#IRA silver investment

Explore tagged Tumblr posts

Text

Buy Silver Canadian Maple Leaf Coin – 1 Oz Fine Silver

The Silver Canadian Maple Leaf Coin, a symbol of Canada’s rich heritage, is crafted with 1 oz of .9999 fine silver. Renowned for its intricate design featuring the iconic maple leaf, this coin offers both investment potential and collectible value. Secure yours today through IRA Gold Proof and invest in quality silver bullion.

#Silver Canadian Maple Leaf Coin#Investment in silver#Canadian silver coin#Precious metal coin#IRA silver investment

0 notes

Text

🐙⚔️

#new method of dining & dashing: dine and doze. sleep until they give up on u and u get out of the bill. its genius#he didnt even order a drink like silver ur bill wouldnt be too high. surely. glances at azul#im actually v curious abt the finances of briar valley students beyond malleus. like im sure lilia is taken care of from military days#but like? the guy is retired. so when did he officially retire in a 'no longer getting income' way. or do they do pensions#or did he invest. or save. does twst have 401ks. what abt roth iras. what abt etfs. money market accts? high int savings?? i need to know#did he get a bond for silver as a baby that he can take out at 18. does silver get allowance. or part time job? i NEED TO KNOW#sebek seems middle class so do lilia and silver BUT I NEED DETAILS#also in the bg pretend trey is talking to jade offscreen. and the canonicity of this drawing is after book 5#so no ortho OR sebek in freshmen squad. not yet#twst#twisted wonderland#twst silver#azul ashengrotto#ace trappola#deuce spade#jack howl#epel felmier#trey clover#suntails#i would say mostro lounge was fun to draw but i dont make a habit of lying#well i mean. it wasnt NOT fun. it was satisfying? i felt accomplished? but the process was a bit rough

265 notes

·

View notes

Text

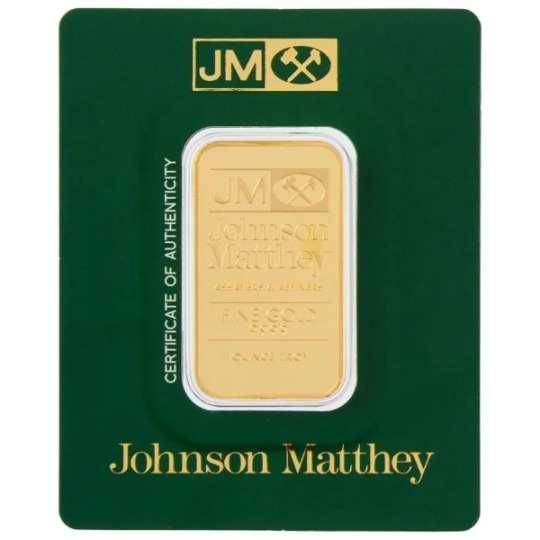

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes

Text

IRA Comparison Guide

Website: https://www.iracomparisonguide.com

Address: 4283 Express Lane, Suite TH1342, Sarasota, FL 34249

Phone: (941) 538-6941

Your ultimate resource for informed financial planning! Offering insights, analysis, and comprehensive reviews on Individual Retirement Accounts (IRAs). Discover expert insights and make informed decisions on gold and silver backed IRAs with IRA Comparison Guide.

#Financial planner#Investment Services#gold ira#precious metal ira#self directed gold ira#silver ira

1 note

·

View note

Text

Best Gold Investment Companies Operating on the US Market

This is a list of the best gold investment companies in the US. Article provided by Nikola Roza of nikolaroza.com https://nikolaroza.com/best-gold-silver-ira-companies/

1 note

·

View note

Text

Looking to diversify your portfolio? Gold and silver investing through a Gold IRA can be a solid financial strategy for protecting your wealth. By rolling over your 401k, you gain access to the stability and potential growth of precious metals. Unlike paper assets, gold offers security against market fluctuations. It's more than just an investment – it’s a way to ensure your financial future is grounded in tangible value. Explore how gold investing can work for your retirement strategy.

https://www.northernliongold.com

3 notes

·

View notes

Video

youtube

Building Wealth With Gold IRA Investments

Retirement and how it is spent is a worry that consumes numerous Americans. Setting up your IRA account during your working a very long time to secure a retirement of bounty ought to be principal to you. Taking into account the current situation visit site here with the economy, you would be justified in having a restless outlook on when you finally quit working professionally.

