#Hydrogen Market Dynamics

Explore tagged Tumblr posts

Text

Investing in Hydrogen: Trends in Technology, Infrastructure, and Policy

As the world races to combat climate change and transition towards cleaner energy sources, hydrogen has emerged as a promising contender in reshaping the energy landscape. The concept of a hydrogen economy, driven by the production and utilization of hydrogen gas, has gained momentum, with a focus on both its potential benefits and the challenges that lie ahead. This article delves into various…

View On WordPress

#Green Energy Transition#Green Hydrogen#green hydrogen economy#Green Hydrogen Projects#Hydrogen#Hydrogen Business#Hydrogen Business Environment#Hydrogen Economic Landscape#Hydrogen Economic Trends#Hydrogen Economics#Hydrogen Economy#Hydrogen Financial System#Hydrogen Fuel Cells#Hydrogen Future#Hydrogen Industry#Hydrogen Industry Outlook#Hydrogen Infrastructure#Hydrogen Market#Hydrogen Market Dynamics#Hydrogen Opportunity#Hydrogen Potential#Hydrogen Production#Hydrogen Production Cost Analysis#Hydrogen Sector#Hydrogen Storage#hydrogen storage solutions#Hydrogen Trade#Hydrogen Trends#Renewable Energy#Zero-Emission Hydrogen

0 notes

Text

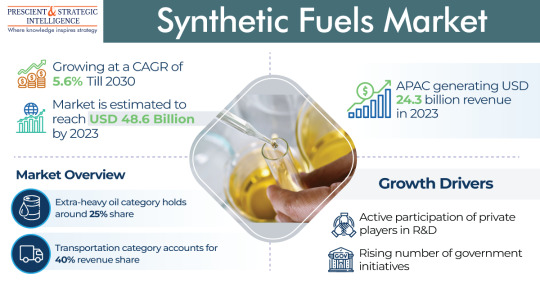

What Are Synthetic Fuels Or E-Fuels?

In labs throughout Europe and the Americas, researchers are busy investigating substitutions to fossil fuels. Besides the harmful releases and intensifying costs of petroleum items, recent geopolitical instability in the east of Europe has additional pressure on looking for new power sources. So, what types of synthetic fuels are in progress today? What Are Synthetic Fuels? Synthetic fuels,…

View On WordPress

#Biomass#Carbon Capture#Energy Transition#Fischer-Tropsch Synthesis#Greenhouse Gas Emissions#Hydrogen#Key players#Market dynamics#Power-to-Liquid#Regulatory frameworks#Renewable Sources#Synthetic Fuels Market

0 notes

Text

Green Ammonia Market Statistics, Segment, Trends and Forecast to 2033

The Green Ammonia Market: A Sustainable Future for Agriculture and Energy

As the world pivots toward sustainable practices, the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammonia, and why is it so important? In this blog, we'll explore the green ammonia market, its applications, benefits, and the factors driving its growth.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359

What is Green Ammonia?

Green ammonia is ammonia produced using renewable energy sources, primarily through the electrolysis of water to generate hydrogen, which is then combined with nitrogen from the air. This process eliminates carbon emissions, setting green ammonia apart from traditional ammonia production, which relies heavily on fossil fuels.

Applications of Green Ammonia

Agriculture

One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers, and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia, farmers can produce food more sustainably, supporting global food security while minimizing environmental impact.

Energy Storage

Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later converted back into hydrogen or directly used in fuel cells. This capability makes it an attractive option for balancing supply and demand in renewable energy systems.

Shipping Fuel

The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for ships, helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.

Benefits of Green Ammonia

Environmental Impact

By eliminating carbon emissions during production, green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat climate change and achieve sustainability goals.

Energy Security

Investing in green ammonia can enhance energy security. As countries strive to reduce their dependence on fossil fuels, green ammonia offers a renewable alternative that can be produced locally, minimizing reliance on imported fuels.

Economic Opportunities

The growth of the green ammonia market presents numerous economic opportunities, including job creation in renewable energy sectors, research and development, and new supply chain dynamics. As demand increases, investments in infrastructure and technology will drive innovation.

Factors Driving the Growth of the Green Ammonia Market

Regulatory Support

Governments worldwide are implementing policies and incentives to promote the adoption of green technologies. These regulations often include subsidies for renewable energy production and carbon pricing mechanisms, making green ammonia more competitive.

Rising Demand for Sustainable Solutions

With consumers and businesses becoming increasingly aware of their environmental impact, the demand for sustainable solutions is on the rise. Green ammonia aligns with this trend, providing an eco-friendly alternative to traditional ammonia.

Advancements in Technology

Ongoing advancements in electrolysis and ammonia synthesis technologies are making the production of green ammonia more efficient and cost-effective. As these technologies mature, they will further enhance the viability of green ammonia in various applications.

Conclusion

The green ammonia market represents a promising avenue for sustainable development across agriculture, energy, and transportation sectors. As technology advances and regulatory support strengthens, green ammonia is poised to become a cornerstone of the global transition to a greener economy. Investing in this market not only contributes to environmental preservation but also opens up new economic opportunities for innovation and growth.

#The Green Ammonia Market: A Sustainable Future for Agriculture and Energy#As the world pivots toward sustainable practices#the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammon#and why is it so important? In this blog#we'll explore the green ammonia market#its applications#benefits#and the factors driving its growth.#Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359#What is Green Ammonia?#Green ammonia is ammonia produced using renewable energy sources#primarily through the electrolysis of water to generate hydrogen#which is then combined with nitrogen from the air. This process eliminates carbon emissions#setting green ammonia apart from traditional ammonia production#which relies heavily on fossil fuels.#Applications of Green Ammonia#Agriculture#One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers#and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia#farmers can produce food more sustainably#supporting global food security while minimizing environmental impact.#Energy Storage#Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later convert#Shipping Fuel#The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for shi#helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.#Benefits of Green Ammonia#Environmental Impact#By eliminating carbon emissions during production#green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat

6 notes

·

View notes

Text

Exploring the Dynamics of the Synthetic Fuels Market: A Sustainable Energy Solution

The Synthetic Fuels Market is rapidly gaining traction as a viable alternative in the quest for sustainable energy sources. With the growing concerns over climate change and the need to reduce carbon emissions, synthetic fuels offer a promising solution. These fuels, also known as e-fuels or renewable fuels, are produced through advanced processes that utilize renewable energy sources such as wind, solar, or hydroelectric power.

