion by 2026. The market is projected to experience growth at a CAGR of 3.5% from 2019 to 2026.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/request-sample/6172

Aviation fuel is a type of petroleum-based fuel used to energize an aircraft. It has better quality than other fuels used in any other medium of transport. The additives used in aviation fuel reduce the risk of icing or explosion due to high temperatures. Aviation fuel is primarily used by most military aircraft and commercial airlines to maximize fuel efficiency and lower operational costs. Aircraft industry is expanding nowadays, which is increasing the competition among aircraft aviation fuel production in all sectors.

The demand from the military sector for efficient and low-cost military-grade fuel has increased as all the nations are increasing their military strength. Owing to increased disposable income and a boom in the tourism industry, a rise in air transportation has been experienced through air travel mode, which further drives the market growth. Moreover, the introduction of new flight routes and investments from the government in the field for the construction of new airports also boost the aviation fuel market growth. However, fluctuations in crude oil prices and rise in concerns over high levels of carbon emissions leading to strict rules and regulations hampers the market growth. Meanwhile, emerging sustainable aviation fuel (SAF) that is produced from typical feedstocks such as cooking oil and other non-palm waste oils from animals or plants, solid waste from homes and businesses, such as packaging, paper, textiles, and food scraps offer lucrative opportunities for the growth of the aviation fuel industry.

𝐆𝐞𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐰𝐢𝐭𝐡 𝐲𝐨𝐮'𝐫𝐞 𝐑𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭𝐬: https://www.alliedmarketresearch.com/request-for-customization/6172

The global aviation fuel is segmented on the basis of fuel type, aircraft type, end user, and region. Depending on fuel type, it is divided into jet A, jet A1, jet B, JP 5, JP 8, avgas, and biofuels. In 2018, jet A1 dominated the market share and is expected to grow at higher a CAGR during the forecast period. Depending on aircraft type, the market is classified into fixed wings, rotorcraft, and others. Fixed wings dominated the market share in 2018 and is expected to remain dominant during the forecast period. By end user, the market is categorized into civil, military, private, and sports & recreational. The civil segment dominated the market share and is expected to grow at a higher CAGR compared to other end users. Region-wise, the aviation fuel market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East and Africa). The global market was dominated by North America while, Asia-Pacific is expected to grow at a higher CAGR owing to high demand from emerging economies in the region.

The key players in Bp p.l.c., Chevron Corporation, Exxon Mobil Corporation, Gazprom, Indian Oil Corporation Limited, Petrobras, Royal Dutch Shell plc, Sinopec Group, Total SA, and Oman Oil Company SAOC.

𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐛𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/6172

𝐊𝐞𝐲 𝐟𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐬𝐭𝐮𝐝𝐲:

1. Global aviation fuel market size is provided in terms of revenue

2. India is projected to grow at the highest CAGR of approximately 4.6%, in terms of revenue, during the forecast period

3. By end-user, the civil segment is anticipated to grow with a CAGR of 3.6%, in terms of revenue, during the forecast period

4. India and U.S. dominated aviation fuel market share with a revenue of over 4.6% and 4.1% in 2018

5. A comprehensive analysis of the factors that drive and restrain the aviation fuel market growth is provided

6. The qualitative data in this report aims at the aviation fuel market trends, dynamics, and developments in the aviation fuel industry

7. The aviation fuel market forecast and estimations are based on factors impacting the market growth

𝐋𝐚��𝐞𝐬𝐭 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐀𝐥𝐥𝐢𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

𝟏. 𝐅𝐮𝐞𝐥 𝐂𝐞𝐥𝐥 𝐁𝐚𝐥𝐚𝐧𝐜𝐞 𝐨𝐟 𝐏𝐥𝐚𝐧𝐭 (𝐁𝐎𝐏) 𝐌𝐚𝐫𝐤𝐞𝐭 - https://www.globenewswire.com/news-release/2023/07/10/2701884/0/en/Fuel-Cell-Balance-of-Plant-BOP-Market-to-Reach-13-9-Billion-Globally-by-2032-at-22-2-CAGR-Allied-Market-Research.html

𝟐. 𝐖𝐚𝐭𝐞𝐫 𝐚𝐬 𝐚 𝐅𝐮𝐞𝐥 𝐌𝐚𝐫𝐤𝐞𝐭 -https://www.globenewswire.com/en/news-release/2023/05/12/2667985/0/en/Water-as-a-Fuel-Market-to-Reach-13-4-Billion-Globally-by-2032-at-12-5-CAGR-Allied-Market-Research.html

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Allied Market Research is a top provider of market intelligence that offers reports from leading technology publishers. Our in-depth market assessments in our research reports take into account significant technological advancements in the sector. In addition to other areas of expertise, AMR focuses on the analysis of high-tech systems and advanced production systems. We have a team of experts who compile thorough research reports and actively advise leading businesses to enhance their current procedures. Our experts have a wealth of knowledge on the topics they cover. Also, they use a variety of tools and techniques when gathering and analyzing data, including patented data sources.

0 notes

Text

How Are Commodities Priced On The Share Market?

Commodities are handled differently from other types of assets on the financial market. The commodities market is a marketplace for buying and selling everyday items. In India and other nations, individuals trade commodities like natural gas, corn, soybeans, gold, silver, and copper on commodity exchanges.

If you wish to trade stocks, you need an online stock broker that can advise you on the best transactions to make. To find out more about Zebu and the services it offers, get in touch with us.

The Multi Commodity Exchange is the most well-known of India's six commodity markets.

Traders can buy and sell complicated financial products like derivatives, swaps, futures, and options on the Indian commodity market. Therefore, the pricing of the items traded on the markets are not set by a single institution. The cost of a product is influenced by a number of economic factors.

Commodities are fundamental products that can be purchased and sold in significant quantities on the open market. Commodities may be a significant asset class for traders when they are traded. The two main categories of commodities are hard commodities and soft commodities. On the world commodity market, these products are traded for commercial purposes.

Types of Commodities

The markets in India trade three different kinds of commodities.

Nickel, copper, zinc, and gold are examples of the metals in this category, along with other metals like precious metals and metals used for other purposes.

Energy - Energy sources traded on the market include crude oil and natural gas.

Agriculture: Products of agriculture and livestock include cotton, black pepper, cardamom, castor seeds, rubber, crude palm oil, and crude pepper.

Factors that affect how much commodities cost

Commodity prices fluctuate constantly due to internal and external market forces, much like stock prices do. Let's examine the variables that influence the market price of commodities.

macroeconomics and world politics

The price of things can frequently change as a result of changes in world politics. For instance, changes in the political and economic conditions of OPEC members have an impact on the price of crude oil on the world market.

Demand and supply

Commodity prices are directly influenced by supply and demand. Prices rise in the market when supply is less than demand. On the other side, when the economy has less supply than it requires, prices decline.