Gold IRA investments give an ideal approach to increasing the worth of your retirement account. The strength that is given by gold investing in IRAs guarantees the increase in worth of your account over the long run. Gold is a product whose price isn't impacted by market influences. Its worth is directed upon by the law of market interest. With the interest for gold barely met by the stockpile, the normal outcome is at gold costs to rise.

To make gold IRS investments you should initially set up an independently managed IRA account. This is achieved either by doing a rollover of funds from a current retirement account or you can put aside a direct installment to open one. Actual treatment of actual resources of a gold IRA by the account owner as well as its director is completely disallowed by the IRS. As per IRS rules, actual gold should be saved directly into an IRS-authorize vault so as not to run into fines and punishments forced by the public authority.

When you have successfully set up your gold IRA you can start your quest for reasonable gold IRA investments. Remembering that the IRS has set norms for actual gold resources that you can keep in your account would keep you from purchasing unacceptable things, accordingly squandering your assets. Gold bullion coins or bars must be at least.999 fine to qualify for your account. A legitimate gold vendor can be your partner in choosing the right gold things for your IRA.

You shouldn't oblige yourself to actual resources when you think about gold IRA investments. Investment opportunities in mining organizations could in like manner be thought about. Actual gold can give you a dependable increase in esteem in time for your retirement however at that point stocks actually finishes the work of increasing its worth at a lot quicker rate. In any case, similar to all stocks, its worth is can be impacted by market influences and consequently implies more gamble. However, stocks can in any case give a method for diversifying your investment portfolio.

Gold IRA investments can likewise be as other precious metals like silver, platinum and palladium. These were augmentations to the standard prior forced by the IRS on precious metals in IRA. The consideration of other precious metals in IRA has opened the ways to contemporary investments for account owners since gold is considerably more expensive.

9 notes

·

View notes

Video

Protecting Your Future by Investing In Gold IRA

Investing in gold is viewed as the best investment nowadays, even proposed by different financial specialists of the world. Certain individuals are making gold investment to become well off whereas others are investing in gold IRA and purchasing silver to protect their well deserved cash for future. Numerous business click here analysts and financial specialists are foreseeing an economic catastrophe in not so distant future subsequent to evaluating the global economic condition and especially the money related arrangement of USA.

Economies of a large portion of the nations in this world are confronting different issues to hold their solidarity. Indeed, even USA economy is faltering with $17 trillion obligation with Government deficiency of almost $ 1000 billion. These alarming assertions of the financial specialists had constrained even the billionaires to invest in gold for their safe future.

Reasons to invest in gold

Gold investments are liked at such an economically startling condition since it has been utilized as a store of significant worth and a solid money since hundreds of years separated. Any cash can be disrespected at such critical points in time printing the money yet at the hour of such inflation gold is the main money that keeps up with its worth. Your investment starting around 2001 in paper items like securities, stocks or common funds could have cleared out inside no time or could have been impacted at the hour of inflation however gold and silver had grown over 400%.

Gold, the precious yellow metal, has exceptional situation for a typical individual since hundreds of years and is being utilized as cash since at the very least 5000 years. The worth of gold has increased during such a long time whereas a few monetary forms had deals with issues meanwhile. Running against the norm US dollar is losing its worth consistently in any event, being a likely cash. If, in 1971, the US paper cash was not supported by gold then it would have lost its true capacity as money. The credit capability of the US Government has supported the dollar at such a pivotal time. This large number of realities are adequate to be certain for investing in gold.

Why to invest in gold at this point?

Monetary standards of the greater part of the nations, including USA, are confronting financial emergency as of now. The reason behind it is that they printed their cash at whatever point required without supporting it with gold. At the point when a nation prints its money without support it with gold then, at that point, its worth decreases in worldwide market. In such circumstance individuals lose their certainty on that cash and begin staying away from it. It is the beginning stage of hyperinflation in the economy of the nation concerned. Its circumstance turns out to be more basic if they print more money to demonstrate the potential. However there can be conceivable outcomes in hyperinflation yet it doesn't ensures any conviction. Eventually you need to get back to gold to keep up with the value of your money. The worth of gold increases with the decrease in the value of any cash even the dollar.

How to invest in gold?

The fundamental inquiry emerges as of now that how to invest in gold? You might know the realities that gold is substantial cash which is utilized all around the world yet neither could you at any point fabricate it nor can erase through any electronic programming. It saves you at the hour of economic breakdown and inflation as a fence. However gold investment is viewed as one of the most dependable investments yet certain individuals have different inquiries about gold IRA investment for securing their retirement. A survey on gold IRA gave in this article might help you in this regard.