One of the primary drivers behind the surge in demand for synthetic fuels is the global shift towards greener energy solutions. Governments, industries, and consumers alike are increasingly recognizing the importance of reducing dependency on fossil fuels and embracing renewable alternatives. Synthetic fuels present a compelling option as they not only offer a cleaner energy source but also provide a pathway to decarbonizing sectors such as transportation, industrial manufacturing, and power generation.

The versatility of synthetic fuels is another factor contributing to their growing popularity. Unlike traditional fossil fuels, synthetic fuels can be easily integrated into existing infrastructure without the need for significant modifications. This means that vehicles, aircraft, and machinery powered by gasoline or diesel can seamlessly transition to synthetic fuels without compromising performance or efficiency. Additionally, synthetic fuels can be tailored to meet specific energy needs, offering a customizable solution for various applications.

Moreover, advancements in technology have significantly improved the efficiency and cost-effectiveness of synthetic fuel production. Innovative processes such as Power-to-Liquid (PtL) and Gas-to-Liquid (GtL) have made it possible to produce synthetic fuels on a commercial scale, driving down production costs and increasing accessibility. As a result, synthetic fuels are becoming increasingly competitive with conventional fossil fuels, further fueling their adoption across different sectors.

The transportation industry stands to benefit significantly from the widespread adoption of synthetic fuels. With concerns over air quality and emissions regulations becoming more stringent, many vehicle manufacturers are exploring alternative fuel options to meet regulatory requirements and consumer demand for greener transportation solutions. Synthetic fuels offer an attractive alternative, providing a bridge between conventional combustion engines and future zero-emission technologies such as electric vehicles and hydrogen fuel cells.

In addition to transportation, synthetic fuels find applications in other sectors such as power generation and industrial manufacturing. The ability to produce clean, reliable energy from renewable sources makes synthetic fuels an appealing choice for companies seeking to reduce their carbon footprint and meet sustainability targets. Furthermore, synthetic fuels offer energy security benefits by reducing reliance on imported oil and mitigating the geopolitical risks associated with fossil fuel dependence.

Looking ahead, the Synthetic Fuels Market is poised for significant growth as the world transitions towards a low-carbon economy. With ongoing advancements in technology, coupled with increasing environmental awareness and regulatory pressures, the demand for synthetic fuels is expected to soar in the coming years. As governments and industries continue to invest in renewable energy solutions, synthetic fuels are well-positioned to play a crucial role in shaping the future of energy production and consumption.

#energy#sustainability#renewable fuels#e-fuels#carbon emissions#alternative energy#transportation#industrial applications

2 notes

·

View notes

Text

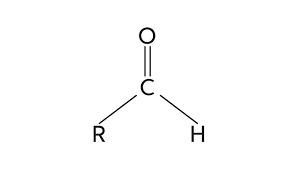

Exploring the Global Aldehydes Market: Key Players and Market Dynamics

The aldehydes market is a segment of the chemical industry that deals with the production and distribution of a class of organic compounds known as aldehydes. These compounds are characterized by the presence of a carbonyl group (C=O) bonded to a hydrogen atom and a carbon atom in their chemical structure. Aldehydes find widespread applications in various industries, thanks to their unique properties and versatile reactivity.

In terms of market overview, the aldehydes market has been experiencing steady growth in recent years. This growth can be attributed to the increasing demand for aldehydes in industries such as pharmaceuticals, agriculture, food and beverages, and cosmetics. Aldehydes serve as crucial intermediates in the synthesis of various chemicals and are essential in the production of fragrances, flavor enhancers, and pharmaceuticals.

The growth in the aldehydes market industry can be primarily attributed to the expansion of these end-user industries. For instance, the pharmaceutical industry relies heavily on aldehydes for the synthesis of a wide range of drugs and active pharmaceutical ingredients (APIs). Additionally, the food and beverage industry utilizes aldehydes for flavor enhancement and preservation purposes, further driving market growth.

The aldehydes market is also influenced by evolving industry trends. One significant trend is the increasing emphasis on green chemistry and sustainable practices. Many companies in the aldehydes sector are adopting environmentally friendly production processes, such as catalytic hydrogenation, to reduce the environmental impact of their operations. This trend aligns with the growing awareness of environmental issues and the need for more eco-friendly chemical manufacturing.

Another noteworthy trend is the constant innovation and development of novel aldehyde derivatives with enhanced properties. This innovation is driven by the demand for higher-quality products in various industries. Researchers and manufacturers are continuously exploring new applications and synthesizing aldehydes tailored to meet specific industry requirements, which contributes to market expansion.

In conclusion, the aldehydes market is a dynamic segment within the chemical industry, driven by the increasing demand from various end-user industries. As industries continue to grow and evolve, the market is expected to witness further advancements, particularly in sustainable production methods and novel aldehyde derivatives, to meet the changing needs of consumers and businesses alike.

2 notes

·

View notes

Text

The combustion burner manufacture sector is vital to numerous industries, providing essential equipment for heat generation in processes ranging from power generation to industrial heating. Manufacturers in this field focus on designing and producing burners that maximize efficiency, minimize emissions, and ensure safety. Key aspects of this industry include:Technological Advancements:Manufacturers are constantly innovating to improve burner performance, with a strong emphasis on reducing NOx and other harmful emissions. Developments in fuel flexibility, allowing burners to operate with various fuel types, including natural gas, oil, and alternative fuels like hydrogen, are also a focus.Advanced control systems and flame detection technologies are integrated to enhance safety and optimize combustion. Industry Applications:Combustion burners are essential components in boilers, furnaces, kilns, and other thermal processing equipment used in diverse sectors such as power plants, petrochemical facilities, and manufacturing plants. Manufacturers cater to specific industry needs by providing customized burner solutions tailored to unique operational requirements. Environmental Considerations:Increasingly stringent environmental regulations drive manufacturers to develop cleaner and more efficient combustion technologies.Efforts to reduce greenhouse gas emissions and improve air quality are central to the industry's research and development activities.Manufacturer diversity:There are many manufacturers that focus on very specific niche markets, and others that make a very broad range of products. From small bussinesses, to large multinational corporations.The industry is dynamic, with manufacturers continuously striving to deliver reliable, efficient, and environmentally responsible combustion solutions.