Speculators

These are traders who buy and sell commodities with the intention of profiting from fluctuations in price. What they do has an impact on market prices for products.

What do the prices of goods in the share market look like?

What buyers and sellers do on the market determines how much a good costs. There are two ways to provide product prices. The first method involves using the price for market futures, which is the price that is mentioned in market news. The second is the "spot price," or the item's actual cash price. The indicated price must be paid in order to purchase the item right now.

A fantastic method to diversify your financial portfolio is by trading commodities. If you are familiar with the fundamentals and know how much risk you can tolerate, you can invest in commodities as an asset class. Commodity trading is dangerous, but it also has the potential to be very lucrative. You should conduct extensive study and educate yourself on every aspect of the goods market before investing a significant amount of your hard-earned money in something. Get started trading commodities by opening a demat account with Zebu.

If you wish to trade stocks, you need an online stock broker that can advise you on the best transactions to make. Contact us to learn more about Zebu and its services.

#online stock trading#lowest brokerage#stock market#share broker#stock market basics#basics of share market#stock market beginner#stock split

0 notes

Text

Edible Oil Industry

India Was Stripped of Its Atmanirbharta in the Edible Oil Industry The rise and fall of the biggest importers of edible oil in the world. Nov 04, 2020 | B.M. Vyas and Manu Kaushik A man loads empty containers of edible oil onto a tricycle at a roadside in Kolkata, India, August 27, 2015. Photo: Reuters/Rupak De Chowdhuri

‘Freedom is the greatest fruit of self-sufficiency’

– Epicurus

The COVID-19 pandemic has been detrimental for globalisation and has led to a clamour for protectionism.

India’s national strategy is also in line with this trend with calls for ‘Atmanirbharta’ and ‘vocal for local’ increasing.

Traditionally, India was an exporter of edible oil before Independence, became self-sufficient post-Independence (till the early 1970s), floundered in 1970s and 80s and regained self-sufficiency in the early 90s (1991-94). We are currently the biggest importers in the world!

India imports around US $ 10 billion of edible oil (15 MT) annually which constitutes nearly 70% of our annual edible oil requirement of 23 million tonnes. Thus, whether you eat a roadside samosa, matthi, dosa or chola bhatura, branded biscuit or namkeen, or even aloo puri or sabzi at home, there is almost a 70% chance that it is made using oil which is not from India.

Furthermore, imported palm oil or its derivatives are used as ingredients in soaps, shampoos, shaving creams and other cosmetics too. This is not an industry that comes across as a shining example for ‘atmanirbhar’ India. An analysis of the last five decades will help us understand how we reached here.

From Independence until the mid-1970s, we averaged 95% self-sufficiency in edible oil, except for the war years and its aftermath when self-sufficiency fell down to early 90s in percentage. The cuisine, cropping patterns and climatic conditions had led to the preference of mustard oil in north and east India, coconut oil in south India, groundnut or cottonseed oil in west India, and sesame oil in Rajasthan.

This regional preference for indigenous edible oils had evolved over centuries and had become a part of our culture. In 1973-74, groundnut, mustard and cottonseed oil had a whopping 96% share of the total consumption of edible oils in India. The oil seeds were traditionally extracted by cold pressing and then filtered; a technology suited to small scale processing leading to employment for generations. It also encouraged localised procurement and distribution networks having a smaller carbon footprint. Thus, it was an ecologically sustainable system and a virtuous cycle.

The 1971 India-Pakistan war compounded by the drought in 1972, led to inflation and food shortages. The per capita edible oil availability, which was 5 litres per annum in 1971 fell down to 3.9 litres per annum in 1973 (its 19 litres now). There were acute shortages in milk and consequently ghee. The shortage of oil and ghee combined with slick marketing led to the demand for vanaspati – which was marketed as a healthier alternative to ghee.

Also read: ‘Agriculture and Atmanirbharta’ Is a Noble Vision, but Needs Hard Decisions and Political Consensus

Edible oil was hydrogenated – by adding hydrogen to convert ‘unsaturated’ liquid fats into ‘saturated’ solid fats – and made into vanaspati. The vanaspati thus formed was ghee-like not just in appearance but also had a higher melting point than oil and was thus more suited for deep frying. Dalda was the flagship brand in the industry.

Dalda vegetable ghee. Photo: Wikimedia Commons, CC BY-SA

This further reduced the edible oil available for consumption as oil per se. Vanaspati consumption essentially took away one fifth of the availability of edible oils during the 1970s-80s. This led to groundnut oil or mustard oil being banned for making vanaspati from 1976-77 to 1987-88, and imported palmolien became the mainstay of the vanaspati industry.

The popularity of vanaspati had a detrimental effect on the growth of domestic edible oils as it pushed the price of edible oil down, making oilseed crop a losing proposition for farmers. Its production stagnated – staying around 10 million tonnes of oilseeds from 1970 to 1986 – while the growing population pushed demand up, forcing the government to import more edible oil. Thus, a vicious cycle was in place.

The public resentment transformed into action on December 20, 1973, when students protested against the hike in their mess bills leading to the Navnirman movement, in Gujarat. This, in turn, inspired Jayaprakash Narayan’s Total Revolution leading to the emergency and the formation of the Janta Party’s Morarji Desai government in 1977. While everyone remembers George Fernandes for having kicked out Coca Cola, the Janta Party government also opened the import gates for edible oil. The 95% reliance on domestic edible oils maintained in the 1960s and 1970s, fell down to 70% during 1977-80.

In 1977, the then finance minister, H.M. Patel – father of Amrita Patel, who later became chairperson of the NDDB – suggested to Dr Verghese Kurien an “Operation Flood” like project for edible oils via a farmers cooperative network based on the Amul model. The objective was self-reliance in edible oils through increased productivity, effective distribution and price stability through Market Intervention Operations (MIO) by NDDB, leading to improved farmer livelihoods. The intent of MIO was to handle 15% of the edible oil produced in the country to manage price fluctuations.

The project was named Operation Golden Flow. Central to the operation was the brand ‘Dhara’, which was created to build a market for the Indian oilseed grower. It was inspired by the wordmark of Dalda in green on a yellow background, the leader in vanaspati. This was a part of the market intervention operation. Dhara was launched in Delhi on August 23, 1988. Dhara pricing was kept low due to economies of scale and blending with the donated oil from CLUSA (Cooperative League of the USA), a strategy taken from the ‘pump priming’ of donated SMP and butter-oil during Operation Flood.

Thus, Dhara brought prices of domestic oil at par with cheaper imported edible oil. NDDB and GCMMF worked as one team and launched several varieties of oil such as filtered and refined mustard oil, cottonseed oil and double filtered groundnut oil. While NDDB handled the cooperatives, procurement and production, GCMMF was the distribution partner. The established Amul distribution network helped launch Dhara in a blitzkrieg. It took the market by storm. By 1991-92, Dhara had achieved sales of 1,32,000 MT pa, which was around 50% of the organised market share.