8 notes

·

View notes

Text

Leading Gold and Silver Investment Company : Your Retirement with IRA Gold Proof

Discover how IRA Gold Proof, a premier gold and silver investment company, can help secure your financial future. Offering expert advice and a wide range of investment options, they make diversifying your retirement portfolio with precious metals simple and reliable. Start your journey to financial security today!

2 notes

·

View notes

Video

youtube

The Benefits of Opening a Gold IRA Account

Why Open a Gold IRA Account

There are four different precious metals which are typically bought as an investment: silver palladium, gold and platinum. Silver is another sound investment however with a spot price of about $20 an ounce, a well off investor would need to purchase a few hundred pounds to accomplish an objective of 20% in their portfolio. The price of putting away that a lot silver would take a lot of the investor's retirement fund so while silver is very steady, it isn't extremely useful. Palladium is worth substantially more than silver yet its spot price vacillates fiercely and it routinely decreases by up to $25 an ounce in a solitary day. Platinum is more intriguing than gold yet it's less steady that palladium and in some learn more cases it's spot price can really dip under the spot price of gold. Subsequently, gold is the most pragmatic of the multitude of precious metals to turn over into a gold IRA account. There are a few benefits to opening a gold IRA and knowing them is fundamental for any savvy investor.

Safe and Easy Tax Relief

Congress passed the taxpayer relief act in 1997, allowing the consideration of the four precious metals into an IRA. A precious metals IRA is something like a self-direct IRA with the exception of the investment can comprise of gold, silver platinum and palladium. Not all gold is allowed as a precious metals IRA investment so knowing what gold is allowed is indispensable. Gold bullion and 24 Karat bars can be included into a precious metals IRA. In any case, these bars must have a validation trademark from one of two different specialists: the New York Commercial Exchange (NYMEX) or the Product Exchange Consolidation (COMEX).

A Variety of Options

The IRS likewise allows specific 24 and 22 Karat gold coins to be included into an IRA. The American Bird, Canadian Maple Leaf and the Australian Philharmonic are the gold coins generally ordinarily included into a precious metals IRA. The gold must likewise be put away at an IRS endorsed safe and a stockpiling expense will be charged. Likewise the gold IRA account, similar to all self-direct IRAs, should have an overseer, for example, a bank or business firm. The overseer will likewise charge an expense so it's ideal to look around and think about prices and administrations.

Assurance against Inflation

In the year 2008, thousands of individuals lost as long as they can remember's saving basically for the time being on the grounds that they had all or a large portion of their cash invested in paper. That implies they had no actual resources and their value was all invested in stocks and bonds. These resources are generally not upheld by gold and they are subject with the impacts of inflation. In any event, when the other precious metals declined somewhat in esteem after the 2008 monetary breakdown, gold really increased in esteem. Gold in a real sense is the gold norm and previously devastated nations, for example, China and India are purchasing each ounce of gold that they can get.

10 notes

·

View notes

Video

youtube

Gold in Your IRA? Read This First!

You can own precious metals in an IRA and broaden your financial resources while protecting them from taxation. Broadening and a tax cover are both beneficial things, as any gold merchant will be glad to call attention to. However, before you go after the telephone - or mouse - you ought to comprehend a couple of central issues that sometimes become mixed up in the fine print.

1. No Collectibles.

The tax code is tied in with encouraging useful investment, not reveling your adoration for baseball cards, money of the Roman Domain or whatever else you need loads of. Thus, collectible or numismatic currencies are out for IRA purposes. On the off chance that a currency's worth is to a great extent founded on its unique case, it turns into an illegal collectible. On the off chance that not, it's an IRA qualified product. Your specialist ought to have the option to let you know which coins are which.

2. Capacity in a Supported Depository

You can't cover your gold in the back yard. It should be put away with an endorsed, outsider depository. To do in any case comprises a circulation, which is a taxable occasion and nullifies the purpose of the whole exercise. Issue: If your reasoning for owning gold includes a breakdown-of-society situation, actual admittance to your metal may be an arrangement buster.

3. Expenses

Neither your gold representative nor the capacity depository works free of charge - likely. Hope to pay for a mix of record set up charge, exchange expense, yearly organization charge, capacity expense, "IRA" charge - or anything they decide to call it. The point isn't to be provided a minimal expense estimate on your metal just to lose your price advantage because of extreme charges. At the point when you shop, look at the metal price in addition to all charges.