#combustion burners manufacturer#combustion burner manufacturer#industrial gas burner#duel fuel weishaupt burner#weishaupt burner#burner spare parts#industrial burner services#industrial burner repair#industrial gas burner suppliers#monarch weishaupt burner#weishaupt burners

0 notes

Text

Green Hydrogen Market Size In 2024: Growth Opportunities and Future Outlook 2033

Green Hydrogen Market Information 2024-2033

Green Hydrogen Market Share is expected to grow at a compound annual growth rate (CAGR) of 39.3% between 2024 and 2033, reaching an estimated USD 135.2 billion by the end of the forecast period. In 2024, the market value is projected to be approximately USD 7.82 billion.

Green hydrogen is created by electrolysis, a technique that splits water molecules and releases hydrogen gas using renewable energy sources like solar, wind, or hydroelectric power. With this process, no pollutants or greenhouse gasses are released, producing a clean, sustainable fuel.

The market for green hydrogen is being driven by the proton exchange membrane (PEM) electrolyzer because of its high efficiency, scalability, and easy integration with renewable energy sources. Small-scale use and large-scale industrial operations can both benefit from its decentralized deployment made possible by its compact and flexible architecture

Request for A Sample of This Research Report https://wemarketresearch.com/reports/request-free-sample-pdf/green-hydrogen-market/1341

The green hydrogen industry is set for significant growth, driven by technological advancements, cost reductions, and strong government and corporate commitments. Improved electrolyzer efficiency and scalability will enhance adoption across sectors like transportation, manufacturing, and energy. Its versatility in heavy transport and potential integration with natural gas further boosts its appeal. Collaborative efforts among governments, industries, and research institutions will accelerate infrastructure development and regulatory frameworks, while public-private partnerships will drive investment and innovation, fostering a robust green hydrogen market.

Key Market Drivers

Decarbonization Targets – Governments worldwide are committing to carbon neutrality, driving industries to transition to cleaner energy solutions.

Advancements in Electrolysis – Innovations in electrolysis technology are enhancing the efficiency and affordability of green hydrogen production.

Policy Support & Incentives – Subsidies, tax benefits, and regulatory backing are accelerating investments in hydrogen infrastructure.

Rising Need for Energy Storage – Green hydrogen plays a crucial role in stabilizing renewable energy grids by providing a reliable storage solution.

Expanding Industrial Adoption – Industries such as steel, chemicals, and transportation are integrating green hydrogen to lower emissions and achieve sustainability goals.

Key Benefits for Stakeholders

Market Insights – Detailed analysis of trends, projections, and dynamics (2024–2033) to identify emerging opportunities.

Strategic Decision Support – Insights on drivers, restraints, and opportunities for informed business strategies.

Competitive Analysis – Porter's Five Forces assessment to enhance profit-driven decisions and supplier-buyer networks.

Targeted Segmentation – Identification of high-growth areas and investment opportunities.

Regional Insights – Revenue-based analysis of key countries for a clear market understanding.

Industry Benchmarking – Competitive positioning to refine business strategies.

Holistic Overview – Coverage of global and regional trends, key players, and growth strategies in the green hydrogen market.

Market Opportunities:

Rising Government Investments

The global green hydrogen market is poised for significant expansion, driven by increasing government investments. Many emerging economies, particularly in Asia and the European Union, as well as parts of North America and the Middle East, are actively developing green hydrogen infrastructure. These initiatives are creating opportunities for manufacturers to scale operations, enhance production capacity, and ultimately lower costs. As nations prioritize the decarbonization of energy systems and the reduction of greenhouse gas emissions, the green hydrogen market is expected to experience substantial growth in the coming years.

Get Customized Report https://wemarketresearch.com/customization/green-hydrogen-market/1341

Challenges in the Green Hydrogen Market

High Production Costs – Electrolysis and renewable energy costs remain high compared to fossil fuel-based hydrogen production.

Infrastructure Gaps – There is a lack of widespread infrastructure for hydrogen storage and transportation.

Energy Loss in Conversion – Hydrogen production, storage, and transportation involve energy losses, impacting overall efficiency.

Market Segmentations:

By Application

Power Generation

Transport

By Renewable Source

Wind

Solar

By End User

Food & Beverages

Medical

Mobility

Industrial

Glass

Grid Injection

Petrochemicals

Market Trends and Future Outlook

Declining Costs: With continuous research and scaling up of production, the cost of green hydrogen is expected to decrease significantly.

Strategic Partnerships: Energy giants and startups are collaborating to accelerate the deployment of hydrogen technology.

Hydrogen-Powered Mobility: Fuel cell vehicles and hydrogen-powered transportation solutions are gaining traction.

Global Expansion: Countries such as Germany, Japan, and the U.S. are investing heavily in hydrogen projects.

Market Geographically Analysis:

Europe leads the market with a 47%+ share, driven by major investments from Germany, France, and the Netherlands, along with strong EU subsidies and ambitious targets.

Asia Pacific is the second-largest market and the fastest-growing, with China, Japan, and South Korea investing to reduce reliance on fossil fuels and tackle air pollution.

North America is set for rapid growth, driven by increasing commercial interest and strict US regulations, despite being in the early stages.

Key Market Players

Power Cell Sweden AB

Green Hydrogen Systems

Biotech

Ballard Power Systems

Cummins Inc.

Siemens Energy

Nel ASA

Plug Power Inc.

Areva H2Gen

Linde plc

ENGIE SA

Kawasaki Heavy Industries, Ltd.

Others

Commonly Asked Questions?

Q1. What is the market's most popular use for green hydrogen?

Q2. What are the global green hydrogen market's next trends?

Q3. Which region has the biggest demand for green hydrogen?

Q4. What is the Green Hydrogen industry's estimated size?

Q5. What are the leading firms in the Green Hydrogen market?

Related Report:

Fuel Gas Supply System Module Market

Oil & Gas Pipeline Market

Solar Diffusion Furnace Market

Conclusion

The green hydrogen market holds immense potential as the world moves toward a sustainable future. While challenges remain, continued investment, technological advancements, and policy support will drive its growth. As costs decline and infrastructure expands, green hydrogen is set to become a cornerstone of the global clean energy transition.

