#I remember feeling sick when I saw our kitchen floor mat floating around on the water like a pool float

Explore tagged Tumblr posts

Text

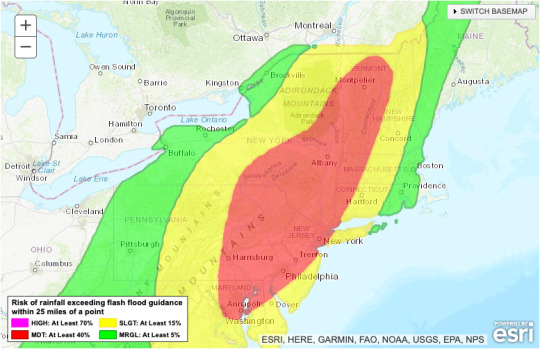

Right now, the northeast is at really high risk for flooding so here's a friendly reminder from someone who learned the hard way:

CHECK YOUR RENTER’S INSURANCE FOR WATER DAMAGE COVERAGE

You will be shocked by how little a standard policy covers when it comes to water and/or flood damage.

Flood insurance almost always requires a completely separate policy managed by the National Flood Insurance Program (NFIP) under the scope of FEMA. You can get it as a renter, but it usually involves calling a local agent because it’s highly regional and takes a lot of different variables into account. NEVER assume the person you’re renting from has adequate coverage. Even if they have homeowner’s insurance, it probably doesn’t extend to renters’ belongings.

While you’re at it, MAKE SURE YOUR POLICY COVERS WATER BACKUP. This is different from flood insurance. A lot of basic policies only cover water damage from appliance malfunctions, like a washing machine overflowing. Coverage for water backing up out of a drain or sewer often costs extra (in my experience not more than a few extra bucks per month) and has to be opted into, it’s not included.

Doing this will save you.

Last December, after three days of nonstop pouring rain, the drainage system outside an entrance to the house we were renting just couldn’t handle the volume anymore and water started pouring in under the door. We used everything we had to try to slow it down, and we were up all night using a wet vac we borrowed from a neighbor to try to contain hundreds of gallons of rainwater. I will never forget the mounting horror as I realized the water wasn’t going to stop until the rain did. It's not like a plumbing issue or dishwasher malfunction where you can cut off the source.

We were lucky, and the rain tapered off by the next morning. The layout of our living room meant that most of our stuff was away from the door, and we were able to bail water fast enough that very little ended up being a total loss and nothing important was damaged. We did, however, need to take our dog and get a hotel for a week, and ended up having to find a new place to live in five days (the week before Christmas, while recovering from COVID) because the damage needed so much renovation that moving was pretty much the only option.

Our renter’s insurance covered nothing. Even without a NFIP policy, I was able to confirm with the insurance company that our claim would have been approved if we’d opted into the water backup coverage, because the rainwater was coming out of the overwhelmed drain. We could have replaced the stuff we lost, and probably a bunch of stuff we had to work really hard to salvage. That particular policy would have covered some of the moving costs too, and they would have paid for temporary accommodations for us. (once again we were extremely lucky, and the hotel costs got reimbursed as a courtesy because they took longer to make a decision than they were supposed to)

Renter’s insurance is not expensive. The tricked out policy I got for our new place with every add-on they offer runs me less than $30/month. It would have covered thousands of dollars of expenses that we’re still trying to crawl out from under more than six months later. In an ideal world you will never need to use it, but if you do, IT. WILL. SAVE. YOU.

I am by no means an expert, and can really only speak from my experience so if someone who knows more about this wants to chime in, please do! Keep in mind that all of this is going to vary significantly depending on which insurance company you use and your specific policy. Just please, for the love of god, get renter's insurance if you don't have it already, and read every page of the policy so you know what's covered and what you might need to opt into. Do it now, because shit like this

isn't going to wait.

#PSA#literally that week was one of the most stressful and awful things I've ever experienced#it didn't help that our landlord was extremely shady and didn't respond or help because she was out of the country and didn't care#our city isn't coastal and the problem areas for floods are in the neighborhoods that are on the water next to a big river#we didn't live anywhere near it#I now live on the 11th floor of a professionally managed building at the top of a hill#but my fiancée and I are traumatized to the point that she had a panic attack when our washing machine sprung a minor leak#I remember feeling sick when I saw our kitchen floor mat floating around on the water like a pool float

2 notes

·

View notes