4. Metal Price? - Isn't this about Gold?

The Taxpayer Help Demonstration of 1997 indicates that gold, silver, platinum and palladium are qualified for leaned toward IRA treatment for however long they are of reasonable fineness or virtue. That implies more scope for you in light of the fact that the price per ounce shifts extraordinarily among the precious metals. If you have any desire to begin with moderately economical silver and your intermediary doesn't deal with it - others do.

5. Should be a New Buy

You say you already have gold and you like to taxproof it? Apologies, the law expects that any bullion or coin be newly bought to qualify. The money utilized for the buy can be old - yet the metal should be new to you.

12 notes

·

View notes

Video

Gold and Silver For Retirement

Individual Retirement Accounts (IRAs) can be supported with actual gold and silver, yet not very many investors know about this reality. They are excluded from all capital additions charges, so in the event that your investments perform above and click here to learn more beyond a significant stretch of time, it can bring about colossal savings.

Expanding your retirement portfolio with precious metals is generally required assuming you properly figure out resource allocation (see the Ibbotson study). Furthermore precious metals typically ascend during times of disrupting occasions like conflicts, psychological warfare, expansion, flattening, slumps in the stock market and the US dollar. Precious metals generally return huge profits in these conditions.

What is interesting about this plan is that you can take actual ownership of the real gold or silver when you make your withdrawals. That is right! You can cash out in truly true blue gold and silver rather than fiat dollars. This is the main element of all. Not too far off, in this generational positively trending market in gold and silver, the chances are in support of yourself that you will want and need the physicals when now is the ideal time to get to your investment.

When you decide that you want to include precious metals in your retirement arranging, you want to decide how much you want to invest. How much relies upon your yearly contribution, your own objectives and your singular investment philosophy. Elements to consider are your age, complete resources and chance resilience.

Not very many organizations are gotten up in a position handle the precious metals part of retirement plans. One of the forerunners in the field is GoldStar Trust Organization. GoldStar Trust Organization for investors who want IRAs that will acknowledge precious metals. GoldStar fills in as overseer for approximately 20,000 independent IRAs with resources in overabundance of $700 million.

GoldStar isn't a coin vendor, however it will work with sellers who trade precious metal coins and bullion for your IRA on your directions.

Laying out an IRA with GoldStar Trust Organization

Setting up a personally managed IRA with GoldStar is simple. I will talk about this at the Money Show in Las Vegas in May. Subsequently there are just three moves toward follow.

1. Present the desk work. 2. Store the account. 3. Direct your broker which precious metals to purchase.

The metals are stored at HSBC Bank USA's New York precious metals vault, which is one of the world's biggest and is utilized by COMEX and other significant products trades. Yearly storage expenses are charged at a level charge of $90 each year no matter what the size of the account.

9 notes

·

View notes

Video

youtube

How To Lay out A Gold IRA

Precious metals, basically gold and silver, provide great portfolio diversification as well as a fence against market instability and inflation. Turning over a current 401k into a gold IRA has turned into a famous approach to both invest in physical read more here precious metals as well as plan for a safer retirement. So this has yet to be addressed: how can one lay out an IRA gold investment?

Adding physical precious metals to an IRA, first turned into an option in contrast to conventional 401k's following the formation of the Tax Payer Relief Demonstration of 1997. Reasonable metals in a gold IRA include gold, silver, platinum, and palladium, which must all be bullion coins or bars and of specific specified fineness. Uncommon coins and other collectable gold and silver coins are not passable in a gold IRA. Your precious metals agent will actually want to work with you and prompt you on which metals are ideal for your portfolio.

Prior to settling on a choice on which metals to buy for your Personally managed IRA, it is insightful to initially start the most common way of laying out an IRA. The best spot to begin is to have your precious metals representative contact your ongoing caretaker to find out if you can add physical metals to your ongoing IRA. Generally speaking, specific IRA plans and certain rules with your ongoing account won't allow for precious metals investments. You should then begin the course of a 401k rollover into a new, gold IRA account.

Your representative will then, at that point, help you select a caretaker who has some expertise in managing gold Ira's. When chosen, some desk work should be finished up, which includes the sum you will be moving into the new gold IRA account, any recipients to be included on the account, alongside some additional standard data.

An IRA gold investment arrangement for the most part takes somewhere in the range of 3-5 business days following the commencement of the cycle. When this is finished, the time has come to choose and put the metals into your IRA account! Remember, there are just sure items that are passable in an IRA, which your dealer ought to be all ready to provide to you.