Get a Purchase of This Report https://wemarketresearch.com/purchase/green-hydrogen-market/1341?license=single

About We Market Research:

WE MARKET RESEARCH is an established market analytics and research firm with a domain experience sprawling across different industries. We have been working on multi-county market studies right from our inception. Over the time, from our existence, we have gained laurels for our deep-rooted market studies and insightful analysis of different markets.

Contact Us:

Mr. Robbin Joseph Corporate Sales, USA We Market Research USA: +1-724-618-3925 Websites: https://wemarketresearch.com/ Email: [email protected]

#Green Hydrogen Market Size#Green Hydrogen Market Share#Green Hydrogen Market Scope#Green Hydrogen Market Demand#Green Hydrogen Market Forecast#Green Hydrogen Market Growth#Green Hydrogen Market Trends#Green Hydrogen Market Analysis#Green Hydrogen Market 2033

0 notes

Text

U.S. Natural Gas Prices, News, Trend, Graph, Chart, Monitor and Forecast

Natural Gas prices a crucial role in the global energy market, influencing industries, households, and economies. The price dynamics of natural gas are shaped by a combination of supply and demand factors, geopolitical developments, weather conditions, storage levels, and market speculation. Over the years, natural gas has become a preferred energy source due to its efficiency, lower carbon emissions compared to coal and oil, and its widespread availability. However, price fluctuations remain a key concern for producers, consumers, and policymakers.

One of the primary drivers of natural gas prices is supply availability. Major producing countries such as the United States, Russia, and Qatar significantly impact the global market through their production levels and export policies. Advances in drilling technologies, such as hydraulic fracturing and horizontal drilling, have boosted production, particularly in the United States, making it a leading exporter of liquefied natural gas (LNG). At the same time, geopolitical factors play a crucial role in price movements. Political tensions, trade disputes, and sanctions on major gas-producing nations can disrupt supply chains, leading to price spikes. For instance, conflicts involving Russia, a dominant gas supplier to Europe, have historically led to volatility in natural gas prices.

Get Real time Prices for Natural Gas : https://www.chemanalyst.com/Pricing-data/natural-gas-1339

Weather conditions also have a profound effect on natural gas demand and, consequently, pricing. In colder months, demand for natural gas surges due to heating needs, leading to upward pressure on prices. Similarly, hot summer months drive demand for electricity generation, as air conditioning usage increases, thereby affecting gas consumption. Natural disasters, such as hurricanes, can also disrupt production and transportation infrastructure, causing short-term price fluctuations. Additionally, renewable energy integration into power grids has begun influencing natural gas demand, as countries transition towards cleaner energy sources.

Storage levels are another critical factor that determines natural gas prices. Countries and companies maintain underground storage facilities to manage seasonal demand fluctuations. When storage levels are high, prices tend to remain stable or decline, whereas low storage levels can lead to price hikes, especially during peak demand periods. Market speculation and trading activities further contribute to price volatility. Traders and investors in natural gas futures markets react to economic data, weather forecasts, and geopolitical events, influencing short-term price movements.

The global shift towards cleaner energy and decarbonization policies is also shaping the natural gas market. Many governments are implementing policies to reduce carbon emissions, which impacts the long-term demand outlook for natural gas. While it remains a transitional fuel in the global energy mix, competition from renewable energy sources, battery storage advancements, and hydrogen development pose challenges to its dominance. At the same time, natural gas remains essential for many industries, including manufacturing, chemicals, and power generation, ensuring that demand continues to persist despite policy shifts.

Price trends in different regions vary based on market structures and dependencies. The United States has a relatively stable price environment due to abundant domestic production, with the Henry Hub benchmark serving as a key pricing reference. In contrast, European natural gas prices are more susceptible to geopolitical risks and supply chain disruptions, with the Dutch TTF and UK NBP acting as major benchmarks. Asia, particularly countries like Japan, China, and South Korea, relies heavily on LNG imports, making prices more sensitive to global supply-demand imbalances and shipping costs.

The impact of inflation, currency fluctuations, and global economic conditions also influences natural gas pricing. During periods of economic growth, industrial activity increases, leading to higher gas consumption and price appreciation. Conversely, economic slowdowns or recessions can weaken demand, exerting downward pressure on prices. Inflationary pressures can also drive up costs related to natural gas extraction, transportation, and infrastructure investments, ultimately affecting market pricing.

Looking ahead, the future of natural gas prices will be shaped by technological advancements, policy changes, and global energy transition goals. The development of new gas fields, pipeline expansions, and LNG infrastructure projects will determine supply-side dynamics. Meanwhile, the pace of renewable energy adoption, government regulations, and environmental concerns will influence demand trends. As natural gas continues to play a significant role in the energy landscape, monitoring market developments and price trends will remain critical for stakeholders across industries.

Get Real time Prices for Natural Gas : https://www.chemanalyst.com/Pricing-data/natural-gas-1339

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Natural Gas#Natural Gas Price#Natural Gas Prices#Natural Gas News#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Green Methanol (Renewable Methanol) Market: A Key to Sustainable Energy

The Green Methanol (Renewable Methanol) Market is gaining momentum as industries seek eco-friendly alternatives to fossil fuels. Produced from renewable sources such as biomass, carbon capture, and green hydrogen, green methanol is emerging as a crucial player in decarbonizing the energy and chemical sectors. The market is set to grow significantly due to its applications in transportation, power generation, and industrial manufacturing.

Key Factors Driving Market Growth

Rising Demand for Low-Carbon Fuels: Green methanol is being adopted in the shipping and automotive industries to meet stringent carbon emission regulations.

Government Policies & Renewable Energy Adoption: Many countries are incentivizing green methanol production to support sustainable energy transitions.

Technological Innovations in Methanol Production: Advances in carbon capture and green hydrogen integration are improving production efficiency.

Industry Trends & Market Dynamics

Expanding Role in Maritime & Aviation Fuels: Green methanol is seen as a viable alternative fuel for reducing carbon footprints in the transportation sector.

Growing Investments in Bio-Based Methanol Projects: Companies are investing in bio-refineries and sustainable methanol production facilities to scale up supply.