In a coordinated attempt the then PM Rajiv Gandhi created a Technology Mission on Oilseeds (TMO) in 1986. Headed by Sam Pitroda, it took concrete steps to boost domestic production of edible oils. The area under oilseed cultivation which had stagnated between 15-18 million hectares between 1970-85 increased to 25 million hectares by 1991 and oilseed production which was stuck at around 10 million tonnes (1970-85) went up to 18 million tonnes in this timeframe. India was producing 98% of its edible oil requirement by 1990-91. A true atmanirbhar success story!

Also read: With Palm Oil Expansion, India is Blazing a Trail to a Parched Future

The period between 1990-94 could be considered the golden era of the Indian edible oil industry.

This self-sufficiency continued till the Narsimha Rao government signed the WTO agreement in 1994 and edible oil was put under OGL (Open General License) with 65% duty. By 1998 we were again importing around 30% of our edible oil. We could never foresee then, what was in store in the near future.

A woman works in a field of mustard plants. Photo: Reuters

Under the Vajpayee government, the import duty on edible oil was further reduced to 15% in July 1998 and coincidentally the Argemone adulteration Dropsy case took place in August 1998. Sixty people died and around 3,000 got sick in Delhi and caught the nation’s attention. All of a sudden, all domestic brands selling mustard oil became outcasts and even loose mustard oil was banned. NDDB had to release advertisements to inform consumers not to buy its trusted Dhara Mustard Oil. Out of fear consumers shifted to ‘purer’ aromaless, colourless, tasteless oils or solvent extracted refined oils, as we know them. Over the next few years, that black swan event, led to a shift in the socio-cultural cooking and consumption patterns of edible oil in the country.

Industry followers consider it deliberate sabotage to discredit indigenous and loose oils and promote imports. Mustard oil contaminated with argemone (essentially weed seed contamination) is an ancient occurrence, but adulteration is never more than 1%. In these cases, adulteration was up to 30%, with argemone, diesel and waste oil as contaminants. The adulteration was therefore done in such a way that it would kill, and do so conspicuously and rapidly. Thus, the tragedy was seemingly not a result of the normal business of adulteration.

As the then Delhi health minister Harsh Vardhan stated, this is not possible without an organised conspiracy. NDDB had always faced opposition to Operation Golden Flow since its inception from the local telia rajas, oil kings. Its Bhavnagar Vegetable Products (BVP) plant had suffered eight mysterious fires between 1977-1982 and senior executives like A.A. Cholani and G.M. Jhala suffered serious accidents while travelling. Even now, it appears as if to set an example, the officers of NDDB and GCMMF till date attend court hearings of the dropsy case. While the mill owner from whom the said lot was bought, and was the main accused, was acquitted in 2006 due to lack of evidence.

After this incident, the Vajpayee government imported a controversial consignment of a million tonnes of soybean seeds from the US, previously rejected by the EU. Prices of indigenous oils fell and farmers protests fell on deaf ears. The area under oilseed cultivation started falling as farmers abandoned the crop. The area under mustard cultivation fell from 7.04 million hectares in 1997-98 to 4.5 million hectares in 2003-04. While edible oil imports increased from 2 million tonnes in 1997-98 to 4.5 million tonnes in 1998-99 and five million tonnes in 2002-03.

Men work on palm fruits at a palm oil factory. Photo: Reuters/Thierry Gouegnon/Files

By 2018, 20 years since the dropsy incident, the situation transposed and 70% of edible oil consumed in India was imported. It is primarily palm and soybean oil both non-indigenous to the country, the cuisine and its people. Palm oil in itself is 50% of the oil consumed in India, one of the unhealthiest oils on the planet.

Thus, one single policy decision, and one suspected sabotage, devastated not just the entire domestic oil cooperative network built over 20 years with painstaking effort but also the cropping pattern of the country which had evolved over centuries. Domestic edible oil prices stagnated and all cooperative federations wound up like a pack of cards. Most cooperative oil mills were forced to shut down. Even today some are lying defunct and vacant.

The NDDB and GCMMF parted ways and distribution of Dhara was taken over by NDDB in 2003. The country which had doubled its oil seed production from 108 lakh tonne to 221 lakh tonne in just a decade (1986-96), was left in a lurch. Today, that very country has become the world’s largest importer of vegetable oil, in spite of having the land, the resources, willing farmers, a ready market and the ability to achieve this self-sufficiency earlier!

Also read: Expanding Oil Palm Plantations in the Northeast Could Exact a Long-Term Cost

This vacuum left the door open for the ‘ABCD quartet’– the big four Agri commodity companies of the world – Archer Daniel Midlands (ADM), Bunge, Cargill and Louis Dreyfus and other American multinationals to enter India. Cargill did a JV with Parakh Foods in 2004. Bunge bought over Dalda from HLL in 2003. Conagra bought a majority stake in Agrotech from ITC in 1997 and the brand ‘Rath’ in 2000. ADM’s was one of the earliest ones and its route was through Malaysia. In 1999, Adani did a 50-50 joint venture with Wilmar to launch Fortune Oil, which in turn has Archer Daniel Midlands (ADM) as a shareholder since 1994 (present stake 24.9%). Wilmar International itself faces a lot of criticism from organisations like Greenpeace & Friends of the Earth for deforestation of tropical Indonesian forests. Amnesty international accuses it of using child labour in plantations.

ADM, in the 1990s, was the poster boy of corporate lobbying in America. It’s then CEO Dwayne Andreas was famous for being a political campaign donor for Nixon, Ronald Regan, Bill Clinton, George Bush and Bod Dole. Allegedly his contribution to Nixon’s re-election campaign was the $25,000 found in the possession of the Watergate burglar Bernand Barker. The ADM Board included Howard Buffet (son of Warren Buffet) and Brian Mulroney, former Canadian PM. Yet in 1999, ADM was fined USD 100 million for price fixing in the international lysine market and Dwayne Andreas’s son, Michael Andreas was sentenced to 24 months in prison. ADM also perfected the art of cultivating senior politicians by flying them in ADM corporate jets. Bob Dole, in his 1988 presidential campaign flew ADM corporate jets 29 times. As recently as 2005, Obama flew twice.

Today Adani Wilmar accounts for one-third of the total edible oil imported in India. The early bird does get the worm.

If one parks aside the balance of trade and the self-sufficiency angle, studies have shown that every additional kg of palm oil consumed per capita annually leads to ischemic heart disease (IHD) mortality rates of 68 per 100,000 in developing countries. India consumes some 7.2 litres per capita of Palm oil. Just replacing it with indigenous oil shall not just save lives but also reduce overall medical costs in the country. Similarly, soybean oil has also more than its fair share of negative reports on health.