2 notes

·

View notes

Text

After a rocky start in 2021, U.S.-European relations have since gone from strength to strength, largely thanks to the unifying effects of Russia’s war against Ukraine. In recent months, however, this key partnership has been rocked by what is viewed in Europe as a resurgence of the “America First” economic policies that so bedeviled relations during the Trump administration.

Europe’s collective ire is directed toward U.S. President Joe Biden’s massive suite of inward investment policies—specifically, the American Rescue Plan Act, the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, and the Inflation Reduction Act (IRA). Together, these programs, which provide generous investment in infrastructure, green subsidies, and related tax breaks, threaten to lure foreign investment from Europe to the United States.

While this has been welcome news to many green energy advocates in the United States and elsewhere, it has caused increasingly public rifts with Europe. Critics believe the Biden administration’s inward investments constitute a new protectionism, one designed to place the United States first and everyone else a distant second. At the Davos World Economic Forum annual meeting in January, European Commission President Ursula von der Leyen declared that “competition on net zero must be based on a level playing field,” and specifically raised concerns about both the United States’ green policy suite and China’s subsidy and restrictive market practices.

After some internal hand-wringing over whether the goal should be to get the Biden administration to back down or instead to keep pace with U.S. initiative, Europe has begun to marshal a tit-for-tat response to challenge and counter U.S. policy efforts with its proposed Green Deal Industrial Plan. This resurgence of economic nationalism within the transatlantic relationship is what has economists such as Adam Tooze so concerned about the IRA.

If the prevailing analyses of European security experts and international economists are anything to go by, the United States and Europe appear to be heading toward yet another round of transatlantic tensions with this latest rift over green investment. But a closer examination suggests there is a real opportunity to turn this rather conventional spat into an alliance-building effort that benefits overlooked peoples and places on both side of the Atlantic.

Collectively worth some $3.8 trillion, the United States’ “doubly remarkable” plans stand out not only for the eye-watering amount of investment, but also the way in which the funds are to be invested. The funds from these plans are to be spent largely on direct investments to underdeveloped areas, as part of a “just transition” to new green technologies and industries. The IRA, for example, targets spending on communities that have been historically disproportionately affected by pollution, as well as those whose workforce would benefit from inclusion in the growing green sector of the economy, such as those with high fossil fuel employment or those with higher than average unemployment rates. As U.S. Treasury Secretary Janet Yellen said in Dearborn, Michigan, “We expect to see dollars catalyze innovative investments across cities and towns that haven’t seen such investment in years.”

The work of revitalizing the long-struggling heartland industrial regions isn’t just a U.S. project, though; rather, it’s of vital importance on both sides of the Atlantic.

As the United States makes unprecedented investments in its industrial heartland, the U.K. government has pursued its own agenda to “level up” the country’s left-behind regions. The European Union has acted similarly, seeking to improve its regional structural adjustment and cohesion policies, whose main task is to support the economic well-being of regions whose development is lagging behind. The OECD is also developing road maps and inventories on successful regional transformations to inform policy decisions in this area.

Policymakers in both Europe and North America have come to understand that, in the words of economic geography professor Andrés Rodríguez-Pose, the “revenge of the places that don’t matter” has political consequences—not just locally, but for their countries’ domestic political institutions, international relations, and place in the global economy. By supporting firms, university spinouts, and new industries in heartland areas through the IRA and related programs, the United States believes it can help rebuild local economies and possibly reduce the likelihood of political disaffection. This in turn will make the United States a better partner in the global economy and the institutions that govern it. Much the same could be said about government programs to assist post-industrial communities in France, Italy, the United Kingdom, Hungary, or Poland.

As such, debates over whether the IRA constitutes a new protectionism obscure a vital point: The economic revival of left-behind places is not a zero-sum game among allied nations. Neither is the commitment to developing new green industries and the supply chains and jobs that come with them. There is a path forward whereby the collective of democracies gets stronger both economically and politically by building new industries in underperforming regions and by working together as partners with shared democratic values. To succeed in revitalizing the industrial heartlands, the United States and Europe cannot work on the problem alone and at the expense of the other. Rather, a cooperative, transatlantic approach is essential for long-term success.