Supportive Regulatory Frameworks: Policies promoting renewable energy adoption and carbon-neutral fuels are accelerating market growth.

Regional Insights

Europe & North America: Leading the market with significant investments in green methanol projects and stringent emission reduction policies.

Asia-Pacific: Rapid industrialization and the shift towards sustainable energy solutions are boosting demand in China, India, and Japan.

Future Outlook

The Global Green Methanol Market is expected to expand as industries transition to cleaner fuel alternatives. With increasing investments in renewable energy technologies, green methanol will play a key role in reducing global carbon emissions and promoting sustainable industrial growth.

For a comprehensive market analysis, visit Mark & Spark Solutions.

0 notes

Text

Hydrogen-Powered Data Centers? The Market is Set to Hit $12.7B by 2034!

Hydrogen-Based Data Centers Market is experiencing significant growth as the industry seeks sustainable energy solutions to meet escalating data processing demands. Hydrogen fuel cells offer a promising alternative to traditional power sources, providing clean and efficient energy for data center operations.

To Request Sample Report: https://www.globalinsightservices.com/request-sample/?id=GIS10989 &utm_source=SnehaPatil&utm_medium=Article

Recent projections indicate that the global fuel cell market for data centers is expected to reach approximately $759.85 million by 2034, growing at a compound annual growth rate (CAGR) of 15.6% from an estimated $178.3 million in 2024.

This surge is driven by the increasing adoption of hydrogen fuel cells, which not only reduce carbon footprints but also enhance energy efficiency.

Companies like ECL are pioneering this transition by developing hydrogen-powered data centers. ECL has successfully delivered and fully leased its first hydrogen-powered facility, underscoring the viability of hydrogen as a primary energy source for data centers.

However, challenges persist, including the current high costs of green hydrogen production and the need for technological advancements to make hydrogen power more accessible and cost-effective. Despite these hurdles, the trajectory of the Hydrogen-Based Data Centers Market points towards a sustainable and resilient future for data infrastructure.

#HydrogenEnergy #DataCenters #SustainableTech #GreenEnergy #FuelCells #CleanTech #RenewableEnergy #DataCenterInnovation #EnergyEfficiency #TechSustainability #HydrogenFuelCells #CarbonNeutral #GreenDataCenters #EnergyTransition #HydrogenEconomy #SustainableInfrastructure #ZeroEmissions #FutureTech #DataCenterTrends #EcoFriendlyTech #HydrogenPower #DigitalSustainability #GreenIT #EnergyInnovation #HydrogenRevolution #DataCenterSustainability #CleanEnergySolutions #TechInnovation #HydrogenFuture #SustainableGrowth

Research Scope:

· Estimates and forecast the overall market size for the total market, across type, application, and region

· Detailed information and key takeaways on qualitative and quantitative trends, dynamics, business framework, competitive landscape, and company profiling

· Identify factors influencing market growth and challenges, opportunities, drivers, and restraints

· Identify factors that could limit company participation in identified international markets to help properly calibrate market share expectations and growth rates

· Trace and evaluate key development strategies like acquisitions, product launches, mergers, collaborations, business expansions, agreements, partnerships, and R&D activities

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

Hydrogen Storage Tank Market: Forecasting Industry Trends and Growth Opportunities

#Hydrogen Storage Tank Market size#Hydrogen Storage Tank Market#Hydrogen Storage Tank Market growth#Hydrogen Storage Tank Market demand#Hydrogen Storage Tank Market share#Hydrogen Storage Tank Market trend#Hydrogen Storage Tank Market analysis#Hydrogen Storage Tank Market dynamics

0 notes

Text

The Future of Steel Manufacturing in India: Trends and Innovations

Steel manufacturing in India is undergoing a transformation, driven by technological advancements, sustainability initiatives, and increasing demand from various sectors. With rapid industrialization and urbanization, the iron and steel industries in India are poised for significant growth. Karnataka, especially Bellary, remains a crucial hub for the nation's steel production, housing some of the leading steel plants in Karnataka.

Sustainable and Smart Manufacturing

Sustainability is becoming a priority for best alloy steel manufacturers company in Karnataka. Companies are adopting energy-efficient production methods, utilizing renewable energy sources, and implementing waste recycling processes. Innovations like electric arc furnaces and hydrogen-based steelmaking are helping reduce the carbon footprint of steel production.

Advanced TMT Bars for Infrastructure Development

With the Indian construction sector growing rapidly, there is an increasing demand for best TMT saria in India. High-quality TMT bars ensure superior strength, corrosion resistance, and durability, making them essential for modern infrastructure projects. The demand for top quality sariya in India is expected to rise, with steel manufacturers focusing on producing high-strength and earthquake-resistant bars.

Digital Transformation in Steel Manufacturing

Automation and artificial intelligence (AI) are revolutionizing the steel industry. From predictive maintenance in Bellary steel plant Karnataka to real-time monitoring in processing units, digital innovations are improving efficiency and reducing operational costs. Companies like A One Steel Bellary are adopting smart technologies to optimize production processes and enhance product quality.

Price Trends and Market Dynamics

Fluctuations in steel prices impact various industries, making it essential for buyers to stay informed. The A One rod price in Karnataka is influenced by raw material availability, global demand, and production costs. As infrastructure and real estate projects expand, steel prices are expected to stabilize, benefiting both manufacturers and consumers.

Strengthening India's Global Presence

India is emerging as a global leader in steel production. With continuous investments in research and development, the country is producing Indian best TMT bar that meets international standards. As export opportunities grow, Indian steel manufacturers are expanding their reach into global markets, reinforcing the nation's position as a key player in the steel industry.

CONCLUSION:

The future of steel manufacturing in India looks promising, with advancements in sustainable production, digital transformation, and high-quality steel products. As demand for best sariya in India continues to grow, manufacturers are investing in innovative techniques to enhance production efficiency and environmental responsibility. With strong support from the government and industry stakeholders, India’s steel sector is set to thrive in the coming years.

0 notes

Text

MENA Marine Vessel Market Analysis by Size, Share, Growth, Trends, Opportunities and Forecast (2024-2032)

The MENA (Middle East and North Africa) region has always been a hub of maritime activity, and recent trends are shaping a dynamic future for the marine vessel market in this region. From technological advancements to sustainability initiatives, several trends are influencing the trajectory of this vital sector. In this article, we'll explore the latest trends and developments that are making waves in the MENA marine vessel market.