Additionally, when oilseed production grows, the country produces not only edible oil but also oil cakes and extraction which is the raw material for dairy (cattle feed) and poultry industry (poultry feed). When we go for more edible oil imports, we are depriving protein supply to dairy and poultry and have to resort to importing corn and maybe soya eventually. In the end, our agriculture is shifting to other countries and so is rural employment and farmer incomes.

The website of the US Department of State in its Agriculture Policy states that “The office of Agricultural Policy (AGP) boosts prosperity of American farmers and ranchers by opening foreign markets to American farm products, promoting transparent, predictable, and science based regulatory systems overseas; and reducing unnecessary trade barriers around the world.”

While we may debate whether we have been ‘opened’ or not, by dismantling technology missions like the TMO and adopting extra liberal import policies at the cost of rural economy we are certainly not helping our cause. We are satisfying urban consumer demands by imports at the cost of the rural economy, thus leading to rural unemployment and rural migration towards cities in search of ‘labour’ work.

Is the dream of doubling farmers income, going to be achieved by reducing the number of farmers by half?

In the light of this history, we are better placed to evaluate the advice received by the PM from agricultural scientists and economists, which he shared while laying the foundation stone of Manipur Water Supply Project on July 23, 2020, regarding cultivating palm oil in North East. The follies of the last two decades can still be overcome by reverting back to the traditional cropping patterns for oilseeds and promoting traditional edible oil as ingredients for food and non-food FMCG. It will take a missionary zeal and the strategic intent of the government, but the self-sufficiency status-quo ante of 1994 in edible oil can still be achieved. By taking up palm oil plantation in the North Eastern States we will not just accept the LAC as LOC, but as the international border.

Also read: How ‘Dirty’ is India’s Palm Oil and What Should We Do About It?

On January 8, 2020, the India Directorate General of Foreign Trade had put palm oil from the ‘Free’ to ‘Restricted’ List in what appeared to be a reaction to the criticism by the Malaysian Prime Minister Mahathir Mohammed regarding the Citizenship Amendment Act and India’s action regarding the reading down of Article 370 in Kashmir. Around 40% of the palm oil imported to India, or 17% of the total edible oil consumed, is from Malaysia.

This led to a spike in palm oil prices and consequentially of other edible oils, making their cultivation more appealing. Improved MSP this year also contributed to the cause. The Ministry of Agriculture’s CWWG report as on September 4, 2020, reported that kharif oilseeds cultivation showed a growth of 12% compared to a growth of 6% for all kharif crops. The edible oil industry is resilient and has the potential for being atmanirbhar. The question would remain- do we really want that?

B.M. Vyas is the former managing director of GCMMF Ltd and had been instrumental in the launch of Dhara. Manu Kaushik is a management professional and has also been associated with GCMMF Ltd.

For more information , visit our website : https://www.punjabenggworks.com

#oil plant machine manufacturers#oil extraction machines#oil expeller machines#oil mill machinery suppliers

2 notes

·

View notes

Quote

Indonesia, the world’s biggest producer of palm oil, boasts lower production costs and has a bigger share of the market in many palm oil-consuming countries. It has also historically offered palm oil at cheaper prices than Malaysia, although recently Malaysian export prices have slumped below Indonesian rates as Indian buyers retreated from the market. Leading industry analyst James Fry said India’s restrictions will shift Indian crude palm oil purchases from Malaysia to Indonesia, and Malaysia may end up selling more refined palm oil globally.

Reuters, 'India's import curbs big blow to Malaysian palm oil' Times of India

#Times of India#Reuters#Indonesia#palm oil#production costs#market share#export prices#Malaysia#India#James Fry#trade restrictions#crude palm oil purchases#refined palm oil

1 note

·

View note

Photo

VEGOILS-Palm oil opens lower on China's anti-dumping probe, fall in Indian imports JAKARTA, Sept 4 (Reuters) - Malaysian palm oil futures opened down on Wednesday, after China announced it would start an anti-dumping probe into canola imports from Canada and a drop in India's palm oil imports. The benchmark palm oil contract FCPOc3 for November delivery on the Bursa Malaysia Derivatives Exchange was down 35 ringgit, or 0.89%, to 3,896 ringgit ($895.43) a metric ton, as of 0231 GMT. FUNDAMENTALS India's palm oil imports in August fell 27% from a month ago on ample stocks and as negative margins prompted refiners to curtail purchases of the tropical oil, five dealers said on Tuesday. Lower purchases by the world's biggest importer of vegetable oils could lead to higher stocks of palm oil in key producers Indonesia and Malaysia, weighing on benchmark futures. China said on Tuesday it plans to start an anti-dumping investigation into canola imports from Canada, after Ottawa moved to impose tariffs on Chinese electric vehicles, sending prices of domestic rapeseed oil futures to a one-month peak. Dalian's most-active soyoil contract DBYcv1 fell 0.26%, while its palm oil contract DCPcv1 was down 1.65%. The Chicago Board of Trade BOcv1 dropped 0.24%. Palm oil tracks price movements in related oils as they compete for a share in the global vegetable oils market. Malaysia's August palm oil exports are seen at 1,376,412 tons, according to Amspec Agri. Exports of Malaysian palm oil products for August fell 9.9% to 1,445,442 tons from 1,604,578 tons shipped during July, cargo surveyor Intertek Testing Services said. The Malaysian ringgit MYR=, palm's currency of trade, gained 0.41% against the dollar. A weaker ringgit makes palm oil more attractive for foreign currency holders. Oil prices fell on Wednesday, extending the previous day's more than 4% plunge, on expectations the political dispute that has halted Libyan exports may be resolved and concerns over lower global demand growth. Stronger crude oil futures make palm a more attractive option for biodiesel feedstock. Palm oil FCPOc3 may drop to 3,864 ringgit per metric ton, as a double-top formed around 4,003 ringgit, according to Reuters' technical analyst Wang Tao. MARKET NEWS Asian shares and global stock futures tumbled, while oil prices hit multi-month lows as a sharp tech selloff on Wall Street and resurgent worries about U.S. growth drove investors out of risky assets.

0 notes

Photo

Indian Palm Oil Market Service and Growth to 2025

India palm oil market size is anticipated to reach USD 13.1 billion by 2025, according to a new report by Grand View Research, Inc Refined derivatives are widely being utilized in food owing to their lower price in comparison to other conventional edible oils derived from groundnut, soybean and sunflower.