The goal here for the United States and Europe should not be to outrun each other, but to become jointly independent from supply chains originating in undemocratic regimes—and, in the process, to establish the transatlantic economic leadership of the global green transition. Viewed through this lens, and not the more typical frame of zero-sum conflict and protectionism, Europe and the United States can and should work together to make this a reality. Ironically, with its tit-for-tat response to the IRA, the European Union has inadvertently taken a first step toward the completion of a transatlantic space in which green investment in heartland manufacturing regions is prioritized.

To transform existing unilateral investments into an intentional transatlantic initiative, a few things have to happen. First, both partners need to leave behind any rhetorical hint of economic nationalism, and instead frame their respective policies as part of a joint effort to meet the challenge of climate change while prioritizing the needs of the left-behind places on both sides of the Atlantic. Second, both partners need to start talking to each other about these issues. Helpfully, a suitable institutional vehicle for this cooperation already exists: the new joint U.S.-European task force, created in the aftermath of the IRA’s passage. Third, compromise will be required. For its part, the Biden administration could send a constructive signal to its partners by eliminating domestic content provisions from the IRA and other recently approved investment programs.

Once such a space becomes a reality, it allows for “ally-shoring”—expanding co-production and strengthening supply chains with countries that share common values and beliefs in an open, rules-based trade and economic global order. The approach outlined above would open the door to market-driven ally-shoring, as firms respond to the new incentives in the transatlantic green investment space. Coordinated action by the United States and the European Union could fuel this process and encourage industry players to invest across both geographies, further strengthening the bonds of U.S.-European interdependence.

The transatlantic partnership has come a long way from the depths of despair and acrimony during the Trump years. It has proved resilient and adaptive when its core security bargain was called into question by Russian aggression. Yet the current fallout over the Biden administration’s industrial policy initiatives underscores the recurring fragility of consensus over the economic dimensions of the partnership. In every crisis, however, there is opportunity. If parties can work together and adopt a different framing, one that prioritizes common interest over competition, the conflict over the IRA could be transformed from a disturbing slide toward economic nationalism into a confident step toward a stronger alliance and greener, more equitable future for citizens on both sides of the Atlantic

2 notes

·

View notes

Photo

Precious Metals are always a good [hedge] investment that should be part of a diversified portfolio to pay/barter for goods and services in case of a financial crisis. One of the best reasons for investing in (purchasing) precious metals, instead of conventional monetary vehicles (like IRAs and stock market EFTs), is that they are, usually, not monitored by, or reported to the IRS, unless is it sold for profit (and voluntarily reported) after the purchase or purchased in excessive amounts. Silver, Copper and Gold (in that order) are the best options because they can be physically held-in-hand as a payment (bartering) source to redeem for cash, products or services. If you buy it, take physical possession of it. Don't give it to some broker to "vault" it for you; there will be fees involved. Consider also Coins instead of Bars or ingots when purchasing.

Junk Silver: Mostly in the form of U.S. Silver Coins (dimes, quarters, half-dollars and silver dollars) minted before 1965, "junk silver" has a high silver content (90%) that makes it a good investment (and purchasing tool) if the current [paper] monetary system fails. What is Junk Silver? How to Manually Calculate Junk Silver Coins Calculate the Value of Junk Silver Coins

Other Resources: Silver VS Gold Best Precious Metals Investment and Trades (2019) Precious Metals vs. the Stock Market 5 Questions To Ask Before Buying Precious Metals Debt: Get Out NOW! Teaching Our Children the Fundamentals of Money [Reference Link]

[11-Cs Basic Emergency Kit] [14-Point Emergency Preps Checklist] [Immediate Steps to Take When Disaster Strikes] [Learn to be More Self-Sufficient] [The Ultimate Preparation] [P4T Main Menu]

This blog is partially funded by Affiliate Program Links and Private Donations. Thank you for your support.

#gold#silver#copper#coins#money#junk silver#bullion#ingot#preciousMetals#investingSilver#investingGold#prepper#survival#shtf#barter#bartering#prepare4tomorrow#prepping

1 note

·

View note

Text

Discover the Benefits of Investing in Silver Coins in Las Vegas

Looking to diversify your portfolio with a reliable and timeless investment? Invest in silver coins Las Vegas for a smart way to protect and grow your wealth. Silver is not only a tangible asset but also a hedge against inflation and economic uncertainty, making it an excellent addition to any financial plan.

At IRA Gold Proof, we offer comprehensive insights and guidance on silver investments tailored to meet your needs. Whether you're a seasoned investor or just getting started, our expert resources will help you navigate the market with confidence.

Don’t wait to secure your financial future. Start exploring the benefits of silver investments today

0 notes