According to the Universal Data Solutions analysis, growing import and export of oil and gas will drive the global scenario of marine vessel and as per their “MENA marine vessel” report, the global market was valued at USD 4,250 million in 2023, growing at a CAGR of 2.3% during the forecast period from 2024 - 2032 to reach USD billion by 2032.

Technological Advancements:

Technology is revolutionizing the marine vessel industry, and the MENA region is embracing these innovations. From autonomous ships and smart navigation systems to digitalization of operations and predictive maintenance, technology is enhancing efficiency, safety, and sustainability in maritime operations. Companies are investing in advanced vessel designs, propulsion systems, and onboard automation to optimize performance and reduce environmental impact.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/reports/mena-marine-vessel-market?popup=report-enquiry

Green Shipping and Sustainability:

The push for environmental sustainability is a global trend, and the MENA marine vessel market is no exception. With stricter regulations and growing environmental consciousness, there's a shift towards cleaner and greener shipping practices. LNG-powered vessels, hybrid propulsion systems, and emission-reducing technologies are gaining traction. Additionally, sustainable ship recycling and waste management initiatives are becoming integral parts of the industry's agenda, aligning with global sustainability goals.

Digitalization and IoT Integration:

The digital transformation of maritime operations is underway in the MENA region. IoT (Internet of Things) sensors, data analytics, and connectivity solutions are being integrated into vessel systems for real-time monitoring, predictive maintenance, and enhanced decision-making. Smart ports and logistics solutions are also emerging, streamlining supply chain processes and optimizing vessel-port interactions. These digital advancements improve efficiency, reduce downtime, and enhance overall performance across the marine vessel market.

Energy Transition and Alternative Fuels:

The MENA region, known for its oil and gas industry, is witnessing a gradual shift towards alternative fuels and energy sources in the marine sector. Apart from LNG, which is gaining popularity due to its lower emissions, there's a growing interest in hydrogen fuel cells, biofuels, and electric propulsion systems. Investments in research and development of sustainable fuels and energy-efficient technologies are driving this energy transition, marking a significant trend in the region's marine vessel market.

Adaptation to Market Dynamics:

The MENA marine vessel market is adapting to changing market dynamics and geopolitical shifts. Emerging trade routes, evolving cargo patterns, and geopolitical developments influence vessel demand, route planning, and investment decisions. Flexibility, agility, and strategic partnerships are key strategies adopted by stakeholders to navigate market uncertainties and capitalize on emerging opportunities in the region's maritime landscape.

Infrastructure Investments and Port Development:

Infrastructure plays a crucial role in supporting the growth of the marine vessel market. The MENA region is witnessing significant investments in port infrastructure, dredging projects, and maritime facilities. Expansion of port capacities, development of specialized terminals (such as LNG terminals and cruise terminals), and implementation of advanced technologies in port operations are enhancing the region's maritime connectivity and competitiveness.

Fig#: MENA region investment by sector 2022-2026

Request for TOC, Research Methodology & Insights Reports - https://univdatos.com/reports/mena-marine-vessel-market

Conclusion:

The MENA marine vessel market is experiencing a transformative phase driven by technological advancements, sustainability imperatives, digitalization, energy transition, market dynamics, and infrastructure investments. Stakeholders across the industry are embracing these trends to enhance operational efficiency, reduce environmental footprint, and seize new opportunities in a rapidly evolving maritime ecosystem. As the region continues to play a strategic role in global trade and shipping, staying abreast of these trends and embracing innovation will be crucial for shaping a sustainable and prosperous future for the MENA Marine Vessel Market.

Contact Us:

UnivDatos Market Insights

Contact Number - +19787330253

Email - [email protected]

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

0 notes

Text

Europe Electric Bus Market Size, Growth, Analysis and Forecast 2030

The Europe Electric Bus Market is poised for significant growth, driven by technological advancements, environmental concerns, and government initiatives. Here’s a comprehensive breakdown of the key aspects shaping this market: 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞: https://www.businessmarketinsights.com/sample/BMIRE00025540

Market Growth and Drivers

Market Size and Growth Rate:

The market is projected to grow from US 1,493.80 million in 2021 to US 1,493.80 million in 2021 to US 5,882.93 million by 2028, at a CAGR of 21.6%.

This growth is fueled by the increasing adoption of electric buses, particularly hydrogen fuel cell buses, which offer longer lifespans and faster refueling times compared to traditional electric buses.

Hydrogen Fuel Cell Buses:

Hydrogen fuel cell buses are gaining traction due to their environmental benefits and operational efficiency.

Over 1,000 hydrogen buses are expected to be launched in the coming years, with significant investments such as the GBP 54 million fund in the UK aimed at developing hydrogen-powered buses and electric trucks.

Environmental and Economic Impact:

Initiatives like those in the UK are expected to create around 10,000 jobs and reduce 45 million tons of carbon emissions, highlighting the dual benefits of economic growth and environmental sustainability.

Market Segmentation

By Vehicle Type:

Battery-Electric Bus: Dominated the market in 2021.

Hybrid Electric Bus and Plug-in Hybrid Electric Bus are also significant segments.

By Hybrid Powertrain:

Parallel Hybrid: Led the market in 2021.

Series-Parallel Hybrid and Series Hybrid are other key segments.

By Battery Type:

Lithium Iron Phosphate (LIP): Dominated the market in 2021.

Lithium Nickel Manganese Cobalt Oxide (NMC) is another important segment.

By End User:

Public Sector: Dominated the market in 2021.

Private Sector is also a growing segment.

By Country:

UK: Led the market in 2021.

Germany, France, Italy, Russia, and the Rest of Europe are other key regions.

Key Players

AB Volvo

BYD Company Ltd

CAF Group (Solaris Bus & Coach)

Daimler AG

Ebusco

King Long United Automotive Industry Co., Ltd

NFI Group

Shenzhen Wuzhoulong Motors Co., Ltd

Van Hool NV

Strategic Insights

Data-Driven Analysis:

Understanding current trends, key players, and regional differences is crucial for strategic planning.

Actionable recommendations can help companies identify untapped market segments and develop unique value propositions.