Rapid urbanization, and changing lifestyles backed by increasing disposable income in India have influenced consumption trends of consumers. Increasing consumption in food & beverages and cosmetics industry is a key factor likely to boost overall growth. A positive factor in the Indian production scenario is a significant growth in the acreage, which registered a CAGR of approximately 20% over the past five years. Improving yield coupled with reducing wastage during production by has created improved business environment in India. In order to encourage domestic cultivation, the government provides subsidies of up to INR 7,000 per hectare for farmers. Furthermore, to ease capital inflows, the government also allowed 100% FDI through automatic route. The lubricants segment is anticipated to exhibit steady growth owing to increasing demand for numerous commercial and industrial products including detergents, soaps, shampoos and cleaners. Further Key Findings from the Study Suggest:

From 2016 to 2025, CPO is projected to register growth rates above 8%, which can be attributed to lowered import duties. CPO import volume was nearly 6.50 million tons in 2014

Indonesia and Malaysia accounted for approximately 90% of the imports in 2015. Kandla, Krishnapatanam, Kolkata, Kakinada, Mangalore and Nhava Sheva were the leading ports of entry from 2014 to 2016

Export taxes of CPO in Indonesia and Malaysia range from 7.5%-22.5% and 4.5%-8.5% respectively. These countries use futures exchange (Bursa Malaysia), FOB quotes, and CIF prices as benchmarks

Edible oil applications accounted for nearly 95% of the consumption volume in 2015. The segment growth is further expected to be driven by high demand from processed foods, fast food chains, and households

As of 2015, fresh fruit bunch (FFB) produced was 1.18 million tons while oil extraction rate stood at 17%. Improving extraction rates is paramount for domestic producers

Sample request: http://www.radiantinsights.com/research/indian-palm-oil-market/request-sample

Increasing acreage is critical for sustainability of the domestic industry. As of 2015, the potential cultivation area identified stood at 1.93 million hectares while only 0.2 million hectares were planted.

Key companies operating in this market include Ruchi Soya Industries, Kamani, Acalmar Oils & Fats, AdaniWilmar, Anik Industries, Aditya Engineers, Sundex Process Engineers Pvt. Ltd., Brissun Technology Pvt. Ltd. and Cargill India

0 notes

Text

The Crafters Guide to Making Praakritik Ghee

If you’re looking to make the world’s most delicious ghee, you need to know where to start. And if you want to do it from scratch, you need The Crafters Guide to Making Praakritik Ghee. Here we take a look at the basics of making this iconic Indian butter, from tasting and lab work to marketing and shipping. We also explore how to get the most out of your production run—from storing your material in cold climates to using the best ingredients possible. So whether you’re an experienced crafter looking for the perfect product or a first-time maker just starting out, we have everything you need right here.

What is Praakritik Ghee.

Prakritik Ghee is a type of butter that is made from the sap of the palm tree. The Crafters Guide to Making Praakritik Ghee explains that Praakritik Ghee has a high melting point, making it an ideal butter for baking and cooking. It is also used in some traditional Thai medicine treatments.

How to Make Praakritik Ghee.

The Crafters Guide to Making Praakritik Ghee offers five steps for making praakritik ghee:

1) Grind the Palm Tree's Sap into a Fine Milligram Powder

2) Heat the Palm Tree's Sap on Low until it Turns into a Liquid

3) Add Some Water To The Palm Tree's Sap And Let It all Meltdown

4) Use The Liquid Won't Have Any Joining Or Separation Marks But It Will Taste Sour All Over

5) Pour TheGhee Into A Mason Jar or Othercontainer And Store It In A Cool Place

What Benefits Do Praakritik Ghee Have.

Prakritik Ghee is a high-quality, butter-based oil that has many benefits for the kitchen and everyday use. These benefits include:

2. it can be used to make a variety of dishes, including curry, chicken curry, seafood curry, and beef stroganoff

2. it can help with digestion and skin care

3. it can be used as a natural moisturizer

How do the Benefits of Making Praakritik Ghee manifest themselves?

The benefits of making praakritik gooey oil manifest themselves in many ways. Some of these ways are as follows:

2. It will help to improve digestion

3. It can help to reduce wrinkles and age spots

4. It can help to improve skin care

What are the Different Types of Praakritik Ghee?

There are three types of praakritik Ghee: cold-pressed, hot-pressed, and blended. Each has its own set of benefits and disadvantages. cold-pressed praakritik ghee is the most complex and has a higher quality content than any other type of praakritik ghee. It can also be harder to find and expensive to purchase. hot-pressed praakritik ghee is less complex but does not have as high a quality content as cold-pressed praakritik ghee. It is also less expensive to purchase. blended praakritik ghee is a mixture of both hot and cold pressed praakiritks, making it the most versatile type of prakirtiks available. It has a lower quality content than either the others but can be more affordable to purchase.

How to Get started in the Stock Market.

If you want to invest in stocks, it’s important to first decide what type of investor you want to be. This can include someone who wants to become a stock market insider, or someone who just wants to play around with the stock market and see what happens.

To get started in the stock market, you first need to open a brokerage account. Brokerages offer a variety of services including investing in stocks and trading. To learn more about how to start trading stocks, head over to a broker’s website or use one of their apps.

Learn the Basics of Stock Trading.

Once you have opened a brokerage account and learned about stocks, it’s time to start trading them! You’ll need some basic skills before starting out, such as knowing how many shares an individual company has, understanding how stock prices work, and knowing when and why to buy or sell shares. You can also check out trader resources like The Crafters Guide to Stock Trading for more tips on getting started in stock trading.

Start Investing in the Stock Market.

When you finally have your Trading skills down pat, it’s time to begin investing in the stock market! One great way to do this is by buying shares of companies that you think will future go up (an “up-and-coming company”). Another option is by selling shares of companies that you think will go down (a “down-and-out company”). Once you have decided which type of investment you want to make, it’s time to startinvesting!

Section 4. How Much Can You Save By Investing In Stocks?

In order for you to save money while investing in stocks, it helps if you understand how stock prices work and when and whyto buy or sell shares. Additionally, it helps if you are experienced with trading securities and know WHEN TO BUY AND WHEN TO SELL SHARES OF COMPANIES! Overall, these three things will help increase your chances of making money while invested in stocks: understanding how they work; being experienced with trading; and using good financial planning techniques.

Section 5. How Much Can You Save By Investing In Mutual Funds?

When it comes to investing in mutual funds, there are a few things you can do to help save money. One of the most important things you can do is to make sure you understand the types of mutual funds that are available and what their risks are. Additionally, make sure you have a solid financial plan in place so that your investment does not cause too much stress.

Why You Should Invest in the Stock Market.

The stock market is a place where investors can buy and sell stocks. It consists of a number of different markets, each with its own set of rules and regulations. The stock market is an important part of the economy because it allows people to get their hands on new products and services.

How Does the Stock Market Work.

The stock market works by allowing people to buy and sell stocks. The process begins by searching for stocks that are in good condition and have a low price tag. Once someone has found a good deal on a stock, they then have to decide whether or not to buy it. They do this by looking at the company’s financial statements, which show how well the company is doing financially. If someone decides to buy a stock, they then have to wait for the company to make money so they can cash out their investment. Finally, people must also be able to afford the stock before buying it.

Conclusion

Making Praakritik Ghee has a number of benefits for crafters. Some of these benefits include increased production, reduced costs, and improved production times. Additionally, the different types of Praakritik Ghee offer unique properties that can be used to create unique products. To get started in the stock market, you will first need to decide what type of investor you want to be. Then open a brokerage account and learn the basics of stock trading. Finally, start investing in the stock market and reap the benefits!