Future-Oriented Perspective:

Anticipating market shifts and positioning for long-term success is essential.

Leveraging data analytics can provide a competitive edge in this dynamic market.

Business Objectives:

Strategic insights empower stakeholders to make informed decisions that drive profitability and achieve business goals.

Conclusion

The Europe electric bus market is on a robust growth trajectory, driven by technological innovations, environmental policies, and economic incentives. Companies that leverage strategic insights and focus on emerging trends, such as hydrogen fuel cell technology, will be well-positioned to capitalize on this expanding market.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio: Akshay Senior Market Research Expert at Business Market Insights

0 notes

Text

Platinum Acetylacetonate Market, Global Outlook and Forecast 2025-2032

Platinum Acetylacetonate (Pt(acac)â) is a platinum coordination complex where platinum (Pt) is chelated by two acetylacetonate (acac) ligands. This chemical compound is primarily used in industrial applications such as catalysis, materials science, and in the production of high-performance materials. It plays a significant role in catalyzing various chemical reactions, including hydrogenation, oxidation, and polymerization, making it indispensable in the chemical and automotive industries.

In addition to its catalytic properties, Platinum Acetylacetonate is also employed in the deposition of platinum thin films for semiconductor devices and advanced electronic applications. Its ability to provide precise control over the properties of thin films has made it an essential component in the electronics sector, especially in the manufacture of electronic components like capacitors, sensors, and connectors.

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/287663/global-platinum-acetylacetonate-forecast-market-2025-2032-333

Market Size

The global Platinum Acetylacetonate market was valued at approximately USD 66 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.00%, reaching an estimated USD 105.98 million by 2030. This growth is primarily attributed to the increasing demand for platinum-based catalysts across various industries, including chemicals, electronics, and automotive.

In North America, the Platinum Acetylacetonate market was valued at USD 17.20 million in 2023. The region is expected to expand at a CAGR of 6.00% from 2024 to 2030, driven by innovations in semiconductor technology, fuel cell development, and stringent emission regulations in the automotive sector. The rising adoption of green chemistry processes and environmentally friendly catalysts in North America further contributes to the region’s growth.

Market Dynamics

Drivers

Growing Demand for Platinum Catalysts: Platinum Acetylacetonate is widely used in catalytic applications such as hydrogenation, oxidation, and polymerization. The increasing need for efficient and environmentally friendly catalytic processes across industries is fueling the demand for platinum-based catalysts. With global industries shifting towards sustainable practices, platinum catalysts are gaining preference due to their high selectivity and efficiency.

Technological Advancements in Electronics: As the demand for high-performance electronic components increases, platinum-based materials, including Platinum Acetylacetonate, are seeing more adoption in the electronics sector. The compound is crucial in manufacturing platinum thin films used in semiconductors and electronic devices. As the electronics industry continues to innovate, the demand for Platinum Acetylacetonate is expected to rise.

Increased Focus on Emission Reduction in Automotive Industry: Platinum-based catalysts, including Platinum Acetylacetonate, are integral to the production of automotive catalytic converters that help reduce harmful emissions. Stricter environmental regulations worldwide are driving the automotive industry to adopt platinum-based solutions for cleaner vehicle emissions, thus propelling market growth.

Rise in Green Chemistry Practices: The adoption of sustainable and green chemistry processes is increasing in various industrial sectors. Platinum Acetylacetonate plays a critical role in promoting eco-friendly catalytic processes, particularly in hydrogenation and oxidation reactions. This trend is expected to support the growth of the Platinum Acetylacetonate market as industries prioritize green and sustainable practices.

Restraints

High Cost of Platinum: Platinum is one of the most expensive precious metals, and the high cost of platinum used in Platinum Acetylacetonate could limit the widespread adoption of this compound in cost-sensitive industries. As platinum prices fluctuate based on market conditions, it can impact the cost-effectiveness of platinum-based catalysts.

Limited Supply of Platinum: The global supply of platinum is concentrated in a few countries, with South Africa being the largest producer. Geopolitical tensions, mining difficulties, and fluctuations in supply can result in price volatility and potentially disrupt the production of Platinum Acetylacetonate. This could hinder market growth and create supply chain challenges.

Competition from Alternative Catalysts: Platinum Acetylacetonate faces competition from alternative catalysts that are made from less expensive metals, such as palladium or nickel-based catalysts. As the search for cost-effective alternatives continues, the market share of platinum-based catalysts may be impacted.

Opportunities

Advancements in Renewable Energy: Platinum Acetylacetonate plays a pivotal role in the development of renewable energy technologies such as hydrogen fuel cells. As the world transitions to cleaner energy sources, the demand for platinum-based catalysts is expected to rise. Fuel cell technology, which relies heavily on platinum catalysts, presents significant growth opportunities for the market.

Expansion in Emerging Markets: As industrialization progresses in emerging markets, particularly in Asia-Pacific, the demand for platinum-based materials and catalysts is expected to increase. Rapid growth in the automotive, electronics, and chemical industries in countries like China, India, and Japan presents significant market potential for Platinum Acetylacetonate.

Research and Development in High-Performance Materials: Ongoing research into high-performance materials, including the development of next-generation semiconductors and coatings, is expected to further boost the demand for Platinum Acetylacetonate. The compound’s role in producing platinum thin films for advanced electronics opens new avenues for growth.

Challenges

Raw Material Price Volatility: As mentioned, the price of platinum is highly volatile, and fluctuations in the cost of this precious metal could affect the overall cost structure of Platinum Acetylacetonate. This volatility creates challenges for manufacturers and suppliers, particularly when it comes to price predictability and maintaining profitability.

Environmental Impact of Platinum Mining: The environmental impact of platinum mining, including habitat disruption and resource depletion, is a growing concern. As regulations around mining practices tighten, the sourcing of platinum may become more costly and ethically challenging.

Regulatory Challenges: The production and use of platinum-based catalysts are subject to various regulatory frameworks, particularly concerning environmental and health safety. Changes in regulations or the introduction of stricter policies could pose challenges to market participants.

Regional Analysis

The global Platinum Acetylacetonate market shows significant regional variations in demand, supply, and growth prospects.

North America: North America remains a major player in the global market, with a significant portion of the demand coming from the automotive and electronics industries. The region's strict emission regulations and focus on technological innovation in the semiconductor industry are driving the growth of Platinum Acetylacetonate.