0 notes

Text

HUL Q3 surpasses estimates even as rural growth remains impacted

The country’s largest fast-moving consumer goods (FMCG) major, Hindustan Unilever (HUL) posted better than expected performance for the quarter ended December 2021 (Q3FY22) on all fronts, sales, operating profit and net profit. It also posted better than industry growth across its business categories. However, the commentary was worrying as the company management said that the operating environment remains challenging, as rural volume growth for the industry in the December ended quarter (Q3FY22) continued to stay in negative territory, citing Nielsen’s market growth numbers.

Volumes started to contract in rural areas from August of last year, according to data by Nielsen shared by HUL in its presentation.

Sanjiv Mehta, chairman and managing director of HUL said in its post earnings call while addressing weak demand, “We are very pleased that we have remained competitive, grown our market share and protected our business model.” But, Mehta pointed out that there needs to be more money in the hands of the rural consumer.

The company reported volume growth of 2 per cent in the third quarter of FY22. Ritesh Tiwari, CFO at HUL explained that almost 30 per cent of HUL’s business comes from packs that operate at price points like Re 1, Rs 5 and Rs 10 and in these packs HUL prefers to reduce grammage instead of increasing prices which resulted in volume decline despite selling the same number of units. “This had a circa 2 per cent impact on our volumes,” Tiwari explained.

The company said that it is significantly ahead of the market volume growth.

In the October-December quarter, HUL’s consolidated revenue increased 10.3 per cent year-on-year (YoY) to Rs 13,439 crore. While its operating margins expanded by 105 basis points and was at 25.8 per cent. Its net profit was also up by 18.6 per cent YoY in the quarter at Rs 2,297 crore. Bloomberg pool of analysts had revenue at Rs 13,051.5 crore, and net profit at Rs 2,225 crore.

Mehta said that the relief provided by the government in the last two years to the rural consumers, needs to be extended in the new fiscal year. “Things like MNREGA outlay may have to increase further and also free food supply, because the (Indian) economy is still in the process of recovering,” Mehta said. Adding: “The economy is recovering and at the end of this fiscal year, the economy will be the same size it was two years back.”

Mehta also said that in his view there are two things which could be done to propel volume growth, one is once inflation starts to come down then prices are also adjusted and second would be if the government could help in the intervening period and put more money in the hands of the people.

The maker of Lux soaps has seen its market share increase both in rural and urban and across all its divisions and price segments, Tiwari said.

Tiwari said that the operating environment remains challenging. FMCG market growths are moderating and consumers are titrating volumes owing to significant inflation.

He also called out commodity headwinds which are challenging for the industry.

“In the near term, the operating environment looks challenging, and we expect to see sequentially more inflation in the March quarter compared to December quarter,” Tiwari said. Adding, “We will continue to manage our business with agility and take all steps required to protect our business model and grow our consumer franchise while maintaining our margins in a healthy range.”

Tiwari pointed out that two commodities which are impacting its business are palm oil which goes into its skin cleansing business, soap business and the hair business. Crude oil and its derivatives are used in its laundry business, homecare business and overall household care business.

HUL sees two thirds of its business is exposed to commodities.

In its tea business, the company has seen some prices of tea come off from its highs due to good production but it still remains higher compared to 2020.

0 notes

Text

Get Indonesia Import-Export Data- To Search Importers and Exporters in Indonesia

Indonesia is a country in Southeast Asia. It is surrounded by the Pacific and the Indian Ocean. There are various other states situated in Indonesia. Talking about the business perspective of Indonesia, they are good in export and import business. They get benefits and profit from the import-export business. In this blog, you will get complete detail about import data from Indonesia, Indonesia import export data, and Indonesia export data. How Indonesia get benefit from the export and import business? Why Indonesia is so special in this business?

What are Imports and Export?

Import and export are two terms that are related to international business. Any company involved in selling or buying goods and services from other countries comes under import and export. Import means the fund or services which are produced internationally and sold to another country. Export is the service and goods produced domestically and sold to the other country. How Indonesia import-export data do their international business? Have a look below.

What Does Trade Data Include?

Indonesia trade data includes all the movement of goods and services through ports. The ports can be by road, by air, by sea. The Indonesia data will analyze the movement of products in the international market.

Indonesia export-import data includes the following details.

HS code: The harmonized commodity description and coding system used to identify the products.

Product description: the product description gives the detail about the product which is received in Indonesia.

Price quality, importer, supplier, country, etc.

Indonesia Export Data of 2020

The top exporters of Indonesia in 2020 are as follows. Indonesia is the largest exporter of palm oil. Based on the exchange rate of 2020 the depreciated value decreased by 9.6% U.S. dollars. The reduction of percentage is due to the pandemic of COVID-19. Less buyer and international trade reduce Indonesia import-export data.

Palm oil

Indonesia is the largest producer and exporter of palm oil in the entire world. The total U.S. $26 billion annually is subjected to this product. Malaysia shares 34% of palm oil from Indonesia.

Coal

The second-largest Indonesian export data comes from coal. The annual output is the U.S. $11 billion and the capital value is 18%. This value is account for 8.5% of total exports.

Copper ore

Talking about the third-largest exporter it is copper ore. Indonesia shares the U.S. $44 billion with a market capitalization of 7%. The largest gold mine and copper mine is situated in Indonesia. Indonesia export data will give the correct market value.

Gold

Indonesia is the 9th largest gold producer in the entire world. 4% of gold is produced globally from Indonesia. The largest producer of the gold exporter is Switzerland with 28% of gold.

Other products

The other products exported from Indonesia are rubber with the U.S. $3.33 billion, Jewelry with 3.17 U.S dollars, Coconut oil with the U.S, $2.73 billion, Plywood and car with the U.S. $2.08 billion.

Benefits of Export and Import Data

There are certain benefits of Indonesia’s import and export data which are mentioned below.

The supplier and buyer can be evaluated easily. In a particular business, the buyer and the supplier are the two hands for the whole business process.

Helps to identify and keep update with trading activities and information in Indonesia. These activities can be understood using the competition level. Indonesia export data and import data Indonesia needs competition in the market.

Better understanding what customers are looking for which will lead them to profit and popular imports.

The information about the import will enable the researcher to stay updated with the actual market changes and conclusions required.

Indonesia Data to Evaluate Future Growth

How to identify the export data to analyze future business growth? Have a look below to have a better understanding.

The understanding of the international level market is the main criterion. You have to keep updated on the current scenario of the market and the trend for international business.

Evaluation is the second step you need to follow. You can evaluate your position in the industry. Indonesia import-export data need the evaluation process.

Check the basic points that you need from Indonesia export data. Identify all the factors and the improvements which will flourish and give rise to the business.

The last step is to use the data according to your Business Growth.

Import data of Indonesia

The import data Indonesia shares its uniqueness. The Indonesia import statistics of 2020 are as follows.

Machinery’s

The goods and services for machinery and various other parts are imported in Indonesia. The machinery parts include $27 billion of total export.

Mineral

Talking about oil, mineral fuels and other types of the mineral consumer products are $23 billion of total import value.

Electronics

The import data Indonesia shares $20 billion from total export for an electronics product. Indonesia’s import-export data is quite different for different products.

Steel and Iron

The import data Indonesia have shared $10 billion of total import value. Iron and steel products have their unique journey.

Plastic

The article and plastic shares $9 billion of total export. Apart from it, optical medical value shares $3 billion.

Top Export and Import Country of Indonesia

The top importer of Indonesia is China, Singapore, Japan, Thailand, United States of America, South Korea, Malaysia, Australia, India, and Vietnam. Import data Indonesia depends upon these countries.

The top exported of Indonesia in the United States of America, Japan, Singapore, India, Philippines, Thailand, Hong Kong, Australia, Bangladesh, United Arab Emirates, Belgium, and France. Indonesia import-export data always have a fresh start of business. Indonesia export data develop with the following countries.

Conclusion

The import data shows that China has been the top import country of Indonesia. The Indonesia trade statistics share 26.2% of total imports. Business is something you need to flourish with your mind. Till now you might be aware of import data Indonesia, Indonesia export data, and Indonesia import-export data. Business is something you need to learn with your experience and knowledge. International business will give you profit in long run. Be the part of Indonesia import-export business

Source Url : https://indonesiatradedatas.blogspot.com/2021/06/get-indonesia-import-export-data-to.html

#indonesiaexportimportdata#globaltradedata#export data#exporters#export#importers#trade data#global#importexport#indonesia#jakarta#importexportdata#import export#global markets#suppliers#manufacturer#wholesale#brands#sale#discount#shipment data#import data#importer#import export business#import#imported goods#imported#exported

0 notes

Photo

VEGOILS-Palm oil drops for third day on concerns of higher Indian import taxes SINGAPORE, Aug 29 (Reuters) - Malaysian palm oil futures extended declines on Thursday to a third session, as the prospect of India, the world's largest vegetable oil importer, raising import taxes weighed on market sentiment. The benchmark palm oil contract FCPOc3 for November delivery on the Bursa Malaysia Derivatives Exchange fell 40 ringgit, or 1.02%, to 3,880 ringgit ($897.11) a metric ton as of 0241 GMT. FUNDAMENTALS India is considering an increase in import taxes on vegetable oils to help protect farmers reeling from lower oilseed prices, two government sources said on Wednesday. The move, likely to be announced in the coming weeks, could dampen demand and reduce overseas purchases of palm oil. Dalian's most-active soyoil contract DBYcv1 dipped 0.05%, while its palm oil contract DCPcv1 lost 0.87%. However, soyoil prices on the Chicago Board of Trade BOcv1 added 0.44%. Palm oil is affected by price movements in related oils as they compete for a share in the global vegetable oils market. The Malaysian ringgit MYR=, palm's currency of trade, strengthened 0.16% against the dollar. A stronger ringgit makes palm oil less attractive for foreign currency holders. Oil prices held mostly steady on Thursday, after losing over 1% on Wednesday, as a smaller-than-expected draw in U.S. crude inventories and continued worries over China demand countered supply disruptions out of Libya. Weaker crude oil futures make palm a less attractive option for biodiesel feedstock. Palm oil may fall into a range of 3,819 ringgit to 3,864 ringgit per metric ton, following its failure to break resistance at 3,966 ringgit and a falling trendline, said Reuters technical analyst Wang Tao. MARKET NEWS Asian shares followed Wall Street futures lower on Thursday as Nvidia's results disappointed some bullish investors, while the dollar steadied and the Treasury yield curve came within a whisker of turning positive.

0 notes

Text

Vanaspati Ghee will be 40,653 Crore Industry by 2024 in India

With the Vanaspati Ghee industry set to expand quickly over the next few years, it is important for investors and at-home cooks alike to familiarize themselves with this culinary staple of the Indian subcontinent. It is predicted that the Vanaspati Ghee will be 40,653 Crore Industry by 2024 in India, and there are an incredibly diverse and interesting set of factors that explain this—ranging from population growth, increases in social mobility/disposable income, ease of access, and even the potential health benefits of these products.

What is Vanaspati Ghee?

To explain Vanaspati Ghee, it is best to start with an explanation of what Ghee is. Ghee is a class of clarified butter, created through a process of simmering butter until it separates into liquid fats and milk solids. As this occurs, impurities are removed from the surface while solid residue settles at the bottom. Ghee is cooked longer than clarified butter, giving it a distinct flavor and yellowish hue. Once complete, the ghee is strained to remove milk particles, and allowed to cool.

Ghee has a higher boiling point than clarified butter and also has a stronger taste and nuttier flavor. This makes it an incredibly popular ingredient for cooking and frying food, as well as being a healthier alternative to traditional butter. Interestingly, Ghee has taken on a revered status in some religions, being used in ceremonial practices—it also plays a role in Ayurveda, a traditional system of medicine developed in India thousands of years ago.

As you can imagine, the status, utility, and benefits of Ghee make it highly sought after, and a product often so expensive that many lower and even middle-class people could not easily afford it. Naturally, a product emerged to meet the demand of the low-cost market, and that product was Vanaspati Ghee. A cheaper alternative, but no less unique in its historic importance for traditional Indian cuisine.

Vanaspati Ghee, a fully or partially hydrogenated vegetable cooking oil made from palm or palmolein oil, is an incredibly important and popular product in India. Hydrogenation is performed using nickel as a catalyst and employing low-medium pressure reactors. Much like Ghee, it has a rich taste and flavor that works well when using it for cooking purposes. It also contains a large amount of trans-fat and is a major dietary source for those living on the subcontinent. As it stands, Vanaspati Ghee has a roughly 10% share of the edible oil market, and 1.2 million tonnes of it are produced annually.

Why is the Industry Growing?

India has a relatively high consumption of edible oils, and a significantly high rate of Vanaspati use over other nations. Vanaspati and other oils are a staple of the Indian kitchen, seeing regular use in meals daily. Given this existing market saturation and popularity, it makes sense that the market would be highly profitable in a country of 1.25 billion.

With a population set to reach 1.53 billion by 2030, the Vanaspati Ghee is bound to rise as well, creating a stable market base with a future of organic growth.

Evolving in conjunction with India’s population growth is the availability of social mobility. More and more Indian citizens are finding it easier to transition between social classes. The impact of a rising middle class will be difficult to predict for the Vanaspati Ghee market.