Europe: Europe is another key market for Platinum Acetylacetonate, driven by the region’s leadership in green chemistry, environmental sustainability, and advanced material science. The European Union's commitment to reducing carbon emissions has spurred demand for platinum-based catalysts, including Platinum Acetylacetonate.

Asia-Pacific: Asia-Pacific is witnessing rapid industrial growth, particularly in the automotive, electronics, and chemical industries. As emerging economies in this region continue to industrialize, the demand for Platinum Acetylacetonate is expected to rise, with China and India being key growth markets.

Latin America and the Middle East: These regions show slower but steady growth, with demand for Platinum Acetylacetonate primarily driven by select industries such as automotive and chemicals.

North America: North America remains a major player in the global market, with a significant portion of the demand coming from the automotive and electronics industries. The region's strict emission regulations and focus on technological innovation in the semiconductor industry are driving the growth of Platinum Acetylacetonate.

Europe: Europe is another key market for Platinum Acetylacetonate, driven by the region’s leadership in green chemistry, environmental sustainability, and advanced material science. The European Union's commitment to reducing carbon emissions has spurred demand for platinum-based catalysts, including Platinum Acetylacetonate.

Asia-Pacific: Asia-Pacific is witnessing rapid industrial growth, particularly in the automotive, electronics, and chemical industries. As emerging economies in this region continue to industrialize, the demand for Platinum Acetylacetonate is expected to rise, with China and India being key growth markets.

Latin America and the Middle East: These regions show slower but steady growth, with demand for Platinum Acetylacetonate primarily driven by select industries such as automotive and chemicals.

Competitor Analysis

Key players in the Platinum Acetylacetonate market include major chemical and material science companies that specialize in catalytic products and materials for electronic and automotive applications. The competitive landscape is marked by a mix of global leaders and regional players who focus on innovation, cost-efficiency, and supply chain management.

Global Platinum Acetylacetonate: Market Segmentation Analysis

This report provides a deep insight into the global Platinum Acetylacetonate market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trends, niche markets, key market drivers, challenges, SWOT analysis, and value chain analysis. The analysis helps readers shape the competition within the industries and strategies for the competitive environment to enhance potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of business organizations.

The report also focuses on the competitive landscape of the global Platinum Acetylacetonate market, providing an overview of the market share, product situation, operation situation, etc., of key players.

Market Segmentation (by Application)

Catalysis: Platinum Acetylacetonate is primarily used in catalytic applications such as hydrogenation, oxidation, and polymerization reactions. This sector remains the dominant driver of the market.

Electronics and Semiconductors: Used in the deposition of platinum thin films for high-performance electronic components.

Automotive Emission Control: Used in catalytic converters to reduce emissions in vehicles.

Market Segmentation (by Type)

Liquid Platinum Acetylacetonate: Primarily used in industrial and chemical applications.

Solid Platinum Acetylacetonate: Typically used in high-temperature processes and for thin-film applications in electronics.

Key Company

Major players in the Platinum Acetylacetonate market include companies specializing in the production of platinum-based catalysts and materials for the electronics, automotive, and chemical industries.

Geographic Segmentation

This report provides a detailed geographic segmentation of the global Platinum Acetylacetonate market, including key regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

FAQ Section

What is the current market size of the Platinum Acetylacetonate market?

The global Platinum Acetylacetonate market was valued at USD 66 million in 2023.

Which are the key companies operating in the Platinum Acetylacetonate market?

Key companies include global leaders in chemical manufacturing and catalyst production, particularly those focused on platinum-based products for electronics and automotive applications.

What are the key growth drivers in the Platinum Acetylacetonate market?

Key growth drivers include the increasing demand for platinum catalysts in automotive emission control, electronics, and green chemistry processes.

Which regions dominate the Platinum Acetylacetonate market?

North America and Europe are dominant regions, with strong demand driven by the automotive, electronics, and chemical industries.

What are the emerging trends in the Platinum Acetylacetonate market?

Emerging trends include the growth of renewable energy technologies, particularly hydrogen fuel cells, and the increasing adoption of platinum-based catalysts in green chemistry applications.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/287663/global-platinum-acetylacetonate-forecast-market-2025-2032-333 Table of content

Table of Contents 1 Research Methodology and Statistical Scope 1.1 Market Definition and Statistical Scope of Platinum Acetylacetonate 1.2 Key Market Segments 1.2.1 Platinum Acetylacetonate Segment by Type 1.2.2 Platinum Acetylacetonate Segment by Application 1.3 Methodology & Sources of Information 1.3.1 Research Methodology 1.3.2 Research Process 1.3.3 Market Breakdown and Data Triangulation 1.3.4 Base Year 1.3.5 Report Assumptions & Caveats 2 Platinum Acetylacetonate Market Overview 2.1 Global Market Overview 2.1.1 Global Platinum Acetylacetonate Market Size (M USD) Estimates and Forecasts (2019-2030) 2.1.2 Global Platinum Acetylacetonate Sales Estimates and Forecasts (2019-2030) 2.2 Market Segment Executive Summary 2.3 Global Market Size by Region 3 Platinum Acetylacetonate Market Competitive Landscape 3.1 Global Platinum Acetylacetonate Sales by Manufacturers (2019-2024) 3.2 Global Platinum Acetylacetonate Revenue Market Share by Manufacturers (2019-2024) 3.3 Platinum Acetylacetonate Market Share by Company Type (Tier 1, Tier 2, and Tier 3) 3.4 Global Platinum Acetylacetonate Average Price by Manufacturers (2019-2024) 3.5 Manufacturers Platinum Acetylacetonate Sales Sites, Area Served, Product Type 3.6 Platinum Acetylacetonate Market Competitive Situation and Trends 3.6.1 Platinum Acetylacetonate Market Concentration Rate 3.6.2 Global 5 and 10 Largest Platinum Acetylacetonate Players Market Share by Revenue 3.6.3 Mergers & Acquisitions, Expansion 4 Platinum AcetylacetonaCONTACT US: North Main Road Koregaon Park, Pune, India - 411001. International: +1(646)-781-7170 Asia: +91 9169162030

Follow Us On linkedin :- https://www.linkedin.com/company/24chemicalresearch/

0 notes