Traditionally, the lower class prefers to use Vanaspati for its versatility and relative affordability, while the middle class favors refined oils. This trend is not set in stone, however, and there is room for the rising middle class to bring their Vanaspati preference with them while exiting their previous class. Additionally, Vanaspati is not constrained to at-home use and is a popular cooking ingredient in many eating establishments across India. As the access to disposable income increases for those entering the middle class, their increased rate of ‘dining out’ or ‘ordering in’ will have a noticeable increase in the indirect consumption of Vanaspati.

Not only is Vanaspati experiencing a market boon, but so too is Ghee. The increased rate of disposable income is not just pushing people to dine out, but also to spend more on dining in. Similarly, the rise in popularity of “traditional Indian” restaurants has seen an increase in Ghee used for those dishes that require it. As people are willing to spend more on a ‘traditionally’ cooked dish, the sale of Ghee to restaurants and other establishments is bound to increase.

Additionally, Ghee is viewed by many to have positive health benefits. Being rich in fat-soluble vitamins A, D, & E—Ghee is believed to help build strong bones, aid digestion, and even decrease inflammation for those that suffer from it. The perception of Ghee as a healthier alternative to butter and other unhealthy cooking alternatives is a factor in its market growth, as is its existing penetration into the market.

Still, the growth of Ghee in the market has been hindered by the continued popularity of cheaper alternatives, as well as examples of ‘Ghee’ substitutes that have been cut with refined and hydrogenated vegetable oils to reduce the price at the cost of purity. It is also important to note the overconsumption of Ghee may lead to cardiovascular disease, something which may have a negative impact on the market.

Looking Forward

With all of these factors at play, the Vanaspati Ghee market is set to experience several years of growth and further market saturation over the next few years. Elements such as population growth, increased social mobility, growing disposable income, and the rising popularity of restaurant dining—make it so the immediate future of the Vanaspati Ghee market rests on stable factors that are unlikely to reverse in any meaningful way over the next decade.

A staple of kitchens on the Indian subcontinent, Vanaspati Ghee is unlikely to have its significant culinary and cultural impact seriously challenged by local competitors for some time to come.

Additional Information:

https://www.medicalnewstoday.com/articles/321707#how-is-ghee-made

https://www.business-standard.com/article/management/40-years-ago-and-now-how-dalda-built-and-lost-its-monopoly-115030501153_1.html

0 notes

Text

COSMETIC SURFACTANTS MARKET ANALYSIS

Cosmetic Surfactants Market, by Source (Natural and Synthetic), by Application (Hair Care, Nail Care, Oral Care, Skin Care, and Others), and by Region (North America, Latin America, Europe, Asia Pacific, Middle East and Africa) – Size, Share, Outlook, and Opportunity Analysis, 2019 – 2027

Cleansing, solubilizing, foaming, thickening, emulsifying, penetration enhancement, and other special effects are attained in cosmetic by the use of surfactants. Surfactants are the most important ingredient in personal care and beauty products. The only reason to use surfactants in cosmetic is that surfactant molecule is compatible with both hot and cold water. Cosmetic ingredients are substances used for composition and formulation of cosmetics. The ingredients mainly used in cosmetics include surfactants, conditioners, colorants, polymers, and active ingredients.

Request Sample

https://www.coherentmarketinsights.com/insight/request-sample/2584

Market Dynamics:-

Rising awareness about beautification and increasing urbanized population are major factors driving growth of the cosmetics surfactants market. Cosmetic ingredients such as surfactants are useful for skin cleansers, due to its exceptional foaming ability. The demand for cosmetic products is increasing due to changing lifestyles and increasing disposal income. Compared to other segments, skincare segment is the major driver for growth of the global cosmetic surfactants market. Significant increase in use of skincare products is expected to boost the cosmetic surfactants market growth over the forecast period, globally. According to Korea Cosmetic Association (KCA), skincare cosmetics market, one of the largest import category in Korea, was expected to reach US$ 4,944 million in 2017, from US$ 4,192 million in 2016.

Stringent government regulations may hamper the market growth of cosmetic surfactants over the use of inorganic surfactants. Since inorganic cosmetic surfactants are irritating to skin and eye, manufactures are using green surfactants in the products. Coconut oil and palm oil is widely used as a green surfactants for manufacturing the cosmetic products.

Download PDF

https://www.coherentmarketinsights.com/insight/request-pdf/2584

Talk to analyst

https://www.coherentmarketinsights.com/insight/talk-to-analyst/2584

Market Outlook:-

Asia Pacific is expected to be the fastest growing region in the cosmetic surfactants market during the forecast period. This is due to rapid globalization & urbanization, and rising disposable income of the populace in this region. According to Ministry of Economy and Industry, Indian beauty and personal care industry is expected to reach US$ 10.5 billion in 2021, up by 40% from US$ 7.5 billion in 2016. Therefore, significant growth in personal care industry is expected to boost growth of the cosmetic surfactants market in the region during the forecast period.

Key Players:-

Key players operating in the cosmetic surfactants market include Lonza Group, AkzoNobel, Solvay SA, Croda International, Eastman Chemical Company, Ashland Global Holdings Inc., Clariant AG, Evonik Industries AG, Koninklijke DSM N.V., The Dow Chemicals, and Innospec Inc.

Market Taxonomy:-

On the basis of source, the global cosmetic surfactants market is segmented into:

Natural

Synthetic

On the basis of application, the global cosmetic surfactants market is segmented into:

Oral care

Skin care

Nail care

Hair care

Others

On the basis of region, the global cosmetic surfactants market is segmented into:

North America

Latin America

Europe

Asia Pacific

Middle East

Africa

U.S.

Mexico

Canada

Brazil

Argentina

Rest of Latin America

Germany

Spain

U.K.

Italy

France

Russia

Rest of Europe

China

India

Japan

South Korea

ASEAN

Australia

Rest of Asia Pacific

Cosmetic Surfactants Market Key Developments:

In November 2015, Clariant AG acquired 30% shares of health personal care division of Beraca Ingredientes Naturais SA, a company engaged in supplying natural and organic certified ingredients for personal care products. Moreover, in October 2017, Beraca along with Clariant launched new Capillus Pro 22 surfactant in Latin America. This surfactant finds application in various hair care products such as conditioners, hair masks, and hair repair & combing cream among others. The surfactant is expected to strengthen hair fibre and offer hair smoothness, and shine.

In July 2015, BASF along with Solazyme, Inc., a renewable microalgae oil and ingredients company, launched first commercial surfactant derived from microalgae oil. This high performance algal betaine based surfactant find its application in home and personal care products.

In May 2019, Lonza Group Ltd. introduced its new ‘SYNETH’ product range of polyglycerol esters. These esters serve as non-ionic surfactants and emulsifiers. SYNETH find its application in beauty and personal care products including cleansers and leave-on and rinse-off applications for skin, hair and scalp care products among others.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized Market Research Services

Industry Analysis Services

Business Consulting Services

Market Intelligence Services

Long term Engagement Model

Country Specific Analysis